UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

“Caterpillar’s Values in Action guide our business conduct with our customers, partners and one another as we fulfill our purpose of helping our customers build a better, more sustainable world.”

D. James Umpleby III

Chairman and Chief Executive Officer

We are sending you these proxy materials in connection with Caterpillar’s solicitation of proxies, on behalf of its board of directors, for the 2023 Annual Meeting of Shareholders (Annual Meeting). Distribution of these materials is scheduled to begin on May 5, 2023. Please submit your vote or proxy by telephone, mobile device, internet or, if you received your materials by mail, you can complete and return your proxy or voting instruction form by mail.

2023

PROXY STATEMENT 3

2023

PROXY STATEMENT 3

DEAR FELLOW SHAREHOLDERS,

D. JAMES UMPLEBY III

Chairman and Chief Executive Officer

“OUR VALUES IN ACTION – INTEGRITY, EXCELLENCE, TEAMWORK, COMMITMENT AND SUSTAINABILITY – ARE THE FOUNDATION OF OUR STRATEGY FOR LONG-TERM PROFITABLE GROWTH. THEY ALIGN OUR FOCUS ON WINNING THE RIGHT WAY AND UPHOLDING OUR SHARED COMMITMENT TO THE HIGHEST ETHICAL STANDARDS.”

On behalf of the board of directors and our entire company, I cordially invite you to attend the Annual Meeting of Shareholders on June 14, 2023, at 8 a.m. Central Time. This year’s meeting will be held virtually.

In addition to an update on the company’s performance, we ask for your vote on several items related to our business. Please refer to page 90 for information on participating in this year’s shareholder meeting.

Please review this proxy statement to learn more about your board of directors, our governance practices, compensation programs and philosophy, and other key items. Your vote is important. We encourage you to vote your shares by virtually attending the annual meeting, by voting online separately, via your mobile phone, by telephone, or by mail.

I would like to recognize Ed Rust, who has served as a director since 2003. The board of directors extends our sincere appreciation for his many years of dedicated service to our company.

We also welcome our newest board members, Judy Marks, Chair, CEO and President of Otis Worldwide Corporation, and Jim Fish, Jr., President and CEO of Waste Management. They joined the board March 1, 2023.

Thank you for your ongoing investment and support of Caterpillar as we continue to execute our enterprise strategy for long-term profitable growth and create shareholder value.

Sincerely,

D. James Umpleby III

Chairman and Chief Executive Officer

2023

PROXY STATEMENT 5

2023

PROXY STATEMENT 5

PROXY SUMMARY

This summary does not contain all of the information you should consider when casting your vote. You should read the complete proxy statement before voting.

ANNUAL MEETING OF SHAREHOLDERS

|

|

|

|

TIME & DATE |

PLACE |

RECORD DATE |

ADMISSION |

8 a.m. Central Time June 14, 2023 |

Virtual Meeting www.meetnow.global/MCP5W5Q |

The close of business |

To attend and to register for the Virtual Meeting, please follow instructions on page 90 |

SHAREHOLDER VOTING MATTERS

Proposal |

Board’s Voting Recommendation |

Page Reference |

|

1 |

Election of 11 Directors Named in this Proxy Statement |

FOR Each Nominee |

10 |

2 |

Ratification of our Independent Registered Public Accounting Firm |

FOR |

36 |

3 |

Advisory Vote to Approve Executive Compensation |

FOR |

39 |

4 |

Advisory Vote on the Frequency of Executive Compensation Votes |

ONE YEAR |

40 |

5 |

Approval of Caterpillar Inc. 2023 Long-Term Incentive Plan |

FOR |

68 |

6 |

Shareholder Proposal - Report on Corporate Climate Lobbying in Line with Paris Agreement |

AGAINST |

75 |

7 |

Shareholder Proposal - Lobbying Disclosure |

AGAINST |

78 |

8 |

Shareholder Proposal - Report on Activities in Conflict-Affected Areas |

AGAINST |

81 |

9 |

Shareholder Proposal - Civil Rights, Non-Discrimination and Returns to Merit Audit |

AGAINST |

84 |

2023

PROXY STATEMENT 6

2023

PROXY STATEMENT 6

OUR DIRECTOR NOMINEES

Nominee and Principal Occupation |

Independent |

Age |

Director Since |

Other Public Company Boards |

Caterpillar Committees |

||||

AC |

CHRC |

SPPC |

NGC |

EC |

|||||

Kelly

A. Ayotte |

Yes |

54 |

2017 |

Blackstone Inc. |

|

|

|

|

|

David

L. Calhoun |

Yes |

65 |

2011 |

The Boeing Company

|

|

|

|

|

|

Daniel

M. Dickinson |

Yes |

61 |

2006 |

None |

|

|

|

|

|

James

C. Fish, Jr. |

Yes |

60 |

2023 |

Waste Management, Inc. |

|

|

|

|

|

Gerald

Johnson |

Yes |

60 |

2021 |

None |

|

|

|

|

|

David

W. MacLennan |

Yes |

63 |

2021 |

Ecolab Inc. |

|

|

|

|

|

Judith

F. Marks |

Yes |

59 |

2023 |

Otis Worldwide Corporation

|

|

|

|

|

|

Debra

L. Reed-Klages |

Yes |

66 |

2015 |

Chevron Corporation |

|

|

|

|

|

Susan

C. Schwab |

Yes |

68 |

2009 |

FedEx Corporation

|

|

|

|

|

|

D.

James Umpleby III |

No |

65 |

2017 |

Chevron Corporation |

|

|

|

|

|

Rayford

Wilkins, Jr. |

Yes |

71 |

2017 |

Morgan Stanley |

|

|

|

|

|

AC: Audit Committee CHRC: Compensation and Human Resources Committee SPPC: Sustainability and other Public Policy Committee NGC: Nominating and Governance Committee EC: Executive Committee |

|

Chair |

|

Member |

2023

PROXY STATEMENT 7

2023

PROXY STATEMENT 7

GOVERNANCE HIGHLIGHTS

Our commitment to good corporate governance stems from our belief that a strong governance framework creates long-term value for our shareholders, strengthens board and management accountability, and builds trust in the Company and its brand. Our governance framework includes, but is not limited to, the following highlights:

Board and Governance Information* |

|

Board and Governance Information |

|

Size of the Board |

11 |

Code of Conduct for Directors, Officers and Employees |

Yes |

Number of Independent Directors |

10 |

Supermajority Voting Threshold for Mergers |

No |

Average Age of Directors |

63 |

Proxy Access |

Yes |

Average Director Tenure (in years) |

6.6 |

Shareholder Action by Written Consent |

No |

Annual Election of Directors |

Yes |

Shareholder Ability to Call Special Meetings |

Yes |

Mandatory Retirement Age |

74 |

Poison Pill |

No |

Women |

36% |

Stock Ownership Guidelines for Directors and Executive Officers |

Yes |

Ethnic/Racial Diversity |

18% |

Anti-Hedging and Pledging Policies |

Yes |

Majority Voting in Director Elections |

Yes |

Clawback Policy |

Yes |

Independent Presiding Director |

Yes |

|

|

*

The information in this table reflects only the director nominees standing for re-election. |

|||

2022 PERFORMANCE HIGHLIGHTS

OPERATING |

PROFIT |

OPERATING |

STRONG |

13.3% |

$12.64 |

$7.8 billion |

$6.7 billion |

Delivered operating profit margin of 13.3% and adjusted operating profit margin(1) of 15.4%. |

Profit per share was $12.64 in 2022, compared with $11.83 in 2021. Adjusted profit per share(2) was $13.84 in 2022, compared with $10.81 in 2021. |

ME&T free cash flow(3) was $5.8 billion in 2022, which was in line with the Company’s full-year target of $4 billion to $8 billion annually. We continue to expect to return substantially all ME&T free cash flow(3) to shareholders over time. |

Returned $6.7 billion to shareholders through share repurchases and dividends. The enterprise cash balance at the end of 2022 was $7.0 billion. |

Adjusted operating profit margin is a non-GAAP measure, and a reconciliation to the most directly comparable GAAP measure is included on page 89.

