UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

||

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 10, 2022, there were

Table of Contents

|

|

Page |

PART I. |

|

|

Item 1. |

1 |

|

|

Unaudited Condensed Consolidated Balance Sheets as of September 30, 2022 and December 31, 2021 |

1 |

|

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss for the three and nine months ended September 30, 2022 and 2021 |

2 |

|

Unaudited Condensed Consolidated Statements of Stockholders’ Equity for the three and nine months ended September 30, 2022 |

3 |

|

4 |

|

|

5 |

|

|

Notes to Unaudited Condensed Consolidated Financial Statements |

6 |

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

Item 3. |

27 |

|

Item 4. |

27 |

|

|

|

|

PART II. |

|

|

Item 1. |

29 |

|

Item 1A. |

29 |

|

Item 2. |

44 |

|

Item 3. |

44 |

|

Item 4. |

44 |

|

Item 5. |

44 |

|

Item 6. |

45 |

|

46 |

||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Report constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These forward-looking statements include statements about future financial and operating results of Surrozen; statements about the plans, strategies and objectives of management for future operations of Surrozen; and statements regarding future performance. In some cases, you can identify these forward-looking statements by the use of terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words or phrases.

These statements are based upon information available to us as of the date of this Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements whether as a result of new information, future events, or otherwise.

There are no guarantees that the transactions and events described will happen as described (or that they will happen at all). The forward-looking statements contained in this Report are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. For a further discussion of these and other factors that could cause the our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section of this Report titled “Risk Factors” and “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on March 28, 2022.

ii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

SURROZEN, INC.

Condensed Consolidated Balance Sheets

(In thousands, except per share amounts)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

(Unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Short-term marketable securities |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Operating lease right-of-use assets |

|

|

|

|

|

|

||

Long-term marketable securities |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Liabilities and stockholders’ equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued and other liabilities |

|

|

|

|

|

|

||

Lease liabilities, current portion |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Lease liabilities, noncurrent portion |

|

|

|

|

|

|

||

Warrant liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

Stockholders’ equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

SURROZEN, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except per share amounts)

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income (expense), net |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

||

Net loss |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Unrealized gain (loss) on marketable securities, net of tax |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

Comprehensive loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss per share attributable to common |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted-average shares used in computing net |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

SURROZEN, INC.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

Additional |

|

|

Accumulated |

|

|

|

|

|

Total |

|

||||||

|

|

Common stock |

|

|

paid-in |

|

|

comprehensive |

|

|

Accumulated |

|

|

stockholders’ |

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

loss |

|

|

deficit |

|

|

equity |

|

||||||

Balance at December 31, 2021 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Issuance of common stock under Equity |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Repurchase of early exercised stock options |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at March 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Repurchase of early exercised stock options |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

||||

Repurchase of early exercised stock options |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at September 30, 2022 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

SURROZEN, INC.

Condensed Consolidated Statements of Redeemable Convertible Preferred Stock and Stockholders’ Equity

(Unaudited)

(In thousands)

|

|

Redeemable convertible |

|

|

|

|

|

|

|

|

Additional |

|

|

Accumulated |

|

|

|

|

|

Total |

|

|||||||||||

|

|

preferred stock |

|

|

Common stock |

|

|

paid-in |

|

|

comprehensive |

|

|

Accumulated |

|

|

stockholders’ |

|

||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

loss |

|

|

deficit |

|

|

equity |

|

||||||||

Balance at December 31, 2020, as previously reported |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

||||||

Retroactive application of recapitalization |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Balance at December 31, 2020, after effect of |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

|

||||

Exercises of stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Restricted stock granted |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Reclassification to liability for early exercised |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at March 31, 2021, after effect of |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

|

||||

Exercises of stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Restricted stock granted |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Restricted stock forfeited |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Reclassification to liability for early exercised |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Repurchase of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2021, after effect of |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

|

||||

Issuance of common stock upon Business Combination |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Exercises of stock options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Reclassification to liability for early exercised stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Vesting of early exercised stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at September 30, 2021 |

