UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report. .. . . . . . . . . . . . . . . . . .

Commission File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

People’s Republic of

(Address of Principal Executive Offices)

People’s Republic of

Tel: +

Email:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| The | ||||

| Warrants* to purchase Class A ordinary shares | UKOMW | The Nasdaq Stock Market LLC |

* expiring on expiring on November 17, 2025.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

i

Introduction

Except where the context otherwise requires and for purposes of this annual report only:

| ● | “AI” refers to artificial intelligence; |

| ● | “app” refers to mobile app; |

| ● | “Beijing Melo” refers to Beijing Melo Technology Co., Ltd.; |

| ● | “Beijing U Bazaar” refers to Beijing Ubazaar Technology Co., Ltd.; |

| ● | “Business Combination” refers to (1) reincorporation of Orisun Acquisition Corp in Cayman Islands by merging with and into our company; and (2) merger of Everstone International Ltd, a Cayman Islands exempted company and wholly owned subsidiary of our company, with and into Ucommune Group Holdings Limited, resulting in Ucommune Group Holdings Limited being a wholly owned subsidiary of our company. |

| ● | “CAGR” refers to compound annual growth rate; |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan, Hong Kong and the Macau Special Administrative Region; |

| ● | “Class A ordinary shares” refers to our Class A ordinary shares, par value US$0.0001 per share, carrying one vote per share; |

| ● | “Class B ordinary shares” refers to our Class B ordinary shares, par value US$0.0001 per share, carrying 15 votes per share; |

| ● | “Frost & Sullivan” refers to Frost & Sullivan (Beijing) Inc., Shanghai Branch Co., a third-party industry research firm; |

| ● | “Generation Z” refers to the demographic cohort in China of individuals born from 1990 to 2009; |

| ● | “GMV” refers to gross merchandize value; |

| ● | “Greater China” refers to, for the purpose of this annual report only, China as well as Hong Kong, Macau Special Administrative Region and Taiwan; |

| ● | “Hong Kong” or “HK” refers to the Hong Kong Special Administrative Region of the PRC; |

| ● | “individual members using workstations” refers to the individuals that use our workstations under a membership agreement as of a given date, excluding the individuals that have access to a workstation on as-needed basis; |

| ● | “IOT” refers to internet of things; |

| ● | “IT” refers to information technology; |

| ● | “mature spaces” refers to spaces that have been open for more than 24 months; |

| ● | “members” refers to the individuals and enterprises that have registered on U Bazaar and have received reward points as of a given date; |

| ● | “new tier-1 cities” refers to the relatively developed cities following the tier-1 cities: Chengdu, Hangzhou, Nanjing, Qingdao, Kunming, Shenyang, Tianjin, Wuhan, Xi’an, Changsha, Chongqing, Suzhou, Ningbo, Zhengzhou and Dongguan; |

| ● | “ordinary shares” refers to our Class A and Class B ordinary shares of par value US$0.0001 per share; |

| ● | “PIPE investment” refers to the investment of $60.9 million in by certain backstop investors in connection with the Company’s Business Combination. |

ii

| ● | “RMB” or “Renminbi” refers to the legal currency of the PRC; |

| ● | “SAFE” refers to the State Administration for Foreign Exchange; |

| ● | “Shengguang Zhongshuo” refers to Zhuhai Shengguang Zhongshuo Digital Marketing Co., Ltd.; |

| ● | “SME” refers to small and medium enterprises; |

| ● | “space(s) operated by our associate(s)” refers to the co-working space(s) in which we have a minority interest investment but are operated by our associate(s); and we account for our investment under the equity method but do not consolidate the revenue of such spaces into our combined and consolidated financial statements; |

| ● | “tier-1 cities” refers to the most developed cities in the PRC: Beijing, Shanghai, Guangzhou and Shenzhen; |

| ● | “U Bazaar” refers to the mobile app developed by Beijing U Bazaar Technology Co., Ltd.; |

| ● | “Ucommune Technology” refers to Ucommune (Beijing) Technology Co., Ltd.; |

| ● | “Ucommune Venture” refers to Ucommune (Beijing) Venture Investment Co., Ltd.; |

| ● | “US$,” “dollars” or “U.S. dollars” refers to the legal currency of the United States; |

