As filed with the Securities and Exchange Commission on May 12, 2022

No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

Delaware |

| 4911 |

| 98-1588588 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

6650 SW Redwood Lane, Suite 210

Portland, OR 97224

(971) 371-1592

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert Temple

General Counsel

6650 SW Redwood Lane, Suite 210

Portland, OR 97224

(971) 371-1592

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Jason M. Brauser

James M. Kearney

Stoel Rives LLP

760 SW Ninth Avenue, Suite 3000

Portland, OR 97205

Tel: (503) 224-3380

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934 (“Exchange Act”).

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

☒ | Smaller reporting company | |||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be issued until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and does not constitute the solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED May 12, 2022

PRELIMINARY PROSPECTUS

228,011,646 Shares of Class A Common Stock

8,900,000 Warrants to Purchase Shares of Class A Common Stock

NUSCALE POWER CORPORATION

This prospectus relates to (1) the issuance by us of up to 178,396,711 shares (“Exchange Shares”) of Class A Common Stock, par value $0.0001 per share (“Class A Common Stock”), of NuScale Power Corporation, a Delaware corporation (“NuScale Corp,” “we,” “our” or “us”), upon exchange (on a one-for-one basis, subject to adjustment) of Class B Units of NuScale Power, LLC, an Oregon limited liability company (“NuScale LLC”) and cancellation of a corresponding number of shares of Class B Common Stock, par value $0.0001 per share, of NuScale Corp, and the resale of 171,755,372 Exchange Shares, the resale of which might otherwise be limited by the resale restrictions imposed on “control securities” under Rule 144 under the Securities Act; (2) the issuance by us of up to 11,500,000 shares of Class A Common Stock upon the exercise of the NuScale Corp Public Warrants (as defined below); (3) the issuance by us of up to 8,900,000 shares of Class A Common Stock upon the exercise of NuScale Corp Private Placement Warrants (defined below) and the resale of such shares; and (4) the resale from time to time by the selling securityholders named in this prospectus or their permitted transferees of up to: 8,900,000 NuScale Corp Private Placement Warrants (as defined below) to purchase Class A Common Stock; 23,700,002 shares of Class A Common Stock, which were issued in private placements to PIPE Investors (defined below) immediately prior to the consummation of the Merger (defined below) pursuant to the terms of the Subscription Agreements (defined below); and 5,514,933 shares of Class A Common Stock held by Spring Valley Acquisition Sponsor Sub, LLC and its affiliates and the former officers and directors of Spring Valley Acquisition Corp (“Spring Valley Founders”).

On May 2, 2022 (the “Closing Date”), Spring Valley Acquisition Corp., formerly a blank check company incorporated as a Cayman Islands exempted company (“Spring Valley”), completed the previously announced transactions pursuant to the Agreement and Plan of Merger dated December 13, 2021 (as amended) between Spring Valley, Spring Valley Merger Sub, LLC, an Oregon limited liability company (“Merger Sub”) and NuScale LLC, including: (a) the domestication of Spring Valley as a Delaware corporation (the “Domestication”) and the change of its name to “NuScale Power Corporation”; and (b) the merger (“Merger”) of Merger Sub with and into NuScale LLC, with NuScale LLC as the surviving business entity in the Merger, through which the combined company was reorganized in an “UP-C” structure, with NuScale Corp now serving as the sole manager of NuScale LLC. NuScale LLC is now owned in part, indirectly through NuScale Corp, by former public and private shareholders of Spring Valley and in part directly by continuing equity owners of NuScale LLC (the “Legacy NuScale Equityholders”).

After the Domestication and immediately before completion of the Merger, Spring Valley issued to certain selling securityholders, in private placements, 23,700,002 shares of Class A Common Stock at approximately $10.00 per share, for an aggregate purchase price of $235,000,000.

The selling securityholders may offer, sell or distribute all or a portion of the NuScale Corp Private Placement Warrants and the shares of Class A Common Stock registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices.

We provide more information about how the selling securityholders may sell their shares in the section entitled “Plan of Distribution.”

We will pay certain offering fees and expenses and fees in connection with the registration of the warrants and the Class A Common Stock and will not receive proceeds from the exchange of NuScale LLC Class B Units (and cancellation of a corresponding number of shares of Class B Common Stock) for Class A Common Stock or from the sale of the warrants or shares of Class A Common Stock by the selling securityholders. The selling securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the warrants or the Class A Common Stock.

Our Class A Common Stock is listed on the New York Stock Exchange (“NYSE”) and trades under the symbol “SMR.” On May 11, 2022, the closing sale price of our Class A Common Stock was $10.19 per share. Our public warrants are listed on the NYSE and trade under the symbol “SMR WS.” On May 11, 2022, the closing sale price of our public warrants was $2.35 per warrant.

We are an “emerging growth company” as defined under applicable federal securities laws, and therefore are subject to certain reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 9 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside the United States: We have taken no actions that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the selling securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by selling securityholders of the securities offered by them.

Neither we nor the selling securityholders (1) have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you; (2) take responsibility for, or provide assurances as to the reliability of, any other information that others may give you; and (3) will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: neither we nor the selling securityholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

We may provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should read both this prospectus and any supplement or post-effective amendment with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.” You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus.

BASIS OF PRESENTATION

We were incorporated on August 20, 2020 as a Cayman Islands exempted company under the name Spring Valley Acquisition Corp. for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On May 2, 2022, we completed the Transactions (as defined herein), following which we were renamed “NuScale Power Corporation,” and we act as the sole manager of NuScale Power, LLC, an Oregon limited liability company (“NuScale LLC”). Unless otherwise indicated, the financial information included herein is that of NuScale LLC, which, following the Transactions, became our business. We are a holding company and, accordingly, all of our assets are held directly by, and all of our operations are conducted through, NuScale LLC, and our only direct asset consists of NuScale LLC Class A Units. As the manager of NuScale LLC, we have the full, exclusive, and complete discretion to manage and control the business of NuScale LLC and to take all action we deem necessary, appropriate, advisable, incidental, or convenient to accomplish the purposes of NuScale LLC set forth in its operating agreement. We may not be removed as the manager of NuScale LLC.

Because we had limited operations before the Transactions, NuScale LLC is our “predecessor” for financial reporting purposes and we present in this prospectus pro forma condensed consolidated financial statements that give

ii

effect to the Merger in the historical periods presented. The financial statements of NuScale LLC for periods following the Transactions will be prepared on a consolidated basis with ours.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Unless the context otherwise requires, references in this prospectus to the “Company,” “NuScale,” “we,” “us,” or “our” refer to the business of NuScale LLC, which became the business of NuScale Power Corporation following the consummation of the Transactions.

