UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

HOLLEY INC.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report) N/A

Securities registered pursuant to Section 12(b) of the Act:

| Trading | Name of each exchange | |||

| Title of each class | symbol(s) | on which registered | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). Yes

As of July 1, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates, computed by reference to the closing sales price of $10.98 reported on the New York Stock Exchange, was approximately $

There were

Documents incorporated by reference: Parts of the registrant’s Proxy Statement for the registrant’s 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Securities Act and Exchange Act, as well as protections afforded by other federal securities laws. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the Company’s business. Forward-looking statements may be accompanied by words such as “believe,” “estimate,” “expect,” “project,” “forecast,” “may,” “will,” “should,” “seek,” “plan,” “scheduled,” “anticipate,” “intend” or similar expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside our control. Therefore, you should not place undue reliance on such statements. These forward-looking statements are subject to a number of risks and uncertainties and actual results could differ materially due to numerous factors, including, but not limited to, the Company’s ability to do any of the following:

| • |

execute its business strategy, including monetization of services provided and expansions in and into existing and new lines of business; |

| • |

anticipate and manage through disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of certain company products in distribution channels; |

| • |

anticipate and manage through supply shortages of key component parts used in our products and the need to shift the mix of products offered in response thereto; |

| • | respond to interruption from catastrophic events and problems such as terrorism, public health crises, cyber-attacks, or failure of key information technology systems; |

|

| • |

maintain key strategic relationships with partners and resellers; |

| • |

anticipate and manage through the rise in interest rates which would increase the cost of capital, as well as respond to inflationary pressures; |

| • |

enhance future operating and financial results; |

| • |

respond to uncertainties associated with product and service development and market acceptance; |

| • |

attract and retain qualified employees and key personnel; |

| • |

protect and enhance the Company’s corporate reputation and brand awareness; |

| • |

effectively respond to general economic and business conditions; |

| • |

acquire and protect intellectual property; |

| • |

collect, store, process and use personal and payment information and other consumer data; |

| • |

comply with privacy and data protection laws and other legal obligations related to privacy, information security, and data protection; |

| • |

meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| • |

obtain additional capital, including use of the debt market; |

| • |

manage to finance operations on an economically viable basis; |

| • |

maintain Holley’s New York Stock Exchange (“NYSE”) listing of its common stock (“Common Stock”) and warrants to purchase Common Stock (“Warrants”); |

| • |

comply with laws and regulations applicable to its business, including laws and regulations related to environmental health and safety; |

| • |

respond to litigation, complaints, product liability claims and/or adverse publicity; |

| • |

stay abreast of modified or new laws and regulations; |

| • |

anticipate the significance and timing of contractual obligations; |

| • |

anticipate the impact of, and response to, new accounting standards; |

| • |

maintain proper and effective internal controls; |

| • |

anticipate the impact of new U.S. federal income tax law, including the impact on deferred tax assets; |

| • |

anticipate the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”); |

| • |

anticipate the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, and demographic trends; and |

| • |

other risks and factors, listed under the caption “Risk Factors” included in this Annual Report. |

Forward-looking statements are based on information available as of the date of this Annual Report on Form 10-K and our management’s expectations, forecasts and assumptions, and involve a number of judgements, risks and uncertainties, and actual results, developments and business decisions may differ materially from those envisaged by such forward-looking statements. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

SUMMARY OF RISK FACTORS

The following summarizes the principal factors that make an investment in Holley speculative or risky. You should carefully consider the following risks as well as the other information included in this Annual Report on Form 10-K, including “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included elsewhere herein, before investing in our securities. See “Risk Factors” for a more detailed discussion of the risk factors listed below.

Risk Related to Our Business and Industry

| • |

A downturn in consumer spending, including as a result of a severe or prolonged economic downturn, could adversely impact our financial condition and results of operations. |

| • |

Inflation could result in higher costs and decreased profitability. |

| • |

Disruptions of supply or shortages of raw materials or components used in our products could harm our business and profitability, as well as the financial condition of our distributors. |

| • |

A significant disruption in the operations of our manufacturing facilities or distribution centers could have a material adverse effect on our business, sales, financial condition and results of operations. |

| • |

A global pandemic, such as the COVID-19 pandemic, could adversely affect our business, sales, financial condition and results of operations and our ability to access current or obtain new lending facilities. |

| • |

Failure to compete effectively or to develop and market new products and a reduction in demand for our products could reduce our business, financial condition and results of operations. |

| • |

Increased electric vehicles ownership could impact our financial condition and results of operations. |

| • |

Inaccurate forecasting of product demand could harm our financial performance. |

| • |

We may not be able to effectively manage our growth. |

| • |

Our growth partially depends on attracting new customers in a cost-effective manner and expanding into additional consumer markets and we may not successfully do so. |

| • |

Our failure to protect our brand could harm our financial condition and results of operations. |

| • |

Our profitability may decline as a result of increasing pressure on pricing. |

| • |

Disruptions in our manufacturing facilities or distribution centers could have a material adverse effect on our sales, profitability and results of operations. |

| • |

Increases in cost, disruption of supply or shortage of raw materials could harm our business. |

| • |

Our current and future products may experience quality problems, which could result in negative publicity, litigation, product recalls, and warranty claims, resulting in decreased sales. |

| • |

Our failure to maintain relationships with retail partners or increase sales through our direct-to-consumer ("DTC") channel could harm our business. |

| • |

Our success depends on the continuing efforts of our employees and retention of skilled personnel, and our results of operations may be adversely affected by labor shortages, turnover and labor cost increases. |

| • |

Our failure to upgrade and maintain information technology systems, to respond to cyber-attacks, security breaches, or computer viruses, or to comply with privacy and data protections laws, and respond to privacy or data breaches could adversely impact our business. |

| • |

If our estimates relating to our accounting policies prove to be incorrect, our results of operations could be harmed. |

| • |

Our disclosure controls and procedures may not prevent or detect all acts of fraud. |

| • |

Our business could be negatively impacted by the effects of global climate change or the increasing scrutiny and evolving expectations with respect to our environment, social and governance practices. |

Legal, Regulatory and Compliance Risks Related to Our Business

| • |

We may become involved in legal or regulatory proceedings, including intellectual property claims or lawsuits that could cause us to incur significant costs or that could prohibit us from selling our products. |

| • |

Unauthorized sales of our products could harm our reputation. |

| • |

We are subject to environmental, health and safety laws and regulations as well as privacy laws, regulations, and standards, which could subject us to liabilities, increase costs or restrict operations in the future. |

| • |

Our insurance policies may not provide adequate levels of coverage against all claims, and we may incur losses that are not covered by our insurance. |

