0001903870

false

0001903870

2021-01-01

2021-09-30

0001903870

dei:BusinessContactMember

2021-01-01

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-20

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-20

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-20

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-20

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:PrivatePlacementMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:WarrantMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-08-20

0001903870

us-gaap:IPOMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

us-gaap:OverAllotmentOptionMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

us-gaap:OverAllotmentOptionMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

us-gaap:WarrantMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

us-gaap:WarrantMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

GLAQ:PrivateSecuritiesMember

GLAQ:GlobisSPACLLCAndUpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

GLAQ:PrivateSecuritiesMember

GLAQ:GlobisSPACLLCAndUpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

srt:MinimumMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

us-gaap:SubsequentEventMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-12-13

2021-12-15

0001903870

us-gaap:SubsequentEventMember

GLAQ:GlobisAcquisitionCorpMember

2021-12-13

2021-12-15

0001903870

GLAQ:TrustAccountMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

us-gaap:FranchiseMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:UnderwriterMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-12

2020-12-31

0001903870

us-gaap:IPOMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

us-gaap:IPOMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:RedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:NonRedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:PlacementUnitsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-12-31

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:PlacementUnitsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:PlacementUnitsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-30

2020-09-01

0001903870

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-05

2020-12-07

0001903870

us-gaap:OverAllotmentOptionMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-05

2020-12-07

0001903870

us-gaap:OverAllotmentOptionMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-07

0001903870

GLAQ:AdministrativeSupportAgreementMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-13

2020-12-15

0001903870

GLAQ:AdministrativeSupportAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-12-31

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:UnderwritingAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-12-31

0001903870

GLAQ:UnderwritingAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

srt:MinimumMember

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:CommonStockPriceBelowNinePointFiveZeroPerShareMember

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

GLAQ:CommonStockPriceAboveSixteenPointFiveZeroPerShareMember

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

us-gaap:FairValueInputsLevel1Member

GLAQ:GlobisAcquisitionCorpMember

2020-12-31

0001903870

srt:MaximumMember

us-gaap:SubsequentEventMember

GLAQ:NotePayableMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-11

0001903870

us-gaap:SubsequentEventMember

GLAQ:NotePayableMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-11

0001903870

us-gaap:SubsequentEventMember

GLAQ:NotePayableMember

GLAQ:GlobisAcquisitionCorpMember

2021-02-02

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

us-gaap:CommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-09-30

0001903870

us-gaap:AdditionalPaidInCapitalMember

GLAQ:GlobisAcquisitionCorpMember

2020-09-30

0001903870

us-gaap:RetainedEarningsMember

GLAQ:GlobisAcquisitionCorpMember

2020-09-30

0001903870

GLAQ:TotalStockholdersEquityMember

GLAQ:GlobisAcquisitionCorpMember

2020-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-09-30

0001903870

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

srt:MinimumMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

srt:MaximumMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-07-19

0001903870

us-gaap:SubsequentEventMember

GLAQ:GlobisAcquisitionCorpMember

2021-10-13

0001903870

us-gaap:IPOMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-03-31

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-06-30

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-03-31

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-04-01

2021-06-30

0001903870

srt:ScenarioPreviouslyReportedMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-06-30

0001903870

srt:RestatementAdjustmentMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-06-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-06-30

0001903870

GLAQ:RedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

GLAQ:NonRedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

GLAQ:RedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:NonRedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:NonRedeemableCommonStockMember

GLAQ:GlobisAcquisitionCorpMember

2020-08-21

2020-09-30

0001903870

us-gaap:OverAllotmentOptionMember

us-gaap:WarrantMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-15

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:GlobisSPACLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:PrivateWarrantsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:PlacementUnitsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:PlacementUnitsMember

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:UpAndUpCapitalLLCMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-06

2020-12-07

0001903870

us-gaap:OverAllotmentOptionMember

GLAQ:GlobisAcquisitionCorpMember

2020-12-06

2020-12-07

0001903870

GLAQ:AdministrativeSupportAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-01

2021-09-30

0001903870

GLAQ:AdministrativeSupportAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:AdministrativeSupportAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:LenderMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-11

0001903870

GLAQ:LenderMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

srt:MaximumMember

GLAQ:GlobisAcquisitionCorpMember

2021-07-19

0001903870

us-gaap:SubsequentEventMember

srt:MaximumMember

GLAQ:GlobisAcquisitionCorpMember

2021-10-13

0001903870

GLAQ:UnderwritingAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:UnderwritingAgreementMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:GlobisAcquisitionCorpMember

2020-12-10

0001903870

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2021-01-01

2021-09-30

0001903870

GLAQ:PublicWarrantsMember

srt:MinimumMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:PublicWarrantsMember

GLAQ:CommonStockPriceBelowNinePointFiveZeroPerShareMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

GLAQ:CommonStockPriceAboveSixteenPointFiveZeroPerShareMember

GLAQ:PublicWarrantsMember

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

us-gaap:FairValueInputsLevel1Member

GLAQ:GlobisAcquisitionCorpMember

2021-09-30

0001903870

us-gaap:SubsequentEventMember

srt:MaximumMember

GLAQ:GlobisAcquisitionCorpMember

2021-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

GLAQ:Days

As

filed with the Securities and Exchange Commission on January 12, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-4

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Globis

NV Merger Corp.

(Exact

name of registrant as specified in its charter)

| Nevada* |

|

6770 |

|

85-2703418 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial Classification Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

7100

W. Camino Real, Suite 302-48

Boca

Raton, Florida 33433

212-847-3248

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul

Packer

Chief

Executive Officer

7100

W. Camino Real, Suite 302-48

Boca

Raton, Florida 33433

212-847-3248

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of all communications, including communications sent to agent for service, should be sent to:

Mark

S. Selinger, Esq.

Daniel

L. Woodard, Esq.

McDermott

Will & Emery LLP

One

Vanderbilt Avenue

New

York, New York 10017

Tel:

(212) 547-5400

Fax:

(212) 547-5444 |

|

Laurence

S. Tauber

Cohen

Tauber Spievack &

Wagner

P.C.

420

Lexington Ave., Suite 2400

New

York NY 10170-2499

Tel:

(212) 586-5800

Fax:

(212) 586-5095 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after (i) this registration statement is declared effective

and (ii) upon completion of the applicable transactions described in the enclosed proxy statement/prospectus.

If

the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance

with General Instruction G, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated |

☒ |

|

Smaller

reporting company |

☒ |

| Non-accelerated filer |

|

|

|

|

| |

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

If

applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange

Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange

Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

CALCULATION

OF REGISTRATION FEE

| Title

of Each Class of Securities to be Registered | |

Amount

to be Registered(6) | | |

Proposed

Maximum Offering Price Per Share | | |

Proposed

Maximum Aggregate Offering Price | | |

Amount

of Registration

Fee | |

| Ordinary shares, $0.001 nominal

value(1) | |

| 15,050,833 | | |

$ | 10.14 | (7) | |

$ | 152,615,446.62 | | |

$ | 14,147.45 | |

| Ordinary shares issuable upon exercise of warrants

(2) | |

| 15,789,722 | | |

$ | 11.50 | (8) | |

$ | 181,581,803.00 | | |

$ | 16,832.63 | |

| Warrants to purchase ordinary

shares (3) | |

| 15,789,722 | | |

$ | 0.72 | (9) | |

$ | 11,368,599.84 | | |

| — | (10) |

| Ordinary shares, $0.001 nominal value(4) | |

| 17,004,762 | | |

$ | 10.14 | (7) | |

$ | 172,428,286.68 | | |

$ | 15,984.10 | |

| Ordinary shares, $0.001 nominal value(5) | |

| 2,000,000 | | |

$ | 10.14 | (7) | |

$ | 20,280,000.00 | | |

$ | 1,879.96 | |

| Total | |

| | | |

| | | |

| | | |

$ | 48,844.14 | |

| (1) |

The

number of ordinary shares of New Forafric (as defined below) being registered represents (i) 11,500,000 shares (the “Public

