Exhibit 99.1

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L Investor Presentation December 2022

2

Disclaimer

About this Presentation

This presentation (“Presentation”) contains information of Kingswood Acquisition Corporation (“KWAC”). This Presentation is made solely for informational purposes, and no representation or warranty, express or implied, is made

by KWAC, Wentworth Management Services LLC (the “Company”) or any of their respective subsidiaries, stockholders, representative or affiliates as to the information contained in these materials or disclosed during any related

presentations or discussions. The recipient of this Presentation not use this Presentation and its contents for any purpose other than as expressly authorized by KWAC and the Company and shall be required to return or destroy all

copies of this Presentation or portions thereof in its possession promptly following request for the return or destruction of such copies.

This Presentation is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination (the “Business Combination”)

between KWAC and the Company and the other parties thereto and related transactions and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this Presentation. Recipients of

this Presentation should consult their own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, confirms that they are not relying on the

information contained herein to make any decision. To the fullest extent permitted by law in no circumstances will KWAC, the Company or any of their respective subsidiaries, stockholders, affiliates, representatives, partners,

directors, officers, employees, investment banks, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on

the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry

publications and sources as well as from research reports prepared for other purposes. Neither KWAC nor the Company has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy

or completeness and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. This data is subject to change. In

addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of KWAC or the Business Combination. Viewers of this Presentation should each make

their own evaluation of KWAC and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. This presentation does not constitute investment, tax or legal advice.

This Presentation does not constitute: (i) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed Business Combination; or (ii) an offer to sell, a solicitation of an offer to buy, or a

recommendation to purchase any security of KWAC, the Company, or any of their respective affiliates. No such offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the

Securities Act of 1933, as amended.

Forward Looking Statements

Certain statements, estimates, targets, and projections in this Presentation may be considered forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements generally relate to future events or involve future performance of, KWAC or the Company. For example, projections of future EBITDA, statements regarding anticipated growth in the industry

in which the Company operates and anticipated growth in demand for the Company’s products, projections of the Company’s future financial results and other metrics, the satisfaction of closing conditions to the Business

Combination and the timing of the completion of the Business Combination are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma”, “may”, “should”, “could”,

“might”, “plan”, “possible”, “project”, “strive”, “budget”, “forecast”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that a statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ

materially from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and assumptions that, whether or not identified in this communication and on the current expectations of KWAC and the Company and their respective management

teams, but are not predictions of actual performance. These estimates and assumptions, considered reasonable by KWAC and its management, and the Company and its management, as the case may be, are inherently uncertain.

Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations

and any subsequent definitive agreements with respect to the Business Combination; the outcome of any legal proceedings that may be instituted against KWAC, the Company, the combined company or others following the

announcement of the Business Combination and any definitive agreements with respect thereto; the inability to complete the Business Combination due to the failure to obtain approval of the stockholders of KWAC, or the

Company to obtain financing to complete the Business Combination or to satisfy other conditions to closing; changes to the proposed structure of the Business Combination that may be required or appropriate as a result of

applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; the ability to meet stock exchange listing standards following the consummation of the Business Combination; the risk

that the Business Combination disrupts current plans and operations of the Company as a result of the announcement and consummation of the Business Combination; the ability to recognize the anticipated benefits of the Business

Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its

management and key employees; costs related to the Business Combination; changes in applicable laws or regulations; the possibility that the Company or the combined company may be adversely affected by other economic,

business, regulatory, and/or competitive factors; the Company’s estimates of expenses and profitability; the evolution of the markets in which the Company competes; the ability of the Company to implement its strategic initiatives

and continue to innovate its existing products; the ability of the Company to defend its intellectual property and satisfy regulatory requirements; the impact of the COVID-19 pandemic on the Company’s business; and other risks and

uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in KWAC’s final prospectus dated November 19, 2020 relating to its initial public offering and other risks and

uncertainties indicated from the time to time in the definitive proxy statement to be delivered to KWAC’s stockholders and related registration statement on Form S-4, including those set forth under “Risk Factors” therein, and other

documents filed to be filed with the United States Securities and Exchange Commission ("SEC") by KWAC.

This Presentation includes preliminary financial information (or “Flash” information) for the fiscal year ended December 31, 2021, which is subject to completion of the Company’s year-end close procedures and further financial

review, and will differ in possible material ways from the financial information in the definitive proxy statement to be delivered to KWAC’s stockholders and related registration statement on Form S-4. Actual results may differ as a

result of the completion of the Company’s year-end closing procedures, review adjustments and other developments that may arise between now and the time such financial information for the period is finalized. As a result, these

estimates are preliminary, may change and constitute forward-looking information and, as a result, are subject to risks and uncertainties. Neither the Company’s independent registered accounting firm nor any other independent

registered accounting firm has audited, reviewed, or compiled, examined, or performed any procedures with respect to the preliminary results, nor have they expressed any opinion or any other form of assurance on the preliminary

financial information. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forwardlooking

statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither KWAC, the Company nor any other person undertakes any duty to

update these forward-looking statements.

3

Use of Projections

This Presentation contains certain financial forecasts, including sales volume, projected revenue, net revenue, gross profit, adjusted EBITDA, net income, capex, net debt (and growth rates and ratios derived therefrom). The

Company’s independent auditors have not studied, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, no independent auditor

has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily

indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and

uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of KWAC’s and the Company’s

control. While all financial projections, estimates and targets are necessarily speculative, KWAC and the Company believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty

the further out in time the projection, estimate or target extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance or that actual results will not

differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a Presentation by any person that the results

contained in the prospective financial information will be achieved.

Presentation of Financial Data

The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented

differently in, any proxy statement, registration statement, or prospectus to be filed by the Company with the SEC. The financial information and data contained in this Presentation, such as Adjusted EBITDA have not been

prepared in accordance with United States generally accepted accounting principles (“GAAP”). The Company and KWAC believe these non-GAAP measures of financial results provide useful information to management and

investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company and KWAC believe that the use of these non-GAAP financial measures provides an

additional tool for investors to use in evaluating projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial

measures to investors; although, other companies may calculate such non-GAAP measures differently, or may use other measures to calculate their financial performance. Accordingly, the Company's non-GAAP measures may not

be directly comparable to similarly titled measures of other companies. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The

principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Additionally, to the extent that forwardlooking

non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain

amounts that are necessary for such reconciliations. You should review the Company’s and KWAC’s audited financial statements, which will be included in the definitive proxy statement relating to the Business Combination.

This Presentation contains trademarks, service marks, trade names and copyrights of KWAC, the Company and other companies, which are the property of their respective owners.

