UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal years ended

For the transition period from ____________to ____________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

(Address of principal executive office and zip code)

Zhejiang

Province,

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No

The

aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding as at August 16, 2024 | |

| Common Stock, $ par value | ||

TABLE OF CONTENTS

| 2 |

EXPLANATORY NOTE

Unless the context requires otherwise, references to “Company,” “ECXJ,” “we,” “us” and “our” are to CXJ Group Co., Limited.

CAUTIONARY NOTES REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | the availability and adequacy of working capital to meet our requirements; | |

| ● | the consummation of any potential acquisitions; | |

| ● | actions taken or omitted to be taken by legislative, regulatory, judicial and other governmental authorities; | |

| ● | changes in our business strategy or development plans; | |

| ● | our ability to continue as a going concern; | |

| ● | the availability of additional capital to support capital improvements and development; | |

| ● | our ability to address and as necessary adapt to changes in foreign, cultural, economic, political and financial market conditions which could impair our future operations and financial performance (including, without limitation, the changes resulting from the global novel coronavirus outbreak of 2019-2021 in China and around the world); | |

| ● | other risks identified in this report and in our other filings with the Securities and Exchange Commission (the “SEC”); and | |

| ● | the availability of new business opportunities. |

This Annual Report on Form 10-K should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report on Form 10-K are made as of the date of this Annual Report on Form 10-K and should be evaluated with consideration of any changes occurring after the date of this Annual Report on Form 10-K. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Except as otherwise indicated by the context hereof, references in this report to “Company,” “ECXJ,” “we,” “us” and “our” are to CXJ Group Co., Limited. All references to “USD” or U.S. Dollars (US$) are to the legal currency of the United States of America. All references to “RMB” are to the legal currency of People’s Republic of China.

| 3 |

PART I

Item 1. Business

Overview

We are an automobile aftermarket products wholesaler, as well as an auto detailing store consultancy company. Our business mainly divided into three sectors, namely sales of automobile aftermarket products, authorization fee on our brand name “Chejiangling / Teenage Hero Car” and provision of auto detailing store consultancy services.

We provide consultancy services to our customers, who are auto detailing store owners or persons who are going to start the stores. Our customer will use our brand name “Chejiangling / Teenage Hero Car” for their auto detailing stores. We will provide professional training and guidelines to our customers for standardizing their stores, in terms of their products and services, store decorations, operating procedures, etc. We will also provide training to the store employees to ensure they provide standardize and professional services to the end customers. We have also developed an enterprise resource planning system (ERP) for our customers. The ERP system can allow information management (from both PC and mobile device) and daily operation of the stores, increasing the efficiency of store management.

Our customer can sell our star product, NOVATE, a fully synthetic motor oil, and Ksoncar or X-Line, an automobile exhaust cleaner, in their auto detailing stores. With our star product and the brand name effect, end customers will be attracted to visit our customers’ store and enjoy other professional services provided by our customers, including automobile detailing services, automobile engine system maintenance, air conditioning system cleaning and maintenance, braking system maintenance and transmission system maintenance. More information can be found in the sections of “Sale and services” and “Customer”.

All our customers’ auto detailing stores are located within three kilometers or 10 minutes drives from the residential area, we target our brand “Chejiangling / Teenage Hero Car” can become popular and recognized as “neighbor auto detailing stores”.

As of May 31, 2024, more than 160 active franchise auto detailing stores use our brand name, the store network has reached 23 provinces and 132 cities in China. We aim to increase 1,000 stores with our customers across China in the next five years.

Corporate History and Structure

CXJ Group Co., Limited (“we”, “us”, the “the Company” or “ECXJ”) was originally incorporated in State of Nevada on August 20, 1998 under the name Global II, Inc and underwent several name changes prior to its current name. Until August 2019, the Company was known as Global Entertainment Corp., which was a dormant company.

On March 04, 2019, the eight judicial District Court of Nevada appointed Custodian Ventures, LLC as custodian for the Company, proper notice having been given to the officers and directors of Global Entertainment Corporation. There was no opposition.

On June 18, 2019, control of the Company was transferred by the entity controlled by Custodian Ventures, LLC to Xinrui Wang, our director, by selling him 10,000,000 shares of Series A Preferred stock and 17,700,000 shares of common stock for a purchase price of $175,000.

On June 21, 2019, Lixin Cai was appointed act as the new President, CEO, Secretary and Chairman of the Board of Directors of the Company. On June 21, 2019, Cuiyao Luo was appointed act as the new CFO, Treasurer and Member of the Board of Directors of the Company. On September 30, 2019, the Company appointed three more members to the Board of Directors of the Company, and they are Xinrui Wang, Wenbin Mao and Baiwan Niu.

| 4 |

Effective July 9, 2019 we changed our name from Global Entertainment Corp to CXJ Group Co., Limited. On July 12, 2019, the Company effectuated a 1 for 200 reverse stock split, while the authorized shares of common stock and preferred shares totally had been increased to 500,000,000. As a result of the foregoing we changed our trading symbol from GNTP and began trading as ECXJ on August 5, 2019.

On October 4, 2019, Xinrui Wang (the “Seller”), entered into a Stock Purchase Agreement to pursuant to which the Seller agreed to sell to Wenbin Mao and Baiwan Niu (the “Purchasers”), totaling 1,500,000 preferred stock of the Company (“Shares”) owned by the Seller, for an amount of $1,500. On October 8, 2019, Xinrui Wang, Wenbin Mao and Baiwan Niu effectuated a 1 for 10 conversion to convert all their preferred stock totaling 10,000,000 to 100,000,000 common shares. As a result of the conversion, there was no preferred stock outstanding of the Company as of October 8, 2019.

On May 28, 2020, we consummated the transactions contemplated by the Share Exchange Agreement among the Company, CXJ Investment Group Company Limited, a British Virgin Islands Corporation (“CXJ”) and the shareholder of CXJ, pursuant to which we acquired all the ordinary shares of CXJ in exchange for the issuance to the shareholder of CXJ of an aggregate of 1,364,800 shares of the Company. The shareholder is the selling security holder in this prospectus and are all affiliates. As a result of the transactions contemplated by the Share Exchange, CXJ became a wholly-owned subsidiary of the Company.

