UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23613

Pioneer Core Trust I

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: August 31, 2024

Date of reporting period: September 1, 2023 through February 29, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| (As a percentage of total investments)* | ||

| 1. | Golden State Tobacco Securitization Corp., Series A-1, 4.214%, 6/1/50 | 4.35% |

| 2. | Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B-2, 5.00%, 6/1/55 | 2.99 |

| 3. | Tobacco Settlement Financing Corp., Series B-1, 5.00%, 6/1/47 | 2.82 |

| 4. | TSASC, Inc., Series B, 5.00%, 6/1/48 | 2.42 |

| 5. | Dominion Water & Sanitation District, 5.875%, 12/1/52 | 2.34 |

| 6. | TSASC, Inc., Series B, 5.00%, 6/1/45 | 2.29 |

| 7. | City of Hammond, Custodial Receipts Cabelas Project, 7.50%, 2/1/29 (144A) | 2.18 |

| 8. | New York Counties Tobacco Trust IV, Settlement pass through, Series A, 5.00%, 6/1/45 | 2.07 |

| 9. | City of Oroville, Oroville Hospital, 5.25%, 4/1/49 | 1.92 |

| 10. | California Statewide Communities Development Authority, Loma Linda University Medical Center, 5.50%, 12/1/58 (144A) | 1.89 |

| (1) | ongoing costs, including management fees and other Portfolio expenses; and |

| (2) | transaction costs. |

| (1) | Divide your account value by

$1,000 Example: an $8,600 account value ÷ $1,000 = 8.6 |

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

| Beginning

Account Value on 9/1/23 |

$1,000.00 |

| Ending

Account Value (after expenses) on 2/29/24 |

$1,043.60 |

| Expenses

Paid During Period* |

$0.15 |

| * | Expenses are equal to the Portfolio’s annualized net expense ratio of 0.03% multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

| Beginning

Account Value on 9/1/23 |

$1,000.00 |

| Ending

Account Value (after expenses) on 2/29/24 |

$1,024.71 |

| Expenses

Paid During Period* |

$0.15 |

| * | Expenses are equal to the Portfolio’s annualized net expense ratio of 0.03% multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

| Principal

Amount USD ($) |

Value | |||||

| UNAFFILIATED ISSUERS — 97.1% | ||||||

| Municipal Bonds — 96.9% of Net Assets(a) | ||||||

| Alabama — 0.4% | ||||||

| 4,525,000 | Hoover Industrial Development Board, 5.75%, 10/1/49 | $ 4,665,999 | ||||

| Total Alabama | $ 4,665,999 | |||||

| Arizona — 2.0% | ||||||

| 1,725,000 | Arizona Industrial Development Authority, Doral Academy Nevada Fire Mesa, Series A, 5.00%, 7/15/39 | $ 1,733,401 | ||||

| 1,675,000 | Arizona Industrial Development Authority, Doral Academy Nevada Fire Mesa, Series A, 5.00%, 7/15/49 | 1,624,398 | ||||

| 125,000 | Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/27 (144A) | 121,434 | ||||

| 265,000 | Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/41 (144A) | 227,105 | ||||

| 1,115,000 | Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/51 (144A) | 880,549 | ||||

| 1,040,000 | Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/56 (144A) | 787,041 | ||||

| 12,490,000 | Industrial Development Authority of the City of Phoenix, 3rd & Indian School Assisted Living Project, 5.40%, 10/1/36 | 11,344,542 | ||||

| 1,000,000 | Industrial Development Authority of the County of Pima, Facility Desert Heights Charter, 7.00%, 5/1/34 | 1,005,030 | ||||

| 3,000,000 | Industrial Development Authority of the County of Pima, Facility Desert Heights Charter, 7.25%, 5/1/44 | 3,014,250 | ||||

| 1,810,000 | Tempe Industrial Development Authority, Series A, 6.125%, 10/1/47 (144A) | 1,105,240 | ||||

| 2,400,000 | Tempe Industrial Development Authority, Series A, 6.125%, 10/1/52 (144A) | 1,367,760 | ||||

| Total Arizona | $ 23,210,750 | |||||

| Principal

Amount USD ($) |

Value | |||||

| Arkansas — 2.2% | ||||||

| 13,000,000 | Arkansas Development Finance Authority, Big River Steel Project, 4.50%, 9/1/49 (144A) | $ 12,671,100 | ||||

| 12,500,000 | Arkansas Development Finance Authority, Green Bond, 5.45%, 9/1/52 | 12,673,625 | ||||

| Total Arkansas | $ 25,344,725 | |||||

| California — 16.1% | ||||||

| 1,755,000 | California County Tobacco Securitization Agency, 5.00%, 6/1/50 | $ 1,769,935 | ||||

| 60,000 | California County Tobacco Securitization Agency, Asset-Backed, Series A, 5.875%, 6/1/43 | 60,223 | ||||

| 1,370,000 | California County Tobacco Securitization Agency, Golden Gate Tobacco Settlement, Series A, 5.00%, 6/1/47 | 1,318,132 | ||||

| 185,000 | California Municipal Finance Authority, Series A, 5.00%, 12/1/36 (144A) | 190,998 | ||||

| 2,000,000 | California Municipal Finance Authority, Series A, 5.00%, 12/1/46 (144A) | 1,978,840 | ||||

| 2,000,000 | California Municipal Finance Authority, Series A, 5.00%, 12/1/54 (144A) | 1,966,560 | ||||

| 2,910,000 | California Municipal Finance Authority, Series B, 4.75%, 12/1/31 (144A) | 2,624,907 | ||||

| 6,115,000 | California Municipal Finance Authority, Series B, 5.25%, 12/1/36 (144A) | 5,393,919 | ||||

| 4,530,000 | California Municipal Finance Authority, Series B, 5.50%, 12/1/39 (144A) | 3,965,200 | ||||

| 2,000,000 | California Municipal Finance Authority, Baptist University, Series A, 5.00%, 11/1/46 (144A) | 1,976,320 | ||||

| 8,350,000 | California Municipal Finance Authority, Baptist University, Series A, 5.50%, 11/1/45 (144A) | 8,383,650 | ||||

| 250,000 | California Municipal Finance Authority, John Adams Academics Project, Series A, 5.00%, 10/1/35 | 252,165 | ||||

| 1,550,000 | California Municipal Finance Authority, John Adams Academics Project, Series A, 5.25%, 10/1/45 | 1,563,128 | ||||

| 500,000 | California Municipal Finance Authority, Santa Rosa Academy Project, 5.125%, 7/1/35 (144A) | 503,485 | ||||

| 1,575,000 | California Municipal Finance Authority, Santa Rosa Academy Project, 5.375%, 7/1/45 (144A) | 1,611,918 | ||||

| 280,000 | California School Finance Authority, Stem Preparatory Schools, Series A, 5.00%, 6/1/43 (144A) | 284,746 | ||||

| 500,000 | California School Finance Authority, Stem Preparatory Schools, Series A, 5.125%, 6/1/53 (144A) | 498,385 | ||||

| Principal

Amount USD ($) |

Value | |||||

| California — (continued) | ||||||

| 1,000,000 | California School Finance Authority, Stem Preparatory Schools, Series A, 5.375%, 5/1/63 (144A) | $ 1,001,990 | ||||

| 100,000 | California School Finance Authority, View Park Elementary & Middle School, Series A, 4.75%, 10/1/24 | 99,953 | ||||

| 830,000 | California School Finance Authority, View Park Elementary & Middle School, Series A, 5.625%, 10/1/34 | 832,648 | ||||

| 3,175,000 | California School Finance Authority, View Park Elementary & Middle School, Series A, 5.875%, 10/1/44 | 3,180,429 | ||||

| 1,000,000 | California School Finance Authority, View Park Elementary & Middle School, Series A, 6.00%, 10/1/49 | 1,001,410 | ||||

| 3,230,000 | California School Finance Authority, View Park High School, Series A, 7.125%, 10/1/48 (144A) | 3,240,724 | ||||

| 1,875,000 | California Statewide Communities Development Authority, Baptist University, Series A, 5.00%, 11/1/41 (144A) | 1,883,212 | ||||

| 1,560,000 | California Statewide Communities Development Authority, Baptist University, Series A, 6.125%, 11/1/33 (144A) | 1,562,075 | ||||

| 4,030,000 | California Statewide Communities Development Authority, Baptist University, Series A, 6.375%, 11/1/43 (144A) | 4,034,312 | ||||

| 5,475,000 | California Statewide Communities Development Authority, Loma Linda University Medical Center, 5.25%, 12/1/43 (144A) | 5,595,559 | ||||

| 20,760,000 | California Statewide Communities Development Authority, Loma Linda University Medical Center, 5.50%, 12/1/58 (144A) | 21,110,844 | ||||