MARKET AND INDUSTRY DATA

This prospectus includes, and any amendment or supplement to this prospectus may include, estimates regarding market and industry data and forecasts, which are based on our own estimates utilizing our management’s knowledge of and experience in, as well as information obtained from trade and business organizations, and other contacts in the market sectors in which we compete, and from statistical information obtained from publicly available information, industry publications and surveys, reports from government agencies, and reports by market research firms. We confirm that, where such information is reproduced herein, such information has been accurately reproduced and that, so far as we are aware and are able to ascertain from information published by publicly available sources and other publications, no facts have been omitted that would render the reproduced information inaccurate or misleading. Industry publications, reports, and other published data generally state that the information contained therein has been obtained from sources believed to be reliable, but we cannot assure you that the information contained in these reports, and therefore the information contained in this prospectus or any amendment or supplement to this prospectus that is derived therefrom, is accurate or complete. Our estimates of our market position may prove to be inaccurate because of the method by which we obtain some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties. As a result, although we believe our sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

TRADEMARKS

NuScale Power Corporation, NuScale Power, LLC, and their logos, and other registered and common law trade names, trademarks and service marks, including NuScale Power Module™, VOYGR™ and Triple Crown For Nuclear Plant Safety™, are the property of NuScale Power, LLC. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names.

This document contains references to trademarks and service marks belonging to other entities. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iii

SELECTED DEFINITIONS

When used in this prospectus, unless the context otherwise requires:

| ● | “A&R NuScale LLC Agreement” refers to the Sixth Amended and Restated Limited Liability Company Agreement of NuScale LLC. |

| ● | “ASC” refers to the Financial Accounting Standards Board Accounting Standards Codification. |

| ● | “Board” refers to the board of directors of NuScale Corp. |

| ● | “Bylaws” refers to the bylaws of NuScale Corp. |

| ● | “Cayman Islands Companies Act” refers to the Companies Act (As Revised) of the Cayman Islands, as the same may be amended from time to time. |

| ● | “Charter” refers to the certificate of incorporation of NuScale Corp. |

| ● | “Class A Common Stock” refers to shares of Class A common stock, par value $0.0001 per share, of NuScale Corp. |

| ● | “Class B Common Stock” refers to shares of Class B common stock, par value $0.0001 per share, of NuScale Corp., which represents the right to one vote per share and carries no economic rights. |

| ● | “Common Stock” refers collectively to shares of Class A Common Stock and Class B Common Stock. |

| ● | “Closing” refers to the closing of the Merger. |

| ● | “Closing Acquiror Cash” refers to, without duplication, an amount equal to (a) the funds contained in the Trust Account as of immediately prior to the Closing; plus (b) all other cash and cash equivalents of Spring Valley as of immediately prior to the Closing; minus (c) the aggregate amount of cash proceeds that were required to satisfy the redemption of any shares of Spring Valley Class A ordinary shares (to the extent not already paid); plus (d) the aggregate proceeds of the PIPE Investment that is actually paid to Spring Valley at or prior to the Closing; minus (e) any Transaction Expenses (as defined in the Merger Agreement) in excess of $43,000,000 in the aggregate. |

| ● | “Closing Date” refers to the date on which the Closing occurred. |

| ● | “COVID-19” refers to the novel coronavirus pandemic. |

| ● | “DGCL” refers to the Delaware General Corporation Law, as amended. |

| ● | “DOE” refers to the U.S. Department of Energy. |

| ● | “Domestication” refers to the continuation of Spring Valley by a way of domestication of Spring Valley into a Delaware corporation, with the ordinary shares of Spring Valley becoming shares of common stock of the Delaware corporation under the applicable provisions of the Cayman Islands Companies Act and the DGCL; the term includes all matters and necessary or ancillary changes in order to effect such Domestication, including the adoption of the Proposed Charter (substantially in the form attached hereto at Annex C) consistent with the DGCL and changing the name and registered office of Spring Valley. |

| ● | “Effective Time” refers to the time when the Merger was consummated. |

iv

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| ● | “Exchange Ratio” refers to the Exchange Ratio as defined in the Merger Agreement. |

| ● | “FASB” refers to the Financial Accounting Standards Board. |

| ● | “Fluor” refers to Fluor Enterprises, Inc., a California corporation, which is wholly owned by Fluor Corporation (NYSE: FLR). |

| ● | “Fluor Convertible Loan Agreement” refers to that certain Amended and Restated Senior Secured Convertible Loan Agreement, dated as of September 30, 2011, between Fluor and NuScale LLC, as amended from time to time. |

| ● | “Fluor Convertible Note” refers to that certain amended and restated secured convertible promissory note issued by NuScale LLC on September 30, 2011 in the aggregate principal amount of $10,281,427.49 pursuant to the Fluor Convertible Loan Agreement. |

| ● | “G&A” refers to general and administrative expenses. |

| ● | “IPO” or “Initial Public Offering” refers to the initial public offering of Spring Valley, which closed on November 27, 2020. |

| ● | “Legacy NuScale Equityholders” refers to the holders of NuScale LLC Units other than NuScale Corp. |

| ● | “Merger” refers to the merger of Merger Sub with and into NuScale LLC, with NuScale LLC as the surviving entity. |

| ● | “Merger Agreement” refers to the Agreement and Plan of Merger, dated as of December 13, 2021 (as amended, modified, supplemented or waived from time to time), by and among Spring Valley, Merger Sub and NuScale LLC. |

| ● | “Merger Sub” refers to Spring Valley Merger Sub, LLC, an Oregon limited liability company and a wholly owned subsidiary of Spring Valley. |

| ● | “MWe” refers to one million watts of electric power. |

| ● | “MWt” refers to one million watts of thermal power. |

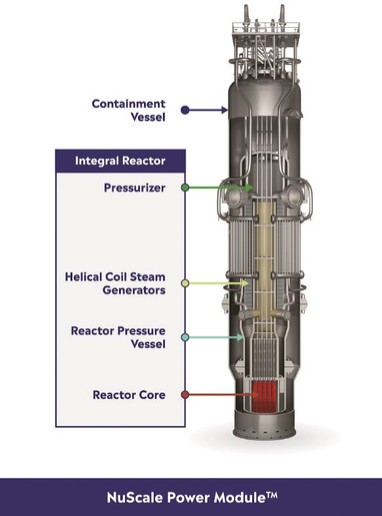

| ● | “NPM” refers to NuScale Power Module™. |

| ● | “NRC” refers to the U.S. Nuclear Regulatory Commission. |

| ● | “NuScale Corp” refers to NuScale Power Corporation, a Delaware corporation and the combined company following the consummation of the Transactions, and its consolidated subsidiaries, including NuScale LLC. |

| ● | “NuScale Corp Private Placement Warrants” refers to the 8,900,000 warrants to purchase Spring Valley Class A ordinary shares that were issued in a private placement concurrently with the IPO and converted in the Transactions into warrants to purchase Class A common shares. |