Effective May 13, 2022, we have appointed Messrs. Tianbing Yang and Rudong Shi as members of our Board of Directors.

On June 14, 2022, the Company completed the issuance and sales of an aggregate of 223,500 shares at a price of $0.66 per shares with each share consisting of one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”) in a private placement to Minggang Qian (the “Purchaser”), pursuant to the Subscription Agreement dated as of June 9, 2022 between the Company and the Purchaser. The net proceeds to the Company amounted to $147,510. The $147,510 in proceeds went directly to the Company as working capital.

On July 15, 2022, Mr. Wenbin Mao, Mr. Baiwan Niu, Mr. Tianbing Yang and Ms. Cuiyao Luo tendered their resignation for personal reasons and resigned as members of the Board of the Company effective from 28 July, 2022. The Board accepted the resignation of Mr. Wenbin Mao, Mr. Baiwan Niu, Mr. Tianbing Yang and Ms. Cuiyao Luo , and expressed sincere gratitude for their service term as a member of the Board.

On August 1, 2023, CXJ Technology (Hangzhou) Co., Ltd, a Chinese corporation and a subsidiary of the Company signed an equity transfer agreement (the “Agreement”) with Mr. Qing Wang. Under this agreement, the Company will dispose 51% equity of Xishijie Automobile Industry Ecology Technology Co., Ltd (formerly known as Shenzhen Lanbei Ecological Technology Co., Ltd), a Chinese company (“Xishijie”) with a purchase price of RMB 1 yuan. After this Agreement comes into force, Xishijie Automobile Industry Ecology Technology Co., Ltd will no longer the subsidiary of CXJ Group Co., Ltd.

On August 14, 2023, the Board approved the appointment of Zhen Hui Certified Public Accountant (“Zhen Hui”) as the Company’s new independent registered public accounting firm for the fiscal year ending May 31, 2022 and May 31, 2023 effective immediately.

On May 3, 2024, the Board approved the resignation of Zhen Hui as the Company’s independent registered public accounting firm with immediate effective.

On May 3, 2024, the Board approved the appointment of J & S Associate PLT (“J & S”) as the Company’s new independent registered public accounting firm for the fiscal year ending May 31, 2024 effective immediately.

On September 1, 2024, the Company entered the Subscription Agreement with Zhongxin Lei (the “Purchaser”) to issue and sales of an aggregate of 160,000 shares at a price of $0.657 per shares with each share consisting of one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”). The net proceeds to the Company amounted to $105,128 and went directly to the Company as working capital.

| 5 |

On September 1, 2024, the Company entered the Subscription Agreement with Shiguo Wang (the “Purchaser”) to issue and sales of an aggregate of 200,000 shares at a price of $0.675 per shares with each share consisting of one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”). The net proceeds to the Company amounted to $135,000 and went directly to the Company as working capital.

On September 2, 2024, the Company entered the Subscription Agreement with Shiguo Wang (the “Purchaser”) to issue and sales of an aggregate of 200,000 shares at a price of $0.648 per shares with each share consisting of one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”). The net proceeds to the Company amounted to $129,600 and went directly to the Company as working capital.

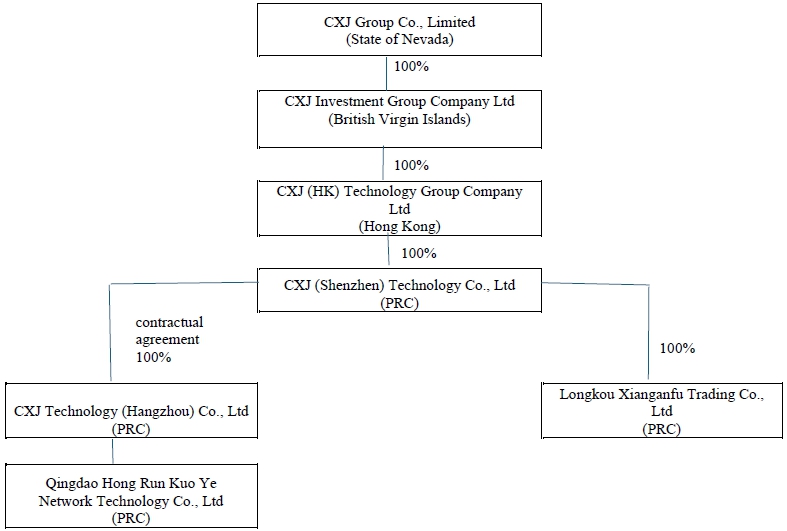

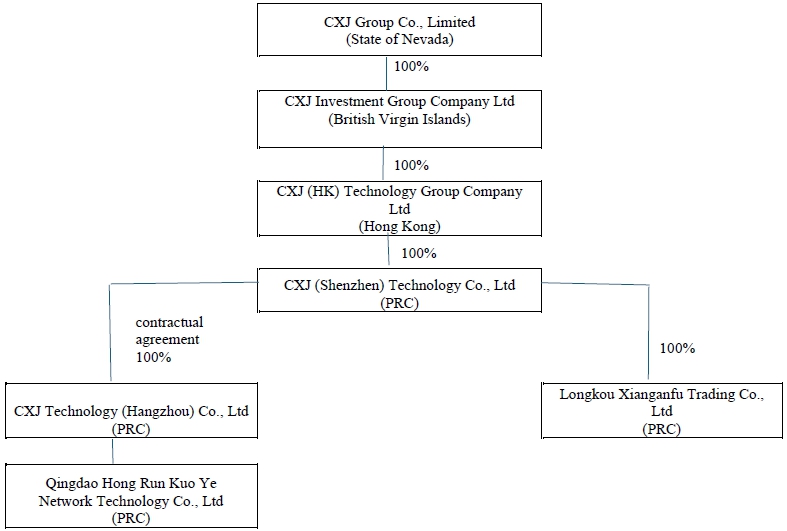

ECXJ, through its wholly owned subsidiary, CXJ and its subsidiaries and the VIE own and operate an active automobiles products trading and services business in the People’s Republic of China.

