UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number:

(Exact Name of Registrant as Specified in Its Charter) |

|

N/A |

(Translation of Registrant’s Name into English) |

|

(Jurisdiction of Incorporation or Organization) |

|

People’s Republic of |

(Address of Principal Executive Offices) |

|

Telephone: Email: People’s Republic of |

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

(The Nasdaq Global Select Market) |

||

|

|

|

(The Nasdaq Global Select Market) |

* Not for trading, but only in connection with the listing our American depositary shares on the Nasdaq Global Select Market, each American depositary shares representing fifty Class A ordinary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

(Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, there were

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.☐ Yes ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer and large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

☒ |

|

Emerging Growth Company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ❑

Indicate by check mark which basis of accounting the registrant has been to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.☐ Yes ☐ No

TABLE OF CONTENTS

|

1 |

|||

2 |

||||

|

|

3 |

||

|

Item 1. |

|

3 |

|

|

Item 2. |

|

3 |

|

|

Item 3. |

|

3 |

|

|

Item 4. |

|

75 |

|

|

Item 4A. |

|

116 |

|

|

Item 5. |

|

116 |

|

|

Item 6. |

|

135 |

|

|

Item 7. |

|

147 |

|

|

Item 8. |

|

149 |

|

|

Item 9. |

|

150 |

|

|

Item 10. |

|

150 |

|

|

Item 11. |

|

166 |

|

|

Item 12. |

|

166 |

|

|

|

168 |

||

|

Item 13. |

|

168 |

|

|

Item 14. |

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

168 |

|

Item 15. |

|

168 |

|

|

Item 16A. |

|

169 |

|

|

Item 16B. |

|

169 |

|

|

Item 16C. |

|

169 |

|

|

Item 16D. |

|

170 |

|

|

Item 16E. |

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

170 |

|

Item 16F. |

|

170 |

|

|

Item 16G. |

|

171 |

|

|

Item 16H. |

|

171 |

|

|

Item 16I. |

|

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

171 |

|

Item 16J. |

|

171 |

|

|

Item 16K. |

|

171 |

|

|

|

173 |

||

|

Item 17. |

|

173 |

|

|

Item 18. |

|

173 |

|

|

Item 19. |

|

173 |

|

i

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references in this annual report on Form 20-F to:

Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

Our reporting currency is Renminbi because our business is mainly conducted through the VIEs and their subsidiaries in mainland China. This annual report on Form 20-F contains translations from RMB to U.S. dollars solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi in this annual report are made at a rate of RMB7.0999 to US$1.00, the exchange rate in effect as of December 29, 2023 as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, or at all.

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. The forward looking statements are contained principally in the sections entitled “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company—B. Business Overview,” and “Item 5. Operating and Financial Review and Prospects.” Known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company—B. Business Overview,” “Item 5. Operating and Financial Review and Prospects,” and other sections in this annual report. You should read thoroughly this annual report and the documents that we refer to with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

2

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Our Holding Company Structure and Contractual Arrangements with the VIEs

17 Education & Technology is not an operating company in mainland China but a Cayman Islands holding company with no equity ownership in the VIEs. We conduct our business in mainland China through (i) our mainland China subsidiaries, (ii) the VIEs with which we have maintained contractual arrangements, and (iii) the subsidiaries of the VIEs. Laws and regulations of mainland China restrict and impose conditions on foreign investment in value-added telecommunications services and certain other businesses. Accordingly, we operate these businesses in mainland China through the VIEs, and rely on contractual arrangements among our mainland China subsidiaries, the VIEs and their respective shareholders to control the business operations of the VIEs and their subsidiaries. This structure involves unique risks to investors. Investors in our ADSs are not purchasing equity interest in the VIEs in mainland China, but are instead purchasing equity interest in a holding company incorporated in the Cayman Islands. The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits direct foreign investment in the operating companies. If the PRC government determines that the contractual arrangements constituting part of the VIE structure do not comply with PRC laws and regulations, or if these laws and regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. The PRC regulatory authorities could disallow the VIE structure, which would likely result in a material adverse change in our operations, and our ADSs may decline significantly in value or become worthless. Revenues contributed by the VIEs and their subsidiaries accounted for 99.2%, 93.9% and 98.3% of our total revenues for 2021, 2022 and 2023, respectively. As used in this annual report, “we,” “us,” “our company” and “our” refers to 17 Education & Technology, our Cayman Islands holding company and its subsidiaries, and, in the context of describing our operations and consolidated financial information, the VIEs and the subsidiaries of the VIEs.

A series of contractual agreements, including proxy agreements and powers of attorney, equity interest pledge agreements, exclusive management services and business cooperation agreements, and exclusive call option agreements, have been entered into by and among our WFOEs, the VIEs and their respective shareholders. Terms contained in each set of contractual arrangements with the VIEs and their respective shareholders are substantially similar. As a result of the contractual arrangements, we have the power to direct the activities of the VIEs that most significantly affect the economic performances of the VIEs and are entitled to receive the economic benefits of the VIEs that could potentially be significant to the VIEs. Therefore, we have determined that we are the primary beneficiary of the VIEs for accounting purposes in accordance with ASC 810, Consolidations under U.S. GAAP, and have consolidated the VIEs’ results of operations, assets and liabilities in our consolidated financial statements for all the periods presented. Neither we nor our investors have an equity ownership in, direct foreign investment in, or control through such ownership or investment of, the VIEs, and the contractual arrangements are not equivalent to an equity ownership in the business of the VIEs. The entity in which investors own or can purchase their interest is 17 Education & Technology Inc., our Cayman Island holding company, whereas the entities in which we conduct our operations include (i) our mainland China subsidiaries, (ii) the VIEs with which we have maintained contractual arrangements, and (iii) the subsidiaries of the VIEs. For more details of these contractual arrangements, see “Item 4. Information on the Company—C. Organizational Structure.”

