UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

or

For the transition period from _____________ to _____________

Commission file number:

CLENE INC.

(Exact name of registrant as specified in its charter)

| | | |

| (State or other jurisdiction of | (I.R.S. Employer |

| | | |

| (Address of principal executive offices) | (Zip Code) |

| ( |

(Registrant’s telephone number, including area code)

| N/A |

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| | | The | ||

| | | The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☒ | Smaller reporting company | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The number of shares outstanding of the Registrant’s common stock as of May 9, 2023 was

Quarterly Report on Form 10-Q for the Quarter Ended March 31, 2023

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited)

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Marketable securities | ||||||||

| Accounts receivable | ||||||||

| Inventory | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Restricted cash | ||||||||

| Operating lease right-of-use assets | ||||||||

| Property and equipment, net | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities | ||||||||

| Operating lease obligations, current portion | ||||||||

| Finance lease obligations, current portion | ||||||||

| Notes payable, current portion | ||||||||

| Total current liabilities | ||||||||

| Operating lease obligations, net of current portion | ||||||||

| Finance lease obligations, net of current portion | ||||||||

| Notes payable, net of current portion | ||||||||

| Convertible notes payable | ||||||||

| Clene Nanomedicine contingent earn-out liability | ||||||||

| Initial Stockholders contingent earn-out liability | ||||||||

| TOTAL LIABILITIES | ||||||||

| Commitments and contingencies (Note 9) | ||||||||

| Stockholders’ equity (deficit): | ||||||||

| Common stock, $ par value: shares authorized; and shares issued and outstanding at March 31, 2023 and December 31, 2022, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive income | ||||||||

| TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) | ( | ) | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | $ | $ | ||||||

See accompanying notes to the condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share amounts)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2023 |

2022 |

|||||||

| Revenue: |

||||||||

| Product revenue |

$ | $ | ||||||

| Royalty revenue |

||||||||

| Total revenue |

||||||||

| Operating expenses: |

||||||||

| Cost of revenue |

||||||||

| Research and development |

||||||||

| General and administrative |

||||||||

| Total operating expenses |

||||||||

| Loss from operations |

( |

) | ( |

) | ||||

| Other income (expense), net: |

||||||||

| Interest income |

||||||||

| Interest expense |

( |

) | ( |

) | ||||

| Gain on termination of lease |

||||||||

| Commitment share expense |

( |

) | ||||||

| Change in fair value of common stock warrant liability |

( |

) | ||||||

| Change in fair value of Clene Nanomedicine contingent earn-out liability |

( |

) | ( |

) | ||||

| Change in fair value of Initial Stockholders contingent earn-out liability |

( |

) | ( |

) | ||||

| Research and development tax credits and unrestricted grants |

||||||||

| Other income (expense), net |

||||||||

| Total other income (expense), net |

( |

) | ( |

) | ||||

| Net loss before income taxes |

( |

) | ( |

) | ||||

| Income tax expense |

||||||||

| Net loss |

( |

) | ( |

) | ||||

| Other comprehensive income: |

||||||||

| Unrealized gain (loss) on available-for-sale securities |

( |

) | ||||||

| Foreign currency translation adjustments |

||||||||

| Total other comprehensive income |

||||||||

| Comprehensive loss |

$ | ( |

) | $ | ( |

) | ||

| Net loss per share – basic and diluted |

$ | ( |

) | $ | ( |

) | ||

| Weighted average common shares used to compute basic and diluted net loss per share |

||||||||

See accompanying notes to the condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands, except share amounts)

(Unaudited)

| Common Stock |

Additional Paid-In |

Accumulated |

Accumulated Other Comprehensive |

Total Stockholders’ |

||||||||||||||||||||

| Shares |

Amount |

Capital |

Deficit |

Income (Loss) |

Equity (Deficit) |

|||||||||||||||||||

| Balances at December 31, 2022 |

$ | $ | $ | ( |

) | $ | $ | |||||||||||||||||

| Issuance of common stock |

||||||||||||||||||||||||

| Stock-based compensation expense |

— | |||||||||||||||||||||||

| Unrealized gain on available-for-sale securities |

— | |||||||||||||||||||||||

| Foreign currency translation adjustment |

— | |||||||||||||||||||||||

| Net loss |

— | ( |

) | ( |

) | |||||||||||||||||||

| Balances at March 31, 2023 |

$ | $ | $ | ( |

) | $ | $ | ( |

) | |||||||||||||||

| Balances at December 31, 2021 |

( |

) | ||||||||||||||||||||||

| Reclassification of common stock warrant liability to equity |

— | |||||||||||||||||||||||

| Exercise of stock options |

||||||||||||||||||||||||

| Stock-based compensation expense |

— | |||||||||||||||||||||||

| Unrealized loss on available-for-sale securities |

— | ( |

) | ( |

) | |||||||||||||||||||

| Foreign currency translation adjustment |

— | |||||||||||||||||||||||

| Net loss |

— | ( |

) | ( |

) | |||||||||||||||||||

| Balances at March 31, 2022 |

$ | $ | $ | ( |

) | $ | $ | |||||||||||||||||

See accompanying notes to the condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2023 |

2022 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation |

||||||||

| Non-cash lease expense |

||||||||

| Commitment share expense |

||||||||

| Change in fair value of common stock warrant liability |

||||||||

| Change in fair value of Clene Nanomedicine contingent earn-out liability |

||||||||

| Change in fair value of Initial Stockholders contingent earn-out liability |

||||||||

| Stock-based compensation expense |

||||||||

| Gain on termination of lease |

( |

) | ||||||

| Accretion of debt discount |

||||||||

| Non-cash interest expense |

||||||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable |

||||||||

| Inventory |

( |

) | ||||||

| Prepaid expenses and other current assets |

( |

) | ( |

) | ||||

| Accounts payable |

( |

) | ||||||

| Accrued liabilities |

( |

) | ||||||

| Operating lease obligations |

( |

) | ||||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| Cash flows from investing activities: |

||||||||

| Purchases of marketable securities |

( |

) | ||||||

| Proceeds from maturities of marketable securities |

||||||||

| Purchases of property and equipment |

( |

) | ( |

) | ||||

| Net cash provided by (used in) investing activities |

( |

) | ||||||

| Cash flows from financing activities: |

||||||||

| Proceeds from exercise of stock options |

||||||||

| Proceeds from issuance of common stock, net of offering costs |

||||||||

| Payments of finance lease obligations |

( |

) | ( |

) | ||||

| Proceeds from the issuance of notes payable |

||||||||

| Net cash provided by financing activities |

||||||||

| Effect of foreign exchange rate changes on cash and restricted cash |

||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash |

( |

) | ||||||

| Cash, cash equivalents and restricted cash – beginning of period |

||||||||

| Cash, cash equivalents and restricted cash – end of period |

$ | $ | ||||||

| Reconciliation of cash, cash equivalents and restricted cash to the consolidated balance sheets |

||||||||

| Cash and cash equivalents |

||||||||

| Restricted cash |

||||||||

| Cash, cash equivalents and restricted cash |

$ | $ | ||||||

| Supplemental disclosure of non-cash investing and financing activities: |

||||||||

| Lease liability arising from obtaining right-of-use assets, leasehold improvements, and lease incentives |