The following diagram illustrates our corporate structure as of the date of this Annual Report.

| 6 |

Recent Developments

Business Plan

Our business plan is to extend our market share through acquiring quality businesses in the Automotive aftermarket industries, in order to increase our customer base and supply channels, as well as to acquire more skilled employees and business connections in the industries. We plan to further develop our online and offline marketing platform and internal enterprise resource planning system (ERP) by engaging an external IT company during 2024.

We consider the following factors when evaluating quality acquisition targets: (i) costs involved in an acquisition; (ii) financial performance of the target; (iii) the reputation of the target in its industry; (iv) the target’s existing customer base; (v) the target’s supplier network; (vi) the expertise and experience of the target’s management and employees; and (vii) the inventory condition of the target.

Our management believes that successful acquisitions will bring synergies to our business and enhance our shareholders’ value.

Our Strategies:

| ● | We plan to diversify our existing product portfolio strategically, and thereby provide our customers with a wider range of choices and broaden our existing customer base. |

| ● | We plan to continue to solidify our relationships with our existing suppliers as well as identifying new suppliers. |

| ● | We plan to strengthen our corporate image by increasing marketing and promotion efforts. |

| ● | We plan to attract, motivate and retain high-quality talent. |

| ● | We will continue to expand and explore additional services and products to enrich our one-stop services to our customers. |

Our Business, Products and Product Distribution

We sell a variety of Automotive aftermarket products, such as engine/machine oil, anti-icing fluid and auto parts. Currently we sell about two different brands of engine/machine oil, most of which are imported from Germany and Malaysia, and the auto parts purchased from domestic, currently we have 259 SKU of auto parts.

We have put significant efforts in developing and promoting our brand name in different regions of China. Our products are mainly sold to 4S repair shops.

We have cultivated business relationships and achieved recognition with different organizations over the years, which have improved our business and management efficacy. We have been a member of China Chain Store and Franchise Association since 2022.

Our Automotive aftermarket product management office is located in Hangzhou City. We lease the building which has over 270 square meters. It includes supply chain, support center, operation center, human resource and finance departments. The warehouse is also located in Hangzhou City with over 400 square meters. As of May 31, 2024, the Company has total four separate operating lease agreements for three office space and one warehouse in PRC with remaining lease terms of from 1 months to 14 months. The Company indicated to continue to keep the facilities.

We have developed an enterprise resource planning system (ERP) for our customers. The ERP system can allow information management (from both PC and mobile device) and daily operation of the stores, increasing the efficiency of store management. Most of our agents ordered from this platform.

| 7 |

Our customers

Our customers refer to all auto detailing store owners or persons who are going to start the stores.

Our customers are authorized to operate the auto detailing stores under our brand name “Chejiangling / Teenage Hero Car” and sell our product Ksoncar in their stores. Our customers have to be fulfilled several criterions before using our brand name, including the location of their stores, services they provided, etc. Our customers must provide respective automobile services according to their store types and scales, including automobile detailing services, automobile engine system maintenance, air conditioning system cleaning and maintenance, braking system maintenance and transmission system maintenance.

We standardize the stores and require our customers to provide standard and professional services to the end customers. The premium experience of visiting the stores will enhance our brand name “Chejiangling / Teenage Hero Car”, and hence attract more customers to join our network of auto detailing stores.

Marketing plan

Our marketing plan primarily focused upon our efforts to attract customers in China. In the coming years, and subsequently, we intend to make efforts to expand throughout the Southeast Asia, especially in Malaysia. Accordingly, we anticipate spending a substantial amount in marketing and advertising in the coming years.

While our marketing plans have not yet been determined in full, we do have tentative plans to penetrate the marketplace and attract customers by building our brand image through print advertisements, and possibly online paid advertisements to create brand awareness. We plan to develop a corporate website, although we do not have any definitive timeline in place to do so, which will introduce the benefits to our prospective clients. We intend to market our products through this corporate website and utilize search engine marketing to improve the number of sub-distributors and consumers who can find and view our future website.

The global presence social media has provided is an invaluable resource. As we begin to grow, create brand awareness and expand our operations to South East Asia, especially in Malaysia, we intend to use social media to reach and engage additional sub-distributors and customers. We intend to create social media pages, on platforms such as Weibo, Twitter, Instagram and Facebook, in the future in order to promote our products to overseas markets. However, we do not have any definitive plans for how we will manage or grow our social media presence at this time.

All of the above marketing plans have not yet been determined in sufficient detail to outline at this time and remain under development. Our support center will continue to launch new marketing plans, to help the authorized agents to further develop the customers and achieve the growth of the company’s sales scale.

Competition

Although there are numerous alternative brands, we intend to distinguish ourselves by creating a strong relationship with our customers. We believe that we will have competitive strengths that will allow us to effectively compete in this market. It is our intention to create competitive strengths via our future pricing model and the quality of our products and network of stores.

Our partners are also important for our marketing, the local resources held by our alliance combine with our mature management and technical support can create huge value and great service for consumers, so we are confident about our advantage for both of our services and products, with more and more club set up in most of the city, our business will become a automobile living cycle focus on automobile aftermarket services.

We believe that our products and services can attract new customers while keeping our current customers satisfied.

| 8 |

Government Regulations

We operate our business in China under a legal regime consisting of the National People’s Congress, which is the country’s highest legislative body; the State Council, which is the highest authority of the executive branch of the PRC central government; and several ministries and agencies under its authority, including the Ministry of Industry and Information Technology, State Administration For Industry & Commerce, State Administration of Taxation and their respective local offices.

REGULATIONS RELATING TO COMMERCIAL FRANCHISING

Pursuant to the Regulations on the Administration of Commercial Franchising(《商業特許經營管理條例》), or the Franchising Regulations, which took effect on 1 May 2007, commercial franchising refers to the business activities where a franchisor, being an enterprise possessing registered trademarks, corporate logos, patents, proprietary technology, or other business resources, licences through contracts its business resources to the franchisees, being other business operators, and the franchisees carry out business operation under a uniform business model and pay franchising fees to the franchisor pursuant to the contracts. The Franchising Regulations requires that any enterprise engaging in trans-provincial franchise business shall register with the Ministry of Commerce, and any enterprise engaging in franchise business within one province shall register with the provincial counterpart of the Ministry of Commerce. The Franchising Regulations also set forth a number of requirements for the franchisors and to govern the franchise agreements. For example, the franchisors and franchisees are required to enter into franchising agreements containing certain required terms, and the franchise term thereunder shall be no less than three years unless otherwise agreed by the franchisee.