3

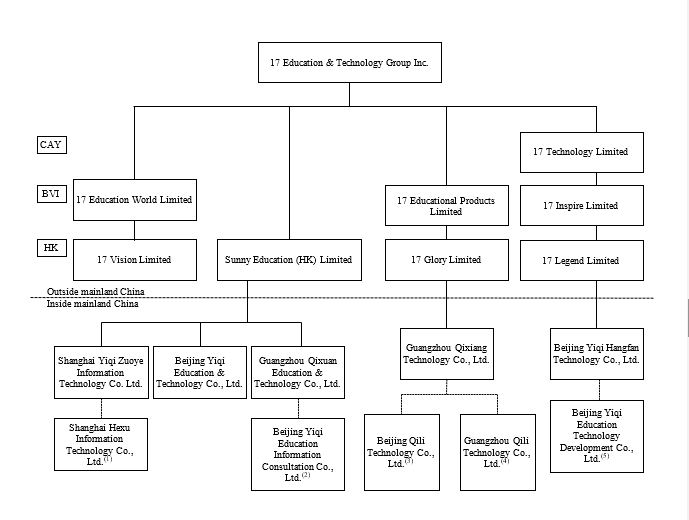

The following diagram illustrates our corporate structure, including our principal subsidiaries and other entities that are material to our business, as of the date of this annual report:

Notes:

4

The following is a summary of the currently effective contractual arrangements among our WFOEs, the VIEs and their respective shareholders:

(i) a series of powers of attorney, pursuant to which, the shareholders of the VIEs irrevocably authorized our WFOEs, or any person designated by our WFOEs, to act as their attorney-in-fact to exercise all of their rights as the shareholders of the VIEs.

(ii) a series of equity interest pledge agreements, pursuant to which, the shareholders of the VIEs have pledged 100% equity interests in the VIEs to our WFOEs to guarantee performance by the VIEs and the shareholders of the VIEs, as applicable, of their obligations under the powers of attorney, the exclusive management services and business cooperation agreements and the exclusive call option agreements.

(iii) a series of exclusive management services and business cooperation agreements, pursuant to which, our WFOEs have the exclusive right to provide the VIEs with operational supports as well as consulting and technical services required by the VIEs’ business. Without our WFOEs’ prior written consent, the VIEs may not accept the same or similar operational supports as well as consulting and technical services provided by any third party during the term of the agreements. Further, pursuant to such exclusive management services and business cooperation agreements, other than the exclusive management services and business cooperation agreement among Shanghai WFOE, Shanghai Hexu and certain subsidiaries of Shanghai Hexu, the VIEs irrevocably granted the WFOEs an exclusive option to purchase all or part of their assets.

(iv) a series of exclusive call option agreements, pursuant to which, the shareholders of the VIEs irrevocably granted our WFOEs an exclusive option to purchase all or part of their equity interests in the VIEs; and pursuant to the exclusive call option agreement among Shanghai WFOE, Shanghai Hexu and Shanghai Hexu’s shareholders, Shanghai Hexu irrevocably granted Shanghai WFOE an exclusive option to purchase all or part of its assets.

(v) a series of spousal consent letters, whereby the spouses of the shareholders of the VIEs agreed that the equity interests in the VIEs held by and registered under the name of the respective shareholders will be disposed pursuant to the contractual agreements with our WFOEs and they agreed not to assert any rights over the equity interest in the VIEs.

For more details of these contractual agreements, see “Item 4. Information on the Company—C. Organizational Structure—Contractual Arrangements with the VIEs and Their Respective Shareholders.”

However, the contractual arrangements may not be as effective as direct ownership in providing us with control over the VIEs. The shareholders of the VIEs may have potential conflicts of interest with us. We may incur substantial costs to enforce the terms of the arrangements. If the VIEs or the shareholders of the VIEs fail to perform their respective obligations under the contractual arrangements, we could be limited in our ability to enforce the contractual arrangements. In addition, these agreements have not been tested in mainland China courts. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with the VIEs and their shareholders for our business operations, which may not be as effective as direct ownership.” and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—The shareholders of the VIEs may have actual or potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.”

There are also substantial uncertainties regarding the interpretation and application of current and future laws, regulations and rules of mainland China regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the VIEs and their respective shareholders. It is uncertain whether any new laws or regulations of mainland China relating to VIE structures will be adopted or if adopted, what they would provide. If we or the VIEs are found to be in violation of any existing or future laws or regulations of mainland China, or fail to obtain or maintain any of the required permits or approvals, the relevant Chinese regulatory authorities would have broad discretion to take action in dealing with such violations or failures. If the Chinese government deems that our contractual arrangements with the VIEs do not comply with regulatory restrictions of mainland China on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company, our mainland China subsidiaries, the VIEs, and investors of our company face uncertainty about potential future actions by the Chinese government that could affect the

5

enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect the financial performance of the VIEs and our company as a whole. As of the date of this annual report, these agreements have not been tested in a court of law. A significant amount of our assets, including the necessary licenses to conduct business in mainland China, are held by the VIEs and their subsidiaries. Substantially all of our revenues are generated by the VIEs and their subsidiaries. Our ADSs may decline in value or become worthless if we are unable to assert our contractual rights over the VIEs. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the PRC government finds that the agreements that establish the structure for operating certain of our operations in mainland China do not comply with regulations of mainland China relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.”

