Delaware |

7374 |

85-1614529 | ||

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer |

☒ | Smaller reporting company | ||||

| Emerging growth company | ||||||

| | ||||||||

Title of Each Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee | ||||

| Common stock, par value $0.001 per share (2)(3) |

42,035,500 | $12.62 (4) |

$530,488,010 | $57,876 (5) | ||||

| Total |

$57,876 | |||||||

| | ||||||||

| | ||||||||

(1) |

Upon consummation of the Business Combination described in the prospectus forming part of this registration statement (the “prospectus”), Good Works Acquisition Corp., a Delaware corporation (“GWAC” or “Good Works” and, after giving effect to the Business Combination (as defined below), “New Cipher”), was renamed “Cipher Mining Inc.” |

(2) |

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

(3) |

The number of shares of common stock of New Cipher (the “common stock” or “New Cipher Common Stock”) being registered for resale represents (i) 32,235,000 shares of common stock issued in a private placement in connection with the consummation of the Business Combination described in more detail in the prospectus; (ii) 1,575,000 shares of common stock issued in connection with the consummation of the Business Combination in exchange for shares of GWAC common stock, par value $0.001 per share (the “GWAC common stock”) originally issued in a private placement to certain Initial Stockholders (as defined below); (iii) 757,500 shares of common stock issued in connection with the consummation of the Business Combination, in exchange for GWAC common stock issued in a private placement to I-B Good Works, LLC (the “Sponsor”); (iv) 562,500 shares of common stock issued in connection with the consummation of the Business Combination, in exchange for GWAC common stock issued in a private placement to GW Sponsor 2, LLC; (v) 677,500 shares of common stock issued in connection with the consummation of the Business Combination, in exchange for GWAC common stock issued in a private placement to the Anchor Investors (as defined below); (vi) 6,000,000 shares of common stock issued to Bitfury Holding B.V. (“Bitfury Holding”) as an affiliate of Bitfury Top HoldCo B.V. (“Bitfury Top HoldCo”) pursuant to the Bitfury Private Placement (as defined below); and (vii) 228,000 shares of common stock issued in connection with the consummation of the Business Combination, in exchange for GWAC common stock originally issued upon separation of the GWAC Private Placement Units issued in a private placement simultaneously with the closing of GWAC’s IPO (as defined below). |

(4) |

Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the common stock on the Nasdaq Global Select Market on September 21, 2021 ($12.62 per share) (such date being within five business days of the date that this registration statement was filed with the U.S. Securities and Exchange Commission). This calculation is in accordance with Rule 457(c) of the Securities Act. |

(5) |

Calculated by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0001091. |

i |

||||

ii |

||||

vi |

||||

vii |

||||

1 |

||||

5 |

||||

47 |

||||

48 |

||||

49 |

||||

58 |

||||

64 |

||||

82 |

||||

88 |

||||

96 |

||||

98 |

||||

99 |

||||

106 |

||||

112 |

||||

116 |

||||

117 |

||||

118 |

||||

119 |

||||

F-1 |

| • | “Amended and Restated Bitfury Subscription Agreement” are to that certain subscription agreement, dated as of March 4, 2021, as amended and restated in its entirety on July 8, 2021 and as subsequently amended and restated in its entirety on August 27, 2021, by and among Bitfury Top HoldCo and GWAC; |

| • | “Anchor Investors” are to certain funds and accounts managed by Magnetar Financial LLC, Mint Tower Capital Management B.V., Peridian Fund L.P., and Polar Multi-Strategy Master Fund; |

| • | “Bitfury Group” are to Bitfury Top HoldCo and its subsidiaries; |

| • | “Bitfury Holding” are to Bitfury Holding B.V., a subsidiary of Bitfury Top HoldCo; |

| • | “Bitfury Private Placement” are to the private placement pursuant to which GWAC entered into the Amended and Restated Bitfury Subscription Agreement with Bitfury Top HoldCo pursuant to which Bitfury Top HoldCo agreed to subscribe for and purchase, and Good Works agreed to issue and sell to Bitfury Top HoldCo (or an affiliate of Bitfury Top HoldCo), an aggregate of 6,000,000 shares of our common stock at a purchase price of $10.00 per share for an aggregate of cash and/or forgiveness of outstanding indebtedness owed by Cipher to Bitfury Top HoldCo (or an affiliate of Bitfury Top HoldCo) of $60,000,000; |

| • | “Bitfury Top HoldCo” are to Bitfury Top HoldCo B.V., the holder of 100% of the shares of Cipher Common Stock prior to the Business Combination; |

| • | “Board” are to our board of directors; |

| • | “Business Combination” are to the Merger and other transactions contemplated by the Merger Agreement, collectively, including the PIPE Financing and the Bitfury Private Placement; |

| • | “Bylaws” are to the Amended and Restated Bylaws of Cipher Mining Inc., adopted on August 27, 2021; |

| • | “Certificate of Incorporation” are to the Second Amended and Restated Certificate of Incorporation of Cipher Mining Inc., as filed with the Delaware Secretary of State on August 27, 2021; |

| • | “Cipher” are to the Cipher Mining Technologies Inc, a Delaware corporation, prior to the consummation of the Business Combination and to Cipher Mining Inc. and its consolidated subsidiaries following the Business Combination; |

| • | “Cipher Common Stock” are to the shares of common stock, par value $0.001 per share, of Cipher; |

| • | “Closing” are to the closing of the Business Combination; |

| • | “Closing Date” are to August 27, 2021; |

| • | “Code” are to the Internal Revenue Code of 1986, as amended; |

| • | “Company Support Agreement” are to that certain support agreement, dated as of March 4, 2021, by and among GWAC, Cipher and Bitfury Top HoldCo; |

| • | “COVID-19” are to the novel coronavirus, SARS-CoV-2 COVID-19 or any mutation of the same, including any resulting epidemics, pandemics, disease outbreaks or public health emergencies; |

| • | “DGCL” are to the Delaware General Corporation Law, as amended; “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| • | “Exchange Ratio” are to the ratio of 400,000 shares of our common stock for each 1 share of Cipher Common Stock; |

| • | “Effective Time” are to the effective time of the Merger; |

| • | “Governing Documents” are to the Certificate of Incorporation and the Bylaws; |

| • | “GWAC” are to Good Works Acquisition Corp., a Delaware corporation; |

| • | “GWAC Common Stock” are to, prior to consummation of the Transactions, GWAC’s common stock, par value $0.001 per share and, following consummation of the Transactions, to the common stock, par value $0.001 per share, of New Cipher; |

| • | “GWAC Founder Shares” are to the 4,478,000 shares of GWAC Common Stock held by the Sponsor, GWAC Sponsor 2, LLC, the Anchor Investors, GWAC’s officers and directors, and certain other GWAC stockholders (collectively, the “Founders”); |

| • | “GWAC’s IPO” are to the initial public offering by GWAC which closed on October 19, 2020; |

| • | “GWAC Private Placement Shares” are to the 228,000 private placement shares of GWAC underlying 228,000 of GWAC Private Placement Units; |

| • | “GWAC Private Placement Units” are to the 228,000 units that were issued in a private placement at a price of $10.00 per unit to certain funds and accounts managed by the Anchor Investors, simultaneously with the closing of the GWAC’s IPO; each unit consists of one GWAC Private Placement Share and one-half of one GWAC warrant; |

