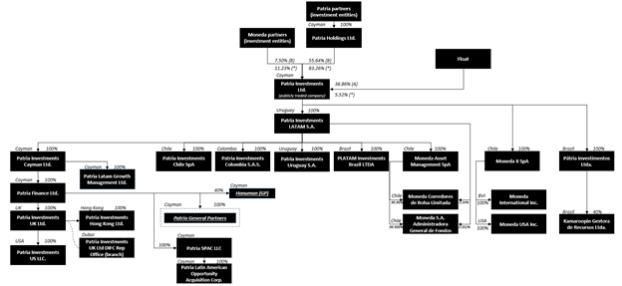

The following chart shows our corporate structure and equity ownership as of December 31, 2021, after giving effect to our corporate reorganization and combination with Moneda. This chart is provided for illustrative purposes only and does not show all of the legal entities:

| (1) | 11,437,198 Class B common shares of the 81,900,000 Class B common shares beneficially owned by Patria Holdings Limited are held of record by SPV PHL, which is a wholly owned subsidiary of Patria Holdings Limited. |

| (2) | References to (A) stand for Class A common shares, (B) stand for Class B common shares, and (*) stand for voting power. |

Special Note Regarding

Non-GAAP

Financial Measures This annual report presents our Fee Related Earnings and Distributable Earnings information, which are

Non-GAAP

measures. A Non-GAAP

financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. Fee Related Earnings

Fee Related Earnings, or FRE, is a performance measure used to assess our ability to generate profits from revenues that are measured and received on a recurring basis. FRE is calculated as management, incentive, advisory and other ancillary fees, net of related taxes, less personnel and administrative expenses, adjusted for brand amortization, amortization of placement agents and rebate fees, excluding the impacts of equity-based compensation and nonrecurring expenses. FRE includes base compensation (salaries and wages) in fixed amounts and variable compensation in the form of discretionary cash bonuses, which are awarded based on each individual’s performance upon consideration of a number of qualitative and quantitative factors (comparing actual individual performance in influencing such factors with prior and anticipated performance), but which are not directly based upon revenues. Accordingly, there are no specific revenue amounts that relate to compensation components included in FRE. Incentive fees are realized performance-based fees earned by certain funds when the returns for such funds surpass the relevant benchmark over a specified time horizon. Such incentive fees are included in FRE because they represent a source of revenues that is measured and received on a recurring basis and is not dependent on realization events from the underlying investments, although the amount of incentive fees may fluctuate based on the performance of the funds relative to the relevant benchmark.

2