UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Apartment Income REIT Corp.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Proxy Statement

COV_2 air communities

Votes submitted electronically must be received by 1:00 a.m., MT, on December 7, 2022.

Vote by Internet, Telephone or Mail

24 Hours a Day, 7 Days a Week

YOUR VOTE IS IMPORTANT

|

|

|

|

|

INTERNET |

MOBILE |

PHONE |

|

|

Go to |

scan the QR code |

Call toll free |

Please mark, sign and date |

2022 Proxy Statement 1

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Meeting”) of Apartment Income REIT Corp. (“AIR” or the “Company”) to be held on December 7, 2022, at 4:00 p.m., Mountain Time, at AIR’s corporate headquarters, 4582 South Ulster Street, Suite 1700, Denver, CO 80237, for the following purposes:

WHETHER OR NOT YOU EXPECT TO BE AT THE MEETING, PLEASE VOTE AS SOON AS

POSSIBLE TO ENSURE THAT YOUR SHARES ARE REPRESENTED.

1To elect nine directors, for a term of one year each, until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified;

2To ratify the selection of Deloitte & Touche LLP, to serve as independent registered public accounting firm for the Company for the fiscal year ending December 31, 2022;

3To conduct an advisory vote on executive compensation; and

4To approve the Apartment Income REIT Corp. Amended and Restated 2020 Stock Award and Incentive Plan.

5 To transact such other business as may properly come before the Meeting or any adjournment(s) thereof.

Only stockholders of record at the close of business on October 20, 2022, will be entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof.

We are again pleased to again use the Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of our Meeting.

On or about October 26, 2022, we intend to mail our stockholders a notice containing instructions on how to access our 2022 proxy statement (the “Proxy Statement”), Annual Report on Form 10-K for the year ended December 31, 2021, and vote online. The notice also provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual materials via email, the email contains voting instructions and links to these documents on the Internet.

By order of the Board of Directors

|

DATE AND TIME December 7, 2022, |

|

|

LOCATION 4582 South Ulster Street, |

|

|

Lisa R. Cohn President, General Counsel, and Secretary |

October 26, 2022

Important Notice Regarding the Availability of Proxy Materials for

AIR’s Annual Meeting of Stockholders to be held on December 7, 2022.

This Proxy Statement and AIR’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available free of charge at the following website: www.envisionreports.com/airc.

2 air communities

TABLE OF CONTENTS

|

1 |

|

|

4 |

|

|

7 |

|

|

10 |

|

|

18 |

|

|

20 |

|

|

22 |

|

|

22 |

|

|

31 |

|

|

32 |

|

|

32 |

|

|

32 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

Corporate Governance Guidelines and Director Stock Ownership |

33 |

|

34 |

|

|

34 |

|

|

34 |

|

|

34 |

|

|

34 |

|

|

34 |

|

|

34 |

|

|

34 |

|

|

40 |

|

|

40 |

|

|

41 |

|

|

41 |

|

|

41 |

2 air communities

2022 Proxy Statement 3

|

|

|

|

PROPOSAL 2: Ratification of Selection of Independent Registered Public Accounting Firm |

42 |

|

44 |

|

|

44 |

|

|

44 |

|

|

44 |

|

|

45 |

|

|

46 |

|

|

46 |

|

|

47 |

|

|

48 |

|

|

50 |

|

|

52 |

|

|

52 |

|

|

Compensation and Human Resources Committee Report to Stockholders |

71 |

|

72 |

|

|

73 |

|

|

74 |

|

|

76 |

|

|

77 |

|

|

Chief Executive Officer Compensation and Employee Compensation |

78 |

|

78 |

|

|

Policies and Procedures for Review, Approval or Ratification of Related Person Transactions |

78 |

|

80 |

|

|

92 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

92 |

|

94 |

|

|

94 |

|

|

94 |

|

|

94 |

|

|

A-1 |

2022 Proxy Statement 3

4 air communities

DEAR AIR SHAREHOLDERS:

We write as shareholders too…and as colleagues who have worked together for the past 15 years to enhance the value of AIR: Tom, first as an Aimco director and now Chairman of the AIR Board of Directors; and Terry as Founder/CEO of “Old Aimco” and now AIR.

Together with our board colleagues, we made the strategic decision two years ago to create AIR as a simple, efficient, and predictable business, differentiated in its focus on operations where AIR has a comparative advantage. The market rewarded that decision as you can read on page 7. More importantly, the decision and resulting steps taken leave us well prepared for the future, including the currently uncertain economy.

We transformed our pre-COVID real estate portfolio by disposing of approximately 40%, or $5.4 billion worth, through $1.8 billion in property sales, $1.4 billion to joint venture partners, and $2.2 billion left with Aimco. The results are significant.

•For what we sold, the timing was excellent: we received property prices equal to 15% more than our previous estimate of their GAV. We used the proceeds to reduce leverage by $850 million and to fund $1.4 billion of acquisitions.

•With lower leverage, our balance sheet is safer and more flexible. We increased liquidity and enhanced the value of AIR’s portfolio of unencumbered properties from $2.4 billion then to $7.8 billion today.

•Refunding and repricing risk over the next three years are now 10% as a percentage of total leverage. Our inaugural corporate debenture was for $400 million and was well received by the market.

•The property purchases increased the profitability and quality of the AIR portfolio. For example,

–We expect the properties acquired to generate unlevered IRRs of 200 basis points or more than the properties sold,

–Average monthly revenue per apartment home, $2,272 at the start of 2020, was $2,596, pro forma for expected property sales, at the end of the second quarter, up 14% (by contrast, the average same store monthly revenue per apartment home of our coastal peers is now $2,625, up only 4% from the start of 2020),

–We reduced regulatory risk, exiting markets such as New York and Chicago,

–We allocated capital to more dynamic markets, such as Southeast Florida where AIR has allocated 19% of its GAV and has by far the largest allocation of the larger multifamily REITs, and

–Acquisitions new to the AIR platform now account for ~14% of GAV, and over the next three to five years are expected to increase NOI at twice the rate of our Same Store portfolio.

•We have a more focused business with no exposure to development nor mezzanine investments, nor their attendant risks.