Shares”) of common stock, par value $0.0001 per share (the “Common Stock”) of Globis Acquisition Corp., a Delaware

corporation (“Globis”), that were registered pursuant to the Registration Statement on Form S-1 (SEC File No. 333-250939)

(the “IPO registration statement”) and offered by Globis in its initial public offering and (ii) 3,550,833 shares of

Common Stock. The Common Stock will automatically be converted by operation of law into Ordinary Shares of New Forafric as a result

of the Redomiciliation (as defined below). |

| (2) |

Represents

ordinary shares of New Forafric to be issued upon the exercise of (i) 11,500,000 redeemable warrants (the “Public Warrants”)

to purchase Common Stock of Globis that were registered pursuant to the IPO registration statement and offered by Globis in its initial

public offering and (ii) 4,289,722 warrants to purchase Common Stock of Globis that were issued in private placements concurrently

with the initial public offering (the “Private Placement Warrants” and, together with the Public Warrants, the “Warrants”).

The Warrants will automatically be converted by operation of law into warrants to acquire Ordinary Shares of New Forafric as a result

of the Redomiciliation. |

| (3) |

The

number of warrants to acquire ordinary shares of New Forafric being registered represents (i) 11,500,000 Public Warrants and (ii)

4,289,722 Private Placement Warrants. |

| (4) |

The

number of ordinary shares of New Forafric being registered represents the maximum number of Ordinary Shares of New Forafric to be

issued to Seller in connection with the Closing of the Business Combination described herein. |

| (5) |

The

number of ordinary shares of New Forafric being registered represents the maximum number of Ordinary Shares of New Forafric to be

issued to Seller as Earnout Shares (as defined below). |

| (6) |

Pursuant

to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable

number of additional securities as may be issued to prevent dilution resulting from share splits, share dividends or similar transactions.

|

| (7) |

Estimated

solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the shares of Common

Stock of Globis (the entity to which New Forafric will succeed following the Redomiciliation) on The Nasdaq Stock Market (“Nasdaq”)

on January 7, 2022 ($10.14 per share of Common Stock). January 7, 2022 was a recent date for which the reported

high and low prices of the shares of Common Stock of Globis were available prior to the initial filing of this registration statement

(such date being within five business days of the date that this registration statement was first filed with the Securities and Exchange

Commission (the “SEC”)). This calculation is in accordance with Rule 457(f)(1) of the Securities Act. |

| (8) |

Represents

the exercise price of the Warrants. |

| (9) |

Estimated

solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the Public Warrants

of Globis (the entity to which New Forafric will succeed following the Redomiciliation) on Nasdaq on January 7, 2022 ($0.72

per Public Warrant). January 7, 2022 was a recent date for which the reported high and low prices of the Public Warrants

of Globis were available prior to the initial filing of this registration statement (such date being within five business days of

the date that this registration statement was first filed with the SEC). This calculation is in accordance with Rule 457(f)(1) of

the Securities Act. |

| (10) |

No

registration fee is required pursuant to Rule 457(g) under the Securities Act. |

| * |

Immediately

prior to the consummation of the Business Combination described in the proxy statement/prospectus, Globis NV Merger Corp. intends

to effect a Redomiciliation in accordance with the applicable provisions of Nevada law and the Companies Act 2014 of the Laws of

Gibraltar (the “Companies Act”) and the Companies (Re-domiciliation) Regulations 1996 of the Laws of Gibraltar (the “Re-domiciliation

Regulations”), pursuant to which the jurisdiction of incorporation for Globis NV Merger Corp. will be changed from the State

of Nevada to Gibraltar (the “Redomiciliation”). All securities being registered will be issued by the continuing entity

following the Redomiciliation, which will be renamed “Forafric Global PLC” in connection with the Business Combination,

as further described in the proxy statement/prospectus. As used in this proxy statement/prospectus, the term “registrant”

refers to Globis Acquisition Corp. (a Delaware corporation) prior to the Merger and Redomiciliation and to New Forafric (a Gibraltar

public company limited by shares) following the Merger and Redomiciliation. As used herein, “New Forafric” refers to

Globis Acquisition Corp. as a Gibraltar public company limited by shares by way of continuation following the Merger and Redomiciliation

and the Business Combination, which in connection with the Merger and Redomiciliation and simultaneously with the Business Combination,

will change its corporate name to “Forafric Global PLC.” |

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

SEC, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation

of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

PRELIMINARY

PROXY STATEMENT AND PROSPECTUS

SUBJECT

TO COMPLETION, DATED JANUARY 12, 2022

PROXY

STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS OF

GLOBIS

ACQUISITION CORP.

PROSPECTUS

FOR

49,845,317

ORDINARY SHARES AND

15,789,722

WARRANTS OF Globis NV Merger Corp.

(AFTER

ITS REDOMICILIATION AS A PUBLIC COMPANY LIMITED BY SHARES INCORPORATED IN GIBRALTAR, WHICH WILL BE RENAMED “Forafric

Global PLC” IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN)

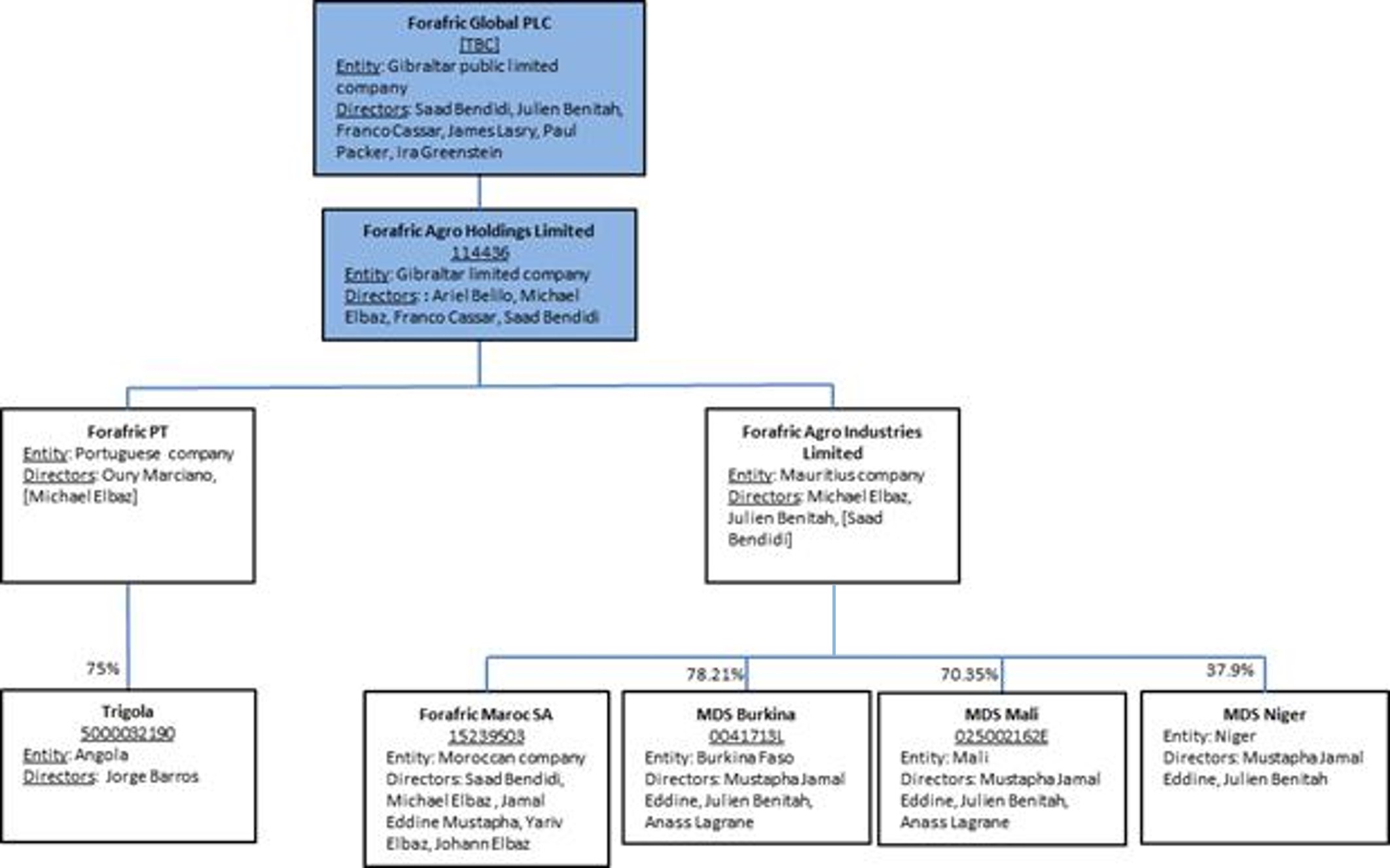

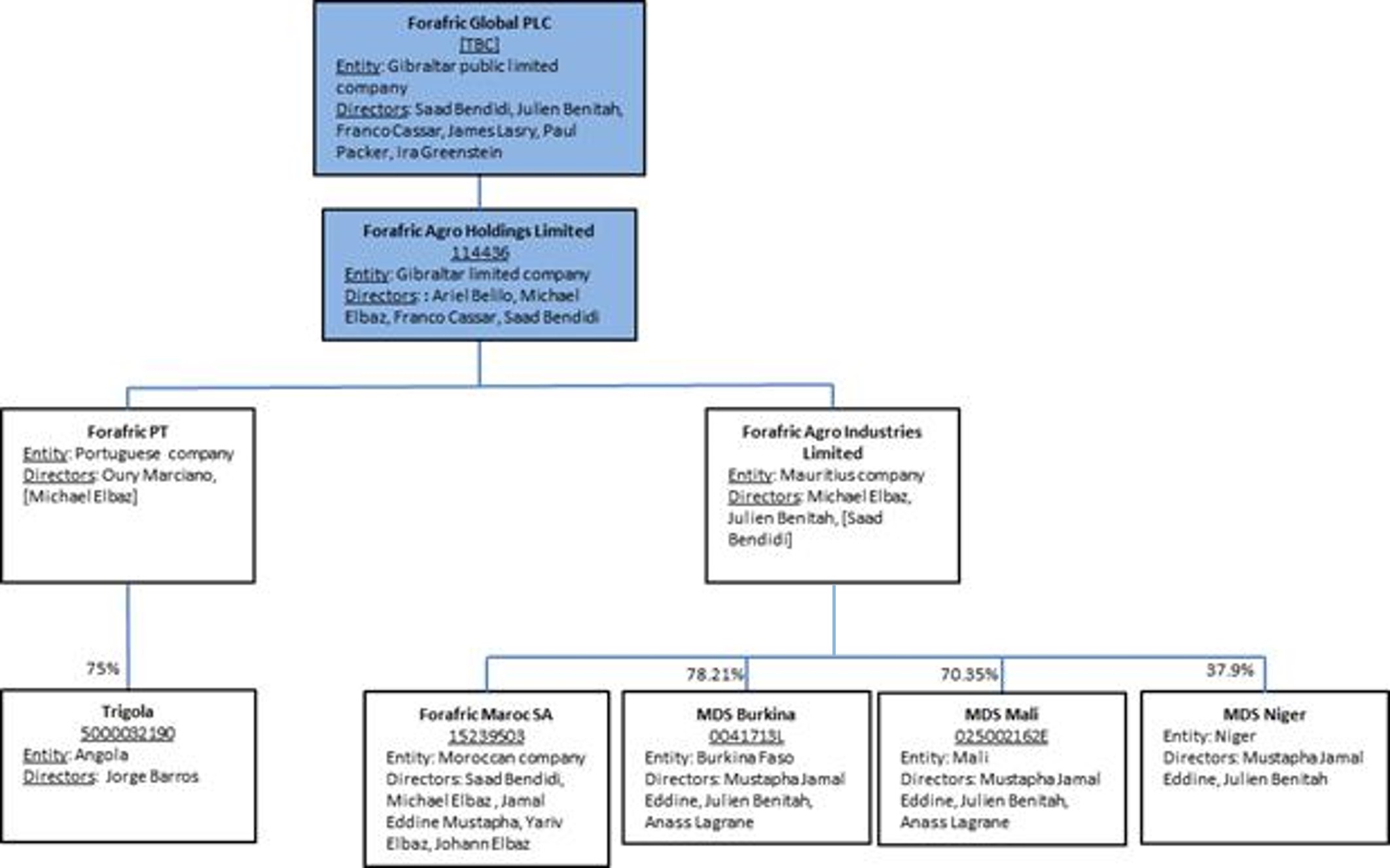

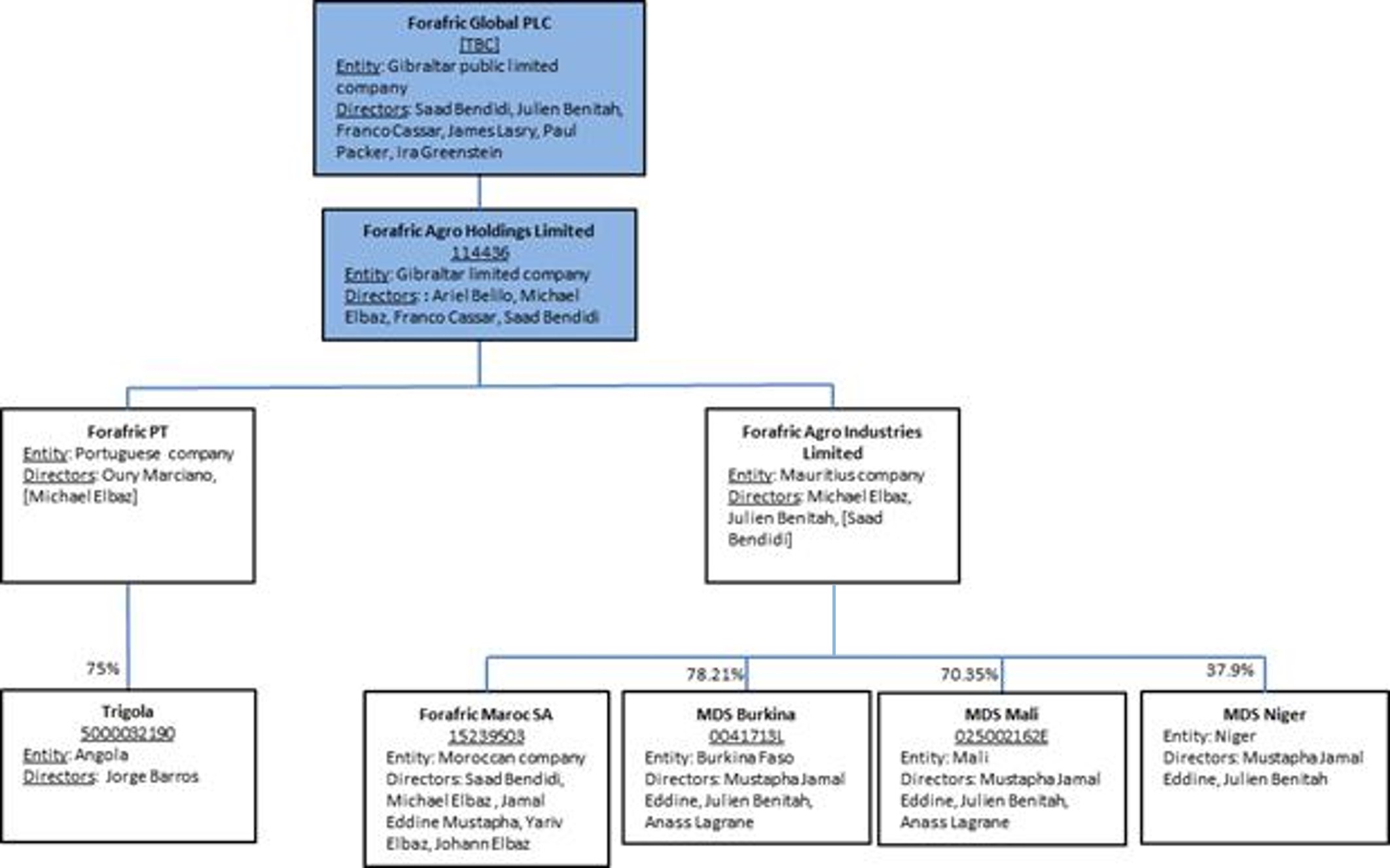

The

board of directors of Globis Acquisition Corp., a Delaware corporation (“Globis”), has unanimously approved, and Globis

has entered into, a securities purchase agreement, dated December 19, 2021 (as it may be further amended or supplemented from time to

time, the “Business Combination Agreement”) which provides for the proposed Business Combination (as defined below)

between Globis and Forafric Agro Holdings Limited, a Gibraltar private company limited by shares (“FAHL”). As described

in this proxy statement/prospectus, Globis’ stockholders are being asked to consider and vote upon (among other things) the Business

Combination.

The

Business Combination Agreement provides for the consummation of the following transactions (collectively, the “Business Combination”):

(i) Globis will merge with and into Globis NV Merger Corp., a Nevada corporation and a wholly-owned subsidiary of Globis (“Globis

Nevada”), with Globis Nevada surviving (the “Merger”); (ii) Globis Nevada will change its jurisdiction of

incorporation by transferring by way of a redomiciliation and domesticating as a Gibraltar public company limited by shares (the “Redomiciliation”)

and change its name to “Forafric Global PLC” (referred to herein as “New Forafric”); and (iii) immediately

following the effectiveness of the Redomiciliation, New Forafric will acquire 100% of the equity interests in FAHL from the Lighthouse

Capital Limited (“Seller”) and FAHL will become a direct subsidiary of New Forafric.

As

a result of the Merger and the Redomiciliation and prior to the consummation of the Business Combination, (i) the issued and outstanding

shares of Common Stock, par value $0.0001 per share (the “ Common Stock”), of Globis will convert automatically by

operation of law, on a one-for-one basis, into ordinary shares, nominal value $0.001 per share, of New Forafric (the “Ordinary

Shares”); (ii) the issued and outstanding redeemable warrants that were registered pursuant to the Registration Statement on

Form S-1 (SEC File No. 333-250939) of Globis (the “IPO registration statement”) will automatically become redeemable

warrants to acquire Ordinary Shares at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in

the applicable warrant agreement (no other changes will be made to the terms of any issued and outstanding public warrants as a result

of the Redomiciliation); (iii) each issued and outstanding warrant of Globis issued in a private placement will automatically become

warrants to acquire Ordinary Shares at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in

the applicable warrant agreement (no other changes will be made to the terms of any issued and outstanding private placement warrants

as a result of the Redomiciliation); and (iv) each issued and outstanding unit of Globis that has not been previously separated into

the underlying Common Stock and underlying warrant upon the request of the holder thereof, will be cancelled and will entitle the holder

thereof to one Ordinary Share and one redeemable warrant to acquire one Ordinary Share at an exercise price of $11.50 per share on the

terms and subject to the conditions set forth in the applicable warrant agreement.

Accordingly, this

prospectus covers 34,055,595 Ordinary Shares, 15,789,722 Ordinary Shares issuable upon exercise of warrants and 15,789,722 warrants

to acquire Ordinary Shares. It is anticipated that, upon completion of the Business Combination, (1) Globis’ Public

Stockholders will own approximately 33.5% of the outstanding Ordinary Shares of New Forafric, (2) the Seller will own 44.0%

of the outstanding Ordinary Shares of New Forafric, (3) the Sponsors and Globis’ independent directors (excluding Ordinary

