rovr-202203210001826018TRUEOn March 21, 2022, Rover Group, Inc. filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “Annual Report”). This post-effective amendment to the Registration Statement (File No. 333-259519)(the “POSAM”) is being filed to: (i) include information from the Annual Report; and (ii) update certain other information in the Registration Statement based on recent developments.

No additional securities are being registered under this POSAM and all applicable registration and filing fees were paid at the time of the original filing of the Registration Statement.

POS AMhttp://fasb.org/us-gaap/2021-01-31#AccountingStandardsUpdate201409MemberP1YP20DP30D00018260182021-01-012021-12-3100018260182021-12-31iso4217:USD00018260182020-12-31iso4217:USDxbrli:sharesxbrli:shares00018260182020-01-012020-12-3100018260182019-01-012019-12-3100018260182018-12-310001826018us-gaap:CommonStockMember2018-12-310001826018us-gaap:AdditionalPaidInCapitalMember2018-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001826018us-gaap:RetainedEarningsMember2018-12-310001826018us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001826018srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001826018us-gaap:CommonStockMember2019-01-012019-12-310001826018us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001826018us-gaap:RetainedEarningsMember2019-01-012019-12-3100018260182019-12-310001826018us-gaap:CommonStockMember2019-12-310001826018us-gaap:AdditionalPaidInCapitalMember2019-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001826018us-gaap:RetainedEarningsMember2019-12-310001826018us-gaap:CommonStockMember2020-01-012020-12-310001826018us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001826018us-gaap:RetainedEarningsMember2020-01-012020-12-310001826018us-gaap:CommonStockMember2020-12-310001826018us-gaap:AdditionalPaidInCapitalMember2020-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001826018us-gaap:RetainedEarningsMember2020-12-310001826018us-gaap:CommonStockMember2021-01-012021-12-310001826018us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001826018us-gaap:RetainedEarningsMember2021-01-012021-12-310001826018us-gaap:CommonStockMember2021-12-310001826018us-gaap:AdditionalPaidInCapitalMember2021-12-310001826018us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001826018us-gaap:RetainedEarningsMember2021-12-31xbrli:pure00018260182020-04-012020-04-300001826018us-gaap:EmployeeSeveranceMember2020-04-012020-04-0100018260182021-07-302021-07-3000018260182021-07-302021-09-30rovr:segment0001826018us-gaap:ComputerEquipmentMember2021-01-012021-12-310001826018us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-01-012021-12-310001826018us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-310001826018us-gaap:LeaseholdImprovementsMember2021-01-012021-12-310001826018us-gaap:SoftwareDevelopmentMember2021-01-012021-12-310001826018rovr:RoverEarnoutSharesMember2021-07-300001826018rovr:DerivativeInstrumentPeriodOneMemberrovr:RoverEarnoutSharesMember2021-07-300001826018rovr:DerivativeInstrumentPeriodOneMemberrovr:RoverEarnoutSharesMember2021-07-302021-07-300001826018rovr:DerivativeInstrumentPeriodTwoMemberrovr:RoverEarnoutSharesMember2021-07-300001826018rovr:DerivativeInstrumentPeriodTwoMemberrovr:RoverEarnoutSharesMember2021-07-302021-07-300001826018rovr:DerivativeInstrumentPeriodThreeMemberrovr:RoverEarnoutSharesMember2021-07-300001826018rovr:DerivativeInstrumentPeriodThreeMemberrovr:RoverEarnoutSharesMember2021-07-302021-07-300001826018rovr:SponsorEarnoutSharesMember2021-07-300001826018rovr:RoverEarnoutSharesMember2021-07-302021-07-300001826018rovr:DerivativeInstrumentPeriodOneMemberrovr:SponsorEarnoutSharesMember2021-07-300001826018rovr:SponsorEarnoutSharesMemberrovr:DerivativeInstrumentPeriodTwoMember2021-07-300001826018rovr:SponsorEarnoutSharesMemberrovr:DerivativeInstrumentPeriodThreeMember2021-09-2900018260182021-07-300001826018rovr:PrivateWarrantMember2021-07-300001826018rovr:PublicWarrantMember2021-07-3000018260182020-12-312020-12-310001826018us-gaap:AccountingStandardsUpdate201409Member2019-01-0100018260182021-01-010001826018rovr:AccountingStandardsUpdate2016_16Member2019-01-012019-12-310001826018us-gaap:PrivatePlacementMember2021-07-302021-07-300001826018us-gaap:PrivatePlacementMember2021-07-300001826018rovr:TrueWindCapitalIILPAndTrueWindCapitalIIALPMemberrovr:SponsorBackstopSubscriptionAgreementMember2021-07-302021-07-300001826018rovr:TrueWindCapitalIILPAndTrueWindCapitalIIALPMemberrovr:SponsorBackstopSubscriptionAgreementMember2021-07-300001826018rovr:LegacyRoverMember2021-07-302021-09-300001826018rovr:CaravelMember2021-07-290001826018rovr:CaravelMember2021-07-302021-07-300001826018rovr:CaravelMemberrovr:CommonShareholdersMember2021-07-302021-07-300001826018rovr:SponsorBackstopSubscriptionAgreementMember2021-07-302021-07-300001826018rovr:AssignmentAgreementMember2021-07-302021-07-300001826018rovr:CaravelMemberrovr:SponsorMembersMember2021-07-302021-07-300001826018rovr:CaravelMemberrovr:SponsorMembersMember2021-07-300001826018rovr:FounderSharesMember2021-07-302021-07-3000018260182021-07-290001826018us-gaap:CommonStockMemberrovr:BarkingDogVenturesLtdMember2018-10-312018-10-310001826018rovr:SeriesGRedeemableConvertiblePeferredStockMemberrovr:BarkingDogVenturesLtdMember2018-10-312018-10-310001826018us-gaap:SeriesGPreferredStockMemberrovr:BarkingDogVenturesLtdMember2018-10-312018-10-310001826018rovr:BarkingDogVenturesLtdMember2018-10-312018-10-310001826018us-gaap:SeriesGPreferredStockMemberrovr:BarkingDogVenturesLtdMember2019-11-012019-11-300001826018rovr:BarkingDogVenturesLtdMember2019-01-012019-12-310001826018rovr:BarkingDogVenturesLtdMember2019-12-310001826018us-gaap:SeriesGPreferredStockMemberrovr:BarkingDogVenturesLtdMember2020-02-290001826018us-gaap:CorporateDebtSecuritiesMember2021-12-310001826018us-gaap:CorporateDebtSecuritiesMember2020-12-310001826018us-gaap:SeriesCPreferredStockMemberrovr:DogHeroLtdMember2019-03-310001826018srt:SouthAmericaMemberrovr:OnlineMarketplaceForPetServicesMemberrovr:DogHeroLtdMember2019-03-310001826018us-gaap:SeriesCPreferredStockMemberrovr:DogHeroLtdMember2019-03-012019-03-3100018260182019-03-012019-03-310001826018rovr:DogHeroLtdMember2020-07-012020-07-310001826018rovr:DogHeroLtdMember2020-11-012020-11-300001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001826018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001826018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001826018us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001826018us-gaap:FairValueInputsLevel3Memberrovr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PrivateWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PrivateWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001826018us-gaap:FairValueInputsLevel3Memberrovr:PrivateWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018rovr:PrivateWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018us-gaap:FairValueMeasurementsRecurringMember2020-12-310001826018rovr:SponsorEarnoutSharesMember2021-09-292021-09-290001826018rovr:RoverEarnoutSharesMember2021-10-062021-10-060001826018us-gaap:FairValueInputsLevel3Memberrovr:ContingentConsiderationLiabilityMember2021-09-292021-09-290001826018rovr:DerivativeInstrumentPeriodOneAndTwoMemberrovr:SponsorEarnoutSharesMember2021-09-290001826018rovr:DerivativeInstrumentPeriodOneMemberrovr:SponsorEarnoutSharesMember2021-09-290001826018rovr:SponsorEarnoutSharesMemberrovr:DerivativeInstrumentPeriodTwoMember2021-09-290001826018rovr:RoverEarnoutSharesMember2021-10-060001826018rovr:DerivativeInstrumentPeriodOneAndTwoMemberrovr:RoverEarnoutSharesMember2021-10-060001826018rovr:DerivativeInstrumentPeriodOneMemberrovr:RoverEarnoutSharesMember2021-10-060001826018rovr:DerivativeInstrumentPeriodTwoMemberrovr:RoverEarnoutSharesMember2021-10-060001826018rovr:DerivativeInstrumentPeriodThreeMemberrovr:RoverEarnoutSharesMember2021-10-060001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputSharePriceMember2021-10-060001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputSharePriceMember2021-09-290001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputSharePriceMember2021-07-300001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-10-060001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-09-290001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-07-300001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2021-10-060001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2021-09-290001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputExpectedTermMember2021-07-300001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMember2021-10-060001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMember2021-09-290001826018rovr:ContingentConsiderationLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMember2021-07-300001826018us-gaap:MeasurementInputExpectedDividendRateMemberrovr:ContingentConsiderationLiabilityMember2021-10-060001826018us-gaap:MeasurementInputExpectedDividendRateMemberrovr:ContingentConsiderationLiabilityMember2021-09-290001826018us-gaap:MeasurementInputExpectedDividendRateMemberrovr:ContingentConsiderationLiabilityMember2021-07-300001826018us-gaap:MeasurementInputExpectedDividendRateMemberrovr:ContingentConsiderationLiabilityMember2021-12-310001826018us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2021-01-012021-12-310001826018rovr:PrivateWarrantsMember2021-01-012021-12-310001826018us-gaap:MeasurementInputSharePriceMember2021-07-300001826018us-gaap:MeasurementInputRiskFreeInterestRateMember2021-07-300001826018us-gaap:MeasurementInputExpectedTermMember2021-07-300001826018us-gaap:MeasurementInputPriceVolatilityMember2021-07-300001826018us-gaap:MeasurementInputExpectedDividendRateMember2021-07-300001826018us-gaap:ComputerEquipmentMember2021-12-310001826018us-gaap:ComputerEquipmentMember2020-12-310001826018us-gaap:FurnitureAndFixturesMember2021-12-310001826018us-gaap:FurnitureAndFixturesMember2020-12-310001826018us-gaap:LeaseholdImprovementsMember2021-12-310001826018us-gaap:LeaseholdImprovementsMember2020-12-310001826018us-gaap:SoftwareDevelopmentMember2021-12-310001826018us-gaap:SoftwareDevelopmentMember2020-12-310001826018rovr:DepreciationAndAmortizationMember2021-01-012021-12-310001826018rovr:DepreciationAndAmortizationMember2020-01-012020-12-310001826018rovr:DepreciationAndAmortizationMember2019-01-012019-12-3100018260182021-12-012021-12-310001826018rovr:CustomerRelationshipsPetParentMember2021-12-310001826018us-gaap:TradeNamesMember2021-12-310001826018rovr:CustomerRelationshipsPetParentMember2020-12-310001826018rovr:CustomerRelationshipsPetServiceProviderMember2020-12-310001826018us-gaap:TradeNamesMember2020-12-310001826018rovr:CustomerRelationshipsPetParentMember2021-01-012021-12-310001826018us-gaap:TradeNamesMember2021-01-012021-12-310001826018us-gaap:LineOfCreditMemberrovr:VariableRateRevolvingLineOfCreditMember2020-03-012020-03-310001826018us-gaap:LineOfCreditMemberrovr:VariableRateGrowthCapitalAdvanceComponentsMember2020-03-012020-03-310001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMember2020-03-012020-03-310001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMember2021-07-302021-07-300001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:VariableRateRevolvingLineOfCreditMember2020-08-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMemberrovr:VariableRateRevolvingLineOfCreditMember2020-08-012020-08-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:VariableRateRevolvingLineOfCreditMember2021-12-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:VariableRateRevolvingLineOfCreditMember2020-08-012020-08-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:VariableRateRevolvingLineOfCreditMember2021-01-012021-12-310001826018us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMemberrovr:VariableRateRevolvingLineOfCreditMember2021-12-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:GrowthCapitalAdvanceLineOfCreditMember2020-08-31rovr:tranche0001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:GrowthCapitalAdvanceLineOfCreditMember2020-01-012020-12-310001826018us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberrovr:GrowthCapitalAdvanceLineOfCreditMember2021-12-310001826018rovr:GrowthCapitalAdvanceComponentMember2021-01-012021-12-310001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-06-300001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMember2020-01-012020-06-300001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-03-012020-03-310001826018us-gaap:LineOfCreditMemberrovr:SubordinatedCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-07-302021-07-300001826018us-gaap:LineOfCreditMember2021-03-3100018260182020-04-012020-04-010001826018us-gaap:BuildingMembersrt:MinimumMember2021-12-310001826018us-gaap:BuildingMembersrt:MaximumMember2021-12-3100018260182018-09-012018-09-30rovr:facility00018260182020-02-012020-02-2900018260182021-04-012021-04-300001826018us-gaap:IndemnificationGuaranteeMember2021-12-310001826018us-gaap:IndemnificationGuaranteeMember2020-12-310001826018rovr:PrivateWarrantMember2021-12-310001826018rovr:PublicWarrantMember2021-12-310001826018rovr:RoverEarnoutSharesMember2021-12-310001826018rovr:SponsorEarnoutSharesMember2021-12-310001826018rovr:SeriesAConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesBConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesCConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesDConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesDOneConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesEConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesFConvertiblePreferredStockMember2020-12-310001826018rovr:SeriesGConvertiblePreferredStockMember2020-12-310001826018rovr:PrivateWarrantMember2021-07-290001826018rovr:PrivateWarrantMember2021-07-302021-07-300001826018rovr:PublicWarrantMember2021-01-012021-12-310001826018rovr:PrivateWarrantMember2021-01-012021-12-310001826018us-gaap:CommonClassAMemberrovr:PublicWarrantMember2021-01-012021-12-310001826018us-gaap:CommonClassAMember2021-09-140001826018us-gaap:WarrantMember2021-07-300001826018us-gaap:SubsequentEventMember2022-01-122022-01-120001826018rovr:CommonStockWarrantsMember2021-12-310001826018rovr:A2011PlanMember2021-07-300001826018rovr:A2021PlanMemberus-gaap:StockCompensationPlanMember2021-07-300001826018rovr:A2021PlanMemberus-gaap:StockCompensationPlanMember2021-12-310001826018us-gaap:EmployeeStockOptionMembersrt:ScenarioPreviouslyReportedMember2019-12-310001826018srt:RestatementAdjustmentMemberus-gaap:EmployeeStockOptionMember2019-12-310001826018us-gaap:EmployeeStockOptionMember2019-12-310001826018us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001826018us-gaap:EmployeeStockOptionMember2020-12-310001826018us-gaap:StockCompensationPlanMember2021-01-012021-12-310001826018us-gaap:StockCompensationPlanMember2021-12-310001826018srt:ScenarioPreviouslyReportedMember2019-12-310001826018srt:ScenarioPreviouslyReportedMember2019-01-012019-12-310001826018srt:RestatementAdjustmentMember2019-12-310001826018srt:MinimumMember2020-01-012020-12-310001826018srt:MaximumMember2020-01-012020-12-310001826018srt:MinimumMember2019-01-012019-12-310001826018srt:MaximumMember2019-01-012019-12-310001826018us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001826018us-gaap:RestrictedStockUnitsRSUMember2020-12-310001826018us-gaap:RestrictedStockUnitsRSUMember2021-12-310001826018rovr:OperationsAndSupportExpenseMember2021-01-012021-12-310001826018rovr:OperationsAndSupportExpenseMember2020-01-012020-12-310001826018rovr:OperationsAndSupportExpenseMember2019-01-012019-12-310001826018us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001826018us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001826018us-gaap:SellingAndMarketingExpenseMember2019-01-012019-12-310001826018us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001826018us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001826018us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001826018us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001826018us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001826018us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001826018us-gaap:EmployeeStockOptionMember2021-01-012021-12-3100018260182020-01-012020-03-310001826018rovr:TerminatedEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2020-04-300001826018rovr:TerminatedEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2020-04-012020-04-300001826018rovr:CurrentEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2020-07-310001826018rovr:CurrentEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2020-07-012020-07-3100018260182020-07-012020-07-310001826018rovr:CurrentEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2021-01-012021-12-310001826018rovr:CurrentEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2020-01-012020-12-310001826018rovr:CurrentEmployeesMemberrovr:ShareBasedPaymentArrangementOptionModifiedMember2021-12-310001826018us-gaap:DomesticCountryMember2021-12-310001826018us-gaap:StateAndLocalJurisdictionMember2021-12-310001826018us-gaap:ForeignCountryMember2021-12-310001826018us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001826018us-gaap:RedeemableConvertiblePreferredStockMember2019-01-012019-12-310001826018us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001826018us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001826018us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001826018us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001826018us-gaap:WarrantMember2020-01-012020-12-310001826018us-gaap:WarrantMember2019-01-012019-12-310001826018rovr:PrivateWarrantMember2021-01-012021-12-310001826018rovr:PublicWarrantMember2021-01-012021-12-310001826018rovr:SponsorEarnoutSharesMember2021-01-012021-12-310001826018rovr:RoverEarnoutSharesMember2021-01-012021-12-310001826018us-gaap:EmployeeSeveranceMember2020-04-012020-04-300001826018us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2022-01-012022-01-310001826018rovr:PublicWarrantsMemberus-gaap:SubsequentEventMember2022-01-012022-01-310001826018rovr:PrivateWarrantsMemberus-gaap:SubsequentEventMember2022-01-012022-01-310001826018us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2022-01-310001826018us-gaap:SubsequentEventMember2022-01-310001826018us-gaap:SubsequentEventMember2022-01-012022-01-31