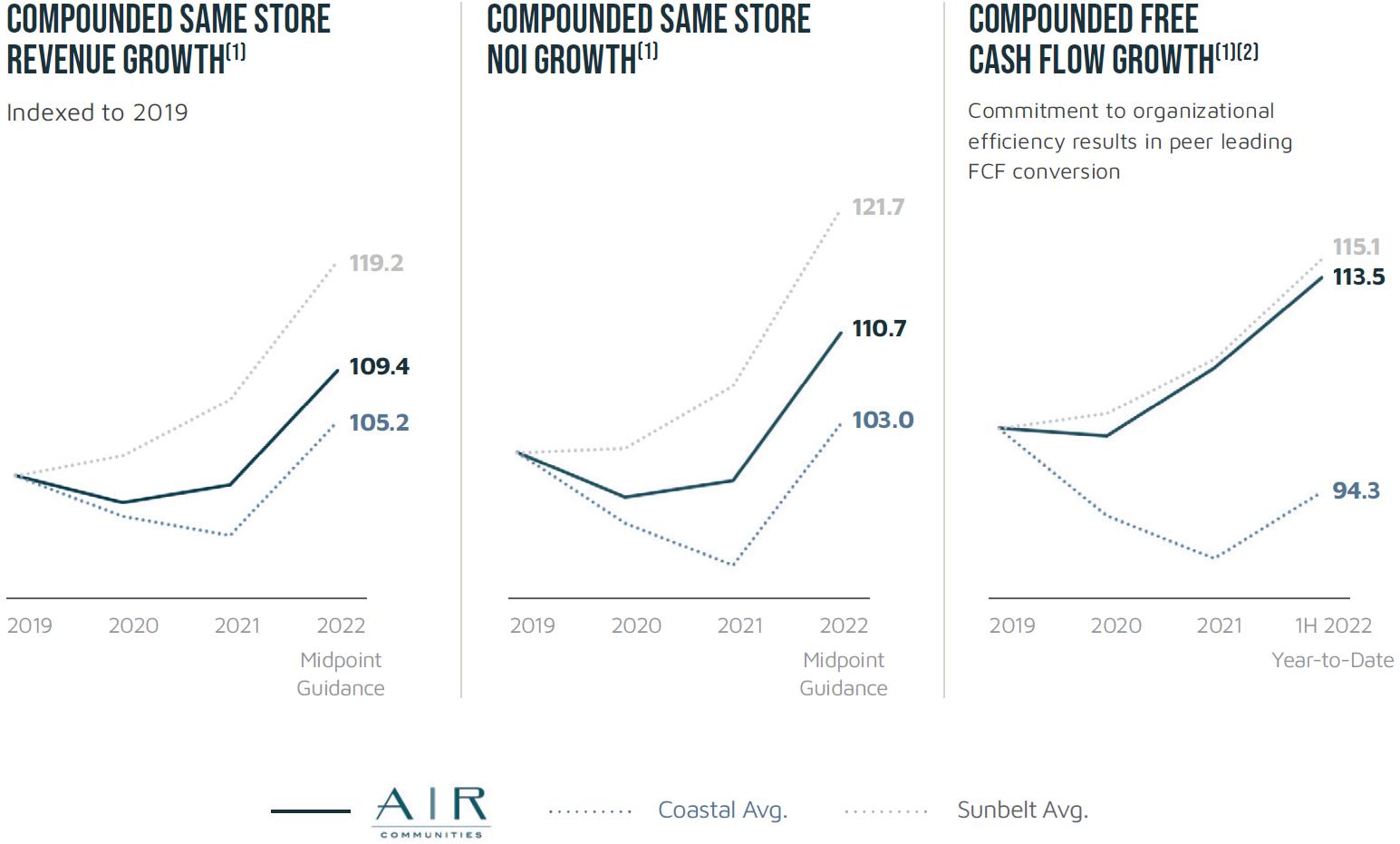

•We continue to benefit from the “AIR Edge,” our property operations, which outperformed coastal peers in same store revenue growth by 425 basis points cumulatively over 2020 to 2022 (assuming 2022 results equal the midpoint of guidance), and outperformed all peers in customer satisfaction and retention, cost control and operating margin.

•AIR is independent of “Old Aimco”: entanglements of approximately 14% of NAV at the Separation are just 34 basis points today.

•We have the benefit of the fresh perspectives of five new directors first elected in 2020 and 2021. Our board colleagues bring diverse experiences and a high level of engagement. Directors meet regularly with shareholders…who have the final say in our annual elections.

2022 Proxy Statement 5

As we write, we are aware of the turbulence in the economy and weakness in the stock market. Happily, AIR has limited exposure to higher interest rates. AIR customers’ income and credit, much higher than industry averages, limit our exposure to recession.

Looking to next year, we have the benefit of an approximately 5% earn-in of 2022 leases and the opportunity to recover in new and renewal leases a loss-to-lease we estimate in the mid- to high-single digits. We have the advantage of a history of cost control founded on productivity (a slightly negative CAGR over the past 12 years; expected to be flat in 2022 notwithstanding the high rate of inflation). Cost discipline combined with organizational efficiency (net G&A is capped at 15 basis points of GAV), allow AIR to convert about 66% of Same Store Revenue into free cash flow. Coastal and sunbelt peers need approximately 7% and 15% higher Same Store Revenue growth, respectively, to match AIR. Our advantage is considerable and durable.

We have a sense of mission “to provide quality apartment homes in a respectful environment delivered by a team of people who care.” We feel a calling to provide homes for others and we take seriously our responsibility to be good employers…and good stewards of your capital.

We are fortunate to work in a vigorous and intentional culture founded on integrity, respect for all, personal responsibility for outcomes, customer focus, and a passion to serve others. Our commitment to collaboration demonstrates again and again the remarkable results that a team can achieve by working together.

Our engaged and experienced Board and our dedicated and talented management team work together in the culture we share. We are motivated by our mission and commitments. We are grateful for your trust. We are shareholders too and take seriously the responsibility for our mutual investment.

We are optimistic about the future of AIR. We ask for your support by voting in favor of the four measures included in this proxy statement.

Sincerely,

|

|

|

Tom Keltner Chairman of the Board |

|

Terry Considine Founder and CEO |

6 air communities

EXPLANATORY NOTE

Apartment Income REIT Corp. (“AIR”), a Maryland corporation, is a self-administered and self-managed real estate investment trust. AIR, through wholly-owned subsidiaries, is the general and special limited partner of Apartment Income REIT, L.P. (the “AIR Operating Partnership”), which is the operating partnership in AIR’s structure. As of October 20, 2022, AIR owned approximately 92.1% of the legal interest in the common partnership units of the AIR Operating Partnership and approximately 93.9% of the economic interest in the AIR Operating Partnership. The remaining approximately 7.9% legal interest is owned by limited partners. As the sole general partner of the AIR Operating Partnership, AIR has exclusive control of the AIR Operating Partnership’s day-to-day management. Except as the context otherwise requires, “Company,” “we,” “our,” and “us” refer to AIR, the AIR Operating Partnership, and their consolidated subsidiaries, collectively.

The AIR Operating Partnership economically holds all of AIR’s assets and manages the daily operations of AIR’s business. Pursuant to the AIR Operating Partnership agreement, AIR is required to contribute to the AIR Operating Partnership all proceeds from the offerings of its securities. In exchange for the contribution of such proceeds, AIR receives additional interests in the AIR Operating Partnership with terms substantially similar to the stock issued by AIR.

On December 15, 2020, Apartment Investment and Management Company (“Aimco”) completed the separation of its business into two, separate and distinct, publicly traded companies, AIR and Aimco (the “Separation”). Notwithstanding the legal form of the Separation, for accounting and financial reporting purposes, Aimco is presented as being spun-off from AIR. This presentation is in accordance with generally accepted accounting principles in the United States and is due primarily to the relative significance of AIR’s business, as measured in terms of revenues, net income, assets, and other relevant indicators, as compared to Aimco before the Separation. Therefore, AIR is considered the divesting entity and treated as the accounting spinner, or accounting predecessor, and Aimco as “spun” for accounting purposes. As a result, unless otherwise stated, the information contained herein relates to matters that related to pre-Separation Aimco as representing AIR’s governance, compensation, and related matters.

2022 Proxy Statement 7

At the Separation, we set goals and expected three years would be required for their accomplishment. To put our efforts in context, we recycled approximately $5.4 billion, or 40% of GAV, held by Aimco at the beginning of 2020 through the Separation, property sales, and joint ventures, all during a period of attractive pricing for multi-family properties. The goals were met in one half the expected time, and the results are significant. AIR’s portfolio, now greatly improved, is designed to be the safest, most efficient and most effective way to invest in multi-family real estate in the public markets.

|

|

Aimco |

AIR |

Change |

|

|

Residents |

Average Household Income ($) |

$165,000 |

$232,000 |

+41% |

|

Median Household Income ($) |

$116,000 |

$160,000 |

+38% |

|

|

CSAT Score (out of 5) |

4.30 |

4.33 (2021) |

+0.03 |

|

|

Kingsley Index |

4.09 |

4.05 |

-0.04 |

|

|

|

Note: AIR named Kingsley Elite Five in 2022, #2 among all operators and #1 for public REITs |

|||

|

Portfolio |

# Properties |

124 |

76 |

-39% |

|

# Apartment Homes |

32,598 |

22,594 |

-31% |

|

|

Average Revenue per Apartment Home |

$2,272 |

$2,596 |

+14% |

|

|

(Re-)Development ($M) |

$230 |

$- |

-$230 |

|

|

Mezzanine Investments ($M) |

$280 |

$- |

-$280 |

|

|

Operating |

Same Store Revenue Growth (%) |

3.8% |

11.6% (Q222) |

+305% |

|

Same Store COE Growth (%) |

-% |

-% (2022E) |

-% |

|

|

Same Store NOI Margin (%) |

73.7% |

74.3% (2022E) |

+60 bps |

|

|

Organizational |

GAAP G&A ($M) |

$47 |

$24 (2 x 1H22) |

-49% |

|

Asset Management Fees ($M) |

$- |

$6 (2 x 1H22) |

n/m |

|

|

Net G&A ($M) |

$47 |

$18 |

-62% |

|

|

Net G&A as % of GAV |

36 bps (per GSA) |

<15 bps (AIR Target) |

-21 bps |

|

|

Balance Sheet |

Net Leverage / EBITDA re |

7.6x |

5.5x (AIR Target) |

-2.1x |

|

Refunding: Next 3-Years (% Total Debt) |

23% |

10% |

-13% |

|

|

Repricing: Next 3-Years (% Total Debt) |

23% |

10% |

-13% |

|

|

Unencumbered Properties ($B) |

$2.4 |

$7.8 |

$5.4 |

|

Source: AIRC / AIV quarterly filings; Green Street Advisors. Non-GAAP measures are defined and are reconciled to the most comparable GAAP measures in the supplemental information in AIR’s earnings releases.

