TrueQ32023December 31000182030200018203022023-01-012023-09-300001820302us-gaap:CommonClassAMember2023-01-012023-09-300001820302us-gaap:WarrantMember2023-01-012023-09-300001820302us-gaap:CommonClassAMember2023-11-10xbrli:shares0001820302bakkt:CommonClassVMember2023-11-100001820302us-gaap:WarrantMember2023-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q/A

(Amendment No. 2)

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 001-39544

BAKKT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 98-1550750 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

10000 Avalon Boulevard, Suite 1000 Alpharetta, Georgia | 30009 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (678) 534-5849

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | BKKT | | The New York Stock Exchange |

| Warrants to purchase Class A Common Stock | | BKKT WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | | |

| Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ☐ No ☒

As of November 10, 2023, there were 91,429,477 shares of the registrant’s Class A common stock, 183,234,872 shares of Class V common stock, and 7,140,808 public warrants issued and outstanding.

EXPLANATORY NOTE

Bakkt Holdings, Inc. (Bakkt,” “we,” “us,” “our,” or the “Company”) is filing this Amendment No. 2 to its Quarterly Report on Form 10-Q/A for the quarterly period ended September 30, 2023 (this “Amended Form 10-Q” or “10-Q/A”), as originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 14, 2023 (the “Original Form 10-Q”).

The final paragraph of the explanatory note of Amendment 1 to the Original Form 10-Q inadvertently omitted certain context around our going concern risk factor, which paragraph has been corrected and revised as below.

This Amended Form 10-Q is presented as of the filing date of the Original Form 10-Q and does not (i) reflect events occurring after that date, except with respect to the information regarding our ability to continue as a going concern in Part II, Item 1A and certain business updates included in Part II, Item 6, or (ii) modify or update disclosures in any way other than as required to reflect the amendment and restatement as described below. Accordingly, this Amended Form 10-Q should be read in conjunction with the Original Form 10-Q and our filings with the SEC subsequent to the date on which we filed the Original Form 10-Q. This Amended Form 10-Q does not change our consolidated financial statements as set forth in the Original Form 10-Q.

The purpose of this Amended Form 10-Q is to (i) amend and restate the disclosure in Part II, Item 1A “Risk Factors” to provide further updates to certain risks resulting from changes to the Company’s business following its acquisition (the “Bakkt Crypto Acquisition”) of Bakkt Crypto Solutions, LLC (“Bakkt Crypto”), formerly Apex Crypto LLC (“Apex Crypto”), and to add a risk factor related to our ability to continue as a going concern as we have subsequently deemed there to be substantial doubt regarding our ability to continue as a going concern 12 months following the date of this Amended Form 10-Q without raising capital, and (ii) amend and restate Part II, Item 5, which provides an update to the Company’s business activities following the Bakkt Crypto Acquisition. Part II, Item 6 “Exhibits” has also been amended and restated to include currently dated certifications of the Company’s principal executive officer and principal financial officer as required by Sections 302 and 906 of the Sarbanes Oxley Act of 2002. The certifications are attached to this Amended Form 10-Q as Exhibits 31.1, 31.2, 32.1 and 32.2.

Table of Contents

| | | | | | | | |

| | Page |

PART II. | | |

Item 1A. | | |

Item 5. | | |

Item 6. | | |

| | |

| | |

| | |

| | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Amended Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. You can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions and strategies regarding future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to our business. Forward-looking statements in this Amended Form 10-Q may include, for example, statements about:

•our future financial performance;

•changes in the market for our products and services;

•the expected impacts from the Bakkt Crypto Acquisition; and

•expansion plans and opportunities. including our plans to expand to international markets.

These forward-looking statements are based on information available as of the date of this Amended Form 10-Q and management’s current expectations, forecasts and assumptions, and involve a number of judgments, known and/or unknown risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable law.

You should not place undue reliance on these forward-looking statements. Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions prove incorrect, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to:

•our ability to grow and manage growth profitably;

•changes in our business strategy;

•changes in the markets in which we compete, including with respect to our competitive landscape, technology evolution or changes in applicable laws or regulations;

•changes in the markets that we target;

•disruptions in the crypto market that subject us to additional risks, including the risk that banks may not provide banking services to us;

•the possibility that we may be adversely affected by other economic, business, and/or competitive factors;

•the inability to launch new services and products or to profitably expand into new markets and services, or the inability to continue offering existing services or products;

•the inability to execute our growth strategies, including identifying and executing acquisitions and our initiatives to add new clients;

•our ability to achieve the expected benefits from the acquisition of Bakkt Crypto;

•our failure to comply with extensive government regulation, oversight, licensure and appraisals;

•the uncertain regulatory regime governing blockchain technologies and crypto;

•the inability to develop and maintain effective internal controls and procedures;

•the exposure to any liability, protracted and costly litigation or reputational damage relating to our data security;

•the impact of any goodwill or other intangible assets impairments on our operating results;

•the impact of any pandemics or other public health emergencies;

•our inability to maintain the listing of our securities on the New York Stock Exchange (the “NYSE”); and

•other risks and uncertainties indicated in this Amended Form 10-Q, including those set forth under “Risk Factors.”

PART II—OTHER INFORMATION

In addition to the information set forth in this Amended Form 10-Q and the Original Form 10-Q, you should carefully consider the risk factors and other cautionary statements described under the heading “Item 1A. Risk Factors” included in our Form 10-K, which could materially affect our businesses, financial condition, or future results. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition, or future results. There have been no material changes in our risk factors from those described in our Form 10-K, other than as set forth below:

Item 1A. Risk Factors.

If we are unable to attract, retain or grow our relationships with our existing clients our business, financial condition, results of operations and future prospects would be materially and adversely affected. Moreover, sales efforts to large clients involve risks that may not be present or that are present to a lesser extent with respect to sales to smaller organizations.

For our platform to be successful, we must continue our existing partnerships, and successfully develop new, partnerships with clients. Our ability to retain and grow our relationships with our clients depends on the willingness of those clients to establish a commercial relationship with us. Moreover, our growth plan includes marketing expense to incentivize clients with whom we develop partnerships to market our platform to their customers, which we expect would accelerate customer adoption of our platform and lower our overall customer acquisition cost. If clients with whom we develop partnerships fail to market or do not effectively market our platform to their customers, or customers fail to adopt our platform through these marketing efforts in such numbers as we have projected, our customer acquisition costs may increase and our business, financial condition and results of operations may be adversely affected.

Sales to large clients involve risks that may not be present or that are present to a lesser extent with sales to smaller organizations, such as longer sales cycles, more complex requirements and substantial upfront sales costs. For example, large clients may require considerable time to evaluate and test our platform prior to making a decision, or may request pricing models that may decrease our potential margins. Several factors influence the length and variability of our sales cycle, including the need to educate potential clients about the uses and benefits of our platform, the discretionary nature of purchasing and budget cycles, and the competitive nature of evaluation and purchasing approval processes. In order for our sales efforts to large organizations to be successful, we often must be able to engage with senior officers of the organization. As a result, the length of our sales cycle, from identification of the opportunity to deal closure, may vary significantly for each client, with sales to large enterprises typically taking longer to complete. If we fail to effectively manage the risks associated with sales cycles and sales to large clients, our business, financial condition and results of operations may be adversely affected.