Other Risks related to Our PRC Operations

We face various risks and uncertainties related to doing business in mainland China. Our business operations are primarily conducted in mainland China through the VIEs and their subsidiaries, and we are subject to complex and evolving laws and regulations of mainland China. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline. With respect to the legal risks associated with being based in and having operations in mainland China, the laws, regulations and the discretion of Chinese governmental authorities discussed in this annual report are expected to apply to mainland China entities and businesses, rather than entities or businesses in Hong Kong, which operate under a different set of laws from mainland China. There are relevant laws and regulations in Hong Kong regarding data security, such as the Personal Data (Privacy) Ordinance and the Unsolicited Electronic Messages Ordinance which impose protocols and obligations regarding the handling of personal data including that, among other things, (i) personal data shall be collected for a lawful purpose, necessary and not excessive, (ii) personal data shall be collected by means that are lawful and fair in the circumstances of the case, and (iii) the person from whom personal data is collected is informed of the purpose of collecting the data. As of the date of this annual report, although certain of our subsidiaries are holding companies located in Hong Kong, we do not conduct any business operations in Hong Kong and therefore regulatory actions related to data security or anti-monopoly concerns in Hong Kong do not have a material impact on our ability to conduct business, accept foreign investment in the future or continue to list on a United States stock exchange. However, if we access data in Hong Kong in the future, we may be required to incur additional cost to ensure our compliance with such laws and regulations, and any violation could result in a material adverse impact on our ability to conduct business, accept foreign investment or continue to list on a United States stock exchange. For a detailed description of risks related to doing business in China, please refer to risks disclosed under “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China.”

PRC government’s significant authority in regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, in this nature may cause the value of such securities to significantly decline. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight over our business operations could result in a material adverse change in our operations and the value of our ADSs.”

Risks and uncertainties arising from the legal system in mainland China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in mainland China, could result in a material adverse change in our operations and the value of our ADSs. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the mainland China legal system could adversely affect us.”

Permissions Required from Chinese Authorities for Our Operations

Our operations in mainland China are governed by laws and regulations of mainland China. Based on the advice of our PRC legal counsel, Tian Yuan Law Firm, we believe that, as of the date of this annual report, except for issues with respect to the filings associated with our mobile apps, the Publishing License, the License for Online Transmission of Audio-Visual Programs, the Permit for Production and Operation of Radio and TV Programs, the

6

private school operating permit, the Online Publishing Service Permit and the security assessment and algorithm filing related to generative AI services, our mainland China subsidiaries and the VIEs have obtained all the permissions and approvals from the relevant Chinese government authorities that are necessary for the business operations of our holding company and the VIEs in mainland China, namely, the Value-added Telecommunications Business Operating License and the Publication Operation License. For issues with respect to the filings associated with our mobile apps, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Uncertainties exist in relation to the interpretation and implementation of, and proposed changes to, the PRC regulatory requirements regarding in-school educational solutions and after-school educational products and services, which may materially and adversely affect our business, financial condition and results of operations.” For issues with respect to the Publishing License, the License for Online Transmission of Audio-Visual Programs, the Permit for Production and Operation of Radio and TV Programs, the private school operating permit, and the Online Publishing Service Permit, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—We face uncertainties with respect to the development of regulatory requirements on operating licenses and permits for our online education services in mainland China. Failure to renew and maintain requested licenses or permits in a timely manner or obtain newly required ones due to adverse changes in regulations or policies could have a material adverse impact on our business, financial condition and results of operations.” For issues with respect to the security assessment and algorithm filing related to generative AI services, see “—The artificial intelligence industry is subject to evolving and extensive regulations. The adoption and use of artificial intelligence in our product offerings may subject us to potential infringement claims and increase our regulatory compliance costs.” Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future.

Furthermore, recent legal developments in mainland China have created compliance uncertainty regarding issuances of securities to foreign investors. Chinese governmental authorities have recently promulgated laws, regulations and regulatory rules of mainland China, relating to cybersecurity review and overseas listing. In connection with our historical issuance of securities to foreign investors, under current laws, regulations and regulatory rules of mainland China, as of the date of this annual report, we, our mainland China subsidiaries and the VIEs, (i) have not been required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, (ii) have not been required to go through cybersecurity review by the Cyberspace Administration of China, and (iii) have not been required to obtain or were denied any requisite permissions by any Chinese authority.

However, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas by, and foreign investment in, China-based issuers, such that we may be required to complete filing with or obtain permissions from the relevant Chinese authorities in connection with any future overseas capital raising activities. Any such action could significantly limit or completely hinder our ability to conduct future offerings of securities to investors and accept foreign investments. Based on the consultation with competent government authorities, under the currently effective laws and regulations in mainland China, as a company that has been listed on the Nasdaq Global Market before the promulgation of the Revised Cybersecurity Review Measures, we, our subsidiaries and the VIEs are not required to go through a cybersecurity review by the Cyberspace Administration of China to conduct a security offering or maintain our listing status on the Nasdaq Global Market. According to the press conference held by CSRC for the release of the Overseas Listing Trial Measures, as our ADSs have been listed on the Nasdaq Global Market prior to March 31, 2023, the effective date of the Overseas Listing Trial Measures, we will be deemed as an “existing issuer” and are not required to complete the filing procedures with the CSRC for our historical issuance of securities to foreign investors. However, we will be required to complete the filing procedures with the CSRC for our overseas offering of equity and equity linked securities in the future within the applicable scope of the Overseas Listing Trial Measures. We cannot assure you that we would be able to comply with such regulatory guidance or any other new requirements relating to any of our potential future overseas capital raising activities. Any failure to obtain or delay in obtaining such approval or completing such procedures would subject us to sanctions by the CSRC, the Cyberspace Administration of China or other Chinese regulatory authorities. These regulatory authorities may impose fines and penalties on our mainland China subsidiaries or the VIEs or take other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects, as well as the trading price of our ADSs.