Shares purchased by officers and directors of Globis participating in the FAHL Bonds) are expected to own approximately 9.2%

of the outstanding Ordinary Shares of New Forafric, (4) the PIPE Investors will own 5.0% of the Ordinary Shares of New

Forafric, which includes Ordinary Shares to be purchased by certain officers and directors of Globis, (5) the FAHL Bond Holders will own

2.9% of the Ordinary Shares of New Forafric and (6) FAHL Related Party Loan Holders will own 4.2% of the Ordinary Shares

of New Forafric. These percentages (i) assume no Public Stockholders exercise their Redemption Rights in connection with the

Business Combination and (ii) do not take into account Public Warrants or Private Placement Warrants to purchase Ordinary Shares of

New Forafric that will be outstanding immediately following the completion of the Business Combination. If the actual facts are

different than these assumptions, the percentage ownership retained by New Forafric’s existing stockholders in New Forafric

will be different.

The

following summarizes the pro forma ownership of Ordinary Shares of New Forafric following the Business Combination, including for the

Seller those Ordinary Shares issuable upon the exchange of the Seller’s FAHL Equity Securities for Ordinary Shares, under two scenarios:

| | |

Assuming

No Redemptions | | |

Assuming

Maximum Redemptions(1) | |

| | |

Shares | | |

% | | |

Shares | | |

% | |

| Globis’ Public Stockholders(1) | |

| 11,500,000 | | |

| 33.5 | % | |

| 0 | | |

| 0.0 | % |

| Sponsors and Independent

Directors(2)(3) | |

| 3,148,333 | | |

| 9.2 | % | |

| 3,148,333 | | |

| 13.4 | % |

| Underwriter | |

| 402,500 | | |

| 1.2 | % | |

| 402,500 | | |

| 1.7 | % |

| Seller(4) | |

| 15,100,000 | | |

| 44.0 | % | |

| 16,248,307 | | |

| 69.4 | % |

| PIPE Investors(5) | |

| 1,712,245 | | |

| 5.0 | % | |

| 1,168,566 | | |

| 5.0 | % |

| FAHL Bond Holders(6) | |

| 1,005,291 | | |

| 2.9 | % | |

| 1,005,291 | | |

| 4.3 | % |

| FAHL Related Party Loan

Holders(7) | |

| 1,445,164 | | |

| 4.2 | % | |

| 1,445,164 | | |

| 6.2 | % |

| |

(1) |

Assumes

that 11,500,000 Public Shares (the estimated maximum number of Public Shares that could be redeemed in connection with the

Business Combination based on a per share redemption price of $10.20) are redeemed in connection with the Business Combination.

|

| |

(2) |

Includes

3,148,333 Ordinary Shares issued upon conversion of the existing Common Stock in connection with the Redomiciliation. The Ordinary

Shares are issued upon the automatic conversion of Common Stock concurrently with the consummation of the Business Combination. |

| |

(3) |

Excludes

1,005,291 Ordinary Shares issuable upon the conversion of the FAHL Bonds (as defined in the accompanying proxy statement/prospectus)

purchased by certain affiliates of the Sponsors. |

| |

(4) |

Assumes

an amount of Remaining Cash (as defined in the Business Combination Agreement) at the Closing

based on Remaining Cash as of September 30, 2021.

|

| |

(5) |

Pursuant

to the terms of the PIPE Subscription Agreement, calculated as 4.99% of all issued and outstanding

ordinary shares, after taking into account the completion of the Business Combination and

related transactions.

|

| |

(6) |

Represents

the number of Ordinary Shares issuable upon the conversion of the FAHL Bonds. |

| |

(7) |

Represents

the number of Ordinary Shares issuable upon the conversion of the FAHL Related Party Loans (as defined in the accompanying proxy

statement/prospectus). |

Globis’

units, Common Stock and warrants are currently listed on Nasdaq under the symbols “GLAQU,” “GLAQ” and “GLAQW,”

respectively. Globis will apply for listing, to be effective at the time of the Business Combination, of New Forafric’s Ordinary

Shares and warrants on Nasdaq under the proposed symbols “AFRI” and “AFRIW,” respectively.