Moreover, when we execute an agreement with a client, we are still dependent on that client to deploy our platform. Larger clients, in particular, often delay deployment for a lengthy period of time after executing an agreement. Even when clients begin their integration into our platform, they do so on a limited basis while frequently requiring that we provide implementation services, which may include customization and controls that limit the functionality of our platform, and negotiate pricing discounts, which increases our upfront investment in the sales effort with no guarantee that sales to these clients will justify our upfront investment, which can be substantial. If a client delays deployment for lengthy periods of time, our consumer and revenue growth may not achieve expectations and our business, financial condition and results of operations may be adversely affected.

Our agreements with our clients have terms that range from approximately one to three years, and in some cases, our existing clients can generally terminate these agreements without cause upon 30 to 90 days’ prior written notice. In addition, many of those agreements also provide for the right of the client to terminate the agreement, or for us to pay financial penalties, in the event that we breach certain service level agreements with respect to the operation of our platform. The termination of one or more of our agreements with a client would result in a reduction in a loss of transacting accounts, transaction volume and revenue attributable to customers generated from that client relationship, and our business, financial condition, results of operations and future prospects would be materially and adversely affected.

Additionally, certain terms of our partner agreements remain subject to further discussion and refinement before they can be implemented, including the potential products and services to bring to market. Our ability to realize the intended benefits of these partnerships will depend on our ability to finalize such agreements, for such products and services, and to do so on terms sufficiently favorable to us. While we continue to negotiate partnership terms, we may be unable to agree to terms with such clients on commercially advantageous terms or at all, which may adversely affect our business and prospects.

Furthermore, our ability to retain existing, or obtain new, partners and customers may be impacted to the extent that clients choose not to partner with us, or customers choose not to transact or to engage in fewer transactions on our platform, in each case, because we do not currently offer or plan to cease offering certain crypto assets. For example, Bakkt has delisted or determined to delist a substantial majority of the crypto assets that had historically been available for trading on the Bakkt Crypto platform. The decision to delist those crypto assets has impacted, and may in the future further impact, our revenues as additional crypto assets are delisted and may impact the expected synergies and benefits from the Bakkt Crypto acquisition. If partners do not engage with us, or if customers choose not to transact or make fewer transactions on our platform, as a result of the decision to delist those crypto assets or our decision not to offer other crypto assets, our revenues will be adversely impacted.

Any of the foregoing could, among other things, adversely impact our stock price, make us less competitive compared to our peers and otherwise significantly adversely affect our business.

Excessive redemptions or withdrawals, or a suspension of redemptions or withdrawals, of crypto assets could adversely impact our business.

We have procedures to process redemptions and withdrawals promptly in accordance with the terms of the applicable user agreements. Although we have not experienced excessive redemptions or withdrawals, or suspensions of redemptions or withdrawals, of crypto assets to date, we could experience process-related withdrawal or redemption delays in the future if there were to be a significant and unexpected volume of withdrawal or redemption requests. To the extent we have process-related delays, even if the delays are brief or due to blockchain network congestion or heightened redemption activity, and even if the delays are within the terms of an applicable user agreement or otherwise communicated by us, we may nonetheless experience, among other things, increased customer complaints, damage to our brand and reputation and additional regulatory scrutiny, any of which could adversely affect our business.

Acquisitions, strategic investments, partnerships, or alliances may be difficult to identify. We may not realize the anticipated benefits of past or future investments, strategic transactions or acquisitions, including our acquisition of Apex Crypto, and integration of these acquisitions may pose integration challenges, divert the attention of management, disrupt our business, dilute stockholder value or otherwise adversely affect our business, financial condition and results of operations.

We have in the past and may in the future seek to acquire or invest in businesses, joint ventures, partnerships, alliances and platform technologies that we believe could complement or expand our platform, enhance our technology, or otherwise offer growth opportunities. For example, on April 1, 2023, we consummated our agreement to acquire all of the membership interests of Apex Crypto, which we have since renamed Bakkt Crypto.

We may not realize the anticipated benefits of past or future investments, strategic transactions, or acquisitions, including the acquisition of Bakkt Crypto, and these transactions involve numerous risks that are not within our control. These risks include the following, among others:

•obtaining the requisite regulatory approvals necessary to consummate the transaction the acquisition, or to integrate the acquired business with our own;

•difficulty in assimilating the operations, systems, and personnel of the acquired business;

•difficulty in effectively integrating the acquired technologies or products with our current products and technologies;

•difficulty in maintaining controls, procedures and policies during the transition and integration;

•disruption of our ongoing business and distraction of our management and employees from other opportunities and challenges due to integration issues;

•difficulty integrating the acquired business’s accounting, management information and other administrative systems;

•inability to retain key technical and managerial personnel of the acquired business;

•inability to retain key customers, vendors and other business clients of the acquired business;

•inability to achieve the financial and strategic goals for the acquired and combined businesses;

•incurring acquisition-related costs or amortization costs for acquired intangible assets that could impact our results of operations;

•regulatory changes that affect the value of the businesses we acquire or our plans for integration of those businesses, or that expose us to additional regulation or litigation in connection with the acquired businesses;

•significant post-acquisition investments which may lower the actual benefits realized through the acquisition;

•potential failure of the due diligence process to identify significant issues with product quality, legal, and financial liabilities among other things; and

•potential inability to assert that internal controls over financial reporting are effective.

In particular, the acquisition of Bakkt Crypto presents risks to our business, including because:

•our ability to retain the legacy clients of Apex Crypto, and expand those relationships, is a key growth driver for us;

•we are in the process of replacing and/or augmenting many of our existing systems and relationships (e.g., agreements with crypto liquidity providers) with those historically used by Apex Crypto;

•we may need to be able to accommodate the significantly increased volume on our platform;

•the completion of the integration of the Bakkt Crypto business—which includes, among other things, merging legal entities, eliminating duplicative licenses, and adjusting the amount of regulatory capital associated therewith—remains subject to regulatory approval, the delay of which extends the timeline for our recognition of the full benefits of the transaction;

•we may have increased liability and/or regulatory risk from the list of additional crypto assets on our platform and from the pre-acquisition activities of Bakkt Crypto, even after we elected to delist certain of the crypto assets on the Bakkt Crypto platform; and

•the commercial relationship with Apex Clearing Corporation that is a part of the acquisition is a key growth driver for us, but that relationship may not produce the benefits that we envision.

Our failure to address these risks, or other problems encountered in connection with our past or future investments, strategic transactions, or acquisitions, could cause us to fail to realize the anticipated benefits of these acquisitions or investments, cause us to incur unanticipated liabilities, and harm our business generally. Future acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses, incremental expenses or the write-off of goodwill, any of which could harm our financial condition or results of operations, and the trading price of our common stock could decline. For example, under the purchase agreement for the acquisition of Apex Crypto, we agreed to pay or issue an aggregate of $200 million in cash and/or common stock as contingent consideration in respect of Bakkt Crypto achieving certain financial targets through 2025. Through November 13, 2023, we have delivered approximately $9.1 million of shares of Class A common stock in respect of such obligations.

