gcm-202212312022FY0001819796Falsehttp://fasb.org/us-gaap/2022#AccountingStandardsUpdate201712MemberP3Y11P1Y0.33http://fasb.org/us-gaap/2022#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2022#OtherAssets00018197962022-01-012022-12-310001819796us-gaap:CommonStockMember2022-01-012022-12-310001819796us-gaap:WarrantMember2022-01-012022-12-3100018197962022-06-30iso4217:USD0001819796us-gaap:CommonClassAMember2023-02-21xbrli:shares0001819796us-gaap:CommonClassCMember2023-02-2100018197962022-12-3100018197962021-12-31iso4217:USDxbrli:shares0001819796us-gaap:CommonClassAMember2021-12-310001819796us-gaap:CommonClassAMember2022-12-310001819796us-gaap:CommonClassBMember2022-12-310001819796us-gaap:CommonClassBMember2021-12-310001819796us-gaap:CommonClassCMember2022-12-310001819796us-gaap:CommonClassCMember2021-12-310001819796us-gaap:AssetManagement1Member2022-01-012022-12-310001819796us-gaap:AssetManagement1Member2021-01-012021-12-310001819796us-gaap:AssetManagement1Member2020-01-012020-12-310001819796us-gaap:ManagementServiceIncentiveMember2022-01-012022-12-310001819796us-gaap:ManagementServiceIncentiveMember2021-01-012021-12-310001819796us-gaap:ManagementServiceIncentiveMember2020-01-012020-12-310001819796us-gaap:ServiceOtherMember2022-01-012022-12-310001819796us-gaap:ServiceOtherMember2021-01-012021-12-310001819796us-gaap:ServiceOtherMember2020-01-012020-12-3100018197962021-01-012021-12-3100018197962020-01-012020-12-310001819796us-gaap:LimitedPartnerMember2019-12-310001819796us-gaap:MemberUnitsMember2019-12-310001819796us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001819796us-gaap:CommonClassCMemberus-gaap:CommonStockMember2019-12-310001819796us-gaap:AdditionalPaidInCapitalMember2019-12-310001819796us-gaap:RetainedEarningsMember2019-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2019-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2019-12-3100018197962019-12-3100018197962019-01-012019-12-310001819796srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:LimitedPartnerMember2019-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2020-01-012020-11-1600018197962020-01-012020-11-160001819796us-gaap:LimitedPartnerMember2020-01-012020-11-160001819796us-gaap:MemberUnitsMember2020-01-012020-11-160001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-11-160001819796us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-11-172020-12-310001819796us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassAMember2020-11-172020-12-310001819796us-gaap:CommonClassAMember2020-11-172020-12-310001819796us-gaap:CommonClassCMemberus-gaap:CommonStockMember2020-11-172020-12-310001819796us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassCMember2020-11-172020-12-310001819796us-gaap:CommonClassCMember2020-11-172020-12-310001819796us-gaap:LimitedPartnerMember2020-11-172020-12-310001819796us-gaap:MemberUnitsMember2020-11-172020-12-310001819796us-gaap:AdditionalPaidInCapitalMember2020-11-172020-12-310001819796us-gaap:RetainedEarningsMember2020-11-172020-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-11-172020-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2020-11-172020-12-3100018197962020-11-172020-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2020-11-172020-12-310001819796us-gaap:LimitedPartnerMember2020-12-310001819796us-gaap:MemberUnitsMember2020-12-310001819796us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001819796us-gaap:CommonClassCMemberus-gaap:CommonStockMember2020-12-310001819796us-gaap:AdditionalPaidInCapitalMember2020-12-310001819796us-gaap:RetainedEarningsMember2020-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2020-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2020-12-3100018197962020-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2021-01-012021-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMembergcm:OtherNoncontrollingSubsidiariesMember2021-01-012021-12-310001819796gcm:OtherNoncontrollingSubsidiariesMember2021-01-012021-12-310001819796us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2021-01-012021-12-310001819796us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassAMember2021-01-012021-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMemberus-gaap:CommonClassAMember2021-01-012021-12-310001819796us-gaap:CommonClassAMember2021-01-012021-12-310001819796us-gaap:RetainedEarningsMember2021-01-012021-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMembergcm:GCMHoldingsMember2021-01-012021-12-310001819796gcm:GCMHoldingsMember2021-01-012021-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001819796us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001819796us-gaap:CommonClassCMemberus-gaap:CommonStockMember2021-12-310001819796us-gaap:AdditionalPaidInCapitalMember2021-12-310001819796us-gaap:RetainedEarningsMember2021-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2021-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2021-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2022-01-012022-12-310001819796us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonClassAMember2022-01-012022-12-310001819796us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2022-01-012022-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMemberus-gaap:CommonClassAMember2022-01-012022-12-310001819796us-gaap:CommonClassAMember2022-01-012022-12-310001819796us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2022-01-012022-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMembergcm:GCMHoldingsMember2022-01-012022-12-310001819796gcm:GCMHoldingsMember2022-01-012022-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-310001819796us-gaap:RetainedEarningsMember2022-01-012022-12-310001819796us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001819796us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-12-310001819796us-gaap:AdditionalPaidInCapitalMember2022-12-310001819796us-gaap:RetainedEarningsMember2022-12-310001819796us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001819796gcm:NoncontrollingInterestOtherNoncontrollingInterestsMember2022-12-310001819796gcm:NoncontrollingInterestLimitedPartnershipsMember2022-12-310001819796gcm:GrosvenorCapitalManagementHoldingsLLLPMember2022-12-31xbrli:pure0001819796gcm:GrosvenorCapitalManagementHoldingsLLLPMember2021-12-310001819796gcm:GrosvenorCapitalManagementHoldingsLLPMember2020-11-170001819796us-gaap:NonUsMember2022-12-310001819796us-gaap:NonUsMember2021-12-310001819796srt:MinimumMember2022-01-012022-12-310001819796srt:MaximumMember2022-01-012022-12-310001819796srt:MinimumMember2022-12-310001819796srt:MaximumMember2022-12-310001819796gcm:GCMHEquityHoldersMember2020-11-170001819796us-gaap:AccountingStandardsUpdate201602Member2022-01-01gcm:segmentgcm:class0001819796gcm:CFFinanceAcquisitionCorpMember2020-11-170001819796gcm:CFFinanceAcquisitionCorpMember2020-01-012020-12-3100018197962020-01-012020-01-0100018197962020-01-010001819796us-gaap:CallOptionMember2020-12-312020-12-310001819796us-gaap:CallOptionMember2020-01-012020-01-010001819796us-gaap:PutOptionMembergcm:MosaicCounterpartyMember2020-01-012020-01-0100018197962021-07-1500018197962021-07-022021-07-020001819796gcm:ManagementFeesBeforeReimbursementRevenueMember2022-01-012022-12-310001819796gcm:ManagementFeesBeforeReimbursementRevenueMember2021-01-012021-12-310001819796gcm:ManagementFeesBeforeReimbursementRevenueMember2020-01-012020-12-310001819796gcm:ExpenseReimbursementMember2022-01-012022-12-310001819796gcm:ExpenseReimbursementMember2021-01-012021-12-310001819796gcm:ExpenseReimbursementMember2020-01-012020-12-310001819796gcm:ManagementServiceIncentivePerformanceFeesMember2022-01-012022-12-310001819796gcm:ManagementServiceIncentivePerformanceFeesMember2021-01-012021-12-310001819796gcm:ManagementServiceIncentivePerformanceFeesMember2020-01-012020-12-310001819796gcm:ManagementServiceIncentiveCarriedInterestMember2022-01-012022-12-310001819796gcm:ManagementServiceIncentiveCarriedInterestMember2021-01-012021-12-310001819796gcm:ManagementServiceIncentiveCarriedInterestMember2020-01-012020-12-310001819796us-gaap:NoncontrollingInterestMember2022-12-310001819796us-gaap:NoncontrollingInterestMember2021-12-310001819796us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-12-310001819796us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-12-310001819796us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-12-310001819796us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-01-012021-12-310001819796us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-12-310001819796gcm:EquityMethodInvestmentMember2022-01-012022-12-310001819796gcm:EquityMethodInvestmentMember2021-01-012021-12-310001819796gcm:EquityMethodInvestmentMember2020-01-012020-12-310001819796us-gaap:FairValueInputsLevel1Member2022-12-310001819796us-gaap:FairValueInputsLevel2Member2022-12-310001819796us-gaap:FairValueInputsLevel3Member2022-12-310001819796us-gaap:FairValueInputsLevel1Membergcm:PublicWarrantsMember2022-12-310001819796us-gaap:FairValueInputsLevel2Membergcm:PublicWarrantsMember2022-12-310001819796us-gaap:FairValueInputsLevel3Membergcm:PublicWarrantsMember2022-12-310001819796gcm:PublicWarrantsMember2022-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001819796gcm:PrivateWarrantsMember2022-12-310001819796us-gaap:FairValueInputsLevel1Member2021-12-310001819796us-gaap:FairValueInputsLevel2Member2021-12-310001819796us-gaap:FairValueInputsLevel3Member2021-12-310001819796us-gaap:FairValueInputsLevel1Membergcm:PublicWarrantsMember2021-12-310001819796us-gaap:FairValueInputsLevel2Membergcm:PublicWarrantsMember2021-12-310001819796us-gaap:FairValueInputsLevel3Membergcm:PublicWarrantsMember2021-12-310001819796gcm:PublicWarrantsMember2021-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819796gcm:PrivateWarrantsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819796gcm:PrivateWarrantsMember2021-12-310001819796us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2022-12-310001819796us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2022-12-310001819796us-gaap:MeasurementInputDiscountRateMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Member2022-12-310001819796us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2021-12-310001819796us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2022-12-310001819796us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2022-12-310001819796us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMembersrt:MinimumMember2021-12-310001819796us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMembersrt:MaximumMember2021-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