| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

• | “A&R LLLPA” are to the Fifth Amended and Restated Limited Liability Limited Partnership Agreement of GCMH; |

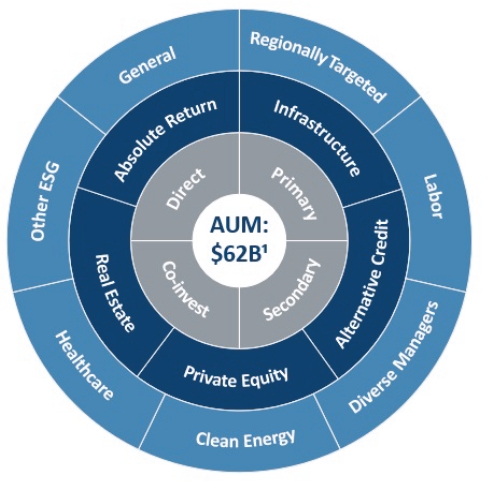

• | “AUM” are to assets under management; |

• | “Business Combination” or “Transaction” are to the transactions contemplated by the Transaction Agreement; |

• | “Business Combination Lock-up Period” are to (a) with respect to the voting parties, the period beginning on the Closing Date and ending on the date that is the 3rd anniversary of the Closing Date and (b) with respect to the CF Sponsor, the period beginning on the Closing Date and ending on the date that is the 18th month anniversary of the Closing Date; |

• | “Bylaws” are to our Amended and Restated Bylaws; |

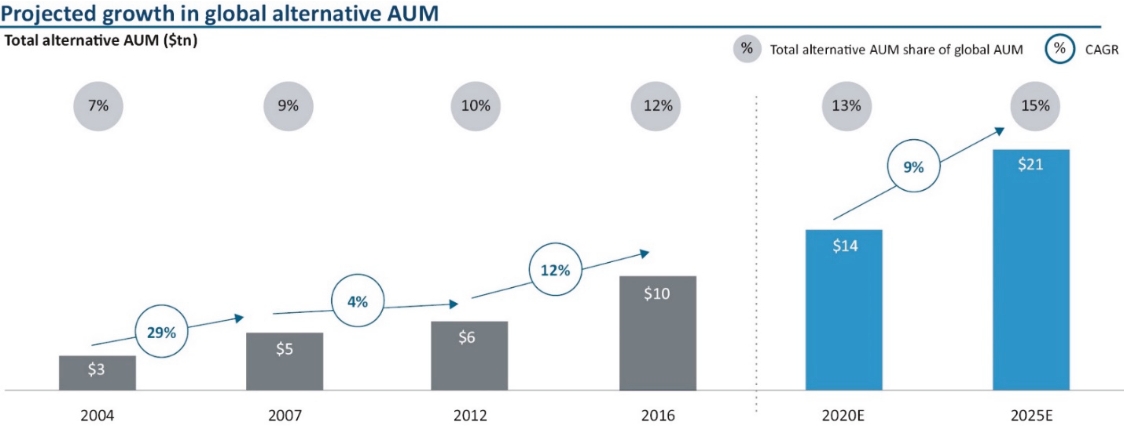

• | “CAGR” are to compound annual growth rate; |

• | “CFAC” are to CF Finance Acquisition Corp., a Delaware corporation; |

• | “CF Investor” are to CF GCM Investor, LLC, a Delaware limited liability company; |

• | “CF Sponsor” are to CF Finance Holdings, LLC, a Delaware limited liability company; |

• | “Charter” are to our Amended and Restated Certificate of Incorporation; |

• | “Class C Share Voting Amount” are to the “Class C Share Voting Amount,” as such term is defined in the Charter, which is generally a number of votes per share equal to (1) (x) an amount of votes equal to 75% of the aggregate voting power of our outstanding capital stock (including for this purpose any Includible Shares), minus (y) the total voting power of our outstanding capital stock (other than the Class C common stock) owned or controlled, directly or indirectly, by the Key Holders (including any Includible Shares), divided by (2) the number of shares of Class C common stock then outstanding; |