| • | “GWAC Private Placement Warrants” means the 114,000 private placement warrants outstanding as of the date of this prospectus to purchase ordinary shares underlying 228,000 of GWAC Private Placement Units that were issued at $10.00 per unit in a private placement as part of the GWAC’s IPO. The GWAC Private Placement Warrants are substantially identical to the public warrants sold as part of the units in the GWAC’s IPO, subject to certain limited exceptions; |

| • | “GWAC Public Warrants” are to the currently outstanding 8,500,000 redeemable warrants to purchase ordinary shares of GWAC that were issued by GWAC in GWAC’s IPO; |

| • | “GWAC Support Agreement” are to that certain support agreement, entered into on March 4, 2021, as amended and restated in its entirety on May 12, 2021, by and among GWAC, the Sponsor, GW Sponsor 2, LLC, Magnetar Financial LLC, Mint Tower Capital Management B.V., Peridian Fund, L.P., Polar Multi-Strategy Master Fund, and Cipher; |

| • | “GWAC Warrant Agreement” means the warrant agreement, dated October 19, 2020, between GWAC and Continental Stock Transfer & Trust Company, as warrant agent, which sets forth the expiration and exercise price of and procedure for exercising the GWAC Warrants; |

| • | “GWAC Warrants” are to the GWAC Public Warrants and the GWAC Private Placement Warrants; “HSR Act” are to the Hart-Scott-Rodino Antitrust Improvements Act of 1976; |

| • | “Incentive Award Plan” are to the New Cipher’s incentive award plan; |

| • | “Initial Stockholder Shares” are to 775,000 shares of our common stock owned by the Initial Stockholders and 800,000 shares of our common stock, which certain Initial Stockholders donated to non-profit organizations listed as the Selling Securityholders in this prospectus; |

| • | “Initial Stockholders” are to GWAC’s former officers and directors, namely Cary Grossman, Fred Zeidman, Douglas Wurth, David Pauker, John J. Lendrum III, Paul Fratamico and Tahira Rehmatullah; |

| • | “Master Services and Supply Agreement” or the “MSSA” are to the master services and supply agreement to entered into at Closing by Cipher and Bitfury Top HoldCo; |

| • | “Merger” are to the merger of Merger Sub with and into Cipher pursuant to the Merger Agreement, with Cipher as the surviving company in the Merger and, after giving effect to such Merger, Cipher becoming a wholly-owned subsidiary of GWAC; |

| • | “Merger Agreement” are to that certain Agreement and Plan of Merger, dated as of March 4, 2021, by and among GWAC, Cipher and Merger Sub; |

| • | “Merger Consideration” are to each share of Cipher Common Stock issued and outstanding immediately prior to the Effective Time, other than any Cipher Cancelled Shares, shall be converted into the right to receive four hundred thousand (400,000) shares of duly authorized, validly issued, fully paid and nonassessable common stock (deemed to have a value of ten dollars ($10.00) per share); |

| • | “Merger Sub” are to Currency Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of GWAC; |

| • | “Named Sponsors” are to I-B Good Works, LLC, Magnetar Financial LLC, Mint Tower Capital Management B.V., Periscope Capital, Inc. and Polar Asset Management Partners Inc.; |

| • | “New Cipher” are to GWAC after giving effect to the Business Combination and its name change from GWAC Acquisition Corp. to Cipher Mining Inc.; |

| • | “New Cipher Common Stock” are to the share of common stock, par value $0.001 per share, of New Cipher; |

| • | “New Cipher Warrants” are to the warrants of New Cipher; |

| • | “PIPE Financing” are to the private placement pursuant to which GWAC entered into the PIPE Subscription Agreements (containing commitments to funding that are subject only to conditions that generally align with the conditions set forth in the Merger Agreement) with certain investors whereby such investors purchased an aggregate of 32,235,000 shares of our common stock at a purchase price of $10.00 per share for an aggregate commitment of $322,350,000; |

| • | “PIPE Investment Amount” are to a consideration in an aggregate value equal to three hundred and eighty-two million, three hundred and fifty thousand dollars ($382,350,000), comprising payments of cash and/or forgiveness of outstanding indebtedness, contemplated by the PIPE Financing and the Bitfury Private Placement; |

| • | “PIPE Investors” are to the investors who participated in the PIPE Financing and entered into the PIPE Subscription Agreements; |

| • | “PIPE Subscription Agreements” are to the subscription agreements entered into by and between GWAC and each of the PIPE Investors in connection with the PIPE Financing; |

| • | “Private Placement Shareholders” are to the holders of the GWAC Private Placement Shares; |

| • | “public shares” are to shares of GWAC Common Stock sold as part of the units in the GWAC’s IPO (whether they were purchased in the GWAC’s IPO or thereafter in the open market); |

| • | “public stockholders” are to the holders of public shares, including the Sponsor and GWAC’s officers and directors to the extent the Sponsor and GWAC’s officers or directors purchase public shares, provided that each of their status as a “public stockholder” shall only exist with respect to such public shares; |

| • | “Registration Rights Agreement” are to that certain registration rights agreement, dated as of August 26, 2021, by and among GWAC, Cipher, the Sponsor, Bitfury Top HoldCo and the other parties thereto; |

| • | “SEC” are to the United States Securities and Exchange Commission; |

| • | “Sponsor” are to I-B Good Works LLC, a Delaware limited liability company; |

| • | “Stockholder Restrictive Covenant Agreement” are to that certain restrictive covenant agreement, dated as of March 4, 2021, by and among Bitfury Top HoldCo and GWAC; |

| • | “Transaction Agreements” are to the Merger Agreement, the GWAC Support Agreement, the Company Support Agreement, the Registration Rights Agreement, the PIPE Subscription Agreements, each |

| Letter of Transmittal, the Proposed Certificate of Incorporation, the Proposed Bylaws, and all the other agreements, documents, instruments and certificates entered into in connection herewith and/or therewith and any and all exhibits and schedules thereto; |

| • | “Transactions” are to, collectively, the Business Combination and the other transactions contemplated by the Merger Agreement; |

| • | “transfer agent” are to Continental Stock Transfer & Trust Company, GWAC’s transfer agent; |

| • | “Treasury Regulations” are to the regulations promulgated under the Code; |

| • | “Trust Account” are to the trust account of GWAC that holds the proceeds from the GWAC’s IPO, governed by the Trust Agreement; and |

| • | “Trust Agreement” are to the investment management trust agreement, dated October 19, 2020, by and between GWAC and Continental Stock Transfer & Trust Company, as trustee, entered into in connection with the GWAC’s IPO. |

| • | our financial and business performance following the Business Combination, including financial projections and business metrics; |

| • | the ability to maintain the listing of our common stock and warrants on Nasdaq, and the potential liquidity and trading of such securities; |

| • | the ability to recognize the anticipated benefits of the Business Combination; |

| • | costs related to the Business Combination; |

| • | our ability to raise financing in the future; |

| • | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following the completion of the Business Combination; |

| • | our expected operational rollout in the initial buildout phase and the second phase, in particular the ability to build out the necessary initial sites in Texas and Ohio; |

| • | our commercial partnerships and supply agreements; |

| • | the effects of competition and regulation on our business; |

| • | the effects of price fluctuations in the wholesale and retail power markets; |

| • | the effects of global economic, business or political conditions, such as the global coronavirus (“COVID-19”) pandemic and the disruption caused by various countermeasures to reduce its spread; |

