UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2021 | |||||

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Date of event requiring this shell company report:

For the transition period from to

Commission File number: 001-39968

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Province of British Columbia

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Legal Officer

TELUS International (Cda) Inc.

Tel: (604 ) 695-6400

(Name, telephone, e-mail and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

At February 10, 2022, 66,046,364 subordinate voting shares were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b of the Exchange Act. (Check one):

Accelerated filer o | Non-accelerated Filer o | Emerging growth company | ||||||||||||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x Standards Board | ||||||||

o US GAAP | o Other | |||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

TABLE OF CONTENTS

1

INTRODUCTION

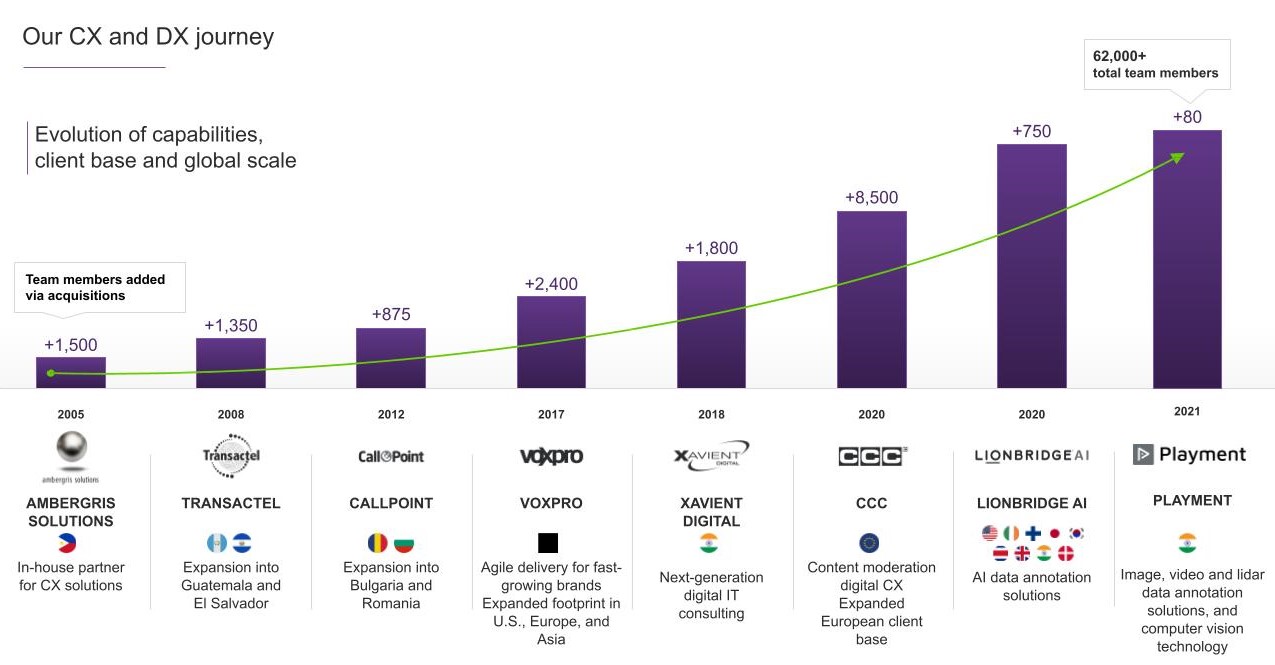

Unless otherwise indicated or where the context requires otherwise, all references in this annual report on Form 20-F (Annual Report) to the “Company”, “TELUS International”, “TI”, “we”, “us”, “our” or similar terms refer to TELUS International (Cda) Inc. and its subsidiaries. All references in this Annual Report to “TELUS” refer to TELUS Corporation and its subsidiaries other than TELUS International. All references in this Annual Report to “Baring” refer to Baring Private Equity Asia. All references in this Annual Report to “Competence Call Center” or “CCC” refer to the entirety of the assets and operations of Triple C Holding which was merged into TELUS International Germany GmbH on December 16, 2020 with TELUS International Germany GmbH as the surviving entity. All references in this Annual Report to “TI Northern Europe” or “TINE” refer to the entity comprised of substantially all the assets of CCC, which we acquired on January 31, 2020 and which was subsequently rebranded. All references to “TELUS International AI Data Solutions”, “TIAI Data Solutions”, “Lionbridge AI” or “TIAI” refer to the data annotation business of Lionbridge Technologies, Inc, which we acquired on December 31, 2020 and Playment, a Bangalore, India-based leader in computer vision tools and services specialized in 2D and 3D image, video and LiDAR (light detection and ranging), which we acquired on July 2, 2021.

We use various trademarks, trade names and service marks in our business, including TELUS, which is used under license from TELUS Corporation. For convenience, we may not include the ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this Annual Report are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim”, “anticipate”, “assume”, “believe”, “contemplate”, “continue”, “could”, “due”, “estimate”, “expect”, “goal”, “intend”, “may”, “objective”, “plan”, “predict”, “potential”, “positioned”, “seek”, “should”, “target”, “will”, “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology.

These forward-looking statements include, but are not limited to, statements about:

•our ability to execute our growth strategy, including by expanding services offered to existing clients and attracting new clients;

•our ability to maintain our corporate culture and competitiveness of our service offerings;

•our ability to attract and retain talent;

•our ability to integrate, and realize the benefits of, our acquisitions of CCC, Managed IT Services business (MITS) and TIAI;

•the relative growth rate and size of our target industry verticals;

•our projected operating and capital expenditure requirements; and

•the impact of the COVID-19 pandemic, including the development and spread of new and existing variants, and related conditions, on our business, financial condition, financial performance and liquidity.

These factors should not be construed as exhaustive and should be read with the other cautionary statements in this Annual Report. These forward-looking statements are based on our current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions, and are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this Annual Report. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data. These forward-looking statements speak only as at the date of this Annual Report. Except as

2

required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Annual Report contains estimates, projections, market research and other information concerning our industry, our business, and the markets for our services. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry and general publications, government data and similar sources.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors”. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

Any references to forward-looking statements in this Annual Report include forward-looking information within the meaning of applicable Canadian securities laws.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The financial statements of TELUS International included in this Annual Report are presented in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB), and consist of the consolidated statements of financial position as at December 31, 2021 and 2020 and the consolidated statements of income and other comprehensive income, changes in owners’ equity, and cash flows, for each of the years in the three-year period ended December 31, 2021.