|

|

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

SURROZEN, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

Nine Months Ended September 30, |

|

|||||

|

2022 |

|

|

2021 |

|

||

Operating activities: |

|

|

|

|

|

||

Net loss |

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

||

Stock-based compensation |

|

|

|

|

|

||

Non-cash operating lease expense |

|

|

|

|

|

||

Amortization of premium on marketable securities, net |

|

|

|

|

|

||

Change in fair value of warrant liabilities |

|

( |

) |

|

|

( |

) |

Other expense related to the commitment shares issued to Lincoln Park |

|

|

|

|

|

||

Transaction costs allocated to warrants in connection with Business Combination |

|

|

|

|

|

||

Changes in operating assets and liabilities: |

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

( |

) |

|

|

( |

) |

Other assets |

|

( |

) |

|

|

( |

) |

Accounts payable |

|

( |

) |

|

|

|

|

Accrued and other liabilities |

|

( |

) |

|

|

|

|

Operating lease liabilities |

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

||

Investing activities: |

|

|

|

|

|

||

Purchases of property and equipment |

|

( |

) |

|

|

( |

) |

Purchases of marketable securities |

|

( |

) |

|

|

( |

) |

Sales of marketable securities |

|

|

|

|

|

||

Proceeds from maturities of marketable securities |

|

|

|

|

|

||

Net cash provided by (used in) investing activities |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

||

Financing activities: |

|

|

|

|

|

||

Proceeds from issuance of common stock upon Business Combination and PIPE |

|

|

|

|

|

||

Proceeds from exercise of stock options |

|

|

|

|

|

||

Repurchase of early exercised stock options |

|

( |

) |

|

|

( |

) |

Net cash (used in) provided by financing activities |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

||

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

( |

) |

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

||

Cash, cash equivalents and restricted cash at end of period |

$ |

|

|

$ |

|

||

|

|

|

|

|

|

||

Supplemental disclosure of noncash investing and financing activities: |

|

|

|

|

|

||

Conversion of redeemable convertible preferred stock into common stock |

$ |

|

|

$ |

|

||

Assumption of warrant liabilities in Business Combination |

$ |

|

|

$ |

|

||

Transaction costs in Business Combination included in accrued liabilities |

$ |

|

|

$ |

|

||

Purchases of property and equipment included in accounts payable |

$ |

|

|

$ |

|

||

Vesting of early exercises of stock options |

$ |

|

|

$ |

|

||

Reclassification of early exercised stock options to liability |

$ |

|

|

$ |

|

||

Increase in right-of-use assets and lease liabilities due to lease extension |

$ |

|

|

$ |

|

||

The following table presents a reconciliation of the Company’s cash, cash equivalents and restricted cash in the Company’s unaudited condensed consolidated balance sheets:

|

September 30, |

|

|||||

|

2022 |

|

|

2021 |

|

||

Cash and cash equivalents |

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

||

Cash, cash equivalents and restricted cash |

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

SURROZEN, INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

Note 1. Organization and Business

Organization

Surrozen, Inc., or the Company, formerly known as Consonance-HFW Acquisition Corp., or Consonance, is a clinical stage biotechnology company committed to discovering and developing drug candidates to selectively modulate the Wnt pathway, a critical mediator of tissue repair, in a broad range of organs and tissues, for human diseases. The Company, a Delaware corporation, is located in South San Francisco, California.

Business Combination and Private Investment in Public Entity Financing

Consonance was a blank check company incorporated as a Cayman Islands exempted company on August 21, 2020. It was formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses.

On August 11, 2021, Consonance consummated a business combination, or the Business Combination, among Consonance, Perseverance Merger Sub Inc., a subsidiary of Consonance, and Surrozen, Inc., or Legacy Surrozen, a Delaware company incorporated on August 12, 2015. Upon closing of the Business Combination, Consonance became a Delaware corporation and was renamed to Surrozen, Inc., Legacy Surrozen, was renamed to Surrozen Operating, Inc., and Legacy Surrozen continued as a wholly-owned subsidiary of the Company. See Note 3, “Recapitalization” for additional details.

In May 2022, Surrozen Netherlands, B.V. was incorporated and located in Rotterdam, Netherlands as a wholly-owned subsidiary of Surrozen Operating, Inc.

