UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |||||||||||||||||||||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||||||||||||||

| ☐ | Definitive Proxy Statement | |||||||||||||||||||||||||

| ☐ | Definitive Additional Materials | |||||||||||||||||||||||||

| ☐ | Soliciting Material under §240.14a-12 | |||||||||||||||||||||||||

VELO3D, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||||||||||||||||||||||||||||||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||||||||||||||||||||||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||||||||||||||||||||||||||||||||

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED APRIL 19, 2024

, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Velo3D, Inc., which will be held virtually at www.virtualshareholdermeeting.com/VLD2024 on Monday, June 10, 2024 at 1:00 p.m. Pacific Time/4:00 p.m. Eastern Time. We believe that a virtual stockholder meeting provides greater access to those who may want to attend, and therefore we have chosen this over an in-person meeting. This approach also lowers costs and enables participation from our global community. The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement. The Annual Meeting materials include the notice, proxy statement, and annual report to stockholders, each of which has been furnished to you over the internet or, if you have requested a paper copy of the materials, by mail.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please cast your vote as soon as possible by Internet, telephone or, if you received a paper copy of the meeting materials by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend virtually. Returning the proxy does not affect your right to attend the Annual Meeting or to vote your shares at the Annual Meeting.

Sincerely, | ||

Bradley Kreger | ||

Interim Chief Executive Officer | ||

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MONDAY, JUNE 10, 2024. THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT HTTP://IR.VELO3D.COM.

VELO3D, INC.

2710 Lakeview Court

Fremont, California 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | Monday, June 10, 2023 at 1:00 p.m. Pacific Time/4:00 p.m. Eastern Time | |||||||||||||||||||||||||||||||||||||

| Place: | Virtually at www.virtualshareholdermeeting.com/VLD2024. There is no physical location for the Annual Meeting. | |||||||||||||||||||||||||||||||||||||

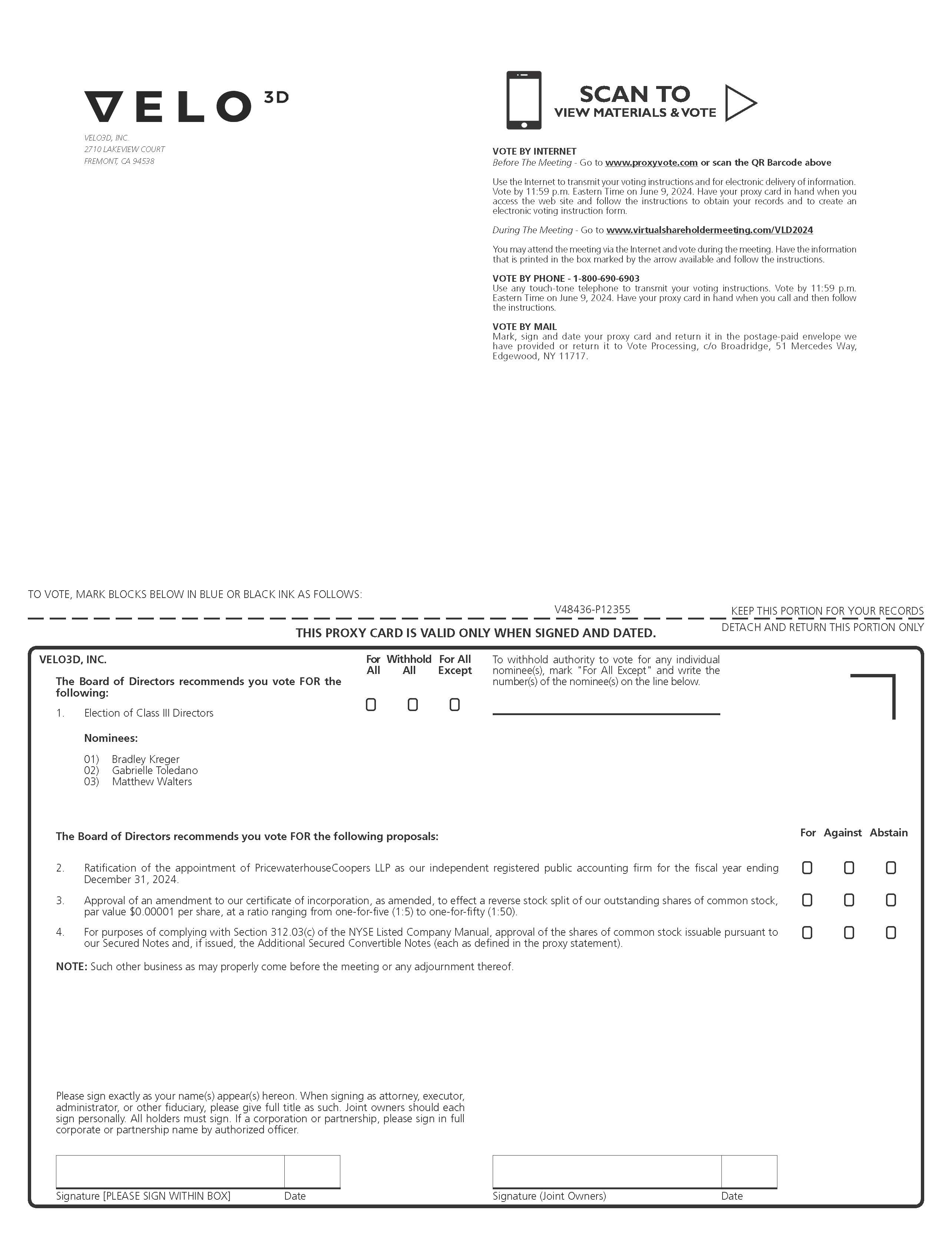

| Items of Business: | 1. | Elect three Class III directors of Velo3D, Inc., each to serve a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified. | ||||||||||||||||||||||||||||||||||||

| 2. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024. | |||||||||||||||||||||||||||||||||||||

| 3. | Approve an amendment to our certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders. | |||||||||||||||||||||||||||||||||||||

| 4. | For purposes of complying with Section 312.03(c) of the NYSE Listed Company Manual, approve the shares of common stock issuable pursuant to our Secured Notes and, if issued, the Additional Secured Convertible Notes (each as defined in the proxy statement). | |||||||||||||||||||||||||||||||||||||

| 5. | Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. | |||||||||||||||||||||||||||||||||||||

| Record Date: | April 15, 2024, which we refer to as our Record Date. Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to attend and vote at, the meeting and any adjournments thereof. | |||||||||||||||||||||||||||||||||||||