2022-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2022-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Member2022-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2021-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2021-12-310001819796gcm:MeasurementInputExpectedReturnLiquidAssetsMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819796us-gaap:FairValueInputsLevel3Membersrt:MinimumMembergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2022-12-310001819796us-gaap:FairValueInputsLevel3Membersrt:MaximumMembergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2022-12-310001819796srt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Membergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2022-12-310001819796us-gaap:FairValueInputsLevel3Membersrt:MinimumMembergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2021-12-310001819796us-gaap:FairValueInputsLevel3Membersrt:MaximumMembergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2021-12-310001819796srt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Membergcm:MeasurementInputExpectedTotalValueToPaidInCapitalMember2021-12-310001819796us-gaap:FairValueInputsLevel3Member2020-12-310001819796us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001819796us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001819796gcm:PrivateWarrantsMember2021-01-012021-12-310001819796us-gaap:ContractBasedIntangibleAssetsMember2022-12-310001819796us-gaap:CustomerRelationshipsMember2022-12-310001819796us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001819796us-gaap:OtherIntangibleAssetsMember2022-12-310001819796us-gaap:ContractBasedIntangibleAssetsMember2021-12-310001819796us-gaap:CustomerRelationshipsMember2021-12-310001819796us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001819796us-gaap:OtherIntangibleAssetsMember2021-12-31gcm:vote0001819796us-gaap:CommonClassAMember2020-12-310001819796us-gaap:CommonClassBMember2020-12-310001819796us-gaap:CommonClassCMember2020-12-310001819796us-gaap:CommonClassBMember2021-01-012021-12-310001819796us-gaap:CommonClassCMember2021-01-012021-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2021-01-012021-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassBMember2021-01-012021-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassCMember2021-01-012021-12-310001819796us-gaap:CommonClassBMember2022-01-012022-12-310001819796us-gaap:CommonClassCMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassBMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassCMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2022-12-310001819796us-gaap:CommonClassAMember2021-01-042021-01-040001819796us-gaap:CommonClassAMember2021-02-252021-02-250001819796us-gaap:CommonClassAMember2021-08-062021-08-060001819796us-gaap:CommonClassAMember2021-11-082021-11-080001819796us-gaap:CommonClassAMember2022-02-102022-02-100001819796us-gaap:CommonClassAMember2022-05-052022-05-050001819796us-gaap:CommonClassAMember2022-08-082022-08-080001819796us-gaap:CommonClassAMember2022-11-072022-11-070001819796us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819796gcm:ClassACommonStockAndWarrantsMember2021-08-060001819796gcm:ClassACommonStockAndWarrantsMember2022-05-050001819796gcm:ClassACommonStockAndWarrantsMember2022-02-100001819796gcm:ClassACommonStockAndWarrantsMember2022-11-070001819796gcm:PublicWarrantsMember2022-01-012022-12-310001819796gcm:PublicWarrantsMember2021-01-012021-12-310001819796gcm:PublicWarrantsMemberus-gaap:CommonClassAMember2022-12-31gcm:day0001819796gcm:PrivatePlacementWarrantsMember2022-01-012022-12-310001819796gcm:PublicWarrantsMember2020-12-310001819796gcm:PrivatePlacementWarrantsMember2020-12-310001819796gcm:PrivatePlacementWarrantsMember2021-01-012021-12-310001819796gcm:PrivatePlacementWarrantsMember2021-12-310001819796gcm:PrivatePlacementWarrantsMember2022-12-310001819796gcm:CapitalFundingCommitmentsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001819796gcm:CapitalFundingCommitmentsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-12-310001819796us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001819796us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-12-310001819796us-gaap:NoncontrollingInterestMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001819796us-gaap:NoncontrollingInterestMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2021-12-310001819796gcm:FurnitureFixturesAndLeaseholdImprovementsMember2022-12-310001819796gcm:FurnitureFixturesAndLeaseholdImprovementsMember2021-12-310001819796gcm:FurnitureFixturesAndLeaseholdImprovementsMembersrt:MinimumMember2022-01-012022-12-310001819796gcm:FurnitureFixturesAndLeaseholdImprovementsMembersrt:MaximumMember2022-01-012022-12-310001819796us-gaap:OfficeEquipmentMember2022-12-310001819796us-gaap:OfficeEquipmentMember2021-12-310001819796us-gaap:OfficeEquipmentMember2022-01-012022-12-310001819796gcm:ComputerEquipmentAndSoftwareMember2022-12-310001819796gcm:ComputerEquipmentAndSoftwareMember2021-12-310001819796gcm:ComputerEquipmentAndSoftwareMembersrt:MinimumMember2022-01-012022-12-310001819796gcm:ComputerEquipmentAndSoftwareMembersrt:MaximumMember2022-01-012022-12-310001819796us-gaap:AirTransportationEquipmentMember2022-12-310001819796us-gaap:AirTransportationEquipmentMember2021-12-310001819796us-gaap:AirTransportationEquipmentMember2022-01-012022-12-310001819796gcm:AssetsInProgressMember2022-12-310001819796gcm:AssetsInProgressMember2021-12-310001819796us-gaap:AirTransportationEquipmentMember2019-08-012019-08-3100018197962021-03-012021-03-310001819796gcm:GCMHEquityholdersAwardsMember2022-01-012022-12-310001819796gcm:GCMHEquityholdersAwardsMember2022-12-310001819796us-gaap:RestrictedStockUnitsRSUMember2021-03-012021-03-310001819796gcm:LiabilityClassifiedRSUsMember2022-01-012022-12-310001819796srt:MinimumMembergcm:OtherAwardsMember2022-01-012022-12-310001819796srt:MaximumMembergcm:OtherAwardsMember2022-01-012022-12-310001819796us-gaap:RestrictedStockUnitsRSUMember2021-12-310001819796us-gaap:RestrictedStockUnitsRSUMember2022-12-310001819796gcm:LiabilityClassifiedRSUsMember2021-12-310001819796gcm:LiabilityClassifiedRSUsMember2022-12-310001819796us-gaap:SeniorNotesMember2022-12-310001819796us-gaap:SeniorNotesMember2021-12-310001819796us-gaap:SeniorNotesMember2020-12-310001819796us-gaap:SeniorNotesMember2020-01-012020-12-310001819796us-gaap:SeniorNotesMembergcm:AmendedTermLoanFacilityDueFebruary242028Member2021-02-240001819796us-gaap:SeniorNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMembergcm:AmendedTermLoanFacilityDueFebruary242028Member2021-02-242021-02-240001819796gcm:AmendedTermLoanFacilityDueFebruary242028Amendment1Memberus-gaap:SeniorNotesMember2021-02-242021-02-240001819796gcm:AmendedTermLoanFacilityDueFebruary242028Amendment1Memberus-gaap:SeniorNotesMember2021-01-012021-12-310001819796gcm:AmendedTermLoanFacilityDueFebruary242028Amendment1Memberus-gaap:SeniorNotesMember2021-12-310001819796gcm:AmendedTermLoanFacilityDueFebruary242028Amendment2Memberus-gaap:SeniorNotesMember2021-06-230001819796us-gaap:SeniorNotesMember2021-06-232021-06-230001819796us-gaap:SeniorNotesMember2022-01-012022-12-310001819796us-gaap:SeniorNotesMember2021-01-012021-12-310001819796us-gaap:SeniorNotesMembergcm:AmendedTermLoanFacilityDueFebruary242028Member2022-12-310001819796us-gaap:SeniorNotesMembergcm:AmendedTermLoanFacilityDueFebruary242028Member2021-12-310001819796us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2014-01-020001819796us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001819796us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001819796gcm:InterestRateSwap437Member2022-12-310001819796gcm:InterestRateSwap133Member2021-12-310001819796gcm:InterestRateSwap139Member2021-12-310001819796us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2021-12-310001819796us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-12-310001819796us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-01-012022-12-310001819796us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2021-01-012021-12-310001819796us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-12-310001819796us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateContractMember2021-01-012021-12-310001819796gcm:InterestRateSwap133Member2021-03-010001819796gcm:InterestRateSwap139Member2021-07-010001819796gcm:InterestRateSwap139Memberus-gaap:LondonInterbankOfferedRateLIBORMember2021-07-010001819796gcm:InterestRateSwap133And139Member2022-10-012022-10-310001819796gcm:InterestRateSwap437Member2022-11-010001819796gcm:InterestRateSwap437Memberus-gaap:LondonInterbankOfferedRateLIBORMember2022-11-010001819796gcm:FixedManagementFeeMember2021-03-102021-03-1000018197962021-03-102021-03-100001819796us-gaap:AirTransportationEquipmentMember2021-03-102021-03-100001819796gcm:GrosvenorCapitalManagementHoldingsLLLPMemberus-gaap:AirTransportationEquipmentMember2021-03-112021-03-1100018197962021-03-112021-03-110001819796gcm:FixedManagementFeeMember2022-01-012022-12-310001819796gcm:CapitalFundingCommitmentsMember2022-12-310001819796gcm:CapitalFundingCommitmentsMember2021-12-310001819796srt:ManagementMember2022-12-310001819796srt:ManagementMember2021-12-310001819796gcm:AircraftUtilizationMembersrt:AffiliatedEntityMembergcm:GrosvenorCapitalManagementHoldingsLLLPMember2022-01-012022-12-310001819796gcm:AircraftUtilizationMembersrt:AffiliatedEntityMembergcm:GrosvenorCapitalManagementHoldingsLLLPMember2021-01-012021-12-310001819796gcm:AircraftUtilizationMembersrt:AffiliatedEntityMembergcm:GrosvenorCapitalManagementHoldingsLLLPMember2020-01-012020-12-310001819796gcm:PrivateWarrantsMember2022-01-012022-12-310001819796gcm:PrivateWarrantsMember2020-11-172020-12-310001819796gcm:PublicWarrantsMember2020-11-172020-12-310001819796gcm:PartnershipUnitsMember2022-01-012022-12-310001819796gcm:PartnershipUnitsMember2021-01-012021-12-310001819796gcm:PartnershipUnitsMember2020-11-172020-12-310001819796us-gaap:WarrantMembergcm:PublicWarrantsMember2022-01-012022-12-310001819796us-gaap:WarrantMembergcm:PublicWarrantsMember2021-01-012021-12-310001819796us-gaap:WarrantMembergcm:PublicWarrantsMember2020-11-172020-12-310001819796us-gaap:WarrantMembergcm:PrivatePlacementWarrantsMember2022-01-012022-12-310001819796us-gaap:WarrantMembergcm:PrivatePlacementWarrantsMember2021-01-012021-12-310001819796us-gaap:WarrantMembergcm:PrivatePlacementWarrantsMember2020-11-172020-12-310001819796gcm:GRVSecuritiesLLCMember2022-12-310001819796us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2023-02-092023-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-K

