velo-202110210001825079falseP2DP10D0.25P3DP3DP2DP10D0.25P3DP3Dhttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrentP3Mhttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://www.velo3d.com/20211021#AccruedExpensesAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent00018250792021-01-012021-06-30iso4217:USD0001825079velo:JAWSSpitfireAcquisitionCorporationMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-12-31xbrli:shares0001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2020-12-31iso4217:USDxbrli:shares0001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-06-300001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2021-04-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2021-04-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2021-01-012021-06-300001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-04-012021-06-300001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2020-12-310001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2021-01-012021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2021-03-310001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-03-310001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-04-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2021-06-300001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-09-110001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-072020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:OverAllotmentOptionMember2020-12-072020-12-070001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2020-12-072020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-12-072020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-12-07xbrli:pure0001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-03-310001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-03-310001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-06-300001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PrivatePlacementWarrantsMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PrivatePlacementWarrantsMember2021-06-3000018250792021-06-300001825079velo:RedeemableCommonClassMember2021-01-012021-06-300001825079velo:RedeemableCommonClassMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-04-012021-06-300001825079velo:RedeemableCommonClassMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:NonRedeemableCommonClassBMember2021-04-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:NonRedeemableCommonClassBMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:OverAllotmentOptionMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2021-01-012021-06-300001825079us-gaap:CommonClassBMembervelo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:FounderSharesMember2020-09-142020-09-140001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-020001825079us-gaap:CommonClassBMembervelo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:OverAllotmentOptionMembervelo:FounderSharesMember2020-12-022020-12-020001825079us-gaap:CommonClassBMembervelo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:FounderSharesMember2020-12-022020-12-020001825079us-gaap:CommonClassBMembervelo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:FounderSharesMember2021-01-012021-06-30velo:item0001825079velo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMemberus-gaap:CommonClassAMember2021-06-300001825079velo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMemberus-gaap:CommonClassAMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PrivatePlacementWarrantsMemberus-gaap:CommonClassAMember2021-06-300001825079velo:AdministrativeSupportAgreementMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-072020-12-070001825079velo:AdministrativeSupportAgreementMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-04-012021-06-300001825079velo:AdministrativeSupportAgreementMembervelo:JAWSSpitfireAcquisitionCorporationMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PromissoryNoteWithRelatedPartyMember2020-09-142020-09-140001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PromissoryNoteWithRelatedPartyMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PromissoryNoteWithRelatedPartyMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RelatedPartyLoansMember2021-06-30velo:Vote0001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PrivatePlacementWarrantsMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:WarrantMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMembervelo:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceeds18.00Member2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceeds10.00Membervelo:PublicWarrantsMember2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceeds18.00Member2021-01-012021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MoneyMarketFundsMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MoneyMarketFundsMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Membervelo:PublicWarrantsMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel2Membervelo:PrivatePlacementWarrantsMember2021-06-300001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Membervelo:PrivatePlacementWarrantsMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputExercisePriceMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputSharePriceMember2020-12-31velo:Y0001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputExpectedTermMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:MeasurementInputPublicWarrantPriceMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2020-09-112020-12-310001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2020-09-100001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-100001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2020-09-100001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-100001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-09-100001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:AdditionalPaidInCapitalMember2020-09-112020-12-310001825079us-gaap:RetainedEarningsMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-09-012020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMember2020-12-310001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMemberus-gaap:CommonClassAMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:CommonClassAMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:CommonClassAMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMemberus-gaap:CommonClassAMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:CommonClassAMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMember2020-09-112020-12-310001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMembersrt:ScenarioPreviouslyReportedMember2020-09-112020-12-310001825079us-gaap:CommonClassBMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:RestatementOfWarrantsAsDerivativeLiabilitiesMembersrt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-09-112020-12-310001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:PrivatePlacementMemberus-gaap:WarrantMember2020-09-112020-12-310001825079velo:RedeemableCommonClassMembervelo:JAWSSpitfireAcquisitionCorporationMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:NonRedeemableCommonClassBMember2020-09-112020-12-310001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMember2020-12-072020-12-070001825079us-gaap:IPOMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:PublicWarrantsMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:OverAllotmentOptionMembervelo:PrivatePlacementWarrantsMember2020-12-072020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:PrivatePlacementWarrantsMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceeds18.00Member2020-09-112020-12-310001825079us-gaap:CommonClassBMembervelo:SponsorMembervelo:JAWSSpitfireAcquisitionCorporationMembervelo:FounderSharesMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:AdministrativeServicesAgreementMember2020-12-072020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:AdministrativeServicesAgreementMember2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RelatedPartyLoansMember2020-12-310001825079velo:RelatedPartyLoansMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:RedemptionOfWarrantsWhenPricePerShareOfClassCommonStockEqualsOrExceeds10.00Member2020-09-112020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-070001825079velo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-310001825079us-gaap:MeasurementInputQuotedPriceMembervelo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Member2020-12-070001825079us-gaap:MeasurementInputQuotedPriceMembervelo:JAWSSpitfireAcquisitionCorporationMemberus-gaap:FairValueInputsLevel3Member2020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMember2020-12-082020-12-310001825079velo:JAWSSpitfireAcquisitionCorporationMembervelo:AfterDomesticationMemberus-gaap:SubsequentEventMember2021-03-222021-03-2200018250792020-12-3100018250792021-04-012021-06-3000018250792020-04-012020-06-3000018250792020-01-012020-06-3000018250792019-12-310001825079us-gaap:CommonStockMember2019-12-310001825079us-gaap:AdditionalPaidInCapitalMember2019-12-310001825079us-gaap:RetainedEarningsMember2019-12-310001825079us-gaap:CommonStockMember2020-01-012020-06-300001825079us-gaap:AdditionalPaidInCapitalMember2020-01-012020-06-300001825079us-gaap:RetainedEarningsMember2020-01-012020-06-3000018250792020-06-300001825079us-gaap:CommonStockMember2020-06-300001825079us-gaap:AdditionalPaidInCapitalMember2020-06-300001825079us-gaap:RetainedEarningsMember2020-06-300001825079us-gaap:CommonStockMember2020-12-310001825079us-gaap:AdditionalPaidInCapitalMember2020-12-310001825079us-gaap:RetainedEarningsMember2020-12-310001825079us-gaap:CommonStockMember2021-01-012021-06-300001825079us-gaap:AdditionalPaidInCapitalMember2021-01-012021-06-300001825079us-gaap:RetainedEarningsMember2021-01-012021-06-300001825079us-gaap:CommonStockMember2021-06-300001825079us-gaap:AdditionalPaidInCapitalMember2021-06-300001825079us-gaap:RetainedEarningsMember2021-06-3000018250792021-03-3100018250792021-02-2800018250792021-03-012021-03-31velo:tranche0001825079velo:ReverseRecapitalizationContingentConsiderationTrancheOneMember2021-03-012021-03-310001825079velo:ReverseRecapitalizationContingentConsiderationTrancheTwoMember2021-03-012021-03-310001825079srt:MinimumMember2021-03-310001825079srt:MaximumMember2021-03-31velo:trading_day00018250792021-05-310001825079us-gaap:MediumTermNotesMember2021-05-310001825079us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-05-310001825079velo:SecuredEquipmentLoanFacilityMember2021-05-310001825079us-gaap:MediumTermNotesMember2021-05-012021-05-310001825079us-gaap:MediumTermNotesMemberus-gaap:SubsequentEventMember2021-07-012021-07-310001825079us-gaap:SalesRevenueNetMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079velo:Customer2Memberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079velo:Customer2Memberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079velo:Customer2Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079velo:Customer2Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer4Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer4Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer4Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer4Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer5Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:SalesRevenueNetMembervelo:Customer5Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer5Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001825079us-gaap:AccountsReceivableMembervelo:Customer5Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-30utr:sqft0001825079us-gaap:BuildingMember2021-06-300001825079us-gaap:LetterOfCreditMember2021-06-012021-06-300001825079us-gaap:LetterOfCreditMember2021-06-300001825079country:US2021-01-012021-06-300001825079country:US2020-01-012020-06-300001825079velo:EastAsiaOceaniaMember2021-01-012021-06-300001825079velo:EastAsiaOceaniaMember2020-01-012020-06-300001825079velo:A3DPrintersMember2021-01-012021-06-300001825079velo:A3DPrintersMember2020-01-012020-06-300001825079velo:SupportServicesMember2021-01-012021-06-300001825079velo:SupportServicesMember2020-01-012020-06-300001825079us-gaap:ShippingAndHandlingMember2021-01-012021-06-300001825079us-gaap:ShippingAndHandlingMember2020-01-012020-06-300001825079velo:PartsMember2021-01-012021-06-300001825079velo:PartsMember2020-01-012020-06-300001825079velo:EquipmentOnLeaseMember2021-01-012021-06-300001825079us-gaap:RedeemableConvertiblePreferredStockMember2021-01-012021-06-300001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-06-300001825079us-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-06-300001825079us-gaap:ConvertibleDebtSecuritiesMember2020-01-012020-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2021-01-012021-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2020-01-012020-06-300001825079velo:WarrantToPurchaseCommonStockMember2021-01-012021-06-300001825079velo:WarrantToPurchaseCommonStockMember2020-01-012020-06-300001825079us-gaap:EmployeeStockOptionMember2021-01-012021-06-300001825079us-gaap:EmployeeStockOptionMember2020-01-012020-06-300001825079velo:ComputersAndSoftwareMember2021-06-300001825079velo:ComputersAndSoftwareMember2020-12-310001825079velo:ResearchAndDevelopmentLaboratoryEquipmentMember2021-06-300001825079velo:ResearchAndDevelopmentLaboratoryEquipmentMember2020-12-310001825079us-gaap:FurnitureAndFixturesMember2021-06-300001825079us-gaap:FurnitureAndFixturesMember2020-12-310001825079us-gaap:LeaseholdImprovementsMember2021-06-300001825079us-gaap:LeaseholdImprovementsMember2020-12-31velo:leased_assetvelo:lease00018250792021-04-300001825079velo:ManufacturingAndResearchAndDevelopmentFacilitiesMember2021-01-012021-06-300001825079us-gaap:ManufacturingFacilityMember2021-06-300001825079velo:ResearchAndDevelopmentFacilityMember2021-06-3000018250792020-01-012020-12-310001825079us-gaap:MediumTermNotesMember2021-06-300001825079us-gaap:MediumTermNotesMember2020-12-310001825079velo:PropertyAndEquipmentLoanMember2021-06-300001825079velo:PropertyAndEquipmentLoanMember2020-12-310001825079velo:EquipmentLoanMember2021-06-300001825079velo:EquipmentLoanMember2020-12-310001825079us-gaap:MediumTermNotesMember2021-05-170001825079us-gaap:MediumTermNotesMember2020-12-170001825079us-gaap:MediumTermNotesMemberus-gaap:PrimeRateMember2020-12-172020-12-170001825079us-gaap:MediumTermNotesMember2020-12-172020-12-170001825079us-gaap:MediumTermNotesMemberus-gaap:PrimeRateMember2021-01-012021-06-300001825079velo:PropertyAndEquipmentLoanMember2018-07-020001825079velo:PropertyAndEquipmentLoanMember2018-09-262018-09-260001825079velo:PropertyAndEquipmentLoanMemberus-gaap:PrimeRateMember2018-09-262018-09-260001825079velo:PropertyAndEquipmentLoanMember2020-12-170001825079velo:PropertyAndEquipmentLoanMemberus-gaap:PrimeRateMember2020-12-172020-12-170001825079velo:PropertyAndEquipmentLoanMember2020-12-172020-12-170001825079velo:EquipmentLoanMembervelo:EquipmentLoanFacilityOneMember2020-12-310001825079velo:EquipmentLoanMemberus-gaap:PrimeRateMembervelo:EquipmentLoanFacilityOneMember2020-01-012020-12-310001825079velo:EquipmentLoanMembervelo:EquipmentLoanFacilityTwoMember2020-12-310001825079velo:EquipmentLoanMember2020-01-012020-12-31velo:advance0001825079velo:EquipmentLoanMembervelo:EquipmentLoanFacilityOneMember2021-01-012021-06-300001825079velo:EquipmentLoanMemberus-gaap:PrimeRateMembervelo:EquipmentLoanFacilityOneMember2021-01-012021-06-300001825079velo:EquipmentLoanMembervelo:EquipmentLoanFacilityOneMember2021-06-300001825079velo:EquipmentLoanMembervelo:EquipmentLoanFacilityTwoMember2021-06-300001825079velo:SecuredEquipmentLoanFacilityMember2021-06-300001825079us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-06-300001825079us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMember2021-01-012021-06-300001825079us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001825079us-gaap:RedeemableConvertiblePreferredStockMember2021-06-300001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-12-310001825079us-gaap:ConvertibleNotesPayableMember2021-06-300001825079us-gaap:ConvertibleNotesPayableMember2020-12-310001825079velo:ConvertibleNotesDueJanuary32023Memberus-gaap:ConvertibleNotesPayableMember2021-01-04velo:share0001825079velo:ConvertibleNotesDueJanuary32023Memberus-gaap:ConvertibleNotesPayableMember2021-01-042021-01-040001825079velo:ConvertibleNotesDueJanuary32023Memberus-gaap:ConvertibleNotesPayableMember2021-06-300001825079us-gaap:FairValueInputsLevel3Memberus-gaap:ConvertibleNotesPayableMember2021-06-300001825079velo:SeriesARedeemableConvertiblePreferredStockMember2020-12-310001825079velo:SeriesARedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesBRedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesBRedeemableConvertiblePreferredStockMember2020-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-12-310001825079velo:SeriesDRedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesDRedeemableConvertiblePreferredStockMember2020-12-3100018250792020-04-130001825079velo:SeriesARedeemableConvertiblePreferredStockMember2020-04-132020-04-130001825079velo:SeriesBRedeemableConvertiblePreferredStockMember2020-04-132020-04-130001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-04-132020-04-130001825079us-gaap:CommonStockMember2020-04-132020-04-130001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-04-1300018250792020-04-132020-04-130001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-04-132020-04-130001825079us-gaap:AdditionalPaidInCapitalMember2020-04-132020-04-130001825079us-gaap:RetainedEarningsMember2020-04-132020-04-130001825079velo:SeriesDRedeemableConvertiblePreferredStockMember2020-04-132020-04-130001825079us-gaap:ConvertibleDebtSecuritiesMember2021-06-300001825079us-gaap:ConvertibleDebtSecuritiesMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2021-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2020-12-310001825079velo:WarrantToPurchaseCommonStockMember2021-06-300001825079velo:WarrantToPurchaseCommonStockMember2020-12-310001825079us-gaap:EmployeeStockOptionMember2021-06-300001825079us-gaap:EmployeeStockOptionMember2020-12-310001825079us-gaap:StockCompensationPlanMember2021-06-300001825079us-gaap:StockCompensationPlanMember2020-12-310001825079velo:CommonStockWarrantsDueDecember22025Member2021-06-30iso4217:USDvelo:warrant0001825079velo:CommonStockWarrantsDueJuly22028Member2021-06-300001825079velo:CommonStockWarrantsDueDecember172030Member2021-06-300001825079velo:CommonStockWarrantsDueFebruary182031Member2021-06-300001825079velo:CommonStockWarrantsDueMarch262031Member2021-06-300001825079velo:CommonStockWarrantsDueApril262031Member2021-06-300001825079velo:WarrantToPurchaseCommonStockMember2021-06-300001825079velo:WarrantToPurchaseCommonStockMember2020-12-310001825079srt:MinimumMembervelo:MeasurementInputExpectedVolatilityMembervelo:WarrantToPurchaseCommonStockMember2021-06-300001825079velo:MeasurementInputExpectedVolatilityMembervelo:WarrantToPurchaseCommonStockMembersrt:MaximumMember2021-06-300001825079us-gaap:MeasurementInputRiskFreeInterestRateMembervelo:WarrantToPurchaseCommonStockMember2021-06-300001825079velo:SeriesARedeemableConvertiblePreferredStockMember2020-12-310001825079velo:SeriesARedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2021-06-300001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-12-310001825079us-gaap:RedeemableConvertiblePreferredStockMember2021-06-300001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2021-06-300001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMember2021-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMembersrt:MaximumMember2021-06-300001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMember2020-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMembersrt:MaximumMember2020-06-300001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2021-06-300001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2020-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputDividendYieldMember2021-06-300001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputDividendYieldMember2020-06-300001825079velo:SeriesARedeemableConvertiblePreferredStockMember2020-06-300001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-06-300001825079velo:A2014EquityIncentivePlanMember2021-06-300001825079velo:A2014EquityIncentivePlanMember2014-01-012014-12-310001825079srt:MinimumMembervelo:A2014EquityIncentivePlanMember2014-01-012014-12-3100018250792019-01-012019-12-310001825079us-gaap:MeasurementInputDiscountForLackOfMarketabilityMember2021-06-300001825079us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300001825079us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-06-300001825079us-gaap:SellingAndMarketingExpenseMember2021-01-012021-06-300001825079us-gaap:SellingAndMarketingExpenseMember2020-01-012020-06-300001825079us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-06-300001825079us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-06-3000018250792018-12-310001825079us-gaap:CommonStockMember2018-12-310001825079us-gaap:AdditionalPaidInCapitalMember2018-12-310001825079us-gaap:RetainedEarningsMember2018-12-310001825079us-gaap:CommonStockMember2019-01-012019-12-310001825079us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079us-gaap:RetainedEarningsMember2019-01-012019-12-310001825079us-gaap:CommonStockMember2020-01-012020-12-310001825079us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001825079us-gaap:RetainedEarningsMember2020-01-012020-12-310001825079velo:SeriesDRedeemableConvertiblePreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001825079velo:SeriesDRedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079velo:SeriesDRedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079velo:SeriesARedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079velo:SeriesARedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079velo:CommonStockWarrantsMember2020-01-012020-12-310001825079velo:CommonStockWarrantsMember2019-01-012019-12-310001825079us-gaap:SalesRevenueNetMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079velo:Customer2Memberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079us-gaap:SalesRevenueNetMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079us-gaap:SalesRevenueNetMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079velo:Customer2Memberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079us-gaap:SalesRevenueNetMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079us-gaap:AccountsReceivableMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079velo:Customer2Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079us-gaap:AccountsReceivableMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001825079us-gaap:AccountsReceivableMembervelo:Customer1Memberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079velo:Customer2Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