Delaware |

6770 |

98-1548118 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Jack Sheridan, Esq. Ryan J. Maierson, Esq. Benjamin A. Potter, Esq. Brian D. Paulson, Esq. Saad Khanani, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 |

Kate DeHoff General Counsel Joby Aviation, Inc. 2155 Delaware Avenue, Suite #225 Santa Cruz, CA 95060 (831) 426-3733 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

| | ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per security |

Proposed maximum aggregate offering price |

Amount of registration fee | ||||

| Common stock (1)(2) |

98,357,200 |

$8.86 (3) |

$871,444,792.00 |

$80,782.94 | ||||

| Total |

$871,444,792.00 |

$80,782.94 | ||||||

| | ||||||||

| | ||||||||

(1) |

Pursuant to Rule 416(a) of the Securities Act, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

(2) |

The number of shares of common stock being registered represents 98,357,200 shares of common stock issued to certain stockholders of Joby Holdings, Inc. in connection with the Joby Holdings Reorganization. |

(3) |

Estimated solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the common stock of Joby Aviation, Inc. (on the New York Stock Exchange (the “NYSE”) on October 22, 2021 (such date being within five business days of the date that this registration statement was first filed with the SEC). This calculation is in accordance with Rule 457(c) of the Securities Act. |

Page |

||||

ii |

||||

iii |

||||

iv |

||||

viii |

||||

1 |

||||

9 |

||||

31 |

||||

32 |

||||

33 |

||||

44 |

||||

59 |

||||

77 |

||||

84 |

||||

94 |

||||

97 |

||||

98 |

||||

105 |

||||

115 |

||||

116 |

||||

119 |

||||

119 |

||||

119 |

||||

F-1 |

||||

| • | “2021 Plan” are to the Joby Aviation, Inc. 2021 Incentive Award Plan; |

| • | “Business Combination” are to the Domestication together with the RTP Merger; |

| • | “Closing” are to the closing of the Business Combination on August 10, 2021; |

| • | “Code” are to the Internal Revenue Code of 1986, as amended; |

| • | “Company,” “we,” “us” and “our” are to Joby Aviation, Inc.; |

| • | “DGCL” are to the General Corporation Law of the State of Delaware; |

| • | “Domestication” are to the domestication of Reinvent Technology Partners as a corporation incorporated in the State of Delaware; |

| • | “ESPP” are to our 2021 Employee Stock Purchase Plan attached to this prospectus as Annex G; |

| • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| • | “Exchange Ratio” are to the quotient obtained by dividing (i) 500,000,000 by (ii) the aggregate — fully diluted number of shares of Joby common stock issued and outstanding immediately prior to the RTP Merger (which is the aggregate number of shares of Joby common stock (a) issued and outstanding immediately prior to the RTP Merger after giving effect to the exercise of the Joby Warrants, (b) issuable upon the conversion of the Joby preferred stock immediately prior to the RTP Merger in accordance with Joby’s organizational documents, (c) issuable upon, or subject to, the exercise of Joby Options (whether or not then vested or exercisable) that are outstanding immediately prior to the RTP Merger, assuming net settlement, or (d) subject to Joby RSUs (whether or not then vested) that are outstanding immediately prior to the RTP Merger), excluding shares of Joby capital stock issuable pursuant to the Note Conversion; |

| • | “First Merger” are to the merger of JA Holdings Acquisition Corp. with and into Joby Holdings, Inc., with Joby Holdings, Inc., surviving the merger as a wholly owned subsidiary of Joby Aviation; |

| • | “Founder Shares” are to the RTP Class B ordinary shares purchased by the Sponsor in a private placement prior to the initial public offering; |

| • | “GAAP” are to accounting principles generally accepted in the United States of America; |

| • | “HSR Act” are to the Hart-Scott-Rodino |

| • | “In-Q-Tel In-Q-Tel, |

| • | “initial public offering” are to RTP’s initial public offering that was consummated on September 21, 2020; |

| • | “IPO registration statement” are to the Registration Statement on Form S-1 (333-248497) filed by RTP in connection with its initial public offering, which became effective on September 16, 2020; |

| • | “JOBS Act” are to the Jumpstart Our Business Startups Act of 2012; |

| • | “Joby Aviation common stock” are to shares of Joby Aviation common stock, par value $0.0001 per share; |

| • | “Joby Aviation, Inc.” are to RTP after the Domestication and its name change from Reinvent Technology Partners; |

| • | “Joby Aviation Options” are to options to purchase shares of Joby Aviation common stock; |

| • | “Joby Aviation RSU Awards” are to awards of restricted stock units based on shares of Joby Aviation common stock; |

| • | “Joby Awards” are to Joby Options and Joby RSUs; |

| • | “Joby capital stock” are to shares of Joby common stock and Joby preferred stock; |

| • | “Joby common stock” are to shares of Joby common stock, par value $0.00001 per share; |

| • | “Joby Equityholder Approval” are to the adoption of the Merger Agreement and approval of the transactions contemplated thereby, including the RTP Merger, by the affirmative vote or written consent of the holders of at least (i) a majority of the outstanding shares of Joby capital stock and (ii) 60% of the outstanding shares of Joby preferred stock, voting as a single class on an as-converted basis; |

| • | “Joby Holdings Reorganization” are to the First Merger and Second Merger, taken together as an integrated transaction; |

| • | “Joby Options” are to options to purchase shares of Joby common stock; |

| • | “Joby PIPE Investor” are to a PIPE Investor that is a holder of shares of Joby capital stock or securities exercisable for or convertible into Joby capital stock as of the date of the Merger Agreement and not a Sponsor Related PIPE Investor; |

| • | “Joby preferred stock” are to the Series Seed-1 preferred stock, Series Seed-2 preferred stock, Series A preferred stock, Series B preferred stock and Series C preferred stock of Joby; |

| • | “Joby RSU Awards” are to awards of restricted stock units based on shares of Joby common stock; |

| • | “Joby Stockholders” are to the stockholders of Joby and holders of Joby Awards prior to the Business Combination; |

| • | “Joby Warrants” are to the SVB Warrants and the In-Q-Tel |

| • | “Merger Agreement” are to the Agreement and Plan of Merger, dated as of February 23, 2021, by and among RTP, RTP Merger Sub and Joby, as amended and modified from time to time; |

| • | “Note Conversion” are to the automatic conversion of the Uber Note into a number of shares of Joby capital stock in accordance with its terms; |

| • | “NYSE” are to the New York Stock Exchange; |

| • | “ordinary shares” are to the RTP Class A ordinary shares and the RTP Class B ordinary shares, collectively; |

| • | “Organizational Documents” are to the Certificate of Incorporation and the Bylaws; |

| • | “Person” are to any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind; |

| • | “PIPE Investment” are to the purchase of shares of Joby Aviation common stock by the PIPE Investors pursuant to the Subscription Agreements, for a total aggregate purchase price of up to $835,000,000; |

| • | “PIPE Investors” are to those certain third-party investors, Joby Stockholders and affiliates of the Sponsor participating in the PIPE Investment pursuant to the Subscription Agreements; |

| • | “pro forma” are to giving pro forma effect to the Business Combination; |

| • | “public shareholders” are to holders of public shares, whether acquired in RTP’s initial public offering or acquired in the secondary market; |

| • | “public shares” are to the RTP Class A ordinary shares (including those that underlie the units) that were offered and sold by RTP in its initial public offering and registered pursuant to the IPO registration statement or the shares of our common stock issued as a matter of law upon the conversion thereof at the time of the Domestication, as context requires; |

| • | “Public Warrants” are to the redeemable warrants (including those that underlie the units) that were offered and sold by RTP in its initial public offering and registered pursuant to the IPO registration statement or the redeemable warrants of Joby Aviation issued as a matter of law upon the conversion thereof at the time of the Domestication, as context requires; |

| • | “Public Warrant Holders” are to holders of Public Warrants, whether acquired in RTP’s initial public offering or acquired in the secondary market; |

| • | “redemption” are to each redemption of public shares for cash pursuant to the Cayman Constitutional Documents and the Organizational Documents; |

| • | “Registration Statement” are to the registration statement of which this prospectus forms a part; |

| • | “Reinvent Capital” are to Reinvent Capital LLC; |

| • | “Reorganization Agreement” are to the Reorganization Agreement, dated October 25, 2021, by and among the Company, Joby Holdings and Holdings Merger Sub, as amended and modified from time to time; |

| • | “RTP” are to Reinvent Technology Partners prior to the Domestication; |

| • | “RTP Class A ordinary shares” are to RTP’s Class A ordinary shares, par value $0.0001 per share; |

