Blue Owl Capital Inc. First Quarter 2024 Earnings May 2, 2024

2 About Blue Owl Blue Owl (NYSE: OWL) is a leading asset manager that is redefining alternatives. With over $174 billion in assets under management as of March 31, 2024, we invest across three multi-strategy platforms: Credit, GP Strategic Capital, and Real Estate. Anchored by a strong permanent capital base, we provide businesses with private capital solutions to drive long-term growth and offer institutional and individual investors differentiated alternative investment opportunities that aim to deliver strong performance, risk-adjusted returns, and capital preservation. Together with over 725 experienced professionals globally, Blue Owl brings the vision and discipline to create the exceptional. To learn more, visit www.blueowl.com. Forward-Looking Statements Certain statements made in this presentation are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Blue Owl’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and speak only as of the date of this presentation. Blue Owl assumes no obligation to update or revise any such forward-looking statements except as required by law. Important factors, among others, that may affect actual results or outcomes include the inability to recognize the anticipated benefits of acquisitions; costs related to acquisitions; the inability to maintain the listing of Blue Owl’s shares on the New York Stock Exchange; Blue Owl’s ability to manage growth; Blue Owl’s ability to execute its business plan and meet its projections; potential litigation involving Blue Owl; changes in applicable laws or regulations; and the possibility that Blue Owl may be adversely affected by other economic, business, geopolitical and competitive factors. The information contained in this presentation is summary information that is intended to be considered in the context of Blue Owl’s filings with the Securities and Exchange Commission (“SEC”) and other public announcements that Blue Owl may make, by press release or otherwise, from time to time. Blue Owl also uses its website to distribute company information, including assets under management and performance information, and such information may be deemed material. Accordingly, investors should monitor Blue Owl’s website (www.blueowl.com). Blue Owl undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. These materials contain information about Blue Owl and its affiliates and certain of their respective personnel and affiliates, information about their respective historical performance and general information about the market. You should not view information related to the past performance of Blue Owl or information about the market, as indicative of future results, the achievement of which cannot be assured. Throughout this presentation, all current period amounts are preliminary and unaudited, “LTM” refers to the last twelve months and “nm” indicates data has not been presented as it was deemed not meaningful. Totals may not sum due to rounding. Disclosures

3 Disclosures Non-GAAP Financial Measures; Other Financial and Operational Data This presentation includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. Blue Owl believes that the use of these non-GAAP financial measures provides an additional tool for investors and potential investors to use in evaluating its ongoing operating results and trends. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. See the footnotes on the slides where these measures are discussed and reconciled to the most directly comparable GAAP measures. Exact net IRRs and multiples cannot be calculated for individual investments held by Blue Owl’s products, or a subset of such investments, due to the lack of a mechanism to precisely allocate fees, taxes, transaction costs, expenses and general partner carried interest. Valuations are as of the dates provided herein and do not take into account subsequent events, including the impact of inflation and rising interest rates, which can be expected to have an adverse effect on certain entities identified or contemplated herein. For the definitions of certain terms used in this presentation, please refer to the “Defined Terms” slides in the appendix. Important Notice No representations or warranties, express or implied are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will Blue Owl or any of its subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Blue Owl. Viewers of this presentation should each make their own evaluation of Blue Owl and of the relevance and adequacy of the information contained herein and should make sure other investigations as they deem necessary. This communication does not constitute an offer to sell, or the solicitation of an offer to buy or sell, any securities, investment funds, vehicles or accounts, investment advice or any other service by Blue Owl or any of its affiliates or subsidiaries. Nothing in this presentation constitutes the provision of tax, accounting, financial, investment, regulatory, legal or other advice by Blue Owl or its advisors. Industry and Market Data This presentation may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s and Fitch Ratings. Such information has not been independently verified and, accordingly, Blue Owl makes no representation or warranty in respect of this information. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

4As of March 31, 2024. Past performance is not a guarantee of future results. Blue Owl Overview With over $174 billion of assets under management, Blue Owl is a leading asset manager that is redefining alternatives • Provides innovative minority equity and financing solutions to private capital managers • Deep and extensive relationships across the alternative asset management ecosystem • Successfully completed over 85 equity and debt transactions since inception • Focused on lending to middle- and upper- middle-market companies backed by a range of private equity and non-sponsored companies • Demonstrated ability to source proprietary investment opportunities with $100 billion in gross originations since inception • Complementary Credit strategies inclusive of Liquid Credit, Healthcare Opportunities, and Strategic Equity GP Strategic CapitalCredit • Flexible and bespoke capital solutions to investment grade and creditworthy tenants • Focused on acquiring high quality assets net-leased to investment grade and creditworthy entities • Established proprietary origination strategy that has completed over 190 transactions Real Estate Investment Platforms $91.3B Assets Under Management 595+ Deals Closed 715+ Sponsor Relationships $55.8B Assets Under Management 10+ Year Track Record 60+ Partnerships since Inception $27.2B Assets Under Management 1,890+ Assets Owned 155+ Tenant Relationships/ Partnerships

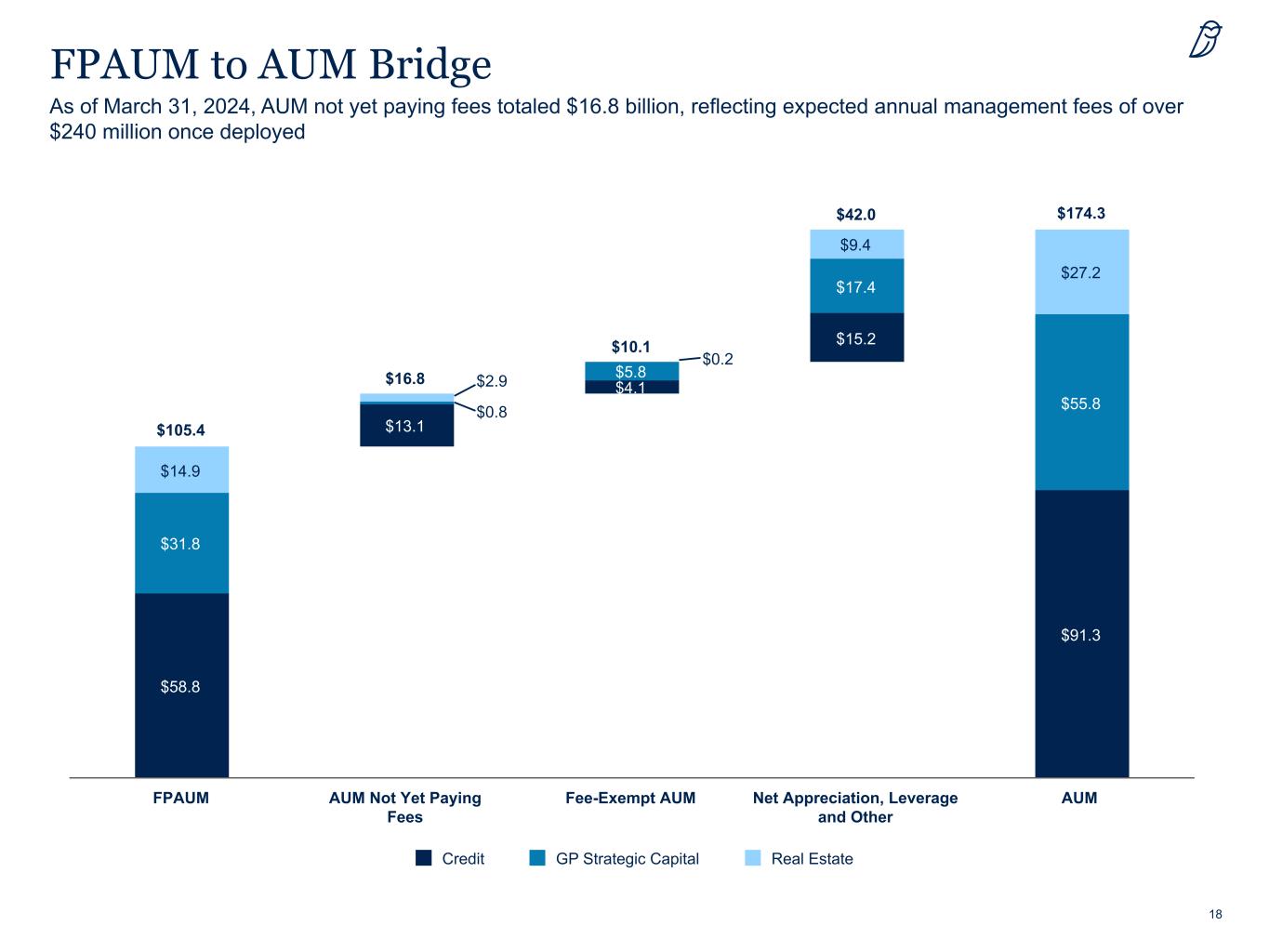

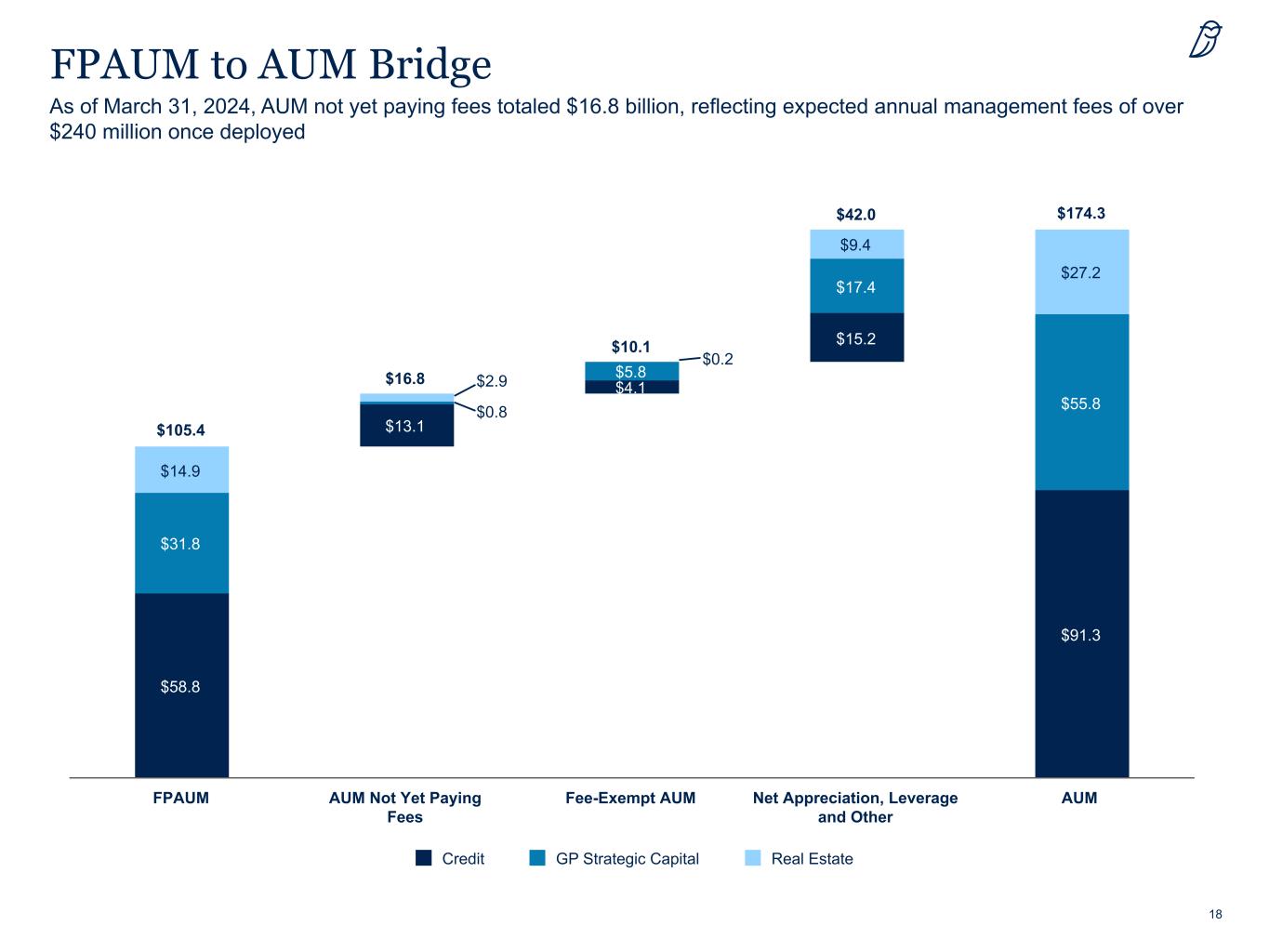

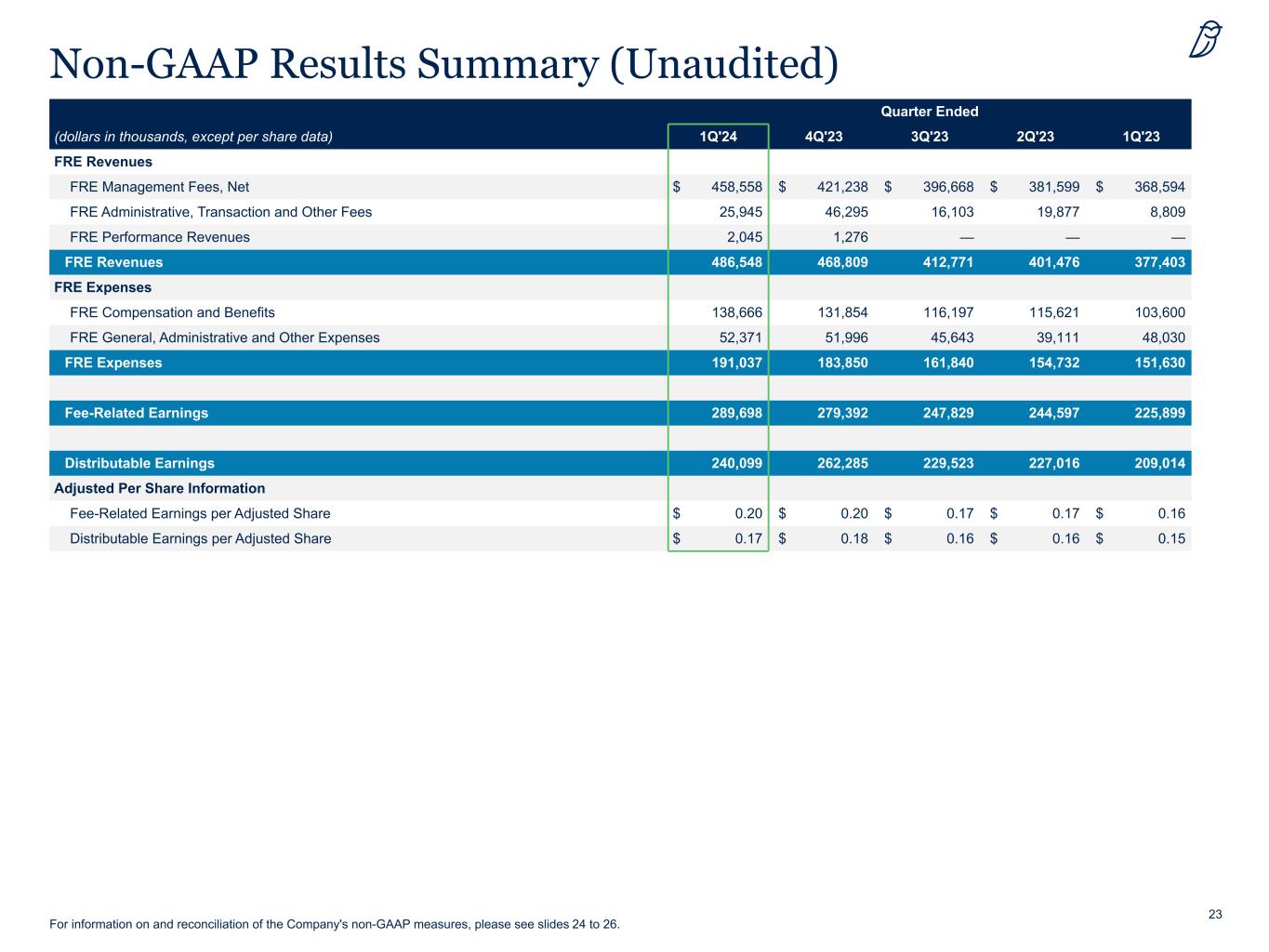

5 First Quarter 2024 Highlights Financial Results • GAAP Net Income of $25.1 million, or $0.05 per basic and $0.04 per diluted Class A Share • Fee-Related Earnings of $289.7 million, or $0.20 per Adjusted Share • Distributable Earnings of $240.1 million, or $0.17 per Adjusted Share Capital Metrics • AUM of $174.3 billion, up 21% since March 31, 2023 ◦ FPAUM of $105.4 billion, up 15% since March 31, 2023 ◦ Permanent Capital of $138.1 billion, up 21% since March 31, 2023 ◦ AUM Not Yet Paying Fees of $16.8 billion, reflecting expected annual management fees of over $240 million once deployed • New Capital Commitments Raised of $9.6 billion ($4.7 billion new equity capital) in the quarter • FPAUM Raised and Deployed of $3.7 billion in the quarter Corporate For information on and reconciliation of the Company's non-GAAP measures, please see slides 24 to 26. • Annual Dividend of $0.72 per Class A Share announced for 2024, up 29% from 2023 ◦ Dividend of $0.18 per Class A Share declared for the first quarter • Acquisition of Kuvare Asset Management (~$20 billion AUM), an insurance-focused investment manager, announced in April 2024 and expected to close in the second or third quarter, as well as invested in preferred equity of Kuvare UK Holdings • Acquisition of Prima Capital Advisors (~$10 billion AUM), a real estate lender, announced in April 2024 and expected to close in the second or third quarter • Issued 10-year unsecured debt in April of $750 million, due 2034 with 6.250% coupon and registration rights