Our failure to safeguard and manage our customers’ crypto could adversely impact our business, operating results, and financial condition.

In our capacity as a crypto custodian, our platform holds crypto for individual and institutional customers, and buys, sells, sends and receives crypto to fulfill buy and sell orders of such customers. Specifically, Bakkt Trust Company LLC (“Bakkt Trust”) provides custody services to customers of Bakkt Marketplace and to its own institutional customers with respect to all crypto assets which we support for trading. In addition, Bakkt Crypto provides custodial services that support the crypto tokens offered on the consumer platform through both third-party providers of custodial services and self-custody through. the Fireblocks Vault service. Should we or one of our third-party custodians fail to implement or maintain the policies, procedures and controls necessary to secure the custody of the crypto assets entrusted to us by our customers in full compliance with applicable law and regulation, the Company could suffer reputational harm and/or significant financial losses; face litigation or regulatory enforcement action potentially leading to significant fines, penalties, and additional restrictions; and see its customers discontinue or reduce their use of our and our partners’ products. Any of these occurrences could adversely impact our business, operating results, and financial condition.

We regard the crypto assets that we hold in custody for customers as the property of those customers, who benefit from the rewards and bear the risks associated with their ownership, and we believe that customer crypto assets, consistent with the nature and terms of the services we offer and applicable law, would not be made available to satisfy the claims of our general creditors in the event of our bankruptcy. In addition, since the acquisition of Bakkt Crypto, we have utilized the services of third-party custodians to hold crypto assets in custody for the benefit of Bakkt Crypto customers. These third-party custodians maintain their own bankruptcy protection procedures and contractual protections designed with the goal that the crypto assets held in custody by these third-party custodians would not be made available to satisfy the claims of such custodian’s general creditors in the event of bankruptcy. However, insolvency law is not fully developed with respect to the holding of crypto assets in custodial arrangements and continues to develop. As a result, there is a risk that crypto assets held in custody could be considered to be the property of a bankruptcy estate in the event of a bankruptcy, and that the crypto assets held in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as general unsecured creditors. This prospect may result in customers finding our custodial services more risky and less attractive.

Both Bakkt Trust and Bakkt Crypto use omnibus wallets to hold crypto assets belonging to the Company as well as crypto assets held for the benefit of and on behalf of customers. The balances of Bakkt Crypto-owned assets in such wallets are de minimis and are maintained solely to facilitate customer transactions, such as by funding the payment of transfer fees and addressing rounding conventions and trade errors. Although the Company maintains detailed internal ledgers recording the ownership of crypto assets held in Company-controlled omnibus wallets, the use of omnibus wallets could complicate the disposition or treatment of customer crypto assets in the event of our bankruptcy, including by increasing the risk that crypto assets held in the omnibus wallets are considered to be the property of our bankruptcy estate.

Further, on March 31, 2022, the SEC issued Staff Accounting Bulletin No. 121, which represents a significant change regarding how a company safeguarding crypto held for its platform users reports such crypto on its balance sheet. Any future changes in U.S. generally accepted accounting principles (“GAAP”) that require us to change the manner in which we account for our crypto held for our customers could have a material adverse effect on our financial results and the market price of our securities.

See “—Risks Related to Risk Management and Financial Reporting—Future changes in financial accounting standards may significantly change our reported results of operations.”

Our business is subject to extensive government regulation, oversight, licensure and approvals. Our failure to comply with extensive, complex, uncertain, overlapping and frequently changing rules, regulations and legal interpretations could materially harm our business.

Our business is subject to laws, rules, regulations, policies and legal interpretations in the markets in which we operate, including, but not limited to, those governing money transmission, crypto asset business activity, consumer protection, anti-money laundering, counter-terrorist financing, privacy and data protection, cybersecurity, economic and trade sanctions, commodities, derivatives, and securities.

We have been, and expect to continue to be, required to apply for and maintain various licenses, certifications and regulatory approvals in jurisdictions where we provide our services, including due to changes in applicable laws and regulations or the interpretation of such laws and regulations. There can be no assurance that we will elect to pursue, or be able to obtain, any such licenses, certifications and approvals. In addition, there are substantial costs and potential product changes involved in maintaining and renewing such licenses, certifications and approvals. For instance, in the United States, each of Bakkt Marketplace and Bakkt Crypto has obtained licenses to operate as a money transmitter (or its equivalent) in the states where it operates and where such licenses are required, as well as in the District of Columbia and Puerto Rico, and as a virtual currency business with the State of New York. In these capacities, each of Bakkt Marketplace and Bakkt Crypto is subject to reporting requirements, restrictions with respect to the investment of consumer funds, bonding requirements and inspection by state regulatory agencies.

As we expand our business activities, both as to the products and services offered and into jurisdictions beyond the United States, including as a result of the Bakkt Crypto acquisition, we have become increasingly obligated to comply with new laws and regulations, including those of any additional countries and markets in which we operate, and we may be subject to increased regulatory oversight and enforcement and more restrictive rules and regulations. Laws outside of the United States often impose different, more specific, or even conflicting obligations on companies, as well as broader liability. For example, certain transactions that may be permissible in a local jurisdiction may be prohibited by regulations of U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) or U.S. anti-money laundering or counter-terrorist financing regulations. Our ability to manage our business and conduct our operations internationally will require considerable management attention and resources, particularly as we have no operating history outside the United States and limited experience with international regulatory environments and market practices. Our failure to successfully manage regulatory risks could harm our international operations and have an adverse effect on our business, operating results, and financial condition.

As we expand our international activities, we become increasingly obligated to comply with the laws, rules, regulations, policies and legal interpretations of both the jurisdictions in which we operate and those into which we offer services on a cross-border basis. For instance, financial regulators outside the United States have increased scrutiny of crypto asset platforms over time, such as by requiring crypto asset platforms operating in their local jurisdictions to be regulated and licensed under local laws. To the extent a customer accesses our services outside of jurisdictions where we have obtained required governmental licenses and authorization, we face a risk of becoming subject to regulations in that local jurisdiction. A regulator’s conclusion that we are servicing customers in its jurisdiction without being appropriately licensed, registered or authorized could result in fines or other enforcement actions.

In general, any failure or perceived failure to comply with existing or new laws, regulations, or orders of any regulatory authority (including changes to or expansion of the interpretation of those laws, regulations, or orders) may subject us to liability, significant fines, penalties, criminal and civil lawsuits, forfeiture of significant assets and enforcement actions in one or more jurisdictions, result in additional compliance and licensure requirements, increase regulatory scrutiny of our business, restrict our operations and force us to change our business practices, make product or operational changes, including ceasing our operations in certain jurisdictions, or delaying planned product launches or improvements. Any of the foregoing could, individually or in the aggregate, harm our reputation, damage our brand and business, impose substantial costs and adversely affect our financial condition and results of operations. The complexity of U.S. federal and state regulatory and enforcement regimes, coupled with the scope of our operations and the evolving regulatory environment, could result in a single event giving rise to a large number of overlapping investigations and legal and regulatory proceedings by multiple authorities. Moreover, we cannot provide any assurance that our employees, contractors, or agents will not violate such laws and regulations.