| • | “RTP Class B ordinary shares” are to RTP’s Class B ordinary shares, par value $0.0001 per share; |

| • | “RTP Merger” are to the merger of RTP Merger Sub with and into Joby, with Joby surviving the merger as a wholly owned subsidiary of Joby Aviation; |

| • | “RTP Merger Sub” are to RTP Merger Sub Inc., a former Delaware corporation and wholly owned subsidiary of RTP; |

| • | “RTP units” and “units” are to the units of RTP, each unit representing one RTP Class A ordinary share and one-fourth of one redeemable warrant to acquire one RTP Class A ordinary share, that were offered and sold by RTP in its initial public offering and registered pursuant to the IPO registration statement (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof); |

| • | “Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002; |

| • | “SEC” are to the United States Securities and Exchange Commission; |

| • | “Second Merger” are to the merger of Joby Holdings with and into Joby Aviation, Inc. with Joby Aviation, Inc. surviving the merger; |

| • | “Securities Act” are to the Securities Act of 1933, as amended; |

| • | “Sponsor” are to Reinvent Sponsor LLC, a Cayman Islands limited liability company; |

| • | “Sponsor Agreement” are to that certain Sponsor Agreement, dated as of February 23, 2021, by and among the Sponsor, RTP and Joby, as amended and modified from time to time; |

| • | “Sponsor Related PIPE Investors” are to Reinvent Technology SPV I LLC, which is an administrative special purpose vehicle managed by Michael Thompson solely to invest in the PIPE Investment, and Reinvent Capital Fund LP, an investment fund co-founded by Reid Hoffman, Mark Pincus and Michael Thompson (together, in each case, with their permitted transferees); |

| • | “Sponsor Support Agreement” are to that certain Sponsor Support Agreement, dated as of February 23, 2021, by and among the Sponsor, RTP, the directors and officers of RTP, and Joby, as amended and modified from time to time; |

| • | “Subscription Agreements” are to the subscription agreements pursuant to which the PIPE Investment will be consummated; |

| • | “Super 8-K” are to the Current Report on Form 8-K to be filed in accordance with the requirements of the Exchange Act and in connection with the transactions contemplated by the Merger Agreement; |

| • | “SVB Warrants” are to the Warrant to Purchase Common Stock, by and between Joby and Silicon Valley Bank, dated as of March 29, 2017, and the Warrant to Purchase Common Stock, by and between Joby and Silicon Valley Bank, dated as of May 2, 2018, in each case, as amended on February 16, 2021; |

| • | “Treasury Regulations” are to the regulations promulgated under the Code by the United States Department of the Treasury (whether in final, proposed or temporary form), as the same may be amended from time to time; |

| • | “trust account” are to the trust account established at the consummation of RTP’s initial public offering at Morgan Stanley & Co. LLC and maintained by Continental Stock Transfer & Trust Company, acting as trustee; |

| • | “Uber Note” are to the Convertible Promissory Note, issued by Joby to Uber Technologies, Inc., dated as of January 11, 2021; |

| • | “Uber Note Principal Amount” are to $75,000,000; |

| • | “Warrant Agreement” are to the Warrant Agreement, dated as of September 16, 2020, by and between RTP and Continental Stock Transfer & Trust Company, as warrant agent; and |

| • | “warrants” are to the Public Warrants and the private placement warrants. |

| • | our public securities’ potential liquidity and trading; |

| • | our ability to raise financing in the future; |

| • | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| • | the impact of the regulatory environment and complexities with compliance related to such environment; |

| • | factors relating to our business, operations and financial performance, including: |

| • | the impact of the COVID-19 pandemic; |

| • | our ability to maintain an effective system of internal controls over financial reporting; |

| • | our ability to grow market share in our existing markets or any new markets we may enter; |

| • | our ability to respond to general economic conditions; |

| • | our ability to manage our growth effectively; |

| • | our ability to achieve and maintain profitability in the future; |

| • | our ability to access sources of capital to finance operations and growth; |

| • | the success of our strategic relationships with third parties; and |

| • | other factors detailed under the section entitled “Risk Factors.” |

| • | Safety : |

| • | Noise: |

| • | Performance : in-house development has allowed for optimization of systems and components across the aircraft, resulting in better energy efficiency, range, and speed than what would otherwise be available using commercial-off-the-shelf |

| • | Our success depends on the growth of the market for Urban Air Mobility and upon the willingness of consumers to adopt aerial ridesharing services; |

| • | We may not be able to launch its aerial ridesharing service beginning in 2024, as currently projected; |

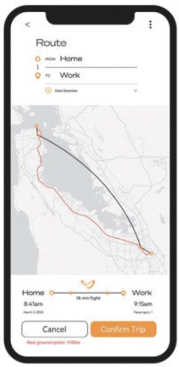

| • | We may not be able to effectively build a customer-facing business or app; |

| • | We may not be able to reduce end-user pricing over time at rates sufficient to stimulate demand and drive expected growth for its aerial ridesharing service; |

| • | We may not be able to capture its first mover advantage if its competitors commercialize their technology first; |

| • | We may not be able to secure or effectively integrate first and last mile ground mobility into our aerial ridesharing service, or otherwise make the service sufficiently convenient to drive customer adoption; |

| • | Risk that homogeneity in broader industry may impact customer perception of us and our reputation; |

| • | Demand for our services may be affected by changes in consumer preferences, discretionary spending and other economic conditions; |

| • | Potential aircraft underperformance or defects or inability to produce aircraft in the volumes projected or on the timelines projected, which anticipate commercialization beginning in 2024; |

| • | Potential material adverse impact of crashes, accidents or incidents of eVTOL aircraft or involving lithium batteries involving us or our competitors; |

| • | We depends on suppliers and service partners for the parts and components in our aircraft and for operational needs; |

| • | We may not be able to obtain relevant regulatory approvals for the commercialization of its aircraft or operation of its mobility service; |

| • | There may be regulatory disagreements regarding integrating its service into the National Airspace System without changes to existing regulations and procedures and potential inability to comply if changes are needed; |

| • | We may face an increase in operating costs and resulting service delays and disruptions if there are changes government regulation imposing additional requirements and restrictions on its operations; |

| • | Risks related to the U.S. Department of Transportation regulation of the terms of sale of our air transportation services; |

| • | We may face cost increases resulting from security regulation; |

| • | Risks related to potential unfavorable changes in U.S. export and import control laws and regulations; |

| • | We may not be able to secure contracts or continue to grow our relationship with the U.S. government and the Department of Defense, limiting its ability to operate prior to receiving FAA certification of airworthiness; |

| • | Risk that the U.S. government may modify, curtail or terminate one or more of our contracts; |

| • | Risks related to unauthorized use by third parties of Joby Aviation’s intellectual property; |

| • | Conflicts may arise between us and our strategic partners; |

| • | Natural disasters, permitting or other external factors affecting operations of Joby Aviation’s facilities; |

| • | We have a history of operating losses and may not be able to generate sufficient revenue to achieve and sustain profitability. |

| • | Risk of any material disruption in our information systems; |

| • | If we are unable to and maintain adequate facilities and infrastructure, including securing access to key infrastructure such as airports, we may not be able to offer useful services; |

| • | The shortage of pilots and mechanics may impact our operating costs and its ability to deploy service at scale; |

| • | Risks associated with weather, climate change, natural disasters, outbreaks and pandemics, regulatory conditions and other external factors; |

| • | Significant expenditures in capital improvements and operating expenses to develop and maintain a skyport network to support a high-volume service; |

| • | We depend on the continued services of our senior management team and other highly skilled personnel, and the loss of one or more key employees or an inability to attract and retain highly skilled employees could harm our business. |

| • | changes in the industries in which we and our customers operate; |

| • | developments involving our competitors; |

| • | changes in laws and regulations affecting our business; |

| • | variations in our operating performance and the performance of our competitors in general; |

| • | actual or anticipated fluctuations in our quarterly or annual operating results; |

| • | publication of research reports by securities analysts about us or our competitors or our industry; |

| • | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| • | actions by stockholders, including the sale by the Third Party PIPE Investors of any of their shares of our common stock; |

| • | additions and departures of key personnel; |

| • | commencement of, or involvement in, litigation involving our company; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of shares of our common stock available for public sale; and |

| • | general economic and political conditions, such as the effects of the COVID-19 outbreak, recessions, interest rates, local and national elections, fuel prices, international currency fluctuations, corruption, political instability and acts of war or terrorism. |

| • | the (a) historical audited financial statements of RTP as of December 31, 2020 and for the period from July 3, 2020 through December 31, 2020 and (b) historical unaudited condensed financial statements of RTP as of and for the six months ended June 30, 2021; |

| • | the (a) historical audited consolidated financial statements of Joby as of and for the year ended December 31, 2020 and (b) historical unaudited condensed consolidated financial statements of Joby as of and for the six months ended June 30, 2021; and |

| • | other information relating to RTP and Joby included in this prospectus and incorporated by reference, including the Business Combination Agreement and the description of certain terms thereof set forth under the section entitled “The Business Combination” herein |

| • | RTP will change its jurisdiction of incorporation from the Cayman Islands to the State of Delaware; |

| • | RTP entered into the Merger Agreement with RTP Merger Sub and Joby, pursuant to which, among other things, following the Domestication, (i) RTP Merger Sub will merge with and into Joby, the separate corporate existence of RTP Merger Sub will cease and Joby will be the surviving corporation and a wholly owned subsidiary of RTP, and RTP will be renamed Joby Aviation, Inc.; |

| • | Upon the consummation of the RTP Merger, Joby’s equityholders will receive or have the right to receive an aggregate of 500,000,000 shares of Joby Aviation common stock (at a deemed value of $10.00 per share), which, in the case of Joby Awards, will be shares underlying awards based on Joby Aviation common stock, representing a pre-transaction equity value of Joby of $5.0 billion (such total number of shares of Joby Aviation common stock, the “Aggregate Merger Consideration”). Accordingly, an estimated 468,837,874 shares of Joby Aviation common stock will be immediately issued and outstanding, based on Joby’s capital stock balance as of August 3, 2021 and |

| • | An estimated 22,487,113 shares will be reserved for the potential future issuance of Joby Aviation common stock upon the exercise of Joby Aviation Options and an estimated 10,204,260 shares will be reserved for the potential future issuance of Joby Aviation common stock upon the settlement of Joby Aviation RSU Awards based on the following transactions contemplated by the Merger Agreement; |

| • | the conversion of all outstanding Joby Options into options exercisable for shares of Joby Aviation common stock with the same terms except for the number of shares exercisable and the exercise price, each of which will be adjusted using the Exchange Ratio; |

| • | the conversion of all outstanding Joby RSU Awards into awards of restricted stock units based on shares of Joby Aviation common stock with the same terms, except the number of restricted stock units comprising the award will be adjusted using the Exchange Ratio; |

| • | Joby Aviation will issue 7,716,780 shares of Joby Aviation common stock to the holder of the Uber Note (the Uber Note will automatically be converted into a number of shares of Joby capital stock immediately prior to the RTP Merger, which will be cancelled and converted into the right to receive such 7,716,780 shares of Joby Aviation common stock based on the Exchange Ratio); |

| • | Joby Aviation will issue and sell 83,500,000 shares of Joby Aviation common stock at $10.00 per share to the PIPE Investors pursuant to the PIPE Investment; and |

| • | 17,130,000 shares of Joby Aviation common stock issued as a result of conversion of 17,130,000 Class B ordinary shares of RTP owned by the Sponsor in the Domestication will be immediately subject to the certain vesting provisions (such shares further referred to as “Sponsor Shares”). |

Pro Forma Combined |

||||||||

Number of Shares |

Percentage of Outstanding Shares |

|||||||

| Joby Aviation Stockholders (1) |

486,654,654 | 80.59 | ||||||

| RTP’s public shareholders |

26,583,290 | 4.40 | ||||||

| Sponsor, its related parties and RTP independent directors (2) |

28,750,000 | 4.76 | ||||||

| Third Party PIPE Investors |

61,900,000 | 10.25 | ||||||

| |

|

|

|

|||||

| Total |

603,887,944 | 100.00 | ||||||

| |

|

|

|

|||||

| (1) | Includes (a) 468,837,874 shares expected to be issued to existing Joby common and preferred shareholders (including holders of the Joby Warrants, which will convert into Joby capital stock immediately prior to the |

| Business Combination), 8,797,780 shares of which are subject to repurchase related to early exercised stock options and unvested restricted stock awards (of which restricted stock awards are 492,650), (b) 10,100,000 shares subscribed for by the Joby PIPE Investors and (c) 7,716,780 shares expected to be issued to the holder of the Uber Note. These share amounts may not sum due to rounding. |

| (2) | Includes 17,130,000 shares held by the Sponsor (the “Sponsor Shares”) (assuming such shares were fully vested), 11,500,000 shares subscribed for by the Sponsor Related PIPE Investors and 120,000 shares held by the current independent directors of RTP. The Sponsor Shares are subject to a vesting schedule with 20% of the Sponsor Shares vesting in tranches when the VWAP of the Joby Aviation common stock is greater than $12.00, $18.00, $24.00, $32.00 and $50.00 for any 20 trading days within a period of 30 trading days. After 10 years following the Closing, the Sponsor agrees to forfeit any Sponsor Shares which have not yet vested. |

Joby Aero, Inc. (Historical) |

Reinvent (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 44,264 | $ | 479 | $ | 690,046 | B |

$ | 1,064,803 | |||||||||||

| (239 | ) | C |

||||||||||||||||||

| (24,150 | ) | D |

||||||||||||||||||

| 835,000 | E |

|||||||||||||||||||

| (8,469 | ) | P |

||||||||||||||||||

| (47,931 | ) | O |

||||||||||||||||||

| (424,197 | ) | H |

||||||||||||||||||

| Short term marketable securities |

375,210 | — | — | 375,210 | ||||||||||||||||

| Other receivables |

3,920 | — | — | 3,920 | ||||||||||||||||

| Prepaid expenses and other current assets |

7,113 | 353 | — | 7,466 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

430,507 | 832 | 1,020,060 | 1,451,399 | ||||||||||||||||

| Investments held in Trust account |

— | 690,046 | (690,046 | ) | B |

— | ||||||||||||||

| Equity method investment |

13,097 | — | — | 13,097 | ||||||||||||||||

| Restricted cash |

762 | — | — | 762 | ||||||||||||||||

| Property and equipment, net |

41,552 | — | — | 41,552 | ||||||||||||||||

| Intangible assets |

14,779 | — | — | 14,779 | ||||||||||||||||

| Deferred offering costs |

5,170 | — | (5,170 | ) | S |

— | ||||||||||||||

| Goodwill |

4,880 | — | — | 4,880 | ||||||||||||||||

| Other non-current assets |

55,330 | — | — | 55,330 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total Assets |

$ | 566,077 | $ | 690,878 | $ | 324,844 | $ | 1,581,799 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY (DEFICIT) |

||||||||||||||||||||

| Current liabilities: |

||||||||||||||||||||

| Accounts payable |

5,531 | 241 | (1,280 | ) | O |

4,265 | ||||||||||||||

| (227 | ) | P |

||||||||||||||||||

| Accrued expenses and other current liabilities |

5,875 | 875 | 44,382 | M |

4,120 | |||||||||||||||

| (46,651 | ) | O |

||||||||||||||||||

| (361 | ) | P |

||||||||||||||||||

| Capital leases, current portion |

415 | — | — | 415 | ||||||||||||||||

| Deferred rent, current portion |

340 | — | — | 340 | ||||||||||||||||

| Debt, current |

254 | — | — | 254 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

12,415 | 1,116 | (4,137 | ) | 9,394 | |||||||||||||||

| Deferred legal fees |

— | 239 | (239 | ) | C |

— | ||||||||||||||

| Debt, noncurrent |

77,113 | — | (76,296 | ) | K |

817 | ||||||||||||||

| Deferred rent, net of current portion |

1,136 | — | 1,136 | |||||||||||||||||

| Deferred underwriting commissions |

— | 24,150 | (24,150 | ) | D |

— | ||||||||||||||

| Derivative liability |

— | — | 149,939 | F |

149,939 | |||||||||||||||

| Derivative warrant liabilities |

— | 56,315 | 56,315 | |||||||||||||||||

| Capital leases, net of current portion |

1,529 | — | 1,529 | |||||||||||||||||

| Warrant liability |

627 | — | (627 | ) | R |

— | ||||||||||||||

| Stock repurchase liability |

1,022 | — | 1,022 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

93,842 | 81,820 | 44,490 | 220,152 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

Joby Aero, Inc. (Historical) |

Reinvent (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| Commitments and contingencies |

||||||||||||||||||||

| Redeemable convertible preferred stock — subject to possible redemption |

845,931 | — | (845,931 | ) | L |

— | ||||||||||||||

| Common shares subject to possible redemption |

— | 604,058 | (604,058 | ) | A |

— | ||||||||||||||

| Stockholders’ equity (deficit): |

||||||||||||||||||||

| Common Stock |

— | 8 | E |

61 | ||||||||||||||||

| 9 | G |

|||||||||||||||||||

| 34 | L |

|||||||||||||||||||

| 13 | J |

|||||||||||||||||||

| (4 | ) | I |

||||||||||||||||||

| 1 | K |

|||||||||||||||||||

| Class A Common Stock |

— | 1 | 6 | A |

— | |||||||||||||||

| (7 | ) | G |

||||||||||||||||||

| (4 | ) | H |

||||||||||||||||||

| 4 | I |

|||||||||||||||||||

| Class B Common Stock |

— | 2 | (2 | ) | G |

— | ||||||||||||||

| Joby Aero Common Stock |

— | — | — | J |

— | |||||||||||||||

| — | N |

|||||||||||||||||||

| Additional paid-in capital |

28,845 | 27,466 | 604,052 | A |

1,764,999 | |||||||||||||||

| (149,939 | ) | F |

||||||||||||||||||

| 834,992 | E |

|||||||||||||||||||

| (44,382 | ) | M |

||||||||||||||||||

| — | N |

|||||||||||||||||||

| (30,350 | ) | Q |

||||||||||||||||||

| 845,897 | L |

|||||||||||||||||||

| (13 | ) | J |

||||||||||||||||||

| (424,193 | ) | H |

||||||||||||||||||

| 77,167 | K |

|||||||||||||||||||

| 627 | R |

|||||||||||||||||||

| (5,170 | ) | S |

||||||||||||||||||

| Accumulated other comprehensive income (loss) |

256 | — | — | 256 | ||||||||||||||||

| Retained Earnings (Accumulated deficit) |

(402,797 | ) | (22,469 | ) | 30,350 | Q |

(403,669 | ) | ||||||||||||

| (7,881 | ) | P |

||||||||||||||||||

| (872 | ) | K |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total stockholders’ equity (deficit) |

(373,696 | ) | 5,000 | 1,730,343 | 1,361,647 | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities, redeemable convertible preferred stock and stockholders’ equity (deficit) |

$ | 566,077 | $ | 690,878 | $ | 324,844 | $ | 1,581,799 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

Year Ended December 31, 2020 |

For the Period from July 3, 2020 (inception) through December 31, 2020 |

|||||||||||||||||||

Joby Aero, Inc. (Historical) |

Reinvent (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

$ | 108,741 | $ | — | $ | — | $ | 108,741 | ||||||||||||

| Selling, general and administrative |

23,495 | 1,105 | 7,881 | P |

32,481 | |||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

132,236 | 1,105 | 7,881 | 141,222 | ||||||||||||||||

| Loss from operations |

(132,236 | ) | (1,105 | ) | (7,881 | ) | (141,222 | ) | ||||||||||||

| Interest income |

5,428 | — | — | 5,428 | ||||||||||||||||

| Interest expense |

(249 | ) | — | — | (249 | ) | ||||||||||||||

| Gain from deconsolidation of a subsidiary |

6,904 | — | — | 6,904 | ||||||||||||||||

| Income from equity method investment |

5,799 | — | — | 5,799 | ||||||||||||||||

| Unrealized gain on investments held in Trust Account |

— | 171 | (171 | ) | AA |

— | ||||||||||||||

| Financing costs — derivative warrant liabilities |

— | (1,289 | ) | (1,289 | ) | |||||||||||||||

| Change in fair value of derivative warrant liabilities |

— | (61,680 | ) | (61,680 | ) | |||||||||||||||

| Other income (expense), net |

221 | — | — | 221 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) before income taxes |

(114,133 | ) | (63,903 | ) | (8,052 | ) | (186,088 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Provision for income taxes |

31 | — | 31 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | (114,164 | ) | $ | (63,903 | ) | $ | (8,052 | ) | $ | (186,119 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding of Class A Common Stock |

69,000,000 | |||||||||||||||||||

| Basic and diluted net loss per share- Class A |

$ | — | ||||||||||||||||||

| Weighted average shares outstanding of Class B Common Stock |

17,250,000 | |||||||||||||||||||

| Basic and diluted net loss per share- Class B |

$ | (3.70 | ) | |||||||||||||||||

| Weighted average shares outstanding of Joby Aero Common Stock |

30,066,847 | |||||||||||||||||||

| Basic and diluted net loss per share- Joby Aero |

$ | (3.80 | ) | |||||||||||||||||

| Weighted average shares outstanding of Joby Aviation Common Stock |

577,960,162 | |||||||||||||||||||

| Basic and diluted net loss per share of JobyAviation |

$ | (0.32 | ) | |||||||||||||||||

Joby Aero, Inc. (Historical) |

Reinvent (Historical) |

Transaction Accounting Adjustments |

Pro Forma Combined |

|||||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

$ | 88,218 | $ | — | $ | — | 88,218 | |||||||||||||

| Selling, general and administrative |

25,980 | 2,295 | — | 28,275 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

114,198 | 2,295 | — | 116,493 | ||||||||||||||||

| Loss from operations |

(114,198 | ) | (2,295 | ) | — | (116,493 | ) | |||||||||||||

| Interest income |

672 | — | — | 672 | ||||||||||||||||

| Interest expense |

(1,904 | ) | — | — | (1,904 | ) | ||||||||||||||

| Income from equity method investment |

8,891 | — | — | 8,891 | ||||||||||||||||

| Unrealized gain on investments held in Trust Account |

— | 105 | (105 | ) | AA |

— | ||||||||||||||

| Change in fair value of derivative warrant liabilities |

— | 43,623 | 43,623 | |||||||||||||||||

| Other income (expense), net |

37 | — | — | 37 | ||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) before income taxes |

(106,502 | ) | 41,433 | (105 | ) | (65,174 | ) | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Provision for income taxes |

9 | — | 9 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | (106,511 | ) | $ | 41,433 | $ | (105 | ) | (65,183 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding of Class A Common Stock |

69,000,000 | |||||||||||||||||||

| Basic and diluted net loss per share- Class A |

$ | 0.00 | ||||||||||||||||||

| Weighted average shares outstanding of Class B Common Stock |

17,250,000 | |||||||||||||||||||

| Basic and diluted net loss per share- Class B |

$ | 2.40 | ||||||||||||||||||

| Weighted average shares outstanding of Joby Aero Common Stock |

32,239,448 | |||||||||||||||||||

| Basic and diluted net loss per share- Joby Aero |

$ | (3.30 | ) | |||||||||||||||||

| Weighted average shares outstanding of Joby Aviation Common Stock |

577,960,162 | |||||||||||||||||||

| Basic and diluted net loss per share of Joby Aviation |

$ | (0.11 | ) | |||||||||||||||||

Six Months Ended June 30, 2021 |

Year Ended December 31, 2020 |

|||||||

| Pro forma net loss |

$ | (65,183 | ) | $ | (186,119 | ) | ||

| Basic weighted average shares outstanding |

577,960,162 | 577,960,162 | ||||||

| Pro forma net loss per share — Basic and Diluted (1) |

$ | (0.11 | ) | $ | (0.32 | ) | ||

| Weighted average shares outstanding- basic and diluted |

||||||||

| RTP Class A shareholders |

26,583,290 | 26,583,290 | ||||||

| Former RTP Class B Founder Shares (3) |

120,000 | 120,000 | ||||||

| Former Joby Aero shareholders (2) |

467,756,872 | 467,756,872 | ||||||

| PIPE Financing |

83,500,000 | 83,500,000 | ||||||

| |

|

|

|

|||||

| 577,960,162 | 577,960,162 | |||||||

| |

|

|

|

|||||

| (1) | Outstanding unvested 22,478,113 options, unvested 10,204,260 RSUs, 28,783,333 warrants to purchase RTP’s Class A ordinary shares and 17,130,000 Sponsor Shares are anti-dilutive and are not included in the calculation of diluted net loss per share. |

| (2) | Amount excludes 8,797,780 shares of Joby Aviation common stock related to the conversion of the outstanding shares of Joby which were issued in respect of unvested restricted stock awards and early exercised stock options, which shares are subject to repurchase. |

| (3) | Amount excludes 17,130,000 Sponsor Shares subject to vesting upon completion of the RTP Merger. |