| • | the value and volatility of Bitcoin and other cryptocurrencies; and |

| • | other factors detailed under the section entitled “ Risk Factors |

| • | We are at an early stage of development. If we are not able to develop our business as anticipated, we may not be able to generate revenues or achieve profitability. |

| • | Our lack of operating history makes evaluating our business and future prospects difficult and increases the risk of an investment in Cipher’s securities. |

| • | Our operating results may fluctuate due to the highly volatile nature of cryptocurrencies in general and, specifically, Bitcoin. |

| • | Bitcoin mining activities are energy intensive, which may restrict the geographic locations of miners and have a negative environmental impact. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations, such as ours. |

| • | We may be affected by price fluctuations in the wholesale and retail power markets. |

| • | We will be vulnerable to severe weather conditions and natural disasters, including severe heat, earthquakes, fires, floods, hurricanes, as well as power outages and other industrial incidents, which could severely disrupt the normal operation of our business and adversely affect our results of operations. |

| • | We may depend on third parties to provide us with certain critical equipment and may rely on components and raw materials that may be subject to price fluctuations or shortages, including ASIC chips that have been subject to an ongoing significant shortage. |

| • | We are exposed to risks related to disruptions or other failures in the supply chain for cryptocurrency hardware and difficulties in obtaining new hardware. |

| • | The properties in our mining network may experience damages, including damages that are not covered by insurance. |

| Issuer |

Cipher Mining Inc. |

| Securities Being Registered |

We are registering the resale by the Selling Securityholders of an aggregate of 42,035,500 shares of common stock, consisting of: |

| • | up to 32,235,000 of PIPE Shares; |

| • | up to 1,575,000 Initial Stockholder Shares; |

| • | up to 757,500 shares of common stock issued in exchange for GWAC common stock issued in a private placement to I-B Good Works, LLC (the “Sponsor”); |

| • | up to 562,500 shares of common stock issued in exchange for GWAC common stock issued in a private placement to GW Sponsor 2, LLC; |

| • | up to 677,500 shares of common stock issued in a private placement to the Anchor Investors (as defined below); |

| • | up to 6,000,000 shares of common stock issued in Bitfury Private Placement; and |

| • | up to 228,000 of Private Placement Shares. |

| Terms of the Offering |

The Selling Securityholders will determine when and how they will dispose of any shares of common stock registered under this prospectus for resale. |

| Use of Proceeds |

All of the shares of common stock offered by the Selling Securityholders will be sold by them for their respective accounts. We will not receive any of the proceeds from these sales. |

| Risk Factors |

See “ Risk Factors |

| Trading Symbols |

Our common stock and public warrants are listed and traded on the Nasdaq under the symbols “CIFR” and “CIFRW”, respectively. |

| • | implement our business model in a timely manner, in particular our ability to set up our planned cryptocurrency mining facilities in Texas and Ohio; |

| • | establish and maintain our commercial and supply partnerships, including our power and hosting arrangements; |

| • | react to challenges from existing and new competitors; |

| • | comply with existing and new laws and regulations applicable to our business and in our industry; and |

| • | anticipate and respond to macroeconomic changes, and industry benchmarks and changes in the markets in which we plan to operate. |

| • | macroeconomic conditions; |

| • | changes in the legislative or regulatory environment, or actions by governments or regulators, including fines, orders, or consent decrees; |

| • | adverse legal proceedings or regulatory enforcement actions, judgments, settlements, or other legal proceeding and enforcement-related costs; |

| • | increases in operating expenses that we expect to incur to grow and expand our operations and to remain competitive; |

| • | system errors, failures, outages and computer viruses, which could disrupt our ability to continue mining; |

| • | power outages and certain other events beyond our control, including natural disasters and telecommunication failures; |

| • | breaches of security or privacy; |

| • | our ability to attract and retain talent; and |

| • | our ability to compete with our existing and new competitors. |

| • | increases and decreases in generation capacity; |

| • | changes in power transmission or fuel transportation capacity constraints or inefficiencies; |

| • | volatile weather conditions, particularly unusually hot or mild summers or unusually cold or warm winters; |

| • | technological shifts resulting in changes in the demand for power or in patterns of power usage, including the potential development of demand-side management tools, expansion and technological advancements in power storage capability and the development of new fuels or new technologies for the production or storage of power; |

| • | federal and state power, market and environmental regulation and legislation; and |

| • | changes in capacity prices and capacity markets. |

| • | the presence of construction or repair defects or other structural or building damage; |

| • | any noncompliance with, or liabilities under, applicable environmental, health or safety regulations or requirements or building permit requirements; |

| • | any damage resulting from extreme weather conditions or natural disasters, such as hurricanes, earthquakes, fires, floods and snow or windstorms; and |

| • | claims by employees and others for injuries sustained at our properties. |

| • | it is an “orthodox” investment company because it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

| • | it is an inadvertent investment company because, absent an applicable exemption, it owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. |

| • | changes in the valuation of our deferred tax assets and liabilities; |

| • | expected timing and amount of the release of any tax valuation allowances; |

| • | tax effects of stock-based compensation; |

| • | costs related to intercompany restructurings; |

| • | changes in tax laws, regulations or interpretations thereof; or |

| • | lower than anticipated future earnings in jurisdictions where we have lower statutory tax rates and higher than anticipated future earnings in jurisdictions where we have higher statutory tax rates. |

| • | continued worldwide growth in the adoption and use of Bitcoin and other digital assets; |

| • | government and quasi-government regulation of Bitcoin and other digital assets and their use, or restrictions on or regulation of access to and operation of the digital asset network or similar digital assets systems; |

| • | the maintenance and development of the open-source software protocol of the Bitcoin network and Ether network; |

| • | changes in consumer demographics and public tastes and preferences; |

| • | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| • | general economic conditions and the regulatory environment relating to digital assets; and |

| • | the impact of regulators focusing on digital assets and digital securities and the costs associated with such regulatory oversight. |

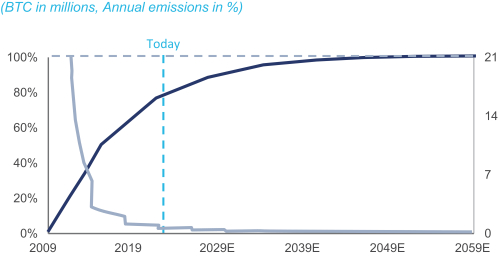

| • | the reduction in mining rewards of Bitcoin, including block reward halving events, which are events that occur after a specific period of time which reduces the block reward earned by miners; |

| • | disruptions, hacks, “forks”, 51% attacks, or other similar incidents affecting the Bitcoin blockchain network; |

| • | hard “forks” resulting in the creation of and divergence into multiple separate networks; |

| • | informal governance led by Bitcoin’s core developers that lead to revisions to the underlying source code or inactions that prevent network scaling, and which evolve over time largely based on |

| • | self-determined participation, which may result in new changes or updates that affect their speed, security, usability, or value; |

| • | the ability for Bitcoin blockchain network to resolve significant scaling challenges and increase the volume and speed of transactions; |

| • | the ability to attract and retain developers and customers to use Bitcoin for payment, store of value, unit of accounting, and other intended uses; |

| • | transaction congestion and fees associated with processing transactions on the Bitcoin network; |

| • | the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoin assets; |

| • | negative public perception of Bitcoin or other cryptocurrencies or their reputation within the fintech influencer community or the general publicity around them; |