As filed with the Securities and Exchange Commission on March 21, 2022

Registration No. 333-259519

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ROVER GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 7200 (Primary Standard Industrial Classification Code Number) | 85-3147201 (I.R.S. Employer Identification Number) |

720 Olive Way, 19th Floor

Seattle, WA 98101

(888) 453-7889

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Aaron Easterly

Chief Executive Officer

720 Olive Way, 19th Floor

Seattle, WA 98101

(888) 453-7889

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | |

Michael Nordtvedt John Brust Craig Sherman Wilson Sonsini Goodrich & Rosati, P.C. 701 Fifth Avenue, Suite 5100 Seattle, Washington 98104-7036 Telephone: (206) 883-2500 | Melissa Weiland

General Counsel

720 Olive Way, 19th Floor

Seattle, WA 98101

Telephone: (888) 453-7889 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

This filing constitutes a Post-Effective Amendment to the Registration Statement on Form S-1 (File No. 333-259519), which was initially declared effective on September 23, 2021. This Post-Effective Amendment shall hereafter become effective in accordance with Section 8(c) of the Securities Act, on such date as the Securities and Exchange Commission, acting pursuant to Section 8(c) of the Securities Act, may determine.

EXPLANATORY NOTE

On September 14, 2021, Rover Group, Inc. (“Rover,” the “Company,” “we,” “us,” or “our”) filed a registration statement with the Securities and Exchange Commission (the “SEC”), on Form S-1 (File No. 333-259519) (the “Registration Statement”). The Registration Statement was declared effective by the SEC on September 23, 2021 to initially register:

•the offer and sale by us of: (a) 2,574,164 shares of our Class A common stock, par value $0,001 per share (the “Class A Common Stock”), issuable upon the exercise of 2,574,164 private placement warrants that were transferred to Nebula Caravel Holdings, LLC (the “Sponsor”) simultaneously with the closing of our legal predecessor Nebula Caravel Acquisition Corp.’s initial public offering (the “Caravel IPO”) and were exercisable at a price of $11.50 per share (the “Private Placement Warrants”) and (b) 5,500,000 shares of Class A Common Stock issuable upon the exercise of 5,500,000 warrants originally sold as part of the units in the Caravel IPO, exercisable on December 11, 2021, at a price of $11.50 per share (the “Public Warrants”, and collectively with the Private Placement Warrants, the “Warrants”); and

•the resale from time to time by the selling securityholders named in prospectus or their permitted transferees (the “Selling Securityholders”) of: (i) 90,064,932 shares of Class A Common Stock consisting of (a) 73,273,590 shares of Class A Common Stock beneficially owned by certain former stockholders of A Place for Rover, Inc. (“Legacy Rover” and such shares, the “Legacy Rover Shares”), (b) up to 11,792,216 shares of Class A Common Stock beneficially owned by certain former stockholders of Legacy Rover, which shall be issuable upon the achievement of certain trading price targets for our Class A Common Stock (the “Rover Earnout Shares”), (c) up to 2,461,626 shares of Class A Common Stock beneficially owned by the Sponsor, which vest upon the achievement of certain trading price targets for our Class A Common Stock (the “Sponsor Earnout Shares”), and (d) 3,437,500 shares of Class A Common Stock issued to Nebula Caravel Holdings, LLC, a Delaware corporation (the “Sponsor”) and certain affiliates of the Sponsor (the “Founder Shares” and, together with the Legacy Rover Shares, the Rover Earnout Shares, and the Sponsor Earnout Shares, the “Affiliated Shares”); (ii) 5,000,000 shares of Class A Common Stock purchased at Closing by a number of subscribers pursuant to separate PIPE Subscription Agreements; and (iii) 1,000,000 shares of Class A Common Stock purchased by Broad Bay at Closing pursuant to the Assignment and Assumption Agreement.

On March 21, 2022, we filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “Annual Report”). This post-effective amendment to the Registration Statement (the “POSAM”) is being filed to: (i) include information from the Annual Report; and (ii) update certain other information in the Registration Statement based on recent developments.

No additional securities are being registered under this POSAM and all applicable registration and filing fees were paid at the time of the original filing of the Registration Statement.

Corporate History and Background

On July 30, 2021 (the “Closing”), Rover Group, Inc. (the “Company”), f/k/a Nebula Caravel Acquisition Corp., our legal predecessor and a special purpose acquisition company (“Caravel”) sponsored by affiliates of True Wind Capital, consummated the previously announced merger with A Place for Rover, Inc., d/b/a Rover (“Legacy Rover”), and Fetch Merger Sub, Inc. (“Merger Sub”), a wholly owned subsidiary of Caravel pursuant to a Business Combination Agreement dated February 10, 2021. Pursuant to the merger, Merger Sub merged with and into Legacy Rover, the separate corporate existence of Merger Sub ceased, and Legacy Rover continued as the surviving corporation in the Merger and as a wholly owned subsidiary of Caravel. On the Closing, the Company changed its name from Nebula Caravel Acquisition Corp. to Rover Group, Inc. Our Class A Common Stock trades on The Nasdaq Global Market under the symbols “ROVR.”