In this Annual Report, unless otherwise specified, all monetary amounts are in U.S. dollars, all references to “US$”, “$”, “USD” and “dollars” mean U.S. dollars and all references to “C$”, “CDN$” and “CAD$”, mean Canadian dollars, and all references to “euro” and “€” mean the currency of the European Union.

ENFORCEMENT OF CIVIL LIABILITIES

We are incorporated under the laws of the Province of British Columbia, Canada, with our principal place of business in Vancouver, Canada. Some of our directors and officers, and the auditor named in this Annual Report, are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets, and all or a substantial portion of our assets, are located outside of the United States. As a result, it may be difficult for shareholders who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for shareholders who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. There can be no assurance that U.S. investors will be able to enforce against us, members of our board of directors, officers or certain experts named herein who are residents of Canada or other countries outside the United States, any judgments in civil and commercial matters, including judgments under the federal securities laws.

3

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 KEY INFORMATION

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Risk Factors Summary

Investing in our subordinate voting shares involves a high degree of risk. You should carefully consider the risks described in this “Item 3D—Risk Factors” before making a decision to invest in our subordinate voting shares. If any of these risks actually occur, our business, financial condition and financial performance would likely be materially adversely affected. In such case, the trading price of our subordinate voting shares would likely decline and you may lose part or all of your investment. Below is a summary of some of the principal risks we face:

•We face intense competition from companies that offer services similar to ours.

•Our growth prospects are dependent upon attracting and retaining enough qualified team members to support our operations, as competition for talent is intense.

•Our ability to grow and maintain our profitability could be materially affected if changes in technology and client expectations outpace our service offerings and the development of our internal tools and processes or if we are not able to meet the expectations of our clients.

•If we cannot maintain our culture as we grow, our services, financial performance and business may be harmed.

•Our business and financial results could be adversely affected by economic and geopolitical conditions and the effects of these conditions on our clients’ businesses and demand for our services.

•Three clients account for a significant portion of our revenue and loss of or reduction in business from, or consolidation of, these or any other major clients could have a material adverse effect.

•Our business may not develop in ways that we currently anticipate due to negative public reaction to offshore outsourcing, proposed legislation or otherwise.

•Our business and financial results have been, and in the future may be, adversely impacted by the COVID-19 pandemic and related conditions.

•Our business would be adversely affected if individuals providing data annotation services through TIAI’s crowdsourcing solutions were classified as employees and not as independent contractors.

•We may be unable to successfully identify, complete, integrate and realize the benefits of acquisitions or manage the associated risks.

4

•The unauthorized disclosure of sensitive or confidential client and customer data, through cyberattacks or otherwise, could expose us to protracted and costly litigation, damage our reputation and cause us to lose clients.

•Our content moderation team members may suffer adverse effects in the course of performing their work. Although the wellness and resiliency programs we offer are designed to support the physical and mental well-being of our team members, there may be occasions where our wellness and resiliency programs do not sufficiently mitigate those effects, given the pace of change in the content to be moderated, changes in regulations, shifts in recommended approaches to address these effects and other influences on this type of work. Our failure to mitigate these effects could adversely affect our ability to attract and retain team members and could result in increased costs, including due to claims against us.

•The dual-class structure contained in our articles has the effect of concentrating voting control and the ability to influence corporate matters with TELUS.

•The market price of our subordinate voting shares may be affected by low trading volume and the market pricing for our subordinate voting shares may decline as a result of future sales, or the perception of the likelihood of future sales, by us or our shareholders in the public market.

•TELUS appointed directors will, for the foreseeable future, control the TELUS International Board of Directors.

Risks Related to Our Business

We face intense competition from companies that offer services similar to ours. If we are unable to differentiate to compete effectively, our business, financial performance, financial condition and cash flows could be materially adversely impacted.

The market for the services we offer is very competitive and we expect competition to intensify and increase from a number of our existing competitors, including professional services companies that offer consulting services, information technology companies with digital capabilities, and traditional contact center and business process outsourcing (BPO) companies that are expanding their capabilities to offer higher-margin and higher-growth services. In addition, the continued expansion of the services we offer and the markets we operate in will result in new and different competitors, many of which may have significantly greater market recognition than we do in the markets we are entering, as well as increased competition with existing competitors who are also expanding their services to cover digital capabilities.

Many of these existing and new competitors have greater financial, human and other resources, greater technological expertise, longer operating histories and more established relationships in the verticals that we currently serve or may expand to serve in the future. In addition, some of our competitors may enter into strategic or commercial relationships among themselves or with larger, more established companies in order to increase their ability to address client needs or enter into similar arrangements with potential clients. We also face competition from service providers that operate in countries where we do not have delivery locations because our clients may, to diversify geographic risk and for other reasons, seek to reduce their dependence on any one country by shifting work to another country in which we do not operate. All of these factors present challenges for us in retaining and growing our business.

From time to time, our clients who currently use our services may determine that they can provide these services in-house. As a result, we face the competitive pressure to continually offer our services in a manner that will be viewed by our clients as better and more cost-effective than what they could provide themselves.

Our inability to compete successfully against companies that offer services similar to ours and to offer our clients a compelling alternative to taking the services we provide in-house could result in increased client churn, revenue loss, pressures on recruitment and retention of team members, service price reductions and increased marketing and promotional expenses, or reduced operating margins which could have a material adverse effect on our business, financial performance, financial condition and cash flows.

5

Our growth prospects are dependent upon attracting and retaining enough qualified team members to support our operations, as competition for talent is intense, and failure to do so may result in an adverse impact on our business and financial results.

Our business is highly competitive and its success is dependent on our ability to access and retain skilled labour. Our growth prospects, success and ability to meet our clients’ expectations and our growth objectives depends on our ability to recruit and retain team members with the right technical skills and/or language capabilities at competitive cost levels. We need to continuously attract and seek new talent, and there is significant competition for professionals with skills necessary to perform the services we offer to our clients. In addition, in many of the geographies we operate there may be a limited pool of potential professionals with the skills we seek. The increased competition for these professionals increases our costs to recruit and retain team members and presents challenges for us in finding team members for our client programs. In particular, we depend on attracting and retaining key sales and account management talent. If we are unable to attract and retain key sales and account management talent, it may reduce our ability to gain new business and maintain existing client relationships.

