UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

Delaware | 4700 | 98-0598290 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Eric J. Bock, Esq.

Chief Legal Officer

Global Business Travel Group, Inc.

666 3rd Avenue, 4th Floor

New York, NY 10017

Telephone: (212) 679-1600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Gregory A Fernicola, Esq. Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, NY 10001-8602 Telephone: (212) 735-3000 | P. Michelle Gasaway, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 300 South Grand Avenue, Suite 3400 Los Angeles, CA 90071 Telephone: (213) 687-5000 |

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the SEC acting pursuant to said Section 8(a), may determine.

STATEMENT PURSUANT TO RULE 429

The registrant is filing a single prospectus in this registration statement pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”). The prospectus is a combined prospectus relating to (i) (a) the issuance by us of up to 409,448,481 shares of Class A common stock, par value of $0.0001 per share (“Class A Common Stock”), of Global Business Travel Group, Inc.; and (b) the resale by certain of the selling securityholders of (1) up to 492,628,569 shares of Class A Common Stock and (2) up to 12,224,134 private placement warrants, all of which are being registered hereunder and (ii) 76,078,391 shares of Class A Common Stock, including shares of Class A Common Stock underlying GBTG Options and warrants, registered under Form S–4 (File No. 333-261820), originally filed with the Securities and Exchange Commission (the “SEC”) on December 21, 2021 and subsequently declared effective (the registration statement referenced in the preceding clause (ii), as amended and/or supplemented, the “Prior Registration Statement”). Pursuant to Rule 429 under the Securities Act, this registration statement on Form S-1 upon effectiveness will serve as a post-effective amendment to the Prior Registration Statement. Such post-effective amendment shall hereafter become effective concurrently with the effectiveness of this registration statement and in accordance with Section 8(c) of, and Rule 429 under, the Securities Act.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 21, 2022

PRELIMINARY PROSPECTUS

GLOBAL BUSINESS TRAVEL GROUP, INC.

UP TO 485,526,872 SHARES OF CLASS A COMMON STOCK

AND

UP TO 492,628,569 SHARES OF CLASS A COMMON STOCK

UP TO 12,224,134 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

OFFERED BY THE SELLING SECURITYHOLDERS

This prospectus relates to the issuance by us of up to 485,526,872 shares of Class A Common Stock, which consists of: (i) shares of Class A Common Stock issuable upon the exercise of private placement warrants and public warrants that were issued to stockholders in connection with the APSG IPO; (ii) shares of Class A Common Stock issuable upon the exchange of GBT B Ordinary Shares (with automatic surrender for cancellation of an equal number of shares of Class B Common Stock) held by the Continuing JerseyCo Owners; and (iii) shares of Class A Common Stock issuable upon the conversion of “earnout” shares held by the Continuing JerseyCo Owners and the holders of GBT Capital Stock and GBT Legacy MIP Options (and, in the case of the Continuing JerseyCo Owners, upon the subsequent exchange of GBT B Ordinary Shares (with automatic surrender for cancellation of an equal number of shares of Class B Common Stock) into which such “earnout” shares will convert); and (iv) shares of Class A Common Stock issuable upon the exercise of GBTG Options held by the holders of GBT Capital Stock and GBT Legacy MIP Options.

This prospectus also relates to the resale by certain of the selling securityholders named in this prospectus, or the Selling Securityholders, of: (1) up to 492,628,569 shares of Class A Common Stock, which consists of (i) shares of Class A Common Stock issuable upon the exercise of private placement warrants and public warrants held by certain of our officers and directors, (ii) shares of Class A Common Stock issuable upon the exchange of GBT B Ordinary Shares (with automatic surrender for cancellation of an equal number of shares of Class B Common Stock) held by the Continuing JerseyCo Owners; (iii) shares of Class A Common Stock issuable upon the conversion of “earnout” shares held by the Continuing JerseyCo Owners and certain of our officers and directors (and, in the case of the Continuing JerseyCo Owners, upon the subsequent exchange of GBT B Ordinary Shares (with automatic surrender for cancellation of an equal number of shares of Class B Common Stock) into which such “earnout” shares will convert); (iv) shares of Class A Common Stock issuable upon the exercise of GBTG Options held by certain of our officers and directors; (v) shares of Class A Common Stock issued in the PIPE Investment; and (vi) converted Founder Shares; and (2) up to 12,224,134 private placement warrants.

See “Selected Definitions” below for certain defined terms used in this prospectus.

We are registering the resale of the shares of Class A Common Stock and warrants for resale pursuant to the Registration Rights Agreement and the PIPE Subscription Agreements. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A Common Stock or warrants. Subject to the terms of the applicable agreements, the Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock, public warrants or private placement warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the shares of Class A Common Stock or warrants in the section entitled “Plan of Distribution.”

We will receive the proceeds from any exercise of the warrants or GBTG Options for cash, but not from the resale of the shares of Class A Common Stock or warrants by the Selling Securityholders.

We will bear all costs, expenses and fees in connection with the registration of the shares of Class A Common Stock and warrants. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the shares of Class A Common Stock and warrants.

Our Class A Common Stock and public warrants are listed on the New York Stock Exchange (the “NYSE”) under the symbols “GBTG” and “GBTG.WS,” respectively. On June 17, 2022, the last reported sale price for our Class A Common Stock as reported on the NYSE was $6.79 per share and the last quoted sale price for our warrants was $1.02 per warrant.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involves a high degree of risk. You should carefully read the discussion in “Risk Factors” beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2022

TABLE OF CONTENTS

iii | |

iii | |

iv | |

xi | |

1 | |

7 | |

42 | |

43 | |

Unaudited Pro Forma Condensed Combined Financial Information | 44 |

54 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 83 |

114 | |

127 | |

137 | |

147 | |

152 | |

Security Ownership of Certain Beneficial Owners and Management | 166 |

168 | |

174 | |

177 | |

178 | |

179 | |

179 | |

F-1 |

i

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any applicable prospectus supplement prepared by us or on our behalf. Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders hereunder may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described in the section entitled under “Where You Can Find More Information.”