• | “clients” are to persons who invest in our funds, even if such persons are not deemed clients of our registered investment adviser subsidiaries for purposes of the Investment Advisers Act 1940, as amended; |

• | “Closing” are to the consummation of the Business Combination; |

• | “Closing Date” are to November 17, 2020; |

• | “Code” are to the U.S. Internal Revenue Code of 1986, as amended; |

• | “Class A common stock” are to our Class A common stock, par value $0.0001 per share; |

• | “Class B common stock” are to our Class B common stock, par value $0.0001 per share; |

• | “Class C common stock” are to our Class C common stock, par value $0.0001 per share; |

• | “Effective Time” are to the time at which the Merger becomes effective pursuant to the Transaction Agreement; |

• | “FPAUM” are to fee-paying AUM; |

• | “GCM Companies” are to GCM LLC and GCMH; |

• | “GCM Grosvenor” are to GCMH, its subsidiaries, and GCM, LLC; |

• | “GCM LLC” are to GCM, L.L.C., a Delaware limited liability company; |

• | “GCM PubCo” are to GCM Grosvenor Inc., a Delaware corporation; |

• | “GCM PubCo private placement warrants” are to the warrants for Class A common stock (which are in identical form of private placement warrants but in the name of GCM PubCo); |

• | “GCM V” are to GCM V, LLC, a Delaware limited liability company; |

• | “GCMG” are to GCM Grosvenor Inc., was incorporated in Delaware as a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP, formed for the purpose of completing the Transaction. Pursuant to the Transaction, Grosvenor Capital Management Holdings, LLLP cancelled its shares in GCM Grosvenor Inc. no longer making GCM Grosvenor Inc. a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP. |

• | “GCMH” are to Grosvenor Capital Management Holdings, LLLP, a Delaware limited liability limited partnership; |

• | “GCMH Consideration” refers to the consideration of $1.00 for the general partnership interest of GCMH plus $1,470,375 for the GCM Class B-1 common units previously held by GCMHGP LLC and paid by IntermediateCo to Holdings in connection with the Business Combination; |

• | “GCM Funds” and “our funds” are to GCM Grosvenor’s specialized funds and customized separate accounts; |

• | “GCMHGP LLC” are to GCMH GP, L.L.C., a Delaware limited liability company; |

• | “GCMH Equityholders” are to Holdings, Management LLC and Holdings II; |

• | “GCMLP” are to Grosvenor Capital Management, L.P., an Illinois limited partnership; |

• | “Grosvenor common units” are to units of partnership interests in GCMH entitling the holder thereof to the distributions, allocations, and other rights accorded to holders of partnership interests in GCMH following the Grosvenor Redomicile and LLLPA Amendment; |

• | “H&F Parties” are to HCFP VI AIV, L.P., H&F Chicago AIV I, L.P., and Hellman & Friedman Capital Executives VI, L.P; |

• | “Holdings” are to Grosvenor Holdings, L.L.C., an Illinois limited liability company; |

• | “Holdings II” are to Grosvenor Holdings II, L.L.C., a Delaware limited liability company; |

• | “Includible Shares” are to any shares of our voting stock issuable in connection with the exercise (assuming, solely for this purpose, full exercise and not net exercise) of all outstanding options, warrants, exchange rights, conversion rights or similar rights to receive voting stock of GCM PubCo, in each case owned or controlled, directly or indirectly, by the Key Holders, but excluding the number of shares of Class A common stock issuable in connection with the exchange of Grosvenor common units, as a result of any redemption or direct exchange of Grosvenor common units effectuated pursuant the A&R LLLPA; |

• | “IntermediateCo” are to GCM Grosvenor Holdings, LLC (formerly known as CF Finance Intermediate Acquisition, LLC), a Delaware limited liability company; |