AIR’s business model is simple, efficient, and predictable, driven by what we call the AIR Edge. The AIR Edge reflects our emphasis on resident selection, satisfaction, and retention, as well as relentless innovation in delivering best-in-class property management. Resident retention measured at approximately 62% over the last 12 months reflecting AIR’s focus on delivering peer leading customer service, where earlier in 2022 we ranked second among all multi-family companies by Kingsley and first among public peers. Customer satisfaction drives customer retention which, in turn, drives lower controllable operating expense, flat since 2009 for AIR, and correspondingly higher NOI. AIR then delivers organizational efficiency with net G&A capped at <15 basis points of GAV. In combination, the result is a ~66% conversion of Same Store Revenue into Free Cash Flow, which we define as Same Store NOI less net property management expense and net G&A expense. Coastal and sunbelt peers1 need to generate ~7% and ~15% higher Same Store Revenue, respectively, to match AIR’s efficiency. This advantage is considerable, and durable.

1 Peers defined as AVB, CPT, EQR, ESS, MAA, and UDR. Coastal peers defined as AVB, EQR, ESS, and UDR. Sunbelt peers defined as CPT and MAA.

8 air communities

SAME STORE REVENUE TO FREE CASH FLOW CONVERSION (%)(2)

To equal AIR’s Free Cash Flow conversion margin, AIR’s Coastal and Sunbelt peers(3) would have to produce approximately 7% and 15% higher revenue, respectively.

In the last 18 months, AIR has also improved and grown its portfolio through leverage neutral “paired trades,” which has allowed for recycling capital into properties with superior prospects, enhanced further by the application of the AIR Edge. The acquisitions in 2021 and 2022 now amount to 13% of AIR’s GAV. AIR’s acquisitions from 2021 will soon move to the Same Store portfolio. These properties are on track to generate approximately 50% higher Same Store Revenue growth in Q4 2022 compared to our current Same Store portfolio. We expect similar performance from the acquisitions made in 2022 as properties outperform in the first two to four years on the AIR platform due to deployment of the AIR Edge, before reversion to growth rates consistent with AIR’s Same Store portfolio.

AIR leads all coastal peers in cumulative Same Store Revenue and Same Store NOI growth measured from year-end 2019 through and after the pandemic. Of note, AIR’s Same Store Revenue fell less than any coastal peer in 2020, and was the sole coastal REIT with positive growth in 2021. With 2019 as an index, and assuming the midpoint of Same Store guidance for 2022, AIR will outperform coastal peers cumulatively on Same Store Revenue and Same Store NOI by approximately 425 and 770 basis points, respectively. When AIR’s organization efficiency and commitment to low G&A is included, AIR’s performance is within approximately 165 basis points of the sunbelt peers, the prime beneficiaries of pandemic disruption in our markets.

2 Reflects Q2 2022 YTD and 2021 financials as reported in company filings. Free Cash Flow Conversion % defined as Same Store NOI less Net Property Management and G&A Expense and divided by Same Store Revenue.

3 Per company filings. Peers defined as AVB, CPT, EQR, ESS, MAA, and UDR. Coastal peers defined as AVB, EQR, ESS, and UDR. Sunbelt peers defined as CPT and MAA.

2022 Proxy Statement 9

|

AIR will continue to focus on executing a simple, efficient, and predictable business model •Maintain a high quality, diversified portfolio, enhanced through disciplined and transparent capital allocation: •Continuously improve our best-in-class operating platform – what we call the AIR Edge – to: –Drive durable organic growth; –Enhance NOI growth as we increase the share of properties new to AIR’s platform; and –With low G&A, drive the highest FCF conversion among peers; •Limit financial risk through low leverage, limit regulatory risk by market selection, limit execution risk by no development; and •Maintain excellence in corporate responsibility, Board engagement, and stockholder focus. |

1 Per company filings. Peers defined as AVB, CPT, EQR, ESS, MAA, and UDR. Coastal peers defined as AVB, EQR, ESS, and UDR. Sunbelt peers defined as CPT and MAA.

2 Reflects Q2 2022 YTD and 2021 financials as reported in company filings. Free Cash Flow Conversion % defined as Same Store NOI less Net Property Management and G&A Expense and divided by Same Store Revenue.

10 air communities

STRONG GOVERNANCE

STOCKHOLDER OUTREACH

We have a culture of transparency. We are accessible to all stockholders and engage regularly with stockholders holding more than 2/3 of our outstanding shares. Board members are available for discussions as requested. In 2022, we determined to include independent directors in as many stockholder meetings as possible, and often multiple independent directors were involved. These engagements included lunches, dinners, video meetings, and calls. In addition, independent directors attended several industry conferences along with management. Already this year, for example, Chairman Tom Keltner has talked directly with stockholders holding more than a majority of our shares to answer questions about such matters as AIR policies or CEO succession plans. Director Ann Sperling, who serves as chairman of our Governance and Corporate Responsibility Committee, has spoken or met with stockholders with ESG questions or concerns. Director Tom Bohjalian, formerly Senior Portfolio Manager at Cohen & Steers, a dedicated REIT investment fund and the largest such, has attended industry conferences and private meetings to listen to investors and provide stockholder assurance that the voice of the investor is well heard in board deliberations.

In 2021, we had formal conversations with stockholders holding approximately 73% of our outstanding shares. These conversations were wide-ranging and included governance, board composition, board refreshment, strategy, and more. In 2022, we have already similarly engaged with stockholders holding approximately 70% of our outstanding shares.

OUR RESPONSES TO STOCKHOLDER INPUT

|

Annual Director Elections (2022) |

|

Board Refreshment (2020 and 2021) |

|

Renamed and gave Governance and Corporate Responsibility Committee special focus for ESG matters with a dedicated relationship with AIR’s Chief Corporate Responsibility Officer (2021) |

|

Created the CCRO position held by Patti Shwayder, a 20-year veteran with nationally recognized subject matter expertise (2021) |

|

Separation of Chairman and CEO (2020) |

|

Opted out of MUTA (2020) as the only apartment REIT to opt out of provisions regarding classified boards |

|

Disclosure regarding Board Oversight of Political and Lobbying Expenditures (2020) |

|

Disclosure regarding Performance of “In Progress” LTI Awards (2020) |

|

ESG Disclosure (2018) |

|

Matrix of Director Qualifications and Expertise (2017) |

|

More Detailed Management Succession Disclosure (2017) |

|

Proxy Access (2016) |

|

LTI Program Overhaul (2015) |

|

Double Trigger Change in Control Provisions (2015) |

|

Claw back Policy (2015) |

|

No Gross-Ups (2015) |

|

Stockholders have their “Say on Pay” with average 98% approval over the |

2022 Proxy Statement 11

BOARD REFRESHMENT & COMPOSITION

This year, the Board, upon the recommendation of the Governance and Corporate Responsibility Committee, proposes the re-election of all nine current members of the Board.

AIR remains focused on a talented and engaged Board, with members who have skills and expertise consistent with our culture and strategy. The Board remains focused on its regular refreshment and an ongoing consideration of board succession planning.

In addition, independent directors are actively making open market purchases of AIR shares demonstrating their alignment with stockholders. In addition, the CEO’s compensation is payable largely in AIR shares with the quantity tied to AIR’s relative TSR.