$ | $ | ||||||

| Lease liability settled through termination of lease |

$ | $ | ||||||

| Reclassification of common stock warrant liability to permanent equity |

$ | $ | ||||||

| Supplemental cash flow information: |

||||||||

| Cash paid for interest expense |

$ | $ | ||||||

See accompanying notes to the condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Nature of the Business

Clene Inc. (the “Company,” “we,” “us,” or similar such references) is a clinical-stage pharmaceutical company pioneering the discovery, development, and commercialization of novel clean-surfaced nanotechnology therapeutics. We have developed an electro-crystal-chemistry drug development platform which enables production of concentrated, stable, highly active, clean-surfaced nanocrystal suspensions. We have multiple drug assets currently in development for applications primarily in neurology. Our efforts are currently focused on addressing the high unmet medical needs in central nervous system disorders including Amyotrophic Lateral Sclerosis (“ALS”), Multiple Sclerosis (“MS”), and Parkinson’s Disease (“PD”). Our patented electro-crystal-chemistry manufacturing platform further enables us to develop very low concentration dietary supplements to advance the health and well-being of broad populations. These dietary supplements can vary greatly and include nanocrystals of varying composition, shapes and sizes as well as ionic solutions with diverse metallic constituents. Dietary supplements are marketed and distributed through our wholly owned subsidiary, dOrbital, Inc., or through an exclusive license with 4Life Research LLC (“4Life”), a related party (see Note 15).

Clene Nanomedicine, Inc. (“Clene Nanomedicine”) became a public company on December 30, 2020 (the “Closing Date”) when it completed a reverse recapitalization (the “Reverse Recapitalization”) with Tottenham Acquisition I Limited (“Tottenham”), Tottenham’s wholly-owned subsidiary and our predecessor, Chelsea Worldwide Inc., and Creative Worldwide Inc., a wholly-owned subsidiary of Chelsea Worldwide Inc. On the Closing Date, Chelsea Worldwide Inc. changed its name to Clene Inc. and listed its shares of common stock, par value $

Going Concern

We incurred a loss from operations of $

We have incurred significant losses and negative cash flows from operations since our inception. We have not generated significant revenues since our inception, and we do not anticipate generating significant revenues unless we successfully complete development and obtain regulatory approval for commercialization of a drug candidate. We expect to incur additional losses in the future, particularly as we advance the development of our clinical-stage drug candidates, continue research and development of our preclinical drug candidates, and initiate additional clinical trials of, and seek regulatory approval for, these and other future drug candidates. We expect that within the next twelve months, we will not have sufficient cash and other resources on hand to sustain our current operations or meet our obligations as they become due unless we obtain additional financing. Additionally, pursuant to our term loan with Avenue Venture Opportunities Fund, L.P. (“Avenue”), we are required to maintain unrestricted cash and cash equivalents of at least $

To mitigate our funding needs, we plan to raise additional funding, including exploring equity financing and offerings, debt financing, licensing or collaboration arrangements with third parties, as well as utilizing our existing at-the-market facility and equity purchase agreement. These plans are subject to market conditions and reliance on third parties, and there is no assurance that effective implementation of our plans will result in the necessary funding to continue current operations. Subsequent to March 31, 2023, we have raised $

The accompanying condensed consolidated financial statements have been prepared assuming we will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. As a result, the accompanying condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of assets and their carrying amounts, or the amounts and classification of liabilities that may result should we be unable to continue as a going concern.

Impact of the COVID-19 Pandemic

We are subject to risks and uncertainties as a result of the COVID-19 pandemic. The extent of the impact of the COVID-19 pandemic, including the resurgence of cases relating to the spread of new variants, on our business and operations is highly uncertain and difficult to predict, as the responses that we, other businesses, and governments are taking continue to evolve. Government measures taken in response to the COVID-19 pandemic have had a significant impact, both direct and indirect, on businesses, commerce, and economies worldwide, as worker shortages have occurred, supply chains have been disrupted, and facilities and production have been suspended. The COVID-19 pandemic may affect our ability to initiate and complete preclinical studies and clinical trials, delay the initiation of future clinical trials, disrupt regulatory activities, or have other adverse effects on our business and operations. In particular, we and our third-party contract research organizations (“CROs”) have faced disruptions that affected our ability to initiate and complete preclinical studies, caused manufacturing disruptions, and created delays at clinical trial site initiation and clinical trial enrollment, which ultimately led to the early conclusion of a clinical trial.

We are monitoring the potential impact of the COVID-19 pandemic on our business, financial condition, results of operations, and cash flows. While the COVID-19 pandemic has led to various research restrictions and led to pauses and early conclusion of one of our clinical trials, these impacts have been temporary and to date we have not experienced material business disruptions or incurred impairment losses in the carrying values of our assets as a result of the COVID-19 pandemic. We are not aware of any specific related event or circumstance that would require us to revise the estimates reflected in our condensed consolidated financial statements. The extent to which the COVID-19 pandemic will directly or indirectly impact our business, financial condition, results of operations, and cash flows, including planned future clinical trials and research and development costs, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19, the actions taken to contain or treat it, and the duration and intensity of the related effects.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of Clene Inc. and our wholly-owned subsidiaries, Clene Nanomedicine, Inc., a subsidiary incorporated in Delaware, Clene Australia Pty Ltd (“Clene Australia”), a subsidiary incorporated in Australia, Clene Netherlands B.V. (“Clene Netherlands”), a subsidiary incorporated in the Netherlands, and dOrbital, Inc., a subsidiary incorporated in Delaware, after elimination of all intercompany accounts and transactions. We have prepared the accompanying condensed consolidated financial statements in accordance with United States (“U.S.”) Generally Accepted Accounting Principles (“GAAP”) for interim financial reporting and as required by Regulation S-X, Rule 10-01. The condensed consolidated financial statements have been prepared on the same basis as our audited annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation. The financial data and other information disclosed in the condensed consolidated financial statements and related notes for the three months ended March 31, 2023 and 2022 are unaudited.

Results of operations for the three months ended March 31, 2023 and 2022 are not necessarily indicative of the results for the entire fiscal year or any other period. The condensed consolidated financial statements for the three months ended March 31, 2023 and 2022 should be read in conjunction with the audited consolidated financial statements included in our Annual Report on Form 10-K.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosure of contingent assets and liabilities, and the reported amounts of expenses. We base our estimates on historical experience and various other assumptions that we believe to be reasonable. Actual results may differ from those estimates or assumptions. Estimates are periodically reviewed in light of changes in circumstances, facts, and experience, and any changes in estimates will be recorded in future periods as they develop.

Risks and Uncertainties

The product candidates we develop require approvals from regulatory agencies prior to commercial sales. There can be no assurance that our current and future product candidates will receive the necessary approvals or be commercially successful. If we are denied approval or approval is delayed, it will have a material adverse impact on our business and our condensed consolidated financial statements.

We are subject to certain risks and uncertainties and believe that changes in any of the following areas could have a material adverse effect on future financial condition, results of operations, or cash flows: ability to obtain additional financing; regulatory approval and market acceptance of, and reimbursement for, product candidates; performance of third-party CROs and manufacturers upon which we rely; protection of our intellectual property; litigation or claims against us based on intellectual property, patent, product, regulatory, or other factors; and our ability to attract and retain employees necessary to support our growth.