Unless the context otherwise requires, the “Company,” “GBTG,” “our,” “we” or “us” refer to Global Business Travel Group, Inc., a Delaware corporation, and its consolidated subsidiaries following the Closing. Unless the context otherwise requires, references to “APSG” refer to Apollo Strategic Growth Capital, a blank check company incorporated as a Cayman Islands exempted company, prior to the Closing, references to “Legacy GBT” refer to GBT JerseyCo Limited, a company limited by shares incorporated under the laws of Jersey, prior to the Closing, and references to “GBT” refer to GBT JerseyCo Limited, a company limited by shares incorporated under the laws of Jersey, following the Closing.

ii

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This prospectus contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks, trade names and service marks. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

MARKET, INDUSTRY AND OTHER DATA

Market, industry and other data used in this prospectus have been obtained from independent industry sources and publications, including the following:

| ● | Global Business Travel Association (“GBTA BTI Outlook Annual Global Report & Forecast: Prospects for Global Business Travel 2020-2024,” January 2021, Global Business Travel Association); |

| ● | World Travel & Tourism Council (“Travel & Tourism: Economic Impact 2021,” April 2021, World Travel & Tourism Council); |

| ● | Travel Weekly (“2021 Power List,” June 2021, Travel Weekly; “2020 Power List,” January 2020, Travel Weekly); |

| ● | Business Travel News (“2020 Corporate Travel 100,” October 2020, Business Travel News); |

| ● | Skift Research (“The Travel Industry Turned Upside Down,” September 2020, Skift Research in Partnership With McKinsey & Company); |

| ● | The American Lawyer (“The 2021 Am Law 100: Ranked by Gross Revenue,” April 2021, The American Lawyer); and |

| ● | Fortune 500® (“Fortune 500,” 2021, FORTUNE and “100 Best Companies to Work For,” 2021, FORTUNE). |

Market and industry data, statistics and forecasts used throughout this prospectus are based on publicly available information, industry publications and surveys, reports by market research firms and our estimates based on our management’s knowledge of, and experience in, the travel industry and customer segments in which we compete. Third-party industry publications and forecasts generally state that the information contained therein has been obtained from sources generally believed to be reliable. In addition, certain information contained in this prospectus, including information relating to the proportion of new opportunities we pursue, represents our management's estimates. While we believe our internal estimates to be reasonable, and we are not aware of any misstatements regarding the industry data presented herein, they have not been verified by any independent sources. Such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the captions “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

iii

SELECTED DEFINITIONS

When used in this prospectus, unless otherwise stated or the context otherwise requires:

| ● | “2020 Executive LTIP” refers to the 2020 Executive Long-Term Cash Incentive Award Plan. |

| ● | “2021 Executive LTIP” refers to the 2021 Executive Long-Term Cash Incentive Award Plan. |

| ● | “2022 Plan” refers to the Global Business Travel Group, Inc. 2022 Equity Incentive Plan. |

| ● | “Adjusted EBITDA” refers to net income (loss) before interest income, interest expense, gain (loss) on early extinguishment of debt, benefit from (provision for) income taxes, depreciation and amortization (or EBITDA) and as further adjusted to exclude costs that our management believes are non-core to our underlying business, consisting of restructuring costs, integration costs, costs related to mergers and acquisitions, separation costs, non-cash equity-based compensation, long-term incentive plan costs, certain corporate costs, foreign currency gains (losses), non-service components of net periodic pension benefit (costs) and gains (losses) on disposal of businesses. |

| ● | “Adjusted Operating Expenses” refers to total operating expenses excluding depreciation and amortization and costs that our management believes are non-core to our underlying business, consisting of restructuring costs, integration costs, costs related to mergers and acquisitions, separation costs, non-cash equity-based compensation, long-term incentive plan costs and certain corporate costs. |

| ● | “Amended & Restated GBT MIP” refers to the GBT JerseyCo Limited Amended and Restated Management Incentive Plan, effective as of December 2, 2021. |

| ● | “American Express” refers to American Express Company and its consolidated subsidiaries. |

| ● | “Amex HoldCo.” refers to American Express Travel Holdings Netherlands Coöperatief U.A. |

| ● | “APSG” refers, prior to the Domestication and the Closing, to Apollo Strategic Growth Capital, a blank check company incorporated as a Cayman Islands exempted company. |

| ● | “APSG Board” refers to the board of directors of APSG prior to the Domestication and the Closing. |

| ● | “APSG Class A Ordinary Shares” refers to Class A ordinary shares, par value $0.00005 per share, of APSG prior to the Domestication and the Closing. |

| ● | “APSG Class B Ordinary Shares” refers to the Class B ordinary shares, par value $0.00005 per share, of APSG prior to the Domestication and the Closing. |

| ● | “APSG IPO” refers to APSG’s initial public offering on October 6, 2020. |

| ● | “APSG Organizational Documents” refers to the Amended and Restated Memorandum and Articles of Association of APSG under the Cayman Islands Companies Act. |

| ● | “APSG Shareholders” refers to the holders of APSG Class A Ordinary Shares and holders of APSG Class B Ordinary Shares prior to Domestication and the Closing. |

| ● | “B2B travel” refers to travel for business purposes that is purchased and fulfilled through a company-sponsored and managed channel. |

| ● | “B2C” refers to channels or platforms used by consumers to book and fulfill travel, including directly with suppliers or through intermediaries such as online travel agencies. B2C may include business travelers who purchase travel outside of a company-sponsored and managed channel, or whose companies does not have such a channel. |

iv

| ● | “BHC Act” refers to the Bank Holding Company Act of 1956, as amended. |

| ● | “Board” refers to the board of directors of GBTG. |

| ● | “Business Combination” refers to the transactions contemplated by the Business Combination Agreement. |

| ● | “Business Combination Agreement” refers to the Business Combination Agreement, dated as of December 2, 2021 (as the same has been amended, modified, supplemented or waived from time to time in accordance with its terms), by and between APSG and Legacy GBT. |

| ● | “Bylaws” refers to the Bylaws of GBTG. |

| ● | “CAGR” refers to a compound annual growth rate. |

| ● | “Certares” refers to Certares Management LLC. |

| ● | “Certificate of Incorporation” refers, collectively, to the Certificate of Incorporation of GBTG, the Certificate of Designations for the Class A-1 Preferred Stock and the Certificate of Designations for the Class B-1 Preferred Stock. |

| ● | “Class A Common Stock” refers to the Class A common stock, par value $0.0001 per share, of GBTG. |

| ● | “Class A Stock” refers to (a) if no shares of Class A-1 Preferred Stock or Class B-1 Preferred Stock have been issued pursuant to and in accordance with the Shareholders Agreement, Class A Common Stock, and (b) if any shares of Class A-1 Preferred Stock or Class B-1 Preferred Stock have been so issued, (i) Class A Common Stock or Class A-1 Preferred Stock and (ii) where the context requires, Class A Common Stock and Class A-1 Preferred Stock, collectively. |

| ● | “Class B Common Stock” refers to the Class B common stock, par value $0.0001 per share of GBTG. |

| ● | “Class B Stock” refers to (a) if no shares of Class A-1 Preferred Stock or Class B-1 Preferred Stock have been issued pursuant to and in accordance with the Shareholders Agreement, Class B Common Stock, and (b) if any shares of Class A-1 Preferred Stock or Class B-1 Preferred Stock have been so issued, (i) Class B Common Stock or Class B-1 Preferred Stock and (ii) where the context requires, Class B Common Stock and Class B-1 Preferred Stock, collectively. |

| ● | “Closing” refers to the consummation of the transactions contemplated by the Business Combination. |

| ● | “Closing Date” refers to May 27, 2022, the date of the closing of the Business Combination. |