If we, our mainland China subsidiaries and the VIEs (i) do not receive or maintain any necessary permissions or approvals from PRC authorities to operate business or offer securities, (ii) inadvertently conclude that such

7

permissions or approvals are not required, or (iii) if applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, we cannot assure you that we will be able to obtain the necessary permissions or approvals in a timely manner, or at all, and such approvals may be rescinded even if obtained. Any such circumstance could subject us to penalties, including fines, suspension of business and revocation of required licenses, significantly limit or completely hinder our ability to continue to offer securities to investors, and cause the value of such securities to significantly decline or become worthless. For more information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Uncertainties exist in relation to the interpretation and implementation of, and proposed changes to, the PRC regulatory requirements regarding in-school educational solutions and after-school educational products and services, which may materially and adversely affect our business, financial condition and results of operations,” “—We face uncertainties with respect to the development of regulatory requirements on operating licenses and permits for our online education services in mainland China. Failure to renew and maintain requested licenses or permits in a timely manner or obtain newly required ones due to adverse changes in regulations or policies could have a material adverse impact on our business, financial condition and results of operations,” “—We are subject to a variety of laws and other obligations regarding data protection. Many of these laws and regulations are subject to change and uncertain interpretation, and any actual or alleged failure to comply with applicable laws and obligations could have a material adverse effect on our business, financial condition and results of operations” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The approval and/or other requirements of the CSRC or other Chinese governmental authorities may be required in connection with an offering under rules, regulations or policies of mainland China, and, if required, we cannot predict whether or how soon we will be able to obtain such approval or complete such other requirements.” Any actions by the government to exert more oversight and regulation over offerings that are conducted overseas and/or foreign investment could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA, as amended by the Consolidated Appropriations Act, 2023, if the Securities and Exchange Commission, or the SEC, determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 29, 2022, the Consolidated Appropriations Act, 2023, was signed into law, which (i) reduced the number of consecutive non-inspection years required for triggering the trading prohibition under HFCAA from three years to two, and (ii) clarified that the PCAOB may determine that it is unable to inspect or investigate completely registered public accounting firms in certain jurisdictions because of positions taken by any foreign authority, not only an authority in the location in which the firms are headquartered or in which they have a branch or office.

On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor. In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we were not identified as a Commission-Identified Issuer under the HFCAA after we filed our annual report on Form 20-F for the fiscal year ended December 31, 2022 and do not expect to be so identified after we file this annual report on Form 20-F for the fiscal year ended December 31, 2023.

Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become

8

subject to the prohibition on trading under the HFCAA. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections.” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Cash Flows through Our Organization

17 Education & Technology is a holding company with no operations of its own. We conduct our business in mainland China through our subsidiaries and the VIEs in mainland China. As a result, although other means are available for us to obtain financing at the holding company level, 17 Education & Technology’s ability to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries and service fees paid by the VIEs. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to 17 Education & Technology. In addition, our PRC subsidiaries are permitted to pay dividends to 17 Education & Technology only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries and VIEs are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. For more details, see “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources—Holding Company Structure.”

Under PRC laws and regulations, our PRC subsidiaries and VIEs are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of mainland China is also subject to examination by the banks designated by the State Administration of Foreign Exchange, or the SAFE. The amounts restricted include the paid-in capital and the statutory reserve funds of our PRC subsidiaries and the VIEs in which we have no legal ownership, totaling RMB4,117.3 million, RMB4,180.7 million and RMB4,289.3 (US$604.1 million) as of December 31, 2021, 2022 and 2023, respectively. Furthermore, cash transfers from our PRC subsidiaries and the VIEs to entities outside of mainland China are subject to PRC government controls on currency conversion. To the extent cash in our business is in the PRC or a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC due to restrictions and limitations imposed by the governmental authorities on currency conversion, cross-border transactions and cross-border capital flows. Shortages in the availability of foreign currency may temporarily delay the ability of our PRC subsidiaries and the VIEs to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. In view of the foregoing, to the extent cash in our business is held in mainland China or by a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC. As of the date of this annual report, there is not equivalent or similar restriction or limitation in Hong Kong on cash transfers in, or out of, our Hong Kong entities. However, if restrictions or limitations were to become applicable to cash transfers in and out of Hong Kong entities in the future, the funds in our Hong Kong entities may not be available to fund operations or for other use outside of Hong Kong. For risks relating to the fund flows of our operations in mainland China, see “Item 3. Key Information— D. Risk Factors—Risks Related to Doing Business in China—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment” and “Item 3. Key Information—Risk Factors—Risks Related to Doing Business in China—Mainland China regulation of loans to and direct investment in mainland China entities by offshore holding companies and governmental regulation of currency conversion may delay or prevent us from making loans or additional capital contributions to our mainland China subsidiaries and the VIEs in China, which could materially and adversely affect our liquidity and our ability to fund and expand our business” and “Introduction—Summary of Risk Factors—Risks Related to Doing Business in China.”