Additionally, our failure to provide innovative benefits to our team members could decrease our competitiveness as an employer and adversely impact our ability to attract and retain a skilled workforce. To attract and retain highly skilled team members, we have had to offer, and believe we will need to continue to offer, differentiated compensation packages, specific to the geography and skill sets of the team members we are seeking to attract and hire. We have also had to incur costs to provide specialized services and amenities to our team members that impact the profitability of our business. We may need to make significant investments to attract and retain team members and we may not realize sufficient returns on these investments. An increase in the attrition rate among our team members, particularly among our higher-skilled workforce, would increase our recruiting and training costs and decrease our operating efficiency, productivity and profit margins. From time to time, and over the course of 2021 in some regions, we have also experienced higher levels of voluntary attrition, and, in those periods, we have been required to expend time and resources to recruit and retain talent, restructure parts of our organization, and train and integrate new team members. If we are not able to effectively attract and retain team members, we may see a decline in our ability to meet our clients’ demands, which may impact the demand for our services and we may not be able to innovate or execute quickly on our strategy, and our ability to achieve our strategic objectives will be adversely impacted and our business will be harmed.

Additionally, evolving technologies, competition and/or client demands may entail high costs associated with retaining and retraining existing team members and/or attracting and training team members with new backgrounds and skills. Changing team member demographics, organizational changes, inadequate organizational structure and staffing, inadequate team member communication, changes in the effectiveness of our leadership, a lack of available career and development opportunities, changes in compensation and benefits, the unavailability of appropriate work processes and tools, client reductions and operational efficiency initiatives may also negatively affect team member morale and engagement, harm our ability to retain acquired talent from our acquisitions, increase team member turnover, increase the cost of talent acquisition and negatively impact service delivery and the customer experience. If we are unable to attract and retain sufficient numbers of highly skilled professionals, our ability to effectively lead our current projects and develop new business could be jeopardized, and our business, financial performance, financial condition and cash flows could be materially adversely affected.

Our ability to grow and maintain our profitability could be materially affected if changes in technology and client expectations outpace our service offerings and the development of our internal tools and processes, which could have a material adverse effect on our business, financial performance, financial condition and cash flows.

Our growth, profitability and the diversity of our revenue sources will depend on our ability to develop and adopt new technologies to expand our existing offerings, proactively identify new revenue streams and improve cost efficiencies in our operations, all while meeting rapidly evolving client expectations. Although we are focused on maintaining and enhancing the range of our offerings, we may not be successful in anticipating or responding to our clients’ expectations and interests in adopting evolving technology solutions and the integration of these technology solutions into our offerings may not achieve the intended enhancements or cost reductions in our operations. New services and technologies offered by our competitors may make our service offerings uncompetitive, which may reduce our clients’ interest in our offerings and our ability to attract new clients. Our failure to innovate, maintain technological advantages or respond effectively and timely to changes in technology could have a material adverse effect on our business, financial performance, financial condition and cash flows.

6

If we fail to establish our digital brand and successfully market our digital service offerings, our growth prospects, anticipated business volumes and financial performance may be adversely affected.

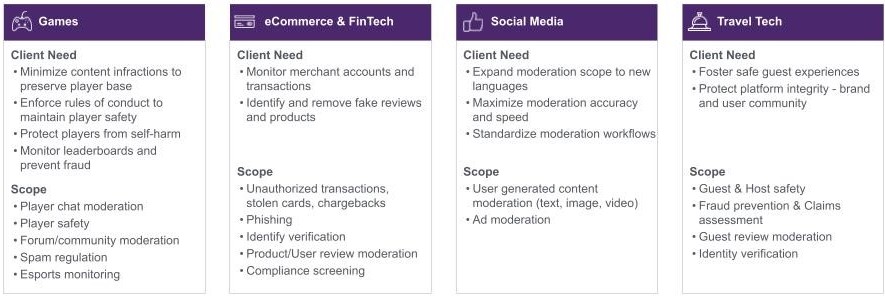

Certain of our existing clients and potential new clients may only know us for our voice-based customer support services. Our ability to realize our digital first strategy and increase revenue across our core verticals, including Tech and Games, Communications and Media, eCommerce and FinTech, Travel and Hospitality and Healthcare, depends on our promotion of our ability to provide digital services in these areas to existing and potential clients. If we are not successful in establishing our digital brand and marketing our expanded service offerings to our existing and potential clients, our ability to shift our existing clients into more profitable digital services and attract new clients to these service offerings may be limited, which may adversely affect our growth prospects and anticipated business volumes and financial performance.

If we cannot maintain our culture as we grow, our services, financial performance and business may be harmed.

We believe that our unique customer-first and caring culture has led to our ability to attract and retain a highly skilled, diverse, engaged and motivated workforce. This has driven our strong client retention and the higher satisfaction scores we receive from our clients’ customers, which has, in part, been responsible for our growth and differentiation in the marketplace. It may become more difficult for us to maintain an inclusive culture that supports our success if we continue to evolve our products and services, grow into new geographies, open new delivery locations, increase the number of team members and acquire new companies. If our unique culture is not maintained, our ability to attract and retain highly skilled team members and clients across our core verticals may be adversely impacted, and our operational and financial results may be negatively affected.

If we fail to maintain a consistently high level of service experience and communicate and implement impactful environmental, social, governance (ESG) initiatives, our ability to attract new and retain existing clients and team members could be adversely affected.

Our clients’ loyalty, likelihood to expand the services that they use with us and likelihood to recommend us is dependent upon our ability to provide a service experience that meets or exceeds our clients’ expectations and that is differentiated from our competitors. Our ability to attract new clients, retain our existing clients and attract and retain team members is highly dependent on the satisfaction ratings that our clients provide about us and the satisfaction ratings that our clients receive from their customers based on the services we provide, all of which affects our reputation. We believe our focus on client experience is critical to attracting new clients and retaining and growing our business with our existing clients. If we are unable to maintain a consistently high level of service, our clients could change service providers, our revenues and profitability could be negatively impacted, and our reputation could suffer.

TELUS International's reputation with team members, customers, investors and stakeholders is related to our commitment to a caring culture that prioritizes our ESG initiatives related to diversity, inclusion, equity, giving back to our communities, sustainability and good governance. As we expand our business, if we fail to live up to our commitments in this regard or fail to do so on a timely basis, it could result in adverse financial and operating results. Further, the corporate sustainability and social-purpose activities that we host assist us in attracting and retaining clients. These activities are important to us and our team members and are a part of our culture, and thus are becoming a differentiating factor for clients in selecting a service provider. More and more companies, including many of our clients, are demanding that their service providers embody corporate sustainability and social purpose goals that reflect their own brand image and are consistent with the ones their customers and other stakeholders have adopted. If we are unable to meet or exceed the evolving expectations of our clients in these areas or implement initiatives on a timely basis, and effectively communicate them to our clients, our reputation may suffer, which may negatively impact our ability to attract new and retain existing clients. Our ESG programs and initiatives are also important to our team members, and our failure to meet or exceed the evolving expectations of our team members in these areas could have adverse impacts on our ability to attract and retain talent upon which our service offerings depend. As a result, we have invested significant resources in developing and maintaining our corporate sustainability and social purpose activities, and the required levels of such investments may increase in the future as such activities become increasingly important to our clients and team members, which would increase our costs and may adversely affect our financial performance and cash flows.