| ● | “Code” refers to the U.S. Internal Revenue Code of 1986, as amended. |

| ● | “Common Stock” refers to Class A Common Stock and Class B Common Stock. |

| ● | “Company,” “GBTG,” “our,” “we” or “us” refer to Global Business Travel Group, Inc., a Delaware corporation, and its consolidated subsidiaries following the Closing. |

| ● | “Continuing JerseyCo Owners” refers to Amex HoldCo., Juweel and Expedia, which hold GBT B Ordinary Shares, shares of Class B Common Stock and “earnout” shares following the Closing. |

| ● | “DGCL” refers to the Delaware General Corporation Law, as amended. |

| ● | “dollars” or “$” refers to U.S. dollars. |

| ● | “Domestication” refers to the domestication of APSG as a Delaware corporation, with the APSG Shares becoming shares of Common Stock of GBTG under the applicable provisions of the Cayman Islands Companies Act (2021 Revision) of the Cayman Islands as the same may be amended from time to time and the DGCL. |

v

| ● | “EBITDA” refers to net income (loss) before interest income, interest expense, gain (loss) on early extinguishment of debt, benefit from (provision for) income taxes and depreciation and amortization. |

| ● | “Egencia” refers to the business acquired in the Egencia Acquisition. |

| ● | “Egencia Acquisition” refers to Legacy GBT’s acquisition of the Egencia business from Expedia pursuant to the Egencia Equity Contribution Agreement. |

| ● | “Egencia Equity Contribution Agreement” refers to the Equity Contribution Agreement, dated as of August 11, 2021, by and among Expedia, Inc., Legacy GBT and Juweel, in connection with the Egencia Acquisition. |

| ● | “Equity Commitment Letters” refers to the equity commitment letters entered into by Juweel and Amex HoldCo. with Legacy GBT, each dated as of August 25, 2020, and each as amended on January 20, 2021. Such equity commitment letters, and the then-remaining commitments thereunder, were terminated at Closing. |

| ● | “ESPP” refers to the Global Business Travel Group Employee Stock Purchase Plan. |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| ● | “Exchange Agreement” refers to the exchange agreement, dated May 27, 2022, by and among GBTG, GBT and each holder of GBT B Ordinary Shares from time to time party thereto. |

| ● | “Exchange Committee” refers to a committee of the Board comprising solely independent directors not nominated by a Continuing JerseyCo Owner who are disinterested with respect to any particular exchange under the Exchange Agreement. The Exchange Committee may be (and the term “Exchange Committee” shall be construed to include) either (a) a standalone committee of the Board or (b) the Audit and Finance Committee of the Board or another committee of the Board that meets the requirements specified in this definition, for so long as the Board has delegated the functions of the Exchange Committee to the Audit and Finance Committee or such other committee, as applicable; provided that, if (i) the Exchange Committee is a standalone committee of the Board, no nominee of a Continuing JerseyCo Owner may be a member of the Exchange Committee, and (ii) the Board has delegated the functions of the Exchange Committee to the Audit and Finance Committee and the members of the Audit and Finance Committee include one or more nominees of a Continuing JerseyCo Owner, then each such nominee of must recuse himself or herself from any and all business of such committee concerning an Exchange. |

| ● | “Expedia” refers to EG Corporate Travel Holdings LLC, a Delaware limited liability company. |

| ● | “Founder Shares” refers to the 20,420,250 APSG Class B Ordinary Shares held in the aggregate by the Sponsor and the Insiders, which were converted into shares of our Class A Common Stock at the Closing. |

| ● | “Free Cash Flow” refers to net cash from (used in) operating activities, less cash used for additions to property and equipment. |

| ● | “GAAP” refers to United States generally accepted accounting principles, consistently applied. |

| ● | “GBT” refers to GBT JerseyCo Limited, a company limited by shares incorporated under the laws of Jersey, following the Closing. |

| ● | “GBT A Ordinary Shares” refers to voting redeemable shares of GBT, designated as “A Ordinary Shares” in the GBT Amended and Restated M&A with a nominal value of €0.00001. |

| ● | “GBT Amended and Restated M&A” refers to the Fourth Amended & Restated Memorandum of Association of GBT and the Third Amended & Restated GBT Articles of Association. |

| ● | “GBT B Ordinary Shares” refers to non-voting redeemable shares of GBT, designated as “B Ordinary Shares” in the GBT Amended and Restated M&A with a nominal value of €0.00001. |

vi

| ● | “GBT C Ordinary Shares” or “earnout shares” refers to non-voting redeemable shares of GBT, designated as “C Ordinary Shares” in the GBT Amended and Restated M&A with a nominal value of €0.00001. |

| ● | “GBT Capital Stock” refers to the GBT A Ordinary Shares, GBT B Ordinary Shares, GBT C Ordinary Shares and the GBT Z Ordinary Share. |

| ● | “GBT DCP” refers to the GBT US LLC Deferred Compensation Plan. |

| ● | “GBT Holders Support Agreement” refers to that certain support agreement, dated as of the date of the signing of the Business Combination Agreement, by and among APSG and certain holders of GBT Capital Stock, as amended or modified from time to time. |

| ● | “GBT Legacy MIP Option” refers to an option to purchase GBT MIP Shares that was granted prior to 2021. |

| ● | “GBT MIP Option” refers to an option to purchase GBT MIP Shares granted under the Amended & Restated GBT MIP (or any predecessor plan), including GBT Legacy MIP Options. |

| ● | “GBT MIP Shares” refers to the MIP Shares (as such term is defined in Legacy GBT’s memorandum of association and articles of association) of €0.00001 each of Legacy GBT, issuable in respect of GBT MIP Options. |

| ● | “GBT Supply MarketPlace” refers to our proprietary capability to source, distribute and manage travel and travel-related content to travelers, clients and Network Partners, through both GBT and third party technology, as well as GBT’s supplier content and management processes and expertise. |

| ● | “GBT UK” refers to GBT Travel Services UK Limited, our wholly owned indirect subsidiary. |

| ● | “GBT Z Ordinary Share” refers to non-voting non-redeemable shares of GBT, designated as the “Z Ordinary Share” in the GBT Amended and Restated M&A with a nominal value of €0.00001. |

| ● | “GBTG Option” refers to an option relating to shares of Class A Common Stock upon substantially the same terms and conditions as are in effect with respect to the GBT MIP Option immediately prior to the Closing from which such GBTG Option was converted in connection with the Business Combination. |

| ● | “GBTG MIP” refers to the Global Business Travel Group Amended and Restated Management Incentive Plan. |

| ● | “GDS” refers to the three major Global Distribution Systems (Amadeus, Sabre and Travelport, inclusive of their constituent GDS) used by GBT as a source for air and other travel content. Global Distribution Systems are common technology infrastructure used by airlines and some other travel suppliers to distribute their content to Points of Sale (“POS”). |

| ● | “HRG Pension Scheme” refers to the defined benefit scheme for certain of associates and retirees of GBT and its affiliates in the United Kingdom (“UK”). |

