☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| Message to Our Shareholders

|

||||

|

| ||||

On behalf of Organon’s Board of Directors and Executive Leadership Team, we are pleased to invite you to our 2024 Annual Meeting of Shareholders on Tuesday, June 4, 2024 at 9 a.m.

In the two years since Organon’s launch, we’ve built a profitable company that is helping patients around the world and advancing an important global vision – a better and healthier every day for every woman. We feel energized by the foundation we’re building today as well as Organon’s prospects for the future.

2023 was a critical year that showed that we continue to have the right strategy to deliver value to our shareholders and all our stakeholders – one defined by solid growth across all our geographies and franchises. We made important progress in expanding access to existing solutions and bringing to market new solutions for unmet health needs. Our financial performance enabled us to return $294 million in cash dividends to shareholders in 2023.

Throughout last year, we continued our strategic focus on expanding the definition of women’s health, by advancing our pipeline and through new business development. A highlight was our new commercialization partnership in Europe with Eli Lilly for two medicines for migraine, a condition that disproportionately affects women. This partnership further bolsters our offerings to women while also aligning with our existing therapeutic and geographic capabilities.

Our company and our commitment to help tackle the unmet health needs of women is being recognized. Importantly, we are nearly halfway to our goal to help prevent 120 million unplanned pregnancies by 2030. In 2023, we launched “Her Plan is Her Power,” an initiative that builds on and accelerates this important work, focusing on global action as well as community-led responses.

Building on our strong foundation

We enter 2024 with strong momentum, and a clear roadmap for again delivering low single-digit revenue growth, with an aim to drive growth in profitability measures even faster. Our focus now is to build on the strong foundation we set in 2023 by driving profitable growth, remaining disciplined on operating costs, and investing in new opportunities – inside and outside our business – that complement our strengths.

Importantly, we are well-positioned to move beyond incurring many of the one-time costs related to standing up the company. One notable example is our global Enterprise Resource Planning system, which we expect to complete the implementation of this year, increasing our efficiency and agility as we move forward.

Looking ahead, we are poised to further unlock this company’s great potential for 2024 and beyond. Our leadership team and Board continue to work closely to advance Organon’s growth strategy. And we’re proud of the company’s approximately 10,000 founders and their commitment and passion for the company.

Thank you for your continued investment in Organon and support of our global vision. We’re confident that we have the right strategy and team in place to seize the many opportunities in front of us as we remain here for her health.

Sincerely,

|

Carrie S. Cox Chairman of the Board |

Kevin Ali Chief Executive Officer |

|

i | 2024 Proxy Statement |

| Business Overview

|

||||||

|

|

||||||

Our Business Performance1

Organon delivered strong business results in 2023, our second full year as a standalone company. Revenue grew 3% excluding the impact of foreign exchange. Our vision is to create a better and healthier every day for every woman. As part of our journey to help patients around world, we are maximizing our foundational strengths in Women’s Health, Biosimilars, and Established Brands, while selectively expanding our therapeutic areas through business development.

Fiscal Year 2023 Business Performance

| $6.3B

Full year revenue |

$1.9B

Adjusted EBITDA |

$4.14

Non-GAAP Adjusted Diluted EPS | ||||||

| Women’s Health

|

Biosimilars

|

Established Brands

| ||||||

| Other highlights from 2023 include2:

• Since spin, we strategically deployed capital with our investment of over half a billion dollars across 9 promising transactions to drive future revenue growth.

• In 2023, the company generated $940 million in free cash flow before one-time costs and returned $294 million in cash dividends to shareholders. We proactively retired $250 million of debt in addition to normally scheduled amortization payments.

• Organon published our second ESG report, marking significant progress toward our goals. Importantly, Organon is almost halfway toward its goal of reducing 120 million unplanned pregnancies by 2030.

• Our Women’s Health franchise grew 3%.

• Our lead product, Nexplanon® (etonogestrel implant), a Long-Acting Reversible Contraceptive (LARC), achieved market leadership in the U.S. LARC market • Our fertility portfolio grew 9%, driven by the U.S., China, and our LAMERA region • Jada® system more than doubled revenue ex-FX • Marvelon™3 (desogestrel and ethinyl estradiol pill) and Mercilon™3 (desogestrel and ethinyl estradiol pill) together grew 24%, their second year of strong double digit growth • We launched Xaciato® (clindamycin phosphate vaginal gel, 2%), an FDA-approved treatment for bacterial vaginosis in females 12 years and older

• Our Biosimilars franchise grew 24%, marking its third consecutive year of double-digit growth.

• Hadlima® (adalimumab-bwwd) - our biosimilar for Humira4 - grew strongly in 2023 since our July 1, 2023 launch in the U.S., and through Q1 2024 is the leading Humira biosimilar in the U.S. • Double digit growth in both Renflexis® (infliximab-abda) and Ontruzant® (trastuzumab-dttb)

• Our Established Brands franchise delivered revenue growth of 2%, demonstrating the durability of the portfolio with a second consecutive year of growth.

|

| 1. | For further explanation of the below non-GAAP measures versus non-GAAP results and a reconciliation to the most directly comparable U.S. GAAP measure, please refer to Appendix A. |

| 2. | All growth rates are excluding the impact of foreign exchange translation. |

| 3. | Only available outside the U.S. |

| 4. | Humira is a trademark registered in the U.S. in the name of Abbvie Biotechnology Ltd. |

|

ii | 2024 Proxy Statement |

| Notice of 2024 Annual Meeting of Shareholders |

||||

|

| ||||

To Organon Shareholders:

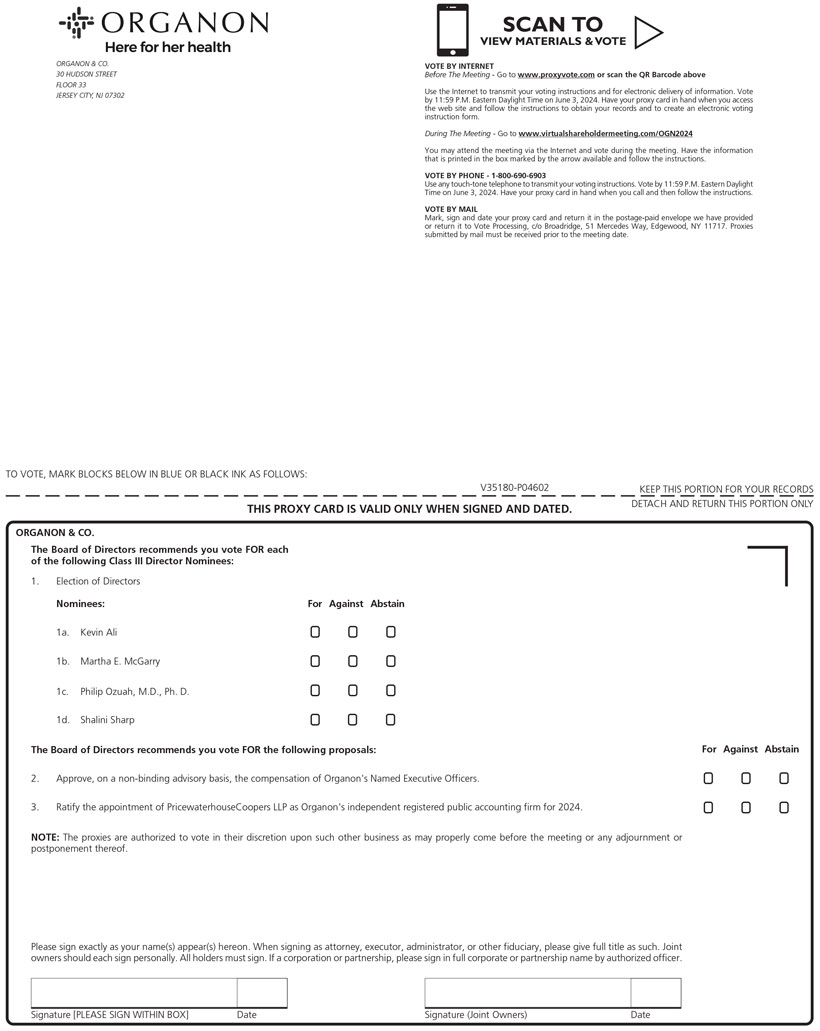

You are cordially invited to the Annual Meeting of Shareholders of Organon & Co. to be held on Tuesday, June 4, 2024, at 9:00 a.m. (Eastern Daylight Time), where we will vote on the matters below. You will be able to attend the Annual Meeting, vote and submit questions via a live webcast by visiting www.virtualshareholdermeeting.com/OGN2024. The Notice of Internet Availability of Proxy Materials is first being mailed, and the proxy materials are first being made available to our shareholders on or about April 25, 2024.