Our eight independent directors are just that, independent and chosen for their expertise. The independent directors:

•incorporate perspectives from various racial and ethnic backgrounds, including the lived experience of African American, Asian, Hispanic, Middle Eastern, and other ethnicities

•possess a broad range of ages

•have an average tenure of four years, with five new directors added to the Board since 2020

•include equal numbers of men and women

HONORED FOR THE PAST 4 CONSECUTIVE YEARS FOR BOARD COMPOSITION

|

|

|

Recognized by the Women’s Forum of New York |

Recipient of Gender Balanced Board from Board bound |

12 air communities

Commitment to our Residents

Providing homes is a high calling, and we do so with the utmost care for our residents, our team, and our neighbors. The people who choose to live and work with AIR are the drivers of our success, and we continuously strive to serve them with mutual respect and consideration.

AIR provides homes for more than 45,000 people across the United States. We take pride that our communities meet or exceed healthy building best practices.

Our Resident Healthy Living Guide, available for each property, provides healthy living opportunities and amenities for residents. We use the “9 Foundations of a Healthy Building”, developed by the Harvard T.H. Chan School of Public Health, to guide health and wellness operational policies.

our progress

|

4.33/5 Customer Satisfaction Score as |

100% Smoke Free |

60.3% Resident Retention in 2021 |

|

|

|

|

|

59k Resident |

96.3% Average Daily |

93% Resident Access |

Resident engagement

•Daily interaction-based feedback

•2-way communication on energy/water consumption and waste

•Social media

•Resident-focused community events

|

Measured Industry Leader in Customer Satisfaction In 2022, AIR was honored as a Kingsley Elite Five, ranking first among public |

2022 Proxy Statement 13

Continued Investment in our Teammates is a Priority

The heart of AIR’s success and what provides the “AIR Edge” is our talented, high-performing team. The relationship we have with our teammates is relational, and not transactional. Joining the AIR team is an opportunity to grow, build relationships, and make a difference in the lives of others in a collaborative decision making environment. We see the value each teammate brings beyond their position, and we reward their dedication through our pay-for-performance, family-friendly benefits, such as 16 weeks of parental leave, and culture of promotion from within that creates opportunities for advancement. We offer flexibility, allowing for people to be present in the lives of their families while meeting their business responsibilities. Our team is committed to community, and their engagement reflects our welcoming culture.

|

demographics |

By the Numbers |

|

|

4.42/5 Employee Satisfaction: |

20.2% Voluntary |

|

100% Team Members Receive |

$15+ Minimum |

|

|

100% Teammates Trained on |

.96 Lost Day |

|

|

57.9% Management Positions |

|

14 air communities

|

|

•Best Large Company to Work For •Best Paying Company |

|

|

||

|

|

||

|

|

•2022 Healthiest Employer in Colorado |

|

|

One of only six companies to be recognized as a “Top Workplace” in Colorado for each of the past 10 years — and

starting in 2021, also in Washington, D.C. and the Bay Area.

In 2022, we were recognized as a |

Commitment to Making A Positive Impact

Corporate Responsibility is a long-standing priority for AIR. We strive for transparency, and continuous improvement as measured by our Company values and by the Global ESG Benchmark for Real Assets (GRESB). In 2021 we improved our GRESB scores by 21% over 2020 — including a perfect score in the ‘social’ metrics and a near perfect score in Governance. In 2022, we received a score of 78, a 13% improvement over 2021. AIR also received an “A” grade for both ESG public disclosure and for alignment with the Task Force for Climate Related Financial Disclosures (TCFD), as well as a “Green Star” for overall Management and Performance in 2022, including a 29% improvement over its 2021 environmental stewardship score, a perfect social responsibility score, and a near-perfect corporate governance score. The overall results place AIR 5th among 11 peers and in the top one-third of residential entities in the Americas.

Additionally, we have established targets for energy, water and GHG reductions, and are working toward environmental certifications for our properties as well as implementing resilience strategies including physical and climate risk assessments of the portfolio.

2022 Proxy Statement 15

Commitment to Positive Impacts on the Environment

|

SOLAR Energy |

|

•1,100 EV charging stations being installed across the portfolio •Aggressively pursuing solar electric generation across the portfolio: three projects underway, two more in final review for immediate execution, and six additional projects under evaluation and preliminary design |

|

Energy |

|

•Tracking whole building performance data for 60% of the portfolio in ENERGY STAR •High efficiency LED lighting in all AIR communities •Building automation systems installed at all high- and mid-rise buildings to optimize efficiency and reduce energy consumption |

|

Water |

|

•Low flow plumbing fixtures have been the standard for more than a decade •Water leak sensors included in the smart home technology installed in all •All communities in California and Denver have smart irrigation systems installed •All cooling towers in high-rise buildings are controlled to minimize evaporation |

|

Resiliency |

|

•Disaster preparedness program that guides all site teams on how to manage their property should a natural disaster occur •Upgrades during renovations that include protections from storm damage and other impacts of natural disasters •MSCI analysis of portfolio and acquisitions for physical and transition risks •Excellent bottom line metric: casualty claims are rare and root causes are assessed and corrected |

|

|

|

|

|

6,690,852 Therms of natural |

235,005,148 kWh of electricity |

923,922,393 Gallons of water |

169,730 Metric tons of |

16 air communities

Commitment to Community

In 2020 and continuing into 2021 and 2022:

•We are focused on investing in and support of the communities where we live and work

•Our Teammates are active and passionate about community service: AIR Gives, provides team members

15 paid hours each year to apply to volunteer activities of their choosing and matches contributions made to AIR Gives causes

|

$412,200+ Raised in 2021 benefiting veterans |

$1,305,000 AIR Gives (formerly Aimco Cares) |

$67,500+ AIR Gives scholarship funds |

•In partnership with the National Leased Housing Association, we continue our longstanding commitment to offer AIR Gives Opportunity Scholarship to students living in affordable housing. During 2Q22, we awarded 14 such Scholarships.

OUR FOCUS ON CONTINUOUS IMPROVEMENT LEADS TO NEW COMMITMENTS

We’ve made new promises, and we intend to continue executing on those commitments and providing transparency on our progress. As of April 2022, we’ve agreed to new targets and goals including:

•Reduction in the amount of energy consumed – 15% energy intensive savings by 2025 over the 2019 baseline

•Reduction in water consumed – 10% savings by 2025 over 2019 baseline

•15% GHG savings over 2019 baseline by 2025

•Investment in teammates – promoting within and maintaining internal mobility at a minimum of 50%

•Engaging others in our ongoing assessment of ESG priorities through training, annual surveys, and outreach

•Continuing to achieve 4.25 or better annually for Customer Satisfaction Score

CORPORATE RESPONSIBILITY REPORT

AIR publishes a Corporate Responsibility Report, which highlights our commitment to environmental and social responsibility. The report includes AIR’s materiality assessment and more on AIR’s commitments. A copy of AIR’s current Corporate Responsibility Report is available on AIR’s website (www.aircommunities.com). Nothing on AIR’s website, including the Corporate Responsibility Report, shall be deemed incorporated by reference into this Proxy Statement.

18 air communities

The Board of Directors (the “Board”) of Apartment Income REIT Corporation (“AIR” or the “Company”) has made these proxy materials available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by mail. We are furnishing this Proxy Statement in connection with the solicitation by our Board of proxies to be voted at our 2022 Annual Meeting (the “Meeting”), and at any and all adjournments or postponements thereof. The Meeting will be held on December 7, 2022, at 4:00 p.m., Mountain Time, at AIR’s corporate headquarters, 4582 South Ulster Street, Suite 1700, Denver, CO 80237.

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to each stockholder entitled to vote at the Meeting. The mailing of such Notice is scheduled to begin on or about October 27, 2022. All stockholders will have the ability to access the proxy materials over the Internet and request a printed copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, the Notice includes instructions on how stockholders may request proxy materials in printed form by mail or electronically by email on an ongoing basis.