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | | | | | |

| PRELIMINARY PROSPECTUS | Subject to Completion | Dated March 21, 2022 |

91,476,337 Shares of Class A Common Stock

This prospectus relates to the resale from time to time by the selling securityholders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of: (i) 87,852,665 shares of Class A common stock, par value $0.0001 per share (“Class A Common Stock”), consisting of (a) 79,746,980 shares of Class A Common Stock beneficially owned by certain former stockholders of A Place for Rover, Inc. (“Legacy Rover” and such shares, the “Legacy Rover Shares”), (b) up to 2,206,559 shares of Class A Common Stock beneficially owned by certain former stockholders of Legacy Rover, which have been issued or shall be issuable upon the achievement of certain trading price targets for our Class A Common Stock (the “Rover Earnout Shares”), (c) up to 2,461,626 shares of Class A Common Stock beneficially owned by the Sponsor, 492,326 of which vest upon the achievement of certain trading price targets for our Class A Common Stock (the “Sponsor Earnout Shares”), and (d) 3,437,500 shares of Class A Common Stock issued to Nebula Caravel Holdings, LLC, a Delaware corporation (the “Sponsor”) and certain affiliates of the Sponsor (the “Founder Shares” and, together with the Legacy Rover Shares, the Rover Earnout Shares, and the Sponsor Earnout Shares, the “Affiliated Shares”); (ii) 1,965,201 shares of Class A Common Stock purchased at Closing by a subscriber pursuant to a PIPE Subscription Agreement; (iii) 1,000,000 shares of Class A Common Stock purchased by Broad Bay at Closing pursuant to the Assignment and Assumption Agreement; and (iv) 658,471 shares of Class A Common Stock received by the Sponsor upon the cashless exercise of 2,574,164 Private Placement Warrants purchased by the Sponsor in connection with the Caravel IPO.

The Selling Securityholders may sell any, all or none of the securities and we do not know when or in what amount the Selling Securityholders may sell their securities hereunder following the date of this prospectus. The Selling Securityholders may sell the securities described in this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell their securities in the section titled “Plan of Distribution” beginning on page 169 of this prospectus. We are registering the offer and sale of these securities to satisfy certain registration rights we have granted under certain agreements between us and the Selling Securityholders. We will not receive any of the proceeds from the sale of the securities by the Selling Securityholders. We will pay the expenses associated with registering the sales by the Selling Securityholders other than any underwriting discounts and commissions, as described in more detail in the section titled “Use of Proceeds” appearing in this prospectus beginning on page 55. Our Class A Common Stock is listed on The Nasdaq Global Market (“Nasdaq”) under the symbol “ROVR.” On March 18, 2022, the last quoted sale price for our Class A Common Stock as reported on Nasdaq was $5.82 per share.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our Class A Common Stock involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 11 of this prospectus. You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2022

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any applicable prospectus supplement prepared by us or on our behalf. Neither we nor the Selling Securityholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Selling Securityholders are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the "SEC") using the “shelf” registration process. Under this shelf registration process, the selling securityholders hereunder may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such selling securityholders of the securities offered by them described in this prospectus.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus titled “Where You Can Find Additional Information.”

The Rover design logo and the Rover mark appearing in this prospectus are the property of Rover Group, Inc. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. We have omitted the ® and TM designations, as applicable, for the trademarks used in this prospectus.

Within this prospectus, we reference information and statistics regarding the travel and pet care industries. We have obtained this information and these statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources, such as Euromonitor International Limited. Some data and other information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor our stockholders can guarantee the accuracy or completeness of any such information contained in this prospectus.

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, references in this prospectus to (1) “Legacy Rover” refers to A Place for Rover, Inc., a Delaware corporation and our wholly owned subsidiary, prior to the Merger, (2) “Caravel” refers to Nebula Caravel Acquisition Corp., a Delaware corporation and our legal predecessor, prior to the Merger, and (3) “Rover,” the “Company,” “Registrant,” “we,” “us” and “our” refers to Rover Group, Inc., a Delaware corporation formerly known as Nebula Caravel Acquisition Corp., and where appropriate, our wholly owned subsidiaries.

In this document:

“Assignment Agreement” means that certain Assignment and Assumption Agreement by and among Caravel, the TWC Funds, and Broad Bay, dated as of July 26, 2021, pursuant to which Broad Bay purchased 1,000,000 shares of Class A Common Stock for a purchase price of $10.00 per share at Closing.

“Board” means the board of directors of Rover.

“Broad Bay” means BBCM Master Fund Ltd.

“Business Combination Agreement” means the Business Combination Agreement, dated as of February 10, 2021, by and among Caravel, Merger Sub and Legacy Rover.

“Caravel” refers to the former Nebula Caravel Acquisition Corp., now known as Rover Group, Inc., a Delaware corporation.

“Caravel IPO” means Caravel’s initial public offering of Units, consummated on December 11, 2020.

“Class A Common Stock” means the shares of Class A common stock of Rover Group, Inc., par value $0.0001 per share.

“Closing” means the consummation of the Merger, which occurred on July 30, 2021.

“Code” means the Internal Revenue Code of 1986, as amended.

“DGCL” means the Delaware General Corporation Law.

“Earnout Period” means the seven year period immediately following the closing of the Merger.

“Earnout Shares” means the total 19,734,183 shares of Class A Common Stock that may be issued upon the Class A Common Stock achieving certain share price milestones pursuant to the Business Combination Agreement (including the 17,540,964 earnout shares that were issued to Legacy Rover stockholders in October 2021 and the 2,192,687 shares that will be earned if the volume weighted average price of Class A Common Stock is greater than or equal to $16.00 over any 20 trading days within any 30 trading day period during the Earnout Period).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“GAAP” means United States generally accepted accounting principles.

“Investor Rights Agreement” means the Investor Rights Agreement, entered into at the Closing, by and among Caravel, Legacy Rover, and certain persons and entities holding Class A Common Stock.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Legacy Rover” means A Place for Rover, Inc. (d/b/a “Rover”), a Delaware corporation.

“Merger” refers to the merging of Merger Sub with and into Legacy Rover, with Legacy Rover surviving the Merger as a wholly owned subsidiary of the Company and the other transactions contemplated by the Business Combination Agreement, consummated as of the Closing.

“Merger Sub” means Fetch Merger Sub, Inc., a Delaware corporation.

“Nasdaq” means The Nasdaq Global Market.

“PIPE Investment” means the purchase of 5,000,000 shares of Class A Common Stock by certain accredited investors pursuant to the PIPE Subscription Agreement in connection with the Closing, for a purchase price of $10.00 per share, in a private placement.

“PIPE Subscription Agreement” means that certain Subscription Agreement between the Company and certain accredited investors (the “PIPE Investors”) pursuant to which the PIPE Investors agreed to purchase, in the aggregate, 5,000,000 shares of Class A Common Stock at $10.00 per share for an aggregate commitment amount of $50,000,000.

“Preferred Stock” means the shares of preferred stock of Rover, par value $0.0001 per share.

“Private Placement Warrants” means the warrants to purchase shares of Class A Common Stock purchased in a private placement in connection with the Caravel IPO, exercisable for one share of Class A Common Stock at a price of $11.50 per share, subject to adjustments.

“Public Warrants” means the warrants to purchase shares of Class A Common Stock that are publicly traded under the “ROVRW” symbol on Nasdaq, exercisable for one share of Class A Common Stock at a price of $11.50 per share, subject to adjustments.

“Remaining Earnout Shares” means the total 2,192,687 shares of Class A Common Stock that may be issued upon the Class A Common Stock achieving a volume weighted average price greater than or equal to $16.00 over any 20 trading days within any 30 trading day period during the Earnout Period).

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Sponsor” means Nebula Caravel Holdings, LLC, a Delaware limited liability company.

“Sponsor Backstop Subscription Agreement” means that certain backstop agreement between Sponsor and Caravel pursuant to which the TWC Funds agreed to purchase shares of Class A Common Stock in an aggregate amount of up to $50,000,000 (or such greater amount at the election of the TWC Fund) to the extent of the amount of any redemption of shares of Class A Common Stock.

“Stockholder Lock-Up Agreement” means that Stockholder Lock-Up Agreement entered into at Closing by and among Rover, the Sponsor, certain affiliates of the Sponsor, and certain Legacy Rover stockholders.

“TWC Funds” means, together, True Wind Capital II, L.P. and True Wind Capital II-A, L.P.

“Warrant Agreement” means the Warrant Agreement, dated as of December 8, 2020, by and between the Company and American Stock Transfer and Trust Company, LLC, as the warrant agent, as amended on December 10, 2021.

“Warrants” means the Public Warrants and Private Placement Warrants.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “possible,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus include statements about:

•the effects of the COVID-19 pandemic, including as a result of new strains or variants of the virus, and other geopolitical events like Russia’s invasion of Ukraine on our business, the travel industry, travel trends, and the global economy generally;

•our expectations regarding our operating and financial performance, including our bookings, gross booking value, revenue and expenses;

•our ability to retain existing and acquire new pet parents and pet care providers;

•the strength of our network, effectiveness of our technology, and quality of the offerings provided through our platform;

•our opportunities and strategies for growth;

•our offering expansion initiatives and market acceptance thereof;

•our ability to match pet parents with high quality and well-priced offerings;

•our assessment of and strategies to compete with our competitors;

•our assessment of our trust and safety practices;

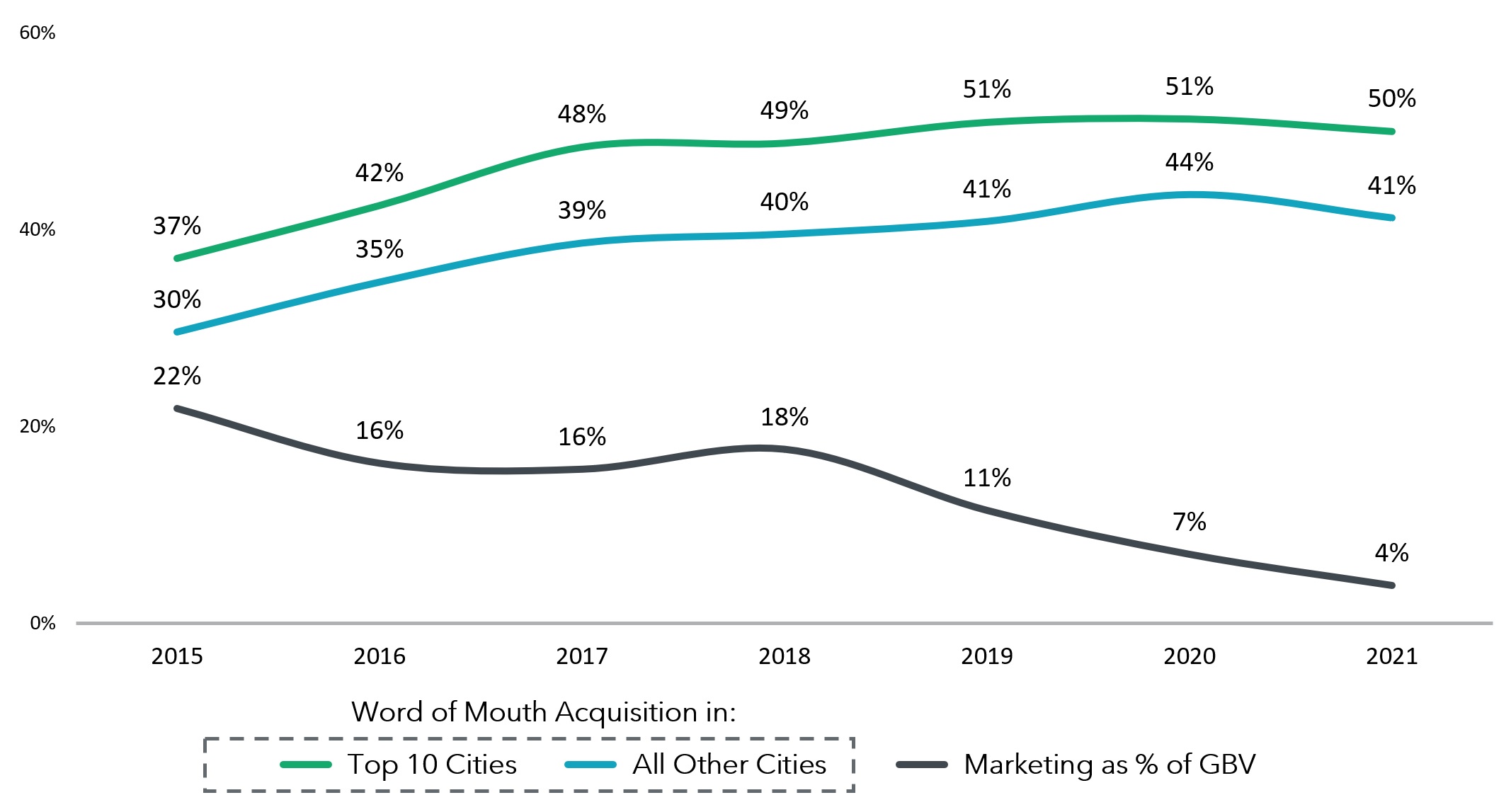

•the success of our marketing strategies;