| Participation in Annual Meeting: | We are pleased to invite you to participate in our Annual Meeting, which will be conducted exclusively online at www.virtualshareholdermeeting.com/VLD2024. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any internet-connected device from any location around the world at no cost. Our virtual meeting format helps us engage with all stockholders-regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact. Please see “Important Information About the Annual Meeting” for additional information. | |||||||||||||||||||||||||||||||||||||

| Voting: | Your vote is very important to us. Please act as soon as possible to vote your shares, even if you plan to participate in the Annual Meeting. For specific instructions on how to vote your shares, please see “Information About Solicitation and Voting” beginning on page 4 of the accompanying proxy statement. Each share of common stock that you own represents one vote. For questions regarding your stock ownership, you may contact us through our website at ir.velo3d.com or, if you are a registered holder, our transfer agent, Continental Stock Transfer & Trust Company, through its website at continentalstock.com, by phone at (212) 509-5586, or by e-mail at cstmail@continentalstock.com | |||||||||||||||||||||||||||||||||||||

This notice of the Annual Meeting, proxy statement, and form of proxy are being distributed and made available on or about April 29, 2024.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy through the Internet or by telephone or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

By Order of the Board of Directors,

Bernard Chung Acting Chief Financial Officer | ||||||||

| Fremont, California | ||||||||

| , 2024 | ||||||||

VELO3D, INC.

PROXY STATEMENT FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained herein may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in our Annual Report on Form 10-K for the year ended December 31, 2023, under the section entitled “Risk Factors” and our other Securities and Exchange Commission, or SEC, filings, which are available on the Investor Relations page of our website at www.ir.velo3d.com and on the SEC website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. There may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement before voting.

Meeting Agenda and Voting Recommendations

| PROPOSAL NO. 1 |  BOARD’S RECOMMENDATION “FOR” this Proposal | |||||||||||||||||||

| ELECTION OF DIRECTORS | ||||||||||||||||||||

| We are asking our stockholders to elect three Class III directors for a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. The table below sets forth information with respect to our three nominees standing for election. All of the nominees are currently serving as directors. Additional information about our director nominees and their respective qualifications can be found under the section titled “Proposal No. 1 Election of Directors-Nominees to Our Board of Directors”. | ||||||||||||||||||||

| Name | Age | Director Since | ||||||||||||||||||

| Bradley Kreger | 49 | January 2024 | ||||||||||||||||||

| Gabrielle Toledano | 55 | September 2021 | ||||||||||||||||||

| Matthew Walters | 36 | September 2021 | ||||||||||||||||||

| PROPOSAL NO. 2 |  BOARD’S RECOMMENDATION “FOR” this Proposal | |||||||||||||||||||

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||||||||||||||||||

| We are asking our stockholders to ratify the audit committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024. Information regarding fees paid to PricewaterhouseCoopers LLP during 2023 and 2022 can be found under the section titled “Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm-Independent Registered Public Accounting Firm Fees and Services.” | ||||||||||||||||||||

2

| PROPOSAL NO. 3 |  BOARD’S RECOMMENDATION “FOR” this Proposal | |||||||

| APPROVAL OF REVERSE STOCK SPLIT | ||||||||

We are asking our stockholders to approve an amendment to our certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be determined by our board of directors, and granting our board of directors the discretion to file the amendment to our certificate of amendment with the Secretary of State of the State of Delaware effecting the reverse stock split prior to December 31, 2024 or to abandon the reverse stock split altogether. The primary goals of the reverse stock split are to: (i) increase the per share market price of our common stock to meet the minimum per share price requirements for continued listing on the New York Stock Exchange, and (ii) effectively increase the number of authorized and unissued shares of our common stock available for future issuance after we effect the reverse stock split. Additional information about the reverse stock split can be found under the section titled “Proposal No. 3 Approval of Reverse Stock Split”. | ||||||||

| PROPOSAL NO. 4 |  BOARD’S RECOMMENDATION “FOR” this Proposal | |||||||

| APPROVAL OF COMMON STOCK ISSUANCE | ||||||||

We are asking our stockholders to approve the shares of common stock issuable pursuant to our Secured Notes and, if issued, the Additional Secured Convertible Notes (each as defined below) in order to comply with Section 312.03(c) of the New York Stock Exchange Listed Company Manual. Pursuant to this section of the Listed Company Manual, stockholder approval is required prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions, subject to certain exceptions, if: (1) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock; or (2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock. For more information, please see the section entitled “Proposal No. 4 Approval of Common Stock Issuance.” | ||||||||

3

GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to good corporate governance, which strengthens the accountability of our board of directors and promotes the long-term interests of our stockholders. The list below highlights our independent board and leadership practices, as discussed further in this Proxy Statement.

INDEPENDENT BOARD AND LEADERSHIP PRACTICES

•Majority of directors are independent (7 out of 9 current directors)

•All committees of the board of directors are composed of independent directors

•Board of directors is focused on enhancing diversity and refreshment

•Comprehensive risk oversight practices, including cybersecurity, data privacy, legal and regulatory matters, and other critical evolving areas

•Our nominating and corporate governance committee oversees our programs relating to environmental, social, and corporate governance matters

•Independent directors conduct regular executive sessions

•Directors maintain open communication and strong working relationships among themselves and have regular access to management

•Directors conduct a robust annual board of directors and committee self-assessment process

•Board of directors has related party transaction standards for any direct or indirect involvement of a director in our business activities

CERTAIN TERMS USED IN THIS PROXY STATEMENT

Unless the contest otherwise requires, references in this Proxy Statement to:

•“Legacy Velo3D” means Velo3D, Inc., a Delaware corporation (n/k/a Velo3D US, Inc.), prior to the closing of the Merger;

•“Merger” means the merger contemplated by that certain Business Combination Agreement, dated as of March 22, 2021, by and among JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company, or “JAWS Spitfire,” Legacy Velo3D and Spitfire Merger Sub, Inc., a Delaware corporation, or “Merger Sub,” as amended by Amendment No. 1 to the Business Combination Agreement, dated as of July 20, 2021, or the “Business Combination Agreement,” whereby Merger Sub merged with and into Legacy Velo3D, with Legacy Velo3D surviving the merger as a wholly-owned subsidiary of the Company, on September 29, 2021;

•“Velo3D,” means Velo3D, Inc., a Delaware corporation (f/k/a JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company), and its consolidated subsidiary following the closing of the Merger; and

•“we,” “us” and “our” or the “Company” refer to Legacy Velo3D prior to the closing of the Merger and to Velo3D following the closing of the Merger.