• | “Key Holders” are to Michael J. Sacks, GCM V and the GCMH Equityholders; |

• | “Lock-up Period” are to (a) with respect to the voting parties, the period beginning on the Closing Date and ending on the date that is the 3rd anniversary of the Closing Date and (b) with respect to the CF Sponsor, the period beginning on the Closing Date and ending on the date that is the 18th month anniversary of the Closing Date; |

• | “lock-up shares” are to (a) with respect to the CF Sponsor, the shares of CFAC common stock held by the CF Sponsor on the Closing Date or received by CF Sponsor in connection with the Business Combination, any warrants to purchase shares of CFAC common stock held by the CF Sponsor on the Closing Date or received by Sponsor in connection with the Business Combination, and any shares of CFAC common stock issued to the CF Sponsor upon exercise of any such warrants to purchase CFAC common stock and (b) with respect to the voting parties, (i) the shares of our common stock received by the voting parties on the Closing Date, (ii) any shares of our common stock received by any voting party after the Closing Date pursuant to a direct exchange or redemption of Grosvenor common units held as of the Closing Date under the A&R LLLPA and (iii) the GCM PubCo private placement warrants held by the voting parties as of the Closing Date and any shares of our common stock issued to the voting parties upon exercise thereof; |

• | “Management LLC” are to GCM Grosvenor Management, LLC, a Delaware limited liability company; |

• | “Mosaic” are to Mosaic Acquisitions 2020, L.P.; |

• | “Mosaic Transaction” are to a transaction, effective January 1, 2020, by which GCMH and its affiliates transferred certain indirect partnerships interests related to historical investment funds managed by GCMH and its affiliates to Mosaic; |

• | “NAV” are to net asset value; |

• | “Option Agreement” are to that certain Option Agreement, dated as of October 5, 2017, by and among Holdings and the H&F Parties; |

• | “Option Consideration” are to the consideration of $110,167,894.55, minus the purchase price payable to the H&F Parties by IntermediateCo under the Option Agreement; |

• | “Option Conveyance” are to the assignment, immediately following the Business Combination, by Holdings and assumption by IntermediateCo of all right, title and interest in and to the Option Agreement in exchange for the Option Consideration and the private placement of GCM PubCo warrants; |

• | “PIPE Investors” are to the qualified institutional buyers and accredited investors that have agreed to purchase shares of Class A common stock in a private placement in connection with the execution of the Transaction Agreement and the Business Combination; |

• | “public warrants” are to the warrants sold by CFAC as part of the units in CFAC’s initial public offering; |

• | “Registration Rights Agreement” are to that certain Amended and Restated Registration Rights Agreement to be entered into by and among us, the CF Sponsor, the GCMH Equityholders and the PIPE Investors; |

• | “Sponsor Support Agreement” are to that certain Sponsor Support Agreement, dated as of August 2, 2020, by and among the CF Sponsor, CFAC, GCMH and Holdings; |

• | “Stockholders’ Agreement” are to that certain Stockholders’ Agreement to be entered into by and among us, the GCMH Equityholders and GCM V; |

• | “Sunset Date” are to the date the GCMH Equityholders beneficially own a number of voting shares representing less than 20% of the number of shares of Class A common stock beneficially owned by the GCMH Equityholders immediately following the Closing Date (assuming, for this purpose, that all outstanding Grosvenor common units are and were exchanged at the applicable measurement time by the GCMH Equityholders for shares of Class A common stock in accordance with the A&R LLLPA and without regard to the lock-up or any other restriction on exchange); |

• | “Transaction Agreement” are to the definitive transaction agreement, dated as of August 2, 2020, by and among CFAC, IntermediateCo, the CF Sponsor, GCMH, the GCMH Equityholders, GCMHGP LLC, GCM V and us; |

• | “underlying funds” are to the investment vehicles managed by third-party investment managers in which GCM Funds invest; |

• | “units” are to CFAC’s units sold in its initial public offering, each of which consists of one share of CFAC’s Class A common stock and three-quarters of one public warrant; |