| ● | “Insiders” refers to Jennifer Fleiss, Mitch Garber and James H. Simmons III. |

| ● | “Juweel” refers to Juweel Investors (SPC) Limited, an exempted segregated portfolio company with limited liability incorporated under the laws of the Cayman Islands, successor-in-interest to Juweel Investors Limited, a company incorporated as an exempted company with limited liability under the laws of the Cayman Islands. |

| ● | “Legacy GBT” refers to GBT JerseyCo Limited, a company limited by shares incorporated under the laws of Jersey, prior to the Closing. |

| ● | “Net Debt (Cash)” refers to total debt outstanding consisting of current and non-current portion of long-term debt (defined as debt (excluding lease liabilities) with original contractual maturity dates of one year or greater), net of unamortized debt discount and unamortized debt issuance costs, minus cash and cash equivalents. |

vii

| ● | “Network Partners” refers to third party travel management companies (“TMCs”) and independent advisors that are clients of GBT Partner Solutions who, through GBT Partner Solutions, can access GBT’s technology platform and content. |

| ● | “NYSE” refers to the New York Stock Exchange. |

| ● | “Old Shareholders Agreement” refers to the Second Amended & Restated Shareholders Agreement, dated as of November 1, 2021, by and among Legacy GBT, Juweel and Amex HoldCo. |

| ● | “Ovation” refers to Ovation Travel, LLC, GBT’s subsidiary, and includes the Ovation, Ovation Vacations and Lawyers Travel brands. |

| ● | “PIPE Investment” or “PIPE” refers to the private placement pursuant to which PIPE Investors subscribed for an aggregate of 32,350,000 newly-issued shares of Class A Common Stock at a purchase price of $10.00 per share for an aggregate purchase price of $323.5 million pursuant to the PIPE Subscription Agreements, which was completed at the Closing. |

| ● | “PIPE Investors” refers to the investors that signed PIPE Subscription Agreements and funded their committed amounts. |

| ● | “PIPE Securities” refers to the shares of Class A Common Stock sold to the PIPE Investors pursuant to the PIPE Subscription Agreements. |

| ● | “PIPE Subscription Agreements” refers to the subscription agreements, dated as of December 2, 2021, by and between APSG and the PIPE Investors, pursuant to which the PIPE Investment was consummated. |

| ● | “private placement warrants” refers to the warrants that were initially issued to the Sponsor in a private placement simultaneously with the closing of the APSG IPO. |

| ● | “public warrants” refers to the redeemable warrants underlying the units that were initially offered and sold by APSG as part of the APSG IPO. |

| ● | “Registration Rights Agreement” refers to the Amended and Restated Registration Rights Agreement, dated as of May 27, 2022, between GBTG, the Sponsor, the Insiders and the Continuing JerseyCo Owners, as the same may be amended, modified, supplemented or waived from time to time in accordance with its terms. |

| ● | “Rule 144” refers to Rule 144 under the Securities Act. |

| ● | “S&P” refers to the rating agency, Standard & Poor. |

| ● | “SEC” refers to the U.S. Securities and Exchange Commission. |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| ● | “Senior Secured Credit Agreement” refers to that certain senior secured credit agreement, dated as of August 13, 2018, by and among GBT Group Services B.V., as borrower, GBT III B.V., as the original parent guarantor, the other loan parties from time to time party thereto, Morgan Stanley Senior Funding, Inc., as administrative agent and as collateral agent, and the lenders and letter of credit issuers from time to time party thereto, as amended from time to time. |

| ● | “Senior Secured Initial Term Loans” refers to the $250 million initial senior secured term loan facility that was obtained under the Senior Secured Credit Agreement on August 13, 2018. |

| ● | “Senior Secured New Tranche B-3 Term Loan Facilities” refers to the $1,000 million new tranche B-3 senior secured term loan facilities that were established under the Senior Secured Credit Agreement on December 16, 2021. |

| ● | “Senior Secured Prior Tranche B-1 Term Loans” refers to the $400 million tranche B-1 senior secured incremental term loan facility that was obtained under the Senior Secured Credit Agreement on September 4, 2020, which facility was subsequently refinanced and repaid in full on December 16, 2021. |

viii

| ● | “Senior Secured Prior Tranche B-2 Term Loan Facility” refers to the $200 million tranche B-2 senior secured delayed draw incremental term loan facility that was established under the Senior Secured Credit Agreement on January 20, 2021, which facility was subsequently refinanced and repaid in full, and the remaining unused commitments thereunder terminated, on December 16, 2021. |

| ● | “Senior Secured Revolving Credit Facility” refers to the $50 million senior secured revolving credit facility under the Senior Secured Credit Agreement. |

| ● | “Shareholders Agreement” refers to the Shareholders Agreement, dated May 27, 2022, between GBTG, GBT, Amex HoldCo., Juweel and Expedia, as the same may be amended, modified, supplemented or waived from time to time in accordance with its terms. |

| ● | “SME” or “SME clients” refer to clients GBT considers small-to-medium-sized enterprises, which GBT generally defines as having an expected annual spend on air travel of less than $20 million. This criterion can vary by country and client needs. |

| ● | “Sponsor” refers to APSG Sponsor, L.P., a Cayman Islands exempted limited partnership. |

| ● | “Sponsor Side Letter” refers to the letter agreement, dated as of December 2, 2021, by and among the Sponsor, the Insiders, APSG and Legacy GBT, as the same may be amended, modified, supplemented or waived from time to time in accordance with its terms. |

| ● | “Sponsor Side Letter Vesting Period” refers to the five years following the Closing. |

| ● | “Sponsor Support Agreement” refers to the support agreement, dated as of December 2, 2021, by and among the Sponsor, the Insiders and Legacy GBT, as the same may be amended, modified, supplemented or waived from time to time in accordance with its terms. |

| ● | “Total Transaction Value” or “TTV” refers to the sum of the total price paid by travelers for air, hotel, rail, car rental and cruise bookings, including taxes and other charges applied by suppliers at point of sale, less cancellations and refunds. |

| ● | “TPN” refers to GBT’s Travel Partner Network, through which GBT services clients globally. All TPNs are Network Partners. |

| ● | “Transactions” refers the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement. |

| ● | “Transfer Agent” refers to Continental Stock Transfer & Trust Company. |

| ● | “Treasury Regulations” refers to the regulations promulgated under the Code by the United States Department of the Treasury (whether in final, proposed or temporary form), as the same may be amended from time to time. |

| ● | “Trust Account” refers to the trust account of APSG, which held the net proceeds from the APSG IPO and certain of the proceeds from the sale of the private placement warrants, together with interest earned thereon, less amounts released to pay taxes. |

| ● | “UK Data Protection Act” refers to the Data Protection Act the UK implemented, effective in May 2018 and statutorily amended in 2019. |

| ● | “UK GDPR” refers to the UK-only adaption of the GDPR, which took effect on January 1, 2021. |

| ● | “VWAP” refers to dollar volume-weighted average price. |

| ● | “warrants” refers to the public warrants and the private placement warrants. |

ix

| ● | “Warrant Agreement” refers to that certain Warrant Agreement, dated as of October 1, 2020, by and between APSG and Continental Stock Transfer & Trust Company. |