Liquidity

The Company has incurred net losses since inception. The Company has historically financed the operations primarily through private placements of redeemable convertible preferred stock. As of September 30, 2022, the Company had cash, cash equivalents and marketable securities of $

In October 2022, the Company executed a Collaboration and License Agreement, or CLA, with Boehringer Ingelheim International GmbH, or BI, pursuant to which the Company is eligible to receive a non-refundable upfront payment of $

Management believes that the existing cash, cash equivalents, and marketable securities, plus the gross cash proceeds of $

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements and accompanying notes have been prepared in accordance with generally accepted accounting principles in the United States of America, or GAAP, and pursuant to the regulations of the U.S. Securities and Exchange Commission, or SEC. As permitted under those rules, certain footnotes or other financial information that are normally required by GAAP have been condensed or omitted and accordingly, the condensed consolidated balance sheet as of December 31, 2021 has been derived from the Company’s audited consolidated financial statements at that date but does not include all of the information required by GAAP for complete consolidated financial statements. These unaudited condensed consolidated financial statements have been prepared on the same basis as the Company’s annual consolidated financial statements and, in the opinion of management, reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair presentation of the Company’s consolidated

6

financial statements. The results of operations for the three and nine months ended September 30, 2022 are not necessarily indicative of the results to be expected for the year ended December 31, 2022 or for any other interim period or future year.

The unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions and balances have been eliminated.

The Business Combination discussed in Note 1 was accounted for as a reverse recapitalization with Legacy Surrozen as the accounting acquirer and Consonance as the acquired company for accounting purposes. Accordingly, all historical financial information presented in the unaudited condensed consolidated financial statements represents the accounts of Legacy Surrozen at their historical cost as if Legacy Surrozen is the predecessor to the Company. The unaudited condensed consolidated financial statements following the closing of the Business Combination reflect the results of the combined entity’s operations. All issued and outstanding common stock, redeemable convertible preferred stock and stock awards of Legacy Surrozen and per share amounts contained in the unaudited condensed consolidated financial statements for the periods presented prior to the closing of the Business Combination on August 11, 2021 have been retroactively restated to reflect the exchange ratio established in the Business Combination. See Note 3, “Recapitalization” for additional details.

The accompanying condensed consolidated financial statements and related financial information should be read in conjunction with the audited consolidated financial statements and the related notes thereto for the year ended December 31, 2021 included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 28, 2022.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the unaudited condensed consolidated financial statements and the reported amounts of expenses during the reporting periods. Significant estimates and assumptions made in the accompanying unaudited condensed consolidated financial statements include, but are not limited to, certain accrued expenses for research and development activities, the fair value of common stock prior to the Business Combination, stock-based compensation expense and income taxes. Management bases its estimates on historical experience and on various other market-specific and relevant assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results could materially differ from those estimates.

Concentration of Credit Risk

Financial instruments, which potentially subject the Company to significant concentration of credit risk, consist of cash, cash equivalents and marketable securities. The Company's cash is held by one financial institution that management believes is creditworthy. Such deposits held with the financial institution may at times exceed federally insured limits, however, its exposure to credit risk in the event of default by the financial institution is limited to the extent of amounts recorded on the unaudited condensed consolidated balance sheets. The Company performs evaluations of the relative credit standing of these financial institutions to limit the amount of credit exposure. The Company's policy is to invest cash in institutional money market funds and marketable securities with high credit quality to limit the amount of credit exposure. The Company currently maintains a portfolio of cash equivalents and marketable securities in a variety of securities, including money market funds, U.S. government bonds, commercial paper and corporate debt securities. The Company has not experienced any realized losses on its cash equivalents and marketable securities.

Marketable Securities

The Company invests its excess cash in U.S. government bonds, commercial paper and corporate debt securities. All marketable securities have been classified as available-for-sale and are carried at estimated fair value as determined based upon quoted market prices or pricing models for similar securities. The Company does not buy or hold securities principally for the purpose of selling them in the near future. The Company’s policy is focused on the preservation of capital, liquidity and return. From time to time, the Company may sell certain securities, but the objectives are generally not to generate profits on short-term differences in price.