6 GAAP Results (Unaudited) Quarter Ended Last Twelve Months (dollars in thousands, except per share data) 1Q'24 1Q'23 % Change 1Q'24 1Q'23 % Change GAAP Revenues Credit (including Part I Fees of $118,043, $84,856, $414,763 and $269,080) $ 270,801 $ 208,188 30% $ 962,515 $ 714,461 35% GP Strategic Capital (including Part I Fees of $2,118, $1,008, $6,880 and $4,038) 135,763 124,680 9% 516,057 519,362 (1%) Real Estate 41,334 25,957 59% 137,742 88,976 55% Management Fees, Net 447,898 358,825 25% 1,616,314 1,322,799 22% Administrative, Transaction and Other Fees 63,397 31,655 100% 232,488 149,205 56% Performance Revenues 2,045 506 304% 5,160 12,727 (59%) GAAP Revenues 513,340 390,986 31% 1,853,962 1,484,731 25% GAAP Expenses Compensation and Benefits 224,791 197,618 14% 897,815 898,412 —% Amortization of Intangible Assets 56,195 70,891 (21%) 285,645 266,274 7% General, Administrative and Other Expenses 76,748 56,134 37% 263,423 233,450 13% GAAP Expenses 357,734 324,643 10% 1,446,883 1,398,136 3% GAAP Results GAAP Net Income Attributable to Blue Owl Capital Inc. 25,091 8,317 202% 71,117 10,843 nm Earnings per Class A Share Basic $ 0.05 $ 0.02 Diluted $ 0.04 $ 0.02 Supplemental Information Credit $ 318,397 $ 228,279 39% $ 1,145,833 $ 821,333 40% GP Strategic Capital 146,563 133,085 10% 550,274 551,630 —% Real Estate 48,380 29,622 63% 157,855 111,768 41% GAAP Revenues 513,340 390,986 31% 1,853,962 1,484,731 25% Management Fees as % from Permanent Capital 90% 93% 92% 93%

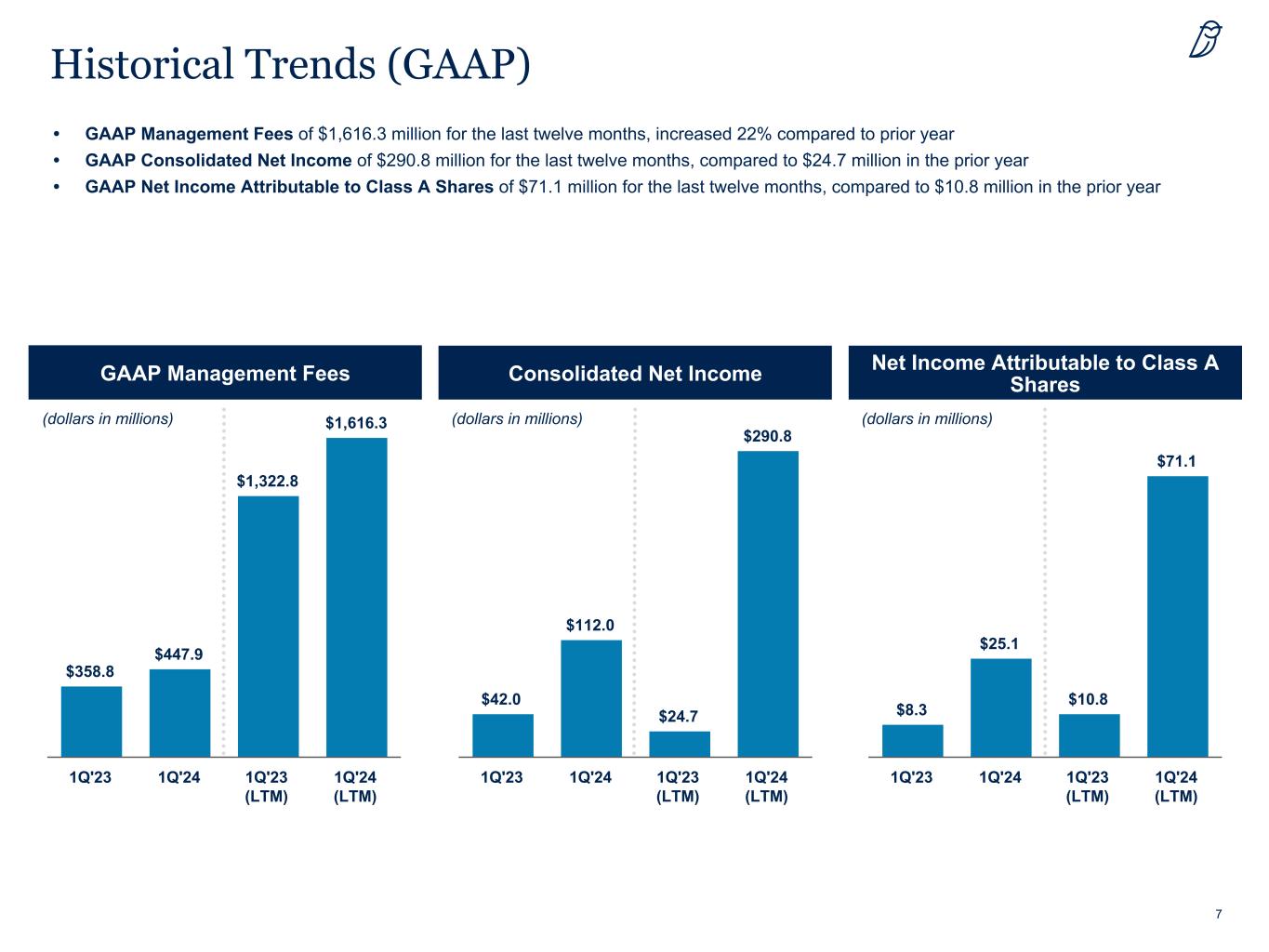

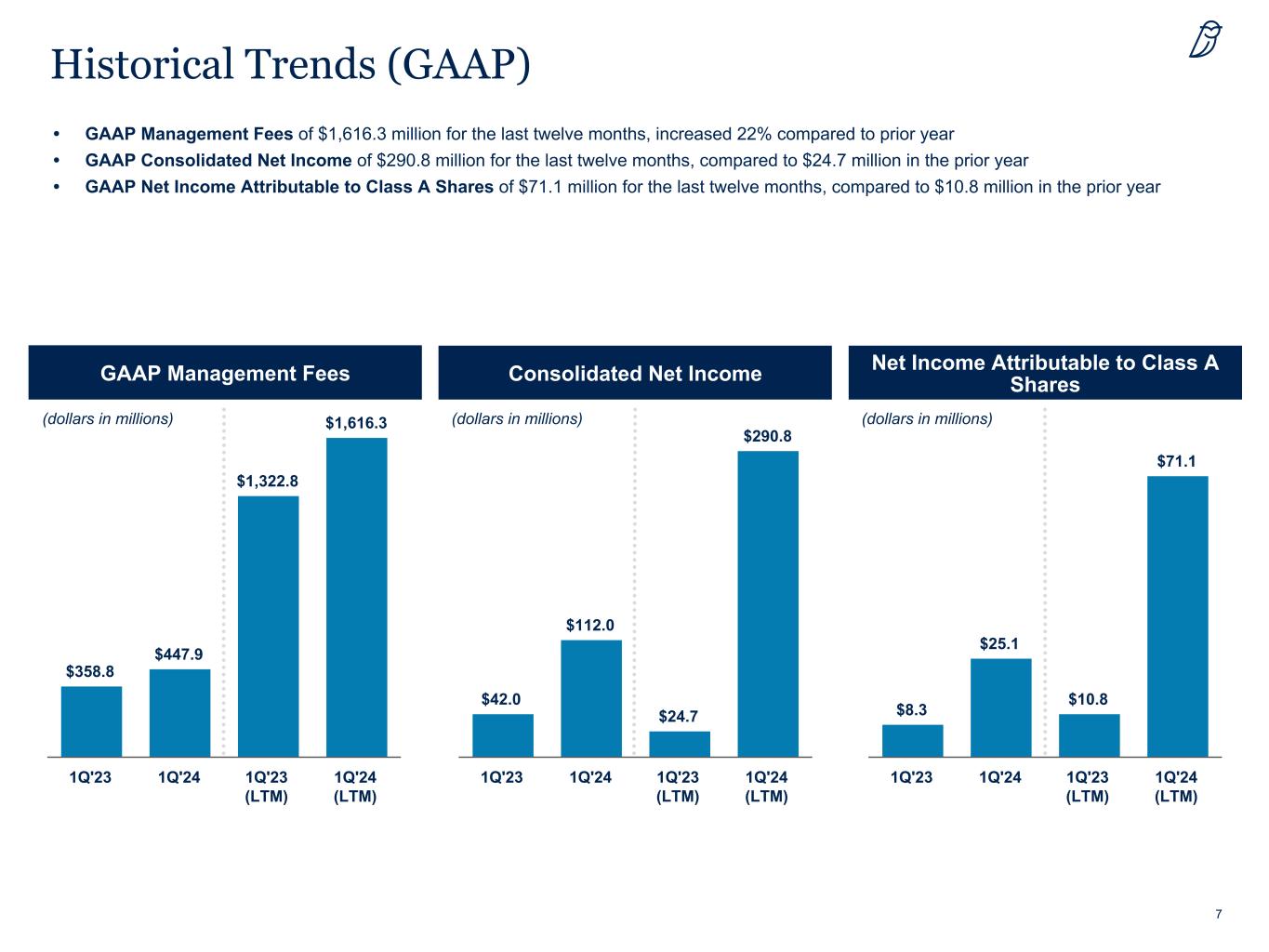

7 Historical Trends (GAAP) • GAAP Management Fees of $1,616.3 million for the last twelve months, increased 22% compared to prior year • GAAP Consolidated Net Income of $290.8 million for the last twelve months, compared to $24.7 million in the prior year • GAAP Net Income Attributable to Class A Shares of $71.1 million for the last twelve months, compared to $10.8 million in the prior year GAAP Management Fees Net Income Attributable to Class A SharesConsolidated Net Income (dollars in millions) (dollars in millions) (dollars in millions) $358.8 $447.9 $1,322.8 $1,616.3 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $8.3 $25.1 $10.8 $71.1 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $42.0 $112.0 $24.7 $290.8 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM)

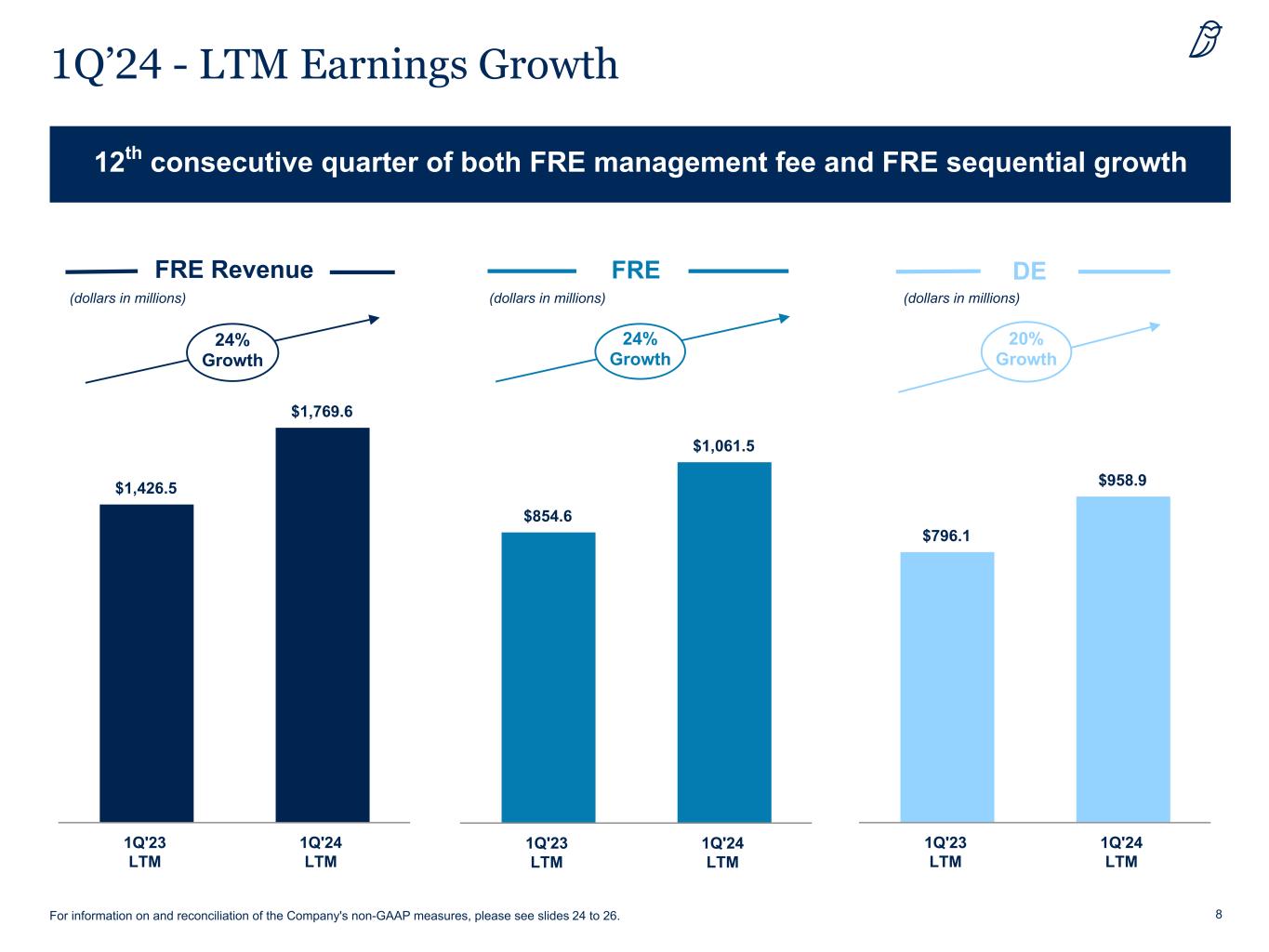

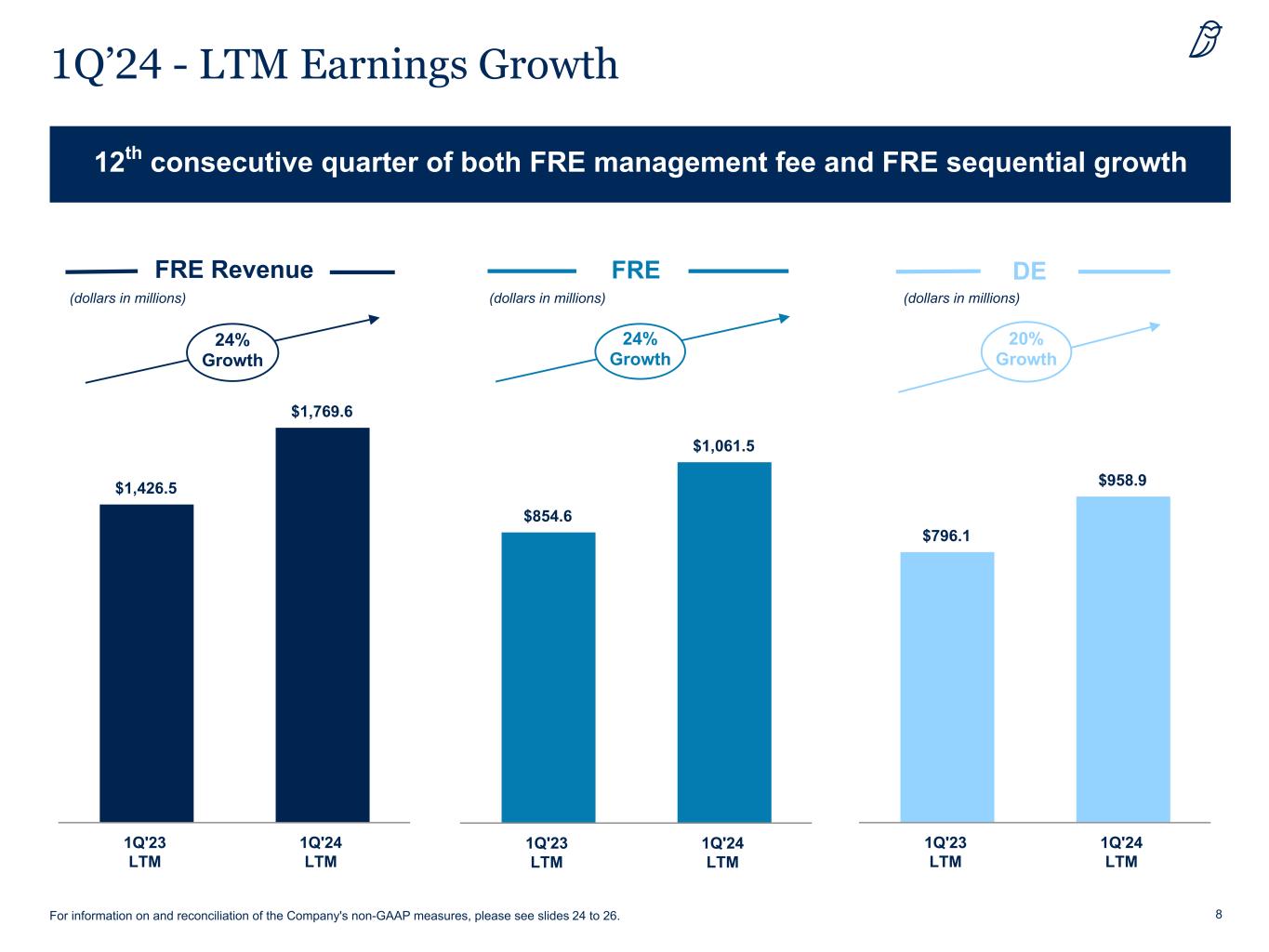

8 1Q’24 - LTM Earnings Growth DEFRE Revenue 24% Growth FRE 24% Growth 20% Growth 12th consecutive quarter of both FRE management fee and FRE sequential growth (dollars in millions) $1,426.5 $1,769.6 1Q'23 LTM 1Q'24 LTM $796.1 $958.9 1Q'23 LTM 1Q'24 LTM $854.6 $1,061.5 1Q'23 LTM 1Q'24 LTM (dollars in millions) (dollars in millions) For information on and reconciliation of the Company's non-GAAP measures, please see slides 24 to 26.