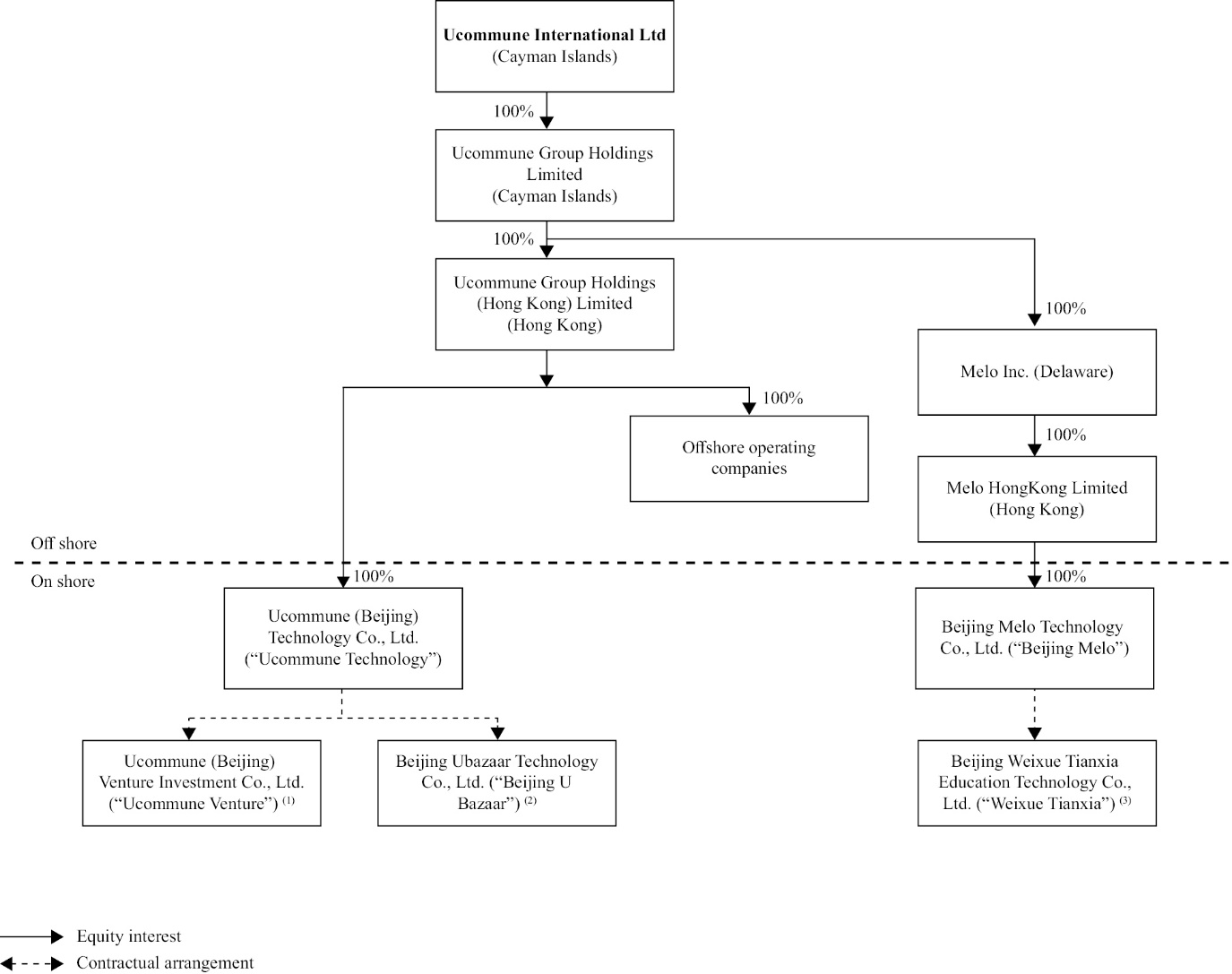

| ● | “variable interest entities” or “VIEs” refers to Ucommune (Beijing) Venture Investment Co., Ltd., Beijing U Bazaar Technology Co., Ltd. and Beijing Weixue Tianxia Education Technology Co., Ltd., which are PRC companies in which we do not have equity interests but whose financial results have been consolidated into our combined and consolidated financial statements in accordance with United States generally accepted accounting principles, or U.S. GAAP, due to our having effective control over, and our being the primary beneficiary of, such entities; |

| ● | “we,” “us,” “our company,” “our” or “Ucommune” refers to Ucommune International Ltd, a Cayman Islands company, its subsidiaries and, in the context of describing our operations and combined and consolidated financial statements, its VIEs; |

| ● | “Weixue Tianxia” refers to Beijing Weixue Tianxia Education Technology Co., Ltd; |

| ● | “2019 plan” refers to a share incentive plan we adopted on August 22, 2019; and |

| ● | “2020 plan” refers to a share incentive plan we adopted in November 17, 2020, to assume and replace the 2019 plan. |

Unless otherwise noted, all statistics with respect to our co-working spaces, cities covered by our co-working space network, managed area of co-working spaces, workstations, occupancy rates and members exclude the spaces operated by our associates.

Certain amounts, percentages and other figures, such as key operating data, presented in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentages may not represent the arithmetic summation or calculation of the figures that accompany them.

Unless otherwise noted, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi in this annual report are made at RMB6.5250 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2020. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all.

iii

FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

| ● | our goals and growth strategies; |

| ● | our future business development, results of operations and financial condition; |

| ● | relevant government policies and regulations relating to our business and industry; |

| ● | our expectation regarding the use of proceeds from securities offerings; |

| ● | general economic and business conditions in China; and |

| ● | assumptions underlying or related to any of the foregoing. |

You should read thoroughly this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this annual report include additional factors which could adversely impact our business and financial performance.

We operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This annual report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-party providers of market intelligence. These industry publications and reports generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information.

iv

part I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

| A. | Selected Financial Data |

Selected Financial Information

The following selected combined and consolidated statements of operations data for the years ended December 31, 2018, 2019 and 2020, selected consolidated balance sheet data as of December 31, 2019 and 2020 and selected combined and consolidated cash flow data for the years ended December 31, 2018, 2019 and 2020 have been derived from our audited combined and consolidated financial statements included elsewhere in this annual report. Our consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”).

Our historical results are not necessarily indicative of results expected for future periods. You should read this selected consolidated financial data together with our combined and consolidated financial statements and the related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report on Form 20-F.

The following table presents our selected combined and consolidated statements of operation data for the years ended December 31, 2018, 2019 and 2020.

| For the Year Ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | ||||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (in thousands, except for shares and per share data) | ||||||||||||||||

| Selected Combined and Consolidated Statements of Operation Data: | ||||||||||||||||

| Revenue: | ||||||||||||||||

| Workspace membership revenue | 394,356 | 557,994 | 422,984 | 64,825 | ||||||||||||

| Marketing and branding service revenue | 24,617 | 534,826 | 317,461 | 48,653 | ||||||||||||

| Other service revenue | 29,535 | 74,538 | 136,692 | 20,949 | ||||||||||||

| Total revenue | 448,508 | 1,167,358 | 877,137 | 134,427 | ||||||||||||

| Cost of revenue(1): | ||||||||||||||||

| Workspace membership | (624,844 | ) | (814,002 | ) | (557,102 | ) | (85,380 | ) | ||||||||

| Marketing and branding services | (22,481 | ) | (485,473 | ) | (297,893 | ) | (45,654 | ) | ||||||||

| Other services | (16,284 | ) | (69,917 | ) | (113,074 | ) | (17,329 | ) | ||||||||

| Total cost of revenue (excluding impairment loss) | (663,609 | ) | (1,369,392 | ) | (968,069 | ) | (148,363 | ) | ||||||||

| Impairment loss on long-lived assets | (111,203 | ) | (52,030 | ) | (36,505 | ) | (5,595 | ) | ||||||||

| Pre-opening expenses | (20,165 | ) | (15,124 | ) | — | — | ||||||||||

| Sales and marketing expenses | (44,783 | ) | (75,841 | ) | (47,061 | ) | (7,212 | ) | ||||||||

| General and administrative expenses | (118,798 | ) | (181,582 | ) | (320,202 | ) | (49,073 | ) | ||||||||

| Remeasurement gain of previously held equity interests in connection with step acquisitions | 27,543 | 386 | — | — | ||||||||||||

| Change in fair value of liabilities to be settled in shares | 25,607 | (179,475 | ) | — | — | |||||||||||

| Loss from operations | (456,900 | ) | (705,700 | ) | (494,700 | ) | (75,816 | ) | ||||||||

| Interest income/(expense), net | 11,672 | (10,402 | ) | (12,863 | ) | (1,971 | ) | |||||||||

| Subsidy income | 31,783 | 16,782 | 13,931 | 2,135 | ||||||||||||

| Impairment loss on long-term investments | (18,990 | ) | (37,453 | ) | (10,060 | ) | (1,542 | ) | ||||||||

| Gain/loss on disposal of long-term investments | 2,030 | — | 8,561 | 1,312 | ||||||||||||

| Other (expense)/income, net | (11,715 | ) | (63,480 | ) | 30,393 | 4,658 | ||||||||||

| Loss before income taxes and loss from equity method investments | (442,120 | ) | (800,253 | ) | (504,441 | ) | (77,309 | ) | ||||||||

| Provision for income taxes | (2,087 | ) | (4,872 | ) | (2,864 | ) | (439 | ) | ||||||||

| Loss from equity method investments | (948 | ) | (1,548 | ) | (639 | ) | (98 | ) | ||||||||

| Net loss | (445,155 | ) | (806,673 | ) | (507,944 | ) | (77,846 | ) | ||||||||

| Less: net loss attributable to non-controlling interests | (15,563 | ) | (15,523 | ) | (19,452 | ) | (2,981 | ) | ||||||||

| Net loss attributable to Ucommune International Ltd. | (429,592 | ) | (791,150 | ) | (488,492 | ) | (74,865 | ) | ||||||||

| Net loss per share attributable to ordinary shareholders of Ucommune International Ltd. | ||||||||||||||||

| – Basic | (9.91 | ) | (15.80 | ) | (7.50 | ) | (1.15 | ) | ||||||||

| – Diluted | (9.91 | ) | (15.80 | ) | (7.50 | ) | (1.15 | ) | ||||||||

| Weighted average shares used in calculating net loss per share | ||||||||||||||||

| – Basic | 43,359,150 | 50,074,152 | 65,141,759 | N/A | ||||||||||||

| – Diluted | 43,359,150 | 50,074,152 | 65,141,759 | N/A | ||||||||||||

| (1) | Our cost of revenue does not include impairment loss, and we generally do not consider impairment factor on a routine basis when operating and managing our co-working space business. |

1

The following table presents our selected combined and consolidated balance sheet data as of December 31, 2018, 2019 and 2020.

| As of December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | ||||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (in thousands) | ||||||||||||||||

| Summary Combined and Consolidated Balance Sheet Data: | ||||||||||||||||

| Current assets | ||||||||||||||||

| Cash and cash equivalents | 274,633 | 175,774 | 348,064 | 53,343 | ||||||||||||

| Restricted cash, current | 11,000 | — | 52,199 | 8,000 | ||||||||||||

| Term deposits, current | 24,000 | 41,715 | 47,710 | 7,312 | ||||||||||||

| Short-term investments | 32,200 | 37,930 | 5,900 | 904 | ||||||||||||

| Accounts receivable, net of allowance | 69,368 | 86,200 | 125,359 | 19,212 | ||||||||||||

| Prepaid expenses and other current assets | 95,784 | 135,830 | 163,401 | 25,039 | ||||||||||||

| Loans receivable | 190,000 | — | — | — | ||||||||||||

| Amounts due from related parties, current | 25,660 | 52,611 | 24,504 | 3,755 | ||||||||||||

| Held-for-sale assets, current | — | 365,233 | — | — | ||||||||||||

| Total current assets | 722,645 | 886,293 | 767,137 | 117,565 | ||||||||||||

| Non-current assets | ||||||||||||||||

| Restricted cash, non-current | 22,273 | 20,527 | 527 | 81 | ||||||||||||

| Long-term investments | 73,167 | 29,329 | 9,051 | 1,387 | ||||||||||||

| Property and equipment, net | 490,351 | 567,844 | 350,980 | 53,790 | ||||||||||||

| Right-of-use assets, net | 1,935,401 | 1,851,729 | 879,348 | 134,766 | ||||||||||||

| Intangible assets, net | 30,142 | 40,105 | 28,420 | 4,356 | ||||||||||||

| Goodwill | 1,419,018 | 1,533,485 | 1,533,485 | 235,017 | ||||||||||||

| Rental deposit | 91,251 | 98,486 | 61,170 | 9,375 | ||||||||||||

| Long-term prepaid expenses | 184,833 | 116,363 | 113,271 | 17,360 | ||||||||||||

| Amounts due from related parties, non-current | 2,220 | 884 | 297 | 46 | ||||||||||||

| Other assets, non-current | 3,385 | 185 | 194,444 | 29,800 | ||||||||||||

| Total non-current assets | 4,252,041 | 4,258,937 | 3,170,993 | 485,978 | ||||||||||||

| Total assets | 4,974,686 | 5,145,230 | 3,938,130 | 603,543 | ||||||||||||

| Total current liabilities | 2,879,466 | 1,625,690 | 1,138,690 | 174,511 | ||||||||||||

| Total non-current liabilities | 1,499,148 | 1,415,426 | 613,824 | 94,072 | ||||||||||||

| Total liabilities | 4,378,614 | 3,041,116 | 1,752,514 | 268,583 | ||||||||||||

| Total shareholders’ equity | 596,072 | 2,104,114 | 2,185,616 | 334,960 | ||||||||||||

| Total liabilities and shareholders’ equity | 4,974,686 | 5,145,230 | 3,938,130 | 603,543 | ||||||||||||

The following table presents our selected combined and consolidated cash flow data for the years ended December 31, 2018, 2019 and 2020.

| For the Year Ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | ||||||||||||||

| (in thousands) | ||||||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| Summary Combined and Consolidated Cash Flow Data: | ||||||||||||||||

| Net cash used in operating activities | (52,071 | ) | (223,357 | ) | (27,644 | ) | (4,235 | ) | ||||||||

| Net cash (used in)/provided by investing activities | (29,685 | ) | 7,424 | (39,258 | ) | (6,017 | ) | |||||||||

| Net cash provided by financing activities | 189,862 | 104,379 | 289,576 | 44,379 | ||||||||||||

| Effects of exchange rate changes | 57 | (51 | ) | (18,185 | ) | (2,787 | ) | |||||||||

| Net increase/(decrease) in cash, cash equivalents and restricted cash | 108,163 | (111,605 | ) | 204,489 | 31,340 | |||||||||||

| Cash, cash equivalents and restricted cash – beginning of the year/period | 199,743 | 307,906 | 196,301 | 30,084 | ||||||||||||

| Cash, cash equivalents and restricted cash – end of the year/period | 307,906 | 196,301 | 400,790 | 61,424 | ||||||||||||

2

Non-GAAP Financial Measures

To supplement our combined and consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, we use the following non-GAAP financial measures for our combined and consolidated results: EBITDA (including EBITDA margin), adjusted EBITDA (including adjusted EBITDA margin) and adjusted net loss. We believe that EBITDA, adjusted EBITDA and adjusted net loss help understand and evaluate our core operating performance.

EBITDA, adjusted EBITDA and adjusted net loss are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP. Investors are encouraged to review the reconciliation of the historical non-GAAP financial measures to their most directly comparable GAAP financial measures. As EBITDA, adjusted EBITDA and adjusted net loss have material limitations as analytical metrics and may not be calculated in the same manner by all companies, they may not be comparable to other similarly titled measures used by other companies.

In light of the foregoing limitations, you should not consider EBITDA, adjusted EBITDA and adjusted net loss as substitutes for, or superior to, net loss prepared in accordance with U.S. GAAP. We encourage investors and others to review its financial information in its entirety and not rely on any single financial measure. For more information on these non-GAAP financial measures, please see the table below.

EBITDA represents net loss before interest income/(expense), net, provision for income taxes, depreciation of property and equipment and amortization of intangible assets.

Adjusted EBITDA represents net loss before (i) interest income/(expense), net, other expense/(income), net, provision for income taxes and loss on disposal of subsidiaries and (ii) certain non-cash expenses, consisting of share-based compensation expense, impairment loss on long-term investments. impairment loss on long-lived assets, depreciation of property and equipment, amortization of intangible assets and change in fair value of liabilities to be settled in shares, which we do not believe are reflective of our core operating performance during the periods presented.

Adjusted net loss represents net loss before share-based compensation expense, impairment loss on long-lived assets, impairment loss on long-term investments, change in fair value of liabilities to be settled in shares and loss on disposal of subsidiaries.