Although we strive to implement a “customer-first” culture, any failure to maintain a consistently high level of customer service, or a market perception that we do not maintain high-quality customer service, or a failure to communicate effectively or meet our clients’ and team members’ expectations about our ESG initiatives, could adversely affect our ability to attract new clients and retain existing clients, and increase attrition and other costs associated with retaining talent, all of which could have a material adverse effect on our business, financial performance, financial condition and cash flows.

7

Our business and financial results could be adversely affected by economic and geopolitical conditions and these conditions could have an effect on our clients’ businesses and levels of business activity, demand for our services, as well as our and our clients’ liquidity and access to capital.

The COVID-19 pandemic has caused, and is likely to continue to cause, additional slowdown in the global economy, as is evidenced by the recent declines in investments, exports and industrial production. The global spread of COVID-19 has created, and is likely to continue to create, significant volatility, uncertainty and economic disruption. In addition, volatility in the domestic politics of major markets may lead to changes in the institutional framework of the international economy. For further information, see “—Our business and financial results have been, and in the future may be, adversely impacted by the COVID-19 pandemic”.

The global economy may enter into a deep recessionary period as there continues to be signs of continued economic slowdown and weakness around the world. Globally, countries may require additional financial support, sovereign credit ratings may continue to decline and there may be default on sovereign debt obligations of certain countries. Any of these global economic conditions may increase the cost of borrowing and cause credit to become more limited, which could have a material adverse effect on our business, financial condition, financial performance and cash flows.

Changes in the general level of economic activity, such as decreases in business and consumer spending, could result in a decrease in demand for the products and services that our clients provide to their customers, and consequently reduce our clients’ demand for our services, which would reduce our revenue. Economic and political uncertainty could undermine business confidence and cause potential new clients to delay engaging us and our existing clients to reduce or defer their spending on our services or reduce or eliminate spending under existing contracts with us. These developments, or the perception that any of them could occur, have had and may continue to have a material adverse effect on global economic conditions and the stability of global financial markets. For example, the withdrawal of the United Kingdom from the European Union in January 2020, commonly referred to as “Brexit”, has created significant political and economic uncertainty regarding the future trading relationship between the United Kingdom and the European Union. These and other economic and geopolitical conditions may affect our business in a number of ways, as we have operations in 28 countries and we service clients across multiple geographic regions. If any of these conditions affect the countries in which our largest clients, including TELUS, are located or conduct their business, we may experience reduced demand for and pricing pressure on our services, which could lead to a reduction in business volumes and could adversely affect financial performance.

The cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads. The current global economic slowdown and the possibility of continued turbulence or uncertainty in the European Union, United States, countries in Asia and international financial markets and economies, and the political climate in the United States, may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our clients. If these market conditions continue or worsen, it may limit our ability to access financing or increase our cost of financing to meet liquidity needs, and affect the ability of our clients to use credit to purchase our services or to make timely payments to us, which could result in material adverse effects on our business, financial condition, financial performance and cash flows.

We cannot predict the timing or duration of an economic slowdown or the timing or strength of a subsequent economic recovery generally or in our targeted verticals. If macroeconomic conditions worsen or the current global economic conditions continue for a prolonged period of time, we are not able to predict the impact that such conditions will have on our business, financial condition, financial performance and cash flows.

If we are unable to accurately forecast our pricing models or optimize the mix of products and services we provide to meet changing client demands, or if we are unable to adapt to changing pricing and procurement demands of our clients, our business, financial performance, financial condition and cash flows may be adversely affected.

Our contracts generally use a pricing model that provides for per-productive-hour or per-transaction billing models and compensation for materials and licensing costs. Industry pricing models are evolving, and companies are increasingly requesting transaction- or outcome-based pricing or other alternative pricing models, which require us to accurately forecast the cost of performance of the contract against the compensation we expect to receive. These forecasts are based on a number of assumptions relating to existing and potential contracts with existing and potential clients, including assumptions related to the team members, other resources and time required to perform the services and our clients’ ultimate use of the contracted service. If we make inaccurate assumptions in pricing our contracts, our profitability may be negatively affected. In addition, if the number of our clients that request alternative pricing models continues to increase in line with industry trends, we may be unable to maintain our historical levels of profitability under these evolving alternative pricing models and our financial performance may be adversely affected, or we may not be able to offer pricing that is attractive relative to our competitors.

8

Some of our clients’ may continue to evolve their procurement methodology by increasing the use of alternative methods, such as reverse auctions. These methods may impact our ability to gain new business and maintain profit margins, and may require us to adapt our sales techniques, which we may be unsuccessful in doing in a timely manner or at all.

In addition, the revenue and income generated from the services we provide to our clients may decline or vary as the type and volume of services we provide under our contracts change over time, including as a result of a shift in the mix of products and services provided. For example, our lower-complexity interactions generate services with lower margins compared to our more complex, sensitive and localized content moderation and digital services, and a shift in the mix of these two types of services by a client could cause a meaningful change in our revenue from that client and the profitability of the services we provide. Furthermore, our clients, some of which have experienced significant and adverse changes in their business, substantial price competition and pressures on their profitability, have in the past and may in the future demand price reductions, decrease the volume of work or complexity of the services we are providing to them, automate some or all of their processes or change their customer experience strategy by moving more work in-house or to other providers, any of which could reduce our profitability. Any inability to accurately forecast the pricing that we use for our contracts, or any significant reduction in or the elimination of the use of the services we provide to any of our clients or any requirement to lower our prices that, in each case, we fail to anticipate, would harm our business, financial performance, financial condition and cash flows.

Three clients account for a significant portion of our revenue and loss of or reduction in business from, or consolidation of, these or any other major clients could have a material adverse effect on our business, financial condition, financial performance and prospects.

We have derived and believe that, in the near term, we will continue to derive, a significant portion of our revenue from a limited number of large clients. Our largest client for the fiscal year ended December 31, 2021, a leading social media company, accounted for approximately 17.7 % and 15.6 % of our revenue for the fiscal years ended December 31, 2021 and 2020, respectively. TELUS, our controlling shareholder, is our second largest client and accounted for approximately 16.1 % and 19.6 % of our revenue for the fiscal years ended December 31, 2021 and 2020, respectively. Our third largest client, Google Inc. (Google), accounted for approximately 11.0 % and 7.5 % of our revenue for the fiscal years ended December 31, 2021 and 2020, respectively.