Regulatory regimes governing blockchain technologies and crypto are evolving and uncertain, and new legislation, regulations, guidance and enforcement actions have in the past required, and may in the future require, us to alter our business practices.

Significant parts of our business, such as our product and service offerings involving crypto, are subject to uncertain and/or evolving regulatory regimes. As crypto has grown in both popularity and market size, governments have reacted differently, with certain governments deeming it illegal and others allowing its use and trade without restriction. The failures of risk management and other control functions at other companies that played a role in the 2022 and 2023 events have accelerated, and continue to accelerate, an existing regulatory trend toward stricter oversight of crypto platforms and the crypto industry. Legislation, regulations and enforcement actions applicable to crypto in the United States include, but are not limited to the following:

•In 2023, the SEC initiated lawsuits against certain crypto asset exchanges, including Bittrex, Coinbase, Binance, and Kraken alleging among other things that those entities operated as unregistered national securities exchanges, unregistered broker-dealers and unregistered clearing agencies and alleging that certain crypto assets available on their platforms are securities.

•The Commodity Futures Trading Commission (“CFTC”) staff has publicly taken the position that certain crypto assets are commodities, and as such, exchange-traded derivatives involving bitcoin are subject to the CFTC’s jurisdiction and enforcement powers. This has been reflected in certain CFTC enforcement actions, including those against Coinflip, Inc. and certain informal CFTC guidance, such as the LabCFTC’s Primer on Virtual Currencies.

•In June 2023, the CFTC won a default judgment against Ooki DAO, a decentralized autonomous organization that the CFTC charged with operating an illegal trading platform and unlawfully offering leveraged and margined retail commodity transactions in crypto assets outside of a registered exchange, unlawfully acting as a Futures Commission Merchant (FCM), and unlawfully failing to comply with Bank Secrecy Act obligations applicable to FCMs.

•In July 2023, a court in the Southern District of New York held that Ripple’s sales of XRP to sophisticated investors pursuant to written contracts did constitute the unregistered offer and sale of investment contracts while sales of XRP to purchasers through blind bid/ask transactions on crypto asset exchanges did not constitute the sale of unregistered securities.

•On July 31, 2023, a different court in the Southern District of New York held that the SEC had asserted a plausible claim that certain inter-related crypto assets offered by Terraform Labs qualified as investment contracts.

•In September 2023, the CFTC issued orders and simultaneously filed and settled charges against Opyn, Inc., ZeroEx, Inc., and Deridex, Inc., alleging that each had offered users the ability to trade crypto asset derivatives without registering with the CFTC as one or more regulated entities.

•The U.S. Congress has expressed the need for both greater federal oversight of the crypto industry and comprehensive crypto asset legislation. In June 2023, a bill was introduced in the U.S. House of Representatives that would place certain crypto assets under SEC oversight, while placing others that qualify as commodities, under the jurisdiction of the CFTC. Under the draft bill, whether a particularly crypto asset is as a security or commodity would depend, among other things, on how decentralized its underlying blockchain is. The bill would also require crypto asset intermediaries, such as certain of our subsidiaries, to register with and be regulated by the CFTC, the SEC or both.

•Certain state regulators, such as NYDFS, have created or are in the process of creating new regulatory frameworks with respect to crypto. For example, in 2015, the State of New York adopted the “BitLicense,” the first U.S. regulatory framework for licensing participants in crypto business activity. Each of Bakkt Marketplace and Bakkt Crypto currently operates under a BitLicense. On January 25, 2023, NYDFS released guidance regarding crypto custody practices, providing that a “virtual currency entity custodian” must: (1) separately account for and segregate customer assets from proprietary assets, (2) take possession of customer assets only for the limited purpose of

carrying out custody and safekeeping services, (3) request approval before implementing any sub-custody arrangements, and (4) provide adequate disclosure to customers. In addition, Louisiana has adopted a virtual currency regulation, effective as of January 1, 2023, which requires operators of virtual currency businesses to obtain a virtual currency license in order to conduct business in Louisiana, and as such, we are in the process of applying for this license. Other states, such as Texas, have published guidance on how their existing regulatory regimes governing money transmitters apply to virtual currencies. Some states, such as New Hampshire, North Carolina and Washington, have amended their state’s statutes to clarify the treatment of virtual currencies within existing licensing regimes, while others have interpreted their existing statutes as requiring a money transmitter license to conduct certain virtual currency business activities.

•FinCEN has released guidance regarding how it considers its regulations to interact with crypto businesses.

•The IRS released guidance treating crypto as property that is not currency for U.S. federal income tax purposes.

•In August 2023, the IRS published proposed regulations on tax reporting requirements for cryptocurrency brokers, which are generally expected to expand the scope of companies that are required to report basis, adjusted basis, gross proceeds and amounts realized from sales of covered crypto assets.

•In October 2023, the governor of California signed into law the Digital Financial Assets Law (“DFAL”), which establishes a required licensing framework administered by the California Department of Financial Protection and Innovation (“DFPI”) for entities engaged in digital financial asset business activity in the state of California. The Company expects that its business will require licensure under the DFAL and will therefore take steps to obtain necessary licenses prior to the enactment’s effective date of July 1, 2025. The Company notes that the DFAL provides that the DFPI may issue a conditional license to companies, such as our subsidiaries, that maintain licenses to conduct virtual currency business activity in New York or hold a charter as a New York limited purpose trust company with approval to conduct a virtual currency business under New York law. The Company will continue to monitor and review guidance from the DFPI clarifying the enactment’s scope and interpretation.

Governmental and regulatory bodies may continue to adopt new laws and regulations, issue new guidance or bring new enforcement actions relating to crypto and the crypto industry generally, and crypto platforms in particular, the direction and timing of which may be influenced by changes in the governing administrations and major events in the crypto industry. In addition, regulators may establish self-regulatory bodies to set guidelines regarding crypto, which could have similar effects on new policies adopted by government bodies. To the extent regulators issue guidance, uncertainties may remain regarding the application of such guidance and any informal guidance may not be an official policy, rule or regulation, may be subject to change and is not necessarily binding on the applicable regulators. Enforcement actions may also be contested in litigation, which could take years to resolve, and can also lead to an uncertain regulatory environment.

The technologies underlying crypto are novel technologies and relatively untested, and the application of securities and other laws to aspects of these technologies and crypto is unclear in certain respects. It is difficult to predict how or whether regulatory agencies may apply existing or new regulation with respect to this technology and its applications, and whether regulators will bring enforcement actions on specific issues. For instance, U.S. bankruptcy courts are now faced with a number of questions of first impression that may determine the status of crypto in bankruptcy, and the rights and obligations of platforms that custody crypto for their customers.