| ● | “NuScale Corp Public Warrants” refers to the 11,500,000 redeemable warrants issued in the IPO and converted in the Transactions into warrants to purchase Class A common shares. |

v

| ● | “NuScale Corp Warrants” refers collectively to the NuScale Corp Public Warrants and the NuScale Corp Private Placement Warrants. |

| ● | “NuScale LLC” refers to NuScale Power, LLC, an Oregon limited liability company. |

| ● | “NuScale LLC Class A Units” refers to the Class A units of NuScale LLC issued to NuScale Corp immediately after the Closing. |

| ● | “NuScale LLC Class B Units” refers to non-voting, Class B units of NuScale LLC. |

| ● | “NuScale LLC Common Units” refers to the collective NuScale LLC limited liability company interests existing immediately after the Closing. |

| ● | “NYSE” means the New York Stock Exchange. |

| ● | “Organizational Documents” refers to the Charter and the Bylaws. |

| ● | “PCAOB” refers to the Public Company Accounting Oversight Board. |

| ● | “PIPE Investment” refers to the PIPE Investors’ purchase an aggregate of 23,700,002 shares of Class A Common Stock at an aggregate cash purchase price of $235,000,000 pursuant to the Subscription Agreements. |

| ● | “PIPE Investors” refers, collectively, to the institutional and accredited investors that made the PIPE Investment. |

| ● | “Pre-Existing NuScale Common Units” refers to the “Common Units” of NuScale LLC as defined in the Fifth Amended and Restated Limited Liability Company Agreement of NuScale LLC. |

| ● | “Pre-Existing NuScale Options” refers to options to purchase Pre-Existing NuScale Common Units, which Pre-Existing NuScale Options converted automatically in the Merger into options to purchase Class A Common Stock. |

| ● | “Public Shareholder” refers to a holder of Spring Valley Class A ordinary shares sold in the Initial Public Offering. |

| ● | “R&D” refers to research and development. |

| ● | “Registration Rights Agreement” refers to the registration rights agreement, dated May 2, 2022 between NuScale Corp., the Sponsor, the Sponsor Sub, the former independent directors of Spring Valley and certain equity holders of NuScale Corp and NuScale LLC. |

| ● | “SEC” refers to the United States Securities and Exchange Commission. |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| ● | “SMR” means small modular reactor. |

| ● | “Sponsor” refers to Spring Valley Acquisition Sponsor, LLC, a Delaware limited liability company. |

| ● | “Sponsor Letter Agreement” refers to the sponsor letter agreement, dated as of December 13, 2021, by and among Sponsor Sub, Spring Valley and NuScale LLC. |

vi

| ● | “Sponsor Sub” refers to SV Acquisition Sponsor Sub, LLC, a Delaware limited liability company. |

| ● | “Spring Valley” refers to Spring Valley Acquisition Corp., a special purpose acquisition company incorporated as a Cayman Islands exempt company. |

| ● | “Spring Valley Letter Agreement” refers to that certain Letter Agreement, dated November 23, 2020, by and between Spring Valley, the Sponsor and each of the officers and directors of Spring Valley. |

| ● | “Subscription Agreements” refers to the subscription agreements (as amended from time to time) that Spring Valley entered into with the PIPE Investors in connection with the Merger Agreement, each dated as of December 13, 2021, March 29, 2022, or April 4, 2022. |

| ● | “Tax Receivable Agreement” or “TRA” refers to that certain tax receivable agreement entered into concurrent with the Closing by and among NuScale Corp, NuScale LLC and the Legacy NuScale Equityholders. |

| ● | “Transactions” refers to the transactions contemplated by the Merger Agreement. |

| ● | “Units” refers to a unit which Spring Valley sold in the IPO consisting of one Spring Valley Class A ordinary share and one half of a Spring Valley Public Warrant. |

| ● | “U.S. GAAP” or “GAAP” refers to generally accepted accounting principles in the United States set forth in the opinions and pronouncements of the Financial Accounting Standards Board or such other principles as may be approved by a significant segment of the accounting profession in the United States, that are applicable to the circumstances as of the date of determination, consistently applied. |

| ● | “VWAP” refers to the dollar volume-weighted average price. |

vii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

| ● | NuScale Corp’s financial and business performance, including financial projections and business metrics; |

| ● | the ability to maintain the listing of the Class A Common Stock on the NYSE, and the potential liquidity and trading of such securities; |

| ● | the ability to obtain regulatory approvals for NuScale Corp to deploy its SMRs in the United States and abroad; |

| ● | changes in applicable laws or regulations; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following the completion of the Transactions, and our ability to attract and retain key personnel; |

| ● | forecasts regarding end-customer adoption rates and demand for NuScale Corp’s products in markets that are new and rapidly evolving; |

| ● | macroeconomic conditions resulting from COVID-19; |

| ● | availability of a limited number of suppliers for NuScale Corp’s products and services; |

| ● | increases in costs, disruption of supply, or shortage of materials; |

| ● | NuScale Corp’s dependence on a small number of customers, and failure to add new customers or expand sales to NuScale Corp’s existing customers; |

| ● | substantial regulations, which are evolving, and unfavorable changes or failure by NuScale Corp to comply with these regulations; |

| ● | product liability claims, which could harm NuScale Corp’s financial condition and liquidity if NuScale Corp is not able to successfully defend or insure against such claims; |

| ● | changes to United States trade policies, including new tariffs or the renegotiation or termination of existing trade agreements or treaties; |

| ● | various environmental and safety laws and regulations that could impose substantial costs upon NuScale Corp and negatively impact the ability of NuScale Corp’s suppliers to operate their manufacturing facilities; outages and disruptions of NuScale Corp’s services if it fails to maintain adequate security and supporting infrastructure as it scales NuScale Corp’s information technology systems; |

| ● | availability of additional capital to support business growth; |

| ● | failure to protect NuScale Corp’s intellectual property; |

viii

| ● | intellectual property rights claims by third parties, which could be costly to defend, related significant damages and resulting limits on NuScale Corp’s ability to use certain technologies, developments and projections relating to NuScale Corp’s competitors and industry; |

| ● | the anticipated growth rates and market opportunities of NuScale Corp; |

| ● | the period over which NuScale Corp anticipates its existing cash and cash equivalents will be sufficient to fund its operating expenses and capital expenditure requirements; |

| ● | the potential for NuScale Corp’s business development efforts to maximize the potential value of its portfolio; |

| ● | NuScale Corp’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● | NuScale Corp’s financial performance; |

| ● | the inability to develop and maintain effective internal controls; |

| ● | the diversion of management’s attention and consumption of resources as a result of potential acquisitions of other companies; |

| ● | failure to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows; |

| ● | cyber-attacks and security vulnerabilities; |

| ● | the effect of COVID-19 and other pandemics on the foregoing; and |

| ● | other factors detailed under the section entitled “Risk Factors.” |

The forward-looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future.