Items of Business:

| • | Election of the four Class III directors named in the accompanying proxy statement to hold office for a one-year term until the 2025 Annual Meeting of Shareholders; |

| • | Approval, on a non-binding advisory basis, of the compensation of our named executive officers; |

| • | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024; and |

| • | Consideration of such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Thank you for your continued support of and interest in Organon.

Sincerely,

Kirke Weaver

General Counsel and Corporate Secretary

April 25, 2024

Your Vote is Important—Vote Right Away

We encourage you to read the accompanying proxy statement with care and vote right away using any of the following methods, even if you intend to attend the Annual Meeting webcast. Voting early will help avoid additional solicitation costs and will not prevent you from voting during the Annual Meeting, if you wish to do so.

|

|

BY INTERNET |

www.proxyvote.com |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON June 4, 2024:

The Notice of Annual Meeting of Shareholders, proxy statement, and Organon’s 2023 Annual Report on Form 10-K are available free of charge at www.proxyvote.com. | |||

|

|

BY PHONE |

In the U.S. or Canada, dial toll-free | ||||

|

|

BY QR CODE |

Scan this QR code to vote with your | ||||

|

|

BY MAIL |

If you received printed copies of the proxy materials, cast your ballot, sign your proxy card or proxy voting instruction form and send back using the in our prepaid envelope and send in our prepaid envelope |

|

|

|

||||||

|

|

||||||

To vote by Internet or telephone, have the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form in hand and follow the instructions. Internet and telephone voting facilities will close at 11:59 p.m. Eastern Daylight Time on June 3, 2024. If your shares are held in a stock brokerage account or by a bank or other nominee, your ability to vote by Internet or telephone depends on your broker’s voting process. Please follow the directions provided to you by your broker, bank, or nominee. For additional information, please refer to the Questions and Answers About the Annual Meeting and Voting section beginning on page 88.

To be admitted to the virtual meeting, have the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form in hand and visit www.virtualshareholdermeeting.com/OGN2024.

Only shareholders listed on Organon’s records at the close of business on April 8, 2024, the record date, are entitled to vote. A list of shareholders of record as of the record date will be available during regular business hours for 10 days ending on the day before the date of the Annual Meeting at the Office of Corporate Secretary at our corporate headquarters located at 30 Hudson Street, Floor 33, Jersey City, New Jersey 07302.

If you have any questions or need assistance voting your shares, please contact Morrow Sodali LLC, our proxy solicitor, by calling 800-662-5200 (or banks and brokers can call collect at 203-658-9400), or by emailing OGN.info@investor.morrowsodali.com.

| 2024 Proxy Statement |

| Table of Contents

|

||||

|

| ||||

| Shareholder Proposals and Director Nominations for the 2025 Annual Meeting of Shareholders | 94 | |||

| Other Matters | 95 | |||

| Appendix A | A-1 | |||

|

Index of Frequently Referenced Pages _______

|

|

||||||

| Board Meeting Attendance | 13 | |||||||

| Board Skills and Experience Matrix | 20-21 | |||||||

| Board Diversity | 22-23 | |||||||

| Board Continuing Education | 24 | |||||||

| Board Evaluation | 24-25 | |||||||

| Auditor Fees | 85-86 | |||||||

| How to Vote | 90-91 | |||||||

|

Compensation Highlights _______

|

|

||||||

| Elements of 2023 Director Compensation | 43 | |||||||

| Executive Compensation Practices | 52 | |||||||

| How Compensation Decisions are Made | 53 | |||||||

| Elements of 2023 Compensation Program | 56 | |||||||

| Clawback Policy | 64 | |||||||

| Hedging and Pledging | 65 | |||||||

|

| Forward-Looking Statements

|

||||||

|

| ||||||

This proxy statement includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectations about Organon’s ESG strategy, and the expected benefits of Organon’s ESG efforts, as well as Organon’s future financial performance and prospects, including those relating to Organon’s ability to drive profitable growth, remain disciplined with respect to operating costs, and invest in new opportunities that complement Organon’s strengths. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning. These statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited to, an inability to execute upon our ESG strategy within expected timeframes, if at all; an inability to execute on our business development strategy and commercialization strategy or realize the benefits of our planned acquisitions; an inability to adapt to the industry-wide trend toward highly discounted channels; changes in tax laws or other tax guidance that could adversely affect our cash tax liability, effective tax rates, and results of operations and lead to greater audit scrutiny; efficacy, safety, or other quality concerns with respect to marketed products, including market actions such as recalls, withdrawals, or declining sales; political and social pressures, or regulatory developments, that adversely impact demand for, availability of, or patient access to contraception or fertility products; general economic factors, including interest rate fluctuations, inflation, recessionary pressures, and currency exchange rate fluctuations; general industry conditions and competition; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment; technological advances; new products and patents attained by competitors; the impact of higher selling and promotional costs; any failure by Organon to obtain an additional period of market exclusivity in the United States for Nexplanon subsequent to the expiration of certain key patents in 2027; challenges inherent in new product development, including obtaining regulatory approval; the company’s ability to accurately predict its future financial results and performance; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; difficulties developing and sustaining relationships with commercial counterparties; dependence on the effectiveness of the company’s patents and other protections for innovative products; and the exposure to litigation, including patent litigation, and/or regulatory actions.

The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the company’s filings with the Securities and Exchange Commission (“SEC”), including the company’s Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent SEC filings, available at the SEC’s Internet site (www.sec.gov). In addition, our environmental, social and governance (“ESG”) goals are aspirational and may change. Statements regarding our goals are not guarantees or promises that they will be met.

Website References

Throughout this proxy statement, we identify certain materials that are available in full on our website and refer the reader to additional information available on our website. The information contained on, or available through Organon’s internet website, is not and shall not be deemed to be incorporated by reference in this proxy statement.

| 1 | 2024 Proxy Statement |

| Proxy Statement Summary

|

||||||

|

|

||||||

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board”) for use at the 2024 Annual Meeting of Shareholders of Organon & Co. (“Organon,” the “company,” “we,” “us,” or “our”). Please review the entire proxy statement and Organon’s 2023 Annual Report on Form 10-K (the “Annual Report”) before voting. The voting items expected to be proposed at the meeting are listed below along with the Board’s voting recommendations.

2024 Annual Meeting of Shareholders

|

|

|

|

||||||

| Time

|

Meeting Date

|

Location

|

||||||

| 9:00 a.m.

|

Tuesday June 4, 2024

Record Date April 8, 2024 |

Via webcast at www.virtualshareholder

|

||||||

| Voting Matters |

Page | Board’s Recommendation | ||||

| Proposal 1 |

Election of the Four Class III Directors Named Herein |

30 | FOR each Nominee | |||

| Proposal 2 |

Approval, on a Non-Binding Advisory Basis, of the Compensation of Organon’s Named Executive Officers | 45 | FOR | |||

| Proposal 3 |

Ratification of the Appointment of PricewaterhouseCoopers LLP as Organon’s Independent Registered Public Accounting Firm for 2024 | 85 | FOR | |||

|

2 |

| Proxy Statement Summary | ||||||

|

| ||||||

Who We Are

Organon is a global healthcare company formed with the vision to improve the health of women. We are the only global company of our size focused on women’s health. Organon has a portfolio of more than 60 medicines and products across a range of therapeutic areas.