Adjusted Profit Per Share is a non-GAAP measure, and a reconciliation to the most directly comparable GAAP measure is included on page 89.

ME&T free cash flow is a non-GAAP measure, and a reconciliation to the most directly comparable GAAP measure is included on page 89.

2023

PROXY STATEMENT 8

2023

PROXY STATEMENT 8

5205 N. O’Connor Boulevard, Suite 100

Irving, TX 75039

Phone (972) 891-7700

www.caterpillar.com

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

The board of directors, after careful consideration, has decided to hold this year’s Annual Meeting exclusively online. If you plan to participate in the virtual meeting, please see the information below as well as the attendance and registration instructions on page 90. There will be no physical location for the Annual Meeting this year.

MEETING INFORMATION

JUNE 14, 2023

8 a.m. Central Time

Website: www.meetnow.global/MCP5W5Q

MEETING AGENDA

Elect 11 director nominees named in this Proxy Statement

Ratify our independent registered public accounting firm for 2023

Approve, by non-binding vote, executive compensation

Approve, by non-binding vote, the frequency of executive compensation votes

Approval of Caterpillar Inc. 2023 Long-Term Incentive Plan

Vote on shareholder proposals

Address any other business that properly comes before the meeting

RECORD DATE

April 17, 2023

By Order of the Board of Directors

Nicole M. Puza

Corporate Secretary

May 5, 2023

PLEASE VOTE YOUR SHARES: |

|||

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation. You may vote in the following ways: |

|||

|

|

|

|

BY INTERNET |

BY MOBILE DEVICE |

BY TELEPHONE |

BY MAIL |

vote online at |

scan this QR code to vote with |

call the number included on |

mail your signed proxy or voting |

Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholder meeting to be held on June 14, 2023. This Notice of Annual Meeting and Proxy Statement and the 2022 Annual Report on Form 10-K are available at www.investorvote.com/CAT. |

|||

2023

PROXY STATEMENT 9

2023

PROXY STATEMENT 9

DIRECTORS & GOVERNANCE

PROPOSAL 1 – ELECTION OF DIRECTORS

|

What am I voting on? |

Shareholders are being asked to elect the 11 director nominees named in this Proxy Statement for a one-year term. |

Board Voting Recommendation: |

|

OVERVIEW OF OUR DIRECTOR NOMINEES

2023

PROXY STATEMENT 10

2023

PROXY STATEMENT 10

BOARD ATTENDANCE - 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

|

100% |

Audit |

10 |

|

|

10 |

|

10 |

|

10 |

|

|

5(1) |

|

|

Compensation and Human Resources |

5 |

|

|

3(1) |

3(1) |

|

2(2) |

3(1) |

|

|

5 |

|

|

Public Policy and Governance (3) |

3 |

3 |

3 |

|

3 |

|

|

3 |

3 |

|

|

|

|

Sustainability and other Public Policy (3) |

3 |

3 |

3 |

|

3 |

3 |

|

|

3 |

|

|

|

|

Nominating and Governance (3) |

3 |

3 |

3 |

|

|

|

3 |

|

3 |

|

|

|

|

Executive (3) |

1 |

1 |

|

1 |

|

|

1 |

|

|

|

1 |

|

|

(1)

Mr. Dickinson, Mr. Johnson and Mr. Rust were appointed to the Compensation and Human Resources Committee on June 8, 2022, and attended all of the Compensation and Human Resources Committee meetings held thereafter; Mr. Wilkins was appointed to the Audit Committee on June 8, 2022, and attended all of the Audit Committee meetings held thereafter. (2)

Ms. Reed-Klages left the CHRC committee on June 8, 2022, when she assumed the Presiding Director role. (3)

Beginning June 2022, a new Executive Committee was established, and the Public Policy and Governance Committee was restructured to form the Sustainability and other Public Policy Committee and the Nominating and Governance Committee. Each director attended all of the meetings of their respective committees and of the board held in 2022.

|

|||||||||||||

The board’s policy is to encourage and expect that all directors attend each Annual Meeting of Shareholders. All then-serving directors attended the 2022 Annual Meeting. The independent directors generally meet in an executive session as part of each regularly scheduled board meeting. The board’s independent Presiding Director presided over the board’s executive sessions in 2022.

BOARD EVOLUTION SINCE 2016

Seven new directors elected

Rotation of board committee chairs

Restructured committees by creating the Sustainability and other Public Policy Committee and the Nominating and Governance Committee

Presiding Director rotation

Expanded qualifications and diversity represented on board

2023

PROXY STATEMENT 11

2023

PROXY STATEMENT 11

DIVERSITY OF SKILLS AND EXPERTISE

The following skills matrix displays the most significant skills and qualifications that each director nominee possesses. The board does not assign a specific weight to any particular skill. Rather, the NGC regularly reviews the composition of the board as a whole to ensure that the board maintains a balance of knowledge and experience and to assess the skills and characteristics that the board may find valuable in the future in light of strategic plans and operating requirements of the Company and the best interests of shareholders.

SUMMARY OF INDIVIDUAL DIRECTOR NOMINEE SKILLS, CORE COMPETENCIES AND ATTRIBUTES

|

|

|

|

|

|

|

|

|

|

|

|||

Caterpillar Board |

6 |

12 |

17 |

0 |

2 |

2 |

0 |

8 |

14 |

6 |

6 |

6.6 years | |

|

Board

of Directors Experience |

• |

• |

• |

• |

|

• |

• |

• |

• |

• |

• |

91% |

|

Audit

Committee Financial Expert |

|

• |

• |

• |

• |

• |

• |

• |

|

• |

• |

100%

of |

|

CEO

|

|

• |

|

• |

|

• |

• |

• |

|

• |

|

55% |

|

Leadership

|

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

100% |

|

Business

Development |

|

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

91% |

|

Government/Regulatory

Affairs |

• |

• |

|

|

|

• |

|

• |

• |

|

• |

55% |

2023

PROXY STATEMENT 12

2023

PROXY STATEMENT 12

|

|

|

|

|

|

|

|

|

|

|

|||

|

Customer

and Product Support Services |

|

• |

• |

|

• |

|

• |

• |

|

• |

• |

64% |

|

Finance

& Accounting |

|

• |

• |

• |

|

• |

• |

• |

|

• |

• |

73% |

|

Risk

Management |

• |

• |

• |

• |

|

• |

• |

• |

• |

• |

• |

91% |

|

Technology

|

• |

• |

|

|

• |

• |

• |

• |

• |

• |

• |

82% |

|

Global

Experience |

• |

• |

• |

|

• |

• |

• |

• |

• |

• |

• |

91% |

|

Manufacturing/Logistics

|

|

• |

• |

|

• |

• |

• |

|

|

• |

|

55% |

Women |

• |

|

|

|

|

|

• |

• |

• |

|

|

36% |

|

Racial/Ethnic Diversity |

|

|

|

|

• |

|

|

|

|

|

• |

18% |

|

Age |

54 |

65 |

61 |

60 |

60 |

63 |

59 |

66 |

68 |

65 |

71 |

63 years |

|

2023

PROXY STATEMENT 13

2023

PROXY STATEMENT 13

DIRECTOR CONTINUOUS EDUCATION AND DEVELOPMENT

The Company places high importance on the continuous development of its board.

Directors benefit from access to various governance and directorship organizations and publications to which Caterpillar subscribes. They also have ongoing education and development opportunities through participation in meetings and attendance at activities and professional development training offered by associations such as the National Association of Corporate Directors and Lead Director Network. They also receive a weekly digest of news articles related to Caterpillar.

Directors receive specialized presentations from experts in the Company’s various businesses in the course of their service. Since the last annual shareholder meeting, these presentations have included:

updates on technology and digital

retail customer aftermarket

strategic focus areas and regular updates concerning the operations of certain businesses within our operating segments

sustainability

talent management

cybersecurity

the Cat® dealer network

Directors are also given development and education opportunities through facility visits, product demonstrations and speaking or meeting directly with members of management and other employees. For example, since the last annual shareholder meeting, the directors visited the Tucson, Arizona, facility and observed new products designed to help our customers achieve their climate-related goals. The directors had the opportunity to observe and operate products such as the battery electric, zero-exhaust-emissions mini excavator. Directors also speak with Company dealers and customers to better understand the Company’s operations and business, and also attend industry trade shows such as CONEXPO.