| 11,320,000 | California Statewide Communities Development Authority, Loma Linda University Medical Center, Series A, 5.25%, 12/1/56 (144A) | 11,365,054 | ||||

| 700,000 | City of Oroville, Oroville Hospital, 5.25%, 4/1/34 | 443,184 | ||||

| 6,980,000 | City of Oroville, Oroville Hospital, 5.25%, 4/1/39 | 4,347,284 | ||||

| 34,720,000 | City of Oroville, Oroville Hospital, 5.25%, 4/1/49 | 21,493,763 | ||||

| 31,800,000 | City of Oroville, Oroville Hospital, 5.25%, 4/1/54 | 19,416,762 | ||||

| 64,000,000 | Golden State Tobacco Securitization Corp., Series A-1, 4.214%, 6/1/50 | 48,691,200 | ||||

| Principal

Amount USD ($) |

Value | |||||

| California — (continued) | ||||||

| 2,500,000(b) | Pittsburg Unified School District Financing Authority, Capital Appreciation General Obligation Pittsburg, 9/1/41 (AGM Insured) | $ 1,245,675 | ||||

| 1,925,000(b) | Pittsburg Unified School District Financing Authority, Capital Appreciation General Obligation Pittsburg, 9/1/42 (AGM Insured) | 900,477 | ||||

| Total California | $ 185,789,066 | |||||

| Colorado — 6.7% | ||||||

| 4,535,000(c) | 2000 Holly Metropolitan District, Series A, 5.00%, 12/1/50 | $ 4,128,165 | ||||

| 577,000(c) | 2000 Holly Metropolitan District, Series B, 7.50%, 12/15/50 | 546,182 | ||||

| 5,000,000 | Aerotropolis Regional Transportation Authority, 4.375%, 12/1/52 | 4,148,000 | ||||

| 1,735,000(c) | Belleview Village Metropolitan District, 4.95%, 12/1/50 | 1,523,087 | ||||

| 1,248,000(c) | Cottonwood Highlands Metropolitan District No. 1, Series A, 5.00%, 12/1/49 | 1,189,831 | ||||

| 2,090,000(c) | Cottonwood Highlands Metropolitan District No. 1, Series B, 8.75%, 12/15/49 | 2,122,040 | ||||

| 4,090,000(c) | Crystal Crossing Metropolitan District, 5.25%, 12/1/40 | 4,104,070 | ||||

| 26,000,000 | Dominion Water & Sanitation District, 5.875%, 12/1/52 | 26,114,400 | ||||

| 8,425,000(c) | Green Valley Ranch East Metropolitan District No. 6, Series A, 5.875%, 12/1/50 | 8,433,425 | ||||

| 15,270,000(c) | Larkridge Metropolitan District No. 2, 5.25%, 12/1/48 | 14,800,448 | ||||

| 1,000,000 | Rampart Range Metropolitan District No 5, 4.00%, 12/1/51 | 742,900 | ||||

| 1,000,000(c) | Ridgeline Vista Metropolitan District, Series A, 5.25%, 12/1/60 | 960,340 | ||||

| 2,000,000(c) | Settler's Crossing Metropolitan District No. 1, Series A, 5.00%, 12/1/40 (144A) | 1,929,920 | ||||

| 3,760,000(c) | Settler's Crossing Metropolitan District No. 1, Series A, 5.125%, 12/1/50 (144A) | 3,440,851 | ||||

| 597,000(c) | Settler's Crossing Metropolitan District No. 1, Series B, 7.625%, 12/15/50 | 569,317 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Colorado — (continued) | ||||||

| 1,232,000(c) | Villas Metropolitan District, Series A, 5.125%, 12/1/48 | $ 1,178,001 | ||||

| 755,000(c) | Willow Bend Metropolitan District, Series B, 7.625%, 12/15/49 | 713,218 | ||||

| Total Colorado | $ 76,644,195 | |||||

| Delaware — 0.2% | ||||||

| 2,250,000 | Delaware State Economic Development Authority, Aspira of Delaware Charter, 4.00%, 6/1/52 | $ 1,651,050 | ||||

| 1,380,000 | Delaware State Economic Development Authority, Aspira of Delaware Charter, 4.00%, 6/1/57 | 966,911 | ||||

| Total Delaware | $ 2,617,961 | |||||

| District of Columbia — 0.5% | ||||||

| 845,000 | District of Columbia, Inspired Teaching Demonstration Public Charter School, 5.00%, 7/1/32 | $ 882,653 | ||||

| 1,500,000 | District of Columbia, Inspired Teaching Demonstration Public Charter School, 5.00%, 7/1/42 | 1,550,805 | ||||

| 1,165,000 | District of Columbia, Inspired Teaching Demonstration Public Charter School, 5.00%, 7/1/47 | 1,173,341 | ||||

| 1,835,000 | District of Columbia, Inspired Teaching Demonstration Public Charter School, 5.00%, 7/1/52 | 1,839,716 | ||||

| 710,000 | District of Columbia Tobacco Settlement Financing Corp., Asset-Backed, 6.75%, 5/15/40 | 735,106 | ||||

| Total District of Columbia | $ 6,181,621 | |||||

| Florida — 2.1% | ||||||

| 500,000(d) | Capital Trust Agency, Inc., Series B, 5.00%, 7/1/43 | $ 40,000 | ||||

| 750,000(d) | Capital Trust Agency, Inc., Series B, 5.00%, 7/1/53 | 60,000 | ||||

| 500,000(d) | Capital Trust Agency, Inc., Series B, 5.25%, 7/1/48 | 40,000 | ||||

| 2,140,000 | Capital Trust Authority, Imagine School At West Pasco Project, Series A, 6.25%, 12/15/43 (144A) | 2,185,175 | ||||

| 2,100,000 | Capital Trust Authority, Imagine School At West Pasco Project, Series A, 6.50%, 12/15/58 (144A) | 2,136,498 | ||||

| 850,000 | County of Lake, 5.00%, 1/15/54 (144A) | 760,240 | ||||

| 170,000 | County of Lake, Imagine South Lake Charter School Project, 5.00%, 1/15/29 (144A) | 170,145 | ||||

| 1,250,000 | County of Lake, Imagine South Lake, Charter School Project, 5.00%, 1/15/39 (144A) | 1,213,375 | ||||

| 2,350,000 | County of Lake, Imagine South Lake, Charter School Project, 5.00%, 1/15/49 (144A) | 2,153,893 | ||||

| 300,000 | Florida Development Finance Corp., Glenridge On Palmer Ranch Project, 5.00%, 6/1/31 (144A) | 294,546 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Florida — (continued) | ||||||

| 13,475,000 | Florida Development Finance Corp., Glenridge On Palmer Ranch Project, 5.00%, 6/1/51 (144A) | $ 11,010,018 | ||||

| 225,000 | Florida Development Finance Corp., The Glenridge On Palmer Ranch Project, 5.00%, 6/1/35 (144A) | 213,885 | ||||

| 2,500,000 | Palm Beach County Health Facilities Authority, Toby & Leon Cooperman Sinai, 4.25%, 6/1/56 | 1,972,325 | ||||

| 2,000,000 | Village Community Development District No 15, 5.25%, 5/1/54 (144A) | 2,034,580 | ||||

| Total Florida | $ 24,284,680 | |||||

| Guam — 0.1% | ||||||

| 1,100,000 | Guam Economic Development & Commerce Authority, Asset-Backed, 5.625%, 6/1/47 | $ 1,096,722 | ||||

| Total Guam | $ 1,096,722 | |||||

| Illinois — 5.8% | ||||||

| 12,170,000(c) | Chicago Board of Education, Series A, 5.00%, 12/1/42 | $ 12,032,479 | ||||

| 1,000,000(c) | Chicago Board of Education, Series A, 7.00%, 12/1/46 (144A) | 1,080,760 | ||||

| 8,000,000(c) | Chicago Board of Education, Series B, 6.50%, 12/1/46 | 8,443,280 | ||||

| 1,415,000(c) | Chicago Board of Education, Series C, 5.25%, 12/1/39 | 1,401,190 | ||||

| 20,000,000(c) | Chicago Board of Education, Series D, 5.00%, 12/1/46 | 19,928,800 | ||||

| 4,050,000(d) | Illinois Finance Authority, Series A-2, 6.00%, 11/15/36 | 3,240,000 | ||||

| 1,591,212(b) | Illinois Finance Authority, Cabs Clare Oaks Project, Series B-1, 11/15/52 | 95,473 | ||||

| 2,520,597(d)(e) | Illinois Finance Authority, Clare Oaks Project, Series A-3, 4.00%, 11/15/52 | 1,638,388 | ||||

| 12,160,000 | Southwestern Illinois Development Authority, 5.00%, 6/1/53 | 11,789,971 | ||||

| 1,235,000 | Southwestern Illinois Development Authority, 8.00%, 6/1/53 | 1,228,084 | ||||