We focus on three key areas to achieve our vision of a better and healthier every day for every woman:

|

|

Women’s Health We believe that women are the foundation of a healthier world, and we know that women need more choices when it comes to their health care. We plan to continue building on our strengths in reproductive health and fertility as we assemble a suite of health options that help address the areas of high unmet needs for women.

| |

|

Biosimilars Biosimilars, which are approved by regulators as being highly similar to approved biologic medicines, are used to treat a range of serious conditions. They offer patients more treatment options and reduce costs compared to biologics—potentially helping expand access to biologic medicines.

| |

|

Established Brands Our established brands include well-known products, which generally are beyond market exclusivity, across a range of therapeutic areas including respiratory, cardiovascular, dermatology, non-opioid pain management, and more.

| |

Led by the women’s health portfolio coupled with an expanding biosimilars business and stable franchise of established medicines, Organon’s products produce strong cash flows that will support investments in innovation and future growth opportunities. In addition, Organon is pursuing opportunities to collaborate with biopharmaceutical innovators looking to commercialize their products by leveraging its scale and presence in fast growing international markets.

Organon has a global footprint with significant scale and geographic reach, and world-class commercial capabilities. As of December 31, 2023, Organon had approximately 10,000 employees worldwide and is headquartered in Jersey City, New Jersey.

On June 2, 2021, Organon separated from Merck & Co., Inc. (“Merck”; known as MSD outside the U.S. and Canada) as a result of a pro rata distribution of Organon’s common stock to shareholders of Merck. We refer to this transaction as the “spinoff.” Since 2021, Organon has been a standalone public company with common stock trading on the New York Stock Exchange (the “NYSE”) under the ticker symbol “OGN.” Organon is also a member of the S&P SmallCap 600 index.

| 3 | 2024 Proxy Statement |

|

|

||||||

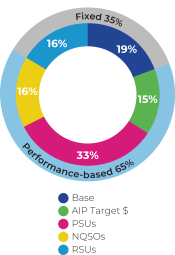

Executive Compensation Highlights (Page 50)

The Talent Committee oversees our executive compensation program, which is designed to support our executive compensation philosophy and objectives, align executive pay with shareholder interests and promote our ongoing business strategy. The Talent Committee will review and consider modifications to our executive compensation program to reflect our business strategy, performance, and evolving corporate governance practices.

Our executive compensation practices demonstrate our commitment to responsible pay and governance principles. For additional information on the components of our 2023 executive compensation, please refer to the Compensation Discussion and Analysis (“CD&A”), beginning on page 50.

Say-on-Pay Advisory Vote (Page 53)

In 2023, shareholders demonstrated their support for our executive compensation program with approximately 93% of the votes cast voted in favor of the say-on-pay proposal. Consistent with Organon’s strong interest in shareholder engagement and our pay-for-performance approach, the Talent Committee continues to evaluate our executive compensation program to promote alignment between the respective interests of our executives and shareholders.

We ask that our shareholders approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) as further described in Proposal 2 on page 45.

|

4 |

| Proxy Statement Summary | ||||||

|

| ||||||

Corporate Governance Highlights (Page 9)

We actively monitor our corporate governance practices to ensure we continue to manage our business in accordance with high standards of ethics, business integrity, and corporate governance. Our corporate governance practices empower the Board to set objectives and monitor performance, and strengthens the accountability of the Board and management. For this reason, we devote considerable time and resources to making sure that:

· our policies reflect our values and business goals;

· we operate in an open, honest, and transparent way; and

· we have an effective corporate governance structure.

We highlight some significant aspects of our corporate governance practices and policies below.

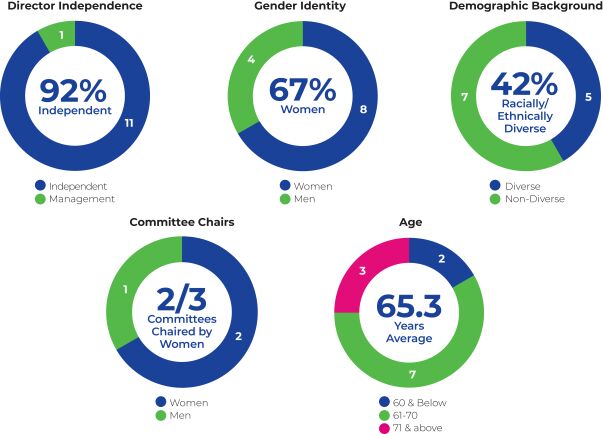

| Independent Leadership

• The Chairman of the Board is independent.

• Eleven of our 12 directors are independent.

• Our independent directors hold regular executive sessions.

• All three of our standing Board committees are composed solely of independent directors.

Director Accountability

• Directors are elected by majority vote.

• Directors who do not receive a majority vote are required to submit their offer to resign from the Board for the Board’s consideration.

• Annual election of all directors starting at Organon’s 2025 annual meeting of shareholders.

Best Practices

• We conduct Board, Board committee and individual director evaluations annually.

• The Board actively engages in succession planning for the CEO.

• Directors may not stand for re-election after age 75.

• We have an overboarding policy that limits the number of public company boards on which directors may serve.

• The Board is diverse in terms of gender, ethnicity, experience, and skills.

• Our Principles of Corporate Governance include a comprehensive Diversity Policy.

• The Board and its committees have a robust risk oversight program.

Alignment with Shareholder Interests

• We have a proxy access provision in our Bylaws whereby shareholders who own 3% of Organon common stock for at least three years may nominate up to 20% of the members of our Board, subject to compliance with Bylaw provisions.

• We do not have a shareholder rights plan (also known as a poison pill). |

• We do not have any supermajority voting provisions.

• Directors and executive officers are subject to stock ownership guidelines.

• We have an active shareholder engagement program, as described more fully on page 25.

Environmental, Social, and Governance (ESG)

• Proactive management of ESG risks and opportunities is integrated into our long-term business strategy.

• The Board’s committees have robust, independent oversight of various ESG topics, including the Audit Committee’s oversight of cybersecurity and compliance matters, the Talent Committee’s oversight of human capital management, and the ESG Committee’s oversight of governance, product quality, corporate reputation and other sustainability matters.

• We have established clear and measurable ESG initiatives and are taking action to make progress toward them over time. For information about our efforts and progress on these initiatives, please visit our website at www.organon.com/about-organon/environmental-social-governance.

• We actively engage shareholders and other stakeholders to understand their ESG priorities and address any questions or concerns.

• Our second ESG Report was published in June 2023. We are preparing our third ESG Report, which we expect to publish in Summer 2024.

|

| 5 | 2024 Proxy Statement |

|

|

||||||

Our Continuing Directors and Director Nominees (Page 31)

Our directors and director nominees possess broad expertise, skills, experience, and perspectives to provide the strong oversight and strategic direction required to govern Organon’s business and strengthen and support senior management. As illustrated by the following charts, our directors and director nominees consist of individuals with expertise in fields that align with Organon’s business and long-term strategy and reflect the Board’s commitment to diverse perspectives.

The following provides summary information about each director nominee and continuing director. Detailed information about each individual’s background, skill sets, and areas of expertise can be found beginning on page 31.

| Committee Memberships | ||||||||||||||||||||||||||||

|

|

Name |

Age | Director Since |

Term Expiring |

Primary Occupation | Audit | Talent | ESG | ||||||||||||||||||||

| Class III Directors Standing for Election at the Annual Meeting |

|

|

|

| ||||||||||||||||||||||||

|

|

Kevin Ali |

63 | 2021 | 2024 | Chief Executive Officer, Organon & Co. | |||||||||||||||||||||||

|

|

Martha E. McGarry |

72 | 2021 | 2024 | Partner, Mayer Brown LLP | ● | ||||||||||||||||||||||

|

|

Philip Ozuah, M.D., Ph. D. |

61 | 2021 | 2024 | President and Chief Executive Officer, Montefiore Medicine | ● | ||||||||||||||||||||||

|

|

Shalini Sharp |

49 | 2021 | 2024 | Former Executive Vice President and Chief Financial Officer, Ultragenyx Pharmaceutical Inc. | ● | ||||||||||||||||||||||

● = Committee Chair ● = Committee Member

|

6 |

| Proxy Statement Summary | ||||||

|

| ||||||

| Committee Memberships | ||||||||||||||||||||||||||||

|

|

Name(1) |

Age | Director Since |

Term Expiring |

Primary Occupation | Audit | Talent | ESG | ||||||||||||||||||||

| Directors Continuing in Office |

|

|

|

| ||||||||||||||||||||||||

|

|

Robert Essner |

76 | 2021 | 2025 | Former Chairman, Chief Executive Officer and President, Wyeth Pharmaceuticals, Inc. |

|

|

|

|

|

|

● | ||||||||||||||||

|

|

Rochelle “Shelly” B. Lazarus |

76 | 2021 | 2025 | Chairman Emeritus of Ogilvy & Mather |

|

|

|

|

|

|

● | ||||||||||||||||

|

|

Cynthia M. Patton |

62 | 2021 | 2025 | General Counsel and Corporate Secretary, Tessera Therapeutics | ● |

|

|

|

|

|

| ||||||||||||||||

|

|

Grace Puma |

61 | 2021 | 2025 | Former Executive Vice President, Chief Operations Officer, PepsiCo, Inc. |

|

|

|

● |

|

|

| ||||||||||||||||

|

|

Carrie S. Cox Board Chairman |

66 | 2021 | 2025 | Former Chief Executive Officer of Humacyte, Inc., former EVP of Schering-Plough and current Chairman of Solventum Corporation and Cartesian Therapeutics, Inc. |

|

|

|

● | ● | ||||||||||||||||||

|

|

Alan Ezekowitz, M.D. |

70 | 2021 | 2025 | Advisory Partner, Third Rock Ventures, LLC, Former CEO and Co—Founder of Abide Therapeutics, and Former SVP and Franchise Head Merck Research Laboratories | ● |

|

|

|

|

|

| ||||||||||||||||

|

|

Helene Gayle, M.D. |

68 | 2021 | 2025 | President of Spelman College |

|

|

|

|

|

|

● | ||||||||||||||||

|

|

Deborah Leone |

59 | 2021 | 2025 | Former Partner & Chief Operating Officer, Investment Management, Goldman Sachs Group, Inc. | ● |

|

|

|

|

|

| ||||||||||||||||

● = Committee Chair ● = Committee Member

| (1) | Ma. Fatima de Vera Francisco, who is currently serving as a Class III director, is not being nominated for re-election at this Annual Meeting, and, as such, she is not standing for re-election at this Annual Meeting. Her term will expire at this Annual Meeting, at which time the size of the Board will be automatically reduced to twelve directors. |

| 7 | 2024 Proxy Statement |

|

|

||||||

Director Qualifications and Expertise

Our continuing directors and director nominees are responsible for overseeing the company’s business consistent with their fiduciary duties. This significant responsibility requires highly skilled individuals with various qualities, attributes, and professional experiences. We believe the Board is well-rounded, with a balance of relevant perspectives and experience, as illustrated by the following chart.

| Executive Leadership / |

· | · | · | · | · | · | · | · | · | · | · | · | 100% | |||||||||||||||||

| Financial / Accounting |

· | · | · | · | · | · | · | · | · | · | · | · | 92% | |||||||||||||||||

| Global Healthcare |

· | · | · | · | · | · | · | · | · | · | · | · | 83% | |||||||||||||||||

| Marketing, Sales or |

· | · | · | · | · | · | · | · | · | · | · | · | 42% | |||||||||||||||||

| Public Policy / Regulatory |

· | · | · | · | · | · | · | · | · | · | · | · | 92% | |||||||||||||||||

| Public Company Board Experience |

· | · | · | · | · | · | · | · | · | · | · | · | 100% | |||||||||||||||||

| Global Business Experience |

· | · | · | · | · | · | · | · | · | · | · | · | 100% | |||||||||||||||||

| Human Capital Management |

· | · | · | · | · | · | · | · | · | · | · | · | 100% | |||||||||||||||||

| Manufacturing/Operational |

· | · | · | · | · | · | · | · | · | · | · | · | 33% | |||||||||||||||||

| Mergers & Acquisitions/ |

· | · | · | · | · | · | · | · | · | · | · | · | 83% | |||||||||||||||||

| Research & Development/ |

· | · | · | · | · | · | · | · | · | · | · | · | 50% | |||||||||||||||||

|

8 |

| Corporate Governance

|

||||||

|

| ||||||

The Board has the legal responsibility for overseeing the management of Organon and its business. The Board’s primary mission is to represent and protect the interests of our shareholders. To that end, the Board selects the CEO and oversees the senior management team, which is charged with conducting Organon’s daily business.

The Board has adopted corporate governance principles (the “Principles of Corporate Governance”) that, together with our Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws, and Board committee charters, form the governance framework for the Board and its committees. The Principles of Corporate Governance cover a wide range of subjects, including the role and composition of the Board; functioning of the Board and Board committees; director qualifications; diversity, overboarding, resignation, and retirement age policies; director compensation; share ownership guidelines; succession planning; evaluation of the CEO; director orientation and continuing education; Board, committee, and director performance evaluations; and shareholder engagement.

The Principles of Corporate Governance and Board committee charters are reviewed at least annually and revised, as appropriate, in response to changing legal, regulatory and stock exchange listing requirements, evolving best practices and the perspectives of our shareholders and other constituents.

Governance Materials

The following items relating to corporate governance at Organon are available on our website at

https://www.organon.com/about-organon/leadership/corporate-governance/

| ● | Amended and Restated Certificate of Incorporation | ● | Amended and Restated Bylaws | |||||

| ● | Principles of Corporate Governance | ● | Board Committee Charters | |||||

In addition, as part of our ethics and compliance program, our Board has approved a Code of Conduct, which is available on our website at www.organon.com/about-organon/mission-vision-and-values/code-of-conduct. The information contained on or accessible through our website does not constitute a part of this proxy statement and is not incorporated herein by reference.

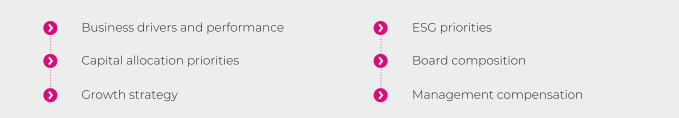

Board’s Role in Strategic Planning

The Board — acting both as a whole and through its three standing committees — is fully engaged and involved in Organon’s strategic planning process. Each director has an obligation to keep informed about Organon’s business and strategies, so they can provide guidance to management in formulating and developing plans and knowledgeably exercise their decision-making authority on matters of importance to Organon.

The Board’s oversight and guidance are inextricably linked to the development and review of Organon’s strategic plan. By exercising sound and independent business judgment on the strategic issues important to Organon’s business, the Board facilitates its long-term success.

Risk Oversight

The Board’s oversight of Organon’s risk is an important component of the Board’s engagement on strategic planning, and the Board has two primary methods of overseeing risk. The first method is through Organon’s Enterprise Risk Management (“ERM”) process, which allows for Board oversight of the most significant risks facing Organon. The second method is through the functioning of the three standing committees of the Board — the Talent Committee, the Audit Committee, and the Environmental, Social and Governance Committee (“ESG Committee”).

| 9 | 2024 Proxy Statement |

|

|

||||||

Management has established the ERM process to facilitate a complete company-wide approach to evaluating risk over six distinct but overlapping risk areas:

| Responsibility and Reputation

|

Risks that may impact the well-being of Organon and its employees, customers, patients, communities, or reputation | |

| Strategy

|

Macro risks that may impact our ability to achieve long-term business objectives | |

| Operations

|

Risks related to our operations, cybersecurity and climate change that may impact our ability to achieve business objectives | |

| Compliance

|

Risks related to compliance with laws, regulations, and Organon’s values, ethics, and policies | |

| Reporting

|

Risks to maintaining accurate financial statements and timely, complete public company financial reporting | |

| Safety

|

Risks to employee, patient, customer, or community health and safety | |

The goal of the ERM process is to provide an ongoing effort, implemented across Organon and aligned to its values and ethics, to identify and assess risk and to monitor risk and agreed-upon mitigating actions. If the ERM process identifies a material risk, it is elevated to the CEO and the Executive Leadership Team for review and then to the Board for review as part of our ERM update. The Audit Committee periodically reviews the ERM process to evaluate whether it is sufficiently robust and functioning effectively.

Each Board committee oversees specific areas of risk relevant to the committee through direct interactions with the CEO, the Executive Leadership Team, the heads of business franchises, and/or compliance and corporate functions. A committee may address risks directly with management or, where appropriate, may elevate a risk for consideration by the Board or another Board committee. The following are examples of Board committees’ responsibilities in risk oversight:

| • | The Audit Committee has primary responsibility for overseeing Organon’s risk-management program relating to cybersecurity, although the Board participates in periodic reviews and discussion dedicated to cyber risks, threats, and protections, as discussed under Board Oversight of Information Security, including Cybersecurity and Data Privacy. The Audit Committee also oversees risk relating to finance, business integrity, compliance, and internal controls, disclosure controls, and related financial reporting through its interactions with the Chief Financial Officer, the General Counsel, the Chief Ethics and Compliance Officer, the Controller, and the Head of Internal Audit. |

| • | The Talent Committee has risk oversight responsibilities over our policies and practices with respect to our executive compensation program. The Talent Committee also has oversight of Organon’s programs, policies, and practices related to its management of human capital resources, including talent and diversity. |

| • | The ESG Committee oversees Organon’s corporate governance, including the practices, policies, and procedures of the Board and its committees, considers the size, structure, and needs of the Board, reviews possible candidates for the Board, recommends director nominees to the Board for approval, and plays a role in ESG-related risk and compliance oversight. |

The ERM process and Board committee approach to risk management leverages the Board’s leadership structure to facilitate the Board’s oversight of risk on both an enterprise-wide approach and through specific areas of competency.

|

10 |

| Corporate Governance | ||||||

|

| ||||||

Board Oversight of Information Security, Including Cybersecurity and Data Privacy

Our Audit Committee has primary responsibility for overseeing our risk-management program relating to cybersecurity, although the Board participates in periodic reviews and discussion dedicated to cyber risks, threats, and protections. Our information security and privacy programs provide that the Board receives an annual report from our Chief Information Security Officer and Chief Ethics and Compliance Officer to discuss our program for managing information security risks, including data security risks, the risk of cybersecurity incidents and, if applicable, remediation of any potential cybersecurity incidents. The Audit Committee also receives regular briefings on both information security and data privacy from the Chief Information Security Officer and Chief Ethics and Compliance Officer, respectively, and meets at least annually with our Chief Information Security Officer regarding our information technology. The Audit Committee receives periodic updates regarding our cybersecurity risk management program, and reports to the Board on the principal risks facing us and the steps being taken to manage and mitigate these risks. Both the Board and the Audit Committee receive periodic reports on our cyber readiness, security controls and our cybersecurity investments. In addition, our directors are apprised of incident simulations and response plans, including for cyber and data breaches. For additional information, please see Item 1C. Cybersecurity included in our Form 10-K filed with the SEC on February 26, 2024.

Program Highlights

| Commitment to Transparency

|

We are committed to responsible handling of personal information under data privacy laws. We balance the need to operate and grow our business against our commitment to transparency and control, fairness, non-discrimination, and accountability. | |

| Security Programs

|

Our multi-layered information security and data privacy programs and practices are designed to foster the safe, secure, and responsible use of the information and data our stakeholders entrust to us. | |

| Governance

|

We work with our customers, governments, policymakers, and others to help develop and implement standards for safe and secure transactions. | |

| Security

|

Independent third parties test and audit our cybersecurity capabilities. | |

| System Tests

|

We regularly test our systems to discover and address any potential vulnerabilities. | |

| Employee Training

|

We conduct annual cybersecurity training for employees. | |

| Insurance Coverage

|

We maintain a business continuity program and cyber insurance coverage. | |

Independence of Directors

The Principles of Corporate Governance require a substantial majority of our directors to be independent. In making independence determinations, the Board observes all relevant criteria established by the SEC and the NYSE. The Board considers all relevant facts and circumstances in making an independence determination.

To be considered independent, an outside director must meet the bright-line independence tests established by the NYSE, and the Board must affirmatively determine that the director has no direct or indirect material relationship with Organon.

The Board also rigorously considers the heightened independence requirements for members of the Audit Committee and the Talent Committee. The ESG Committee reviews the Board’s approach to determining director independence periodically and recommends changes, as appropriate, for consideration and approval by the Board.

| 11 | 2024 Proxy Statement |

|

|

||||||

Independence Determinations

The Board has determined that each of Organon’s directors and director nominees, with the exception of our CEO, Kevin Ali—namely, Carrie S. Cox, Robert Essner, Alan Ezekowitz, M.D., Ma. Fatima de Vera Francisco, Helene Gayle, M.D., Rochelle B. Lazarus, Deborah Leone, Martha E. McGarry, Philip Ozuah, M.D., Ph.D., Cynthia Patton, Grace Puma, and Shalini Sharp—are independent under the NYSE Listing Standards. All members of the Board’s Audit Committee, Talent Committee, and ESG Committee are independent under these standards, and all members of the Audit Committee and Talent Committee meet the enhanced independence requirements for audit committee members and compensation committee members, respectively in the NYSE Listing Standards.

In making these determinations, the Board considered relationships that exist between Organon and other organizations where each director serves, as well as the fact that in the ordinary course of business, transactions may occur between such organizations and Organon or one of our subsidiaries. The Board also evaluated whether there were any other facts or circumstances that might impair a director’s independence.

Related Person Transactions

Related Person Transaction Policies and Procedures

The Board has adopted written Related Person Transaction Policies and Procedures (the “Related Person Policy”). The Related Person Policy, which is administered by the Audit Committee, governs the review, approval, ratification, or disapproval by the Audit Committee of transactions between us or any of our subsidiaries and any “related person” in which the amount involved since the beginning of our last completed fiscal year will or may be expected to exceed $100,000 and in which one or more of such related persons has a direct or indirect material interest. The Related Person Policy defines a “related person” to include anyone who served as a director, director nominee, or executive officer since the beginning of Organon’s last fiscal year, any greater than 5% shareholder, or any immediate family member of any of those persons.

Pursuant to the Related Person Policy, management will provide the Audit Committee all material information relevant to transactions that require the Audit Committee’s approval. In approving or disapproving any such transaction, the Audit Committee will consider all relevant factors, including, as applicable, Organon’s business rationale for entering into the transaction, the alternatives to entering into the transaction, whether the transaction is on terms comparable to those generally available to an unaffiliated third party under the same or similar circumstances, the extent of the related person’s interest in the transaction, and the potential for the transaction to lead to an actual or apparent conflict of interest. Any member of the Audit Committee who is deemed a related person with respect to a transaction under review will not be permitted to participate in the discussion or approval of the transaction.

The Audit Committee will review and assess ongoing related person transactions as necessary throughout the duration of their term, but no less than annually, to help ensure that the transactions are in compliance with any Audit Committee guidelines and the transactions remain fair and reasonable to Organon and consistent with the interests of Organon and its shareholders.

Certain Related Person Transactions

Each director, director nominee and executive officer of Organon is required to annually complete a Director & Officer (“D&O”) Questionnaire. The D&O Questionnaire requests, among other things, information regarding whether any director, director nominee, executive officer, or their immediate family members had an interest in any related person transaction or proposed transaction with Organon or its subsidiaries or has a relationship with a company that has entered or proposes to enter into such a transaction.