Risks Related to Ownership of Our Securities

| • |

Certain of our stockholders, including Holley Parent Holdings, LLC (the “Holley Stockholder”) and the Empower Sponsor Holdings LLC (the “Sponsor”) (together with its affiliates), may have conflicts of interest with other stockholders and may limit your ability to influence corporate matters. |

| • |

Warrants are exercisable for Common Stock, which could increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders. |

| • |

The Warrants may never be in the money, they may expire worthless, or the terms of the Warrants may be amended in a manner adverse to a holder if holders of at least 50% of the then-outstanding Warrants approve of such amendment. |

| • |

The market price and trading volume of Common Stock and Warrants may be volatile. |

| • |

Reports published by analysts could adversely affect the market price and trading volume of Common Stock and Warrants. |

| • |

Future sales of our Common Stock and Warrants in the public market could cause our stock price to fall. |

| • |

We may redeem unexpired Warrants to their exercise at a time that is disadvantageous to the Warrant holders, thereby making the Warrants worthless. |

About Us

Founded in 1903, Holley, Inc. (“Holley” or the “Company”) has been a part of the automotive industry for well over a century. We are a leading designer, marketer, and manufacturer of high-performance automotive aftermarket products for car and truck enthusiasts. Our products span a number of automotive platforms and are sold across multiple channels. We attribute a major component of our success to our brands, including “Holley”, “APR”, “MSD” and “Flowmaster”, among others. In addition, we have recently added to our brand lineup through a series of strategic acquisitions, including our 2022 acquisitions of substantially all the assets of John’s Ind., Inc. (“John’s”), Southern Kentucky Classics (“SKC”), and Vesta Motorsports USA, Inc., d.b.a. RaceQuip (“RaceQuip”), our 2021 acquisitions of substantially all the assets of AEM Performance Electronics (“AEM”), Classic Instruments LLC (“Classic Instruments”), ADS Precision Machining, Inc., d.b.a. Arizona Desert Shocks (“ADS”), Baer, Inc, d.b.a. Baer Brakes (“Baer”), Brothers Mail Order Industries, Inc., d.b.a. Brothers Trucks (“Brothers”), Rocket Performance Machine, Inc., d.b.a. Rocket Racing Wheels (“Rocket”), and Speartech Fuel Injections Systems, Inc. (“Speartech”), and our 2020 acquisitions of Simpson Racing Products, Inc. (“Simpson”), Drake Automotive Group LLC (“Drake”) and Detroit Speed, Inc. (“Detroit Speed”). Through these strategic acquisitions, we have increased our market position in the otherwise highly fragmented performance automotive aftermarket industry.

We operate in the performance automotive aftermarket parts industry. We believe there is ample opportunity to continue our expansion into new products and markets, such as exterior accessories and mobile electronics, representing a natural progression for us to grow market share as these adjacencies are driven by passionate enthusiasts, consistent with our core categories. See also “Risk Factors—Risks Relating to Holley’s Business and Industry—If the Company is unable to successfully design, develop and market new products, the Company business may be harmed” for a discussion of the risks related to the Company’s new product development.

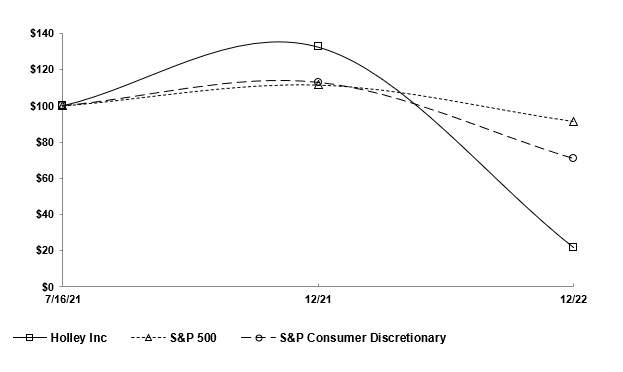

On July 16, 2021, we consummated a business combination (“Business Combination”) pursuant to that certain Agreement and Plan of Merger dated March 11, 2021 (the “Merger Agreement”), by and among Empower Ltd., (“Empower”), Empower Merger Sub I Inc., a direct wholly owned subsidiary of Empower (“Merger Sub I”), Empower Merger Sub II LLC, a direct wholly owned subsidiary of Empower (“Merger Sub II”), and Holley Intermediate Holdings, Inc. ("Holdings"). The Merger Agreement provided for, among other things, the following transactions: (i) Merger Sub I merged with and into Holdings, the separate corporate existence of Merger Sub I ceased, and Holdings became the surviving corporation, and (ii) Holdings merged with and into Merger Sub II, the separate corporate existence of Holdings ceased, and Merger Sub II became the surviving limited liability company. Upon closing, Empower changed its name to Holley Inc. and its trading symbol on the New York Stock Exchange (the “NYSE”) from “EMPW” to “HLLY.”

Business Strategy

Our vision is to be the most compelling and inclusive platform for automotive enthusiasts, to inspire and support enthusiasts’ transition to cleaner, more sustainable technologies, and to further accelerate the automotive lifestyle. Our aim is to provide a platform where automotive enthusiasts can purchase aftermarket auto parts for both old model restorations and new vehicle enhancements. We believe our consumers are enthusiastic and passionate about the performance and the personalization of their classic and modern cars. We aim to provide the products and service they need to pursue that passion. We will continue to drive growth and value for our shareholders through our key strategies:

| • |

Continuous New Product Development: New products allow us to increase market share in existing categories, extend into adjacent categories, capture new enthusiast consumers and extend or further penetrate new vehicle platforms. See “Risk Factors—Risks Relating to Holley’s Business and Industry—If the Company is unable to successfully design, develop and market new products, the Company business may be harmed” for a discussion of the risks related to the Company’s new product development. |

| • |

Accelerate Growth Through Continued M&A: We have historically used strategic acquisitions to expand our brand portfolio, enter new product categories and consumer segments, and expand share in current product categories. While we believe our business is positioned for continued organic growth, we intend to continue evaluating opportunities for strategic acquisitions that complement our current business and expand our addressable target market. We believe that our scalable business platform, relationships with our distribution and channel partners, strong loyalty with our growing consumer base, and experienced management team and board of directors, position us to realize the benefits from the integration of recent acquisitions and prime us for future acquisitions. See “Risk Factors—Risks Relating to Holley’s Business and Industry—The Company may acquire or invest in other companies, which could divert the Company management’s attention, result in dilution to the Company stockholders, and otherwise disrupt the Company operations and harm the Company business, sales, financial condition and results of operations” for a discussion of the risks related to the Company’s M&A activity. |

| • |

Expand Direct-to-Consumer (“DTC”) Sales and Further Engage with Our Consumers: We are highly focused on deepening our engagement with our enthusiast consumers and selling them products through our fast-growing online platform. We have multiple touch points in our consumer ecosystem, ranging from social media to our website, to our many in-person enthusiast events. See “Risk Factors—Risks Relating to Holley’s Business and Industry—If the Company’s plans to increase sales through its DTC channel are not successful, the Company’s business, sales, financial condition and results of operations could be harmed” for a discussion of the risks related to the Company’s DTC channel. |

Competition

The performance automotive industry is highly competitive, and we face substantial competition in all the markets that we serve. The principal factors on which industry participants compete include technical features, performance, product design, innovation, reliability and durability, brand, time to market, customer service, reliable order execution, and price. Our success in the marketplace depends on our ability to execute our Business Strategy discussed above.