Additional information about the Business Combination and where to find it

The Business Combination will be submitted to stockholders of KWAC for their consideration. KWAC intends to file a Registration Statement on Form S-4 with the SEC, which will include a preliminary proxy statement and a

definitive proxy statement, to be distributed to KWAC’s stockholders in connection with KWAC’s solicitation of proxies for the vote by KWAC’s stockholders in connection with the Business Combination and other matters as

described in the definitive proxy statement. After the Registration Statement on Form S-4 has been filed and declared effective, KWAC will mail a definitive proxy statement and other relevant documents to its stockholders as of

the record date established for voting on the Business Combination. KWAC’s stockholders and other interested persons are advised to read, once available, the preliminary proxy statement and any amendments thereto and, once

available, the definitive proxy statement, in connection with KWAC’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Business Combination, because these documents

will contain important information about the Company, KWAC and the Business Combination. Stockholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed

with the SEC regarding the Business Combination and other documents filed with the SEC by KWAC, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Michael Nessim (email:

mnessim@kingswoodus.com or phone: (212) 404-7002).

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE

OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the solicitation

The Company, KWAC and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from KWAC’s

stockholders in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of KWAC’s stockholders in connection with the Business

Combination will be set forth in KWAC’s proxy statement when it is filed with the SEC. You can find more information about KWAC’s directors and executive officers in KWAC’s final prospectus filed with the SEC on November 19,

2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in KWAC’s proxy statement when it becomes available. Stockholders, potential

investors, and other interested persons should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources

indicated above.

Conflicts of Interest

Oppenheimer & Co. Inc. ("Oppenheimer") acted as the underwriter of KWAC's initial public offering and acquired private placement units in KWAC that were deemed underwriting compensation. Additionally, Oppenheimer has

been engaged by KWAC as financial and capital markets advisor in connection with a potential business combination with the Company, and, in connection therewith, may be entitled to receive fees from KWAC or its affiliates if

the Business Combination is consummated.

Disclaimer (Cont.)

4 Note: See Appendix for the full bios of the Wentworth Management Team. David Shane Incoming Chief Financial Officer – Binah Capital Larry Roth Incoming Executive Chairman – Binah Capital 30+Years of Experience • Previously Chief Financial Officer of Sanctuary Wealth 30+Years of Experience • Previously Chief Executive Officer of Cetera Financial Group and AIG Advisor Group Craig Gould Incoming Chief Executive Officer – Binah Capital 25+Years of Experience • Founder and Current President of Wentworth Management and Cabot Lodge Securities Michael Nessim CEO KWAC & MP Kingswood US 25+Years of Experience • Kingswood U.S. CEO and Managing Partner Today’s Presenters

5 Kingswood Acquisition Corp. Overview . Long]term value creation strategy through organic and inorganic initiatives in a global fragmented sector ripe for consolidation underpinned by positive macro tailwinds .. Leadership with a track record of supporting businesses through their lifecycles with substantial operating and investing experience to deliver meaningful shareholder value . Gary Wilder, Executive Chairman has 30+ years of experience across M&Amp;A, investments and operations .. Mike Nessim, Chief Executive Officer has 24+ years of experience across M&A, capital markets and operations . 54+ years of combined industry experience and 100+ $33B+ in value completed transactions . Diverse board of directors led by Larry Roth, Lead Independent Director, who has 30+ years experience as an operator, dealmaker, strategic advisor and entrepreneur . Highly qualified board of directors boasting significant M&A, capital markets, financial, operations, compliance and legal experience . 225+ years of combined industry experience and 1,100+ completed transactions Diverse Board of Directors Experienced Primary Sponsor Group KWAC Value Add Seasoned Leadership Team .. KPI Nominees Limited is a private UK holding company formed in 2004 involved in a range of investment activities . Pollen Street Capital is a global, independent alternative investment management company focused on the financial and businesses services sectors . KPI Nominees Limited and Pollen Street Capital both have a number of significant investments in the financial services industry Kingswood Acquisition Corp. "KWAC" is a natural partner for Wentworth given its leadership's experience and proven track record in the wealth and investment management industry

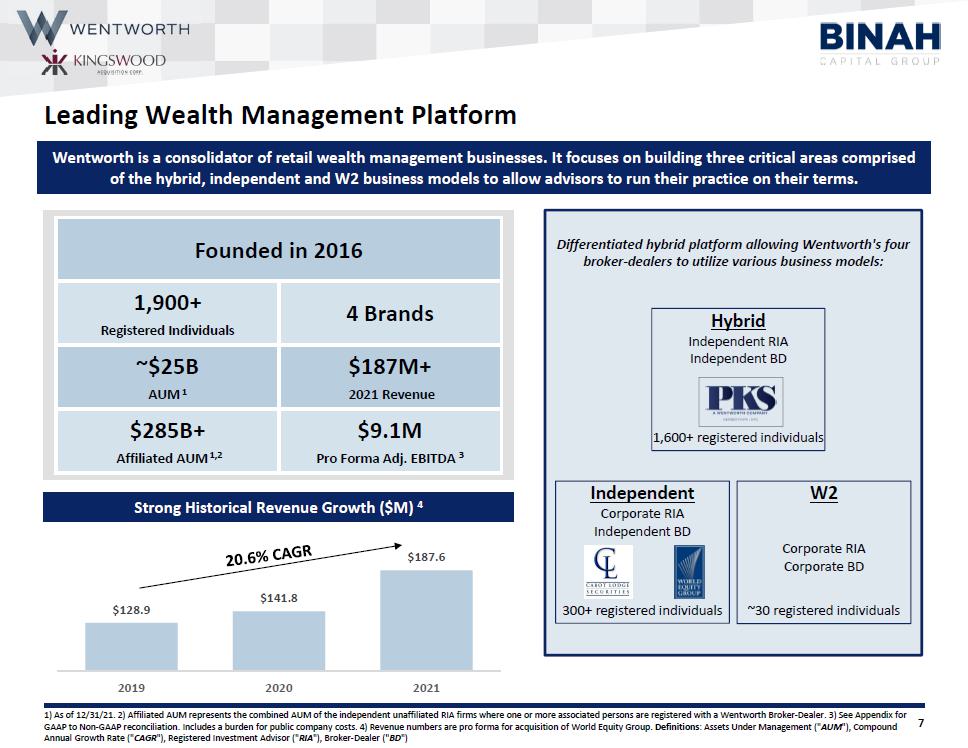

7 $128.9 $141.8 $187.6 2019 2020 2021 Leading Wealth Management Platform 1 As of 12/31/21. 2 Affiliated AUM represents the combined AUM of the independent unaffiliated RIA firms where one or more associated persons are registered with a Wentworth Broker]Dealer. 3 See Appendix for GAAP to Non]GAAP reconciliation. Includes a burden for public company costs. 4 Revenue numbers are pro forma for acquisition of World Equity Group. Definitions: Assets Under Management "AUM", Compound Annual Growth Rate "CAGR", Registered Investment Advisor "RIA", Broker]Dealer "BD" Founded in 2016 1,900+ Registered Individuals 4 Brands ~$25B AUM1 $187M+ 2021 Revenue $285B+ Affiliated AUM1,2 $9.1M Pro Forma Adj. EBITDA 3 Strong Historical Revenue Growth $M 4 Differentiated hybrid platform allowing Wentworth's four broker]dealers to utilize various business models: Independent Corporate RIA Independent BD 300+ registered individuals W2 Corporate RIA Corporate BD ~30 registered individuals Hybrid Independent RIA Independent BD 1,600+ registered individuals Wentworth is a consolidator of retail wealth management businesses. It focuses on building three critical areas comprised of the hybrid, independent and W2 business models to allow advisors to run their practice on their terms.

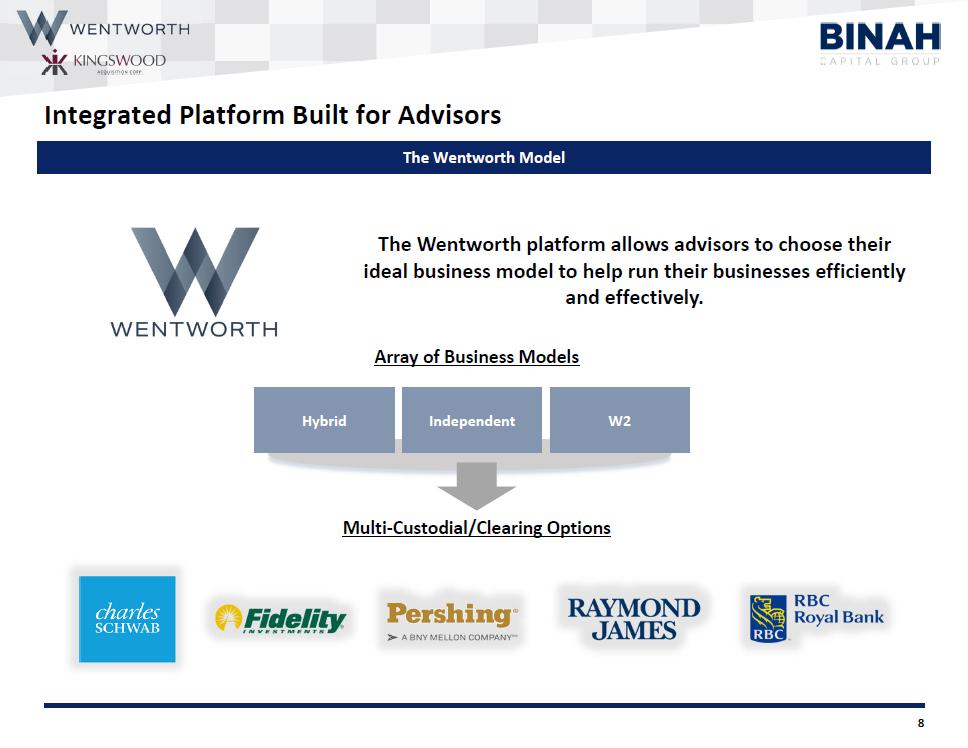

8 Integrated Platform Built for Advisors The Wentworth Model Hybrid Independent W2 Array of Business Models Multi]Custodial/Clearing Options The Wentworth platform allows advisors to choose their ideal business model to help run their businesses efficiently and effectively.

9 Integrated Platform Built for Growth Full]service model and easy]to]use platform Integrated Platform Array of Product Offerings M&A Capabilities Succession Planning Practice Management Affiliation Optionality End]to]End Service Platform Succession Planning Knowledge Sharing Across Platform Enhanced Marketing and Branding Wentworth provides an easy]to]use platform with access to multiple clearing custodians, technology platforms and products/services, allowing advisors to choose what is best for their business.

10 Advisor Journey to Wentworth Platform Hybrid Breakaway / Wirehouse Advisors RIAs Independent W2 Asset Management Platform Insurance Platform Alternatives Platform DST 1031 Platform Lending Services Recruiting & M&A Efforts Increased Products and Platform Assets Distribution Access Independent / Hybrid Advisors

11 Revenue Growth Margin Expansion Technology Platform Lift]outs & Acquisitions .. Enhanced advisor recruitment efforts . Expansion of product offerings for advisors, including: . Delaware Statutory Platform gDSTh .. Hedge Fund Products . Private Equity Funds . Asset]Backed Lending . Develop strategic M&A pipeline to gain scale and profitability .. Focus on existing client access to new products on the WMS platform . Recognize synergies across broker]dealers to reduce costs . Expand upon shared services to enhance efficiency and provide more offerings to advisors: . Finance / Accounting . Operations / HR . IT / Tech Platform . Continue to build upon tech stack through modernization and digitization . Drive scale through technology products .. Expand advisor network via pipeline of potential lift]outs . Continue to add scale through the consolidation of other firms onto Wentworth's platform . Leverage managementfs existing relationships and experience to identify and integrate the best partners . Promote brand to the market to develop recognition and further attract advisors Key Growth Drivers

12 „Ï Total advisor.managed assets has more than doubled from 2011 to 2020 with expectations of similar continued growth over the coming years „Ï Hybrid and independent RIAs have shown the strongest advisor.managed asset growth of all wealth managers with 10.year CAGRs over 10% 2 Total Advisor.Managed Assets 2 Expanding Addressable Market The addressable market for hybrid RIAs is significant and Wentworth is well.positioned to capture market share in this high growth, large total addressable market $54.1T $109.9T Total US Investable Assets Total US Assets held by Intermediaries 2 Total US Household Net Worth 1 $42.4T $25.7T Source: Envestnet, Cerulli. 1 Federal Reserve data as of 12/31/20. 2 Cerulli as of 2020. 3 Cerulli, 2021.2025 Advisor Assets $T assumes growth based on 2011.2020 historical CAGR.

13 Advisors and Assets Continue to Shift to the Independent Channel Wirehouse Hybrid Independent Broker Dealers “IBD” RIA Banks BDs Regional BDs Insurance BDs Losing Advisors Gaining Advisors Wentworth’s full suite of solutions for advisors Advisor Marketshare % Advisor Assets Marketshare % Source: Cerulli. 58.9% 59.1% 57.9% 58.6% 57.8% 56.7% 55.2% 53.6% 41.1% 40.9% 42.1% 41.4% 42.2% 43.3% 44.8% 46.4% Wirehouses, Regional, Insurance and Bank BDs Hybrid RIAs, RIAs, IBDs 68.0% 66.5% 64.8% 63.7% 62.8% 60.7% 58.7% 56.0% 32.0% 33.5% 35.2% 36.3% 37.2% 39.0% 41.3% 44.0% Wirehouses, Regional, Insurance and Bank BDs Hybrid RIAs, RIAs, IBDs

14 Industry Trends Towards Hybrid RIAs & Independent RIAs Industry trends show steady year]over]year migration to hybrid and independent RIA models, allowing for continued growth opportunities for Wentworth Source: Envestnet, Cerulli. 1 Data as of 2020. 23% 24% 20% 17% 16% 27% 24% 22% 62% 31% Sell Equity in my Practice to an RIA Aggregator Sell Equity to an Established RIA Brand Sell Equity to a Passive Investor Affiliate With an RIA Platform Offered by an IBD Contract End]to]End Infrastructure From a Platform Provider All RIAs Employee Advisors Who Prefer Independence % Of Advisors Who Consider the RIA Affiliation Model Appealing: 2020 Retail Focused RIAs . Assets by Year $B Advisor Headcount Growth: 10]Year CAGR % 1

15 Wentworth offers the most optionality to advisors through its platform relative to comparables Clearing capabilities through all major clearing and custodial firms „Ï Ability to keep identity and brand „Ï „Ï „Ï Flexibility in using independent RIA or corporate RIA „Ï „Ï LIMITED Breadth of shared services offered to advisors „Ï „Ï „Ï „Ï Ability to seamlessly integrate upon joining „Ï „Ï „Ï Ability to leverage enterprise relationships „Ï „Ï Wentworth Differentiation to Peers Source: Company Websites and Filings.

16 1 gRIA Affiliatesh is defined as an Independent unaffiliated RIA firm where one or more associated persons are registered with a Wentworth Broker]Dealer. Wentworthfs Leading RIA Affiliates 1

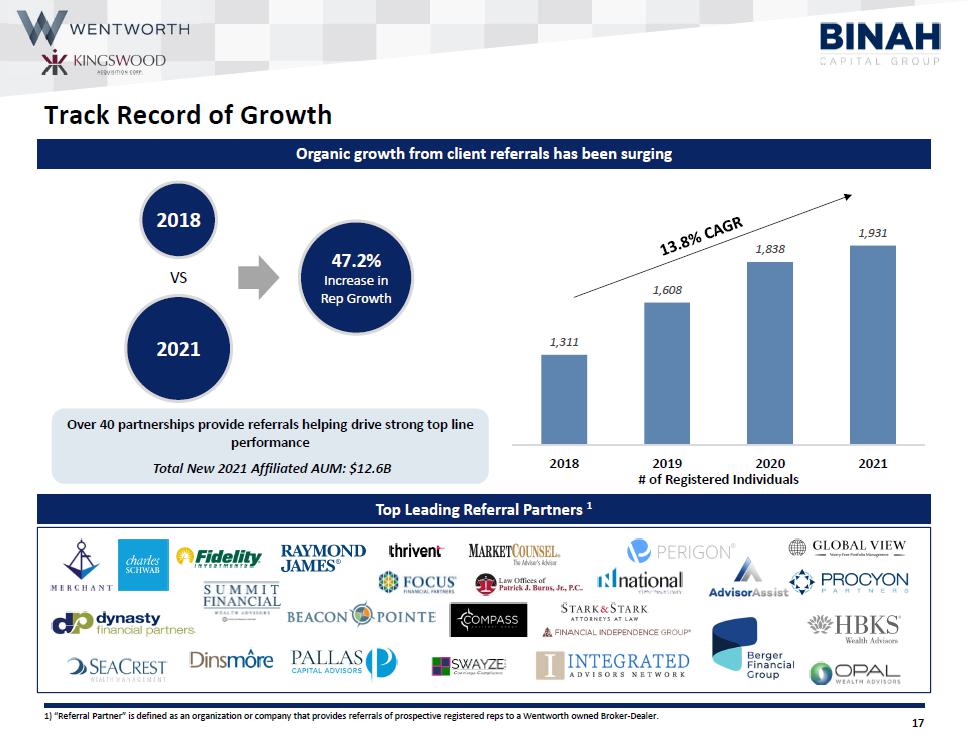

17 Organic growth from client referrals has been surging Over 40 partnerships provide referrals helping drive strong top line performance Total New 2021 Affiliated AUM: $12.6B Top Leading Referral Partners 1 1 gReferral Partnerh is defined as an organization or company that provides referrals of prospective registered reps to a Wentworth owned Broker]Dealer. 1,311 1,608 1,838 1,931 2018 2019 2020 2021 # of Registered Individuals VS 2018 2021 47.2% Increase in Rep Growth Track Record of Growth

18 Robust Wealth Management M&A Activity The U.S. wealth management landscape is highly fragmented and is among the few remaining sectors in the financial services industry to continue to experience significant consolidation Source: Cerulli, Echelon, Fidelity, industry research and analysis. Based on publicly available and reported data. 1 Cerulli as of 2020. 2 RIA Channel as of 2020. 3 Echelon as of 3Q22. 4 Excludes deals with over $20 billion and under $100 million assets under management. „X 15,000+ Independent Wealth Manager and Hybrid RIA & Broker.Dealer Affiliate firms with over $6 trillion of AUM in the U.S. 1 „X Highly fragmented market as the wealth management firms with over $1 billion in assets make up only 3% of total firms in the space, but manage nearly 50% of the market¡¦s total AUM, representing a significant buying opportunity for Wentworth to consolidate 2 U.S. Wealth Management M&A Activity Number of Announced Deals 3 AUM Transacted $B 3,4 Wentworth believes it is well.positioned to capitalize on the market fragmentation by offering independent managers a platform they can leverage to access asset gathering opportunities that would not otherwise exist on a standalone basis Strong Pace of Wealth Management M&A Has Continued through 2022 as Buyers Seek to Capitalize on a Highly Fragmented Marketplace 99 125 138 168 181 203 205 307 269 2014 2015 2016 2017 2018 2019 2020 2021 3Q '22 $53 $112 $144 $170 $230 $285 $319 $576 $443 2014 2015 2016 2017 2018 2019 2020 2021 3Q '22

19 Wentworth¡¦s current business model is positioned for rapid growth driven in the existing market by synergistic strategic initiatives and inorganic opportunities that it anticipates will enhance the scale of its profitability and margins Pipeline „« Wentworth has a healthy pipeline with 8 potential acquisitions that would generate approximately $80M in revenue and add over 600 reps „« Wentworth has built the ¡¥chassis¡¦ allowing for the next few transactions to be tuck.ins and therefore able to achieve margin improvement in the business „« With its tech.enabled platform, Wentworth can easily integrate new tech developments, product enhancements and new advisors onto the platform and realize the related revenue and expense synergies quickly „« With more scale and additional relationships, the platform only becomes more attractive for additional lift.outs and advisor recruitment Project Philly 250+ Reps // ~$25M in Revenue 1 Project SC ~100 Reps // ~$10M in Revenue 2 Project Chicago Splinter ~50 Reps // ~$8M Revenue 3 Project Chicago Price ~60 Reps // ~$10M Revenue 4 The Wentworth and KWAC combination provides an avenue for rapid growth through: 1. Providing Wentworth access to public capital markets to fund a robust pipeline of opportunities at a lower cost of capital 2. Ability to use public stock as a mechanism to recruit and retain top advisor talent as well as top level management 3. Wentworth¡¦s management team along with the KWAC Board brings extensive experience and the ability to leverage a wide network of relationships in the wealth management industry to continue to strategically build out the WMS platform Opportunity Suited for Growth and Profitability

20 Note: Financials included are non]GAAP. Pro forma figures include full]year financials for World Equity Group. 1 Total Adjusted G&A includes adjustments to exclude certain non]recurring G&A expenses. 2 Adjusted EBITDA is defined as net earnings loss before interest expense, benefit depreciation and amortization and is adjusted for certain non]recurring expenses as more fully defined in the Appendix: Reconciliation of Non]GAAP Financials. Post]Close amounts include the addition of public company costs. Adjusted EBITDA is a non]GAAP financial measure and may be different from measures of Adjusted EBITDA used by other companies. Please defer to Disclaimer . Presentation of Financial Data for additional information. 3 See Appendix for GAAP to non]GAAP Financials. Compelling Financial Growth Profile Pro Forma Post Close Pro Forma Pro Forma Pro Forma TTM Pro Forma $ in millions 2019 2020 2021 September '22 TTM September Commissions ] Sales based $38.1 $31.1 $38.0 $35.0 $35.0 ] Trailing 60.2 78.4 108.0 105.4 105.4 Advisory Fees 18.0 19.6 24.6 24.2 24.2 Investment Banking 2.1 3.0 4.6 4.2 4 .2 Alternatives 8.3 7.1 8.9 9.5 9 .5 Interest and other income 2.3 1.9 3.3 5.4 5 .4 Total Revenue $128.9 $141.1 $187.3 $ 183.7 $183.7 Cost of Revenue 102.5 114.8 153.1 150.5 150.5 Gross Profit $26.4 $26.2 $34.2 $33.1 $33.1 Total Adjusted G&A 1,2 20.2 18.1 22.5 20.9 24.0 Adjusted EBITDA 2,3 $6.2 $8.1 $11.7 $12.2 $9.1

21 Transaction Summary „X Kingswood Acquisition Corp. ¡§KWAC¡¨ is merging with Wentworth, at an enterprise valuation of $213.6 million representing 1.1x 2021 Pro Forma Revenue „X Cash in Trust reflects 0% redemptions from the post.extension balance of $5.4 million „X Wentworth equity holders ¡§Seller¡¨ will roll 100% of their equity in the transaction, representing a 77.8% equity ownership at closing „X Wentworth and KWAC intend to raise $30 million in convertible preferred equity capital and $24.2 million in debt capital in conjunction with the transaction „X The Company may also consider a modest sized Reg. D common stock offering for additional liquidity Key Transaction Terms Sources and Uses in millions Sources $ % Seller Rollover Equity $120.0 66.8% Cash in Trust 5.4 3.0% New Debt 24.2 13.5% New Convertible Preferred Equity 30.0 16.7% Total Sources $179.6 100% Uses $ % Seller Rollover Equity $120.0 66.8% KWAC Sponsor Loan Repayment, net 2 0.9 0.5% Pro Forma Cash to Balance Sheet 17.8 9.9% Term Debt Repayment 24.2 13.5% Existing Preferred Equity Redemption 2.8 1.5% Transaction Expenses 3 14.0 7.8% Total Uses $179.6 100% Pro Forma Economic Ownership at Close 1 SPAC: Acquisition Valuation at Close in millions 3.5% Seller: 77.8% Sponsor: 18.7% Pro Forma Enterprise Value $213.6 Less: Pro Forma Debt 47.2 Less: New Convertible Preferred Equity 30.0 Plus: Pro Forma Available Cash 17.8 Pro Forma Equity Value $154.2 1 Economic ownership at close assumes an illustrative price of $10.00 per share, 0% redemptions, $30 million convertible preferred equity capital raise and $24.2 million debt capital raise. 2 Assumes excess cash from KWAC also is used for loan repayment. 3 Transaction expenses include capital raise, M&A, deferred underwriting, financial diligence, compliance and legal fees.

22 National Wealth Management Platform Supporting 1,900+ Registered Individuals With Over $285B+ of „Ï Affiliated AUM Across Four Broker.Dealers/RIAs 1,2 Public.Ready Company with a Track Record of Building a Platform Capable of Significant Scale „Ï Along With Strategic Initiatives to Continue to Drive its Growth via Access to Public Capital Industry Tailwinds Show Trend of Advisors Shifting to The Hybrid and Independent Models „Ï With These Channels Consisting of Over 45% of Market Share by 2024 3 Open Architecture Model Providing Access to an Array of Solutions for Advisors and Their „Ï Clients via Expanded Product Offerings and Shared Services Strategically Positioned as The ¡¥Friendly¡¦ Hybrid RIA of Choice With Top Clearing and Custodial „Ï Relationships and Strategic Partnerships Tech.Enabled Platform Allowing for Seamless Integration and Providing Advisors With „Ï End.to.End Services Enhancing Efficiency Highly Attractive Financial Model Experiencing Organic Growth, Highly Recurring Revenues and „Ï Expanding Margins 1 As of 12/31/21. 2 Affiliated AUM represents the combined AUM of the independent unaffiliated RIA firms where one or more associated persons are registered with a Wentworth Broker.Dealer. 3 Source: Cerulli. Binah Investment Case

23 Appendix

24 Pro Forma Post Close Pro Forma Pro Forma Pro Forma TTM Pro Forma $ in millions 2019 2020 2021 September '22 TTM September '22 Net Earnings Loss 1 $8.8 $7.7 $1.5 $1.3 $4.5 Adjustments: Interest expense, net 4.1 2.6 2.7 3.3 3.3 Income tax expense benefit 0.6 0.4 0.8 0.8 0.8 Depreciation and amortization 5.0 5.3 5.5 5.2 5.2 Non]recurring expenses 2 5.3 8.3 5.8 5.9 5.9 Adjusted EBITDA 3 $6.2 $8.1 $11.7 $12.2 $9.1 Note: Non]GAAP financials are unaudited figures. Pro forma figures include full]year financials for World Equity Group. 1 Net earnings loss post]Close amounts include the addition of public company costs. 2 Non]recurring expenses include i M&A transaction]related costs ii one]time severance payments iii legal settlements and iv other one]time historical adjustments. 3 Adjusted EBITDA is defined as net earnings loss before interest expense, income tax expense benefit depreciation and amortization and is adjusted for certain non]recurring expenses as more fully defined in footnote 2. Post]Close amounts include the addition of public company costs. Adjusted EBITDA is a non]GAAP financial measure and may be different from measures of Adjusted EBITDA used by other companies. Please refer to Disclaimer . Presentation of Financial Data for additional information. Reconciliation of Non]GAAP Financials

24 Pro Forma Post Close Pro Forma Pro Forma Pro Forma TTM Pro Forma $ in millions 2019 2020 2021 September '22 TTM September '22 Net Earnings Loss 1 $8.8 $7.7 $1.5 $1.3 $4.5 Adjustments: Interest expense, net 4.1 2.6 2.7 3.3 3.3 Income tax expense benefit 0.6 0.4 0.8 0.8 0.8 Depreciation and amortization 5.0 5.3 5.5 5.2 5.2 Non]recurring expenses 2 5.3 8.3 5.8 5.9 5.9 Adjusted EBITDA 3 $6.2 $8.1 $11.7 $12.2 $9.1 Note: Non]GAAP financials are unaudited figures. Pro forma figures include full]year financials for World Equity Group. 1 Net earnings loss post]Close amounts include the addition of public company costs. 2 Non]recurring expenses include i M&A transaction]related costs ii one]time severance payments iii legal settlements and iv other one]time historical adjustments. 3 Adjusted EBITDA is defined as net earnings loss before interest expense, income tax expense benefit depreciation and amortization and is adjusted for certain non]recurring expenses as more fully defined in footnote 2. Post]Close amounts include the addition of public company costs. Adjusted EBITDA is a non]GAAP financial measure and may be different from measures of Adjusted EBITDA used by other companies. Please refer to Disclaimer . Presentation of Financial Data for additional information. Reconciliation of Non]GAAP Financials

26 Public Peer Benchmarking Sources: FactSet, SNL, Company Filings; Data as of December 21, 2022. 1 Share price change calculated excluding dividends. 2 Market Capitalization calculated based on fully diluted shares outstanding. 3 Enterprise Value calculated as Equity Value plus Net Debt Total Debt less Cash & Cash Equivalents and Non]Controlling Interest. 4 Recurring Revenue consists of revenues that are considered recurring]in]nature, including advisory fees, commissions, insurance and other fee]based revenues. Recurring Revenue $1,717M 96% Non]Recurring Revenue $81M 4% Recurring Revenue $7,052M 91% Non]Recurring Revenue $669M 9% 2021 Recurring vs Non]Recurring Revenue 4 FOCS LPL WMS Recurring Revenue $171M 91% 2021 YoY Revenue Growth % 31.5% 32.1% 32.7% Non]Recurring FOCS LPL WMS Revenue $17M 9% $ in millions, except per share figures Share Price % of 52 Ģ Share Price 1 Market Enterprise EV / Revenue EV / EBITDA Price / Earnings Company Name Ticker 12/21/22 Week High YTD LTM Cap 2 Value 3 2021A 2022E 2023E 2021A 2022E 2023E 2021A 2022E 2023E U.S. Wealth Managers LPL Financial Holdings Inc. LPLA]US $212.44 78.2% 31.4% 39.2% $16,910 $18,410 2.4x 2.1x 1.9x 19.2x 12.3x 7.5x 30.3x 19.0x 11.2x Focus Financial Partners, Inc. FOCS 37.71 6 0.6 39.1 32.8 2,923 5,450 3.0 2.6 2.4 12.1 10.5 9.7 9.6 8.7 8.7

27 Larry Roth ¡V Incoming Executive Chairman Biography „X Mr. Roth will serve as Binah¡¦s Executive Chairman upon closing of the transaction. Larry has over 30 years of experience as an operator of companies, a dealmaker, a strategic advisor and a successful entrepreneur. Larry, an Attorney and CPA, is currently the Managing Partner of RLR Strategic Partners LLC, a consulting company, where he works closely with senior management teams, boards of directors and advisory boards across the wealth management space to deliver high.impact strategic growth plans, as well as plan execution support. In addition to strategic planning, Larry also provides comprehensive M&A advisory solutions, delivered in association with Berkshire Global Advisors, a leading global boutique investment bank focused on mergers & acquisitions for the financial services sector. „X With three decades of experience in the wealth management industry, Larry will complement Wentworth¡¦s strategy through the expertise and relationships he has built over time as a CEO of some of the largest independent firms in the industry; a current and past board member of both public and private entities; an investment banker who has structured numerous value.creating transactions; and an entrepreneur who has acquired early.stage retail financial advice businesses, and grown them to achieve profitable exits. He currently serves on the boards of directors as well as advisory boards for leading organizations in the wealth management industry, including: Advisory Board Chairman of Haven Tower Group, Member of the Board of Directors of Oppenheimer & Co., Inc., Member of the Board of Directors of Clark Capital Management Group and Editorial Advisory Board Member for Real Assets Adviser. Mr. Roth served as Chief Executive Officer of Cetera Financial Group, the second largest network of independent brokerdealers in the U.S. Mr. Roth was Chief Executive Officer of AIG Advisors Group, one of the largest networks of independent broker.dealers in the U.S. He has also previously served as a Managing Director of Berkshire Global Advisors and remains affiliated with the firm today as a Senior Advisor. Mr. Roth first entered the wealth management industry as an entrepreneur when he personally acquired Vestax, a Hudson, Ohio.based full.service independent broker.dealer that he grew and successfully sold to ING Group. „X Mr. Roth has an undergraduate degree from Michigan State University and a J.D. from the University of Detroit School of Law. He is also a graduate of the Owner/President Management Program at Harvard University¡¦s Graduate School of Business Administration. He holds Series 7, 24, 63 and 79 FINRA registrations. Larry Roth

28 Craig Gould ¡V Incoming Chief Executive Officer Biography „X Mr. Gould will serve as the Chief Executive Officer of Wentworth Management Services, a holding company that acquires and manages businesses in the wealth management industry. „X Craig has over 25 years in senior management roles in the financial services industry, including Chief Executive Officer, National Sales Manager and Head of Investment Banking. Mr. Gould started Cabot Lodge Securities as its President in 2012. Previously, he was the President of Fintegra, a Midwest broker/dealer. Prior to Fintegra, he was the National Sales Manager for Wunderlich Securities, and prior to that he was the Vice Chairman of Olympic Cascade Financial Corporation an AMEX listed company. „X In his roles, he helped raise in excess of $700 million and managed over 25 initial public offerings. Mr. Gould has also been an officer or director for several public and private companies. „X Mr. Gould graduated with a B.A. from the University of Wisconsin.Madison. Craig Gould

29 David Shane ¡V Incoming Chief Financial Officer Biography „X Mr. Shane will serve as Binah¡¦s Chief Financial Officer upon the closing of the transaction. Currently David is an independent consultant providing financial advisory services including accounting, financial reporting, regulatory reporting and transaction structuring services to companies primarily in the Financial Services Industry. „X David has thirty plus years of experience in the financial services industry. David¡¦s financial services experience includes dealings with securities broker.dealers, registered investment advisors, asset management companies and alternative asset companies including private equity, venture capital and hedge funds. David has extensive public accounting experience having served as a Financial Services Audit Partner for RSM and FGMK, LLC. David¡¦s clients included both closely.held and publicly.held financial services companies. David also has experience in mergers and acquisitions, capital raising in both the public and private markets and transaction structuring. In addition to David¡¦s public accounting experience, he has served as the Chief Financial Officer for financial services companies, with most recently as the Chief Financial Officer of Sanctuary Wealth. In addition to David¡¦s technical skills and business acumen, he brings an extensive network within the financial services industry to Wentworth. „X David is a graduate of Indiana University with a degree in finance, a certified public accountant, and holds a Series 27 FINRA registration. David Shane

30

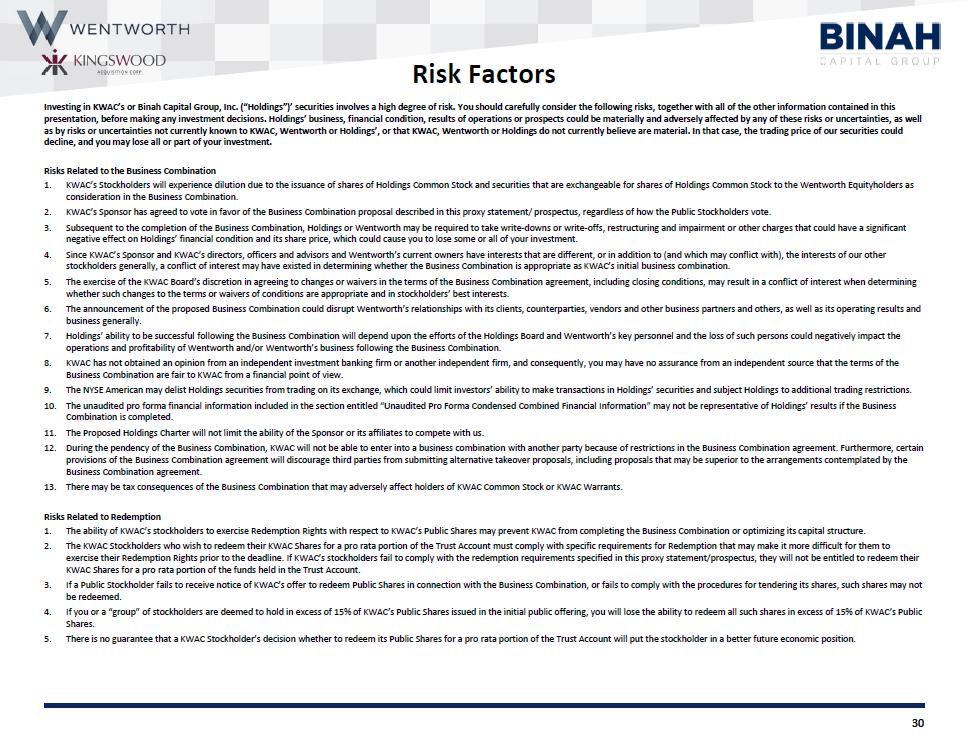

Investing in KWAC’s or Binah Capital Group, Inc. (“Holdings”)’ securities involves a high degree of risk. You should carefully consider the following risks, together with all of the other information contained in this

presentation, before making any investment decisions. Holdings’ business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks or uncertainties, as well

as by risks or uncertainties not currently known to KWAC, Wentworth or Holdings’, or that KWAC, Wentworth or Holdings do not currently believe are material. In that case, the trading price of our securities could

decline, and you may lose all or part of your investment.

Risks Related to the Business Combination

1. KWAC’s Stockholders will experience dilution due to the issuance of shares of Holdings Common Stock and securities that are exchangeable for shares of Holdings Common Stock to the Wentworth Equityholders as

consideration in the Business Combination.

2. KWAC’s Sponsor has agreed to vote in favor of the Business Combination proposal described in this proxy statement/ prospectus, regardless of how the Public Stockholders vote.

3. Subsequent to the completion of the Business Combination, Holdings or Wentworth may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant

negative effect on Holdings’ financial condition and its share price, which could cause you to lose some or all of your investment.

4. Since KWAC’s Sponsor and KWAC’s directors, officers and advisors and Wentworth’s current owners have interests that are different, or in addition to (and which may conflict with), the interests of our other

stockholders generally, a conflict of interest may have existed in determining whether the Business Combination is appropriate as KWAC’s initial business combination.

5. The exercise of the KWAC Board’s discretion in agreeing to changes or waivers in the terms of the Business Combination agreement, including closing conditions, may result in a conflict of interest when determining

whether such changes to the terms or waivers of conditions are appropriate and in stockholders’ best interests.

6. The announcement of the proposed Business Combination could disrupt Wentworth’s relationships with its clients, counterparties, vendors and other business partners and others, as well as its operating results and

business generally.

7. Holdings’ ability to be successful following the Business Combination will depend upon the efforts of the Holdings Board and Wentworth’s key personnel and the loss of such persons could negatively impact the

operations and profitability of Wentworth and/or Wentworth’s business following the Business Combination.

8. KWAC has not obtained an opinion from an independent investment banking firm or another independent firm, and consequently, you may have no assurance from an independent source that the terms of the

Business Combination are fair to KWAC from a financial point of view.

9. The NYSE American may delist Holdings securities from trading on its exchange, which could limit investors’ ability to make transactions in Holdings’ securities and subject Holdings to additional trading restrictions.

10. The unaudited pro forma financial information included in the section entitled “Unaudited Pro Forma Condensed Combined Financial Information” may not be representative of Holdings’ results if the Business

Combination is completed.

11. The Proposed Holdings Charter will not limit the ability of the Sponsor or its affiliates to compete with us.

12. During the pendency of the Business Combination, KWAC will not be able to enter into a business combination with another party because of restrictions in the Business Combination agreement. Furthermore, certain

provisions of the Business Combination agreement will discourage third parties from submitting alternative takeover proposals, including proposals that may be superior to the arrangements contemplated by the

Business Combination agreement.

13. There may be tax consequences of the Business Combination that may adversely affect holders of KWAC Common Stock or KWAC Warrants.

Risks Related to Redemption

1. The ability of KWAC’s stockholders to exercise Redemption Rights with respect to KWAC’s Public Shares may prevent KWAC from completing the Business Combination or optimizing its capital structure.

2. The KWAC Stockholders who wish to redeem their KWAC Shares for a pro rata portion of the Trust Account must comply with specific requirements for Redemption that may make it more difficult for them to

exercise their Redemption Rights prior to the deadline. If KWAC’s stockholders fail to comply with the redemption requirements specified in this proxy statement/prospectus, they will not be entitled to redeem their

KWAC Shares for a pro rata portion of the funds held in the Trust Account.

3. If a Public Stockholder fails to receive notice of KWAC’s offer to redeem Public Shares in connection with the Business Combination, or fails to comply with the procedures for tendering its shares, such shares may not

be redeemed.

4. If you or a “group” of stockholders are deemed to hold in excess of 15% of KWAC’s Public Shares issued in the initial public offering, you will lose the ability to redeem all such shares in excess of 15% of KWAC’s Public

Shares.

5. There is no guarantee that a KWAC Stockholder’s decision whether to redeem its Public Shares for a pro rata portion of the Trust Account will put the stockholder in a better future economic position.

Risk Factors

31

Risks Related to Consummation of the Business Combination

1. If the conditions to the Business Combination agreement are not met, the Business Combination may not occur.

2. If KWAC is unable to complete an initial business combination by November 24, 2022, unless otherwise extended, KWAC will cease all operations except for the purpose of winding up and it would redeem the Public

Shares and liquidate, in which case the Public Stockholders are entitled to share ratably in all assets remaining available for distribution to them after payment of liabilities.

3. Public Stockholders have limited rights or interests in funds in the Trust Account. To liquidate your investment, therefore, you may be forced to sell your Public Shares or KWAC Public Warrants, potentially at a loss.

Risks Related to our Organizational Structure after the Business Combination

1. Holdings will be a holding company and its only material asset after completion of the Business Combination will be its interest in its subsidiaries, and it is accordingly dependent upon distributions made by their

subsidiaries to pay taxes and pay dividends.

Risks Related to Wentworth

1. Misconduct by our advisors, who operate in a decentralized environment, is difficult to detect and deter and could harm our business, reputation, results of operations or financial condition.

2. Poor performance of the investment products and services recommended or sold to our clients or competitive pressures on pricing of such products and services may have a material adverse effect on our business.

3. We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future or fail to maintain an effective system of internal control over

financial reporting, which may result in material misstatements of Holdings consolidated financial statements or cause Holdings to fail to meet its periodic reporting obligations.

4. Maintaining and enhancing our Wentworth brand and reputation is critical to our growth, and if we are unable to maintain and enhance our brand, our business, results of operations and financial condition could be

adversely affected.

5. Our subsidiaries are broker-dealers registered with the SEC and members of FINRA, and therefore are subject to extensive regulation and scrutiny.

6. Our subsidiaries are subject to net capital and other regulatory capital requirements; failure to comply with these rules could harm our business.

7. It is possible that FINRA will require changes to our business practices based on the ownership of our subsidiaries, which could impose additional costs or disrupt our business.

8. We rely on clearing brokers and the termination of our clearing agreements could disrupt our business.

9. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading.

10. A decline in the economy in general may adversely affect our business.

11. Increases in interest rates may reduce the profitability of our business.

12. We may experience cash flow problems due to delays or other disruptions in receiving proceeds from our credit facility.

13. We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all.

14. We rely on the experience and expertise of our senior management team, key technical employees, and other highly skilled personnel.

Legal, Regulatory or Compliance Risks

1. Legislative, judicial, or regulatory changes to the classification of independent contractors could increase our operating expenses.

2. We collect, process, store, share, disclose and use customer information and other data, and our actual or perceived failure to protect such information and data, respect customers’ privacy or comply with data

privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results.

3. Regulators may limit our ability to expand or implement and/or may eliminate or restrict the confidentiality of our proprietary technology, which could have a material adverse effect on our financial condition and

results of operations.

4. Litigation and legal proceedings filed by or against us and our subsidiaries could have a material adverse effect on our business, results of operations and financial condition.

5. The increasing adoption by states of cybersecurity regulations could impose additional compliance burdens onus and expose us to additional liability.

6. We may be subject to certain industry regulations, including the Truth-in-Lending Act.

7. Changes in applicable tax laws, regulations or administrative interpretations thereof may materially adversely affect our financial condition, results of operations and cash flows.

8. Failure to comply with anti-corruption and anti-money laundering laws, including the FCPA and similar laws associated with our activities outside of the United States, could subject us to penalties and other adverse

consequences.

9. Claims by others that we infringed their proprietary technology or other intellectual property rights could harm our business.

Risk Factors (Cont.)

32

Risks Relating to Cybersecurity and Technology

1. Security incidents or real or perceived errors, failures or bugs in our systems or our website could impair our operations, result in loss of personal customer information, damage our reputation, and brand, and harm

our business and operating results.

2. We may be unable to prevent or address the misappropriation of our data.

3. Failure to protect or enforce our intellectual property rights could harm our business, results of operations and financial condition.

Risks Related to Being a Public Company

1. The market price and trading volume of Holdings Common Stock and warrants may be highly volatile and could decline significantly following the Business Combination.

2. Holdings’ management team has limited experience managing a public company.

3. If securities or industry analysts do not publish research or reports about our business, if they adversely change their recommendations regarding our shares or if our results of operations do not meet their

expectations, our share price and trading volume could decline.

4. As a public company, we will become subject to additional laws, regulations, and stock exchange listing standards, which will impose additional costs on us and may strain our resources and divert our management’s

attention.

5. The Proposed Holdings Charter will provide that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders, which could limit our

stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees.

6. A significant portion of our total outstanding shares of Holdings Common Stock are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of Holdings

Common Stock to drop significantly, even if our business is doing well.

7. Warrants will become exercisable for Holdings Common Stock, which will increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

8. Our quarterly operating results and other operating metrics may fluctuate from quarter to quarter, which makes these metrics difficult to predict.

9. Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes- Oxley Act could have a material adverse effect on our business and stock price.

10. Taking advantage of the reduced disclosure requirements applicable to “emerging growth companies” may make Holdings Common Stock less attractive to investors.

11. The requirements of being a public company, including maintaining adequate internal control over our financial and management systems, may strain our resources, divert management’s attention, and affect our

ability to attract and retain executive management and qualified board members.

12. Our ability to raise capital in the future may be limited.

13. The forecasts of market growth and other projections included in this proxy statement/prospectus may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, we cannot

assure you that our business will grow at a similar rate, if at all.

14. Holdings’ business and operations could be negatively affected if it becomes subject to any securities litigation or stockholder activism, which could cause Holdings to incur significant expense, hinder execution of

business and growth strategy and impact its stock price.

15. We may amend the terms of the Holdings Public Warrants in a manner that may be adverse to holders of Holdings Public Warrants with the approval by the holders of at least 50% of the then outstanding Holdings

Public Warrants. As a result, the exercise price of your warrants could be increased, the exercise period could be shortened and the number of shares of Holdings Common Stock purchasable upon exercise of a

Holdings Public Warrant could be decreased, all without a warrant holder’s approval.

16. Your unexpired Holdings Public Warrants may be redeemed prior to their exercise at a time that is disadvantageous to you, thereby making your Holdings Public Warrants worthless.

Risks Related to KWAC

1. KWAC’s stockholders may be held liable for claims by third parties against KWAC to the extent of distributions received by them upon Redemption of their shares.

2. If third parties bring claims against KWAC, the proceeds held in the Trust Account could be reduced and the Redemption Price received by Public Stockholders may be less than $10.25 per share.

3. KWAC’s directors may decide not to enforce the indemnification obligations of the Sponsor under the Insider Letter Agreement, resulting in a reduction in the amount of funds in the Trust Account available for

distribution to Public Stockholders.

4. If, after KWAC distributes the proceeds in the Trust Account to its Public Stockholders, KWAC files a bankruptcy petition or an involuntary bankruptcy petition is filed against KWAC that is not dismissed, a bankruptcy

court may seek to recover such proceeds and the members of the KWAC Board may be viewed as having breached their fiduciary duties to KWAC’s creditors, thereby exposing the members of the KWAC Board and

KWAC to claims of punitive damages.

5. Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect the business, investments, and results of operations of KWAC.

Risk Factors (Cont.)

33 Thank You!