One of our largest clients, based on our revenues earned from them, is TELUS, our controlling shareholder. We provide services to TELUS under the master services agreement (TELUS MSA), which expires in January 2031. The TELUS MSA provides for a minimum annual spend of $200 million, subject to adjustment in accordance with its terms, although TELUS has the ability to delay or terminate specific services for certain specified reasons with limited notice. See “Item 7B—Related Party Transactions—Our Relationship with TELUS—Master Services Agreement”. In addition, the master services agreements (MSAs) with all other clients do not have minimum annual spend and the terms of these master service agreements permit our clients to delay, postpone or even terminate contracted services at their discretion and with limited notice to us.

Additionally, the volume of work performed for specific clients or the revenue we generate can vary from year to year. For example, a client may demand price reductions, change its customer engagement strategy or move work in-house. Also, in many of the verticals in which we offer services, the continued consolidation activity could result in the loss of a client if, as a result of a merger or acquisition involving one or more of our clients, the surviving entity chooses to use one of our competitors for the services we currently provide or to provide the services we offer in-house. Our clients may also choose to consolidate their providers as they grow, as their business needs change, or as their leadership changes, and we could be removed from a client’s vendor network. As a result of the foregoing, a major client in one year may not provide the same level of revenue in any subsequent year. Any significant reduction in or elimination of the use of the services we provide as a result of consolidation or our removal from a key client’s vendor network would result in reduced revenue to us and could harm our business. In addition, such consolidation may encourage clients to apply increasing pressure on us to lower the prices we charge for our solutions. All the foregoing could have a material adverse effect on our business, financial condition, financial performance and prospects.

Our client contracts, which can be canceled at any time, are generally long-term, requiring us to estimate the resources and time required for the contracts upfront, and contain certain price benchmarking, compliance-related penalties and other provisions adverse to us, all of which could have an adverse effect on our business, financial performance, financial condition and cash flows.

Although the term of our client contracts typically ranges from three to five years, with the vast majority of contracts having a term of three years, such contracts may be terminated by our clients for convenience with limited notice and without payment of a penalty or termination fee. Additionally, our clients, other than TELUS, are not contractually committed to provide us with specific volumes under the contracts we enter into with them. Our clients may also delay, postpone, cancel or remove certain of

9

the services we provide without canceling the whole contract, which would adversely impact our revenue. Any failure to meet a client’s expectations could result in a cancellation or non-renewal of a contract or a reduction in the services provided by us. We may not be able to replace any client that elects to terminate or not renew its contract with us, which would reduce our revenues. The loss of or financial difficulties at any of our clients could have an adverse effect on our business, financial performance, financial condition and cash flows. For example, we have had a limited number of clients who entered into insolvency proceedings and have defaulted on their obligations to us.

Additionally, our contracts require us to comply with, or facilitate, our clients’ compliance with numerous and complex legal regimes on matters such as anti-corruption, internal and disclosure control obligations, data privacy and protection, wage-and-hour standards, and employment and labor relations. Many of our contracts contain provisions that would require us to pay penalties to our clients and/or provide our clients with the right to terminate the contract if we do not meet pre-agreed service level requirements. Failure to meet these requirements or accurately estimate the productivity benefits could result in the payment of significant penalties to our clients, which in turn could have a material adverse effect on our business, financial performance, financial condition and cash flows.

A few of our contracts allow the client, in certain limited circumstances, to request a benchmark study comparing our pricing and performance with that of an agreed list of other service providers for comparable services. Based on the results of the study and depending on the reasons for any unfavorable variance, we may be required to make improvements in the services we provide, reduce the pricing for services on a prospective basis to be performed under the remaining term of the contract, or our clients could elect to terminate the contract, any of which could have an adverse effect on our business, financial performance, financial condition and cash flows.

Some of our contracts contain provisions which, to various degrees, restrict our ability to provide certain services to other of our clients or to companies who are in competition with our clients. Such terms may restrict the same team members from providing services for competing clients, require us to ensure a certain distance between the locations from where we serve competing clients or prevent us from serving a competing client from locations in the same country, all of which reduce our flexibility in deploying our team members and delivery locations in the most effective and efficient manner and may force us to forego opportunities to attract business from companies that compete with our existing clients, even if such opportunities are more profitable or otherwise attractive to us.

Additionally, a number of our service contracts provide for high or unlimited liability for the benefit of our clients related to damages resulting from breaches of privacy or data security in connection with provision of our services. Violations of the terms of these contracts could subject us to significant legal liability. See “—The unauthorized disclosure of sensitive or confidential client and customer data could expose us to protracted and costly litigation, damage our reputation and cause us to lose clients”.

Furthermore, in some of our customer experience management contracts we commit to long-term pricing structures under which we bear the risk of cost overruns, completion delays, resource requirements, wage inflation and adverse movements in exchange rates in connection with these contracts. If we fail to accurately estimate the team members, other resources and time required for these longer term contracts and their overall expected profitability, potential productivity benefits over time, future wage inflation rates or currency exchange rates (if we fail to effectively hedge our currency exchange rate exposure) or if we fail to complete our contractual obligations within the contracted timeframe, our financial performance, financial condition and cash flows may be negatively affected. See “—If we are unable to accurately forecast our pricing models or optimize the mix of products and services we provide to meet changing client demands, or if we are unable to adapt to changing pricing and procurement demands of our clients, our business, financial performance, financial condition and cash flows may be adversely affected”.

We may face difficulties in delivering complex projects for our clients that could cause clients to discontinue their work with us, which may have a material adverse impact on our financial performance, financial condition and cash flows.

We have, over time, been expanding the nature, scope and complexity of our engagements. Our ability to offer a wider breadth of more complex services to our clients depends on our ability to attract new or existing clients to an expanded collection of service offerings. When seeking to obtain engagements for complex projects, we are more likely to compete with large, well-established international firms, many of which have greater resources and market reputation than we do. To compete for these projects, we will likely incur increased sales and marketing costs. Obtaining mandates for more complex projects will require us to establish closer relationships with our clients and develop a more thorough understanding of their operations. Our ability to establish such relationships will depend on a number of factors, including our ability to form a team with the necessary proficiency in these new services. We cannot be certain that we will effectively meet client needs at the necessary scale in the required timeframes in connection with these services. For example, if a new program requires us to hire a large number of

10

team members with specific skills in a specific geography, we could face challenges in implementing the program on a client’s desired timetable or at all. Our failure to deliver services that meet the requirements specified by our clients could result in termination of client contracts, which could result in us being liable to our clients for significant penalties or damages and negatively impact our reputation. More complex projects may involve multiple engagements or stages, and there is a risk that a client may choose not to retain us for later stages or may cancel or delay additional planned engagements, which may be the more profitable portions of the overall planned engagement. Such cancellations or delays make it difficult to plan for project resource requirements and inaccuracies in such resource planning and allocation may have a material adverse impact on our financial performance, financial condition and cash flows.