The performance automotive aftermarket parts industry in the United States is large and highly fragmented. In addition, we have seen consistent growth within the automotive aftermarket parts industry over the last two decades. Products in the performance automotive aftermarket parts industry range from functional products that enhance vehicle performance to products that improve safety, stability, handling and appearance.

Our core competitive set is comprised of four primary types of competitors with fragmentation across the majority of our major product categories:

| • |

Multi-product category providers: legacy brands with coverage across multiple performance aftermarket products with multiple brands often under one banner and built through acquisition. We are one of the largest multi-product category brands in the performance automotive aftermarket based on gross sales. |

| • |

Single-product category providers: established companies focused on one product category in the market primarily selling via resellers. Single-product category providers generally offer either lower priced products or higher-quality products focused within one product category. |

| • |

E-Tailer Private Labels: traditional online resellers sell other manufactured products and offer private label products, often at a lower price point. E-tailer private labels generally occupy the value end of the market and have a greater presence in less engineered categories with less product-specific brand strength. |

| • |

Niche custom manufacturers: while not our core competitors, smaller shops typically focus on fully customizing specific make or model vehicles. Niche custom manufacturers are typically local or regionally focused, and some also may resell customized products from other manufactured brands. |

We believe the following factors distinguish Holley from its competitors:

| • |

Brand that resonates with enthusiasts: we actively engage enthusiasts at the platform level across multiple channels (e.g., events, digital media, online communities, etc.), creating reference networks for potential consumers. |

| • |

Innovative, product development: we invest heavily in product research, innovation and development, and introduce products that meet latest platform and use case-specific needs of our enthusiast consumers. |

| • |

Operational ability that enables efficient order execution: we make significant investments in sourcing, manufacturing and distribution excellence, enabling management of multiple product lines while maintaining scale and attractive relative pricing. |

| • |

Differentiated go-to-market strategy: we offer a mix of single product and platform-oriented solutions across DTC and reseller channels, delivering a strong overall consumer experience. |

Brands

We have a strong portfolio of brands covering various product categories. Our portfolio consists of over 70 brands spanning across 30 product categories. Our top seven brands generated 68% of our sales in 2022.

| • |

Holley EFI: Currently our largest brand and represented 14% of our sales for 2022. Our Holley EFI brand focuses on electronic fuel injection technology and showcases our new product development engine. |

| • |

Holley: Currently our second largest brand and represented 14% of our sales for 2022. The Holley brand resonates with consumers as the majority of automotive enthusiast consumers recognize the Holley brand. Holley offers a variety of products across multiple categories but traces its roots back to carburetors which originally made the brand famous with automotive enthusiasts. |

| • |

MSD: Currently our third leading brand and represented 10% of our sales for 2022. MSD has historically been focused on production of ignition products but today has been more focused on developing electronics for the powertrain category. |

| • |

Simpson: Currently our fourth leading brand and represented 9% of our sales for 2022. Simpson was acquired in 2020 and has focused on motorsport safety products including helmets, head and neck restraints, seat belts and fire suits. |

| • |

Powerteq: Currently our fifth leading brand and represented 8% of our sales for 2022. Powerteq is focused on exhaust, intakes, drivetrain and engine tuning products and accessories. |

| • |

Accel: Currently our sixth largest brand and represented 7% of our sales in 2022. Accel is focused on performance fuel and ignition systems. |

| • |

Flowmaster: Currently our seventh largest brand and represented 6% of our sales in 2022. Flowmaster's main focus is on developing exhaust products. |

We believe the popularity of our brands is the result of consistently delivering high quality, innovative products that resonate with our enthusiast consumers. Our brands have allowed us to build direct, trusted and long-lasting relationships with our consumers and resellers.

Product Development

We have a history of developing innovative products, including new products in existing categories like Electronic Fuel Injection, product line expansions, and products that bring us into new markets including components for converting ICE vehicles to electric powertrains. We have thoughtfully expanded our product portfolio over time to adapt to consumer needs and find solutions to new consumer demands. We expand our existing product families and enter new product categories by creating solutions grounded in our expert insights and relevant market knowledge. We believe we have a meaningful runway across our target product categories and product vintages, and we are well positioned for future growth by expanding in adjacent and transformational categories that present opportunities for further market penetration in the Performance Suspension, Braking and Powertrain Conversion Systems markets. We believe there are also opportunities to capitalize on growing our powertrain agnostic categories like Automotive and Motorcycle Safety.

Suppliers

We run a flexible sourcing model with a mix of global sourcing and in-house manufacturing. Our best value sourcing model decisions are based on a mix of cost, quality and service. We have a diverse global supplier base and no material supplier concentration. Our efficient sourcing model enables strong gross margins and cash conversion.

We believe there is an adequate supply of raw materials and key components; however, there can be no assurance over the long term that the availability of materials and components or increases in commodity prices will not materially affect our business or results of operations. Ongoing supply chain disruptions, resulting in supply shortages and higher shipping charges, have and could continue to impact our ability to maintain supplies of products and the costs associated with obtaining raw materials and key components. We have experienced, and may continue to experience, disruptions due to the global supply shortage of automotive-grade microchips, which has resulted in increased microchip delivery lead times.

Marketing

We reach and engage our consumers where they participate in the performance automotive aftermarket – online and in person. Our marketing strategy is centered on strong brand equity, leading new product innovation capabilities and delivering consistently high-quality products. In 2022, we spent approximately $11.6 million (or approximately 2% of our 2022 annual gross sales) on marketing and advertising. Going forward, consistent with our value creation strategies, we intend to continue our investments in direct consumer marketing and advertising as well as refocus our current mix of spending towards activities believed to generate the highest return on investment. We believe these strategies will have a meaningfully positive impact across our brand portfolio.