Short-term marketable securities have maturities less than or equal to one year as of the balance sheet date. Long-term marketable securities have maturities greater than one year as of the balance sheet date. These marketable securities are carried at estimated fair value with unrealized holding gains or losses included in accumulated other comprehensive loss in stockholders’ equity until realized. Gains and losses on marketable security transactions are reported on the specific-identification method. Interest income is recognized in the unaudited condensed consolidated statements of operations and comprehensive loss when earned.

7

Warrant Liabilities

The Company's Public Warrants, Private Placement Warrants and PIPE Warrants were classified as liabilities (see Note 9). At the end of each reporting period, any changes in fair value during the period are recognized in other income, net within the unaudited condensed consolidated statements of operations and comprehensive loss. The Company will continue to adjust the warrant liabilities for changes in the fair value until the earlier of a) the exercise or expiration of the warrants or b) the redemption of the warrants, at which time such warrants will be reclassified to additional paid-in capital.

Net Loss Per Share

Basic net loss per share is calculated by dividing the net loss attributable to common stock by the weighted-average number of shares of common stock outstanding for the period, without consideration for potential dilutive securities. Since the Company was in a loss position for the periods presented, basic net loss per share is the same as diluted net loss per share as the effects of potentially dilutive securities are antidilutive.

|

|

September 30, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

|

|

|

|

|

|

||

Options outstanding |

|

|

|

|

|

|

||

Unvested restricted stock |

|

|

|

|

|

|

||

Unvested common stock subject to repurchase |

|

|

|

|

|

|

||

Warrants to purchase common stock |

|

|

|

|

|

|

||

Total |

|

|

|

|

|

|

||

Note 3. Recapitalization

On August 11, 2021, Consonance consummated the Business Combination (see Note 1). Immediately after the consummation of the Business Combination, certain investors subscribed for and purchased an aggregate of

Accordingly, for accounting purposes, the reverse recapitalization was treated as the equivalent of Legacy Surrozen issuing stock for the net assets of Consonance, accompanied by a recapitalization. The net assets of Consonance are stated at historical cost, with

8

Pursuant to the business combination agreement, upon the closing of the Business Combination, (i) each share of redeemable convertible preferred stock of Legacy Surrozen (on an as converted to common stock basis) and each share of common stock of Legacy Surrozen, whether vested or unvested, was converted into

Note 4. Fair Value Measurement

The following tables summarize the Company’s financial assets and liabilities that are measured at fair value on a recurring basis (in thousands):

|

|

September 30, 2022 |

|

|||||||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Commercial paper |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Corporate bonds |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Government bonds |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total financial assets measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Liabilities(2): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Public Warrants |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Private Placement Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

||||

PIPE Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total financial liabilities measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

December 31, 2021 |

|

|||||||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Commercial paper |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Corporate bonds |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Government bonds |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign bonds |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total financial assets measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Liabilities(2): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Public Warrants |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Private Placement Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

||||

PIPE Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total financial liabilities measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

There were

Corporate bonds, commercial paper, foreign bonds and government bonds are classified as Level 2 as they were valued based upon quoted market prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets.

9

The Public Warrants are classified as Level 1 due to the use of an observable market quote in an active market. The Private Placement Warrants and PIPE Warrants are classified as Level 2 due to the use of observable market data for identical or similar liabilities. The fair value of each Private Placement Warrant and PIPE Warrant was determined to be consistent with that of a Public Warrant because the Private Placement Warrants and PIPE Warrants are also subject to the make-whole redemption feature, which allows the Company to redeem both types of warrants on similar terms when the stock price is in the range of $

The following tables provide the Company’s marketable securities by security type (in thousands):

|

|

September 30, 2022 |

|

|||||||||||||

|

|

Amortized Cost |

|

|

Gross Unrealized Gains |

|

|

Gross Unrealized Losses |

|

|

Fair Value |

|

||||

Commercial paper |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Corporate bonds |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Government bonds |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Total short-term marketable securities |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

|

|

December 31, 2021 |

|

|||||||||||||

|

|

Amortized Cost |

|

|

Gross Unrealized Gains |

|

|

Gross Unrealized Losses |

|

|

Fair Value |

|

||||

Commercial paper |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Corporate bonds |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Foreign bonds |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Total short-term marketable securities |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Government bonds |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Corporate bonds |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Total long-term marketable securities |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