This

proxy statement/prospectus provides stockholders of Globis with detailed information about the Business Combination and other matters

to be considered at the special meeting of stockholders of Globis. We encourage you to read this entire document, including the Annexes

and other documents referred to herein, carefully and in their entirety. You should also carefully consider the risk factors described

in “Risk Factors” beginning on page 34 of this proxy statement/prospectus.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED

IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS

OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY

CONSTITUTES A CRIMINAL OFFENSE.

This

proxy statement/prospectus is dated , 2022 and

is

first being mailed to Globis’ stockholders on or about ,

2022.

GLOBIS

ACQUISITION CORP.

7100

W. Camino Real, Suite 302-48,

Boca

Raton, Florida 33433

To

the Stockholders of Globis:

You

are cordially invited to attend the special meeting of stockholders (the “Stockholders Meeting”) of Globis Acquisition

Corp., a Delaware corporation (“Globis” and, after the Redomiciliation as described below, “New Forafric”),

at 9 a.m., Eastern Time, on , 2022, at the

offices of McDermott Will & Emery LLP located at One Vanderbilt Avenue, 45th Floor, New York, New York 10017, or via a

virtual meeting, or at such other time, on such other date and at such other place to which the meeting may be adjourned.

As

all stockholders will no doubt be aware, due to the current novel coronavirus (“COVID-19”) global pandemic, there

are restrictions in place in many jurisdictions relating to the ability to conduct in-person meetings. As part of our precautions regarding

COVID-19, we are planning for the possibility that the meeting may be held virtually over the Internet, but the physical location of

the meeting will remain at the location specified above. If we take this step, we will announce the decision to do so via a press release

and posting details on our website that will also be filed with the SEC as proxy material.

At

the Stockholders Meeting, stockholders of Globis will be asked to consider and vote upon a proposal, which is referred to herein as the

“Business Combination Proposal,” to approve and adopt the Business Combination Agreement, entered into as of December

19, 2021 (as may be further amended or supplemented from time to time, the “Business Combination Agreement”), by and

among Globis, Lighthouse Capital Limited (“Seller”) and Forafric Agro Holdings Limited (“FAHL”),

a copy of which is attached to the accompanying proxy statement/prospectus as Annex A, and the transactions contemplated

thereby. In accordance with the terms and subject to the conditions of the Business Combination Agreement, among other things, following

the Merger and the Redomiciliation of Globis Nevada (as defined below) to Gibraltar as described below, New Forafric (as defined below)

will acquire 100% of the equity interests of FAHL from Seller, its sole shareholder, with FAHL becoming a direct subsidiary of New Forafric

as a result thereof (the “Business Combination”). As a condition to closing the Business Combination, the board of

directors of Globis has unanimously approved, and stockholders of Globis are being asked to consider and vote upon (i) a proposal to

approve and adopt (the “Merger Proposal”) the merger of Globis with and into Globis NV Merger Corp., a Nevada corporation

and a wholly-owned subsidiary of Globis (“Globis Nevada”), with Globis Nevada surviving (the “Merger”),

and (ii) a proposal to approve and adopt (the “Redomiciliation Proposal”) a change of Globis Nevada’s jurisdiction

of incorporation by deregistering as a corporation in the State of Nevada and transferring by way of continuation and redomiciliation

as a public company limited by shares incorporated under the laws of Gibraltar (the “Redomiciliation”) and, in connection

with the Redomiciliation and simultaneously with the consummation of the Business Combination, a change of its corporate name to

“Forafric Global PLC” (referred to herein as “New Forafric”).

The

total consideration to be paid to the Seller in the Business Combination will be (i) 15,100,000 Ordinary Shares, subject to

reduction to the extent that the Closing Payment (as defined below) is less than $0, provided that the Seller may be issued up to

1,904,762 additional Ordinary Shares determined based on the amount of Remaining Cash (as defined in the Business Combination

Agreement) at the Closing; plus (ii) an amount (the “Closing Payment”) equal to $20,000,000 minus the outstanding amount

of all Funded Debt (as defined in the Business Combination Agreement) as of the Closing (other than Permitted Debt); provided that

Seller may receive up to an additional $20,000,000 determined based on the amount of Remaining Cash (as defined in the Business

Combination Agreement) at the Closing. The Closing Payment shall be funded by remaining funds in the Trust Account after giving

effect to any Buyer Share Redemptions (as defined in the Business Combination Agreement) and the proceeds of any potential private

placement financing. In addition, the Seller is also entitled to receive up to 2,000,000 Ordinary Shares (the

“Earnout Shares”), subject to New Forafric achieving certain performance and share price thresholds prior to

certain future dates, in each case as described in the Business Combination Agreement. The Seller will also be entitled to receive,

as additional consideration, 20% of any cash proceeds received by New Forafric from the exercise of outstanding warrants.

As

a result of the Merger and the Redomiciliation and prior to the consummation of the Business Combination, (i) the issued and outstanding

shares of Common Stock, par value $0.0001 per share (the “ Common Stock”), of Globis will convert automatically by

operation of law, on a one-for-one basis, into ordinary shares, nominal value $0.001 per share, of New Forafric (the “Ordinary

Shares”); (ii) the issued and outstanding redeemable warrants that were registered pursuant to the Registration Statement on

Form S-1 (SEC File No. 333-250939) of Globis (the “IPO registration statement”) will automatically become redeemable

warrants to acquire Ordinary Shares at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in

the applicable warrant agreement (no other changes will be made to the terms of any issued and outstanding public warrants as a result

of the Redomiciliation); (iii) each issued and outstanding warrant of Globis issued in a private placement will automatically become

warrants to acquire Ordinary Shares at an exercise price of $11.50 per share on the terms and subject to the conditions set forth in

the applicable warrant agreement (no other changes will be made to the terms of any issued and outstanding private placement warrants

as a result of the Redomiciliation); and (iv) each issued and outstanding unit of Globis that has not been previously separated into

the underlying Common Stock and underlying warrant upon the request of the holder thereof, will be cancelled and will entitle the holder

thereof to one Ordinary Share and one redeemable warrant to acquire one Ordinary Share at an exercise price of $11.50 per share on the

terms and subject to the conditions set forth in the applicable warrant agreement. For further details, see “Proposal 1: The

Merger Proposal” and “Proposal 2: The Redomiciliation Proposal.”