• | “voting party” are to GCM V and the GCMH Equityholders; |

• | “voting shares” are to our securities of that are beneficially owned by a voting party that may be voted in the election of our directors, including any and all of our securities acquired and held in such capacity subsequent to the date of the Transaction Agreement; and |

• | “Warrant Agreement” are to that certain Warrant Agreement, dated as of December 12, 2018, between Continental Stock Transfer & Trust Company and CFAC. |

• | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

• | our expansion plans and opportunities; |

• | our ability to pay dividends on our Class A common stock on the terms currently contemplated or at all; |

• | our ability to grow AUM and the performance of the GCM Funds; |

• | our ability to compete in the asset management industry; |

• | our ability to comply with domestic and foreign regulatory regimes; |

• | our ability to expand our business and enter into new lines of business or geographic markets; |

• | the impact of the novel coronavirus (“COVID-19”) pandemic; |

• | our ability to identify suitable investment opportunities for our clients; |

• | our ability to deal appropriately with conflicts of interest in the ordinary course of our business; and |

• | other factors detailed under the section entitled “Risk Factors.” |

• | The historical performance of our funds should not be considered as indicative of the future results of our operations or any returns expected on an investment in our Class A common stock. |

• | Investors in our open-ended, specialized funds may generally redeem their investments in these funds on a periodic basis. Investors in most of our closed-ended, specialized funds may terminate the commitment periods of these funds or otherwise cause our removal as general partner of these funds under certain circumstances. |

• | The COVID-19 pandemic has caused severe disruptions in the U.S. and global economies and may adversely impact our business, financial condition and results of operations. |

• | Our business and financial condition may be materially adversely impacted by the variable nature of our revenues, and in particular the performance-based aspect of certain of our revenues and cash flows. |

• | The industry in which we operate is intensely competitive. If we are unable to compete successfully, our business and financial condition could be adversely affected. |

• | A decline in the pace or size of fundraising or investments made by us on behalf of our funds may adversely affect our revenues. |

• | We are subject to numerous conflicts of interest that are both inherent to our business and industry and particular to us. |

• | Our entitlement to receive carried interest from many of our funds may create an incentive for us to make more speculative investments and determinations on behalf of a fund than would be the case in the absence of such arrangement. |

• | Our international operations subject us to numerous risks. |

• | Extensive government regulation, compliance failures and changes in law or regulation could adversely affect us. |

• | Difficult market, geopolitical and economic conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our funds, reducing the number of high-quality investment managers with whom we may invest, and reducing the ability of our funds to raise or deploy capital. |

• | If the investments we make on behalf of our funds perform poorly, we may suffer a decline in our revenues |

• | We operate our business globally, with clients and offices across North America, Europe, Asia-Pacific, Latin America and the Middle East. The ability to easily travel and meet with prospective and current clients in person helps build and strengthen our relationships with them in ways that telephone and video conferences may not always afford. In addition, the ability of our employees to conduct their daily work in our offices helps to ensure a level of productivity that may not be achieved when coming to the office every day is not an option. Further, our investment strategies target opportunities globally. Restrictions on travel and public gatherings as well as stay-at-home orders mean that most of our client and prospect meetings are not currently taking place in person, and the vast majority of our employees are working from home. As a consequence, our ability to market our funds and raise new business has been impeded (which may result in lower or delayed revenue growth), it has become more difficult to conduct due diligence on investments (which can impede the identification of investment risks) and an extended period of remote working by our employees could strain our technology resources and introduce operational risks, including heightened cybersecurity risk, as remote working environments can be less secure and more susceptible to hacking attacks. |

• | A slowdown in fundraising activity has in the past resulted in delayed or decreased management fees and could result in delayed or decreased management fees in the future compared to prior periods. In addition, in light of declines in public equity markets and other components of their investment portfolios, investors may become restricted by their asset allocation policies to invest in new or successor funds that we provide, or may be prohibited by new laws or regulations from funding existing commitments. We may also experience a slowdown in the deployment of our capital, which could also adversely affect our ability to raise capital for new or successor funds. |