We have established stringent controls and procedures for cash flows within our organization. Each transfer of cash between our Cayman Islands holding company and a subsidiary, the VIEs or the subsidiaries of the VIEs is

9

subject to internal approval. The cash of our group is under the unified management of our finance department, and is dispatched and applied to each operating entity based on the budget and operating conditions of the specific operating entity. Each cash requirement, after it is raised by an operating entity, is required to go through a two-level review process of our finance department. The funding team of the finance department will allocate the cash to the operating entity after the application for cash requirement is approved by the responsible person in the finance department. The controls and procedures on cash transfers in the policy adhere to relevant regulatory requirements. Under PRC law, 17 Education & Technology may provide funding to our PRC subsidiaries only through capital contributions or loans, and to the VIEs only through loans, subject to satisfaction of applicable government registration and approval requirements. For the years ended December 31, 2021, 2022 and 2023, 17 Education & Technology made capital contributions in the amount of RMB1,478.5 million, RMB63.3 million and nil to our subsidiaries, respectively. For the years ended December 31, 2021, 2022 and 2023, the VIEs received debt financing of RMB18.4 million, RMB65.4 million and RMB0.6 million (US$0.1 million) from the primary beneficiary of VIEs, respectively. The VIEs may transfer cash to the primary beneficiary of the VIEs by paying service fees according to the exclusive management services and business cooperation agreements. For the years ended December 31, 2021, 2022 and 2023, cash paid by the VIEs to the primary beneficiary of the VIEs for service fees were RMB618.6 million, RMB114.0 million and RMB44.2 million (US$6.2 million), respectively. The relevant WFOEs will determine the service fees payable by the VIEs based on the factors stipulated in the VIE agreements. If there is any amount payable to the relevant WFOEs under the VIE agreements, the VIEs will settle the amount accordingly, in compliance with PRC laws and regulations. For more details regarding our intragroup cash flow, see the condensed consolidating schedules and statements under “Financial Information Related to the VIEs.”

In addition, our board of directors has discretion on whether to distribute dividends, subject to certain requirements of Cayman Islands law. Even if we decide to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board of directors may deem relevant. If we pay any dividends on our ordinary shares, we will pay those dividends which are payable in respect of the underlying Class A ordinary shares represented by the ADSs to the depositary, as the registered holder of such Class A ordinary shares, and the depositary then will pay such amounts to the ADS holders in proportion to the underlying Class A ordinary shares represented by the ADSs held by such ADS holders, subject to the terms of the deposit agreement, including the fees and expenses payable thereunder. See “Item 8. Financial Information—A. Consolidated Statements and other Financial Information—Dividend Policy.”

17 Education & Technology has not declared or paid any cash dividends, nor does it have any present plan to pay any cash dividends on our ordinary shares in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For PRC and United States federal income tax considerations of an investment in our ADSs, see “Item 10. Additional Information—E. Taxation.”

For purposes of illustration, the following discussion reflects the hypothetical taxes that might be required to be paid within mainland China, assuming that: (i) we have taxable earnings, and (ii) we determine to pay a dividend in the future:

|

|

Tax |

|

|

Hypothetical pre-tax earnings(2) |

|

|

100 |

% |

Tax on earnings at statutory rate of 25%(3) |

|

|

(25 |

)% |

Net earnings available for distribution 75% |

|

|

75 |

% |

Withholding tax at standard rate of 10%(4) |

|

|

(7.5 |

)% |

Net distribution to Parent/Shareholders |

|

|

67.5 |

% |

Note:

10

The table above has been prepared under the assumption that all profits of the VIEs will be distributed as fees to our WFOEs under tax neutral contractual arrangements. If, in the future, the accumulated earnings of the VIEs exceed the service fees paid to our WFOEs (or if the current and contemplated fee structure between the intercompany entities is determined to be non-substantive and disallowed by Chinese tax authorities), the VIEs could make a non-deductible transfer to our WFOEs for the amounts of the stranded cash in the VIEs. This would result in such transfer being non-deductible expenses for the VIEs but still taxable income for the WFOEs. Such a transfer and the related tax burdens would reduce our after-tax income to approximately 50.6% of the pre-tax income. Our management believes that there is only a remote possibility that this scenario would happen.

Financial Information Related to the VIEs

The following tables provide condensed consolidating schedules depicting the results of operations, financial position and cash flows for 17 Education & Technology, its subsidiaries, the consolidated VIEs, and any eliminating adjustments and consolidated totals (in thousands of RMB) as of and for the dates presented. You should read this section together with our consolidated financial statements and the related notes in conjunction with “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report.

Selected Condensed Consolidated Statements of Operations Information

|

|

For the Year Ended December 31, 2023 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Third-party net revenues |

|

|

— |

|

|

|

— |

|

|

|

2,877 |

|

|

|

168,085 |

|

|

|

— |

|

|

|

170,962 |

|

Inter-company net revenues |

|

|

— |

|

|

|

7,843 |

|

|

|

42,292 |

|

|

|

4,755 |

|

|

|

(54,890 |

) |

|

|

— |

|

Total costs and expenses |

|

|

(112,345 |

) |

|

|

(162,303 |

) |

|

|

(112,568 |

) |

|

|

(126,496 |

) |

|

|

— |

|

|

|

(513,712 |

) |

Inter-company costs and |

|

|

— |

|

|

|

— |

|

|

|

(4,755 |

) |

|

|

(50,135 |

) |

|

|

54,890 |

|

|

|

— |

|

Income from non-operations |

|

|

24,270 |

|

|

|

1,863 |

|

|

|

4,133 |

|

|

|

702 |

|

|

|

— |

|

|

|

30,968 |

|

Share of loss from subsidiaries, |

|

|

(223,707 |

) |

|

|

(71,110 |

) |

|

|

(3,089 |

) |

|

|

— |

|

|

|

297,906 |

|

|

|

— |

|

Loss before income tax expenses |

|

|

(311,782 |

) |

|

|

(223,707 |

) |

|

|

(71,110 |

) |

|

|

(3,089 |

) |

|

|

297,906 |

|

|

|

(311,782 |

) |

Less: income tax expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

|

(311,782 |

) |

|

|

(223,707 |

) |

|

|

(71,110 |

) |

|

|

(3,089 |

) |

|

|

297,906 |

|

|

|

(311,782 |

) |

11

|

|

For the Year Ended December 31, 2022 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Third-party net revenues |