| 1,415,000(d) | Southwestern Illinois Development Authority, Village of Sauget Project, 5.625%, 11/1/26 | 1,061,250 | ||||

| 3,040,000 | Village of Lincolnwood, Series A, 4.82%, 1/1/41 (144A) | 2,830,453 | ||||

| 2,165,000 | Village of Matteson, 6.50%, 12/1/35 | 2,249,283 | ||||

| Total Illinois | $ 67,019,411 | |||||

| Principal

Amount USD ($) |

Value | |||||

| Indiana — 9.2% | ||||||

| 8,230,000 | City of Anderson, 5.375%, 1/1/40 (144A) | $ 7,155,162 | ||||

| 420,000 | City of Evansville, Silver Birch Evansville Project, 4.80%, 1/1/28 | 409,336 | ||||

| 6,475,000 | City of Evansville, Silver Birch Evansville Project, 5.45%, 1/1/38 | 5,839,544 | ||||

| 500,000 | City of Fort Wayne, 5.125%, 1/1/32 | 481,645 | ||||

| 4,665,000 | City of Fort Wayne, 5.35%, 1/1/38 | 4,315,871 | ||||

| 24,990,000 | City of Hammond, Custodial Receipts Cabelas Project, 7.50%, 2/1/29 (144A) | 24,366,000 | ||||

| 945,000 | City of Kokomo, Silver Birch of Kokomo, 5.75%, 1/1/34 | 955,376 | ||||

| 7,825,000 | City of Kokomo, Silver Birch of Kokomo, 5.875%, 1/1/37 | 7,819,679 | ||||

| 990,000 | City of Lafayette, Glasswater Creek Lafayette Project, 5.60%, 1/1/33 | 979,961 | ||||

| 6,000,000 | City of Lafayette, Glasswater Creek Lafayette Project, 5.80%, 1/1/37 | 5,733,120 | ||||

| 800,000 | City of Mishawaka, Silver Birch Mishawaka Project, 5.10%, 1/1/32 (144A) | 763,352 | ||||

| 5,890,000 | City of Mishawaka, Silver Birch Mishawaka Project, 5.375%, 1/1/38 (144A) | 5,122,415 | ||||

| 4,560,000 | City of Terre Haute, 5.35%, 1/1/38 | 3,894,924 | ||||

| 5,190,000 | Indiana Finance Authority, Multipurpose Educational Facilities, Avondale Meadows Academy Project, 5.125%, 7/1/37 | 5,242,108 | ||||

| 2,830,000 | Indiana Finance Authority, Multipurpose Educational Facilities, Avondale Meadows Academy Project, 5.375%, 7/1/47 | 2,760,750 | ||||

| 1,975,000 | Indiana Finance Authority, Sanders Glen Project, Series A, 4.25%, 7/1/43 | 1,508,169 | ||||

| 2,020,000 | Indiana Finance Authority, Sanders Glen Project, Series A, 4.50%, 7/1/53 | 1,346,754 | ||||

| 11,985,000 | Indiana Housing & Community Development Authority, Series A, 5.00%, 1/1/39 (144A) | 9,893,857 | ||||

| 8,260,000 | Indiana Housing & Community Development Authority, Evergreen Village Bloomington Project, 5.50%, 1/1/37 | 7,501,567 | ||||

| 10,170,000 | Town of Plainfield Multifamily Housing Revenue, 5.375%, 9/1/38 | 10,076,538 | ||||

| Total Indiana | $ 106,166,128 | |||||

| Kansas — 1.2% | ||||||

| 400,000 | Kansas Development Finance Authority, Series A, 5.25%, 11/15/33 | $ 363,808 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Kansas — (continued) | ||||||

| 15,405,000 | Kansas Development Finance Authority, Series A, 5.25%, 11/15/53 | $ 11,239,796 | ||||

| 2,500,000 | Kansas Development Finance Authority, Series A, 5.50%, 11/15/38 | 2,156,600 | ||||

| Total Kansas | $ 13,760,204 | |||||

| Massachusetts — 1.1% | ||||||

| 2,790,000 | Massachusetts Development Finance Agency, Series A, 5.00%, 7/1/44 | $ 2,748,875 | ||||

| 635,502(d) | Massachusetts Development Finance Agency, Adventcare Project, 7.625%, 10/15/37 | 64 | ||||

| 1,661,444(d) | Massachusetts Development Finance Agency, Adventcare Project, Series A, 6.75%, 10/15/37 (144A) | 166 | ||||

| 1,250,000 | Massachusetts Development Finance Agency, International Charter School, 5.00%, 4/15/40 | 1,262,713 | ||||

| 4,500,000 | Massachusetts Development Finance Agency, Linden Ponds, 5.125%, 11/15/46 (144A) | 4,603,455 | ||||

| 4,000,000 | Massachusetts Development Finance Agency, Lowell General Hospital, Series G, 5.00%, 7/1/44 | 3,934,000 | ||||

| Total Massachusetts | $ 12,549,273 | |||||

| Michigan — 2.7% | ||||||

| 8,490,000 | David Ellis Academy-West, 5.25%, 6/1/45 | $ 7,946,470 | ||||

| 1,250,000 | Flint Hospital Building Authority, Hurley Medical Center, Series A, 5.25%, 7/1/39 | 1,239,925 | ||||

| 5,485,000 | Flint International Academy, 5.75%, 10/1/37 | 5,485,000 | ||||

| 5,720,000 | Michigan Finance Authority, 5.75%, 4/1/40 | 5,954,349 | ||||

| 4,000,000(e) | Michigan Strategic Fund, Series B, 7.50%, 11/1/41 | 4,250,800 | ||||

| 7,100,000(e) | Michigan Strategic Fund, Michigan Department Offices Lease, Series B, 7.75%, 3/1/40 | 6,296,635 | ||||

| Total Michigan | $ 31,173,179 | |||||

| Minnesota — 2.5% | ||||||

| 1,310,000 | City of Bethel, 6.00%, 7/1/57 | $ 1,214,933 | ||||

| 4,210,000 | City of Bethel, Series A, 5.00%, 7/1/48 | 4,037,643 | ||||

| 1,000,000 | City of Bethel, Series A, 5.00%, 7/1/53 | 917,930 | ||||

| 2,440,000 | City of Brooklyn Park, Prairie Seeds Academy Project, Series A, 5.00%, 3/1/34 | 2,361,749 | ||||

| 2,000,000 | City of Brooklyn Park, Prairie Seeds Academy Project, Series A, 5.00%, 3/1/39 | 1,867,940 | ||||

| 3,515,000 | City of Deephaven, Eagle Ridge Academy Project, Series A, 5.00%, 7/1/55 | 3,614,685 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Minnesota — (continued) | ||||||

| 400,000 | City of Deephaven, Eagle Ridge Academy Project, Series A, 5.25%, 7/1/37 | $ 400,912 | ||||

| 1,500,000 | City of Deephaven, Eagle Ridge Academy Project, Series A, 5.50%, 7/1/50 | 1,502,055 | ||||

| 1,500,000(d) | City of Rochester, Rochester Math & Science Academy, Series A, 5.125%, 9/1/38 | 1,365,495 | ||||

| 3,145,000(d) | City of Rochester, Rochester Math & Science Academy, Series A, 5.25%, 9/1/43 | 2,652,430 | ||||

| 6,080,000(d) | City of Rochester, Rochester Math & Science Academy, Series A, 5.375%, 9/1/50 | 4,892,029 | ||||

| 2,000,000 | Housing & Redevelopment Authority of The City of St. Paul Minnesota, Great River School Project, Series A, 5.50%, 7/1/52 (144A) | 1,967,800 | ||||

| 1,300,000 | Housing & Redevelopment Authority of The City of St. Paul Minnesota, St. Paul City School Project, Series A, 5.00%, 7/1/36 | 1,366,495 | ||||

| Total Minnesota | $ 28,162,096 | |||||

| Missouri — 0.3% | ||||||

| 200,000 | Kansas City Industrial Development Authority, Series A, 4.25%, 4/1/26 (144A) | $ 197,298 | ||||

| 1,000,000 | Kansas City Industrial Development Authority, Series A, 5.00%, 4/1/36 (144A) | 957,260 | ||||

| 2,300,000 | Kansas City Industrial Development Authority, Series A, 5.00%, 4/1/46 (144A) | 2,082,880 | ||||

| Total Missouri | $ 3,237,438 | |||||

| Nevada — 0.1% | ||||||

| 1,125,000 | City of Las Vegas Special Improvement District No 611, Sunstone Phase I and II, 4.125%, 6/1/50 | $ 944,696 | ||||

| Total Nevada | $ 944,696 | |||||

| New Jersey — 1.0% | ||||||

| 1,255,000 | New Jersey Economic Development Authority, Series A, 5.25%, 10/1/38 (144A) | $ 1,209,506 | ||||