As

conditions to closing the Business Combination and effecting the Merger and the Redomiciliation, you will also be asked to consider and

vote upon, assuming the Business Combination Proposal, the Merger Proposal and the Redomiciliation Proposal are approved and adopted,

(i) a proposal to approve and adopt the Forafric 2022 Long Term Employee Share Incentive Plan, or the Equity Incentive Plan, a copy of

which is attached to the accompanying proxy statement/prospectus as Annex H (the “Equity Incentive Plan Proposal”);

(ii) a proposal to elect six directors who, upon consummation of the Business Combination, will be the directors of New Forafric (the

“Director Election Proposal”); (iii) a proposal to approve and adopt the proposed Memorandum and Articles of Association

(as defined below) upon the Redomiciliation (the “Charter Proposal”); and (iv) a proposal to approve, for purposes

of complying with the applicable provisions of Nasdaq Stock Exchange Listing Rule 5635, the issuance of Ordinary Shares and securities

convertible into or exchangeable for Ordinary Shares in connection with the Business Combination, and the Ordinary Shares issued in connection

with the closing of the PIPE Investment, the conversion of the FAHL Bonds and the conversion of the FAHL Related Party Loans (the “Nasdaq

Proposal”). The Business Combination will be consummated only if the Business Combination Proposal, the Merger Proposal, the

Redomiciliation Proposal, the Equity Incentive Plan Proposal, the Director Election Proposal and the Charter Proposal and the Nasdaq

Proposal (collectively, the “Condition Precedent Proposals”) are approved at the Stockholders Meeting, or otherwise

waived by the party for whose benefit such condition exists. Each of the Condition Precedent Proposals is cross-conditioned on the approval

of each other.

In

addition, you will be asked to consider and vote upon (i) on a non-binding advisory basis, certain material differences between Globis’

existing Amended and Restated Certificate of Incorporation (the “Existing Organizational Documents”) and the proposed

new Memorandum and Articles of Association (the “Memorandum and Articles of Association”) of New Forafric upon the

Redomiciliation (the “Organizational Documents Proposals”); and (ii) a proposal to approve the adjournment of the

Stockholders Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there

are insufficient votes for the approval of one or more proposals at the Stockholders Meeting, which is referred to herein as the “Adjournment

Proposal.” The Adjournment Proposal is not conditioned upon the approval of any other proposal. Each of these proposals is

more fully described in the accompanying proxy statement/prospectus, which each stockholder is encouraged to read carefully in its entirety.

In

accordance with the terms and subject to the conditions of the Business Combination Agreement and assuming No Redemptions, at the Effective

Time, (i) the Seller will receive (a) up to 17,004,762 Ordinary Shares in New Forafric, and (b) the Closing Payment, (ii) existing stockholders

of Globis will retain 15,050,833 Ordinary Shares in New Forafric (iii) PIPE Investors will receive 1,712,245 Ordinary Shares sold

through the PIPE Investment, (iv) holders of the FAHL Bonds will receive 1,005,291 Ordinary Shares in New Forafric upon the conversion

of the FAHL Bonds, (v) holders of the FAHL Related Party Loans will receive 1,445,164 Ordinary Shares in New Forafric upon the

conversion of the FAHL Convertible Debt and (vi) New Forafric will hold 100% of FAHL’s equity securities. For further details,

see “Proposal 3: The Business Combination Proposal — The Business Combination Agreement — Business Combination Consideration.”

In

connection with the Business Combination, on December 31, 2021, Globis entered into a subscription agreement (the “PIPE Subscription

Agreement”) with an “accredited investor” (as such term is defined in Rule 501 of Regulation D) (the “PIPE

Investor”), pursuant to, and on the terms and subject to the conditions of which, the PIPE Investor will purchase Ordinary

Shares of New Forafric in a private placement following the Redomiciliation and prior to the closing of the Business Combination. Pursuant

to the PIPE Subscription Agreement, the PIPE Investor will purchase, at a purchase price of $10.50 per share, a number of Ordinary

Shares (the “PIPE Shares”) that will be equal to the lesser of (i) 4.99% of all issued and outstanding ordinary

shares, after taking into account the completion of the Business Combination and all ordinary shares issued pursuant to the FAHL Bonds

(defined below) and other related subscription agreements, if any, and (ii) 1,904,761 ordinary shares (the “PIPE Investment”);

accordingly, the maximum aggregate amount to be paid by the PIPE Investor for the PIPE Shares is approximately $20 million. The purpose

of the sale of the PIPE Shares is to raise additional capital for use in connection with the Business Combination. The closing of the

PIPE Investment is contingent upon, among other things, the substantially concurrent consummation of the Business Combination. The PIPE

Subscription Agreement provide that Globis will grant the investors in the PIPE Investment certain customary registration rights and

indemnification.

In

connection with the proposed Business Combination, between December 31, 2021 and January 3, 2022, affiliates (each a “Bond Investor”)

of Up and Up Capital, LLC and Globis SPAC LLC, the sponsors of Globis, subscribed for convertible bonds of FAHL, as issuer, in an aggregate

principal amount of $9.5 million (the “FAHL Bonds”) in a private placement, issued pursuant to a Bond Subscription

Deed (the “Bond Subscription Deed”), among FAHL, the Seller and the Bond Investors. The FAHL Bonds are unsecured obligations

of FAHL and are not transferable without the consent of FAHL (such consent not to be unreasonably withheld). Unless earlier converted

or redeemed in accordance with the terms of the FAHL Bonds, the FAHL Bonds will mature and be redeemed on June 15, 2026. Interest shall

accrue on the FAHL Bonds at a rate of 6% per annum and the Bond Investors are entitled to certain customary information rights. Pursuant

to the current terms of the FAHL Bonds, upon consummation of the Business Combination, the FAHL Bonds will automatically convert into

ordinary shares of New Forafric at a price per share that is a 10% discount to the PIPE Investment, subject to certain adjustments.

The number of ordinary shares will be equal to the quotient that results from dividing the aggregate principal amount of the respective

FAHL Bond by $9.45, subject to certain adjustments.

In connection

with the proposed Business Combination, certain loans issued by parties affiliated with the Seller

(the “FAHL Related Party Loans”) will be repaid at the Closing of the Business Combination; provided that up

to $20 million of the FAHL Related Party Loans may be converted into Ordinary Shares of FAHL at a price of $10.50 per share at the option

of the lender. As of September 30, 2021, the FAHL Related Party Loans had a balance of $15.2 million and thus were convertible into up

to 1,445,164 Ordinary Shares. For further details, see “Certain Relationships and Related Person Transactions — FAHL Related

Person Transactions — Related Party Loans.”

Concurrently

with the IPO, on December 15, 2020, Globis and the Sponsor Parties entered into the Letter Agreement (the “Sponsor Letter Agreement”),

pursuant to which, among other things, the Sponsor Parties agreed to (i) vote in favor of the Business Combination Agreement and the

transactions contemplated thereby, (ii) be bound by certain other covenants and agreements related to the Business Combination and (iii)

be bound by certain transfer restrictions with respect to his, her or its shares in Globis prior to the closing of the Business Combination

(the date on which such closing occurs, the “Closing Date”), or the earlier termination of the Business Combination

Agreement. For further details, see “Proposal 3: The Business Combination Proposal — The Business Combination Agreement

— Business Combination Consideration.”

Concurrently

with the consummation of the Business Combination, Seller and the Sponsors will execute and deliver to New Forafric the Lock-Up Agreement,

substantially in the forms attached to this proxy statement/prospectus as Annexes D and E, pursuant to which,

among other things, the Seller and Sponsors will agree not to, subject to certain exceptions set forth in the Lock-Up Agreement, during

the period commencing from the Closing and through the date that is 180 days from the date of the Closing (the “Lock-Up Period”):

(i) sell, offer to sell, contract, or agree to sell, hypothecate, pledge, grant any option to purchase, or otherwise transfer or dispose

of or agree to transfer or dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease

a call equivalent position within the meaning of Section 16 of the Exchange Act with respect to, any portion of New Forafric’s

Ordinary Shares, or (ii) enter into any swap or other contract that transfers to another, in whole or in part, any of the economic consequences

of ownership of any of the Ordinary Shares, whether any such transaction is to be settled by delivery of Ordinary Shares or such other

equity securities, in cash or otherwise, or (iii) publicly announce any intention to effect any transaction specified in clause (i) or

(ii). Any waiver by New Forafric of the provisions of the Lock-Up Agreement requires the approval of a committee consisting of (a) Paul

Packer and another individual designated by Paul Packer, and (b) two “independent” directors of Globis as of after the Closing,

who shall be agreed to by each of Globis and FAHL before the Closing.