New interpretations of, or changes to, existing laws, regulations and guidance, and new enforcement actions, may adversely impact the development of the crypto industry as a whole and our legal and regulatory status in particular by changing how we operate our business, how our products and services are regulated, and what products or services we and our competitors can offer, requiring changes to our compliance and risk mitigation programs, policies and procedures, imposing new licensing requirements, or imposing a total ban on certain crypto transactions, as has occurred in certain jurisdictions in the past. In addition, new or changing laws, regulations, guidance or enforcement actions, could severely or materially adversely impact, among other things, the permissibility of the operation of the blockchain networks underlying crypto and our operations; adversely impact the value or liquidity of crypto; limit the ability to access marketplaces or exchanges on which to trade crypto; adversely impact the structure, rights and transferability of crypto and the treatment of crypto and holders of crypto in insolvency proceedings; and result in further negative publicity relating to particular crypto assets or platforms or the crypto industry more generally. Any of the foregoing could significantly adversely impact our business.

See also “—Risks Related to Regulation, Taxation and Law—A crypto asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if crypto assets on our platform are later determined to be securities, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition.”

A crypto asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if crypto assets on our platform are later determined to be securities, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition.

The SEC and its staff have taken the position that certain crypto assets fall within the definition of a “security” under the

U.S. federal securities laws, and it is possible the SEC may take this position with respect to other assets that may be transacted on our platform. Certain legal tests for determining whether any given asset is a security may require highly complex and fact-driven analyses, and the outcome is difficult to predict. The SEC, as well as other regulators, have been increasingly focused on the regulation of crypto, which has impacted and will continue to impact our business. In recent months, the SEC has alleged a number of additional crypto assets to be securities in the course of enforcement actions and lawsuits brought against crypto market participants, including lawsuits brought against the crypto exchanges Bittrex, Coinbase, Binance, and Kraken. Among the crypto assets identified as securities in these actions are assets that were previously listed on Bakkt Crypto’s platform, which Bakkt has since delisted. Prior SEC enforcement activity had not alleged crypto assets made available for trading on or through a Bakkt platform to be securities. It is not clear what actions the SEC will take with respect to those or other crypto assets, including in the course of the SEC inquiry regarding the Bakkt Crypto platform that began prior to Bakkt’s acquisition, or what decisions the courts will reach regarding the status of specific crypto assets as securities. For example, in December 2020, the SEC initiated a lawsuit against Ripple Labs, Inc. (“Ripple”) and two of its executives, alleging that they engaged in the unlawful offer and sale of unregistered securities through sales of XRP, Ripple’s crypto asset, since 2012. On July 13, 2023, a court in the Southern District of New York held that Ripple’s sales of XRP to sophisticated investors pursuant to written contracts did constitute the unregistered offer and sale of investment contracts while sales of XRP to purchasers through blind bid/ask transactions on crypto asset exchanges did not constitute the sale of unregistered securities. There also remains a significant lack of clarity over whether individual crypto assets that purport to maintain a fixed or “stable” value relative to a fiat currency or other underlying asset, known as “stablecoins,” will be deemed to be “securities.”

The classification of an asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer, sale, trading and clearing of such assets. For example, an asset that is a security in the United States may generally only be offered or sold in the United States pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption from registration. Persons that effect transactions in assets that are classified as securities in the United States may be subject to registration with the SEC and states in which they offer and sell securities as a “broker” or “dealer” and subject to the corresponding rules and regulations of the SEC, relevant states and self-regulatory organizations, including FINRA. Platforms that bring together buyers and sellers of assets that are classified as securities in the United States constitute securities exchanges and will be either required to register as such with the SEC, or to operate pursuant to an exemption, as an alternative trading system (“ATS”).

We could be subject to legal or regulatory action in the event the SEC, a foreign regulatory authority, or a court were to determine that a supported crypto asset bought, sold, converted, spent or sent through our platform is a “security” under applicable laws. Because our platform is not yet registered or licensed with the SEC or foreign authorities as a broker-dealer, national securities exchange, or ATS (or foreign equivalents), and we do not seek to register or rely on an exemption from such registration or license to facilitate the offer and sale of crypto assets on our platform, we currently only permit transactions in crypto assets that we have determined are not securities. We intend to offer other crypto assets on our platform in the future, although which crypto assets will be allowed on our platform, and the timing for such crypto assets to be allowed on our platform, is uncertain. We will only allow those crypto assets for which we determine there are reasonably strong arguments to conclude that the crypto asset is not a security.

However, the application of securities laws to the specific facts and circumstances of crypto may be complex and subject to change, and a listing determination does not guarantee any conclusion under the United States federal securities laws. While we have policies that are designed to help us analyze whether a particular crypto asset is a “security”, our policies and procedures are not a legal standard, but rather a framework for analysis that permits us to make a risk-based assessment regarding the likelihood that a particular crypto asset could be deemed a “security” under applicable laws. Regardless of our conclusions, we could be subject to legal or regulatory action in the event the SEC, a state or foreign regulatory authority, or a court, were to determine that a crypto asset currently offered, sold or traded on our platform is a “security” under applicable laws. Moreover, although we expect our risk assessment policies and procedures to regularly evolve to take into account developments in case law, facts and developments in technology, regulatory clarity and changes in market acceptance and adoption of these crypto assets, these developments and changes may occur more rapidly than we are able to change our related policies and procedures. Actions may also be brought by private individuals or entities alleging illegal transactions involving crypto assets that they claim are securities, and seeking rescission of those transactions, and/or other legal and equitable relief under federal or state securities laws.

In addition, in connection with our acquisition of Bakkt Crypto we have needed to, and if we engage in any other acquisitions in the future, may further need to, update our policies and procedures to account for additional types of crypto assets or additional functionalities, and there may be a delay in adopting uniform policies and procedures relating to the acquired company or in applying such policies and procedures to an acquired company’s crypto assets. In applying our policies and procedures to an acquired company’s crypto assets, we may determine to delist some or all of such company’s crypto assets. See also “—If we are unable to attract, retain or grow our relationships with our existing clients, our business, financial condition, results of operations and future prospects would be materially and adversely affected. Moreover, sales efforts to large clients involve risks that may not be present or that are present to a lesser extent with respect to sales to smaller organizations.”

There can be no assurances that we will properly characterize any given crypto asset as a security or non-security for purposes of determining if that crypto asset is allowed to be offered through our platform, or that the SEC, foreign regulatory authority, or a court, if the question was presented to it, would agree with our assessment. If the SEC, foreign regulatory authority, or a court were to determine that bitcoin or any other crypto asset to be offered, sold, or traded on our platform in the future is a security, we would not be able to offer such crypto asset for trading until we are able to do so in a compliant manner, such as through an alternative trading system approved to trade crypto assets that constitute securities, and such determination may have adverse consequences for such supported crypto assets. A determination by the SEC, a foreign regulatory authority, or a court that an asset that we support for trading on our platform constitutes a security may also result in a determination that we should remove such asset from our platform, as well as other assets that have similar characteristics to such asset deemed to be a security. In addition, we could be subject to judicial or administrative sanctions for failing to offer or sell the asset in compliance with the registration requirements, or for acting as a broker, dealer, or national securities exchange without appropriate registration. Similarly, the SEC has recently alleged that certain crypto asset exchanges have acted without appropriate registration as clearing agencies. Although our platform functions differently from those alleged to have functioned as unregistered clearing agencies in actions brought by the SEC to date, we could face a similar action if the SEC and its staff take a different position with respect to our activities. An action for failure to register as a broker, dealer, national securities exchange, or clearing agency when such registration was required could result in injunctions, cease and desist orders, as well as civil monetary penalties, fines and disgorgement, criminal liability and reputational harm. Customers that traded such supported assets on our platform and suffered trading losses could also seek to rescind a transaction that we facilitated on the basis that it was conducted in violation of applicable law, which could subject us to significant liability.