•our ability to accurately and effectively use data and engage in predictive analytics;

•our ability to attract and retain talent and the effectiveness of our compensation strategies and leadership;

•general economic conditions and their impact on demand for our platform;

•seasonal sales fluctuations;

•our future capital requirements and sources and uses of cash;

•the sufficiency of our cash, cash equivalents, and investments to meet our liquidity needs;

•changes in applicable laws or regulations;

•our ability to stay in compliance with laws and regulations, including tax laws, that currently apply or may become applicable to our business both in the United States and internationally and our expectations regarding various laws and restrictions that relate to our business;

•the outcome of any known and unknown litigation and regulatory proceedings;

•the increased expenses associated with being a public company;

•our ability to maintain and protect our brand;

•our current plans, considerations, expectations and determinations regarding future compensation programs; and

•other risks and uncertainties set forth in the section titled “Risk Factors” beginning on page 11 of this prospectus. We caution you that the foregoing list does not contain all of the forward-looking statements made in this prospectus.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, operating results, financial condition and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this prospectus to reflect events or circumstances after the date of this prospectus or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information you should consider before investing in our Class A Common Stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Where You Can Find Additional Information,” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. In this prospectus, unless the context requires otherwise, all references to “we,” “our,” “us,” “Rover,” the “Registrant,” and the “Company” refer to Rover Group, Inc. and its consolidated subsidiaries. ROVER GROUP, INC.

Overview

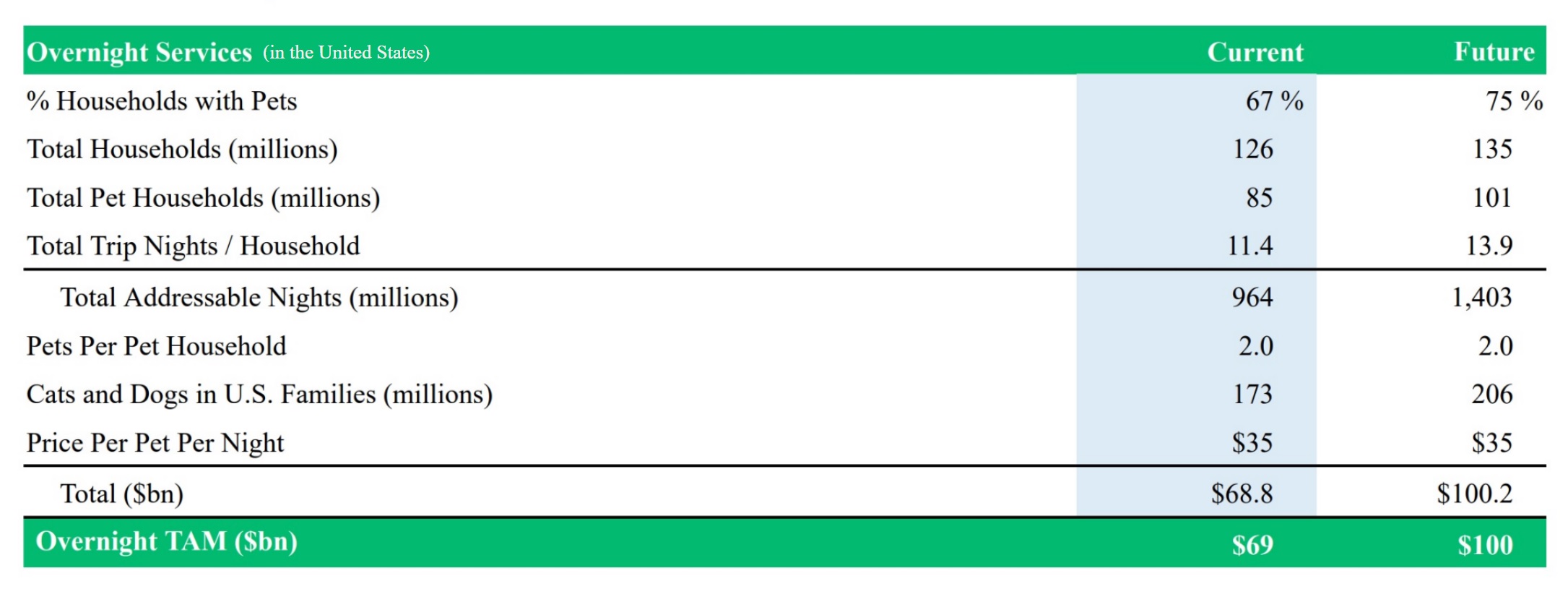

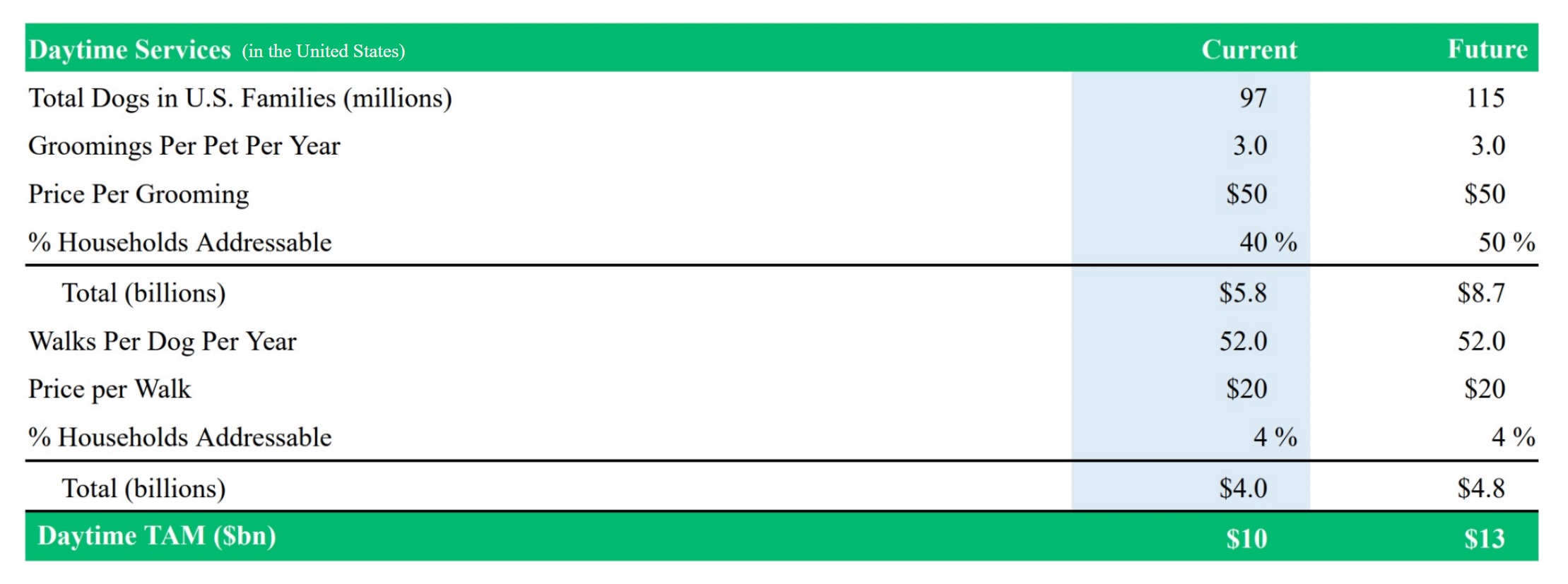

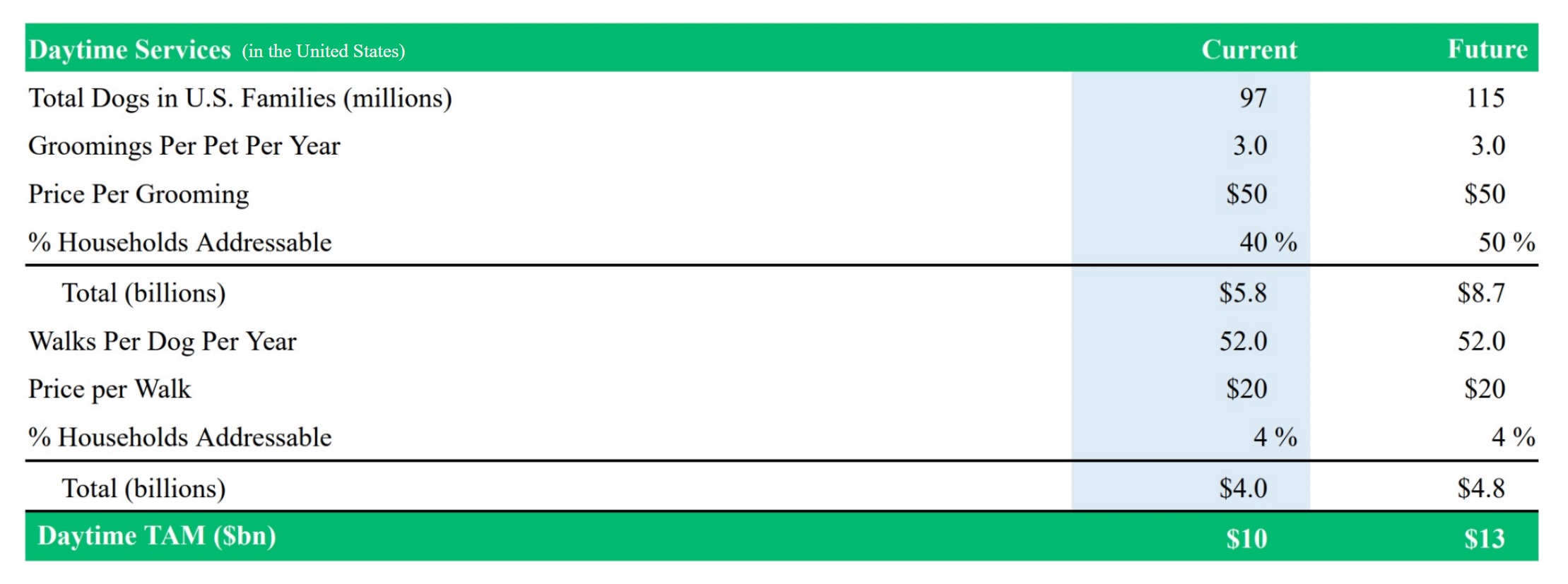

Rover is the world’s largest online marketplace for pet care. We connect pet parents with loving pet care providers who offer overnight services, including boarding and in-home pet sitting, as well as daytime services, including doggy daycare, dog walking, and drop-in visits. Through December 31, 2021, over three million unique pet parents and more than 660,000 pet care providers across North America, the United Kingdom and Western Europe have booked a service on Rover, enabling millions of moments of joy and play for people and pets.