__________________________________

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39716

__________________________________

GCM Grosvenor Inc.

(Exact Name of Registrant as Specified in Its Charter)

__________________________________

| | | | | | | | | | | | | | |

| Delaware | | | | 85-2226287 |

| (State or Other Jurisdiction of Incorporation or Organization) | | | | (I.R.S. Employer Identification No.) |

900 North Michigan Avenue, Suite 1100 Chicago, IL | | | | 60611 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

312-506-6500

Registrant's telephone number, including area code

__________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A common stock, $0.0001 par value per share | GCMG | The Nasdaq Stock Market LLC |

Warrants to purchase shares of Class A common stock | GCMGW | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $288.4 million, based on the closing price of the registrant’s common stock on the Nasdaq Stock Market on June 30, 2022 of $6.85 per share.

As of February 21, 2023, there were 41,611,742 shares of the registrant’s Class A common stock, par value $0.0001 per share, outstanding and 144,235,246 shares of the registrant’s Class C common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

BASIS OF PRESENTATION

As used in this Annual Report on Form 10-K, unless as the context requires otherwise, as used herein, references to “GCM,” the “Company,” “we,” “us,” and “our,” and similar references refer collectively to GCM Grosvenor Inc. and its consolidated subsidiaries.

Unless the context otherwise requires, references in this Annual Report on Form 10-K to:

•“A&R LLLPA” are to the Fifth Amended and Restated Limited Liability Limited Partnership Agreement of GCMH;

•“AUM” are to assets under management;

•“Business Combination” or “Transaction” are to the transactions contemplated by the Transaction Agreement;

•“Business Combination Lock-up Period” are to (a) with respect to the voting parties, the period beginning on the Closing Date and ending on the date that is the 3rd anniversary of the Closing Date and (b) with respect to the CF Sponsor, the period beginning on the Closing Date and ending on the date that is the 18th month anniversary of the Closing Date, subject to early expiration;

•“Bylaws” are to our Amended and Restated Bylaws;

•“CAGR” are to compound annual growth rate;

•“CFAC” are to CF Finance Acquisition Corp., a Delaware corporation;

•“CF Investor” are to CF GCM Investor, LLC, a Delaware limited liability company;

•“CF Sponsor” are to CF Finance Holdings, LLC, a Delaware limited liability company;

•“Charter” are to our Amended and Restated Certificate of Incorporation;

•“Class C Share Voting Amount” are to the “Class C Share Voting Amount,” as such term is defined in our Charter, which is generally a number of votes per share equal to (1) (x) an amount of votes equal to 75% of the aggregate voting power of our outstanding capital stock (including for this purpose any Includible Shares), minus (y) the total voting power of our outstanding capital stock (other than the Class C common stock) owned or controlled, directly or indirectly, by the Key Holders (including any Includible Shares), divided by (2) the number of shares of Class C common stock then outstanding;

•“clients” are to persons who invest in our funds, even if such persons are not deemed clients of our registered investment adviser subsidiaries for purposes of the Investment Advisers Act 1940, as amended;

•“Closing” are to the consummation of the Business Combination;

•“Closing Date” are to November 17, 2020;

•“Code” are to the U.S. Internal Revenue Code of 1986, as amended;

•“Class A common stock” are to our Class A common stock, par value $0.0001 per share;

•“Class B common stock” are to our Class B common stock, par value $0.0001 per share;

•“Class C common stock” are to our Class C common stock, par value $0.0001 per share;

•“FPAUM” are to fee-paying AUM;

•“GCMG” are to GCM Grosvenor Inc., which was incorporated in Delaware as a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP, formed for the purpose of completing the Transaction. Pursuant to the Transaction, Grosvenor Capital Management Holdings, LLLP cancelled its shares in GCM Grosvenor Inc. no longer making GCM Grosvenor Inc. a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP;

•“GCM Grosvenor” are to GCMH, its subsidiaries, and GCM, LLC;

•“GCM LLC” are to GCM, L.L.C., a Delaware limited liability company;

•“GCM private placement warrants” are to the warrants for Class A common stock (which are in identical form of private placement warrants but in the name of GCM Grosvenor Inc.);

•“GCM V” are to GCM V, LLC, a Delaware limited liability company;

•“GCMH” are to Grosvenor Capital Management Holdings, LLLP, a Delaware limited liability limited partnership;

•“GCM Funds” and “our funds” are to GCM Grosvenor’s specialized funds and customized separate accounts;

•“GCMHGP LLC” are to GCMH GP, L.L.C., a Delaware limited liability company;

•“GCMH Equityholders” are to Holdings, Management LLC, Holdings II, and GCM Progress Subsidiary LLC;

•“GCMLP” are to Grosvenor Capital Management, L.P., an Illinois limited partnership;

•“Grosvenor common units” are to units of partnership interests in GCMH entitling the holder thereof to the distributions, allocations, and other rights accorded to holders of partnership interests in GCMH following the Grosvenor Redomicile and LLLPA Amendment;

•“Holdings” are to Grosvenor Holdings, L.L.C., an Illinois limited liability company;

•“Holdings II” are to Grosvenor Holdings II, L.L.C., a Delaware limited liability company;

•“Includible Shares” are to any shares of our voting stock issuable in connection with the exercise (assuming, solely for this purpose, full exercise and not net exercise) of all outstanding options, warrants, exchange rights, conversion rights or similar rights to receive voting stock of GCM Grosvenor Inc., in each case owned or controlled, directly or indirectly, by the Key Holders, but excluding the number of shares of Class A common stock issuable in connection with the exchange of Grosvenor common units, as a result of any redemption or direct exchange of Grosvenor common units effectuated pursuant the A&R LLLPA;

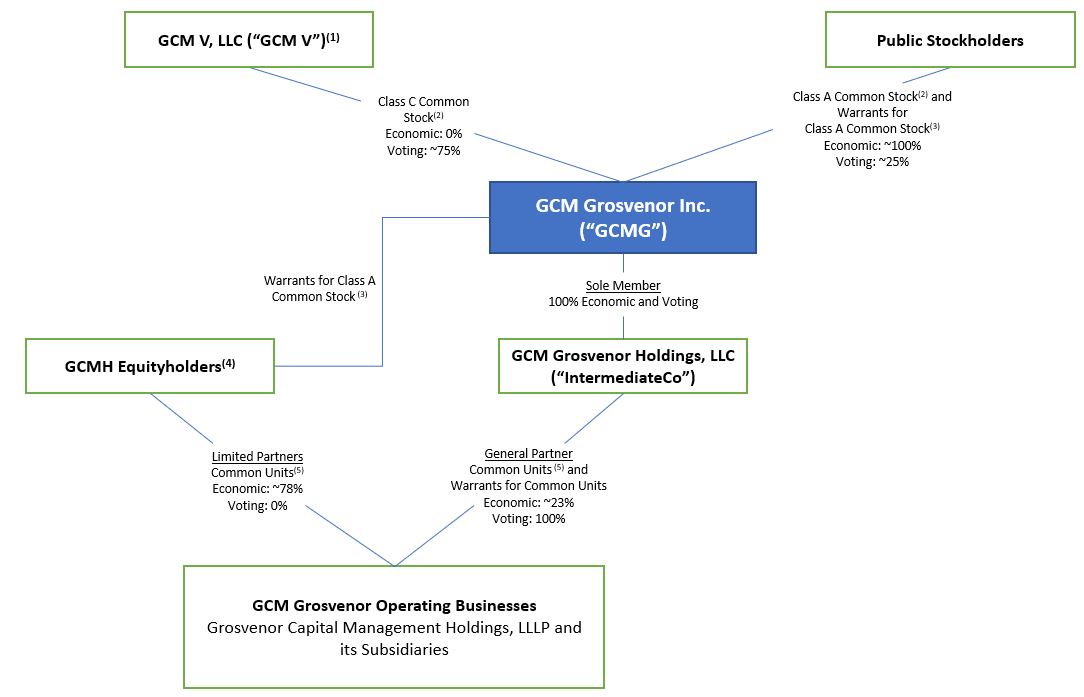

•“IntermediateCo” are to GCM Grosvenor Holdings, LLC (formerly known as CF Finance Intermediate Acquisition, LLC), a Delaware limited liability company;

•“Key Holders” are to Michael J. Sacks, GCM V and the GCMH Equityholders;

•“lock-up shares” are to (a) with respect to the CF Sponsor, the shares of CFAC common stock held by the CF Sponsor on the Closing Date or received by CF Sponsor in connection with the Business Combination, any warrants to purchase shares of CFAC common stock held by the CF Sponsor on the Closing Date or received by CF Sponsor in connection with the Business Combination, and any shares of CFAC common stock issued to the CF Sponsor upon exercise of any such warrants to purchase CFAC common stock and (b) with respect to the voting parties, (i) the shares of our common stock received by the voting parties on the Closing Date, (ii) any shares of our common stock received by any voting party after the Closing Date pursuant to a direct exchange or redemption of Grosvenor common units held as of the Closing Date under the A&R LLLPA and (iii) the GCM private placement warrants held by the voting parties as of the Closing Date and any shares of our common stock issued to the voting parties upon exercise thereof;

•“Management LLC” are to GCM Grosvenor Management, LLC, a Delaware limited liability company;

•“Mosaic” are to Mosaic Acquisitions 2020, L.P.;

•“Mosaic Transaction” are to a transaction, effective January 1, 2020, by which GCMH and its affiliates transferred certain indirect partnerships interests related to historical investment funds managed by GCMH and its affiliates to Mosaic;

•“NAV” are to net asset value;

•“PIPE Investors” are to the qualified institutional buyers and accredited investors that agreed to purchase shares of Class A common stock in a private placement in connection with the execution of the Transaction Agreement and the Business Combination;

•“Registration Rights Agreement” are to that certain Amended and Restated Registration Rights Agreement to be entered into by and among us, the CF Sponsor, the GCMH Equityholders and the PIPE Investors;

•“Sponsor Support Agreement” are to that certain Sponsor Support Agreement, dated as of August 2, 2020, by and among the CF Sponsor, CFAC, GCMH and Holdings;

•“Stockholders’ Agreement” are to that certain Stockholders’ Agreement to be entered into by and among us, the GCMH Equityholders and GCM V;

•“Sunset Date” are to the date the GCMH Equityholders beneficially own a number of voting shares representing less than 20% of the number of shares of Class A common stock beneficially owned by the GCMH Equityholders immediately following the Closing Date (assuming, for this purpose, that all outstanding Grosvenor common units are and were exchanged at the applicable measurement time by the GCMH Equityholders for shares of Class A common stock in accordance with the A&R LLLPA and without regard to the lock-up or any other restriction on exchange);

•“Transaction Agreement” are to the definitive transaction agreement, dated as of August 2, 2020, by and among CFAC, IntermediateCo, the CF Sponsor, GCMH, the GCMH Equityholders, GCMHGP LLC, GCM V and us;

•“Underlying funds” are to the investment vehicles managed by third-party investment managers in which GCM Funds invest;

•“TRA Parties” are to the GCMH LLLP Equityholders, and their successors and assigns with respect to the Tax Receivable Agreement (“TRA”);

•“Voting shares” are to our securities that are beneficially owned by a voting party that may be voted in the election of our directors, including any and all of our securities acquired and held in such capacity subsequent to the date of the Transaction Agreement; and

•“Warrant Agreement” are to that certain Warrant Agreement, dated as of December 12, 2018, between Continental Stock Transfer & Trust Company and CFAC.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including, but not limited to, statements regarding our future results of operations or financial condition; business strategy and plans; and market opportunity may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “forecasts,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to statements regarding our future results of operations and financial position, industry and business trends, equity compensation, business strategy, plans, market growth and our objectives for future operations.

The forward-looking statements in this Annual Report on Form 10-K are only current expectations and predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the historical performance of GCM Grosvenor’s funds may not be indicative of GCM Grosvenor’s future results; risks related to redemptions and termination of engagements; the variable nature of GCM Grosvenor’s revenues; competition in GCM Grosvenor’s industry; effects of government regulation or compliance failures; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks related to the performance of GCM Grosvenor’s investments; and the other important factors discussed under the caption “Risk Factors” in this Annual Report on Form 10-K. The forward-looking statements in this Annual Report on Form 10-K are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed as exhibits to this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained in this Annual Report on Form 10-K.

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” in this Annual Report on Form 10-K, that represent challenges that we face in connection with the successful implementation of our strategy and the growth of our business. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of shares of our Class A common stock or warrants:

•The historical performance of our funds should not be considered as indicative of the future results of our operations or any returns expected on an investment in our Class A common stock;

•Investors in our open-ended, specialized funds may generally redeem their investments in these funds on a periodic basis. Investors in most of our closed-ended, specialized funds may terminate the commitment periods of these funds or otherwise cause our removal as general partner of these funds under certain circumstances;

•Our business and financial condition may be materially adversely impacted by the variable nature of our revenues, and in particular the performance-based aspect of certain of our revenues and cash flows;

•The industry in which we operate is intensely competitive. If we are unable to compete successfully, our business and financial condition could be adversely affected;

•A decline in the pace or size of fundraising or investments made by us on behalf of our funds may adversely affect our revenues;

•We are subject to numerous conflicts of interest that are both inherent to our business and industry and particular to us;

•Our entitlement to receive carried interest from many of our funds may create an incentive for us to make more speculative investments and determinations on behalf of a fund than would be the case in the absence of such arrangement;

•Our international operations subject us to numerous risks;

•Our indebtedness may expose us to substantial risks;

•Extensive government regulation, compliance failures and changes in law or regulation could adversely affect us;

•Difficult market, geopolitical and economic conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our funds, reducing the number of high-quality investment managers with whom we may invest, and reducing the ability of our funds to raise or deploy capital;

•If the investments we make on behalf of our funds perform poorly, we may suffer a decline in our revenues;

•The loss of experienced and senior personnel could have a material adverse effect on our business and financial condition;

•We intend to expand our business and may enter into new lines of business or geographic markets, which may result in additional risks and uncertainties in our business; and

•Operational risks may disrupt our business, damage our reputation, result in financial losses or limit our growth.

Part I.