We often face a long selling cycle to secure a new client or a new program with an existing client. If we are not successful in obtaining and efficiently maintaining contractual commitments after the selling cycle our business, financial performance, financial condition and cash flows may be adversely affected.

We often face a long selling cycle to secure a new client contract or launch a new program for an existing client. When we are successful in obtaining a new engagement, which is generally followed by a long implementation period in which the services are planned in detail and we demonstrate to a client that we can successfully integrate our processes and resources with their operations. During this time a contract is also negotiated. Before or after entering into a definitive contract with a client, we may run a pilot program that may or may not be successful. There is then a long ramping up period in order to commence providing the services. We typically incur significant business development expenses during the selling cycle and may experience misalignment with the client on the magnitude of investment. Misalignment may occur when the client does not have prior experience with the type and scope of services that we are offering. At the end of this selling cycle, we may not succeed in winning a new client’s business due to a variety of factors, including changes in the client’s decision to move forward with our services, in which case we receive no revenues and may receive no reimbursement for such expenses. A potential client may choose a competitor or decide to perform the work in-house prior to the time a final contract is signed. Our clients may also experience delays in obtaining internal approvals or delays associated with technology or system implementations, thereby further lengthening the implementation cycle. If we enter into a contract with a client, we will typically receive no revenues until implementation actually begins. If we are not successful in obtaining contractual commitments after the selling cycle, in maintaining contractual commitments after the implementation cycle or in maintaining or reducing the duration of unprofitable initial periods in our contracts, our business, financial performance, financial condition and cash flows may be adversely affected.

The inelasticity of our labor costs relative to short-term movements in client demand could adversely affect our business, financial condition and financial performance.

Our business depends on maintaining large numbers of team members to service our clients’ business needs and on being able to quickly respond to new client programs or new programs for existing clients. As a result, and consistent with our caring culture, we try where possible not to terminate team members in response to temporary declines in demand when existing projects end or when clients terminate services. Moreover, rehiring and retraining team members at a later date could force us to incur additional expenses and we may not be able to do so in a timely manner. Additionally, any termination of our team members could also have a negative impact on our hiring and recruitment efforts and the morale of the remaining team members and could involve the incurrence of significant additional costs in the form of severance payments to comply with labor regulations in the various jurisdictions in which we operate, all of which would have an adverse impact on our operating profit margins. Furthermore, we are subject to a variety of legal requirements related to the termination of team members in the countries and cities where we operate. These factors limit our ability to adjust our labor costs for unexpected changes in client demand, which could have a material adverse effect on our business, financial condition and financial performance, particularly if demand for our services fails to meet the levels we anticipate. See “—Our growth prospects are dependent upon attracting and retaining enough qualified team members to support our operations, as competition for highly skilled personnel is intense, and failure to do so may result in an adverse impact on our business and financial results”.

Team member wage increases in certain geographies may prevent us from sustaining our competitive advantage and may reduce our profit margin.

Our most significant costs are the salaries and related benefits of our team members. Our wage costs in India, the Philippines, Romania, El Salvador, Guatemala and Bulgaria have historically been significantly lower than wage costs in the United States, Canada and other parts of Europe for comparably skilled professionals, which has been one of our competitive advantages. As economic growth increases in the countries where we benefit from lower wage costs, concurrent with increased demand by us and our competitors for skilled employees, wages for comparably skilled employees are increasing at a faster rate than in the United States, Canada and other parts of Europe, which may, over time, reduce this competitive advantage. Similarly, inflationary pressures could drive up wage costs in certain areas where we currently have team members, which may also

11

reduce this competitive advantage. In connection with potential future growth and inflation, we may need to increase the levels of team member compensation more rapidly than in the past to remain competitive in attracting and retaining the quality and number of team members that our business requires. To the extent that we are not able to control or share wage increases with our clients, wage increases may reduce our margins and cash flows. We may not be successful in our attempts to control such costs.

Our policies, procedures and programs to safeguard the health, safety and security of our team members and others may not be adequate.

We have undertaken to implement what we believe to be the best practices to safeguard the health, safety and security of our team members, independent contractors, clients and others at our worksites. If these policies, procedures and programs are not adequate, or team members do not receive related adequate training or do not follow these policies, procedures and programs for any reason, the consequences may be harmful to us, which could impair our operations and cause us to incur significant legal liability or fines as well as reputational damage and negatively impact the engagement of our team members. Our insurance may not cover, or may be insufficient to cover, any legal liability or fines that we incur for health, safety or security incidents.

Our senior management team is critical to our continued success and the loss of one or more members of our senior management team could have a material adverse effect on our business, financial performance, financial condition and cash flows.

Our future success substantially depends on the continued services and performance of the members of our senior management team, and other key team members possessing technical and business capabilities, including industry expertise, that are difficult to replace. Specifically, the loss of the services of one or more members our executive leadership team, without immediate and suitable successors, could seriously impair our ability to continue to manage and expand our business. There is intense competition for experienced senior management and personnel with technical and industry expertise in the industry in which we operate, and we may not be able to retain these members of our senior management team or other key team members. Although we have entered into employment and non-competition agreements with all of our executive officers, certain terms of those agreements may not be enforceable and, in any event, these agreements do not ensure the continued service of these executive officers. Further, although we have engaged in succession planning for our senior management team, we may not successfully implement those plans.

In addition, we currently do not maintain “key person” insurance covering any member of our management team. The loss of any of our key team members, particularly to competitors, could have a material adverse effect on our business, financial performance, financial condition and cash flows.

If more stringent labor laws become applicable to us, if we are subject to more employment-related litigation, if our team members unionize, if our team members strike or cause other labor-related disruptions, or if more of our team members become part of workers councils, our business and financial results may be adversely affected.