Concentrations of Credit Risk

Financial instruments which potentially subject us to significant concentrations of credit risk consist primarily of cash. Our cash is held in financial institutions and amounts on deposit may at times exceed federally insured limits. We have not experienced any losses on our deposits of cash and do not believe that we are subject to unusual credit risk beyond the normal credit risk associated with commercial banking relationships.

Cash and Cash Equivalents

We consider all short-term investments with original maturities of 90 days or less when purchased to be cash equivalents.

Restricted Cash

We classify cash as restricted when it is unavailable for withdrawal or use in our general operating activities. Restricted cash is classified as current and noncurrent on the condensed consolidated balance sheets based on the nature of the restriction. Our restricted cash balance includes contractually restricted deposits related to our corporate credit card.

Marketable Securities

Marketable securities are investments with original maturities of more than 90 days when purchased. We do not invest in securities with original maturities of more than one year. Marketable debt securities are considered available-for-sale, and are recorded at fair value, with unrealized gains and losses included as a component of accumulated other comprehensive income until realized. Realized gains and losses are included in other income (expense), net, on the basis of specific identification. The cost of marketable securities is adjusted for amortization of premiums or accretion of discounts to maturity, and such amortization or accretion is included in other income (expense), net.

Inventory

Inventory is stated at historic cost on a first-in first-out basis. Our inventory consisted of $

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Property and equipment consist of laboratory and office equipment, computer software, and leasehold improvements. Depreciation is calculated using the straight-line method over the estimated economic useful lives of the assets, which are

We capitalize costs to obtain or develop computer software for internal use, including development costs incurred during the software development stage and costs to obtain software for access and conversion of historical data. We also capitalize costs to modify, upgrade, or enhance existing internal-use software that result in additional functionality. We expense costs incurred during the preliminary project stage, training costs, data conversion costs, and maintenance costs.

Debt

When debt is issued and a derivative is required to be separated (e.g., bifurcated conversion option) or another separate freestanding financial instrument (e.g., warrant) is issued, costs and fees incurred are allocated to the instruments issued (or bifurcated) in proportion to the allocation of proceeds. When some portions of the costs and fees relate to a bifurcated derivative or freestanding financial instrument that is being subsequently measured at fair value, those allocated costs are expensed immediately. Debt discounts, debt premiums, and debt issuance costs related to debt are recorded as deductions that net against the principal value of the debt and are amortized to interest expense over the contractual term of the debt using the effective interest method.

Convertible Debt

In accordance with ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, when we issue notes with conversion features, we evaluate if the conversion feature is freestanding or embedded. If the conversion feature is embedded, we do not separate the conversion feature from the host contract for convertible notes that are not required to be accounted for as derivatives, or that do not result in substantial premiums accounted for as paid-in-capital. Consequently, we account for a convertible note as a single liability measured at its amortized cost, and we account for a convertible preferred stock as a single equity instrument measured at its historical cost, as long as no other features require separation and recognition as derivatives. If the conversion feature is freestanding, or is embedded and meets the requirements to be separated, we account for the conversion feature as a derivative under ASC 815, Derivatives and Hedging (“ASC 815”). We record the derivative instrument at fair value at inception, and subsequently re-measure to fair value at each reporting period and immediately prior to the extinguishment of the derivative instrument, with any changes recorded in the condensed consolidated statements of operations and comprehensive loss.

Leases

At inception of a contract, we determine if a contract meets the definition of a lease. We determine if the contract conveys the right to control the use of an identified asset for a period of time. We assess throughout the period of use whether we have both of the following: (i) the right to obtain substantially all of the economic benefits from use of the identified asset, and (ii) the right to direct the use of the identified asset. This determination is reassessed if the terms of the contract are changed. Leases are classified as operating or finance leases based on the terms of the lease agreement and certain characteristics of the identified asset. Right-of-use assets and lease liabilities are recognized at the lease commencement date based on the present value of the future lease payments less any lease incentives received. At the lease commencement date, the discount rate implicit in the lease is used to discount the lease liability if readily determinable. If not readily determinable or leases do not contain an implicit rate, our incremental borrowing rate is used as the discount rate.

Our policy is to not record leases with an original term of twelve months or less within the condensed consolidated balance sheets. We recognize lease expense for these short-term leases on a straight-line basis over the lease term in the condensed consolidated statements of operations and comprehensive loss.

Certain lease agreements may require us to pay additional amounts for taxes, insurance, maintenance, and other expenses, which are generally referred to as non-lease components. Such variable non-lease components are treated as variable lease payments and recognized in the period in which the obligation for these payments is incurred. Variable lease components and variable non-lease components are not measured as part of the right-of-use asset and liability. Only when lease components and their associated non-lease components are fixed are they accounted for as a single lease component and are recognized as part of a right-of-use asset and liability. Total contract consideration is allocated to the fixed lease and non-lease component. This policy election applies consistently to all asset classes under lease agreements.

Leases may contain clauses for renewal at our option. Payments to be made in option periods are recognized as part of the right-of-use lease assets and lease liabilities when it is reasonably certain that the option to extend the lease will be exercised, or is not at our option. We determine whether the reasonably certain threshold is met by considering contract-, asset-, market-, and entity-based factors. In the condensed consolidated statements of operations and comprehensive loss, operating lease expense, which is recognized on a straight-line basis over the lease term, and the amortization of finance lease right-of-use assets, which are included in property and equipment and depreciated, are included in research and development or general and administrative expenses consistent with the leased assets’ primary use. Accretion on the liabilities for finance leases is included in interest expense.

Contingent Earn-Out Liabilities

In connection with the Reverse Recapitalization, certain of Clene Nanomedicine’s stockholders are entitled to receive additional shares (the “Clene Nanomedicine Contingent Earn-out”) of Common Stock as follows: (i)

In accordance with ASC 815, the Contingent Earn-outs are not indexed to our own stock and therefore were accounted for as a liability at the Reverse Recapitalization date and are subsequently remeasured to fair value at each reporting date with changes recorded as a component of other income (expense), net.

Common Stock Warrants

We account for common stock warrants as either equity-classified instruments or liability-classified instruments based on an assessment of the warrant terms and applicable authoritative guidance. The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to our Common Stock, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and, for liability-classified warrants, at each reporting period end date while the warrants are outstanding.

Grant Funding

We may submit applications to receive grant funding from governmental and non-governmental entities. We account for grants by analogizing to the grant accounting model under IAS 20, Accounting for Government Grants and Disclosure of Government Assistance (“IAS 20”). We recognize grant funding without conditions or continuing performance obligations, including certain research and development tax credits, as other income in the condensed consolidated statements of operations and comprehensive loss. We accrue certain research and development tax credits receivable in other current assets (see Note 4) in the condensed consolidated balance sheets in an amount equal to the qualifying expenses incurred in each period multiplied by the applicable reimbursement percentage and we recognize other income in the condensed consolidated statements of operations and comprehensive loss. After submission of our tax returns, we receive a cash refund of certain research and development tax credits and relieve the receivable.

We recognize grant funding with conditions or continuing performance obligations as a reduction in research and development expenses in the condensed consolidated statements of operations and comprehensive loss in the period during which the related qualifying expenses are incurred and as the conditions or performance obligations are fulfilled. Any amount received in advance of fulfilling such conditions or performance obligations is recorded in accrued liabilities in the condensed consolidated balance sheets if the conditions or performance obligations are expected to be met within the next twelve months. We did not fulfill any grant conditions or performance obligations during the three months ended March 31, 2023 and 2022.