In recent years, we have shifted our marketing efforts towards digital advertising and have increased investments in consumer engagement directly via digital and social media platforms and campaigns. Additionally, since mid-2020 we increased resources focused on expanding our e-commerce and digital platforms. These efforts have included turning Holley.com into a destination for automotive enthusiasts and launching Motor Life, our internal digital publication that is available to the public on our website. As a result, we have experienced a significant increase in social media and online engagement since that time. Continued expansion of and investment in digital and social media are expected in the future, including focusing on strategies to grow the high margin DTC channel.

We have also spent significant time and effort in creating engaging, in-person events to build the Holley tribe. These events focus on creating memorable experiences for enthusiasts, celebrate car culture, build community and show enthusiasts how Holley products can help them enjoy their vehicles. Since 2015, our events have grown in total annual attendance from 14,000 to106,000 in2022. We currently host seven annual self-funding events, including LS Fest East, LS Fest West, Ford Fest, MoParty, High Voltage, Brother's Truck Show, plus a new event launched in 2022, LS Fest Texas, our largest inaugural event to date.

Sales and Distribution

We have a diverse omni-channel distribution strategy led by our growing DTC channel. Our omni-channel model enables us to reach our consumers through DTC, E-tailer, warehouse distributor, traditional retailer, and jobber/ installer channels. We have mutually beneficial relationships with our resellers and are able to maintain strong pricing discipline across our channels with strict conformance to minimum advertised pricing.

DTC channel: Consumers are increasingly meeting us online through our DTC channel. Our DTC channel provides consumers full access to all of our brands, our unique branded content and our full product assortment. We have turned Holley.com into our primary hub for consumer communication and continue to add features and brands that make it an increasingly attractive digital destination for our consumers. Our DTC channel enables us to directly interact with our customers, more effectively control our brand experience, better understand consumer behavior and preferences, and offer exclusive products, content, and customization capabilities. We believe our control over our DTC channel provides our customers with quality brand engagement and further builds customer loyalty, while generating attractive margins.

Resellers: We have historically sold the majority of our products through resellers who purchase our products and resell them through various channels. These resellers consist of E-tailers, warehouse distributors, traditional retailers, and jobber/installers with E-tailers and warehouse distributors accounting for 60% of our sales in 2022, and our top ten resellers accounting for 39% of our sales in 2022 with our largest reseller making up 19% of our sales in 2022.

We have established mutually beneficial and long-term relationships with our resellers. We believe resellers benefit from our broad suite of product offerings that they can leverage to meet consumer demand across multiple product categories. Based on the value that we offer to our resellers, we are able to operate with pricing discipline that supports the value of our products in the marketplace and buttresses our profit margins. We believe our approach to pricing allows us to better understand consumer demand and identify what our end consumers are buying.

Intellectual Property

Patents, trademarks, and other proprietary rights are important to the continued success of our business. We own and have licensing arrangements for a number of U.S. and foreign patents, trademarks, and other proprietary rights related to our products and business. We also rely upon continuing technological innovation and licensing opportunities to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including the use of confidentiality and other similar agreements. We do not consider our business to be dependent on any single patent, nor is the expiration of any patent expected to materially affect our business. Our current patents will expire over various periods and we continue to file new patent applications on newly developed technology. From time to time, we become aware of potential infringement of our patent, trademark, or other proprietary rights, and we investigate instances of alleged infringement where we believe it is merited and take appropriate actions under applicable intellectual property laws in response to such infringements where we determine it is valuable to do so. Similarly, from time to time we are the subject of intellectual property and other proprietary rights related suits and other litigation.

Seasonality

Holley’s operating results have fluctuated on a quarterly and annual basis in the past and can be expected to continue to fluctuate in the future as a result of a number of factors, some of which are beyond the Company’s control. Traditionally, our sales in the first half of the year are generally higher than in the second half of the year. Due to these factors and others, which may be unknown to the Company at this time, operating results in future periods can be expected to fluctuate. Accordingly, the Company’s historical results of operations may not be indicative of future performance.

Regulations

We are subject to a variety of federal, state, local and foreign laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances or wastes, and the cleanup of contaminated sites. Some of our operations require environmental permits and controls to prevent and reduce air and water pollution. These permits are subject to modification, renewal and revocation by issuing authorities. We believe we are in substantial compliance with all material environmental laws and regulations applicable to our plants and operations. Historically, our annual costs of achieving and maintaining compliance with environmental, health and safety requirements have not been material to our financial results.

Increasing global efforts to control emissions of carbon dioxide, methane, ozone, nitrogen oxide and other greenhouse gases and pollutants, as well as the shifting focus of regulatory efforts towards total emissions output, have the potential to impact our facilities, costs, products and customers. The U.S. Environmental Protection Agency (“EPA”) has taken action to control greenhouse gases from certain stationary and mobile sources. In addition, several states have taken steps, such as adoption of cap-and-trade programs or other regulatory systems, to address greenhouse gases. There have also been international efforts seeking legally binding reductions in emissions of greenhouse gases. These developments and further actions that may be taken in the U.S. and in other countries, states or provinces could affect our operations both positively and negatively (e.g., by affecting the demand for or suitability of some of our products).

We also may be subject to liability as a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act and similar state or foreign laws for contaminated properties that we currently own, lease or operate or that we or our predecessors have previously owned, leased or operated, and sites to which we or our predecessors sent hazardous substances. Such liability may be joint and several so that we may be liable for more than our share of any contamination, and any such liability may be determined without regard to causation or knowledge of contamination. We or our predecessors have been named potentially responsible parties at contaminated sites from time to time. We do not anticipate any potential liability relating to contaminated sites to be material to our financial results.

Employees

Holley’s employees are integral to our strategic growth and success. We consider our team members to be our most valuable asset and seek to attract and maintain the highest quality talent by offering competitive benefits and wellness services, opportunities to grow professionally, and regular evaluations, among other initiatives. As of December 31, 2022, we employed 1,622 full-time employees and 100 temporary employees. Approximately 48% of our full-time employees are based primarily in our Bowling Green, KY headquarters, distribution center and manufacturing plants. None of our employees are subject to collective bargaining agreements or represented by a labor union. We believe our facilities are in labor markets with ready access to adequate numbers of skilled and unskilled workers, and we believe our relations with our employees are good.

Many of our employees are automotive enthusiasts. We pride ourselves on having a platform built for enthusiasts by enthusiasts. As of December 2022, our Engineering function includes approximately 203 employees, including many enthusiast-focused engineers who are passionate about cars. We continue to seek out top level talent that will help accomplish our mission and vision moving forward. Our goal is to create an inclusive and safe environment for our employees that keeps them engaged in their work.