|

|

— |

|

|

|

17,547 |

|

|

|

14,915 |

|

|

|

498,602 |

|

|

|

— |

|

|

|

531,064 |

|

Inter-company net revenues |

|

|

— |

|

|

|

174,505 |

|

|

|

210,863 |

|

|

|

— |

|

|

|

(385,368 |

) |

|

|

— |

|

Total costs and expenses |

|

|

(149,071 |

) |

|

|

(212,328 |

) |

|

|

(183,610 |

) |

|

|

(197,203 |

) |

|

|

— |

|

|

|

(742,212 |

) |

Inter-company costs and |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(385,368 |

) |

|

|

385,368 |

|

|

|

— |

|

Income from non-operations |

|

|

5,575 |

|

|

|

3,294 |

|

|

|

16,153 |

|

|

|

8,254 |

|

|

|

— |

|

|

|

33,276 |

|

Share of loss from subsidiaries, |

|

|

(34,376 |

) |

|

|

(17,394 |

) |

|

|

(75,715 |

) |

|

|

— |

|

|

|

127,485 |

|

|

|

— |

|

Loss before income tax expenses |

|

|

(177,872 |

) |

|

|

(34,376 |

) |

|

|

(17,394 |

) |

|

|

(75,715 |

) |

|

|

127,485 |

|

|

|

(177,872 |

) |

Less: income tax expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

|

(177,872 |

) |

|

|

(34,376 |

) |

|

|

(17,394 |

) |

|

|

(75,715 |

) |

|

|

127,485 |

|

|

|

(177,872 |

) |

|

|

For the Year Ended December 31, 2021 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Third-party net revenues |

|

|

— |

|

|

|

354 |

|

|

|

17,839 |

|

|

|

2,166,327 |

|

|

|

— |

|

|

|

2,184,520 |

|

Inter-company net revenues |

|

|

— |

|

|

|

195,115 |

|

|

|

734,075 |

|

|

|

— |

|

|

|

(929,190 |

) |

|

|

— |

|

Total costs and expenses |

|

|

(204,594 |

) |

|

|

(643,314 |

) |

|

|

(1,455,387 |

) |

|

|

(1,354,711 |

) |

|

|

— |

|

|

|

(3,658,006 |

) |

Inter-company costs and expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(929,190 |

) |

|

|

929,190 |

|

|

|

— |

|

Income/(loss) from non-operations |

|

|

4,002 |

|

|

|

2,187 |

|

|

|

39,133 |

|

|

|

(13,749 |

) |

|

|

— |

|

|

|

31,573 |

|

Share of loss from subsidiaries, |

|

|

(1,241,321 |

) |

|

|

(795,663 |

) |

|

|

(131,323 |

) |

|

|

— |

|

|

|

2,168,307 |

|

|

|

— |

|

Loss before income tax expenses |

|

|

(1,441,913 |

) |

|

|

(1,241,321 |

) |

|

|

(795,663 |

) |

|

|

(131,323 |

) |

|

|

2,168,307 |

|

|

|

(1,441,913 |

) |

Less: income tax expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

|

(1,441,913 |

) |

|

|

(1,241,321 |

) |

|

|

(795,663 |

) |

|

|

(131,323 |

) |

|

|

2,168,307 |

|

|

|

(1,441,913 |

) |

Selected Condensed Consolidated Balance Sheets Information

|

|

For the Year Ended December 31, 2023 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Cash and cash equivalents |