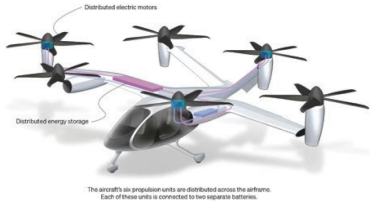

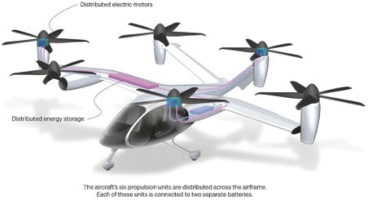

| • | Noise : all-electric powertrain, we’ve spent substantial engineering resources to reduce the noise signature of the aircraft even further. The result is an aircraft that is 100-times quieter than a twin-engine helicopter, exhibiting a noise profile in the range of 65 dBA during takeoff and landing (the noisiest configuration), roughly the volume of a normal speaking voice. In over-head flight, the aircraft is near silent at even 500ft to 1,000ft flyover. |

| • | Safety : centrally-located internal combustion engines, we’re able to deliver a fault-tolerant overall architecture for the aircraft. Each propeller is powered by two independent electric motors, each in turn driven by independent electric motor drive-units. Each drive-unit draws power from a separate battery, of which there are four onboard the aircraft. |

| • | Performance : in-house development has allowed for optimization of systems and components across the aircraft, resulting in better energy efficiency, range, and speed than what would otherwise be available using commercial-off-the-shelf best-in-class watt-hour per passenger seat mile basis across most trip distances, and greater efficiency leads to longer range. We believe that our 150-mile range on a single charge and 200 mph cruise speed represent best-in-class time-savings of our service and results in greater operational flexibility and reduced operating costs. |

| • | Environmental — Our Environmental pillar is focused on being a good steward of the natural environment through the production and development of innovative designs that reduce resource use and energy consumption. |

| • | Social — Our Social pillar is focused on promoting diversity, equity and inclusion, while underpinning all of our activities with a core focus on health and safety. |

| • | Governance — Our Governance pillar focuses on upholding our commitment to ethical business conduct, integrity and corporate responsibility, and integrating strong governance and enterprise risk management oversight across all aspects of our business. |

Six Months Ended June 30, |

Change |

|||||||||||||||

2021 |

2020 |

($) |

(%) |

|||||||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

$ | 88,218 | $ | 46,227 | 41,991 | 91 | % | |||||||||

| Selling, general and administrative |

25,980 | 9,597 | 16,383 | 171 | % | |||||||||||

| |

|

|

|

|||||||||||||

| Total operating expenses |

114,198 | 55,824 | 58,374 | 105 | % | |||||||||||

| |

|

|

|

|||||||||||||

| Loss from operations |

(114,198 | ) | (55,824 | ) | (58,374 | ) | 105 | % | ||||||||

| Interest income |

672 | 3,598 | (2,926 | ) | (81 | )% | ||||||||||

| Interest expense |

(1,904 | ) | (128 | ) | (1,776 | ) | 1,388 | % | ||||||||

| Income from equity method investment |

8,891 | — | 8,891 | 100 | % | |||||||||||

| Other income, net |

37 | 134 | n.m. | n.m. | ||||||||||||

| |

|

|

|

|||||||||||||

| Total other income, net |

7,696 | 3,604 | 4,092 | 114 | % | |||||||||||

| Loss before income taxes |

(106,502 | ) | (52,220 | ) | (54,282 | ) | 104 | % | ||||||||

| |

|

|

|

|||||||||||||

| Income tax expenses |

9 | 17 | n.m. | n.m. | ||||||||||||

| Net loss |

$ | (106,511 | ) | $ | (52,237 | ) | (54,274 | ) | 104 | % | ||||||

| |

|

|

|

|||||||||||||

| * | n.m. marks changes that are not meaningful for further discussion. |

Year Ended December 31, |

Change |

|||||||||||||||

2020 |

2019 |

($) |

(%) |

|||||||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

$ | 108,741 | $ | 70,178 | 38,563 | 55 | % | |||||||||

| Selling, general and administrative |

23,495 | 13,970 | 9,525 | 68 | % | |||||||||||

| |

|

|

|

|||||||||||||

| Total operating expenses |

132,236 | 84,148 | 48,088 | 57 | % | |||||||||||

| |

|

|

|

|||||||||||||

| Loss from operations |

(132,236 | ) | (84,148 | ) | (48,088 | ) | 57 | % | ||||||||

| Interest income |

5,428 | 1,937 | 3,491 | 180 | % | |||||||||||

| Interest expense |

(249 | ) | (22,952 | ) | 22,703 | (99 | )% | |||||||||

| Income from equity method investment |

5,799 | — | 5,799 | 100 | % | |||||||||||

| Gain on deconsolidation of subsidiary |

6,904 | — | 6,904 | 100 | % | |||||||||||

| Loss from changes in fair value of derivative liabilities |

— | (4,947 | ) | 4,947 | (100 | )% | ||||||||||

| Convertible note extinguishment loss |

— | (366 | ) | 366 | (100 | )% | ||||||||||

| Other income, net |

221 | 129 | n.m. | n.m. | ||||||||||||

| |

|

|

|

|||||||||||||

| Total other income (expense), net |

18,103 | (26,199 | ) | |||||||||||||

| |

|

|

|

|||||||||||||

| Loss before income taxes |

(114,133 | ) | (110,347 | ) | (3,786 | ) | 3 | % | ||||||||

| |

|

|

|

|||||||||||||

| Income tax expenses |

31 | 2 | n.m. | n.m. | ||||||||||||

| Net loss |

$ | (114,164 | ) | $ | (110,349 | ) | (3,815 | ) | 3 | % | ||||||

| |

|

|

|

|||||||||||||

| * | n.m. marks changes that are not meaningful for further discussion. |

Six Months Ended June 30, |

Change |

|||||||||||||||

2021 |

2020 |

($) |

(%) |

|||||||||||||

| Net cash (used in) provided by: |

||||||||||||||||

| Operating activities |

$ | (77,533 | ) | $ | (47,938 | ) | (29,595 | ) | 62 | % | ||||||

| Investing activities |

(28,940 | ) | (409,535 | ) | 380,595 | (93 | )% | |||||||||

| Financing activities |

73,469 | 72,000 | 1,469 | 2 | % | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash |

$ | (33,004 | ) | $ | (385,473 | ) | 352,469 | (91 | )% | |||||||

| |

|

|

|

|

|

|||||||||||

Year Ended December 31, |

Change |

|||||||||||||||

2020 |

2019 |

($) |

(%) |

|||||||||||||

| Net cash (used in) provided by: |

||||||||||||||||

| Operating activities |

$ | (105,900 | ) | $ | (76,237 | ) | (29,663 | ) | 39 | % | ||||||

| Investing activities |

(393,159 | ) | (9,240 | ) | (383,919 | ) | 4,155 | % | ||||||||

| Financing activities |

69,220 | 468,410 | (399,190 | ) | (85 | )% | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Net (decrease) increase in cash, cash equivalents, and restricted cash |

$ | (429,839 | ) | $ | 382,933 | (812,772 | ) | (212 | )% | |||||||

| |

|

|

|

|

|

|||||||||||

| • | contemporaneous valuations of our common stock performed by independent third-party specialists; |

| • | the prices, rights, preferences, and privileges of our convertible preferred stock relative to those of our common stock; |

| • | the prices paid for common or convertible preferred stock sold to third-party investors by us and prices paid in secondary transactions for shares repurchased by us in arm’s-length transactions, including any tender offers, if any; |

| • | the lack of marketability inherent in our common stock; |

| • | our actual operating and financial performance; |

| • | our current business conditions and projections; |

| • | the hiring of key personnel and the experience of our management; |

| • | the history of the company and the introduction of new products; |

| • | our stage of development; |

| • | the likelihood of achieving a liquidity event, such as an initial public offering (IPO), a merger, or acquisition of our company given prevailing market conditions; |

| • | the operational and financial performance of comparable publicly traded companies; and |

| • | the U.S. and global capital market conditions and overall economic conditions. |