Compensation and Benefits. We strive to hire, develop and retain top talent. We attract and reward our employees by providing competitive benefits, including market-competitive compensation, medical, dental and vision insurance, short-term and long-term disability insurance, basic life and accidental death and dismemberment insurance, voluntary supplemental coverages, flexible spending accounts, paid time off, and our 401(k) program. Holley matches employee contributions to the 401(k) Plan up to 3.5% each pay period, and an additional discretionary match of up to 1.5% is made based on company performance to targets.

Health, Safety and Wellness. Holley is committed to the health and well-being of its employees and designs its compensation and benefit programs to demonstrate this commitment. Our programs are intended to support the physical and mental well-being of our employees and their families by providing the tools and resources for employees to improve or maintain their health and to lessen concerns about missing work and the potential financial impact.

Employee health and safety in the workplace is one of our top priorities. We have implemented programs and training designed to eliminate workplace incidents, risks and hazards. The core training provided includes Emergency Response, OSHA Reporting, Fire Safety, and Office Ergonomics. We also review and monitor our performance closely. In response to the COVID-19 pandemic, we followed guidance from the Centers for Disease Control, the World Health Organization, and the various states and counties in which we operate in order to keep our employees safe. We will continue to make the health and wellbeing of our employees a priority.

Inclusion. We know that diversity throughout our company creates stronger teams, leads to innovation, and results in an organization that provides the best service to our customers. We have a recruitment strategy that encourages diversity across the company. We leverage our employee referral program to identify diverse talent during the recruitment process. We also engage with a local development board and a local refugee center in Bowling Green, KY to increase our diverse talent candidate pool.

We believe our employees should reflect the customers we serve. Notably, approximately 30% of Holley consumers are female. Accordingly, we recognize the benefits of female representation in our workforce, and in 2022 over 30% of our workforce were women. We are committed to closing the gender gap and our recruitment and retention strategies support improving women’s representation in leadership roles.

Our Culture. At Holley, we believe that an engaged workforce leads to a more innovative, productive, and profitable organization. For this reason, we measure employee engagement through periodic culture surveys. These surveys allow our employees to provide confidential feedback on culture, company strategy and trust in their direct leaders. This feedback helps create action plans to improve the engagement of our employees. These survey results have demonstrated that our employees have a strong sense of belonging, trust in management, and confidence in Holley. These strengths provide a foundation for our success, and we are dedicated to enhancing the employee experience at Holley.

Talent Development. The development of our employees’ skills and knowledge is critical to Holley’s success. Our educational assistance program is designed to encourage personal development by helping employees maintain and improve their skills or knowledge related to their current job or a potential future position at Holley through reimbursement of certain educational expenses, including external training programs or educational courses, pursuit and maintenance of job-related professional licenses and certifications, workshops, seminars, and professional conferences. Further, we are introducing an internship program designed to provide students in the community an opportunity to gain practical experience. We are committed to fostering an equitable work environment that seeks to ensure fair treatment, equality of opportunity, and fairness in access to information and resources.

Social Responsibility. We are committed to social responsibility. Our socially responsible initiatives include donations to community organizations, sponsorship of local sports teams and weekend family events. Through these programs, Holley and its employees are able to give back to the community through monetary donations and by providing community services. Holley gives its subsidiaries the ability to lead their own community engagement initiatives through contributions to charities and participation in fundraising events.

Available Information

Our principal executive offices are located at 1801 Russellville Rd., Bowling Green, KY 42101, and our telephone number is (270) 782-2900. Our Internet address is www.holley.com. The information on our website is not, and should not be considered, part of this Form 10-K and is not incorporated by reference in this Form 10-K. The website is, and is only intended to be, for reference purposes only. We make available free of charge on or through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. These reports and other information are also available, free of charge, at www.sec.gov. In addition, we will provide, at no cost, paper or electronic copies of our reports and other filings made with the SEC. Requests can be made in writing or by phone.

Item 1A. Risk Factors

The following discussion of "Risk Factors" identifies factors that may adversely affect our business, operations, financial condition or future performance. This information should be read in conjunction with “Cautionary Note Regarding Forward-Looking Statements,” "Management’s Discussion and Analysis of Financial Condition and Result of Operations" and the consolidated financial statements and related notes. The following discussion of risks is not all-inclusive but is designed to highlight what we believe are the material factors to consider when evaluating our business and expectations. These factors could cause our future results to differ materially from our historical results and from expectations reflected in forward-looking statements.

Risks Relating to Our Business and Industry

Unfavorable economic conditions could have an adverse impact on consumer discretionary spending and therefore adversely impact our business, sales, financial condition and results of operations.

Our products are largely recreational in nature and are therefore discretionary purchases for consumers. Consumers are generally more willing to make discretionary purchases of automotive products during favorable economic conditions and when consumers are feeling confident and prosperous. Discretionary spending is also affected by many other factors, including general business conditions, inflation, interest rates, the availability of consumer credit, taxes, and consumer confidence in future economic conditions. Purchases of our products could decline during periods when disposable income is lower, or during periods of actual or perceived unfavorable economic conditions. A significant or prolonged decline in general economic conditions or uncertainties regarding future economic prospects that adversely affect consumer discretionary spending, whether in the United States or in our international markets, could result in reduced sales of our products, which in turn would have an adverse impact on our business, sales, financial condition and results of operations.

Inflation could result in higher costs and decreased profitability.

Rising inflation may continue to adversely affect us by increasing the cost of raw materials. Our products contain various raw materials, including corrosion-resistant steel, non-ferrous metals such as aluminum and nickel, and precious metals such as platinum and palladium. We use raw materials directly in manufacturing and in components that we purchase from our suppliers. We generally purchase components with significant raw material content on the open market. Volatility in the prices of raw materials such as steel, aluminum and nickel could continue to increase the cost of manufacturing our products. In some cases, those cost increases can be passed on to customers in the form of price increases, in other cases, they cannot. Recent inflationary pressures and other factors have also resulted in significant increases in transportation and freight service costs due to limited capacity and/or availability of containers, shipping vessels, and/or receiving port services. If the prices of raw material and other inputs increase, and we are not able to charge our customers higher prices to compensate, our results of operations would be adversely affected.

Many of the markets in which we sell have been experiencing high levels of inflation, which may depress consumer demand for our products and reduce our profitability. Even in the event that increased costs can be passed through to customers, our gross margin percentages may decline. Additionally, our suppliers are also subject to fluctuations in the prices of raw materials and may attempt to pass all or a portion of such increases on to us. In the event they are successful in doing so, our margins would decline. If prolonged, and if they cannot be passed on to customers in the form of price increases, these fluctuations in the price of raw materials, product components, other inputs, and/or transportation services could have a material adverse effect on our business, sales, financial condition and results of operations.