079us-gaap:AccountsReceivableMembervelo:Customer3Memberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001825079velo:EquipmentOnLeaseMember2020-01-012020-12-310001825079velo:ComputersAndSoftwareMember2020-01-012020-12-310001825079velo:ResearchAndDevelopmentLaboratoryEquipmentMember2020-01-012020-12-310001825079us-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001825079us-gaap:LeaseholdImprovementsMember2020-01-012020-12-310001825079country:US2020-01-012020-12-310001825079country:US2019-01-012019-12-310001825079velo:EastAsiaOceaniaMember2020-01-012020-12-310001825079velo:EastAsiaOceaniaMember2019-01-012019-12-310001825079velo:A3DPrintersMember2020-01-012020-12-310001825079velo:A3DPrintersMember2019-01-012019-12-310001825079velo:SupportServicesMember2020-01-012020-12-310001825079velo:SupportServicesMember2019-01-012019-12-310001825079srt:MinimumMembervelo:A3DPrintersMember2020-01-012020-12-310001825079velo:A3DPrintersMembersrt:MaximumMember2020-01-012020-12-310001825079us-gaap:ShippingAndHandlingMember2019-01-012019-12-310001825079us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079us-gaap:RedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079us-gaap:ConvertibleDebtSecuritiesMember2020-01-012020-12-310001825079us-gaap:ConvertibleDebtSecuritiesMember2019-01-012019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079velo:WarrantToPurchaseCommonStockMember2020-01-012020-12-310001825079velo:WarrantToPurchaseCommonStockMember2019-01-012019-12-310001825079us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001825079us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001825079velo:ComputersAndSoftwareMember2019-12-310001825079velo:ResearchAndDevelopmentLaboratoryEquipmentMember2019-12-310001825079us-gaap:FurnitureAndFixturesMember2019-12-310001825079us-gaap:LeaseholdImprovementsMember2019-12-3100018250792019-01-010001825079us-gaap:MediumTermNotesMember2019-12-310001825079velo:PropertyAndEquipmentLoanMember2019-12-310001825079velo:EquipmentLoanMember2019-12-3100018250792020-12-1700018250792019-04-180001825079us-gaap:MediumTermNotesMember2019-04-180001825079us-gaap:MediumTermNotesMemberus-gaap:PrimeRateMember2019-04-182019-04-180001825079us-gaap:MediumTermNotesMember2019-04-182019-04-180001825079us-gaap:RedeemableConvertiblePreferredStockMember2019-12-310001825079us-gaap:ConvertibleNotesPayableMember2019-12-310001825079velo:ConvertibleNotesDueNovember152024Memberus-gaap:ConvertibleNotesPayableMember2019-11-150001825079velo:ConvertibleNotesDueNovember152024Memberus-gaap:ConvertibleNotesPayableMember2019-12-310001825079velo:ConvertibleNotesDueNovember152024Membervelo:SeriesDRedeemableConvertiblePreferredStockMember2020-04-170001825079velo:ConvertibleNotesDueNovember152024Member2020-04-170001825079velo:ConvertibleNotesDueApril172035Memberus-gaap:ConvertibleNotesPayableMember2020-04-170001825079velo:ConvertibleNotesDueApril172035Memberus-gaap:ConvertibleNotesPayableMember2020-04-172020-04-170001825079velo:SeriesDRedeemableConvertiblePreferredStockMembervelo:ConvertibleNotesDueApril172035Member2020-04-170001825079velo:ConvertibleNotesDueApril172035Memberus-gaap:ConvertibleNotesPayableMember2020-06-112020-06-110001825079velo:SeriesDRedeemableConvertiblePreferredStockMembervelo:ConvertibleNotesDueApril172035Member2020-06-110001825079velo:SeriesARedeemableConvertiblePreferredStockMember2019-12-310001825079velo:SeriesBRedeemableConvertiblePreferredStockMember2019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-04-300001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-04-012019-04-3000018250792019-04-012019-04-300001825079us-gaap:CommonStockMember2019-04-012019-04-300001825079us-gaap:RedeemableConvertiblePreferredStockMember2019-02-012019-02-280001825079us-gaap:CommonStockMember2019-02-012019-02-2800018250792019-02-2800018250792019-02-012019-02-280001825079srt:MinimumMemberus-gaap:SubsequentEventMember2021-03-012021-03-310001825079us-gaap:ConvertibleDebtSecuritiesMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2019-12-310001825079velo:WarrantToPurchaseCommonStockMember2019-12-310001825079us-gaap:EmployeeStockOptionMember2019-12-310001825079us-gaap:StockCompensationPlanMember2019-12-310001825079velo:CommonStockWarrantsDueDecember22025Member2020-12-310001825079velo:CommonStockWarrantsDueJuly22028Member2020-12-310001825079velo:CommonStockWarrantsDueDecember172030Member2020-12-310001825079velo:CommonStockWarrantsDueDecember22025Member2019-12-310001825079velo:WarrantToPurchaseCommonStockMember2019-12-310001825079velo:MeasurementInputExpectedVolatilityMembervelo:WarrantToPurchaseCommonStockMember2020-12-310001825079us-gaap:MeasurementInputRiskFreeInterestRateMembervelo:WarrantToPurchaseCommonStockMember2020-12-310001825079velo:SeriesARedeemableConvertiblePreferredStockMember2019-12-310001825079velo:SeriesCRedeemableConvertiblePreferredStockMember2019-12-310001825079us-gaap:RedeemableConvertiblePreferredStockMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2018-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2019-01-012019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMember2020-01-012020-12-310001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMembersrt:MaximumMember2020-12-310001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputExpectedVolatilityMembersrt:MaximumMember2019-12-310001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2020-12-310001825079srt:MinimumMembervelo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMemberus-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2019-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputDividendYieldMember2020-12-310001825079velo:WarrantToPurchaseRedeemableConvertiblePreferredStockMembervelo:MeasurementInputDividendYieldMember2019-12-310001825079velo:A2014EquityIncentivePlanMember2020-12-310001825079velo:A2014EquityIncentivePlanMember2020-01-012020-12-310001825079us-gaap:MeasurementInputDiscountForLackOfMarketabilityMember2020-12-310001825079us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001825079us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001825079us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001825079us-gaap:SellingAndMarketingExpenseMember2019-01-012019-12-310001825079us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001825079us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-3100018250792019-05-132019-05-1300018250792019-05-130001825079us-gaap:DomesticCountryMember2020-12-310001825079us-gaap:StateAndLocalJurisdictionMember2020-12-310001825079us-gaap:DomesticCountryMember2019-12-310001825079us-gaap:StateAndLocalJurisdictionMember2019-12-310001825079us-gaap:DomesticCountryMemberus-gaap:ResearchMember2020-12-310001825079us-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2020-12-310001825079us-gaap:SubsequentEventMemberus-gaap:ConvertibleNotesPayableMember2021-01-310001825079velo:SeriesDRedeemableConvertiblePreferredStockMemberus-gaap:SubsequentEventMember2021-01-012021-01-310001825079us-gaap:BuildingMemberus-gaap:SubsequentEventMember2021-04-300001825079us-gaap:SubsequentEventMemberus-gaap:LoansPayableMember2021-04-300001825079us-gaap:SubsequentEventMember2021-03-310001825079us-gaap:SubsequentEventMember2021-04-012021-04-300001825079velo:ReverseRecapitalizationContingentConsiderationTrancheTwoMemberus-gaap:SubsequentEventMember2021-04-012021-04-300001825079velo:ReverseRecapitalizationContingentConsiderationTrancheOneMemberus-gaap:SubsequentEventMember2021-04-012021-04-300001825079srt:MinimumMemberus-gaap:SubsequentEventMember2021-04-300001825079us-gaap:SubsequentEventMembersrt:MaximumMember2021-04-30