These opportunities allow directors to be well-informed and to expand their knowledge of trends and issues relevant to their role.

BOARD’S ROLE IN COMPANY STRATEGY

The board has an active role in overseeing the Company’s strategy. The board regularly reviews management’s progress in executing the strategy. In 2022, the board initiated annual strategic reviews that included individual strategy reviews with members of the Executive Office. These reviews included discussions of the key geopolitical policies, economic, technological, environmental, talent and competitive challenges and opportunities of the Company’s business. The board plans to continue this practice going forward.

BOARD’S ROLE IN RISK OVERSIGHT

The board has oversight for risk management with a focus on the most significant risks facing the Company, including strategic, operational, financial and legal compliance risks. The board’s risk oversight process builds upon management’s risk assessment and mitigation processes, which include an enterprise risk management program, regular internal management disclosure compliance committee meetings, a Code of Conduct that applies to all employees, executives and directors, quality standards and processes, an ethics and compliance program, and comprehensive internal audit processes. The board’s risk oversight role also includes the selection and oversight of the independent auditors. The board implements its risk oversight function both as a board and through delegation to board committees, which meet regularly and report back to the board. The board has delegated the oversight of specific risks to board committees that align with their functional responsibilities.

The Audit Committee (AC) assists the board in overseeing the enterprise risk management program and evaluates and monitors risks related to the Company’s financial reporting requirements, system of internal controls, the internal audit program, the independent auditor, the compliance program and the information security program. The AC assesses cybersecurity and information technology risks and the controls implemented to monitor and mitigate these risks. The Chief Information Officer attends all bimonthly AC meetings and provides cybersecurity updates to the AC and board.

The Compensation and Human Resources Committee (CHRC) monitors and assesses risks associated with the Company’s employment and compensation policies and practices.

The Nominating and Governance Committee (NGC) oversees various governance matters and the Sustainability and other Public Policy Committee (SPPC) oversees risks related to sustainability and other public policy issues that affect the Company, including health and safety, lobbying and political contributions, and human rights.

2023

PROXY STATEMENT 14

2023

PROXY STATEMENT 14

DIRECTOR NOMINATIONS AND EVALUATIONS

PROCESS FOR NOMINATING AND EVALUATING DIRECTORS

The Nominating and Governance Committee (NGC) solicits and receives recommendations for potential director candidates from shareholders, management, directors, professional search firms and other sources. In its assessment of each potential candidate, the NGC considers each candidate’s professional experience, integrity, honesty, judgment, independence, accountability, willingness to express independent thought, understanding of the Company’s business and other factors that the NGC determines are pertinent in light of the current needs of the board. Candidates must have successful leadership experience and stature in their primary fields, with a background that demonstrates an understanding of business affairs as well as the complexities of a large, publicly held company. In addition, candidates must have demonstrated an ability to think strategically and make decisions with a forward-looking focus and the ability to assimilate relevant information on a broad range of complex topics. In evaluating director candidates, the NGC also considers key skills and experience related to the Company’s strategy for long-term profitable growth, which identifies services, expanded offerings, operational excellence and sustainability as primary focus areas. Moreover, candidates must have the ability to devote the time necessary to meet a director’s responsibilities and serve on no more than four public company boards in addition to Caterpillar.

The board values diversity of talents, skills, abilities and experiences and believes that board diversity of all types enhances the performance of the board and provides significant benefits to the Company. Accordingly, the NGC takes into account the diversity of the board in selecting new director candidates.

DIRECTOR RECRUITMENT PROCESS

CANDIDATE RECOMMENDATIONS |

|

NGC |

|

BOARD OF DIRECTORS |

|

SHAREHOLDERS |

from Shareholders, Management, Directors, professional search firms and other sources |

|

Discusses & Reviews Qualifications and Expertise Enterprise Strategy Board Needs Diversity Interviews Recommends Nominees |

|

Discusses NGC Recommendations Analyzes Independence Selects Nominees |

|

Vote on Nominees at Annual Meeting |

The following table summarizes certain key characteristics of the Company’s businesses and the associated qualifications, skills and experience that the NGC believes should be represented on the board.

BUSINESS CHARACTERISTICS |

|

QUALIFICATIONS, SKILLS AND EXPERIENCE |

■

The Company is a global manufacturer with products sold around the world. |

|

■

Manufacturing or logistics operations experience ■

Broad international exposure |

■

Technology and customer and product support services are important. |

|

■

Technology experience ■

Customer and product support experience |

■

The Company’s businesses undertake numerous transactions in many countries and in many currencies. |

|

■

Diversity of race, ethnicity, gender, cultural background or professional experience ■

High level of financial literacy ■

Mergers and acquisitions experience |

■

Demand for many of the Company’s products is tied to conditions in the global commodity, energy, construction and transportation markets. |

|

■

Experience in the evaluation of global economic conditions ■

Knowledge of commodity, energy, construction or transportation markets |

■

The Company’s businesses are impacted by regulatory requirements and policies of various governmental entities around the world. |

|

■

Governmental and international trade experience |

■

The board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. |

|

■

Risk oversight/management expertise ■

Relevant executive and leadership experience ■

Cybersecurity experience |

2023

PROXY STATEMENT 15

2023

PROXY STATEMENT 15

NOMINATIONS FROM SHAREHOLDERS

The NGC considers unsolicited inquiries and director nominees recommended by shareholders in the same manner as nominees from all other sources. Recommendations should be sent to the Corporate Secretary, 5205 N. O’Connor Boulevard, Suite 100, Irving, TX 75039. Shareholders may nominate a director candidate to serve on the board by following the procedures described in our bylaws. Deadlines for shareholder nominations for Caterpillar’s 2024 Annual Meeting of Shareholders are included in the “Shareholder Proposals and Director Nominations for the 2024 Annual Meeting” section on page 86.

The number of persons comprising the Caterpillar board of directors is currently established as 12. All of the board’s nominees have consented to being named in this proxy statement and to serve if elected. If all nominees are elected, the number of persons comprising the board will be 11 following the Annual Meeting. If any of the board’s nominees should become unavailable to serve as a Director prior to the Annual Meeting, the size of the board and number of board nominees will be reduced accordingly.

2023

PROXY STATEMENT 16

2023

PROXY STATEMENT 16

DIRECTOR CANDIDATE BIOGRAPHIES AND QUALIFICATIONS

Directors have been in their current positions for the past five years unless otherwise noted. Information is as of April 1, 2023. The board has nominated the following individuals to stand for election for a one-year term expiring at the Annual Meeting of Shareholders in 2024.

The experiences and qualifications of each of the director nominees enable each of them to provide meaningful input and guidance to the board.

|

||||

|

|

KELLY A. AYOTTE Former U.S. Senator representing New Hampshire

Age: 54 Director since: 2017 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Blackstone Inc. ■

Boston Properties, Inc. ■

News Corporation |

CATERPILLAR BOARD COMMITTEES: ■

Sustainability and other Public Policy, Chair ■

Executive ■

Nominating and Governance |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

Bloom Energy Corporation |

||||

|

||||

Experience ■

U.S. Senator representing the State of New Hampshire (2011–2016) ■

Attorney General (2004–2009), Deputy Attorney General (2003–2004), State of New Hampshire |

||||

Qualifications ■

Leadership, Government/Regulatory Affairs and Global Experience – obtained from her service as Attorney General, Deputy Attorney General and Chief of the Homicide Prosecution Unit for New Hampshire and as a U.S. Senator. As a U.S. Senator, she gained especially valuable insights on important public policy issues from serving on the Senate Commerce, Science and Transportation Committee and the Senate Budget Committee. She championed policies for cleaner energy production, preservation of outdoor spaces and advocated for the U.S. to be a world leader in reducing greenhouse gas emissions. As New Hampshire’s Attorney General, she worked to preserve and strengthen the Clean Air Act and other important environmental regulations. She also served as a Senior Advisor to Citizens for Responsible Energy Solutions.

■

Board of Directors Experience (other boards), Risk Management and Technology – gained while serving on the boards of multiple public companies, including as Lead Independent Director of Boston Properties, as well as currently serving on two private boards, including as Chair of BAE Systems, Inc., and three nonprofit boards that focus on human rights and other global issues. |

||||

2023

PROXY STATEMENT 17

2023

PROXY STATEMENT 17

|

||||

|

|

DAVID L. CALHOUN President and CEO of The Boeing Company (aviation and defense)

Age: 65 Director since: 2011 INDEPENDENT

|

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

The Boeing Company |

CATERPILLAR BOARD COMMITTEES: ■

Sustainability and other Public Policy ■

Nominating and Governance |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

Gates Industrial Corporation plc ■

Nielsen Holdings plc |

||||

|

||||

Experience ■

President and CEO (2020–present), The Boeing Company ■

Senior Managing Director and Head of Portfolio Operations (2014–2020), The Blackstone Group (now Blackstone Inc.) ■

Executive Chairman (2014–2016), Chief Executive Officer (2006–2013), Nielsen Holdings ■

Vice Chairman (2005–2006), President and Chief Executive Officer, GE Infrastructure (2005–2006), held numerous operating, finance and marketing roles and led multiple business units including GE Transportation, GE Aircraft Engines, GE Employers Reinsurance Corporation, GE Lighting and GE Transportation Systems, joined the company in 1981, The General Electric Company (GE) |

||||

Qualifications ■

CEO, Leadership, and Business Development and Strategy – gained from his almost 30 years in leadership positions at Boeing, where as CEO, he oversees more than 140,000 people worldwide and operations involving a wide variety of strategic, business, safety and regulatory matters; Blackstone, where he was the Senior Managing Director and Head of Portfolio Operations; Nielsen, where as CEO, he led the company’s transformation into a leading global information and measurement firm listed on the New York Stock Exchange; and GE, where he rose to Vice Chairman of the company and President and Chief Executive Officer of GE Infrastructure, its largest business unit, that included Aviation, Rail, Energy and Water. In his leadership roles at Boeing, he oversaw significant environmental initiatives, such as, the company maintaining net-zero emissions for Scope 1 and 2 in both 2020 and 2021; launching a five-year ecoDemonstrator program partnership with NASA to collect and analyze data on sustainable aviation fuel emissions in an effort to enable the transition to carbon neutral aerospace; and becoming a founding member of MIT Climate and Sustainability Consortium and of First Movers Coalition to accelerate new technology development to reduce emissions.

■

Government/Regulatory Affairs, Customer and Product Support Services, Risk Management and Global Experience – developed over his more than 40-year career in global positions that involved navigating complex situations including government regulation, client support and management of risk.

■

Audit Committee Financial Expert and Finance & Accounting – gained while serving as Senior Managing Director and Head of Portfolio Operations at Blackstone, where he focused on creating and driving added-value initiatives with Blackstone’s portfolio company CEOs, which allows him to bring a unique perspective to the board. In addition, during his tenure at GE, he led GE’s audit staff.

■

Technology and Manufacturing/Logistics – obtained from his current role as CEO of Boeing, the world’s leading aerospace company and largest manufacturer of commercial and military aircraft, his experience at Nielsen and his 26-year tenure at GE. At Boeing, he is responsible for managing one of the largest, most sophisticated global industrial supply chains in the world. At Nielsen, he led one of the largest consumer data analytics platform in the world and at GE Aviation he led a sophisticated data collection and analytics platform.

■

Board of Directors Experience (other boards) – gained while serving on numerous public company boards, including Gates Industrial, where he served as Chairman; Nielsen, where he served as Executive Chairman; and Refinitiv, where he served as Chairman. |

||||

2023

PROXY STATEMENT 18

2023

PROXY STATEMENT 18

|

||||

|

|

DANIEL M. DICKINSON Managing Partner of HCI Equity Partners (private equity firm)

Age: 61 Director since: 2006 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

None |

CATERPILLAR BOARD COMMITTEES: ■

Audit, Chair ■

Compensation and Human Resources ■

Executive |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Experience ■

Co-Founder and Managing Partner (2001–present), HCI Equity Partners ■

Held roles including Co-Head of Global M&A, Head of European M&A and Head of Global Manufacturing and Services M&A (1993–2001), Merrill Lynch ■

Vice President, M&A Group (1987–1993), The First Boston Corporation (now Credit Suisse) |

||||

Qualifications ■

Audit Committee Financial Expert, Leadership, Business Development and Strategy, Finance & Accounting, Risk Management and Business Development and Strategy – obtained during his over 35-year career in mergers and acquisitions, private equity business and investment banking, both in the U.S. and internationally, at HCI Equity Partners, where he founded and led the firm to become a leading lower middle market private equity firm; as Co-Head of Global M&A at Merrill Lynch; and as Vice President, M&A at First Boston, which allows him to provide insights for evaluating investment opportunities and contributes to the board’s understanding and analysis of complex issues. He also serves as Chairman of five of HCI’s portfolio companies and drives metric-based environmental stewardship, diversity, equity and inclusion and governance initiatives at these companies. He has also led environmental, social and governance-related transformations at many of the firm’s investments. He also serves as a board member of Right to Dream, a global organization developing schools and sports academies to provide educational and athletic opportunities for children from underdeveloped areas of Africa.

■

Customer and Product Support Services and Manufacturing/Logistics – gained while serving as Head of Global Manufacturing and Services M&A at Merrill Lynch.

■

Board of Directors Experience (other boards) – gained while serving on various public company boards, including on the board of Mistras Group and Progressive Waste Solutions (now known as Waste Connections). |

||||

2023

PROXY STATEMENT 19

2023

PROXY STATEMENT 19

|

||||

|

|

JAMES C. FISH, JR. President and CEO of Waste Management, Inc. (waste and environmental services)

Age: 60 Director since: 2023 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Waste Management, Inc. |

CATERPILLAR BOARD COMMITTEES: ■

Audit ■

Sustainability and other Public Policy |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Mr. Fish was brought to the attention of the board through a professional search firm. |

||||

Experience ■

President and Chief Executive Officer (2016–present), Chief Financial Officer (2012–2016), Executive Vice President (2012–2016), Senior Vice President – Eastern Group (2011–2012), Vice President – PA/WV Area (2009–2011), Vice President – Pricing (2003–2006), Director – Financial Planning (2001–2003), Waste Management, Inc. ■

Vice President – Finance (1999–2001), Westex ■

Vice President – Revenue Management (1995–1999), Trans World Airlines, Inc. ■

Director of Yield Management (1986–1995), America West Airlines, Inc. |

||||

Qualifications ■

CEO, Leadership, Business Development and Strategy, and Risk Management – obtained while serving in leadership roles, including CEO, of Waste Management, North America’s largest comprehensive waste management environmental solutions provider. As President and CEO of Waste Management, he has shifted the company’s sustainability strategy to focus on minimizing its environmental impact by reducing carbon emissions, investing in differentiated, innovative technologies and automation, and expanding recycling and renewable energy infrastructure to help Waste Management’s customers achieve their sustainability goals. As CEO of a heavily regulated business, he leads a large government affairs team that interacts with all levels of government.

■

Audit Committee Financial Expert and Finance & Accounting – obtained while serving as CFO of Waste Management where he gained valuable expertise in accounting and external reporting.