The following table indicates the length of the time that individual securities have been in a continuous unrealized loss position as of September 30, 2022 (dollars in thousands):

|

|

|

|

|

|

|

Less Than 12 Months |

|

||||||

|

|

|

|

Number of Investments |

|

|

Fair Value |

|

|

Unrealized Losses |

|

|||

Corporate bonds |

|

|

|

|

|

|

$ |

|

|

$ |

|

|||

Government bonds |

|

|

|

|

|

|

|

|

|

|

|

|||

Total |

|

|

|

|

|

|

$ |

|

|

$ |

|

|||

As of September 30, 2022 and December 31, 2021, all short-term marketable securities had maturities of one year or less. There have been no significant realized gains or losses on the short-term and long-term marketable securities during the three and nine months ended September 30, 2022 and 2021. The Company periodically reviews the available-for-sale investments for other-than-temporary impairment loss. All investments with unrealized losses have been in a loss position for less than 12 months. The Company determined that the unrealized loss was primarily attributed to changes in current market interest rates and not to credit quality. The Company does not intend to sell the marketable securities that are in an unrealized loss position, nor is it more likely than not that the Company will be required to sell the marketable securities before the recovery of the amortized cost basis, which may be at maturity. As a result, the Company did recognize any other-than-temporary impairment losses as of September 30, 2022.

10

Note 5. Balance Sheet Components

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

Prepaid insurance |

|

$ |

|

|

$ |

|

||

Prepaid research and development expenses |

|

|

|

|

|

|

||

Prepaid rent |

|

|

|

|

|

|

||

Interest and other receivables |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

$ |

|

|

$ |

|

||

Accrued and Other Liabilities

Accrued and other liabilities consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

Accrued payroll and related expenses |

|

$ |

|

|

$ |

|

||

Accrued research and development expenses |

|

|

|

|

|

|

||

Accrued legal and audit fees |

|

|

|

|

|

|

||

Liability for early exercised stock options |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

Accrued and other liabilities |

|

$ |

|

|

$ |

|

||

Note 6. License Agreements

Stanford License Agreements

In March 2016, the Company entered into a license agreement with Stanford University, or the 2016 Stanford Agreement, which was amended in July 2016, October 2016 and January 2021, pursuant to which the Company obtained from Stanford a worldwide, exclusive, sublicensable license under certain patents, rights, or licensed patents and technology related to its engineered Wnt surrogate molecules to make, use, import, offer to sell and sell products that are claimed by the licensed patents or that use or incorporate such technology, or licensed products, for the treatment, diagnosis and prevention of human and veterinary diseases. The Company agreed to pay Stanford an aggregate of up to $

In June 2018, the Company entered into another license agreement with Stanford, or the 2018 Stanford Agreement, pursuant to which the Company obtained from Stanford a worldwide, exclusive, sublicensable license under certain patent rights related to its surrogate R-spondin proteins, or the licensed patents, to make, use, import, offer to sell and sell products that are claimed by the licensed patents, or licensed products, for the treatment, diagnosis and prevention of human and veterinary diseases, or the exclusive field. Additionally, Stanford granted the Company a worldwide, non-exclusive, sublicensable license under the licensed patents to make and use licensed products for research and development purposes in furtherance of the exclusive field and a worldwide, non-exclusive license to make, use and import, but not to offer to sell or sell, licensed products in any other field of use. The Company agreed to pay Stanford an aggregate of up to $

11

For the three and nine months ended September 30, 2022, the Company incurred de minimis and $

UCSF License and Option Agreements

In September and October 2016, the Company entered into two separate license and option agreements with The Regents of the University of California, or the UCSF Agreements, pursuant to which the Company obtained exclusive licenses from UCSF for internal research and antibody discovery purposes and an option to negotiate with UCSF to obtain an exclusive license under UCSF’s rights in the applicable library to make, use, sell, offer for sale and import products incorporating antibodies identified or resulting from the Company’s use of such library, or licensed products.