| • | development in mathematics, technology, including in digital computing, algebraic geometry, and quantum computing that could result in the cryptography being used by Bitcoin becoming insecure or ineffective; and |

| • | laws and regulations affecting the Bitcoin network or access to this network, including a determination that Bitcoin constitutes a security or other regulated financial instrument under the laws of any jurisdiction. |

| • | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “ Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| • | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

| • | you may not be able to liquidate your investment in shares of our common stock; |

| • | the market price of shares of our common stock may experience significant price volatility; and |

| • | there may be less efficiency in carrying out your purchase and sale orders. |

| • | changes in financial estimates by us or by any securities analysts who might cover our stock; |

| • | proposed changes to laws in the U.S. or foreign jurisdictions relating to our business, or speculation regarding such changes; |

| • | delays, disruptions or other failures in the supply of cryptocurrency hardware, including chips; |

| • | conditions or trends in the digital assets industries and, specifically cryptoasset mining space; |

| • | stock market price and volume fluctuations of comparable companies; |

| • | fluctuations in prices of Bitcoin and other cryptocurrencies; |

| • | announcements by us or our competitors of significant acquisitions, strategic partnerships or divestitures; |

| • | significant lawsuits or announcements of investigations or regulatory scrutiny of its operations or lawsuits filed against us; |

| • | recruitment or departure of key personnel; |

| • | investors’ general perception of our business or management; |

| • | trading volume of our common stock; |

| • | overall performance of the equity markets; |

| • | publication of research reports about us or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts; |

| • | the impacts of the ongoing COVID-19 pandemic and related restrictions; |

| • | general political and economic conditions; and |

| • | other events or factors, many of which are beyond our control. |

| • | existing stockholders’ proportionate ownership interest in us will decrease; |

| • | the amount of cash available per share, including for payment of dividends in the future, may decrease; |

| • | the relative voting strength of each previously outstanding our common stock may be diminished; and |

| • | the market price of our common stock may decline. |

| • | the limitation of the liability of, and the indemnification of, its directors and officers; |

| • | a prohibition on actions by its stockholders except at an annual or special meeting of stockholders; |

| • | a prohibition on actions by its stockholders by written consent; and |

| • | the ability of the Board to issue preferred stock without stockholder approval, which could be used to institute a “poison pill” that would work to dilute the stock ownership of a potential hostile acquirer, effectively preventing acquisitions that have not been approved by the Board. |

| • | any derivative action or proceeding brought on our behalf; |

| • | any action asserting a breach of fiduciary duty; |

| • | any action asserting a claim against us arising under the DGCL or the Governing Documents; and |

| • | any action asserting a claim against us that is governed by the internal-affairs doctrine or otherwise related to our internal affairs. |

| • | the accompanying notes to the unaudited pro forma condensed combined financial statements; |

| • | GWAC’s unaudited interim consolidated financial statements as of and for the six months ended June 30, 2021, and the related notes, each of which are included elsewhere in this prospectus; |

| • | the historical audited financial statements of GWAC for the period from June 24, 2020 (inception) through December 31, 2020 and the related notes, each of which are included elsewhere in this prospectus; |

| • | Cipher’s unaudited interim financial statements as of and for the six months ended July 31, 2021, and the related notes, each of which are included elsewhere in this prospectus; |

| • | the historical audited financial statements of Cipher for the period from January 7, 2021 (inception) through January 31, 2021 and the related notes, each of which are included elsewhere in this prospectus; and |

| • | other information relating to GWAC and Cipher included elsewhere in this prospectus “ Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| • | the cancellation of each issued and outstanding share of Cipher common stock; and |

| • | the conversion into the right to receive a number of shares of our common stock based upon the Exchange Ratio. |

| • | Cipher’s existing shareholders will have the greatest voting interest in the combined entity; |

| • | Cipher has the ability to nominate a majority of the members of the Board; |

| • | Cipher’s senior management will be the senior management of the combined entity; and |

| • | Cipher’s operations prior to the acquisition comprising the only ongoing operations of New Cipher. |

Pro Forma Combined |

||||||||

Number of Shares |

% Ownership |

|||||||

| New Cipher public shares |

4,345,619 | 1.8 | % | |||||

| New Cipher founder Shares |

4,250,000 | 1.7 | % | |||||

| New Cipher private placement shares |

228,000 | 0.1 | % | |||||

| New Cipher shares issued to PIPE Investors / Bitfury private placement |

38,235,000 | 15.5 | % | |||||

| New Cipher shares issued in merger to Cipher |

200,000,000 | 81.0 | % | |||||

| |

|

|

|

|||||

| Shares outstanding |

247,058,619 |

100.0 |

% | |||||

| |

|

|

|

|||||

Cipher (Historical) (1) |

GWAC (Historical) (2) |

Transaction Accounting Adjustments (Note 2) |

Pro Forma Combined |

|||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Current assets |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 655,172 | $ | 127,722 | $ | 170,032,591 | (1 | ) | $ | 381,711,790 | ||||||||||

| 377,438,209 | (3 | ) | ||||||||||||||||||

| (39,972,330 | ) | (4 | ) | |||||||||||||||||

| — | (8 | ) | ||||||||||||||||||

| (126,569,575 | ) | (9 | ) | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Prepaid expenses |

16,936 | 247,593 | — | 264,529 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

672,108 | 375,315 | 380,928,896 | 381,976,319 | ||||||||||||||||

| Marketable securities held in Trust Account |

— | 170,032,591 | (170,032,591 | ) | (1 | ) | — | |||||||||||||

| Deferred offering costs |

2,775,767 | — | (2,775,767 | ) | (6 | ) | — | |||||||||||||

| Deferred investment costs |

205,000 | — | — | 205,000 | ||||||||||||||||

| Deposits |

3,368,586 | — | — | 3,368,586 | ||||||||||||||||

| Property and equipment, net |

4,094 | — | — | 4,094 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

$ |

7,025,555 |

$ |

170,407,906 |

$ |

208,120,538 |

$ |

385,553,999 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY |

||||||||||||||||||||

| Current liabilities |

||||||||||||||||||||

| Accounts payable |

$ | 203,692 | $ | 918,867 | $ | — | $ | 1,122,559 | ||||||||||||

| Accounts payable—related party |

47,475 | — | (47,475 | ) | — | |||||||||||||||

| Accrued legal costs |

2,705,000 | — | (2,500,000 | ) | 205,000 | |||||||||||||||

| Accrued expenses |

25,651 | — | — | 25,651 | ||||||||||||||||

| Promissory note |

— | — | — | (8 | ) | — | ||||||||||||||

| Related party loan |

4,864,316 | — | (4,864,316 | ) | (3 | ) | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

7,846,134 | 918,867 | (7,411,791 | ) | 1,353,210 | |||||||||||||||

| Warrant liabilities |

— | 199,402 | — | 199,402 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

7,846,134 | 1,118,269 | (7,411,791 | ) | 1,552,612 | |||||||||||||||

| Commitments and contingencies |

||||||||||||||||||||

| Common stock subject to possible redemption |

— | 170,000,000 | (170,000,000 | ) | (2 | ) | — | |||||||||||||

| Stockholders’ (deficit) equity |

||||||||||||||||||||

| Common stock |

1 | 4,478 | 17,000 | (2 | ) | 247,059 | ||||||||||||||

| 38,235 | (3 | ) | ||||||||||||||||||

| (4,478 | ) | (5 | ) | |||||||||||||||||

| (191,823 | ) | (7 | ) | |||||||||||||||||

| Additional paid-in capital |

4 | 1,451,170 | 169,983,000 | (2 | ) | 384,574,912 | ||||||||||||||

| 382,311,765 | (3 | ) | ||||||||||||||||||

| (37,472,330 | ) | (4 | ) | |||||||||||||||||

| (2,161,533 | ) | (5 | ) | |||||||||||||||||

| (2,775,767 | ) | (6 | ) | |||||||||||||||||

| (191,823 | ) | (7 | ) | |||||||||||||||||

| (126,569,575 | ) | (9 | ) | |||||||||||||||||

| Accumulated deficit |

(820,584 | ) | (2,166,011 | ) | 2,166,011 | (5 | ) | (820,584 | ) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total stockholders’ (deficit) equity |