409A Valuation Date |

Common Stock Fair Value |

|||

| 12/23/2019 |

$ | 7.85 | ||

| 4/20/2020 |

$ | 10.08 | ||

| 9/30/2020 |

$ | 16.78 | ||

| 1/11/2021 |

$ | 28.45 | ||

| 2/23/2021 |

$ | 29.70 | ||

| 6/14/2021 |

$ | 31.01 | ||

Date of Option Grant |

Number of Options Granted |

Number of RSUs granted |

||||||

| 2/10/2020 |

37,500 | — | ||||||

| 4/20/2020 |

1,736,750 | — | ||||||

| 6/23/2020 |

299,500 | — | ||||||

| 9/3/2020 |

335,450 | — | ||||||

| 11/10/2020 |

989,175 | — | ||||||

| 12/18/2020 |

735,354 | — | ||||||

| 12/26/2020 |

3,774 | — | ||||||

| 1/19/2021 |

— | 1,123,941 | ||||||

| 2/23/2021 |

— | 963,293 | ||||||

| 4/5/2021 |

— | 352,758 | ||||||

| 6/14/2021 |

— | 627,011 | ||||||

| Name |

Age |

Position | ||

| Executive Officers: |

||||

| JoeBen Bevirt |

47 | Chief Executive Officer, Chief Architect and Director | ||

| Matthew Field |

49 | Chief Financial Officer and Treasurer | ||

| Eric Allison |

44 | Head of Product | ||

| Bonny Simi |

59 | Head of Air Operations and People | ||

| Greg Bowles |

45 | Head of Government and Regulatory Affairs | ||

| Kate DeHoff |

44 | General Counsel and Corporate Secretary | ||

| Justin Lang |

37 | Head of Partnerships and Corporate Strategy | ||

| Didier Papadopoulos |

46 | Head of Program Management & Systems Engineering | ||

| Non-Employee Directors: |

||||

| Aicha Evans |

52 | Director | ||

| Reid Hoffman |

53 | Director | ||

| James Kuffner |

50 | Director | ||

| Halimah DeLaine Prado |

45 | Director | ||

| Dipender Saluja |

56 | Director | ||

| Paul Sciarra |

40 | Director, Executive Chairman | ||

| Laura Wright |

61 | Director | ||

| • | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| • | discussing with our independent registered public accounting firm their independence from management; |

| • | reviewing with our independent registered public accounting firm the scope and results of their audit; |

| • | pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| • | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and |

| • | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officers, evaluating the performance of our Chief Executive Officer in light of these goals and objectives and setting or making recommendations to the Board regarding the compensation of our Chief Executive Officer; |

| • | reviewing and setting or making recommendations to our board of directors regarding the compensation of our other executive officers; |

| • | making recommendations to our board of directors regarding the compensation of our directors; |

| • | reviewing and approving or making recommendations to our board of directors regarding |

| • | our incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants. |

| • | identifying individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors; |

| • | recommending to our board of directors the nominees for election to our board of directors at annual meetings of our stockholders; |

| • | overseeing an evaluation of our board of directors and its committees; and |

| • | developing and recommending to our board of directors a set of corporate governance guidelines. |

| • | JoeBen Bevirt, our President and Chief Executive Officer; |

| • | Bonny Simi, our Head of Air Operations and People; and |

| • | Justin Lang, our former Head of Corporate and Legal and current Head of Partnerships and Corporate Strategy. |

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) (1) |

Option Awards ($) (2) |

All Other Compensation ($) (3) |

Total ($) |

||||||||||||||||||

| JoeBen Bevirt |

2020 | 293,600 | — | — | 3,000 | 296,600 | ||||||||||||||||||

| President and Chief Executive Officer |

||||||||||||||||||||||||

| Bonny Simi (4) |

2020 | 13,462 | 250,000 | 9,408,556 | — | 9,672,018 | ||||||||||||||||||

| Head of Air Operations and People |

||||||||||||||||||||||||

| Justin Lang |

2020 | 277,038 | — | 2,111,944 | — | 2,388,982 | ||||||||||||||||||

| Head of Partnerships and Corporate Strategy |

||||||||||||||||||||||||

| (1) | Amount reported represents a sign on bonus paid to Ms. Simi in connection with her commencement of employment with us. |

| (2) | Amounts reported represent the aggregate grant date fair value of stock options granted to our named executive officers during 2020 computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 2 to our audited consolidated financial statements included in this prospectus. |

| (3) | Amounts reported represent matching contributions under our 401(k) plan. |

| (4) | Ms. Simi commenced employment with us on December 15, 2020. |

Option awards |

Stock awards |

|||||||||||||||||||||||||||

| Name |

Vesting commencement date |

Number of securities underlying unexercised options (#) exercisable |

Number of securities underlying unexercised options (#) unexercisable |

Option exercise price ($) |

Option expiration date |

Number of shares that have not vested (#) |

Market value of shares that have not vested ($) (1) |

|||||||||||||||||||||

| JoeBen Bevirt |

— | — | — | — | — | — | — | |||||||||||||||||||||

| Bonny Simi |

12/15/2020 | (2) |

282,024 | 114,560 | 6.11 | 12/17/2030 | 40,916 | 249,997 | ||||||||||||||||||||

| Justin Lang |

3/11/2019 | (3) |

36,241 | 106,259 | 0.70 | 4/22/2029 | — | — | ||||||||||||||||||||

| 2/3/2020 | (3) |

— | 32,500 | 3.00 | 4/19/2030 | — | — | |||||||||||||||||||||

| 10/31/2020 | (3) |

— | 95,000 | 3.00 | 11/9/2030 | — | — | |||||||||||||||||||||

| (1) | Amount reported based on $6.11 per share, which was the fair market value of Joby common stock as of December 31, 2020, as determined by the Joby board of directors. |

| (2) | Option to purchase 437,500 shares of Joby common stock vests as to 1/6th of the shares on the first anniversary of the vesting commencement date and as to 1/20th of the shares on each quarterly anniversary of the vesting commencement date thereafter, subject to continued service to us through the applicable vesting date. As of December 31, 2020, the option had been exercised as to 40,916 shares prior to vesting 282,024 of the shares underlying Ms. Simi’s option are exercisable prior to vesting and the remaining 114,560 shares underlying the option become exercisable in equal installments on each March 15 of 2021, 2022, 2023, 2024, 2025, 2026 and January 1, 2027. Shares that are acquired prior to vesting are reported in the stock awards columns and are subject to repurchase at the original exercise price upon any termination of employment with us until such shares vest in accordance with the option’s vesting schedule. |

| (3) | Option vests and becomes exercisable as to 1/6th of the shares on the first anniversary of the vesting commencement date and as to 1/20th of the shares on each quarterly anniversary of the vesting commencement date thereafter, subject to continued service to us through the applicable vesting date. |

| • | to the extent that an award terminates, expires or lapses for any reason or an award is settled in cash without the delivery of shares, any shares subject to the award at such time will be available for future grants under the 2021 Plan; |

| • | to the extent shares are tendered or withheld to satisfy the tax withholding obligation with respect to any award, such shares will be available for future grants under the 2021 Plan; |

| • | to the extent shares are tendered or withheld in payment of the exercise price of a stock option award or not issued in connection with stock settlement of a SAR, such shares will not be available for future grants under the 2021 Plan; |

| • | the payment of dividend equivalents in cash in conjunction with any outstanding awards will not be counted against the shares available for issuance under the 2021 Plan; and |

| • | to the extent permitted by applicable law or any exchange rule, shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form of combination by us or any of our subsidiaries will not be counted against the shares available for issuance under the 2021 Plan. |

| • | Non-Qualified Stock Options |

| • | Incentive Stock Options |

| • | Restricted Stock |

| • | Restricted Stock Units |

| • | Stock Appreciation Rights |

| • | Performance Bonus Awards and Performance Stock Units |

| • | Other Stock or Cash Based Awards |

| • | Dividend Equivalents |

| Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($) (1) |

All Other Compensation ($) |

Total ($) |

||||||||||||

| Sky Dayton |

— | — | — | — | ||||||||||||

| Aicha Evans |

— | 93,863 | — | 93,863 | ||||||||||||

| James Kuffner |

— | — | — | — | ||||||||||||

| Dipender Saluja |

— | — | — | — | ||||||||||||

| Paul Sciarra |

— | — | — | — | ||||||||||||

| (1) | Amounts reported represent the grant date fair value of a stock option granted to Ms. Evans computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of this amount is included in Note 2 to our audited consolidated financial statements included in this prospectus. As of December 31, 2020, our non-employee directors held the following outstanding options: |

| Name |

Option Awards Outstanding at Year End |

|||

| Sky Dayton |

— | |||

| Aicha Evans |

3,774 | |||

| James Kuffner |

— | |||

| Dipender Saluja |

— | |||

| Paul Sciarra |

— | |||

| • | each person who is known to be the beneficial owner of more than 5% of our voting shares; |

| • | each of our executive officers and directors; and |

| • | all of our executive officers and directors as a group. |

Number of Shares |

% of Ownership |

|||||||

| Name and Address of Beneficial Owner (1) |

||||||||

| 5% Holders |

||||||||

| Entities affiliated with Sciarra Management Trust (2) |

59,962,168 | 9.9 | % | |||||

| Entities affiliated with Toyota Motor Corporation (3) |

78,752,611 | 13.0 | % | |||||

| Entities affiliated with Intel Capital Corporation (4) |

46,040,786 | 7.6 | % | |||||

| Entities affiliated with Capricorn (5) |

37,455,596 | 6.2 | % | |||||

| Mark Pincus (6)(7) |

33,163,333 | 5.4 | % | |||||

| Directors and Executive Officers |

||||||||

| JoeBen Bevirt (8) |

98,696,148 | 16.3 | % | |||||

| Bonny Simi |

141,454 | * | ||||||

| Justin Lang (9) |

381,310 | * | ||||||

| Kate DeHoff |

— | * | ||||||

| Matthew Field |

— | * | ||||||

| Eric Allison |

— | * | ||||||

| Gregory Bowles (10) |

159,865 | * | ||||||

| Paul Sciarra (2) |

59,962,168 | 9.9 | % | |||||

| Reid Hoffman (6)(11) |

30,663,333 | 4.9 | % | |||||

| Aicha Evans (12) |

11,955 | * | ||||||

| James Kuffner (13) |

78,752,611 | 13.0 | % | |||||

| Halimah DeLaine Prado |

— | * | ||||||

| Dipender Saluja (14) |

37,455,596 | 6.2 | % | |||||

| Laura Wright |

— | * | ||||||

| Didier Papadopoulos |

— | * | ||||||

| All Joby Aviation directors and executive officers as a group (15 individuals) |

306,224,440 |

50.7 |

% | |||||

| * | Less than 1%. |

| (1) | Unless otherwise noted, the business address of each of those listed in the table above is 2155 Delaware Avenue, Suite #225, Santa Cruz, CA 95060. |

| (2) | Consists of (i) 59,912,168 shares of Joby Aviation common stock held by the Sciarra Management Trust and (iii) 50,000 shares held by the Sciarra Foundation. Mr. Sciarra has voting, investment and dispositive power over the shares held in the Sciarra Management Trust and the Sciarra Foundation, and therefore may be deemed to be the beneficial owner of such shares. The address for U.S. Trust Company of Delaware, as agent for Sciarra Management Trust, is 2951 Centerville Road, Suite 200, Wilmington, DE 19808. |

| (3) | Consists of (i) 72,871,831 shares of Joby Aviation common stock held by Toyota Motor Corporation, (ii) 5,813,286 shares of Joby Aviation common stock held by Toyota A.I. Ventures Fund I, L.P., and (iii) 67,494 shares of Joby Aviation common stock held by Toyota A.I. Ventures Parallel Fund I-A, L.P. Toyota Motor Corporation has dispositive control over the shares held by Toyota A.I. Ventures Fund I, L.P. and Toyota A.I. Ventures Parallel Fund I-A, L.P. and may be deemed to beneficially own such shares. The business address for Toyota Motor Corporation is 4-7-1 450-8171, Japan. |

| (4) | Consists of (i) 38,947,301 shares of Joby Aviation common stock held of record by Intel Capital Corporation and (ii) 7,093,485 shares of Joby Aviation common stock held of record by Middlefield Ventures, Inc. Each of Intel Capital Corporation and Middlefield Ventures, Inc. is a direct or indirect wholly-owned subsidiary of Intel Corporation. Intel Capital Corporation and Middlefield Ventures, Inc. share voting and investment power over their respectively held shares with Intel Corporation. The address for each of Intel Capital Corporation and Middlefield Ventures, Inc. is c/o Intel Corporation, 2200 Mission College Blvd., M/S RN6-59, Santa Clara, CA, 95054, Attn: Intel Capital Portfolio Manager. |

| (5) | Consists of (i) 10,193,889 shares of Joby Aviation common stock held by Capricorn-Libra Investment Group, L.P., (ii) 26,086,247 shares of Joby Aviation common stock held by Technology Impact Fund, L.P., and (iii) 1,175,460 shares of Joby Aviation common stock held by Technology Impact Growth Fund, L.P. Capricorn-Libra Partners, LLC is the general partner of Capricorn-Libra Investment Group, L.P., TIF Partners, LLC is the general partner of Technology Impact Fund, L.P. and TIGF Partners, LLC is the general partner of Technology Impact Growth Fund, L.P. Capricorn-Libra Partners, LLC is wholly owned by Dipender Saluja. TIF Partners, LLC is owned by Ion Yadigaroglu and Dipender Saluja. TIGF Partners, LLC is owned by Ion Yadigaroglu, Dipender Saluja and Capricorn Investment Group, LLC. The business address of each of Capricorn-Libra Investment Group, L.P., Technology Impact Fund, L.P., Technology Impact Growth Fund, L.P., Capricorn-Libra Partners, LLC, TIF Partners, LLC and TIGF Partners, LLC is 250 University Avenue Palo Alto, CA 94301. |

| (6) | Messrs. Hoffman and Pincus may be deemed to beneficially own Joby Aviation common stock and Joby Aviation private placement warrants held by Reinvent Sponsor LLC by virtue of their shared control over Reinvent Sponsor LLC. Each of Messrs. Hoffman and Pincus disclaims beneficial ownership of the securities held by Reinvent Sponsor LLC except to the extent of their actual pecuniary interest therein. The address of Reinvent Sponsor LLC is c/o Reinvent 215 Park Avenue, Floor 11, New York, NY 10003. |

| (7) | Consists of (i) 17,130,000 shares of Joby Aviation common stock held by Reinvent Sponsor LLC, (ii) 11,533,333 shares of Joby Aviation common stock underlying the private placement warrants held by Reinvent Sponsor LLC, (iii) 1,200,000 shares of Joby Aviation common stock held by Workplay Ventures LLC, (iv) 800,000 shares of Joby Aviation common stock held by MJP DT Holdings LLC and (v) 2,500,000 shares of Joby Aviation common stock held by Reinvent Capital Fund LP. Mr. Pincus may be deemed to beneficially own the shares held by Workplay Ventures LLC, MJP DT Holdings LLC and Reinvent Capital Fund LP. Mr. Pincus disclaims beneficial ownership of the securities held by Workplay Ventures LLC, MJP DT Holdings LLC and Reinvent Capital Fund LP, except to the extent of his actual pecuniary interest therein. The address of Mr. Pincus and Reinvent Capital Fund LP is c/o Reinvent 215 Park Avenue, Floor 11, New York, NY 10003. The address of Workplay Ventures LLC is 3450 Sacramento St., Unit 720, San Francisco, CA 94118. The address of MJP DT Holdings LLC is 3450 Sacramento St, Unit 722, San Francisco, CA 94118. |

| (8) | Consists of (i) 64,124,185 shares of Joby Aviation common stock held by JoeBen Bevirt, as trustee of The Joby Trust and (ii) 34,571,963 shares of Joby Aviation common stock held by JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020. Mr. Bevirt has voting and dispositive power over the shares held in the Joby Trust and the JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020, and therefore may be deemed to be the beneficial owner of such shares. The business address for The Joby Trust and the JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020, is 2155 Delaware Avenue, Santa Cruz, CA 95060. |

| (9) | Consists of (i) 77,786 shares of Joby Aviation common stock and (ii) 303,531 shares of Joby Aviation common stock issuable upon exercise of outstanding stock options exercisable within 60 days from September 30, 2021. |

| (10) | Consists of (i) 57,610 shares of Joby Aviation common stock and (ii) 102,260 shares of Joby Aviation common stock issuable upon exercise of outstanding stock options exercisable within 60 days from September 30, 2021. |

| (11) | Consists of (i) 17,130,000 shares of Joby Aviation common stock held by Reinvent Sponsor LLC, (ii) 11,533,333 shares of Joby Aviation common stock underlying the private placement warrants held by Reinvent Sponsor LLC and (iii) 2,000,000 shares of Joby Aviation common stock held by Reprogrammed Interchange LLC (“Reprogrammed”). Mr. Hoffman may be deemed to beneficially own the shares held by Reprogrammed by virtue of his voting and investment control over Reprogrammed. The address of Mr. Hoffman is c/o Reinvent 215 Park Avenue, Floor 11, New York, NY 10003. The address of Reprogrammed is c/o Frank Huang, Freeland Cooper & Foreman, 150 Spear Street, Suite 1800, San Francisco, CA 94105. |

| (12) | Consists of 11,955 shares of Joby Aviation common stock issuable upon exercise of outstanding stock options exercisable within 60 days from September 30, 2021. |