On 12 December 2011, the Ministry of Commerce promulgated the Administrative Measures for the Filing of Commercial Franchisees (《商業特許經營備案管理辦法》), which took effect on 1 February 2012 and sets forth in detail the procedures and documents required for such filing, including, among other things, within 15 days after executing the first franchise agreement, the franchisor shall file with the Ministry of Commerce or its local counterparts for record, and if there occurs any change to the franchisor’s business registration, business resources, and the franchisee store network throughout China, the franchisor shall apply to the Ministry of Commerce for alteration within 30 days after the occurrence of such change. Furthermore, within the first quarter of each year, the franchisor shall report the execution, revocation, termination, and renewal of the franchise agreements occurring in the previous year to the Ministry of Commerce or its local counterparts, the failure of which may subject the franchisor to an order of rectification and a fine up to RMB50,000. Furthermore, the franchisor is required to implement information disclosure system. The Administrative Measures on the Information Disclosure of Commercial Franchising(《商業 特許經營信息披露管理辦法》), which took effect on 1 April 2012, provides a list of information that the franchisor shall disclose to franchisees in writing at least 30 days prior to the execution of the franchising agreements.

Regulations on Hazardous Chemicals

According to the Work Safety Law of the PRC(《中華人民共和國安全生產法》), which was promulgated by the SCNPC in 2002 and was latest amended in June 2021, where dangerous goods are to be manufactured, sold, transported, stored, used or to be disposed of or scrapped, business operators shall abide by relevant laws and regulations, as well as the national standards or industrial specifications, establish a special system for safety control, adopt reliable safety measures, and subject themselves to supervision and control by the competent departments in accordance with law. The Regulation on the Safety Administration of Hazardous Chemicals(《危險化學品安全管理條例》 ), which was promulgated by the State Council and latest amended in 2013, has further stipulates that enterprises using hazardous chemicals shall, in accordance with the types and hazard characteristics of the used hazardous chemicals as well as the amount and mode of use, establish and perfect the safety administration regulations and safety operating rules for the use of hazardous chemicals so as to guarantee the safe use of hazardous chemicals, and shall comply with the provisions of laws and regulations regarding the storage hazardous chemicals. Enterprise fails to comply with such regulatory requirements shall be ordered to rectify, to suspend business operations, be imposed fines, or even has its permits or business licence be revoked by the relevant government authorities.

| 9 |

Pursuant to the Regulation on the Safety Administration of Hazardous Chemicals, enterprises engaging in road transportation of hazardous chemicals shall, according to the provisions of the laws and administrative regulations concerning road transportation, obtain the permits for road transportation of dangerous goods, and go through the registration formalities with the administration for industry and commerce. The Regulations on Governing the Road Transportation of Dangerous Goods(《道路危險貨物運輸管理規定》),which was promulgated by the Ministry of Transport in 1993, latest amended in 2019, has further stipulates where a shipper entrusts an entity that has not obtained a permit for road transportation of dangerous goods in accordance with the law to carry dangerous chemicals, it shall be ordered to make corrections by the competent road transport administrative authority at or above the county level and shall be imposed a fine ranging from RMB100,000 to RMB200,000.

Regulations on Disposal of Hazardous Waste

Pursuant to the Law on the Prevention and Control of Environmental Pollution Caused by Solid Waste (《中華人民共和國固體廢物污染環境防治法》), which was promulgated by the SCNPC in 1995 and was latest amended on 1 September 2020, entities generating hazardous waste shall store, utilise and dispose hazardous waste according to the relevant requirements of the state and environmental protection standards, and shall not dump or pile up hazardous waste without authorisation. Furthermore, it is forbidden to entrust hazardous waste to entities without a permit for disposal, or else the competent ecological and environmental authorities shall order it to make rectification, impose fines, confiscate illegal gains, and in serious circumstance, order it to suspend business or close down upon the approval of the government authorities.

Intellectual Property

We rely on a combination of patents, copyrights, trademarks and trade secret laws and restrictions on disclosure to protect our intellectual property rights. We own copyrights to the Automotive aftermarket product content and software we developed in-house. We also own copyrights to the automotive aftermarket content we commission third parties to develop for us. As of May 31, 2024, we had 102 registered trademarks, 5 patents, 14 registered software copyrights and 3 registered works copyrights with the PRC State Copyright Bureau, and 3 registered domain names.

Despite our efforts to protect ourselves from infringement or misappropriation of our intellectual property rights, unauthorized parties may attempt to copy or otherwise obtain and use our intellectual property. In the event of a successful claim of infringement and our failure or inability to develop non-infringing intellectual property or license the infringed or similar intellectual property on a timely basis, our business could be harmed. See “Risk Factors — Risks Related to Our Business and Industry — We may from time to time be subject to infringement claims relating to intellectual properties of third parties.” and “Risk Factors — If we fail to protect our intellectual property rights, our brand and business may suffer” in this document for details. During the two years ended May 31, 2024, we were not a party to any material disputes relating to intellectual property infringement or misappropriation.

| 10 |

Employees

As of May 31, 2024, the Company has 20 employees, all of which were on a full-time basis. The following table sets forth the number of our full-time employees categorized by function as of May 31, 2024:

| Function | Number of Employees | |

| Finance | 4 | |

| Operation center | 9 | |

| IT and Engineering | 1 | |

| General and Administrative | 5 | |

| Supply Chain | 1 | |

| Total | 20 |

There are 15 employees based in HZ CXJ, 1 employee in SZ CXJ and 4 employees in Longkou CXJ respectively, where our operations are located.

As required by PRC regulations, we participate in various government statutory employee benefit plans, including social insurance funds, namely a pension contribution plan, a medical insurance plan, an unemployment insurance plan, a work-related injury insurance plan, a maternity insurance plan and a housing provident fund. We are required under PRC law to make contributions to employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time. We have not made adequate employee benefit payments, and may be required to make up the contributions for these plans as well as to pay late fees and fines.