(820,579 | ) | (710,363 | ) | 385,532,329 | 384,001,387 | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities and stockholders’ (deficit) equity |

$ |

7,025,555 |

$ |

170,407,906 |

$ |

208,120,538 |

$ |

385,553,999 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| (1) | Represents the historical balance sheet of Cipher as of July 31, 2021. |

| (2) | Represents the historical balance sheet of GWAC as of June 30, 2021. |

Cipher (Historical) (1) |

GWAC (Historical) (2) |

Transaction Accounting Adjustments (Note 2) |

Pro Forma Combined |

|||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | ||||||||||||

| Expenses |

||||||||||||||||||||

| Administrative expenses |

815,088 | 2,032,419 | — | 2,847,507 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total expenses |

815,088 | 2,032,419 | — | 2,847,507 | ||||||||||||||||

| Operating loss |

(815,088 | ) | (2,032,419 | ) | — | (2,847,507 | ) | |||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Change in fair value of warrant liabilities |

— | (76,332 | ) | — | (76,332 | ) | ||||||||||||||

| Interest expense |

(2,016 | ) | — | — | (2,016 | ) | ||||||||||||||

| Interest income |

— | 49,769 | (49,769 | ) | (1 | ) | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

$ |

(817,104 |

) |

$ |

(2,058,982 |

) |

$ |

(49,769 |

) |

$ |

(2,925,855 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) per share, basic and diluted, redeemable shares |

$ |

(0.00 |

) |

|||||||||||||||||

| |

|

|||||||||||||||||||

| Loss per share, basic and diluted, non-redeemable shares |

$ |

(0.44 |

) |

|||||||||||||||||

| |

|

|||||||||||||||||||

| Weighted average redeemable shares outstanding, basic and diluted |

— | 16,818,439 | — | — | ||||||||||||||||

| Weighted average non-redeemable shares outstanding, basic and diluted |

— | 4,659,492 | — | — | ||||||||||||||||

| Net income (loss) per share, basic and diluted |

$ | (1,874.09 | ) | $ | — | $ |

(0.01 |

) | ||||||||||||

| |

|

|

|

|

|

|||||||||||||||

| Weighted average shares outstanding, basic and diluted |

436 | 247,058,183 | (2) |

247,058,619 | ||||||||||||||||

| (1) | Represents the historical statement of operations of Cipher for the six months ended July 31, 2021. |

| (2) | Represents the historical statement of operations of GWAC for the six months ended June 30, 2021. |

Cipher (Historical) (1) |

GWAC (Historical) (2) |

Transaction Accounting Adjustments (Note 2) |

Pro Forma Combined |

|||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | ||||||||||||

| Expenses |

||||||||||||||||||||

| Administrative expenses |

3,480 | 153,657 | — | 157,137 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total expenses |

3,480 | 153,657 | — | 157,137 | ||||||||||||||||

| Operating loss |

(3,480 | ) | (153,657 | ) | — | (157,137 | ) | |||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Change in fair value of warrant liabilities |

19,284 | — | 19,284 | |||||||||||||||||

| Interest income |

— | 27,342 | (27,342 | ) | (1 | ) | — | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ |

(3,480 |

) |

$ |

(107,031 |

) |

$ |

(27,342 |

) |

$ |

(137,853 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) per share, basic and diluted, redeemable shares |

$ |

(0.00 |

) |

|||||||||||||||||

| |

|

|||||||||||||||||||

| Loss per share, basic and diluted, non-redeemable shares |

$ |

(0.02 |

) |

|||||||||||||||||

| |

|

|||||||||||||||||||

| Weighted average redeemable shares outstanding, basic and diluted |

16,723,356 | |||||||||||||||||||

| Weighted average non-redeemable shares outstanding, basic and diluted |

4,483,216 | |||||||||||||||||||

| Net income (loss) per share, basic and diluted |

$ |

(0.00 |

) | |||||||||||||||||

| |

|

|||||||||||||||||||

| Weighted average shares outstanding, basic and diluted |

247,058,183 | (2 | ) | 247,058,619 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| (1) | Represents the historical statement of operations of Cipher for the period from January 7, 2021 (inception) through January 31, 2021. |

| (2) | Represents the historical statement of operations of GWAC for the period from June 24, 2020 (inception) through December 31, 2020. |

| • | the accompanying notes to the unaudited pro forma condensed combined financial statements; |

| • | GWAC’s unaudited interim consolidated financial statements as of and for the six months ended June 30, 2021, and the related notes, each of which are included elsewhere in this prospectus; |

| • | the historical audited financial statements of GWAC for the period from June 24, 2020 (inception) through December 31, 2020 and the related notes, each of which are included elsewhere in this prospectus; |

| • | Cipher’s unaudited interim financial statements as of July 31, 2021 and for the six months ended July 31, 2021, and the related notes, each of which are included elsewhere in this prospectus; |

| • | the historical audited financial statements of Cipher for the period from January 7, 2021 (inception) through January 31, 2021 and the related notes, each of which are included elsewhere in this prospectus; and |

| • | other information relating to GWAC and Cipher included elsewhere in this prospectus “ Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| (1) | Reflects the liquidation and reclassification of cash and investments held in the Trust Account that becomes available for general use by Cipher following the Business Combination. |

| (2) | Reflects the transfer of GWAC’s approximately $170 million common stock subject to possible redemptions balance as of June 30, 2021 to permanent equity. |

| (3) | Reflects the gross receipt of $377.4 million from the PIPE Financing ($322.4 million) and Bitfury Private Placement ($60.0 million) (38.2 million common shares at $10.00 per share) less the $4.9 million already disbursed to Cipher as a related party loan as of July 31, 2021 and the accounts payable related party balance of approximately $47,000. |

| (4) | Reflects the payment of transaction costs of approximately $40.0 million. Transaction costs include legal, financial advisory, deferred underwriters’ discount payable and other professional fees related to the Business Combination. |

| (5) | Reflects the elimination of GWAC’s accumulated deficit and its common stock balances into additional paid in capital. |

| (6) | Reflects the reclassification of deferred offering costs to additional paid in capital. |

| (7) | Reflects the reorganization of Cipher into New Cipher. |

| (8) | Reflects issuance and payoff of $50,000 promissory note issued after June 30, 2021. |

| (9) | Reflects the transaction accounting adjustment, for the actual redemption of 12,654,381 GWAC Common Stock (at a redemption price of slightly over $10.00 per share) totaling approximately $126.6 million. |

| (1) | Reflects the adjustment to eliminate interest earned on balances held in the Trust Account. |

| (2) | Reflects the increase in the weighted average shares outstanding due to the issuance of common stock (and the maximum redemption scenario) in connection with the Business Combination. |

