UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ___________ to __________

Commission file number 001-39463

____________________________

(Exact name of registrant as specified in its charter)

____________________________

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||

(831 ) 201-6700

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to section 12(g) of the Act:

| None | ||

| (Title of class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| x | Accelerated filer | o | ||||||||||||

| Non-accelerated filer | o | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $2.20 billion, based upon the closing sales price of the common stock as reported on the New York Stock Exchange. Shares of common stock held by executive officers and directors have been excluded from this calculation because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. o Yes o No

APPLICABLE ONLY TO CORPORATE REGISTRANTS:

The registrant had outstanding 628,585,600 shares of common stock as of February 21, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| Page | |||||

i

Part I

Special Note Regarding Forward-Looking Statements

Statements contained in this Annual Report on Form 10-K which are not historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, without limitation, statements regarding the future financial position, business strategy and plans and objectives of management of Joby Aviation, Inc. (the “Company,” “we,” “us” or “our”). These statements constitute projections and forecasts and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Annual Report, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on information available as of the date of this Annual Report and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties including those set forth in Part I, Item 1A “Risk Factors” and elsewhere in this Annual Report and in other documents we file with the U.S. Securities and Exchange Commission. These risks and uncertainties may cause actual results or performance to differ materially from the expectations expressed or implied. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Market and Industry Data

This Annual Report includes industry and market data obtained from periodic industry publications, third-party surveys and studies, including from Morgan Stanley and government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this Annual Report, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Each publication, study and report speaks as of its original publication date (and not as of the date of this Annual Report). Certain of these publications, studies and reports were published before the COVID-19 pandemic and therefore do not reflect any impact of COVID-19 on any specific market. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources replied upon or cited herein.

Item 1. Business

Overview

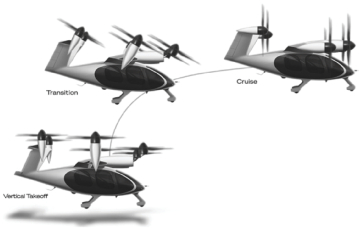

Our mission is to help the world connect faster and more easily with the people and places that matter most by delivering a new form of clean, quiet aerial transportation. Building on recent advancements in energy storage, microelectronics, material science and software, we are developing an all-electric aircraft with zero operating emissions that will transport a pilot and four passengers at speeds of up to 200 mph, while also having the ability to takeoff and land vertically. In order to successfully bring our aircraft to market, we are focused on the following three goals: 1) achieving type certification of our aircraft 2) scaling our manufacturing capabilities and 3) preparing for commercial operations.

We are working closely with the Federal Aviation Administration (“FAA”) to certify our aircraft for commercial operations. Joby was the first electric, vertical take off and landing (“eVTOL”) company to receive a signed, stage 4 G-1 certification basis and we have now effectively completed two of the five stages of type certification. Type certification has five stages: 1) Certification Basis - details air worthiness requirements 2) Means of Compliance - details how to demonstrate compliance with safety rules 3) Certification Plans - extrapolates which test are required for each system 4) Testing & Analysis - detailed plans, documentation and completion of tests from stage 3 certification plans and 5) Show & Verify - involves FAA review and verification of testing results. We plan to complete the entire certification process in time to begin commercial passenger operations in 2025. We have also begun working with regulators in the United Kingdom and Japan, leveraging our work with the FAA.

2

We intend to operate our aircraft on journeys of 5 to 150 miles, providing rapid and cost-effective connections between cities and their surrounding areas. Compared to traditional, ground-based infrastructure such as road and rail, aerial ridesharing networks can be set up rapidly, and at significantly lower cost, enabling us to provide a sustainable solution to today’s dual challenges of congestion and climate change. We have completed more than 1,000 test flights with our prototype aircraft, demonstrating the range, acoustic profile, speed and altitude capabilities of the aircraft.

In 2022, we completed the construction of our pilot production lines in San Carlos and Marina, CA, and we began manufacturing our production prototype aircraft. The 130,000 square foot facility in Marina was designed with support from our partners at Toyota, and will be used to validate and certify our manufacturing processes. This approach enables us to prove-out scalable technologies before making the sizable investments required for higher-volume production.

Our preparations for commercialization include forming sector-leading partnerships with partners like Uber and Delta Air Lines, both of whom have invested in Joby, as well as global partners like SK Telecom in South Korea and ANA Airlines in Japan. We have also established relationships with infrastructure providers such as Macquarie, Skyports, Reef and Related.

Successfully operating a commercial service also requires a Part 135 operating license, which we received in 2022, demonstrating the advancement of our procedures and training program and importantly, enabling our team to begin exercising the operations and customer technology platforms that will underpin multi-modal ridesharing service in future.

By combining the freedom of air travel with the efficiency of our aircraft, we expect to deliver journeys that are up to 5 times faster than driving, and it is our goal to steadily drive down end-user pricing in the years following commercial launch to make the service widely accessible.

Our aircraft has been specifically designed to achieve a considerably lower noise footprint than that of today’s conventional aircraft or helicopters. It is quiet at takeoff and near silent when flying overhead, which we anticipate will allow us to operate from new skyport locations nearer to where people live and work, in addition to utilizing the more than 5,000 heliport and airport infrastructure facilities already in existence in the U.S. alone.

We do not currently intend to sell these aircraft to independent third parties or individual consumers. Instead, we plan to manufacture, own and operate our aircraft ourselves, building a vertically integrated transportation company that will deliver transportation services to our customers, including the U.S. Air Force through contracted operations, and to individual end-users through a convenient app-based aerial ridesharing service. Our goal is to begin initial service operations with the Department of Defense in 2024, followed by commercial passenger operations in 2025. We believe this business model will generate the greatest economic returns, while providing us with end-to-end control over the customer experience to optimize for customer safety, comfort and value. There may be circumstances in which it is either required (for example, due to operating restrictions on foreign ownership in other countries) or otherwise desirable to sell aircraft in the future. While we do not expect this would change our core focus on building a vertically integrated transportation company, we may choose to sell aircraft in circumstances where we believe there is a compelling reason to do so.

The emerging Urban Air Mobility (“UAM”) sector’s annual total addressable market is projected to reach $1 trillion globally by 2040 according to Morgan Stanley’s 2021 eVTOL/Urban Air Mobility TAM Update, growing to $9 trillion in 2050 as adoption and uses cases expand.

By leveraging our vertically integrated business model, technological differentiation and best-in-class strategic relationships, we believe we have an historic opportunity to define a new market for sustainable daily mobility, enabling people to rethink the way they move in and around metropolitan areas and the rural communities around them.