ITEM 1. BUSINESS

Our Company

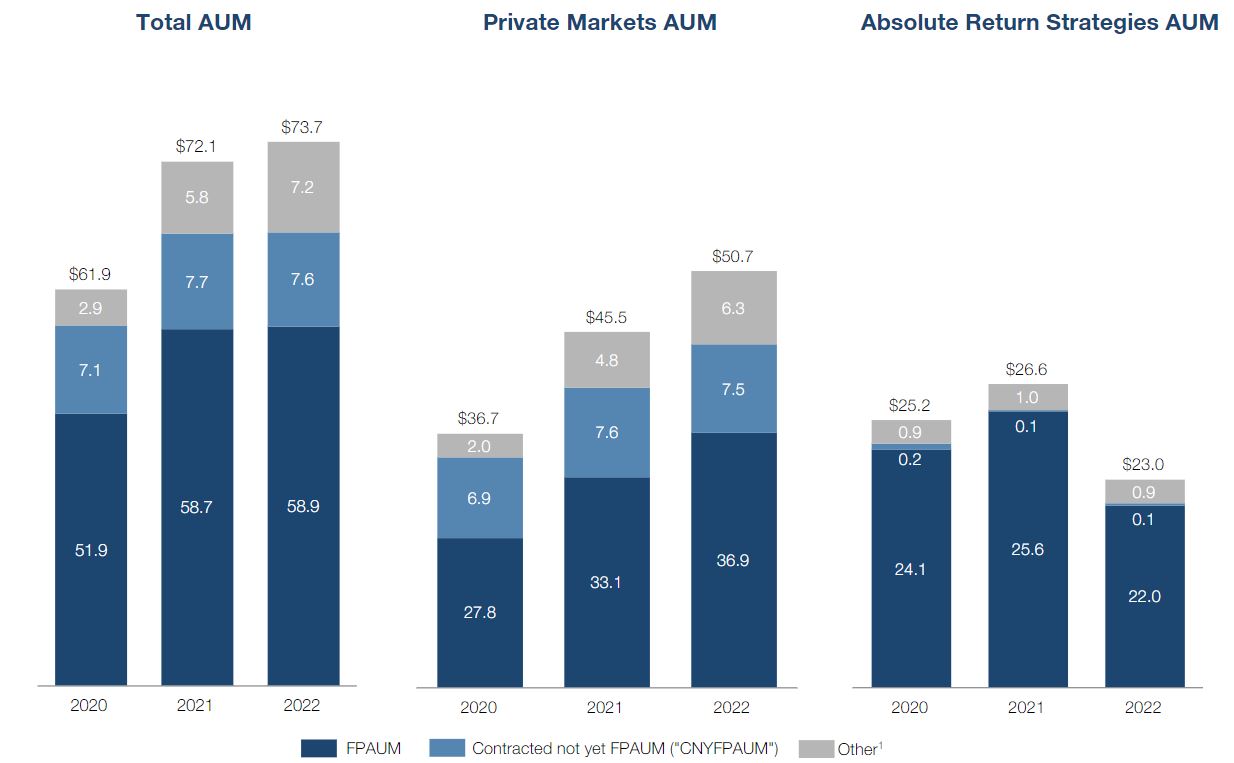

Over our 51-year history we have been a leading global alternative asset management solutions provider. We invest across all major alternative investment strategies and are highly flexible in how we structure our solutions to meet each client’s specific needs. As of December 31, 2022, we had $73.7 billion in AUM.

We collaborate with our more than 500 clients as of December 31, 2022 to invest on their behalf across the private and public markets, either through portfolios customized to meet a client’s specific objectives or through specialized funds that are developed to meet broad market demands for strategies and risk-return objectives. Our clients include large, sophisticated, global institutional investors and a growing non-institutional client base. In both cases, our clients rely on our investment expertise and differentiated investment access to navigate the alternatives market. As one of the pioneers of customized separate account solutions, we are equipped to provide investment services to clients with a wide variety of needs, internal resources and investment objectives, and our client relationships are deep and frequently span decades.

As of December 31, 2022, we had 529 employees, including 170 investment professionals, operating in eight offices throughout the United States and in Frankfurt, Hong Kong, London, Seoul, Tokyo, and Toronto.

For the years ended December 31, 2022 and 2021, our total management fees were $367 million and $351 million, respectively, total operating revenues were $447 million and $532 million, respectively, our net income was $20 million and $21 million, respectively, our fee related earnings were $129 million and $120 million, respectively, and our adjusted net income was $94 million and $119 million, respectively.

We believe our history, experience, expertise and scale across the full range of alternative investment strategies, combined with our flexible implementation approach, are key differentiators and position us well to provide a strong value proposition for clients. In addition, we believe our culture, which is rooted in values of integrity and responsibility, is a key intangible asset to all our stakeholders.

Investment Strategies

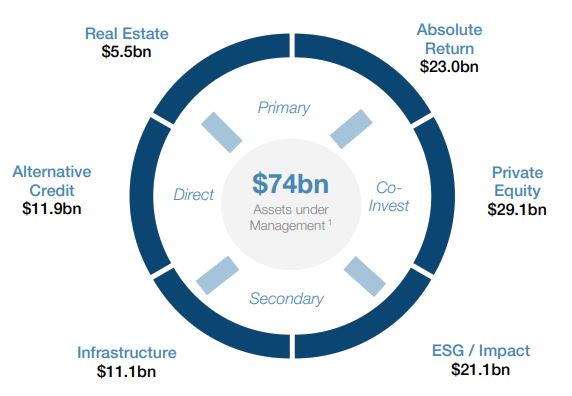

1 AUM as of December 31, 2022; ESG / Impact and Alternative Credit investments overlap with investments in other strategies.

We operate at scale across the full range of private markets and absolute return strategies. Private markets and absolute return strategies are primarily defined by the liquidity of the underlying securities purchased, the length of the client

commitment, and the form and timing of incentive fees. We offer the following private markets and absolute return investment strategies:

Private Markets

Private Markets represents $50.7 billion of AUM, or 69% of total AUM. Private Markets consists of Private Equity, Infrastructure and Real Estate as well as certain strategies that span the full breadth of the platform, which are addressed in more detail below.

•Private Equity. We are a recognized industry leader in private equity with global capabilities investing in primary funds, secondaries and co-investments. As of December 31, 2022, we managed $29.1 billion of AUM in private equity strategies.

•Infrastructure. We are a leading open architecture infrastructure platform with nearly two decades of experience. Our investment activities span geographies, infrastructure subsectors, and include fund investing, secondary investing and direct investing. As of December 31, 2022, we managed $11.1 billion of AUM in infrastructure strategies.

•Real Estate. We manage real estate investment portfolios through a flexible investment platform to provide differentiated exposure to opportunistic real estate investments, primarily in North America. We are a leader in seeding new platforms, joint venture investing, and other creative and innovative implementation methods to access attractive real estate returns. As of December 31, 2022, we managed $5.5 billion of AUM in real estate strategies.

Absolute Return Strategies

•Absolute Return Strategies. We have been investing in hedge fund strategies for over 50 years. We are an experienced and scaled platform with a leading capability in providing customized solutions. As of December 31, 2022, we managed $23.0 billion of AUM in our absolute return strategies, or 31% of our total AUM.

Strategies Across Private Markets and Absolute Return Strategies

•Middle Market and Small, Emerging, and Diverse Managers. Over the past 30 years, we have developed a market-leading, dedicated effort to investing in and alongside middle market and small and emerging managers, which we believe adds significant, differentiated value to our clients. In addition, we have invested with diverse managers for approximately 20 years, consistent with our firm’s commitment to seeking the best possible risk-adjusted investment returns for our clients. We believe diverse managers represent a compelling, yet undercapitalized investment opportunity in the alternatives universe. In the fourth quarter of 2022, we launched the GCM Grosvenor Elevate strategy (“Elevate”) with a $500 million anchor investment. Elevate is a natural extension of our existing platform and is focused on making catalytic seed investments in small, emerging, and diverse investor entrepreneurs to help build and scale their investment firms. As of December 31, 2022, we managed $17.9 billion of AUM in small and emerging managers and $13.1 billion of AUM in diverse managers.

•Alternative Credit. We are a leader in alternative credit investing and our one firm approach to the asset class provides us with a competitive advantage. Our activities cover the liquidity spectrum across structured credit, corporate credit, distressed, direct lending, and real assets. As of December 31, 2022, we managed $11.9 billion of AUM in alternative credit strategies.

•Opportunistic Investing. Our Strategic Investments Group combines our unparalleled deal sourcing platform with the flexibility to capture an evolving opportunity set across asset classes, liquidity profiles, capital structures and geographies. We integrate this deal sourcing capability and flexible mandate with a seamless execution process that has allowed our Strategic Investments Group to become one of the leading opportunistic investing platforms in the marketplace. Total AUM for our Strategic Investments Group is $5.0 billion as of December 31, 2022.

•ESG and Impact Strategies. We have implemented ESG and Impact solutions for clients for over two decades. We were early adopters of offering clients choice around the inclusion of Environmental, Social, Governance, and/or Impact factors into their portfolio construction. We have been consistently committed to helping our clients achieve their ESG and/or Impact objectives by designing solutions that meet our clients’ varied goals, priorities,

and risk tolerances. As of December 31, 2022, we managed $21.1 billion of AUM in ESG and Impact investments.

Client Offerings and Value Proposition

We strive to put our clients’ needs first, and a key to doing that is by providing solutions across alternatives strategies with a high degree of flexibility. Within each investment strategy, we make primary investments in funds managed by third-party managers, which we refer to as primary fund investments; we acquire secondary stakes in such funds, which we refer to as secondaries; we co-invest alongside such primary fund managers, which we refer to as co-investments; and we invest directly into operating businesses and operating assets, which we refer to as direct investing. A number of our clients utilize multiple strategies and approaches.