We believe that we maintain a good working relationship with our employees, and we have not experienced any major labor disputes.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The foregoing website addresses are provided as inactive textual references only. We periodically provide other information for investors on our corporate website. This includes press releases and other information about financial performance and information on corporate governance. The information contained on the websites referenced in this Form 10-K is not part of this report and is not incorporated by reference into this filing.

Item 1A. Risk Factors

You should carefully consider the risks described below and elsewhere in this Annual Report, which could materially and adversely affect our business, results of operations or financial condition. Our business faces significant risks and the risks described below may not be the only risks we face. Additional risks not presently known to us or that we currently believe are immaterial may materially affect our business, results of operations, or financial condition. If any of these risks occur, the trading price of our common stock could be decline and you may lose all or part of your investment.

| 11 |

Risks associated with doing business in China

Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completed our auditors for three consecutive years beginning in 2021, or for two consecutive years if the Accelerating Holding Foreign Companies Accountable Act or the America COMPETES Act becomes law.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if the PCAOB determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On November 5, 2021, the SEC adopted the PCAOB rule to implement HFCA Act, which provides a framework for the PCAOB to determine whether it is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 16, 2021 the PCAOB issued its determinations (the “PCAOB Determination”) that they are unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong. The Determination includes lists of public accounting firms headquartered in mainland China and Hong Kong that the Board is unable to inspect or investigate completely. Our auditor is not currently on such lists.

On May 3, 2024, the Board approved the resignation of Zhen Hui as the Company’s independent registered public accounting firm with immediate effective. In the meantime, the Board approved the appointment of J & S Associate PLT (“J & S”) as the Company’s new independent registered public accounting firm for the fiscal year ending May 31, 2024 effective immediately.

Our current auditor, J & S, an independent registered public accounting firm that is headquartered in Malaysia, is a firm registered with the U.S. Public Company Accounting Oversight Board (the “PCAOB”). Although we believe that the Holding Foreign Companies Accountable Act and the related regulations do not currently affect us, we cannot assure you that there will not be any further implementations and interpretations of or amendments to the Holding Foreign Companies Accountable Act or the related regulations, which might pose regulatory risks to and impose restrictions on us because of our operations in mainland China. A potential consequence is that our securities are delisted by the exchange on which our securities are listed

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCAA. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

On December 16, 2021, the PCAOB announced the PCAOB Holding Foreign Companies Accountable Act determinations (the “PCAOB determinations”) relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong.

| 12 |

The lack of access to the PCAOB inspection or investigation in China prevents the PCAOB from fully evaluating audits and quality control procedures of the auditors based in China. As a result, the investors may be deprived of the benefits of such PCAOB inspections. The inability of the PCAOB to conduct inspections or investigation of auditors in China makes it more difficult to evaluate the effectiveness of these accounting firms’ audit procedures or quality control procedures as compared to auditors outside of China that are subject to the PCAOB inspections and investigation, which could cause existing and potential investors in our stock to lose confidence in our audit procedures and reported financial information and the quality of our financial statements.

China’s political climate and economic conditions, as well as changes in government policies, laws and regulations which may be quick with little advance notice, could have a material adverse effect on our business, financial condition and results of operations.

Our principal executive offices are located in China and our sole executive officer and director is a resident of and is physically located in and has significant ties to China. Our business, financial condition, results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in China. For example, as a result of recent proposed changes in the cybersecurity regulations in China that would require certain Chinese technology firms to undergo a cybersecurity review before being allowed to list on foreign exchanges, this may have the effect of further narrowing the list of potential businesses in China’s consumer, technology and mobility sectors that we intend to focus on for our business combination or the ability of the combined entity to list in the United States.

China’s economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past two to three decades, growth has been uneven, both geographically and among various sectors of the economy. Demand for target services and products depends, in large part, on economic conditions in China. Any slowdown in China’s economic growth may cause our potential customers to delay or cancel their plans to purchase our services and products, which in turn could reduce our net revenues.

Although China’s economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth through allocating resources, controlling the incurrence and payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Changes in any of these policies, laws and regulations may be quick with little advance notice and could adversely affect the economy in China and could have a material adverse effect on our business and the value of our common stock.

The PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation of financial and other resources. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce new measures that will have a negative effect on us, or more specifically, we cannot assure you that the PRC government will not initiate possible governmental actions or scrutiny to us, which could substantially affect our operation and the value of our common stock may depreciate quickly. China’s social and political conditions may change and become unstable. Any sudden changes to China’s political system or the occurrence of widespread social unrest could have a material adverse effect on our business and results of operations.

| 13 |

Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

On December 28, 2021, the CAC, NDRC, and several other agencies jointly issued the final version of the Revised Measures for Cybersecurity Review, or the Revised Cybersecurity Measures, which took effect on February 15, 2022 and replaced the previously issued Revised Measures for Cybersecurity Review. Under the Revised Cybersecurity Measures, an “online platform operator” in possession of personal data of more than one million users must apply for a cybersecurity review if it intends to list its securities on a foreign stock exchange. The operators of critical information infrastructure purchasing network products and services, and the online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. Pursuant to the Revised Cybersecurity Measures, we don’t believe we will be subject to the cybersecurity review by the CAC, given that (i) our online platform business just start up, we possess personal information of a very small number of users (less than 300 users) in our business operations as of the date of this report, significantly less than the one million user threshold set for a data processing operator applying for listing on a foreign exchange that is required to pass such cybersecurity review; and (ii) data processed in our business does not have a bearing on national security and thus shall not be classified as core or important data by the authorities. We don’t believe that we are an Operator within the meaning of the Revised Cybersecurity Measures, nor do we control more than one million users’ personal information, and as such, we should not be required to apply for a cybersecurity review under the Revised Cybersecurity Measures.

However, regulatory requirements on cybersecurity and data security in the PRC are constantly evolving and can be subject to varying interpretations or significant changes, which may result in uncertainties about the scope of our responsibilities in that regard.

Failure to comply with the Individual Foreign Exchange Rules relating to the overseas direct investment or the 13engagement in the issuance or trading of securities overseas by our PRC resident stockholders may subject such stockholders to fines or other liabilities.