This solicitation is made on behalf of AIR’s Board. Costs of the solicitation will be borne by AIR. Further solicitation of proxies may be made by telephone, fax, other electronic means of communication or personal interview by the directors, officers and employees of the Company and its affiliates, who will not receive additional compensation for the solicitation. The Company has retained the services of Alliance Advisors LLC, for an estimated fee of $11,000, plus out-of-pocket expenses, to assist in the solicitation of proxies from brokerage houses, banks, and other custodians or nominees holding stock in their names for others. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to stockholders.

Holders of record of the Class A Common Stock of the Company (“Common Stock”) as of the close of business on the record date, October 20, 2022 (the “Record Date”), are entitled to receive notice of, and to vote at, the Meeting. Each share of Common Stock entitles the holder to one vote. At the close of business on the Record Date, there were 151,388,648 shares of Common Stock issued and outstanding.

Whether you are a “stockholder of record” or hold your shares through a broker or nominee (i.e., in “street name”) you may direct your vote without attending the Meeting in person.

If you are a stockholder of record, you may vote via the Internet by following the instructions in the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing your proxy card and returning it by mail or by submitting your vote by telephone. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney, or officer of a corporation), you should indicate your name and title or capacity.

If you are the beneficial owner of shares held in street name, you may be eligible to vote your shares electronically over the Internet or by telephone by following the instructions in the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing the voting instruction card provided by your bank or broker and returning it by mail. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you have directed.

The persons named as proxy holders are officers of AIR. All proxies properly submitted in time to be counted at the Meeting will be voted in accordance with the instructions contained therein. If you submit your proxy without voting instructions, your shares will be voted in accordance with the recommendations of the Board. Proxies may be revoked at any time before voting by

2022 Proxy Statement 19

filing a notice of revocation with the Corporate Secretary of the Company, by filing a later dated proxy with the Corporate Secretary of the Company or by voting in person at the Meeting.

You are entitled to attend the Meeting only if you were an AIR stockholder or joint holder as of the Record Date or if you hold a valid proxy for the Meeting. If you are not a stockholder of record but hold shares in street name, you should provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. If you are a beneficial owner of shares and do not provide your broker, as stockholder of record, with voting instructions, your broker has authority under applicable stock market rules to vote those shares for or against “routine” matters at its discretion. At the Meeting,

the following matters are not considered routine: the election of directors, the advisory vote on executive compensation, and the approval of the amendment to the Company’s stock award and incentive plan. Where a matter is not considered routine, shares held by your broker will not be voted (a “broker non-vote”) absent specific instructions from you, which means your shares may go unvoted on those matters and will not affect the outcome if you do not specify a vote. The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Meeting constitutes a quorum.

The principal executive offices of the Company are located at 4582 South Ulster Street, Suite 1700, Denver, Colorado 80237.

20 air communities

Election

of Directors

The Board of Directors recommends a

vote “FOR” each of the nine nominees.

2022 Proxy Statement 21

As we detailed in last year’s proxy, and pursuant to AIR’s Articles of Amendment and Restatement (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”), all nine of AIR’s current directors were elected for terms expiring at the 2022 annual meeting of stockholders. AIR’s Bylaws currently authorize a Board consisting of not fewer than three persons; the Board currently consists of nine directors.

The AIR Board cannot be classified without stockholder approval; that is, AIR has voluntarily opted out of the provisions of Maryland law (known as the Maryland Unsolicited Takeover Act or MUTA) that allow for board classification without stockholder approval.

The nine nominees for election to the Board for a one-year term expiring at the 2023 annual meeting of stockholders, recommended by the Governance and Corporate Responsibility Committee of the Board and nominated by the Board to be voted upon at the Meeting, are:

|

Terry Considine Thomas L. Keltner Thomas N. Bohjalian |

Kristin Finney-Cooke Devin I. Murphy Margarita Paláu-Hernández |

John D. Rayis Ann Sperling Nina A. Tran |

None of these nominees (other than AIR’s founder and CEO, Mr. Considine) are employed by, or affiliated with, AIR, other than by virtue of serving as directors of AIR. Unless authority to vote for the election of directors has been specifically withheld, the persons named in the accompanying proxy intend to vote for the election of all nine nominees to hold office as directors for a term of one year and until their successors are duly elected and qualified at the next Annual Meeting of Stockholders. All nominees have advised the Board that they are able and willing to serve as directors.

If any nominee becomes unavailable for any reason (which is not anticipated), the shares represented by the proxies may be voted for such other person or persons as may be determined by the holders of the proxies (unless a proxy contains instructions to the contrary). In no event will the proxy be voted for more than nine nominees.

In an uncontested election at the meeting of stockholders, any nominee to serve as a director of the Company will be elected if the director receives a vote of the majority of votes cast, which means that the number of shares voted “for” a director exceeds the number of votes “against” that director. With respect to a contested election, a plurality of all the votes cast at the meeting of stockholders will be sufficient to elect a director. If a nominee who currently is serving as a director receives a greater number of “against” votes for his or her election than votes “for” such election (a “Majority Against Vote”) in an uncontested election, Maryland law provides that the director would continue to serve on the Board as a “holdover director.” However, under AIR’s Bylaws, any nominee for election as a director in an uncontested election who receives a Majority Against Vote is obligated to tender his or her resignation to the Board for consideration following certification of the vote. The Governance and Corporate Responsibility Committee will consider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Governance and Corporate Responsibility Committee’s recommendation.

For purposes of the election of directors, abstentions or broker non-votes as to the election of directors will not be counted as votes cast and will have no effect on the result of the vote. Unless instructed to the contrary in the proxy, the shares represented by the proxies will be voted FOR the election of the nine nominees named above as directors.

PROPOSAL 1

22 air communities

TERRY Chief Executive Officer, Air Communities Age: 75 |

Experience •Chief Executive Officer, AIR (2020 - present) •Chief Executive Officer and Chairman, Aimco •In 1975, founded and subsequently managed the predecessor companies that became Aimco at its initial public offering in 1994 Qualifications •Business Operations, Capital Markets, Investor Relations, Property Management and Operations, Real Estate – Mr. Considine has been an active real estate investor for 50 years, serving five REITs as CEO including as founder of Aimco •Investment and Finance – more than 50 years of experience investing in real estate, television broadcasting, convenience stores, environmental services, and venture capital •Mr. Considine also brings expertise in Real Estate, particularly Real Estate Investment, Finance, and Operations, Capital Markets, Investment and Finance, Corporate Governance, Talent Development, and Team Leadership Education •BA, Harvard University •JD, Harvard University |

|

Other Boards/ •Aimco (since 1994) •Intrepid Potash, Inc., a publicly held diversified producer of minerals, water, and oilfield services (2008 – 2021) |

|

|

2022 Proxy Statement 23

THOMAS L. Chairman of the Board Age: 76 |

Experience •Executive Vice President and Chief Executive Officer — Americas and Global Brands, Hilton Hotels Corporation (March 2007 - March 2008, which concluded the transition period following Hilton’s acquisition by The Blackstone Group); joined in 1999 and served in various roles. •Served in several positions, Promus Hotel Corporation, including President, Brand Performance and Development (1993 - 1999) •Senior Vice President and COO, Franchise Hotel Division, Holiday Inn Worldwide; President and Managing Director, Holiday Inns International •President, Saudi Marriott Company, a division of Marriott Corporation •Management consultant, Cresap, McCormick and Paget, Inc. •Served as an officer in the U.S. Navy Submarine Service Qualifications •Business Operations, Customer Service, Marketing and Branding, Property Management and Operations – Mr. Keltner has more than 20 years of experience in the areas of hotel development, acquisition, disposition, franchising, and management at major companies including Hilton, Promus, Holiday Inn and Marriott •Mr. Keltner also brings expertise in Financial Expertise and Literacy, Investment and Finance, Talent Development and Management, and Real Estate Education •BA, Ohio University •MBA, Stanford Graduate School of Business |

|

Other Boards •Aimco (2007 – 2020) Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility •AIR-AIV Transactions |