After review of the D&O Questionnaires by the Office of Corporate Secretary, the responses are collected, summarized, and distributed to responsible areas within Organon to identify any potential related person transactions. All relevant relationships and any transactions, along with payables and receivables, are compiled for each person and affiliation. Management submits a report of the affiliations, relationships, transactions, and

|

12 |

| Corporate Governance | ||||||

|

| ||||||

appropriate supplemental information to the Audit Committee for its review. Based on this information, the Audit Committee has determined that since January 1, 2023, there have been no transactions that require disclosure under Item 404(a) of SEC Regulation S-K.

Board Leadership Structure

|

|

| |||||||||

| The Board annually reviews its leadership structure to evaluate whether it remains |

||||||||||

|

Carrie S. Cox serves as independent Chairman of the Board and Kevin Ali serves as our CEO. The Board believes that this leadership structure, which separates the Chairman and CEO roles, is optimal at this time. With separate Chairman and CEO roles, our independent Chairman can lead the Board in the performance of its duties by establishing agendas, presiding at all meetings of the Board and executive sessions of non-management directors, engaging with the CEO and executive leadership team between Board meetings on business developments, and providing overall guidance to our CEO as to the Board’s views and perspectives, particularly on the strategic direction of Organon. Meanwhile, our CEO can focus his time and energy on setting Organon’s strategic direction, overseeing daily operations, engaging with external constituents, developing our leaders, and promoting employee engagement at all levels of the organization. The Board believes our governance practices help ensure that skilled and experienced independent directors provide independent leadership.

|

||||||||||

Board Meetings and Committees

Under the Principles of Corporate Governance, directors are expected to attend regular Board meetings, applicable Board committee meetings, and the annual meetings of shareholders. All directors attended at least 75% of the meetings of the Board and of the Board committees on which they served in 2023. Organon held its 2023 annual shareholder meeting on June 6, 2023. All thirteen directors then serving on the Board attended the 2023 annual meeting of shareholders.

The Board met five times in 2023 and the independent directors of the Board met in five executive sessions in 2023. Ms. Cox, Chairman of the Board, presided over the executive sessions.

The Board’s three standing committees, each of which is made up solely of independent directors, are the Audit, Talent and ESG Committees. In addition, the Board from time to time may establish other committees to focus on particular issues as the need arises. All standing committees are governed by Board-approved charters, which are available on our website at https://www.organon.com/about-organon/leadership/corporate-governance/. Each committee evaluates its performance and reviews its charter annually. Additional information about the committees is provided on the following pages. Our CEO, Mr. Ali, is not an independent director under NYSE Listing Standards and is therefore not a member of any standing Board committee with an independence requirement. The primary functions, current committee membership and the number of meetings each committee held in 2023 are further described below.

| 13 | 2024 Proxy Statement |

|

|

||||||

Audit Committee

|

Shalini Sharp Chair

Other Members Alan Ezekowitz, M.D. Deborah Leone Cynthia M. Patton

Financial Experts on Audit Committee

The Board has determined that each member of the Audit Committee is financially literate and that each of Mss. Leone and Sharp is an “audit committee financial expert” as defined by the SEC and has accounting or related financial management expertise as required by the NYSE Listing Standards. |

Overview

The Audit Committee oversees our accounting and financial reporting processes, internal controls and audits, and Organon’s risk management process. The Audit Committee also consults with management, the internal auditors, and our independent auditors on, among other items, matters related to the annual audit, the published financial statements, and the accounting principles applied. The Audit Committee has established policies and procedures for the pre-approval of all services provided by our independent auditors (as described on page 86 of this proxy statement).

The Audit Committee’s Report is included on page 87 of this proxy statement.

The Primary Functions of this Committee Include:

• Assisting our Board in fulfilling its oversight responsibility relating to: (i) the integrity of our financial statements and financial statement audits; (ii) our and our subsidiaries’ accounting and financial reporting processes and system of internal controls over financial reporting and disclosures; (iii) our compliance with legal and regulatory requirements; (iv) the independent public accountants’ qualifications and independence; (v) the performance of our internal audit function and our independent public accountants; (vi) our risk management processes; and (vii) preparation of the annual report required by the SEC rules to be included in our annual proxy statement;

• Being directly responsible for the appointment (subject to ratification by our shareholders), compensation, retention and oversight of the work of our independent public accountants (including the resolution of disagreements between management and the independent public accountants regarding financial reporting);

• Evaluating the independent public accountants’ qualifications, performance and independence, including a review and evaluation of the lead partner and partner rotation requirements;

• Monitoring our compliance program with respect to legal and regulatory requirements, our code(s) of conduct and our policies on ethical business practices and reporting on these items to the Board;

• Establishing and periodically reviewing policies and procedures for the review, approval, and ratification of related person transactions, as defined in applicable SEC rules and the NYSE Listing Standards, and reviewing and approving, disapproving, or ratifying related person transactions in accordance with these policies and procedures, and overseeing other related person transactions governed by applicable accounting standards;

• Establishing and overseeing procedures for handling (receipt, retention and treatment, on a confidential basis) of complaints of potential misconduct, including: (i) violations of law or our code(s) of conduct; (ii) complaints regarding accounting, internal accounting controls, auditing, and federal securities law matters; and (iii) the confidential, anonymous submission of concerns by employees regarding accounting, internal accounting controls, auditing, and federal securities law matters; and

• Periodically reviewing our enterprise risk assessment policies and processes, including meeting at least annually with our Chief Information Security Officer regarding our information technology and receiving periodic updates regarding our cybersecurity risk management program, and reporting to the Board on the principal risks facing us and the steps being taken to manage and mitigate these risks. | |||||

|

14 |

| Corporate Governance | ||||||

|

| ||||||

Talent Committee

|

Carrie S. Cox Chair

Other Members(1) Martha E. McGarry Grace Puma

Compensation Committee Interlocks and Insider Participation

There were no Talent Committee interlocks or insider (employee) participation during 2023.

(1) Ma. Fatima de Vera Francisco, who is currently serving as a member of the Talent Committee, is not standing for re-election at this Annual Meeting. Effective as of the Annual Meeting, the Talent Committee will consist of three members, including the Chair. |

Overview

The Talent Committee oversees our overall compensation philosophy, policies and programs, and assesses whether the company’s compensation philosophy establishes appropriate incentives for management and employees. The Talent Committee also oversees our human capital management, including leadership development, diversity and inclusion, and workplace culture. The details of the processes and procedures involved are described in the CD&A beginning on page 50. The Talent Committee may delegate its duties and responsibilities to one or more subcommittees as it determines appropriate. The independent members of the Board ultimately make the final decisions regarding the CEO’s compensation.

The Talent Committee’s Report is included on page 65 of this proxy statement.

The Primary Functions of this Committee Include:

• Reviewing and approving corporate goals and objectives relevant to the compensation of the CEO and the other executive officers, evaluating their performance against these goals and objectives, and, based on this evaluation, recommending to the independent directors of the Board the CEO’s compensation level and approving the compensation of the other executive officers;

• Overseeing succession planning for positions held by executive officers, and reviewing succession planning and management development at least annually with the Board, including recommendations and evaluations of potential successors to fill these positions;

• Regularly reviewing the form and amount of compensation of directors for service on the Board and its committees and recommending changes in compensation to the Board as appropriate;

• Reviewing and recommending for inclusion executive compensation disclosures made in our annual proxy statement, including the Compensation Discussion and Analysis and the Talent Committee Report;

• Reviewing our strategies and programs for leadership development and for maintaining a talent pipeline for executive roles;

• Reviewing and discussing with management our diversity and inclusion initiatives, objectives, and progress; and

• Reviewing and discussing with management our organizational development activities, including key policies, practices, and trends related to: (i) the recruitment, development, and retention of our personnel; (ii) employee engagement and effectiveness; and (iii) workplace environment and culture. |

| 15 | 2024 Proxy Statement |

|

|

||||||

Environmental,

Social and

Governance

Committee

|

|

Robert A. Essner Chair

Other Members Carrie S. Cox Helene Gayle, M.D. Shelly Lazarus Philip Ozuah, M.D., Ph.D.

|

|

Overview

The ESG Committee performs a leadership role in shaping Organon’s corporate governance, including by overseeing succession planning for the Board and its committees. The ESG Committee annually reviews the size, structure, and needs of the Board and Board committees, reviews possible candidates for the Board, and recommends director nominees to the Board for approval. The details of the review process and assessment of candidates are described under Criteria for Board Membership and Director Nomination Process beginning on page 19 of this proxy statement.