Innovation and new technology present opportunities to rethink aircraft design. At Joby, we reviewed the components currently available in the marketplace and opted to work with leading partners on certain building blocks for our design while leveraging in-house expertise on batteries, software, mechanics and more to create custom components. Our commitment to vertical integration and in-house development has allowed us to optimize systems and components across the aircraft, resulting in better energy efficiency, range, and speed than what would otherwise be available using commercial-off-the-shelf components.

Joby Aero, Inc. (“Legacy Joby”) was incorporated in Delaware on November 21, 2016. In August 2021, Legacy Joby and Reinvent Technology Partners, a Cayman Islands exempted company and special purpose acquisition company (“RTP”), completed a merger and other transactions pursuant to which a subsidiary of RTP was merged with and into Legacy Joby

3

and Legacy Joby survived as a wholly owned subsidiary of RTP. In connection with the transactions, Legacy Joby changed its name to Joby Aviation, Inc. See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Part II, Item 8. “Financial Statements and Supplementary Data” for more information.

Our principal executive office is located at 2155 Delaware Avenue, Suite #225, Santa Cruz, CA 95060. In March 2023, we will be moving our principal executive office to 333 Encinal Street, Santa Cruz, CA 95060. Our telephone number is (831) 201-6700. Our website address is www.jobyaviation.com. The U.S. Securities and Exchange Commission (“SEC”) maintains a website at www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. We also make available, free of charge, all of our SEC filings on our website at ir.jobyaviation.com as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. The information contained on any of the websites referenced in this Annual Report on Form 10-K are not part of or incorporated by reference into this or any other report we file with or furnish to the SEC.

The Emerging Urban Air Mobility Market

Ground-Based Transportation Networks are Under Strain

Population growth and urbanization are stretching ground-based transportation infrastructure to its limits. Today, more than fifty percent of the world’s 7.8 billion people live in urban areas.

The top fifteen megacities alone are home to more than 300 million inhabitants, and the United Nations (“UN”) predicts that by 2050 the world’s urban population will grow by an additional 2.5 billion people. We expect these trends to continue for the foreseeable future, which is why we have identified New York, Los Angeles, London, south Florida and the San Francisco Bay Area as potential early launch markets for our Delta partnership. Our collaboration with companies like SK Telecom (South Korea) and ANA (Japan) will further allow access to urban centers across Asia.

Transportation is the life-blood of urban areas, and population growth combined with increased urbanization will continue to push this infrastructure to the brink. According to recent research, the cost of traffic congestion to the U.S. economy alone was more than $190 billion in 2019. The same study found that, in the top 15 metro areas alone, automobile commuters spent an aggregate of 4.69 billion hours per year in traffic congestion and burned an extra 1.83 billion gallons of fuel.

Expanding ground-based networks to address congestion and move people cost-effectively through cities has become increasingly difficult, if not impossible. The cost of transportation infrastructure has consistently outpaced inflation over the past fifty years, putting an ever-increasing strain on national, regional and municipal budgets. New light rail lines cost more than $100 million per mile in the U.S. and routinely exceed twice that number. Moving beneath the surface to expand our subway networks is even more expensive, with new subway lines often costing nearly a $1 billion per mile. These ground-based networks can’t scale efficiently, and the costs are prohibitive. We believe that cities need a new, sustainable mobility solution.

Extending the Electrification of Transportation to the Skies

Developing sustainable mobility solutions has never been more needed given the threat that climate change poses to our communities and to our planet. According to the U.S. Environmental Protection Agency (“EPA”), the top source of CO2 emissions in the U.S. is the transportation sector. Any solution to current and future transportation demands must embrace sustainability.

Over the past two decades, improvements in lithium-ion batteries and power electronics alongside the ever-increasing performance of microelectronics have enabled the development and deployment of new sustainable energy and transportation solutions. The success of electric ground vehicles has fueled continued investments in improving these technologies. Battery energy densities, in particular, have improved enough that application to aviation is now practical. Additionally,we believe that other future technologies, such as hydrogen and solid-state batteries, have the potential to play an important role in decarbonizing flight in the longer term.

We expect the electrification of transportation to accelerate and extend to the skies in the decade ahead, representing a bright spot where technology, economy and sustainability converge. Applying electrification to small aircraft unlocks new degrees of freedom in aircraft design that were not possible with traditional, combustion engines. In particular, using

4

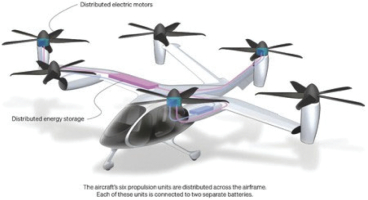

multiple small electric motors (which has been called “distributed electric propulsion”) rather than a single central engine enables a new class of quiet, safe, and economical vertical takeoff and landing aircraft that were previously not possible.

A New Type of Local Transportation Network

Deploying eVTOL aircraft through the business model of app-driven, on-demand mobility that has been validated by ridesharing companies globally will provide a revolutionary new method of daily transportation. The low noise, low operating costs and zero operating emissions enabled by the all-electric powertrain, combined with the ability to takeoff and land vertically, unlocks aerial access to urban cores. We believe this will result in a new market for high-volume aerial mobility in and around cities and the communities around them. We believe this new solution will enable people to rethink how they get around on a daily basis and provide greater freedom to choose where they call home relative to the economic, cultural and social opportunities that have historically drawn people together.

We intend to deploy our eVTOL aircraft in local aerial ridesharing networks in cities around the world. Operating point-to-point in and around cities, these new aerial networks will sidestep the major problems of cost and scale that plague ground-based networks. Fundamentally, an aerial mobility network is nodal vs. the path-based nature of ground mobility. Each new node added to the network adds connectivity to all the other nodes, whereas each new mile of road, rail, or tunnel only extends one single route by one mile. In a nodal network, a linear increase in the number of nodes leads to an exponential increase in the number of connections.

Massive Untapped Market Opportunity

We believe that deploying a new type of aerial mobility network in cities represents an extensive market opportunity that we expect to expand over time, as the megatrend of urbanization is being felt globally. In addition, the challenges associated with getting in and out of city centers can make frequent, casual travel impractical. We expect that streamlining this experience will open up previously untapped sources of latent demand, much the same way that the development of modern jetliners unlocked demand for transatlantic travel.

Leading investment banks and consulting firms have recently assessed the scale of this market. According to a 2021 report by Morgan Stanley, the urban air mobility sector's total addressable market is projected to reach $1 trillion globally by 2040. While this may initially reflect replacement of loud, carbon-fuel focused transportation with clean energy eVTOL options, we believe additional use cases and applications will emerge as the market evolves.