From a structural standpoint, we offer investment portfolios to clients in two broad categories:

•Customized separate accounts. We construct customized portfolios to meet our clients’ specific objectives with regards to asset classes, implementation types, return, risk tolerance, diversification, liquidity and other factors. Generally available for commitments of $100 million or more, customized separate accounts comprised $54.3 billion, or 74% of our AUM as of December 31, 2022.

•Specialized funds. We organize, invest and manage specialized primary, secondary and direct/co-investment and multi-asset class funds across both private markets and absolute return strategies. Since 2015, we have increased our focus on building our offering of specialized funds particularly within private market strategies to leverage our existing investment capabilities and expand our investor footprint. Our product offerings have grown steadily since focusing in this area. Our specialized funds comprised $19.4 billion, or 26% of our AUM as of December 31, 2022.

We believe that our strong economic value proposition helps create a moat around our strategic partnerships with our clients, which in turn helps foster long-term relationships. Depending on the program, we offer our clients fee savings and preferential terms as well as access to proprietary capacity or deal flow.

Beyond our strong economic value proposition, for many of our large clients we also provide value-add ancillary services, including fund administration, portfolio risk management and research access. Clients also can benefit from the scale of GCM Grosvenor’s data and technology systems.

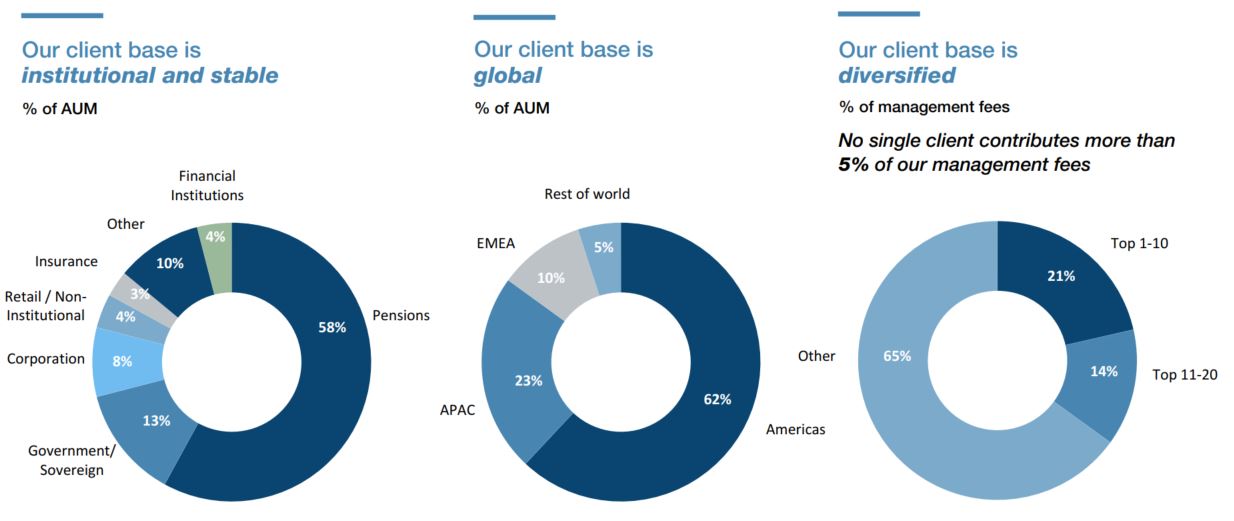

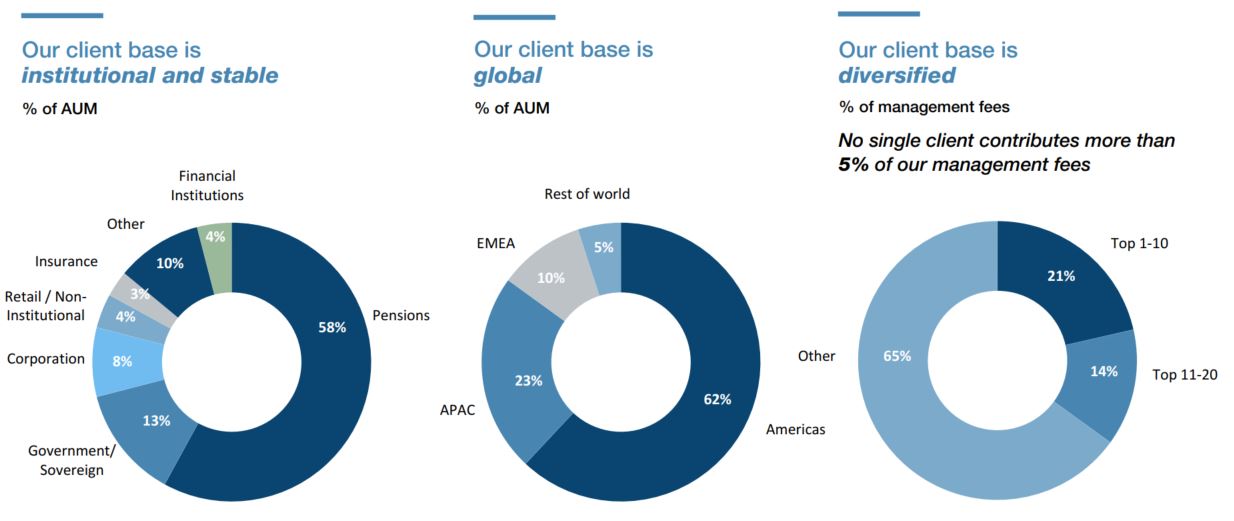

Global Footprint and Diversified Client Base

Our client base is highly tenured, in large part due to the aforementioned strength of our value proposition. Our 25 largest clients by AUM have been with us for an average of approximately 14 years and 88% of these clients have expanded their investment relationship with us over the last three years. Across our customized separate accounts, capital raised from existing clients was more than 69% of the total capital raised in 2022 and has typically been 50%-80% of total annual capital raised historically. Notably, capital from existing clients has pertained to both existing programs and new portfolios in different investment strategies, and cross-selling has traditionally been a driver of the firm’s growth. As of December 31, 2022, 50% of our top 50 clients by AUM worked with us in multiple investment strategies (i.e., private equity, infrastructure, real estate, and absolute return strategies), compared to 48% as of December 31, 2021. Our existing clients continue to be a significant source of fundraising.

We had over 500 institutional clients as of December 31, 2022, which were broadly diversified by type, size, geography, and revenue. Our clients include some of the world’s largest pension funds, sovereign wealth entities, corporations, financial institutions, and insurance corporations. Our non-institutional client base includes family offices and high-net-worth and mass affluent individuals.

Note: AUM as of December 31, 2022. Management fees for the twelve months ended December 31, 2022.

Over our history we have continued to expand our global footprint, which we believe provides us with the opportunity to in turn continue to benefit from the ongoing global growth of the alternative asset management industry. We operate in eight primary offices in seven countries. We serve clients from 33 countries and have deployed capital in over 100 countries across a wide range of investment strategies.

Note: As of December 31, 2022.

Our History

Since the launch of our first multi-manager absolute return portfolio more than 50 years ago, we have specialized in creating and managing alternative investment portfolios on behalf of our clients. From 1971 to the mid-1990s, we provided

specialized absolute return portfolios primarily to high-net-worth and family office investors. During the 1990s, we began to expand our absolute return service offerings and have since developed an institutional-quality operating infrastructure.

Starting in the early 1990s, we increased our emphasis on customized portfolios and broadened our absolute return advisory service offerings. As our assets grew and we strengthened our relationships with managers, we sought to use our scale, experience and industry relationships to tailor investment mandates and negotiate for improved terms for our clients. Over the years, we expanded our global presence through the opening of offices in Europe and Asia to support our growing institutional client base.

In January 2014, we further evolved by adding complementary private markets capabilities through our acquisition of the Customized Fund Investment Group from Credit Suisse Group AG, which was established in 1999. The acquisition added private equity, infrastructure and real estate investment strategies to our business and has been a success both economically and culturally with a commitment to a “one firm” model that is collaborative across investment strategies. We believe this “one firm” culture across the entire range of alternative investment strategies is an important differentiator for us because it enhances the overall value proposition for our clients.

Today, we continue to evolve and expand the ways in which we provide solutions to our global clients. In 2021, we opened new offices in Toronto, Canada and Frankfurt, Germany, and launched GCM Grosvenor Insurance Solutions in an effort to more effectively deliver our alternative investment solutions to the multi-trillion dollar insurance market. In the fourth quarter of 2022, we launched Elevate with a $500 million anchor investment. Elevate is a natural extension of our existing platform and is focused on making catalytic seed investments in small, emerging, and diverse investor entrepreneurs to help build and scale their investment firms.

Our Market Opportunity

The alternative asset management industry continues to see strong growth. According to a 2022 report by Preqin, total alternative AUM is expected to grow from $14 trillion in 2021 to more than $23 trillion in 2027.