Our ability to conduct foreign exchange activities in the PRC may be subject to the interpretation and enforcement of the Implementation Rules of the Administrative Measures for Individual Foreign Exchange promulgated by SAFE in January 2007 (as amended and supplemented, the “Individual Foreign Exchange Rules”). Under the Individual Foreign Exchange Rules, any PRC individual seeking to make a direct investment overseas or engage in the issuance or trading of negotiable securities or derivatives overseas must make the appropriate registrations in accordance with SAFE provisions. PRC individuals who fail to make such registrations may be subject to warnings, fines or other liabilities.

SAFE promulgated the Notice on Relevant Issues Relating to Domestic Resident’s Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or Notice 37, in July 2014 that requires PRC residents or entities to register with SAFE or its local branch in connection with their establishment or control of an offshore entity established for the purpose of overseas investment or financing. In addition, such PRC residents or entities must update their SAFE registrations when the offshore special purpose vehicle undergoes material events relating to material change of capitalization or structure of the PRC resident itself (such as capital increase, capital reduction, share transfer or exchange, merger or spin off).

We may not be fully informed of the identities of all our beneficial owners who are PRC residents. For example, because the investment in or trading of our shares will happen in an overseas public or secondary market where shares are often held with brokers in brokerage accounts, it is unlikely that we will know the identity of all of our beneficial owners who are PRC residents. Furthermore, we have no control over any of our future beneficial owners and we cannot assure you that such PRC residents will be able to complete the necessary approval and registration procedures required by the Individual Foreign Exchange Rules.

| 14 |

To our knowledge, our beneficial owners, who are PRC residents, have not completed the Notice 37 registration. And we cannot guarantee that all or any of the shareholders will complete the Notice 37 registration prior to the closing of this Offering. Failure by any such shareholders or beneficial owners to comply with Notice 37 could restrict our overseas or cross-border investment activities, limit our PRC subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects. In addition, the PRC resident shareholders who fail to complete Notice 37 registration may subject to fines less than RMB50,000.

As these foreign exchange and outbound investment related regulations are relatively new and their interpretation and implementation has been constantly evolving, it is unclear how these regulations, and any future regulation concerning offshore or cross-border investments and transactions, will be interpreted, amended and implemented by the relevant government authorities.

It is uncertain how the Individual Foreign Exchange Rules will be interpreted or enforced and whether such interpretation or enforcement will affect our ability to conduct foreign exchange transactions. Because of this uncertainty, we cannot be sure whether the failure by any of our PRC resident stockholders to make the required registration will subject our PRC subsidiaries to fines or legal sanctions on their operations, delay or restriction on repatriation of proceeds of our securities offerings into the PRC, restriction on remittance of dividends or other punitive actions that would have a material adverse effect on our business, results of operations and financial condition.

Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed an Enterprise Income Tax Law (the “EIT Law”) and implementing rules, both of which became effective on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation of China issued the Notice Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of de facto Management Bodies, or the Notice, further interpreting the application of the EIT Law and its implementation to offshore entities controlled by a Chinese enterprise or group. Pursuant to the Notice, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “non-domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate stamps, board and stockholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management are often resident in China. A resident enterprise would be subject to an enterprise income tax rate of 25% on its worldwide income and must pay a withholding tax at a rate of 10% when paying dividends to its non-PRC stockholders.

ECXJ does not have a PRC enterprise or enterprise group as its primary controlling shareholder and is therefore not a Chinese-controlled offshore incorporated enterprise within the meaning of the Notice, so we believe the Notice is not applicable to us. However, in the absence of guidance specifically applicable to us, we have applied the guidance set forth in the Notice to evaluate the tax residence status of ECXJ.

We do not believe that we meet some of the conditions outlined. As a holding company, the key assets and records of ECXJ including the resolutions and meeting minutes of our board of directors and the resolutions and meeting minutes of our shareholders, are located and maintained outside the PRC. In addition, we are not aware of any offshore holding companies with a corporate structure similar to ours that have been deemed a PRC “resident enterprise” by the PRC tax authorities. Accordingly, we believe that ECXJ should not be treated as a “resident enterprise” for PRC tax purposes if the criteria for “de facto management body” as set forth in the Notice were deemed applicable to us. However, as the tax residency status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body” as applicable to our offshore entities, we will continue to monitor our tax status.

| 15 |

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Currently, we do not have any non-China source income, so this would have minimal effect on us; however, if we develop non-China source income in the future, we could be adversely affected. Second, under the EIT Law and its implementing rules, dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income.” Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. If we were treated as a “resident enterprise” by the PRC tax authorities, we would be subject to taxation in both the U.S. and China, but our PRC source income will not be taxed in the U.S. again because the U.S.-China tax treaty will avoid double taxation between these two nations.

PRC regulation of loans and direct investment by offshore holding companies in PRC entities may delay or prevent us from using the proceeds of our securities offerings to make loans or additional capital contributions to our PRC operating subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

In the normal course of our business or in utilizing proceeds of any future securities offerings, we may make loans to our PRC subsidiaries or may make additional capital contributions to our PRC subsidiaries. Any loans to our PRC subsidiaries are subject to PRC regulations. For example, loans by us to our subsidiaries in China, which are FIEs, to finance their activities cannot exceed statutory limits and must be registered with the State Administration of Foreign Exchange, or SAFE. Currently, China is holding more open and tolerant attitude toward FIEs. More open rules and regulations are published in recent years to replace previous ones which are more restrictive. On March 30th, 2015, SAFE promulgated Circular 19 which is about Reforming the Management Approach regarding the Settlement of Foreign Exchange Capital of Foreign-invested Enterprises) and effective since June 1, 2015. Circular 19 has made some important changes in rules regarding the conversion of foreign exchanges to RMB, which are as follows in particular:

| (1) | Instead of the payment-based exchange settlement system under previous Circular 142 and Circular 88, new rules of discretional foreign exchange settlement have been established, which means the foreign exchange capital in the capital account of foreign-invested enterprises for which the confirmation of rights and interests of monetary contribution by the local foreign exchange bureau (or the book-entry registration of monetary contribution by the banks in accordance with Circular 13 as we mentioned in the comment below) has been handled can be settled at the banks based on the actual operational needs of the enterprises, and the proportion of foreign exchange which can be discretionally converted by each FIE is temporarily determined as 100% (SAFE may adjust such scale as necessary). So regulation wise FIEs no longer needs to report the use of its RMB before or after a conversion which are required by previous Circular 142 and Circular 88. However, actually SAFE and the banks are experiencing a transitional period in this regard, so for the time being, most banks still need the FIEs to report their proposed use of the RMB to be converted from foreign exchanges, as well as the actual use of the RMB obtained in the last conversion. Certainly, the transitional period will not be too long and therefore optimistically from the year of 2016, the report obligation will no longer be required. | |