|

|

231,825 |

|

|

|

15,707 |

|

|

|

16,028 |

|

|

|

43,369 |

|

|

|

— |

|

|

|

306,929 |

|

Term deposit |

|

|

110,847 |

|

|

|

58,909 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

169,756 |

|

Accounts receivable |

|

|

— |

|

|

|

— |

|

|

|

1,863 |

|

|

|

57,343 |

|

|

|

— |

|

|

|

59,206 |

|

Prepaid expenses and |

|

|

3,911 |

|

|

|

3,559 |

|

|

|

10,233 |

|

|

|

77,132 |

|

|

|

— |

|

|

|

94,835 |

|

Amount due from inter-companies |

|

|

865,964 |

|

|

|

210,293 |

|

|

|

836,556 |

|

|

|

124,333 |

|

|

|

(2,037,146 |

) |

|

|

— |

|

Property and equipment, net |

|

|

— |

|

|

|

12,016 |

|

|

|

584 |

|

|

|

19,413 |

|

|

|

— |

|

|

|

32,013 |

|

Right-of-use assets |

|

|

— |

|

|

|

5,252 |

|

|

|

— |

|

|

|

14,755 |

|

|

|

— |

|

|

|

20,007 |

|

Other non-current assets |

|

|

— |

|

|

|

785 |

|

|

|

221 |

|

|

|

774 |

|

|

|

— |

|

|

|

1,780 |

|

Total assets |

|

|

1,212,547 |

|

|

|

306,521 |

|

|

|

865,485 |

|

|

|

337,119 |

|

|

|

(2,037,146 |

) |

|

|

684,526 |

|

Accrued expenses and other |

|

|

4,472 |

|

|

|

5,725 |

|

|

|

86,532 |

|

|

|

31,272 |

|

|

|

— |

|

|

|

128,001 |

|

Deferred revenue current and |

|

|

— |

|

|

|

— |

|

|

|

2,181 |

|

|

|

42,768 |

|

|

|

— |

|

|

|

44,949 |

|

Amount due to inter-companies |

|

|

— |

|

|

|

402,834 |

|

|

|

609,474 |

|

|

|

1,024,838 |

|

|

|

(2,037,146 |

) |

|

|

— |

|

Deficits of investments in |

|

|

713,806 |

|

|

|

1,272,051 |

|

|

|

2,183,554 |

|

|

|

— |

|

|

|

(4,169,411 |

) |

|

|

— |

|

Operating lease liabilities current |

|

|

— |

|

|

|

4,996 |

|

|

|

— |

|

|

|

12,311 |

|

|

|

— |

|

|

|

17,307 |

|

Total liabilities |

|

|

718,278 |

|

|

|

1,685,606 |

|

|

|

2,881,741 |

|

|

|

1,111,189 |

|

|

|

(6,206,557 |

) |

|

|

190,257 |

|

Total shareholders’ equity/(deficit) |

|

|

494,269 |

|

|

|

(1,379,085 |

) |

|

|

(2,016,256 |

) |

|

|

(774,070 |

) |

|

|

4,169,411 |

|

|

|

494,269 |

|

Total liabilities and shareholders’ |

|

|

1,212,547 |

|

|

|

306,521 |

|

|

|

865,485 |

|

|

|

337,119 |

|

|

|

(2,037,146 |

) |

|

|

684,526 |

|

12

|

|

For the Year Ended December 31, 2022 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Cash and cash equivalents |

|

|

493,201 |

|

|

|

56,124 |

|

|

|

4,026 |

|

|

|

154,544 |

|

|

|

— |

|

|

|

707,895 |

|

Restricted cash |

|

|

— |

|

|

|

— |

|

|

|

10,231 |

|

|

|

— |

|

|

|

— |

|

|

|

10,231 |

|

Short-term investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,531 |

|

|

|

— |

|

|

|

19,531 |

|

Accounts receivable |

|

|

— |

|

|

|

— |

|

|

|

1,890 |

|

|

|

32,934 |

|

|

|

— |

|

|

|

34,824 |

|

Prepaid expenses and other |

|

|

3,750 |

|

|

|

8,735 |

|

|

|

18,278 |

|

|

|

110,131 |

|

|

|

— |

|

|

|

140,894 |

|

Amount due from inter-companies |

|

|

788,947 |

|

|

|

266,261 |

|

|

|

835,305 |

|

|

|

123,073 |

|

|

|

(2,013,586 |

) |

|

|

— |

|

Property and equipment, net |

|

|

— |

|

|

|

22,154 |

|

|

|

877 |

|

|

|

9,264 |

|

|

|

— |

|

|

|

32,295 |

|

Right-of-use assets |

|

|

— |

|

|

|

16,434 |

|

|

|

1,374 |

|

|

|

12,244 |

|

|

|

— |

|

|

|

30,052 |

|

Other non-current assets |

|

|

— |

|

|

|

1,438 |

|

|

|

294 |

|

|

|

3,070 |

|

|

|

— |

|

|

|

4,802 |

|

Total assets |

|

|

1,285,898 |

|

|

|

371,146 |

|

|

|

872,275 |

|

|

|

464,791 |

|

|

|

(2,013,586 |

) |

|

|

980,524 |

|

Accrued expenses and other |

|

|

3,437 |

|

|

|

17,947 |

|

|

|

96,419 |

|

|

|

35,220 |

|

|

|

— |

|

|

|

153,023 |

|

Deferred revenue current and |

|

|

— |

|

|

|

— |

|

|

|

2,293 |

|

|

|

40,092 |

|

|

|

— |

|

|

|

42,385 |

|

Amount due to inter-companies |

|

|

29,781 |

|

|

|

325,817 |

|

|

|

608,214 |

|

|

|

1,049,774 |

|

|

|

(2,013,586 |

) |

|

|

— |

|

Deficits of investments in |

|

|

493,817 |

|

|

|

1,152,327 |

|

|

|

2,013,235 |

|

|

|

— |

|

|

|

(3,659,379 |

) |

|

|

— |

|

Operating lease liabilities current |

|

|

— |

|

|

|

13,070 |

|

|

|

1,441 |

|

|

|

11,742 |

|

|

|

— |

|

|

|

26,253 |

|

Total liabilities |

|

|

527,035 |

|

|

|

1,509,161 |

|

|

|

2,721,602 |

|

|

|

1,136,828 |

|

|

|

(5,672,965 |

) |

|

|

221,661 |

|

Total shareholders’ equity/(deficit) |

|

|

758,863 |

|

|

|

(1,138,015 |

) |

|

|

(1,849,327 |

) |

|

|

(672,037 |

) |

|

|

3,659,379 |

|

|

|

758,863 |

|

Total liabilities and shareholders’ |

|

|

1,285,898 |

|

|

|

371,146 |

|

|

|

872,275 |

|

|

|

464,791 |

|

|

|

(2,013,586 |

) |

|

|

980,524 |

|

Selected Condensed Consolidated Cash Flows Information

|

|

For the Year Ended December 31, 2023 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Net cash used in operating |