• | To the extent the market dislocation caused by COVID-19 may present attractive investment opportunities due to increased volatility in the financial markets, we may not be able to complete those investments, which could impact revenues, particularly for our funds that charge fees on invested capital. |

• | Our liquidity and cash flows may be adversely impacted by declines or delays in realized incentive fees and management fee revenues. |

• | Our funds invest in industries that have been materially impacted by the COVID-19 pandemic, including healthcare, travel, entertainment, hospitality and retail. Companies in these industries are facing operational and financial hardships resulting from the pandemic, and if conditions do not improve, they could continue to suffer materially, become insolvent or cease operations altogether, any of which would decrease the value of the investments. |

• | COVID-19 presents a threat to our employees’ well-being and morale. If our senior management or other key personnel become ill or are otherwise unable to perform their duties for an extended period of time, we may experience a loss of productivity or a delay in the implementation of certain strategic plans. In addition to any potential impact of such extended illness on our operations, we may be exposed to the risk of litigation by our employees against us for, among other things, failure to take adequate steps to protect their well-being, particularly in the event they become sick after a return to the office. Further, local COVID-19-related laws can be subject to rapid change depending on public health developments, which can lead to confusion and make compliance with laws uncertain and subject us to increased risk of litigation for non-compliance. |

• | We anticipate that regulatory oversight and enforcement will become more rigorous for public companies in general, and for the financial services industry in particular, as a result of the recent volatility in the financial markets. |

• | a number of our competitors have greater financial, technical, marketing and other resources and more personnel than we do; |

• | some of our competitors have recently raised, or are expected to raise, significant amounts of capital, and many of them have investment objectives similar to ours, which may create additional competition for investment opportunities that our funds seek to exploit; |

• | some of our funds may not perform as well as competitors’ funds or other available investment products; |

• | several of our competitors have significant amounts of capital, and many of them have similar investment objectives to ours, which may create additional competition for investment opportunities and may reduce the size and duration of pricing inefficiencies that many alternative investment strategies seek to exploit; |

• | some of our competitors may have a lower cost of capital, which may be exacerbated to the extent potential changes to the Code limit the deductibility of interest expense; |

• | some of our competitors may have access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities; |

• | some of our competitors may be subject to less regulation and accordingly may have more flexibility to undertake and execute certain businesses or investments than we can and/or bear less compliance expense than we do; |

• | some of our competitors may have more flexibility than us in raising certain types of investment funds under the investment management contracts they have negotiated with their investors; |

• | some of our competitors may have better expertise or be regarded by investors as having better expertise in a specific asset class or geographic region than we do; and |

• | other industry participants may, from time to time, seek to recruit our investment professionals and other employees away from us. |

• | greater difficulties in managing and staffing foreign operations; |

• | differences between the U.S. and foreign capital markets, such as for accounting, auditing, financial reporting and legal standards, practices and disclosure requirements; |

• | fluctuations in foreign currency exchange rates that could adversely affect our results; |

• | additional costs of complying with, and exposure to liability under, foreign regulatory regimes; |

• | unexpected changes in trading policies, regulatory requirements, tariffs and other barriers; |

• | longer transaction cycles; |

• | higher operating costs; |

• | local labor conditions and regulations; |

• | adverse consequences or restrictions on the repatriation of earnings; |

• | potentially adverse tax consequences, such as trapped foreign losses; |

• | less stable political and economic environments; |

• | terrorism, political hostilities, war, public health crises and other civil disturbances or other catastrophic or pandemic events that reduce business activity; |

• | cultural and language barriers and the need to adopt different business practices in different geographic areas; and |

• | difficulty collecting fees and, if necessary, enforcing judgments. |

• | making certain payments in respect of equity interests, including, among others, the payment of dividends and other distributions, redemptions and similar payments, payments in respect of warrants, options and other rights, and payments in respect of subordinated indebtedness; |