Some of the geographies where we operate have stringent employee-friendly labor legislation, including legislation that sets forth detailed procedures for dispute resolution and employee separations that impose financial obligations on employers. Therefore, in some countries, it may be difficult for us to maintain flexible human resource policies and dismiss team members when there is a business need, and our compensation and/or legal expenses may increase significantly. Additionally, in certain of the states and regions in which we operate, we are subject to stringent wage and hour requirements, which has exposed us, and we expect will continue to expose us, to claims brought by individual team members and team member groups. Although these claims are not individually or in the aggregate material, we expect to be subject to more such claims in the future.

In addition, some of our team members may form unions, become part of workers councils, or may become subject to collective bargaining agreements. In certain countries, we are subject to laws that could require us to establish a co-determined supervisory board which could subject us to significant additional administrative requirements. As a result, we may be required to raise wage levels or grant other benefits that could result in an increase in our compensation expenses or lack of flexibility, or take on increased costs to address administrative requirements, in which case our financial performance and cash flows may be materially and adversely affected.

Furthermore, strikes by, or labor disputes with, our team members at our delivery locations and independent contractors that we retain may adversely affect our ability to conduct business. Work interruptions or stoppages could have a material adverse effect on our business, financial performance, financial condition and cash flows.

12

We are vulnerable to natural disasters, technical disruptions, pandemics, accidents and other events impacting our facilities that could severely disrupt the normal operation of our business and adversely affect our business, financial performance, financial condition and cash flows.

Our delivery locations and our data and voice communications, including in Central America, India, Europe and the Philippines, in particular, may be damaged or disrupted as a result of natural disasters or extreme weather events, including those resulting from or exacerbated by climate change, such as earthquakes, floods, volcano eruptions, heavy rains, winter storms, tsunamis and cyclones; epidemics or pandemics, including the COVID-19 pandemic; technical disruptions and infrastructure breakdowns including damage to, or interruption of, electrical grids, transportation systems, communication systems or telecommunication cables; issues with information technology systems and networks, including computer glitches, software vulnerabilities and electronic viruses or other malicious code; accidents and other events such as fires, floods, failures of fire suppression and detection, heating, ventilation or air conditioning systems or other events, such as protests, riots, labor unrest, security threats and terrorist attacks. Any of these events may lead to the disruption of information systems and telecommunication services for sustained periods and may create delays and inefficiencies in providing services to clients and potentially result in closure of our sites. They also may make it difficult or impossible for team members to reach or work in our business locations. Some locations may not be well-suited to work-from-home approaches to providing client services due to connectivity, infrastructure or other issues. Damage or destruction that interrupts our provision of services could adversely affect our reputation, our relationships with our clients, our leadership team’s ability to administer and supervise our business or may cause us to incur substantial additional expenditures to repair or replace damaged equipment or sites. We also may be liable to our clients for disruption in service resulting from such damage or destruction. Our resiliency and disaster recovery plans may not be adequate to provide continuity and reliability of service during disruptions or reduce the duration and impact of service outages sufficiently or at all. While we currently have commercial liability insurance, our insurance coverage may be insufficient or may not provide coverage at all for certain events. Furthermore, we may be unable to secure such insurance coverage at premiums acceptable to us in the future, or such insurance may become unavailable. Prolonged disruption of our services could also entitle our clients to terminate their contracts with us or require us to pay penalties or damages to our clients. Any of the above factors may materially adversely affect our business, financial performance, financial condition and cash flows.

We may choose to expand our operations to additional countries, which carries significant risks, and we may not be successful in maintaining our current profit margins in, or repatriating cash from, our new locations due to factors beyond our control.

We have offices and operations in various countries around the world and provide services to clients globally. An important component of our growth strategy is our continuing international expansion, which depends in part on the availability of the resources we require in order to conduct business in new markets. We continuously evaluate additional locations outside of our current operating geographies in which to invest in delivery locations, in order to maintain an appropriate cost structure for our client programs. We cannot predict the availability of qualified workers, monetary and economic conditions or the existence or extent of government support in other countries. Additionally, we may expand into less developed countries that have less political, social or economic stability and more vulnerable infrastructure and legal systems. Although some of these factors will influence our decision to establish operations in another country, there are inherent risks beyond our knowledge and control, including exposure to currency fluctuations, political and economic instability, unexpected changes in regulatory regimes, foreign exchange restrictions and foreign regulatory restrictions. We may also face difficulties integrating new facilities in different countries into our existing operations. One or more of these factors, or other factors relating to expanded international operations, could affect our ability to repatriate cash, result in increased operating expenses and make it more difficult for us to manage our costs and operations, which could have a material adverse effect on our business, financial performance, financial condition and cash flows.

Our business may not develop in ways that we currently anticipate and demand for our services may be reduced due to negative reaction to offshore / nearshore outsourcing or automation.

We developed our strategy for future growth based on certain assumptions regarding our industry, future demand in the market for our services and the manner in which we would provide these services, including the assumption that a significant portion of the services we offer will continue to be delivered through offshore / nearshore facilities. The trend of transitioning key business processes to offshore / nearshore third parties may not continue and could reverse.

The issue of domestic companies outsourcing services to organizations operating in other countries is a topic of political discussion in the United States, as well as in Europe, countries in the Asia-Pacific region and other regions where we have clients. Some countries and special interest groups have expressed a perspective that associates offshore outsourcing with the loss of jobs in a domestic economy. This has resulted in increased political and media attention to offshore outsourcing,

13

especially in the United States. It is possible that there could be a change in the existing laws that would restrict or require disclosure of offshore outsourcing or impose new standards that have the effect of restricting the use of certain visas in the foreign outsourcing context. The measures that have been enacted to date are generally directed at restricting the ability of government agencies to outsource work to offshore business service providers. These measures have not had a significant effect on our business because governmental agencies are not currently a focus of our operations. Some legislative proposals, however, would, for example, require delivery locations to disclose their geographic locations, require notice to individuals whose personal information is disclosed to non-U.S. affiliates or subcontractors, require disclosures of companies’ foreign outsourcing practices, or restrict U.S. private sector companies that have federal government contracts, federal grants or guaranteed loan programs from outsourcing their services to offshore service providers. In addition, changes in laws and regulations concerning the transfer of personal information to other jurisdictions could limit our ability to engage in work that requires us to transfer data in one jurisdiction to another. Potential changes in tax laws may also increase the overall costs of outsourcing or affect the balance of offshore and onshore business services. Such changes could have an adverse impact on the economics of outsourcing for private companies in the United States, which could, in turn, have an adverse impact on our business with U.S. clients.