5

Our Business Strategy

Our Aerial Ridesharing Service

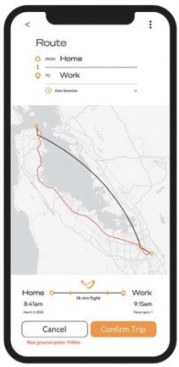

We intend to build an aerial ridesharing service powered by a network of eVTOL aircraft that we will manufacture and operate. We are developing an app-based platform that will enable consumers to book rides directly through our service. We also plan to integrate access to our service into leading third-party demand aggregation platforms, including through our partnerships with Uber and Delta Air Lines. Whether our service is accessed through our own platform, or through a partner app, we will integrate ground transportation providers for the first and last mile with our aerial service, providing a seamless travel experience.

We refer to trips that integrate air and ground legs together as ‘multimodal’. By building network management software that efficiently sequences multimodal trips, we believe we can provide substantial time savings to travelers while coordinating the development of optimally-located skyport infrastructure. Additionally, we are developing software that will coordinate multiple riders into each air leg, allowing us to drive high utilization rates for our aircraft and, in turn, progressive reduction in end-user pricing.

We believe that our app-based aerial ridesharing service will be fast, convenient, comfortable, environmentally sustainable and, over time, progressively more affordable. By maintaining full control over the design, development, test, manufacture and operations of our aircraft, we intend to deliver a service that is optimized from beginning to end, positioning us to be the leading company in this market.

Our vertically integrated business model ensures we are not simply manufacturing aircraft for sale and receiving one-time revenues, but instead generating recurring revenues over the lifetime of the aircraft with corresponding benefits to contribution margin.

The Most Capable Aircraft for Aerial Ridesharing

Our team of world-class engineers has been working for more than a decade to develop an aircraft specifically designed for aerial ridesharing. Over that period, we have built a team that is deeply committed to vertically integrated engineering, testing, prototyping and manufacturing. Developing much of the aircraft in-house has required greater up-front investment, but has also allowed us to develop systems and components that are specifically engineered for their intended application. We believe this has resulted in an aircraft with best-in-class capabilities across key performance metrics, while reducing

6

reliance on program critical third-party suppliers that add cost to the final product and risk to development and certification schedules.

When designing the aircraft, we prioritized three areas that we believe are central to unlocking high-volume aerial ridesharing: (i) safety, (ii) quiet and (iii) performance.

•Safety: By utilizing distributed electric propulsion, rather than centrally-located internal combustion engines, we’re able to deliver a fault-tolerant overall architecture for the aircraft. Each propeller is powered by two independent electric motors, each in turn driven by independent electric motor drive-units. Each drive-unit draws power from one of four separate batteries onboard the aircraft.

This emphasis on redundancy is extended to other critical subsystems of the aircraft, including the flight computers, control surfaces, communications network and actuators. The result is a design intended to have no single points of failure across aircraft systems.

While these advancements in technology contribute to the overall safety of the aircraft, we recognize that safely delivering a commercial aviation operation requires both organizational and cultural commitments. We’ve made safety a core value, and we actively promote that value across the team.

Given our intent to both manufacture and operate our aircraft, we are developing a comprehensive, vertically-integrated, Enterprise Safety Management System (“SMS”), covering aircraft, manufacturing, operations, maintenance and flight training. Through the enterprise approach, SMS interfaces will facilitate the exchange of information to continuously improve the safety of our aircraft and operations.

•Quiet: Developing an aircraft with a low noise footprint that allows for regular operations within metropolitan areas is critical to community acceptance. In addition to the benefits afforded by an all-electric powertrain, we’ve spent substantial engineering resources to reduce the noise signature of the aircraft even further. The result is an aircraft that is 100-times quieter than a twin-engine helicopter, exhibiting a noise profile in the range of 65 dBA during takeoff and landing (the noisiest configuration), roughly the volume of a normal speaking voice. In over-head flight as low as 500 feet the aircraft is near silent. We have independently validated the noise footprint of our prototype aircraft through our work with NASA.

• Performance: Our commitment to vertical integration and in-house development has allowed for optimization of systems and components across the aircraft, resulting in better energy efficiency, range, and speed than what would otherwise be available using commercial-off-the-shelf componentry. Our aircraft demonstrates energy efficiency comparable to best-in-class electric ground vehicles on a watt-hour per passenger seat mile basis across most trip distances, and greater efficiency leads to longer range. While we anticipate our average journey to be around 25 miles, we believe the expected range and speed of our aircraft will allow us to service a more diverse set of passengers and trips, resulting in greater operational flexibility and reduced operating costs.

The end result is a transformational new electric aircraft that is uniquely capable of pioneering this exciting new market - all with a minimal environmental footprint.

The innovations that we’ve produced to deliver this best-in-class performance are supported by extensive proprietary intellectual property and defended by a robust patent portfolio. Over more than a decade of development, we have generated broad fundamental patents around the architecture of our aircraft and the core technologies that enable our best-

7

in-class performance. We intend to continue to build our intellectual property (“IP”) portfolio with respect to the technologies that we develop and refine.

Certification Path

In the U.S., new aircraft designs are required to pass through the rigorous FAA design certification process, known as type certification, before the aircraft can be issued a standard airworthiness certificate to fly in the National Airspace System (“NAS”). This is an exacting process often extending over 5 or more years that requires extensive ground and in-flight testing with FAA scientists, engineers and flight test pilots across a fleet of multiple aircraft.

We consider the type certification process in five stages. Stages one to three can be considered the “definition”

phase, while stages four and five are the “implementation” phase. Progress in type certification is not always linear, meaning it is possible to make simultaneous progress in different stages on different aircraft parts or systems, depending on their maturity.

•Stage 1 - Certification Basis: The company works with the FAA to define the scope of the type certification project, reaching an agreement on what type of aircraft it being built and which set of rules and regulations will apply.

•Stage 2 - Means of Compliance: The company looks more closely at the safety rules and identifies the means of demonstrating compliance with them.

•Stage 3 - Certification Plans: The company develops a wide range of detailed certification plans stipulating which tests need to be performed for each system area in order to satisfy the means of compliance.

•Stage 4 - Testing & Analysis: The company plans, documents and completes thousands of inspections, tests and analyses in accordance with the certification plans previously drawn up in the third stage.

•Stage 5 - Show & Verify: The results of the testing are verified by the FAA. Upon successful completion of this stage, a type certification is issued.

We believe that we are further along in this type certification process than any of our direct competitors, having substantially completed two of the five stages of the certification process. We have been flying full-scale prototypes of our aircraft through the full transition flight envelope since 2017, conducting tests and gathering data. We were the first eVTOL company to sign a stage 4 certification basis (known within the industry as a G-1). The G-1 certification basis is an agreement with the FAA that lays out the specific requirements that need to be met by our aircraft for it to be certified for commercial operations. Our aircraft was originally intended to be certified in line with the FAA’s existing Part 23 requirements for Normal Category Airplanes, with special conditions introduced to address requirements specific to our unique aircraft. In May 2022, the FAA indicated that they were revisiting the decision to certify all eVTOLs under Part 23 and would, instead, require certification under the “powered lift” classification. Based on the FAA’s revised certification requirements, we signed an updated G-1 certification basis in July 2022, which was published in the federal register in November 2022. We subsequently reached 94% progress on stage two of the process, defining our Means of Compliance, and effectively marking the completion of this stage.