• | incurring additional debt; |

• | providing guarantees in respect of obligations of other persons; |

• | making loans, advances and investments; |

• | entering into transactions with investment funds and affiliates; |

• | creating or incurring liens; |

• | entering into negative pledges; |

• | selling all or any part of the business, assets or property, or otherwise disposing of assets; |

• | making acquisitions or consolidating or merging with other persons; |

• | entering into sale-leaseback transactions; |

• | changing the nature of our business; |

• | changing our fiscal year; |

• | making certain modifications to organizational documents or certain material contracts; |

• | making certain modifications to certain other debt documents; and |

• | entering into certain agreements with respect to the repayment of indebtedness, the making of loans or advances, or the transferring of assets. |

• | market conditions and investment opportunities during previous periods may have been significantly more favorable for generating positive performance than those we may experience in the future; |

• | the performance of our funds that distribute carried interest is generally calculated on the basis of the net asset value of the funds’ investments, including unrealized gains, which may never be realized and therefore never generate carried interest; |

• | our historical returns derive largely from the performance of our earlier funds, whereas future fund returns will depend increasingly on the performance of our newer funds or funds not yet formed; |

• | our newly established closed-ended funds may generate lower returns during the period that they initially deploy their capital; |

• | competition continues to increase for investment opportunities, which may reduce our returns in the future; |

• | the performance of particular funds also will be affected by risks of the industries and businesses in which they invest; and |

• | we may create new funds that reflect a different asset mix and new investment strategies, as well as a varied geographic and industry exposure, compared to our historical funds, and any such new funds could have different returns from our previous funds. |

• | currency exchange matters, such as exchange rate fluctuations between the U.S. dollar and the foreign currency in which the investments are denominated, and costs associated with conversion of investment proceeds and income from one currency to another; |

• | differences between the U.S. and foreign capital markets, including the absence of uniform accounting, auditing, financial reporting and legal standards, practices and disclosure requirements and less government supervision and regulation; |

• | certain economic, social and political risks, including exchange control regulations and restrictions on foreign investments and repatriation of capital, the risks of political, economic or social instability; and |

• | the possible imposition of foreign taxes with respect to such investments or confiscatory taxation. |

• | Certain of the underlying funds in which we invest are newly established funds without any operating history or are managed by management companies or general partners who may not have as significant track records as an independent manager. |

• | Generally, the execution of these hedge funds’ investment strategies is subject to the sole discretion of the management company or the general partner of such funds. |

• | Hedge funds may engage in speculative trading strategies, including short selling. |

• | Hedge funds are exposed to the risk that a counterparty will not settle a transaction in accordance with its terms and conditions because of a dispute over the terms of the contract (whether or not bona fide) or because of a credit or liquidity problem or otherwise, thus causing the fund to suffer a loss. |

• | Credit risk may arise through a default by one of several large institutions that are dependent on one another to meet their liquidity or operational needs, so that a default by one institution causes a series of defaults by the other institutions. |

• | The efficacy of investment and trading strategies depend largely on the ability to establish and maintain an overall market position in a combination of financial instruments. A hedge fund’s trading orders may not be executed in a timely and efficient manner due to various circumstances, including systems failures or human error. In such event, the funds might only be able to acquire some but not all of the components of the position, or if the overall position were to need adjustment, the funds might not be able to make such adjustment. |

• | Hedge funds may make investments or hold trading positions in markets that are volatile and which may become illiquid. Timely divestiture or sale of trading positions can be impaired by decreased trading volume, increased price volatility, concentrated trading positions, limitations on the ability to transfer positions in highly specialized or structured transactions to which they may be a party, and changes in industry and government regulations. It may be impossible or costly for hedge funds to liquidate positions rapidly in order to meet margin calls, withdrawal requests or otherwise, particularly if there are other market participants seeking to dispose of similar assets at the same time or the relevant market is otherwise moving against a position or in the event of trading halts or daily price movement limits on the market or otherwise. For example, in 2008 many hedge funds, including some of our funds, experienced significant declines in value. In many cases, these declines in value were both provoked and exacerbated by margin calls and forced selling of assets. Moreover, certain of our funds of hedge funds were invested in third-party hedge funds that halted redemptions in the face of illiquidity and other issues, which precluded those funds of hedge funds from receiving their capital back on request. |