4

VELO3D, INC.

2710 Lakeview Court

Fremont, California 94538

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

April , 2024

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors, or the Board, of Velo3D, Inc. for use at our 2024 Annual Meeting of Stockholders, or Annual Meeting, to be held virtually at www.virtualshareholdermeeting.com/VLD2024 on Monday, June 10, 2024 at 1:00 p.m. Pacific Time/4:00 p.m. Eastern Time, and any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials and this Proxy Statement for the Annual Meeting, or this Proxy Statement, and the accompanying form of proxy were first distributed and made available on the Internet to stockholders on or about April , 2024. An annual report for the fiscal year ended December 31, 2023 is available with this Proxy Statement by following the instructions in the Notice of Internet Availability of Proxy Materials.

In this Proxy Statement, we refer to Legacy Velo3D prior to the closing of the Merger and to Velo3D following the closing of the Merger as “we,” “us” and “our” or the “Company.” References to our website in this Proxy Statement are not intended to function as hyperlinks and the information contained on our website is not intended to be incorporated into this Proxy Statement.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with U.S. Securities and Exchange Commission, or SEC, rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly and helps in conserving natural resources.

GENERAL INFORMATION ABOUT THE MEETING

Purpose of the Annual Meeting

You are receiving this Proxy Statement because our Board is soliciting your proxy to vote your shares at the Annual Meeting with respect to the proposals described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you pursuant to the rules and regulations of the SEC and is designed to assist you in voting your shares.

We intend to ensure that our stockholders are afforded the same rights and opportunities to participate virtually as they would at an in-person meeting. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any internet-connected device from any location around the world at no cost. Our virtual meeting format helps us engage with all stockholders-regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact.

Record Date; Quorum

Only holders of record of our common stock at the close of business on April 15, 2024, or the Record Date, will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 296,145,070 shares of common stock outstanding and entitled to vote. At the close of business on the Record Date, our directors and

5

executive officers and their respective affiliates beneficially owned and were entitled to vote 13,088,842 shares of common stock at the Annual Meeting, or approximately 4.3% of the voting power of the shares of our common stock outstanding on such date. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our headquarters, at 2710 Lakeview Court, Fremont, California, 94538. A list of stockholders entitled to vote at the Annual Meeting will also be available for examination on the internet through the virtual web conference during the Annual Meeting.

The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or if you have properly submitted a proxy.

Participating in the Annual Meeting

•Instructions on how to attend the Annual Meeting are posted at www.virtualshareholdermeeting.com/VLD2024.

•You may log in to the meeting platform beginning at 12:45 p.m. Pacific Time on June 10, 2024. The meeting will begin promptly at 1:00 p.m. Pacific Time.

•You will need the 16-digit control number provided in your proxy materials to attend the Annual Meeting at www.virtualshareholdermeeting.com/VLD2024.

•Stockholders of record and beneficial owners as of the Record Date may vote their shares electronically during the Annual Meeting.

•If you wish to submit a question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/VLD2024, type your question into the “Ask a Question” field, and click “Submit.” If your question is properly submitted during the relevant portion of the meeting agenda, we will respond to your question during the live webcast, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition. We reserve the right to exclude questions that are irrelevant to meeting matters, irrelevant to our business, or derogatory or in bad taste; that relate to pending or threatened litigation; that are personal grievances; or that are otherwise inappropriate (as determined by the chair of the Annual Meeting).

•If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any situation, we will promptly notify stockholders of the decision via www.virtualshareholdermeeting.com/VLD2024. If you encounter technical difficulties accessing our meeting or asking questions during the meeting, a support line will be available on the login page of the virtual meeting website.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of common stock represents one vote. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote by telephone, through the Internet or, if you request or receive paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If, on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in

6

directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Each director will be elected by a plurality of the votes cast, which means that the three individuals nominated for election to our Board at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may vote “FOR ALL NOMINEES,” “WITHHOLD AUTHORITY FOR ALL NOMINEES,” or vote “FOR ALL EXCEPT” one or more of the nominees you specify. Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and approval of the shares of common stock issuable pursuant to our Secured Notes and, if issued, the Additional Secured Convertible Notes (each as defined in the section entitled “Proposal No. 4 Approval of Common Stock Issuance”) will be obtained if the number of votes cast “FOR” these proposals at the Annual Meeting exceeds the number of votes “AGAINST” these proposals. Approval of the amendment to our certificate of incorporation, as amended, to effect the reverse stock split will be obtained if the holders of a majority of our outstanding shares vote “FOR” the proposal at the Annual Meeting.

Recommendations of Our Board on Each of the Proposals Scheduled to be Voted on at the Annual Meeting

| Proposal | Board Recommendation | Page Reference | |||||||||||||||||||||||||||||||||

| Proposal No. 1 | The election of the Class III directors named in this Proxy Statement. | FOR all nominees | |||||||||||||||||||||||||||||||||

| Proposal No. 2 | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | FOR | |||||||||||||||||||||||||||||||||

| Proposal No. 3 | The approval of an amendment to certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders. | FOR | |||||||||||||||||||||||||||||||||

| Proposal No. 4 | For purposes of complying with Section 312.03(c) of the New York Stock Exchange Listed Company Manual, approval of the shares of common stock issuable pursuant to our Secured Notes and, if issued, the Additional Secured Convertible Notes. | FOR | |||||||||||||||||||||||||||||||||

None of our non-employee directors have any substantial interest in any matter to be acted upon except with respect to the directors so nominated. None of our executive officers have any substantial interest in any matter to be acted upon that are different from or greater than those of any other of our stockholders.

Abstentions; Broker Non-Votes

Under Delaware law, abstentions are counted as present and entitled to vote for purposes of determining whether a quorum is present. At the Annual Meeting, abstentions will have no effect on Proposal No. 1, Proposal No. 2 and Proposal No.4 but will be treated the same as voting “against” Proposal No. 3.

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted because the broker did not receive voting instructions from the beneficial owner and lacked discretionary authority to vote the shares. Under Delaware law, broker non-votes are counted as present and entitled to vote for purposes of determining whether a quorum is present. However, brokers have limited discretionary authority to vote shares that are beneficially owned. While a broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters. At our Annual Meeting, only Proposal

7

No. 2 is considered a routine matter and brokers have discretionary authority to vote shares that are beneficially owned on Proposal No. 2. If a broker chooses not to vote shares for or against Proposal No. 2, it would have the same effect as an abstention. The other proposals presented at the Annual Meeting, Proposal No. 1, Proposal No. 3 and Proposal No. 4, are non-routine matters and therefore broker non-votes are not deemed to be shares entitled to vote on and will have no effect on these proposals.

Voting Instructions; Voting of Proxies

| Vote By Internet | Vote By Telephone or Internet | Vote By Mail | ||||||

You may vote via the virtual meeting website-any stockholder can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/VLD2024, where stockholders may vote and submit questions during the meeting. The meeting starts at 1:00 p.m. Pacific Time/4:00 p.m. Eastern Time. Please have your 16-Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com. | You may vote by telephone or through the Internet-in order to do so, please follow the instructions shown on your proxy card. | You may vote by mail-if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and promptly return it in the envelope provided or, if the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717. Your completed, signed, and dated proxy card must be received prior to the Annual Meeting. | ||||||

Votes submitted by telephone or through the Internet must be received by 8:59 p.m. Pacific Time/11:59 p.m. Eastern Time on June 9, 2024. Submitting your proxy, whether by telephone, through the Internet or, if you request or receive a paper proxy card, by mail will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct your nominee on how to vote your shares. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board stated above.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card by telephone, through the Internet, or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign, and return each proxy card you received to ensure that all of your shares are voted.

We strongly recommend that you vote your shares in advance of the meeting as instructed above, even if you plan to attend the Annual Meeting virtually.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

•delivering to our Secretary by mail a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date;

•voting again by telephone or through the Internet; or

•attending virtually and voting during the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

8

Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies, including preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any other information furnished to stockholders. Following the original mailing of the soliciting materials, we and our agents, including directors, officers, and other employees, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means, or in person. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees, and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote through the Internet, you are responsible for any Internet access charges you may incur.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

9

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD OF DIRECTORS;

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our Board and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the governance of our company. Our Corporate Governance Guidelines are available on the “Investor Relations” section of our website, which is located at www.ir.velo3d.com, by clicking “Governance Documents” in the “Governance” section of our website. Our nominating and corporate governance committee reviews the Corporate Governance Guidelines annually, and changes are recommended to our Board as warranted.

Independence of Directors

The listing rules of the New York Stock Exchange, or the NYSE, require that a majority of the members of a listed company’s Board be independent. Under the rules of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s Board, that person does not have a material relationship with the company, either directly or as an officer, partner or stockholder of the company, that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In addition, our audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board, or any other committee of the Board: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries.

Our Board conducts an annual review of the independence of our directors. In its most recent review, our Board determined that Carl Bass, Michael Idelchik, Adrian Keppler, Stefan Krause, Ellen Smith, Gabrielle Toledano and Matthew Walters, representing seven of our nine directors, are “independent directors” as defined under the applicable rules, regulations, and listing standards of NYSE and the applicable rules and regulations promulgated by the SEC. Our Board has also determined that all members of our audit committee, compensation committee and nominating and corporate governance committee satisfy the relevant independence requirements.

Board of Directors and Committee Self-Evaluations

Throughout the year, our Board discusses corporate governance practices with management and third-party advisors to ensure that the Board and its committees follow practices that are optimal for us and our stockholders. Based on an evaluation process recommended by our nominating and corporate governance committee pursuant to the committee’s authority set forth in its charter, the Board conducts an annual self-evaluation in order to determine whether the Board and its committees are functioning effectively.

Board of Directors Leadership Structure

The nominating and corporate governance committee periodically considers the leadership structure of our Board and makes such recommendations to our Board with respect thereto as appropriate. When the positions of Chairman and Chief Executive Officer are held by the same person, our Board may, by a majority vote of our independent directors, designate a “lead independent director.” In cases in which the Chairman and Chief Executive Officer are the same person, the Chairman schedules and sets the agenda for meetings of our Board in consultation with the lead independent director, and the Chairman, or if the Chairman is not present, the lead independent director, chairs such meetings.

10

Currently, our Board believes that it should maintain flexibility to select the Chairman of our Board and adjust our Board leadership structure from time to time. Carl Bass is the Chairman of our Board. Our Board believes that Mr. Bass’s executive experience in the technology sector and public company board experience at technology companies make him well qualified to serve as the Chairman of our Board.

Our Board believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of our Board, and sound corporate governance policies and practices.

Committees of Our Board of Directors

Our Board has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below.

| DIRECTOR | AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||||||||||||||||||||||||||||||||

| Carl Bass | X | ||||||||||||||||||||||||||||||||||

| Benny Buller | |||||||||||||||||||||||||||||||||||

| Bradley Kreger | |||||||||||||||||||||||||||||||||||

| Michael Idelchik | X | CHAIR | |||||||||||||||||||||||||||||||||

| Adrian Keppler | X | ||||||||||||||||||||||||||||||||||

| Stefan Krause | CHAIR | ||||||||||||||||||||||||||||||||||

| Ellen Smith | X | ||||||||||||||||||||||||||||||||||

| Gabrielle Toledano | CHAIR | ||||||||||||||||||||||||||||||||||

| Matthew Walters | X | X | |||||||||||||||||||||||||||||||||

Each of these committees has a written charter approved by our Board. Copies of the charters for each committee are available, without charge, upon request in writing to Velo3D, Inc., 2710 Lakeview Court, Fremont, California 94538, Attn: Nancy Krystal or in the “Investor Relations” section of our website, which is located at www.ir.velo3d.com, by clicking on “Governance Documents” in the “Governance” section of our website. Members serve on these committees until their resignations or until otherwise determined by our Board.

Audit Committee

Our audit committee is composed of Mr. Krause, who is the chair of our audit committee, and Ms. Smith and Mr. Walters. Each member of our audit committee is independent under the current NYSE and SEC rules and regulations. Each member of our audit committee is financially literate as required by the current NYSE listing standards. Our Board has also determined that Mr. Krause is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K, or Regulation S-K, promulgated under the Securities Act of 1933, as amended, or the Securities Act. This designation does not impose any duties, obligations, or liabilities that are greater than those generally imposed on members of our audit committee and our Board. We have adopted an audit committee charter which outlines the principal functions of the audit committee, which include:

•selecting a firm to serve as our independent registered public accounting firm to audit our financial statements;

•ensuring the independence of the independent registered public accounting firm, reviewing the qualifications and performance of the independent registered public accounting firm, and overseeing the rotation of the independent registered public accounting firm’s audit partners;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results;

•establishing procedures for employees to anonymously submit concerns about accounting, audit or other matters;

11

•considering the adequacy of internal controls and the design, implementation, and performance of the internal audit function;

•reviewing related party transactions that are material or otherwise implicate disclosure requirements; and

•pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm.

Compensation Committee

Our compensation committee is composed of Ms. Toledano, who is the chair of our compensation committee, Mr. Bass and Mr. Idelchik. Each member of our compensation committee is independent under the current NYSE and SEC rules and regulations. Each member of this committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act. We have adopted a compensation committee charter which outlines the principal functions of the compensation committee, which include:

•reviewing and approving, or recommending that the Board approve, the compensation, including the terms of any compensatory agreements, of our Interim Chief Executive Officer and our other executive officers;

•reviewing and recommending to the Board the compensation of its directors;

•administering our stock and equity incentive plans;

•reviewing and approving, or making recommendations to the Board with respect to, incentive compensation and equity plans;

•establishing our overall compensation philosophy; and

•such other functions as are required to comply with NYSE listing rules.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is composed of Mr. Idelchik, who is the chair of the nominating and corporate governance committee, and Dr. Keppler and Mr. Walters. Each member of our nominating and corporate governance committee is independent under the current NYSE and SEC rules and regulations. We have adopted a nominating and corporate governance committee charter which outlines the principal functions of the nominating and corporate governance committee, which include:

•identifying and recommending candidates for membership on the Board;

•recommending directors to serve on board committees;

•oversight of our environmental, social and governance initiatives;

•reviewing and recommending to the Board any changes to our corporate governance principles;

•reviewing proposed waivers of the code of conduct for directors and executive officers;

•overseeing the process of evaluating the performance of the Board; and

•advising the Board on corporate governance matters.

Our Board of Directors’ Role in Risk Oversight

Our Board, as a whole, has responsibility for overseeing our risk management process, although the committees of our Board oversee and review risk areas that are particularly relevant to them. The risk oversight responsibility of our Board and its committees is supported by our management reporting processes. Our management reporting processes are designed to provide our Board and our personnel responsible for risk assessment with visibility into the identification, assessment, and management of critical risks and management’s risk mitigation strategies. These areas of focus include competitive, economic, operational, financial (accounting, credit, investment, liquidity, compensation-related risk, and tax), human capital, legal, regulatory, cybersecurity and data privacy and reputational risks. Our Board reviews strategic and operational risk in the context of discussions, question-and-answer sessions,

12

and reports from the management team at each regular board meeting, receives reports on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions.

Each committee of the Board meets with key management personnel and representatives of outside advisors to oversee risks associated with their respective principal areas of focus, as described below. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our Board leadership structure supports this approach. The audit committee reviews (i) our major financial risks and enterprise exposures and the steps management has taken to monitor or mitigate such risks and exposures, including our risk assessment and risk management policies, as well as cybersecurity and data privacy risks and risk exposures in other areas, as the audit committee deems appropriate from time to time; (ii) our programs for promoting and monitoring compliance with applicable legal and regulatory requirements, as well as major legal regulatory compliance risk exposures and the steps management has taken to monitor or mitigate such exposures; and (iii) the status of any significant legal and regulatory matters and any material reports or inquiries received from regulators or government agencies that reasonably could be expected to have a significant impact on our financial statements. The compensation committee reviews major compensation- and human capital-related risk exposures and the steps management has taken to monitor or mitigate such exposures. The nominating and corporate governance committee reviews and assesses risks relating to our corporate governance practices, reviews and assesses our performance, risks, controls, reviews the independence of our Board, and reviews and discusses our Board’s leadership structure and role in risk oversight.

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee in 2023 was at any time during 2023 or at any other time an officer or employee of ours or any of our subsidiaries, and none had or have any relationships with us that are required to be disclosed under the Exchange Act, or Regulation S-K. During 2023, none of our executive officers served as a member of the Board, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board or compensation committee.

Anti-Hedging

We have adopted an Insider Trading Policy that applies to all of our employees, contractors, consultants, directors, and officers, including our Chief Executive Officer and other executive officers, which prohibits such individuals from engaging in hedging or monetization transactions involving our securities, such as zero cost collars and forward sales contracts, or from contributing our securities to exchange funds in a manner that could be interpreted as hedging.

Compensation Recovery Policy

We have adopted a Compensation Recovery Policy in order to comply with the NYSE listing standards and corresponding SEC rules. The Compensation Recovery Policy requires us to recover certain incentive-based compensation paid or granted to our officers, and such additional employees as may be identified from time to time, in the event we are required to prepare an accounting restatement due to our material noncompliance with any financial reporting requirement under the securities laws. The policy requires each person covered thereby to reimburse or forfeit to us all incentive-based compensation received by them prior to the restatement that exceeds the amount they would have received had their incentive-based compensation been calculated based on the financial restatement. The recovery period extends up to three years prior to the date that it is, or reasonably should have been, concluded that we are required to prepare a restatement. The policy applies to incentive-based compensation that is received (as defined in the applicable rule) after the effective date of the applicable NYSE listing standards. Per applicable requirements, the policy is enforced without consideration of responsibility or fault or lack thereof. The full text of the policy is included as Exhibit 97.1 to our Annual Report on Form 10-K for the year ended December 31, 2023.

Board of Directors and Committee Meetings and Attendance

Our Board and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. During 2023, our Board met four times for regular meetings, eight times for special

13

meetings and acted by unanimous written consent 16 times, the audit committee met ten times and acted by unanimous written consent one time, the compensation committee met five times and acted by unanimous written consent two times, and the nominating and corporate governance committee met five times and acted by unanimous written consent one time. During 2023, each member of our Board attended at least 75% of the aggregate of all meetings of our Board and of all meetings of committees of our Board on which such member served that were held during the period in which such director served.

Board of Directors Attendance at Annual Stockholders’ Meeting

Our policy is to invite and encourage each member of our Board to be present at our annual meetings of stockholders. All nine of the directors serving on our Board at the time attended our 2023 Annual Meeting of Stockholders.

Communication with Directors

Stockholders and interested parties who wish to communicate with our Board, non-management members of our Board as a group, a committee of our Board, or a specific member of our Board (including our Chairman or lead independent director, if any) may do so by letters addressed to the attention of our Secretary.

All communications are reviewed by the Secretary and provided to the members of our Board as appropriate. Unsolicited items, sales materials, abusive, threatening, or otherwise inappropriate materials, and other routine items and items unrelated to the duties and responsibilities of our Board will not be provided to directors.

The address for these communications is:

Velo3D, Inc.

c/o Nancy Krystal

2710 Lakeview Court

Fremont, California 94538

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the members of our Board, officers, and employees, and we expect our agents, representatives, consultants and contractors to conform to the standards of our Code of Business Conduct and Ethics. Our Code of Business Conduct and Ethics is posted on the “Investor Relations” section of our website, which is located at www.ir.velo3d.com under “Governance Documents” in the “Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website at the address and location specified above.

Human Capital Resources

We have a strong team of employees who contribute to our success. As of December 31, 2023, we had 237 full-time employees, the majority of them based at our headquarters. We rely on consultants and outside contractors in roles and responsibilities that include engineering, operations and finance.

To date, we have not experienced any work stoppages and consider our relationship with our employees to be in good standing. None of our employees are subject to a collective bargaining agreement or are represented by a labor union.

In the first quarter of 2023, we launched a leadership development program for global people managers across our company to strengthen our collective management skills and enhance our culture. The program ran for the duration of 2023 and focused on best practices for managing relationships with employees, suppliers, customers and the communities in which we operate. The program resulted in increased management alignment, increased skills around communication, cross-functional collaboration, and talent development, and provided us with a management framework for leadership practices going forward. Through this development program we increased our leadership community and discussion of important micro and macro global topics such as diversity and inclusion, employee

14

friendly policies and practices, employee retention, corporate social responsibility, sustainability, climate-risks, and other important topics that will benefit our company, employees, customers, suppliers, shareholders and investors.

Our Board oversees matters relating to managing our human capital resources. Our human capital resources objectives include identifying, recruiting, and hiring qualified talent. We then focus on training, developing, and retaining talent, while ensuring fair compensation and incentives for global employees. We focus heavily on ensuring compliance and workplace safety. We review our compensation and benefit policies and programs regularly through industry benchmarks. We believe we offer competitive benefits and total compensation packages, of which the principal purposes are to attract, retain and motivate our employees.

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our Board are selected by our Board based on the recommendation of the nominating and corporate governance committee in accordance with the committee’s charter, our certificate of incorporation, as amended, or Certificate of Incorporation, and our amended and restated bylaws, or Bylaws, and the criteria approved by our Board regarding director candidate qualifications. In recommending candidates for nomination, the nominating and corporate governance committee considers candidates recommended by directors, officers, employees, stockholders, and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates as appropriate and, in addition, the committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our Board is set forth below under “Additional Information-Stockholder Proposals to Be Presented at Next Annual Meeting.”

Director Qualifications; Diversity

With the goal of developing a diverse, experienced and highly qualified Board, the nominating and corporate governance committee is responsible for developing and recommending to our Board the desired qualifications, expertise, and characteristics of members of our Board, including any specific minimum qualifications that the committee believes must be met by a committee-recommended nominee for membership on our Board and any specific qualities or skills that the committee believes are necessary for one or more of the members of our Board to possess. We value diversity on a company-wide basis and seek to achieve a mix of members to our Board that represent a diversity of background and experience, including with respect to age, gender, race, ethnicity, and occupation. Although the Board does not establish specific goals with respect to diversity, the Board’s overall diversity is a significant consideration in the director nomination process.

Because the identification, evaluation, and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our Board from time to time, our Board has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal and regulatory requirements and the provisions of our Certificate of Incorporation, Bylaws and charters of the committees of our Board. In addition, neither our Board nor our nominating and corporate governance committee has a formal policy with regard to the consideration of diversity in identifying nominees. When considering nominees, the nominating and corporate governance committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, diversity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry, and ability to devote adequate time and effort to responsibilities of our Board in the context of its existing composition. Through the nomination process, the nominating and corporate governance committee seeks to promote membership to the Board that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds, and other characteristics that are expected to contribute to our Board’s overall effectiveness. The brief biographical description of each director set forth in Proposal No. 1 below includes the

15

primary individual experience, qualifications, attributes, and skills of each of our directors that led to the conclusion that each director should serve as a member of our Board at this time.

16

PROPOSAL NO. 1

ELECTION OF DIRECTORS

ELECTION OF DIRECTORS

Our Board currently consists of nine directors and is divided into three classes. Each class serves for three years, with the terms of office of the respective classes expiring in successive years. Directors in Class III will stand for election at the Annual Meeting. The terms of office of directors in Class I and Class III do not expire until the annual meetings of stockholders held in 2025 and 2026, respectively. At the recommendation of our nominating and corporate governance committee, our Board proposes that each of the three Class III nominees named below, each of whom is currently serving as a director in Class III, be elected as a Class III director for a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification, or removal. Each director will be elected by a plurality of the votes cast, which means that the three individuals nominated for election to our Board at the Annual Meeting receiving the highest number of “FOR” votes will be elected.

Shares represented by proxies will be voted “FOR” the election of each of the three nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected. Proxies may not be voted for more than three directors. Stockholders may not cumulate votes for the election of directors.

Nominees to Our Board of Directors

The nominees and their ages, occupations, and length of service on our Board as of the date of this Proxy Statement, are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| Name of Director/Nominee | Age | Position | Director Since | ||||||||||||||||||||||||||||||||||||||

Bradley Kreger | 49 | Director | January 2024 | ||||||||||||||||||||||||||||||||||||||

Gabrielle Toledano(1) | 55 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

Matthew Walters(2)(3) | 36 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

| (1) | Chair of the compensation committee | ||||||||||||||||

| (2) | Member of the audit committee | ||||||||||||||||

| (3) | Member of the nominating and corporate governance committee | ||||||||||||||||

Bradley Kreger has served as a member of our Board since January 2024 and as our Interim Chief Executive Officer since December 2023. In connection with his appointment to our Board, Mr. Kreger has agreed to resign as a member of our Board upon the appointment of a new Chief Executive Officer as Mr. Kreger’s successor, or earlier upon Mr. Kreger’s resignation or removal as our Interim Chief Executive Officer. Mr. Kreger previously served as our Executive Vice President of Operations from December 2022 to December 2023. Prior to joining us, he served as Senior Vice President, Global Operations at Fluidigm Corporation (now known as Standard BioTools Inc.), a manufacturing company for biological research equipment, from April 2018 to October 2022, and as Senior Director, Operations, Clinical Sequencing Division at Thermo Fisher Scientific, a supplier of laboratory and scientific products and services, from December 2016 to March 2018, from October 2013 to December 2016, Vice President, Reagent Manufacturing at Affymetrix Incorporated, a manufacturing company for biological research equipment. Mr. Kreger holds a B.S. in Biotechnology and Business from Charter Oak State College and an M.S. in Management and Leadership and an M.B.A. from Western Governors University. We believe Mr. Kreger is qualified to serve on the Board because of his broad operational and managerial experience at public manufacturing companies.

Gabrielle Toledano has served as a member of our Board since September 2021. Prior to the consummation of the Merger, Ms. Toledano served as a member of Legacy Velo3D’s Board from July 2021 until September 2021. Since January 2020, Ms. Toledano has served as Chief Operating Officer at Keystone Strategy LLC, a strategy and economics consulting firm. From December 2020 to March 2021, Ms. Toledano served as Chief Talent Officer of

17

ServiceNow Inc., a software company. From May 2017 to October 2018, Ms. Toledano served as the Chief People Officer of Tesla Inc., a manufacturer of electric vehicles and energy storage products. From February 2006 to May 2017, Ms. Toledano served as Chief Talent Officer and Advisor at Electronic Arts Inc., a video game company. Ms. Toledano has served as a director of Lilium since July 2021, Vaxxinity since February 2023 and Fountain since August 2023. Prior to her current boards, Ms. Toledano served on the boards of Better.com from April 2021 to April 2022, Namely from February 2019 to October 2022, Bose from June 2020 to August 2022, Glu Mobile from December 2017 to April 2021 and Jive Software, Inc. from November 2015 to June 2017. Ms. Toledano holds a B.A. in Modern Thought and Literature and an M.A. in Education from Stanford University. We believe that Ms. Toledano is qualified to serve on the Board because of her strong background in technology management and her broad experience as a director of technology companies.

Matthew Walters has served as a member of our Board since September 2021. Prior to the Merger, Mr. Walters served as the Chief Executive Officer of JAWS Spitfire from September 2020 to September 2021. Mr. Walters is also a Managing Director at JAWS Estates Capital LLC, a public and private direct investing focused single family office, where since 2015 he has directed the private investment strategy with a particular emphasis on the consumer and technology sectors. Prior to joining JAWS Estates Capital LLC, Mr. Walters spent his entire career at L Catterton, the largest, most global consumer-focused private equity firm, where he worked on sourcing and investment strategy for both the buyout and growth-oriented funds. Mr. Walters also acts as the Chief Operating Officer of JAWS Mustang Acquisition Corporation. Mr. Walters received a B.A. from the University of Virginia and an M.S. in Finance from Fairfield University. We believe Mr. Walters’ significant investment experience make him well qualified to serve as a member of the Board.

Continuing Directors

The directors who are serving for terms that end after the Annual Meeting and their ages, occupations, and length of service on our Board as of the date of this Proxy Statement are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

| Name of Director | Age | Position | Director Since | ||||||||||||||||||||||||||||||||||||||

Class I Directors: | |||||||||||||||||||||||||||||||||||||||||

Carl Bass(1) | 71 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

Benny Buller | 61 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

Adrian Keppler(2) | 59 | Director | July 2023 | ||||||||||||||||||||||||||||||||||||||

Class II Directors: | |||||||||||||||||||||||||||||||||||||||||

Michael Idelchik(1)(3) | 71 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

Stefan Krause(4) | 61 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

Ellen Smith(5) | 64 | Director | September 2021 | ||||||||||||||||||||||||||||||||||||||

| (1) | Member of the compensation committee | ||||

| (2) | Member of the nominating and corporate governance committee | ||||

| (3) | Chair of the nominating and corporate governance committee | ||||

| (4) | Chair of the audit committee | ||||

| (5) | Member of the audit committee | ||||

Carl Bass has served as the Chairman of the Board since September 2021. Prior to the consummation of the Merger, Mr. Bass served as Legacy Velo3D’s chairman of the Board from July 2018 until September 2021. He is a board member for public technology companies and has held multiple executive roles in the technology industry. Mr. Bass has served as the lead independent director of Zendesk Inc., a customer service software company, since 2016, where he is the chair of its compensation committee, and as a director at Box, Inc., a cloud software company, since May 2020. Mr. Bass also serves on the Board of other technology companies, including Arris Composites, Built Robotics, Bright Machines, Formlabs, nTopology and Planet Labs. Previously, Mr. Bass served as the president and

18

chief executive officer at Autodesk, Inc., a software company, from 2006 to February 2017. Mr. Bass spent 24 years at Autodesk, where he held other executive positions, including chief technology officer and chief operating officer. Prior to Autodesk, Mr. Bass co-founded Ithaca Software and Buzzsaw.com (both acquired by Autodesk). In the last five years, Mr. Bass served on the Board of Autodesk and Hewlett-Packard, a provider of software and technology. He also served on the board of E2open, Inc., a software company, from July 2011 until March 2015 when it was acquired by Insight Venture Partners. Mr. Bass serves on the board of trustees of the California College of the Arts and on the advisory boards of Cornell Computing and Information Science, UC Berkeley School of Information and UC Berkeley College of Engineering. Mr. Bass has a B.A. in mathematics from Cornell University. We believe Mr. Bass will be a valuable member of the Board due to his executive experience in the technology sector and public company board experience at technology companies.

Benny Buller has served as member of our Board since September 2021. Mr. Buller previously served as our Chief Executive Officer from September 2021 to December 2023. He is Legacy Velo3D’s founder and, prior to the consummation of the Merger, served as Legacy Velo3D’s Chief Executive Officer and a member of Legacy Velo3D’s Board from June 2014 until September 2021. From April 2012 to June 2014, Mr. Buller was an investor at Khosla Ventures, a venture capital firm. Earlier in his career, Mr. Buller worked at Applied Materials, a semiconductor company, Solyndra, Inc., an energy company, and First Solar, a solar company, where he founded the device physics team. Mr. Buller holds a B.Sc. in Physics and a M.Sc. in Applied Physics from Jerusalem University. He also holds an M.Sc. in Science from the Technion, Israel Institute of Technology. We believe Mr. Buller is qualified to serve on the Board because of the historical knowledge, technical and operational expertise and continuity that he will bring to the Board as our founder and our former Chief Executive Officer.

Adrian Keppler has served as a member of the Board of Directors since July 2023. Dr. Keppler is the chief executive officer of AM Scalation, an additive manufacturing consulting company, which he founded in April 2021. He previously held multiple positions at EOS GmbH, or EOS, a global provider of 3D printing solutions, including serving as managing director from October 2019 to March 2021, chief executive officer from May 2017 to September 2019 and chief marketing officer from October 2012 to April 2017. Prior to EOS, he held different management positions within Siemens AG, a global manufacturing and technology company headquartered in Munich. Dr. Keppler currently serves on the advisory boards of Incus GmBH, a 3D printer manufacturer, AM-Flow, a provider of end-to-end automation for 3D-printing factories, and Roboze, an industrial 3D printer manufacturer. He also serves as an industry advisor to PartsCloud GmBH, a provider of cloud-based logistics for spare parts, and as a member of the board of directors of Sun Metalon, Inc., a metal 3D printing manufacturer. Dr. Keppler holds a PhD in Geotechnical Engineering from Ludwig Maximilians University of Munich and a degree in in Business Administration from the University of Zurich. We believe Dr. Keppler will be a valuable member of the Board due to his experience in additive manufacturing as a former chief executive officer.

Michael Idelchik has served as a member of our Board since September 2021. Prior to the consummation of the Merger, Mr. Idelchik served as a member of Legacy Velo3D’s Board from July 2021 until September 2021. Mr. Idelchik spent 38 years at General Electric, or GE, a multinational energy conglomerate, across several business units, culminating in his role as Vice President of Advanced Technology of GE Global Research, the research and development division of GE, for which he served for over a decade until 2017. Mr. Idelchik also serves as a member on a number of boards, including those of Singapore’s National Research Foundation, Columbia Engineering and Ellis Medicine. Mr. Idelchik received his B.S. in Mechanical Engineering from Columbia University and a Master’s degree in Mechanical and Electrical Engineering from Massachusetts Institute of Technology. We believe that Mr. Idelchik’s knowledge of the global technology supply chain and industry success qualifies him to serve on the Board.

Stefan Krause has served as a member of our Board since September 2021. Prior to the consummation of the Merger, Mr. Krause served as a member of Legacy Velo3D’s Board from February 2021 until September 2021. He was the founder and Chief Executive Officer and Chairman of Canoo, an electric car company, from December 2017 to May 2020. He has served on two DAX Company Management Boards from May 2002 until December 2015. He served as Chief Financial Officer of Deutsche Bank AG and had held positions of increasing seniority at BMW AG, an automotive company, that began in 1987, where he eventually served as the company’s Chief Financial Officer. Mr. Krause has served on may boards of public companies in Europe and the U.S. Mr. Krause

19

holds an M.B.A. in Business Administration and Management from the Julius Maximilians University of Würzburg. We believe that Mr. Krause is qualified to serve on the Board because of his extensive strategic leadership experience, his significant public company experience and expertise in finance and accounting.

Ellen Smith has served as a member of our Board since September 2021. Prior to the consummation of the Merger, Ms. Smith served as a member of Legacy Velo3D’s Board from July 2021 until September 2021. Ms. Smith has served as the Senior Managing Director of FTI Consulting, a global business advisory firm, since May 2013, and has more than 30 years of operational experience. Prior to joining FTI Consulting, Ms. Smith was the Chief Operations Officer and Executive Vice President at National Grid, a multinational electricity and gas utility company. Ms. Smith served on the board of Sunrun Inc. from November 2019 to June 2021 and Vivint Solar, Inc. (now a wholly owned subsidiary of Sunrun Inc.) from March 2019 to November 2019. Ms. Smith has served as a trustee of Union College since 2010. Ms. Smith holds a B.S. in Mechanical Engineering and M.S.E. in Power Systems from Union College. We believe that Ms. Smith is qualified to serve on the Board because of her extensive industry experience in energy, power and products.

There are no family relationships among our directors and executive officers.

Non-Employee Director Compensation

The Board has adopted the following compensation program for our non-employee directors:

Our non-employee directors receive an annual cash retainer of $50,000, payable monthly, and an annual grant of restricted stock units, or RSUs, with an aggregate grant-date value of $200,000, or the Grant Date Value. A non-employee director’s annual RSU award is granted on the date of each annual meeting of our stockholders and vest in equal quarterly installments, provided such director continues to serve as a director through each vesting date. In addition, new non-employee directors receive an initial RSU award upon joining the Board, with a Grant Date Value that is prorated for the period from the grant date to the next annual meeting of stockholders, which vest on the first anniversary of the grant date, provided such director continues to serve as a director through the vesting date.

The Chairman of our Board receives an additional annual cash retainer of $60,000. Members of our audit committee receive an additional annual cash retainer of $10,000, and the Chairman of our audit committee receives an additional cash retainer of $10,500 (in lieu of the annual retainer for membership on the audit committee). Members of our compensation committee receive an additional annual cash retainer of $6,000, and the Chairman of our compensation committee receives an additional cash retainer of $9,000 (in lieu of the annual retainer for membership on the compensation committee). Members of our nominating and governance committee (including the Chairman of the nominating and governance committee) receive an additional annual cash retainer of $5,000.

20

The following table sets forth the compensation earned by or paid to our non-employee directors for services provided during the year ended December 31, 2023. Mr. Buller, our former Chief Executive Officer, received no compensation for their service as directors during 2023.

| Name | Fees Earned or Paid in Cash | Stock Awards ($)(1) | Option Awards ($)(1) | Total | ||||||||||||||||||||||

| Carl Bass | $ | 116,000 | $ | 136,379 | $ | — | $ | 252,379 | ||||||||||||||||||

| Benny Buller(2) | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||

| Michael Idelchik | $ | 61,000 | $ | 138,520 | $ | — | $ | 197,379 | ||||||||||||||||||

| Adrian Keppler(3) | $ | 22,917 | $ | 60,489 | $ | — | $ | 161,437 | ||||||||||||||||||

| Stefan Krause | $ | 60,500 | $ | 136,379 | $ | — | $ | 196,879 | ||||||||||||||||||

| Ellen Pawlikowski(3) | $ | 32,083 | $ | 136,379 | $ | — | $ | 168,462 | ||||||||||||||||||

| Ellen Smith | $ | 60,000 | $ | 136,379 | $ | — | $ | 196,379 | ||||||||||||||||||

| Gabrielle Toledano | $ | 59,000 | $ | 136,379 | $ | — | $ | 195,379 | ||||||||||||||||||

| Matthew Walters | $ | 65,000 | $ | 136,379 | $ | — | $ | 201,379 | ||||||||||||||||||