Each potential purchaser of securities of NuScale Corp should be aware that the occurrence of the events described in the “Risk Factors” section and elsewhere in this prospectus may adversely affect us.

ix

SUMMARY

This summary highlights selected information included in this prospectus and does not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus, the registration statement of which this prospectus is a part and the documents incorporated by reference herein carefully, including the information set forth under the heading “Risk Factors” and our financial statements.

NuScale Corp

NuScale Power Corporation is an advanced nuclear technology company that is developing an SMR to generate steam that can be used for electrical generation, district heating, desalination, hydrogen production and other process heat applications. For more information regarding NuScale Corp, see the sections entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Background

NuScale Power Corporation (formerly named “Spring Valley Acquisition Corp.”) was a blank check company incorporated under the laws of the Cayman Islands. Spring Valley, Merger Sub and NuScale LLC entered into Merger Agreement on December 13, 2021, as amended, and the following transactions contemplated by the Merger Agreement were completed on May 2, 2022:

| ● | Spring Valley changed its jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands, domesticated as a corporation under the laws of the State of Delaware, and changed its name to “NuScale Power Corporation”; |

| ● | NuScale Corp was designated as the sole manager of NuScale LLC; |

| ● | Merger Sub merged into NuScale LLC with NuScale LLC surviving; and |

| ● | the combined company was organized in an “UP-C” structure, in which substantially all of the assets and business of the combined company are held by NuScale LLC. |

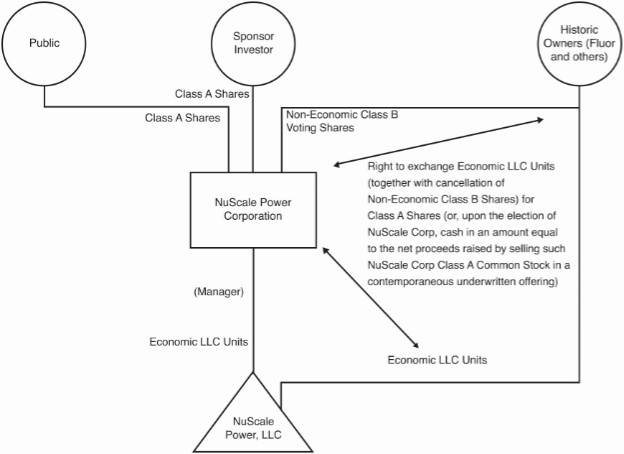

As a result of these transactions, former public shareholders of Spring Valley own shares of Class A Common Stock of NuScale Corp; NuScale Corp and the Legacy NuScale Equityholders hold NuScale LLC Class A Units and NuScale LLC Class B Units, respectively; and Legacy NuScale Equityholders hold a number of shares of Class B Common Stock (which represent a right to cast one vote per share at the NuScale Corp level, and carry no economic rights) equal to the number of NuScale LLC Class B Units held by the Legacy NuScale Equityholders.

1

The following diagram illustrates in simplified terms the structure of NuScale Corp and NuScale LLC.

In connection with entering into the Merger Agreement, Spring Valley entered into the Subscription Agreements with certain PIPE Investors, pursuant to which, among other things, the PIPE Investors party thereto agreed to purchase an aggregate of 21,300,002 shares of Class A Common Stock immediately prior to the Closing at an aggregate purchase price of $211,000,000. On March 29, 2022, Spring Valley entered into a Subscription Agreement with another PIPE Investor, pursuant to which, among other things, the PIPE Investor party thereto agreed to purchase 1,000,000 shares of Class A Common Stock immediately prior to the Closing for a purchase price of $10,000,000. In addition, on April 4, 2022, Spring Valley entered into a Subscription Agreement with another PIPE Investor, pursuant to which, among other things, the PIPE Investor party thereto agreed to purchase 1,500,000 shares of Class A Common Stock immediately prior to Closing for a purchase price of $15,000,000. On April 26, 2022, Spring Valley entered into an Amendment to Subscription Agreement with one of the PIPE Investors to change its subscription from 200,000 shares of Class A Common Stock for a purchase price of $2,000,000 to 100,000 shares of Class A Common Stock for a purchase price of $1,000,000.

Summary of Risk Factors (page 9)

The investment in our securities involve significant risks, and you should carefully read and consider the factors discussed under “Risk Factors.” The following is a summary of some of these risks. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to Our Structure and Governance

| ● | We are subject to risks related to our dependency on NuScale LLC to pay taxes, make payments under the Tax Receivable Agreement and pay dividends; |

| ● | If NuScale LLC were treated as a corporation for United States federal income tax or state tax purposes, then the amount available for distribution by NuScale LLC could be substantially reduced and the value of NuScale Corp shares could be adversely affected; |

| ● | In certain cases, payments under the Tax Receivable Agreement may be accelerated and/or significantly exceed the actual tax benefits NuScale Corp realizes; |

2

| ● | NuScale Corp is a “controlled company” under the NYSE listing standards, and as a result, its stockholders may not have certain corporate protections that are available to stockholders of companies that are not controlled companies; and |

| ● | Spring Valley identified a material weakness in its internal control over financial reporting. This material weakness could continue to adversely affect NuScale Corp’s ability to report its results of operations and financial condition accurately and in a timely manner. |

Risks Related to NuScale LLC’s Business and Industry

| ● | NuScale LLC has not yet delivered an NPM to a customer or entered into a binding contract with a customer to deliver NPMs, and there is no guarantee that it will be able to do so; |

| ● | Competitors in China and Russia currently operate commercial SMRs and may have advantages in marketing their SMRs to potential customers; |

| ● | NuScale LLC may be unable to charge Utah Associated Municipal Power Systems (UAMPS), its first customer, for some costs NuScale LLC has incurred and it may be required to reimburse UAMPS if NuScale LLC fails to achieve specified performance measures; |

| ● | Any delays in the development and manufacture of NPMs and related technology, the failure of any commercial or demonstration missions, or the failure to timely deliver NPMs to customers may adversely impact NuScale LLC’s business and financial condition; |

| ● | NuScale LLC has incurred significant losses since inception, expects to incur losses in the future, and may not be able to achieve or maintain profitability; |

| ● | The cost of electricity generated from nuclear sources may not be cost competitive with other electricity generation sources in some markets, and NuScale LLC may fail to effectively incorporate updates to the design, construction, and operations of NuScale LLC plants to ensure cost competitiveness, which could materially and adversely affect NuScale LLC’s business; |

| ● | The market for SMRs is not yet established and may not achieve the growth potential expected or may grow more slowly than expected; |

| ● | NuScale LLC’s commercialization strategy relies heavily on its relationship with Fluor, and other strategic investors and partners, who may have interests that diverge from NuScale LLC and who may not be easily replaced if their relationships terminate; |

| ● | NuScale LLC may be unable to manage its future growth effectively, which could make it difficult to execute its business strategy; |

| ● | If manufacturing and construction issues are not identified prior to design finalization, long-lead procurement, and/or module fabrication, then those issues will be realized during production, fabrication, or construction and may impact plant deployment cost and schedule; |

| ● | NuScale LLC and its customers operate in a politically sensitive environment, and may be affected by the public perception of nuclear energy and accidents, terrorist attacks or other high-profile events involving nuclear materials; |

| ● | NuScale LLC’s supply base may not be able to scale to the production levels necessary to meet sales projections, and a lack of availability and cost of component raw materials may affect the manufacturing processes for plant equipment and increase NuScale LLC’s costs; |

3

| ● | NuScale LLC is highly dependent on its senior management team and other highly skilled personnel, and may not be able to successfully implement its business strategy if it is unable to attract highly qualified personnel; |

| ● | NuScale LLC may require additional future funding; |

| ● | NuScale LLC may be unable to adequately protect its intellectual property rights, in particular its rights in non-U.S. jurisdictions, and may be subject to infringement claims from others; |

| ● | NuScale LLC’s SDA (defined below) application for the 77 MWe power module has not yet been submitted to the NRC, and its approval is not guaranteed; |

| ● | NuScale LLC’s design is only approved in the United States and it must obtain approvals on a country- by-country basis before it can sell its products abroad, which approvals may be delayed or denied or which may require modification to its design; |

| ● | NuScale LLC’s customers must obtain additional, site-specific regulatory approvals before they can construct power plants using NPMs, which may be delayed or denied; and |

| ● | NuScale LLC’s business is subject to a wide variety of extensive and evolving laws and regulations — including export and import controls, nuclear material and nuclear power regulations, and environmental regulations — and changes in and/or failure to comply with such laws and regulations could have a material adverse effect on its business. |

Risks Related to Ownership of Our Shares of Class A Common Stock and NuScale Corp Warrants

| ● | We are subject to risks related to the volatility of the price of our Class A Common Stock and NuScale Corp’s warrants; |

| ● | We are subject to risks related to the sale of total outstanding shares after the immediate resale restrictions have elapsed, which could cause the market price of our Class A Common Stock to drop significantly; |

| ● | NuScale Corp Warrants are exercisable for Class A Common Stock, which, if exercised, would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders; and |

| ● | A market for shares of the Class A Common Stock may fail to develop. |

Emerging Growth Company Status

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) exempts emerging growth companies (“EGCs”) from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with such standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-EGCs but any such election to opt out is irrevocable. We intend to take advantage of the benefits of this extended transition period.

We will remain an EGC until the earlier of: (1) the last day of the fiscal year (a) 2025, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. We expect to remain an EGC until December 31, 2025, the last day of the fiscal year following the fifth anniversary of the completion of our IPO on November 27, 2020.

4

Corporate Information

We were incorporated on August 20, 2020 as a Cayman Islands exempted company under the name Spring Valley Acquisition Corp. for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On May 2, 2022, we completed the Transactions, following which we were renamed “NuScale Power Corporation.” Our principal executive offices are located at 6650 SW Redwood Lane, Suite 210, Portland, OR 97224, and our telephone number is (971) 371-1592. Our website is www.nuscalepower.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this prospectus.

5

THE OFFERING

Issuer | NuScale Power Corporation (NYSE: SMR) |

Securities Being Registered | The issuance of up to 178,396,711 shares of Class A Common Stock to Legacy NuScale Equityholders in exchange for the NuScale LLC Class B Units, and the resale of a majority of such shares; the issuance of up to 11,500,000 shares of Class A Common Stock upon the exercise of NuScale Corp Public Warrants; and the issuance of up to 8,900,000 shares of Class A Common Stock upon the exercise of NuScale Corp Private Placement Warrants and the resale of those shares. The resale of up to 23,700,002 shares of Class A Common Stock owned by selling securityholders who are PIPE Investors. The resale of the following securities owned by selling securityholders comprising the Sponsor and its affiliates: up to 5,514,933 shares of Class A Common Stock, and up to 8,900,000 warrants to purchase Class A Common Stock. |

Term of the Offering | We may issue shares of Class A Common Stock upon the exchange of NuScale LLC Class B Units pursuant to the terms of the A&R NuScale LLC Agreement, and upon exercise of NuScale Corp Warrants. The selling securityholders will determine when and how they will dispose of any shares of Class A Common Stock registered under this prospectus for resale. The selling securityholders will pay any underwriting fees, discounts, selling commissions, stock transfer taxes, and certain legal expenses incurred by them in disposing of their shares of Class A Common Stock, and we will bear all other costs, fees, and expenses incurred in effecting the registration of securities covered by this prospectus, including registration and filing fees, NYSE listing fees, and fees and expenses of our legal counsel and our independent registered public accountants. |

Use of Proceeds | We will not receive any proceeds from sales by selling securityholders. |

Risk Factors | See “Risk Factors” beginning on page 9 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the securities being offered by this prospectus. |

NYSE Ticker Symbols | Class A Common Stock: “SMR” Warrants: “SMR WS” |

6

SUMMARY HISTORICAL AND PRO FORMA

FINANCIAL INFORMATION AND OTHER DATA

The following table presents the summary historical combined financial and other data for NuScale LLC and its subsidiaries and the summary pro forma condensed consolidated financial data for NuScale Corp for the periods and at the dates indicated. NuScale Corp is a holding company, and its sole material asset is a controlling equity interest in NuScale LLC. NuScale Corp operates and controls all of the business and affairs of NuScale LLC and, through NuScale LLC and its subsidiaries, conducts our business. NuScale LLC is the predecessor of NuScale Corp for financial reporting purposes. As a result, the consolidated financial statements of NuScale Corp will recognize the assets and liabilities received in the reorganization at their historical carrying amounts, as reflected in the historical financial statements of NuScale LLC. NuScale Corp will consolidate NuScale LLC in its consolidated financial statements and record a non-controlling interest related to the NuScale LLC Common Units held by the members of NuScale LLC on its consolidated balance sheet and statement of operations. The summary statements of operations data and summary statements of cash flows data presented below for the years ended December 31, 2020 and 2021 and the summary balance sheet data presented below as of December 31, 2020 and 2021 have been derived from the financial statements of NuScale LLC included elsewhere in this prospectus. The summary financial information of NuScale LLC as of March 31, 2021 and for the three months ended March 31, 2021 and 2022 was derived from the unaudited condensed financial statements of NuScale LLC included elsewhere in this prospectus. The unaudited condensed financial statements of NuScale LLC have been prepared on the same basis as the audited financial statements and, in our opinion, have included all adjustments, which include normal recurring adjustments, necessary to present fairly in all material respects our financial position and results of operations. The results for any interim period are not necessarily indicative of the results that may be expected for the full year.