Disruptions of supply or shortages of raw materials or components used in our products could harm our business and profitability.

We have experienced, and may continue to experience, disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of steel, non-ferrous metals and precious metals. Additionally, we have been adversely impacted by the global supply shortage of automotive-grade microchips. This shortage has resulted in increased microchip delivery lead times, delays in production and increased costs to source available automotive-grade microchips. If our supply of these products continues to be adversely affected, there can be no assurance that we will be able to obtain adequate replacements for the existing components or that supplies will be available on terms and prices that are favorable to us, if at all.

Our success depends in part on our ability to anticipate and react to changes in supply costs and disruptions in the supply chain due to factors beyond our control. We have taken steps to minimize the adverse impacts of supply chain volatility and rising inflation by implementing cost savings initiatives, increasing prices to customers, increasing inventory levels of certain products, and working closely with our suppliers and customers to minimize disruptions in delivering products to customers. Despite the actions we have undertaken to minimize these impacts, there can be no assurance that unforeseen future events in the global supply chain and our ability to pass on inflationary costs to our customers could have a material adverse effect on our business, financial condition and results of operations.

Current global economic conditions, including inflation and supply chain disruptions, could continue to adversely affect our distributors’ financial condition, their levels of business activity and their ability to pay trade obligations.

We primarily sell our products to retailers directly and through our domestic and foreign subsidiaries, and to foreign distributors. We generally require no collateral from our customers. However, if the current economic conditions and macroeconomic trends, including heightened inflation, capital market volatility, and interest rate fluctuations, continue, our results of operations may be adversely affected. These disruptions and delays have strained certain domestic and international supply chains, which have affected and could continue to adversely affect the flow or availability of certain products or components. As a result, we have experienced, and could continue to experience, disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of certain of our products in distribution channels.

A prolonged or severe downturn in the general economy could adversely affect the retail market, which in turn, would adversely impact the liquidity and cash flows of our customers, including the ability of such customers to obtain credit to finance purchases of our products and to pay their trade obligations. This could result in increased delinquent or uncollectible accounts for some of our customers. A failure by our customers to pay on a timely basis a significant portion of outstanding account receivable balances would adversely impact our business, sales, financial condition and results of operations.

A significant disruption in the operations of our manufacturing facilities or distribution centers could have a material adverse effect on our business, sales, financial condition and results of operations.

A significant disruption at any of our manufacturing facilities or distribution centers could materially and adversely affect our business, sales, financial condition and results of operations. Our manufacturing facilities and distribution centers are highly automated, which means that our operations are complicated and may be subject to a number of risks related to computer viruses, the proper operation of software and hardware, electronic or power interruptions, and other system failures, including failures caused by factors outside of our control, such as hostilities, political unrest, terrorist attacks, war (including the ongoing conflict in Ukraine), natural disasters or extreme weather (including events that may be caused or exacerbated by climate change). Risks associated with upgrading or expanding these facilities may significantly disrupt or increase the cost of our operations, which may have an immediate, or in some cases prolonged, impact on our margins. Our risk management, business continuity and disaster recovery plans may not be effective at preventing or mitigating the effects of such disruptions, particularly in the case of catastrophic events or longer-term developments, such as the impacts of climate change.

A global pandemic, such as the COVID-19 pandemic could adversely affect our business, sales, financial condition and results of operations and our ability to access current or obtain new lending facilities.

A global pandemic, or the outbreak of a disease, such as the COVID-19 pandemic, could adversely affect our business. The preventative measures taken to contain or mitigate a pandemic may cause, and are continuing to cause, business slowdowns or shutdowns in affected areas and significant disruption in the financial markets both globally and in the United States, which could lead to a decline in discretionary spending by consumers, and in turn impact, possibly materially, our business, sales, financial condition and results of operations. These impacts could include, but are not limited to:

| • |

the possibility of renewed retail store closures or reduced operating hours and/or decreased retail traffic; |

| • |

disruption to our distribution centers and other vendors, including the effects of facility closures as a result of outbreaks of COVID-19 or measures taken by federal, state or local governments to reduce its spread, reductions in operating hours, labor shortages, and real time changes in operating procedures, including for additional cleaning and disinfection procedures; and |

| • |

significant disruption of global financial markets, which could have an adverse impact on our ability to access capital in the future. |

The outbreak of a different global pandemic, or the further spread of COVID-19, and the requirements to take action to help limit the spread of the illness, could impact our ability to carry out our business as usual and may materially adversely impact global economic conditions, our business, sales, financial condition and results of operations. The extent of the impact of a global pandemic, such as COVID-19, on our business and financial results will depend on future developments, including the duration and spread of such outbreak within the markets in which we operate, the related impact on consumer confidence and spending, and the effect of governmental regulations imposed in response to the pandemic, all of which are highly uncertain and ever-changing. The duration of any such impacts cannot be predicted.

Failure to compete effectively could reduce our market share and significantly harm our business, sales, financial condition and results of operations.

Our industry is highly competitive, and our success depends on our ability to compete with suppliers of automotive aftermarket products, some of which may have substantially greater financial, marketing and other resources than we do. Due to the diversity of our product offering, we compete with several large and medium-sized companies and a large number of smaller regional and specialty companies and numerous category-specific competitors. In addition, we face competition from original equipment manufacturers, which, through their automotive dealerships, supply many of the same types of replacement parts that we sell. Existing competitors may expand their product offerings and sales strategies, and new competitors may enter the market.

Some of our competitors may have larger customer bases and significantly greater financial, technical and marketing resources than we do. These factors may allow our competitors to:

| • |

respond more quickly than we can to new or emerging technologies and changes in customer requirements by devoting greater resources than we can to the development, promotion and sale of automotive aftermarket products; |

| • |

engage in more extensive research and development; and |

| • |

spend more money and resources on marketing and promotion. |

Increased competition could put additional pressure on us to reduce prices or take other actions, which may have an adverse effect on our business, sales, financial condition and results of operations. We may also lose significant customers or lines of business to competitors.

If we are unable to successfully design, develop and market new products, our business may be harmed.

To maintain and increase sales, we must continue to introduce new products on a timely basis to respond to new and evolving consumer preferences and improve or enhance our existing products. The success of our new and enhanced products depends on many factors, including anticipating consumer preferences, finding innovative solutions to consumer problems, differentiating our products from those of our competitors, and maintaining the strength of our brands. The design and development of our products is costly, and we typically have several products in development at the same time. Problems in the design or quality of our products, or delays in product introduction, may harm our brands, business, sales, financial condition and results of operations. Any new products that we develop and market may not generate sufficient revenues to recoup our development, production, marketing, selling and other costs.