Foreign Currency Translation and Transactions

Our functional currency is the U.S. dollar. Clene Australia determined its functional currency to be the Australian dollar and Clene Netherlands determined its functional currency to be the Euro. We use the U.S. dollar as our reporting currency for the condensed consolidated financial statements. The results of our non-U.S. dollar based functional currency operations are translated to U.S. dollars at the average exchange rates during the period. Our assets and liabilities are translated using the current exchange rate as of the balance sheet date and stockholders’ equity (deficit) is translated using historical rates.

Adjustments resulting from the translation of the condensed consolidated financial statements of our foreign functional currency subsidiaries into U.S. dollars are excluded from the determination of net loss and are accumulated in a separate component of stockholders’ equity (deficit). We also incur foreign exchange transaction gains and losses for purchases denominated in foreign currencies. Foreign exchange transaction gains and losses are included in other income (expense), net, as incurred.

Comprehensive Loss

Comprehensive loss includes net loss as well as other changes in stockholders’ equity (deficit) that result from transactions and economic events other than those with stockholders. The only elements of other comprehensive loss in any periods presented were translation of foreign currency denominated balances of Clene Australia and Clene Netherlands to U.S. dollars for consolidation and unrealized gain (loss) on available-for-sale securities.

Segment Information

We have determined that our chief executive officer is the chief operating decision maker (“CODM”). Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the CODM in making decisions regarding resource allocation and assessing performance. We view our operations and manage our business in two operating segments, which are our reportable segments: (1) the development and commercialization of novel clean-surfaced nanotechnology therapeutics (“Drugs”), and (2) the development and commercialization of dietary supplements (“Supplements”).

Income Taxes

We account for income taxes using the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in the condensed consolidated financial statements or in our tax returns. Deferred tax assets and liabilities are determined based on the differences between the financial statement basis and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Changes in deferred tax assets and liabilities are recorded in the provision for income taxes. We assess the likelihood that our deferred tax assets will be recovered from future taxable income and, to the extent we believe, based upon the weight of available evidence, that it is more likely than not that all or a portion of the deferred tax assets will not be realized, a valuation allowance is established through a charge to income tax expense. Potential for recovery of deferred tax assets is evaluated by estimating the future taxable profits expected and considering prudent and feasible tax planning strategies.

We account for uncertainty in income taxes recognized in the condensed consolidated financial statements by applying a two-step process to determine the amount of tax benefit to be recognized. First, the tax position must be evaluated to determine the likelihood that it will be sustained upon external examination by the taxing authorities. If the tax position is deemed more-likely-than-not to be sustained, the tax position is then assessed to determine the amount of benefit to recognize in the condensed consolidated financial statements. The amount of the benefit that may be recognized is the largest amount that has a greater than 50% likelihood of being realized upon ultimate settlement. The provision for income taxes includes the effects of any resulting tax reserves, or unrecognized tax benefits, which are considered appropriate as well as the related net interest and penalties.

Stock-Based Compensation

We account for stock-based compensation arrangements using a fair value-based method for costs related to all share-based payments including stock options and stock awards. Stock-based compensation expense is recorded in research and development and general and administrative expenses based on the classification of the work performed by the grantees. The fair value is recognized over the period during which a grantee is required to provide services in exchange for the option award and service-based stock awards, known as the requisite service period (usually the vesting period), on a straight-line basis. For stock awards with market conditions, the fair value is recognized over the period based on the expected milestone achievement dates as the derived service period (usually the vesting period), on a straight-line basis. For stock awards with performance conditions, the grant-date fair value of these awards is the market price on the applicable grant date, and compensation expense will be recognized when the conditions become probable of being satisfied. We recognize a cumulative true-up adjustment once the conditions become probable of being satisfied as the related service period had been completed in a prior period. We elect to account for forfeitures as they occur, rather than estimating expected forfeitures. We determine the fair value of each share of Common Stock underlying stock-based awards using a Black-Scholes option pricing model based on the closing price of our Common Stock as reported by Nasdaq on the date of grant. The fair value of stock awards with market conditions are determined using a Monte Carlo valuation model.

Recently Adopted Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The amendments in this update, among other things, require the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. Financial institutions and other organizations will now use forward-looking information to better inform their credit loss estimates. As a smaller reporting company, the guidance was effective for our fiscal years beginning after December 15, 2022. The adoption of this guidance did not have an impact on our condensed consolidated financial statements.

Note 3. Marketable Securities

Available-for-Sale Securities

We had

| December 31, 2022 | ||||||||||||||||

| (in thousands) | Amortized Cost | Gross Unrealized | Gross Unrealized | Fair Value | ||||||||||||

| Commercial paper | $ | $ | $ | ( | ) | $ | ||||||||||

| Corporate debt securities | ||||||||||||||||

| Total | $ | $ | $ | ( | ) | $ | ||||||||||

We received proceeds from maturities of available-for-sale securities of $

Note 4. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets as of March 31, 2023 and December 31, 2022 were as follows:

| March 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Research and development tax credits receivable | $ | $ | ||||||

| Metals to be used in research and development | ||||||||

| Other | ||||||||

| Total prepaid expenses and other current assets | $ | $ | ||||||

Note 5. Property and Equipment, Net

Property and equipment, net, as of March 31, 2023 and December 31, 2022 were as follows:

| March 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Lab equipment | $ | $ | ||||||

| Office equipment | ||||||||

| Computer software | ||||||||

| Leasehold improvements | ||||||||

| Construction in progress | ||||||||

| Less accumulated depreciation | ( | ) | ( | ) | ||||

| Total property and equipment, net | $ | $ | ||||||

Depreciation expense recorded in research and development expense and general and administrative expense for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| General and administrative | $ | $ | ||||||

| Research and development | ||||||||

| Total depreciation expense | $ | $ | ||||||

Note 6. Accrued Liabilities

Accrued liabilities as of March 31, 2023 and December 31, 2022 were as follows:

| March 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Accrued compensation and benefits | $ | $ | ||||||

| Accrued CRO and clinical fees | ||||||||

| Other | ||||||||

| Total accrued liabilities | $ | $ | ||||||

Note 7. Leases

We lease laboratory and office space and certain laboratory equipment under non-cancellable operating and finance leases. The carrying value of our right-of-use lease assets is substantially concentrated in our real estate leases, while the volume of lease agreements is primarily concentrated in equipment leases.

Operating Leases

Operating leases primarily consist of real estate leases for office and laboratory space. We have

As of March 31, 2023 and December 31, 2022, our operating lease obligations had a weighted-average discount rate of

Finance Leases

Assets recorded under finance lease obligations and included in property and equipment as of March 31, 2023 and December 31, 2022 were as follows:

| March 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Lab equipment | $ | $ | ||||||

| Work in process | ||||||||

| Total | ||||||||

| Less accumulated depreciation | ( | ) | ( | ) | ||||

| Net | $ | $ | ||||||

As of March 31, 2023 and December 31, 2022, our finance lease obligations had a weighted-average interest rate of

Maturity Analysis of Leases

The maturity analysis of our finance and operating leases as of March 31, 2023 was as follows:

| (in thousands) | Finance Leases | Operating Leases | ||||||

| 2023 (remainder) | $ | $ | ||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 | ||||||||

| Thereafter | ||||||||

| Total undiscounted cash flows | ||||||||

| Less amount representing interest/discounting | ( | ) | ( | ) | ||||

| Present value of future lease payments | ||||||||

| Less lease obligations, current portion | ( | ) | ( | ) | ||||

| Lease obligations, long term portion | $ | $ | ||||||

We expect that, in the normal course of business, the existing leases will be renewed or replaced by similar leases.