For pets and their parents, we started Rover to create a better pet care solution than the existing options of friends and family, neighbors, and kennels. We built a marketplace where pet parents could match with pet people who wanted to earn earning extra income doing what they loved: spending time with pets. We built a simple and easy-to-use platform that enables pet parents to discover, book, pay and review pet care providers online or in our app. For pet care providers, we built tools to easily create a listing in the Rover marketplace along with simple tools for scheduling and booking care, communicating with pet parents, and receiving payment.

We generate revenue from service fees charged to pet care providers and pet parents based on a percentage of the booking value on our marketplace. We also earn revenue from ancillary sources such as background checks, affiliate advertising deals, and the Rover Store.

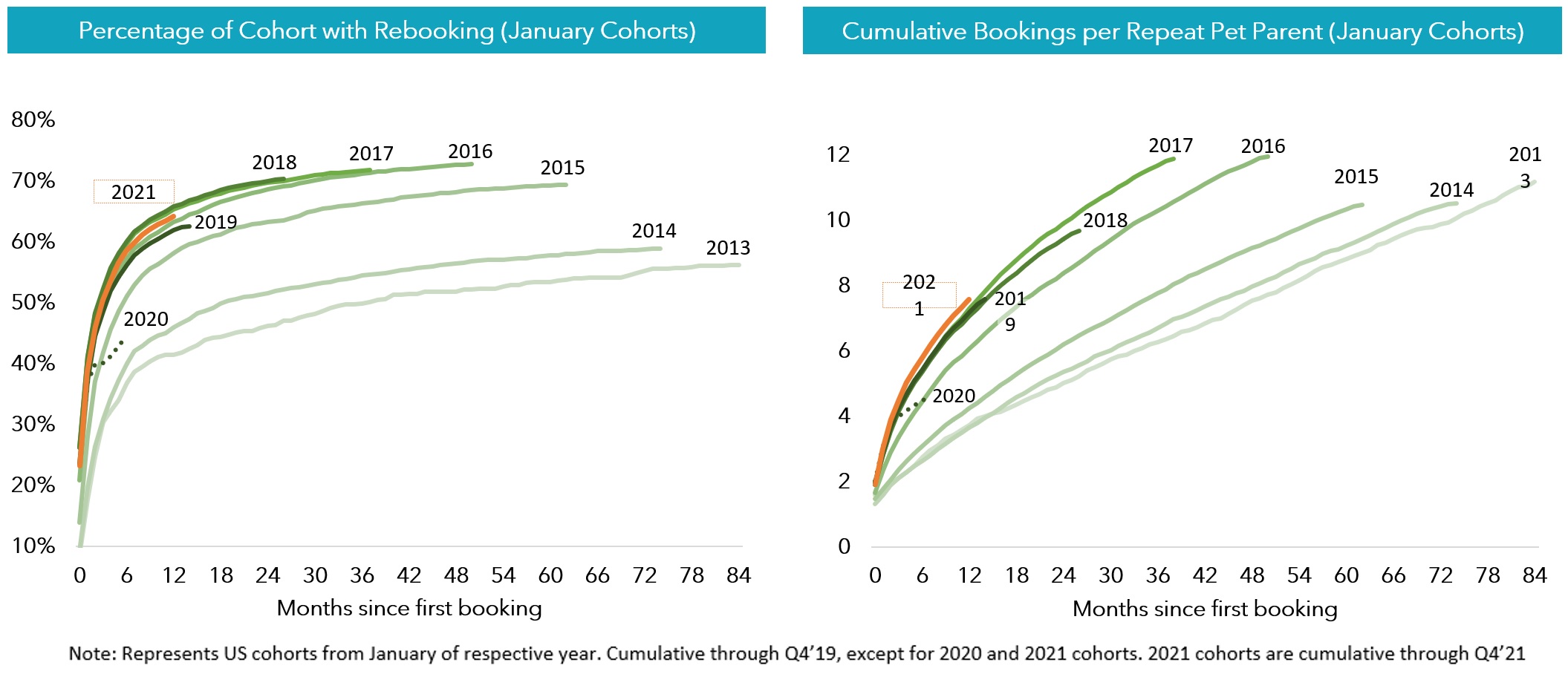

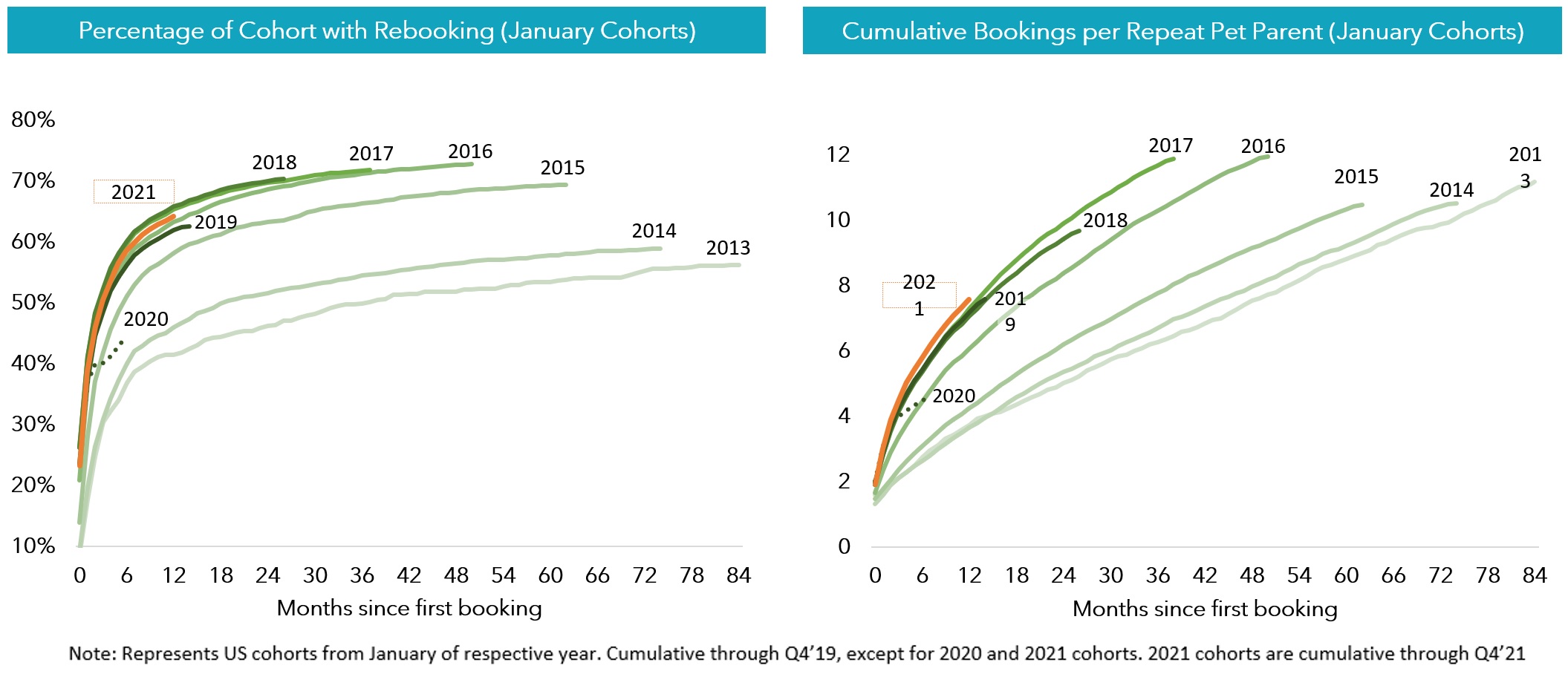

Our objective is to attract new pet parents to our platform and to successfully convert them into repeat bookers. We are inspired to keep building our business to bring the love of pets to people everywhere, especially in the times when people need that companionship the most.

Background

On July 30, 2021, Nebula Caravel Acquisition Corp., our legal predecessor company and a special purpose acquisition company sponsored by True Wind Capital that closed its initial public offering in December 2020, consummated the previously announced merger with A Place for Rover, Inc. and Fetch Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Caravel. Pursuant to the Merger, Merger Sub merged with and into A Place for Rover, Inc., the separate corporate existence of Merger Sub ceased, and A Place for Rover Inc. continued as the surviving corporation in the Merger and as a wholly owned subsidiary of Caravel. The Merger was approved by Caravel’s stockholders at a meeting held on July 28, 2021. On the Closing, Caravel changed its name to Rover Group, Inc.

On August 2, 2021, our common stock, formerly of Caravel, began trading on The Nasdaq Global Market under the ticker symbol “ROVR.”.

As a result of the Merger, we raised gross proceeds of $268.3 million, including the contribution of $275.1 million of cash held in Caravel’s trust account from its initial public offering, net of the redemption of Caravel common stock held by Caravel’s public stockholders of $146.8 million, $50.0 million private investment in public equity at $10.00 per share of our Class A Common Stock, and $80.0 million of additional gross proceeds from the Sponsor Backstop Subscription Agreement. Under the Sponsor Backstop Subscription Agreement, TWC Funds purchased an aggregate of 8,000,000 shares of our Class A Common Stock at $10.00 per share. In addition, pursuant to the Assignment Agreement, we raised additional gross proceeds of $10.0 million from the sale of our Class A

Common Stock at $10.00 per share. As a result of the Merger, we received net proceeds of $235.6 million, net of deferred transaction costs paid of $32.7 million.

Recent Developments

On March 1, 2022, Tracy Knox, the Company’s Chief Financial Officer, indicated her intent to retire as Chief Financial Officer on September 1, 2022. In connection with her planned retirement, we entered into an Employment and Transition Agreement (the “Transition Agreement”), dated as of March 4, 2022, with Ms. Knox. Subject to earlier separation of her at-will employment, the Transition Agreement provides that Ms. Knox will continue to serve as our Chief Financial Officer through September 1, 2022 (the “Succession Date”) and will remain employed at-will as an advisor to the Company through December 31, 2022 (the “Planned Separation Date”). The Transition Agreement supersedes the prior employment arrangements with Ms. Knox. From the Succession Date through her separation from employment (the “Transition Period”), Ms. Knox will remain employed at her current full-time salary and benefits for purposes of assisting with the transition of her duties to a successor Chief Financial Officer. See “Executive Compensation—Narrative Disclosure to Summary Compensation Table—Named Executive Officer Employment Arrangements—Tracy Knox.” On March 7, 2022, we announced that the Board, as part of its Chief Financial Officer succession planning, has identified Charlie Wickers, our current Vice President of Finance, as successor Chief Financial Officer effective on the Succession Date. Mr. Wickers, 36, has served as our Vice President of Finance since July 30, 2021 and of A Place for Rover, Inc., our wholly owned subsidiary, since September 2019, and served as the Head of Financial Planning and Analysis (“FP&A”) from May 2017 to September 2019. Prior to joining us, Mr. Wickers served as Director of FP&A at Ivanti, Inc., an IT software company, from May 2014 to April 2017. Mr. Wickers brings over 16 years of technology company experience in financial operations, financial planning and analysis and business analytics. In his tenure at the Company, Mr. Wickers has led FP&A and strategic finance, and has been part of the executive leadership team. Mr. Wickers serves as a leading member of our investor relations team including involvement in roadshows, conferences, and earnings communications.

Risk Factors Summary

The following is a summary of the principal risks we face that could materially adversely affect our business, results of operations, and financial condition, all of which are more fully described in the section titled “Risk Factors” immediately following this prospectus summary. This summary should be read in conjunction with the “Risk Factors” section and should not be relied upon as an exhaustive summary of the material risks facing our business. •The COVID-19 pandemic has materially adversely impacted and may continue to materially adversely impact our business, operating results and financial condition.

•We have incurred net losses in each year since inception and may not be able to achieve profitability.

•Our revenue growth rate has slowed over time, and may slow or reverse again in the future.

•Online marketplaces for pet care are still in relatively early stages of growth and if demand for them does not continue to grow or grows slower than expected our business, financial condition and operating results could be materially adversely affected.