24 air communities

THOMAS N. Age: 57 |

Experience •Executive Vice President/Senior Portfolio Manager, the Head of U.S. Real Estate and Trading departments and responsible for investment decisions for $40 billion of the firm’s assets, Cohen & Steers, a $96 billion global asset manager focused on listed Real Assets (2002 – 2021). Qualifications •Capital Markets, Investment and Finance, Investor Relations, Financial Expertise and Literacy, Real Estate – Mr. Bohjalian has over 30 years of real estate and finance experience including investment management and real estate investment; during his tenure was responsible for two 5-Star Morningstar ranked funds, was a five-time winner of the Lipper Fund of the year award, and consistently ranked in the top decile of all real estate fund managers. •Mr. Bohjalian also brings expertise in Corporate Governance and Talent Development and Management Education •BS, Business Administration, Northeastern University •MBA, Northeastern University •Chartered Financial Analyst |

|

Other Organizations •New York Society of Security Analysts, Member Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility |

2022 Proxy Statement 25

KRISTIN R. Managing Director, JP Morgan Multi Asset Solutions Group Age: 52 |

Experience •Managing Director, JP Morgan Multi Asset Solutions Group (September 2021 – present) •Senior Consultant and Co-Chair of the Diverse Manager Advisory Committee, NEPC Chicago office (2010 – September 2021) •Principal, including three years as the National Public Fund Segment Leader, Mercer (2004 – 2010) •Spent six years at Credit Suisse First Boston •Frequent speaker at conferences and testifies annually at the Illinois State Senate Hearings on behalf of her clients Qualifications •Capital Markets, Investment and Finance – Ms. Finney-Cooke has enjoyed a 23-year career in investment management at firms including JP Morgan, NEPC and Mercer. She provided investment advice including policy development, asset allocation, asset liability and performance modelling and multi-asset solutions. •Financial Expertise and Literacy – In addition to her 23-year career providing investment advice to large asset pools and other public, endowment, healthcare and corporate fund clients, Ms. Finney-Cooke received her MBA in Finance and Accounting, is a CAIA designee and •Talent Development and Management – While serving as a Senior Consultant in the NEPC Chicago office, she was the Co-Chair of the Diverse Manager Advisory Committee Education •BS, Howard University •MBA, Finance and Accounting, University of Chicago •Chartered Alternative Investment Analyst (CAIA) designee |

|

Other Organizations •Board of Trustees, Chicago State University Foundation, Member & Investment Committee Chair •Board of Trustees, Ann & Robert H. Lurie Children’s Hospital of Chicago Medical Center •Economic Club of Chicago, Member Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility |

26 air communities

DEVIN I. President, Phillips Edison & Company Age: 62 |

Experience •President, Phillips Edison & Company (2019 – present); Chief Financial Officer (2013 – 2019) •Vice Chairman, Morgan Stanley (2009 – 2013) •Managing Partner, Coventry Real Estate Advisors, a real estate private equity firm (2008 - 2009) •Global Head of Real Estate Investment Banking, Deutsche Bank, where his team executed over 500 transactions of all types for clients representing total transaction volume exceeding $400 billion, including initial public offerings, mergers and acquisitions, common stock offerings, secured and unsecured debt offerings and private placements of both debt and equity (2004 – 2007) •Held a number of senior positions including Co-head of U.S. Real Estate Investment Banking and Head of Real Estate Private Capital Markets; served on the Investment Committee of the Morgan Stanley Real Estate Funds, a series of global private real estate funds with over $35 billion in assets under management, Morgan Stanley (1994 – 2004) Qualifications •Business Operations, Capital Markets, Investment and Finance – Mr. Murphy served as an investment banker for 28 years including as Vice Chair of Morgan Stanley and Global Head of Real Estate Investment Banking at Deutsche Bank. He has been a c-suite executive of Phillips Edison, a $7 billion market capitalization owner and operator of grocery-anchored shopping centers, for 9 years. •Real Estate Investment and Finance, Property Management and Operations – Mr. Murphy’s experience at Phillips Edison, and Coventry, which sponsored institutional investment funds that acquire and develop retail properties, as well as his roles at Deutsche Bank and Morgan Stanley •Mr. Murphy also brings expertise in Accounting and Auditing for Large Business Organizations, Corporate Governance, Financial Expertise and Literacy, Investor Relations and Talent Development and Management Education •BS, English and History, College of William and Mary •MBA, Finance, General, University of Michigan |

|

Other Boards •CoreCivic, Inc., a NYSE listed company that is the nation’s leading provider of high-quality corrections and detention management facilities •Aimco (2020 – 2021) Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility |

2022 Proxy Statement 27

MARGARITA Founder and Chief Executive Officer, Hernández Ventures Age: 66 |

Experience •Founder and Chief Executive Officer, Hernández Ventures, (1988 – present) •Nominated to serve as a Representative of the United States of America to the Seventy-third Session of the General Assembly of the United Nations with the personal rank of Ambassador (2018) •Attorney, McCutcheon, Black, Verleger & Shea (1985 - 1988) Qualifications •Business Operations, Financial Expertise and Literacy – Ms. Palau-Hernandez is the founder/CEO of a privately held enterprise involved in Spanish-language media, business and real estate ventures •Legal, Real Estate – During the time she practiced law, Ms. Palau-Hernandez specialized in real estate transactions •Ms. Palau-Hernandez also brings expertise in Corporate Governance and Talent Development Education •BA, magna cum laude, University of San Diego •JD, UCLA School of Law |

|

Other Boards and •Xerox Holdings Corporation •Conduent Incorporated •Occidental Petroleum •Herbalife Nutrition, Ltd. •ALJ Regional Holdings, Inc. •Yale School of Management Council of Global Advisors, Chair •National Museum of the American Latino at the Smithsonian, Vice Chair •Ronald Reagan UCLA Medical Center Board of Advisors Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility |

28 air communities

JOHN DINHA Senior Strategic Advisor, Tax and Transaction Liability, Lockton Age: 68 |

Experience •Senior Strategic Advisor, Tax and Transaction Liability, Lockton (2022 – present) •Adjunct Professor of Tax Law, Stetson University College of Law (2021 – present) •Partner, Tax, Skadden, Arps, Slate, Meagher & Flom LLP; (1982 - 2016); Of Counsel (2016 – 2018) •Admitted to practice before the U.S. Supreme Court •Repeatedly selected for inclusion in Chambers Global: The World’s Leading Lawyers for Business in the “Capital Markets: REITs” category, in Chambers USA, America’s Leading Lawyers for Business as one of America’s leading REIT tax lawyers, and in The Best Lawyers in America Qualifications •Legal, REIT Tax, Financial Expertise and Literacy, Real Estate Investment and Finance – Mr. Rayis spent over 36 years as an attorney advising clients on a variety of complex corporate, partnership and REIT tax law matters •Mr. Rayis also brings expertise in Capital Markets, Corporate Governance, Talent Development and Team Leadership. Education •BA, BS, Michigan State University •JD, Wayne State University •LL.M, University of Michigan |

|

Other Boards •Aimco (2020 – 2021) •The University of Chicago Medical Center, Board of Trustees (2021 – present) •Longboat Key Florida Citizens Tax Oversight Committee. Member Committees •Audit •Compensation and Human Resources, Chairman •Governance and Corporate Responsibility •AIR-AIV Transactions |

2022 Proxy Statement 29

ANN Advisor, Trammell Crow Company Age: 67 |

Experience •Advisor (2021 – present); Senior Director (2013 – 2021), held a variety of roles, including Senior Managing Director and Area Director for the Rocky Mountain Region (1982 - 2006), Trammell Crow Company, the development subsidiary of the public company, CBRE •President, Markets West, Jones Lang LaSalle, the public real estate investment and services firm (2012 – 2013), Chief Operating Officer, Americas and served on the governance focused Global Operating Committee (2009 - 2012) •Managing Director, Catellus, then a mixed-use development and investment subsidiary of the public REIT, Prologis, prior to this subsidiary’s preparation for sale (2007 - 2009) Qualifications •ESG – While at Jones Lang LaSalle, Ms. Sperling served on the Global Operating Committee, which was governance-focused. •Real Estate Investment and Finance, Property Management and Operations - During her over 33 years at Trammell Crow, Ms. Sperling was focused leadership and governance, property management and the sourcing, capitalization, and execution of new commercial developments •Business Operations, Marketing and Branding, Financial Expertise and Literacy, Talent Development and Management – during Ms. Sperling’s 40 years of real estate and management experience, including roles at Jones Lang LaSalle and Catellus, she was responsible for oversight of operations, finance, marketing, research, operations, human resources, legal, and engineering Education •BS, Biology and Psychology, magna cum laude, Tufts University •MBA, Harvard School of Business |

|

Other Boards/ •SmartRent, a NYSE-listed provider of smart home automation technology •Aimco (2018 – 2021) •Cadence Capital, Advisory Board •Gates Center for Regenerative Medicine, Vice Chair •Tufts University School of Arts and Sciences, Advisory Board •University of Colorado Real Estate Center, Advisory Board •Urban Land Institute, Industrial and Office Properties Council (IOPC) Green Flight; Assistant Chair Committees •Audit •Compensation and Human Resources •Governance and Corporate Responsibility, Chairman |