| (13) | Consists of (i) 72,871,831 shares of Joby Aviation common stock held by Toyota Motor Corporation, (ii) 5,813,286 shares of Joby Aviation common stock held by Toyota A.I. Ventures Fund I, L.P., and (iii) 67,494 shares of Joby Aviation common stock held by Toyota A.I. Ventures Parallel Fund I-A, L.P.Toyota Motor Corporation has dispositive control over the shares held by Toyota A.I. Ventures Fund I, L.P. and Toyota A.I. Ventures Parallel Fund I-A, L.P. and may be deemed to beneficially own such shares. Mr. Kuffner is a director of Toyota Motor Corporation and disclaims beneficial ownership of all applicable shares except to the extent of his actual pecuniary interest in such shares. |

| (14) | Consists of (i) 10,193,889 shares of Joby Aviation common stock held by Capricorn-Libra Investment Group, L.P., (ii) 26,086,247 shares of Joby Aviation common stock held by Technology Impact Fund, L.P., and (iii) 1,175,460 shares of Joby Aviation common stock held by Technology Impact Growth Fund, L.P. Capricorn-Libra Partners, LLC is the general partner of Capricorn-Libra Investment Group, L.P., TIF Partners, LLC is the general partner of Technology Impact Fund, L.P. and TIGF Partners, LLC is the general partner of Technology Impact Growth Fund, L.P. Capricorn-Libra Partners, LLC is wholly owned by Dipender Saluja. TIF Partners, LLC is owned by Ion Yadigaroglu and Dipender Saluja. TIGF Partners, LLC is owned by Ion Yadigaroglu, Dipender Saluja and Capricorn Investment Group, LLC. Mr. Saluja disclaims beneficial ownership of all applicable shares except to the extent of his actual pecuniary interest in such shares. |

Securities Beneficially Owned after this Offering |

||||||||||||||||||||||||

| Name of Selling Shareholder |

Shares of Common Stock Owner Prior to this Offering |

Shares of Common Stock to be Sold in this Offering (1) |

Shares of Common Stock |

Percentage |

|

|

||||||||||||||||||

| Alec Clark |

1,624,882 | 1,624,882 | — | — | — | — | ||||||||||||||||||

| Alex Stoll |

3,046,654 | 3,046,654 | — | — | — | — | ||||||||||||||||||

| Baixi Pei |

812,441 | 812,441 | — | — | — | — | ||||||||||||||||||

| Edward Stilson |

4,062,206 | 4,062,206 | — | — | — | — | ||||||||||||||||||

| Gregor Veble Mikic |

1,037,159 | 1,037,159 | — | — | — | — | ||||||||||||||||||

| Joby Trust (2) |

34,375,765 | 34,375,765 | — | — | — | — | ||||||||||||||||||

| JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020 (3) |

34,571,960 | 34,571,960 | — | — | — | — | ||||||||||||||||||

| Rory Giffen |

812,441 | 812,441 | — | — | — | — | ||||||||||||||||||

| Sciarra Management Trust (4) |

10,371,589 | 10,371,589 | — | — | — | — | ||||||||||||||||||

| Scott Berry |

1,071,731 | 1,071,731 | — | — | — | — | ||||||||||||||||||

| Steven Waller |

1,037,159 | 1,037,159 | — | — | — | — | ||||||||||||||||||

| Other Selling Shareholders (5) |

5,533,213 | 5,533,213 | — | — | — | — | ||||||||||||||||||

| (1) | The amounts set forth in this column are the number of shares of common stock that may be offered by such Selling Shareholder using this prospectus. These amounts do not represent any other shares of our common stock that the Selling Shareholder may own beneficially or otherwise. |

| (2) | Mr. Bevirt has voting and dispositive power over the shares held in the Joby Trust and therefore may be deemed to be the beneficial owner of such shares. The business address for The Joby Trust is 2155 Delaware Avenue, Santa Cruz, CA 95060. |

| (3) | Mr. Bevirt has voting and dispositive power over the shares held in the JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020, and therefore may be deemed to be the beneficial owner of such shares. The business address for the JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020, is 2155 Delaware Avenue, Santa Cruz, CA 95060. |

| (4) | Mr. Sciarra has voting, investment and dispositive power over the shares held in the Sciarra Management Trust and therefore may be deemed to be the beneficial owner of such shares. The address for U.S. Trust Company of Delaware, as agent for Sciarra Management Trust, is 2951 Centerville Road, Suite 200, Wilmington, DE 19808. |

| (5) | Consists of Selling Shareholders not otherwise listed in this table who collectively own less than 1% of our common stock immediately following the Joby Holdings Reorganization. |

| • | we have been or are to be a participant; |

| • | the amount involved exceeds or will exceed $120,000; and |

| • | any of our directors, executive officers or beneficial holders of more than 5% of our capital stock, or any immediate family member of, or person sharing the household with, any of these individuals (other than tenants or employees), had or will have a direct or indirect material interest. |

| Name |

2018 Notes principal and interest |

Shares of Series C convertible preferred stock |

||||||

| Entities affiliated with Toyota Motor Corporation (1) |

$ | 47,811,628.11 | 3,085,385 | |||||

| Entities affiliated with Capricorn Investment Group (2) |

$ | 10,537,534.25 | 680,008 | |||||

| Entities affiliated with Intel Corporation (3) |

$ | 31,795,068.49 | 2,051,803 | |||||

| |

|

|

|

|||||

| Total |

$ |

90,144,230.85 |

5,817,196 |

|||||

| |

|

|

|

|||||

| (1) | Consists of (i) $46,632,767.12 in principal plus accrued interest held by Toyota Motor Corporation, (ii) $1,096,340.81 in principal plus accrued interest held by Toyota A.I. Ventures Fund I, L.P. and (iii) $82,520.18 in principal plus accrued interest held by Toyota A.I. Ventures Parallel Fund I-A, L.P. |

| (2) | Consists of (i) $5,268,767.12 in principal plus accrued interest held by Technology Impact Fund, L.P. and (ii) 5,268,767.12 in principal plus accrued interest held by Technology Impact Growth Fund LP. |

| (3) | Consists of $31,795,068.49 in principal plus accrued interest held by Middlefield Ventures, Inc. |

| Name |

Shares of Series C Preferred Stock |

Total Purchase Price |

||||||

| Entities affiliated with Toyota Motor Corporation (1) |

18,068,992 | $ | 349,999,988.84 | |||||

| |

|

|

|

|||||

| Total |

18,068,992 |

$ |

349,999,988.84 |

|||||

| |

|

|

|

|||||

| (1) | Consists of (i) 18,068,992 shares of Joby’s Series C preferred stock held by Toyota Motor Corporation |

| • | any person who is, or at any time during the applicable period was, one of Joby Aviation’s executive officers or directors; |

| • | any person who is known by the post-combination company to be the beneficial owner of more than 5% of Joby Aviation’s voting stock; |

| • | any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law sister-in-law |

| • | any firm, corporation or other entity in which any of the foregoing persons is a partner or principal, or in a similar position, or in which such person has a 10% or greater beneficial ownership interest. |

| • | in whole and not in part; |

| • | at a price of $0.01 per warrant; |

| • | upon not less than 30 days’ written notice of redemption to each warrant holder; and |

| • | if and only if, the last reported sale price of the shares of common stock for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders (which we refer to as the “Reference Value”) equals or exceeds $18.00 per share (as adjusted for share splits, share dividends, rights issuances, subdivisions, reorganizations, recapitalizations and the like) |

| • | in whole and not in part; |

| • | at $0.10 per warrant upon a minimum of 30 days’ prior written notice of redemption provided that holders will be able to exercise their warrants on a cashless basis prior to redemption and receive that number of shares determined by reference to the table below, based on the redemption date and the “fair market value” (as defined below) of our shares of common stock except as otherwise described below; |

| • | if, and only if, the Reference Value (as defined above under “Redemption of warrants when the price per share of common stock equals or exceeds $18.00”) equals or exceeds $10.00 per share (as adjusted for share splits, share dividends, rights issuances, subdivisions, reorganizations, recapitalizations and the like); and |

| • | if the Reference Value is less than $18.00 per share (as adjusted for share splits, share dividends, rights issuances, subdivisions, reorganizations, recapitalizations and the like), the private placement warrants must also be concurrently called for redemption on the same terms as the outstanding public warrants, as described above. |

| Redemption Date |

Fair Market Value of Common Stock |

|||||||||||||||||||||||||||||||||||

| (period to expiration of warrants) |

>10.00 |

11.00 |

12.00 |

13.00 |

14.00 |

15.00 |

16.00 |

17.00 |

>18.00 |

|||||||||||||||||||||||||||

| 60 months |

0.261 | 0.281 | 0.297 | 0.311 | 0.324 | 0.337 | 0.348 | 0.358 | 0.361 | |||||||||||||||||||||||||||

| 57 months |