In addition to being the first eVTOL manufacturer to have a G-1 certification basis published in the federal register, we believe that we were also the first company developing eVTOL aircraft to receive airworthiness approval from the U.S. Air Force.

With a mature design based on more than 1,000 test flights to date, we are well on our way towards certification and are engaging with the FAA on a daily basis to perform the hard work and testing required to earn FAA type certification prior to our goal of launching our commercial passenger service in 2025.

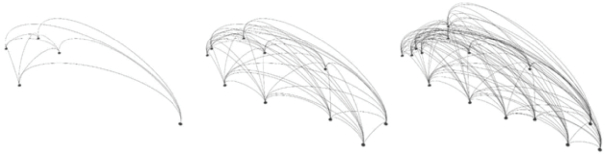

A typical flight test program takes place over several years and is centered around a process called “envelope expansion” – gradually working the aircraft through a variety of flight conditions, while incrementally increasing speed, range, altitude and other performance characteristics until the target specifications are met. In the early stages of the envelope expansion process, a successful test flight may be little more than a brief hover just a few feet off the ground. As the flight test program progresses, however, the flights become increasingly higher, faster and longer range. Accordingly, we record a successful test flight based on completion of the desired test objective, rather than a particular flight duration. Our 2.0 full-scale prototype aircraft, version 1.0 full-scale prototype aircraft and its sub-scale models have successfully progressed through the test flight program from early hovers to the transition to wing-borne flight and, finally, through a systematic progression of expanding the flight envelope. Generally, these flight tests are remotely piloted, with the aircraft controlled by a ground-based flight test pilot as a safety precaution.

8

While the number of test flights performed by our competitors is not broadly publicized, we believe that the number of successful flights, amount of time spent flight testing and the level of maturity of our flight test program compare favorably to the development and testing programs of competitive aircraft.

Our dedicated team of aerospace certification professionals is led by Didier Papadopoulos, our Head of Aircraft OEM. Previously, Didier led the team that certified the revolutionary “Autoland” feature at Garmin, winning the team the Collier Trophy which is presented annually for the “greatest achievement in aeronautics in America.” Our government and regulatory affairs team is led by Greg Bowles, who chaired the FAA Rulemaking Committee that rewrote more than 800 Part 23 regulations.

We expect the FAA type certificate will be reciprocated internationally pursuant to the bilateral agreements between the FAA and its counterpart civil aviation authorities. In 2022, we applied for aircraft certification in the United Kingdom and Japan, following announcements by regulators in those countries adopting streamlined certification processes based on FAA certification. This will provide a means of efficient international expansion as we develop commercial operations around the world.

FAA certification of new aircraft designs is hard and time consuming. There are no shortcuts, and it takes years to develop the team and the expertise needed to develop a certification basis with the FAA. While the agreement with the FAA for our G-1 certification basis has blazed a trail for others to follow, each certification basis is unique to the specific aircraft. The companies in our industry that are following our lead will also need to put in the hard work to develop the team and work independently with the FAA to solidify their own path to certification.

Capitalize on First Mover Advantage

In order to help the world connect faster and more easily with the people and places that matter most, we will need to deliver a transformational service at a price point that is economically accessible. This service has the potential to impact how often people see their families, where and how they live, work and connect, and how people spend their time. We believe that being early to market with the right aircraft will provide important first mover advantages that will enable us to steadily drive down end-user pricing in the years following commercial launch.

Emerging technologies often benefit from positive network effects as the product or service enters the market, and we expect this to hold true for aerial ridesharing. As additional passengers enter the network, utilization rates for our aircraft will increase, thereby improving unit economics and allowing costs to be amortized over a greater number of trips. At the same time, reductions in per aircraft costs driven by greater manufacturing scale can support progressively lower pricing while maintaining similar per aircraft unit profitability. A combination of these local network effects coupled with the economies of scale in manufacturing allow us to estimate that, as our services scale, we anticipate being able to offer the service at a cost of $3 per passenger mile, with opportunities to drive that end-user pricing down even further over time.

We expect this to result in a virtuous cycle. As additional passengers enter the network, we will be able to support the establishment of new routes and infrastructure, further increasing the value and utility of the service to the passengers using it. We believe this will position us to capture customer mindshare and establish a trusted, recognized brand that will keep passengers returning to the service and further reinforce these positive network effects.

Since the certification basis for new aircraft is determined on an aircraft-by-aircraft basis, the rigorous multi-year certification process requires a substantial investment of both time and capital by competitors, limiting their ability to rapidly enter the market. We believe this provides for an extended window in which to enjoy the benefits of the networks effects outlined above. The FAA certification process also requires a substantial investment of both time and capital for competitors to modify their designs or technologies to match the best-in-class performance of our aircraft. We believe this will make the first mover advantage particularly meaningful in the aerial ridesharing market.

Finally, we believe that network effects, combined with our strong engineering function, will provide a robust base for investments in next generation technologies such as autonomy and improvements in battery energy density. Accelerating the development, or otherwise capturing the benefits of improvements in these technologies will provide another lever for improving unit economics and driving down end-user pricing, precipitating the next cycle of network effects.

9

Compelling Unit Economics with Quick Payback Period

From the early design stage, we have focused on developing an aircraft that delivers compelling unit economics. First, we expect the fault-tolerant architecture of the aircraft, combined with a design intended to have no single point of failure across aircraft systems, will result in substantially lower maintenance costs and down times relative to existing aircraft. Second, with a top speed nearly double that of conventional helicopters, we will be able to deliver faster operating speeds and amortize fixed and variable costs over a greater number of passenger seat miles. Finally, by being all-electric, the aircraft operates with substantially lower fuel costs relative to conventionally fueled alternatives. These low maintenance costs, low fuel costs and high operating speeds combine to deliver an operating cost projected to be 1/4th of the cost per mile flown as a twin engine helicopter.

On a per plane basis, at a price point of $3.00 per seat mile at scale, we anticipate each aircraft will generate approximately $2.2 million of net revenue, which when combined with the all-in favorable unit cost profile, will generate approximately $1.0 million of earnings. This creates an attractive payback period of just 1.3 years for an aircraft with a projected 10-year service life, and demonstrates the compelling opportunity we have to increase scale.