Components of Lease Cost

The components of finance and operating lease costs for the three months ended March 31, 2023 and 2022 were as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Finance lease costs: | ||||||||

| Amortization | $ | $ | ||||||

| Interest on lease liabilities | ||||||||

| Operating lease costs | ||||||||

| Variable lease costs | ||||||||

| Total lease costs | $ | $ | ||||||

Supplemental Cash Flow Information

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Operating cash flows from operating leases | $ | ( | ) | $ | ( | ) | ||

| Operating cash flows from finance leases | $ | ( | ) | $ | ( | ) | ||

| Financing cash flows from finance leases | $ | ( | ) | $ | ( | ) | ||

Note 8. Notes Payable and Convertible Notes Payable

Our notes payable and convertible notes payable as of March 31, 2023 and December 31, 2022 was as follows:

| Stated | March 31, | December 31, | ||||||||||

| (in thousands, except interest rates) | Interest Rate | 2023 | 2022 | |||||||||

| Notes payable | ||||||||||||

| Advance Cecil, Inc. (commenced April 2019) | % | $ | $ | |||||||||

| Maryland DHCD (commenced February 2019) | % | |||||||||||

| Maryland DHCD (commenced May 2022) | % | |||||||||||

| Avenue Venture Opportunities Fund, L.P. (commenced May 2021) | % | |||||||||||

| Accrued and unpaid interest | ||||||||||||

| Less unamortized discount and debt issuance costs | ( | ) | ( | ) | ||||||||

| Less notes payable, current portion, net of unamortized discount and debt issuance costs | ( | ) | ( | ) | ||||||||

| Total notes payable, net of current portion | $ | $ | ||||||||||

| Convertible notes payable | ||||||||||||

| Avenue Venture Opportunities Fund, L.P. (commenced May 2021) | % | $ | $ | |||||||||

| Maryland DHCD (commenced December 2022) | % | |||||||||||

| Accrued and unpaid interest | ||||||||||||

| Less unamortized discount and debt issuance costs | ( | ) | ( | ) | ||||||||

| Total convertible notes payable | $ | $ | ||||||||||

Maryland DHCD Loans

In February 2019, we entered into a loan agreement (the “2019 MD Loan”) with the Department of Housing and Community Development (“DHCD”), a principal department of the State of Maryland, for a term loan of $

In May 2022, we entered into a loan agreement (the “2022 MD Loan”) with DHCD, which provides for a term loan of up to $

In December 2022, we entered into a loan agreement (the “2022 DHCD Loan”) with DHCD for a term loan of $

Cecil County Loan

In April 2019, we entered into a loan agreement (the “2019 Cecil Loan”) with Advance Cecil Inc., a non-stock corporation formed under the laws of the state of Maryland, for a term loan of $

Avenue Loan

In May 2021, we entered into a loan agreement (the “2021 Avenue Loan”) with Avenue for a term loan of up to $

At any time between May 21, 2022 and May 21, 2024, Avenue may, in its sole discretion, convert up to $

We are subject to covenants until maturity, including limitations on our ability to retire, repurchase, or redeem our Common Stock, options, and warrants other than per the terms of the securities; limitations on our ability to pay dividends of cash or property; and we are required to maintain unrestricted cash and cash equivalents of at least $

Additionally, we issued a warrant to purchase Common Stock to Avenue based on the amount of funded principal, equal to

Debt Maturities

Future principal payments, net of unamortized discounts, and without giving effect to any potential future exercise of conversion features, are as follows:

| (in thousands) | 2019 MD Loan | 2019 Cecil Loan | 2021 Avenue Loan | 2022 MD Loan | 2022 DHCD Loan | |||||||||||||||

| 2023 (remainder) | $ | $ | $ | $ | $ | |||||||||||||||

| 2024 | ||||||||||||||||||||

| 2025 | ||||||||||||||||||||

| 2026 | ||||||||||||||||||||

| 2027 | ||||||||||||||||||||

| 2028 | ||||||||||||||||||||

| Thereafter | ||||||||||||||||||||

| Subtotal of future principal payments | ||||||||||||||||||||

| Accrued and unpaid interest | ||||||||||||||||||||

| Less unamortized discount and debt issuance costs | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Total | $ | $ | $ | $ | $ | |||||||||||||||

Note 9. Commitments and Contingencies

Commitments

We enter into agreements in the normal course of business with CROs for clinical trials and with vendors for preclinical studies and other services and products for operating purposes, which are cancelable at any time by us, subject to payment of our remaining obligations under binding purchase orders and, in certain cases, nominal early termination fees. These commitments are not deemed significant. As of March 31, 2023 and December 31, 2022, we had commitments under various agreements for capital expenditures totaling $

Contingencies

From time to time, we may have certain contingent legal liabilities that arise in the ordinary course of business activities. We accrue a liability for such matters when it is probable that future expenditures will be made, and such expenditures can be reasonably estimated. We are not aware of any current material pending legal matters or claims.

In September 2019, we received grant funding of $

Note 10. Income Taxes

The components of loss before income taxes for the three months ended March 31, 2023 and 2022 were as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| United States | $ | ( | ) | $ | ( | ) | ||

| Foreign | ( | ) | ( | ) | ||||

| Net loss before income taxes | $ | ( | ) | $ | ( | ) | ||

We are subject to taxation in the U.S., Australia, Netherlands, and various state jurisdictions. Our tax returns from 2016 to present are subject to examination by the U.S. and state authorities due to the carry forward of unutilized net operating losses and research and development credits. There are currently no pending examinations. We compute our quarterly income tax provision by using a forecasted annual effective tax rate and adjust for any discrete items arising during the quarter. The primary difference between the effective tax rate and the federal statutory tax rate relates to the full valuation allowance on our net operating losses and other deferred tax assets.

Note 11. Benefit Plans

401(k) Plan

Our 401(k) plan is a deferred salary arrangement under Section 401(k) of the Internal Revenue Code. We match

Stock Compensation Plans

The Clene Nanomedicine, Inc. 2014 Stock Plan (“the 2014 Stock Plan”) was adopted in July 2014. Effective as of the closing of the Reverse Recapitalization, no additional awards may be granted under the 2014 Stock Plan. As of March 31, 2023,

The Clene Inc. 2020 Stock Plan (the “2020 Stock Plan”) was adopted in December 2020 and

Stock-Based Compensation Expense

Stock-based compensation expense recorded in research and development expense and general and administrative expense for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| General and administrative | $ | $ | ||||||

| Research and development | ||||||||

| Total stock-based compensation expense | $ | $ | ||||||

Stock-based compensation expense by award type for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Stock options | $ | $ | ||||||

| Stock awards | ||||||||

| Total stock-based compensation expense | $ | $ | ||||||

Stock Options

Outstanding stock options and related activity for the three months ended March 31, 2023 was as follows:

| (in thousands, except share, per share, and term data) | Number of Options | Weighted Average Exercise Price Per Share | Weighted Average Remaining Term (Years) | Intrinsic Value | ||||||||||||

| Outstanding – December 31, 2022 | $ | $ | ||||||||||||||

| Granted | — | |||||||||||||||

| Forfeited | ( | ) | — | — | ||||||||||||

| Outstanding – March 31, 2023 | $ | $ | ||||||||||||||

| Vested and exercisable – March 31, 2023 | $ | $ | ||||||||||||||

| Vested, exercisable or expected to vest – March 31, 2023 | $ | $ | ||||||||||||||