The summary historical consolidated financial and other data of NuScale Corp has not been presented because, prior to the consummation of the Transactions, NuScale Corp was a blank check company with no business transactions or activities, and assets or liabilities, during the periods presented, other than those activities, assets, and liabilities related to its search for a potential initial business combination.

Historical results are not necessarily indicative of the results expected for any future period. You should read the summary historical consolidated financial data below, together with our audited consolidated financial statements and related notes thereto, the audited financial statements of Spring Valley and related notes thereto, our unaudited consolidated financial statements and related notes thereto, and the unaudited financial statements of Spring Valley and related notes thereto, each included elsewhere in this prospectus, as well as “Unaudited Pro Forma Condensed Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the other information appearing elsewhere in this prospectus.

The summary unaudited pro forma condensed consolidated financial data of NuScale Corp presented below have been derived from our unaudited pro forma condensed consolidated financial statements included elsewhere in this prospectus. The summary unaudited pro forma condensed consolidated statements of operations data for the three months ended March 31, 2022 and the year ended December 31, 2021 give effect to the Transactions as if they had occurred on January 1, 2021. The summary unaudited pro forma condensed consolidated balance sheet data as of March 31, 2022 gives effect to the Transactions as if they had occurred on March 31, 2022.

The summary unaudited condensed consolidated pro forma financial data is presented for illustrative purposes only and is not necessarily indicative of the operating results or financial position that would have occurred if the relevant transactions had been consummated on the dates indicated, nor is it indicative of future operating results or financial position. Spring Valley and NuScale LLC have not had any historical relationship prior to the Transactions. Accordingly, no pro forma adjustments were required to eliminate activities between the companies. The financial

7

results may have been different had the companies always been combined. See “Unaudited Pro Forma Condensed Consolidated Financial Information.”

Three Months Ended March 31, | Year Ended December 31, | |||||||||||||

(in thousands) |

| 2022 |

| 2021 |

| 2021 |

| 2020 | ||||||

Summary Statements of Operations Data: | ||||||||||||||

Revenue | $ | 2,445 | $ | 664 | $ | 2,862 | $ | 600 | ||||||

Net Loss | (23,373) | (22,666) | (102,493) | (88,387) | ||||||||||

(in thousands) |

| As of |

| As of December 31, |

| |||||

March 31, 2022 | 2021 |

| 2020 | |||||||

Summary Balance Sheet Data: | ||||||||||

Total assets | $ | 91,072 | $ | 121,197 | $ | 47,057 | ||||

Total liabilities | 45,149 | 52,799 | 74,056 | |||||||

Total mezzanine and members’ equity | 45,923 | 68,398 | (26,999) | |||||||

(in thousands) | Three Months Ended March 31, | Year Ended December 31, | |||||||||||

| 2022 |

| 2021 |

| 2021 |

| 2020 | ||||||

Summary Statements of Cash Flows: |

| ||||||||||||

Operating Cash Flows | $ | (33,151) | $ | (29,787) | $ | (99,162) | $ | (47,235) | |||||

Investing Cash Flows | (1,187) | (111) | (1,952) | (3,526) | |||||||||

Financing Cash Flows | (73) | 63,211 | 173,344 | 38,494 | |||||||||

NuScale Corp Pro Forma | |||||||

(In thousands, except share and per share information) |

| Three Months Ended |

| Year Ended | |||

Summary Unaudited Pro Forma Condensed Consolidated Statement of Operations Data |

| ||||||

Revenue | $ | 2,445 | $ | 2,862 | |||

Net loss per share of common stock – basic and diluted | $ | (0.18) | $ | (0.46) | |||

Weighted average number of shares of common stock outstanding – basic and diluted | 41,971,380 | 41,971,380 | |||||

| NuScale Corp Pro Forma |

| ||

(In thousands) | As of March 31, 2022 | |||

Summary Unaudited Pro Forma Condensed Consolidated Balance Sheet Data | ||||

Total assets | $ | 428,245 | ||

Total liabilities | 75,640 | |||

Total equity | 352,606 | |||

8

RISK FACTORS

We have identified the following risks and uncertainties that may have a material adverse effect on our business, financial condition, results of operations or reputation. The risks described below are not the only risks we face. Additional risks not presently known to us or that we currently believe are not material may also significantly affect our business, financial condition, results of operations or reputation. Our business could be harmed by any of these risks. In assessing these risks, you should also refer to the other information contained in this prospectus, including our financial statements and related notes.

Risks Related to Our Structure and Governance

NuScale Corp is a holding company and its only material asset is its interest in NuScale LLC, and it is accordingly dependent upon distributions made by its subsidiaries to pay taxes, make payments under the Tax Receivable Agreement and pay dividends.

NuScale Corp is a holding company with no material assets other than its ownership of the NuScale LLC Common Units. As a result, NuScale Corp has no independent means of generating revenue or cash flow. NuScale Corp’s ability to pay taxes, cause NuScale LLC to make payments under the Tax Receivable Agreement, and pay dividends depends on the financial results and cash flows of NuScale LLC and the distributions it receives (directly or indirectly) from NuScale LLC. Deterioration in the financial condition, earnings or cash flow of NuScale LLC for any reason could limit or impair its ability to pay such distributions. Additionally, to the extent that NuScale Corp needs funds and NuScale LLC is restricted from making such distributions under applicable law or regulation or under the terms of any financing arrangements, or NuScale LLC is otherwise unable to provide such funds, it could materially adversely affect NuScale Corp’s liquidity and financial condition.

Subject to the discussion herein, NuScale LLC is treated as a partnership for United States federal income tax purposes and, as such, generally will not be subject to any entity-level United States federal income tax. Instead, taxable income will be allocated to holders of NuScale LLC Common Units. Accordingly, NuScale Corp will be required to pay income taxes on its allocable share of any net taxable income from NuScale LLC. Under the terms of the A&R NuScale LLC Agreement, NuScale LLC is obligated to make tax distributions to holders of the NuScale LLC Common Units calculated at certain assumed tax rates. In addition to income taxes, NuScale Corp is also expected to incur expenses related to its operations, including payment obligations under the Tax Receivable Agreement, which could be significant, and some of which will be reimbursed by NuScale LLC (excluding payment obligations under the Tax Receivable Agreement). NuScale Corp intends to cause NuScale LLC to make ordinary distributions and tax distributions to holders of the NuScale LLC Class A Units and NuScale LLC Class B Units on a pro rata basis in amounts sufficient to cover all applicable taxes, relevant operating expenses, payments under the Tax Receivable Agreement and dividends, if any, declared by NuScale Corp. However, as discussed above, NuScale LLC’s ability to make such distributions may be subject to various limitations and restrictions, including, but not limited to, retention of amounts necessary to satisfy the obligations of NuScale LLC and restrictions on distributions that would violate any applicable restrictions contained in NuScale LLC’s debt agreements, if any, any applicable law or that would have the effect of rendering NuScale LLC insolvent. To the extent that NuScale Corp is unable to make payments under the Tax Receivable Agreement for any reason, such payments will be deferred and will accrue interest until paid; provided, however, that nonpayment for a specified period may constitute a breach of a material obligation under the Tax Receivable Agreement and therefore accelerate payments under the Tax Receivable Agreement, which could be substantial.