30 air communities

NINA A. Chief Financial Officer, Pacaso Age: 54 |

Experience •Chief Financial Officer, Pacaso, a technology-enabled marketplace focused on co-ownership of luxury second homes (2021 – present) •Chief Financial Officer, Veritas Investments, a real estate investment manager that owns and operates mixed-use-multifamily properties in the San Francisco Bay Area and Southern California (2016 – 2021) •Chief Financial Officer, Starwood Waypoint Residential Trust, a leading publicly traded REIT that owns and operates single-family rental homes (2013 - 2016) •Held various positions including Senior Vice President and Chief Accounting Officer, and most recently as Chief Global Process Officer, where she helped lead the merger integration of AMB and Prologis, AMB Property Corporation (now Prologis, Inc.), the largest publicly traded global industrial REIT (1995 - 2013) •Senior Associate, PricewaterhouseCoopers (1991-1995) Qualifications •Accounting and Auditing for Large Business Organizations, Capital Markets, Investment and Finance, Real Estate Investment and Finance, Multifamily – Ms. Tran has over 25 years of real estate and financial management experience, including as CFO, focused on real estate and REITs, including multifamily properties •Talent Development and Management Business Operations, Financial Expertise and Literacy – as part of Ms. Tran’s various roles over her career, she was responsible for building and leading finance and accounting teams •Cybersecurity, Information Technology - Ms. Tran brings expertise gained through her current and previous positions, including enterprise technology implementations Education •BS, Accounting and Computer Information Systems, California State University – East Bay •Certified Public Accountant (CPA), (inactive) |

|

Other Boards/ •American Assets Trust, a publicly-traded diversified REIT •Advisory Board, Asian Pacific Fund •Aimco (2016 – 2021) Committees •Audit, Chairman •Compensation and Human Resources •Governance and Corporate Responsibility •AIR-AIV Transaction |

2022 Proxy Statement 31

Summary of Director Qualifications and Expertise

In meeting its oversight responsibilities, the Board benefits from its composition by having directors with complementary skills, experience, and expertise. All nominees possess public company board experience as well as executive leadership experience. In addition, nominees have particular skills and expertise directly relevant to AIR’s business.

|

Summary of Director |

Mr. Bohjalian |

Mr. Considine |

Ms. Finney- |

Mr. Keltner |

Mr. Murphy |

Ms. Paláu- |

Mr. Rayis |

Ms. Sperling |

Ms. Tran |

|

Accounting and Auditing for Large Business Organizations |

• |

• |

|||||||

|

Business Operations |

• |

• |

• |

• |

• |

• |

• |

||

|

Capital Markets |

• |

• |

• |

• |

• |

• |

|||

|

Corporate Governance |

• |

• |

• |

• |

• |

• |

|||

|

Customer Service |

• |

||||||||

|

C-Suite Experience |

• |

• |

• |

• |

• |

||||

|

Cybersecurity |

• |

||||||||

|

ESG |

• |

||||||||

|

Financial Expertise |

• |

• |

• |

• |

• |

• |

• |

• |

• |

|

Information Technology |

• |

||||||||

|

Investment and Finance |

• |

• |

• |

• |

• |

• |

|||

|

Investor Relations |

• |

• |

• |

||||||

|

Legal |

• |

• |

• |

||||||

|

Marketing and Branding |

• |

• |

|||||||

|

Multifamily Experience |

• |

• |

• |

||||||

|

Property Management |

• |

• |

• |

• |

• |

||||

|

Other Public Company |

• |

• |

• |

• |

• |

• |

• |

||

|

Real Estate Investment |

• |

• |

• |

• |

• |

• |

• |

• |

• |

|

REIT Tax |

• |

• |

|||||||

|

Talent Development |

• |

• |

• |

• |

• |

• |

• |

• |

• |

|

Team Leadership |

• |

• |

• |

• |

• |

• |

• |

32 air communities

Board Composition, Board Refreshment, and Director Tenure

The AIR Board is focused on being well-constructed and high performing. To that end, the Governance and Corporate Responsibility Committee selects nominees for director based on, among other things, breadth and depth of experience, knowledge, skills, expertise, integrity, ability to make independent analytical inquiries, understanding of AIR’s business environment, and willingness to devote adequate time and effort to Board responsibilities. In considering nominees for director, the Governance and Corporate Responsibility Committee seeks to have a diverse range of experience and expertise relevant to AIR’s business. The Governance and Corporate Responsibility Committee places a premium on individual directors who work well in the collegial and collaborative AIR culture, think and act independently, and can communicate their convictions clearly and effectively. The Governance and Corporate Responsibility Committee also assesses the appropriate balance of skills and experiences included in the composition of the Board and makes recommendations to the Board.

The Governance and Corporate Responsibility Committee has specifically considered the feedback of some stockholders as well as the discussions of some commentators that suggest lengthy Board tenure should be balanced with new perspectives. The Board has structured itself such that there are directors of varying tenures, with new directors and perspectives joining the Board every few years including three new directors who were elected in 2021 and two new directors who were elected in 2020. They have done this while retaining the institutional memory of longer-tenured directors. New directors go through an extensive onboarding process, including meeting with members of management across the entire business. This onboarding process provides an understanding of the business and of the team that drives it.

The Governance and Corporate Responsibility Committee believes that longer-tenured directors, balanced with less-tenured directors, enhance the Board’s oversight capabilities. AIR’s directors work effectively together, functioning as a team with a broad range of expertise and perspectives. Directors also coordinate closely with senior management, interact periodically with the broader AIR team in town hall settings and onsite, comprehend AIR’s challenges and opportunities, and frame AIR’s business strategy. AIR’s

Board members have established relationships with each other and in the business community that inform their work to apply effectively their collective business savvy in setting policies for the AIR enterprise and supporting management in their achievement.

When formulating its Board membership recommendations, the Governance and Corporate Responsibility Committee also considers advice and recommendations from others, including stockholders, as it deems appropriate. Such recommendations are evaluated based on the same criteria noted above. The three most recently added directors were recommended to the Governance and Corporate Responsibility Committee by an independent search firm, retained to help identify and review director candidates. Prior director candidates were also identified and reviewed by the same independent search firm.

The Board is responsible for nominating members for election to the Board and for filling vacancies on the Board that may occur between annual meetings of stockholders.

The Board has determined that to be considered independent, a director may not have a direct or indirect material relationship with AIR or its subsidiaries (directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). A material relationship is one that impairs or inhibits, or has the potential to impair or inhibit, a director’s exercise of critical and disinterested judgment on behalf of AIR and its stockholders. In determining whether a material relationship exists, the Board considers all relevant facts and circumstances, including whether the director or a family member is a current or former employee of the Company, family member relationships, compensation, business relationships and payments, and charitable contributions between AIR and an entity with which a director is affiliated (as an executive officer, partner or substantial stockholder). The Board consults with the Company’s counsel to ensure that such determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent director,” including but not limited to those categorical standards set forth in Section 303A.02 of the listing standards of the New York Stock Exchange.

Consistent with these considerations, the Board has affirmatively determined that all of the director nominees (other than Mr. Considine) are independent.