9 Non-GAAP Results (Unaudited) For information on and reconciliation of the Company's non-GAAP measures, please see slides 24 to 26. Quarter Ended Last Twelve Months (dollars in thousands, except per share data) 1Q'24 1Q'23 % Change 1Q'24 1Q'23 % Change FRE Revenues Credit (including Part I Fees of $118,043, $84,856, $414,763 and $269,080) $ 270,801 $ 208,188 30% $ 962,515 $ 714,461 35% GP Strategic Capital (including Part I Fees of $2,118, $1,008, $6,880 and $4,038) 146,423 134,449 9% 557,806 557,592 —% Real Estate 41,334 25,957 59% 137,742 88,976 55% FRE Management Fees, Net 458,558 368,594 24% 1,658,063 1,361,029 22% FRE Administrative, Transaction and Other Fees 25,945 8,809 195% 108,220 65,516 65% FRE Performance Revenues 2,045 — nm 3,321 — nm FRE Revenues 486,548 377,403 29% 1,769,604 1,426,545 24% FRE Expenses FRE Compensation and Benefits 138,666 103,600 34% 502,338 389,672 29% FRE General, Administrative and Other Expenses 52,371 48,030 9% 189,121 189,541 —% FRE Expenses 191,037 151,630 26% 691,459 579,213 19% Fee-Related Earnings 289,698 225,899 28% 1,061,516 854,647 24% Distributable Earnings 240,099 209,014 15% 958,923 796,090 20% Adjusted Per Share Information Fee-Related Earnings per Adjusted Share $ 0.20 $ 0.16 Distributable Earnings per Adjusted Share $ 0.17 $ 0.15 Supplemental Information Credit $ 295,251 $ 215,712 37% $ 1,066,283 $ 774,912 38% GP Strategic Capital 148,041 135,652 9% 563,465 562,321 —% Real Estate 43,256 26,039 66% 139,856 89,312 57% FRE Revenues 486,548 377,403 29% 1,769,604 1,426,545 24% FRE Management Fees as % from Permanent Capital 91% 93% 92% 93%

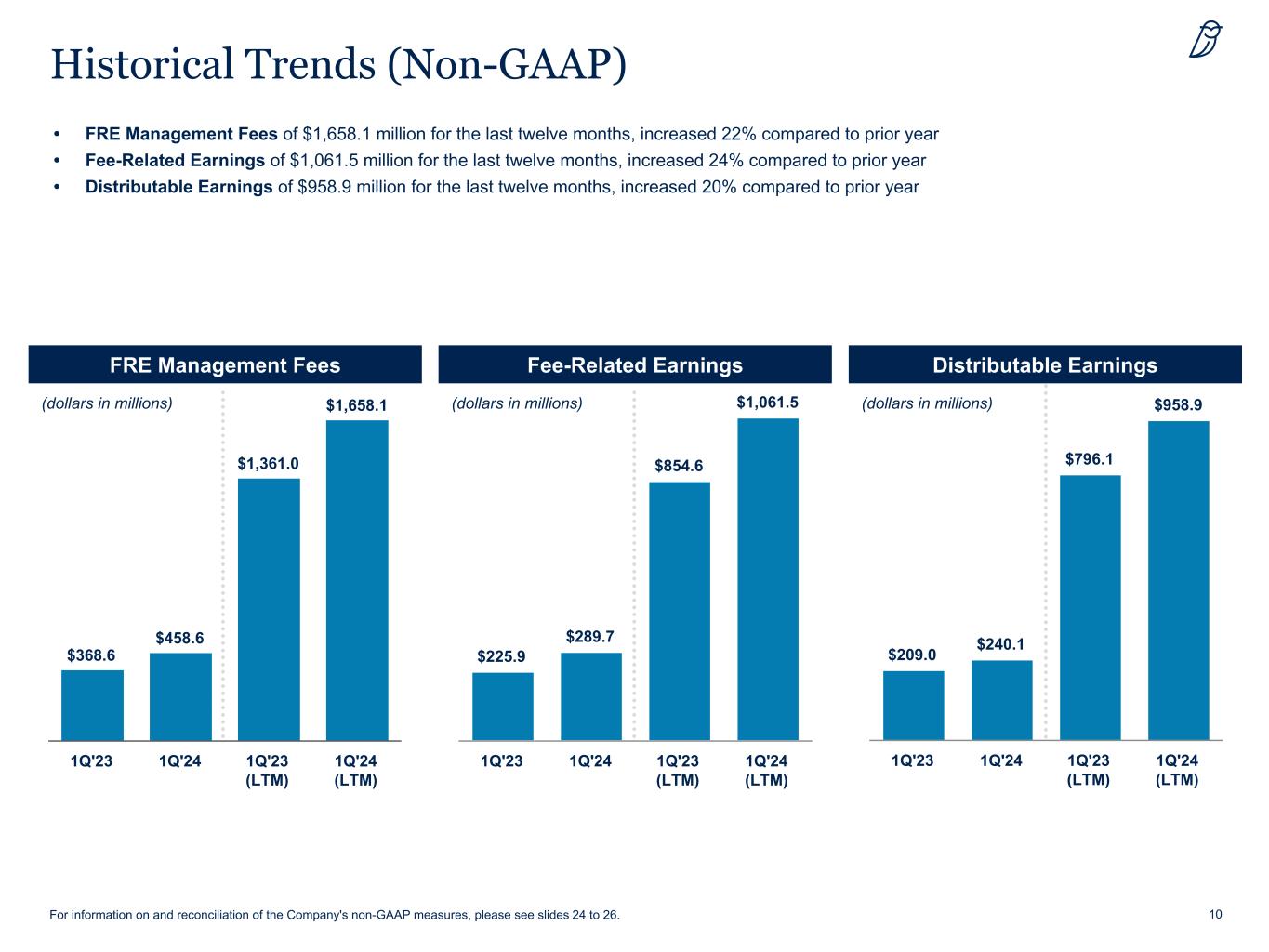

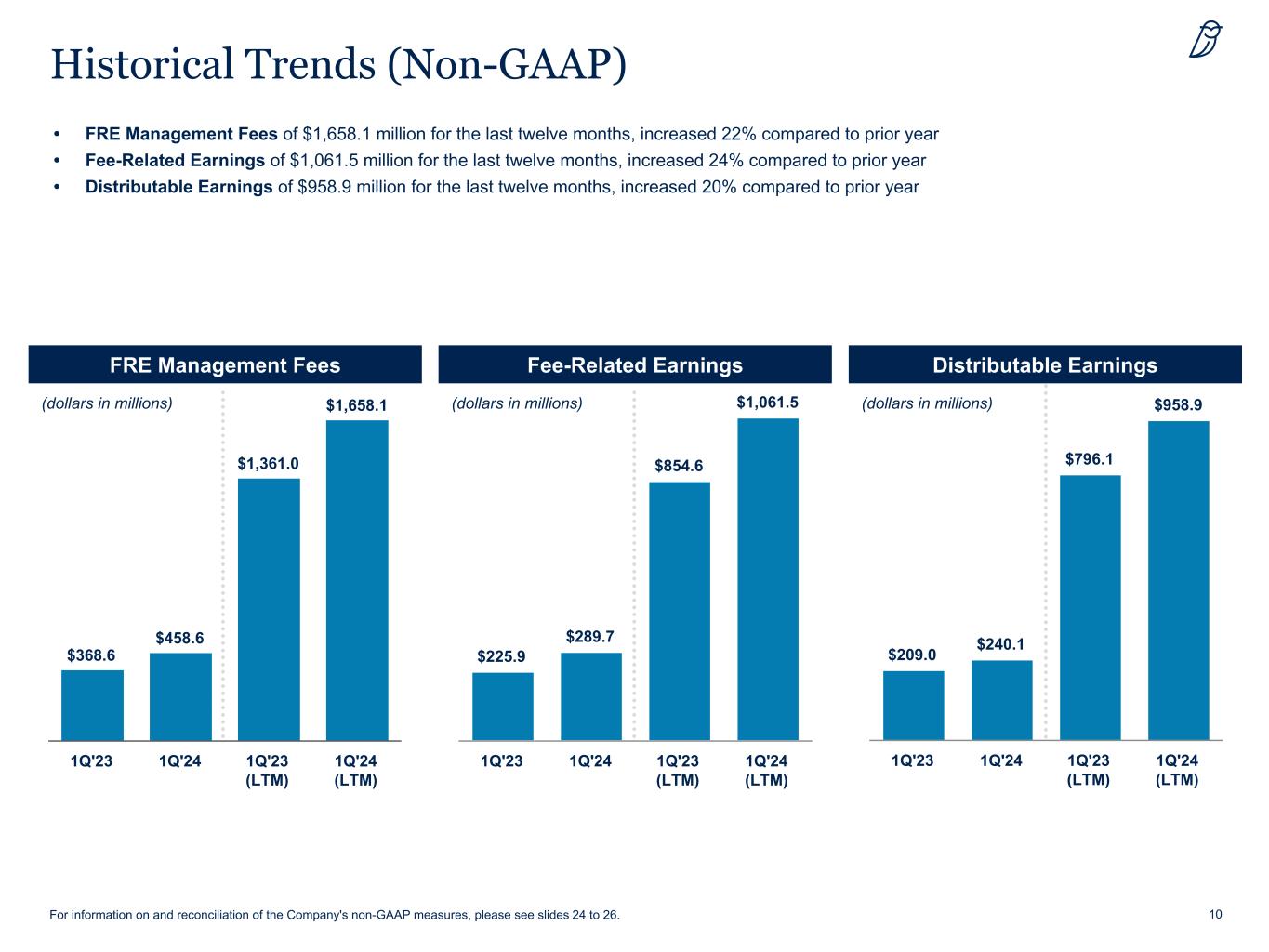

10 Historical Trends (Non-GAAP) • FRE Management Fees of $1,658.1 million for the last twelve months, increased 22% compared to prior year • Fee-Related Earnings of $1,061.5 million for the last twelve months, increased 24% compared to prior year • Distributable Earnings of $958.9 million for the last twelve months, increased 20% compared to prior year FRE Management Fees Distributable EarningsFee-Related Earnings (dollars in millions) (dollars in millions) (dollars in millions) $209.0 $240.1 $796.1 $958.9 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $225.9 $289.7 $854.6 $1,061.5 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $368.6 $458.6 $1,361.0 $1,658.1 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) For information on and reconciliation of the Company's non-GAAP measures, please see slides 24 to 26.

