UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: November 4, 2020

Commission File Number: 001-39570

TIM

S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Quarterly information on

30 September 2020

TIM S.A.

QUARTERLY INFORMATION

30 September 2020

Index

| Independent auditors ' report on quarterly information | 1 |

| Quarterly audited information | |

| Balance sheets | 3 |

| Statements of income | 5 |

| Statements of comprehensive income | 6 |

| Statements of changes in equity | 7 |

| Cash flow statements | 9 |

| Statements of value added | 11 |

| Earnings release | 12 |

| Notes to quarterly information | 39 |

| Opinion of the Fiscal Council | 108 |

| Directors' statement on quarterly information | 109 |

| Directors' statement on independent auditors' report | 110 |

INDEPENDENT AUDITOR’S REVIEW REPORT ON QUARTERLY INFORMATION

The shareholders, board of directors and officers

TIM S.A.

Rio de Janeiro - RJ

Introduction

We have reviewed the accompanying interim financial information, contained in the Quarterly Information Form (ITR) of Tim S.A. (“Company”) for the quarter ended September 30, 2020, comprising the balance sheet as of September 30, 2020 and the statements of income and comprehensive income for the three-month and nine-month periods then ended, and the statements of changes in shareholders’ equity and cash flows for the nine-month period then ended, including the explanatory notes.

Management is responsible for preparation of the interim financial information in accordance with NBC TG 21 – Demonstração Intermediária, and IAS 34 – Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), as well as for the fair presentation of this information in conformity with the rules issued by the Brazilian Securities and Exchange Commission (CVM) applicable to the preparation of the Quarterly Information Form (ITR). Our responsibility is to express a conclusion on this interim financial information based on our review.

Scope of review

We conducted our review in accordance with Brazilian and international standards on review engagements (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information performed by the Independent Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with auditing standards and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

| 1 |

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the accompanying interim financial information included in the quarterly information referred to above are not prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation of Quarterly Information Form (ITR), and presented consistently with the rules issued by the Brazilian Securities and Exchange Commission (CVM).

Other matters

Statements of value added

The quarterly information referred to above includes the statements of value added (DVA) for the nine-month period ended September 30, 2020, prepared under the responsibility of the Company's management and presented as supplementary information for IAS 34 purposes. These statements have been subject to review procedures performed in conjunction with the review of quarterly information to conclude that they are reconciled with interim financial information and accounting records, as applicable, and if their form and content are consistent with the criteria defined in NBC TG 09 “Statement of Added Value”. Based on our review, we are not aware of any fact that leads us to believe that these statements of value added were not prepared, in all material respects, in accordance with the criteria established in the Technical Pronouncement and is consistent with respect to the interim financial information taken as whole.

Review of prior year/period corresponding figures

The amounts corresponding to the statements of income and comprehensive income for the three-month and nine-month periods ended September 30, 2019, changes in shareholders’ equity, cash flows and value added, for the nine-month period then ended, and presented for comparative purposes, were previously reviewed by other independent auditors who issued an unqualified review report on the interim accounting information on February 05, 2020.

Rio de Janeiro, November 03, 2020.

ERNST & YOUNG

Auditores Independentes S.S.

CRC-2SP015199/O-6

Fernando Alberto S. Magalhães

Accountant CRC-1SP133169/O-0

| 2 |

| TIM S.A. | |||||

| BALANCE SHEETS | |||||

| 30 September 2020 and 31 December 2019 | |||||

| (In thousands of reais) | |||||

| Note | 09/2020 | 12/2019 | |||

| Asset | 39,790,080 | 39,857,182 | |||

| Current assets | 9,601,207 | 8,418,034 | |||

| Cash and cash equivalents | 4 | 2,124,706 | 2,284,048 | ||

| Marketable securities | 5 | 1,513,016 | 642,312 | ||

| Trade accounts receivable | 6 | 2,986,094 | 3,182,935 | ||

| Inventory | 7 | 206,862 | 203,278 | ||

| Indirect taxes, charges and contributions recoverable | 8 | 371,170 | 420,284 | ||

| Direct taxes, charges and contributions recoverable | 9 | 1,553,003 | 1,366,809 | ||

| Prepaid expenses | 11 | 275,403 | 173,139 | ||

| Derivative financial instruments | 35 | 383,852 | 16,602 | ||

| Leases | 15 | 4,812 | 4,931 | ||

| Regulatory credits recoverable | 16 | 57,684 | 33,090 | ||

| Other assets | 124,605 | 90,606 | |||

| Non-current assets | 30,188,873 | 31,439,148 | |||

| Long-term receivables | 3,819,270 | 4,526,228 | |||

| Marketable securities | 5 | 6,634 | 3,849 | ||

| Trade accounts receivable | 6 | 125,839 | 103,075 | ||

| Indirect taxes, charges and contributions recoverable | 8 | 833,642 | 823,349 | ||

| Direct taxes, charges and contributions recoverable | 9 | 1,140,869 | 2,367,608 | ||

| Deferred income tax and social contribution | 10 | 482,269 | - | ||

| Judicial deposits | 12 | 863,920 | 919,850 | ||

| Prepaid expenses | 11 | 64,271 | 68,628 | ||

| Derivative financial instruments | 35 | 122,839 | 29,909 | ||

| Leases | 15 | 147,390 | 151,447 | ||

| Other assets | 31,597 | 58,513 | |||

| Property, plant and equipment | 13 | 17,357,330 | 17,612,164 | ||

| Intangible | 14 | 9,012,273 | 9,300,756 | ||

The explanatory notes are an integral part of the financial statements.

| 3 |

| TIM S.A. | ||||

| BALANCE SHEETS | ||||

| 30 September 2020 and 31 December 2019 | ||||

| (In thousands of reais) | ||||

| Note | 09/2020 | 12/2019 | ||

| Liabilities and Shareholders´ equity | 39,790,080 | 39,857,182 | ||

| Total liabilities | 16,540,853 | 17,798,375 | ||

| Current liabilities | 6,670,340 | 8,135,119 | ||

| Suppliers | 17 | 2,176,054 | 3,916,048 | |

| Borrowing and financing | 19 | 1,835,290 | 1,384,180 | |

| Leases | 15 | 953,405 | 873,068 | |

| Derivative financial instruments | 35 | 11,100 | 858 | |

| Payroll and related charges | 286,988 | 217,523 | ||

| Indirect taxes, charges and contributions payable | 20 | 811,342 | 463,075 | |

| Direct taxes, charges and contributions payable | 21 | 251,777 | 270,489 | |

| Dividends and interest on shareholders’ equity payable | 24 | 46,745 | 597,550 | |

| Authorizations payable | 18 | 65,086 | 88,614 | |

| Deferred revenues | 22 | 218,447 | 281,930 | |

| Other liabilities | 14,106 | 41,784 | ||

| Non- current liabilities | 9,870,513 | 9,663,256 | ||

| Borrowing and financing | 19 | 758,571 | 644,908 | |

| Derivative financial instruments | 35 | - | 3,547 | |

| Leases | 15 | 6,915,983 | 6,907,802 | |

| Indirect taxes, charges and contributions payable | 20 | 3,083 | 2,997 | |

| Direct taxes, charges and contributions payable | 21 | 212,834 | 212,310 | |

| Deferred income tax and social contribution | 10 | - | 78,230 | |

| Provision for legal and administrative proceedings | 23 | 885,634 | 703,522 | |

| Pension plan and other post-employment benefits | 5,782 | 5,782 | ||

| Authorizations payable | 18 | 254,123 | 237,723 | |

| Deferred revenue | 22 | 772,136 | 827,182 | |

| Other liabilities | 62,367 | 39,253 | ||

| Shareholders’ equity | 24 | 23,249,227 | 22,058,807 | |

| Capital stock | 13,477,891 | 13,476,172 | ||

| Capital reserves | 394,586 | 36,154 | ||

| Profit reserves | 8,550,298 | 8,550,298 | ||

| Accumulated other comprehensive income | (3,817) | (3,817) | ||

| Net income for the period | 830,269 | - | ||

Explanatory notes are an integral part of the quarterly information.