Furthermore, if we remove any assets from trading on our platform, our decision may be unpopular with our customers and may reduce our ability to attract and retain customers, especially if such assets remain traded on unregulated exchanges, which includes many of our competitors.

We are subject to significant litigation risk and risk of regulatory liability and penalties. Any current or future litigation or regulatory proceedings against us could be costly and time-consuming to defend.

We are from time to time subject to legal proceedings and claims as well as regulatory proceedings that arise in the ordinary course of business, such as securities class action litigation or other shareholder litigation, claims brought by our clients or customers in connection with commercial disputes, or employment claims made by our current or former employees, and patent litigation. For example, on April 21, 2022, a putative class action was filed against Bakkt Holdings, Inc. and certain of its directors and officers prior to the VIH Business Combination in the U.S. District Court for the Eastern District of New York on behalf of certain purchasers of securities of VIH and/or purchasers of Bakkt Class A common stock issued in connection with the VIH Business Combination, seeking damages as well as fees and costs. On March 14, 2023, the parties reached a settlement in principle. On

April 12, 2023, the parties completed a stipulation of settlement resolving the litigation for $3.0 million, subject to Court approval. A motion for preliminary approval was filed with the Court on April 17, 2023. The motion remains pending. We expect the settlement will be covered by our insurance less our contractual retention. On June 23, 2023, an “opt-out” action related to the foregoing class action was filed against Bakkt Holdings, Inc. and the individuals named in the class action. On February 20, 2023, a derivative action related to the foregoing class action was filed against Bakkt Holdings, Inc. and all of its directors in the U.S. District Court for the Eastern District of New York. On June 13, 2023, the defendants filed with the Court a pre-motion letter setting forth the reasons for the dismissal of the action. On July 20, 2023, the parties filed with the Court a stipulation of a voluntary dismissal of the action without a settlement or compromise between them. On July 31, 2023, the Court issued an order to dismiss the action. In addition, prior to our acquisition of Bakkt Crypto, Bakkt Crypto received requests from the SEC for documents and information about certain aspects of its business, including the operation of its trading platform, processes for listing assets, the classification of certain listed assets, and relationships with customers and service providers, among other topics. We are in the process of responding to the SEC and cannot estimate the potential impact, if any, of the resolution of this matter on our business or financial statements at this time, which could be material.

Many aspects of our business involve substantial litigation risks, including potential liability from disputes over terms of a trade, the claim that a system failure or delay caused monetary losses to a customer, that we entered into an unauthorized transaction, that we provided materially false or misleading statements in connection with a transaction or that we failed to effectively fulfill our regulatory oversight responsibilities. We may be subject to disputes regarding the quality of customer order execution, the settlement of customer orders or other matters relating to our services.

Litigation, even claims without merit, could result in substantial costs and may divert management’s attention and resources, which might seriously harm our business, financial condition and results of operations. Insurance may not cover such claims, may not provide sufficient payments to cover all the costs to resolve one or more such claims, and may not continue to be available on terms acceptable to us (including premium increases or the imposition of large deductible or co-insurance requirements). A claim brought against us that is uninsured or underinsured could result in unanticipated costs, potentially harming our business, financial position and results of operations. In addition, we cannot be sure that our existing insurance coverage and coverage for errors and omissions will continue to be available on acceptable terms, or that our insurers will not deny coverage as to any future claim.

In light of our business model based on crypto, we are also subject to substantial regulatory risks. For more information about the regulatory risks to which our business is subject, see “A crypto asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if crypto assets on our platform are later determined to be securities, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition,” “Regulatory regimes governing blockchain technologies and crypto are evolving and uncertain, and new legislation, regulations, guidance and enforcement actions have in the past required, and may in the future require, us to alter our business practices” and “Our business is subject to extensive government regulation, oversight, licensure and approvals. Our failure to comply with extensive, complex, uncertain, overlapping and frequently changing rules, regulations and legal interpretations could materially harm our business.”

Adverse resolution of any lawsuit or claim or regulatory proceeding against us, or any regulatory investigation involving us, could have a material adverse effect on our business and our reputation. To the extent we are found to have failed to fulfill our regulatory obligations, we could lose our authorizations or licenses or become subject to conditions that could make future operations more costly and impair our profitability. Such events could also result in consumer dissatisfaction and a decline in consumers’ willingness to use our platform.

We might not be able to continue as a going concern.

Our unaudited condensed consolidated financial statements as of September 30, 2023 were prepared under the assumption that we would continue as a going concern for the next twelve months from the date we filed the Original Form 10-Q, which contemplated the realization of assets and the satisfaction of liabilities in the normal course of business and did not include any adjustments relating to recoverability and the classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of certain uncertainties.

Subsequent to the filing of the Original Form 10-Q and in connection with the filing of this Amended Form 10-Q, we have determined that we do not believe that our cash and restricted cash are sufficient to fund our operations for the 12 months following the date of this Amended Form 10-Q. There is significant uncertainty associated with our expansion to new markets and the growth of our revenue base given the rapidly evolving environment associated with crypto assets. Accordingly, we cannot conclude it is probable we will be able to increase revenues substantially beyond levels that we have attained in the past in order to generate sustainable operating profit and sufficient cash flows to continue doing business without raising additional capital in the near future. As a result of our expected operating losses and cash burn for the foreseeable future and recurring losses from operations, if we are unable to raise sufficient capital through additional debt or equity arrangements, there will be uncertainty regarding our ability to maintain liquidity sufficient to operate our business effectively, which has raised substantial doubt as to our ability to continue as a going concern. If we cannot continue as a viable entity, our stockholders would likely lose most or all of their investment in us.

As we are currently unable to generate sustainable operating profit and sufficient cash flows, we have determined that our future success will depend on our ability to raise capital. We are seeking additional financing and evaluating financing alternatives in order to meet our cash requirements for the next 12 months. We cannot be certain that raising additional capital, whether through selling additional equity or debt securities or obtaining a line of credit or other loan, will be available to us or, if available, will be on terms acceptable to us. If we issue additional securities to raise funds, these securities may have rights, preferences, or privileges senior to those of our common stock, and our current stockholders may experience dilution. If we are unable to obtain funds when needed or on acceptable terms, we may be required to curtail our current platform expansion programs, cut operating costs, forego future development and other opportunities or even terminate our operations.

If we are unable to develop and maintain effective internal controls over financial reporting, we may not be able to produce timely and accurate financial statements, which could have a material adverse effect on our business.