Six Months Ended June 30, 2021 |

||||

| Pro forma net loss |

(2,925,855 | ) | ||

| Weighted average shares outstanding—basic and diluted |

247,058,619 | |||

| Net loss per share—basic and diluted (1) |

(0.01 | ) | ||

| |

|

|||

Year Ended December 31, 2020 |

||||

| Pro forma net loss |

(137,853 | ) | ||

| Weighted average shares outstanding—basic and diluted |

247,058,619 | |||

| Net income (loss) per share—basic and diluted (1) |

(0.00 | ) | ||

| |

|

|||

| New Cipher public shares |

4,345,619 | |||

| New Cipher founder shares |

4,250,000 | |||

| New Cipher private placement shares |

228,000 | |||

| New Cipher shares issued to PIPE Investors / Bitfury private placement |

38,235,000 | |||

Year Ended December 31, 2020 |

||||

| New Cipher shares issued in merger to Cipher |

200,000,000 | |||

| |

|

|||

| Shares outstanding |

247,058,619 | |||

| |

|

|||

| (1) | Outstanding options and warrants are anti-dilutive and are not included in the calculation of diluted net loss per share. |

| • | Step 1: Identify the contract with the customer |

| • | Step 2: Identify the performance obligations in the contract |

| • | Step 3: Determine the transaction price |

| • | Step 4: Allocate the transaction price to the performance obligations in the contract |

| • | Step 5: Recognize revenue when the Company satisfies a performance obligation |

| • | Variable consideration |

| • | Constraining estimates of variable consideration |

| • | The existence of a significant financing component in the contract |

| • | Noncash consideration |

| • | Consideration payable to a customer |

| (1) | Hashrate represents a 7-day average |

|

|

| • | The initial buildout phase: |

| • | The second phase: |

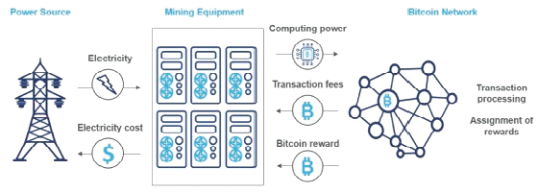

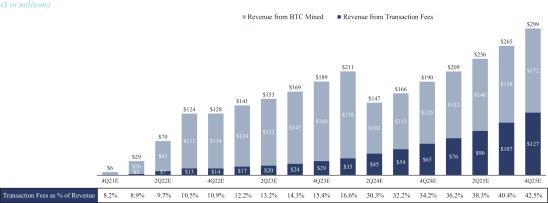

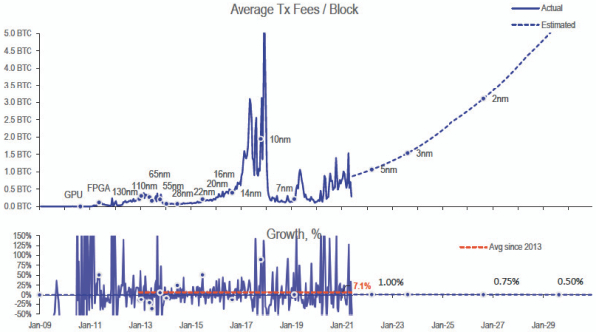

| • | block rewards |

| • | transaction fees |

| Name |

Age |

Title | ||

| Tyler Page |

45 | Chief Executive Officer and Director | ||

| Edward Farrell |

61 | Chief Financial Officer | ||

| Patrick Kelly |

42 | Chief Operating Officer | ||

| William Iwaschuk |

46 | Chief Legal Officer | ||

| Cary Grossman |

67 | Director | ||

| Caitlin Long |

52 | Director | ||

| James Newsome |

62 | Director | ||

| Wesley (Bo) Williams |

45 | Director | ||

| Holly Morrow Evans |

45 | Director | ||

| Robert Dykes |

72 | Director |

| • | appointing, compensating, retaining, evaluating, terminating and overseeing New Cipher’s independent registered public accounting firm; |

| • | discussing with New Cipher’s independent registered public accounting firm their independence from management; |

| • | reviewing with New Cipher’s independent registered public accounting firm the scope and results of their audit; |

| • | pre-approving all audit and permissible non-audit services to be performed by New Cipher’s independent registered public accounting firm; |

| • | overseeing the financial reporting process and discussing with management and New Cipher’s independent registered public accounting firm the interim and annual financial statements that New Cipher’s files with the SEC; |

| • | reviewing and monitoring New Cipher’s accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and |

| • | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |

| • | reviewing and setting or making recommendations to the Board regarding the compensation of New Cipher’s executive officers; |

| • | making recommendations to the Board regarding the compensation of the Board; |

| • | reviewing and approving or making recommendations to the Board regarding New Cipher’s incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants. |

| • | identifying and recommending candidates for membership on the Board; |

| • | recommending directors to serve on the Board committees; |

| • | reviewing and recommending to the Board any changes to our corporate governance principles; |

| • | reviewing proposed waivers of the code of conduct for directors and executive officers; |

| • | overseeing the process of evaluating the performance of the Board; and |

| • | advising the Board on corporate governance matters. |

| • | during any period of two consecutive years, individuals who, at the beginning of such period, constitute the Board together with any new directors (other than a director designated by a person who shall have entered into an agreement with Cipher Mining Inc. to effect a change in control transaction) whose election by the Board or nomination for election by Cipher Mining Inc.’s stockholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the two-year period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority thereof; or |

| • | the consummation by Cipher Mining Inc. (whether directly or indirectly) of (x) a merger, consolidation, reorganization, or business combination or (y) a sale or other disposition of all or substantially all of Cipher Mining Inc.’s assets in any single transaction or series of related transactions or (z) the acquisition of assets or stock of another entity, in each case other than a transaction: |

| • | which results in Cipher Mining Inc.’s voting securities outstanding immediately before the transaction continuing to represent either by remaining outstanding or by being converted into voting securities of the company or the person that, as a result of the transaction, controls, directly or indirectly, the company or owns, directly or indirectly, all or substantially all of Cipher Mining Inc.’s assets or otherwise succeeds to Cipher Mining Inc.’s business, directly or indirectly, at least a majority of the combined voting power of the successor entity’s outstanding voting securities immediately after the transaction, and |

| • | after which no person or group beneficially owns voting securities representing 50% or more of the combined voting power of the successor entity; provided, however, that no person or group shall be treated as beneficially owning 50% or more of the combined voting power of the successor entity solely as a result of the voting power held in Cipher Mining Inc. prior to the consummation of the transaction. |

| • | any person who is, or at any time during the applicable period was, one of New Cipher’s executive officers or directors; |

| • | any person who is known by New Cipher to be the beneficial owner of more than 5% of New Cipher voting stock; |

| • | any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, in- law or sister-in-law |

| • | any firm, corporation or other entity in which any of the foregoing persons is a partner or principal, or in a similar position, or in which such person has a 10% or greater beneficial ownership interest. |

| • | each person who is the beneficial owner of more than 5% of the outstanding shares of our common stock; |