• | Hedge fund investments are subject to risks relating to investments in commodities, futures, options and other derivatives, the prices of which are highly volatile and may be subject to the theoretically unlimited risk of loss in certain circumstances, including if the fund writes a call option. |

• | Ownership of infrastructure assets may present risk of liability for personal and property injury or impose significant operating challenges and costs with respect to, for example, compliance with zoning, environmental or other applicable laws. |

• | Infrastructure asset investments may face construction risks including shortages of suitable labor and equipment, adverse construction conditions and challenges in coordinating with public utilities, all of which could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent completion of construction activities once undertaken. Certain infrastructure asset investments may remain in construction phases for a prolonged period and, accordingly, may not be cash generative for a prolonged period. Recourse against the contractor may be subject to liability caps or may be subject to default or insolvency on the part of the contractor. |

• | The management of the business or operations of an infrastructure asset may be contracted to a third-party management company unaffiliated with us. Although it would be possible to replace any such operator, the failure of such an operator to adequately perform its duties or to act in ways that are in our best interest, or the breach by an operator of applicable agreements or laws, rules and regulations, could have an adverse effect on the investment’s financial condition and results of operations. |

• | it is an “orthodox” investment company because it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

• | it is an inadvertent investment company because, absent an applicable exemption, it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. |

• | general economic and business conditions; |

• | our strategic plans and prospects; |

• | our business and investment opportunities |

• | our financial condition and operating results, including our cash position, net income and realizations on investments made by its investment funds; |

• | working capital requirements and anticipated cash needs; |

• | contractual restrictions and obligations, including payment obligations pursuant to the Tax Receivable Agreement; and |

• | legal, tax and regulatory restrictions. |

• | not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act; |

• | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

• | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation or golden parachute payments not previously approved. |

• | the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; |

• | the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; |

• | the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or |

• | the last day of the fiscal year ending after the fifth anniversary of CFAC’s initial public offering. |

• | the fact that the Class C common stock may be entitled to multiple votes per share until (i) such share of Class C common stock is canceled/redeemed for no consideration upon, subject to certain exceptions, (ii) the disposition of (a) the Grosvenor common units and (b) the shares of Class A common stock (as a result of a redemption of Grosvenor common units) paired with such Class C common stock, as applicable, and (iii) with respect to all shares of Class C common stock, the Sunset Date; |

• | the sole ability of directors to fill a vacancy on the board of directors; |

• | advance notice requirements for stockholder proposals and director nominations; |

• | after we no longer qualify as a “controlled company” under Nasdaq Listing Rule 5605(c)(1), provisions limiting stockholders’ ability to call special meetings of stockholders, to require special meetings of stockholders to be called and to take action by written consent; and |

• | the ability of our governing body to designate the terms of and issue new series of preferred stock without stockholder approval, which could be used, among other things, to institute a rights plan that would have the effect of significantly diluting the stock ownership of a potential hostile acquiror, likely preventing acquisitions that have not been approved by our governing body. |

• | the realization of any of the risk factors presented in this prospectus; |

• | reductions or lack of growth in our assets under management, whether due to poor investment performance by our funds or redemptions by investors in our funds; |

• | difficult global market and economic conditions; |

• | loss of investor confidence in the global financial markets and investing in general and in alternative asset managers in particular; |

• | competitively adverse actions taken by other fund managers with respect to pricing, fund structure, redemptions, employee recruiting and compensation; |

• | inability to attract, retain or motivate our active executive managing directors, investment professionals, managing directors or other key personnel; |