|

|

(3,757 |

) |

|

|

(19,300 |

) |

|

|

(68,918 |

) |

|

|

(120,100 |

) |

|

|

— |

|

|

|

(212,075 |

) |

Capital contribution to Group |

|

|

— |

|

|

|

(70,999 |

) |

|

|

— |

|

|

|

— |

|

|

|

70,999 |

|

|

|

— |

|

Loans (provided to)/settled by |

|

|

(77,017 |

) |

|

|

29,781 |

|

|

|

(600 |

) |

|

|

— |

|

|

|

47,836 |

|

|

|

— |

|

Other investing activities |

|

|

(110,847 |

) |

|

|

(58,909 |

) |

|

|

290 |

|

|

|

8,325 |

|

|

|

— |

|

|

|

(161,141 |

) |

Net cash (used in)/generated |

|

|

(187,864 |

) |

|

|

(100,127 |

) |

|

|

(310 |

) |

|

|

8,325 |

|

|

|

118,835 |

|

|

|

(161,141 |

) |

Capital contribution from Group |

|

|

— |

|

|

|

— |

|

|

|

70,999 |

|

|

|

— |

|

|

|

(70,999 |

) |

|

|

— |

|

Loans (repaid to)/borrowed from |

|

|

(29,781 |

) |

|

|

77,017 |

|

|

|

— |

|

|

|

600 |

|

|

|

(47,836 |

) |

|

|

— |

|

Other financing activities |

|

|

(51,357 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(51,357 |

) |

Net cash (used in)/generated |

|

|

(81,138 |

) |

|

|

77,017 |

|

|

|

70,999 |

|

|

|

600 |

|

|

|

(118,835 |

) |

|

|

(51,357 |

) |

13

|

|

For the Year Ended December 31, 2022 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Net cash used in operating |

|

|

(23,206 |

) |

|

|

(129,839 |

) |

|

|

(175,015 |

) |

|

|

(135,866 |

) |

|

|

— |

|

|

|

(463,926 |

) |

Capital contribution to Group |

|

|

(63,328 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

63,328 |

|

|

|

— |

|

Loans provided to Group |

|

|

(55,184 |

) |

|

|

(30,281 |

) |

|

|

(73,900 |

) |

|

|

(5,000 |

) |

|

|

164,365 |

|

|

|

— |

|

Other investing activities |

|

|

— |

|

|

|

— |

|

|

|

579 |

|

|

|

(9,510 |

) |

|

|

— |

|

|

|

(8,931 |

) |

Net cash used in investing |

|

|

(118,512 |

) |

|

|

(30,281 |

) |

|

|

(73,321 |

) |

|

|

(14,510 |

) |

|

|

227,693 |

|

|

|

(8,931 |

) |

Capital contribution from Group |

|

|

— |

|

|

|

63,328 |

|

|

|

— |

|

|

|

— |

|

|

|

(63,328 |

) |

|

|

— |

|

Loans borrowed from Group |

|

|

29,781 |

|

|

|

68,684 |

|

|

|

500 |

|

|

|

65,400 |

|

|

|

(164,365 |

) |

|

|

— |

|

Other financing activities |

|

|

(33,857 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(33,857 |

) |

Net cash (used in)/generated |

|

|

(4,076 |

) |

|

|

132,012 |

|

|

|

500 |

|

|

|

65,400 |

|

|

|

(227,693 |

) |

|

|

(33,857 |

) |

|

|

For the Year Ended December 31, 2021 |

|

|||||||||||||||||||||

|

|

17 Education |

|

|

Other |

|

|

Primary |

|

|

VIEs and |

|

|

Eliminations |

|

|

Consolidated |

|

||||||

|

|

(RMB in thousands) |

|

|||||||||||||||||||||

Net cash used in operating |

|

|

(3,979 |

) |

|

|

(535,194 |

) |

|

|

(829,912 |

) |

|

|

(137,607 |

) |

|

|

— |

|

|

|

(1,506,692 |

) |

Capital contribution to Group |

|

|

(1,478,469 |

) |

|

|

(960,375 |

) |

|

|

— |

|

|

|

— |

|

|

|

2,438,844 |

|

|

|

— |

|

Loans provided to Group |

|

|

— |

|

|

|

— |

|

|

|

(18,400 |

) |

|

|

(2,000 |

) |

|

|

20,400 |

|

|

|

— |

|

Other investing activities |

|

|

— |

|

|

|

(56,707 |

) |

|

|

(1,483 |

) |

|

|

(59,413 |

) |

|

|

— |

|

|

|

(117,603 |

) |

Net cash used in investing |

|

|

(1,478,469 |

) |

|

|

(1,017,082 |

) |

|

|

(19,883 |

) |

|

|

(61,413 |

) |

|

|

2,459,244 |

|

|

|

(117,603 |

) |

Capital contribution from Group |

|

|

— |

|

|

|

1,478,469 |

|

|

|

960,375 |

|

|

|

— |

|

|

|

(2,438,844 |

) |

|

|

— |

|

Loans borrowed from Group |

|

|

— |

|

|

|

2,000 |

|

|

|

— |

|

|

|

18,400 |

|

|

|

(20,400 |

) |

|

|

— |

|

Other financing activities |

|

|

4,905 |

|

|

|

— |

|

|

|

(3,953 |

) |

|

|

— |

|

|

|

— |

|

|

|

952 |

|

Net cash generated from financing |

|

|

4,905 |

|

|

|

1,480,469 |

|

|

|

956,422 |

|

|

|

18,400 |

|

|

|

(2,459,244 |

) |

|

|

952 |

|

Not Applicable.

Not Applicable.

Summary of Risk Factors