■

Board of Directors Experience (other boards) – gained while serving as a director of Waste Management. |

||||

2023 PROXY STATEMENT 20

2023 PROXY STATEMENT 20

|

||||

|

|

GERALD JOHNSON Executive Vice President, Global Manufacturing and Sustainability of General Motors Company (manufacturing)

Age: 60 Director since: 2021 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

None |

CATERPILLAR BOARD COMMITTEES: ■

Compensation and Human Resources ■

Sustainability and other Public Policy |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Experience ■

Executive Vice President, Global Manufacturing and Sustainability (2019–present), Vice President North America Manufacturing and Labor Relations (2017–2019), Vice President Global Operational Excellence (2014–2017), joined in the company 1980, General Motors Company (GM) |

||||

Qualifications ■

Audit Committee Financial Expert, Leadership, Business Development and Strategy, Customer and Product Support Services, Technology, Global Experience and Manufacturing/Logistics – obtained during his over 40-year career at GM, including his current role, where he is responsible for the quality and safety performance for 103,000 employees, representing more than 129 manufacturing facilities in 16 countries on five continents, which allows him to provide valuable insight and perspective to the Board on strategic and business matters. He leads global manufacturing and sustainability at GM where he is responsible for GM’s achievement of its climate commitments. He has also led GM’s Global Manufacturing, Sustainability, Manufacturing Engineering and Labor Relations organizations. He was a founding member of GM’s Inclusion Advisory Board, created to foster and grow an inclusive internal culture while ensuring continuous improvement in diversity and equity. He is an active member of General Motors African Ancestry Network, the mission of which is to attract, develop and retain employees of African ancestry. He has also served as a member of the GM Political Action Committee Board and Steering Committee since 2020. |

||||

2023

PROXY STATEMENT 21

2023

PROXY STATEMENT 21

|

||||

|

|

DAVID W. MACLENNAN Executive Chair of the Board of Cargill, Inc. (food and agriculture)

Age: 63 Director since: 2021 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Ecolab Inc. |

CATERPILLAR BOARD COMMITTEES: ■

Audit ■

Sustainability and other Public Policy |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Experience ■

Executive Chair (2023–present), Chair (2015–2022), Chief Executive Officer (2013–2022), Chief Operating Officer (2011–2013), Chief Financial Officer (2008–2011), joined the company in 1991, Cargill, Inc. |

||||

Qualifications ■

CEO, Leadership, Business Development and Strategy, Government/Regulatory Affairs, Risk Management, Technology, Global Experience and Manufacturing/Logistics – obtained while serving in leadership roles at and as former CEO of Cargill, a large multinational corporation, where he helped develop a business model and culture to position Cargill for long-term success. He oversaw Cargill’s building of expertise in alternative proteins and development of technologies and digital solutions to transform farming, supply chains and food delivery, and undertook several large acquisitions during his tenure. As CEO of Cargill, he worked to address climate change and water risks by investing in renewable diesel; decarbonize maritime shipping by developing new wind propulsion technology that aimed to reduce shipping carbon dioxide emissions by as much as 30% and strengthen the food system by training over five million farmers globally on regenerative agriculture practices that sequester carbon, improve soil health and increase crop yields. He also directed numerous diversity, equity and inclusion initiatives including establishing specific time bound goals for gender and ethnic representation in senior management and helped establish the most diverse top leadership team in Cargill’s history. He created a particular focus on safety and reduction of injuries in Cargill’s facilities. His CEO responsibilities also included frequent interaction with government officials throughout the world and he also served on Cargill’s Business Conduct Committee.

■

Finance & Accounting and Audit Committee Financial Expert – developed while serving as CFO of Cargill, where he was responsible for all financial aspects of the business, including financing, internal controls and reporting, capital investments and budgeting.

■

Board of Directors Experience (other boards) – gained while serving as a director on the board of Ecolab since 2016 where he is a member of the Audit Committee and the Governance Committee and where he will serve as Lead Director beginning on May 4, 2023. He also serves as Chairman of the Board at Cargill. |

||||

2023

PROXY STATEMENT 22

2023

PROXY STATEMENT 22

|

||||

|

|

JUDITH F. MARKS Chair, CEO and President of Otis Worldwide Corporation (elevator and escalator manufacturing, installation and service)

Age: 59 Director since: 2023 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Otis Worldwide Corporation |

CATERPILLAR BOARD COMMITTEES: ■

Audit ■

Compensation and Human Resources |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

Hubbell Incorporated |

||||

|

||||

Ms. Marks was brought to the attention of the board through a professional search firm. |

||||

Experience ■

Chair of the Board (2022–present), Chief Executive Officer (2019–present), President (2017–present), Otis Worldwide Corporation ■

Chief Executive Officer (2017), Executive Vice President of New Equipment Solutions (2016–2017), Executive Vice President of Global Solutions (2015–2016), Dresser-Rand Group, Inc. ■

Chief Executive Officer (2017), Siemens USA, President and Chief Executive Officer (2011–2015), Siemens Government Technologies, Inc. ■

Vice President of Strategy & Business Development, Electronic Systems (2009–2011), President of Transportation & Security Solutions (2005–2009), President of Information Systems & Global Services (2005–2009), Executive Vice President of Transportation and Security Solutions (2005), President of Distribution Technologies Division (2001–2005), Lockheed Martin Corporation |

||||

Qualifications ■

Audit Committee Financial Expert, CEO, Leadership, Business Development and Strategy, Customer and Product Support Services, Finance & Accounting, Risk Management, Technology, Global Experience and Manufacturing/Logistics – gained from her experience in executive positions at Otis Worldwide Corporation, the world’s leading provider and maintainer of elevators, escalators and moving walkways; as Executive Vice President of New Equipment Solutions and Executive Vice President of Global Solutions of Dresser-Rand Group, Inc.; as President and CEO of Siemens USA and Siemens Government Technologies, Inc.; and in various senior leadership positions at Lockheed Martin Corporation.During her current tenure at Otis, she led the successful spin-off of Otis to an independent publicly traded company, and prioritized and advanced Otis’ sustainability program by embedding it into the company strategy as a key element to drive added value for all stakeholders; oversaw the company announcing that 100% of global factories achieved ISO certification four years ahead of the company goal and launching the Otis Gen360 connected elevator designed to offer higher energy efficiency and a light carbon footprint comparable Gen2 configurations. She also sponsored Made to Move Communities, Otis’ signature corporate social responsibility program that focuses on advancing youth STEM education and inclusive mobility solutions and serves as Chair of Otis’ Diversity, Equity and Inclusion Advisory Group. In her role as CEO of Siemens USA, she led a $24B global organization in the areas of electrification, automation and digitalization with 50,000 employees and 60 manufacturing locations.

■

Board of Directors Experience (other boards) – gained while serving as a director and Chair of the Board of Otis Worldwide Corporation. She also previously served as a director on the boards of AdvanceCT, Hubbell Incorporated and Siemens Government Technologies, Inc. |

||||

2023

PROXY STATEMENT 23

2023

PROXY STATEMENT 23

|

||||

|

|

DEBRA L. REED-KLAGES Former Chairman and CEO of Sempra Energy (energy infrastructure and utilities)

Age: 66 Director since: 2015 INDEPENDENT Presiding Director |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Chevron Corporation ■

Lockheed Martin Corporation |

CATERPILLAR BOARD COMMITTEES: ■

Nominating and Governance, Chair ■

Executive |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

Halliburton Company ■

Oncor Electric Delivery Company LLC ■

Sempra Energy |

||||

|

||||

Experience ■

Chairman of the Board (2012–2018), Chief Executive Officer (2011–2018), Executive Vice President (2010–2011), President and Chief Executive Officer, San Diego Gas and Electric and Southern California Gas Co., joined the company in 1978, Sempra Energy |

||||

Qualifications ■

Audit Committee Financial Expert, CEO, Leadership, Business Development and Strategy, Customer and Product Support Services, Finance & Accounting, Risk Management, Technology and Global Experience – gained over her three decades of experience in senior management and executive positions, including as former CEO at Sempra, an energy infrastructure and utilities company, which also conducts business in Mexico and South America. While leading Sempra, she oversaw significant growth in the use of renewable generation, allowing her to provide valuable insights into trends in the power, oil and gas industries, which are key end-user markets for Caterpillar products. As Chair and CEO of Sempra Energy, she led the transformation of San Diego Gas & Electric from all fossil fuel generation to become one of the utilities with the highest percentage of renewables in its portfolio and oversaw initiatives such as developing infrastructure in Mexico. Sempra Energy led renewable development, building wind and solar projects in the U.S. and Mexico to provide clean energy to customers. She also led diversity and inclusion and supplier diversity at Sempra. In her role as Vice President of Human Resources at Southern California Gas Co., she led diversity and inclusion and succession planning and development efforts and oversaw labor relations and union negotiations. Additionally, she also led compliance efforts enacting the corporate ethics policy at Sempra and ensuring proper governance and compliance frameworks were in place.

■

Government/Regulatory Affairs – gained while in leadership roles at Sempra while serving four years on the National Petroleum Council, an advisory committee to the United States Secretary of Energy to study energy policy. In her leadership roles at Sempra, she led highly regulated energy businesses in numerous states and internationally and worked extensively with a wide array of government entities and regulators.

■

Board of Directors Experience (other boards) – gained while a director of other large, publicly traded corporations such as Chevron, Lockheed Martin and Halliburton. She previously chaired the Nominating and Corporate Governance Committee at Haliburton and currently serves on the Nominating and Corporate Governance Committee at Lockheed Martin and chairs the Audit Committee at Chevron. |

||||

2023

PROXY STATEMENT 24

2023

PROXY STATEMENT 24

|

||||

|

|

SUSAN C. SCHWAB Professor Emerita at the University of Maryland School of Public Policy and Strategic Advisor for Mayer Brown LLP (global law firm)

Age: 68 Director since: 2009 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

FedEx Corporation ■

Marriott International, Inc. |

CATERPILLAR BOARD COMMITTEES: ■

Sustainability and other Public Policy ■

Nominating and Governance |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

The Boeing Company |

||||

|

||||

Experience ■

Board Chair (2022–present), National Foreign Trade Council ■

Professor Emerita (2019–present), Professor (2009–2019), University of Maryland School of Public Policy ■

Strategic Advisor (2010–present), Mayer Brown LLP ■

U.S. Trade Representative (2006–2009), Deputy U.S. Trade Representative (2005–2006), United States Government ■

President and Chief Executive Officer (2004–2005), University System of Maryland Foundation ■

Consultant (2003), U.S. Department of Treasury ■

Dean (1995–2003), University of Maryland School of Public Policy ■

Director of Corporate Business Development (1993–1995), Motorola, Inc. ■

Assistant Secretary of Commerce (1989–1993), U.S. and Foreign Commercial Service |

||||

Qualifications ■

Leadership, Business Development and Strategy, Risk Management and Global Experience – obtained over her 30-year career in international trade, commerce and public policy education, which allows her to provide important insights for the Company’s global business model and long-standing support of open trade, as well as meaningful input and guidance to the board on strategy and the evaluation of global economic conditions. As Dean of the University of Maryland School of Public Policy, she led a strategic realignment of the school’s curriculum that introduced a new specialization in philanthropy and non-profit management and also co-founded a non-profit to encourage education and fund students of color to benefit from graduate programs and consider careers in public policy and international affairs. While working as a U.S. Trade Representative, she worked to eliminate tariff barriers to environmental goods, such as clean energy technologies, worked with key non-governmental organizations to help champion negotiations to eliminate subsidization of industrial fishing fleets that contribute to overfishing of the oceans, and helped build enforceable environmental and labor provisions into U.S. trade agreements for the first time.

■

Government/Regulatory Affairs – gained as U.S. Trade Representative and Director-General of the U.S. and Foreign Commercial Service, the export promotion arm of the U.S. government. As Director General of U.S. and Foreign Commercial Service, she was responsible for over 200 field offices in the U.S. and 70 countries, with supervisory responsibility for American and international employees in multiple employment systems. She also introduced the agency’s first training curriculum with diversity, equity and inclusion components.

■

Board of Directors Experience (other boards) and Technology – gained while serving as a director of other large, publicly traded multinational corporations, including FedEx, Marriott and Boeing. |

||||

2023

PROXY STATEMENT 25

2023

PROXY STATEMENT 25

|

||||

|

|

D. JAMES UMPLEBY III Chairman and CEO of Caterpillar Inc.

Age: 65 Director since: 2017 MANAGEMENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Chevron Corporation |

CATERPILLAR BOARD COMMITTEES: ■

None |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Experience ■

Chairman (2018–present), Chief Executive Officer (2017–present), Group President, Energy & Transportation segment (2013–2016), Vice President and President of Solar Turbines (2010–2012), joined a company subsidiary in 1980, Caterpillar Inc. |

||||

Qualifications ■

Audit Committee Financial Expert, CEO, Leadership, Business Development and Strategy, Finance & Accounting and Risk Management – obtained during his more than three decades of experience in senior management and executive positions and more than a decade of financial responsibility and experience at Caterpillar. This includes oversight of all aspects of Caterpillar’s environmental and sustainability policies and strategies, such as the introduction of new products and services that contribute to sustainability efforts by reducing waste and fuel consumption and increasing safety and operator ease of use. He also formerly served as a director of the World Resources Institute, which works to secure a sustainable future. Additionally he oversees all aspects of Caterpillar’s diversity and inclusion policies and strategies, including the introduction of Caterpillar’s five pillar diversity and inclusion framework.

■

Customer and Product Support Services, Technology, Global Experience and Manufacturing/Logistics – developed during his long career at Caterpillar, the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives with extensive international operations.

■

Board of Directors Experience (other boards) – gained while serving as a director Chevron Corporation, where he is a member of the Board Nominating and Governance Committee and the Public Policy and Sustainability Committee. |

||||

2023

PROXY STATEMENT 26

2023

PROXY STATEMENT 26

|

||||

|

|

RAYFORD WILKINS, JR. Former CEO of Diversified Businesses at AT&T Inc. (telecommunications)

Age: 71 Director since: 2017 INDEPENDENT |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ■

Morgan Stanley ■

Valero Energy Corporation |

CATERPILLAR BOARD COMMITTEES: ■

Compensation and Human Resources, Chair ■

Audit ■

Executive |

OTHER DIRECTORSHIPS WITHIN THE LAST FIVE YEARS: |

||||

■

None |

||||

|

||||

Experience ■

CEO of Diversified Businesses (2007–2012), held other leadership roles including Group President of Marketing and Sales, SBC Communications, President and CEO, SBC and Pacific Bell, and President and CEO Southwestern Bell Telephone, joined in 1974, AT&T Inc. |

||||

Qualifications ■

Audit Committee Financial Expert, Leadership, Business Development & Strategy, Government/Regulatory Affairs, Customer and Product Support Services, Finance & Accounting, Risk Management, Technology and Global Experience – gained while in leadership roles at AT&T, where he was responsible for international investments, AT&T Interactive, AT&T Advertising Solutions, customer information services and the consumer wireless initiative in India; his service on the Advisory Council of the McCombs School of Business at the University of Texas at Austin and his service as a director at Valero Energy Corporation and Morgan Stanley. As chair of Valero’s Human Resources and Compensation Committee, he was integral to Valero’s progress in linking pay with HSE (health, safety and environmental) and ESG performance. He also served on the Institute for Inclusion Advisory Board at Morgan Stanley, which aims to develop and accelerate an integrated and transparent diversity, equity and inclusion strategy.

■

Board of Directors Experience (other boards) – gained while a director and committee chair of other large, publicly traded corporations, including as chair of the Governance and Sustainability Committee at Morgan Stanley and chair of the Human Resources and Compensation Committee and the newly established Sustainability and Public Policy Committee at Valero Energy Corporation. |

||||

2023

PROXY STATEMENT 27

2023

PROXY STATEMENT 27

DIRECTOR COMPENSATION

The following table sets forth information concerning the compensation for our non-employee directors during the year ended December 31, 2022. Mr. Umpleby, who served as Chairman and CEO during 2022, did not receive separate compensation for his service on the board.

Annual compensation for non-employee directors for 2022 was comprised of the following components:

|

|

|

|

Restricted Stock Units (1 Year Vesting) |

$ |

150,000 |

|

Cash Retainer |

$ |

150,000 |

|

Cash Stipends: |

|

|

|

Presiding Director (Executive Committee Chair) |

$ |

50,000 |

|

Audit Committee Chair |

$ |

30,000 |

|

Compensation and Human Resources Committee Chair |

$ |

25,000 |

|

Nominating and Governance Committee Chair |

$ |

20,000 |

1 |

Sustainability and other Public Policy Committee Chair |

$ |

20,000 |

1 |

(1)

Cash Stipend Effective June 8, 2022

|

|

|

|

Directors are required to own Caterpillar common stock equal to five times their annual cash retainer. Directors have a five-year period from the date of their election or appointment to meet the target ownership guidelines. All directors are in compliance with these guidelines. Under the Company’s Directors’ Deferred Compensation Plan, directors may defer 50% or more of their annual cash retainer and stipend into an interest-bearing account or an account representing phantom shares of Caterpillar stock. Directors may also defer 50% or more of any stock-based compensation (effective for grants other than options and stock appreciation rights made on or after January 1, 2019) upon vesting into an account representing phantom shares of Caterpillar stock. Directors that joined the board prior to April 1, 2008, also are able to participate in a Charitable Award Program. A donation of up to $500,000 will be made by the Company in the director’s name to charitable organizations selected by the director and a donation of up to $500,000 also will be made by the Company in the director’s name to the Caterpillar Foundation. Directors derive no financial benefit from the Charitable Award Program.

2023

PROXY STATEMENT 28

2023

PROXY STATEMENT 28

DIRECTOR COMPENSATION FOR 2022

Director |

|

Fees Earned or Paid in Cash |

|

|

Restricted Stock Units(1) (2) |

|

|

All Other Compensation(3) |

|

|

Total |

Kelly A. Ayotte |

$ |

161,209 |

(4) |

$ |

187,517 |

|

$ |

— |

|

$ |

348,726 |

David L. Calhoun |

$ |

185,000 |

(4) |

$ |

187,517 |

|

$ |

5,000 |

|

$ |

377,517 |

Daniel M. Dickinson |

$ |

180,000 |

|

$ |

187,517 |

|

$ |

20,656 |

|

$ |

388,173 |

Gerald Johnson |

$ |

150,000 |

|

$ |

187,517 |

|

$ |

— |

|

$ |

337,517 |

David W. MacLennan |

$ |

150,000 |

|

$ |

187,517 |

|

$ |

— |

|

$ |

337,517 |

Debra L. Reed-Klages |

$ |

201,731 |

(4) |

$ |

187,517 |

|

$ |

— |

|

$ |

389,248 |

Edward B. Rust, Jr. |

$ |

150,000 |

|

$ |

187,517 |

|

$ |

25,574 |

|

$ |

363,091 |

Susan C. Schwab |

$ |

150,000 |

|

$ |

187,517 |

|

$ |

— |

|

$ |

337,517 |

Miles D. White |

$ |

65,934 |

(5) |

$ |

— |

|

$ |

11,000 |

|

$ |

76,934 |

Rayford Wilkins, Jr. |

$ |

164,011 |

(4) |

$ |

187,517 |

|

$ |

5,000 |

|

$ |

356,528 |

(1)

Restricted stock units awarded in 2022 include a one-time adjustment to reflect the change in annual grant date from March to June that was implemented in 2022. (2)

As of December 31, 2022, the number of RSUs (including accrued dividend equivalent units) and Phantom Shares held by those serving as non-employee directors during 2022 were: Ms. Ayotte: 3,256 (which consists of 825 RSUs and 2,431 Phantom Shares); Mr. Calhoun: 24,347 (which consists of 825 RSUs and 23,522 Phantom Shares); Mr. Dickinson: 30,762 (which consists of 825 RSUs and 29,937 Phantom Shares); Mr. Johnson: 825 RSUs; Mr. MacLennan: 1,069 (which consists of 825 RSUs and 244 Phantom Shares); Ms. Reed-Klages: 11,629 (which consists of 825 RSUs and 10,804 Phantom Shares); Mr. Rust: 40,239 (which consists of 825 RSUs and 39,414 Phantom Shares); Ms. Schwab: 21,489 (which consists of 825 RSUs and 20,664 Phantom Shares); Mr. White: 12,909 Phantom Shares; and Mr. Wilkins: 825 RSUs. Mr. Calhoun and Ms. Schwab elected to defer 100% of their 2022 Cash Retainer and Cash Stipend (as applicable) into Phantom Shares of Caterpillar stock in the Directors’ Deferred Compensation Plan. These deferrals, plus the accumulated value of previous retainer deferrals for each of Ms. Ayotte, Mr. Dickinson, Ms. Reed-Klages, Mr. Rust and Mr. White, are included in the Phantom Shares totals above. Mr. Johnson elected to defer 100% of his 2022 Cash Retainer into the Interest Fund in the Directors’ Deferred Compensation Plan. Ms. Ayotte, Mr. Calhoun, Mr. MacLennan, Ms. Reed-Klages and Ms. Schwab elected to defer a portion of their equity award that vested on March 1, 2022, into the Directors’ Deferred Compensation Plan. These deferrals, plus the accumulated deferrals of previous equity awards, are also included in the Phantom Share totals above. Ms. Ayotte and Mr. MacLennan elected to defer 50%, and Mr. Calhoun, Ms. Reed-Klages and Ms. Schwab elected to defer 100% of the equity award granted on June 8, 2022. (3)

All Other Compensation represents amounts paid in connection with the Directors’ Charitable Award Program, Caterpillar Foundation’s Matching Gifts Program and the Caterpillar Political Action Committee Charitable Matching Program (CATPAC’s PACMATCH program). For directors eligible to participate in the Directors Charitable Award Program, the amounts listed include the insurance premium and administrative fees as follows: Mr. Dickinson $20,656 and Mr. Rust $20,574. In 2022, the Caterpillar Foundation matched contributions to eligible 501(c)(3) nonprofits and accredited U.S. public/private preK-12 schools or school districts to which contributions are tax-deductible, up to a maximum match of $10,000 per participant per calendar year. Additionally in 2022, the Caterpillar Foundation also provided a 2:1 match program for a period of time in support of the Foundation’s 70th Anniversary and Giving Tuesday that allowed participants to donate up to $500 to be matched at a 2:1 ratio. The amounts listed include Charitable Foundation matching gifts as follows: Mr. White $11,000. As part of CATPAC’s PACMATCH program, Caterpillar Inc. will contribute to up to four charities on behalf of eligible members who contribute at the suggested giving level. The annual CATPAC contribution limit is $5,000. Mr. Calhoun, Mr. Rust and Mr. Wilkins had contributions matched. (4)

Total fees earned or paid in 2022 include pro-rated Cash Retainer and/or Cash Stipends for directors who ceased board service or transitioned between committee chair positions over the course of the year. The cash compensation for Ms. Ayotte, Mr. Calhoun, Ms. Reed-Klages and Mr. Wilkins reflect pro-ration of chair stipends for the transition of roles on June 8, 2022. (5)

Mr. White did not stand for re-election, thereby concluding his board service June 8, 2022. His cash compensation includes pro-ration to the date his board service ceased. |

|||||||||||

2023

PROXY STATEMENT 29

2023

PROXY STATEMENT 29

BOARD ELECTION AND LEADERSHIP STRUCTURE

Directors are elected at each annual meeting to serve for a one-year term. In uncontested elections, directors are elected by a majority of the votes cast for such directorship. If an incumbent director does not receive a greater number of “for” votes than “against” votes, such director must tender his or her resignation to the board. In contested elections, directors are elected by a plurality vote.

The mandatory retirement age for directors is 74. Each director who will have reached the age of 74, on or before the date of the next shareholders’ meeting, shall not stand for re-election at that annual meeting of the shareholders without an express waiver by the board.

Under Caterpillar’s bylaws, the directors annually elect a Chairman. The board has no fixed policy on whether to have an executive or non-executive chairman and believes this determination should be made based on the best interests of the Company and its shareholders in light of the circumstances at the time. As previously disclosed, the board determined to appoint Ms. Reed-Klages as its Presiding Director, effective June 8, 2022.

In the role of Presiding Director, Ms. Reed-Klages has provided strong independent oversight of management and served as a liaison between the independent directors and the Chairman and CEO, as further described below. Ms. Reed-Klages also led the board’s annual evaluation of Mr. Umpleby, and the independent members of the board set Mr. Umpleby’s compensation annually based on the recommendation of the Compensation and Human Resources Committee.

DUTIES AND RESPONSIBILITIES OF PRESIDING DIRECTOR

Preside at all meetings of the board at which the Chairman & CEO is not present, including executive sessions of the independent directors.

Serve as a liaison between the Chairman & CEO and the independent directors.

Approve the type of information sent to the board.

Provide input and approve meeting agendas for the board.