2022 Proxy Statement 33

Majority Voting for the Election of Directors

In an uncontested election at the meeting of stockholders, any nominee to serve as a director of the Company will be elected if the director receives a majority of votes cast, which means that the number of shares voted “for” a director exceeds the number of shares voted “against” that director. With respect to a contested election, a plurality of all the votes cast at the meeting of stockholders will be sufficient to elect a director. If a nominee who currently is serving as a director receives a greater number of “against” votes for his or her election than votes “for” such election (a “Majority Against Vote”) in an uncontested election, Maryland law provides that the director continue to serve on the Board as a “holdover director.” However, under AIR’s Bylaws, any nominee for election as a director in an uncontested election who receives a Majority Against Vote is obligated to tender his or her resignation to the Board for consideration following certification of the vote. The Governance and Corporate Responsibility Committee will consider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Governance and Corporate Responsibility Committee’s recommendation. Additional details are set out in Article II, Section 2.03 (Election and Tenure of Directors; Resignations) of AIR’s Bylaws.

Based on stockholder feedback, corporate governance best practices and trends, and the Company’s particular facts and circumstances, the Board determined to provide in the Company’s Bylaws a proxy access right to stockholders. A stockholder or a group of up to 20 stockholders, owning at least 3% of our shares for at least three years, may submit nominees for up to 20% of the Board, or two nominees, whichever is greater, for inclusion in our proxy materials, subject to complying with the requirements contained in our Bylaws.

How We Govern and Are Governed

The Board has adopted a code of ethics entitled “Code of Business Conduct and Ethics” that applies to the members of the Board, all of AIR’s executive officers and all teammates of AIR or its subsidiaries, including AIR’s principal executive officer, principal financial officer, and principal accounting officer. The Code of Business

Conduct and Ethics is posted on AIR’s website (www.aircommunities.com) and is also available in print to stockholders, upon written request to AIR’s Corporate Secretary. If, in the future, AIR amends, modifies, or waives a provision in the Code of Business Conduct and Ethics, rather than filing a Current Report on Form 8-K, AIR intends to satisfy any applicable disclosure requirement under Item 5.05 of Form 8-K by posting such information on AIR’s website (www.aircommunities.com), as necessary.

Corporate Responsibility Report

AIR publishes a Corporate Responsibility Report, which highlights our commitment to environmental and social responsibility. A copy of AIR’s current Corporate Responsibility Report is available on AIR’s website (www.aircommunities.com). Nothing on AIR’s website, including the Corporate Responsibility Report, shall be deemed incorporated by reference into this Proxy Statement.

Corporate Governance Guidelines and Director Stock Ownership

The Board has adopted and approved Corporate Governance Guidelines. These guidelines are available on AIR’s website (www.aircommunities.com) and are also available in print to stockholders, upon written request to AIR’s Corporate Secretary. In general, the Corporate Governance Guidelines address director qualification standards, director responsibilities, director access to management and independent advisors, director compensation, director orientation and continuing education, the role of the Board in planning management succession, stock ownership guidelines and retention requirements, and an annual performance evaluation of the Board.

With respect to stock ownership guidelines for the independent directors, the Corporate Governance Guidelines provide that by the completion of five years of service, an independent director is expected to own, at a minimum, the lesser of 27,500 shares or shares having a value of at least $550,000. Each of AIR’s continuing directors meets the ownership requirement or has not yet completed five years of service. In addition, many of our independent directors have purchased shares on the open market. As described elsewhere in this proxy statement, our founder and CEO, Mr. Considine and his family have substantial holdings of AIR securities, and Mr. Considine takes most of his compensation in AIR securities with the quantity based on AIR’s performance.

34 air communities

Majority Voting with a Resignation Policy

AIR requires its directors to be elected by a majority of the votes cast. Directors failing to get a majority of the votes cast are expected to tender their resignation. If a nominee who currently is serving as a director receives a greater number of “against” votes for his or her election than votes “for” such election (a “Majority Against Vote”) in an uncontested election, Maryland law provides that the director would continue to serve on the Board as a “holdover director.” However, under AIR’s Bylaws, any nominee for election as a director in an uncontested election who receives a Majority Against Vote is obligated to tender his or her resignation to the Board for consideration following certification of the vote. The Governance and Corporate Responsibility Committee will consider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Governance and Corporate Responsibility Committee’s recommendation.

Rather than impose arbitrary limits on service, the Company regularly (and at least annually) reviews each director’s continued role on the Board and considers the need for periodic board refreshment.

Transactions in AIR Securities

The Company has a policy and training program focused on compliance with the securities laws, which are designed to prevent insider trading and ensure compliance with fair disclosure regulations. Any transaction in AIR securities by a director, officer or other employee on certain projects requires pre-clearance with the General Counsel and typically such transactions are permitted only during certain open trading windows. In addition, the Company’s policy against insider trading prohibits short sales and provides certain limitations to help ensure that any sort of margin account, pledges, hedges, or option transactions are consistent with the securities laws and aligned with the best interests of stockholders.

The Board has a culture of collaboration and a commitment to acting with consensus. The Board asks all independent directors to serve on all standing committees, have a breadth and depth of experience, knowledge, skills, expertise, integrity, ability to make independent analytical inquiries, and a willingness to devote adequate time and effort to Board responsibilities. The Board focuses on regular

refreshment and seeks to have a diverse range of experience and expertise relevant to AIR’s business. AIR places a premium on directors who work well in the collegial and collaborative culture of the Board, who think and act independently, and who can clearly and effectively communicate their convictions.

In connection with the Separation, Mr. Considine recommended and the Board concluded that separating the Chairman and CEO role would be most effective for the Company’s leadership and governance. Mr. Keltner serves as Chairman of the Board, which includes: presiding over meetings of the Board; presiding over executive sessions of the independent directors, which are held regularly and not less than four times per year; with the CEO, setting meeting agendas and schedules; calling meetings of the independent directors; and being available for direct communication with stockholders.

All committees are composed solely of independent directors. The Audit, Compensation and Human Resources, and Governance and Corporate Responsibility Committees are composed solely of all independent directors so that each independent director hears all information unfiltered and reduces repetitive or summarized reports. This practice ensures that elected and independent directors have broad awareness of the AIR business and make Board decisions with the perspective of the stockholders who elected them and own the AIR business.

Separate Sessions of Independent Directors

AIR’s Corporate Governance Guidelines (described above) provide that the non-management directors shall meet in executive session without management on a regularly scheduled basis, but no less than four times per year. The non-management directors, which group currently is made up of the eight independent directors, met in executive session without management four times during the year ended December 31, 2021.

The Corporate Governance Guidelines (described above) provide that the Company generally expects that the Chairman of the Board will attend all annual and special meetings of the stockholders. Other members of the Board are not required to attend such meetings. All of the members of the Board attended the Company’s 2021 Annual Meeting of Stockholders.

2022 Proxy Statement 35

The Board held six meetings during the year ended December 31, 2021. During 2021, there were three standing committees: Audit; Compensation and Human Resources; and Governance and Corporate Responsibility. In addition, the AIR-AIV Transactions Committee was formed mid-year 2021. During 2021, no director attended fewer than 75% of the aggregate total number of meetings of the Board and each committee on which such director served.

The following table sets forth the number of meetings held by the Board and each committee during the year ended December 31, 2021.

|

|

Board |

Non-Management |

Audit |

Compensation |

Governance |

AIR-AIV |

|

Number of Meetings |

6 |

4 |

6 |

5 |

3 |

2 |

Below is a table illustrating the current standing committee memberships and chairmen. Additional detail on each committee follows the table.

|

Director |

AIR-AIV |

Audit |

Compensation |

Governance |

|

Terry Considine |

|

|

|

|

|

Thomas L. Keltner |

† |

• |

• |

• |

|

Thomas N. Bohjalian |

|

• |

• |

• |

|

Kristin R. Finney-Cooke |

|

• |

• |

• |

|

Devin I. Murphy |

|

• |

• |

• |

|

Margarita Paláu-Hernández |

|

• |

• |

• |

|

John Dinha Rayis |

• |

• |

† |

• |

|

Ann Sperling |

|

• |

• |

† |

|

Nina A. Tran |

• |

† |

• |

• |

•indicates a member of the committee