Similar concerns have also led certain European Union jurisdictions to enact regulations which allow team members who are dismissed as a result of transfer of services, which may include outsourcing to non-European Union companies, to seek compensation either from the company from which they were dismissed or from the company to which the work was transferred. This could discourage European Union companies from outsourcing work offshore and/or could result in increased operating costs for us. In addition, there has been publicity about the negative experiences, such as theft and misappropriation of sensitive customer data of various companies that use offshore outsourcing.

Additionally, we may face negative public reaction to increased automation of or reduction in employment positions through the use of artificial intelligence or the other technologies we use to provide our services, which could reduce the demand for many of our service offerings. Increased negative public perception by public and private companies and related legislative efforts in economies around the world could have adverse impact on the demand for our services.

Terrorist attacks and other acts of violence, including those involving any of the countries in which we or our clients have operations, could lead to or exacerbate an economic recession and pose significant risks to our team members and facilities.

Terrorist attacks and other acts of violence or war may adversely affect worldwide financial markets and could potentially lead to, or exacerbate, an economic recession, which could adversely affect our business, financial performance, financial condition and cash flows. These events could adversely affect our clients’ levels of business activity and precipitate sudden significant changes in regional and global economic conditions and cycles. These events also pose significant risks to our team members and to our delivery locations and operations around the world. We generally do not have insurance for losses and interruptions caused by terrorist attacks, military conflicts and wars. Any such event could have a material adverse effect on our business, financial performance, financial condition and cash flows.

If we are not able to manage our resource utilization levels or price our services appropriately, our business, financial performance, financial condition and cash flows may be adversely affected.

Our profitability is largely a function of the efficiency with which we use our resources, particularly our team members and our delivery locations and the pricing that we are able to obtain for our services. Our resource utilization levels are affected by a number of factors, including our ability to attract, train, and retain team members, transition team members from completed projects to new assignments, forecast demand for our services (including potential client reductions in required resources or terminations) and maintain an appropriate number of team members in each of our delivery locations, as well as our need to dedicate resources to team member training and development. The prices we are able to charge for our services are affected by a number of factors, including price competition, our ability to accurately estimate revenues from client engagements, our ability to estimate resources and other costs for long-term pricing, margins and cash flows for long-term contracts, our clients’ perceptions of our ability to add value through our services, introduction of new services or products by us or our competitors, and general economic and political conditions. Therefore, if we are unable to appropriately price our services or manage our resource utilization levels, there could be a material adverse effect on our business, financial performance, financial condition and cash flows.

14

Our operating results may experience significant variability and, as a result, it may be difficult for us to make accurate financial forecasts and our actual operating results may experience variability, including falling short of our forecasts.

Our growth has not been, and in the future is not expected to be, linear as our period-to-period results have been in the past and may, in the future, fluctuate due to certain factors, including client demand, a long selling cycle, delays or failures by our clients to provide anticipated business, losses or wins of key clients, variations in team member utilization rates resulting from changes in our clients’ operations, delays or difficulties in expanding our delivery locations and infrastructure (including hiring new team members or constructing new delivery locations), capital investment amounts that may be inappropriate if our financial forecasts are inaccurate, changes to our pricing structure or that of our competitors, currency fluctuations, seasonal changes in the operations of our clients, our ability to recruit team members with the right skill set, failure to meet service delivery requirements as a result of technological disruptions, the timing of acquisitions and other events identified in this Annual Report, all of which may significantly impact our results and the accuracy of our forecasts from period to period. For example, the volume of business with some of our clients in our Travel and Hospitality vertical is significantly affected by seasonality, with our revenue typically higher in the third and fourth quarters due to spending patterns of our clients with calendar fiscal years.

Our revenues are also affected by changes in pricing under our contracts at the time of renewal or by pricing under new contracts. In addition, while we seek to forecast the revenue we expect to receive with a client when we enter into a contract, most of our contracts do not commit our clients to provide us with a specific volume of business over a specific period and, therefore, the associated revenue from such a contract could decline, and such forecasts may not prove to be correct. See “—If we are unable to accurately forecast our pricing models or optimize the mix of products and services we provide to meet changing client demands, or if we are unable to adapt to changing pricing and procurement demands of our clients, our business, financial performance, financial condition and cash flows may be adversely affected”. In addition, our clients are generally able to delay or postpone services for which we have been contracted to provide and, in many cases, terminate existing service contracts with us with limited notice, all of which could adversely impact revenue we expect to generate in any period. The selling cycle for our services and the budget and approval processes of prospective clients make it difficult to predict the timing of for the services we provide to our clients, entering into definitive agreements with new clients. The completion of implementation varies significantly based upon the complexity of the processes being implemented.

As a result, it may be difficult for us to accurately make financial forecasts and our actual operating results may experience variability, including falling short of our forecasts.

Our inability to manage our rapid growth effectively could have an adverse effect on our business and financial results.

Since we were founded in 2005, we have experienced rapid growth and significantly expanded our operations. The number of our team members has increased significantly over the past several years. We expect to develop and improve our internal systems in the locations where we operate in order to address the anticipated continued growth of our business. We are also continuing to look for delivery locations outside of our current operating geographies to decrease the risks of operating from a limited number of countries. We may not, however, be able to effectively manage our infrastructure and team member expansion, open additional delivery locations or hire additional skilled team members as and when they are required to meet the ongoing needs of our clients and to meet our current growth trajectory, and we may not be able to develop and improve our internal systems. We also need to manage cultural differences between our team member populations and that may increase the risk for employment law claims. Our inability to execute our growth strategy, to ensure the continued adequacy of our current systems or to manage our expansion, capital and other resources effectively could have a material adverse effect on our business, financial performance, financial condition and cash flows.

Our business and financial results have been, and in the future may be, adversely impacted by the COVID-19 pandemic.

The global outbreak of COVID-19 continues to evolve. The COVID-19 pandemic has spread to nearly all countries around the world, including each of the countries where our delivery locations are located, and has created significant uncertainty and disruption. Governmental measures and regulations, such as city or country-wide lockdowns, local, domestic and international travel restrictions, as well as closures of the enabling infrastructure necessary for our business to operate smoothly, have resulted, and may in the future result, in restrictions on our ability to fully deliver services to our clients. Such measures present concerns that may dramatically affect our ability to conduct our business effectively, including, but not limited to, adverse effects on our team members’ health, a slowdown and often a stoppage of delivery, work, travel and other activities which are critical for maintaining on-going business activities. Our ability to continue operations effectively during the COVID-19 pandemic is dependent on a number of factors, such as the continued availability of high-quality internet bandwidth, an uninterrupted supply of electricity, the sustainability of social infrastructure to enable our team members who are working remotely to continue delivering services, and on otherwise adequate conditions for remote-working, all of which are outside of

15