| • | each of New Cipher’s current executive officers and directors; and |

| • | all executive officers and directors of New Cipher, as a group. |

| Name of Beneficial Owners |

Number of Shares of Common Stock Beneficially Owned |

Percentage of Outstanding Common Stock |

||||||

| 5% Stockholders and Affiliated Entities: |

||||||||

| Bitfury Top HoldCo (1) |

200,000,000 | 80.9 | % | |||||

| Bitfury Holding (2) |

6,000,000 | 2.4 | % | |||||

| GW Sponsor 2, LLC (3) |

562,500 | 0.0023 | % | |||||

| Directors and Named Executive Officers: |

||||||||

| Tyler Page |

— | — | ||||||

| Edward Farrell |

— | — | ||||||

| Patrick Kelly |

— | — | ||||||

| William Iwaschuk |

— | — | ||||||

| Cary Grossman |

195,000 | 0.00078 | % | |||||

| Caitlin Long |

— | — | ||||||

| James Newsome |

— | — | ||||||

| Wesley (Bo) Williams |

— | — | ||||||

| Holly Morrow Evans |

— | — | ||||||

| Robert Dykes |

— | — | ||||||

| All Directors and Named Executive Officers as a group (10 individuals) |

195,000 | 0.00078 | % | |||||

| (1) | Bitfury Top HoldCo is indirectly controlled by Valerijs Vavilovs. The business address of Bitfury Top HoldCo is Strawinskylaan 3051, 1077ZX Amsterdam, the Netherlands, and the business address of Valerijs Vavilovs is Serenia Residences, North A-502, Crescent Road East, The Palm Jumeirah, Dubai, UAE. |

| (2) | Bitfury Holding is a fully owned subsidiary of Bitfury Top HoldCo and received the common stock pursuant to the Bitfury Private Placement. Together with Bitfury Top HoldCo, the Bitfury Group owns 206,000,000 of our common stock or 83.4% of the total outstanding stock. |

| (3) | GW Sponsor 2, LLC is controlled by Cary Grossman. Mr. Grossman has sole voting and dispositive power with respect to the securities disclosed above. The business address of the Sponsor and for Cary Grossman is 4265 San Felipe, Suite 603, Houston, TX 77027. |

| • | up to 32,235,000 PIPE Shares; |

| • | up to 1,575,000 shares of Initial Stockholder Shares; |

| • | up to 757,500 shares of common stock held by the Sponsor; |

| • | up to 562,500 shares of common stock held by GW Sponsor 2, LLC; |

| • | up to 677,500 shares of common stock held by the Anchor Investors; |

| • | up to 6,000,000 shares of common stock held by Bitfury Holding B.V; and |

| • | up to 228,000 Private Placement Shares. |

Shares of Common Stock |

||||||||||||||||

Name of Selling Stockholder |

Number Beneficially Owned Prior to Offering |

Number Being Registered Hereby (*) |

Number Beneficially Owned After this Offering |

Percentage Owned After Offering (**) |

||||||||||||

| Alexander Morcos |

500,000 | 500,000 | — | — | ||||||||||||

| American Committee for Shaare Zedek Hospital in Jerusalem, Inc. |

2,500 | 2,500 | — | — | ||||||||||||

| Athanor International Master Fund, LP. |

250,300 | 250,300 | — | — | ||||||||||||

| Athanor Master Fund, LP. |

749,700 | 749,700 | — | — | ||||||||||||

| Ballet Theatre Foundation, Inc. |

250,000 | 250,000 | — | — | ||||||||||||

| Bitfury Holding B.V. |

6,000,000 | 6,000,000 | — | 2.43 | % | |||||||||||

| Cary Grossman |

195,000 | 195,000 | — | — | ||||||||||||

| CC Arb West, LLC. |

163,000 | 163,000 | — | — | ||||||||||||

| CC Arbitrage, Ltd. |

37,000 | 37,000 | — | — | ||||||||||||

| CVI Investments, Inc. (1) |

1,500,000 | 1,500,000 | — | — | ||||||||||||

Shares of Common Stock |

||||||||||||||||

Name of Selling Stockholder |

Number Beneficially Owned Prior to Offering |

Number Being Registered Hereby (*) |

Number Beneficially Owned After this Offering |

Percentage Owned After Offering (**) |

||||||||||||

| D. E. Shaw Oculus Portfolios, L.L.C. (2) |

375,000 | 375,000 | — | — | ||||||||||||

| D. E. Shaw Valence Portfolios, L.L.C. (3) |

1,125,000 | 1,125,000 | — | — | ||||||||||||

| David Pauker |

47,500 | 47,500 | — | — | ||||||||||||

| Divenire Holding |

200,000 | 200,000 | — | — | ||||||||||||

| Douglas Wurth |

195000 | 195000 | — | — | ||||||||||||

| FIAM Target Date Blue Chip Growth Commingled Pool By: Fidelity Institutional Asset Management Trust Company as Trustee (4) |

290,693 | 290,693 | — | — | ||||||||||||

| Fidelity Blue Chip Growth Commingled Pool By: Fidelity Management Trust Company, as Trustee (5) |

132,477 | 132,477 | — | — | ||||||||||||

| Fidelity Blue Chip Growth Institutional Trust By its manager Fidelity Investments Canada ULC (6) |

10,024 | 10,024 | — | — | ||||||||||||

| Fidelity Growth Company Commingled Pool By: Fidelity Management Trust Company, as Trustee (7) |