| 1,215,000 | New Jersey Economic Development Authority, Charter Hatikvah International Academy, Series A, 5.25%, 7/1/37 (144A) | 1,159,402 | ||||

| Principal

Amount USD ($) |

Value | |||||

| New Jersey — (continued) | ||||||

| 2,500,000 | New Jersey Economic Development Authority, Charter Hatikvah International Academy, Series A, 5.375%, 7/1/47 (144A) | $ 2,319,575 | ||||

| 7,205,000 | New Jersey Economic Development Authority, Marion P. Thomas Charter School, Inc., Project, Series A, 5.375%, 10/1/50 (144A) | 6,665,345 | ||||

| Total New Jersey | $ 11,353,828 | |||||

| New Mexico — 1.5% | ||||||

| 16,135,000(e) | County of Otero, Otero County Jail Project, Certificate Participation, 9.00%, 4/1/28 | $ 15,408,925 | ||||

| 1,750,000 | Lower Petroglyphs Public Improvement District, 5.00%, 10/1/48 | 1,638,665 | ||||

| Total New Mexico | $ 17,047,590 | |||||

| New York — 17.0% | ||||||

| 375,000(d) | Buffalo & Erie County Industrial Land Development Corp., 5.00%, 10/1/28 (144A) | $ 165,000 | ||||

| 4,150,000(d) | Buffalo & Erie County Industrial Land Development Corp., 5.00%, 10/1/38 (144A) | 1,826,000 | ||||

| 6,175,000 | Chautauqua Tobacco Asset Securitization Corp., 5.00%, 6/1/48 | 5,944,611 | ||||

| 9,250,000 | Dutchess County Local Development Corp., Health Quest Systems Inc., Series B, 5.00%, 7/1/46 | 9,086,275 | ||||

| 10,000,000(d) | Erie County Industrial Development Agency, Galvstar LLC Project, Series A, 9.25%, 10/1/30 | 1,250,000 | ||||

| 8,000,000(d) | Erie County Industrial Development Agency, Galvstar LLC Project, Series B, 9.25%, 10/1/30 | 1,890,000 | ||||

| 1,795,000(d) | Erie County Industrial Development Agency, Galvstar LLC Project, Series C, 9.25%, 10/1/30 | 424,069 | ||||

| 8,755,000 | Erie Tobacco Asset Securitization Corp., Asset-Backed, Series A, 5.00%, 6/1/45 | 8,436,318 | ||||

| 22,015,000 | Nassau County Tobacco Settlement Corp., Asset-Backed, Series A-3, 5.00%, 6/1/35 | 20,862,074 | ||||

| 15,020,000 | Nassau County Tobacco Settlement Corp., Asset-Backed, Series A-3, 5.125%, 6/1/46 | 14,227,695 | ||||

| 14,700,000 | New York Counties Tobacco Trust IV, Series A, 5.00%, 6/1/42 | 14,222,250 | ||||

| 5,700,000 | New York Counties Tobacco Trust IV, Series A, 6.25%, 6/1/41 (144A) | 5,700,228 | ||||

| 24,455,000 | New York Counties Tobacco Trust IV, Settlement pass through, Series A, 5.00%, 6/1/45 | 23,142,011 | ||||

| Principal

Amount USD ($) |

Value | |||||

| New York — (continued) | ||||||

| 51,600,000(b) | New York Counties Tobacco Trust V, Capital Appreciation Pass Through, Series 4A, 6/1/60 (144A) | $ 2,717,772 | ||||

| 7,440,000 | New York Counties Tobacco Trust VI, Series A-2B, 5.00%, 6/1/45 | 7,149,096 | ||||

| 11,745,000 | New York Counties Tobacco Trust VI, Settlement pass through, Series 2B, 5.00%, 6/1/51 | 11,180,888 | ||||

| 2,625,000 | Riverhead Industrial Development Agency, 7.65%, 8/1/34 | 2,626,628 | ||||

| 26,890,000 | TSASC, Inc., Series B, 5.00%, 6/1/45 | 25,616,758 | ||||

| 29,980,000 | TSASC, Inc., Series B, 5.00%, 6/1/48 | 27,031,467 | ||||

| 9,000,000 | Westchester County Local Development Corp., Purchase Senior Learning Community, 4.50%, 7/1/56 (144A) | 7,475,130 | ||||

| 5,000,000 | Westchester County Local Development Corp., Purchase Senior Learning Community, Inc. Project, 5.00%, 7/1/36 (144A) | 5,159,200 | ||||

| Total New York | $ 196,133,470 | |||||

| Ohio — 3.4% | ||||||

| 35,100,000 | Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B-2, 5.00%, 6/1/55 | $ 33,405,372 | ||||

| 980,000 | Ohio Housing Finance Agency, Sanctuary Springboro Project, 5.125%, 1/1/32 (144A) | 846,838 | ||||

| 5,275,000 | Ohio Housing Finance Agency, Sanctuary Springboro Project, 5.45%, 1/1/38 (144A) | 4,428,890 | ||||

| Total Ohio | $ 38,681,100 | |||||

| Pennsylvania — 5.9% | ||||||

| 1,000,000 | Chester County Industrial Development Authority, Collegium Charter School, Series A, 5.125%, 10/15/37 | $ 964,890 | ||||

| 2,535,000 | Chester County Industrial Development Authority, Collegium Charter School, Series A, 5.25%, 10/15/47 | 2,335,724 | ||||

| 8,465,000 | Delaware County Industrial Development Authority, Chester Charter School Arts Project, Series A, 5.125%, 6/1/46 (144A) | 7,920,447 | ||||

| 1,205,000 | Philadelphia Authority for Industrial Development, 5.00%, 4/15/32 (144A) | 1,231,691 | ||||

| 2,290,000 | Philadelphia Authority for Industrial Development, 5.00%, 4/15/42 (144A) | 2,256,268 | ||||

| 3,335,000 | Philadelphia Authority for Industrial Development, 5.00%, 4/15/52 (144A) | 3,054,993 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Pennsylvania — (continued) | ||||||

| 1,660,000 | Philadelphia Authority for Industrial Development, 5.125%, 6/1/38 (144A) | $ 1,708,671 | ||||

| 6,045,000(e) | Philadelphia Authority for Industrial Development, 5.125%, 12/15/44 (144A) | 5,616,349 | ||||

| 3,500,000 | Philadelphia Authority for Industrial Development, 5.25%, 6/1/48 (144A) | 3,540,845 | ||||

| 4,370,000 | Philadelphia Authority for Industrial Development, 5.375%, 6/1/53 (144A) | 4,394,341 | ||||

| 9,435,000 | Philadelphia Authority for Industrial Development, 5.50%, 6/1/49 (144A) | 8,880,033 | ||||

| 900,000 | Philadelphia Authority for Industrial Development, Series A, 5.00%, 11/15/31 | 899,568 | ||||

| 4,055,000 | Philadelphia Authority for Industrial Development, 2800 American Street Co. Project, Series A, 5.625%, 7/1/48 (144A) | 4,090,846 | ||||

| 8,295,000 | Philadelphia Authority for Industrial Development, Global Leadership Academy Charter School Project, Series A, 5.00%, 11/15/50 | 7,508,800 | ||||

| 2,200,000 | Philadelphia Authority for Industrial Development, Greater Philadelphia Health Action, Inc. Project, Series A, 6.50%, 6/1/45 | 2,150,786 | ||||

| 2,940,000 | Philadelphia Authority for Industrial Development, Greater Philadelphia Health Action, Inc., Project, Series A, 6.625%, 6/1/50 | 2,880,847 | ||||

| 255,000 | Philadelphia Authority for Industrial Development, Green Woods Charter School, Series A, 5.00%, 6/15/32 | 256,599 | ||||

| 1,045,000 | Philadelphia Authority for Industrial Development, Green Woods Charter School, Series A, 5.125%, 6/15/42 | 1,024,748 | ||||

| 970,000 | Philadelphia Authority for Industrial Development, Green Woods Charter School, Series A, 5.25%, 6/15/52 | 915,680 | ||||

| 1,020,000 | Philadelphia Authority for Industrial Development, Green Woods Charter School, Series A, 5.375%, 6/15/57 | 963,523 | ||||

| 2,000,000 | Philadelphia Authority for Industrial Development, Tacony Academy Charter school Project, 5.00%, 6/15/33 (144A) | 2,025,320 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Pennsylvania — (continued) | ||||||

| 1,500,000 | Philadelphia Authority for Industrial Development, Tacony Academy Charter school Project, 5.375%, 6/15/38 (144A) | $ 1,527,360 | ||||

| 1,750,000 | Philadelphia Authority for Industrial Development, Tacony Academy Charter school Project, 5.50%, 6/15/43 (144A) | 1,767,482 | ||||

| Total Pennsylvania | $ 67,915,811 | |||||

| Puerto Rico — 1.7% | ||||||

| 10,689,000(c) | Commonwealth of Puerto Rico, Restructured Series A1, 4.00%, 7/1/46 | $ 9,591,988 | ||||

| 6,685,000 | Puerto Rico Electric Power Authority, Series AAA, 5.25%, 7/1/21 | 1,871,800 | ||||

| 3,535,000 | Puerto Rico Electric Power Authority, Series CCC, 4.80%, 7/1/28 | 989,800 | ||||

| 1,285,000 | Puerto Rico Electric Power Authority, Series CCC, 5.00%, 7/1/24 | 359,800 | ||||

| 3,735,000 | Puerto Rico Electric Power Authority, Series DDD, 5.00%, 7/1/23 | 1,045,800 | ||||

| 3,315,000 | Puerto Rico Electric Power Authority, Series TT, 5.00%, 7/1/21 | 928,200 | ||||

| 1,000,000 | Puerto Rico Electric Power Authority, Series WW, 5.00%, 7/1/28 | 280,000 | ||||

| 1,130,000 | Puerto Rico Electric Power Authority, Series ZZ, 4.75%, 7/1/27 | 316,400 | ||||

| 4,000,000 | Puerto Rico Highway & Transportation Authority, Series A, 5.85%, 3/1/27 | 3,950,800 | ||||

| 665,000 | Puerto Rico Industrial Tourist Educational Medical & Environmental Control Facilities Financing Authority, Series A, 5.20%, 7/1/24 | 669,276 | ||||

| Total Puerto Rico | $ 20,003,864 | |||||

| Rhode Island — 0.1% | ||||||

| 2,065,000(d) | Central Falls Detention Facility Corp., 7.25%, 7/15/35 | $ 826,000 | ||||

| Total Rhode Island | $ 826,000 | |||||

| Tennessee — 0.1% | ||||||

| 1,095,000 | Metropolitan Government Nashville & Davidson County Industrial Development Board, 4.00%, 6/1/51 (144A) | $ 917,938 | ||||

| Total Tennessee | $ 917,938 | |||||

| Texas — 4.3% | ||||||

| 325,000 | Arlington Higher Education Finance Corp., 3.50%, 3/1/24 (144A) | $ 325,000 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Texas — (continued) | ||||||

| 16,875,000 | Arlington Higher Education Finance Corp., 5.45%, 3/1/49 (144A) | $ 17,764,819 | ||||

| 100,000 | Arlington Higher Education Finance Corp., Series A, 5.875%, 3/1/24 | 100,000 | ||||

| 525,000 | Arlington Higher Education Finance Corp., Series A, 6.625%, 3/1/29 | 526,186 | ||||

| 375,000 | Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.00%, 3/1/34 | 375,656 | ||||

| 7,030,000 | Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.125%, 3/1/44 | 7,031,195 | ||||

| 160,000 | City of Celina, 5.50%, 9/1/24 | 160,466 | ||||

| 16,755,000(d)(e) | Greater Texas Cultural Education Facilities Finance Corp., 8.00%, 2/1/50 (144A) | 10,220,550 | ||||

| 3,335,000(d)(e) | Greater Texas Cultural Education Facilities Finance Corp., Series B, 8.00%, 2/1/33 (144A) | 2,034,350 | ||||

| 1,250,000(d) | New Hope Cultural Education Facilities Finance Corp., Village On The Park, Series C, 5.50%, 7/1/46 | 250,000 | ||||

| 1,000,000(d) | New Hope Cultural Education Facilities Finance Corp., Village On The Park, Series C, 5.75%, 7/1/51 | 200,000 | ||||

| 75,000(d) | New Hope Cultural Education Facilities Finance Corp., Village On The Park, Series D, 6.00%, 7/1/26 | 7,500 | ||||

| 1,350,000(d) | New Hope Cultural Education Facilities Finance Corp., Village On The Park, Series D, 7.00%, 7/1/51 | 135,000 | ||||

| 17,350,000(d) | Sanger Industrial Development Corp., Texas Pellets Project, Series B, 8.00%, 7/1/38 | 4,272,437 | ||||

| 8,142,447(d) | Tarrant County Cultural Education Facilities Finance Corp., Series A, 5.75%, 12/1/54 | 5,292,591 | ||||

| 1,000,000(e) | Texas Midwest Public Facility Corp., Secure Treatment Facility Project, Restructured, 0.01%, 12/1/30 | 687,540 | ||||

| Total Texas | $ 49,383,290 | |||||

| Virginia — 4.9% | ||||||

| 17,925,000 | Tobacco Settlement Financing Corp., Series A-1, 6.706%, 6/1/46 | $ 15,456,010 | ||||

| 33,495,000 | Tobacco Settlement Financing Corp., Series B-1, 5.00%, 6/1/47 | 31,487,980 | ||||

| 5,905,000(e) | Tobacco Settlement Financing Corp., Series B-2, 5.20%, 6/1/46 | 5,904,941 | ||||

| 14,000,000(b) | Tobacco Settlement Financing Corp., Series D, 6/1/47 | 3,719,520 | ||||

| Total Virginia | $ 56,568,451 | |||||

| Principal

Amount USD ($) |

Value | |||||

| Wisconsin — 3.8% | ||||||

| 2,500,000 | Public Finance Authority, American Preparatory Academy - Las Vegas Project, Series A, 5.125%, 7/15/37 (144A) | $ 2,521,750 | ||||

| 1,550,000 | Public Finance Authority, Community School of Davidson Project, 5.00%, 10/1/33 | 1,567,499 | ||||

| 5,905,000 | Public Finance Authority, Community School of Davidson Project, 5.00%, 10/1/48 | 5,650,613 | ||||

| 1,590,000 | Public Finance Authority, Coral Academy Science Las Vegas, Series A, 5.625%, 7/1/44 | 1,600,351 | ||||

| 370,000 | Public Finance Authority, Coral Academy Science Reno, 5.00%, 6/1/29 (144A) | 368,786 | ||||

| 1,710,000 | Public Finance Authority, Coral Academy Science Reno, 5.00%, 6/1/39 (144A) | 1,640,916 | ||||

| 2,660,000 | Public Finance Authority, Coral Academy Science Reno, 5.00%, 6/1/50 (144A) | 2,371,975 | ||||

| 400,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 4.00%, 6/1/36 (144A) | 362,604 | ||||

| 700,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 4.00%, 6/1/51 (144A) | 511,959 | ||||

| 2,280,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 4.00%, 6/1/61 (144A) | 1,574,454 | ||||

| 335,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 5.375%, 6/1/37 (144A) | 334,608 | ||||

| 900,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 5.875%, 6/1/52 (144A) | 895,005 | ||||

| 1,565,000 | Public Finance Authority, Coral Academy Science Reno, Series A, 6.00%, 6/1/62 (144A) | 1,560,994 | ||||

| 9,310,000 | Public Finance Authority, Gardner Webb University, 5.00%, 7/1/31 (144A) | 9,769,355 | ||||

| 225,000 | Public Finance Authority, Lead Academy Project, Series A, 4.25%, 8/1/26 (144A) | 223,175 | ||||

| 2,000,000 | Public Finance Authority, Lead Academy Project, Series A, 5.00%, 8/1/36 (144A) | 2,061,300 | ||||

| 2,500,000 | Public Finance Authority, Lead Academy Project, Series A, 5.125%, 8/1/46 (144A) | 2,540,050 | ||||

| 230,000 | Public Finance Authority, Quality Education Academy Project, Series A, 5.25%, 7/15/33 (144A) | 232,815 | ||||

| 690,000 | Public Finance Authority, Quality Education Academy Project, Series A, 6.00%, 7/15/43 (144A) | 704,318 | ||||

| 640,000 | Public Finance Authority, Quality Education Academy Project, Series A, 6.25%, 7/15/53 (144A) | 649,376 | ||||

| 1,175,000 | Public Finance Authority, Quality Education Academy Project, Series A, 6.50%, 7/15/63 (144A) | 1,198,888 | ||||

| Principal

Amount USD ($) |

Value | |||||

| Wisconsin — (continued) | ||||||

| 2,000,000 | Public Finance Authority, SearStone CCRC Project, 4.00%, 6/1/41 (144A) | $ 1,584,960 | ||||

| 1,500,000 | Public Finance Authority, SearStone CCRC Project, Series A, 5.00%, 6/1/37 (144A) | 1,435,800 | ||||

| 2,500,000 | Public Finance Authority, SearStone CCRC Project, Series A, 5.00%, 6/1/52 (144A) | 2,075,150 | ||||

| 10,640,000(b)(d) + | Public Finance Authority, Springshire Pre-Development Project, 12/1/20 (144A) | — | ||||