The following table sets forth a reconciliation of net loss to EBITDA and adjusted EBITDA for the periods indicated:

| For the Year Ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | ||||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net loss | (445,155 | ) | (806,673 | ) | (507,944 | ) | (77,846 | ) | ||||||||

| Interest (income)/expense, net | (11,672 | ) | 10,402 | 12,863 | 1,971 | |||||||||||

| Provision for income taxes | 2,087 | 4,872 | 2,864 | 439 | ||||||||||||

| Depreciation of property and equipment | 79,162 | 108,303 | 76,353 | 11,702 | ||||||||||||

| Amortization of intangible assets | 1,907 | 10,803 | 11,202 | 1,717 | ||||||||||||

| EBITDA (non-GAAP) | (373,671 | ) | (672,293 | ) | (404,662 | ) | (62,017 | ) | ||||||||

| Share-based compensation expense | — | — | 202,333 | 31,009 | ||||||||||||

| Impairment loss on long-lived assets | 111,203 | 52,030 | 36,505 | 5,595 | ||||||||||||

| Change in fair value of liabilities to be settled in shares | (25,607 | ) | 179,475 | — | — | |||||||||||

| Impairment loss on long-term investments | 18,990 | 37,453 | 10,060 | 1,542 | ||||||||||||

| Loss on disposal of subsidiaries | — | — | 39,703 | 6,085 | ||||||||||||

| Other expense/(income), net | 11,715 | 63,480 | (30,393 | ) | (4,658 | ) | ||||||||||

| Adjusted EBITDA (non-GAAP) | (257,370 | ) | (339,855 | ) | (146,454 | ) | (22,444 | ) | ||||||||

3

The table below sets forth a reconciliation of net loss to adjusted net loss for the periods indicated:

| For the Year Ended December 31, | ||||||||||||||||

| 2018 | 2019 | 2020 | ||||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net loss | (445,155 | ) | (806,673 | ) | (507,944 | ) | (77,846 | ) | ||||||||

| Share-based compensation expense | - | - | 202,333 | 31,009 | ||||||||||||

| Impairment loss on long-lived assets | 111,203 | 52,030 | 36,505 | 5,595 | ||||||||||||

| Change in fair value of liabilities to be settled in shares | (25,607 | ) | 179,475 | - | - | |||||||||||

| Impairment loss on long-term investments | 18,990 | 37,453 | 10,060 | 1,542 | ||||||||||||

| Loss on disposal of subsidiaries | — | — | 39,703 | 6,085 | ||||||||||||

| Adjusted net loss (non-GAAP) | (340,569 | ) | (537,715 | ) | (219,343 | ) | (33,615 | ) | ||||||||

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Risks Relating to Our Business and Industry

Our limited operating history makes it difficult to predict our future prospects, business and financial performance.

We launched our first space in September 2015 and officially launched our app, U Bazaar, in April 2016. We expanded our operations beyond Greater China to Singapore in July 2017. We entered into the New York market through the space operated by our associate in April 2018. In addition, we continually review the operating models of our spaces and explore new operating models for enhancing our operational efficiency and broadening our monetization channels. For example, we further expanded our operations under U Partner, a category under our asset-light model, in July 2019.

Our short operating history may not serve as an adequate basis for evaluating our prospects and future operating results, including our key operating data, net revenue, cash flows and operating margins. In addition, the co-working space industry in China remains at an early stage of development and continues to evolve. As a result, you may not be able to fully discern the market dynamics to which we are subject and assess our business prospects.

We have encountered risks, challenges and uncertainties experienced by companies at an early stage, including those relating to our ability to adapt to the industry, to maintain and monetize our member base and to introduce new offerings and services. If we cannot successfully address these risks and uncertainties, our business, financial condition and results of operations could be materially adversely affected.

We may not retain existing members, especially those who enter into short-term contracts with us, or attract new members at a level necessary to sustain or grow our business.

Our membership fees constitute an important part of our net revenue, and we depend on the enlargement of our member base to build the vibrant community that we envision. Any failure to attract existing members or bring new members in adequate numbers or at adequate rental rates would materially adversely affect our business. To sustain our growth, we endeavor to retain our existing members and continually add new members to maintain or improve our occupancy rates.

4

Because the agile office space industry is relatively new and rapidly evolving, we face uncertainties and challenges in maintaining and growing our member base. A significant number of our existing and target members consists of SMEs. These members frequently have limited budgets and are more vulnerable to adverse economic conditions and unfavorable changes in the regulatory environment.

If these businesses experience economic hardship, they may be unwilling or unable to use our services. This would reduce demand for our services, increase customer attrition and adversely affect our business, financial condition and results of operations. In addition, we may lose members due to adverse changes in general economic conditions or the regulatory environment in the regions in which we operate or the industries in which our members operate.

We have experienced fluctuations in our member base. Our members may terminate their membership agreements for leasing our workstations or spaces with us at any time upon one-month’s notice. Furthermore, our existing spaces may become unsuitable to members for a number of reasons. For example, our community could become less popular because of a shift in the local economic landscape, or our members may no longer favor our products and service offerings because of new work style trends or changes in the large enterprise members’ business plans.

Launching new spaces, as mentioned above, is expensive and involves certain risks. Likewise, it would be costly and risky to develop and introduce new lines of products or service offerings. Even if we attract new members, these new members may not maintain the same level of involvement in our community. For example, they may not use our U Plus services. In addition, our net revenue might suffer because of the discounts and other incentives we offer to attract new members.

Our growth has experienced volatility and in subject to various factors, some of which are beyond our control. If we are unable to manage our growth effectively, our business may be materially adversely affected.

Our growth has experienced volatility. The number of our agile office spaces increased from 191 as of December 31, 2018 to 204 as of December 31, 2019 and further to 234 as of December 31, 2020. The number of our spaces in operation increased from 162 as of December 31, 2018 to 174 as of December 31, 2019 and decreased to 163 as of December 31, 2020. The number of workstations available in our spaces in operation increased from approximately 64,200 as of December 31, 2018 to approximately 73,300 as of December 31, 2019 and decreased to approximately 57,500 as of December 31, 2020.

Our growth rates remain subject to various factors, some of which are beyond our control, including increasing competition within the industry, declining growth of China’s agile office space industry in general, emergence of alternative business models, or changes in government policies or general economic conditions. For example, a significant portion of our existing and target member base consists of SMEs, whose growth and expansion have benefited from favorable policies encouraging entrepreneurship and innovation in recent years in China. If changes in policies adversely affect the growth of SMEs, our growth rate may decline due to the reduction in agile office needs in general.

We have incurred significant losses historically, and we may experience significant losses in the future.

We have incurred net losses since our inception in April 2015. For the years ended December 31, 2018, 2019 and 2020, we incurred net loss of RMB445.2 million, RMB806.7 million, and RMB507.9 million (US$77.8 million) respectively.

Our significant losses have resulted primarily from the investments made to grow our business, including opening additional spaces, redeveloping existing spaces and acquiring businesses that could contribute to realizing our enterprise vision. We expect that these costs and investments will grow as our business develops. Moreover, we plan to invest significant capital in upgrading our technology system, recruiting a large number of members and launching more spaces.

We also expect to incur additional general and administrative expenses and compliance costs. These expenditures may make it difficult for us to achieve profitability, and we cannot predict whether we will achieve profitability in the near term or at all. The costs actually incurred could exceed our expectations, and the investments may be unsuccessful and not generate adequate revenue and cash flow, if any at all.

5

We have substantial indebtedness and other liabilities and are exposed to liquidity constraints, which could make it difficult to obtain additional financing on favorable terms or at all and could adversely affect our financial condition, results of operations and ability to repay our debts.

We have substantial debt, which we have incurred primarily to finance the capital expenditures needed to carry out our daily operations. We had working capital (defined as total current assets deducted by total current liabilities) deficits of RMB739.4 million and RMB371.6 million (US$56.9 million), as of December 31, 2019 and 2020, respectively. Historically, we have not been profitable or generated positive net cash flows.

As of December 31, 2020, we had RMB49.5 million (US$7.6 million) in short-term borrowings, RMB3.6 million (US$0.6 million) as the current portion of long-term borrowings and RMB15.2 million (US$2.3 million) in long-term borrowings. To service our debt, we intend to extend or renew those borrowings, or to borrow new loans from commercial banks or other institutions or entities. See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources.”

If we were unable to obtain financing on favorable terms, this could hamper our ability to obtain further financing and meet our principal and interest payment obligations to our creditors. As a result, we may face liquidity constraints. In order to provide additional liquidity, we could be forced to reduce our planned capital expenditures, implement austerity measures and/or sell additional non-strategic assets to raise funds.

A reduction in our capital expenditure program could adversely affect our financial condition and results of operations, in particular, our ability to achieve our anticipated growth or maintain the operations of our current spaces. Such events, if they occur, would adversely affect our financial condition and results of operations.

We have recorded negative cash flows from operating activities historically and may experience significant cash outflows or have net current liabilities in the future.

We have experienced significant cash outflow from operating activities historically. We had net cash used in operating activities of RMB52.1 million, RMB223.4 million, and RMB27.6 million (US$4.2 million) in 2018, 2019 and 2020, respectively. The cost of continuing operations could further reduce our cash position, and an increase in our net cash outflow from operating activities could adversely affect our operations by reducing the amount of cash available for our operations and business expansion.

Failure to generate positive cash flow from operations may adversely affect our ability to raise capital for our business on reasonable terms, if at all. It may also diminish the willingness of members or other parties to enter into transactions with us, and have other adverse effects that harm our long-term viability.

We had net current liabilities of RMB739.4 million and RMB371.6 million (US$56.9 million) as of December 31, 2019 and December 31, 2020, respectively. Net current liabilities expose us to liquidity risk. We have satisfied our liquidity requirements primarily through equity financing activities and short-term/long-term borrowings. Such financing might not be available to us in a timely manner or on terms that are acceptable, or at all.

Our business will require significant working capital to support our growth. Our future liquidity and ability to make additional capital investments will depend primarily on our ability to maintain sufficient cash generated from operating activities and to obtain adequate external financing. We may not renew existing bank facilities or obtain equity or other sources of financing.

Our financial condition and operational results are affected by our occupancy rates. We face heightened risks as we rely on many large enterprise members to sustain our occupancy rates.

In pre-opening process, our spaces typically have a three to five month vacancy period to redevelop space and conduct other pre-opening preparation work. The vacancy period might also be longer than expected if we cannot attract members to our new spaces or maintain members of our existing spaces.

We rely on a limited number of key large enterprise members to sustain our occupancy rates. Our top 25 large enterprise members accounted for approximately 35.0% of our tenancy in terms of workstations as of December 31, 2020 and contributed to 16.9% of our total net revenue for 2020. Such concentration leads to heightened risks, for instance, if one of these key enterprises terminates its contract with us, our business could suffer.

6

Large enterprise members often sign membership agreements on longer lease terms and for larger spaces or a greater number of workstations than some of our other members. They generally account for a high proportion of our net revenue at a particular community. A default by a large enterprise member under its agreement with us could significantly reduce the operating cash flow generated by the community where that large enterprise member is situated.

In addition, the larger amount of available space occupied by any individual large enterprise member means that the time and effort required to execute a definitive agreement tailored for such a member is greater than that required for our standard membership agreements. In some instances, we agree to varying levels of customization of the spaces we license to these large enterprise members.

Large enterprise members may nevertheless delay commencement of their membership agreements, fail to make timely lease payments, declare bankruptcy or otherwise default on their obligations. Any of these events could result in the termination of that large enterprise member’s agreement with us and, potentially, sunk costs and transaction costs that are difficult or impossible for us to recover.

If the members choose not to continue using our spaces, new members may not use the current space or we need additional time and cost to redevelop the space, which may result in longer vacancy periods and adversely affect our operational results.

Our key operational metrics and other estimates may not accurately measure our operating performance.

We continually review the numbers of spaces, workstations, members and occupancy rates to evaluate our growth trends, measure our performance and make strategic decisions. We calculate these metrics using internal data and they may not be indicative of our future operating performance. While these numbers are based on what we believe to be reasonable estimates for the applicable period of measurement, measuring how our spaces are used across a large member base involves significant challenges.

For example, the number of our members may include members who do not actively use our spaces or services. If investors do not perceive our operating metrics to accurately represent our operating performance, or if we discover material inaccuracies in our operating metrics, our business, financial condition and reputation may be materially adversely affected.

We require significant capital to fund our operations and growth. If we cannot obtain sufficient capital on acceptable terms, our business, financial condition and prospects may suffer.

We require significant capital and resources for our operations and continued growth. We expect to make significant investments in the expansion and operations of our spaces, which may significantly increase our net cash used in operating activities. Our sales and marketing expenses may also increase to retain existing members and attract new members. In addition, we invest heavily in our technology systems, which are essential to our expansion and operations. It may take substantial time to realize returns on such investments, if at all.

We have historically funded our cash requirements primarily through capital contributions from our shareholders, short-term/long-term borrowings and securities offerings. If these resources are insufficient to satisfy our cash requirements, we may seek to raise funds through additional equity offerings or debt financing or additional bank facilities.

Our ability to obtain additional capital in the future, however, is subject to a number of uncertainties, including our future business development, financial condition and results of operations, general market conditions for financing activities by companies in our industry, and macro-economic and other conditions in China and globally. If we cannot obtain sufficient capital on acceptable terms to meet our capital needs, we may not execute our growth strategies, and our business, financial condition and prospects may be materially adversely affected.

Our advertising and branding services are subject to risks associated with concentration of customers.

The majority of our marketing and branding services revenue generated in 2020 was mainly attributed to one of our subsidiaries, Shengguang Zhongshuo, a digital marketing services provider we acquired in December 2018. In 2020, the top four customers of Shengguang Zhongshuo accounted for approximately 79.4% of our revenue from our advertising and branding services.

Such concentration leads to heightened risks. For example, any adverse changes or loss of one of our major customers of our advertising and branding services may materially decrease our marketing and branding services revenue, and any interruption or adjustments of those major customers’ businesses may lead to material fluctuations in our marketing and branding services revenue. Due to the decreased marketing and branding spending by certain major clients in 2020, our marketing and branding services revenue decreased by 40.6% from RMB534.8 million in 2019 to RMB317.5 million (US$48.7 million) in 2020.

7

In addition, the historical financial results of our marketing and branding services may not serve as an adequate basis for evaluating the future financial results of this segment. Our history of operating Shengguang Zhongshuo is limited and the concentration of customers increases the likelihood of material fluctuations of our marketing and branding services net revenue.

For example, we experienced substantial growth in net revenue from marketing and branding services in the third quarter of 2020 primarily due to the increased demand from major customers. However, such growth rate may not be sustainable since our net revenue from marketing and branding services will be largely impacted by fluctuations in demand for marketing and branding services from our major customers.

Our expansion into new regions, markets and business areas may pose increased risks.

We plan to expand our operations in China and overseas markets. To provide superior services to our members, we also intend to increase our U Plus service offerings. This expansion will incur significant costs, and inherently involves uncertainties and risks as we may encounter unexpected issues or situations for which we are unprepared.

As our business expands into new regions, we plan to invest substantial resources and may face new operational risks and challenges associated with business, economic and regulatory environments with which we are not familiar. We must understand and comply with local regulations, partner with local businesses or individuals, hire, train, manage and retain local workforce, and cope with members or potential members with different preferences.

In launching new spaces in a new region, we need to negotiate satisfactory leasing terms with local parties, adapt the designs and features of our spaces and services to accommodate local conventions, and adjust our pricing and marketing approaches based on local rental prices. All these adjustments we make may be ineffective and adversely affect our business. Our strategy of overseas expansion will further subject us to different cultural norms and business practices, risks relating to fluctuations in currency exchange rates, and unpredictable disruptions as a result of security threats or political or social unrest and economic instability.

We have incurred, and may in the future incur, impairment loss on long-lived assets. Significant impairment of our long-lived assets could materially impact our financial position and results of our operations.

We have made significant investment in long-lived assets. We review our long-lived assets, including right-of-use of assets arising from certain long-term leases, property, plant and equipment and assets recorded in connection with business combinations, whenever events or changes in circumstances indicate that the carrying amount of an asset may no longer be recoverable. When these events occur, we measure impairment by comparing the carrying value of the long-lived assets to the estimated undiscounted future cash flows expected to result from the use of the assets and their eventual disposition.

If the sum of the expected undiscounted cash flow is less than the carrying amount of the assets, we recognize an impairment loss based on the fair value of the assets. The application of long-lived asset impairment test requires significant management judgment. If our estimates and judgments are inaccurate, the fair value determined could be inaccurate and the impairment may not be adequate, and we may need to record additional impairments in the future.

We had impairment loss on long-lived assets of RMB52.0 million in 2019 and RMB36.5 million (US$5.6 million) in 2020. These impairment losses primarily reflected impairment of right-of-use of assets arising from certain long-term leases, including certain long-term lease agreements with certain shareholders. For further information, see “Item 5. Operating and Financial Review and Prospects—A. Operating Results — Key Components of Results of Operations.” We could record additional impairments on long-lived assets in the future. Any significant impairment losses charged against our long-lived assets could materially adversely affect our results of operations.

We face vigorous competition. If we are not able to compete effectively with others, our business, financial condition and results of operations may be materially and adversely affected.

While we are a leader in the Chinese agile office space industry, the industry remains at an early stage of development. If new companies launch competing solutions in the markets in which we operate, we may face increased competition for members. Our competitors include global players, up-and-coming local companies and traditional workspace operators. Some competitors may have more resources, operate in more jurisdictions and be able to provide a better member experience at more competitive prices.

8

We may face heightened competition under certain operating models. For example, for our spaces under U Brand, our competitors may charge lower management fees and we may lose clients due to pricing or be forced to lower our fees. Our inability to compete effectively in securing new or repeat businesses could hinder our growth or adversely impact our operating results.

In addition, some of the services we provide or plan to provide are served by companies established in their markets. Failure to compete in such services markets could damage our ability to cultivate the vibrant community we seek to build.

Our success depends on the continuing efforts of our key management and capable personnel as well as our ability to recruit new talent. If we fail to hire, retain or motivate our staff, our business may suffer.

Our future success depends in a large part on the continued service of our key management. If we lose the services of any member of our key management, we may not hire suitable or qualified replacements, and may incur additional expenses to recruit and train new staff, which could severely disrupt our business and growth. If any member of our key management joins a competitor or forms a competing business, we may lose customers, know-how and key professionals and staff members.

Our rapid growth also requires us to hire, train, and retain a wide range of personnel that can adapt to a dynamic, competitive and challenging business environment and that help us conduct effective marketing, innovate new products and service offerings, and develop technological capabilities. We may need to offer attractive compensation and other benefits packages, including share-based compensation, to attract and retain them.

We also need to provide our employees with sufficient training to help them realize their career development and grow with us. Any failure to attract, train, retain or motivate experienced and capable personnel could severely disrupt our business and growth.

Certain of our affiliated persons or entities are now or may in the future lease the building spaces they own to us or have other transactions with us. We may have conflicts of interest with our officers and directors for such related party transactions and we may not resolve such conflicts on terms favorable to us.

Certain of our officers and directors are now or may in the future lease the building spaces they own to us or have other transactions with us. For example, we lease certain spaces from Youxiang Group, an affiliate of Dr. Daqing Mao, our founder. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions.”

Those related parties negotiated satisfactory terms that are in the best interests of their businesses as a whole. Although our audit committee, consisting of independent non-executive directors, reviews and approves all proposed related party transactions, we may not resolve all potential conflicts of interest in this regard.

We have engaged in transactions with related parties, and such transactions present potential conflicts of interest that could adversely affect our business and results of operations.

In addition to leasing building spaces from related parties, we have entered into a number of other transactions with related parties. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions.” for more details. We may enter into additional transactions with our related parties. Interests of these related parties may not necessarily be aligned with our interests and the interests of our other shareholders.

For example, conflicts of interest may arise in connection with transaction arrangements which may be less favorable to us than similar arrangements negotiated with unaffiliated third parties. Conflicts of interest may also arise in connection with the exercise of contractual remedies, such as the treatment of events of default. As a result, those related party transactions, individually or in the aggregate, may adversely affect our business and results of operations.

9

Unexpected termination of leases or other arrangements, failure to negotiate satisfactory terms for or perform leases or other arrangements, failure to renew leases or other arrangements of our existing premises or to renew leases or other arrangements at acceptable terms could materially adversely affect our business.

Our ability to increase the number of spaces and to operate them profitably depends on the execution and performance of these leases or other arrangements and whether we can negotiate these leases and other arrangements on satisfactory terms. Lessors may also not duly perform their obligations under the leases or other arrangements due to various reasons, such as lessors’ failure to deliver the possession of the premises as agreed.

The increases in rental rates, particularly in markets where initial terms under our leases are shorter, could adversely affect our business. In addition, our ability to negotiate favorable terms to extend an lease agreement or in connection with an alternate space depend on prevailing conditions in the real estate market, such as overall lease expenses, competition from other would-be tenants for desirable leased spaces, our relationships with building owners and landlords, or other factors beyond our control.

If we cannot renew or replace an expiring lease agreement, we will incur significant costs related to vacating that space or redeveloping the space. This could result in loss of members who may have chosen that space based on the design, location or other attributes of that particular space.

Strategic alternatives to pure leasing arrangements, such as acquisitions, strategic alliances and asset management agreements, accounted for a significant percentage of the spaces we obtain. These arrangements are generally more flexible and require less direct capital expenditures than a traditional lease arrangement but also involve risks and uncertainties.

For example, we have experienced delays or failure to deliver the possession of the premises with some of the counterparties for various reasons, including the delay of completion of the construction and the change of title of the premises before delivery. Although we have experienced such delays or failures in limited cases, we could experience delays or failures to deliver the premises in the future. Disruption of these strategic arrangements will adversely affect our business.

Growth of our business will partially depend on the recognition of our brand. Failure to maintain, protect and enhance our brand would limit our ability to expand or retain our member base, which would materially adversely affect our business, financial condition and results of operations.

We believe that recognition of our brand among members and business partners has reduced member acquisition costs and contributed to the growth and success of our business. Maintaining, protecting and enhancing our brand remains critical to our business and market position. Maintaining, protecting and enhancing our brand depends on several factors, including our ability to:

| ● | maintain the quality and attractiveness of the services we offer; |

| ● | maintain relationships with landlords and other business partners; |

| ● | increase brand awareness through marketing and brand promotion activities; |

| ● | comply with relevant laws and regulations; |

| ● | compete effectively against existing and future competitors; and |

| ● | preserve our reputation and goodwill generally and in the event of any negative publicity on our services and data security, or other issues affecting us, and China’s agile office space industry in general. |

A public perception that we, or other industry participants do not provide satisfactory services, even if factually incorrect or based on isolated incidents, could damage our reputation, diminish the value of our brand, undermine the trust and credibility we have established and negatively impact our ability to attract and retain members, as well as our business, financial condition and results of operations.