| (2) | Foreign currency-denominated capital no longer needs to be verified by an accounting firm before converting into RMB. | |

| (3) | As stipulated in Circular 19, the use of capital by FIEs shall follow the principles of authenticity and self-use within the business scope of enterprises, shall not be used for the following purposes: |

| a) | it shall not be directly or indirectly used for the payment beyond the business scope of the enterprises or the payment prohibited by national laws and regulations; |

| 16 |

| b) | it shall not be directly or indirectly used for investment in securities unless otherwise provided by laws and regulations; | |

| c) | it shall not be directly or indirectly used for granting the entrust loans in RMB (unless permitted by the scope of business), repaying the inter-enterprise borrowings (including advances by the third party) or repaying the bank loans in Renminbi that have been sub-lent to the third party; and | |

| d) | it shall not be used for paying the expenses related to the purchase of real estate not for self-use, except for the foreign-invested real estate enterprises. |

On May 10, 2013, SAFE released Circular 21, which came into effect on May 13, 2013; also, on February 13, 2015 SAFE published Circular 13 (Circular of the State Administration of Foreign Exchange on Further Simplifying and Improving the Direct Investment-related Foreign Exchange Administration Policies) to update some measures stipulated in Circular 21. According to Circular 21, SAFE has significantly simplified the foreign exchange administration procedures with respect to the registration, account openings and conversions, settlements of FDI-related foreign exchange, as well as fund remittances. Meanwhile, Circular 13 has further simplified foreign exchange administration procedures, most important among which is that SAFE delegated foreign exchange registration to the banks, meanwhile the related registration approval by SAFE has been annulled.

Even with more and more open policy toward FDI and FIEs, the Circulars mentioned above may still have some limit our ability to convert, transfer and use the net proceeds from our securities offerings and any offering of additional equity securities in China, which may adversely affect our liquidity and our ability to fund and expand our business in the PRC.

We may also decide to finance our subsidiaries by means of capital contributions. These capital contributions must be approved by the Ministry of Commerce of China, or MOFCOM, or its local counterpart. We may not be able to obtain these government approvals on a timely basis, if at all, with respect to future capital contributions by us to our PRC subsidiaries. If we fail to receive such approvals, we will not be able to use the proceeds of our offerings and capitalize our PRC operations, which could adversely affect our liquidity and our ability to fund and expand our business.

PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to penalties and limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us, or otherwise adversely affect us.

The SAFE promulgated the Notice on Relevant Issues Relating to Domestic Resident’s Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or Notice 37, in July 2014 that requires PRC residents or entities to register with SAFE or its local branch in connection with their establishment or control of an offshore entity established for the purpose of overseas investment or financing. In addition, such PRC residents or entities must update their SAFE registrations when the offshore special purpose vehicle undergoes material events relating to material change of capitalization or structure of the PRC resident itself (such as capital increase, capital reduction, share transfer or exchange, merger or spin off). On October 16, 2015, nine of our shareholders who are Chinese residents completed the registration with SAFE under this Notice.

China’s M&A Rules and certain other PRC regulations establish complex procedures for some acquisitions of PRC companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, and some other regulations and rules concerning mergers and acquisitions established complex procedures and requirements for acquisition of Chinese companies by foreign investors, including requirements in some instances that the Ministry of Commerce of the PRC be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Moreover, the Anti-monopoly Law promulgated by the Standing Committee of the National People’s Congress requires that transactions which are deemed concentrations and involve parties with specified turnover thresholds must be cleared by the anti-monopoly enforcement agency before they can be completed. In addition, the Measures for the Security Review of Foreign Investment promulgated by the NDRC and the Ministry of Commerce in December 2020 specify that foreign investments in military, national defense-related areas or in locations in proximity to military facilities, or foreign investments that would result in acquiring the actual control of assets in certain key sectors, such as critical agricultural products, energy and resources, equipment manufacturing, infrastructure, transport, cultural products and services, information technology, Internet products and services, financial services and technology sectors, are required to obtain approval from designated governmental authorities in advance.

| 17 |

In the future, we and the VIEs may pursue potential strategic acquisitions that are complementary to our and the VIEs’ business and operations. Complying with the requirements of the above-mentioned regulations and other rules to complete such transactions could be time-consuming, and any required approval processes may delay or inhibit our and the VIEs’ ability to complete such transactions, which could affect our and the VIEs’ ability to expand business or maintain market share. Furthermore, according to the M&A Rules, if a PRC entity or individual plans to merger or acquire its related PRC entity through an overseas company legitimately incorporated or controlled by such entity or individual, such a merger and acquisition will be subject to examination and approval by the Ministry of Commerce. There is a possibility that the PRC regulators may promulgate new rules or explanations requiring that we and the VIEs obtain the approval of the Ministry of Commerce or other PRC governmental authorities for our and the VIEs’ completed or ongoing mergers and acquisitions. Any action by the PRC government to exert more oversight and control over foreign investment in China-based companies could result in a material change in our operation, cause the value of our ordinary shares to significantly decline or become worthless, and significantly limit, or completely hinder our ability to offer or continue to offer our ordinary shares to investors.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under our current corporate structure, our income will currently only be derived from dividend payments from our PRC subsidiaries. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our security-holders.

We and the VIEs face foreign exchange risk, and fluctuations in exchange rates could have an adverse effect on our and the VIEs’ business and investors’ investments.