As of March 31, 2023 and December 31, 2022, we had approximately $

The weighted-average grant-date fair value of stock options granted during the three months ended March 31, 2023 and 2022 was $

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Expected stock price volatility | ||||||||

| Risk-free interest rate | ||||||||

| Expected dividend yield | % | % | ||||||

| Expected term of options (in years) | ||||||||

Stock Awards

Stock awards include rights to restricted stock awards with market-based vesting conditions and restricted stock units with service-based vesting conditions. Outstanding stock awards and related activity for the three months ended March 31, 2023 was as follows:

| Number of Stock Awards | Weighted Average Grant Date Fair Value | |||||||

| Unvested balance – December 31, 2022 | $ | |||||||

| Granted | ||||||||

| Forfeited | ( | ) | ||||||

| Unvested balance – March 31, 2023 | $ | |||||||

As of March 31, 2023, we had approximately $

Note 12. Fair Value

Cash, cash equivalents, and marketable securities are carried at fair value. Financial instruments, including accounts receivable, accounts payable, and accrued expenses are carried at cost, which approximates fair value given their short-term nature. Our remaining fair value measures are discussed below.

Financial Instruments with Fair Value Measurements on a Recurring Basis

The fair value hierarchy for financial instruments measured at fair value on a recurring basis as of March 31, 2023 is as follows:

| March 31, 2023 | ||||||||||||||||

| (in thousands) | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Cash equivalents | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Clene Nanomedicine contingent earn-out liability | ||||||||||||||||

| Initial Stockholders contingent earn-out liability | ||||||||||||||||

The fair value hierarchy for financial instruments measured at fair value on a recurring basis as of December 31, 2022 is as follows:

| December 31, 2022 | ||||||||||||||||

| (in thousands) | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Cash equivalents | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Marketable securities | ||||||||||||||||

| Commercial paper | ||||||||||||||||

| Corporate debt securities | ||||||||||||||||

| Clene Nanomedicine contingent earn-out liability | ||||||||||||||||

| Initial Stockholders contingent earn-out liability | ||||||||||||||||

There were no transfers between Level 1, Level 2, or Level 3 during any of the periods above.

Changes in the fair value of our Level 3 financial instruments for the three months ended March 31, 2023 were as follows:

| (in thousands) | Clene Nanomedicine Contingent Earn-out | Initial Stockholders Contingent Earn-out | ||||||

| Balance – December 31, 2022 | $ | $ | ||||||

| Change in fair value | ||||||||

| Balance – March 31, 2023 | $ | $ | ||||||

Changes in the fair value of our Level 3 financial instruments for the three months ended March 31, 2022 were as follows:

| (in thousands) | Common Stock Warrant Liability | Clene Nanomedicine Contingent Earn-out | Initial Stockholders Contingent Earn-out | |||||||||

| Balance – December 31, 2021 | $ | $ | $ | |||||||||

| Change in fair value | ||||||||||||

| Reclassification from liability to equity | ( | ) | ||||||||||

| Balance – March 31, 2022 | $ | $ | $ | |||||||||

Valuation of Notes Payable and Convertible Notes Payable

The 2019 MD Loan and the 2019 Cecil Loan are carried at the greater of principal plus accrued interest or the value of Phantom Shares (see Note 8), which approximates fair value. The 2021 Avenue Loan, the 2022 MD Loan, and the 2022 DHCD Loan are carried at amortized cost, which approximates fair value due to our credit risk and market interest rates. Our notes payable and convertible notes payable are categorized within Level 3 of the fair value hierarchy.

Valuation of the Common Stock Warrant Liability

The Avenue Warrant, comprised of the Tranche 1 warrant and the contingently issuable Tranche 2 warrant to purchase shares of Common Stock, were classified as liabilities and recorded at fair value at inception of the 2021 Avenue Loan. As of March 31, 2022, the exercise price and quantity of shares for the Tranche 1 warrant became fixed and therefore qualified for equity classification. We remeasured the Tranche 1 warrant liability to fair value as of March 31, 2022 and recognized the change in fair value in the condensed consolidated statements of operations and comprehensive loss and the Tranche 1 warrant liability was reclassified to additional paid-in capital. Our ability to draw Tranche 2 expired on December 31, 2022 and the Tranche 2 warrant liability was extinguished and we recognized income of $

Valuation of the Contingent Earn-Out Liabilities

The Contingent Earn-outs are carried at fair value, determined using a Monte Carlo valuation model in order to simulate the future path of our stock price over the earn-out periods. The carrying amount of the liabilities may fluctuate significantly and actual amounts paid may be materially different from the liabilities’ estimated value. The unobservable inputs to the Monte Carlo valuation model were as follows:

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Expected stock price volatility | % | % | ||||||

| Risk-free interest rate | % | % | ||||||

| Expected dividend yield | % | % | ||||||

| Expected term (in years) | ||||||||

Note 13. Capital Stock

As of March 31, 2023 and December 31, 2022, our amended and restated certificate of incorporation (the “Certificate”) authorized us to issue

Our common stockholders are entitled to one vote per share and to notice of any stockholders’ meeting. Voting, dividend, and liquidation rights of the holders of Common Stock are subject to the prior rights of holders of all classes of stock and are qualified by the rights, powers, preferences, and privileges of the holders of preferred stock. No distributions shall be made with respect to Common Stock until all declared dividends to preferred stock have been paid or set aside for payment. Common Stock is not redeemable at the option of the holder.

Common Stock Warrants

As of March 31, 2023 and December 31, 2022, outstanding warrants to purchase shares of Common Stock were as follows:

| Date Exercisable | Number of | Exercise Price | Expiration | ||||||||

| December 2020 | (1) | $ | December 2025 | ||||||||

| December 2020 | (2) | $ | December 2025 | ||||||||

| December 2020 | (3) | $ | April 2023 | ||||||||

| May 2021 | (4) | $ | May 2026 | ||||||||

| Total | |||||||||||

| (1) | Consists of |

| (2) | Consists of |

| (3) | Consists of |

| (4) | Consists of |

Public Offerings

In October 2022, we sold

Common Stock Sales Agreement

In April 2022, we entered into an Equity Distribution Agreement (the “ATM Agreement”) with Canaccord Genuity LLC and Oppenheimer & Co. Inc., as placement agents (the “Placement Agents”). In December 2022, we amended the ATM Agreement and removed Oppenheimer & Co. Inc. as a Placement Agent. In accordance with the terms of the ATM Agreement, we may offer and sell shares of Common Stock having an aggregate offering price of up to $

Subject to terms of the ATM Agreement, the Placement Agent is not required to sell any specific number or dollar amount of Common Stock but will act as our placement agent, using commercially reasonable efforts to sell, on our behalf, all of the Common Stock requested by us to be sold, consistent with the Placement Agent’s normal trading and sales practices, on terms mutually agreed between the Placement Agent and us. The Placement Agent will be entitled to compensation under the terms of the ATM Agreement at a fixed commission rate of

Common Stock Purchase Agreement

On March 3, 2023, we entered into a purchase agreement (the “Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which Lincoln Park committed to purchase up to $