We face risks associated with the redevelopment and construction of the spaces we occupy.

Opening new spaces subjects us to risks associated with redevelopment projects in general, such as delays in construction, contract disputes and claims, fines or penalties levied by government authorities relating to our construction activities. We may also experience delays when opening a new space as a result of building owners or landlords not completing their base building work on time or as a result of delays in our obtaining land-use, building, occupancy and other required governmental permits and authorizations. Failure to open a space on schedule may result in lost revenue from that space, damage our brand and require that we lease and provide temporary space for our members.

10

Despite having our own design and building team during the development phase of our space, we rely in part on the availability and satisfactory performance of third-party general contractors and subcontractors to perform the actual construction work, and in many cases to select and obtain the related building materials. The timing and quality of the redevelopment of our occupied spaces depend on the performance of these third party contractors acting on our behalf.

The people we engage in connection with a construction project are subject to the usual hazards associated with providing construction and related services on construction project sites, which can cause personal injury, damage to or destruction of property, plant and equipment, and environmental damage. Although we are insured against many of these risks, our insurance coverage may be inadequate in scope or coverage amount, and may be insufficient to fully compensate us for losses arising from any such events.

Despite our detailed specifications and our inspection, project management and quality control procedures, in some cases, general contractors and their subcontractors may use improper construction practices or defective materials. Improper construction practices or defective materials can result in the need to perform extensive repairs to our spaces and potentially lead to personal injury. We could also suffer damage to our reputation, and may be exposed to possible liability, if these third parties fail to comply with applicable laws.

We incur significant costs related to the redevelopment of our spaces, which we may be unable to recover in a timely manner or at all.

Redevelopment of a space typically takes three to five months from the date we take possession of the space under the relevant occupancy agreement to the opening date. During this time, we incur substantial costs without generating any revenues from the space, especially the costs for spaces under our self-operated model for which we bear lease and redevelopment costs.

If we cannot complete our redevelopment and construction activities, or conditions in the real estate market or the broader economy change in unfavorable ways, we may be unable to recover these costs in a timely manner or at all. In addition, our redevelopment activities are subject to cost and schedule overruns as a result of many factors, some of which are beyond our control and ability to foresee, including increases in the cost of materials and labor.

We incur costs relating to the maintenance, refurbishment and remediation of our spaces.

Our lease agreements generally require that we keep the spaces we occupy in good status and we typically must maintain and repair spaces we decorate. Our lease agreements for overseas spaces may also require us to return the space to the landlord at the end of the term in the same condition it was delivered to us, which, in such instances, will require removing all fixtures and improvements to the space. The costs associated with this maintenance, removal and repair work may be significant.

We may also have to periodically refurbish our spaces to keep pace with the changing needs of our members. Extensive refurbishments may be costly and time-consuming and negatively impact our operational and financial performance. Our member experience may also be adversely affected if extensive refurbishments disrupt our operations at our spaces.

The long-term and fixed cost nature of our leases may limit our operating flexibility and could adversely affect our liquidity.

We currently lease a significant majority of our spaces under long-term leases with an average term of approximately eight years. Our obligations to landlords under these agreements extend for periods that significantly exceed the length of our membership agreements with our members, which our members may terminate upon one-month’s notice. Our leases generally provide for fixed monthly payments that are not tied to member usage or the size of our member base, and all of our leases contain minimum lease payment obligations.

As a result, if members at a particular space terminate their membership agreements with us and if we are unable to attract our members to actively use our spaces or services, our lease expenses may exceed our net revenue. In areas where retail cost for real estate is decreasing, we may not lower our fixed monthly payments under our leases to rates commensurate with prevailing market rates. At the same time, we would be pressured to lower our membership fees charged to the members, potentially resulting in our lease expense exceeding our net revenue. In such events, we could not reduce our lease expenses or otherwise terminate the relevant lease in accordance with its terms.

11

If we experience a prolonged reduction in net revenue at a particular space, our results of operations in respect of that space would be adversely affected unless and until either the lease expires, or we are able to assign the lease or sublease the space to a third party, or we default under the lease and cease operations at the leased spaces. Our ability to assign a lease or sublease the space to a third party may be constrained by provisions in the lease that restrict these transfers without the prior consent of the landlord.

In addition, we could incur significant costs if we decide to assign or sublease unprofitable leases, as we may incur transaction costs associated with finding and negotiating with potential transferees, and the ultimate transferee may require upfront payments or other inducements. A default under a lease could expose us to breach of contract and other claims which could result in direct and indirect costs to us, and could result in operational disruptions that could harm our reputation and brand.

Failure to comply with the terms of our indebtedness could result in default, which could have an adverse effect on our cash flow and liquidity.

We may enter into credit facilities and debt financing arrangements containing financial and other covenants that could, among other things, restrict our operations. If we breach any of these covenants, including the failure to maintain certain financial ratios, our lenders may accelerate our debt obligations. Any default under our credit facility could result in the repayment of these loans prior to maturity as well as the inability to obtain additional financing, which may materially adversely affect our cash flow and liquidity.

Some of the lease agreements of our leased properties have not been registered with PRC government authorities as required by PRC law, which may expose us to potential fines.

Under PRC law, we must register lease agreements of commodity housing tenancy with the local construction (real estate) departments. Some of our lease agreements for our leased properties in China, including leased properties for our spaces, have not been registered with PRC government authorities. The reasons for the incomplete registration and filing of lease agreements include:

| ● | the lessors failed to provide necessary documents for us to register the leases with the local government authorities; |

| ● | certain local regulatory authorities do not process certain leases registration applications; and |

| ● | we did not file registrations for certain of our lease agreements that were close to expiration. |

Failure to complete the registration and filing of lease agreements will typically not affect the validity of the lease agreements. However, if the parties to the lease agreements fail to rectify such non-compliance within the prescribed timeframes after receiving notice from the PRC government authorities, they may be exposed to potential fines ranging from RMB1,000 to RMB10,000 for each unregistered lease, at the discretion of the relevant authority. As advised by our PRC counsel, if we fail to rectify the unregistered leases within the period required by relevant government authorities, the maximum amount of potential fines arising from the unregistered leases would be approximately RMB0.8 million as of the date of this annual report. However, no material penalty has been imposed on us to date for the failure to register the relevant lease agreements.

We have taken several steps to strengthen our compliance for registration of lease agreements, including:

| ● | liaising with the relevant lessors to provide required documentation for completing the registration; |

| ● | filing registrations for lease agreements that are close to expiration if such agreements are extended; and |

| ● | strengthening our internal control procedures to ensure registration of lease agreements for our new spaces. |

12

Property owners, government authorities or other third parties could challenge our rights to use our leased properties, which may disrupt our operations and incur relocation costs.