Approve meeting schedules, in consultation with the Chairman & CEO and the independent directors, to assure that there is sufficient time for discussion of all agenda items.

Has the authority to call meetings of the independent directors.

If requested by major shareholders, is available, when appropriate, for consultation and direct communication.

Provide the Chairman & CEO with the results of his/her annual performance review in conjunction with the chairman of the Compensation and Human Resources Committee.

The board believes it is important to maintain flexibility as to the board’s leadership structure. The board will continue to regularly review its leadership structure and exercise its discretion in adopting an appropriate and effective framework to ensure effective governance and accountability, taking into consideration the needs of the board and the Company.

CORPORATE GOVERNANCE GUIDELINES AND CODE OF CONDUCT

Our board has adopted Guidelines on Corporate Governance Issues (Corporate Governance Guidelines), which are available on our website at www.caterpillar.com/governance. The guidelines reflect the board’s commitment to oversee the effectiveness of policy and decision-making both at the board and management level, with a view to enhance shareholder value over the long term.

Caterpillar’s Code of Conduct is called Our Values in Action. Integrity, Excellence, Teamwork, Commitment and Sustainability are the core values identified in the code. Our Values in Action apply to all members of the board and to management and employees worldwide. These values embody the high ethical standards that Caterpillar has upheld since its formation in 1925. Our Values in Action are available on our website at www.caterpillar.com/code.

2023

PROXY STATEMENT 30

2023

PROXY STATEMENT 30

BOARD EVALUATION PROCESS

The board conducts an annual self-evaluation to determine whether the board and its committees are functioning effectively. In 2022, the Chair of the NGC interviewed each board member to solicit their feedback. The NGC Chair then led a discussion during the board’s executive session. Each of the committees of the board followed a similar process and reported to the board on the outcome of their self-evaluations. The self-evaluation provides the board with actionable feedback to enhance its performance and effectiveness.

Starting in 2022, the board enhanced its self-evaluation process through the addition of individual director assessments. Pursuant to this part of the process, each director sends a confidential performance evaluation with respect to each other individual director to outside counsel retained by the Company at the request of the Nominating and Governance Committee. Outside counsel reviews and compiles the results and provides summaries of each director’s performance evaluation to the Presiding Director, other than her own review, which summary is instead provided to the Chair of the Audit Committee. The Presiding Director then has an individual conversation with each director, reviewing the results and feedback received as well as providing recommendations for improvement, if any (with the Chair of the Audit Committee undertaking such review with the Presiding Director). The Nominating and Governance Committee also reviews the collective results and makes any further recommendations or improvements. In concert with the broader annual board self-evaluation, the board believes it has proper processes in place to evaluate the board, its committees and each individual director’s effectiveness and potential areas of improvement.

BOARD COMMITTEES

The board currently has five standing committees: Audit, Compensation and Human Resources, Sustainability and other Public Policy, Nominating and Governance, and Executive. Each committee meets regularly throughout the year, reports its actions and recommendations to the board, receives reports from management, annually evaluates its performance and has the authority to retain outside advisors at its discretion. The current primary responsibilities of each committee are summarized below and set forth in more detail in each committee’s written charter, which can be found on Caterpillar’s website at www.caterpillar.com/governance. All committee members are independent under Company, NYSE and SEC standards applicable to board and committee service, and the board has determined that each member of the Audit Committee is “financially literate” and an “audit committee financial expert” as defined under SEC rules.

AUDIT COMMITTEE

Committee Members: Daniel M. Dickinson, Chair Number of Meetings in 2022: 10 |

COMMITTEE ROLES AND RESPONSIBILITIES |

■

Selects and oversees independent auditors, including annual evaluation of the lead audit partner. |

|

■

Oversees our financial reporting activities, including our financial statements, annual report and accounting standards and principles. |

|

■

Reviews with management the Company’s risk assessment and risk management framework. ■

Approves audit and non-audit services provided by the independent auditors. ■

Reviews the organization, scope and effectiveness of the Company’s internal audit function, disclosures and internal controls. ■

Sets parameters for and monitors the Company’s hedging and derivatives practices. ■

Provides oversight for the Company’s compliance program and Code of Conduct. ■

Monitors any significant litigation, regulatory and tax compliance matters. ■

Oversees information technology systems and related security. ■

Reviews with management cybersecurity risks and strategy to mitigate these risks. |

2023

PROXY STATEMENT 31

2023

PROXY STATEMENT 31

COMPENSATION AND HUMAN RESOURCES COMMITTEE

Committee Members: Rayford Wilkins, Jr., Chair Number of Meetings in 2022: 5 |

COMMITTEE ROLES AND RESPONSIBILITIES |

■

Recommends the CEO’s compensation to the board and establishes the compensation of other executive officers. |

|

■

Establishes, approves and oversees the Company’s equity compensation and employee benefit plans. |

|

■

Reviews incentive compensation arrangements to ensure that incentive pay does not encourage unnecessary risk-taking, and reviews and discusses the relationship between risk management policies and practices, corporate strategy and executive compensation. |

|

■

Recommends to the board the compensation of independent directors. ■

Provides general oversight of the Company’s approach to talent management, succession planning and diversity and inclusion for senior leaders. ■

Furnishes an annual Committee Report on executive compensation and approves the Compensation Discussion and Analysis section in the Company’s proxy statement. |

SUSTAINABILITY AND OTHER PUBLIC POLICY COMMITTEE

Committee Members: Kelly A. Ayotte, Chair Number of Meetings in 2022: 3 |

COMMITTEE ROLES AND RESPONSIBILITIES |

■

Identifies, evaluates and monitors sustainability issues that affect the Company’s operations and performance, including those related to environmental issues and climate change. |

|

■

Monitors the development and implementation of the goals established by the Company for its performance with respect to its sustainability framework and initiatives. |

|

■

Reviews and evaluates risks that may arise in connection with the sustainability and other public policy aspects of the Company’s operations. |

|

■

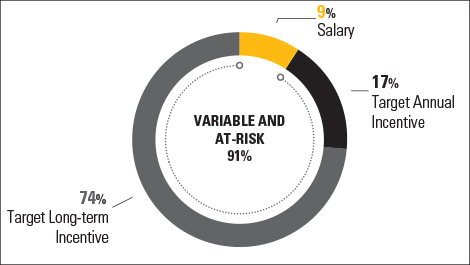

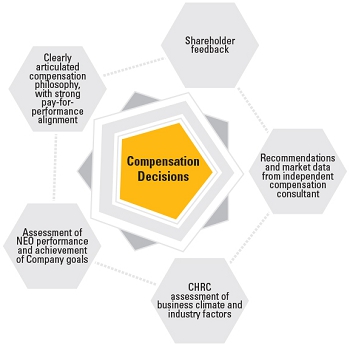

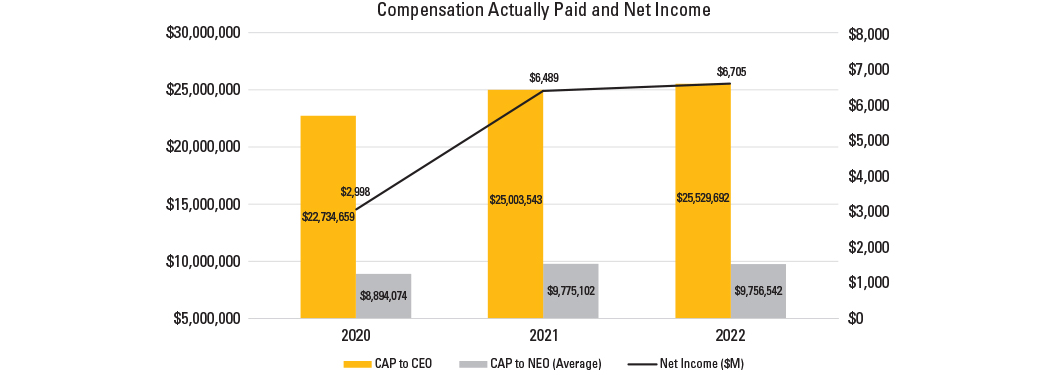

Provides general oversight over social issues, including those related to human rights, that affect the Company’s operations and performance. ■