Several trends and developments have shaped the alternative investing industry and continue to serve as the primary drivers of our growth:

Growth in Institutional Wealth

Global institutional wealth has increased significantly in recent years and is expected to continue to grow. According to a 2022 report from PricewaterhouseCoopers (“PwC”), total global assets under management for the asset and wealth management market is expected to increase from $127.5 trillion in 2021 to approximately $157.2 trillion in 2026. Continued growth in the investable capital base of these investors is expected to continue to support growth in the alternative investment strategies. Despite volatility in the financial markets in 2022, the longer-term trend remains.

Growth in Allocations to Alternative Investment Strategies

Within the institutional client base, defined benefit pension schemes have found it difficult to achieve targeted returns to meet rising pension fund obligations within a framework of conventional asset allocations to equities and bonds. While this challenge in part originated in the low yield environment of the decade following the financial crisis of the late 2000s, market volatility stemming from rising inflation and interest rates has not lessened the need for alternative investment strategies. In response, pension fund allocations to alternative investment strategies have increased as a means to improve returns to meet these long-term obligations. Similarly, insurance investors have increased their appetite for risk assets, but credit quality and liquidity needs remain key priorities, providing an opportunity for strategies and structures that address those concerns.

Despite the slowdown of the global economy in 2022, according to the 2022 Global Alternative Fund Survey conducted by Ernst & Young, 92% of surveyed institutional investors plan to maintain or increase their current allocations to private equity in 2023. Based on the same survey, 87% of institutional investors plan to maintain or increase their allocations to absolute return strategies. Those numbers are even higher for infrastructure and alternative credit.

Non-institutional capital, which we define as being comprised of high-net-worth, mass affluent and retail investors, also represents a significant market opportunity. Analysis by PwC anticipates that high-net-worth and mass affluent individuals will have approximately $203 trillion of assets available for investment by 2025. Relative to institutional investors, non-institutional investors are generally newer to investing in alternatives and consequently the products and structures offered to this group

continue to evolve. The flexibility of our platform and breadth of our offerings consequently positions us well to capture a greater share of this significant market.

Importance of Sourcing

Growth in the alternative asset management industry over the past two decades has created a competitive environment. According to Preqin data, the number of active fund management firms is expected to increase by 21% from approximately 28,000 in 2018 to approximately 34,000 in 2023. Consequently, more managers compete for capital and also investments, making careful sourcing and evaluations of both managers and transactions critical to generating strong performance.

In addition, a combination of growing inflation, tightening monetary and fiscal policy and high market volatility creates a backdrop for improving alpha generation and also potentially creates higher dispersion in performance. Consequently, our expertise in sourcing alpha generating investment opportunities will be paramount to continued return generation, which is rooted in the breadth and depth of our manager and industry relationships combined with our rigorous due diligence process.

We believe investors will increasingly look to the scale, experience and platform of firms like us to identify high performing investments. Our broad strategy set and flexible implementation platform enables clients to access different investment strategies at different points in economic cycles.

Alternatives Are Now Increasingly a Portfolio Mainstay

Alternative investment strategies have established a track record of strong returns and outperformance versus both the fixed income and public equity markets in the longer term. In addition to strong absolute and relative returns, alternative investments provide diversification, offer an inflation hedge, typically have low correlation to other asset classes and generate relatively stable income. As a result, we expect alternative investment strategies to continue to play an important role in institutional portfolios in the future.

Increasing Focus on ESG and Impact Investing

ESG and Impact investing are increasingly top of mind for many investors and we believe this growth will continue. We have been consistently committed to helping our clients achieve their ESG and Impact objectives by offering choice and designing solutions at their request and specific to our clients’ varied goals, priorities and risk tolerances.

In addition, certain investors increasingly seek a data-driven approach to evaluating success and impact in these areas of investment. We believe we are currently ahead of the industry curve in our ability to flexibly integrate ESG and Impact investment considerations where appropriate, which positions us well with these clients.

Data and Technology Are Important for Investors

Extensive data and technology infrastructure are becoming more important as investors demand greater analytics and transparency. As a result, investors are increasingly seeking to work with firms that not only have a proven track record of investing across multiple investment strategies but are also highly sophisticated in their non-investment functions such as portfolio monitoring, reporting, accounting, legal and compliance, operations and data analysis.

Given our long history in the market and the resulting depth and scale of our relationships and investments, we believe we have one of the most comprehensive sets of data in the industry. In addition, our information advantage spans the breadth of private markets and absolute return investment strategies, which is essential in sourcing differentiated, high-quality investment opportunities. For example, as of December 31, 2022, we tracked more than 6,500 managers across our platform. Our extensive proprietary data and analytics capabilities drive our investment selection decisions, helping us generate consistently strong investment returns.

Our Competitive Strengths

We Offer the Full Breadth of Alternative Investment Strategies

We are one of the few solutions providers globally with breadth and flexibility of execution across a broad spectrum of alternative investment strategies (private markets, including private equity, infrastructure, real estate and alternative credit, and absolute return strategies) and implementation methodologies (primary fund investments, secondaries, co-investments and direct investments). We believe this offers us a unique vantage point as we sit at the intersection of a tremendous amount of

market intelligence and deal flow across our entire platform. As investors try to limit the number of asset manager relationships they maintain by trimming duplicative strategies and managers, they have increasingly turned their focus on a smaller number of solutions providers like us that offer access to multiple investment strategies. According to Preqin’s H1 2020 Investor Outlook Report on Alternative Assets, approximately 52% of institutional investors invest in two or more alternative investment strategies. As of December 31, 2022, 50% of our top 50 clients by AUM worked with us in multiple investment strategies.

We Are a Market Leader in Customized Alternative Investment Solutions

The institutional investor community has increasingly embraced tailored investment programs that are different from the one-size-fits-all solution offered by specialized funds. We believe we were pioneers in the customized separate account / strategic partnership / solutions business, having launched our first absolute return-focused customized separate account in 1996 and our first private markets separate account in 1999. In our customized programs we are deeply embedded with our clients and customized investment solutions provide the ability for a collaborative relationship between clients and asset managers, which can enable clients to address specific interests, issues and needs. Our customized separate account relationships have long tenures and high re-up rates. Capital deployment is typically highly programmatic, meaning re-ups in the case of closed-end programs typically occur every few years. As of December 31, 2022, we had $54.3 billion in AUM across our customized separate accounts for 152 clients across 248 customized portfolios.

We Use our Size, Scale and More Than 50-Year History to Drive a Strong Value Proposition

Over 50-years of industry participation and leadership has afforded us with a vast network of relationships across the full spectrum of the alternatives landscape. Today, we seek to capture the benefits of these relationships, further amplified by our scale as a $73.7 billion investor as of December 31, 2022, to our clients. Depending on the program, we offer our clients fee savings and preferential terms, access to hard to access managers, and proprietary deal flow. In addition, certain investment approaches including co-investing and investing in secondaries rely on the breadth of our firm network from a sourcing and intelligence standpoint.

Leader in ESG and Impact Investment Strategies

As of December 31, 2022 we had $21.1 billion of AUM allocated to ESG and Impact investments, which has increased at a 24% CAGR since 2019. We have dedicated efforts in a number of ESG- and Impact-related themes, including infrastructure investments where we believe partnering with union labor enhances risk-adjusted returns, investing with firms owned by women or minority professionals, and other themes like regionally targeted and clean energy. We believe that we were early adopters of offering clients choice around the integration of ESG and Impact factors into their portfolio construction. We have been committed to helping our clients achieve their ESG and Impact objectives by designing, at their request, solutions that meet our clients’ varied goals, priorities, and risk tolerances. Classification as ESG and Impact is based on the assessment of each such investment by GCM Grosvenor investment team members. There is subjectivity in placing an investment in a particular category, and conventions and methodologies used by GCM Grosvenor in categorizing investments and calculating the data presented may differ from those used by other investment managers.

Note: Some investments are counted in more than one ESG category.

Given our size and scale, we believe we are uniquely placed to engage with stakeholders in our industry and beyond about ESG and Impact factors. Therefore, we are engaged in multiple partnerships with organizations committed to enhancing greater industry transparency and measurement of ESG and Impact factors where appropriate for certain client programs.

Strong Long-Term Performance Across Breadth of Alternative Investment Strategies

As shown below, for our realized and partially realized investments, we have outperformed the respective market benchmarks across all of our private markets strategies on an inception-to-date basis as of September 30, 2022. Past performance is not indicative of future results.

($ in millions, unless otherwise mentioned)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Outperformance of PME by | | PME Index | | Annualized Returns Since Inception | | Inception Date |

| Private Equity | | | | | | | | |

Primary Fund Investments(1) | | 3.4 | % | | S&P 500 | | 14.0 | % | | 2000 |

Secondaries Investments(2) | | 8.6 | % | | S&P 500 | | 20.5 | % | | 2014 |

Co-Investments/Direct Investments(3) | | 5.0 | % | | S&P 500 | | 21.5 | % | | 2009 |

Infrastructure(4) | | 6.1 | % | | MSCI World Infrastructure | | 12.9 | % | | 2006 |

Real Estate(5) | | 7.7 | % | | FNERTR Index | | 20.3 | % | | 2010 |

| | | | | | | | |

| ESG and Impact Strategies | | | | | | | | |

Diverse Managers(6) | | 8.2 | % | | S&P 500 | | 23.2 | % | | 2007 |

| Labor Impact Investments | | N/A | | MSCI World Infrastructure | | N/A | | N/A |

Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through September 30, 2022. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, performance fees, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor.