Changes in the value of the RMB against the U.S. dollar, Euro and other foreign currencies are affected by, among other things, changes in China’s political and economic conditions. Any significant revaluation of the RMB may have a material adverse effect on our revenues and financial condition, and the value of, and any dividends payable on our shares in U.S. dollar terms. For example, to the extent that we need to convert U.S. dollars we receive from our securities offerings into RMB for our operations, appreciation of the RMB against the U.S. dollar would have an adverse effect on RMB amount we would receive from the conversion. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of paying dividends on our common stock or for other business purposes, appreciation of the U.S. dollar against the RMB would have a negative effect on the U.S. dollar amount available to us. In addition, fluctuations of the RMB against other currencies may increase or decrease the cost of imports and exports, and thus affect the price-competitiveness of our products against products of foreign manufacturers or products relying on foreign inputs.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

| 18 |

We reflect the impact of currency translation adjustments in our financial statements under the heading “accumulated other comprehensive income (loss).” For the years ended May 31, 2024 and 2023, we had foreign currency translation gain of $36,925 and $30,105 respectively. Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange gains and losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Payment of dividends is subject to restrictions under Nevada and the PRC laws.

Under Nevada law, we may only pay dividends subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities after the payment of such dividends. Our ability to pay dividends will therefore depend on our ability to generate adequate profits. In addition, because of a variety of rules applicable to our operations in the PRC and the regulations on foreign investments as well as the applicable tax law, we may be subject to further limitations on our ability to declare and pay dividends to our shareholders.

We can give no assurance that we will declare dividends of any amounts, at any rate or at all in the future. The declaration of future dividends, if any, will be at the discretion of our board of directors and will depend upon our future operations and earnings, capital requirements, general financial conditions, legal and contractual restrictions and other factors that our board of directors may deem relevant.

U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections of our and the VIEs’ operations in China.

The Securities and Exchange Commission, the U.S. Department of Justice, the PCAOB, and other U.S. authorities may also have difficulties in bringing and enforcing actions against us or our directors or executive officers in the PRC and Hong Kong. The SEC has stated that there are significant legal and other obstacles to obtaining information needed for investigations or litigation in China. China has adopted a revised securities law that became effective on March 1, 2020, Article 177 of which provides, among other things, that no overseas securities regulator is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. Accordingly, without governmental approval in China, no entity or individual in China may provide documents and information relating to securities business activities to overseas regulators when it is under direct investigation or evidence discovery conducted by overseas regulators, which could present significant legal and other obstacles to obtaining information needed for investigations and litigation conducted outside of China.

Additional factors outside of our control related to doing business in China could negatively affect our business.

Additional factors that could negatively affect our business include a potential significant revaluation of the Renminbi, which may result in an increase in the cost of commodity or products in the PRC supply chain industry, labor shortages and increases in labor costs in China as well as difficulties in moving products manufactured in China out of the country, whether due to infrastructure inadequacy, labor disputes, slowdowns, PRC regulations and/or other factors. Prolonged disputes or slowdowns can negatively impact both the time and cost of goods. Natural disasters or health pandemics impacting China can also have a significant negative impact on our business. Further, the imposition of trade sanctions or other regulations against products supplied or sold in the supply chain industry transactions for which we provide solutions or the loss of “normal trade relations” status with China could significantly affect our operating results and harm our business.

| 19 |

Introduction of new laws or changes to existing laws by the PRC government may adversely affect our and the VIEs’ business.

The PRC legal system is a codified legal system made up of written laws, regulations, circulars, administrative directives and internal guidelines. Unlike common law jurisdictions like the U.S., decided cases (which may be taken as reference) do not form part of the legal structure of the PRC and thus have no binding effect on subsequent cases with similar issues and fact patterns. Furthermore, in line with its transformation from a centrally planned economy to a relatively free market economy, the PRC government is still in the process of developing a comprehensive set of laws and regulations. As the legal system in the PRC is still evolving, laws and regulations or the interpretation of the same may be subject to further changes. For example, the PRC government may impose restrictions on the amount of service fees that may be payable by municipal governments to wastewater and sludge treatment service providers. Also, the PRC central and municipal governments may impose more stringent environmental regulations which would affect our ability to comply with, or our costs to comply with, such regulations. Such changes, if implemented, may adversely affect our and the VIEs’ business operations and may reduce our profitability.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the foreign corrupt practices act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We will have operations, agreements with third parties and make sales in the PRC, which may experience corruption. Our proposed activities in the PRC create the risk of unauthorized payments or offers of payments by one of the employees, consultants, or sales agents of our Company, because these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, or sales agents of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

It may be difficult to effect service of process upon us, our Directors or our executive officers that reside in the PRC or to enforce against them or us in the PRC any judgments obtained from non-PRC courts.

The legal framework to which our Company is subject is materially different from the Companies Ordinance or corporate law in the United States and other jurisdictions with respect to certain areas, including the protection of minority shareholders. In addition, the mechanisms for enforcement of rights under the corporate governance framework to which our Company is subject are also relatively undeveloped and untested. However, according to the PRC Company Law, shareholders may commence a derivative action against the directors, supervisors, officers or any third party on behalf of a company under certain circumstances.

On July 14, 2006, the Supreme People’s Court of the PRC and the Government of Hong Kong signed the Arrangement on Reciprocal Recognition and Enforcement of Judgments in Civil and Commercial Matters by the Courts of the Mainland and of the Hong Kong Special Administrative Region Pursuant to Choice of Court Agreements between Parties Concerned. Under such an arrangement, where any designated people’s court in the PRC or any designated Hong Kong court has made an enforceable final judgment requiring payment of money in a civil and commercial case pursuant to a choice of court agreement in writing by the parties, any party concerned may apply to the relevant people’s court in the PRC or Hong Kong court for recognition and enforcement of the judgment. Although this arrangement became effective on August 1, 2008, the outcome and effectiveness of any action brought under the arrangement may still be uncertain.

| 20 |

All of our senior management members reside in the PRC, and substantially all of our and the VIEs’ assets, and substantially all of the assets of those persons are located in the PRC. Therefore, it may be difficult for investors to effect service of process upon those persons inside the PRC or to enforce against us or them in the PRC any judgments obtained from non-PRC courts. The PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the Cayman Islands, the United States, the United Kingdom, Japan and many other developed countries. Therefore, recognition and enforcement in the PRC of judgments of a court in any of these jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or even impossible.

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct all of our business through our subsidiaries in China. Our operations in China are governed by PRC laws and regulations. Our PRC subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference but have limited precedential value.