| Total Wisconsin | $ 43,436,701 | |||||

| Total

Municipal Bonds (Cost $1,248,176,327) |

$1,115,116,187 | |||||

| Debtors in

Possession Financing — 0.2% of Net Assets# |

||||||

| Retirement Housing — 0.2% | ||||||

| 9,000,000(d) + | Springshire Retirement LLC - Promissory Note, 9.00%, 12/31/24 | $ 2,970,000 | ||||

| 40,576 + | The Oaks at Bartlett - Promissory Note, 14.00%, 12/1/24 | 40,576 | ||||

| Total Retirement Housing | $ 3,010,576 | |||||

| TOTAL

DEBTORS IN POSSESSION FINANCING (Cost $9,040,576) |

$ 3,010,576 | |||||

| TOTAL

INVESTMENTS IN UNAFFILIATED ISSUERS — 97.1% (Cost $1,257,216,903) |

$1,118,126,763 | |||||

| OTHER ASSETS AND LIABILITIES — 2.9% | $ 32,941,819 | |||||

| net assets — 100.0% | $ 1,151,068,582 | |||||

| AGM | Assured Guaranty Municipal Corp. |

| (144A) | The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At February 29, 2024, the value of these securities amounted to $338,465,338, or 29.4% of net assets. |

| (a) | Consists of Revenue Bonds unless otherwise indicated. |

| (b) | Security issued with a zero coupon. Income is recognized through accretion of discount. |

| (c) | Represents a General Obligation Bond. |

| (d) | Security is in default. |

| (e) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at February 29, 2024. |

| + | Security is valued using significant unobservable inputs (Level 3). |

| # | Securities are restricted as to resale. |

| Restricted Securities | Acquisition date | Cost | Value |

| Springshire Retirement LLC - Promissory Note | 12/1/2021 | $9,000,000 | $2,970,000 |

| The Oaks at Bartlett - Promissory Note | 2/6/2024 | 40,576 | 40,576 |

| Total Restricted Securities | $3,010,576 | ||

| % of Net assets | 0.2% |

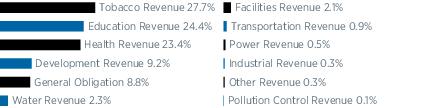

| Revenue Bonds: | |

| Tobacco Revenue | 27.7% |

| Education Revenue | 24.4 |

| Health Revenue | 23.4 |

| Development Revenue | 9.2 |

| Water Revenue | 2.3 |

| Facilities Revenue | 2.1 |

| Transportation Revenue | 0.9 |

| Power Revenue | 0.5 |

| Industrial Revenue | 0.3 |

| Other Revenue | 0.3 |

| Pollution Control Revenue | 0.1 |

| 91.2% | |

| General Obligation Bonds: | 8.8% |

| 100.0% |

| Level 1 | – | unadjusted quoted prices in active markets for identical securities. |

| Level 2 | – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| Level 3 | – | significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments). |

| Level 1 | Level 2 | Level 3 | Total | |

| Municipal Bonds | $— | $1,115,116,187 | $ —* | $1,115,116,187 |

| Debtors in Possession Financing | — | — | 3,010,576 | 3,010,576 |

| Total Investments in Securities | $ — | $ 1,115,116,187 | $ 3,010,576 | $ 1,118,126,763 |

| * | Securities valued at $0. |

| ASSETS: | |

| Investments in unaffiliated issuers, at value (cost $1,257,216,903) | $1,118,126,763 |

| Cash | 11,781,064 |

| Receivables — | |

| Proceeds from contributions | 1,337,998 |

| Interest | 21,325,061 |

| Other assets | 322,149 |

| Total assets | $ 1,152,893,035 |

| LIABILITIES: | |

| Payables — | |

| Value of withdrawals | $ 1,709,272 |

| Trustees’ fees | 12,053 |

| Administrative expenses | 29,931 |

| Accrued expenses | 73,197 |

| Total liabilities | $ 1,824,453 |

| NET ASSETS: | |

| Paid-in capital | $1,164,332,127 |

| Distributable earnings (loss) | (13,263,545) |

| Net assets | $ 1,151,068,582 |

| INVESTMENT INCOME: | ||

| Interest from unaffiliated issuers | $33,473,419 | |

| Total Investment Income | $33,473,419 | |

| EXPENSES: | ||

| Administrative expenses | $ 31,367 | |

| Custodian fees | 5,420 | |

| Professional fees | 64,772 | |

| Printing expense | 12,775 | |

| Officers’ and Trustees’ fees | 35,109 | |

| Insurance expense | 10,649 | |

| Miscellaneous | 584 | |

| Total expenses | $ 160,676 | |

| Net investment income | $33,312,743 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | ||

| Net realized gain (loss) on: | ||

| Reimbursement by the Adviser | $ 56,738 | |

| Investments in unaffiliated issuers | (9,338,325) | $ (9,281,587) |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investments in unaffiliated issuers | $25,858,710 | |

| Net realized and unrealized gain (loss) on investments | $16,577,123 | |

| Net increase in net assets resulting from operations | $49,889,866 |

| Six

Months Ended 2/29/24 (unaudited) |

Year

Ended 8/31/23 | |

| FROM OPERATIONS: | ||

| Net investment income (loss) | $ 33,312,743 | $ 77,181,556 |

| Net realized gain (loss) on investments | (9,281,587) | (71,900,401) |

| Change in net unrealized appreciation (depreciation) on investments | 25,858,710 | (49,144,124) |

| Net increase (decrease) in net assets resulting from operations | $ 49,889,866 | $ (43,862,969) |

| FROM CAPITAL TRANSACTIONS: | ||

| Proceeds from contributions | $ 153,475,852 | $ 514,947,243 |

| Value of withdrawals | (365,086,822) | (777,581,636) |

| Net decrease in net assets resulting from capital transactions | $ (211,610,970) | $ (262,634,393) |

| Net decrease in net assets | $ (161,721,104) | $ (306,497,362) |

| NET ASSETS: | ||

| Beginning of period | $1,312,789,686 | $1,619,287,048 |

| End of period | $ 1,151,068,582 | $1,312,789,686 |

| Six

Months Ended 2/29/24 (unaudited) |

Year

Ended 8/31/23 |

Year

Ended 8/31/22 |

12/21/20

to 8/31/21* | |

| Total return | 4.36%(a)(b) | (2.71)% | (9.34)% | 6.30%(b) |

| Ratio of net expenses to average net assets | 0.03%(c) | 0.02% | 0.02% | 0.02%(c) |

| Ratio of net investment income (loss) to average net assets | 5.56%(c) | 5.35% | 4.47% | 3.07%(c) |

| Portfolio turnover rate | 3%(b) | 37% | 38% | 11%(b)(d) |

| Net assets, end of period (in thousands) | $1,151,069 | $1,312,790 | $1,619,287 | $2,054,850 |

| * | The Portfolio commenced operations on December 21, 2020. |

| (a) | For the six months ended February 29, 2024, the Portfolio’s total return includes a reimbursement by the Adviser (see Notes to the Financial Statements — Note 1B). The impact on the total return was less than 0.005%. |

| (b) | Not annualized. |

| (c) | Annualized. |

| (d) | The portfolio turnover rate excludes purchases and sales from the transfer of assets from Pioneer High Income Municipal Fund (see Note 1). |

| A. | Security Valuation |

| Investments are stated at value, computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. | |

| Fixed-income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed-income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers. | |

| Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Portfolio pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities. | |

| Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Portfolio’s net asset value. Examples of a significant event might include political or economic |

| news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Portfolio’s securities may differ significantly from exchange prices, and such differences could be material. | |

| B. | Investment Income and Transactions |

| Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. | |

| Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. | |

| Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. | |

| During the six months ended February 29, 2024, the Portfolio realized a loss of $56,738 due to an operational error. The Adviser voluntarily reimbursed the Portfolio for this loss, which is reflected on the Statement of Operations as Reimbursement by the Adviser. | |

| The Portfolio makes a daily allocation of its net investment income and realized and unrealized gains and losses from securities to its investors in proportion to their investment in the Portfolio. | |

| C. | Federal Income Taxes |

| The Portfolio is classified as a partnership for federal income tax purposes. As such, each investor in the Portfolio is treated as the owner of its proportionate share of the net assets, income, expenses and realized and unrealized gains and losses of the Portfolio. Therefore, no federal income tax provision is required. It is intended that the Portfolio’s assets will be managed so an investor in the Portfolio can satisfy the requirements of Subchapter M of the Internal Revenue Code. | |

| Management has analyzed the Portfolio’s tax positions taken on income tax returns for all open tax years and has concluded no provision for income tax is required in the Portfolio’s financial statements. The Portfolio’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. |