•If we fail to retain existing pet care providers and pet parents or attract new pet care providers and pet parents, or if pet care providers fail to provide high-quality offerings, or if pet parents fail to receive high-quality offerings, our business, operating results and financial condition would be materially adversely affected.

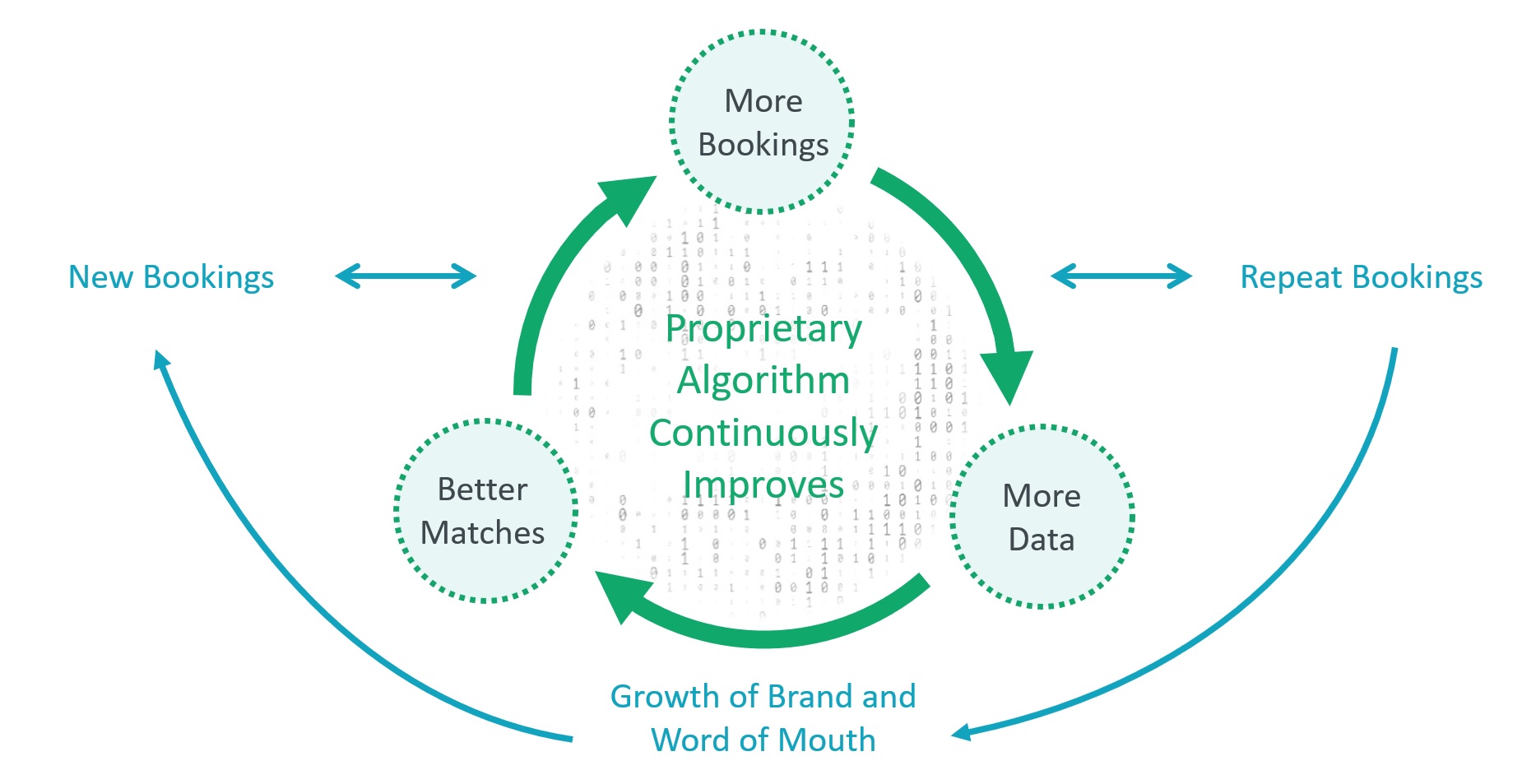

•The success of our platform relies on our matching algorithms and other proprietary technology and any failure to operate and improve our algorithms or to develop other innovative proprietary technology effectively could materially adversely affect our business, financial condition and operating results.

•Any further and continued decline or disruption in the travel and pet care services industries or economic downturn would materially adversely affect our business, results of operations and financial condition.

•The business and industry in which we participate are highly competitive and we may be unable to compete successfully with our current or future competitors.

•Maintaining and enhancing our brand reputation is critical to our growth and negative publicity could damage the Rover brand.

•Actions by pet care providers or pet parents that are criminal, violent, inappropriate, or dangerous, or fraudulent activity, may undermine the safety or the perception of safety of our platform and materially adversely affect our reputation, ability to attract and retain pet care providers and pet parents, business, operating results and financial conditions.

•If pet care providers are reclassified as employees under applicable law or new laws are passed causing the reclassification of pet care providers as employees or otherwise adopting employment-like restrictions with regard to pet care providers who use our platform, our business would be materially adversely affected.

•Our business is subject to a variety of U.S. laws and regulations, many of which are unsettled and still developing and failure to comply with such laws and regulations could subject us to claims or otherwise adversely affect our business, financial condition, or operating results.

•We have been subject to cybersecurity incidents in the past and anticipate being the target of future attacks. Any actual or perceived breach of security or security incident or privacy or data protection breach or violation could interrupt our operations, harm our brand and adversely affect our reputation, brand, business, financial condition and operating results.

•We rely on third-party payment service providers to process payments made by pet parents and payments made to pet care providers on our platform. If these third-party payment service providers become unavailable or we are subject to increased fees, our business, operating results and financial condition could be materially adversely affected.

•We depend on our highly skilled employees to grow and operate our business and if we are unable to hire, retain, manage and motivate our employees, or if our new employees do not perform as anticipated, we may not be able to grow effectively and our business, financial condition and operating results could be materially adversely affected.

•Our support function is critical to the success of our platform and any failure to provide high-quality service could affect our ability to retain our existing pet care providers and pet parents and attract new ones.

•We may face difficulties as we expand our operations into new local markets in which we have limited or no prior operating experience.

•Because we recognize revenue upon the start of a booked service and not at booking, upticks or downturns in bookings are not immediately reflected in our operating results.

•Our management has limited experience in operating a public company.

•We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future or fail to maintain an effective system of internal control over financial reporting which could result in a misstatement of the accounts or disclosures in our financial statements, that would result in a material misstatement of our annual or interim financial statements that would not be prevented or detected or cause us to fail to meet our periodic reporting obligations.

•We may face litigation and other risks as a result of the material weakness in the internal controls of our financial reporting.

•Insiders currently have and may continue to possess substantial influence over us, which could limit investors’ ability to affect the outcome of key transactions, including a change of control.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company” as defined in the JOBS Act. As such, we may take advantage of reduced disclosure and other requirements otherwise generally applicable to public companies, including:

•exemption from the requirement to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting;

•exemption from compliance with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditor’s report on the financial statements;

•reduced disclosure about our executive compensation arrangements; and

•exemption from the requirement to hold non-binding advisory votes on executive compensation or golden parachute arrangements.

We will remain an emerging growth company until the earliest to occur of: (1) the last day of the fiscal year in which we have at least $1.07 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” with at least $700.0 million of equity securities held by non-affiliates; (3) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period; and (4) the last day of the fiscal year ending after the fifth anniversary of the Caravel IPO, or December 31, 2025.

As a result of this status, we have taken advantage of reduced reporting requirements in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. In particular, in this prospectus, we have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies unless it otherwise irrevocably elects not to avail itself of this exemption. We have elected to use this extended transition period for complying with new or revised accounting standards until we are no longer an emerging growth company or until we affirmatively and irrevocably opt out of the extended transition period. As a result, our financial statements may not be comparable to the financial statements of companies that comply with the new or revised accounting pronouncements as of public company effective dates.

We are also a “smaller reporting company” as defined in Rule 12b-2 promulgated under the Exchange Act. We will remain a smaller reporting company until the first to occur of the last day of the fiscal year in which the aggregate market value of our common stock that is held by non-affiliates is at least $250 million and we have less than $100 million in revenue and the last day of the fiscal year in which we have at least $100 million in revenue and the aggregate market value of our common stock that is held by non-affiliates is at least $700 million (in each case, with respect to the aggregate market value of our common stock held by non-affiliates, as measured as of the last business day of the second quarter of such fiscal year). If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Additional Information

Our principal executive offices are located at 720 Olive Way, 19th Floor, Seattle, WA 98101, and our telephone number is (888) 453-7889.

Our website address is www.rover.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information contained on our website in deciding whether to purchase shares of our Class A Common Stock.

Our investor relations website is located at https://investors.rover.com/. We use our investor relations website to post important information for investors, including news releases, analyst presentations, and supplemental financial information, and as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website, in addition to following press releases, SEC filings and public conference calls and webcasts. We also make available, free of charge, on our investor relations website under “Financials—SEC Filings,” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC. The information on, or that can be accessed through, our investor relations website is not part of this prospectus, and you should not consider information contained on our investor relations website in deciding whether to purchase shares of our Class A Common Stock.

THE OFFERING

| | | | | | | | |

Shares of Class A Common Stock offered by the Selling Securityholders hereunder (representing the PIPE Shares, the Assigned Shares, and the Affiliated Shares as of the date of this prospectus) | | 91,476,337 shares |

| | |

| Shares of Class A Common Stock outstanding | | 180,261,620 shares |

| | |

| Use of Proceeds | | We will not receive any proceeds from the sale of our Class A Common Stock offered by the Selling Securityholders (the “Securities”). See the section of this prospectus titled “Use of Proceeds” appearing on page 55 of this prospectus for more information. We will pay certain costs associated with the sale of shares by the Selling Securityholders, other than underwriting discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred by them in disposing of the Securities. |

| | |

| Dividend Policy | | |

| | |

Risk Factors | | See the section titled “Risk Factors” beginning on page 11 of this prospectus and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our Class A Common Stock. |

| | |

Nasdaq Symbol | | “ROVR” |

The number of shares of Class A Common Stock outstanding after this offering is based on 180,261,620 shares of our Class A Common Stock outstanding as of March 4, 2022 and excludes:

•2,192,687 shares of Class A Common Stock that are the Remaining Earnout Shares;

•19,658,254 shares of Class A Common Stock issuable upon the exercise of outstanding options;

•4,098,934 shares of Class A Common Stock issuable upon the vesting of outstanding restricted stock units;

•12,687,682 shares of Class A Common Stock reserved for future issuance under our 2021 Equity Incentive Plan (the “2021 Plan”); and

•2,600,000 shares of Class A Common Stock reserved for future issuance under our 2021 Employee Stock Purchase Plan (the “2021 ESPP”).

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 57 of this prospectus and our consolidated financial statements and related notes thereto included elsewhere in this prospectus. Our business, operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the following risks actually occur, our business, operating results, financial condition and prospects could be materially and adversely affected. In that event, the market price of our Class A Common Stock could decline, and you could lose part or all of your investment. Risks Related to Our Business and Industry

The COVID-19 pandemic and the impact of actions to mitigate the COVID-19 pandemic have materially adversely impacted and may continue to materially adversely impact our business, operating results and financial condition.

Governments have imposed various restrictions to limit the spread of COVID-19, including emergency declarations at the federal, state and local levels, school and business closings, quarantines, “shelter at home” orders, travel restrictions, limitations on social or public gatherings and other social distancing measures. These actions, pet owners and pet care providers being infected with COVID-19, and new habits such as increased reliance on online meeting tools rather than in-person meetings and business travel, have had and may continue to have a material adverse impact on our long-term business, operations and financial condition, and the demand for pet care.