Develop Partnerships to Reduce Risk

We believe that our strategic relationships provide us with another point of competitive differentiation. Across each of the important activities of high-volume manufacturing, go-to-market strategy and pre-certification operations, we have established strong collaborations and relationships with Toyota, Delta, Uber and the U.S. Government to help to de-risk our commercial strategy.

Toyota Motor Corporation

Toyota has invested nearly $400 million in Joby to date, making Toyota our largest outside investor. However, the collaboration goes beyond pure financial backing. Toyota engineers are working shoulder to shoulder with their Joby counterparts on a daily basis, collaborating on projects such as factory planning and layout, manufacturing process development and design for manufacturability.

The production volumes that we are targeting for our aircraft are closer to the volumes associated with the automotive industry than traditional aerospace manufacturing. Capturing economies of scale in both production and operations is an important component of our strategy to deliver a global mobility service that steadily drives down end-user pricing in the years following commercial launch.

We believe that our collaboration with Toyota has provided and continues to provide us with a significant competitive advantage as we design and build out our high-volume manufacturing capability. In addition to being the world’s largest automaker, Toyota is globally recognized for delivering quality, safety and reliability at scale, all of which are necessary characteristics in aerospace manufacturing. We believe this makes Toyota a strong collaboration partner as we continue to develop our high-volume manufacturing capabilities.

Uber Technologies, Inc.

We believe that our partnership with Uber Technologies, Inc. and our acquisition of Uber’s Elevate business, provides us with two important competitive advantages in our go-to-market planning and execution.

First, through our acquisition of Elevate we were able to welcome approximately 40 experienced team members from Uber, along with a set of software tools focused on planning and operations the Elevate team had developed over several years. The planning tools we acquired enable higher fidelity decision-making on market selection, infrastructure siting, demand simulation and multi-modal operations, and are supported by underlying mobility data sets that feed these software tools. The operational tools we acquired were developed to support the Uber Copter service, a multi-modal aerial ridesharing service run by Uber in late 2019 and early 2020. We also acquired a portfolio of 5 issued or allowed patents and 74 pending patent applications, many of which relate to aerial rideshare technology such as fleet and infrastructure utilization, routing, air traffic coordination, app technology, and takeoff and landing infrastructure. We believe the acquisition of Elevate positions us to make uniquely informed, data-driven decisions in the lead up to commercial launch, as well as accelerating our operational readiness.

10

Second, the collaboration agreement that we entered into with Uber at the closing of the Elevate acquisition provides for the integration of our aerial ridesharing service into the Uber app across all U.S. launch markets. In 2022, we further expanded this collaboration to include global markets. We believe this will provide a best-in-class platform to funnel demand to our aerial ridesharing service, while allowing us to reduce customer acquisition costs in the early years of commercial operations. Uber will also be reciprocally integrated into any future Joby Aviation mobile application on a non-exclusive basis to service the ground-based component of multi-modal journeys booked by customers through our application. The goal of this mutual integration is to ensure passengers can access a multi-modal travel experience, seamlessly transitioning from ground-to-air-to-ground with unified, one-click booking.

Delta Air Lines, Inc.

In October of 2022, we entered into a collaboration agreement with Delta Air Lines, Inc. (“Delta”) to develop a long-term strategic relationship for a premium airport transportation service that we plan to offer to Delta passengers in select markets through the Delta booking platform. At the same time, Delta invested $60 million through a purchase of our common stock and also received warrants which, if exercised, could expand their total investment to $200 million. We believe that our relationship with Delta, in addition to providing additional capital, will be another important method of customer acquisition when we launch our commercial passenger service, and will also provide opportunities to leverage Delta’s expertise in providing a seamless passenger experience and experience in building out infrastructure at key airports.

U.S. Air Force

In December of 2020, we became, to our knowledge, the first company to receive airworthiness approval for an eVTOL aircraft from the U.S. Air Force, and in the first quarter of 2021 we officially began on-base operations under contract pursuant to the U.S. Air Force’s Agility Prime program. Our multi-year relationship with the U.S. Air Force and other U.S. Government agencies provides us with a compelling opportunity to more thoroughly understand the operational capabilities and maintenance profiles of our aircraft in advance of commercial launch. We believe it will also provide an opportunity to test various aspects of the consumer-facing aerial ridesharing service. By operating our aircraft on U.S. military installations on a contractor-owned, contractor-operated model, we expect to gain valuable insight that will result in a more reliable service at launch.

In addition to the operational learnings, our existing contracts, which we expanded in July 2022 to include the U.S. Marine Corps., also provide for more than $75 million of payments through 2025 based upon full performance, and we are actively pursuing additional contracts and relationships that would increase these on-base operations going forward.

In addition to the strategic relationships outlined above, we continue to pursue and develop strategic partnerships with key stakeholders across the eVTOL value chain. We maintain regular dialogue with regulatory bodies and aviation authorities (domestic and international), cities and municipalities, real estate and infrastructure partners, and transportation service providers, to name a few.

Future Market Opportunities

We believe there are opportunities to address markets that are adjacent to our core mobility business, including delivery and logistics as well as emergency services. We may make select investments to address these market adjacencies over time.

We also believe that developments in advanced flight controls, battery technologies and alternative methods of energy storage could have a meaningful impact on our core mobility business. Advanced flight controls, including additional “pilot assist” features and, in time, fully-autonomous flight, may allow us to drive-down cost and lower customer pricing as well as relieve operational constraints to scaling our service. Improvements in battery technology or alternative methods of energy storage may allow us to increase the range, speed and/or payload of our vehicles, dramatically expanding the range of trips and use-cases we can serve.

We are investing, and will continue to invest, strategically in these areas to ensure that we are well-positioned to capture the benefits offered by these new developments. For example,we believe that other future technologies, such as hydrogen fuel cells or solid-state batteries, have the potential to play an important role in decarbonizing flight in the longer term and may seek to invest in or develop these opportunities as they arise.

11

Our Regulatory Strategy

Over the near-term, our priorities will include support for the FAA certification process and policy engagements with decision makers and communities.

FAA Certification Process

There can be no compromise on safety, and aircraft designed to carry people are certified against the FAA's stringent safety criteria. Our aircraft is no exception.

In contrast to non-passenger carrying drones, which have been allowed to fly without design certification provided they do not put people on the ground at risk, our business is required to comply with FAA regulations governing aircraft airworthiness and installation, production and quality systems, repair procedures and continuing operational safety. Outside the U.S., similar requirements exist for airworthiness, installation and operational approvals. These requirements are generally administered by the national aviation authorities of each country.

Design Certification

The aircraft design certification process, known as type certification, allows for the manufacture of aircraft meeting the approved design to be issued a standard airworthiness certificate in order to fly in the National Airspace System.