| D. | Risks |

| The value of securities held by the Portfolio may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, the spread of infectious illness or other public health issues, inflation, changes in interest rates, armed conflict such as between Russia and Ukraine or in the Middle East, sanctions against Russia, other nations or individuals or companies and possible countermeasures, lack of liquidity in the bond markets or adverse investor sentiment. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. Inflation and interest rates have increased and may rise further. These circumstances could adversely affect the value and liquidity of the Portfolio’s investments and negatively impact the Portfolio’s performance. | |

| The long-term impact of the COVID-19 pandemic and its subsequent variants on economies, markets, industries and individual issuers, are not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets, reduced liquidity of many instruments, increased government debt, inflation, and disruptions to supply chains, consumer demand and employee availability, may continue for some time. Following Russia’s invasion of Ukraine, Russian securities lost all, or nearly all, their market value. Other securities or markets could be similarly affected by past or future political, geopolitical or other events or conditions. | |

| Governments and central banks, including the U.S. Federal Reserve, have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. These actions have resulted in significant expansion of public debt, including in the U.S. The consequences of high public debt, including its future impact on the economy and securities markets, may not be known for some time. | |

| The U.S. and other countries are periodically involved in disputes over trade and other matters, which may result in tariffs, investment restrictions and adverse impacts on affected companies and securities. For example, the U.S. has imposed tariffs and other trade barriers on Chinese exports, has restricted sales of certain categories of goods to China, and has established barriers to investments in China. Trade disputes may adversely affect the economies of the U.S. and its trading partners, as well as companies directly or indirectly affected and |

| financial markets generally. If the political climate between the U.S. and China does not improve or continues to deteriorate, if China were to attempt unification of Taiwan by force, or if other geopolitical conflicts develop or get worse, economies, markets and individual securities may be severely affected both regionally and globally, and the value of the Portfolio’s assets may go down. | |

| At times, the Portfolio’s investments may represent industries or industry sectors that are interrelated or have common risks, making the Portfolio more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors. | |

| Normally, the Portfolio invests at least 80% of its net assets (plus the amount of borrowings, if any, for investment purposes) in debt securities and other obligations issued by or on behalf of states, counties, municipalities, territories and possessions of the United States and the District of Columbia and their authorities, political subdivisions, agencies and instrumentalities, the interest on which is exempt from regular federal income tax ("municipal securities"). | |

| The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities. Liquidity can be reduced unpredictably in response to overall economic conditions or credit tightening. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. Issuers often depend on revenues from these projects to make principal and interest payments. The value of municipal securities can also be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory and political developments, tax law changes or other legislative actions, and by uncertainties and public perceptions concerning these and other factors. Municipal securities may be more susceptible to downgrades or defaults during recessions or similar periods of economic stress. Financial difficulties of municipal issuers may continue or get worse, particularly in the event of political, economic or market turmoil or a recession. To the extent the Portfolio invests significantly in a single state (including California, Illinois, New York and Indiana), city, territory (including Puerto Rico), or region, or in securities the payments on which are dependent upon a single project or source of revenues, or that relate to a sector or industry, including health care facilities, education, |

| transportation, special revenues and pollution control, the Portfolio will be more susceptible to associated risks and developments. | |

| The Portfolio invests in below-investment-grade (high-yield) debt securities and preferred stocks. Some of these high-yield securities may be convertible into equity securities of the issuer. Debt securities rated below-investment-grade are commonly referred to as “junk bonds” and are considered speculative with respect to the issuer’s capacity to pay interest and repay principal. These securities involve greater risk of loss, are subject to greater price volatility, and may be less liquid and more difficult to value, especially during periods of economic uncertainty or change, than higher rated debt securities. | |

| The market prices of the Portfolio’s fixed income securities may fluctuate significantly when interest rates change. The value of your investment will generally go down when interest rates rise. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. For example, if interest rates increase by 1%, the value of a Portfolio’s portfolio with a portfolio duration of ten years would be expected to decrease by 10%, all other things being equal. In recent years interest rates and credit spreads in the U.S. have been at historic lows. The U.S. Federal Reserve has raised certain interest rates, and interest rates may continue to go up. A general rise in interest rates could adversely affect the price and liquidity of fixed income securities. The maturity of a security may be significantly longer than its effective duration. A security’s maturity and other features may be more relevant than its effective duration in determining the security’s sensitivity to other factors affecting the issuer or markets generally, such as changes in credit quality or in the yield premium that the market may establish for certain types of securities (sometimes called “credit spread”). In general, the longer its maturity the more a security may be susceptible to these factors. When the credit spread for a fixed income security goes up, or “widens”, the value of the security will generally go down. | |

| If an issuer or guarantor of a security held by the Portfolio or a counterparty to a financial contract with the Portfolio defaults on its obligation to pay principal and/or interest, has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines, the value of your investment will typically decline. Changes in actual or perceived creditworthiness may occur quickly. The Portfolio could be delayed or hindered in its enforcement of rights against an issuer, guarantor or counterparty. | |

| With the increased use of technologies such as the Internet to conduct business, the Portfolio is susceptible to operational, information security |

| and related risks. While the Portfolio’s Adviser has established business continuity plans in the event of, and risk management systems to prevent, limit or mitigate, such cyber-attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified. Furthermore, the Portfolio cannot control the cybersecurity plans and systems put in place by service providers to the Portfolio such as the Portfolio’s custodian and accounting agent, and the Portfolio’s transfer agent. In addition, many beneficial owners of Portfolio shares hold them through accounts at broker-dealers, retirement platforms and other financial market participants over which neither the Portfolio nor the Adviser exercises control. Each of these may in turn rely on service providers to them, which are also subject to the risk of cyber-attacks. Cybersecurity failures or breaches at the Adviser or the Portfolio’s service providers or intermediaries have the ability to cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Portfolio’s ability to calculate its net asset value, impediments to trading, the inability of investors in the Portfolio to purchase or withdraw interests in the Portfolio, loss of or unauthorized access to private investor information and violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, or additional compliance costs. Such costs and losses may not be covered under any insurance. In addition, maintaining vigilance against cyber-attacks may involve substantial costs over time, and system enhancements may themselves be subject to cyber-attacks. | |

| The Portfolio’s registration statement on Form N-1A contains unaudited information regarding the Portfolio’s principal risks. Please refer to that document when considering the Portfolio’s principal risks. | |

| E. | Restricted Securities |

| Restricted Securities are subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under the Securities Act of 1933. Private placement securities are generally considered to be restricted except for those securities traded between qualified institutional investors under the provisions of Rule 144A of the Securities Act of 1933. | |

| Disposal of restricted investments may involve negotiations and expenses, and prompt sale at an acceptable price may be difficult to achieve. Restricted investments held by the Portfolio at February 29, 2024 are listed in the Schedule of Investments. |

Amundi Asset Management US, Inc.

The Bank of New York Mellon Corporation

Ernst & Young LLP

Amundi Distributor US, Inc.

Morgan, Lewis & Bockius LLP

BNY Mellon Investment Servicing (US) Inc.

60 State Street

Boston, MA 02109

ITEM 2. CODE OF ETHICS.

(a) Disclose whether, as of the end of the period covered by the report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. If the registrant has not adopted such a code of ethics, explain why it has not done so.

The registrant has adopted, as of the end of the period covered by this report, a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer and controller.

(b) For purposes of this Item, the term “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

(c) The registrant must briefly describe the nature of any amendment, during the period covered by the report, to a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item. The registrant must file a copy of any such amendment as an exhibit pursuant to Item 10(a), unless the registrant has elected to satisfy paragraph (f) of this Item by posting its code of ethics on its website pursuant to paragraph (f)(2) of this Item, or by undertaking to provide its code of ethics to any person without charge, upon request, pursuant to paragraph (f)(3) of this Item.

The registrant has made no amendments to the code of ethics during the period covered by this report.

(d) If the registrant has, during the period covered by the report, granted a waiver, including an implicit waiver, from a provision of the code of ethics to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this Item, the registrant must briefly describe the nature of the waiver, the name of the person to whom the waiver was granted, and the date of the waiver.

Not applicable.

(e) If the registrant intends to satisfy the disclosure requirement under paragraph (c) or (d) of this Item regarding an amendment to, or a waiver from, a provision of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item by posting such information on its Internet website, disclose the registrant’s Internet address and such intention.

Not applicable.

(f) The registrant must:

(1) File with the Commission, pursuant to Item 12(a)(1), a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, as an exhibit to its annual report on this Form N-CSR (see attachment);

(2) Post the text of such code of ethics on its Internet website and disclose, in its most recent report on this Form N-CSR, its Internet address and the fact that it has posted such code of ethics on its Internet website; or

(3) Undertake in its most recent report on this Form N-CSR to provide to any person without charge, upon request, a copy of such code of ethics and explain the manner in which such request may be made. See Item 10(2)

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

(a) (1) Disclose that the registrant’s Board of Trustees has determined that the registrant either:

(i) Has at least one audit committee financial expert serving on its audit committee; or

(ii) Does not have an audit committee financial expert serving on its audit committee.