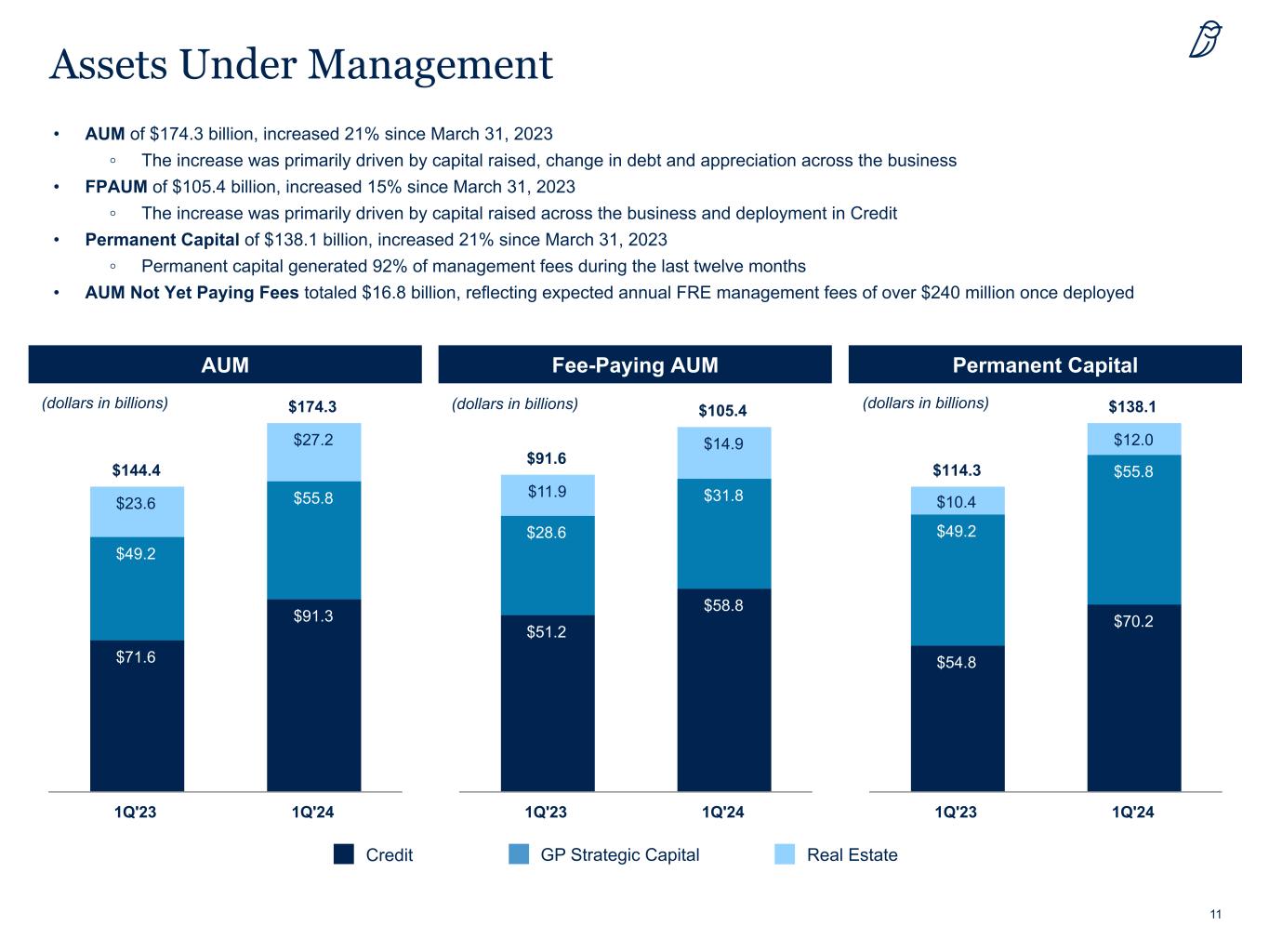

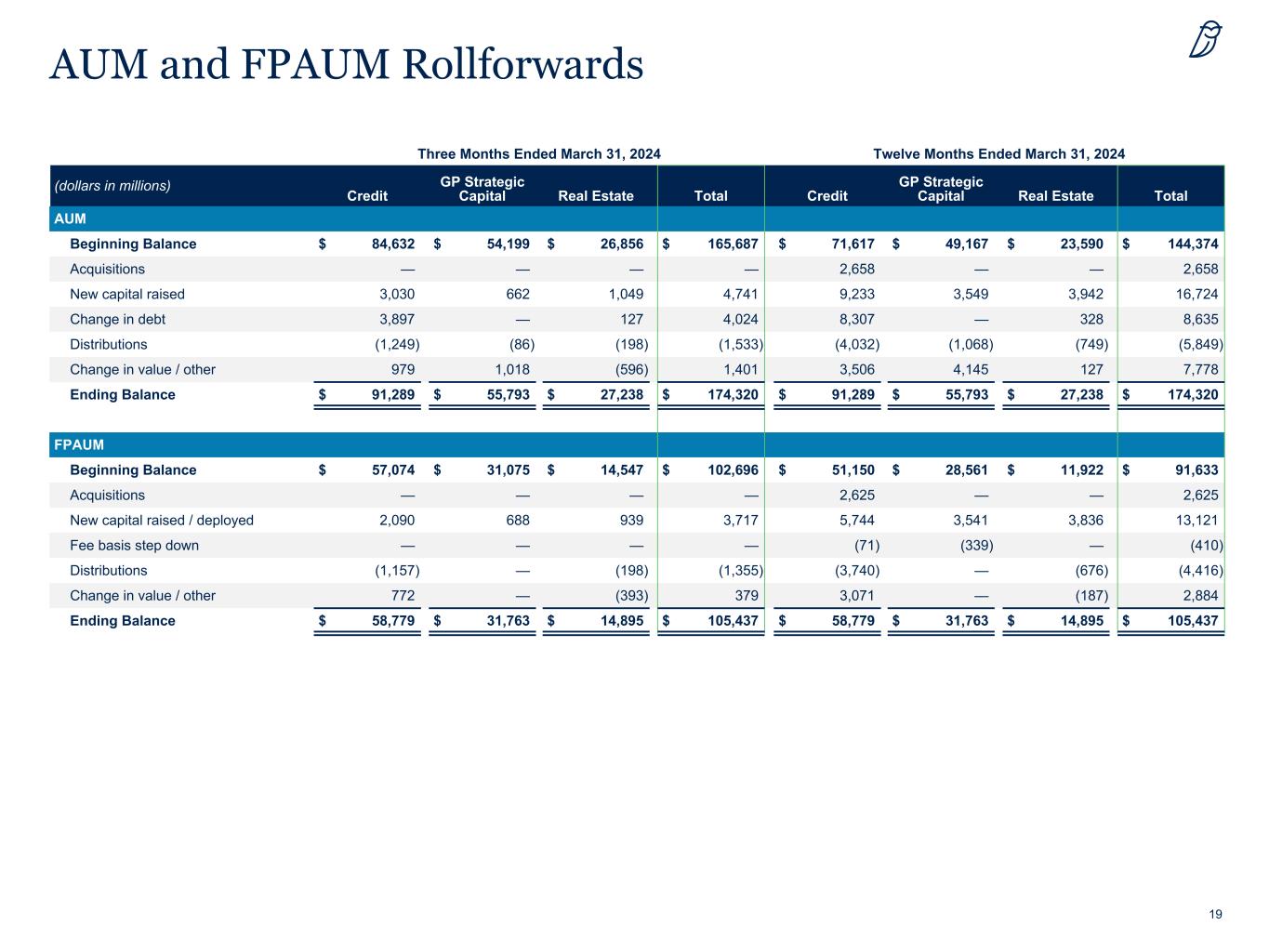

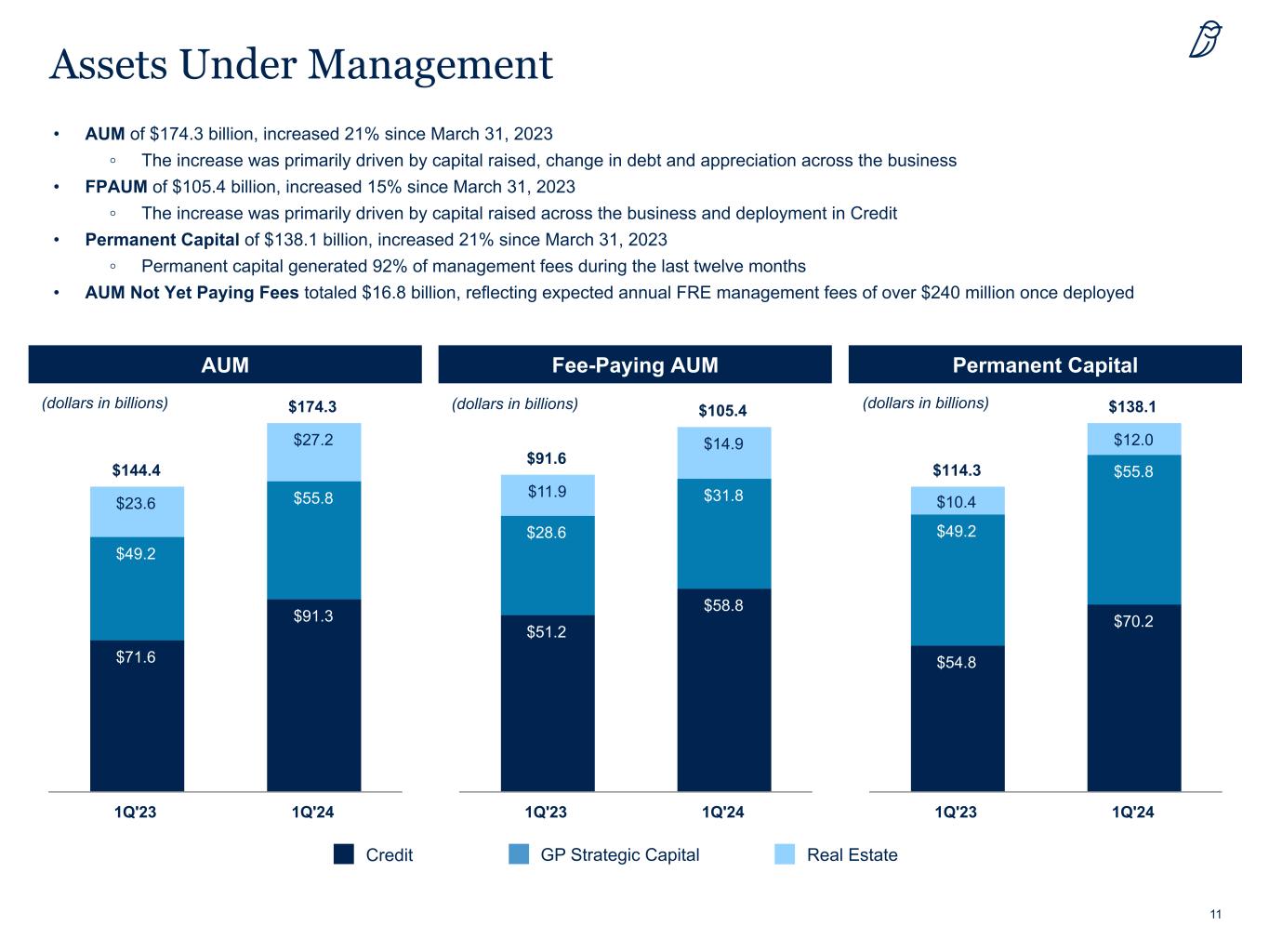

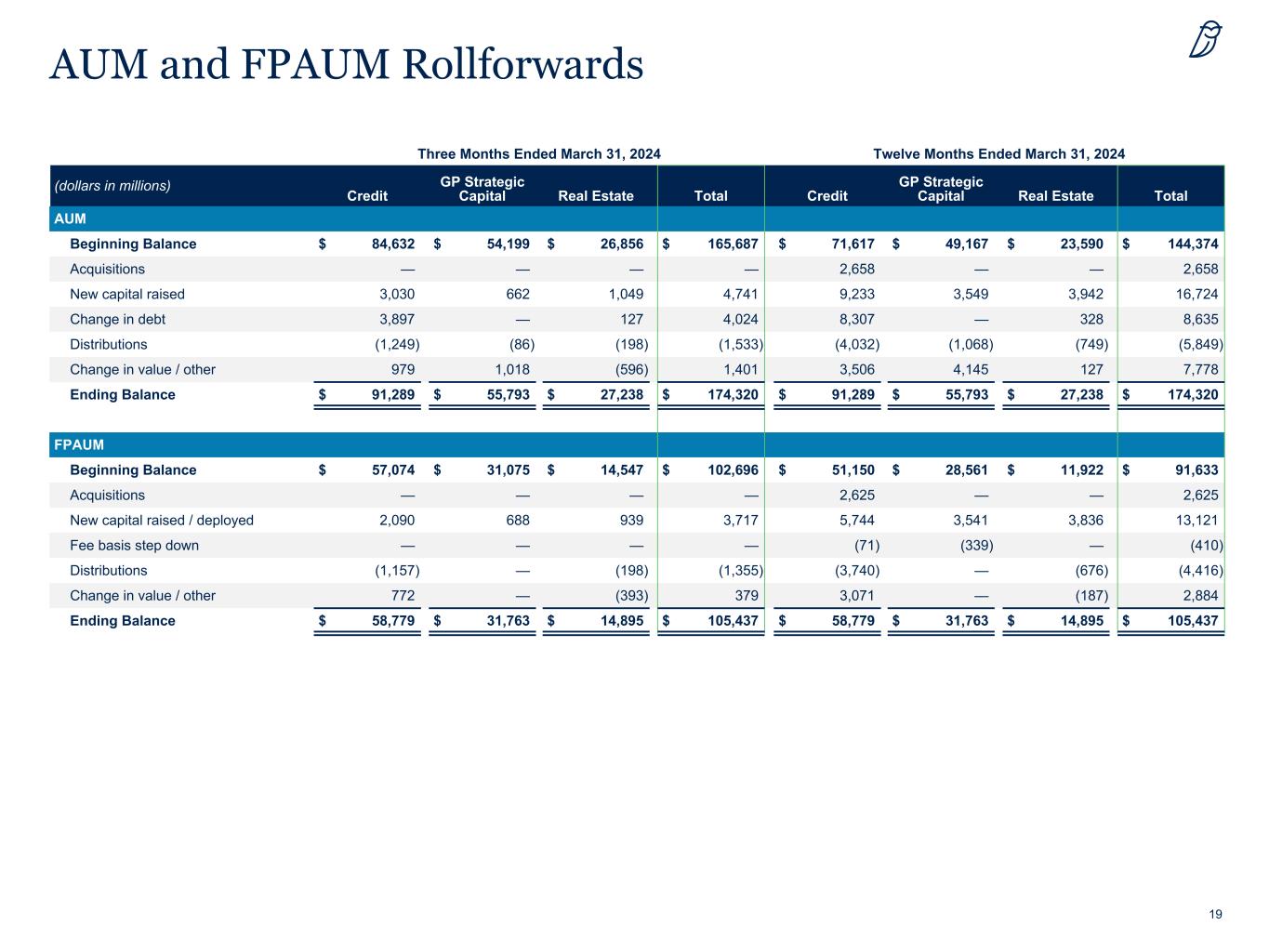

11 Assets Under Management • AUM of $174.3 billion, increased 21% since March 31, 2023 ◦ The increase was primarily driven by capital raised, change in debt and appreciation across the business • FPAUM of $105.4 billion, increased 15% since March 31, 2023 ◦ The increase was primarily driven by capital raised across the business and deployment in Credit • Permanent Capital of $138.1 billion, increased 21% since March 31, 2023 ◦ Permanent capital generated 92% of management fees during the last twelve months • AUM Not Yet Paying Fees totaled $16.8 billion, reflecting expected annual FRE management fees of over $240 million once deployed AUM Fee-Paying AUM Permanent Capital Credit GP Strategic Capital Real Estate (dollars in billions) (dollars in billions) (dollars in billions) $144.4 $174.3 $71.6 $91.3 $49.2 $55.8$23.6 $27.2 1Q'23 1Q'24 $91.6 $105.4 $51.2 $58.8 $28.6 $31.8$11.9 $14.9 1Q'23 1Q'24 $114.3 $138.1 $54.8 $70.2 $49.2 $55.8 $10.4 $12.0 1Q'23 1Q'24

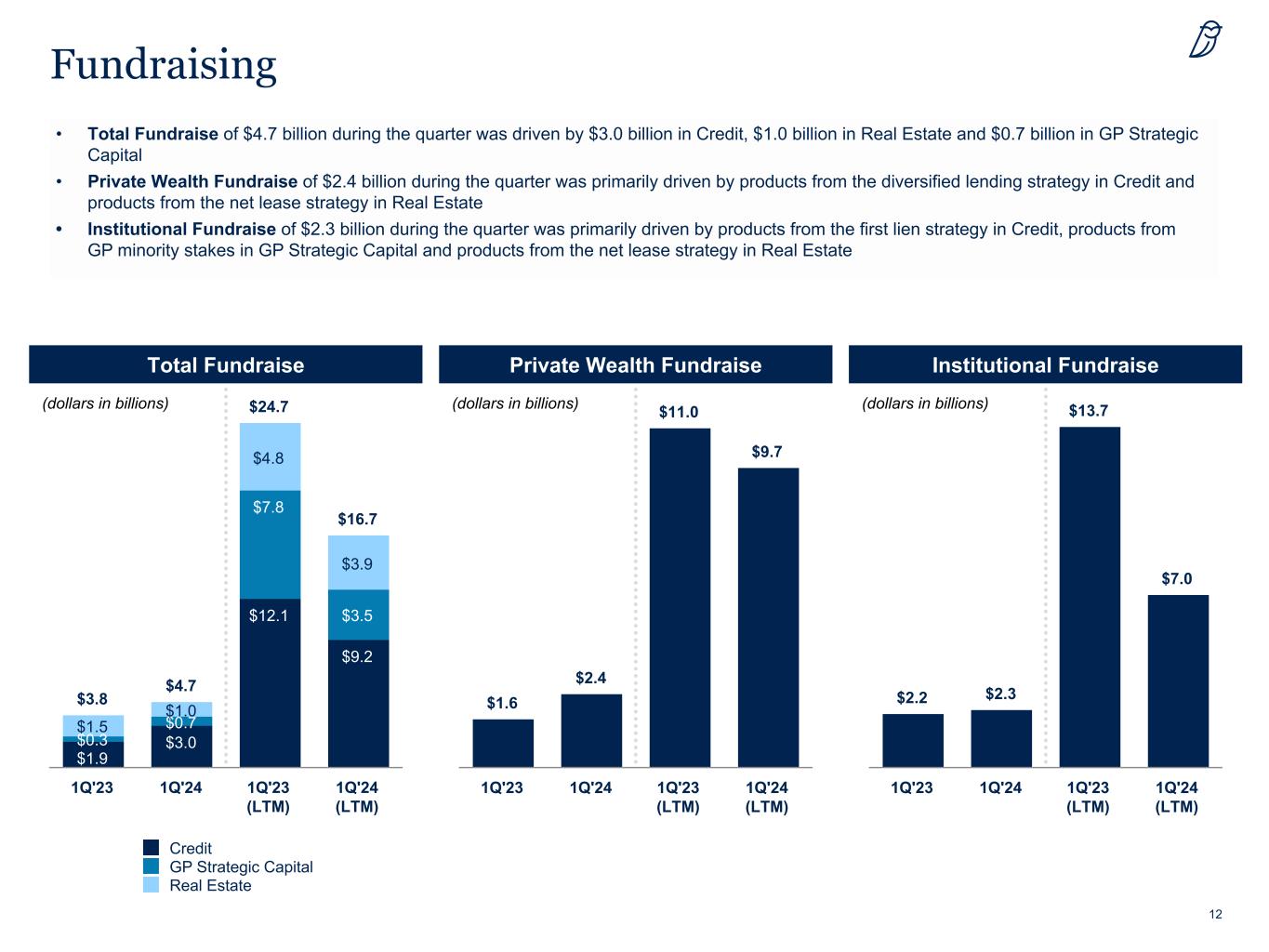

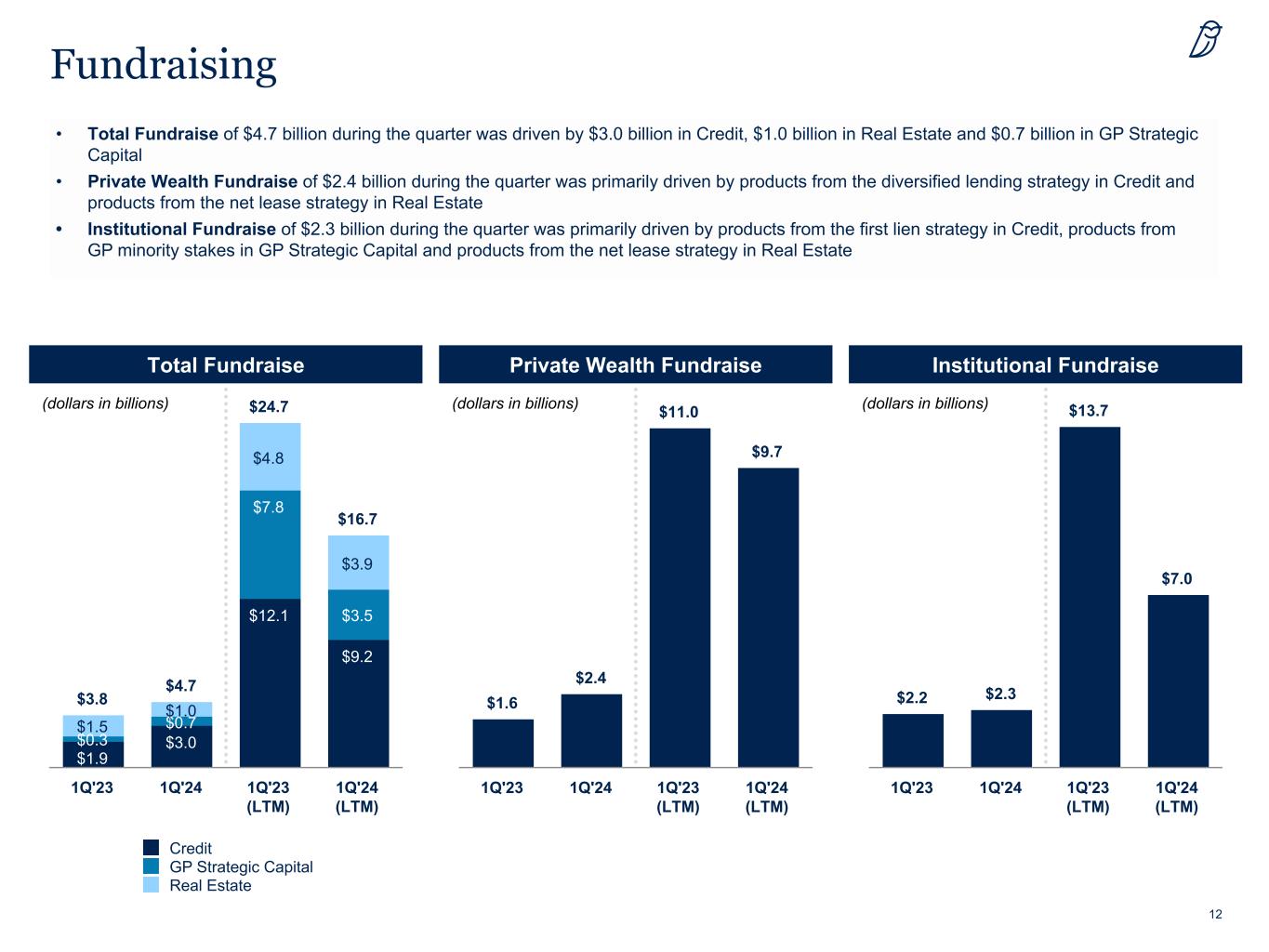

12 Fundraising Total Fundraise (dollars in billions) Private Wealth Fundraise (dollars in billions) Institutional Fundraise (dollars in billions) $1.9 $3.8 $4.7 $24.7 $16.7 $1.9 $3.0 $12.1 $9.2 $0.3 $0.7 $7.8 $3.5 $1.5 $1.0 $4.8 $3.9 Credit GP Strategic Capital Real Estate 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $1.6 $2.4 $11.0 $9.7 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) $2.2 $2.3 $13.7 $7.0 1Q'23 1Q'24 1Q'23 (LTM) 1Q'24 (LTM) • Total Fundraise of $4.7 billion during the quarter was driven by $3.0 billion in Credit, $1.0 billion in Real Estate and $0.7 billion in GP Strategic Capital • Private Wealth Fundraise of $2.4 billion during the quarter was primarily driven by products from the diversified lending strategy in Credit and products from the net lease strategy in Real Estate • Institutional Fundraise of $2.3 billion during the quarter was primarily driven by products from the first lien strategy in Credit, products from GP minority stakes in GP Strategic Capital and products from the net lease strategy in Real Estate