As filed with the Securities and Exchange Commission on October 21, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Velo3D, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 3559 | 98-1556965 |

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

511 Division Street

Campbell, California 95008

(408) 610-3915

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Benyamin Buller

Chief Executive Officer

511 Division Street

Campbell, California 95008

(408) 610-3915

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Per B. Chilstrom

Fenwick & West LLP

902 Broadway

New York, New York 10010

(212) 430-2600

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| | | | | | | | | | | | | | |

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum

Offering Price Per Share | Proposed Maximum

Aggregate Offering Price | Amount of

Registration Fee |

Common stock, par value $0.00001 per share(2)(3) | 169,147,569 | $7.98 (6) | $1,349,797,600(6) | $125,126.24(9) |

Common stock, par value $0.00001 per share(2)(4) | 13,075,000 | $11.50(7) | $150,362,500(7) | $13,938.60(9) |

Warrants to purchase common stock(2)(5) | 4,450,000 | $---(8) | $---(8) | $---(8) |

Total | | | | $125,126.24(9)(10) |

(1)In connection with the consummation of the business combination (the “Business Combination”) described in the prospectus (the “prospectus”) forming part of this registration statement, JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company (“JAWS Spitfire” and, after giving effect to the Business Combination, “New Velo3D”), effected a deregistration and a transfer by way of continuation from the Cayman Islands to the State of Delaware, pursuant to which JAWS Spitfire’s jurisdiction of incorporation was changed from the Cayman Islands to the State of Delaware (the “Domestication”) as further described in the prospectus. Further, in connection with the consummation of the Business Combination, New Velo3D was renamed “Velo3D, Inc.” All securities being registered were or will be issued by New Velo3D.

(2)Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(3)The number of shares of common stock, par value $0.00001 per share (the “common stock”), being registered represents 169,147,569 shares of common stock to be offered and sold by the selling securityholders named in the prospectus (the “Selling Securityholders”), consisting of (i) 15,500,000 shares of common stock issued in a private placement pursuant to subscription agreements each entered into on March 22, 2021 (the “PIPE Financing”); (ii) 8,625,000 shares of common stock issued in connection with the consummation of the Business Combination in exchange for Class B ordinary shares originally issued in a private placement to Spitfire Sponsor LLC (the “Sponsor”); (iii) 140,572,569 shares of common stock issued or issuable to certain former stockholders and equity award holders of Velo3D in connection with or as a result of the consummation of the Business Combination, consisting of (a) 123,058,137 shares of common stock; (b) 1,902,945 shares of common stock issuable upon the exercise of certain options;] and (c) 15,611,487 shares of common stock (the “Earn-Out Shares”) that certain former stockholders and equity award holders of Velo3D have the contingent right to receive upon the achievement of certain vesting conditions; and (iv) 4,450,000 shares of common stock issuable upon the exercise of the private placement warrants (as defined below).

(4)The number of shares of common stock being registered represents up to 13,075,000 shares of common stock to be offered and sold by the registrant, consisting of: (i) 8,625,000 shares of common stock that are issuable by the registrant upon the exercise of 8,625,000 warrants originally issued in the registrant’s initial public offering; and (ii) up to 4,450,000 shares of common stock that are issuable by the registrant upon the exercise of the private placement warrants.

(5)The number of warrants being registered represents 4,450,000 warrants (the “private placement warrants”) originally issued in a private placement to the Sponsor.

(6)Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the common stock on the New York Stock Exchange on October 15, 2021 ($7.98 per share). This calculation is in accordance with Rule 457(c) of the Securities Act.

(7)Calculated pursuant to Rule 457(g) under the Securities Act, based on the applicable exercise prices of the warrants.

(8)No separate fee due in accordance with Rule 457(g).

(9)Calculated by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0000927.

(10)Pursuant to Rule 457(p) under the Securities Act, the registrant is offsetting the registration fee due under this registration statement by $13,938.60, which represents the portion of the registration fee paid with respect to securities that had previously been included in the registrant’s registration statement on Form S-4 (Registration Statement No. 333-256057), which was originally filed with the Securities and Exchange Commission on May 13, 2021

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 21, 2021

PRELIMINARY PROSPECTUS

Velo3D, Inc.

169,147,569 Shares of Common Stock

4,450,000 Warrants to Purchase Shares of Common Stock

13,075,000 Shares of Common Stock Underlying Warrants

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of (A) up to 169,147,569 shares of our common stock, par value $0.00001 per share (our “common stock”), consisting of (i) up to 15,500,000 shares of our common stock (the “PIPE shares”) issued in a private placement pursuant to subscription agreements each entered into on March 22, 2021 (the “PIPE Financing”); (ii) up to 8,625,000 shares of our common stock (the “Founder Shares”) issued in connection with the consummation of the Business Combination (as defined below), in exchange for our Class B ordinary shares originally issued in a private placement to Spitfire Sponsor LLC (the “Sponsor”); (iii) up to 140,572,569 shares of our common stock issued or issuable to certain former stockholders and equity award holders of Velo3D (the “Velo3D equity holders”) in connection with or as a result of the consummation of the Business Combination, consisting of (a) up to 123,058,137 shares of our common stock; (b) up to 1,902,945 shares of our common stock issuable upon the exercise of certain options; and (c) up to 15,611,487 shares of our common stock (the “Earn-Out Shares”) that certain Velo3D equity holders have the contingent right to receive upon the achievement of certain vesting conditions; and (iv) up to 4,450,000 shares of our common stock issuable upon the exercise of the private placement warrants (as defined below); and (B) up to 4,450,000 warrants (the “private placement warrants”) originally issued in a private placement to the Sponsor.

In addition, this prospectus relates to the offer and sale of: (i) up to 8,625,000 shares of our common stock that are issuable by us upon the exercise of 8,625,000 warrants (the “public warrants”) originally issued in our initial public offering (the “IPO”); and (ii) up to 4,450,000 shares of our common stock that are issuable by us upon the exercise of the private placement warrants.

On September 29, 2021 (the “Closing Date”), we consummated the transactions contemplated by that certain Business Combination Agreement, dated as of March 22, 2021 (as amended, the “Business Combination Agreement”), by and among JAWS Spitfire Acquisition Corporation (“JAWS Spitfire” and, after the consummation of the Business Combination, “New Velo3D”), Spitfire Merger Sub, Inc. (“Merger Sub”) and Velo3D, Inc. (“Velo3D”). In particular, as contemplated by the Business Combination Agreement, on the Closing Date, JAWS Spitfire filed a notice of deregistration with the Cayman Islands Registrar of Companies, together with the necessary accompanying documents, and filed a certificate of incorporation and a certificate of corporate domestication with the Secretary of State of the State of Delaware, under which JAWS Spitfire was domesticated and continued as a Delaware corporation (the “Domestication”). Further, as contemplated by the Business Combination Agreement, on the Closing Date, Merger Sub was merged with and into Velo3D, with Velo3D surviving the merger (the “Surviving Corporation”) as a wholly-owned subsidiary of us (the “Merger” and, together with the Domestication and the other transactions contemplated by the Business Combination Agreement, including the PIPE Financing, the “Business Combination”). In connection with the consummation of the Business Combination, we changed our name to “Velo3D, Inc.” and the Surviving Corporation changed its name to “Velo3D US, Inc.”

The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of our common stock or warrants, except with respect to amounts received by us upon the exercise of the warrants for cash. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of our common stock or warrants. See “Plan of Distribution” beginning on page 130 of this prospectus.

Our common stock and public warrants are listed on the New York Stock Exchange (the “NYSE”) under the symbols “VLD” and “VLD WS”, respectively. On October 18, 2021, last reported sales price of our common stock was $8.68 per share and the last reported sales price of our public warrants was $1.69 per warrant.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, have elected to comply with certain reduced disclosure and regulatory requirements.

Investing in our securities involves risks. See the section entitled “Risk Factors” beginning on page 11 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell or otherwise distribute the securities offered by them as described in the section titled “Plan of Distribution” in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of common stock issuable upon the exercise of any warrants. We will receive proceeds from any exercise of the warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

Unless the context otherwise requires, references in this prospectus to references to:

•“JAWS Spitfire” refer to JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company, prior to the Closing (as defined herein);

•“New Velo3D” refer to Velo3D, Inc., a Delaware corporation (f/k/a JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company), and its consolidated subsidiary following the Closing;

•“Velo3D” refer to Velo3D, Inc., a Delaware corporation, prior to the Closing; and

•“we,” “us,” and “our” or the “Company” refer to New Velo3D following the Closing and to Velo3D prior to the Closing.

SELECTED DEFINITIONS

Unless otherwise stated in this prospectus or the context otherwise requires, references to:

“Board” or “Board of Directors” means the board of directors of the Company.

“Bylaws” means the restated bylaws of the Company.

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including the Domestication, the Merger and the PIPE Investment.

“Business Combination Agreement” means that certain Business Combination Agreement, dated as of March 22, 2021, by and among JAWS Acquisition, Merger Sub and Velo3D, as amended by Amendment #1 to Business Combination Agreement dated as of July 20, 2021.

“Certificate of Incorporation” means the restated certificate of incorporation of the Company.

“common stock” means the shares of common stock, par value $0.00001 per share, of the Company.

“Class A ordinary shares” means the Class A ordinary shares, par value $0.0001 per share, of JAWS Spitfire, prior to the Domestication, which automatically converted, on a one-for-one basis, into shares of common stock in connection with the Closing.

“Class B ordinary shares” means the Class B ordinary shares, par value $0.0001 per share, of JAWS Spitfire, prior to the Domestication, which automatically converted, on a one-for-one basis, into shares of common stock in connection with the Closing.

“Closing” means the closing of the Business Combination.

“Closing Date” means September 29, 2021.

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” means New Velo3D following the Closing and to Velo3D prior to the Closing.

“Domestication” means the domestication contemplated by the Business Combination Agreement, whereby JAWS Spitfire effected a deregistration and a transfer by way of continuation from the Cayman Islands to the State of Delaware, pursuant to which JAWS Spitfire’s jurisdiction of incorporation was changed from the Cayman Islands to the State of Delaware.

“DGCL” means the General Corporation Law of the State of Delaware.

“Earn-Out Shares” means up to 21,758,149 shares of our common stock issuable pursuant to the Business Combination Agreement to certain Velo3D equity holders upon the achievement of certain vesting conditions.

“Effective Time” means the time at which the Merger became effective.

“Equity Incentive Plan” means the Velo3D, Inc. 2021 Equity Incentive Plan.

“ESPP” means the Velo3D, Inc. 2021 Employee Stock Purchase Plan.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Founder Shares” means the 8,625,000 shares of our common stock issued to the Sponsor and the other Initial Stockholders in connection with the automatic conversion of the Class B ordinary shares in connection with the Closing.

“GAAP” means United States generally accepted accounting principles.

“Initial Stockholders” means the Sponsor together with Andy Appelbaum, Mark Vallely and Serena J. Williams.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IPO” means the Company’s initial public offering, consummated on December 7, 2020, of 34,500,000 units (including 4,500,000 units that were issued to the underwriters in connection with the exercise in full of their over-allotment option) at $10.00 per unit.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Merger” means the merger contemplated by the Business Combination Agreement, whereby Merger Sub merged with and into Velo3D, with Velo3D surviving the merger as a wholly-owned subsidiary of the Company on the Closing Date.

“Merger Sub” means Spitfire Merger Sub, Inc., a Delaware corporation.

“New Velo3D” refer to Velo3D, Inc., a Delaware corporation (f/k/a JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company), and its consolidated subsidiary following the Closing.

“NYSE” means the New York Stock Exchange.

“PIPE Financing” means the private placement pursuant to which the PIPE Investors collectively subscribed for 15,500,000 shares of our common stock at $10.00 per share, for an aggregate purchase price of $155,000,000, on the Closing.

“PIPE Investors” means certain institutional investors that invested in the PIPE Financing.

“PIPE Shares” means the 15,500,000 shares of our common stock issued in the PIPE Financing.

“private placement warrants” means the 4,450,000 warrants originally issued to the Sponsor in a private placement in connection with our IPO.

“public shares” means the Class A ordinary shares included in the units issued in our IPO.

“public shareholders” means holders of public shares.

“public warrants” means the 8,625,000 warrants included in the units issued in our IPO.

“Sarbanes-Oxley Act” or “SOX” means the Sarbanes-Oxley Act of 2002.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Selling Securityholders” means the selling securityholders named in this prospectus.

“Sponsor” means Spitfire Sponsor LLC, a Delaware limited liability company.

“Subscription Agreements” means, collectively, those certain subscription agreements, entered into on March 22, 2021, between the Company and the PIPE Investors.

“Transfer Agent” means Continental Stock Transfer & Trust Company.

“Trust Account” means the trust account of the Company that held the proceeds from the IPO and a portion of the proceeds from the sale of the private placement warrants.

“Velo3D” means Velo3D, Inc., a Delaware corporation, prior to the Closing.

“Velo3D equity holder” means certain former stockholders and equity award holders of Velo3D.

MARKET AND INDUSTRY DATA

Information contained in this prospectus concerning the market and the industry in which we compete, including our market position, general expectations of market opportunity and market size, is based on information from various third-party sources, assumptions made by us based on such sources and our knowledge of the markets for our services and solutions. Any estimates provided herein involve numerous assumptions and limitations, and you are cautioned not to give undue weight to such information. Third-party sources generally state that the information contained in such source has been obtained from sources believed to be reliable but that there can be no assurance as to the accuracy or completeness of such information. These third party sources include the following reports and publications (the “Market and Industry Reports”):

•Investment Casting Market Size, Share & Trends Analysis Report By Application (Aerospace & Defense, Energy Technology), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts, 2020 – 2027, October 2020

•Market Research Future, Global Metal Forging Market, February 2021

•Technavio, Metal Machining Market by End-user and Geography 2020 – 2024, 2020

•ResearchAndMarkets.com, Braze Alloys – Global Market Trajectory & Analytics, April 2021

•SmarTech Analysis, Q3 2020 Market Report

The industry in which we operate is subject to a high degree of uncertainty and risk. As a result, the estimates and market and industry information provided in this prospectus are subject to change based on various factors, including those described in the section entitled “Risk Factors — Risks Related to Our Business” and elsewhere in this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to the Business Combination. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

•our projected financial information, growth rate and market opportunity;

•the ability to maintain the listing of our common stock and the public warrants on the NYSE, and the potential liquidity and trading of such securities;

•the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees;

•costs related to the proposed Business Combination;

•changes in applicable laws or regulations;

•the inability to develop and maintain effective internal controls;

•our ability to raise financing in the future

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors

•the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements;

•the potential for our business development efforts to maximize the potential value of our portfolio;

•regulatory developments in the United States and foreign countries;

•the impact of laws and regulations;

•our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•our financial performance;

•the effect of COVID-19 on the foregoing; and

•other factors detailed under the section entitled “Risk Factors”.