The unaudited pro forma condensed combined financial information of GBTG presented in this prospectus has been derived by applying the pro forma adjustments described in “Unaudited Pro Forma Condensed Combined Financial Information” to the historical consolidated financial statements of Legacy GBT included elsewhere in this prospectus. These pro forma adjustments give effect to the Business Combination, the Egencia Acquisition and the other related adjustments described in “Unaudited Pro Forma Condensed Combined Financial Information” as if they had occurred on January 1, 2021, in the case of the unaudited pro forma condensed combined statements of operations, and as if the Business Combination and other related adjustments had occurred on March 31, 2022, in the case of the unaudited pro forma condensed combined balance sheet. The unaudited pro forma condensed combined financial information has been prepared using, and should be read in conjunction with, the historical financial statements of APSG, Legacy GBT and Egencia and related notes thereto included elsewhere in this prospectus. See “Unaudited Pro Forma Condensed Combined Financial Information” for a complete description of the adjustments and assumptions underlying the unaudited pro forma condensed combined financial information included in this prospectus.

All financial statements presented in this prospectus have been prepared in accordance with GAAP and, unless otherwise noted, are presented in U.S. dollars.

Certain monetary amounts, percentages and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

This prospectus contains “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with GAAP. Specifically, we use “EBITDA,” “Adjusted EBITDA,” “Adjusted EBITDA Margin,” “Adjusted Operating Expenses,” “Free Cash Flow” and “Net Debt (Cash)” as non-GAAP financial measures. For a discussion on our use of non-GAAP financial measures and a reconciliation to the most directly comparable GAAP measures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Key Operating and Financial Metrics — Non-GAAP Financial Measures.”

The COVID-19 pandemic severely restricted the level of economic activity around the world and has continued to have an unprecedented effect on the global travel industry, decreasing business travel significantly below 2019 levels. Accordingly, our last year of normalized operations before the COVID-19 pandemic was the year ended December 31, 2019. In various discussions of our business trends and performance, we have excluded a discussion of our performance for the years ended December 31, 2021 and 2020 in this prospectus because we do not believe those results are indicative of our normal operations and the travel industry more generally due to the unprecedented impact of the COVID-19 pandemic. We believe the historical track record of growth and the emergent recovery of business travel as travel restrictions have been relaxed supports the fundamental growth drivers and long-term growth potential of business travel worldwide in the future. However, the profile, extent and timing of economic and travel recovery and the pace of future growth remains inherently uncertain given the nature of the COVID-19 pandemic and changes to business practices that may become permanent and reduce the need for business travel. There can be no assurance that any emerging growth patterns will continue or that we will replicate our historical growth in the future. For information on the impact of the COVID-19 pandemic on business travel, see “Business — Recent Performance and COVID-19 Update,” “Management’s Discussion and Analysis of Financial Condition and Result of Operations — Key Factors Affecting Our Results of Operations — Impact of the COVID-19 Pandemic” and “Risk Factors — Risks Relating to Our Business and Industry.”

x

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus are “forward looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and are subject to the safe harbor created thereby under the Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projected,” “expects,” “estimated,” “anticipates,” “suggests,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “could,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of the parties, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include:

| ● | our projected financial information, anticipated growth rate and market opportunities; |

| ● | our ability to maintain our existing relationships with customers and suppliers and to compete with existing and new competitors in existing and new markets and offerings; |

| ● | various conflicts of interest that could arise among us, affiliates and investors; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | intense competition and competitive pressures from other companies in the industry in which we operate; |

| ● | factors relating to our business, operations and financial performance, including market conditions and global and economic factors beyond our control; |

| ● | the impact of COVID-19, Russia’s invasion of Ukraine and related changes in base interest rates, inflation and significant market volatility on our business, the travel industry, travel trends and the global economy generally; |

| ● | costs related to the Business Combination; |

| ● | the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| ● | the effect of a prolonged or substantial decrease in global travel on the global travel industry; |

| ● | political, social and macroeconomic conditions (including the widespread adoption of teleconference and virtual meeting technologies which could reduce the number of in person business meetings and demand for travel and our services); |

| ● | the effect of legal, tax and regulatory changes; and |

| ● | other factors detailed under the section entitled “Risk Factors.” |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in this prospectus. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

xi

PROSPECTUS SUMMARY

This summary highlights selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making an investment decision. You should carefully read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary Statement Regarding Forward Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information,” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus before making an investment decision. The definition of some of the terms used in this prospectus are set forth under the section “Selected Definitions.”

Company Overview

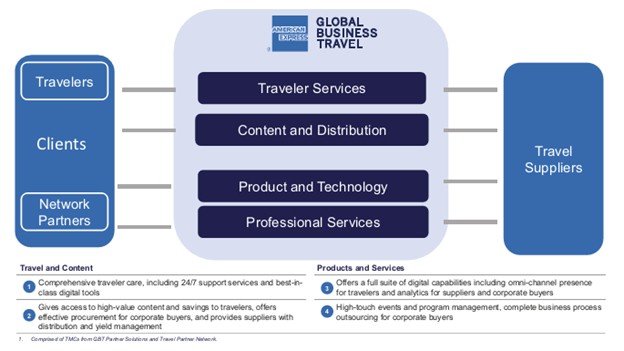

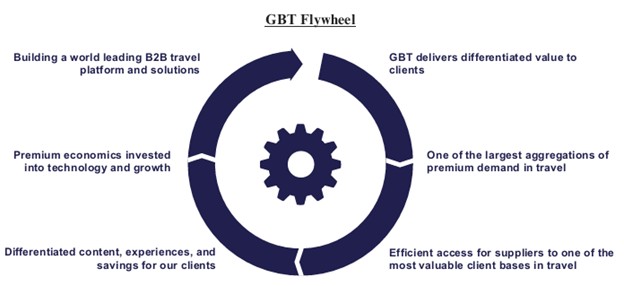

We are the world’s leading platform serving travel for business purposes that is purchased and fulfilled through a company-sponsored and managed channel measured by 2019 TTV according to Travel Weekly (“2021 Power List,” June 2021, Travel Weekly). We provide a full suite of differentiated, technology-enabled solutions to business travelers and corporate clients, suppliers of travel content (such as airlines, hotels, ground transportation and aggregators) and third party travel agencies.