__________

(1)Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs.

(2)GCM Grosvenor established a dedicated private equity secondaries vertical in September 2014. Track record reflects all secondaries investments since the new vertical was formed.

(3)GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy in December 2008. Track record reflects co-investments/direct investments made since 2009.

(4)Reflects infrastructure investments since 2006. Infrastructure investments exclude labor impact investments.

(5)Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy.

(6)Since 2007.

| | | | | | | | | | | | | | | | | |

| | Annualized Returns Since Inception - Period Ended December 31, 2022 | | Inception Date | | | |

| Absolute Return Strategies | | 6.7 | % | | 1996 | | | |

| GCMLP Diversified Multi-Strategy Composite | | 7.7 | % | | 1993 | | | |

Note: Absolute Return Strategies (Overall) is since 1996. GCMLP Diversified Multi-Strategy Composite is since 1993.

For additional details on our investment performance and explanatory footnotes, please see “— Investment Performance”. In addition to our investment performance, we believe clients value our services and support in portfolio monitoring, reporting, accounting, legal and compliance, operations and data analysis functions.

Scalable and Predictable Business Model

The strength of our business model is derived from the following valuable attributes:

•High management fee centricity. For each of the years ended December 31, 2022 and 2021, net management fees were $356.4 million and $340.8 million, respectively, compared to $13.9 million and $55.5 million of net incentive fees attributable to GCM Grosvenor, respectively.

•Stable management fee base. Our management fee stability is rooted in the long-dated nature of our investment programs. As of December 31, 2022, more than $31.3 billion of our AUM is in evergreen programs - $23.0 billion in absolute return strategies and $8.3 billion in private markets evergreen programs, defined as those with an open-ended structure or NAV target. In addition, as of December 31, 2022, 73% of our AUM in private markets strategies, or $37.3 billion of our AUM, had a remaining tenor of seven years or more.

•Significant visibility into future growth. We have experienced steady growth in the fee-paying AUM (“FPAUM”) that drives our management fees; as of December 31, 2022, we had $58.9 billion in FPAUM and, consequently, management fees have historically been also largely predictable. As of December 31, 2022, we also had an additional approximately $7.6 billion of contracted not yet fee-paying AUM on which we expect to start charging management fees, under existing contracts, over the course of applicable commitments periods that extend for approximately the next three years, bolstering our potential FPAUM growth over the next several years.

•Additional earnings power from incentive fees. Though subject to more variability, including on account of factors out of our control, we believe our incentive fees from both private markets and absolute return strategies have the opportunity to increase significantly in the future due to the amount of assets able to earn incentive fees and recent fundraising success. Incentive fees are comprised of both carried interest earnings and annual performance fees and made up approximately 26% of total revenues in the last three years. The incentive fees have greater variability between time periods; for example, total incentive fees decreased approximately 57% and firm share of incentive fees decreased approximately 70% for the year ended December 31, 2022 compared to 2021. However, we believe that incentive fees also provide potential upside to our revenue stream in the future. For example, as of December 31, 2022, the firm’s share of unrealized carried interest increased by 11% to $368 million, compared to December 31, 2021. Run rate annual performance fees, which reflect the potential annual performance fees generated by performance fee-eligible AUM at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, were $29.6 million as of December 31, 2022.

•Embedded operating leverage. Our business benefits from embedded operating leverage, which in turn drives scalability. Over the last decade, we have made significant investments in our platform infrastructure by building out our investment teams across investment strategies and geographies, which we believe positions us well for continued margin expansion. Our margin on Fee-Related Earnings increased to 36% for the year ended December 31, 2022 compared to 35% in 2021.

Deep Bench of Talent and Strong Corporate Culture

At our firm, we believe culture is one of our most important and defensible assets. We believe in setting the right tone at the top as it relates to compliance and carrying it throughout the organization. That investment in culture is reflected in the stability and diversity of our team as well as the fact that we do not operate on a star system and therefore are not beholden to any one individual. We are committed to investing responsibly, operating our business with integrity, and building a diverse and inclusive workplace where our employees can thrive.

As of December 31, 2022, we had 529 employees, including 170 investment professionals, operating in eight offices throughout the United States and in Toronto, London, Frankfurt, Hong Kong, Seoul and Tokyo. In addition to a competitive compensation structure, we promote a work environment that we believe is interesting and challenging, providing our employees the opportunity to grow professionally. As of December 31, 2022, our current, former employees and the firm had approximately $622 million of their own capital (including through leveraged vehicles) invested into our various investment programs, which we believe aligns our interests with those of our clients.

We believe that diversity, equity, inclusion and belonging are at the heart of our ethos. As of December 31, 2022, 62% of our employees based in the U.S. were women or ethnically diverse, and of our U.S. senior professionals, 54% were women or ethnically diverse employees. We aim to work hard to maintain our focus and continuously improve our efforts in this area.

Finally, we have made significant investments in training, talent and technology so that we are serving our clients with the highest levels of integrity and professionalism. We have been a registered investment adviser since 1997 with a culture of compliance rooted in what we believe is a proper tone at the top.

Strategic Priorities

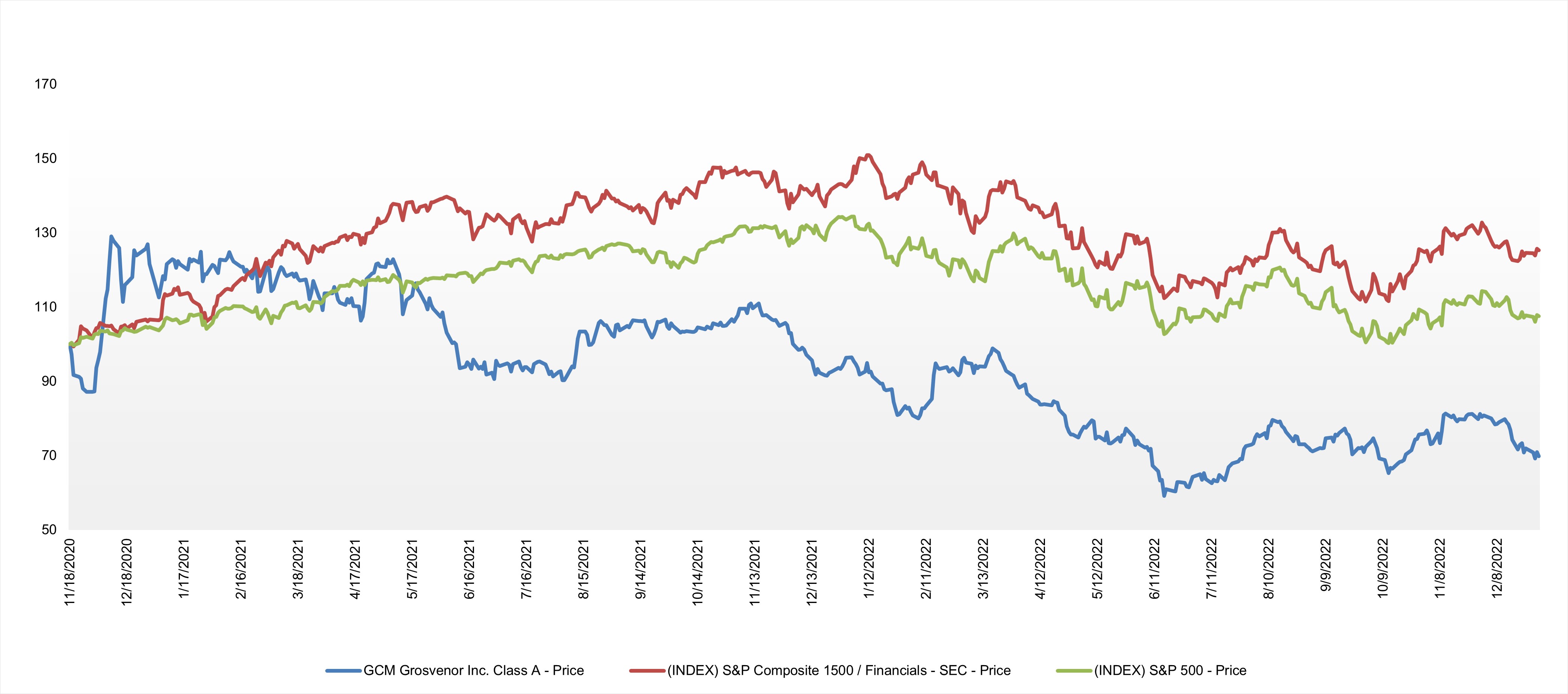

Expand Relationships with Existing Clients