Pursuant to the Purchase Agreement, we may direct Lincoln Park to purchase up to

We evaluated the Purchase Agreement under ASC 815-40 “Derivatives and Hedging—Contracts on an Entity's Own Equity” as it represents the right to require Lincoln Park to purchase shares of Common Stock in the future, similar to a put option. We concluded it represents a freestanding derivative instrument that does not qualify for equity classification and therefore requires fair value accounting. We analyzed the terms of the contract and concluded the derivative instrument has

On the date of the Purchase Agreement, we issued

Note 14. Net Loss Per Share

The computation of basic and diluted net loss per share attributable to common stockholders for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands, except share and per share data) | 2023 | 2022 | ||||||

| Numerator: | ||||||||

| Net loss attributable to common stockholders | $ | ( | ) | $ | ( | ) | ||

| Denominator: | ||||||||

| Weighted average common shares outstanding | ||||||||

| Net loss per share attributable to common stockholders – basic and diluted | $ | ( | ) | $ | ( | ) | ||

The following shares of potentially dilutive securities were excluded from the computation of diluted net loss per share attributable to common stockholders for the three months ended March 31, 2023 and 2022 because they were antidilutive, out-of-the-money, or the issuance of such shares is contingent upon certain conditions which were not satisfied by the end of the period:

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Convertible notes payable (see Note 8) | ||||||||

| Common stock warrants (see Note 13) | ||||||||

| Options to purchase common stock (see Note 11) | ||||||||

| Unvested restricted stock awards (see Note 11) | ||||||||

| Contingent earn-out shares (see Note 2) | ||||||||

| Total | ||||||||

Note 15. Related Party Transactions

License and Supply Agreements

In August 2018, we entered into a license agreement and exclusive supply agreement (collectively, the “4Life Agreement”) in conjunction with 4Life’s investment in our Series C preferred stock and warrants. Pursuant to the 4Life Agreement, we granted 4Life an exclusive license to sell certain dietary supplements. The term of the exclusive license is years from the commencement of product sales under the 4Life Agreement, which was in April 2021, with options to renew for additional -year terms. We provide non-pharmaceutical product to 4Life for development, and 4Life pays royalties of

Total revenue under the 4Life Agreement for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Product revenue from related parties | $ | $ | ||||||

| Royalty revenue from related parties | ||||||||

| Total revenue from related parties | $ | $ | ||||||

Note 16. Segment Information

Our operating segment profit measure is segment loss from operations, which is calculated as revenue less cost of revenue, research and development, and general and administrative expenses. Profit and loss information by reportable segment for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Drugs: | ||||||||

| Revenue from external customers | $ | $ | ||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Supplements: | ||||||||

| Revenue from external customers | $ | $ | ||||||

| Income from operations | ||||||||

| Consolidated: | ||||||||

| Revenue from external customers | $ | $ | ||||||

| Loss from operations | ( | ) | ( | ) | ||||

A reconciliation of the total of the reportable segments’ loss from operations to consolidated net loss before income taxes for the three months ended March 31, 2023 and 2022 was as follows:

| Three Months Ended March 31, | ||||||||

| (in thousands) | 2023 | 2022 | ||||||

| Segment loss from operations | $ | ( | ) | $ | ( | ) | ||

| Total other income (expense), net | ( | ) | ( | ) | ||||

| Net loss before income taxes | $ | ( | ) | $ | ( | ) | ||

Segment assets exclude corporate assets, such as cash, restricted cash, and corporate facilities. Total assets by reportable segment as of March 31, 2023 and December 31, 2022, were as follows:

| March 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Total assets: | ||||||||

| Drugs | $ | $ | ||||||

| Supplements | ||||||||

| Corporate | ||||||||

| Consolidated | $ | $ | ||||||

Note 17. Subsequent Events

Common Stock Purchase Agreement

Subsequent to March 31, 2023, we sold

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements reflecting our or management team’s expectations, hopes, beliefs, intentions, strategies, estimates, and assumptions concerning events and financial trends that may affect our future financial condition or results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws. Unless the context otherwise requires, for purposes of this section, the terms the “Company,” “we,” “us,” or “our” are intended to mean the business and operations of Clene Inc. and its consolidated subsidiaries.

Business Overview

We are a clinical-stage pharmaceutical company pioneering the discovery, development, and commercialization of novel clean-surfaced nanotechnology (“CSN®”) therapeutics. CSN® therapeutics are comprised of atoms of transition elements that, when assembled in nanocrystal form, possess unusually high, unique catalytic activities not present in those same elements in bulk form. These catalytic activities drive, support, and maintain beneficial metabolic and energetic cellular reactions within diseased, stressed, and damaged cells.

Our patent-protected, proprietary position affords us the potential to develop a broad and deep pipeline of novel CSN therapeutics to address a range of diseases with high impact on human health. We began in 2013 by innovating an electro-crystal-chemistry drug development platform that draws from advances in nanotechnology, plasma and quantum physics, material science, and biochemistry. Our platform process results in nanocrystals with faceted structures and surfaces that are free of the chemical surface modifications that accompany other production methods. Many traditional methods of nanoparticle synthesis involve the unavoidable deposition of potentially toxic organic residues and stabilizing surfactants on the particle surfaces. Synthesizing stable nanocrystals that are both nontoxic and highly catalytic has overcome this significant hurdle in harnessing transition metal catalytic activity for human therapeutic use. Our clean-surfaced nanocrystals exhibit catalytic activities many-fold higher than multiple other commercially available nanoparticles, produced using various techniques, that we have comparatively evaluated.

We have multiple drug assets currently in development and/or clinical trials for applications primarily in neurology. Our development and clinical efforts are currently focused on addressing the high unmet medical needs in central nervous system disorders including Amyotrophic Lateral Sclerosis (“ALS”), Multiple Sclerosis (“MS”), and Parkinson’s Disease (“PD”). We currently have no drugs approved for commercial sale and have not generated any revenue from drug sales. We have never been profitable and have incurred operating losses in each year since inception. We generate revenue from sales of dietary supplements through our wholly owned subsidiary, dOrbital, Inc., or through an exclusive license with 4Life Research LLC (“4Life”), a stockholder and related party. We anticipate these revenues to be small compared to our operating expenses and to the revenue we expect to generate from potential future sales of our drug candidates, for which we are currently conducting clinical trials.

Reverse Recapitalization

Clene Nanomedicine, Inc. (“Clene Nanomedicine”) became a public company on December 30, 2020 (the “Closing Date”) when it completed a reverse recapitalization (the “Reverse Recapitalization”) with Tottenham Acquisition I Limited (“Tottenham”), and with Tottenham’s wholly-owned subsidiary and our predecessor, Chelsea Worldwide Inc., and Creative Worldwide Inc., a wholly-owned subsidiary of Chelsea Worldwide Inc. On the Closing Date, Chelsea Worldwide Inc. changed its name to Clene Inc. and listed its shares of common stock, par value $0.0001 per share (“Common Stock”) on the Nasdaq Capital Market (“Nasdaq”) under the symbol “CLNN.”

In connection with the Reverse Recapitalization, certain of Clene Nanomedicine’s common stockholders are entitled to receive earn-out payments (the “Clene Nanomedicine Contingent Earn-out”), and Tottenham’s former officers and directors and Norwich Investment Limited (collectively, the “Initial Stockholders”) are entitled to receive earn-out payments (the “Initial Stockholders Contingent Earn-out,” and both collectively the “Contingent Earn-outs”) based on achieving certain milestones.