In January 2020, the Company amended and restated the UCSF Agreements to provide non-exclusive licenses to make and use a certain human Fab naïve phage display library and to make and use a certain phage display llama VHH single domain antibody library for internal research and antibody discovery purposes and an option to negotiate with UCSF to obtain a non-exclusive commercial license under UCSF’s rights in the applicable library to make, use, sell, offer for sale and import products incorporating antibodies identified or resulting from the Company’s use of such library, or licensed products.

In March 2022, the Company exercised the option under the UCSF Agreements and entered into a non-exclusive commercial license agreement to make and use licensed products derived from the phage display llama VHH single domain antibody library. Under the commercial license agreement, the Company paid UCSF a nominal license issue fee and agreed to pay a nominal annual license maintenance fee, five- to six-digit payments per licensed product upon achievement of a regulatory milestone, nominal minimum annual royalties, and earned royalties equal to a sub-single digit percentage of the Company’s and the Company’s sublicensees’ net sales of licensed products.

For the three and nine months ended September 30, 2022, the Company incurred de minimis and $

Distributed Bio Subscription Agreement

In September 2016, the Company entered into, and in January 2019, the Company amended, an antibody library subscription agreement with Charles River Laboratories International, Inc., formerly known as Distributed Bio, Inc., or the Distributed Bio Agreement, in which the Company obtained from Distributed Bio a non-exclusive license to use Distributed Bio’s antibody library to identify antibodies directed to an unlimited number of the Company’s proprietary targets and to make, use, sell, offer for sale, import and exploit products incorporating the antibodies that the Company identifies, or licensed products. The Company agreed to pay Distributed Bio an annual fee in the low six figures after the first three years. Additionally, the Company agreed to pay Distributed Bio an aggregate of $

For the three and nine months ended September 30, 2022, the Company incurred $

Note 7. Commitments and Contingencies

Lease Agreements

In August 2016, the Company entered into a lease agreement for office and lab space, which consists of approximately

12

In January 2020, the Company entered into a lease agreement for a term of

The operating lease expense for the three and nine months ended September 30, 2022 and 2021 was $

Aggregate future minimum rental payments under the operating leases as of September 30, 2022, were as follows (in thousands):

Remaining three months ending December 31, 2022 |

|

$ |

|

|

Year ending December 31, 2023 |

|

|

|

|

Year ending December 31, 2024 |

|

|

|

|

Year ending December 31, 2025 |

|

|

|

|

Total lease payments |

|

|

|

|

Less: Imputed interest |

|

|

( |

) |

Operating lease liabilities |

|

$ |

|

Note 8. Stockholders’ Equity

Equity Purchase Agreement

In February 2022, the Company entered into the Equity Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park is obligated to purchase up to $

Upon execution of the Equity Purchase Agreement, the Company issued

As contemplated by the Equity Purchase Agreement, and so long as the closing price of the Company’s common stock exceeds $

The Company may also direct Lincoln Park to purchase additional shares no less than the Regular Purchase Share Limit and no greater than

As of September 30, 2022, the Company has

13

Note 9. Common Stock Warrants

In connection with the Business Combination, Legacy Surrozen, as the accounting acquirer, was deemed to assume warrants held by Consonance’s stockholders, or the Public Warrants, and warrants held by Consonance's sponsor, or the Private Placement Warrants. In addition, in the PIPE Financing, certain investors subscribed for and purchased an aggregate of

Type |

|

Classification |

|

Expiration Date |

|

Exercise Price per Warrant |

|

|

Number of Warrants |

|

|

Fair Value |

|

|||

Public Warrants |

|

|

|

$ |

|

|

|

|

|

$ |

|

|||||

Private Placement Warrants |

|

|

|

|

|

|

|

|

|

|

|

|||||

PIPE Warrants |

|

|

|

|

|

|

|

|

|

|

|

|||||

Total |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|||

Public Warrants

Each whole Public Warrant entitles the holder to purchase one share of the Company’s common stock at a price of $

The Company may redeem the outstanding Public Warrants at a price of $

In no event will the Company be required to net cash settle the Public Warrants. The Public Warrant holders do not have the rights or privileges of common stockholders and any voting rights until they exercise their Public Warrants and receive common stock.

