Business Products

We have two major product lines: Direct Lending and GP Capital Solutions. We believe our products, while distinct, are complementary to each other and together enable us to provide a differentiated platform of various capital solutions to the alternative asset management industry. Each of our products employ a disciplined investment philosophy with a focus on long-term investment horizons and are managed by tenured leadership and investment professionals with significant experience in their respective strategies.

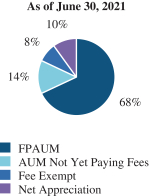

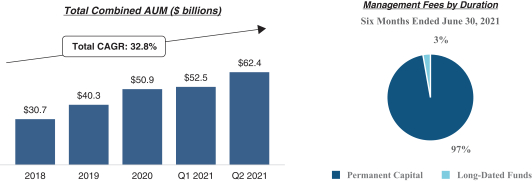

| Blue Owl AUM: $62.4 billion | ||

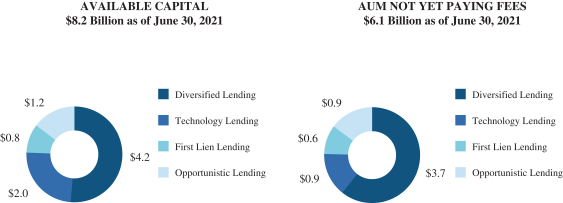

| Direct Lending Products AUM: $31.2 billion |

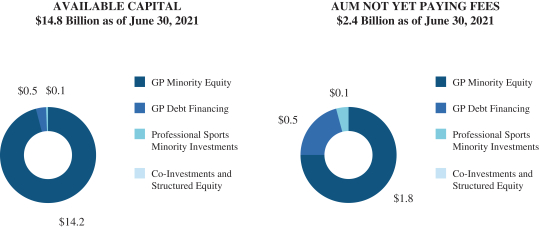

GP Capital Solutions Products AUM: $31.2 billion | |

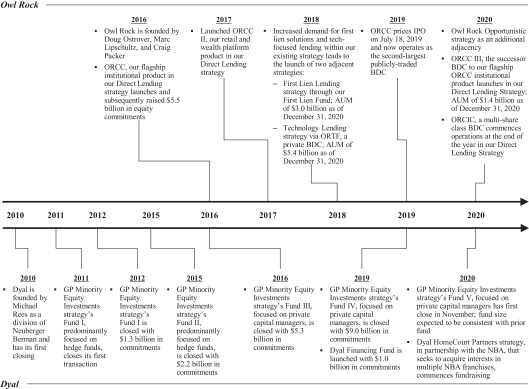

| Diversified Lending Commenced 2016 AUM: $19.8 billion |

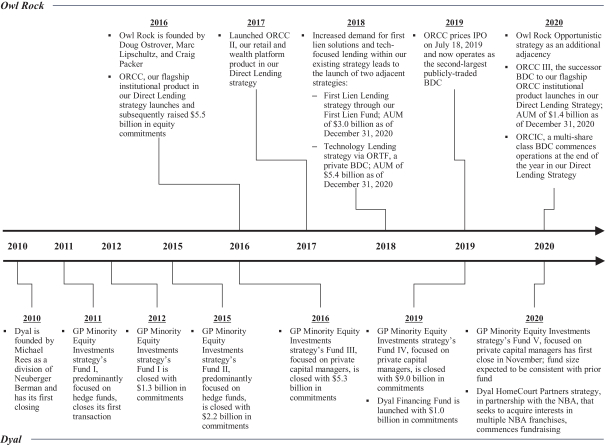

GP Minority Equity Commenced 2010 AUM: $30.0 billion | |

| Technology Lending Commenced 2018 AUM: $6.2 billion |

GP Debt Financing Commenced 2019 AUM: $1.0 billion | |

| First Lien Lending Commenced 2018 AUM: $3.2 billion |

Professional Sports Minority Investments Commenced 2021 AUM: $0.2 billion | |

| Opportunistic Lending Commenced 2020 AUM: $1.9 billion |

Co-Investments and Structured EquityNot Yet Launched | |

Note:

Co-Investments and

Structured Equity is an expected new strategy of the Dyal business. There can be no assurance that such strategy will launch as expected. Direct Lending

Our Direct Lending products offer private credit products to middle-market companies seeking capital solutions. We believe our breadth of offerings establishes us as the lending partner of choice for private-equity sponsored companies, as well as other predominately

non-cyclical,

recession-resistant businesses. Since the launch of our flagship institutional product, ORCC, we have continued to prudently expand our offerings, focusing on adjacent strategies that are both additive and complementary to our existing product base. We 2