We have limited accounting and finance personnel and other resources and must develop our own internal controls and procedures consistent with SEC regulations. We intend to continue to evaluate actions to enhance our internal controls over financial reporting, but there is no assurance that we will not identify control deficiencies or material weaknesses in the future. Furthermore, in accordance with SEC guidance, our assessment of our internal controls over financial reporting has excluded Bakkt Crypto. There is no assurance that we will not identify control deficiencies or material weaknesses when our assessment include Bakkt Crypto in future periods.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. Pursuant to the Sarbanes-Oxley Act we are required to make a formal assessment of the effectiveness of our internal control over financial reporting, and once we cease to be an “emerging growth company” under the JOBS Act, we will also be required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

To comply with Section 404 of the Sarbanes-Oxley Act, we have incurred substantial cost, expended significant management time on compliance-related issues and hired additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. We expect these costs to increase once we cease to be an emerging growth company and be required to provide an attestation report on internal controls over financial reporting. Moreover, if we are not able to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in a timely manner or if we or our independent registered public accounting firm identify deficiencies in our internal control over financial reporting that are deemed to be material weaknesses, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Any failure to maintain effective disclosure controls and procedures or internal control over financial reporting could have an adverse effect on our business and operating results, and cause a decline in the price of our securities.

The NYSE may delist our securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

Our securities are currently listed on NYSE. However, we cannot assure you that we will be able to meet the NYSE’s continued listing requirements for our common stock or our warrants in the future. For example, as of November 13, 2023, our stock price had closed below $1.00 for the preceding nine consecutive trading days and, if it does not increase, we may receive a written notification from the NYSE that we are not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE Listed Company Manual, which requires that the closing price of our Class A Common Stock

is not less than an average of $1.00 per share over a consecutive 30 trading-day period. While the NYSE rules generally provide for a six-month period to return to compliance following delivery of a noncompliance notice including by taking an action that will require approval of our shareholders, there can be no assurances that we will be able to achieve compliance with the minimum bid price requirements or any other listing requirements during such period, or at all.

If the NYSE delists our securities from trading on its exchange and we are not able to list its securities on another national securities exchange, we expect our securities could be quoted on an over-the-counter market. If this were to occur, we could face significant material adverse consequences, including:

•a limited availability of market quotations for our securities;

•reduced liquidity for our securities;

•determination that our Class A Common Stock is a “penny stock,” which will require brokers trading in the common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

•a limited amount of news and analyst coverage; and

•a decreased ability to issue additional securities or obtain additional financing in the future.

Item 5. Other Information.

We are providing an update to our business activities following our acquisition of Bakkt Crypto, formerly Apex Crypto, on April 1, 2023. Effective June 12, 2023, we changed the name of Apex Crypto to Bakkt Crypto. This business update should be read together with “Item 1. Business” and “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Recent Developments” in the Original Form 10-Q and “Item 1A. Risk Factors” in this Amended Form 10-Q.

Some of the information contained in this update, including information with respect to our plans and strategy for our business, includes forward-looking statements. Such forward-looking statements are based on the beliefs of our management, as well as assumptions made by, and information currently available to, our management. Actual results could differ materially from those contemplated by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those factors discussed in “Cautionary Statement Regarding Forward-Looking Statements” and “Item 1A. Risk Factors” in this Amended Form 10-Q.

Overview

In this Amended Form 10-Q, we use the following terms, which are defined as follows:

•Client means businesses with whom we contract to provide services to customers on our platform, and includes financial institutions, hedge funds, merchants, retailers, third party partners, and other businesses (except in the accompanying notes to the consolidated financial statements, where we refer to revenue earned from customers, instead of clients). The term customers is in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers.).

•Crypto assets (or crypto) means an asset that is built using blockchain technology, including virtual currencies (as used in the State of New York), coins, cryptocurrencies, stablecoins, and other tokens. Our platform enables transactions in certain supported crypto assets. For purposes of this Amended Form 10-Q, we use crypto assets, virtual currency, coins, and tokens interchangeably.

•Customer means an individual user of our platform. Customers include customers of our loyalty clients who use our platform to transact in loyalty points, as well as customers of our clients who transact in crypto through, and have accounts on, our platform (except as defined for ASC 606 purposes above).

•Loyalty points means loyalty and/or reward points that are issued by clients to their customers.

Our Corporate Structure

We operate primarily through the following entities:

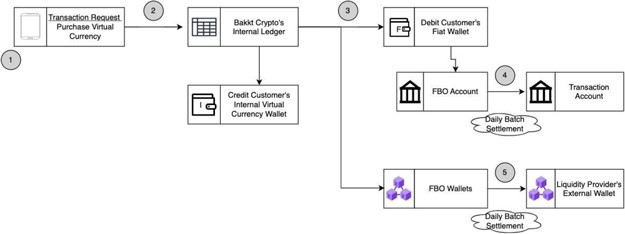

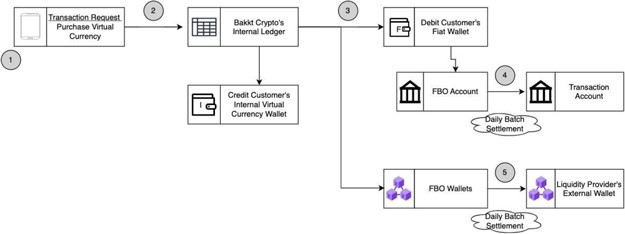

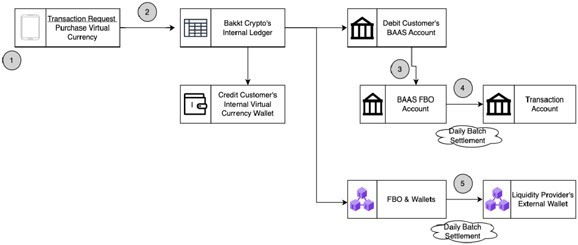

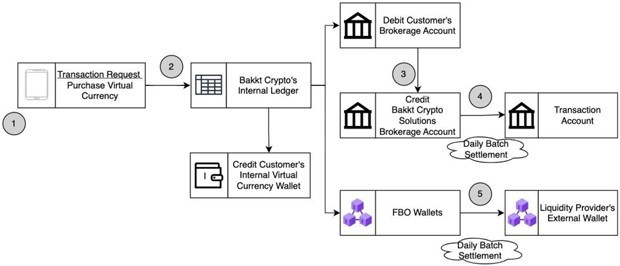

•Bakkt Marketplace, LLC (“Bakkt Marketplace”) and Bakkt Crypto – through these entities we operate integrated platforms that provide customers with the ability to buy, sell and store crypto in a simple, intuitive digital experience accessed via application programming interfaces (“APIs”) or embedded web experience. Bakkt Marketplace holds a New York State virtual currency license (commonly referred to as a “BitLicense”), and money transmitter licenses from all states throughout the United States (“U.S.”) where such licenses are required for the operation of its business, and is registered as a money services business with the Financial Crimes Enforcement Network of the United States Department of the Treasury. Bakkt Crypto similarly holds a BitLicense and money transmitter licenses in various states, where its business requires. Currently, all of the outstanding equity interests of Bakkt Crypto are held by Bakkt Marketplace. The Bakkt Crypto and Bakkt Marketplace platforms generally are operated separately, though Bakkt Marketplace provides fiat funding services to Bakkt Crypto in instances where a client does not have that capability. The Bakkt Marketplace platform was originally conceived and built in connection with a consumer app that enabled crypto asset transactions, and, at the time, represented a direct-to consumer business model, which is no longer being pursued by the Company. In contrast, the Bakkt Crypto platform was originally conceived and built as an embedded crypto trading platform that would be integrated into client environments to service customers in those environments. Subject to applicable regulatory approvals, which we are presently pursuing, we intend to merge Bakkt Crypto with and into Bakkt Marketplace, with the surviving entity of the merger to be renamed Bakkt Crypto Solutions, LLC. The two platforms will then be combined into one business, which will be operated by the surviving entity. Similar to the Bakkt Crypto business model, the combined business will focus on a client-led, or “business-to-business-to-consumer” (“B2B2C”), strategy in which crypto asset solutions can be embedded into client environments.