The Primary Functions of this Committee Include:

• Engaging in succession planning for the Board;

• Identifying individuals to become qualified Board members (consistent with criteria approved by the Board);

• Recommending to the Board director candidates for election at our annual meeting of shareholders;

• Reviewing and recommending changes to the Board of our corporate governance principles;

• Considering and making recommendations to the Board on other matters pertaining to the effectiveness of the Board;

• Periodically reviewing and recommending to the Board the skills, experience, characteristics, and other criteria for identifying and evaluating directors;

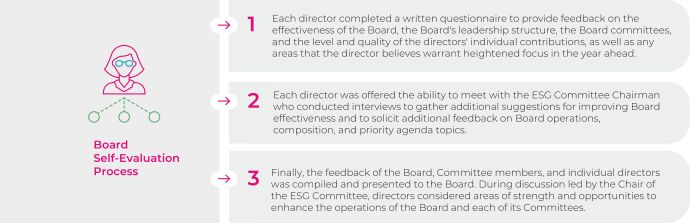

• Overseeing the annual evaluation of the Board, its committees, and individual directors;

• Overseeing compliance with the GxP requirements (i.e., regulations and guidelines applicable to life sciences organizations);

• Overseeing our shareholder engagement program and making recommendations to the Board regarding its involvement in shareholder engagement;

• Advising the Board and management on our policies and practices that pertain to our responsibilities as a global corporate citizen, our special obligations as a healthcare company whose products and services affect the health and quality of life around the world, and our commitment to the highest standards of ethics and integrity in all our dealings; and

• Reviewing public policy positions, strategy regarding political engagement, and corporate responsibility initiatives with significant financial or reputational impact, as appropriate, and overseeing and making recommendations to the Board regarding environmental, social, governance, and other sustainability matters and risks relevant to our business. |

|

16 |

| Corporate Governance | ||||||

|

| ||||||

Our Approach to Environmental, Social, and Governance

At Organon, our vision is to create a better and healthier every day for every woman. Our mission is to deliver impactful medicines and solutions for a healthier every day. We focus on the ESG and sustainability issues that matter most to our business, our stakeholders and women around the world.

In addition to the governance matters discussed within this proxy statement and the foundational elements that we believe are essential to conducting our business in an ethical, compliant, and transparent manner, there are focus areas within our ESG strategy that demonstrate our commitment to being a purpose-driven company1:

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

|

Working together with our partners, we aim to prevent an estimated 120 million unintended pregnancies by 2030. |

|

We aim to redefine and harness innovation in women’s health by dedicating a majority of our pre-clinical and clinical development activity toward areas that address the unmet health needs of women and girls.

We will work with partners to expand access to treatment options that improve her health and help secure her promise. |

|

We aim to achieve balanced gender representation through all levels of the company globally by 2030, and achieve pay equity. |

|

We aim to support the transition to a sustainable economy, with an ambition to achieve net zero green house gas (“GHG”) emissions and the integration of water stewardship and circular economy principles into our business models.

To meet these ambitions, we have set quantitative goals to reduce GHG emissions, water usage and waste in our operations and in our supply chain. |

|

We are committed to upholding the highest levels of ethics and integrity throughout our business.

Our highly capable Board of Directors is one of the most diverse in the healthcare industry. We aspire to maintain the expertise as well as diversity of thought and experience that characterizes our Board today. | |||||||||

| 1 Please refer to the Forward-Looking Statements on page 1. |

| |||||||||||||||||

Importance of ESG at Organon

At Organon, we are guided by our purpose — to help women achieve their promise through better health. Our ESG strategy helps to advance this purpose and is embedded into our business strategy. Building a strong, sustainable and resilient company requires that we consider long-term risks and opportunities presented by social, environmental and governance matters. Successfully navigating these challenges helps to mitigate political and reputational risk, drives employee engagement, and enhances our reputation as a responsible partner, all of which help create long-term value for shareholders and other stakeholders. Moreover, by addressing gender-related disparities in health, we are helping to build a more sustainable future for women, families, and society.

| 17 | 2024 Proxy Statement |

|

|

||||||

ESG Governance at Organon

We have developed practices and policies designed to promote strong Board oversight over the entirety of our ESG program.

|

Board of Directors

The full Board has oversight of Organon’s ESG strategy and performance and receives regular updates from management on these topics. |

Audit Committee engages on specific ESG topics such as cybersecurity, ethics and compliance with all ESG-related regulations.

| |||

| ESG Committee advises on policies and practices that pertain to our responsibilities as a global corporate citizen, and our special obligations as a healthcare company whose products and services affect health and quality of life around the world. The ESG Committee also reviews feedback from shareholder engagements on ESG, our ESG reporting and disclosure practices, and the company’s performance on priority ESG and sustainability issues, including environmental and product quality matters. As needed, the ESG Committee receives information from third-party consultants and other experts on relevant ESG topics to inform the Committee’s thought process and to encourage continuous knowledge-building in support of its ESG oversight role. | ||||

|

Management

The entire Executive Leadership Team is responsible for implementing Organon’s ESG strategy and is accountable for making progress against the goals and targets that have been set.

|

Talent Committee plays an important governance role on matters related to human capital management including executive compensation, employee engagement and workplace culture, and Organon’s diversity, equity, and inclusion programs. As discussed in the CD&A, beginning on page 60 under the heading “Organizational Health Priorities,” ESG performance was also embedded into the 2023 Company Scorecard, which impacted annual incentive payouts. The Talent Committee plays a role in the selection and oversight of the specific metrics from the ESG strategy that are included in the Company Scorecard.

| |||

| Executive Leadership Team is supported by a cross-functional Public Policy and ESG Council consisting of senior leaders within each function with direct responsibility for key areas of the ESG strategy. The General Counsel and Corporate Secretary reports directly to the CEO, is a member of the Executive Leadership Team and also co-chairs the Public Policy and ESG Council. He has a dedicated team of professionals, including the Heads of Environmental, Sustainability, and Corporate Responsibility and Safety, Health and Environment, which collaborate with internal stakeholders across the company to support progress against our ESG goals and targets and to promote timely and transparent ESG reporting.

|

Organon’s ESG Strategy

In 2021, immediately after the company’s spinoff, Organon embarked upon a robust process to develop its ESG strategy. We analyzed leading ESG reporting standards and frameworks including the Sustainability Accounting Standards Board (“SASB”), the Global Reporting Initiative (“GRI”), and the Task Force on Climate-Related Financial Disclosures (“TCFD”), conducted an ESG prioritization assessment, interviewed internal subject-matter experts, engaged our top shareholders, and sought input from a broad base of our employees. The Public Policy and ESG Council, the Executive Leadership Team, and the ESG Committee of the Board were consulted regularly during this process, and each approved the final plan, as did the full Board.

Organon published its first ESG Report in June 2022. The report included extensive disclosures, aligned with SASB and GRI standards, as well as our U.S. Equal Employment Opportunity Commission EEO-1 data for our U.S.-based workforce.