Additionally, although NuScale LLC generally will not be subject to any entity-level United States federal income tax, it may be liable under recent United States federal tax legislation for adjustments to prior year tax returns, absent an election to the contrary. In the event NuScale LLC’s calculations of taxable income are incorrect, NuScale LLC and its members, including NuScale Corp, in later years may be subject to material liabilities pursuant to this legislation and its related guidance.

9

If NuScale LLC were treated as a corporation for United States federal income tax or state tax purposes, then the amount available for distribution by NuScale LLC could be substantially reduced and the value of NuScale Corp shares could be adversely affected.

An entity that would otherwise be classified as a partnership for United States federal income tax purposes (such as NuScale LLC) may nonetheless be treated as, and taxable as, a corporation if it is a “publicly traded partnership” unless an exception to such treatment applies. An entity that would otherwise be classified as a partnership for United States federal income tax purposes will be treated as a “publicly traded partnership” if interests in such entity are traded on an established securities market or interests in such entity are readily tradable on a secondary market or the substantial equivalent thereof. If NuScale LLC is determined to be treated as a “publicly traded partnership” (and taxable as a corporation) for United States federal income tax purposes, it would be taxable on its income at the United States federal income tax rates applicable to corporations and distributions by NuScale LLC to its partners (including NuScale Corp) could be taxable as dividends to such partners to the extent of the earnings and profits of NuScale LLC. In addition, we would no longer have the benefit of increases in the tax basis of NuScale LLC’s assets as a result of exchanges of NuScale LLC Class B Units. Pursuant to the A&R NuScale LLC Agreement, certain Legacy NuScale Equityholders may, from time to time, subject to the terms of the A&R NuScale LLC Agreement, exchange their interests in NuScale LLC and have such interests redeemed by NuScale LLC for cash or Class A Common Stock. While such exchanges could be treated as trading in the interests of NuScale LLC for purposes of testing “publicly traded partnership” status, the A&R NuScale LLC Agreement contains restrictions on redemptions and exchanges of interests in NuScale LLC that are intended to prevent NuScale LLC entities from being treated as a “publicly traded partnership” for United States federal income tax purposes. Such restrictions are designed to comply with certain safe harbors provided for under applicable United States federal income tax law. NuScale Corp may also impose additional restrictions on exchanges that it determines to be necessary or advisable so that NuScale LLC is not treated as a “publicly traded partnership” for United States federal income tax purposes. Accordingly, while such position is not free from doubt, NuScale LLC is expected to be operated such that it is not treated as a “publicly traded partnership” taxable as a corporation for United States federal income tax purposes and we intend to take the position that NuScale LLC is so treated as a result of exchanges of its interests pursuant to the A&R NuScale LLC Agreement.

Pursuant to the Tax Receivable Agreement, NuScale Corp will be required to pay to certain Legacy NuScale Equityholders 85% of certain tax benefits, if any, that it realizes (or in certain cases is deemed to realize) as a result of any increases in tax basis and related tax benefits resulting from any exchange of NuScale LLC Class B Units for shares of Class A Common Stock or cash in the future, and those payments may be substantial.

The Legacy NuScale Equityholders may in the future exchange their NuScale LLC Class B Units for Class A Common Stock (or, upon the election of NuScale Corp, cash in an amount equal to the net proceeds raised by selling such Class A Common Stock in a contemporaneous underwritten offering), subject to certain restrictions. Such transactions are expected to result in increases in NuScale Corp’s share of the tax basis of the tangible and intangible assets of NuScale LLC. These increases in tax basis may result in increased tax depreciation and amortization deductions and therefore reduce the amount of income or franchise tax that NuScale Corp would otherwise be required to pay in the future had such sales and exchanges never occurred.

NuScale Corp is party to the Tax Receivable Agreement with NuScale LLC, each of the TRA Holders (as defined in the Tax Receivable Agreement) party thereto and Fluor, in its capacity as TRA Representative (as defined in the Tax Receivable Agreement). Pursuant to the Tax Receivable Agreement, NuScale Corp will be required to pay 85% of the net cash tax savings from certain tax benefits, if any, that it realizes (or in certain cases is deemed to realize) as a result of any increases in tax basis and other tax benefits resulting from any exchange by the TRA Holders of NuScale LLC Class B Units for shares of Class A Common Stock or cash in the future. Any such payments to TRA Holders will reduce the cash provided by the tax savings generated from future exchanges that would otherwise have been available to NuScale Corp for other uses, including reinvestment or dividends to Class A stockholders. Cash tax savings from the remaining 15% of the tax benefits will be retained by NuScale Corp. NuScale Corp’s obligations under the Tax Receivable Agreement accelerate upon a change in control and certain other termination events, as defined therein. These payments are the obligation of NuScale Corp and not of NuScale LLC. The actual increase in NuScale Corp’s allocable share of NuScale LLC’s tax basis in its assets, as well as the amount and timing of any payments under the Tax Receivable Agreement, will vary depending upon a number of factors, including the timing of exchanges, the market

10

price of the Class A Common Stock at the time of the exchange, the extent to which such exchanges are taxable and the amount and timing of the recognition of NuScale Corp’s income. While many of the factors that will determine the amount of payments that NuScale Corp will make under the Tax Receivable Agreement are outside of its control, NuScale Corp expects that the payments it will make under the Tax Receivable Agreement will be substantial and could have a material adverse effect on NuScale Corp’s financial condition. Any payments made by NuScale Corp under the Tax Receivable Agreement will generally reduce the amount of overall cash flow that might have otherwise been available to NuScale Corp. To the extent that NuScale Corp is unable to make timely payments under the Tax Receivable Agreement for any reason, the unpaid amounts will be deferred and will accrue interest until paid; however, nonpayment for a specified period may constitute a material breach of a material obligation under the Tax Receivable Agreement and therefore accelerate payments due under the Tax Receivable Agreement, as further described below. Furthermore, NuScale Corp’s future obligation to make payments under the Tax Receivable Agreement could make it a less attractive target for an acquisition, particularly in the case of an acquirer that cannot use some or all of the tax benefits that may be deemed realized under the Tax Receivable Agreement. See the section entitled “Certain Relationship and Related Person Transactions — Tax Receivable Agreement.”

In certain cases, payments under the Tax Receivable Agreement may exceed the actual tax benefits NuScale Corp realizes.