Given the evolving nature of COVID-19, including novel strains of the virus and the uncertainty it has produced around the world, we do not believe it is possible to predict the COVID-19 pandemic’s cumulative and ultimate impact on our future business, operating results and financial condition. The extent of the impact of the COVID-19 pandemic on our business and financial results will depend largely on future developments, including the duration and extent of the spread of COVID-19, the development, severity and transmissibility of novel strains of the COVID-19 virus, such as the Delta and Omicron variants, the availability, uptake, and effectiveness of vaccines and boosters, the prevalence of local, national and international travel restrictions, impacts on travel or work behavior, any risk or perceived risk that pets may be a vector for COVID-19, the impact on capital and financial markets and on the United States and global economies and governmental or regulatory orders that impact our business, all of which are highly uncertain and cannot be predicted.

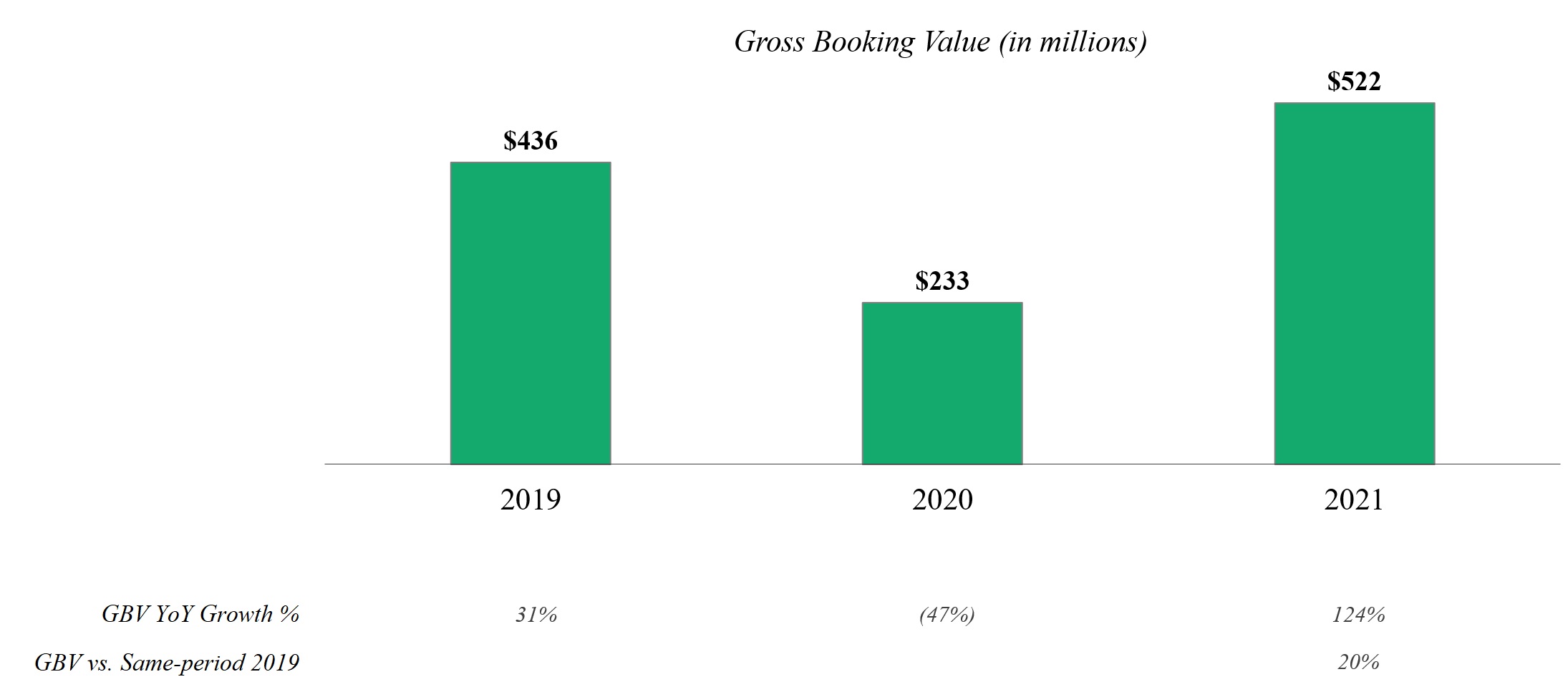

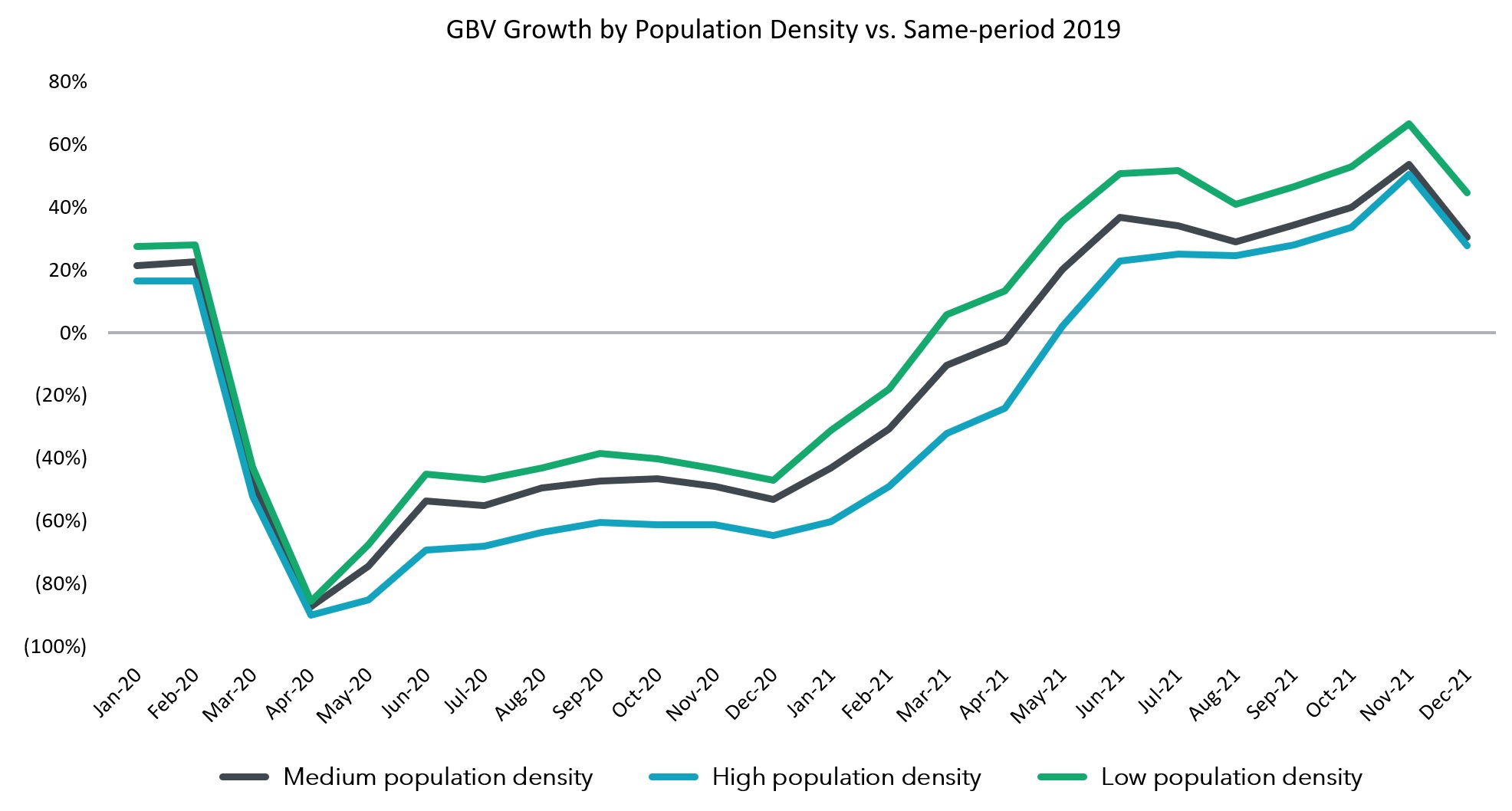

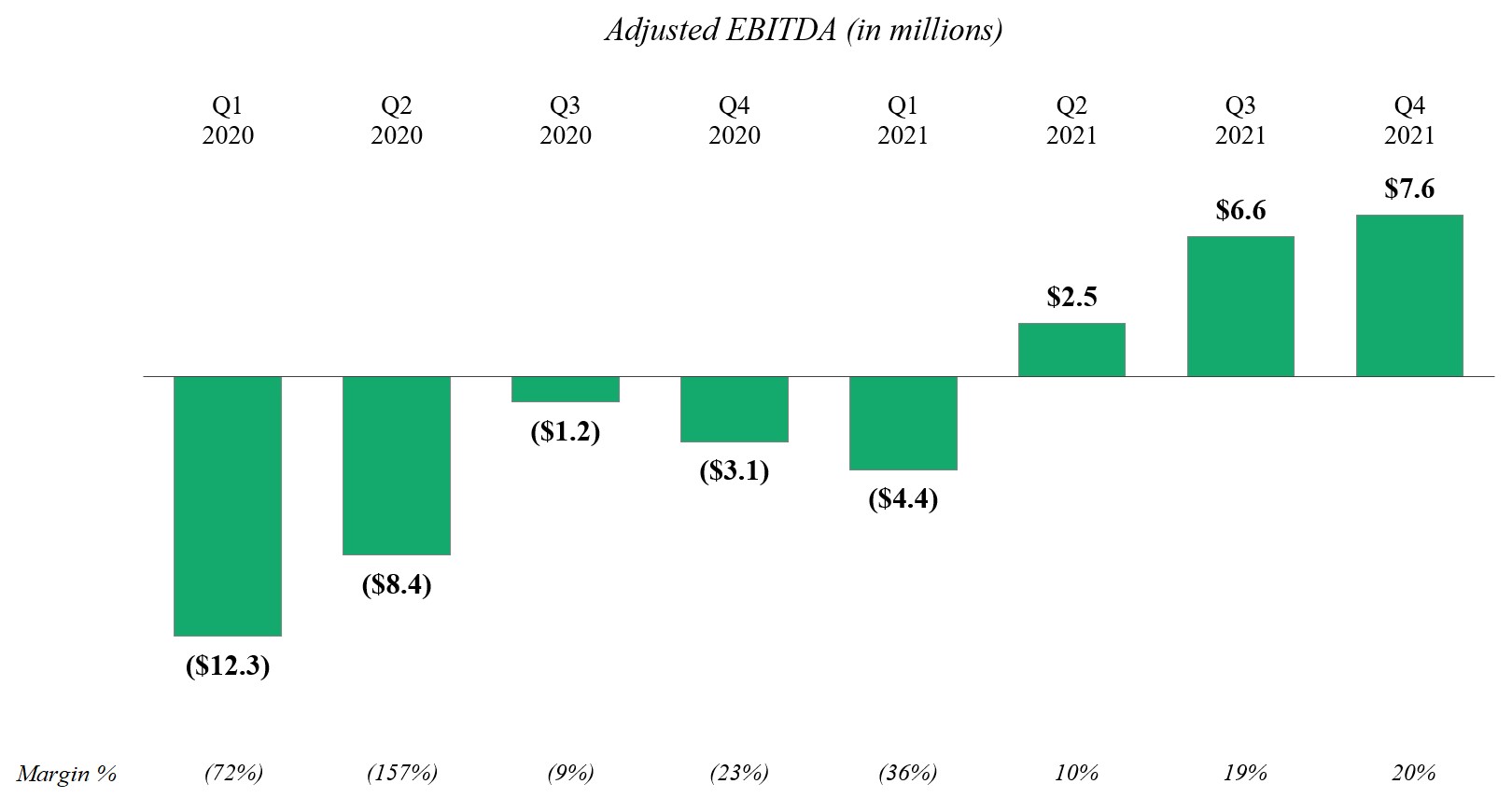

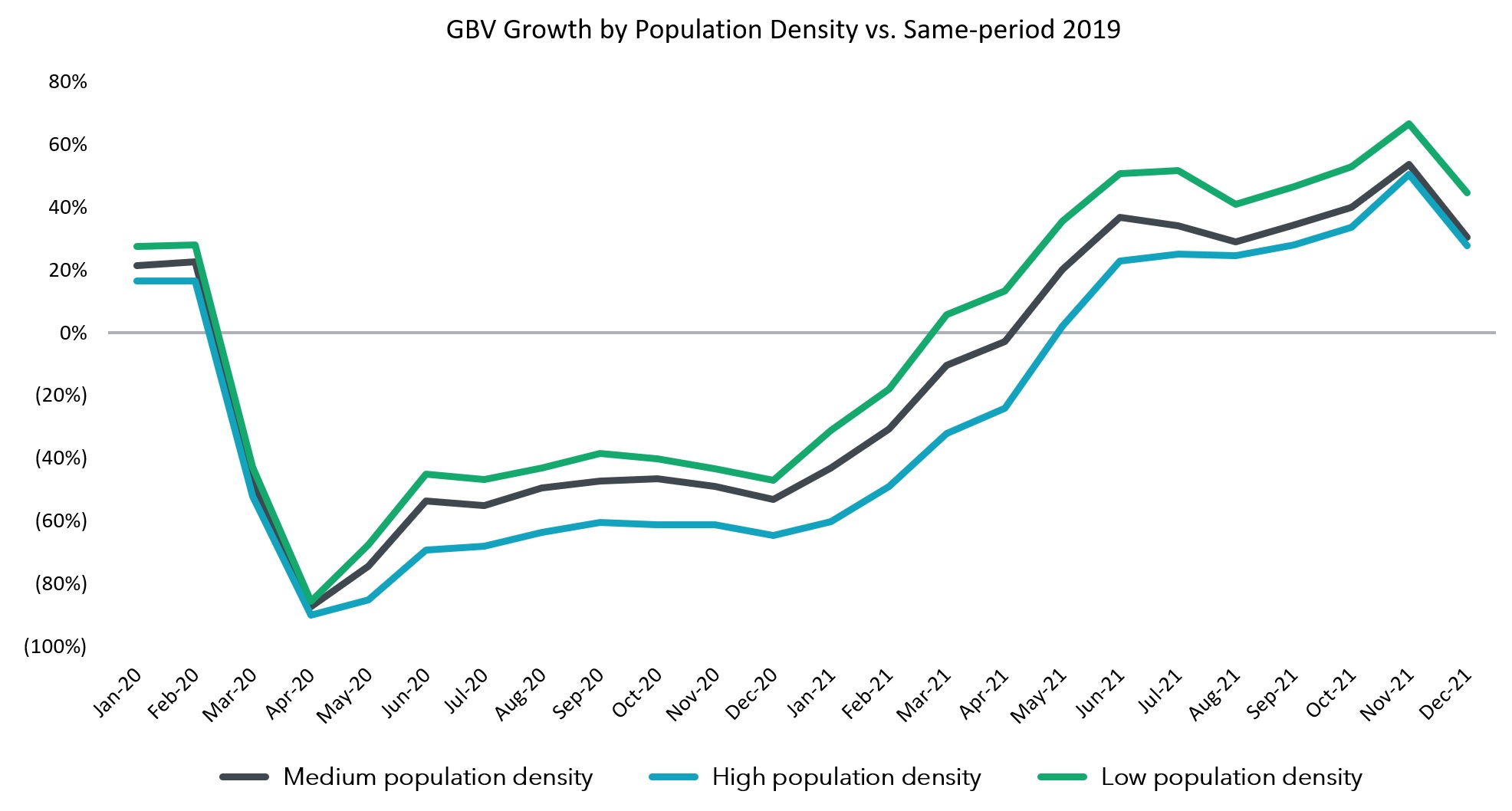

Although demand for our offerings resumed in May 2021 as shelter-in-place orders and travel advisories lifted and we achieved record quarterly highs for new and repeat bookings during the third quarter of 2021 during the Delta wave and record high gross booking value, or GBV, during the fourth quarter of 2021, we continue to see demand adversely impacted as a result of each COVID wave or variant and cancellation rates that remain elevated compared to pre-pandemic levels. Accordingly, our business may again be negatively impacted if governmental orders and advisories are reinstated due to novel strains of COVID-19 or if our pet parent and pet care provider base is infected with COVID-19, and may remain depressed for a significant length of time if COVID-19 results in long-term changes in behavior. We cannot predict when, if ever, cancellation rates will return to pre-pandemic levels, nor do we know how pet parent and pet service provider behavior will be impacted even if pre-pandemic levels of cancellation rates return. Any of the foregoing factors, or other cascading effects of the COVID-19 pandemic that are not currently foreseeable, will materially adversely impact our business, operating results, financial condition and prospects.

Most of our employees and many pet parents are still working remotely and these arrangements, especially if maintained over the long-term, could have a number of materially negative impacts on our business, including:

•reduced demand for daytime pet care services due to pet parents’ presence at home;

•lower customer satisfaction resulting from potential delays or slower than usual response times in support assistance to pet parents and pet service providers that use our platform;

•slower execution of our business plans and reduced productivity and availability of key personnel, other employees and third-party service providers that perform critical services;

•potential operational failures due to changes in our normal business practices;

•increased consumer privacy, information technology security and fraud risks; and