We are at the center of the global B2B travel ecosystem, managing the end-to-end logistics of corporate travel and providing an important link between businesses, their employees, travel suppliers and other industry participants. We service our clients in the following ways:

| ● | Our travel management solutions (delivered through the portfolio of GBT’s brands, including American Express Global Business Travel, Ovation, Lawyers Travel and Egencia) provide our clients with extensive access to flights, hotel rooms, car rentals and other travel services, including exclusive negotiated content, supported by a full suite of services that allows them to design and operate an efficient travel program and solve complex travel requirements. |

| ● | GBT Partner Solutions extends our platform to third party travel management companies and independent advisors, offering them access to our differentiated content and technology. Through GBT Partner Solutions, we aggregate business travel demand serviced by our Network Partners at low incremental cost, which we believe enhances the economics of our platform, generates increased return on investment (“ROI”) and expands our geographic and segment footprint. |

| ● | GBT Supply MarketPlace provides travel suppliers with efficient access to business travel clients serviced by our brands and Network Partners. We believe this access allows travel suppliers to benefit from premium demand (which we generally view as demand that is differentially valuable and profitable to suppliers) without incurring the costs associated with directly marketing to, and servicing, the complex needs of our corporate clients. Our travel supplier relationships generate efficiencies and cost savings that can be passed on to our corporate clients. |

As of April 30, 2022, we served approximately 19,000 corporate clients and more than 260 Network Partners.

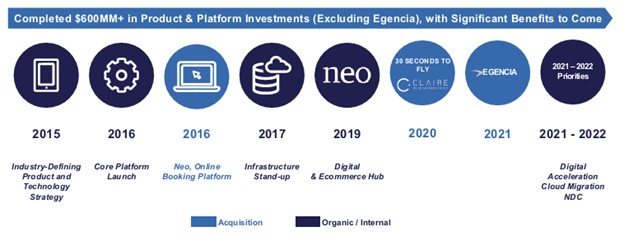

In June 2014, American Express established a joint venture (the “JV”) comprising the Legacy GBT operations with a predecessor of Juweel and a group of institutional investors led by an affiliate of Certares. Following the formation of the JV in 2014, we have evolved from a leading TMC into a complete B2B travel platform, becoming one of the leading marketplaces in travel for corporate clients and travel suppliers according to Travel Weekly (“2021 Power List,” June 2021, Travel Weekly). Before June 2014, our operations were owned by American Express and primarily consisted of providing business travel solutions for corporate clients.

Prior to the Closing Date, we operated our business travel, business consulting and meetings and events businesses under the brands American Express Global Business Travel and American Express Meetings & Events pursuant to an exclusive and worldwide license from American Express. Effective as of the Closing Date, we executed long-term commercial agreements with American Express, including the A&R Trademark License Agreement (as defined elsewhere in this prospectus), pursuant to which we continue to license the American Express trademarks used in the American Express Global Business Travel brand, continue to license the American Express trademarks used in American Express Meetings & Events (solely during a 12-month transition period) brand, and license the American Express trademarks used in the American Express GBT Meetings & Events brand for business travel, meetings and events, business consulting and other services related to business travel, in each case on an exclusive and worldwide basis.

As of May 31, 2022, we had approximately 17,000 employees worldwide with a proprietary presence or operations in 31 countries. We service clients in the rest of the world through our Travel Partners Network.

1

The Business Combination

On May 25, 2022, APSG held an extraordinary general meeting of its shareholders (the “Shareholder Meeting”) at which the APSG Shareholders considered and adopted, among other matters, a proposal to approve the Business Combination pursuant to the terms of the Business Combination Agreement. Upon the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement on May 27, 2022, GBT became a direct subsidiary of APSG, with APSG being re-domesticated as a Delaware corporation and renamed “Global Business Travel Group, Inc.” and conducting its business through GBT in an umbrella partnership-C corporation structure.

As a result of the Business Combination, we raised gross proceeds of approximately $365 million, including (i) the contribution of approximately $42 million of cash held in the trust account from the APSG IPO, net of the redemption of APSG Class A Ordinary Shares held by APSG Shareholders of approximately $776 million and (ii) $323.5 million PIPE Investment at $10.00 per share of our Class A Common Stock. As a result of the Business Combination, we received net proceeds of approximately $128 million, net of transaction costs related to the Business Combination of approximately $69 million and redemption of approximately $168 million of Legacy GBT’s preferred shares (including dividend accrued thereon). See “Unaudited Pro Forma Condensed Consolidated Financial Information” elsewhere in this prospectus for more information.

The PIPE Investment

Pursuant to subscription agreements entered into in connection with the Business Combination Agreement and funded at the Closing, certain investors subscribed for an aggregate of 32,350,000 newly-issued shares of Class A Common Stock at a purchase price of $10.00 per share for an aggregate purchase price of $323.5 million. At the Closing, the Company consummated the PIPE Investment.

After giving effect to the Transactions and the consummation of the PIPE Investment, we have 56,945,033 shares of Class A Common Stock issued and outstanding, 394,448,481 shares of Class B Common Stock issued and outstanding, 36,535,801 GBTG Options to purchase Class A Common Stock and 39,451,134 warrants to purchase Class A Common Stock issued and outstanding as of the date of this prospectus.

Earnout

In connection with the Closing, 15 million “earnout” shares were issued to the holders of GBT Capital Stock and GBT Legacy MIP Options. Each earnout share is in the form of GBT C Ordinary Share. The earnout shares are subject to earnout achievement milestones based on the dollar VWAP of the Class A Common Stock.

Summary of Risk Factors

In addition to the other information contained in this prospectus, the following risks have the potential to impact our business and operations. An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described in this prospectus, together with the other information contained in this prospectus. These risk factors are not exhaustive and all investors are encouraged to perform their own investigation with respect to our business, financial condition and prospects. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe are immaterial could have a material adverse effect on our business, financial condition, results of operations and prospects. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. Such risks include, but are not limited to, the following:

| ● | The COVID-19 pandemic has had, and is expected to continue to have, an adverse impact on our business, including our financial results and prospects, and the travel suppliers on which our business relies; |

| ● | The ongoing impact of the COVID-19 pandemic on our business and the impact on our results of operations is uncertain; |

| ● | Our revenue is derived from the global travel industry, and a prolonged or substantial decrease in global travel, particularly air travel, could adversely affect us; |