Payments under the Tax Receivable Agreement will be based on the tax reporting positions that NuScale Corp determines, and the U.S. Internal Revenue Service (“IRS”) or another taxing authority may challenge all or any part of the tax basis increases, as well as other tax positions that NuScale Corp takes, and a court may sustain such a challenge. In the event that any tax benefits initially claimed by NuScale Corp are disallowed, the Legacy NuScale Equityholders will not be required to reimburse NuScale Corp for any excess payments that may previously have been made under the Tax Receivable Agreement, for example, due to adjustments resulting from examinations by taxing authorities. Rather, excess payments made to such holders will be netted against any future cash payments otherwise required to be made by NuScale Corp under the Tax Receivable Agreement, if any, after the determination of such excess. However, a challenge to any tax benefits initially claimed by NuScale Corp may not arise for a number of years following the initial time of such payment or, even if challenged early, such excess cash payment may be greater than the amount of future cash payments that NuScale Corp might otherwise be required to make under the terms of the Tax Receivable Agreement and, as a result, there might not be future cash payments against which to net. As a result, in certain circumstances NuScale Corp could make payments under the Tax Receivable Agreement in excess of NuScale Corp’s actual income tax savings, which could materially impair NuScale Corp’s financial condition.

Moreover, the Tax Receivable Agreement provides that, in certain events, including a change of control, breach of a material obligation under the Tax Receivable Agreement, or NuScale Corp exercise of early termination rights, NuScale Corp obligations under the Tax Receivable Agreement will accelerate and NuScale Corp will be required to make a lump-sum cash payment to the Legacy NuScale Equityholders party to the Tax Receivable Agreement equal to the present value of all forecasted future payments that would have otherwise been made under the Tax Receivable Agreement, which lump-sum payment would be based on certain assumptions, including those relating to NuScale Corp future taxable income. The lump-sum payment could be substantial and could exceed the actual tax benefits that NuScale Corp realizes subsequent to such payment because such payment would be calculated assuming, among other things, that NuScale Corp would have certain tax benefits available to it and that NuScale Corp would be able to use the potential tax benefits in future years.

There may be a material negative effect on NuScale Corp’s liquidity if the payments required to be made by NuScale Corp under the Tax Receivable Agreement exceed the actual income or franchise tax savings that NuScale Corp realizes. Furthermore, NuScale Corp’s obligations to make payments under the Tax Receivable Agreement could also have the effect of delaying, deferring or preventing certain mergers, asset sales, other forms of business combinations or other changes of control.

11

NuScale Corp is a “controlled company” within the meaning of NYSE rules and, as a result, qualifies for exemptions from certain corporate governance requirements. The stockholders of NuScale Corp do not have the same protections afforded to stockholders of companies that are subject to such requirements.

Fluor owns a majority of the voting power of our Common Stock. As a result, we are a “controlled company” under the NYSE rules. As a controlled company, we are exempt from certain corporate governance requirements, including those that would otherwise require our Board to have a majority of independent directors and require that we either establish compensation and nominating and corporate governance committees, each comprised entirely of independent directors, or otherwise ensure that the compensation of our executive officers and nominees of directors are determined or recommended to our board of directors by independent members of our board of directors. To the extent we rely on one or more of these exemptions, our stockholders will not have the same protections afforded to stockholders of companies that are subject to all of the NYSE corporate governance requirements.

We are an EGC within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to “emerging growth companies,” this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies.

We are an EGC within the meaning of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not EGCs including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. As a result, our shareholders may not have access to certain information they may deem important. We could be an EGC until December 31, 2025, although circumstances could cause us to lose that status earlier, including if the market value of Common Stock held by non-affiliates exceeds $700,000,000 as of any June 30 before that time, in which case we would no longer be an EGC as of the following December 31. We cannot predict whether investors will find our securities less attractive because we will rely on these exemptions. If some investors find our securities less attractive as a result of our reliance on these exemptions, the trading prices of our securities may be lower than they otherwise would be, there may be a less active trading market for our securities and the trading prices of our securities may be more volatile.

Further, Section 102(b)(1) of the JOBS Act exempts EGCs from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-EGCs but any such election to opt out is irrevocable. We intend to take advantage of the benefits of this extended transition period.

Spring Valley identified a material weakness in its internal control over financial reporting. This material weakness could continue to adversely affect NuScale Corp’s ability to report its results of operations and financial condition accurately and in a timely manner.

Prior to the closing of the Transactions, Spring Valley’s management was responsible for establishing and maintaining adequate internal control over financial reporting designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP. Spring Valley’s management was likewise required, on a quarterly basis, to evaluate the effectiveness of our internal controls and to disclose any changes and material weaknesses identified through such evaluation in those internal controls. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

As described in the Amendment No. 1 to the Annual Report Form on 10-K filed with the SEC on May 7, 2021, Spring Valley identified a material weakness in Spring Valley’s internal control over financial reporting related to the accounting for a significant transaction related to the warrants we issued in connection with our initial public offering in

12

November 2020. As a result of this material weakness, Spring Valley’s management concluded that our internal control over financial reporting was not effective as of December 31, 2020. This material weakness resulted in a material misstatement of our warrant liabilities, change in fair value of warrant liabilities, additional paid-in capital, accumulated deficit and related financial disclosures as of and for the period from August 20, 2020 (inception) through December 31, 2020.

Spring Valley’s management and its audit committee also concluded that it was appropriate to restate previously issued financial statements for the affected periods.

As described in Amendment No. 2 to the Annual Report on Form 10-K filed with the SEC on December 21, 2021, Spring Valley identified a material weakness in Spring Valley’s internal control over financial reporting related to the Company’s application of ASC 480-10-S99-3A to its accounting classification of the Public Shares and the calculation of earnings per share. As a result of this material weakness, Spring Valley’s management concluded that Spring Valley’s internal control over financial reporting was not effective as of December 31, 2020. Historically, a portion of Spring Valley Class A ordinary shares subject to possible redemption was classified as permanent equity to maintain shareholders’ equity greater than $5 million on the basis that Spring Valley would not redeem its Class A ordinary shares in an amount that would cause its net tangible assets to be less than $5,000,001, as described in the charter. Pursuant to Spring Valley’s re-evaluation of Spring Valley’s application of ASC 480-10-S99-3A to its accounting classification of its Class A ordinary shares subject to possible redemption, Spring Valley’s management determined that the Class A ordinary shares include certain provisions that require classification of all of the Class A ordinary shares as temporary equity regardless of the net tangible assets redemption limitation contained in the charter.

To respond to these material weaknesses, Spring Valley devoted, and NuScale plans to continue to devote, significant effort and resources to the remediation and improvement of our internal control over financial reporting. While we have processes to identify and appropriately apply applicable accounting requirements, we plan to enhance these processes to better evaluate our research and understanding of the nuances of the complex accounting standards that apply to our financial statements. Our plans at this time include providing enhanced access to accounting literature, research materials and documents and increased communication among our personnel and third-party professionals with whom we consult regarding complex accounting applications. The elements of the remediation plan can only be accomplished over time, and we can offer no assurance that these initiatives will ultimately have the intended effects.