•impairment charges related to real property lease agreements if remote work arrangements become permanent.

We have incurred net losses in each year since inception and may not be able to achieve profitability.

As of December 31, 2021, we had an accumulated deficit of $320.3 million. Historically, we have invested significantly in efforts to grow our pet parent and pet care provider network, introduced new or enhanced offerings and features, increased marketing spend, expanded operations, and hired additional employees. We are passionate about continually enhancing the experience of pets, pet parents and pet care providers, which may not necessarily maximize short-term financial results. This focus may not be consistent with our short-term expectations and may not produce the long-term benefits expected. In the second quarter of 2020, as a result of the COVID-19 pandemic, we significantly reduced fixed and variable costs. We have begun to reinvest in our business, however, and have made significant investments related to improving market conditions and becoming a public company. Especially in light of the COVID-19 pandemic, we may not succeed in increasing revenue sufficiently to offset these higher expenses, which would adversely impact our ability to achieve profitability.

Our historic revenue growth rate has slowed over time and may slow or reverse again in the future.

Prior to COVID-19, we experienced significant revenue growth from 2016 to 2019, growing from $16 million to $95 million in revenue. In 2020 revenue decreased 49% from 2019 due to the COVID-19 pandemic. Although 2021 revenue exceeded 2019 levels despite the continued adverse impacts of the COVID-19 pandemic on travel and demand for pet services, such growth may again reverse or slow due to novel strains of the COVID-19 virus, low vaccination rates, seasonal variations or negative impacts on travel due to increased fuel costs or geopolitical events related to the ongoing Russian invasion of Ukraine. Investors should not rely on our revenue or revenue growth for any previous quarterly or annual period as any indication of revenue or revenue growth in future periods.

Future revenue growth depends on the growth of the number of pet parents on our platform, the frequency with which they seek to book services, our ability to attract sufficient high-quality pet care providers to meet pet parent demand, and the effects of general economic and business conditions worldwide, including trends in the travel industry. We also expect to continue to make investments in the development and expansion of our technology and business, which may not result in increased revenue or growth. If the demand for access to online marketplaces for individual pet care services does not grow, or if we are unable to maintain share, our revenue growth rate could be materially adversely affected. A softening of demand, whether caused by events outside of our control, such as COVID-19, changes in pet parent and pet care provider preferences or other risks described elsewhere in this prospectus, will result in decreased revenue.

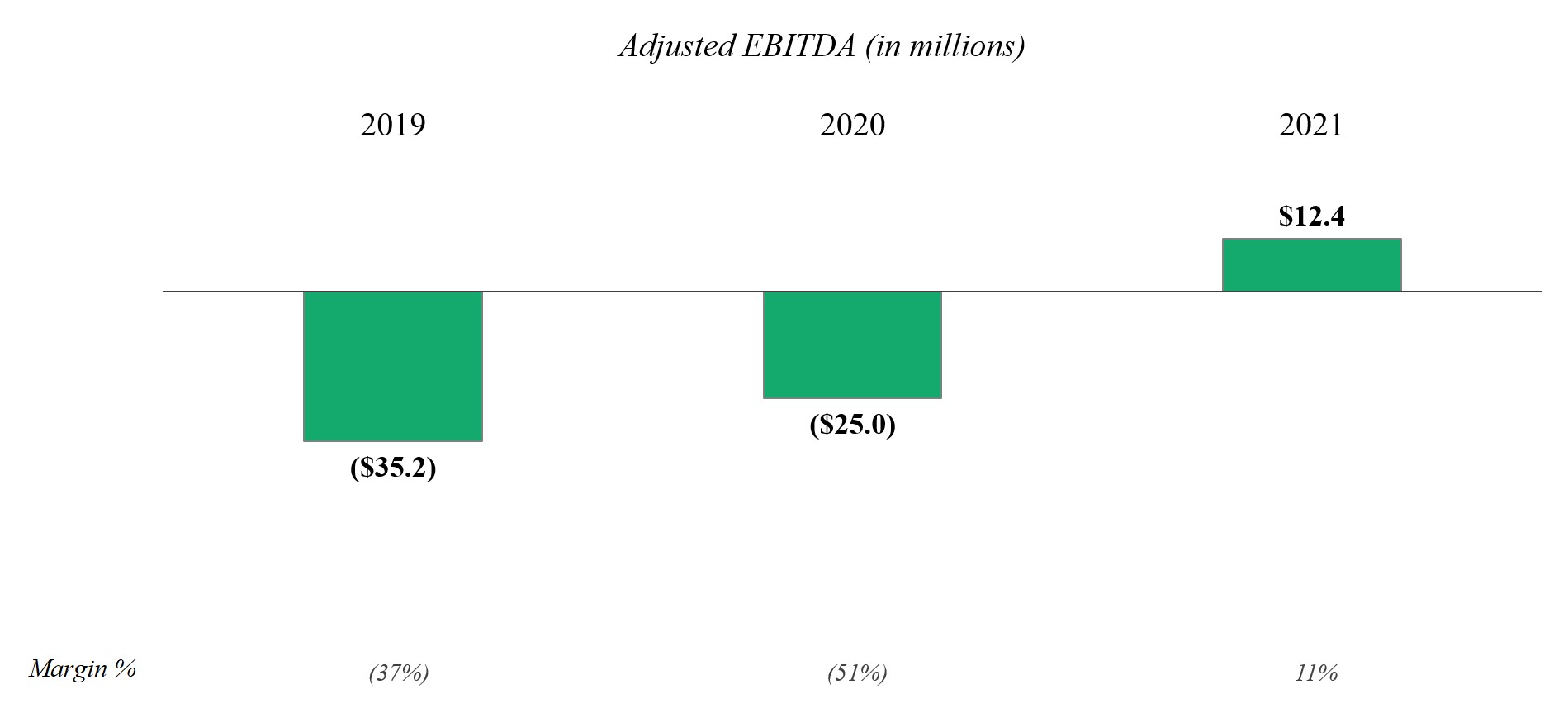

Our Adjusted EBITDA may not continue to grow over time and may slow or reverse again in the future.