2

| ● | The widespread adoption of teleconference and virtual meeting technologies could reduce the number of in-person business meetings and demand for travel and our services, which could adversely affect our business, financial condition and results of operations; |

| ● | The travel industry is highly competitive; |

| ● | Consolidation in the travel industry may result in lost bookings and reduced revenue; |

| ● | Our business and results of operations may be adversely affected by macroeconomic conditions; |

| ● | Downturns in domestic or global economic conditions, or other macroeconomic factors more generally, could have adverse effects on our results of operations; |

| ● | Our international business exposes us to geo-political and economic risks associated with doing business in foreign countries; |

| ● | Complaints from travelers or negative publicity about our services can diminish client confidence and adversely affect our business; |

| ● | Certain results and trends related to our business and the travel industry more generally are based on preliminary data and assumptions, and as a result, are subject to change and may differ materially from what we expect; |

| ● | If we are unable to maintain existing, and establish new, arrangements with travel suppliers, or if our travel suppliers and partners reduce or eliminate the commission and other compensation they pay us, our business and results of operations would be negatively impacted; |

| ● | Our business and results of operations could be adversely affected if one or more of our major travel suppliers suffers a deterioration in its financial condition or restructures its operations or, as a result of consolidation in the travel industry, loses bookings and revenue; |

| ● | We may be unable to identify and consummate new acquisition opportunities, which would significantly impact our growth strategy; |

| ● | We may not realize the intended benefits of the Egencia Acquisition; |

| ● | Cybersecurity attacks or security breaches could adversely affect our ability to operate, could result in personal information and our proprietary information being lost, stolen, made inaccessible, improperly disclosed or misappropriated and may cause us to be held liable or subject to regulatory penalties and sanctions and to litigation (including class action litigation), which could have a material adverse effect on our reputation and business; |

| ● | Because we are deemed to be “controlled” by American Express under the BHC Act, we are and will be subject to supervision, examination and regulation by the Federal Reserve which could adversely affect our future growth and our business, results of operations and financial condition; |

| ● | We are a holding company, our principal asset is an equity interest in GBT and our ability to pay taxes and expenses will depend on distributions made by our subsidiaries and may be otherwise limited by our structure and the terms of our existing and future indebtedness; |

| ● | The classification of the Board may have anti-takeover effects, including discouraging, delaying or preventing a change of control; and |

| ● | We have incurred significant increased costs as a result of being a newly public company, and our management will be required to devote substantial time to new compliance initiatives. |

See “Risk Factors” included elsewhere in this prospectus for more information.

3

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period , which means that when a standard is issued or revised and it has different application dates for public or private companies, we as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with those of another public company that is neither an emerging growth company nor an emerging growth company that has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the Closing Date, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates equals or exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated with the term in the JOBS Act.

Corporate Information

Our website address is www.amexglobalbusinesstravel.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information contained on our website in deciding whether to purchase shares of our Class A Common Stock.

Our principal executive office is located at 666 3rd Avenue, 4th Floor, New York, NY 10017. Our telephone number is (212) 679-1600.

4

THE OFFERING

Issuer |

| Global Business Travel Group, Inc. |

Issuance of Class A Common Stock | ||

Total shares of Class A Common Stock issuable upon (i) the exercise of all public warrants, private placement warrants, GBTG Options, (ii) the exchange of GBT B Ordinary Shares (with automatic surrender for cancellation of an equal number of shares of Class B Common Stock), and (iii) the conversion of “earnout” shares | 485,526,872 shares | |

Exercise price of the public warrants and private placement warrants | $11.50 per share, subject to adjustment as described herein | |

Use of proceeds | We will receive up to an aggregate of approximately $453,688,041 from the exercise of all public warrants and private placement warrants, assuming the exercise in full of all such warrants for cash. We will receive up to an aggregate of $287,568,024.15 from the exercise of all GBTG Options, assuming the exercise in full of all such options for cash. We expect to use the net proceeds from such exercises for general corporate purposes, which may include acquisitions and other business opportunities and the repayment of indebtedness. See the section of this prospectus titled “Use of Proceeds” appearing elsewhere in this prospectus for more information. | |

Resale of Class A Common Stock and Warrants | ||

Shares of Class A Common Stock that may be offered and sold from time to time by the Selling Securityholders | 492,628,569 shares of Class A Common Stock | |

Private placement warrants offered by the Selling Securityholders hereunder | 12,224,134 warrants | |

Use of proceeds | All of the shares of Class A Common Stock and public warrants offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from such sales. | |

Transfer Restrictions | In connection with certain agreements related to the Business Combination, certain Selling Securityholders who received Founder Shares, GBTG Options, GBT MIP Options, GBT B Ordinary Shares, Class B Common Stock, “earnout” shares and any shares of Class A Common Stock into which such stock and shares are converted are subject to a post-Closing lock-up until the date that is 180 days after the Closing Date. The PIPE Securities will not be subject to a post-Closing lock-up period. See the section titled “Shares Eligible for Future Sale — Lock-Up Agreements.” | |

Dividend Policy | We have not paid any cash dividends on our Class A Common Stock to date. The payment of any cash dividends in the future will be within the discretion of our Board at such time. Furthermore, our ability to pay dividends is |

5

limited by the Senior Secured Credit Agreement and may be limited by covenants under other indebtedness we and our subsidiaries incur in the future, as well as other limitations and restrictions imposed by law. We currently expect to retain future earnings to finance operations and grow our business, and we do not expect to declare or pay cash dividends for the foreseeable future. Pursuant to the Senior Secured Credit Agreement, so long as GBT is treated as a partnership or a disregarded entity for U.S. federal income tax purposes, GBT may make Tax Distributions (as defined and set forth in the Shareholders Agreement after the effectiveness thereof), subject to certain limitations on future amendments, if any, to the Shareholders Agreement and certain restrictions on making Tax Distributions with respect to any income included under Section 965(a) of the Code. We may receive tax distributions from GBT significantly in excess of our tax liabilities. If we become a guarantor under the Senior Secured Credit Agreement, then our ability to make dividends on the Class A Common Stock in the amount of any excess cash balances from such tax distributions, as well as certain other cash dividends, would be subject to fixed-dollar caps set forth in the Senior Secured Credit Agreement in the event that the total leverage ratio (calculated in a manner set forth in the Senior Secured Credit Agreement) would be greater than 3.00:1.00 after giving pro forma effect to such dividends. If we do not become a guarantor, then the ability of our subsidiaries to make certain cash dividends to us will be subject to similar restrictions. | ||

NYSE Symbol | “GBTG” for our Class A Common Stock and “GBTG.WS” for our public warrants. | |

Risk Factors | See the section titled “Risk Factors” beginning on page 7 of this prospectus and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our Class A Common Stock and public warrants. |

6

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the other information contained in this prospectus, the following risks have the potential to impact our business and operations. These risk factors are not exhaustive and all investors are encouraged to perform their own investigation with respect to our business, financial condition and prospects. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe are immaterial could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Risks Relating to Our Business and Industry

The COVID-19 pandemic has had, and is expected to continue to have, an adverse impact on our business, including our financial results and prospects, and the travel suppliers on which our business relies.

In response to the COVID-19 pandemic, many governments around the world have implemented, and continue to implement, a variety of measures to reduce the spread of COVID-19, including travel restrictions and bans, instructions to residents to practice social distancing, quarantine advisories, shelter-in-place orders, required closures of non-essential businesses and additional restrictions on businesses as part of re-opening plans. These government mandates have had a significant negative impact on the travel industry and many of the travel suppliers on which our business relies, as well as on our workforce, operations and clients. While restrictions have been fully or partly lifted in many geographies, some restrictions remain in place or may be reinstated in the future. There remains uncertainty around when remaining restrictions will be lifted, the potential impact of the new variants of COVID-19, if additional restrictions may be initiated, if there will be changes to travel behavior patterns when government restrictions are fully lifted, the continued efficacy of existing vaccines and other preventative therapies against the new variants and the timing of distribution and administration of vaccines and other preventative therapies globally.