In

connection with the Business Combination, certain related agreements have been, or will be entered into on or prior to the closing of

the Business Combination (the date on which such closing occurs, the “Closing Date”), including the Memorandum and

Articles of Association (as defined in the accompanying proxy statement/prospectus). See “Proposal 3: The Business Combination

Proposal — Certain Agreements Related to the Business Combination” in the accompanying proxy statement/prospectus for

more information.

Pursuant

to the Existing Organizational Documents, a holder of Public Shares (“Public Stockholder”) may request that Globis

redeem all or a portion of such stockholder’s Public Shares for cash if the Business Combination is consummated. Holders of units

must elect to separate the units into the underlying Public Shares and Public Warrants prior to exercising redemption rights with respect

to the Public Shares. If holders hold their units in an account at a brokerage firm or bank, holders must notify their broker or bank

that they elect to separate the units into the underlying Public Shares and Public Warrants, or if a holder holds units registered in

its own name, the holder must contact VStock Transfer, LLC (the “Transfer Agent”), Globis’ transfer agent, directly

and instruct it to do so. The redemption rights include the requirement that a holder must identify itself in writing as a beneficial

holder and provide its legal name, phone number and address to the Transfer Agent in order to validly redeem its shares. Public Stockholders

may elect to redeem their Public Shares even if they vote “FOR” the Business Combination Proposal. If the Business Combination

is not consummated, the Public Shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated,

and if a Public Stockholder properly exercises its right to redeem all or a portion of the Public Shares that it holds and timely delivers

its shares to the Transfer Agent, New Forafric will redeem such Public Shares for a per-share price, payable in cash, equal to the pro

rata portion of the Globis’ trust account established at the consummation of its initial public offering (the “Trust Account”),

calculated as of two business days prior to the consummation of the Business Combination. For illustrative purposes, as of ,

2022, this would have amounted to approximately $

per issued and outstanding Public Share. If a Public Stockholder exercises its redemption rights in full, then it will be electing to

exchange its Public Shares for cash and will no longer own Public Shares. The redemption takes place following the Redomiciliation and

accordingly it is Ordinary Shares of New Forafric that will be redeemed immediately after consummation of the Business Combination. See

“Stockholders Meeting — Redemption Rights” in the accompanying proxy statement/prospectus for a detailed description

of the procedures to be followed if you wish to redeem your Public Shares for cash.

Notwithstanding

the foregoing, a Public Stockholder, together with any affiliate of such Public Stockholder or any other person with whom such Public

Stockholder is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934,

as amended (“Exchange Act”)), will be restricted from redeeming its Public Shares with respect to more than an aggregate

of 20% of the Public Shares. Accordingly, if a Public Stockholder, alone or acting in concert or as a group, seeks to redeem more than

20% of the Public Shares, then any such shares in excess of that 20% limit would not be redeemed for cash.

The

Business Combination Agreement is also subject to the satisfaction or waiver of certain other closing conditions as described in the

accompanying proxy statement/prospectus. There can be no assurance that the parties to the Business Combination Agreement would waive

any such provision of the Business Combination Agreement. In addition, the Business Combination Agreement provides that the obligations

of FAHL, the Seller and Globis to consummate the Business Combination are conditioned on, among other things, Globis having, after giving

effect to the Business Combination and the transactions contemplated thereby, net tangible assets (as determined in accordance with Rule

3a51-1(g)(1) of the Exchange Act) of at least $5,000,001.

Globis

is providing the accompanying proxy statement/prospectus and accompanying proxy card to Globis’ stockholders in connection with

the solicitation of proxies to be voted at the Stockholders Meeting and at any adjournments of the special meeting. Information about

the Stockholders Meeting, the Business Combination and other related business to be considered by Globis’ stockholders at the Stockholders

Meeting is included in the accompanying proxy statement/prospectus. Whether or not you plan to attend the Stockholders Meeting, all

of Globis’ stockholders are urged to read the accompanying proxy statement/prospectus, including the Annexes and other documents

referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk

Factors” beginning on page 34 of the accompanying proxy statement/prospectus.

After

careful consideration, the board of directors of Globis has unanimously approved the Business Combination and unanimously recommends

that stockholders vote “FOR” the adoption of the Business Combination Agreement and approval of the transactions contemplated

thereby, including the Business Combination, and “FOR” all other proposals presented to Globis’ stockholders in the

accompanying proxy statement/prospectus. When you consider the recommendation of these proposals by the board of directors of Globis,

you should keep in mind that Globis’ directors and officers have interests in the Business Combination that may conflict with your

interests as a stockholder. See the section entitled “Proposal 3: The Business Combination Proposal — Interests of Globis’

Directors and Officers and Others in the Business Combination” in the accompanying proxy statement/prospectus for a further

discussion of these considerations.

The

approval of the Equity Incentive Plan Proposal, the Organizational Documents Proposals, the Nasdaq Proposal and the Adjournment Proposal

will require the affirmative vote of a majority of the votes cast by the stockholders present in person (which would include presence

at a virtual meeting) or represented by proxy at the Stockholders Meeting. The Organizational Documents Proposals are voted upon on a

non-binding advisory basis. Notwithstanding the foregoing, the Business Combination is conditioned upon the approval of the Condition

Precedent Proposals. The approval of the Merger Proposal, the Redomiciliation Proposal, and the Charter Proposal will require the affirmative

vote of the holders of a majority of the outstanding shares of Common Stock, voting together as a single class. Directors are elected

by a plurality of all of the votes cast by the stockholders present in person (which would include presence at a virtual meeting) or

represented by proxy at the Stockholder Meeting. This means that the six director nominees who receive the most affirmative votes will

be elected. If any of the Condition Precedent Proposals fail to receive the required approval by the stockholders of Globis at the Stockholders

Meeting, the Business Combination will not be completed.

Your

vote is very important. Whether or not you plan to attend the Stockholders Meeting, please vote as soon as possible by following

the instructions in the accompanying proxy statement/prospectus to make sure that your shares are represented at the Stockholders Meeting.

If you hold your shares in “street name” through a bank, broker or other nominee, you will need to follow the instructions

provided to you by your bank, broker or other nominee to ensure that your shares are represented and voted at the Stockholders Meeting.

The transactions contemplated by the Business Combination Agreement will be consummated only if the Condition Precedent Proposals are

approved at the Stockholders Meeting. Each of the Condition Precedent Proposals is cross-conditioned on the approval of each other. The

Adjournment Proposal is not conditioned on the approval of any other proposal set forth in the accompanying proxy statement/prospectus.

If

you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted FOR each of the proposals

presented at the Stockholders Meeting. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how

to vote, and do not attend the Stockholders Meeting in person, the effect will be, among other things, that your shares will not be counted

for purposes of determining whether a quorum is present at the Stockholders Meeting. If you are a stockholder of record and you attend

the Stockholders Meeting and wish to vote in person, you may withdraw your proxy and vote in person.

TO

EXERCISE YOUR REDEMPTION RIGHT, YOU MUST DEMAND IN WRITING THAT YOUR PUBLIC SHARES ARE REDEEMED FOR A PRO RATA PORTION OF THE FUNDS HELD

IN THE TRUST ACCOUNT AND TENDER YOUR SHARES TO GLOBIS’ TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE STOCKHOLDERS

MEETING. IN ORDER TO EXERCISE YOUR REDEMPTION RIGHT, YOU NEED TO IDENTIFY YOURSELF AS A BENEFICIAL HOLDER AND PROVIDE YOUR LEGAL NAME,

PHONE NUMBER AND ADDRESS IN YOUR WRITTEN DEMAND. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATES (IF ANY) AND

OTHER REDEMPTION FORMS TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC

(DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL BE RETURNED TO YOU OR

YOUR ACCOUNT. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW

THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHT.