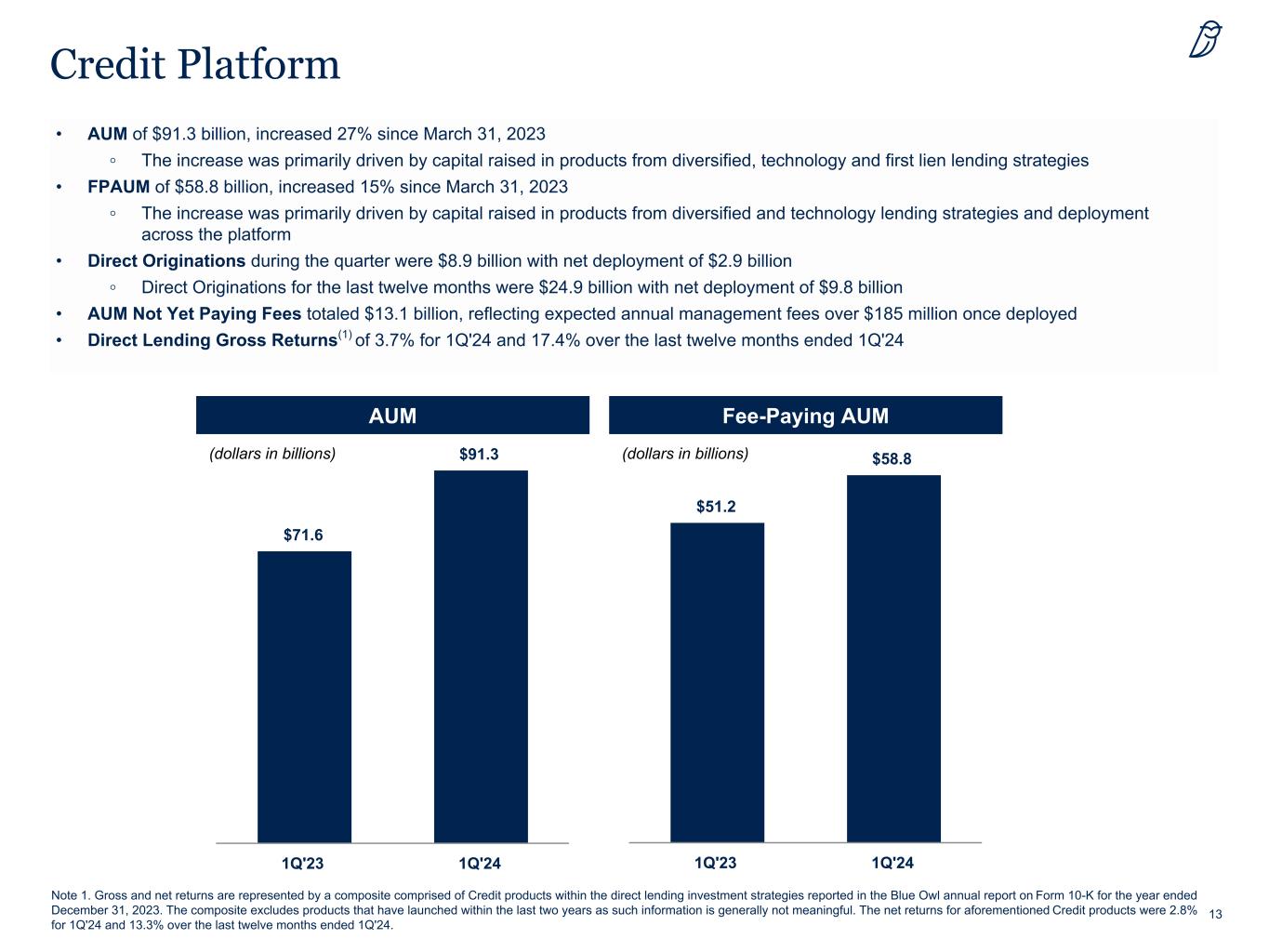

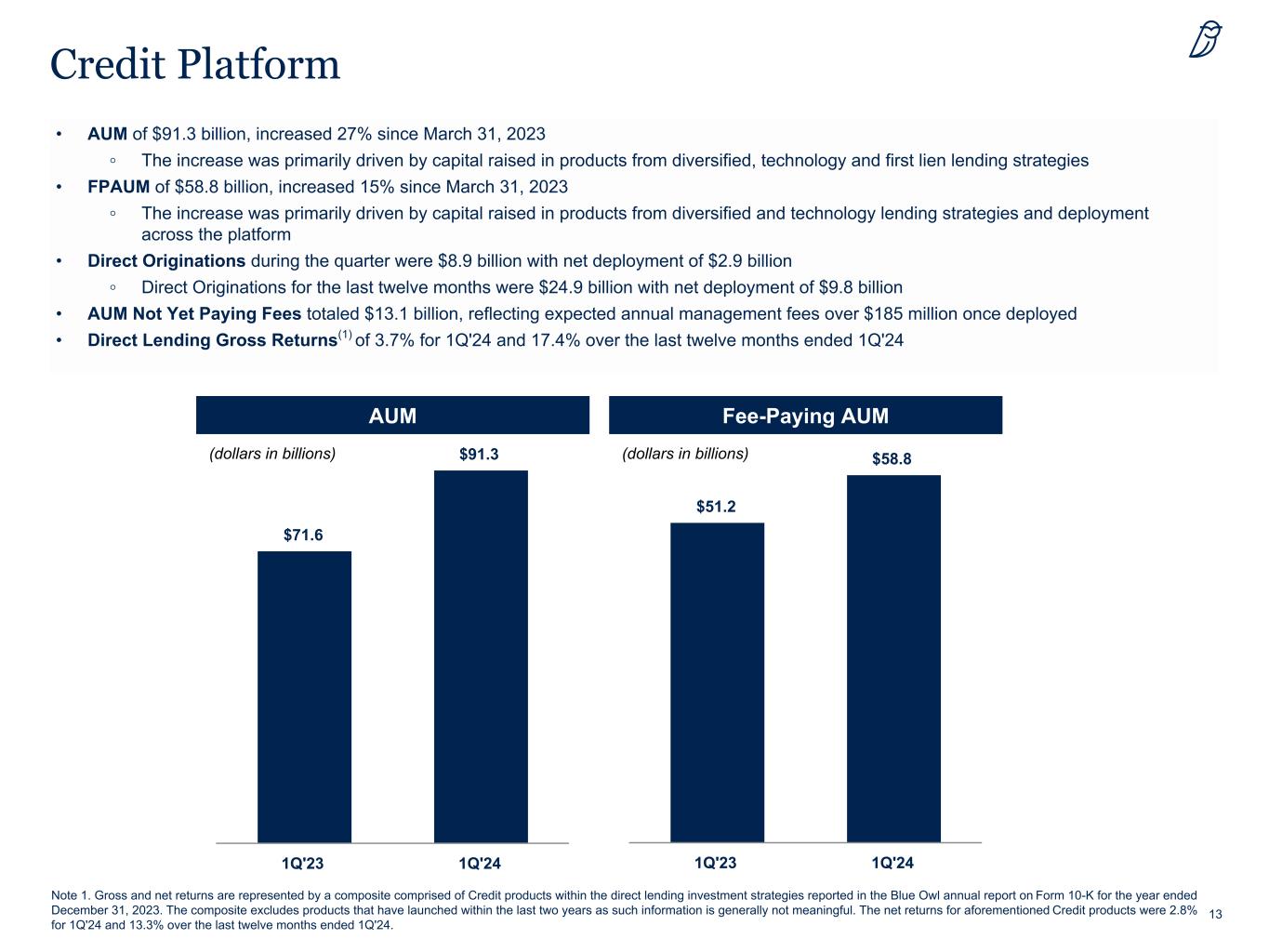

13 Credit Platform • AUM of $91.3 billion, increased 27% since March 31, 2023 ◦ The increase was primarily driven by capital raised in products from diversified, technology and first lien lending strategies • FPAUM of $58.8 billion, increased 15% since March 31, 2023 ◦ The increase was primarily driven by capital raised in products from diversified and technology lending strategies and deployment across the platform • Direct Originations during the quarter were $8.9 billion with net deployment of $2.9 billion ◦ Direct Originations for the last twelve months were $24.9 billion with net deployment of $9.8 billion • AUM Not Yet Paying Fees totaled $13.1 billion, reflecting expected annual management fees over $185 million once deployed • Direct Lending Gross Returns(1) of 3.7% for 1Q'24 and 17.4% over the last twelve months ended 1Q'24 AUM (dollars in billions) (dollars in billions) Fee-Paying AUM Note 1. Gross and net returns are represented by a composite comprised of Credit products within the direct lending investment strategies reported in the Blue Owl annual report on Form 10-K for the year ended December 31, 2023. The composite excludes products that have launched within the last two years as such information is generally not meaningful. The net returns for aforementioned Credit products were 2.8% for 1Q'24 and 13.3% over the last twelve months ended 1Q'24. $71.6 $91.3 1Q'23 1Q'24 $51.2 $58.8 1Q'23 1Q'24

14Note 1: Net IRR since inception as of March 31, 2024 for Blue Owl GP Stakes III, Blue Owl GP Stakes IV and Blue Owl GP Stakes V was 23.4%, 42.0% and 15.1%, respectively. GP Strategic Capital Platform • AUM of $55.8 billion, increased 13% since March 31, 2023 ◦ The increase was primarily driven by appreciation across the platform and capital raised in our mid-cap minority equity stakes product • FPAUM of $31.8 billion, increased 11% since March 31, 2023 ◦ The increase was primarily driven by capital raised in our mid-cap minority equity stakes product • AUM Not Yet Paying Fees totaled $0.8 billion, reflecting expected annual management fees of over $15 million once deployed • Gross IRR Since Inception as of March 31, 2024(1) ◦ Blue Owl GP Stakes III: 30.2% ◦ Blue Owl GP Stakes IV: 64.9% ◦ Blue Owl GP Stakes V: 34.1% AUM Fee-Paying AUM $49.2 $55.8 1Q'23 1Q'24 $28.6 $31.8 1Q'23 1Q'24 (dollars in billions)(dollars in billions)

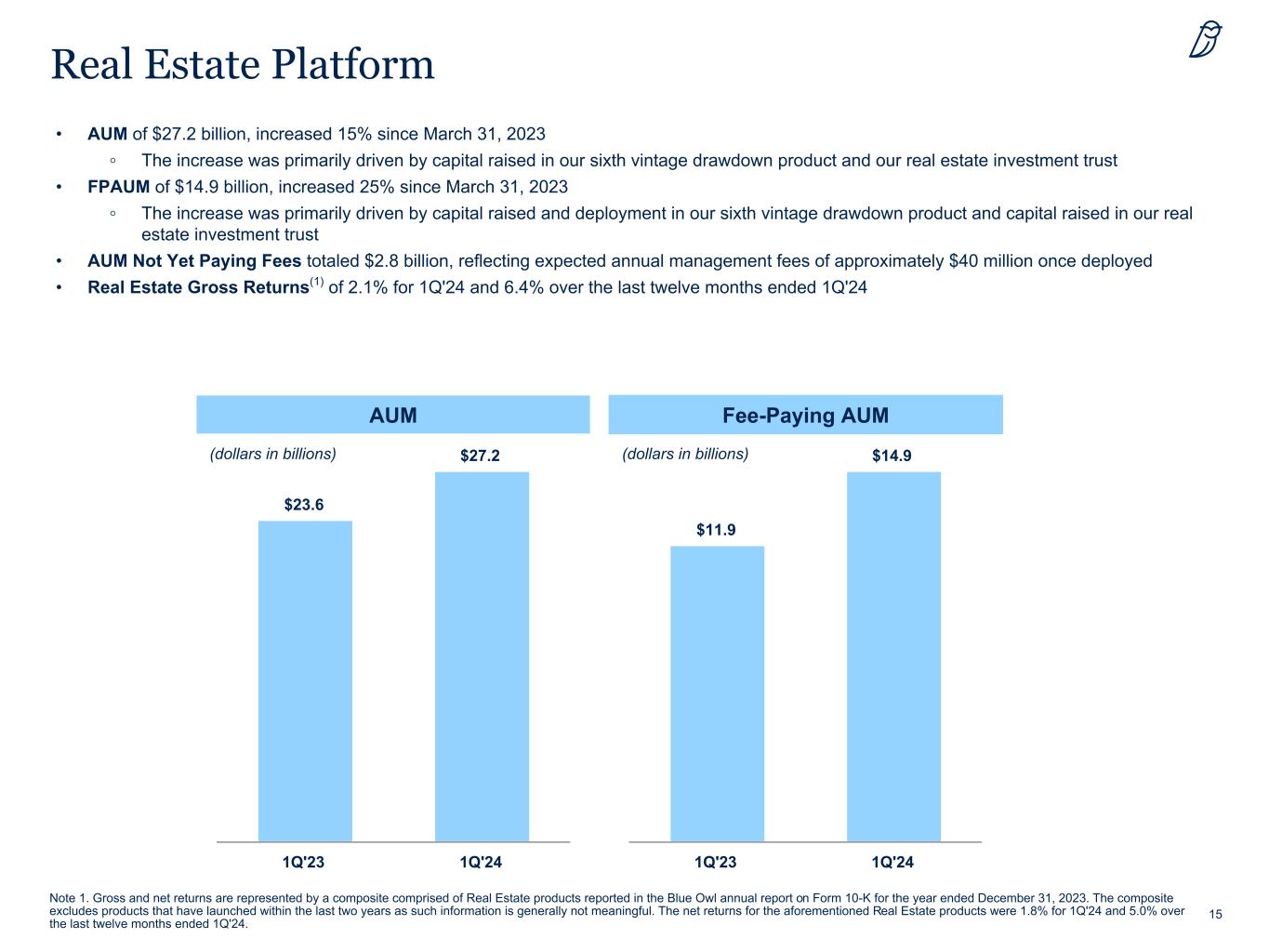

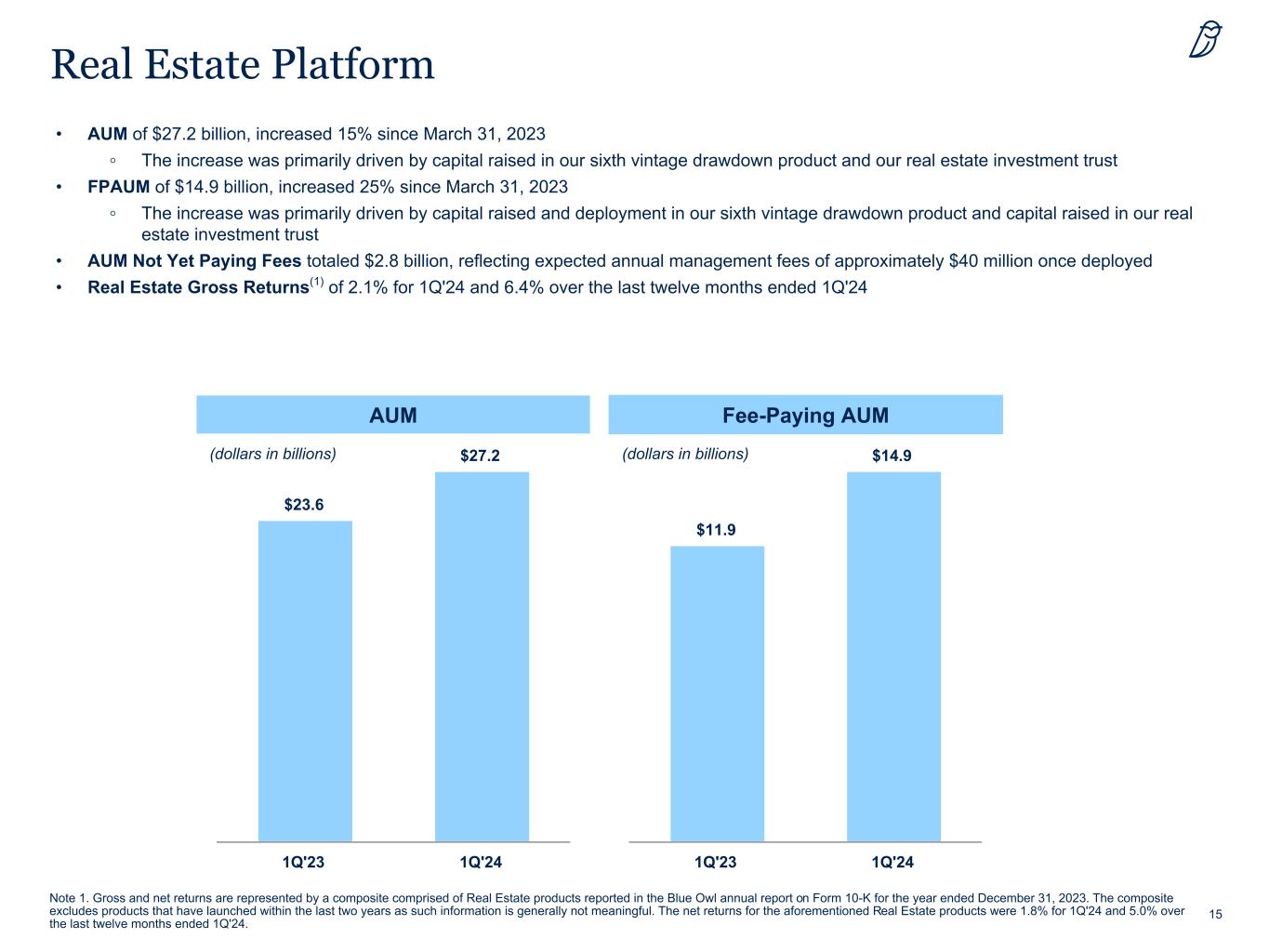

15 Note 1. Gross and net returns are represented by a composite comprised of Real Estate products reported in the Blue Owl annual report on Form 10-K for the year ended December 31, 2023. The composite excludes products that have launched within the last two years as such information is generally not meaningful. The net returns for the aforementioned Real Estate products were 1.8% for 1Q'24 and 5.0% over the last twelve months ended 1Q'24. Real Estate Platform • AUM of $27.2 billion, increased 15% since March 31, 2023 ◦ The increase was primarily driven by capital raised in our sixth vintage drawdown product and our real estate investment trust • FPAUM of $14.9 billion, increased 25% since March 31, 2023 ◦ The increase was primarily driven by capital raised and deployment in our sixth vintage drawdown product and capital raised in our real estate investment trust • AUM Not Yet Paying Fees totaled $2.8 billion, reflecting expected annual management fees of approximately $40 million once deployed • Real Estate Gross Returns(1) of 2.1% for 1Q'24 and 6.4% over the last twelve months ended 1Q'24 AUM Fee-Paying AUM $23.6 $27.2 1Q'23 1Q'24 $11.9 $14.9 1Q'23 1Q'24 (dollars in billions)(dollars in billions)

Supplemental Information

17 As of March 31, 2024, the average maturity of the Company's outstanding notes is ~12 years. In April 2024, the Company issued 10-year unsecured debt of $750 million, due 2034 with 6.250% coupon. Note 1. In April 2024, the Company fully repaid the outstanding borrowings under the Revolving Credit Facility using proceeds from the $750 million unsecured debt issuance. Note 2. Cost of debt reflects average annual after tax interest rate on notes outstanding, assuming a 22% tax rate. Excludes borrowings under the Revolving Credit Facility. Supplemental Liquidity Metrics Credit Ratings BBB+ BBB Fitch S&P Total Debt ($M) Available Liquidity ($M) 3.0% Cost of Debt(2) $759 $156 $948 Revolving Credit Facility Cash and Cash Equivalents $700 $400 $350 $60 $595 Revolving Credit Facility(1) 2028 Unsecured Notes 2051 Unsecured Notes 2032 Unsecured Notes 2031 Unsecured Notes $1.1B Available Liquidity

18 As of March 31, 2024, AUM not yet paying fees totaled $16.8 billion, reflecting expected annual management fees of over $240 million once deployed FPAUM to AUM Bridge $51.2 $71.6 $28.6 $105.4 $174.3 $105.4 $122.2 $132.3 $58.8 $13.1 $4.1 $15.2 9 .3 $31.8 $5.8 $17.4 $55.8 $14.9 $9.4 $27.2 $16.8 $10.1 $42.0 Credit GP Strategic Capital Real Estate FPAUM AUM Not Yet Paying Fees Fee-Exempt AUM Net Appreciation, Leverage and Other AUM $0.2 $2.9 $0.8

19 AUM and FPAUM Rollforwards Three Months Ended March 31, 2024 Twelve Months Ended March 31, 2024 (dollars in millions) Credit GP Strategic Capital Real Estate Total Credit GP Strategic Capital Real Estate Total AUM Beginning Balance $ 84,632 $ 54,199 $ 26,856 $ 165,687 $ 71,617 $ 49,167 $ 23,590 $ 144,374 Acquisitions — — — — 2,658 — — 2,658 New capital raised 3,030 662 1,049 4,741 9,233 3,549 3,942 16,724 Change in debt 3,897 — 127 4,024 8,307 — 328 8,635 Distributions (1,249) (86) (198) (1,533) (4,032) (1,068) (749) (5,849) Change in value / other 979 1,018 (596) 1,401 3,506 4,145 127 7,778 Ending Balance $ 91,289 $ 55,793 $ 27,238 $ 174,320 $ 91,289 $ 55,793 $ 27,238 $ 174,320 FPAUM Beginning Balance $ 57,074 $ 31,075 $ 14,547 $ 102,696 $ 51,150 $ 28,561 $ 11,922 $ 91,633 Acquisitions — — — — 2,625 — — 2,625 New capital raised / deployed 2,090 688 939 3,717 5,744 3,541 3,836 13,121 Fee basis step down — — — — (71) (339) — (410) Distributions (1,157) — (198) (1,355) (3,740) — (676) (4,416) Change in value / other 772 — (393) 379 3,071 — (187) 2,884 Ending Balance $ 58,779 $ 31,763 $ 14,895 $ 105,437 $ 58,779 $ 31,763 $ 14,895 $ 105,437

Appendix

21 GAAP Results (Unaudited) Quarter Ended Last Twelve Months (dollars in thousands, except share and per share data) 1Q'24 1Q'23 1Q'24 1Q'23 Revenues Management fees, net (includes Part I Fees of $120,161, $85,864, $421,643 and $273,118) $ 447,898 $ 358,825 $ 1,616,314 $ 1,322,799 Administrative, transaction and other fees 63,397 31,655 232,488 149,205 Performance revenues 2,045 506 5,160 12,727 Total Revenues, Net 513,340 390,986 1,853,962 1,484,731 Expenses Compensation and benefits 224,791 197,618 897,815 898,412 Amortization of intangible assets 56,195 70,891 285,645 266,274 General, administrative and other expenses 76,748 56,134 263,423 233,450 Total Expenses 357,734 324,643 1,446,883 1,398,136 Other Loss Net gains on investments 3,173 612 6,764 475 Interest and dividend income 4,755 4,789 22,142 9,146 Interest expense (22,484) (18,362) (79,818) (65,596) Change in TRA liability 1,019 (1,964) 1,327 (3,747) Change in warrant liability (14,700) (1,950) (26,800) 14,926 Change in earnout liability (585) (994) (6,000) (14,986) Total Other Loss (28,822) (17,869) (82,385) (59,782) Income Before Income Taxes 126,784 48,474 324,694 26,813 Income tax expense 14,771 6,440 33,939 2,098 Consolidated Net Income 112,013 42,034 290,755 24,715 Net income attributable to noncontrolling interests (86,922) (33,717) (219,638) (13,872) Net Income Attributable to Blue Owl Capital Inc. $ 25,091 $ 8,317 $ 71,117 $ 10,843 Net Income Attributable to Class A Shares $ 25,091 $ 8,317 $ 71,117 $ 10,843 Earnings per Class A Share Basic $ 0.05 $ 0.02 Diluted $ 0.04 $ 0.02 Weighted-Average Class A Shares Basic 488,435,221 456,189,118 Diluted 498,738,547 461,911,117

22 Quarter Ended (dollars in thousands, except per share data) 1Q'24 4Q'23 3Q'23 2Q'23 1Q'23 GAAP Revenues Management Fees, Net $ 447,898 $ 410,578 $ 386,009 $ 371,829 $ 358,825 Administrative, Transaction and Other Fees 63,397 80,342 43,641 45,108 31,655 Performance Revenues 2,045 3,115 — — 506 GAAP Revenues 513,340 494,035 429,650 416,937 390,986 GAAP Expenses Compensation and Benefits 224,791 250,767 213,976 208,281 197,618 Amortization of Intangible Assets 56,195 56,809 56,724 115,917 70,891 General, Administrative and Other Expenses 76,748 69,708 65,485 51,482 56,134 GAAP Expenses 357,734 377,284 336,185 375,680 324,643 GAAP Results GAAP Net Income Attributable to Blue Owl Capital Inc. 25,091 18,058 15,109 12,859 8,317 Earnings per Class A Share Basic $ 0.05 $ 0.04 $ 0.03 $ 0.03 $ 0.02 Diluted $ 0.04 $ 0.03 $ 0.03 $ 0.02 $ 0.02 GAAP Results Summary (Unaudited)

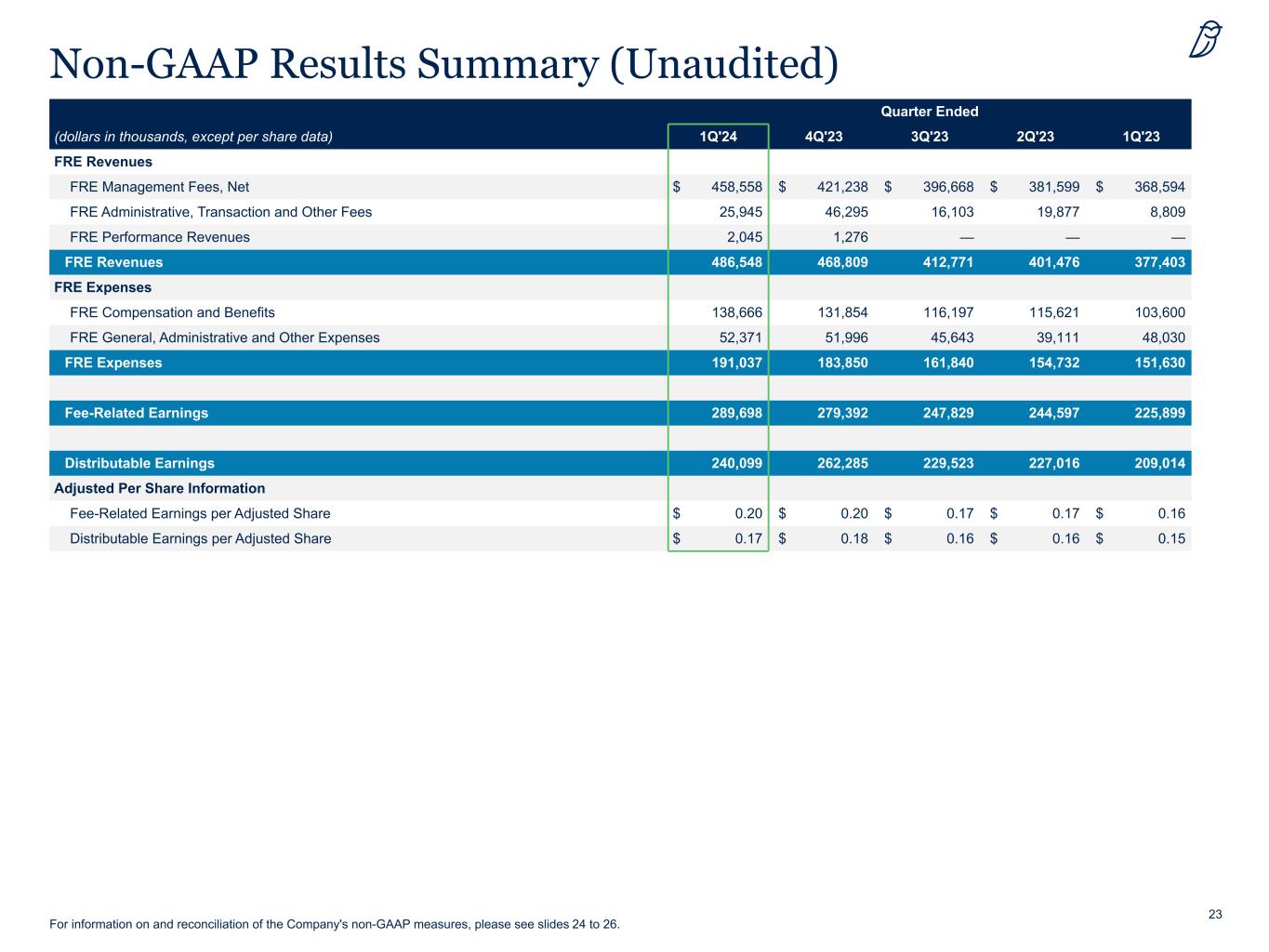

23 Quarter Ended (dollars in thousands, except per share data) 1Q'24 4Q'23 3Q'23 2Q'23 1Q'23 FRE Revenues FRE Management Fees, Net $ 458,558 $ 421,238 $ 396,668 $ 381,599 $ 368,594 FRE Administrative, Transaction and Other Fees 25,945 46,295 16,103 19,877 8,809 FRE Performance Revenues 2,045 1,276 — — — FRE Revenues 486,548 468,809 412,771 401,476 377,403 FRE Expenses FRE Compensation and Benefits 138,666 131,854 116,197 115,621 103,600 FRE General, Administrative and Other Expenses 52,371 51,996 45,643 39,111 48,030 FRE Expenses 191,037 183,850 161,840 154,732 151,630 Fee-Related Earnings 289,698 279,392 247,829 244,597 225,899 Distributable Earnings 240,099 262,285 229,523 227,016 209,014 Adjusted Per Share Information Fee-Related Earnings per Adjusted Share $ 0.20 $ 0.20 $ 0.17 $ 0.17 $ 0.16 Distributable Earnings per Adjusted Share $ 0.17 $ 0.18 $ 0.16 $ 0.16 $ 0.15 Non-GAAP Results Summary (Unaudited) For information on and reconciliation of the Company's non-GAAP measures, please see slides 24 to 26.