A drive toward electric vehicles or away from vehicle ownership in general could impact our business, sales, financial condition and results of operations.

The automotive industry is increasingly focused on the development of hybrid and electric vehicles and of advanced driver assistance technologies, with the goal of developing and introducing a commercially viable, fully automated driving experience, and many manufacturers have announced plans to transition from internal- combustion engines into electric vehicle platforms over the coming years. There has also been an increase in consumer preferences for mobility on demand services, such as car and ride sharing, as opposed to automobile ownership, which may result in a long-term reduction in the number of vehicles per capita. Accordingly, if we do not continue to innovate and develop, or acquire, new and compelling products that capitalize upon new technologies in response to original equipment manufacturer and consumer preferences, or if there is a future shift in consumer preferences towards ownership of more utilitarian vehicles or vehicles that are otherwise less interesting to a large portion of our customers who are automotive enthusiasts, or if there is otherwise a future shift away from automobile ownership among consumers in general, our and our subsidiaries’ business, sales, financial condition and results of operations could be impacted.

Our business depends on maintaining and strengthening our brands to generate and maintain ongoing demand for our products, and a significant reduction in such demand could harm our business, sales, financial condition and results of operations.

Our success depends on the value and reputation of our brands, which, in turn, depends on factors such as the quality, design, performance, functionality, and durability of our products, the image of our e-commerce platform and retail partner floor spaces, our communication activities, including advertising, social media, and public relations, and our management of the customer experience, including direct interfaces through customer service. Maintaining, promoting, and positioning our brands are important to expanding our customer base, and will largely depend on the success of our marketing and merchandising efforts and our ability to provide consistent, high-quality customer experiences. We intend to continue making investments in these areas in order to maintain and enhance our brands, and such investments may not be successful. Ineffective marketing, negative publicity, product diversion to unauthorized distribution channels, product or manufacturing defects, counterfeit products, unfair labor practices, and failure to protect the intellectual property rights in our brands are some of the potential threats to the strength of our brands, and those and other factors could rapidly and severely diminish our relationships with customers and suppliers. These factors could cause our customers to lose the personal connection they feel with our brands and reduce our ability to attract new customers and lead to suppliers terminating their relationships with us. We believe that maintaining and enhancing the image of our brands in our current markets and in new markets where we have limited brand recognition is important to expanding our customer base. If we are unable to maintain or enhance our brands in current or new markets, our business, sales, financial condition and results of operations could be harmed.

If we inaccurately forecast demand for our products, we may manufacture either insufficient or excess quantities, which, in either case, could adversely affect our financial performance.

We plan our manufacturing capacity based upon the forecasted demand for our products. Forecasting the demand for our products is very difficult given the manufacturing lead time and the amount of specification involved especially given the volatility of the markets and the economic downturn, including the impact of the COVID-19 pandemic. Aside from supply chain disruptions and inflationary pressures, forecasting demand for specific automotive parts can also be challenging due to changing consumer preferences and competitive pressures and longer supply lead times. The nature of our business makes it difficult to quickly adjust our manufacturing capacity if actual demand for our products varies from forecasted demand. If actual demand for our products exceeds forecasted demand, we may not be able to produce sufficient quantities of new products in time to fulfill actual demand, which could limit our sales and adversely affect our financial performance. On the other hand, if actual demand is less than forecasted demand for our products, we could produce excess quantities, resulting in excess inventories and related obsolescence charges that could adversely affect our financial performance.

We may not be able to effectively manage our growth.

As we grow our business, slower growing or reduced demand for our products, increased competition, a decrease in the growth rate of our overall market, failure to develop and successfully market new products, or the maturation of our business or markets could harm our business. We have made and expect to continue to make significant investments in our research and development and sales and marketing organizations, expand our operations and infrastructure both domestically and internationally, design and develop new products, and enhance our existing products. If our sales do not increase at a sufficient rate to offset these increases in our operating expenses, our profitability may decline in future periods.

We only have a limited history operating our business as a public company at its current scale. Consequently, if our operations grow at a rapid pace in the future, we may experience difficulties in managing this growth and building the appropriate processes and controls. Future rapid growth may increase the strain on our resources, and we could experience operating difficulties, including difficulties in sourcing, logistics, recruiting, maintaining internal controls, marketing, designing innovative products, and meeting consumer needs. If we do not adapt to meet these evolving challenges, the strength of our brands may erode, the quality of our products may suffer, we may not be able to deliver products on a timely basis to our customers, and our corporate culture may be harmed.

We have set certain growth initiatives for our business to meet long-term strategic objectives and improve stockholder value. We may incur certain costs to achieve our growth initiatives, and we may not meet anticipated implementation timetables or stay within budgeted costs. As these growth initiatives are undertaken, we may not achieve our expected results, which could adversely impact our customer retention or results of operation.

If we fail to attract new customers, or fail to do so in a cost-effective manner, we may not be able to increase sales.

Our success depends, in part, on our ability to attract customers in a cost-effective manner. In order to expand our customer base, we must appeal to and attract customers ranging from automotive enthusiasts to individuals who simply value products of uncompromising quality and design. We have made, and expect to continue to make, significant investments in attracting new customers, including through the use of traditional, digital, and social media and participation in, and sponsorship of, community events. Marketing campaigns can be expensive and may not result in the cost-effective acquisition of customers. Further, as our brands become more widely known, future marketing campaigns may not attract new customers at the same rate as past campaigns. If we are unable to attract new customers, or fail to do so in a cost-effective manner, our growth could be slower than we expect, and our business may be harmed.

Our growth depends, in part, on expanding into additional consumer markets, and we may not be successful in doing so.

We believe that our future growth depends not only on continuing to reach our current core demographic, but also continuing to broaden our retail partner and customer bases. The growth of our business will depend, in part, on our ability to continue to expand our retail partner and customer bases in the United States, as well as in international markets. In these markets, we may face challenges that are different from those we currently encounter, including competitive, merchandising, distribution, hiring, and other difficulties. We may also encounter difficulties in attracting customers due to a lack of consumer familiarity with or acceptance of our brands, or a resistance to paying for premium products, particularly in international markets. We continue to evaluate marketing efforts and other strategies to expand the customer base for our products. In addition, although we are investing in sales and marketing activities to further penetrate newer regions, including expansion of our dedicated sales force, we cannot ensure that we will be successful. If we are not successful, our business, sales, financial condition and results of operations may be harmed.

Competitors have attempted, and will likely continue to attempt to, imitate our products and technology. If we are unable to protect or preserve the image of our brands and proprietary rights, our business, sales, financial condition and results of operations may be harmed.

As our business continues to expand, our competitors have imitated or attempted to imitate, and will likely continue to imitate or attempt to imitate, our product designs and branding, which could harm our business, sales, financial condition and results of operations. Only a portion of the intellectual property used in the manufacture and design of our products is patented, and we, therefore, rely significantly on trade secrets, trade and service marks, trade dress, and the strength of our brands. We regard our patents, trade dress, trademarks, copyrights, trade secrets, and similar proprietary rights as critical to our success. We also rely on trade secret protection and confidentiality agreements with our employees, consultants, suppliers, manufacturers, and others to protect our proprietary rights. Nevertheless, the steps we take to protect our proprietary rights against infringement or other violations may be inadequate, and we may experience difficulty in effectively limiting the unauthorized use of our patents, trademarks, trade dress, and other intellectual property and proprietary rights worldwide. We also cannot guarantee that others will not independently develop technology with the same or similar function to any proprietary technology that we rely on to conduct our business and differentiate our self from our competitors. Unauthorized use or invalidation of our patents, trademarks, copyrights, trade dress, trade secrets, or other intellectual property or proprietary rights may cause significant damage to our brands and harm our business, sales, financial condition and results of operations.

While we actively develop and protect our intellectual property rights, there can be no assurance that we will be adequately protected in all countries in which we conduct our business or that we will prevail when defending our patent, trademark, and proprietary rights. Additionally, we could incur significant costs and management distraction in pursuing claims to enforce our intellectual property rights through litigation and defending any alleged counterclaims. If we are unable to protect or preserve the value of our patents, trade dress, trademarks, copyrights, or other intellectual property rights for any reason, or if we fail to maintain the image of our brands due to actual or perceived product or service quality issues, adverse publicity, governmental investigations or litigation, or other reasons, our brands and reputation could be damaged, and our business may be harmed.

Our profitability may decline as a result of increasing pressure on pricing.

Our industry is subject to significant pricing pressure caused by many factors, including unfavorable economic conditions, intense competition, consolidation in the retail industry, pressure from retailers to reduce the costs of products, and changes in consumer demand. The current economic conditions and macroeconomic trends, including heightened inflation, capital market volatility, interest rate and current rate fluctuations, have had and may continue to have an impact on pricing. These factors may cause us to reduce our prices to retailers and customers or engage in more promotional activity than we anticipate, which could adversely impact our margins and cause our profitability to decline if we are unable to offset price reductions with comparable reductions in our operating costs. This could materially harm our business, sales, financial condition and results of operations. In addition, ongoing and sustained promotional activities could harm the image of our brands.

Our current and future products may experience quality problems from time to time that can result in negative publicity, litigation, product recalls, and warranty claims, which could result in decreased sales and operating margin, and harm to our brand.

Although we extensively and rigorously test new and enhanced products, there can be no assurance we will be able to detect, prevent, or fix all defects. Defects in materials or components can unexpectedly interfere with the products’ intended use and safety and damage our reputation. Failure to detect, prevent, or fix defects could result in a variety of consequences, including a greater number of product returns than expected from customers and retail partners, litigation, product recalls, and credit claims, among others, which could harm our business, sales, financial condition and results of operations. The occurrence of real or perceived quality problems or material defects in our current and future products could expose us to product recalls, warranty, or other claims. In addition, any negative publicity or lawsuits filed against us related to the perceived quality and safety of our products could also harm our brand and decrease demand for our products.

Our reliance on foreign suppliers for some of the automotive parts we sell to our customers or include in our products presents risks to the business.

A portion of automotive parts and components we use in our manufacturing processes are imported from suppliers located outside the U.S. As a result, we are subject to various risks of doing business in foreign markets and importing products from abroad, and these risks may become heightened as a result of unfavorable global economic conditions, including as a result of COVID-19. These risks may include, but are not limited to:

| • |

shortages of key component parts used in our products sourced from non-U.S. suppliers; |

| • |

increased transportation costs; |

| • |

significant delays in the delivery of cargo due to port security considerations; |

| • |

imposition of duties, taxes, tariffs or other charges on imports; |

| • |

potential recalls or cancellations of orders for any product that does not meet our quality standards; |

| • |

disruption of imports by labor disputes or strikes and local business practices; |

| • |

heightened terrorism security concerns, which could subject imported goods to additional, more frequent or more thorough inspections, leading to delays in deliveries or impoundment of goods for extended periods; |

| • |

political tensions, conflicts, and wars, such as the ongoing conflict in Ukraine; |

| • |

natural disasters, disease, epidemics and health related concerns, which could result in closed factories, reduced workforces, scarcity of raw materials and scrutiny or embargoing of goods produced in infected areas; |

| • |

inability of our non-U.S. suppliers to obtain adequate credit or access liquidity to finance their operations; and |

| • |

our ability or inability to enforce any agreements with our foreign suppliers. |

Any of the foregoing factors, or a combination of them, could increase the cost or reduce the supply of products available to us and materially and adversely impact our business, sales, financial condition and results of operations.

We depend on retail partners to display and present our products to customers, and our failure to maintain and further develop our relationships with retail partners could harm our business.

We sell a significant amount of our products through knowledgeable national, regional, and independent retail partners. Our retail partners service customers by stocking and displaying our products, explaining the attributes of our products, and sharing the story of our brands. Our relationships with these retail partners are important to the authenticity of our brands and the marketing programs we continue to deploy. Our failure to maintain these relationships with our retail partners or financial difficulties experienced by these retail partners could harm our business.

We have key relationships with national retail partners. If we lose any of our key retail partners or any key retail partner reduces their purchases of our existing or new products or their number of stores or operations, or promotes products of our competitors over ours, our sales would be harmed. Because Holley is a premium brand, our sales depend, in part, on retail partners effectively displaying our products, including providing attractive space and point of purchase displays in their stores, and training their sales personnel to sell our products. If our retail partners reduce or terminate those activities, we may experience reduced sales of our products, resulting in lower gross margins, which would harm our business, financial condition and results of operations.

If our plans to increase sales through our DTC channel are not successful, our business, sales, financial condition and results of operations could be harmed.

For 2022, we generated through our DTC channel approximately $149.1 million in gross sales. Part of our growth strategy involves increasing sales through our DTC channel. The level of customer traffic and volume of customer purchases through our website is substantially dependent on our ability to provide a content-rich and user-friendly website, a hassle-free customer experience, sufficient product availability, and reliable, timely delivery of our products. If we are unable to maintain and increase customers’ use of our website, allocate sufficient product to our website, and increase any sales through our website, our business, sales, financial condition and results of operations could be harmed.

Our future success depends on the continuing efforts of our management and key employees, and on our ability to attract and retain highly skilled personnel and senior management.