The 2022 ESG Report, our latest report published in June 2023, includes expanded and more detailed disclosures around our progress against our ESG goals and targets as well as our inaugural TCFD index. Furthermore, we submitted our first CDP Climate and Water reports. These enhanced disclosures have resulted in improved scores and rankings by key third-party ESG evaluators, such as ISS, MSCI, and Morningstar Sustainalytics, and we are pleased to have our efforts recognized by the Bloomberg Gender Equality Index and the JUST Capital Rankings.

|

18 |

| Corporate Governance | ||||||

|

| ||||||

In March 2023, we launched a three-year initiative called “Her Plan is Her Power.” This programming builds on our efforts to help reduce unplanned pregnancies and empower women and girls through a global collaboration with UNFPA, the United Nations sexual and reproductive health agency, that is focused on innovation, education, and advocacy; a global grants program that focuses on providing resources to help women and girls take control of their reproductive health; and new U.S. programming with NGOs to expand access to education, products, and other resources in so-called “contraceptive deserts” around the country and historically Black colleges and universities (HBCUs). These efforts contribute to our ESG goal of preventing 120 million unplanned pregnancies by reaching 100 million women and girls with affordable access to contraceptive options. At the end of 2022, we had reached approximately 47 million women with access to our contraceptive products since the beginning of the initiative.

For more information about Organon’s ESG strategy and initiatives, please review our 2022 data published in our 2022 ESG Report, which is available on our website at www.organon.com/about-organon/environmental-social-governance.

Criteria for Board Membership and Director Nomination Process

The ESG Committee is responsible for screening and nominating director candidates to be considered for election by the Board. As part of this process, the ESG Committee considers the composition of the Board at the time, including the depth of experience, balance of professional skills, expertise, and diversity of perspectives represented by its members. The ESG Committee evaluates prospective nominees identified on its own initiative as well as candidates recommended by other Board members, management, shareholders, or search consultants. From time to time, the ESG Committee may also retain a search firm to identify possible candidates who meet the Board’s qualifications, to interview and screen such candidates (including conducting reference checks), and to assist in scheduling candidate interviews with Board members.

Individual Experience, Qualifications, Attributes, and Skills

The ESG Committee evaluates the composition of the Board annually to assess whether the skills, experience, characteristics, and other criteria established by the Board are currently represented on the Board as a whole, and in individual directors, and to assess the criteria that may be needed in the future in light of Organon’s anticipated needs. The Board should have a balanced membership, with representation of relevant areas of experience, types of expertise, and backgrounds. These include pharmaceutical industry expertise, global management experience, marketing, sales and public relations skills, public company governance expertise, women’s health experience, medical expertise, risk management experience, and financial expertise. The ESG Committee uses this input in its planning and director search process.

Each of our current directors initially joined the Board in connection with our spinoff from Merck, and the Class I directors subsequently stood for election at our 2022 annual meeting of shareholders. At the 2023 annual meeting of shareholders, the Class II directors stood for election for a two-year term and were subsequently elected by our shareholders. The Class III Directors are standing for election by shareholders at the 2024 Annual Meeting for a one-year term ending at our 2025 annual meeting of shareholders. Beginning with our 2025 annual meeting of shareholders, all of our directors will be subject to annual election. As noted in the director biographies that follow this section, our directors have experience, qualifications, and skills across a wide range of public and private companies, possessing a broad spectrum of experience both individually and collectively. The following chart highlights the key background, experience, and skills the Board considered for qualification and is not intended to be an exhaustive list of our continuing directors’ and director nominees skills or contributions to the Board. These attributes are amply represented by our continuing directors’ and director nominees. Our continuing directors and director nominees have developed competencies in these skills through education, direct experience, and oversight responsibilities. Further information on each continuing director’s and director nominee’s qualifications and relevant experience is provided in the individual biographical descriptions beginning on page 31.

| 19 | 2024 Proxy Statement |

|

|

||||||

| Board Key Skills and Experience | ||||||||||||||||||||||||||

|

|

|

Ali | Cox | Essner | Ezekowitz | Gayle | Lazarus | Leone | McGarry | Ozuah | Patton | Puma | Sharp | |||||||||||||

|

|

Executive Leadership / CEO Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Financial / Accounting |

● | ● | ● | ● |

|

● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Global Healthcare |

● | ● | ● | ● | ● | ● |

|

● | ● | ● |

|

● | |||||||||||||

|

|

Marketing, Sales or Public Relations |

● | ● | ● |

|

|

● |

|

|

● |

|

|

| |||||||||||||

|

|

Public Policy / Regulatory |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

|

● | |||||||||||||

|

|

Public Company Board Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Global Business Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Human Capital Management |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

|

|

Manufacturing/Operational |

● | ● | ● |

|

|

|

|

|

|

|

● |

| |||||||||||||

|

|

Mergers & Acquisitions/Business Development |

● | ● | ● | ● |

|

● | ● | ● | ● | ● |

|

● | |||||||||||||

|

|

Research & Development/ |

● | ● | ● | ● | ● |

|

|

|

● |

|

|

| |||||||||||||

Skills Categories:

| Skill |

Description | Relevance to the Company | ||

|

|

Leadership experience for a significant enterprise, resulting in a practical understanding of organizations, processes, strategic development, and risk management. Demonstrated strengths in driving change and long-term growth, developing talent and planning succession.

|

Experience serving as a CEO or other prominent leader provides unique perspectives to assist the Board to independently oversee the Company’s executive leadership team, and increases understanding and appreciation of the various components of international organizations, including strategic planning, improving operations, financial reporting and compliance and risk oversight.

| ||

|

|

Significant experience in financial accounting and reporting processes or the financial management of a major organization. | Significant experience and understanding of finance and financial reporting is valuable to promote effective capital allocation, robust controls, and financial oversight. | ||

|

20 |

| Corporate Governance | ||||||

|

| ||||||

| Skill |

Description | Relevance to the Company | ||

|

Experience with global complex issues within the healthcare industry.

|

An understanding of the unique challenges of a global, heavily regulated healthcare company provides useful insight for assessing the Company’s strategy, challenges and opportunities.

| ||

|

|

Strategic or management experience on a global scale involving the marketing, advertising and branding of products. | Expertise in marketing, advertising and branding at a scale relevant to the Company’s global business promotes the Company’s ability to operate effectively in a highly competitive industry. | ||

|

|

Experience with public policy and regulation in the healthcare industry or other highly-regulated industries.

|

Experience with managing governmental and regulatory matters supports the Company’s business operations and provides valuable insights for navigating the heavily regulated healthcare industry.

| ||

|

|

Experience as a board member of another publicly-traded company or current or former executive officer of a publicly-traded company. | In-depth knowledge of public company reporting and the issues commonly faced by public companies supports our goals of strong Board and management accountability, transparency and long-term shareholder value. | ||

|

|

Extensive leadership experience leading an organization that operates internationally on a broad basis and/or in the geographic regions in which the company operates.

|

Provides practical insights on the challenges and opportunities the Company may encounter in diverse business environments, economic conditions, and cultures attributable to the Company’s global activities.

| ||

|

|

Experience with executive recruiting, talent development and retention, and succession planning. | Experience with human capital management responsibilities assists the Board in overseeing succession planning, talent development, attraction and retention, employee engagement and the Company’s executive compensation program.

| ||

|

|

Experience managing an organization or department responsible for manufacturing operations and/or supply of goods. | In-depth knowledge of global manufacturing operations increases the Board’s understanding to help the company maximize supply chain efficiency, distribution footprint and vendor management.

| ||

|

|

Significant experience with leading growth and development opportunities through mergers, acquisitions, licensing, and other business combinations. | Significant experience with mergers, acquisitions and other business combinations facilitates the Board’s oversight of management’s assessment of potential opportunities consistent with the Company’s strategic priorities.

| ||

|

|

Experience with scientific research and development or relevant experience as a healthcare provider. | Relevant scientific research and development expertise in the healthcare industry provides valuable insight and perspectives for the Company’s business and value creation initiatives.

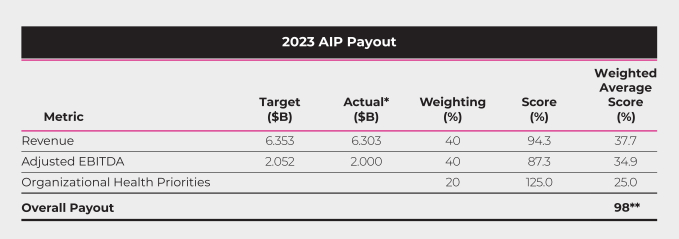

| ||