The registrant’s Board of Trustees has determined that the registrant has at least one audit committee financial expert.

(2) If the registrant provides the disclosure required by paragraph (a)(1)(i) of this Item, it must disclose the name of the audit committee financial expert and whether that person is “independent.” In order to be considered “independent” for purposes of this Item, a member of an audit committee may not, other than in his or her capacity as a member of the audit committee, the Board of Trustees, or any other board committee:

(i) Accept directly or indirectly any consulting, advisory, or other compensatory fee from the issuer; or

(ii) Be an “interested person” of the investment company as defined in Section 2(a)(19) of the Act (15 U.S.C. 80a-2(a)(19)).

Mr. Fred J. Ricciardi, an independent Trustee, is such an audit committee financial expert.

(3) If the registrant provides the disclosure required by paragraph (a)(1) (ii) of this Item, it must explain why it does not have an audit committee financial expert.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Disclose, under the caption AUDIT FEES, the aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

N/A

(b) Disclose, under the caption AUDIT-RELATED FEES, the aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(c) Disclose, under the caption TAX FEES, the aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(d) Disclose, under the caption ALL OTHER FEES, the aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

N/A

(e) (1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

PIONEER FUNDS

APPROVAL OF AUDIT, AUDIT-RELATED, TAX AND OTHER SERVICES

PROVIDED BY THE INDEPENDENT AUDITOR

SECTION I - POLICY PURPOSE AND APPLICABILITY

The Pioneer Funds recognize the importance of maintaining the independence of their outside auditors. Maintaining independence is a shared responsibility involving Amundi Asset Management US, Inc., the audit committee and the independent auditors.

The Funds recognize that a Fund’s independent auditors: 1) possess knowledge of the Funds, 2) are able to incorporate certain services into the scope of the audit, thereby avoiding redundant work, cost and disruption of Fund personnel and processes, and 3) have expertise that has value to the Funds. As a result, there are situations where it is desirable to use the Fund’s independent auditors for services in addition to the annual audit and where the potential for conflicts of interests are minimal. Consequently, this policy, which is intended to comply with Rule 210.2-01(C)(7), sets forth guidelines and procedures to be followed by the Funds when retaining the independent audit firm to perform audit, audit-related tax and other services under those circumstances, while also maintaining independence.

Approval of a service in accordance with this policy for a Fund shall also constitute approval for any other Fund whose pre-approval is required pursuant to Rule 210.2-01(c)(7)(ii).

In addition to the procedures set forth in this policy, any non-audit services that may be provided consistently with Rule 210.2-01 may be approved by the Audit Committee itself and any pre-approval that may be waived in accordance with Rule 210.2-01(c)(7)(i)(C) is hereby waived.

Selection of a Fund’s independent auditors and their compensation shall be determined by the Audit Committee and shall not be subject to this policy.

| SECTION II - POLICY | ||||

| SERVICE CATEGORY |

SERVICE CATEGORY DESCRIPTION |

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES | ||

| I. AUDIT SERVICES | Services that are directly related to performing the independent audit of the Funds | • Accounting research assistance

• SEC consultation, registration statements, and reporting | ||

| • Tax accrual related matters | ||||

| • Implementation of new accounting standards | ||||

| • Compliance letters (e.g. rating agency letters) | ||||

| • Regulatory reviews and assistance regarding financial matters | ||||

| • Semi-annual reviews (if requested) | ||||

| • Comfort letters for closed end offerings | ||||

| II. AUDIT-RELATED SERVICES | Services which are not prohibited under Rule 210.2-01(C)(4) (the “Rule”) and are related extensions of the audit services support the audit, or use the knowledge/expertise gained from the audit procedures as a foundation to complete the project. In most cases, if the Audit-Related Services are not performed by the Audit firm, the scope of the Audit Services would likely increase. The Services are typically well-defined and governed by accounting professional standards (AICPA, SEC, etc.) | • AICPA attest and agreed-upon procedures

• Technology control assessments

• Financial reporting control assessments

• Enterprise security architecture assessment | ||

| AUDIT COMMITTEE APPROVAL POLICY |

AUDIT COMMITTEE REPORTING POLICY | |

| • “One-time” pre-approval for the audit period for all pre-approved specific service subcategories. Approval of the independent auditors as auditors for a Fund shall constitute pre approval for these services. |

• A summary of all such services and related fees reported at each regularly scheduled Audit Committee meeting. | |

| • “One-time” pre-approval for the fund fiscal year within a specified dollar limit for all pre-approved specific service subcategories |

• A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. | |

| • Specific approval is needed to exceed the pre-approved dollar limit for these services (see general Audit Committee approval policy below for details on obtaining specific approvals)

• Specific approval is needed to use the Fund’s auditors for Audit-Related Services not denoted as “pre-approved”, or to add a specific service subcategory as “pre-approved” |

SECTION III - POLICY DETAIL, CONTINUED

| SERVICE CATEGORY |

SERVICE CATEGORY DESCRIPTION |

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES | ||

| III. TAX SERVICES | Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, or the ability to maintain a desired level of confidentiality. | • Tax planning and support

• Tax controversy assistance

• Tax compliance, tax returns, excise tax returns and support

• Tax opinions |

| AUDIT COMMITTEE APPROVAL POLICY |

AUDIT COMMITTEE REPORTING POLICY | |

| • “One-time” pre-approval for the fund fiscal year within a specified dollar limit |

• A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. | |

| • Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) |

||

| • Specific approval is needed to use the Fund’s auditors for tax services not denoted as pre-approved, or to add a specific service subcategory as “pre-approved” |

||

SECTION III - POLICY DETAIL, CONTINUED

| SERVICE CATEGORY |

SERVICE CATEGORY DESCRIPTION |

SPECIFIC PRE-APPROVED SERVICE SUBCATEGORIES | ||

| IV. OTHER SERVICES

A. SYNERGISTIC, UNIQUE QUALIFICATIONS |

Services which are not prohibited by the Rule, if an officer of the Fund determines that using the Fund’s auditor to provide these services creates significant synergy in the form of efficiency, minimized disruption, the ability to maintain a desired level of confidentiality, or where the Fund’s auditors posses unique or superior qualifications to provide these services, resulting in superior value and results for the Fund. | • Business Risk Management support

• Other control and regulatory compliance projects | ||

| AUDIT COMMITTEE APPROVAL POLICY |

AUDIT COMMITTEE REPORTING POLICY | |

| • “One-time” pre-approval for the fund fiscal year within a specified dollar limit |

• A summary of all such services and related fees (including comparison to specified dollar limits) reported quarterly. | |

| • Specific approval is needed to exceed the pre-approved dollar limits for these services (see general Audit Committee approval policy below for details on obtaining specific approvals) |

||

| • Specific approval is needed to use the Fund’s auditors for “Synergistic” or “Unique Qualifications” Other Services not denoted as pre-approved to the left, or to add a specific service subcategory as “pre-approved” |

||

SECTION III - POLICY DETAIL, CONTINUED

| SERVICE CATEGORY |

SERVICE CATEGORY DESCRIPTION |

SPECIFIC PROHIBITED SERVICE SUBCATEGORIES | ||

| PROHIBITED SERVICES | Services which result in the auditors losing independence status under the Rule. | 1. Bookkeeping or other services related to the accounting records or financial statements of the audit client* | ||

| 2. Financial information systems design and implementation* | ||||

| 3. Appraisal or valuation services, fairness* opinions, or contribution-in-kind reports | ||||

| 4. Actuarial services (i.e., setting actuarial reserves versus actuarial audit work)* | ||||

| 5. Internal audit outsourcing services* | ||||

| 6. Management functions or human resources | ||||

| 7. Broker or dealer, investment advisor, or investment banking services | ||||

| 8. Legal services and expert services unrelated to the audit | ||||

| 9. Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible | ||||

| AUDIT COMMITTEE APPROVAL POLICY |

AUDIT COMMITTEE REPORTING POLICY | |

| • These services are not to be performed with the exception of the(*) services that may be permitted if they would not be subject to audit procedures at the audit client (as defined in rule 2-01(f)(4)) level the firm providing the service. |

• A summary of all services and related fees reported at each regularly scheduled Audit Committee meeting will serve as continual confirmation that has not provided any restricted services. |

GENERAL AUDIT COMMITTEE APPROVAL POLICY:

| • | For all projects, the officers of the Funds and the Fund’s auditors will each make an assessment to determine that any proposed projects will not impair independence. |

| • | Potential services will be classified into the four non-restricted service categories and the “Approval of Audit, Audit-Related, Tax and Other Services” Policy above will be applied. Any services outside the specific pre-approved service subcategories set forth above must be specifically approved by the Audit Committee. |