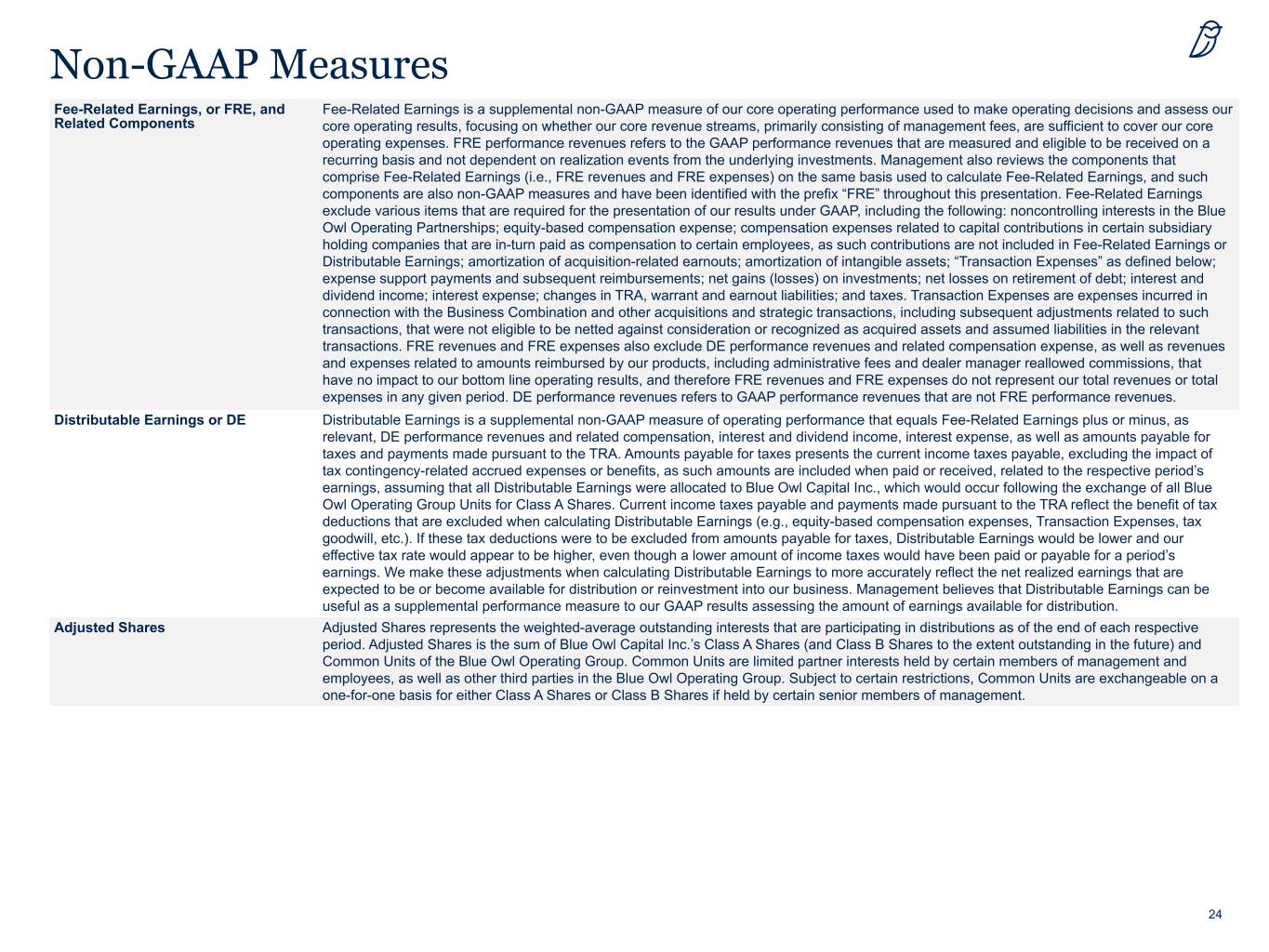

24 Non-GAAP Measures Fee-Related Earnings, or FRE, and Related Components Fee-Related Earnings is a supplemental non-GAAP measure of our core operating performance used to make operating decisions and assess our core operating results, focusing on whether our core revenue streams, primarily consisting of management fees, are sufficient to cover our core operating expenses. FRE performance revenues refers to the GAAP performance revenues that are measured and eligible to be received on a recurring basis and not dependent on realization events from the underlying investments. Management also reviews the components that comprise Fee-Related Earnings (i.e., FRE revenues and FRE expenses) on the same basis used to calculate Fee-Related Earnings, and such components are also non-GAAP measures and have been identified with the prefix “FRE” throughout this presentation. Fee-Related Earnings exclude various items that are required for the presentation of our results under GAAP, including the following: noncontrolling interests in the Blue Owl Operating Partnerships; equity-based compensation expense; compensation expenses related to capital contributions in certain subsidiary holding companies that are in-turn paid as compensation to certain employees, as such contributions are not included in Fee-Related Earnings or Distributable Earnings; amortization of acquisition-related earnouts; amortization of intangible assets; “Transaction Expenses” as defined below; expense support payments and subsequent reimbursements; net gains (losses) on investments; net losses on retirement of debt; interest and dividend income; interest expense; changes in TRA, warrant and earnout liabilities; and taxes. Transaction Expenses are expenses incurred in connection with the Business Combination and other acquisitions and strategic transactions, including subsequent adjustments related to such transactions, that were not eligible to be netted against consideration or recognized as acquired assets and assumed liabilities in the relevant transactions. FRE revenues and FRE expenses also exclude DE performance revenues and related compensation expense, as well as revenues and expenses related to amounts reimbursed by our products, including administrative fees and dealer manager reallowed commissions, that have no impact to our bottom line operating results, and therefore FRE revenues and FRE expenses do not represent our total revenues or total expenses in any given period. DE performance revenues refers to GAAP performance revenues that are not FRE performance revenues. Distributable Earnings or DE Distributable Earnings is a supplemental non-GAAP measure of operating performance that equals Fee-Related Earnings plus or minus, as relevant, DE performance revenues and related compensation, interest and dividend income, interest expense, as well as amounts payable for taxes and payments made pursuant to the TRA. Amounts payable for taxes presents the current income taxes payable, excluding the impact of tax contingency-related accrued expenses or benefits, as such amounts are included when paid or received, related to the respective period’s earnings, assuming that all Distributable Earnings were allocated to Blue Owl Capital Inc., which would occur following the exchange of all Blue Owl Operating Group Units for Class A Shares. Current income taxes payable and payments made pursuant to the TRA reflect the benefit of tax deductions that are excluded when calculating Distributable Earnings (e.g., equity-based compensation expenses, Transaction Expenses, tax goodwill, etc.). If these tax deductions were to be excluded from amounts payable for taxes, Distributable Earnings would be lower and our effective tax rate would appear to be higher, even though a lower amount of income taxes would have been paid or payable for a period’s earnings. We make these adjustments when calculating Distributable Earnings to more accurately reflect the net realized earnings that are expected to be or become available for distribution or reinvestment into our business. Management believes that Distributable Earnings can be useful as a supplemental performance measure to our GAAP results assessing the amount of earnings available for distribution. Adjusted Shares Adjusted Shares represents the weighted-average outstanding interests that are participating in distributions as of the end of each respective period. Adjusted Shares is the sum of Blue Owl Capital Inc.’s Class A Shares (and Class B Shares to the extent outstanding in the future) and Common Units of the Blue Owl Operating Group. Common Units are limited partner interests held by certain members of management and employees, as well as other third parties in the Blue Owl Operating Group. Subject to certain restrictions, Common Units are exchangeable on a one-for-one basis for either Class A Shares or Class B Shares if held by certain senior members of management.

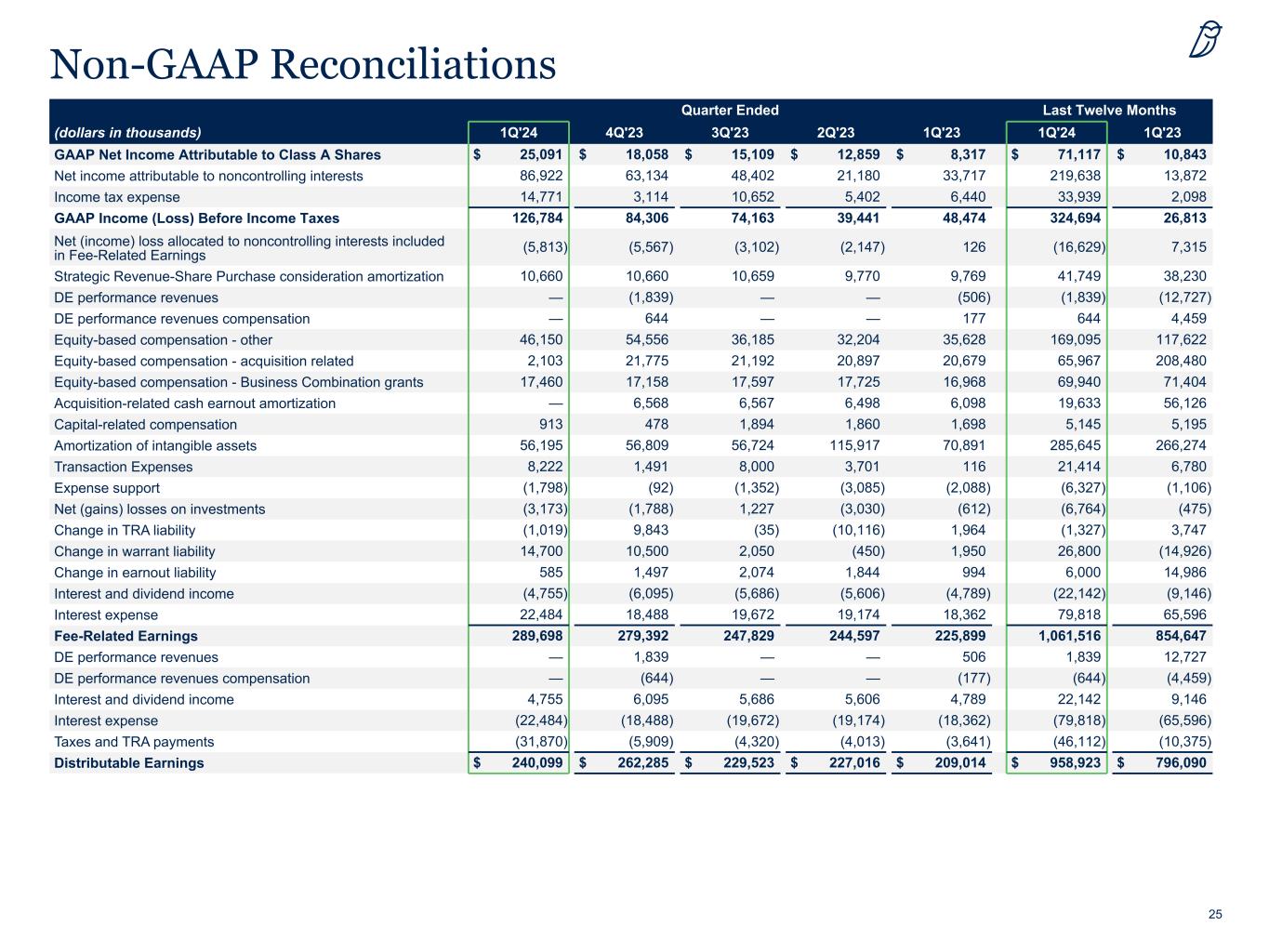

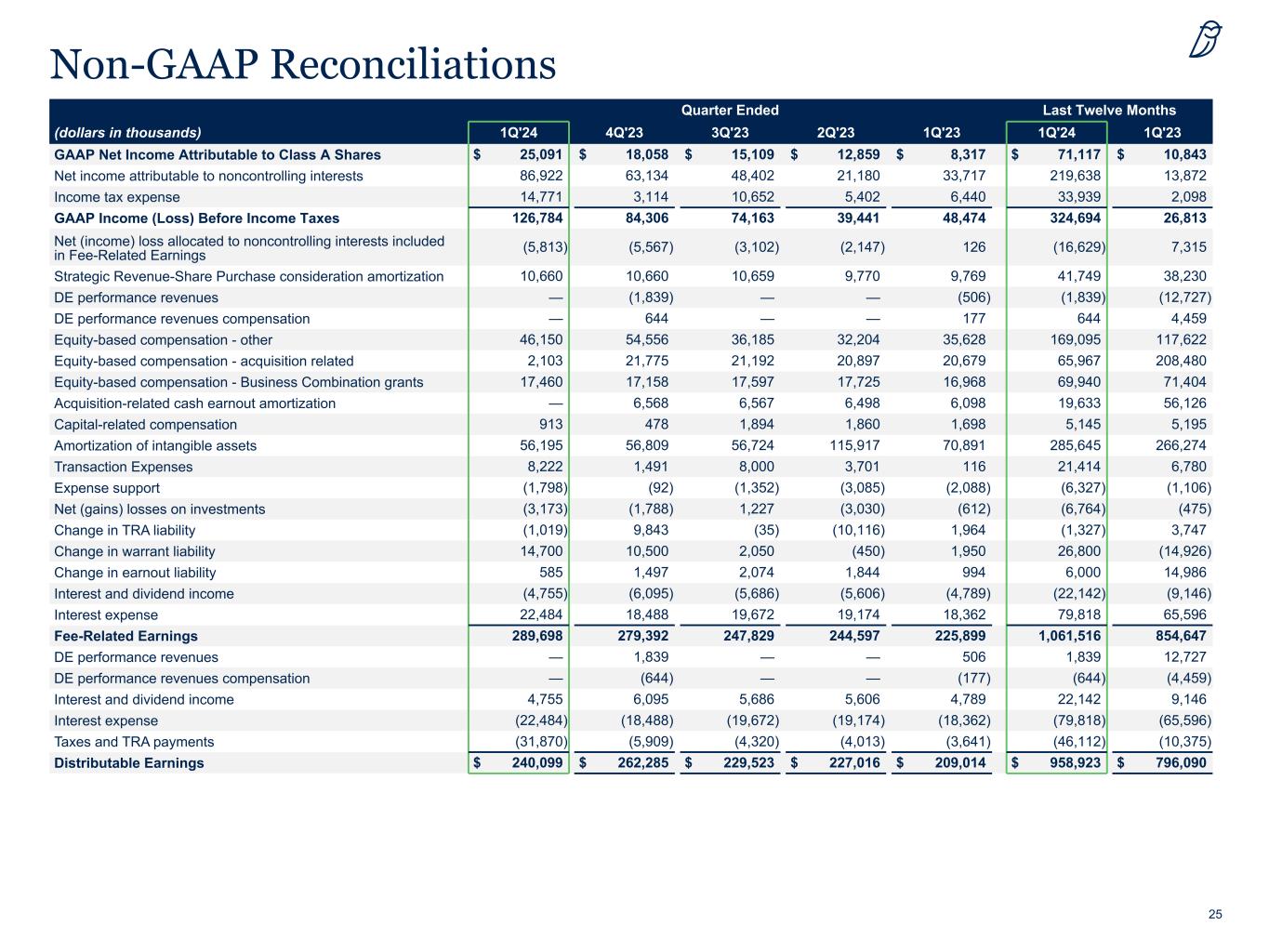

25 Non-GAAP Reconciliations Quarter Ended Last Twelve Months (dollars in thousands) 1Q'24 4Q'23 3Q'23 2Q'23 1Q'23 1Q'24 1Q'23 GAAP Net Income Attributable to Class A Shares $ 25,091 $ 18,058 $ 15,109 $ 12,859 $ 8,317 $ 71,117 $ 10,843 Net income attributable to noncontrolling interests 86,922 63,134 48,402 21,180 33,717 219,638 13,872 Income tax expense 14,771 3,114 10,652 5,402 6,440 33,939 2,098 GAAP Income (Loss) Before Income Taxes 126,784 84,306 74,163 39,441 48,474 324,694 26,813 Net (income) loss allocated to noncontrolling interests included in Fee-Related Earnings (5,813) (5,567) (3,102) (2,147) 126 (16,629) 7,315 Strategic Revenue-Share Purchase consideration amortization 10,660 10,660 10,659 9,770 9,769 41,749 38,230 DE performance revenues — (1,839) — — (506) (1,839) (12,727) DE performance revenues compensation — 644 — — 177 644 4,459 Equity-based compensation - other 46,150 54,556 36,185 32,204 35,628 169,095 117,622 Equity-based compensation - acquisition related 2,103 21,775 21,192 20,897 20,679 65,967 208,480 Equity-based compensation - Business Combination grants 17,460 17,158 17,597 17,725 16,968 69,940 71,404 Acquisition-related cash earnout amortization — 6,568 6,567 6,498 6,098 19,633 56,126 Capital-related compensation 913 478 1,894 1,860 1,698 5,145 5,195 Amortization of intangible assets 56,195 56,809 56,724 115,917 70,891 285,645 266,274 Transaction Expenses 8,222 1,491 8,000 3,701 116 21,414 6,780 Expense support (1,798) (92) (1,352) (3,085) (2,088) (6,327) (1,106) Net (gains) losses on investments (3,173) (1,788) 1,227 (3,030) (612) (6,764) (475) Change in TRA liability (1,019) 9,843 (35) (10,116) 1,964 (1,327) 3,747 Change in warrant liability 14,700 10,500 2,050 (450) 1,950 26,800 (14,926) Change in earnout liability 585 1,497 2,074 1,844 994 6,000 14,986 Interest and dividend income (4,755) (6,095) (5,686) (5,606) (4,789) (22,142) (9,146) Interest expense 22,484 18,488 19,672 19,174 18,362 79,818 65,596 Fee-Related Earnings 289,698 279,392 247,829 244,597 225,899 1,061,516 854,647 DE performance revenues — 1,839 — — 506 1,839 12,727 DE performance revenues compensation — (644) — — (177) (644) (4,459) Interest and dividend income 4,755 6,095 5,686 5,606 4,789 22,142 9,146 Interest expense (22,484) (18,488) (19,672) (19,174) (18,362) (79,818) (65,596) Taxes and TRA payments (31,870) (5,909) (4,320) (4,013) (3,641) (46,112) (10,375) Distributable Earnings $ 240,099 $ 262,285 $ 229,523 $ 227,016 $ 209,014 $ 958,923 $ 796,090