Our aircraft was originally intended to be certified in line with the FAA's existing Part 23 requirements as a normal category piloted electric airplane that can also takeoff and land vertically. We began working with the FAA in 2017 to establish the specific design criteria that would apply to the aircraft. In 2020 the FAA provided us with a signed, stage 4 G-1 certification basis.

The G-1 certification basis for our aircraft was built on a foundation of more than 1,000 test flights completed across various prototypes, including the world’s first transition flight of a full-scale, vectored thrust, eVTOL in 2017. Recent advances in technology allow for the majority of test flights to be remotely piloted from the ground, although short piloted hover flights of our aircraft were completed in 2020.

In May 2022, the FAA indicated that they were revisiting the decision to certify all eVTOLs under Part 23 and would, instead, require certification under the “powered lift” classification. Based on the FAA’s revised certification requirements, we signed an updated G-1 certification basis in July 2022, which was published in the federal register in November 2022. We anticipate we will initially certify the aircraft for day and night visual flight rules (“VFR”) operations and we will quickly amend the design to include instrument flight rules (“IFR”) capabilities.

To date we believe we have removed a large amount of unknown risk from the certification program through years of work with the FAA. Our path to certification leverages a majority of existing processes, procedures and standards. Our certification team has continued to progress the means of compliance (how we will show compliance) and to work on defining tests and analysis that will be utilized to prove compliance to the FAA based upon the agreed to certification basis.

Production Certification

Aviation manufacturing businesses are heavily regulated in most markets. As we ramp up production, we expect to interact with numerous U.S. government agencies and entities, including the FAA, with respect to certification of our production and quality systems. We are developing the systems and processes needed to obtain FAA production certification, and intend to obtain our production certificate shortly following completion of our aircraft type certificate.

We believe there are opportunities to leverage advanced manufacturing techniques such as additive manufacturing to further improve the performance of the aircraft. However, we also appreciate that the certification of unconventional production processes adds additional risk to our program. As a result, we have ensured that our aircraft can be produced utilizing conventional aerospace manufacturing techniques in the event additively manufactured components or other advanced production processes cannot be certified expediently.

Operating Certification

The U.S. Department of Transportation (“DOT”) and the FAA exercise regulatory authority over air transportation operations in the U.S. Our intended transportation service is expected to be regulated by the Federal Aviation Regulations,

12

including 14 Code of Federal Regulations 135 (“Part 135”). We received our Part 135 Air Carrier Certificate in 2022. Air carriers holding Part 135 operations specifications can conduct on-demand operations, which may include limited scheduled operations. If such an air carrier receives a commuter air carrier authorization from the DOT, the air carrier may provide unlimited scheduled operations as well as on-demand operations.

The FAA recently indicated that they do not expect the relevant operational regulations, or Special Federal Aviation Regulations (“SFARs”), for eVTOL aircraft to be finalized until late 2024. If the publication of the SFARs is further delayed, if the FAA requires further modifications to our existing G-1 certification basis, or if there are other regulatory changes or revisions, this could delay our ability to obtain type certification, and could delay our ability to launch our commercial passenger service.

Our operations may also be subject to certain provisions of the Communications Act of 1934 because of their extensive use of radio and other communication facilities, and we may be required to obtain an aeronautical radio license from the Federal Communications Commission (“FCC”). To the extent we are subject to FCC requirements, we will take all necessary steps to comply with those requirements.

Our operations may become subject to additional federal requirements in the future under certain circumstances. We are also subject to state and local laws and regulations at locations where we operate and may become subject to the regulations of various local authorities that operate airports we intend to operate from.

Airspace Integration

The aircraft has been designed to be operated under fixed-wing flight rules and regulations with a qualified pilot in command onboard the aircraft.

As the density of air traffic increases, we believe there are opportunities to expand ground infrastructure and create air traffic efficiencies. Over time, we anticipate the importance of working with the FAA, local authorities and other stakeholders to identify and develop procedures along high demand routes to support increased scale and operational tempo. Constructs for operating along those routes may include specific airspace corridors like those outlined by the FAA. In the long term, digital clearance deliveries, airspace authorizations and automated coordination between service providers and operators may be required to further increase airspace scalability. We expect to continue to be involved in long-term activities to develop concepts and technologies (for example those led by the National Aeronautics and Space Administration (“NASA”) and the FAA) to further enable scaling towards mature and autonomous operations.

Policy Engagements with Decision Makers & Communities

Providing a successful air transportation service requires collaboration with local communities to assure the services provide the right solutions in the right locations. We plan to grow our engagement at the state and local levels within the U.S. and with key international partners in the coming years.

While the regulation of the aircraft and its operation with the NAS falls within the purview of the FAA, takeoff and landing locations often require state and local approval for zoning and land use. In many cases, existing airports and heliports are subject to regulations by local authorities.

Noise Regulations

Our aircraft has been designed to minimize noise to allow for operations in and out of new skyports that are nearer to where people want to live and work. At our noisiest configuration, the aircraft has a noise profile in the range of 65 dBA, roughly the volume of a normal talking voice. Given our low noise profile, we do not expect our operations to be constrained to on-airport operations.

The Airport Noise and Capacity Act of 1990 recognizes the rights of operators of airports to implement noise and access restrictions so long as such programs do not interfere unreasonably with interstate or foreign commerce or the national air transportation system. In addition, states and local municipalities are able to set ordinances for zoning and land use, which may include noise or other restrictions such as curfews. Finally, foreign governments may allow airports and/or municipalities to enact similar restrictions. Accordingly, minimizing the volume and characteristics of noise within and above communities has been an important focus for us in order to drive community acceptance.

13

Intellectual Property

Our success depends in part upon our ability to protect our core technology and intellectual property. To establish and protect our proprietary rights, we rely on a combination of intellectual property rights (e.g., patents, patent applications, trademarks, copyrights, and trade secrets, including know-how and expertise) and contracts (e.g., license agreements, confidentiality and non-disclosure agreements with third parties, employee and contractor disclosure and invention assignment agreements, and other similar contractual rights).

As of January 15, 2023, we have 164 issued or allowed patents (of which 128 are U.S. filings) and 193 pending patent applications (of which 98 are U.S. filings). The patent portfolio is primarily related to eVTOL vehicle technology and UAM/aerial rideshare technology. We regularly file patent applications and from time to time acquire patents from third parties.

Our patent filings include 66 issued or allowed patents and 134 pending patent applications relating to our aircraft, its architecture, powertrain, acoustics, energy storage and distribution systems, flight control system and system resiliency, as well as certain additional aircraft configurations and technologies. Additionally, we have 98 issued or allowed patents and 30 pending patent applications related to aerial rideshare technology, such as fleet and infrastructure utilization, routing, air traffic coordination, rideshare software applications, vertiport infrastructure, and ancillary computer technologies.