Private Placement Warrants

The Private Placement Warrants have terms and provisions that are identical to those of the Public Warrants, except that so long as they are held by Consonance's sponsor or any of its permitted transferees, the Private Placement Warrants: (i) may be exercised for cash or on a cashless basis, (ii) may not be transferred, assigned or sold until

PIPE Warrants

Each whole PIPE Warrant entitles the holder to purchase one share of the Company’s common stock at a price of $

14

Classification

The Public Warrants, Private Placement Warrants and PIPE Warrants are not considered indexed to the Company’s common stock as certain provisions of the warrant agreements could change the settlement amount of these warrants. As a result, they were classified as liabilities and recorded at fair value with subsequent change in their respective fair value recognized in the other income (expense), net within the unaudited condensed consolidated statements of operations and comprehensive loss at each reporting date. See Note 4 for the discussion of warrant valuations.

Note 10. Stock-Based Compensation Plan

The Company maintains the 2021 Equity Incentive Plan, or the 2021 Plan, which provides for the granting of stock awards to employees, directors and consultants. Options granted under the 2021 Plan may be either incentive stock options, or ISOs, or nonqualified stock options, or NSOs. Options granted under the 2021 Plan expire no later than

The Company adopted the 2021 Employee Stock Purchase Plan, or the ESPP, in August 2021. The ESPP allows eligible employees to purchase shares of the Company’s common stock at a discount through payroll deductions of up to

Stock-based compensation expense under the ESPP is measured at the beginning of the offering period using the Black-Scholes option-pricing model and recognized on a straight-line basis over the offering period.

Stock Options

A summary of stock option activity is set forth below:

|

|

Options outstanding |

|

|||||||||||||

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

||||

|

|

|

|

|

Weighted |

|

|

Average |

|

|

Aggregate |

|

||||

|

|

Number of |

|

|

Average |

|

|

Remaining |

|

|

Intrinsic |

|

||||

|

|

Options |

|

|

Exercise |

|

|

Contractual Life |

|

|

Value |

|

||||

|

|

(In thousands) |

|

|

Price |

|

|

(In years) |

|

|

(In thousands) |

|

||||

Outstanding – December 31, 2021 |

|

|

|

|

$ |

|

|

|

|

|

|

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Forfeited |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Expired |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Outstanding – September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

$ |

|

||||

Exercisable – September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

The aggregate intrinsic values of options outstanding and exercisable are the differences between the exercise price of the options and the fair value of the Company’s common stock at September 30, 2022.

During the nine months ended September 30, 2022, the Company granted options with a weighted-average grant-date fair value of $

15

The fair value of options is estimated at the grant date using the Black-Scholes option-pricing model with the following weighted-average assumptions:

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Expected term (in years) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expected volatility |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Risk-free rate |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Dividend yield |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Restricted Stock Awards

The following table summarizes the Company’s restricted stock award activity:

|

|

|

|

|

Weighted |

|

||

|

|

Number of |

|

|

Average |

|

||

|

|

Shares |

|

|

Grant Date |

|

||

|

|

(In thousands) |

|

|

Fair Value |

|

||

RSAs, unvested at December 31, 2021 |

|

|

|

|

$ |

|

||

Vested |

|

|

( |

) |

|

|

|

|

RSAs, unvested at September 30, 2022 |

|

|

|

|

|

|

||

The fair value of restricted stock awards vested during the nine months ended September 30, 2022 was $

Stock-Based Compensation

The total stock-based compensation expense recorded in the unaudited condensed consolidated statements of operations and comprehensive loss related to stock options, restricted stock awards and ESPP was as follows (in thousands):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total stock-based compensation expense |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

As of September 30, 2022, there was approximately $

Note 11. Subsequent Events

Option Exchange

In October 2022, the Company’s Compensation Committee authorized and approved a stock option exchange whereby certain outstanding stock options held by current employees were exchanged for stock options on a one-for-one basis with an exercise price at the current market price on the date of the exchange. As a result of this exchange,

16

Collaboration and License Agreement

In October 2022, the Company executed the CLA with BI to research, develop and commercialize Fzd4 bi-specific antibodies designed using the Company’s SWAP™ technology, including SZN-413. BI and the Company will conduct partnership research focused on SZN-413 during a one-year period, which BI has the right to extend by up to 6 months. After completion of the partnership research, BI will have an exclusive, royalty-bearing, worldwide, sublicensable license to be responsible for all further research, preclinical and clinical development, manufacturing, regulatory approvals and commercialization of the licensed products at its expense.