•Bakkt Trust is a New York limited-purpose trust company that is chartered by and subject to the supervision and oversight of New York Department of Financial Services and governed by an independent Board of Managers. Bakkt Trust provides our institutional-grade qualified custody solution, which caters to more experienced market participants and also supports our consumer-facing crypto business. Bakkt Trust’s custody solution also provides support to Bakkt Marketplace with respect to all crypto assets supported by the Company. See “—Crypto Assets and Services Offered by Bakkt.”

We acquired Bumped Financial, LLC (“Bumped”) (renamed Bakkt Brokerage), a registered broker-dealer, in February 2023. Bakkt Brokerage is not engaged in any business activities at this time and we have no current plans for it to engage in future business activities.

Bakkt Crypto

In April 2023, we acquired Apex Crypto, a platform for integrated crypto trading, which we renamed Bakkt Crypto. This

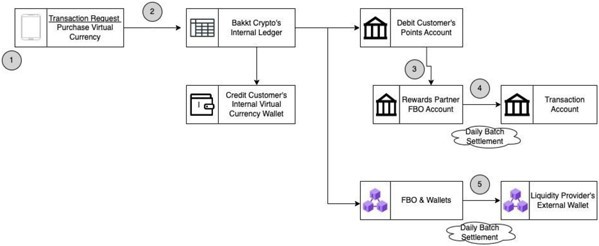

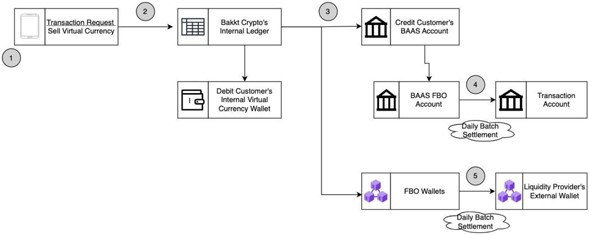

platform supports clients with a range of crypto solutions. We expect to leverage Bakkt Crypto’s proprietary trading platform and existing relationships with liquidity providers to provide a wider range of crypto assets and competitive pricing to our customers. Bakkt Crypto complements our B2B2C growth strategy by broadening our business partnerships to broker-dealers, registered investment advisors, fintechs and neo-banks. Specifically, Bakkt Crypto offers customers the ability to purchase, sell, store and, in approved jurisdictions, deposit and withdraw approved crypto assets, all from within the applications of our clients with whom customers already have a relationship. Using Bakkt Crypto’s platform, customers can purchase approved crypto assets, store crypto assets in custodial wallets, liquidate their holdings, and transfer supported crypto assets between a custodial wallet maintained by Bakkt Crypto and external wallets in certain jurisdictions, if enabled by the client.

As part of our acquisition of Bakkt Crypto, we also acquired its agreements with more than 30 third-party partners pursuant to which the partners made Bakkt Crypto’s crypto asset trading service available to their customer base. The agreements with these third-party fintech partners (referred to as clients) provide for licensing of their front-end trading platforms by Bakkt Crypto and cooperation between the parties in facilitating customers’ transactions in crypto assets. The agreements are for a term of either one or two years and can be terminated by either party for breach or in case of a change of control. In most cases, the agreements also contain provisions giving Bakkt Crypto discretion in the choice of crypto assets offered to each client through its platform and, in some cases, exclusivity covenants pursuant to which clients have agreed not to refer their customers to other crypto asset trading platforms.

Bakkt Crypto is regularly exploring additional ways to innovate and provide additional products and services to its clients. Bakkt Crypto is in the process of developing, subject to applicable regulatory approvals, a solution to facilitate international remittances where users can remit fiat currency, with Bakkt leveraging crypto rails to settle the transaction, and conversion of certain loyalty and rewards points into supported crypto assets. We are actively pursuing opportunities to provide crypto asset trading services in jurisdictions outside of the United States, including the United Kingdom, Hong Kong, Spain and throughout Latin America, subject to applicable local regulatory approvals. Bakkt Crypto is currently live with customers in Spain, Mexico, Argentina, and Brazil through a partnership with Hapi Crypto. Bakkt Crypto executes a de minimis amount of trades for entity accounts in jurisdictions other than the State of New York. Subject to applicable regulatory approvals, Bakkt Crypto intends to expand the provision of trading services for institutional clients.

Crypto Market Developments

Over approximately the last eighteen months, the crypto markets were impacted by, among other developments, significant decreases and volatility in crypto asset prices, a loss of confidence in many participants in the crypto asset ecosystem, regulatory actions and adverse publicity around specific companies, the crypto industry and crypto assets more broadly, including as a result of continued industry-wide consequences from the Chapter 11 bankruptcy filings of crypto asset exchange FTX, crypto hedge fund Three Arrows, crypto miners Compute North and Core Scientific, and crypto lenders Celsius Network, Voyager Digital and BlockFi. In addition, the liquidity of the crypto asset markets has been adversely impacted by these bankruptcy filings as, among other things, certain entities affiliated with FTX and other former participants had engaged in significant trading activity. Although we did not have any exposure to these companies, and we do not have material assets that may not be recovered or may otherwise be lost or misappropriated due to the bankruptcies, we were nonetheless impacted by, and continue to be impacted by, the broader conditions in the crypto markets.

The crypto markets also have been and continue to be impacted by the broader macroeconomic conditions, including the strength of the overall macroeconomic environment, high and rising interest rates, spikes in inflation rates, general market volatility, and geopolitical concerns. We expect the macroeconomic environment and the state of the crypto markets to remain dynamic in the near-term.

In addition, crypto assets and crypto market participants have recently faced increased scrutiny by regulators. For example, in 2023, the SEC has brought charges against a number of crypto asset exchanges, including Bittrex, Coinbase, Binance, Kraken, and other crypto asset service providers, identifying a number of crypto assets as securities and alleging violations of, and non-compliance with, U.S. federal securities laws. We continue to monitor regulatory developments in this area and assess our business model and the assets we support in light of such developments. For more information see “—Regulation—Regulation of Our Virtual Currency Business,” below.

Crypto Assets and Services Offered by Bakkt

Retail Customers