Our Commitment to Environmental, Social and Governance (“ESG”) Leadership

By developing an efficient, all-electric aircraft with no operating emissions, a low noise footprint and high levels of safety, we believe we can make a meaningful contribution to tackling the dual challenges of congestion and climate change.

We are building a dedicated, diverse and inclusive workforce to achieve this goal while adhering to best practices in risk assessment, mitigation and corporate governance. We plan to report how we oversee and manage ESG factors material to our business, and also evaluate how our ESG objectives align with elements of the United Nations Sustainable Development Goals (“SDGs”) in our first ESG/sustainability report, which we expect to release in 2023.

Our ESG initiative is organized into three pillars, which, in turn, contain focus areas for our attention and action:

•Environmental - Our Environmental pillar is focused on being a good steward of the natural environment through the production and development of innovative designs that reduce resource use and energy consumption.

•Social - Our Social pillar is focused on promoting diversity, equity, and inclusion, while underpinning all of our activities with a core focus on health and safety.

•Governance - Our Governance pillar focuses on upholding our commitment to ethical business conduct, integrity, and corporate responsibility, and integrating strong governance and enterprise risk management oversight across all aspects of our business.

Our Focus on Sustainable Manufacturing and Safety

Our engineering and design standards are designed to ensure that we are operating in an efficient, safe, sustainable and compliant manner, and encourage us to be leaders in pursuing environmentally friendly production practices. Our Environmental Sustainability Team works closely with our operating units to track material inputs and outputs, to build strategies for chemical reduction and eliminations, and to review the proper handling and disposal of our materials. In 2022, we implemented two new recycling programs for the manufacturing processes. We are now able to recycle our aircraft batteries after testing or end-of-life as well as our carbon fiber scraps. We also conducted a life cycle assessment of our aircraft manufacturing and planned operational processes in order to build a reliable and transparent data set that will allow us to monitor and mitigate our emissions, waste and natural resource consumption over time.

With safety as a core value, we emphasize the importance of safety in everything that we do. This includes adherence to safety rules, best practices, and compliance. Every employee is trained in the safety policies and procedures that are relevant to their role, and we encourage all employees to participate in company-wide safety initiatives, including participating in our non-punitive safety reporting program to identify hazards and reduce risks. Employees are encouraged to own and participate in safety and we conduct regular audits to ensure proper safety procedures are being used and that hazard identification and risk assessment information is being conducted.

Given our intent to both manufacture and operate our aircraft, we are developing a comprehensive, vertically integrated, enterprise Safety Management System (“SMS”), covering aircraft, manufacturing, operations, maintenance and flight

14

training. Through the enterprise approach, SMS interfaces will facilitate the exchange of information to continuously improve the safety of our aircraft and operations.

Social and Human Capital

To achieve our goal of enabling the world to connect faster and more easily with the people and places that matter most, we will need to attract and retain employees with a diverse set of skills and perspectives as we grow our business. Many of our employees are located in highly competitive labor markets. In addition to competitive cash and equity compensation, offering employees a compelling vision and an opportunity to positively impact their communities is a key part of our strategy to grow our workforce. Additionally. we make multiple workforce investments in the communities where we operate, with programs enabling accessibility, education and training. This has multiple benefits including broadening the reach of new technologies such as electric aviation, improving awareness and social license to operate in communities, extending opportunities to underserved communities, and developing our future workforce. For example, we are working with Aviation High School in New York City to prepare the next generation of aircraft maintenance technicians and aerospace leaders for career opportunities created by the electric age of flight.

Our annual employee engagement survey captures team member feedback. The measurement model is a combination of vendor content and in-house-developed content led by our Industrial/Organizational Psychologists on the Talent Development & Analytics team. For 2022, we achieved a response rate of 85% and the survey included 72 items capturing 13 key areas of the employee experience.

As of January 31, 2023, we had 1,422 employees, with over 80% directly supporting our engineering, certification and early manufacturing operations. None of our employees are represented by a labor union. We believe we have good relationships with our employees and have not experienced any interruptions of operations due to labor disagreements.

Diversity and Inclusion

We work diligently to create a diverse, inclusive and equitable work environment. We provide equal opportunities for growth, success, promotion, learning and development, and aim to achieve parity in the way we organize, assign and manage projects. We encourage employee engagement through resource groups including Women of Joby and Joby Pride. We also host seminars to discuss gender and racial equality issues and other topics that are important to our employees. We are focused on building support across all teams and individuals, ensuring everyone has a voice, and treats each other with respect.

Competition

We believe that the primary sources of competition for our service are ground-based mobility solutions, other eVTOL developers/operators and local/regional incumbent aircraft charter services.

We believe the primary factors that will drive success in the UAM market include:

•the performance of our eVTOL aircraft relative to both competitive eVTOL aircraft and traditional aircraft;

•the ability to certify the aircraft and begin service operations in a timely manner;

•the ability to manufacture efficiently at scale;

•the ability to scale the service adequately to drive down end-user pricing;

•the ability to capture first-mover advantage, if any;

•the ability to offer services and routes that provide adequate value proposition for passengers;

•the ability to develop or otherwise capture the benefits of next generation technologies; and

•the ability to deliver products and services to a high-level of quality, reliability and safety.

While there are differentiated approaches to vehicle designs and business models, we believe that our aircraft and vertically-integrated approach offer the greatest long-term prospects to certify and produce the best aircraft to serve our customers and, in turn, to monetize the full value chain from development through operations.

15

Item 1A. Risk Factors

RISK FACTORS

In the course of conducting our business operations, we are exposed to a variety of risks. Any of the risk factors we describe below have affected or could materially adversely affect our business, financial condition, results of operations, and brand. The market price of shares of our common stock could decline, possibly significantly or permanently, if one or more of these risks and uncertainties occurs. Certain statements in “Risk Factors” are forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

Market & Service

The market for UAM has not been established with precision, is still emerging and may not achieve the growth potential we expect or may grow more slowly than expected.

The UAM market is still emerging and has not been established with precision. It is uncertain to what extent market acceptance will grow, if at all. This market is new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, new aircraft and changing consumer demands and behaviors. We intend to initially launch operations in a limited number of metropolitan areas. The success of these markets and the opportunity for future growth in these markets may not be representative of the potential market for UAM in other metropolitan areas. Our success will depend to a substantial extent on regulatory approval and availability of eVTOL technology, as well as the willingness of commuters and travelers to widely adopt air mobility as an alternative to ground transportation. If the public does not perceive UAM as beneficial, or chooses not to adopt UAM then the market for our offerings may not develop, may develop more slowly than we expect or may not achieve the growth potential we expect. As a result, the number of potential passengers using our services cannot be predicted with any degree of certainty, and we cannot assure you that we will be able to operate in a profitable manner in any of our targeted markets. Any of the foregoing could materially adversely affect our business, financial condition and results of operations.