Under the terms of the CLA, the Company will receive a non-refundable upfront payment of $

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q, or this Report, and our consolidated financial statements and related notes thereto for the year ended December 31, 2021 included in the Annual Report on Form 10-K filed on March 28, 2022. Unless otherwise indicated, the terms “Surrozen,” “we,” “us,” or “our” refer to Surrozen Operating, Inc., or Legacy Surrozen, prior to the Business Combination with Consonance-HFW Acquisition Corp. and Surrozen, Inc., formerly known as Consonance-HFW Acquisition Corp., together with its consolidated subsidiaries after giving effect to the Business Combination.

Forward-Looking Statements

The following discussion of our financial condition and results of operations contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including those relating to future events or our future financial performance and financial guidance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of terms like these or other comparable terminology, and other words or terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are only predictions.

All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and other factors. In evaluating these statements, you should specifically consider various factors, including the risks outlined under the caption “Risk Factors” set forth in Item 1A of Part II of this Report, as well as those contained from time to time in our other filings with the SEC. We caution investors that our business and financial performance are subject to substantial risks and uncertainties.

Overview

We are discovering and developing biologic drug candidates to selectively modulate the Wnt pathway, a critical mediator of tissue repair, in a broad range of organs and tissues, for human diseases. Building upon the seminal work of our founders and scientific advisors who discovered the Wnt gene and key regulators of the Wnt pathway, we have made breakthrough discoveries that we believe will overcome previous limitations in harnessing the potential of Wnt biology. These breakthroughs enable us to rapidly and flexibly design tissue-targeted therapeutics that modulate Wnt signaling. As a result of our discoveries, we are pioneering the selective activation of Wnt signaling, designing and engineering Wnt pathway mimetics, and advancing tissue-specific Wnt candidates.

Our lead product candidates are multi-specific, antibody-based therapeutics that mimic the roles of naturally occurring Wnt or R-spondin proteins, which are involved in activation and enhancement of the Wnt pathway, respectively. Given Wnt signaling is essential in tissue maintenance and regeneration throughout the body, we have the potential to target a wide variety of severe diseases, including certain diseases that afflict the intestine, liver, retina, cornea, lung, kidney, cochlea, skin, pancreas and central nervous system. In each of these areas, we believe our approach has the potential to change the treatment paradigm for the disease and substantially impact patient outcomes.

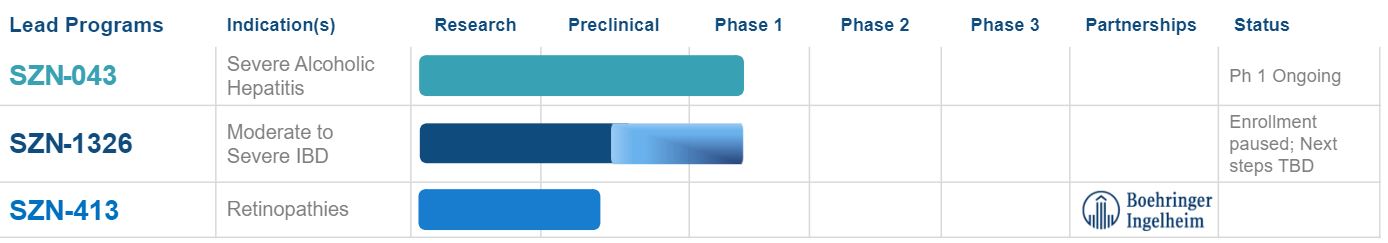

Our strategy is to exploit the full potential of Wnt signaling by identifying disease states responsive to Wnt modulation, design tissue-specific therapeutics, and advance candidates into clinical development in targeted indications with high unmet need. Our unique approach and platform technologies have led to the discovery and advancement of two lead product candidates.