Certain lessors of our leased properties in China have failed to provide us with valid property ownership certificates or authorizations from the property owners for the lessors to sublease the properties. If such lessors do not have the relevant property ownership certificates or the right to lease or sublease such properties to us, the relevant rightful title holders or other third parties may challenge our use of such leased properties. As a result, we may be forced to vacate these properties and be required to seek alternative properties for lease or choose to terminate the lease earlier while bearing the penalty for early termination under the lease.

The usage of our leased properties might also be challenged by other various reasons, such as restrictions purposed by laws, regulations or policies based on the nature or usage of certain leased properties. With respect to these properties, if the lessors violate relevant laws and regulations for providing such leased properties to us, and incur penalties by government authorities, we may not lease and use such properties. In such an event, our operations may be interrupted, and we would incur relocation costs. Moreover, if third parties challenge our lease agreements, we could incur time, attention and costs associated with defending such actions, even if such challenges are ultimately determined in our favor.

If our promotional and marketing plans are not effective, our business and prospects may be negatively affected.

We invest in sales and marketing activities to promote our brand and spaces and deepen our relationships with members. We also pay for online advertisements to platforms to sustain our exposure and publicity. To foster our member base, we may offer discounts or other incentives, which incur costs and might not be effective for obtaining new members.

Our members may not appreciate our sales and marketing activities. The evolving marketing landscape may require us to experiment with new marketing methods to keep pace with industry trends and member preferences. Failure to refine our existing marketing approaches or introduce new marketing approaches in a cost-effective manner could reduce our members, occupancy rates and market share.

We also rely on a number of agencies, business partners and our own business development team to attract new members and enlarge our member base. Any disruption of our relationship with these intermediaries could harm our abilities to promote our business. We may not recover the costs of our sales and marketing activities and these activities may not retain or attract members.

A significant interruption in the operations of our suppliers could potentially disrupt our operations.

We partially rely on third-party suppliers for certain equipment, furniture and other fixtures. We also depend on third-party suppliers to provide certain services to facilitate our daily operations, such as security services and maintenance services. We have limited control over the operations of third-party suppliers, and any significant interruption in their operations may adversely impact our operations. For example, a significant interruption in the operations of our internet service provider could impact the operations of our applications, malfunctioning of our security equipment could lead to safety issues of our spaces, and lighting disruptions could result in poor member experience.

Disruptions in the supply chain may result from weather-related events, natural disasters, trade restrictions, tariffs, border controls, acts of war, terrorist attacks, pandemics, third-party strikes or ineffective cross dock operations, work stoppages or slowdowns, shipping capacity constraints, supply or shipping interruptions or other factors beyond our control. If we cannot resolve the impact of the interruptions of operations of our third-party suppliers or service providers, our operations and financial results may be materially adversely affected.

In some cases, we may rely on a single source for procurement of construction materials or other supplies in a given region. Any disruption in the supply of certain materials could disrupt operations at our existing spaces or significantly delay our opening of a new space, which may harm our reputation and brand.

A large portion of our members are concentrated in major metropolitan areas and certain industries. An economic downturn in any of these areas or industries may result in reduction of our members and adversely affect our results of operations.

A significant portion of our existing and target member base consists of SMEs who may be disproportionately affected by adverse economic conditions. In addition, the concentration of our operations in specific cities magnifies the risk of localized economic conditions in those cities or the surrounding regions to any business.

13

In 2018, 2019 and 2020, we generated the majority of our net revenue from our agile office spaces located in Beijing, Shanghai, Guangzhou and Shenzhen. Adverse changes in general economic conditions or real estate markets as well as relevant regulatory environment in these cities may disproportionately affect our member base, occupancy rates and/or pricing.

In addition, our members are concentrated in certain industries, such as the technology, media and telecommunications industries. Adverse changes in those industries may affect the demand for agile office spaces of our members and further affect our operation results. Our business may also be affected by generally prevailing economic conditions in the markets where we operate, which can result in a general decline in real estate activity, reduce demand for occupancy and our services and exert downward pressure on pricing.

We face risks related to natural disasters, extreme weather conditions, health epidemics and other catastrophic incidents, which could significantly disrupt our operations.

China has experienced significant natural disasters, including earthquakes, extreme weather conditions, as well as health scares related to epidemic or pandemic diseases, and any similar event could materially impact our business in the future. If a disaster or other disruption occurred that affects the regions where we operate our business, the resulting loss of personnel and damage to property could materially adversely affect our business. Even if we are not directly affected, such a disaster or disruption could affect the operations or financial condition of our ecosystem participants, which could harm our results of operations.

In addition, our business could be affected by public health epidemics, such as the outbreak of avian influenza, severe acute respiratory syndrome, or SARS, Zika virus, Ebola virus, COVID-19 or other disease. In December 2019, a novel strain of coronavirus (“COVID-19”) surfaced in China. While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, infections have spread globally. The World Health Organization declared COVID-19 to constitute a “Public Health Emergency of International Concern” on January 30, 2020 and characterized it as a pandemic on March 11, 2020.

To contain the COVID-19 outbreak, the PRC government imposed strict measures across the country including, but not limited to, travel restrictions, mandatory quarantine requirements, temporary closure of business premises, and postponed resumption of business. Our operations were severely disrupted in the first quarter of 2020 but gradually resumed after April 2020. In particular, most of our space in China temporarily shut down from February 2020 to April 2020 as a result of government restrictions and regulations. Due to the economic downturn in China and worldwide caused by COVID-19, the demand for our spaces has been adversely affected since January 2020.

As some of our members are vulnerable to the COVID-19 outbreak and the slowdown of the macroeconomic conditions, they could not make payments in a timely manner or stopped renewing their leases, resulting in decreased occupancy rates. Although China has controlled COVID-19 to some extent and our business started to recover after the second quarter of 2020, the potential impact brought by and the duration of the COVID-19 outbreak is difficult to assess or predict and the full impact of COVID-19 on our operations will depend on many factors beyond our control.

While it is unknown how long these conditions will last and what the complete financial effect will be on us, we are closely monitoring the impact of COVID-19. Our business, results of operations, financial condition and prospects could be materially adversely affected to the extent that COVID-19 harms the Chinese and global economy in general.

Our business and our reputation may be affected if our employees or members of our community or guests who enter our spaces behave badly.

Our emphasis on our values makes our reputation particularly sensitive to allegations of violations of community rules or applicable laws by employees, members, or guests who enter our spaces. If employees, members or guests violate our policies or engage in illegal or unethical behavior, or are perceived to do so, we may be subject to negative publicity and our reputation may be harmed. This behavior may also lead to existing members ceasing to use our spaces, which would adversely impact occupancy and revenue for the affected spaces.

14

We are exposed to risks relating to our cooperation with our business partners.

We select and rely on a number of business partners to provide various services such as corporate secretary and human resources, to facilitate more service options and better experience for our members. Due to the reliance on such business partners, any interruption of their operations, any failure of them to accommodate our fast growing business scale, any termination or suspension of our partnership arrangements, any change in cooperation terms, or any deterioration of cooperative relationships with them may materially adversely affect our brand image and impact our operations.

We have limited control over our business partners. Failure by third parties to provide satisfactory services or comply with laws and regulations could subject us to reputational harm based on their association with us and our brand. If we become subject to claims arising from services provided by our business partners, we may attempt to seek compensation from the relevant business partners. However, such compensation may be limited.

If no claim can be asserted against a business partner, or we cannot fully recover amounts claimed from business partners, we may be required to bear such losses and compensation at our own costs. This could materially adversely affect our business, financial condition and results of operations.