On

behalf of the board of directors of Globis, I would like to thank you for your support and look forward to the successful completion

of the Business Combination.

| |

Sincerely, |

| |

|

| |

Paul

Packer |

| |

Chairman |

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED

IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS

OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY

CONSTITUTES A CRIMINAL OFFENSE.

The

accompanying proxy statement/prospectus is dated , 2022

and is first being mailed to stockholders on or about ,

2022.

ADDITIONAL

INFORMATION

The

accompanying document is the proxy statement of Globis for the Stockholders Meeting and the prospectus for the securities of New Forafric,

the continuing Gibraltar public company limited by shares following the Redomiciliation. This registration statement and the accompanying

proxy statement/prospectus is available without charge to stockholders of Globis upon written or oral request. This document and other

filings by Globis with the Securities and Exchange Commission may be obtained by either written or oral request to Globis Acquisition

Corp., 7100 W. Camino Real, Suite 302-48, Boca Raton, FL 33433 or by telephone at (212) 847-3248.

The

Securities and Exchange Commission maintains an internet site that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the Securities and Exchange Commission. You may obtain copies of the materials described

above at the commission’s internet site at www.sec.gov.

In addition, if you have questions

about the Proposals or the accompanying proxy statement/ prospectus, would like additional copies of the accompanying proxy statement/prospectus,

or need to obtain proxy cards or other information related to the proxy solicitation, please contact (“

”), our proxy solicitor, by calling ( )

- , or banks and brokers can call collect at

( ) - ,

or by emailing . You will not be charged for

any of the documents that you request.

See

the section entitled “Where You Can Find More Information” of the accompanying proxy statement/ prospectus for further

information.

Information

contained on the Globis website, or any other website, is expressly not incorporated by reference into the accompanying proxy statement/prospectus.

To

obtain timely delivery of the documents, you must request them no later than five business days before the date of the Stockholders Meeting,

or no later than , 2022.

GLOBIS

ACQUISITION CORP.

7100

W. Camino Real, Suite 302-48

Boca

Raton, FL 33433

NOTICE

OF special meeting of stockholders

TO

BE HELD ON , 2022

TO

THE STOCKHOLDERS OF GLOBIS ACQUISITION CORP.:

NOTICE

IS HEREBY GIVEN that a special meeting of stockholders (the “Stockholders Meeting”) of Globis Acquisition Corp., a

Delaware corporation (“Globis” and, after the Redomiciliation as described below, “New Forafric”),

will be held at 9 a.m., Eastern Time, on , 2022, at the offices

of McDermott Will & Emery located at One Vanderbilt Avenue, 45th Floor, New York, New York 10017, or via a virtual meeting, or at

such other time, on such other date and at such other place to which the meeting may be adjourned.

As

all stockholders will no doubt be aware, due to the current novel coronavirus (“COVID-19”) global pandemic, there

are restrictions in place in many jurisdictions relating to the ability to conduct in-person meetings. As part of our precautions regarding

COVID-19, we are planning for the possibility that the meeting may be held virtually over the Internet, but the physical location of

the meeting will remain at the location specified above for the purposes of our Amended and Restated Certificate of Incorporation. If

we take this step, we will announce the decision to do so via a press release and posting details on our website that will also be filed

with the SEC as proxy material. You are cordially invited to attend the Stockholders Meeting, which will be held for the following purposes:

| (1) |

Proposal

No. 1 — The Merger Proposal — To consider and vote upon a proposal to approve and adopt the merger of Globis with

and into Globis NV Merger Corp., a Nevada corporation and a wholly-owned subsidiary of Globis (“Globis Nevada”),

with Globis Nevada surviving (the “Merger”). |

| |

|

| (2) |

Proposal

No. 2 — The Redomiciliation Proposal — To consider and vote upon a proposal to change the corporate structure and

jurisdiction of incorporation of Globis Nevada by way of continuation from a corporation incorporated under the laws of the State

of Nevada to a public company limited by shares incorporated under the laws of Gibraltar (the “Redomiciliation”).

The Redomiciliation will be effected immediately prior to the consummation of the Business Combination (as defined below) by Globis

Nevada filing an application for establishing domicile in Gibraltar, along with all applicable notices, undertakings and other documents

required to be filed, and filing an application to de-register with the Nevada Secretary of State. As used herein, “New

Forafric” refers to Globis as a Gibraltar public company limited by shares by way of continuation following the Redomiciliation,

which, in connection with the Redomiciliation and simultaneously with the consummation of the Business Combination, will change its

corporate name to “Forafric Global PLC.” We refer to this proposal as the “Redomiciliation Proposal.”

The form of the proposed Memorandum and Articles of Association of New Forafric to become effective upon the Redomiciliation, is

attached to the accompanying proxy statement/ prospectus as Annex C. |

| |

|

| (3) |

Proposal

No.3 — The Business Combination Proposal — To consider and vote upon a proposal to approve the Business Combination

Agreement, entered into as of December 19, 2021 (as amended or supplemented from time to time, the “Business Combination

Agreement”), by and among Globis, Lighthouse Capital Limited (“Seller”) and Forafric Agro Holdings Limited

(“FAHL”), and the transactions contemplated by the Business Combination Agreement (collectively, the “Business

Combination”). Pursuant to the Business Combination Agreement, among other things, Globis will acquire 100% of the equity

interests of FAHL from Seller, its sole shareholder, with FAHL becoming a direct subsidiary of New Forafric as a result thereof,

as described in more detail in the accompanying proxy statement/prospectus. We refer to this proposal as the “Business Combination

Proposal.” A copy of the Business Combination Agreement is attached to the accompanying proxy statement/prospectus as Annex

A. |

| |

|

| (4) |

Proposal

No. 4 — The Equity Incentive Plan Proposal — To consider and vote upon the approval of the Equity Incentive Plan.

We refer to this as the “Equity Incentive Plan Proposal.” A copy of the Equity Incentive Plan is attached to the

accompanying proxy statement/prospectus as Annex H. |

| (5) |

Proposal

No. 5 — The Director Election Proposal — To consider and vote upon a proposal to elect six directors to serve

on the board of directors of New Forafric (the “New Forafric Board”) until the 2025 annual general meeting

and until their respective successors are duly elected and qualified. We refer to this as the “Director Election Proposal.”

|

| |

|

| (6) |

Proposal

No. 6 — The Charter Proposal — To consider and vote upon the approval of the amendment and restatement of the Existing

Organizational Documents (as defined herein) in their entirety by the proposed new memorandum and articles of association (the “Memorandum

and Articles of Association”) of New Forafric (a public company limited by shares domiciled in Gibraltar), assuming the

Merger Proposal and the Redomiciliation Proposal is approved and adopted, and the filing with and acceptance by the Registrar of

Companies in Gibraltar of the filing of the application for establishing domicile in Gibraltar in accordance with the Companies Act

2014 of the Laws of Gibraltar (the “Companies Act”) and the Companies (Re-domiciliation) Regulations 1996 of the

Laws of Gibraltar (the “Re-domiciliation Regulations”), including authorization of the change in authorized share

capital as indicated therein and the change of name of Globis to “Forafric Global PLC” in connection with the Business

Combination. We refer to this as the “Charter Proposal.” A copy of the Memorandum and Articles of Association

is attached to the accompanying proxy statement/prospectus as Annex C. |

| |

|

| (7) |

Proposal

No. 7 — The Organizational Documents Proposals — To consider and vote upon, on a non-binding advisory basis, certain

governance provisions in the Memorandum and Articles of Association (collectively, the “Organizational Documents Proposals”),

to approve the following material differences between the current Amended and Restated Certificate of Incorporation of Globis (the