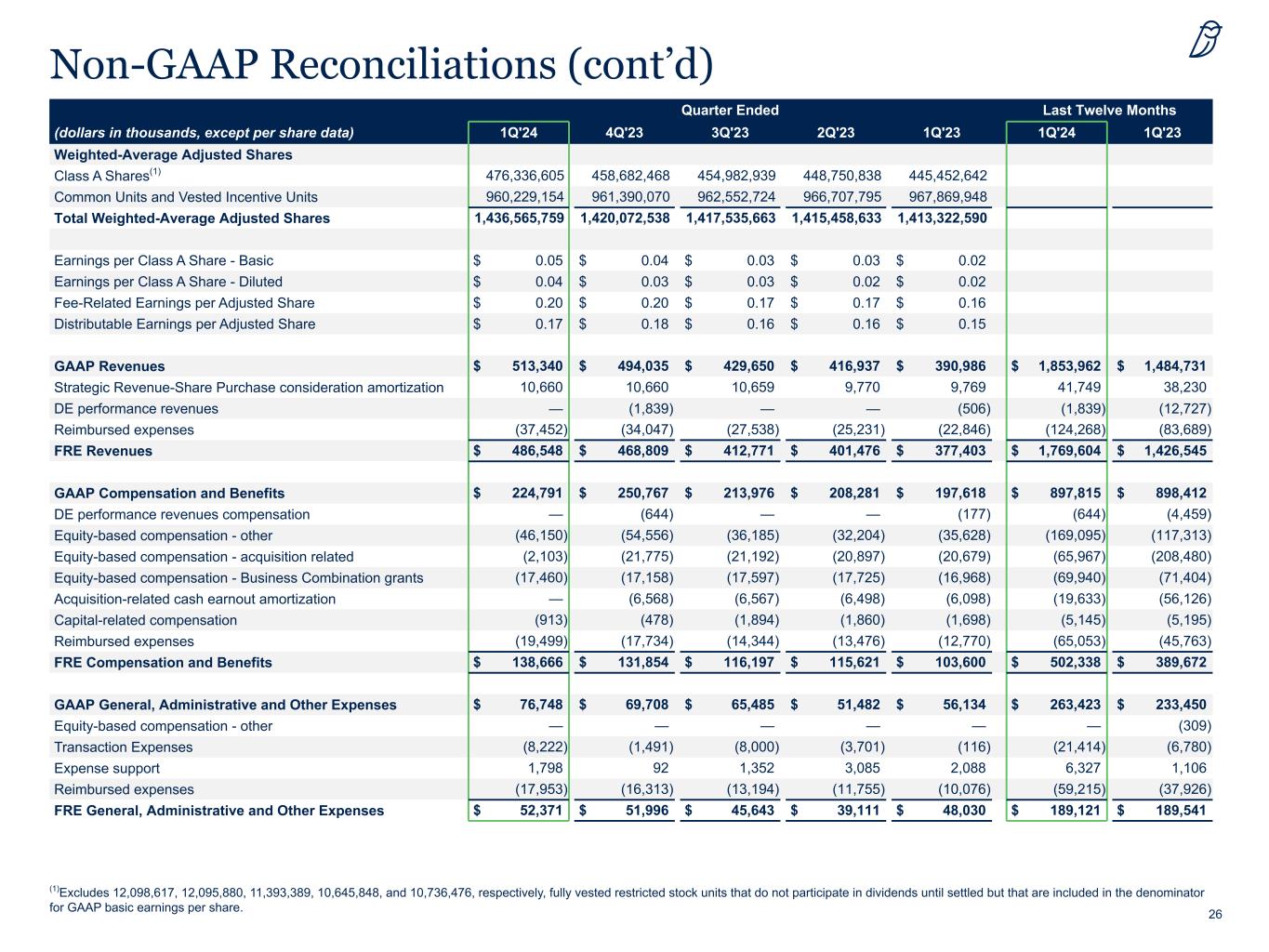

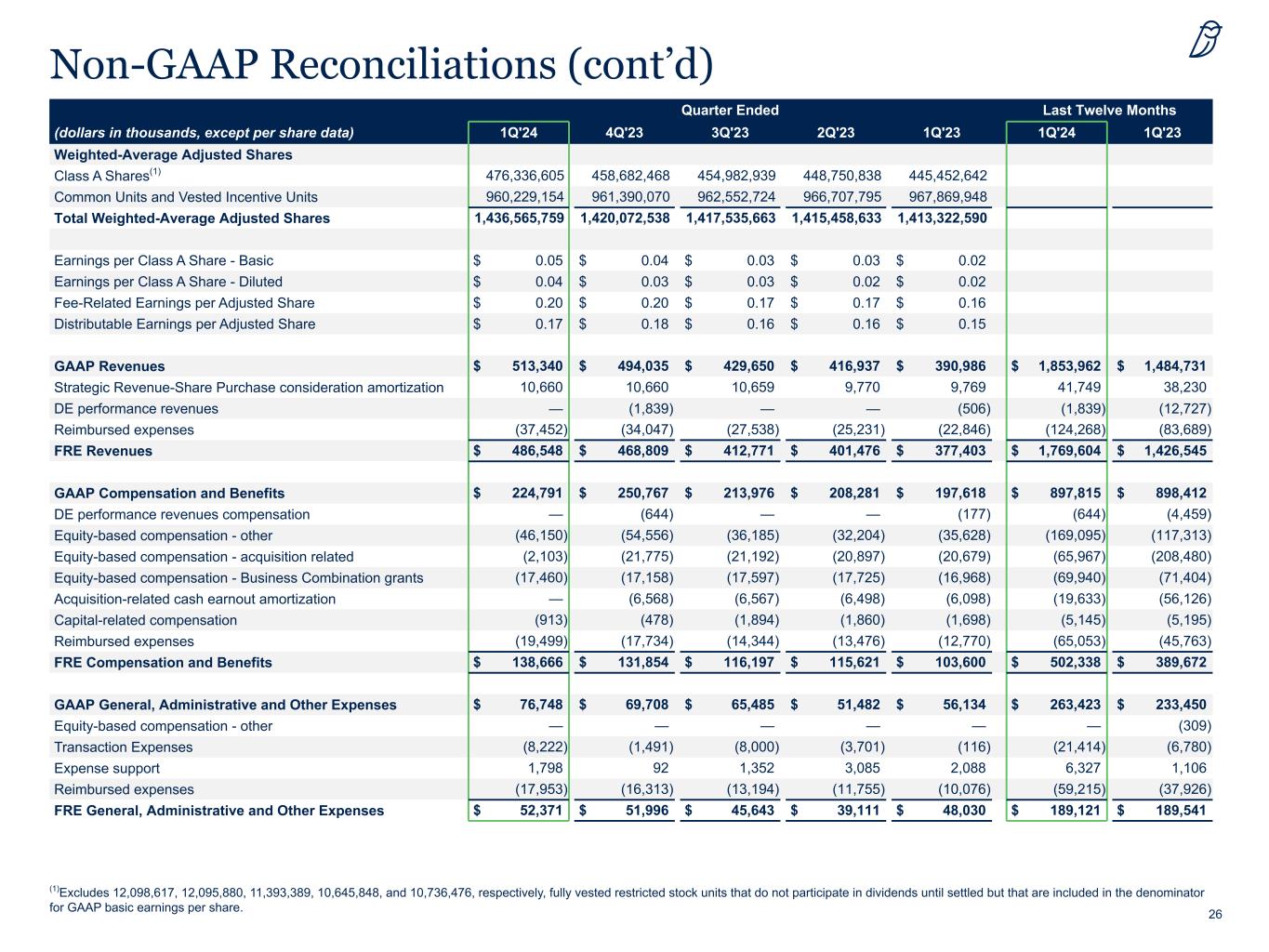

26 Non-GAAP Reconciliations (cont’d) Quarter Ended Last Twelve Months (dollars in thousands, except per share data) 1Q'24 4Q'23 3Q'23 2Q'23 1Q'23 1Q'24 1Q'23 Weighted-Average Adjusted Shares Class A Shares(1) 476,336,605 458,682,468 454,982,939 448,750,838 445,452,642 Common Units and Vested Incentive Units 960,229,154 961,390,070 962,552,724 966,707,795 967,869,948 Total Weighted-Average Adjusted Shares 1,436,565,759 1,420,072,538 1,417,535,663 1,415,458,633 1,413,322,590 Earnings per Class A Share - Basic $ 0.05 $ 0.04 $ 0.03 $ 0.03 $ 0.02 Earnings per Class A Share - Diluted $ 0.04 $ 0.03 $ 0.03 $ 0.02 $ 0.02 Fee-Related Earnings per Adjusted Share $ 0.20 $ 0.20 $ 0.17 $ 0.17 $ 0.16 Distributable Earnings per Adjusted Share $ 0.17 $ 0.18 $ 0.16 $ 0.16 $ 0.15 GAAP Revenues $ 513,340 $ 494,035 $ 429,650 $ 416,937 $ 390,986 $ 1,853,962 $ 1,484,731 Strategic Revenue-Share Purchase consideration amortization 10,660 10,660 10,659 9,770 9,769 41,749 38,230 DE performance revenues — (1,839) — — (506) (1,839) (12,727) Reimbursed expenses (37,452) (34,047) (27,538) (25,231) (22,846) (124,268) (83,689) FRE Revenues $ 486,548 $ 468,809 $ 412,771 $ 401,476 $ 377,403 $ 1,769,604 $ 1,426,545 GAAP Compensation and Benefits $ 224,791 $ 250,767 $ 213,976 $ 208,281 $ 197,618 $ 897,815 $ 898,412 DE performance revenues compensation — (644) — — (177) (644) (4,459) Equity-based compensation - other (46,150) (54,556) (36,185) (32,204) (35,628) (169,095) (117,313) Equity-based compensation - acquisition related (2,103) (21,775) (21,192) (20,897) (20,679) (65,967) (208,480) Equity-based compensation - Business Combination grants (17,460) (17,158) (17,597) (17,725) (16,968) (69,940) (71,404) Acquisition-related cash earnout amortization — (6,568) (6,567) (6,498) (6,098) (19,633) (56,126) Capital-related compensation (913) (478) (1,894) (1,860) (1,698) (5,145) (5,195) Reimbursed expenses (19,499) (17,734) (14,344) (13,476) (12,770) (65,053) (45,763) FRE Compensation and Benefits $ 138,666 $ 131,854 $ 116,197 $ 115,621 $ 103,600 $ 502,338 $ 389,672 GAAP General, Administrative and Other Expenses $ 76,748 $ 69,708 $ 65,485 $ 51,482 $ 56,134 $ 263,423 $ 233,450 Equity-based compensation - other — — — — — — (309) Transaction Expenses (8,222) (1,491) (8,000) (3,701) (116) (21,414) (6,780) Expense support 1,798 92 1,352 3,085 2,088 6,327 1,106 Reimbursed expenses (17,953) (16,313) (13,194) (11,755) (10,076) (59,215) (37,926) FRE General, Administrative and Other Expenses $ 52,371 $ 51,996 $ 45,643 $ 39,111 $ 48,030 $ 189,121 $ 189,541 (1)Excludes 12,098,617, 12,095,880, 11,393,389, 10,645,848, and 10,736,476, respectively, fully vested restricted stock units that do not participate in dividends until settled but that are included in the denominator for GAAP basic earnings per share.

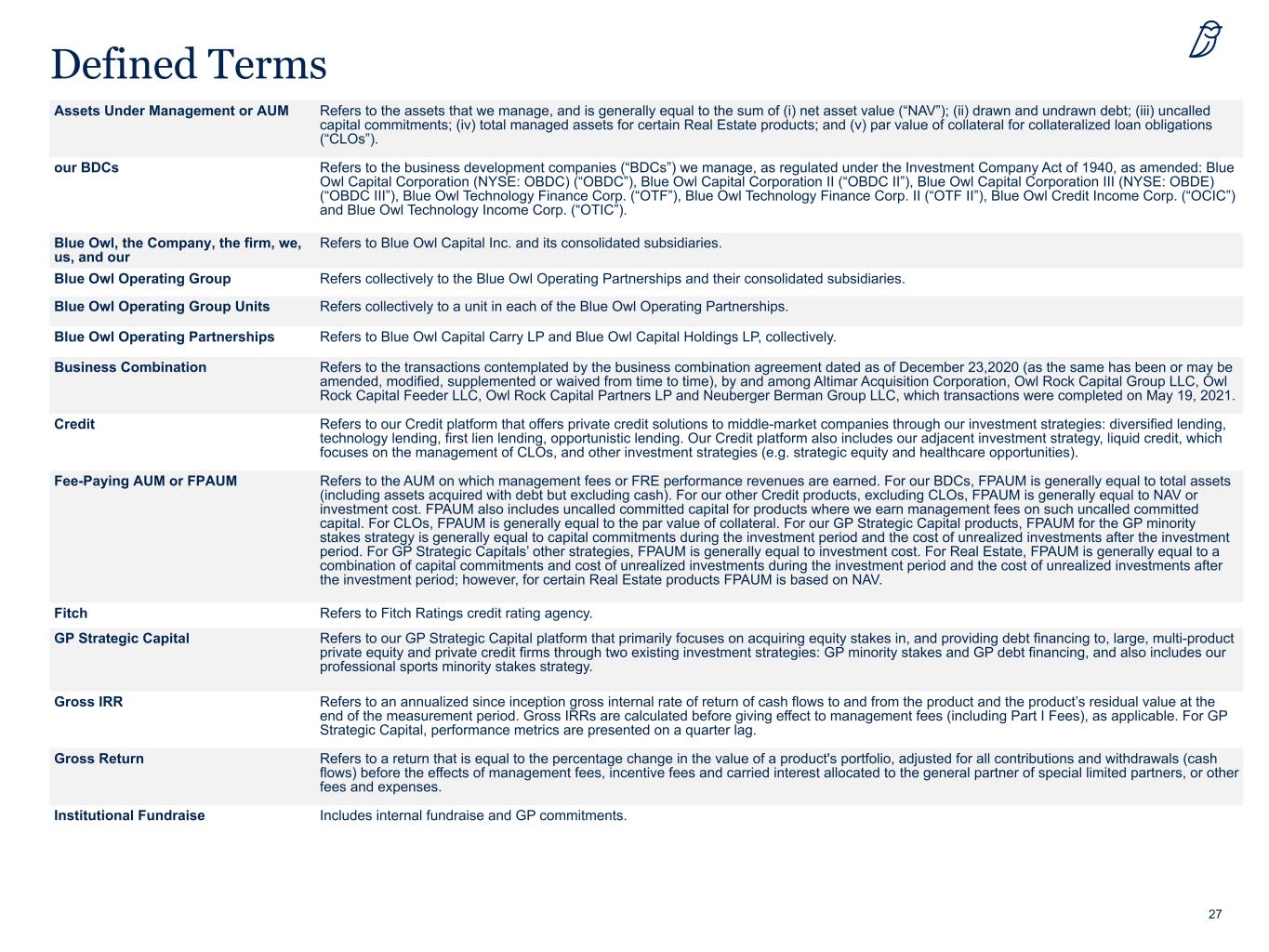

27 Defined Terms Assets Under Management or AUM Refers to the assets that we manage, and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Real Estate products; and (v) par value of collateral for collateralized loan obligations (“CLOs”). our BDCs Refers to the business development companies (“BDCs”) we manage, as regulated under the Investment Company Act of 1940, as amended: Blue Owl Capital Corporation (NYSE: OBDC) (“OBDC”), Blue Owl Capital Corporation II (“OBDC II”), Blue Owl Capital Corporation III (NYSE: OBDE) (“OBDC III”), Blue Owl Technology Finance Corp. (“OTF”), Blue Owl Technology Finance Corp. II (“OTF II”), Blue Owl Credit Income Corp. (“OCIC”) and Blue Owl Technology Income Corp. (“OTIC”). Blue Owl, the Company, the firm, we, us, and our Refers to Blue Owl Capital Inc. and its consolidated subsidiaries. Blue Owl Operating Group Refers collectively to the Blue Owl Operating Partnerships and their consolidated subsidiaries. Blue Owl Operating Group Units Refers collectively to a unit in each of the Blue Owl Operating Partnerships. Blue Owl Operating Partnerships Refers to Blue Owl Capital Carry LP and Blue Owl Capital Holdings LP, collectively. Business Combination Refers to the transactions contemplated by the business combination agreement dated as of December 23,2020 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar Acquisition Corporation, Owl Rock Capital Group LLC, Owl Rock Capital Feeder LLC, Owl Rock Capital Partners LP and Neuberger Berman Group LLC, which transactions were completed on May 19, 2021. Credit Refers to our Credit platform that offers private credit solutions to middle-market companies through our investment strategies: diversified lending, technology lending, first lien lending, opportunistic lending. Our Credit platform also includes our adjacent investment strategy, liquid credit, which focuses on the management of CLOs, and other investment strategies (e.g. strategic equity and healthcare opportunities). Fee-Paying AUM or FPAUM Refers to the AUM on which management fees or FRE performance revenues are earned. For our BDCs, FPAUM is generally equal to total assets (including assets acquired with debt but excluding cash). For our other Credit products, excluding CLOs, FPAUM is generally equal to NAV or investment cost. FPAUM also includes uncalled committed capital for products where we earn management fees on such uncalled committed capital. For CLOs, FPAUM is generally equal to the par value of collateral. For our GP Strategic Capital products, FPAUM for the GP minority stakes strategy is generally equal to capital commitments during the investment period and the cost of unrealized investments after the investment period. For GP Strategic Capitals’ other strategies, FPAUM is generally equal to investment cost. For Real Estate, FPAUM is generally equal to a combination of capital commitments and cost of unrealized investments during the investment period and the cost of unrealized investments after the investment period; however, for certain Real Estate products FPAUM is based on NAV. Fitch Refers to Fitch Ratings credit rating agency. GP Strategic Capital Refers to our GP Strategic Capital platform that primarily focuses on acquiring equity stakes in, and providing debt financing to, large, multi-product private equity and private credit firms through two existing investment strategies: GP minority stakes and GP debt financing, and also includes our professional sports minority stakes strategy. Gross IRR Refers to an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees (including Part I Fees), as applicable. For GP Strategic Capital, performance metrics are presented on a quarter lag. Gross Return Refers to a return that is equal to the percentage change in the value of a product's portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees and carried interest allocated to the general partner of special limited partners, or other fees and expenses. Institutional Fundraise Includes internal fundraise and GP commitments.

28 Defined Terms (cont’d) Net IRR Refers to an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs are calculated after giving effect to fees, as applicable, and all other expenses. An individual investor’s IRR may be different to the reported IRR based on the timing of capital transactions. For GP Strategic Capital, performance metrics are presented on a quarter lag. Net Return Refers to a return that is equal to the percentage change in the value of a product's portfolio, adjusted for all contributions and withdrawals (cash flows) after the effects of management fees, incentive fees and carried interest allocated to the general partner of special limited partners, or other fees and expenses. Part I Fees Refers to quarterly performance income on the net investment income of our BDCs and similarly structured products, subject to a fixed hurdle rate. These fees are classified as management fees throughout this report, as they are predictable and recurring in nature, not subject to repayment, and cash-settled each quarter. Permanent Capital Refers to AUM in products that do not have ordinary redemption provisions or a requirement to exit investments and return the proceeds to investors after a prescribed period of time. Some of these products, however, may be required or can elect to return all or a portion of capital gains and investment income, and some may have periodic tender offers or redemptions. Permanent Capital includes certain products that are subject to management fee step downs or roll-offs or both over time. Real Estate Refers, unless context indicates otherwise, to our Real Estate platform that primarily focuses on acquiring triple net lease real estate occupied by investment grade or creditworthy tenants. S&P Refers to Standard & Poor's credit rating agency. Tax Receivable Agreement or TRA Refers to the Amended and Restated Tax Receivable Agreement, dated as of October 22, 2021, as may be amended from time to time.