Recent Developments of Our Clinical Programs

Amyotrophic Lateral Sclerosis

In October 2022, we reported topline data from the Phase 2/3 HEALEY ALS Platform Trial, which evaluated the safety and efficacy of CNM-Au8 in patients with ALS. In March 2023, we reported additional exploratory results for time to clinical worsening events. The full analyses, including data on biomarkers of neurodegeneration and additional exploratory efficacy results, are expected to be received from the Sean M. Healey & AMG Center for ALS at Massachusetts General Hospital in mid-2023. The open label extension (“OLE”) will continue to follow participants for an additional 52-week treatment period and we expect matured survival data in mid-2023. Additionally, we expect exploratory efficacy results from the OLE in the second half of 2023. Based on numerous requests from clinical trial sites, we have decided to increase the capacity of the second Expanded Access Program (“EAP”) up to 200 participants, contingent on the magnitude of available funding, with expansion to sites across the U.S. The expansion protocol amendment was filed with the FDA in December 2022 and additional sites continue to be enrolled.

In March 2023, we reported data from the most recent 120-week data cut of the OLE of our Phase 2 RESCUE-ALS clinical trial, which evaluated the efficacy, safety, pharmacokinetics, and pharmacodynamics of CNM-Au8 in patients with early symptomatic ALS, and we anticipate releasing updated clinical and survival data during 2023.

CNM-Au8 was well-tolerated without long term safety concerns in both RESCUE-ALS and the HEALEY ALS Platform Trial. We are presently discussing the design of an international Phase 3 study, RESTORE-ALS, with expert ALS clinical advisors and expect to initiate the trial in the first half of 2024, contingent on funding. We plan to work closely with regulatory health authorities from the U.S. Food and Drug Administration (“FDA”) and European Medicines Agency, ALS experts, and patient representatives to determine the proper path to support potential approval. We do not know when or if we will be able to file a New Drug Application (“NDA”) with the FDA based on our accumulation of clinical evidence until we meet with the FDA in an end of Phase 2 meeting which is expected in the third quarter of 2023. If the forthcoming biomarker data is supportive, we anticipate a request-to-file NDA meeting with the FDA in the fourth quarter of 2023. Based on the outcome of the request-to-file meeting, we believe we could file an NDA with the FDA in mid-2024 with a potential accelerated approval Prescription Drug User Fee Act (“PDUFA”) action date by the end of 2024.

Multiple Sclerosis

In February and March 2023, we reported updated exploratory data from our Phase 2 VISIONARY-MS clinical trial, which evaluated the efficacy and safety of CNM-Au8 in stable relapsing remitting MS patients. We expect additional exploratory results up to 144 weeks from the OLE in the second half of 2023. We also completed the first dosing cohort of REPAIR-MS, an open-label, investigator blinded Phase 2 clinical trial, and have initiated a second dosing cohort in non-active progressive MS patients which is expected to be complete in the second half of 2023. We plan to work closely with regulatory health authorities from the FDA and EMA, MS experts, and patient representatives to determine the proper path to advance our assets into Phase 3 and potential future approval. We expect to meet with the FDA in an end of Phase 2 meeting in the fourth quarter of 2023. We are presently discussing the design of an international Phase 3 MS study with expert MS clinical advisors and expect to initiate the trial in mid-2024, contingent on funding.

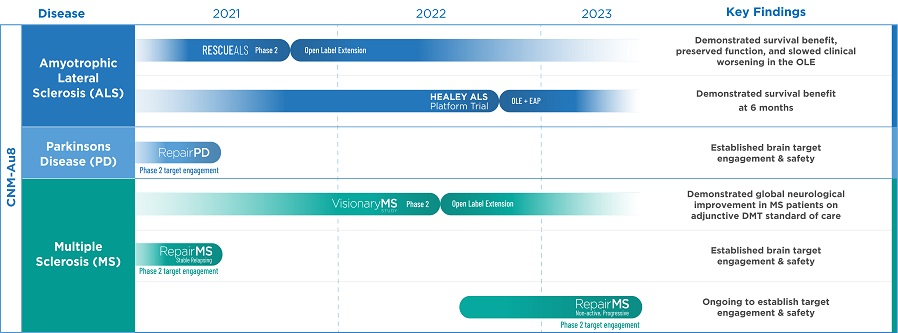

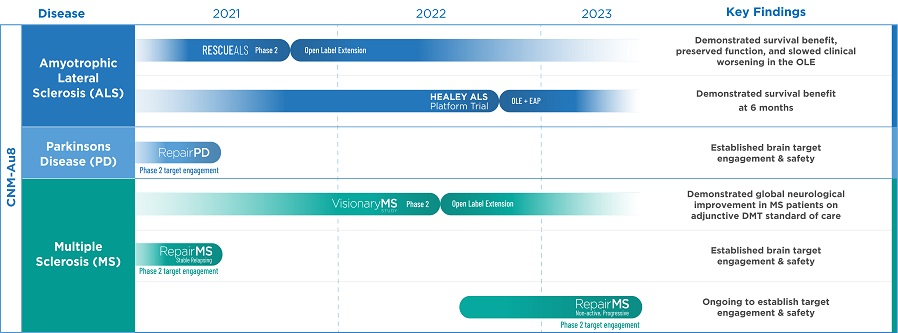

The chart below reflects the growing body of evidence for CSN therapeutics from our completed and ongoing clinical programs.

Recent Competition Update

Despite the great need for an effective disease-modifying treatment for ALS and significant research efforts by the pharmaceutical industry to meet this need, there have been limited clinical successes and no curative therapies approved to date. In May 2022, the FDA approved an orally administered version of edaravone, which has been available since 2017 as an intravenous infusion for the treatment of ALS. In September 2022, the FDA approved AMX0035, branded as Relyvrio, a drug from Amylyx Pharmaceuticals, Inc. for the treatment of ALS. AMX0035 previously received a conditional approval by Health Canada in June 2022.

In February 2023, Prilenia Therapeutics B.V. announced its pridopidine investigational drug did not meet the primary and key secondary endpoints in the HEALEY ALS Platform Trial, but consistent, positive trends were observed among participants receiving pridopidine across several pre-specified secondary and exploratory endpoints, including a reduction in neurofilament light chain (“NfL”) levels in rapidly declining patients with disease duration less than 18 months compared to placebo.

On March 27, 2023, BrainStorm Cell Therapeutics Inc. (“BrainStorm”) announced the FDA will hold a meeting of the FDA Peripheral and Central Nervous System Drugs Advisory Committee (“PCNSDAC”) to review the Biologics License Application (“BLA”) for its investigational therapeutic NurOwn for the treatment of ALS. BrainStorm completed a Phase 3 trial in ALS which did not meet the primary and secondary endpoints, however a pre-specified subgroup of participants showed a trend to a meaningful increase in the clinical response with NurOwn compared to placebo and met the secondary endpoint of average ALSFRS-R change from baseline to week 28. Additional post-hoc sensitivity analyses also showed a statistical trend towards a clinically meaningful treatment effect with NurOwn across subgroups. Finally, biomarker data in all trial participants also showed consistent patterns of NurOwn reducing markers of inflammation and neurodegeneration, and increasing neuroprotective and anti-inflammatory markers relative to placebo.