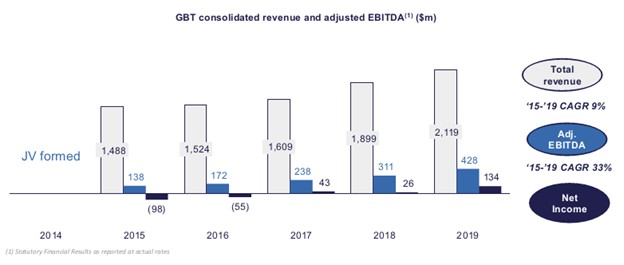

The COVID-19 pandemic and the resulting economic conditions and government orders forced many of our travel suppliers, including airlines and hotels, to pursue cost reduction measures and seek financing, including government financing and support, in order to reduce financial distress and continue operating, and to curtail drastically their service offerings. The COVID-19 pandemic has resulted, and may continue to result, in the restructuring or bankruptcy of certain of those travel suppliers, and renegotiation of the terms of our agreements with them. In addition, the COVID-19 pandemic resulted in a material decrease in business and consumer spending and an unprecedented decline in transaction volumes in the global travel industry. Our financial results and prospects are largely dependent on these transaction volumes. As a result, our financial results for the years ended December 31, 2021 and 2020 were significantly and negatively impacted, with a material decline in total revenues, net income, cash flow from operations and Adjusted EBITDA (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Key Operating and Financial Metrics”) as compared to 2019, our last year of normalized operations. Our revenue for the years ended December 31, 2021 and 2020 was $763 million and $793 million, respectively, compared to revenue of $2,119 million for the year ended December 31, 2019. Further, (i) we incurred a net loss of $475 million and $619 million for the years ended December 31, 2021 and 2020, respectively, compared to a net income of $138 million for the year ended December 31, 2019, (ii) we had cash outflow from operations of $512 million and $250 million for the years ended December 31, 2021 and 2020, respectively, compared to cash inflow from operations of $227 million for the year ended December 31, 2019 and (iii) our Adjusted EBITDA was $(340) million and $(363) million for the years ended December 31, 2021 and 2020, respectively, compared to Adjusted EBITDA of $428 million for the year ended December 31, 2019.

Starting late in the fourth quarter of 2020, initial COVID-19 vaccines were approved for widespread distribution across the world. With vaccination programs well advanced in many countries, many governments around the world have lifted restrictions and transaction volumes in the global travel industry have experienced a material recovery. As of May 2022, transaction volumes, including Egencia and Ovation, were approximately 70% of 2019 levels. However there remains uncertainty around the path to full economic and travel recovery from the COVID-19 pandemic. As a result, we are unable to predict accurately the impact that the COVID-19 pandemic will have on our business going forward. While travel has historically been resilient to macroeconomic events, with the continued spread of COVID-19 and other variants throughout the world, the COVID-19 pandemic and its effects could continue to have an adverse impact on our business, financial condition, results of operations and cash flows for the foreseeable future.

The ongoing impact of the COVID-19 pandemic on our business and the impact on our results of operations is uncertain.

The extent of the effects of the COVID-19 pandemic on our business, results of operations, cash flows and growth prospects are uncertain and will ultimately depend on future developments. These include, but are not limited to, the severity, extent and duration of

7

the global pandemic, including as a result of any new variants of COVID-19, any resurgences of the pandemic, the global distribution of the vaccines and other preventative therapies and their efficacy against existing and any future variants of COVID-19, and their impacts on the travel industry and business and consumer spending more broadly; actions taken by national, state and local governments to contain the spread of COVID-19, including travel restrictions and bans, required closures of non-essential businesses, constraints on businesses during reopening transitions and aid and economic stimulus efforts; the effect of the changes in hiring levels and remote working arrangements that we have implemented on our operations, including the health, productivity, retention and morale of management and our employees and our ability to maintain our financial reporting processes and related controls; the impact on the financial condition on our supplier partners, and any potential restructurings or bankruptcies of our supplier partners; the impact on our contracts with our supplier partners, including force majeure provisions and requests to renegotiate the terms of existing agreements prior to their expiration, including providing temporary concessions regarding contractual minimums; our ability to withstand increased cyberattacks; the speed and extent of the recovery across the broader travel ecosystem, including the speed at which clients feel comfortable traveling again as restrictions on travel are lifted, which we believe will be impacted by the pace of roll out and continued effectiveness of widespread vaccinations or treatments; short- and long-term changes in travel patterns, including business travel; and the duration, timing and severity of the impact on client spending, including how long it takes to recover from economic recessions and inflationary pressures resulting from the COVID-19 pandemic. The COVID-19 pandemic may continue to spread in regions that have not yet been affected or have been minimally affected by the COVID-19 pandemic after conditions begin to recover in currently affected regions, which could continue to affect our business. Also, existing restrictions in affected areas could be extended after COVID-19 has been contained in order to avoid resurgent waves, and regions that recover from the COVID-19 pandemic may suffer from a resurgence and re-imposition of restrictions. There may also be restrictions on certain travel activity related to whether travelers have been vaccinated. Governmental restrictions and societal norms with respect to travel may change permanently in ways that cannot be predicted and that can change the travel industry in a manner adverse to our business. Additionally, the potential failure of travel service providers and travel agencies (or acquisition of troubled travel service providers or travel agencies) may result in further consolidation of the industry, potentially affecting market dynamics for our services.

Our business is dependent on the ability of businesses to travel, particularly by air. The ability of businesses to travel internationally has been significantly impacted by the various travel restrictions between countries. While business performance has improved with the relaxation of some of these restrictions, economic and operating conditions for our business may not fully recover to pre COVID-19 levels unless and until most businesses are once again willing and able to travel, more companies have re-opened and fully staffed their offices and our travel suppliers are once again able to serve those businesses. This may not occur until well after the broader global economy has fully recovered and recent inflationary, labor and supply chain disruption challenges abate. Additionally, our business is also dependent on corporate sentiment and travel and expense spending patterns. Macroeconomic uncertainty in key geographical areas as a consequence of direct or indirect impacts of COVID-19 may negatively impact corporate travel and expense spending. Even though we have seen improvements in the economic and operating conditions for our business since the outset of the COVID-19 pandemic, we cannot predict the long-term effects of the COVID-19 pandemic on our business or the travel industry as a whole. If the travel industry is fundamentally changed by the COVID-19 pandemic in ways that are detrimental to our operating model, our business may continue to be adversely affected even if the broader global economy recovers.

To the extent that the COVID-19 pandemic continues to adversely affect our business and financial performance, it may also have the effect of heightening many of the other risks identified in this “Risk Factors” section, such as those relating to our substantial amount of outstanding indebtedness.

Our revenue is derived from the global travel industry, and a prolonged or substantial decrease in global travel, particularly air travel, could adversely affect us.