1,065,052 | 1,065,052 | — | — | ||||||||||||

| Fidelity Mt. Vernon Street Trust: Fidelity Growth Company K6 Fund (8) |

185,605 | 185,605 | — | — | ||||||||||||

| Fidelity Mt. Vernon Street Trust: Fidelity Growth Company Fund (9) |

1,036,026 | 1,036,026 | — | — | ||||||||||||

| Fidelity Mt. Vernon Street Trust: Fidelity Series Growth Company Fund (10) |

213,317 | 213,317 | — | — | ||||||||||||

| Fidelity Securities Fund: Fidelity Blue Chip Growth Fund (11) |

3,712,314 | 3,712,314 | — | 1.50 | % | |||||||||||

| Fidelity Securities Fund: Fidelity Blue Chip Growth K6 Fund (12) |

408,492 | 408,492 | — | — | ||||||||||||

| Fidelity Securities Fund: Fidelity Flex Large Cap Growth Fund (13) |

8,454 | 8,454 | — | — | ||||||||||||

| Fidelity Securities Fund: Fidelity Series Blue Chip Growth Fund (14) |

437,546 | 437,546 | — | — | ||||||||||||

| Fred S Zeidman |

195,000 | 195,000 | — | — | ||||||||||||

| Ghisallo Master Fund LP |

350,000 | 350,000 | — | — | ||||||||||||

| Glazer Capital, LLC (15) |

500,000 | 500,000 | — | — | ||||||||||||

| Gray’s Creek Capital Partners Fund I, LP |

200,000 | 200,000 | — | — | ||||||||||||

| GW Sponsor 2, LLC (16) |

562,500 | 562,500 | — | — | ||||||||||||

| Harris County Hospital District Foundation |

2,500 | 2,500 | — | — | ||||||||||||

| I-B Good Works, LLC |

757,500 | 757,500 | — | — | ||||||||||||

| Integrated Core Strategies (US) LLC (17) |

500,000 | 500,000 | — | — | ||||||||||||

| Iridian Durascent Fund, LP |

10,000 | 10,000 | — | — | ||||||||||||

| Iridian Eagle Fund, LP |

261,000 | 261,000 | — | — | ||||||||||||

| Iridian Raven Fund, LP |

129,000 | 129,000 | — | — | ||||||||||||

| Iridian Wasabi Fund, LP |

100,000 | 100,000 | — | — | ||||||||||||

| James M McCrory |

305,000 | 305,000 | — | — | ||||||||||||

| John J. Lendrum III |

47,500 | 47,500 | — | — | ||||||||||||

| KC10T Cipher SPV, LLC |

1,185,000 | 1,185,000 | — | — | ||||||||||||

| Kepos Alpha Master Fund L.P. (18) |

650,000 | 650,000 | — | — | ||||||||||||

Shares of Common Stock |

||||||||||||||||

Name of Selling Stockholder |

Number Beneficially Owned Prior to Offering |

Number Being Registered Hereby (*) |

Number Beneficially Owned After this Offering |

Percentage Owned After Offering (**) |

||||||||||||

| Magnetar Financial LLC (19) |

226,375 | 226,375 | — | — | ||||||||||||

| Maven Investment Partners US Limited—NY Branch |

250,000 | 250,000 | — | — | ||||||||||||

| Memorial Hermann Foundation |

47,500 | 47,500 | — | — | ||||||||||||

| MMF LT, LLC (20) |

1,000,000 | 1,000,000 | — | — | ||||||||||||

| Morgan Stanley Investment Management Inc. (21) |

10,000,000 | 10,000,000 | — | 4.05 | % | |||||||||||

| Nadia’s Initiative Inc. |

50,000 | 50,000 | — | — | ||||||||||||

| Paolo E. Floriani |

35,000 | 35,000 | — | — | ||||||||||||

| Paul Fratamico |

47,500 | 47,500 | — | — | ||||||||||||

| Peridian Fund, L.P. (22) |

226,375 | 226,375 | — | — | ||||||||||||

| Polar Multi-Strategy Master Fund (23) |

226,375 | 226,375 | — | — | ||||||||||||

| Ratan Capital Master Fund Ltd. |

500,000 | 500,000 | — | — | ||||||||||||

| Schonfeld Strategic 460 Fund LLC |

300,000 | 300,000 | — | — | ||||||||||||

| Shelley Leonard |

160,000 | 160,000 | — | — | ||||||||||||

| Social Accountability International, Inc. |

125,000 | 125,000 | — | — | ||||||||||||

| Stichting Juridisch Eigendom Mint Tower Arbitrage Fund |

726,375 | 726,375 | — | — | ||||||||||||

| Suhas and Felicitie Daftuar |

500,000 | 500,000 | — | — | ||||||||||||

| Tahira Rehmatullah |

47,500 | 47,500 | — | — | ||||||||||||

| Tech Opportunities LLC (24) |

700,000 | 700,000 | — | — | ||||||||||||

| The Children’s Aid Society |

125,000 | 125,000 | — | — | ||||||||||||

| The National World War II Museum, Inc. |

2,500 | 2,500 | — | — | ||||||||||||

| The University of Texas Foundation, Inc. |

175,000 | 175,000 | — | — | ||||||||||||

| The Washington University |

10,000 | 10,000 | — | — | ||||||||||||

| Ulter GW LLC |

1,500,000 | 1,500,000 | — | — | ||||||||||||

| University of St. Thomas |

10,000 | 10,000 | — | — | ||||||||||||

| VB Capital |

200,000 | 200,000 | — | — | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| TOTAL |

42,035,500 |

42,035,500 |

||||||||||||||

| (*) | The amounts set forth in this column are the number of shares of common stock that may be offered by such Selling Securityholder using this prospectus. These amounts do not represent any other shares of our common stock that the Selling Securityholder may own beneficially or otherwise. |

| (**) | The percentage of shares to be beneficially owned after completion of the offering is calculated on the basis of 246,858,619 shares of common stock outstanding. |

| (1) | Heights Capital Management, Inc., the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. The principal business address of CVI is c/o Heights Capital Management, Inc., 101 California Street, Suite 3250, San Francisco, California 94111. |

| (2) | D. E. Shaw Oculus Portfolios, L.L.C. has the power to vote or to direct the vote of (and the power to dispose or direct the disposition of) the shares of common stock directly owned by it to be registered for resale pursuant to this registration statement (the “Subject Shares”). D. E. Shaw & Co., L.P. (“DESCO LP”), as the investment adviser of D. E. Shaw Oculus Portfolios, L.L.C., may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. D. E. Shaw & Co., L.L.C. (“DESCO LLC”), as the manager of D. E. Shaw Oculus Portfolios, L.L.C., may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. Julius Gaudio, Maximilian Stone, and Eric Wepsic, or their designees, exercise voting and investment control over the Subject Shares on DESCO LP’s and DESCO LLC’s behalf. D. E. Shaw & Co., Inc. (“DESCO Inc.”), as general partner of DESCO LP, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. D. E. Shaw & Co. II, Inc. (“DESCO II Inc.”), as managing member of DESCO LLC, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. None of DESCO LP, DESCO LLC, DESCO Inc., or DESCO II Inc. owns any shares of the Company directly, and each such entity disclaims beneficial ownership of the Subject Shares. David E. Shaw does not own any shares of the Company directly. By virtue of David E. Shaw’s position as President and sole shareholder of DESCO |

| Inc., which is the general partner of DESCO LP, and by virtue of David E. Shaw’s position as President and sole shareholder of DESCO II Inc., which is the managing member of DESCO LLC, David E. Shaw may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, David E. Shaw may be deemed to be the beneficial owner of the Subject Shares. David E. Shaw disclaims beneficial ownership of the Subject Shares. The business address of D. E. Shaw Oculus Portfolios, L.L.C. is c/o D. E. Shaw & Co., L.P., 1166 Avenue of the Americas, 9th Floor, New York, NY 10036. |

| (3) | D. E. Shaw Valence Portfolios, L.L.C. has the power to vote or to direct the vote of (and the power to dispose or direct the disposition of) the shares of common stock directly owned by it to be registered for resale pursuant to this registration statement (the “Subject Shares”). D. E. Shaw & Co., L.P. (“DESCO LP”), as the investment adviser of D. E. Shaw Valence Portfolios, L.L.C., may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. D. E. Shaw & Co., L.L.C. (“DESCO LLC”), as the manager of D. E. Shaw Valence Portfolios, L.L.C., may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. Julius Gaudio, Maximilian Stone, and Eric Wepsic, or their designees, exercise voting and investment control over the Subject Shares on DESCO LP’s and DESCO LLC’s behalf. D. E. Shaw & Co., Inc. (“DESCO Inc.”), as general partner of DESCO LP, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. D. E. Shaw & Co. II, Inc. (“DESCO II Inc.”), as managing member of DESCO LLC, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares. None of DESCO LP, DESCO LLC, DESCO Inc., or DESCO II Inc. owns any shares of the Company directly, and each such entity disclaims beneficial ownership of the Subject Shares. David E. Shaw does not own any shares of the Company directly. By virtue of David E. Shaw’s position as President and sole shareholder of DESCO Inc., which is the general partner of DESCO LP, and by virtue of David E. Shaw’s position as President and sole shareholder of DESCO II Inc., which is the managing member of DESCO LLC, David E. Shaw may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the Subject Shares and, therefore, David E. Shaw may be deemed to be the beneficial owner of the Subject Shares. David E. Shaw disclaims beneficial ownership of the Subject Shares. The business address of D. E. Shaw Valence Portfolios, L.L.C. is c/o D. E. Shaw & Co., L.P., 1166 Avenue of the Americas, 9th Floor, New York, NY 10036. |

| (4) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (5) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (6) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (7) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under |

| the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (8) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (9) | Managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |