UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+86-0577-56765303

(Address of principal executive offices)

Telephone: 86-13968836059

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

$0.0005 par value per share | The |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

| * | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared

or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

TABLE OF CONTENTS

INTRODUCTION

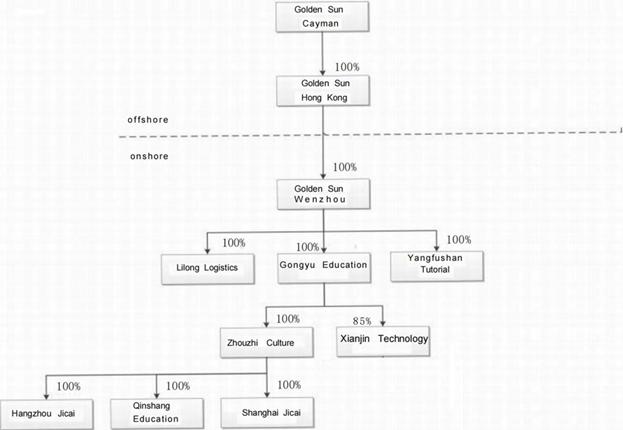

We are a holding company incorporated in the Cayman Islands with no material operations of our own. We are not a Chinese company. Investors of our Class A ordinary shares own shares of a Cayman Islands holding company. Unless otherwise stated, as used in this annual report and in the context of describing our operations and consolidated financial information, “we,” “us,” the “Company,” or “our company” refers to Golden Sun Education Group Limited, a Cayman Islands holding company. For a description of our corporate structure, see “Item 3. KEY INFORMATION–Corporate Structure.”

Our Chinese subsidiaries operate in the Chinese education section, which has been going through a series of reforms, and new laws and guidelines have been recently promulgated and released to regulate this industry. On September 1, 2021, the revised Implementation Rules for the Law for Promoting Private Education of the PRC (the “Implementing Regulation”), which regulates the establishment, organization and operation of private schools, teachers and educators, assets and financial management of schools, became effective. The revised Implementing Regulation prohibits private schools that provide compulsory education to be controlled by means of agreements (such as VIE Agreements, as defined below), or to enter into any transactions with any related parties. In September 2021, the Company completed a reorganization to divest its operations of two private schools, or the two former variable interest entities (VIEs), that provided compulsory education through a series of contractual arrangements (the “VIE Agreements”), which provided contractual exposure to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the Chinese operating companies, which practice is prohibited by the revised Implementation Regulation. See “Item 3. KEY INFORMATION–The Reorganization” for more information on the above-referenced reorganization. As of the date of this annual report, the Company does not provide any compulsory education in China, and all discussions relating to the Company’s operation of its former VIEs are provided for historical context only.

In this annual report on Form 20-F, unless the context otherwise requires, references to:

| ● | “China” or the “PRC” are to the People’s Republic of China; | |

| ● |

“Chongwen Middle School” are to Wenzhou City Longwan District Chongwen Middle School, which we controlled prior to the Reorganization via an entrustment agreement among Chongwen Middle School, Golden Sun Shanghai and Mr. Xueyuan Weng, as well as a Concerted Action Agreement among two of Chongwen Middle School’s sponsors and the representative of its employees;

| |

| ● | “Class A ordinary shares” are to our Class A ordinary shares, par value $0.0005 per share; | |

| ● | “Class B ordinary shares” are to our Class B ordinary shares, par value $0.0005 per share. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights: each Class A ordinary Share is entitled to one vote, and each Class B ordinary share is entitled to five votes and is convertible into one Class A ordinary share at any time by the holder thereof, while Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances; | |

| ● | “compulsory education” are to the nine years of education mandated by the PRC, consisting of six years of primary education and three years of secondary education; | |

| ● | “Double First Class University Plan” are to “The World First Class University” and “First Class Academic Discipline Construction” combined, a tertiary education development initiative designed by the PRC government in 2015 aiming to comprehensively develop elite Chinese universities and their individual faculty departments into world-class institutions by the end of 2050; |

| ● | “Gaokao” are to China’s standardized college entrance examination; | |

| ● | “Golden Sun Cayman” are to Golden Sun Education Group Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands; | |

| ● | “Golden Sun Hong Kong” are to the wholly owned subsidiary of Golden Sun Cayman, Hongkong Jintaiyang International Education Holding Group, a Hong Kong private limited company; | |

| ● | “Golden Sun Shanghai” are to Shanghai Golden Sun Education Group Co., Limited, a Hong Kong private limited company, which was Golden Sun Cayman’s wholly owned subsidiary prior to the Reorganization; |

| ● | “Golden Sun Wenzhou” are to the wholly owned subsidiary of Golden Sun Hong Kong, Zhejiang Golden Sun Education Co., Ltd., formerly known as Wenzhou Golden Sun Education Development Co., Ltd., a PRC limited liability company; | |

| ● | “Gongyu Education” are to the wholly owned subsidiary of Golden Sun Wenzhou, Shanghai Golden Sun Gongyu Education Technology Co., Ltd., a PRC limited liability company; | |

| ● | “Group” are to our Company and its subsidiaries as a whole; | |

| ● | “Hongkou Tutorial” are to a tutorial center operated by Xianjin Technology; previously, “Hongkou Tutorial” were to Shanghai Hongkou Practical Foreign Language Tutorial School, which ceased operation and transferred its existing business to Xianjin Technology in December 2021; | |

| ● | “Hangzhou Jicai” are to Hangzhou Jicai Tutorial School Co., Ltd.; | |

|

|

● | “Jicai Tutorial” are to Hangzhou Jicai; |

| ● |

“Key Universities” are to universities in China that are included in Project 211, Project 985 and Double First Class University Plan and that receive a high level of support from the Chinese government;

| |

|

●

|

“Lilong Logistics” are to the wholly owned subsidiary of Golden Sun Wenzhou, Wenzhou Lilong Logistics Services Co., Ltd., a PRC limited liability company;

| |

|

●

|

“MOE” are to the Ministry of Education of the PRC; | |

|

●

|

“partner-schools” are to high schools that Qingshang Education partners with to provide students on-site non-English foreign languages tutorial services;

| |

|

●

|

“Project 211” are to a project initiated in 1995 by the MOE with the intent of raising the research standards of high-level universities and cultivating strategies for socio-economic development;

| |

|

●

|

“Project 985” are to a project first announced in 1998 to promote the development and reputation of the Chinese higher education system by founding world-class universities in the 21st century, involving both national and local PRC governments allocating large amounts of funding to certain universities;

| |

| ● |

“Ouhai Art School” are to Wenzhou City Ouhai District Art School, which we controlled prior to the Reorganization via a series of contractual arrangements between Ouhai’s shareholders and Golden Sun Wenzhou;

| |

| ● |

“Qinshang Education” are to the wholly owned subsidiary of Golden Sun Wenzhou, Zhouzhi Culture, Shanghai Qinshang Education Technology Co., Ltd., a PRC limited liability company;

| |

| ● | “RMB” or “Renminbi” are to the legal currency of China; | |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; |

| ● |

“Securities Act” are to the Securities Act of 1933, as amended;

|

| ● |

“secondary schools” are to middle and high schools;

| |

| ● | “Shanghai Jicai” are to Shanghai Yangpu District Jicai Tutorial School, which transferred its existing business to Zhouzhi Culture in fiscal year 2022; |

| ● | “shares,” “Shares,” or “ordinary shares” are to the ordinary shares of Golden Sun Cayman, par value $0.0005 per share and. conditioned upon and effective immediately prior to the completion of this offering, collectively, our Class A ordinary shares and Class B ordinary shares; |

| ● | “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; | |

| ● | “VIE” are to variable interest entity; | |

| ● | “VIEs” are to the former variable interest entities, Ouhai Art School and Chongwen Middle School; | |

| ● | “we,” “us,” “our Company,” or the “Company” are to Golden Sun Cayman; | |

| ● | “WFOE” are to wholly foreign-owned enterprise; | |

| ● | “Xianjin Technology” are to Shanghai Xianjin Technology Development Co., Ltd., a PRC limited liability company; | |

| ● | “Yangfushan Tutorial” are to Wenzhou City Ouhai District Yangfushan Culture Tutorial Center; |

| ● | “Yangtze River Delta” is a triangle-shaped megalopolis comprising areas of Shanghai, southern Jiangsu province and northern Zhejiang province; |

| ● | “Zhongkao” are to China’s standardized high school entrance examination; |

| ● | “Zhouzhi Culture” are to the wholly owned subsidiary of Gongyu Education, Shanghai Zhouzhi Culture Development Co., Ltd., a PRC limited liability company; and |

| ● | “Zhouzhi Tutorial” are to the tutorial center operated by Zhouzhi Culture. |

This annual report on Form 20-F includes our audited consolidated balance sheet data as of September 30, 2022 and 2021, and the consolidated statements of operations and comprehensive (loss) income, changes in shareholders’ equity (deficit), and cash flows for the fiscal years ended September 30, 2022, 2021 and 2020. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets.

This annual report contains translations of certain RMB amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

| September 30, 2022 | September 30, 2021 | September 30, 2020 | ||||||||||

| Balance sheet items, except for equity accounts | US$1=RMB 7.1135 | US$1=RMB 6.4580 | US$1=RMB 6.8033 | |||||||||

| Items in the statements of income and cash flows | US$1=RMB 6.5332 | US$1=RMB 6.5095 | US$1=RMB 7.0077 |

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “assesses,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | assumptions about our future financial and operating results, including revenue, income, expenditures, cash balances, and other financial items; | |

| ● | our ability to execute our growth, and expansion, including our ability to meet our goals; | |

| ● | current and future economic and political conditions; | |

| ● | our capital requirements and our ability to raise any additional financing which we may require; | |

| ● | our ability to attract clients and further enhance our brand recognition; | |

| ● | our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; | |

| ● | trends and competition in the education industry; | |

| ● | the impact of the coronavirus pandemic (“COVID-19”) and other pandemic or natural disaster; and | |

| ● | other assumptions described in this annual report underlying or relating to any forward-looking statements. |

We describe certain material risks, uncertainties and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors.” We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

Industry Data and Forecasts

This annual report contains data related to the education industry in China. This industry data includes projections that are based on a number of assumptions which have been derived from industry and government sources which we believe to be reasonable. The education industry may not grow at the rate projected by industry data, or at all. The failure of the industry to grow as anticipated is likely to have a material adverse effect on our business and the market price of our Class A ordinary shares. In addition, the rapidly changing nature of the education industry subjects any projections or estimates relating to the growth prospects or future condition of our industry to significant uncertainties. Furthermore, if any one or more of the assumptions underlying the industry data turns out to be incorrect, actual results may, and are likely to, differ from the projections based on these assumptions.

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Item 3. KEY INFORMATION

We are not a Chinese company, but rather a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations through our operating entities in the PRC.

We are a provider of tutorial services in China. Established in 1997 and headquartered in Shanghai, China, we have over twenty years of experience providing educational services that focus on the development of each of our student’s strengths and potential, and the promotion of life-long skills and interests in learning. Prior to the Reorganization (as defined below), we operated one premium primary private school and one premium secondary private school through two VIEs, in addition to our current operations that include tutorial centers for children and adults, one educational company that partners with high schools to offer language classes to their students, and one logistics company that provides logistic and consulting services. Since the Reorganization, we no longer operate primary or secondary private schools and no longer use a VIE structure.

The Reorganization

On September 1, 2021, the revised Implementing Regulation became effective. The revised Implementing Regulation prohibits private schools that provide compulsory education to be controlled by means of agreements or to enter into any transactions with any related parties. Until September 2021, the Company had controlled and received economic benefits from the VIEs, Ouhai Art School and Chongwen Middle School, two private schools that provide compulsory education, through a series of contractual arrangements (the “VIE Agreements”) to provide contractual exposure to foreign investment in Chinese-based companies, where Chinese law prohibits direct foreign investment in Chinese operating companies. In order to become compliant with the revised Implementing Regulation, in September 2021, the Company completed a reorganization to divest its operations of Ouhai Art School and Chongwen Middle School. Through the Reorganization, (1) the Company sold all of its shares in Golden Sun Shanghai (the entity that controls Chongwen Middle School through contractual arrangements); and (2) Golden Sun Wenzhou, one of the Company’s subsidiaries, terminated its VIE Agreements with Ouhai Art School. As a result of the foregoing, neither the Company nor any of its subsidiaries controls or receives economic benefits from any private schools that provide compulsory education, and, as of the date of this annual report, we believe the Company and its subsidiaries are compliant with the revised Implementing Regulation. All discussions in this annual report relating to the Company’s operation of Quhai Art School or Chongwen Middle School are provided for historical context only.

For the fiscal years ended September 30, 2021 and 2020, the revenues generated by the VIEs accounted for approximately 32% and 45% of our total revenue, respectively. The divestures of the VIEs, which represented a strategic shift that had a major effect on the Company’s operations and financial results, triggered discontinued operations accounting in accordance with ASC 205-20-45, and resulted in the VIEs being considered as discontinued operations. The assets and liabilities related to the discontinued operations were retroactively classified as assets/liabilities of discontinued operation in the consolidated financial statements for the periods presented, while results of operations related to the discontinued operations were retroactively reported as income (loss) from discontinued operations in the consolidated financial statements for the periods presented. Please refer to the financial statements included in this registration statement for more details.

1

Corporate Structure

We are a Cayman Islands exempted company incorporated on September 20, 2018. Exempted companies are Cayman Island companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act (Revised).

The following diagram illustrates our corporate structure as of the date of this annual report.

The VIE Agreements

Prior to our Reorganization in September 2021, we operated Ouhai Art School and Chongwen Middle School through VIE structures. Neither we nor our subsidiaries owned any shares in Ouhai Art School or Chongwen Middle School. Instead, we controlled and received the economic benefits of the business operations of Ouhai Art School and Chongwen Middle School through the VIE Agreements. As a result of our indirect ownership of Golden Sun Wenzhou and Golden Sun Shanghai, as well as the VIE Agreements which were designed so that the operations of the VIEs were solely for the benefit of the Company, the Company was deemed to have a controlling financial interest in, and be the primary beneficiary of, the VIEs, for accounting purposes under U.S. GAAP. Accordingly, we had consolidated the financial results of the VIEs in our consolidated financial statements in accordance with U.S. GAAP for the fiscal years ended September 30, 2021 and 2020. As a result of the Reorganization, we no longer operate any VIEs.

2

Ouhai Art School

On March 1, 2019, Golden Sun Wenzhou, Ouhai Art School, and Xiulan Ye and Xueyuan Weng, the shareholders of Ouhai (“Ouhai Shareholders”) entered into contractual arrangements (the “Ouhai Agreements”) for a term of 10 years with preferred renewal rights. The Ouhai Agreements were designed to provide Golden Sun Wenzhou with the power, rights, and obligations equivalent in all material respects to those it would possess as the person with exclusive rights to control the operations of Ouhai Art School, including the power to control Ouhai Art School and the rights to the assets, property, and revenue of Ouhai Art School. In September 2021, the Quhai Agreements were terminated as a result of the Reorganization and the Company no longer operates Quhai Art School through the VIE structure.

Chongwen Middle School

On August 19, 2015, the Company, through its wholly-owned subsidiary, Golden Sun Shanghai, entered into an entrustment agreement (“Entrustment Agreement”) with Chongwen Middle School and Xueyuan Weng for the period from September 1, 2015 to August 31, 2023, which Entrustment Agreement was renewable for an additional seven years if elected. The Entrustment Agreement was subsequently amended on March 1, 2021, and, pursuant to such amendment, Golden Sun Shanghai had the exclusive right to control the operations of Chongwen Middle School, including making operational and financial decisions. In return, the Company was entitled to receive the residual return from Chongwen Middle School’s operation and at the same time to bear the risk of loss from the operation.

As part of the Reorganization, the Company sold all of its shares of Golden Sun Shanghai for a consideration of Hong Kong Dollar 100,000 (approximately $12,845) and no longer operates Chongwen Middle School through the VIE structure.

Risks Associated with Our Corporate Structure

Our holding company structure involves certain risks in terms of dividend distribution, direct investment in PRC entities, and obtaining benefits under relevant tax treaty. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in the PRC—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirement we may have, and any limitation on the ability of our subsidiaries to make payments to us and any tax we are required to pay could have a materially adverse effect on our ability to conduct our business,” “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in the PRC—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using proceeds from our future financing activities to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business,” “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in the PRC—PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or otherwise expose us or our PRC resident shareholders to liabilities or penalties,” and “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in the PRC—Under the EIT Law, we may be classified as a ‘resident enterprise’ of China, which could result in unfavorable tax consequences to us and our non-PRC shareholders.” See also “Item 4. INFORMATION ON THE COMPANY—B. Business Overview—Regulations—Regulations Related to Foreign Exchange.”

3

Risks Associated with Doing Business in the PRC

We are subject to certain legal and operational risks associated with having the majority of our operations in China, which could significantly limit or completely hinder our ability to offer securities to investors and cause the value of our securities to significantly decline or be worthless. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in the PRC—Any actions by the Chinese government, including any decision to intervene or influence the operating entities’ operations or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause them to make material changes to their operations, may limit or completely hinder their ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless.” Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structures, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this annual report, we and our subsidiaries have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. As of the date of this annual report, we are not subject to cybersecurity review by the Cyberspace Administration of China (the “CAC”), since we currently do not have over one million users’ personal information and do not anticipate that we will be collecting over one million users’ personal information in the foreseeable future, which we understand might otherwise subject us to the Cybersecurity Review Measures. We are not subject to network data security review by the CAC if the Draft Regulations on the Network Data Security Administration (Draft for Comments) (the “Security Administration Draft”) are enacted as proposed, because we currently do not have over one million users’ personal information, we do not collect data that affect or may affect national security and we do not anticipate that we will be collecting over one million users’ personal information or data that affect or may affect national security in the foreseeable future, which we understand might otherwise subject us to the Security Administration Draft. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in the PRC—Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the operating entities’ business and our offerings.” According to our PRC counsel, Pacgate Law Firm (“Pacgate”), no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) for our overseas listing. As of the date of this annual report, we and our subsidiaries have not received any inquiry, notice, warning, or sanction regarding our overseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions are newly published, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential impact such modified or new laws and regulations will have on the daily business operations of our subsidiaries, our ability to accept foreign investments, and our listing on an U.S. exchange. The Standing Committee of the National People’s Congress (the “SCNPC”) or PRC regulatory authorities may in the future promulgate laws, regulations, or implementing rules that require us or our subsidiaries to obtain regulatory approval from Chinese authorities for listing in the U.S.

In addition, pursuant to the Holding Foreign Companies Accountable Act (“HFCAA”), our securities may be prohibited from trading on a national exchange or over-the-counter if the Public Company Accounting Oversight Board of the United States, or the “PCAOB,” is unable to inspect our auditor for three consecutive years beginning in 2021. On December 23, 2022, the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was enacted and decreased the number of non-inspection years for foreign companies to comply with PCAOB audits from three to two, thus, reducing the period before our securities may be prohibited from trading or delisted if the PCAOB determines that it cannot inspect or investigate our auditor completely. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to AHFCAA, which also reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two. Our current auditor, Marcum Asia CPAs LLP, the independent registered public accounting firm that issues the audit report included elsewhere in this annual report, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the U.S., pursuant to which the conducts regular inspections to assess its compliance with the applicable professional standards. As of the date of this annual report, the PCAOB has access to inspect the working papers of our auditor. If trading in our Class A ordinary shares is prohibited in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, Nasdaq may determine to delist our Class A ordinary shares and trading in our Class A ordinary shares could be prohibited. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in the PRC—Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offerings.”

4

Permissions Required from PRC Authorities

Approvals from the PRC Authorities to Issue Our Ordinary Shares to Foreign Investors

As of the date of this annual report, our PRC counsel, Pacgate, has advised us that neither we nor our PRC subsidiaries (1) are required to obtain approvals from any PRC authorities to issue our ordinary shares to foreign investors, (2) are subject to approval requirements from the China Securities Regulatory Commission (the “CSRC”), the CAC, or any other entity to approve our operations, or (3) have been denied such permissions by any PRC authorities. Nevertheless, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the “Opinions”, which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies.

Approvals from the PRC Authorities to Conduct Our Operations

As of the date of this annual report, our Company and our PRC subsidiaries have received from the PRC authorities all requisite licenses, permissions, or approvals that are required for conducting our operations in China, such as business licenses, private school operation permits, certificates of registration for a privately operated non-enterprise entity for not-for-profit private schools, certificates of registration for-profit private schools. However, it is uncertain whether we or our PRC subsidiaries will be required to obtain additional approvals, licenses, or permits in connection with our business operations pursuant to evolving PRC laws and regulations, and whether we would be able to obtain and renew such approvals on a timely basis or at all. Failing to do so could result in a material change in our operations, and the value of our Class A ordinary shares could depreciate significantly or become worthless. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Our Business—We are subject to various approvals, licenses, permits, registrations and filings for our education and other services in the PRC.”

As advised by our PRC counsel, Pacgate Law Firm, other than those requisite for a domestic company in China to engage in the businesses similar to those of the operating entities, the operating entities are not required to obtain any permission from Chinese authorities, including the CSRC, the CAC, or any other governmental agency that is required to approve the operating entities’ operations. However, if the operating entities do not receive or maintain the approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change such that the operating entities are required to obtain approval in the future, the operating entities may be subject to investigations by competent regulators, fines or penalties, ordered to suspend the operating entities’ relevant operations and rectify any non-compliance, prohibited from engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in the operating entities’ operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. As of the date of this annual report, we and the operating entities have received from PRC authorities all requisite licenses, permissions, or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied.

We are currently not required to obtain permission from any of the PRC authorities to operate and issue our securities to foreign investors. In addition, we and our subsidiaries are not required to obtain permission or approval relating to our securities from the PRC authorities, including the CSRC or the CAC, for our subsidiaries’ operations, nor have we or our subsidiaries received any denial for our subsidiaries’ operations with respect to the offerings of our securities. Recently, however, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the “Opinions,” which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision over overseas listings by Chinese companies. The Opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. The aforementioned policies and any related implementation rules to be enacted may subject us to additional compliance requirements in the future. Given the current regulatory environment in the PRC, we are still subject to the uncertainty of different interpretation and enforcement of the rules and regulations in the PRC adverse to us, which may take place quickly with little advance notice. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in the PRC—The Opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council may subject the operating entities to additional compliance requirement in the future.”

5

Transfer of Funds and Other Assets Between Our Company and Our Subsidiaries

As of the date of this annual report, Golden Sun Cayman transferred to Golden Sun Hong Kong $18.3 million of the proceeds from an initial public offering (“IPO”) completed in June 24, 2022. Golden Sun Hong Kong then transferred approximately $2.5 million to Golden Sun Cayman, Golden Sun Cayman further transferred approximately $0.2 million to WFOE and approximately $0.9 million to Qinshang Education.

Our finance department is supervising cash management, following the instructions of our management. Our finance department is responsible for establishing our cash operation plan and coordinating cash management matters among our subsidiaries and departments. Each subsidiary and department initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and submits it to our finance department. The finance department reviews the cash demand plan and prepares a summary for the management of our Company. Management examines and approves the allocation of cash based on the sources of cash and the priorities of the needs. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred.

Dividends or Distributions and Tax Consequences

Under Cayman Islands law, a Cayman Islands exempted company may pay a dividend on its shares out of either profits or share premium amounts, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts due in the ordinary course of business. As of the date of this annual report, no dividends or distributions have been made by a subsidiary or the former VIEs, and the Company has not made any dividends or distributions to investors. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future, or any funds will be transferred from one entity to another. As such, we have not installed any cash management policies that dictate how funds are transferred among Golden Sun Cayman, its subsidiaries, or investors.

Our PRC operating entities receive substantially all of our revenue in RMB. Under our current corporate structure, to fund any cash and financing requirements we may have, Golden Sun Cayman may rely on dividend payments from its PRC operating subsidiaries, Golden Sun Wenzhou and its subsidiaries, which may make distribution of such payments to Golden Sun Hong Kong and then to Golden Sun Cayman as dividends.

Under existing PRC foreign exchange regulations, payment of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange (the “SAFE”) by complying with certain procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from the SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents. Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions.

Current PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

6

Cash dividends, if any, on our Class A ordinary shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however, does not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends paid by Golden Sun Wenzhou to its immediate holding company, Golden Sun Hong Kong. As of the date of this annual report, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Golden Sun Hong Kong intends to apply for the tax resident certificate if and when Golden Sun Wenzhou plans to declare and pay dividends to Golden Sun Hong Kong.

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our Class A ordinary shares involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, prospects, financial condition or results of operations could suffer. In that case, the trading price of our capital stock could decline, and you may lose all or part of your investment. Below please find a summary of the principal risks we face, organized under relevant headings.

Summary Risk Factors

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Item 3.D. “Risk Factors” in this annual report for a more thorough description of these and other risks.

7

Risks Related to Our Business

| ● | We face intense competition in the PRC education sector, which could lead to adverse pricing pressure, reduced operating margins, loss of market share, departure of qualified teachers and increasing capital expenditure. |

| ● | Our business and results of operations mainly depend on the level of tuition fees we are able to charge and our ability to maintain and raise tuition fees. |

| ● | We face risks related to health epidemics, natural disasters, or terrorist attacks in China. |

| ● | If we are not able to continue to secure agreements with some or all of our existing partner-schools, or secure new agreements with additional partner-schools for our non-English foreign language program, our results of operations and financial condition may be materially and adversely affected. |

| ● | We are subject to various approvals, licenses, permits, registrations and filings for our education and other services in the PRC. |

| ● | New legislation or changes in the PRC regulatory requirements regarding private education have affected, and may further affect, our business operations and prospects materially and adversely. |

| ● | We have limited sources of working capital, which have been primarily funded from operations, bank loans, and advances from shareholders, and we cannot assure you that our needs for additional financing will be met in the future. |

Risks Related to Doing Business in the PRC

| ● | A severe or prolonged slowdown in the Chinese economy could materially and adversely affect the operating entities’ business and financial condition. |

| ● | Changes in the policies, regulations, rules, and the enforcement of laws of the PRC government may be quick with little advance notice and could have a significant impact upon the operating entities’ ability to operate profitably in the PRC. |

| ● | Given the Chinese government’s significant oversight and discretion over the conduct of the operating entities’ business, the Chinese government may intervene or influence the operating entities’ operations at any time, which could result in a material change in their operations and/or the value of our ordinary shares. |

| ● | Any actions by the Chinese government, including any decision to intervene or influence the operating entities’ operations or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause them to make material changes to their operations, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless. |

| ● | Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact the operating entities’ business and our offerings. |

| ● | The Opinions recently issued by the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council may subject the operating entities to additional compliance requirement in the future. |

| ● | Increases in labor costs in the PRC may adversely affect the operating entities’ business and profitability. |

8

| ● | Because we are a Cayman Islands exempted company and all of our business is conducted in the PRC, you may be unable to bring an action against us or our officers and directors or to enforce any judgment you may obtain. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China. |

| ● | Recent joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offerings. |

| ● | PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us, or otherwise expose us or our PRC resident shareholders to liabilities or penalties. |

| ● | We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirement we may have, and any limitation on the ability of our subsidiaries to make payments to us and any tax we are required to pay could have a materially adverse effect on our ability to conduct our business. |

| ● | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using proceeds from our future financing activities to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business. |

| ● | Because the operating entities’ business is conducted in RMB and the price of our ordinary shares is quoted in U.S. dollars, changes in currency conversion rates may affect the value of your investments. |

| ● | Under the EIT Law, we may be classified as a “resident enterprise” of China, which could result in unfavorable tax consequences to us and our non-PRC shareholders. |

| ● | There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiaries, and dividends payable by our PRC subsidiaries to our Hong Kong subsidiaries may not qualify to enjoy certain treaty benefits. |

| ● | We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

| ● | Our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may have a material adverse effect on our ability to conduct our business. |

| ● | If we become directly subject to the scrutiny, criticism, and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price, and reputation. |

| ● | The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC. |

| ● | The M&A Rules and certain other PRC regulations establish complex procedures for certain acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China. |

9

Risks Related to Our Ordinary Shares and the Trading Market

| ● | Substantial future sales of our Class A ordinary shares or the anticipation of future sales of our ordinary shares, whether by us or our shareholders, could cause the price of our Class A ordinary shares to decline. |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on the price appreciation of our Class A ordinary shares for return on your investment. |

| ● | The trading price of our Class A ordinary shares is likely to be volatile, which could result in substantial losses to our investors. |

| ● | If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting, and other expenses that we would not incur as a foreign private issuer. |

| ● | Because we are a foreign private issuer and have taken advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer. |

| ● | Anti-takeover provisions in our amended and restated memorandum and articles of association may discourage, delay, or prevent a change in control. |

| ● | During the course of the audit of our consolidated financial statements, we identified material weaknesses in our internal control over financial reporting. If we fail to establish and maintain an effective system of internal control over financial reporting, our ability to accurately and timely report our financial results or prevent fraud may be adversely affected, and investor confidence and the market price of our ordinary shares may be adversely impacted. |

| ● | Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our Class A ordinary shares. |

| ● | The dual-class structure of our ordinary shares may adversely affect the trading market for our Class A ordinary shares. |

| ● | Since we are a “controlled company” within the meaning of the Nasdaq listing rules, we are allowed to follow certain exemptions from certain corporate governance requirements that could adversely affect our public shareholders. |

Risks Related to Our Business

We face intense competition in the PRC education sector, which could lead to adverse pricing pressure, reduced operating margins, loss of market share, departure of qualified teachers and increasing capital expenditure.

The education sector in China is fast evolving, highly fragmented and competitive, and we expect competition in this sector to continue and intensify. Furthermore, education institutions’ performance is highly sensitive to demographic changes in China. Student enrollment in primary and secondary education in China can be substantially affected by PRC government policies on family planning. In Zhejiang province and Shanghai, where most of our operations are located, we face intense competition and pricing pressure. Our competitors may adopt similar or better curricula, student support services and marketing strategies, with more appealing pricing and service packages than what we are able to offer. In addition, some of our competitors may have more resources than we do and may be able to dedicate greater resources than we can to school development and promotion and respond more quickly than we can to changes in student demand, market needs and/or new technologies. As such, we may need to lower our tuition fees, or increase our spending in order to be competitive by retaining or attracting students and qualified teachers or identifying and pursuing new market opportunities. If we are unable to successfully compete for new students or partners, maintain or increase our fee levels, attract and retain qualified teachers or other key personnel, enhance the quality of our educational services or control the costs of our operations, our business, results of operations and financial condition may be materially and adversely affected.

10

Our business and results of operations mainly depend on the level of tuition fees we are able to charge and our ability to maintain and raise tuition fees.

The amount of tuition fees we are able to charge represents one of the most significant factors affecting our profitability. The majority of our revenues are derived from fees from our tutorial centers. Our fees have been determined based on demand for our educational programs and training courses, the cost of our operations, the geographic markets in which we operate our business, the fees charged by our competitors, our pricing strategy to gain market share and the general economic conditions in China and in the areas in which our tutorial centers are located, subject to applicable approvals by local government according to the nature of the private schools, e.g., for-profit or not-for-profit. Pursuant to the Law of the People’s Republic of China on the Promotion of Privately-run Schools amended in 2016 and further amended in 2018, the measures for the collection of fees by not-for-profit schools shall be formulated by local government of various provinces, autonomous regions and centrally-administrated municipalities. The Company’s business, operations and revenue have not been affected by such law, because local government regulations of Zhejiang and Shanghai, where our not-for-profit schools are located, have generally allowed school sponsors autonomy in running schools, including autonomy in pricing of tuition fees, and as a result we are able to charge tuition fees based on market conditions; the charging criteria of for-profit private schools are subject to market and shall be determined by the schools themselves. For the purposes of this law, among our operating entities that are established as schools, Hangzhou Jicai is a for-profit private school, while Yangfushan Tutorial is a not-for-profit school. There can be no assurance that we will be able to maintain or raise the fee levels we charge in the future, due to various reasons, many beyond our control, such as failure to obtain necessary approvals for fee increases, and even if we are able to maintain or raise fees, we are unsure how our fee rates will impact the number of student applications and enrollment. Our business, financial position and results of operations may be materially and adversely affected, if we fail to maintain or raise our fees while attracting sufficient students.

We face risks related to health epidemics, natural disasters, or terrorist attacks in China.

China and elsewhere worldwide have recently experienced and, in some parts of the world, including the U.S., are still experiencing the impacts of the COVID-19 pandemic, a disease caused by a novel and highly contagious form of coronavirus. The pandemic resulted in travel restrictions, massive closure of businesses and schools, and quarantine measures imposed by governments across the world. Substantially all of our operations are conducted in China and our students had to remain home from January to early April, 2020. Although we implemented measures to proactively respond to the situation by training our teachers to adapt to remote teaching, the COVID-19 pandemic has caused a disruption to our tutorial business. In April 2020, we resumed in-person teaching across our schools and tutorial centers, without substantial negative impact on the attendance of our teachers and students. A new COVID-19 subvariant (Omicron) outbreak hit China in March 2022, spreading more quickly and easily than previous strains. As a result, a new round of lockdowns, quarantines, and travel restrictions were imposed upon different provinces or cities in China by the relevant local government authorities. The Company temporarily closed its Shanghai office and the related tutorial centers and suspended offline marketing activities starting from April 1, 2022, as required by the local authorities in Shanghai, and employees located in Shanghai work remotely. Starting from June 1, 2022, the Company reopened the Shanghai office and resumed offline marketing activities. As such, during the fiscal year ended September 30, 2022, the COVID-19 pandemic had a material negative impact on the Company’s financial positions and operating results. As of the date of this annual report, the COVID-19 pandemic continues to impact the economy in China and worldwide, we currently are unable to predict the duration and severity of the spread of COVID-19, the responses thereto, and their impact on our business and operations, our results of operations, financial condition, cash flows and liquidity, as these depend on rapidly evolving developments, which are highly uncertain and will be a function of factors beyond our control. Such factors include, among others, the continued spread or recurrence of contagion, the implementation of effective preventative and containment measures, the development of effective medical solutions, and the extent to which governmental restrictions on travel, public gatherings, mobility and other activities remain in place or are augmented.

Additionally, our business could be materially and adversely affected by natural disasters, such as earthquakes, floods, landslides, tornados and tsunamis, and other outbreaks of health epidemics such as avian influenza and severe acute respiratory syndrome, or SARS, and Influenza A virus, such as H5N1 subtype and H5N2 subtype flu viruses, as well as terrorist attacks, other acts of violence or war or social instability in the region in which we operate or those generally affecting China. If any of these occur, our schools and facilities may be required to temporarily or permanently close and our business operations may be suspended or terminated. Our students, teachers and staff may also be negatively affected by such event. Our physical facilities may also be affected. In addition, any of these could adversely affect the Chinese economy and demographics of the affected region, which could cause significant declines in the number of our students in that region and could have a material adverse effect on our business, financial condition and results of operations.

Our business is heavily dependent on the reputation of our tutorial services.

Our ability to maintain our reputation depends on a number of factors, some of which are beyond our control. As we continue to grow and adapt our programs and services to the demand of our students, it may become difficult to maintain the quality and consistency of the services we offer, which may lead to diminishing confidence in our brand names.

Numerous factors can potentially impact the reputation of our tutorial services, including but not limited to, the degree of students’ and their parents’ satisfaction with our curriculum, our teachers and teaching quality, teacher or student scandals, negative press, interruptions to our services, failure to pass inspections by government educational authorities, loss of certifications and approvals that enable us to operate our tutorial centers and other businesses in the manner they are currently operated, and unaffiliated parties using our brands without adhering to our standards. Any negative impact on the reputation of one or more of our tutorial centers or businesses may lead to a decrease in students’ or their parents’ interest in our tutorial services or lead to termination of our cooperation with our partner-schools, which would materially and adversely affect our business.

11

We have established and developed our student base primarily through a variety of marketing methods. However, we cannot assure you that these marketing efforts will be successful or sufficient in further promoting our brands or in helping us to maintain our competitiveness. If we are unable to further enhance our reputation and increase market awareness of our programs or services, or if we need to incur excessive marketing and promotional expenses in order to remain competitive, our business, financial condition and results of operations may be materially and adversely affected. If we are unable to maintain or strengthen our reputation and brand recognition, we may not be able to maintain or increase student enrollment, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

We may fail to continue to attract and retain students in our tutorial centers.

The success of our business largely depends on the number of students enrolled in our tutorial centers, as well as on the amount of fees our students and/or parents are willing to pay. Therefore, our ability to continue to attract students to enroll in our tutorial centers is critical to the continued success and growth of our business. The success of our efforts to enroll students will depend on several factors, including without limitation our ability to:

| ● | enhance existing programs to respond to market changes and student demands; |

| ● | develop new programs that appeal to our students; |

| ● | expand our geographic reach; |

| ● | manage our growth while maintaining the consistency of our teaching quality; |

| ● | effectively market our tutorial centers and programs to a broader base of prospective students; and |

| ● | respond to the increasing competition in the market. |

In addition, local and provincial government authorities may restrict our ability to provide tutorial services, and our business, financial condition and results of operations could be materially and adversely affected if we cannot maintain or increase our enrollment.

If we are not able to continue to secure agreements with some or all of our existing partner-schools, or secure new agreements with additional partner-schools for our non-English foreign language program, our results of operations and financial condition may be materially and adversely affected.

In December 2019, we started offering our non-English foreign language program by partnering with high schools nationwide in China. We intend to continue to grow this segment of our business by actively seeking and partnering with more high schools and by expanding to various parts of China. Typically, our agreements with these partner-schools are for three years, and these schools are not obligated to renew their existing agreements with us. If any of our current partner-schools discontinue our services, we cannot assure you that we will be able to timely secure service agreements with other schools to replace the lost revenue, if at all, and therefore, our results of operations and financial condition may be affected.

Our tutorial centers offer refunds to students who withdraw from enrollment within a certain predetermined period, and we cannot assure you that our estimates of refund will be accurate, or that such refunds will remain insignificant to our results of operations and our financial condition.

For our tutorial centers, we generally offer refunds for any remaining classes to students who decide to withdraw from a course within the predetermined period in the education contract the student enters into with the relevant school or center. The refund is limited to the amount of fees that would be charged for any undelivered classes. Refund liability estimates are based on a historical refund ratio on a portfolio basis using the expected value method. As of September 30, 2022, 2021 and 2020, refund liability amounted to $237,691, $348,472 and $246,935, respectively. The refund amount is currently insignificant to our results of operations and our financial condition. However, we cannot assure you that our estimates of refund will be accurate. Additionally, we cannot assure you that such refunds will remain insignificant to our results of operations and our financial condition.

12

We may fail to continue to attract and retain teachers and we may not be able to maintain consistent teaching quality throughout our schools and tutorial centers.

Our teachers are critical to maintaining and improving the quality of our tutorial services, and to supporting the expansion of our services. We must continue to attract qualified teachers who have strong command of their subject areas and who meet our qualifications. Currently, there is a limited number of teachers in China with the necessary experience, expertise and qualifications that meet our requirements. We also have to provide competitive compensation packages to attract and retain qualified teachers.

The annual retention rate of our teachers as of September 30, 2022, 2021 and 2020, was 25.2%, 73.8% and 80.4%, respectively. The retention rate declined significantly due to the COVID-19 and reorganization in fiscal year 2022. “Retention rate” is calculated as 100% minus the quotient of the number of teachers who cease being employed during the period by the number of teachers at the beginning of that period (not including teachers hired during that period). Shortages of qualified teachers, or significant decreases in the quality of our tutorial services, whether actual or perceived in one or more of our partner-schools or tutorial centers, may have a material and adverse effect on our business and our reputation. In addition, we may not be able to hire or retain enough qualified teachers to maintain consistent teaching quality. Further, any significantly increase in teacher salaries may have a material adverse effect on our business, financial condition and results of operations.

Our historical results may not be indicative of our future performance.

Our financial condition and results of operations may fluctuate due to a number of other factors, such as expansion and related costs in a given period, our ability to maintain and increase our profitability and to enhance our operational efficiency, increased competition and market perception and acceptance of any newly introduced educational programs in any given year. In addition, while we plan to further expand our network of partner-schools and tutorial centers, there is no guarantee that we will be able to do so successfully. Furthermore, we may not be successful in continuing to increase the number of students admitted to our programs.

We may not grow in future periods, and we may not achieve profitability on a quarterly or annual basis in the future. Our historical results, growth rates and profitability may not be indicative of our future performance. Our ordinary shares could be subject to significant price volatility should our earnings fail to meet the expectations of the investment community. Any of these events could cause the price of our ordinary shares to materially decrease.

We may not be able to successfully execute our growth strategies or effectively manage our growth, which may hinder our ability to capitalize on new business opportunities.

Managing and supporting our growth strategies require substantial management time and know-how, as well as the commitment of significant resources and expenditure. If any of these elements are not fulfilled, we may not be able to grow or effectively and efficiently manage the growth of our operations. Any failure to effectively and efficiently manage our resources may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our business and financial results.

We plan to leverage our existing operations and resources to further expand our network of partner schools and tutorial centers. In addition, we plan to explore acquisition opportunities. We may not succeed in executing our growth strategies due to a number of factors, including failure to do any of the following:

| ● | identify cities with sufficient growth potential in which we can establish new partner schools; |

| ● | identify suitable acquisition targets; |

| ● | establish cooperation with partners; |

| ● | effectively execute our expansion plans; |

| ● | acquire or lease suitable land sites in the cities in which we plan to expand our operations; |

| ● | obtain government support in cities where we already have schools or in cities or areas in which we plan to expand our operations; |

| ● | effectively market our tutorial services in new markets or promote ourselves in existing markets; |

| ● | replicate our successful growth model in new markets or new geographical locations outside of Zhejiang province and Shanghai city area; |

| ● | obtain the requisite licenses and permits from the authorities necessary to open tutorial centers at our desired locations; |

| ● | continue to enhance our course materials or adapt our course materials to changing student needs and teaching methods; and |

| ● | achieve the benefits we expect from our expansion. |

If we fail to successfully execute our growth strategies, we may not be able to grow as expected, and as a result, our business, financial condition and results of operations may be materially and adversely affected.

13

We are subject to taxation in multiple jurisdictions, which is complex and often requires making subjective determinations subject to scrutiny by, and disagreements with, tax regulators.

We are subject to many different forms of taxation in each of the countries and regions we form and/or conduct our business, of operation including, but not limited to, income tax, withholding tax, property tax, VAT and social security and other payroll-related taxes. Tax law and administration is complex, subject to change and varying interpretations and often requires us to make subjective determinations. In addition, we take positions in the course of our business with respect to various tax matters, including in connection with our operations. Tax authorities worldwide are increasingly rigorous in their scrutiny of corporate tax structures and may not agree with the determinations that are made, or the positions taken, by us with respect to the application of tax law. Such disagreements could result in lengthy legal disputes, an increased overall tax rate applicable to us and, ultimately, in the payment of substantial amounts of tax, interest and penalties, which could have a material adverse effect on our business, results of operations and financial condition.