The forward-looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the section entitled “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak

and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PROSPECTUS SUMMARY

The following summary highlights information contained in greater details elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock or warrants. You should carefully consider, among other things, our financial statements and related notes and the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Company Overview

We seek to fulfill the promise of additive manufacturing, also referred to as 3D printing (“AM”), to deliver breakthroughs in performance, cost and lead time in the production of high-value metal parts.

We produce a full-stack hardware and software solution based on our proprietary powder bed fusion (“PBF”) technology, which enables support-free production. Our technology enables the production of highly complex, mission-critical parts that existing AM solutions cannot produce without the need for redesign or additional assembly. Our products give our customers who are in space, aviation, defense, energy and industrial markets the freedom to design and produce metal parts with complex internal features and geometries that had previously been considered impossible for AM. We believe our technology is years ahead of competitors.

Our technology is novel compared to other AM technologies based on its ability to deliver high-value metal parts that have complex internal channels, structures and geometries. This affords a wide breadth of design freedom for creating new metal parts, and it enables replication of existing parts without the need to redesign the part to be manufacturable with AM. Because of these features, we believe our technology and product capabilities are highly valued by our customers. Our customers are primarily original equipment manufacturers (“OEMs”) and contract manufacturers who look to AM to solve issues with traditional metal parts manufacturing technologies. Those traditional manufacturing technologies rely on processes, including casting, stamping, and forging, that typically require high volumes to drive competitive costs and have long lead times for production. Our customers look to AM solutions to produce assemblies that are lighter, stronger and more reliable than those manufactured with traditional technologies. Our customers also expect AM solutions to drive lower costs for low volume parts and substantially shorter lead times. However, many of our customers have found that legacy AM technologies failed to produce the required designs for the high-value metal parts and assemblies that our customers wanted to produce with AM. As a result, other AM solutions often require that parts be redesigned so that they can be produced and frequently incur performance losses for high-value applications. For these reasons, AM solutions of our competitors have been largely relegated to tooling and prototyping or the production of less complex, lower-value metal parts.

In contrast, our technology can deliver complex high-value metal parts with the design advantages, lower costs and faster lead times associated with AM, and generally avoids the need to redesign the parts. As a result, our customers have increasingly adopted our technology into their design and production processes. We believe our value is reflected in our sales patterns, as most customers purchase a single machine to validate our technology and purchase additional systems over time as they embed our technology in their product roadmap and manufacturing infrastructure. We consider this approach a “land and expand” strategy, oriented around a demonstration of our value proposition followed by increasing penetration with key customers.

Our customers range from small- and medium-sized enterprises to Fortune 500 companies in the space, aviation, defense, energy and industrial markets. As of June 30, 2021, December 31, 2020 and December 31, 2019, we had sixteen, eight and three customers, respectively, for our 3D Printer sales, and SpaceX, our largest customer, accounted for approximately, 16.3%, 40.8% and 74.9% of our revenue for the six months ended June 30, 2021 and the fiscal years ended December 31, 2020 and 2019, respectively. Including part sales and other services to customers, we had 66 customers as of June 30, 2021. Our customers include both OEMs, as well as contract manufacturers who provide service and parts on behalf of OEMs.

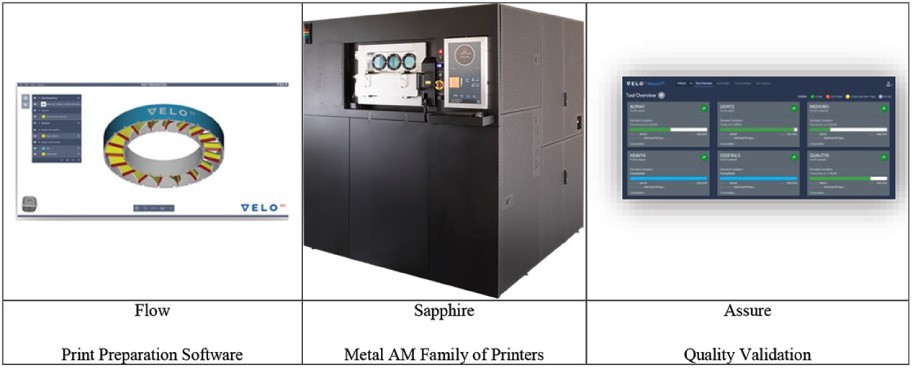

We offer customers a full-stack solution, which includes the following key components:

•Flow™ print preparation software conducts sophisticated analysis of the features of the metal part and specifies a production process that enables support-free printing of the part.

•Sapphire® metal AM printers produce the part using our proprietary PBF technology, which enables support-free production. Our technology produces metal parts by fusing many thousands of very thin layers of metal powder with precisely controlled laser beams in a sophisticated software-defined sequence (or “recipe”) defined by our Flow software.

•Assure™ quality validation software validates the product made by Sapphire to confirm that it is made to the specifications required by the original design.

Legacy AM technologies often rely on internal supports to prevent deformation of the metal part during the 3D printing process. These supports inhibit the production of parts with complex internal geometries, which are often required in high-performance applications, because there is limited or no access to remove them after production. Our technological advances enable our Sapphire product to print metal parts that do not require internal supports, enabling our customers to produce designs that would otherwise be infeasible to make with AM.