There may be reluctance by consumers to adopt this new form of mobility, or unwillingness to pay our projected prices.

Our growth is highly dependent upon consumer adoption of an entirely new form of mobility offered by eVTOL aircraft and the UAM market. If consumers do not adopt this new form of mobility or are not willing to pay the prices we project for our services, our business may never materialize.

Our success in a given market will depend on our ability to develop a service network that provides passengers significant time savings when compared with alternative modes of transportation and accurately assess and predicts passenger demand and price sensitivity, which may fluctuate based on a variety of factors, including general economic conditions, quality of service, negative publicity, safety incidents, perceived political or geopolitical affiliations, or general dissatisfaction with our services. If we fail to attract passengers, deliver sufficient value to our passengers, or accurately predict demand and price sensitivity, it would harm our financial performance and our competitors’ products may achieve greater market adoption and may grow at a faster rate than our service.

We may not be able to launch our aerial ridesharing service beginning in 2025, as currently projected.

We will need to address significant regulatory, political, operational, logistical, and other challenges in order to launch our aerial ridesharing service. We do not currently have infrastructure in place to operate the service and such infrastructure may not be available or may be occupied on an exclusive basis by competitors. We also have not yet received FAA certification of our aircraft or other required airspace or operational authority and approvals, which are essential to operate our service, and for aircraft production and operation.

Our pre-certification operations may also reveal issues with our aircraft, which could result in certification delays. For example, in February 2022, one of our remotely piloted, experimental prototype aircraft was involved in an accident during flight testing. We are jointly investigating the accident with the FAA and National Transportation Safety Board (“NTSB”). At this time, we do not expect the accident to have a significant impact on our business operations or certification timing. Any delay in the financing, design, manufacture and commercial release of our aircraft, which are often experienced by aircraft manufacturers, could materially damage our brand, business, prospects, financial condition and operating results. If

16

we are not able to overcome these challenges, our business, prospects, operating results and financial condition will be negatively impacted and our ability to grow our business will be harmed.

We may be unable to effectively build a customer-facing business or app.

We have not yet developed the application through which users will book trips. We may experience difficulty in developing the applications necessary to operate the business, including the customer-facing application. The software underlying the application will be complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after the code has been released. The third-party software that we incorporate into our platform may also be subject to errors or vulnerabilities. Any errors or vulnerabilities, whether in our proprietary code or any third-party software on which we rely, could result in negative publicity, a loss of users or revenue, access or other performance issues, security incidents, or other liabilities. Such vulnerabilities could also prevent passengers from booking flights, which would adversely affect our passenger utilization rates, or disrupt communications within the Company (e.g., flight schedules or passenger manifests), which could affect our performance. We may need to expend significant financial and development resources to address any errors or vulnerabilities. Any failure to timely and effectively resolve any such errors or vulnerabilities could adversely affect our business, financial condition and results of operations as well as negatively impact our reputation or brand.

We may be unable to reduce end-user pricing at rates sufficient to drive expected growth for our service.

We may not be able to reduce end-user pricing over time to increase demand, address new market segments and develop a significantly broader customer base. We expect that our initial end-user pricing may be most attractive to relatively affluent consumers, and we will need to address new markets and expand our customer base in order to further grow our business. In particular, we intend for our aerial ridesharing service to be economically accessible to a broad segment of the population and appeal to the customers of ground-based ridesharing services, taxis, and other methods of transportation.

Reducing end-user pricing is dependent on accurately estimating the unit economics of our aircraft and the corresponding service. Our estimates rely, in part, on future technology advancements, such as aerial and ground-based autonomy. If our estimates are inaccurate regarding factors such as production volumes, utilization rates, demand elasticity, operating conditions, deployment volumes, production costs, indirect cost of goods sold, landing fees, charging fees, electricity availability and/or other operating expenses, or if technology such as aerial and ground-based autonomy fails to develop, mature or be commercially available within the periods we expect, we may be unable to offer our service at pricing that is sufficiently compelling to bring about the local network effects that we are predicting and may have an adverse impact on our business, financial condition and results of operations.

Our competitors may commercialize their technology before us, or we may not be able to fully capture the first mover advantage that we anticipate.

While we believe we are well positioned to be first to market with an eVTOL piloted aerial ridesharing service, we expect this industry to be increasingly competitive and our competitors could get to market before or at the same time as us, either generally or in specific markets. Even if we are first to market, we may not fully realize the benefits we anticipate, and we may not receive any competitive advantage or may be overcome by other competitors. If new or existing companies launch competing solutions in the markets in which we intend to operate and obtain large scale capital investment, we may face increased competition. Additionally, our competitors may benefit from our efforts in developing consumer and community acceptance for eVTOL aircraft and aerial ridesharing, making it easier for them to obtain the permits and authorizations required to operate an aerial ridesharing service.

Many of our current and potential competitors are larger and have substantially greater resources than we have and expect to have in the future, which may allow them to devote greater resources to the development, certification and marketing of their products and services or to offer lower prices. Our competitors may also establish strategic relationships amongst themselves or with third parties that may further enhance their resources and offerings. Some have more experience in the aerospace industry than we have, and foreign competitors could benefit from subsidies or other protective measures offered by their home countries. If our competitors commercialize their technology before us, or if we do not capture the first mover advantage that we anticipate, it may harm our business, financial condition, operating results and prospects.

17

We may be unable to make our service sufficiently convenient to drive customer adoption.

Our service will depend, in part, on third-party ground operators to take customers from their origin to their departure skyport and from their arrival skyport to their ultimate destination. While we expect to be able to integrate these third-party ground operators into our service, we cannot guarantee that we will be able to do so effectively, at prices that are favorable to us, or at all. We do not intend to own or operate the ground portion of our multimodal service. Our business and our brand will be affiliated with these third-party ground operators, and we may experience harm to our reputation if they suffer from financial instability, poor service, negative publicity, accidents, or safety incidents which could have an adverse impact on our business, financial condition and results of operations.

Our reputation may be harmed by the broader industry, and customers may not differentiate our services from our competitors.

Passengers and other stakeholders may not differentiate between us and the broader aviation industry or, more specifically, the UAM service industry. If other participants in this market have problems such as safety, technology development, engagement with certification authorities or other regulators, community engagement, security, data privacy, flight delays, or customer service, such problems could impact the public perception of the entire industry, including our business. We may fail to adequately differentiate our brand, our services and our aircraft from others in the market which could impact our ability to attract passengers or engage with other key stakeholders and have an adverse impact on our business, financial condition and results of operations.

Our prospects may be adversely affected by changes in consumer preferences, discretionary spending and other economic conditions that affect demand for our services, including changes resulting from the COVID-19 pandemic.