| 4 |

| TIM S.A. | |||||||||

| STATEMENT OF INCOME | |||||||||

| Periods ended September 30, 2020 and 2019 | |||||||||

| (In thousands of reais, except as otherwise stated) | |||||||||

| Note | 3rd Qtr/20 | 09/2020 | 3rd Qtr/19 | 09/2019 | |||||

| Net revenue | 26 | 4,387,369 | 12,589,783 | 4,337,063 | 12,790,630 | ||||

| Costs of services provided and goods sold | 27 | (2,051,150) | (5,879,700) | (1,839,071) | (5,485,463) | ||||

| Gross income | 2,336,219 | 6,710,083 | 2,497,992 | 7,305,167 | |||||

| Operating income (expenses): | |||||||||

| Selling expenses | 27 | (1,133,255) | (3,347,862) | (1,237,964) | (3,753,725) | ||||

| General and administrative | 27 | (412,194) | (1,238,982) | (415,479) | (1,268,694) | ||||

| Other income (expense), net | 28 | (107,873) | (282,736) | (50,877) | 1,369,155 | ||||

| (1,653,322) | (4,869,580) | (1,704,320) | (3,653,264) | ||||||

| Operating income | 682,897 | 1,840,503 | 793,672 | 3,651,903 | |||||

| Financial income (expenses): | |||||||||

| Financial revenue | 29 | 181,049 | 725,170 | 143,728 | 1,461,273 | ||||

| Financial expenses | 30 | (424,743) | (1,488,082) | (321,581) | (1,068,225) | ||||

| (243,694) | (762,912) | (177,853) | 393,048 | ||||||

| Income before income tax and social contribution | - | 439,203 | 1,077,591 | 615,819 | 4,044,951 | ||||

| Income tax and social contribution | 31 | (49,165) | (247,322) | 128,955 | (926,487) | ||||

| Net profit for the period | 390,038 | 830,269 | 744,774 | 3,118,464 | |||||

| Earnings per share attributable to the Company’s shareholders (expressed in R $ per share) | |||||||||

| Basic earnings per share | 32 | 0.36 | 0.03 | 0.02 | 0,07 | ||||

| Diluted earnings per share | 32 | 0.36 | 0.03 | ||||||

Explanatory notes are an integral part of the quarterly information

| 5 |

| TIM S.A. | ||||||||

| STATEMENT OF COMPREHENSIVE INCOME | ||||||||

| Periods ended September 30, 2020 and 2019 | ||||||||

| (In thousands of reais) | ||||||||

| 3rd Qtr/20 | 09/2020 | 3rd Qtr/19 | 09/2019 | |||||

| Net income for the period | 390,038 | 830,269 | 744,774 | 3,118,464 | ||||

| Other items in comprehensive income | - | - | - | - | ||||

| Total comprehensive income for the period | 390,038 | 830,269 | 744,774 | 3,118,464 | ||||

Explanatory notes are an integral part of the quarterly information.

| 6 |

| TIM S.A. | ||||||||||||||||

| STATEMENT OF CHANGES IN EQUITY | ||||||||||||||||

| Period ended 30 September | ||||||||||||||||

| (In thousands of reais) | ||||||||||||||||

| Profit reserves | ||||||||||||||||

| Share Capital | Capital reserve | Legal reserve | Reserve for expansion | Tax incentive Reserve | Asset valuation adjustments | Accumulated profits | Total | |||||||||

| Balances on December 31, 2019 | 13,476,172 | 36,154 | 952,486 | 5,985,793 | 1,612,019 | (3,817) | - | 22,058,807 | ||||||||

| Total comprehensive income for the period | ||||||||||||||||

| Net profit for the period | - | - | - | - | - | - | 830,269 | 830,269 | ||||||||

| Total comprehensive income for the period | - | - | - | - | - | - | 830,269 | 830,269 | ||||||||

| Total shareholder contributions and distributions to shareholders | ||||||||||||||||

| Incorporation of a company from TIM Group (Note 1) | 1,719 | 353,604 | - | - | 355,323 | |||||||||||

| Stock options | - | 4,828 | - | - | - | - | 4,828 | |||||||||

| Total contributions from shareholders and distributions to shareholders | 1,719 | 358,432 | - | - | - | - | - | - | - | - | - | - | - | 360,151 | ||

| Balances on September 30, 2020 | 13,477,891 | 394,586 | 952,486 | 5,985,793 | 1,612,019 | (3,817) | 830,269 | 23,249,227 | ||||||||

Explanatory notes are an integral part of the quarterly information.

| 7 |

| TIM S.A. | ||||||||||||||||

| STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY | ||||||||||||||||

| Periods ended 30 September | ||||||||||||||||

| (In thousands of reais) | ||||||||||||||||

| Profit reserves | ||||||||||||||||

| Share Capital | Capital reserve | Legal reserve | Reserve for expansion | Tax incentive Reserve | Asset valuation adjustments | Accumulated profits | Total | |||||||||

| Balances on January 1, 2019 | 13,476,172 | 33,363 | 769,187 | 5,063,991 | 39,958 | (1,882) | - | 19,380,789 | ||||||||

| Total comprehensive income for the period | ||||||||||||||||

| Net income for the period | 3,118,464 | 3,118,464 | ||||||||||||||

| Total comprehensive income for the period | - | - | - | - | - | - | 3,118,464 | 3,118,464 | ||||||||

| Total shareholder contributions and distributions to shareholders | ||||||||||||||||

| Stock options | - | 2,281 | - | - | - | - | 2,281 | |||||||||

| Interest on shareholders´ equity | - | - | - | - | (905,000) | (905,000) | ||||||||||

| Total shareholder contributions and distributions to shareholders | - | 2,281 | - | - | - | - | (905,000) | (902,719) | ||||||||

| Balances as of September 30, 2019 | 13,476,172 | 35,644 | 769,187 | 5,063,991 | 39,958 | (1,882) | 2,213,464 | 21,596,534 | ||||||||

Explanatory notes are an integral part of the quarterly information.

| 8 |

| TIM S.A. | |||||

| CASH FLOW STATEMENT | |||||

| Period ended September 30 | |||||

| (In thousands of reais) | |||||

| Note | 09/2020 | 09/2019 | |||

| Operational activities | |||||

| Income before income tax and social contribution | 1,077,591 | 4,044,951 | |||

| Adjustments to reconcile income to net cash generated by operating activities: | |||||

| Depreciation and amortization | 27 | 4,148,184 | 3,747,057 | ||

| Residual value of property, plant and equipment and intangible written off | 14.389 | 23,254 | |||

| Interest on asset retirement obligation | (217) | 286 | |||

| Provision for administrative proceedings and lawsuits | 23 | 257,190 | 439,531 | ||

| Monetary restatement on judicial deposits and legal and administrative proceedings | 104,256 | 175,696 | |||

| Interest, monetary and exchange rate variations on borrowings and other financial adjustments | 147,722 | (1,111,831) | |||

| Interest on leases payable | 30 | 604,119 | 616,710 | ||

| Interest on leases receivable | 29 | 572 | (6,422) | ||

| Provision for expected credit losses | 27 | 455,357 | 561,455 | ||

| Stock options | 25 | 4,829 | 2,281 | ||

| 6,813,992 | 8,492,968 | ||||

| Reduction (increase) in operating assets | |||||

| Trade accounts receivable | (225,583) | (867,983) | |||

| Taxes, charges and contributions recoverable | 1,180,796 | (1,647,694) | |||

| Inventories | (3,584) | (27,975) | |||

| Prepaid expenses | (95,353) | (158,867) | |||

| Judicial deposits | 132,850 | 120,146 | |||

| Other assets | (40,870) | (60,569) | |||

| Increase (decrease) in operating liabilities | |||||

| Payroll and related charges | 68,021 | 30,346 | |||

| Suppliers | (1,773,769) | (1,394,230) | |||

| Taxes, fees and contributions | (465,972) | (27,438) | |||

| Authorizations payable | (19,208) | (108,508) | |||

| Payments for legal and administrative proceedings | 23 | (309,865) | (429,979) | ||

| Deferred revenue | (118,528) | (176,697) | |||

| Other liabilities | (100,751) | (83,104) | |||

| Cash generated by operations | 5,042,176 | 3,660,416 | |||

| Income tax and social contribution paid | (66,890) | (179,280) | |||

| Net cash generated by operating activities | 4,975,286 | 3,481,136 | |||

| 9 |

| TIM S.A. | ||||||||||

| CASH FLOW STATEMENT | ||||||||||

| Period ended September 30 | ||||||||||

| (In thousands of reais) | ||||||||||

| Note | 09/2020 | 09/2019 | ||||||||

| Investment activities | |||||

| Marketable securities | (871,039) | (4,872) | |||

| Additions to property, plant and equipment and intangible | (2,427,392) | (2,511,846) | |||

| Cash from the incorporation of TIM Participações | 21,959 | - | |||

| Receipt of leases | 3,605 | 7,968 | |||

| Net cash applied on investment activities | (3,272,867) | (2,508,750) | |||

| Financing activities | |||||

| New borrowings | 1,800,000 | 1,000,000 | |||

| Amortization of borrowings | (1,737,010) | (513,344) | |||

| Interest paid- Borrowings | (62,695) | (86,673) | |||

| Payment of leases | (679,786) | (571,663) | |||

| Interest paid on leases | (597,845) | (598,369) | |||

| Derivative financial instruments | 13,130 | 21,901 | |||

| Dividends and interest on shareholders´ equity paid | (597,555) | (423,792) | |||

| Net cash applied in financing activities | (1,861,761) | (1,171,940) | |||

| Increase (decrease) in cash and cash equivalents | (159,342) | (199,554) | |||

| Cash and cash equivalents at the beginning of the financial period | 2,284,048 | 1,075,363 | |||

| Cash and cash equivalents at the end of the period | 2,124,706 | 875,809 |

| 09/2020 | 09/2019 | ||||||||

| Non-cash transactions | |||||||||

| Additions to property, plant and equipment and intangible assets - with no effect on cash | (693,865) | (6,169,968) | |||||||

| Increase in lease liabilities - no effect on cash | 693,865 | 6,169,968 | |||||||

Explanatory notes are an integral part of the quarterly information.

| 10 |

| TIM S.A. | ||||

| STATEMENT OF VALUE ADDED | ||||

| Periods ended September 30, 2020 and 2019 | ||||

| (In thousands of reais) | ||||

| 09/2020 | 09/2019 | |||

| Revenue | ||||

| Gross operating income | 17,891,710 | 18,649,818 | ||

| Other revenue | - | 1,795,000 | ||

| Provision for expected credit losses | (455,357) | (561,455) | ||

| Discounts granted, returns and others | (1,892,087) | (2,115,726) | ||

| 15,544,266 | 17,767,637 | |||

| Supplies acquired from third parties | ||||

| Costs of services provided and goods sold | (1,872,486) | (1,914,552) | ||

| Materials, energy, third-party services and others | (2,187,597) | (2,571,577) | ||

| (4,060,083) | (4,486,129) | |||

| Retentions | ||||

| Depreciation and amortization | (4,148,184) | (3,747,057) | ||

| Net added value generated | 7,335,999 | 9,534,451 | ||

| Value added received in transfer | ||||

| Financial revenue | 725,170 | 1,461,273 | ||

| 725,170 | 1,461,273 | |||

| Total added value to be distributed | 8,061,169 | 10,995,724 | ||

| Added value distribution | ||||

| Personnel and expenses | ||||

| Direct remuneration | 392,274 | 384,586 | ||

| Benefit | 147,775 | 129,877 | ||

| F. G. T. S | 43,728 | 42,126 | ||

| Others | 32,710 | 97,605 | ||

| 616,487 | 654,194 | |||

| Taxes, fees and contributions | ||||

| Federal | 1,618,441 | 2,586,315 | ||

| State | 2,791,312 | 2,898,868 | ||

| Municipal | 88,447 | 82,349 | ||

| 4,498,200 | 5,567,532 | |||

| Third-party Capital Remuneration | ||||

| Interest | 1,486,522 | 1,067,008 | ||

| Rentals | 626,968 | 585,525 | ||

| 2,113,490 | 1,652,533 | |||

| Others | ||||

| Social investment | 2,723 | 3,001 | ||

| 2,723 | 3,001 | |||

| Shareholder's Equity Remuneration | ||||

| Dividends and interest on shareholders´ equity | - | 905,000 | ||

| Retained earnings | 830,269 | 2,213,464 | ||

| 830,269 | 3,118,464 | |||

Explanatory notes are an integral part of the quarterly information

| 11 |

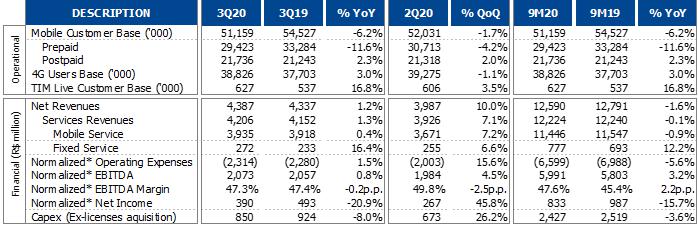

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Highlights

From volume to value: new approach brought more resilience and contributed to the ongoing and gradual recovery of commercial dynamics

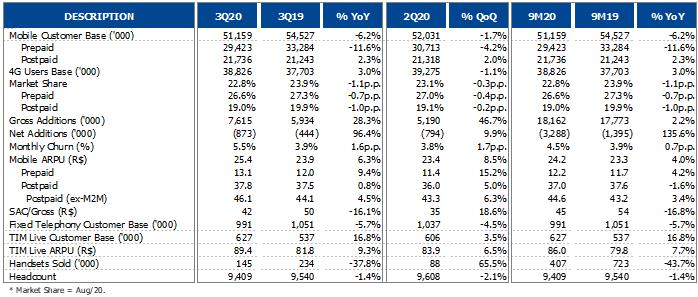

| · | Mobile ARPU posted strong growth of 6.3% YoY, reaching R$ 25.4; |

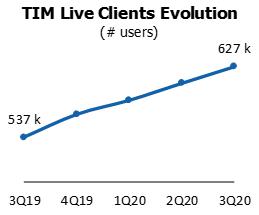

| · | TIM Live’s UBB customer base reached 627k connections, adding ~90k customers in the 12 past months, up 16.8% YoY; |

| · | TIM Live’s ARPU posted robust growth of 9.3% YoY, reaching R$ 89.4. |

Strong infrastructure development despite the pandemic challenges

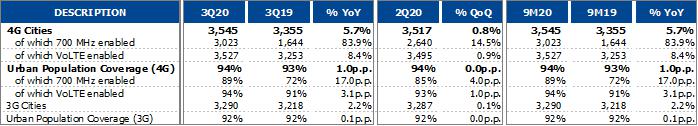

| · | Leader in 4G coverage spanning 3,545 cities, with emphasis to 700MHz frequency expansion, now reaching 3,023 cities; |

| · | VoLTE technology available in more than 3,527 cities, improving users’ voice experience; |

| · | Acceleration of FTTH expansion with 3.1 million homes passed by fiber optic in 30 cities in September. |

Revenue growth picks up without losing cost efficiency

| · | Service Revenue posted solid trend reversal and growth of 1.3% YoY, with contribution from Mobile (+0.4% YoY) and Fixed (+16.4% YoY) segments; |

| · | TIM Live Revenues advanced 29.1% YoY, maintaining its strong growth; |

| · | Provision for Doubtful Accounts (Bad Debt) fell 46.2% YoY, to 1.76% of Gross Revenue (lower level since 2017) and contributed to keep Normalized Costs and Expenses* growing less than inflation (+1.5% YoY), after commercial activity picked up; |

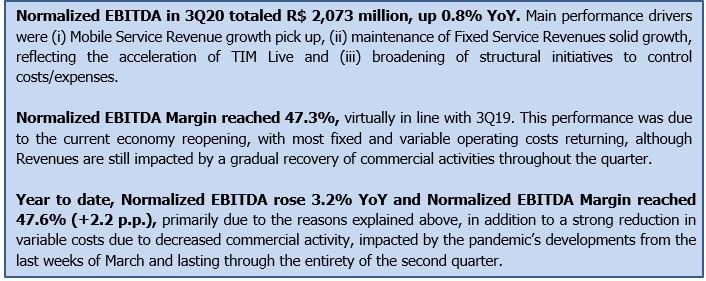

| · | Normalized EBITDA* reached R$ 2.1 billion, up 0.8% YoY, reflecting gradual commercial activity pick-up; |

| · | Operating Free Cash Flow posted a significant increase, up by 11.8% YoY, reaching R$ 1.3 billion in the quarter. |

*Normalized EBITDA according to the items in the Costs section (+R$ 2.6 million in 1Q20, -R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Financial Results normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 66.4 million in 3Q19 and -R$ 1,051 million in 2Q19). Net income normalized by tax credit and other effects (+R$ 35.2 million in 3Q19 and +R$ 865 million in 2Q19) and by adjustment to deferred taxes (+R$ 30.3 million in 1Q19).

| 12 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Financial Performance (Including the effects of IFRS 9, 15 and 16)

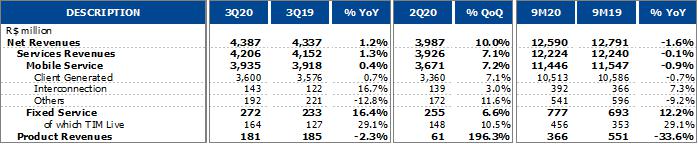

OPERATING REVENUE

Note: due to the reverse incorporation of TIM Participações S.A. into TIM S.A. (former wholly owned subsidiary of TIM Participações S.A.) by the end of August 2020, 3Q20 and 9M20 results present TIM S.A.’s figures, in accordance with company’s financial statements (ITR). In order to provide an adequate comparison from an economic standpoint, 3Q19 and 9M19 data disclosed reflect the numbers reported under TIM Participações’ financial statements as of September 2019.

Year to date, Net Revenues totaled R$ 12,590 million, down by 1.6%, reflecting reduced commercial activities due to the Covid-19 pandemic, which caused drops of 0.1% in Service Revenues and 33.6% in Product Revenues.

Breakdown of Mobile Segment (net of taxes and deductions):

Mobile Service Revenues (MSR) reached R$ 3,935 million in 3Q20, up by 7.2% compared to 2Q20, mainly reflecting the recovery in the prepaid segment, with gradual increase in the number of rechargers, positively impacted by the economy reopening in most Brazilian cities.

| 13 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Year on year, MSR increased by 0.4% in 3Q20. This expansion is mostly related to the Mobile ARPU (Average Monthly Revenues per User) performance, that grew 6.3% YoY and reached R$25.4, reflecting the maintenance of the company's successful efforts to monetize its customer base through migrations to higher value prepaid and postpaid plans.

The segments' ARPU, which excludes other mobile revenues, increased by 9.4% YoY in prepaid (R$ 13.1) and by 4.5% YoY in postpaid (ex-M2M) (R$ 46.1).

Breaking down each mobile segment in the third quarter:

| (i) | In the prepaid segment, with economic activity gradually resuming, we noted a steady recovery in rechargers, ending the quarter close to pre-pandemic levels. Rechargers rose by 10.6% vs. 2Q20, although still 2.6% below 3Q19 figures. The assertiveness of TIM Pré-Top still contributes to an increased recurrence and expansion of the segment’s ARPU. All effects combined caused Prepaid Revenue to drop 2.0% YoY (excluding interconnection), improving versus the decrease recorded in 2Q (-13.0% YoY). |

| (ii) | Postpaid segment also posted good recovery in the quarter, after the gradual reopening of physical sales channels by the end of the second quarter. In 3Q, we launched new offers for TIM’s Control and Postpaid clients together with C6 Bank, an unprecedented partnership that combines financial and telecom services, contributing to the good performance of new Postpaid lines acquisition (+418 thousand net additions YoY). Price readjustment for part of B2C plans in September had a small impact in revenue increase this quarter. Postpaid Revenues grew 1.2% YoY in the quarter (excluding interconnection), versus -1.7% YoY in 2Q20. |

Year to date, MSR was down 0.9% YoY, due to COVID-19 impacts and a still challenging economic environment of uneven recovery.

| 14 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Interconnection Revenues (ITX) grew 16.7% YoY in 3Q20, reflecting the impact from a higher MTR rate (Mobile Termination Revenue +31.2% YoY) in addition to an increase in incoming traffic (+11.3% YoY). After successive cuts to MTR, the foreseen Anatel’s increase was applied at the end of the first quarter. The incidence of MTR on Net Service Revenues reached 2.7% in the quarter.

Other Revenues fell 12.8% YoY in 3Q20, but increased compared to the prior quarter (+11.6%). The annual decline was basically due to the reduction of fines on other mobile service revenues. It should be noted that the performance of this line is still impacted mainly by revenues from network sharing and swap agreements, in line with the company's strategy to expand the fiber optic transport infrastructure (backbone and backhaul) with higher efficiency in the allocation of resources (Capex and Opex).

Breakdown of Fixed Segment (net of taxes and deductions):

| Fixed Service Revenues totaled R$ 272 million in the quarter, a 16.4% increase from 3Q19. This performance reflects the growth of TIM Live, which rose 29.1% YoY in 3Q20 and already accounts for approximately 60% of fixed service revenues. At the end of September, Live was present in 32 cities and will keep expanding in the coming quarters. |  |

The remaining fixed services reversed the drop observed in the previous quarter and grew 1.2% YoY (versus -7.3% in 2Q20). Year to date, Total Fixed Service Revenues summed R$ 777 million, up 12.2% YoY.

| ARPU (Average Monthly Revenues per User) for TIM Live was R$ 89.4, 9.3% higher than in 3Q19. The performance is explained by the growing penetration of higher-value FTTH offers with faster speeds and price readjustments as of July 2020 in most plans. |  |

| 15 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

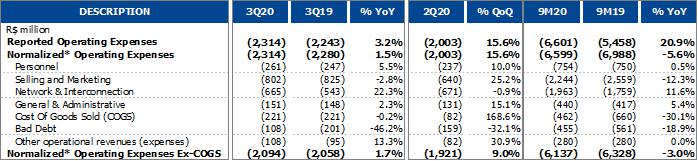

OPERATING COSTS AND EXPENSES

*Operating Costs normalized by adjustments to the sale-leaseback contract of towers (+R$ 2.6 million in 1Q20 and +R$ 1.5 million in 1Q19), tax credit due to the exclusion of ICMS from the calculation basis for PIS/COFINS (-R$ 75.2 million in 3Q19 and -R$ 1,720 million in 2Q19), legal services connected to the PIS/COFINS court decision (+R$ 4.4 million in 3Q19 and +R$ 3.5 million in 2Q19), revision of loss prognosis for labor contingencies related to employees, tax contingencies and civil contingencies (+R$ 11.2 million in 3Q19 and +R$ 221.8 million in 2Q19) and contract losses (+R$ 22.4 million in 3Q19).

Reported Operating Costs and Expenses were R$ 2,314 million in 3Q20 (+3.2% YoY), mainly explained by non-recurring effects accounted for in 3Q19 and referred to: i) tax credits (R$ 75 million positive impact) related to the exclusion of ICMS tax from the calculation basis for PIS/COFINS and ii) revision of loss prognosis for civil contingencies, contract losses and legal services (R$38.1 million negative impact). In this quarter, the line was not impacted by non-recurring expenses.

Note: due to the adoption of IFRS 16, Operating Costs and Expenses - mainly those reported within the Network account - are not impacted by rents, sharing or other types of leases with terms exceeding 12 months, as determined by the standard. Therefore, the amounts for long-term contracts related to infrastructure lease (in addition to others less relevant), important for the company’s operations, are reflected in the P&L under Depreciation and Financial Expenses.

Breakdown of Costs and Expenses Performance:

Personnel increased by 5.5% YoY in 3Q20. This performance was mostly influenced by organic elements such as inflation on wages and benefits. Year to date, personnel posted a smaller increase (+0.5% YoY), given the reduction in 2Q20 in commercial personnel expenses because of the closing of physical sales channels partially offset 1Q20 and 3Q20 increases.

| 16 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Selling and Marketing Expenses were down 2.8% YoY in 3Q20, reflecting another quarter marked by the structural trends, with efficiency gains from process digitalization, increased penetration of digital channels and a reduction in FISTEL expenses more than offsetting increased marketing expenses related to more exposure in the media. Year to date, it has fallen 12.3%, due to - in addition to the items mentioned above – the reduced sales observed in 2Q20, with decreased spending on commissions for recharges and for line activations and lower marketing costs during the pandemic.

The Network and Interconnection Group rose 22.3% YoY in 3Q20, boosted by higher costs from the interconnection subgroup (ITX), which are explained mainly by a higher mobile termination rate (MTR) as from February 2020. Network expenses also increased in 3Q20, stemming from higher costs from infrastructure rental, sharing and maintenance. Year to date, Network and Interconnection have risen 11.6%, given the same reasons for the quarterly increase.

General and Administrative Expenses (G&A) grew 2.3% YoY in the quarter. This increase is mostly explained by the net effect between: i) higher third-party service expenses, vehicle rentals and fines; and ii) lower expenses with professional services (especially legal) and cleaning and surveillance regular services. Year to date, the line has risen 5.4%, explained, in addition to the items above, by higher spending on IT projects, consulting, legal and administrative services in 1Q20.

Cost of Goods Sold (COGS) remained stable, totaling R$ 221 million in 3Q20 (-0.2% YoY). The increase of higher value products in the mix compensated the lower volume of handsets sold. It is important to mention that the increase in this account in relation to 2Q20 (+168.6%) followed the trend observed in Product Revenues, which posted a strong recovery after the pandemic. There has been a significant increase in handset sales (+66% QoQ), related to the reopening of the majority of TIM’s physical channels (the most relevant handset sales channel for the company) since June, as well as to adjustments in commercial policy and assertive offers. In 9M20, this account has experienced a decrease of 30.1% YoY, due to the closing of stores previously mentioned.

| 17 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

In 3Q20, Provisions for Doubtful Accounts (Bad Debt) fell 46.2% YoY, representing the second consecutive quarter with an annual decline. In a quarterly comparison, Bad Debt also improved (-32.1% QoQ), reflecting the continuous efforts to enhance client acquisition through more robust credit models and policies, and higher efficiency in collection and recovery. The collection curves have shown continuous improvement in the past few months and helped bad debt returning to levels observed in 2017, totaling R$ 108 million, and accounting for 1.8% of TIM’s Gross Revenue. Year to date, the line declined 18.9% YoY. |

|

Other Operating Expenses were up by 13.3% YoY in 3Q20, explained by the net effect between: i) lower revenues from late payment fines (the company stopped collecting fines of this nature when the pandemic began and resumed collection in August); ii) increase in provisioning for third-party labor lawsuits; and iii) reduction in losses from labor lawsuits. Year to date, this line remained stable.

Subscriber Acquisition Costs (SAC = subsidy + commissioning + advertising expenses) totaled R$ 42.0 per gross addition in 3Q20, down by 16.1% YoY. The steep reduction was due to more efficient selling and marketing costs.

|

The SAC/ARPU ratio (payback per client) fell YoY, reaching 1.7 month from 2.1 months in 3Q19.

|

| 18 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

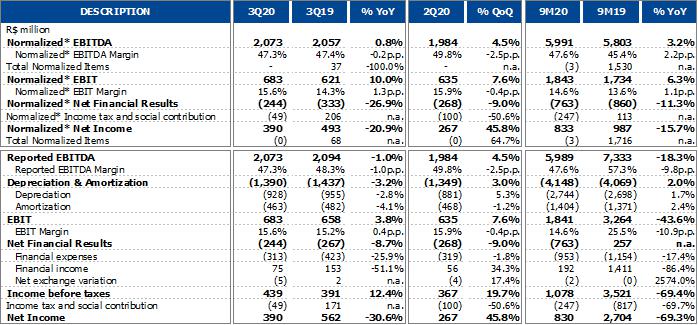

FROM EBITDA TO NET INCOME

*EBITDA normalized according to the items in the Costs section (+R$ 2.6 million in 1Q20, -R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19). Financial Results normalized by monetary correction on tax credit and labor, tax and civil contingencies (-R$ 64.6 million in 3Q19 and -R$ 1,051 million in 2Q19). Net income normalized by tax credit and other effects (+R$ 35.2 million in 3Q19 and +R$ 865 million in 2Q19) and by adjustment to deferred taxes (+R$ 30.3 million in 1Q19).

EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization)

EBITDA exposure to MTR was 0.7% in 3Q20. This quarter, net MTR (revenue – cost) was positive due to interconnection revenues slightly higher than MTR costs.

| 19 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

DEPRECIATION AND AMORTIZATION (D&A) / EBIT

In 3Q20, D&A declined 3.2% YoY, explained mostly by a decrease in Depreciation of Leasings Right-of-Use and Software Amortization. Year to date, D&A grew 2.4% YoY, explained by an increase in the amortization of the 700 Mhz license related to operational expansion in new cities in the first half of the year, more than offsetting the changes explained above.

Normalized EBIT in 3Q20 grew 10.0% YoY. Normalized EBIT Margin ended the quarter at 15.6%, 1.3 p.p. wider compared to 3Q19. Year to date, Normalized EBIT rose 6.3% YoY and Normalized EBIT Margin reached 14.6%, up 1.1 p.p.

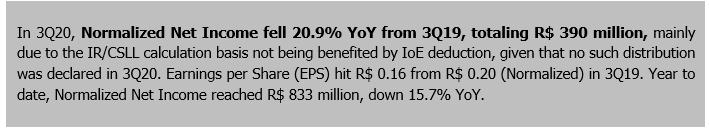

NET FINANCIAL RESULTS

Net Financial Results in 3Q20 were negative by R$ 244 million, R$ 90 million better compared to 3Q19. The difference is mainly related to the net result between:

| (i) | Lower financial expenses related to PIS/COFINS payments on Interest on Equity (IoE), which was declared in 3Q19 but not in 3Q20; |

| (ii) | Lower financial expenses due to the decrease in interest rates and, consequently, lower debt interest accrual; |

| (iii) | Slight decrease in revenues from Interest on Financial Investments due to the reduction in the basic interest rate in the period, partially offset by a significant higher Cash position; |

| (iv) | Lower financial revenue from the monetary correction of the tax credit balance stemming from the right to exclude the ICMS from the calculation basis for PIS and COFINS payments (the remaining balance at the end of each period is updated by the Selic rate until full compensation, thus becoming a recurring element for the subsequent years) due to: i) lower credit balance and ii) lower basic interest rate. |

INCOME TAX AND SOCIAL CONTRIBUTION

In 3Q20, Reported Income Tax and Social Contribution totaled -R$ 49 million, compared to +R$ 171 million in 3Q19. The worsening is due to a comparison base benefited by IoE declared in 3Q19.

On a Normalized basis, there was a R$ 255 million worsening in 3Q20 compared to +R$ 206 million in 3Q19. This difference is also explained by IoE declared in 3Q19 but not in 3Q20.

In 3Q20, the effective tax rate was -11.2% vs. +71.1% in 3Q19 (on a Normalized basis). Year to date, the effective rate was -22.9% vs. +13.0% in 9M19 (on a Normalized basis), explained by the same reasons observed in 3Q20.

| 20 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

NET INCOME

| 21 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

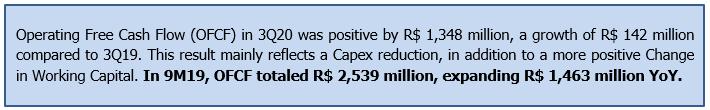

CASH FLOW, DEBT AND CAPEX

*Normalized EBITDA according to the items in the Costs section (+R$ 2.6 million in 1Q20, -R$ 37.1 million in 3Q19, -R$ 1,494 million in 2Q19 and +R$ 1.5 million in 1Q19).

In 3Q20, EBITDA-Capex reached R$ 1,223 million, with an increase of 7.9% YoY, taking EBITDA-Capex over Net Revenues to 27.9% (versus 26.1% in 3Q19). In 9M20, EBITDA-Capex growth was 8.5% YoY, while margin indicator was 28.3%.

In an exercise to exclude the financial leases effects from these indicators, 3Q20 EBITDA was recalculated considering these contracts as operating leases, thus affecting operating expenses. Therefore, EBITDA-AL (After Lease) minus Capex would sum up to R$ 805 million in 3Q20 (+10.5% YoY). In 9M20, EBITDA-AL minus Capex would be R$ 2,290 million (+7.7% YoY).

CAPEX

Capex totaled R$ 850 million in 3Q20, down by 8.0% compared to 3Q19. The drop is primarily explained by the reassessment of projects that were initially planned. As social distancing started, we noticed a change in the usage profile of our mobile network and, therefore, the mobile network dedicated Capex was reassessed, while the investments in fiber optic were maintained due to the higher demand for the broadband service.

Investments are still being allocated to infrastructure (91% of the total), mainly to projects in IT, 4G technology through 700 MHZ, transport network and FTTH expansion (which received approximately 16% of 3Q20 investments).

CHANGE IN WORKING CAPITAL

Change in Working Capital was positive by R$ 125 million compared to R$ 35 million in 3Q19. The smaller amount in 3Q19 is mostly due to an increase in Recoverable Taxes, due to tax credits related to the exclusion of ICMS from the calculation basis for PIS and COFINS payments. In 3Q20, this line was also benefited by the use of credits. Additionally, year on year, in the third quarter of 2020 the line was positively impacted by the variation in Trade Accounts Receivable, due to improvements in the collection curve, and Suppliers.

| 22 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Furthermore, in 1Q20, the inspection fees payment was postponed (about R$ 790 million) – which are usually due in March – to August 31st. In 3Q20, we partially paid these fees, nearly R$ 300 million, related to Condecine and CFRP, negatively impacting Change in Working Capital and Cash Flow for 3Q20. The remaining amount, related to Fistel (TFF), is still suspended with a payment date yet to be set.

DEBT AND CASH

Gross Debt in 3Q20 was R$ 9,815 million, up R$ 309 million YoY. The current balance includes (i) leasing recognition in the total amount of R$ 7,717 million (related to the sale of towers, the LT Amazonas project and leasing contracts with terms exceeding 12 months pursuant to IFRS 16); (ii) financing with banks summing up to R$ 2,594 million; and (iii) hedge position in the amount of R$ 496 million (reducing gross debt).

As of September 2020, TIM's financings (post-hedge) totaled R$ 2,098 million, being composed by contracts with foreign private banks and fully hedged to local currency. The average cost of debt excluding leases was 2.6% p.a. in the quarter, down when compared to 6.9% p.a. in 3Q19.

As mentioned in the 1Q20 and 2Q20 Earnings Releases, in April, the company's Board of Directors approved the borrowing of R$ 1,000 million to enhance liquidity ahead of possible impacts that the COVID-19 pandemic could cause on the economy. Of that amount, R$ 574 million were borrowed from Scotiabank in the same month. During 2Q20 TIM assessed the best conditions for borrowing the remainder and in July the company contracted R$ 426 million from BNP Paribas. Also, in July, TIM fully paid its Debentures (in the amount of R$1,000 million) originally distributed in January 2019.

| 23 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

At the end of the quarter, Cash and Short-term Investments totaled R$ 3,638 million, an increase of R$ 1,980 million YoY.

The average cash yield was 2.2% p.a. in 3Q20, down compared to 5.9% p.a. in 3Q19, following the reduction of the Selic base rate.

In 3Q20, Net Debt totaled R$ 6,178 million, down by R$ 1,671 million compared to the same period of the prior year, when net debt was R$ 7,849 million. This reduction is explained by the growth of Cash and Short-term Investments outpacing the rise of debt and leasing balance. Net Debt excluding financial leasing effects, Net Debt-AL, would reach -R$ 1,692 million, in other words, a “net cash” position with an improvement of R$ 2,040 million compared to the previous year.

Net Debt/EBITDA stood at 0.74x in the quarter. Excluding financial leases related to the adoption of IFRS 16, Net Debt-AL/EBITDA-AL was -0.26x in the quarter, down compared to 0.05x in 3Q19.

| 24 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

QUARTERLY EVENTS AND SUBSEQUENT EVENTS

PAYMENT OF INTEREST ON SHAREHOLDER’S EQUITY

On October 7th, 2020, TIM S.A. announced that the company’s Board of Directors approved the distribution of R$ 500 million as Interest on Equity (“IoE”). The payment will occur on November 10th, 2020, being October 19th, 2020, the date that for identification of shareholders entitled to receive such values. Thus, the shares acquired after that date will be ex-Interest on Shareholders’ Equity rights.

“STALKING HORSE” QUALIFICATION IN THE “OI MOBILE ASSETS UPI” ACQUISITION PROCESS

On September 7th, 2020, in continuity with the Material Facts disclosed on March 10th, 2020, July 18th, 2020, July 27th, 2020 and August 7th, 2020, TIM S.A. informed its shareholders and to the market in general that, in replacement of the revised binding offer presented to the Oi Group on July 27th, 2020 (“Revised Offer”), together with Telefônica Brasil S.A. (“VIVO”) and Claro S.A. (“Claro” and, jointly with TIM and VIVO, the “Offerors”) a new proposal was submitted by the Offerors, on September 7th, 2020, through which they ratified the amount of R$16,500,000,000.00 (including R$756,000,000.00 for services to be provided in the transition period for until 12 months by Oi Group to the Offerors). In addition to this amount, the Offerors took the commitment to enter in long-term contracts for the provision of transmission capacity services and adjusted certain terms of the Revised Offer.

As a result, the Offerors were effectively qualified by Oi Group to participate in the competitive process of sale of Mobile Assets UPI, on the condition of “stalking horse”, which should be reflected in the proposal of adjustment of Oi's Judicial Reorganization Plan, to be deliberate at the Creditors’ General Meeting of Oi Group convened for September 8th, 2020.

As a “stalking horse”, the Offerors will also have the right, at their sole discretion, to cover the highest value offer that may be presented in the said competitive process (“right to top”).

CORPORATE RESTRUCTURING CONCLUSION AND CHANGES IN NEGOTIATING CODES (TICKERS)

On October 13th, 2020, TIM shares adopted new tickers on the Brazilian (B3) and New York (NYSE) stock exchanges. At B3, it will change from TIMP3 to TIMS3. On the NYSE, it will become TIMB, and no longer TSU. The change was celebrated on October 14th at the American stock exchange with a "Ring the Bell".

| 25 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

The change results from the incorporation of TIM Participações into its wholly owned subsidiary TIM S.A., which will start trading shares and will be listed on the ‘Novo Mercado’, a B3’s special listing segment intended for companies that voluntarily adopt corporate governance practices in addition to those required by Brazilian law. TIM is the only telco operator listed in the segment.

TIM AND FCA CLOSE UNPRECEDENT PARTNERSHIP FOR CONNECTED CARS

TIM and Fiat Chrysler Automobiles (FCA) have established a partnership to offer connectivity solutions for vehicles of the Fiat, Jeep and RAM brands in Brazil from the first half of 2021. As part of the global strategy to develop ecosystems for connected services and enhance the digital experience of customers, future FCA’s launches in the country will feature eSIM, a virtual chip for onboard native Wi-Fi access, with the quality of TIM's 4G coverage and Internet of Things ("IoT") network.

The connectivity will allow the car to communicate actively and in real time with the customer, the FCA and the dealers network. FCA customers will benefit from a variety of services, from entertainment and security content to applications that interacts with the vehicle. It will also allow the remote identification of possible vehicle failures with the possibility of more agile and accurate diagnostics. All this thanks to the connected sensors, which continuously send data to the FCA.

The

partnership strengthens TIM's presence in the segment of services provided to companies – B2B, inaugurating its operations

in the vertical of connected cars that joins the solid portfolio of IoT solutions. At the same time, it enables the opening of

new ways of reaching the customer in the segment of services provided to consumers – B2C, through the provision of "in-car"

services.

| 26 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Operating and Marketing Performance

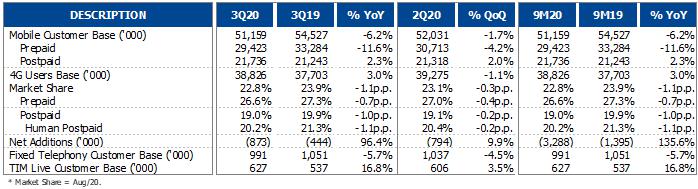

MOBILE SEGMENT:

GENERAL MARKET

In August 2020, the mobile market reported a slight drop of 0.4% YoY, the lowest retreat in five years. Prepaid continued to boost this retreat, which results from continued structural trend of SIM card consolidation, however, to a lesser extent compared to previous periods. The segment lost 8.7 million users in the past 12 months. Postpaid segment maintained its expansion pace, with net additions of 7.8 million in the last 12 months. This is the smallest difference recorded among the segments’ additions since 2015.

TIM

TIM ended 3Q20 with a total of 51.2 million users, down by 6.2% in the period.

|

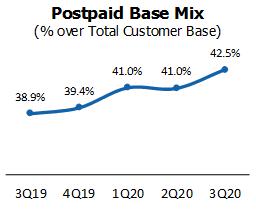

The postpaid base totaled 21.7 million lines up by 2.3% YoY. This segment mix over total base reached the highest share ever recorded, 42.5% (+3.5 p.p. YoY). Additions over the past 12 months accounted for a positive balance of 493k users. Even though brick and mortar stores operated with ~80% of potential capacity throughout the third quarter, human post-paid gross additions increased 75% QoQ. A positive trend was also noticed in churn, with an expressive improvement in involuntary disconnection, a result of better acquisition quality and growth in collection curve. Thus, B2C churn rate reached the lowest level in the past 2 years. |

In the quarter, strengthening its innovation DNA, the Company began the first partnership between a telecom company and a digital bank. Offers launched together with C6 Bank add advantages to the portfolio, by providing more convenience and adding new experiences to Control and Postpaid plans offers. The partnership brings relevant figures: up to now, the opening of accounts in the digital bank exceeded 800k.

| 27 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

The prepaid base ended the quarter with 29.4 million users, down by 11.6% YoY. Despite net disconnections reaching 3.9 million lines in the past 12 months, the quarter posted the largest gross additions volume since 2Q18. The combination of this increase with the adjustments made to this segment’s cancellation rule provides a more positive expectation to the addition dynamics in the coming periods. Recharge indicators continue to present a significant sequential improvement. We almost returned to pre-COVID levels, with rechargers mix in the base surpassing the average of the first two months of the year and recharges sell out being at a close level.

The 4G base ended the period with 38.8 million users, maintaining its continuous growth trend, but to a slower pace (+3.0% YoY). Total handsets featuring this technology reached 83% of human accesses (+8.7 p.p. YoY).

The M2M base ended the quarter with 4.1 million users (+19% YoY). With the economy gradually picking up, this segment’s demand is growing again, mainly from the financial services sector. Excluding the Porto Seguro Conecta incorporation period (in 2Q19), 3Q20 posted a record in net additions, +280k users in the quarter.

FIXED SEGMENT:

TIM Live reached 627k connections in 3Q20 (+16.8% YoY). Net additions to FTTH (Fiber To The Home) kept accelerating, with 37k new users in the quarter and 133k in the past 12 months.

The largest share of speed over 100 mbps in the sales mix – more than 70% in the period - reflected in the base, as, at the end of the period, had 44% of the users with faster speed plans (+17.6 p.p. YoY). |

|

We ended the quarter in 32 cities, of which 30 with FTTH (+50% YoY). In October, continuing the expansion plan, we carried out the commercial launch of another strategic city: Guarulhos (SP).

| 28 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Quality and Network

QUALITY AND CUSTOMER EXPERIENCE

The quality of our customer caring processes has always been greatly important to the Company in the ongoing pursuit of efficiency. Therefore, we developed mechanisms to simplify self-service, which have been showing positive results. In 3Q20, Meu TIM once again proves to be a fundamental toll to simplify caring processes - providing customers with greater transparency and control to manage their plans. The 4.3% YoY growth in the monthly average number of Meu TIM app unique users in the quarter demonstrates the Company’s success in stimulating and providing functionalities of interest to customers through this channel. The 43.9% YoY decline in human interactions also corroborates to the channel’s importance, reducing dependency on call centers.

Another innovative initiative explored by the Company is the use of artificial intelligence at the customer service center. These innovations bring benefits to customers, by implementing tools that can automatically detect possible problems in the services provided to the users, suggesting corrective measures or solving them. TIM’s cognitive self-service provide voice responses, in natural language and in real time, to consumers’ doubts or problems about the benefits of each plan, invoice payment, in addition to other services such as hiring data service, unblock lines, information contestation and others. In 3Q20, we had on average 3.5 million self-services per month through the cognitive assistant – serving our three main segments: Postpaid, Control and Prepaid. In addition to the currently existing retention in the traditional IVR, it is already possible to replace 35% of the calls that would be answered by a human attendant by the cognitive assistant using artificial intelligence. By the end of the quarter, with the implementation of this technology, we experienced an increase of 70% in the primary retention rate of the new IVR when compared to the previous model. This initiative, favoring consumers, complies with TIM’s purpose of providing the best experience within the digital transformation scope.

| 29 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

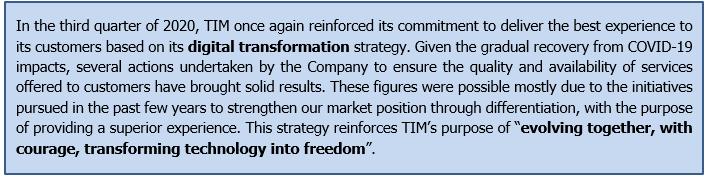

Regarding sales, despite the gradual reopening of stores throughout the country, the use of digital channels remained strong in the quarter. In the period, digital channel sales posted solid results: pure postpaid acquisitions increased by 12.8% YoY, while consumer control was up by 4.0% YoY and TIM Live digital sales rose 15.9% YoY. Digital recharges mix also continued to be relevant, with a ~2 p.p. growth YoY.

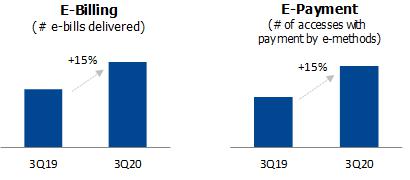

Following the same trend, digital mechanisms for billing and payment kept their growth pace in 3Q20. Invoices delivered through these channels posted a 14.9% YoY growth. At the same time, total customers digitally paying their invoice increased by 15.3% YoY. Another convenience offered to TIM’s customers is the possibility to recharge and/or check balances and usage limits, as well as the opportunity to receive their invoices through WhatsApp.

| 30 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

NETWORK DEVELOPMENT

For another quarter, the Company reinforced its commitment to the enhancement of its services and continuous quality improvement to ensure the best user experience for its customers. The focus on the expansion and improvement of its network infrastructure remains a pivotal pillar in our business plan.

Capex allocated to infrastructure projects (Network + IT) surpassed 90%, using analytical tools to ensure efficient allocation of resources. Some of the most important initiatives are:

| o | Expansion of the fiber optic network (backbone, backhaul and FTTH); |

| o | Frequency refarming; |

| o | Aggregation of carriers; |

| o | Densification of sites; | |

| o | Network sharing agreements. |

Among the main actions and projects underway focused on the modernization, efficiency and enhancement of our infrastructure, we highlight:

| o | Installation of multiple data centers to enhance experience, being 14 DCC (Data Center Core) and 19 DCE (Data Center Edge) - total of 33 at the end of 3Q20; |

| o | Expansion of the 4G coverage to all Brazilian municipalities until 2023; |

| o | Expansion of 4.5G coverage to 1,279 cities; |

| o | Expansion of 700MHz frequency 4G use for 3,023 cities; |

| o | Expansion of VoLTE, available in 3,527 cities; |

| o | Extension of refarming of 2.1 GHz frequency in 4G, reaching 319 cities; |

| o | Infrastructure virtualization project; |

| o | Mobile infrastructure sharing agreement with Vivo, geared towards Capex and Opex allocation efficiency; |

| o | Expansion of network capacity through the Massive MIMO solution; |

| 31 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

| o | Consolidation of NB-IoT network present in more than 3,445 municipalities, enabling the creation of IoT solutions in big cities as well as in distant municipalities. |

In 3Q19, TIM once again maintains the leadership in 4G coverage, reaching 3,545 cities (94% of the country's urban population). The 24% YoY growth in network elements for this technology reinforces the company's commitment to the evolution of the mobile network's infrastructure quality and capacity. As a result, 4G data traffic reached its highest level ever in the quarter and accounted for approximately 89% of the total (+5.0 p.p. YoY).

In transport infrastructure, TIM reached a total of 21,762 sites in 3Q20, and 81% of said units are connected via high capacity backhaul. As a result, it reached more than 105,000 km with fiber optic for backbone and backhaul, a 11.1% YoY advance.

The expansion of fixed broadband coverage keeps evolving positively. FTTH rolled out commercial activities in another 4 regions in the quarter: Belo Horizonte (MG), Taguatinga (DF), Samambaia (DF) and Ceilândia (DF). Thus, total homes passed served with the technology reached 3.1 million units, while FTTC ended 3Q20 at 3.7 million – totaling 6.2 million households in 32 cities (FTTH + FTTC)[1].

Finally, with 1,668 active Biosites at the end of 3Q20, the development of Biosite installation projects is also aligned with the company's corporate social responsibility values. These structures provide a solution for the densification of the mobile access network (antennas/towers) with an extremely low visual and urban impact. Biosites also contribute to the harmonization with the environment and urban infrastructure – having a multifunctional capability of aggregating telecommunications transmission, lighting and security cameras -, besides being cheaper and faster to install.

Currently, the company is authorized to use more than 110 MHz, with 36 MHz in frequencies below 1 GHz distributed as follows:

[1] (+) Rio de Janeiro (RJ), São Gonçalo (RJ), Nilópolis (RJ), Nova Iguaçu (RJ), São João do Meriti (RJ), Duque de Caxias (RJ), São Paulo (SP), Mauá (SP), Poá (SP), Suzano (SP), Francisco Morato (SP), Franco da Rocha (SP), Diadema (SP), Salvador (BA), Lauro de Freitas (BA), Camaçari (BA), Feira de Santana (BA), Recife (PE), Olinda (PE), Jaboatão dos Guararapes (PE), Paulista (PE), Goiânia (GO), Aparecida de Goiânia (GO), Anápolis (GO), Manaus (AM), Betim (MG), Contagem (MG) and Brasília (DF).

| 32 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

| Average Spectrum Weighted by Population | |||||

| 700 MHz | 850 MHz | 900 MHz | 1,800 MHz | 2,100 MHz | 2,500 MHz |

| 20 | 11 | 5 | 35 | 22 | 20 |

| 33 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Environmental, Social & Governance

NETWORK DEVELOPMENT

TIM is pioneer in ESG (“Environmental, Social & Governance”) concerns in the Brazilian Telecommunications sector and has been working on these pillars for more than a decade with a long-term vision and integrated with its strategy, which are reflected in important milestones: 12 consecutive years in the portfolio of the B3 Sustainability Index (ISE-B3); since 2011, it is part of the Novo Mercado; it was the first and unique Telco to be awarded the Pró-Ética Seal by the Brazilian Office of the Comptroller General (“CGU”).; it is a signatory to the Global Compact since 2008 and member of the Human Rights Working Group organized by the Brazilian Network of the Global Compact since 2015; in addition, since 2010 it publishes its GHG emissions inventory in accordance with the Brazil GHG Protocol Program and, for 12 years, it has published for its stakeholders its Sustainability Report in accordance with the Global Reporting Initiative (“GRI”) Standards methodology. In this context, we highlight the main ESG accomplishments and developments in the quarter:

| o | TIM was announced as a constituent of the new S&P B3 Brasil ESG Index and ranked among the top 10 companies in the index. In addition, the Company was announced among the three companies listed on B3 with more women on the Board of Directors, according to the TEVA ESG Women on the Board Index®, which is the first diversity and governance index in Brazil. |

| o | In August, Instituto TIM (“TIM Institute”) celebrated its 7 years of existence. Throughout these years, the TIM Institute has remained steadfast in its purpose of democratizing science, technology and innovation, promoting human development in more than 500 municipalities in the 26 states and the Federal District, benefiting more than 700 thousand people, either through its own initiatives or by supporting projects of organizations that work towards this same objective. |

| o | To minimize the social impacts caused by COVID-19, Instituto TIM has decided to add efforts to the action promoted by the Instituto Biomob for ensuring the feeding of families of impaired people in communities from Rio de Janeiro. At least 3,000 people were benefited by the donation of more than 18 tons of food. |

| o | Diversity: TIM sponsored the AfroPresença initiative, an online event promoted by the Public Labour Prosecution Office and the UN Global Compact to promote work opportunities to black college students. |

| 34 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

| o | In September TIM had 1,668 biosites installed. Solution for the densification of the mobile access network, these sites are more sustainable, less expensive, easier and faster to install. They have a low visual impact and are multifunctional, permitting the aggregation of other services such as lighting, surveillance cameras, in addition to telecommunications transmissions. |

| o | GHG Emissions Inventory disclosed on the Public Emissions Registry of the Brazil GHG Protocol Program and CDP Climate Change 2020 Questionnaire submitted to the evaluation of the organization. In this context, Energy Management is a material topic for TIM, besides being a crucial part of the ESG Ambitions Plan. Currently, TIM has a total amount of 19 power plants, generating approximately 13 GWh/month and compensating the low-voltage energy consumption of the Company. |

| o | On October 13, the Company finalized the corporate restructuring process that resulted in the incorporation of TIM Participações by the wholly owned subsidiary TIM S.A.. The transaction took place through the exchange of shares between the companies in a ratio of 1 to 1 and where they were kept all the rights and corporate structures existing at TIM Participações, only one shareholder exercised his withdrawal right. As a result of this movement, TIM S.A. became the only entity listed on B3 and with ADRs on the NYSE. TIM remains the only telephony operator listed in a special segment of B3, Novo Mercado, aimed at companies that voluntarily adopt corporate governance practices in addition to those required by Brazilian law. |

To access the Environmental, Social & Governance (“ESG”) quarterly report, please refer to: www.tim.com.br/ri/ESG-Report.

| 35 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Disclaimer

The consolidated financial and operating information disclosed in this document, except where otherwise indicated, is presented in accordance with the International Financial Reporting Standards (IFRS) and in Brazilian Reais (R$), in compliance with the Brazilian Corporate Law (Law 6,404/76). Comparisons refer to the third quarter of 2020 (3Q20) and the year to date (9M20), except when otherwise indicated.

This document may contain forward-looking statements. Such statements are not statements of historical fact and reflect the beliefs and expectations of the Company's management. The words "anticipates,” "believes,” "estimates,” "expects,” "forecasts,” "plans,” "predicts,” "projects,” "targets" and similar words are intended to identify these statements, which necessarily involve known and unknown risks and uncertainties foreseen, or not, by the Company. Therefore, the Company’s future operating results may differ from current expectations and readers of this report should not base their assumptions exclusively on the information given herein. Forward-looking statements only reflect opinions on the date on which they are made and the Company is not obliged to update them in light of new information or future developments.

| 36 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Investor Relations Contacts

Telephone Number: (+55 21) 4109-3360 / 4112-6048

E-mail: ri@timbrasil.com.br

Investor Relations Website: www.tim.com.br/ri

Attachments

Attachment 1: Operating Indicators

| 37 |

2020 Third Quarter Results (Including the effects of IFRS 9, 15 and 16)

Attachment 1

TIM S.A.

Operating Ratios

| 38 |

NOTES TO THE QUARTERLY INFORMATION

As at September 30

(In thousands of Reais, except as otherwise stated)

|

1. | Operations |

1.a The Corporate structure

TIM S.A. (“TIM” “Company” and/or “Enterprise”) is a public limited company with Registered office in the city of Rio de Janeiro, RJ, and a subsidiary of TIM Brasil Serviços e Participações S.A. (“TIM Brasil”). TIM Brasil is a subsidiary of the Telecom Italia Group and held 66.58% of the capital of TIM S.A as at September 30, 2020. On December 31, 2019, TIM S.A, it was fully controlled by TIM Participações S.A., which subsequently, on August 31, 2020, was incorporated by its subsidiary.

The Company provides Landline Switched Telephone Service (”STFC“) in Local, National Long-Distance and International Long-Distance modes, as well as Personal Mobile Service (”SMP“) and Multimedia Communication Service (”SCM"), in all Brazilian states and in the Federal District.

The Company's shares are traded on B3 (formerly BM&F/Bovespa). Additionally, TIM S.A. has American Depositary Receipts (ADRs), Level II, traded on the New York Stock Exchange (NYSE) – USA. As a result, the company is subject to the rules of the Securities and Exchange Commission (“CVM”) and the Securities and Exchange Commission (“SEC”). In order to comply with good market practices, the company adopts as a principle the simultaneous disclosure of its financial information in both markets, in reais, in Portuguese and English.

Corporate Reorganization

On July 29, 2020, the Board of Directors of the Company approved the submission to the Extraordinary General Meeting of the proposed incorporation of TIM Participações by TIM S.A.

The Extraordinary General Meeting was held on August 31, 2020, and approved, by a majority of votes, the incorporation of TIM Participações by TIM S. A, in accordance with the protocol and justification of Incorporation concluded between the administrations of the Companies on July 29, 2020.

As a result the Company’s Management proceeded with the merger on August 31, 2020, based on the net book assets of TIM Participações, in the amount of R$ 355,323.

The changes in TIM Participações’s equity between the date of the report (March 31, 2020) and the merger (August 31, 2020) were transferred, absorbed and incorporated into the operating income of TIM Participações S.A. (incorporated), as set forth in the protocol of incorporation. As a result of the merger, all operations of TIM Participações were transferred to TIM S.A., which succeeded it in all its assets, rights and obligations, universally and for all purposes of law. This transaction had no economic or tax impact and the incorporated goodwill will not be used for the purposes of any tax offsets.

| 39 |

NOTES TO THE QUARTERLY INFORMATION As at September 30 (In thousands of Reais, except as otherwise stated) |

This corporate reorganization aimed to provide greater efficiency and simplification of the organizational structure of the TIM Group, making the structure of internal controls more efficient. In addition, the corporate reorganization provides a better tax efficiency in future distributions of Interest on Equity, and also, greater integration of administrative and financial unities allowing a cut-off in operational costs and expenses, as well as improvement of synergies, which shall result in a more efficient operation. As a result from this transaction, there was no impact on the controlling and non-controlling shareholders.

After the merger, TIM S.A. became a company listed in the special segment of listing Novo Mercado of B3 S.A. – Brazil, Bolsa, Balcão (“B3”) and with American Depositary Receipts (“ADRs”) traded on the New York Stock Exchange - New York Stock Exchange (“NYSE”). Starting to be traded with the codes TIMS3 on B3 and TIMB on the NYSE.

The net assets as of September 01, 2020, is summarized below:

| Note | 01/09/20 | Note | 01/09/20 | |||||

| Assets | Liability | |||||||

| Current | Current | |||||||

| Cash and cash equivalents | 4 | 21,959 | Taxes, fees and contributions to be collected | 20 and 21 | 368 | |||

| Taxes, fees and contributions to be recovered | 8 and 9 | 28,515 | Other liabilities | 10,708 | ||||

| Other assets | 166 | Total current liabilities | 11,076 | |||||

| Total current assets | 50,640 | |||||||

| Non-current | ||||||||

| Non-current | Provision for judicial and administrative proceedings | 23 | 36,850 | |||||

| Judicial deposits | 12 | 72,346 | Other liabilities | 29,752 | ||||

| Other assets | 1,254 | Total non-current liabilities | 66,602 | |||||

| Shareholders´ equity | ||||||||

| Goodwill (1) | 308,761 | Share Capital | 24 | 1,719 | ||||

| Total non-current assets | 382,361 | Booking | 24 | 353,604 | ||||

| Total equity | 355,323 | |||||||

| Total assets | 433,001 | Total liabilities and equity | 433,001 |

(1) The Incorporated goodwill has the following composition:

| Goodwill Future profitability (Note 14) | 367,571 | ||

| Price purchase adjustment on provision for legal and administrative proceedings (Note 23) | (89,106) | ||

| Deferred income tax price purchase adjustment | 30,296 | ||

| 308,761 |

| 40 |

NOTES TO THE QUARTERLY INFORMATION As at September 30 (In thousands of Reais, except as otherwise stated) |

The net assets, including the 8-month result of TIM Participações, in the amount of R$ 15,436 was incorporated into the equity of TIM S.A, as demonstrated in the change in equity.

Comparability of quarterly information

For the purposes of better presentation of the TIM Economic Group comparatives’, we present in the table below TIM Participações’ results consolidated information disclosed in the quarterly information of September 30, 2019.

|

TIM Participações Consolidated Sep/19 | |

| Net revenue | 12,790,630 |

| Costs of services rendered and goods sold | (5,769,535) |

| Gross profit | 7,021,095 |

| Operating income (expenses): | |

| Selling expenses | (3,775,995) |

| General and administrative expenses | (1,303,979) |

| Other income (expense), net | 1,323,099 |

| (3,756,875) | |

| Operating profit | 3,264,220 |

| Financial income (expenditure): | |

| Financial income | 1,460,737 |

| Financial expenses | (1,203,789) |

| 256,948 | |

| Profit before income tax and social contribution | 3,521,168 |

| Income tax and social contribution | (817,353) |

| Net profit for the period | 2,703,815 |

| 41 |

NOTES TO THE QUARTERLY INFORMATION As at September 30 (In thousands of Reais, except as otherwise stated) |

2. Basis for preparation and presentation of the quarterly information

The quarterly information was prepared in accordance with accounting practices adopted in Brazil, which comprise the resolutions issued by the CVM and the pronouncements, guidelines and interpretations issued by Comitê de Pronunciamentos Contábeis [Accounting pronouncements committee] (CPC) and the International Financial Reporting Standards (International Financial Reporting Standards ("IFRS"), issued by the International Accounting Standards Board (IASB) and show all relevant information specific to the quarterly information, and only this information, which is consistent with that used by management in its management. In addition, the Company considered the guidance issued by Technical Guidance OCPC 07 in the preparation of its quarterly information. In this way, the relevant information specific to the quarterly information is being evidenced and correspond to those used by the management in its duties.

The main accounting policies applied in the preparation of this quarterly information are defined below and / or presented in their respective notes. Such policies were consistently applied in the exercises presented, unless otherwise stated.

| a. | General criteria for preparation and disclosure |

The quarterly information was prepared considering historical cost as a value basis and financial assets and liabilities (including derivative financial instruments) measured at fair value.

Assets and liabilities are classified according to their degree of liquidity and collectability. They are reported as current when they are likely to be realized or settled over the next 12 months. Otherwise, they are recorded as non-current. The exception to this procedure involves deferred income tax and social contribution balances (assets and liabilities) and contingent liabilities that are fully classified as long-term.

The presentation of Statement of Value Added (Demonstração do Valor Adicionado – “DVA”) is required by the Brazilian Corporate Legislation and accounting practices adopted in Brazil applicable to listed companies. The DVA was prepared according to the criteria set forth in CPC Technical Pronouncement No. 09 - “Statement of Value Added”. IFRS does not require the presentation of this statement. As a consequence, according to the IFRS, this statement is presented as supplementary information, without affecting the quarterly information.

Interests paid are classified as financing cash flow in the statement of cash flows as it represents costs of obtaining financial resources.

| b. | Functional currency and presentation currency |

The currency of presentation of the quarterly information is the Real (R$), which is also the Company´s functional currency.

Foreign currency transactions are recognized at the exchange rate on the date of the transaction. Monetary items in foreign currency are converted into reais at the exchange rate on the balance sheet date, informed by Banco Central do Brasil [Central Bank of Brazil]. Foreign exchange gains and losses linked to these items are recorded in the statement of income.

| 42 |

NOTES TO THE QUARTERLY INFORMATION As at September 30 (In thousands of Reais, except as otherwise stated) |

| c. | Segment information |

Operating segments are components of the entity that carry out business activities from which revenues can be obtained and expenses incurred. Its operating results are regularly reviewed by the entity's main operations manager, who makes decisions on resource allocation and evaluates segment performance. For the segment to exist, individualized financial information is required.

The main operational decision maker in the Company, responsible for the allocation of resources and periodically evaluating performance, is the Executive Board, which, along with the Board of Directors, are responsible for making the strategic decisions of the company and its management.

The Group's strategy is focused on optimizing results, and from the corporate reorganization mentioned in Note 1, all the operating activities of the group are concentrated exclusively in TIM S.A.. Although there are diverse activities, decision makers understand that the company represents only one business segment and do not contemplate specific strategies focused only on one service line. All decisions regarding strategic, financial planning, purchases, investments and investment of resources are made on a consolidated basis. The aim is to maximize the consolidated result obtained by operating the SMP, STFC and SCM licenses.

| d. | Approval of quarterly information |

This quarterly information was approved by the company's Board of Directors on November 3, 2020.

| e. | New standards, ammendments and interpretations of standards |

The following new standards were issued by Comitê de Pronunciamentos Contábeis [Accounting pronouncements committee] (CPC) and the International Accounting Standards Board (IASB), but are not in effect for the period ended on September 30, 2020.

| · | CPC 11- Insurance Contracts |

In May 2017, the IASB issued IFRS 17 - Insurance Contracts, a standard not yet issued by CPC in Brazil, but which will be codified as CPC 50 - Insurance Contracts and will replace CPC 11 - Insurance Contracts. The overall objective of IFRS 17 is to provide an accounting model for insurance contracts that is more useful and consistent for insurers.

| · | Changes to CPC 15 (R1): Definition of business |

In October 2018, the IASB issued changes to the definition of business in IFRS 3, these changes being reflected in revision 14 of the CPC, amending CPC 15 (R1) to help entities determine whether an acquired set of activities and assets consists or not in a business. They clarify the minimum requirements for a company, eliminate the assessment of whether market participants are able to replace any missing element, include guidelines to help entities assess whether an acquired process is substantive, better define business and product definitions and introduce an optional fair value concentration test. New illustrative cases were provided with the changes.

| 43 |

NOTES TO THE QUARTERLY INFORMATION As at September 30 (In thousands of Reais, except as otherwise stated) |

As the changes apply prospectively to transactions or other events that occur on or after the first application, the Company will not be affected by those changes on the transition date.

| · | Changes to CPC 26 (R1) and IAS 8: Definition of material omission |