• | inability to refinance or replace our senior secured term loan facility and revolving credit facility either on acceptable terms or at all; |

• | adverse market reaction to indebtedness we may incur, securities we may grant under our 2020 Incentive Award Plan or otherwise, or any other securities we may issue in the future, including shares of Class A common stock; |

• | unanticipated variations in our quarterly operating results or dividends; |

• | failure to meet securities analysts’ earnings estimates; |

• | publication of negative or inaccurate research reports about us or the asset management industry or the failure of securities analysts to provide adequate coverage of Class A common stock in the future; |

• | changes in market valuations of similar companies; |

• | speculation in the press or investment community about our business; |

• | additional or unexpected changes or proposed changes in laws or regulations or differing interpretations thereof affecting our business or enforcement of these laws and regulations, or announcements relating to these matters; |

• | increases in compliance or enforcement inquiries and investigations by regulatory authorities, including as a result of regulations mandated by the Dodd-Frank Act and other initiatives of various regulators that have jurisdiction over us related to the alternative asset management industry; and |

• | adverse publicity about the alternative asset management industry. |

• | general economic and business conditions; |

• | our strategic plans and prospects; |

• | our business and investment opportunities; |

• | our financial condition and operating results, including its cash position, its net income and its realizations on investments made by its investment funds; |

• | working capital requirements and anticipated cash needs; |

• | contractual restrictions and obligations, including payment obligations pursuant to the Tax Receivable Agreement and restrictions pursuant to any credit facility; and |

• | legal, tax and regulatory restrictions. |

| | | Shares | | | % | |

GCM Grosvenor rollover equity | | | 144,235 | | | 78.3 |

Public Shareholder | | | 11,602 | | | 6.3 |

Shares held by Sponsor and other holders of founder shares | | | 8,813 | | | 4.8 |

PIPE Investors | | | 19,500 | | | 10.6 |

Total Class A Shares | | | 184,150 | | | 100.0 |

Class C Shares* | | | 144,235 | | |

* | Shares of GCM Class C common stock carry up to 10 votes per share and represent no more than 75% of the voting power of GCM Grosvenor Inc.’s voting stock. As these shares have no economic or participating rights, they have been excluded from the calculation of earnings per share. The numbers of shares related to GCM Grosvenor rollover equity represents the shares that would be outstanding if all Grosvenor common units were exchanged for GCM Class A common stock. |

| | | GCM | | | Mosaic Transaction Accounting Adjustments | | | Business Combination Transaction Accounting Adjustments | | | Pro Forma | |

Revenues | | | (a) | | | | | | ||||

Management fees | | | $310,745 | | | $— | | | $— | | | $310,745 |

Incentive fees | | | 111,650 | | | — | | | — | | | 111,650 |

Other operating income | | | 7,586 | | | — | | | — | | | 7,586 |

Total operating revenues | | | 429,981 | | | — | | | — | | | 429,981 |

Expenses | | | | | | | | | ||||

Employee compensation and benefits | | | 388,465 | | | — | | | — | | | 388,465 |

General, administrative and other | | | 84,631 | | | — | | | — | | | 84,631 |

Total operating expenses | | | 473,096 | | | — | | | — | | | 473,096 |

Operating income (loss) | | | (43,115) | | | — | | | — | | | (43,115) |

Investment income | | | 10,742 | | | — | | | — | | | 10,742 |

Interest income | | | — | | | — | | | — | | | — |

Interest expense | | | (23,446) | | | 660(b) | | | 992(c) | | | (21,794) |

Other expense | | | (9,562) | | | — | | | — | | | (9,562) |

Change in fair value of warrant liabilities | | | (13,315) | | | | | | | (13,315) | ||

Net other income (expense) | | | (35,581) | | | 660 | | | 992 | | | (33,929) |

Income (loss) before income taxes | | | (78,696) | | | 660 | | | 992 | | | (77,044) |

Income taxes | | | 4,506 | | | — | | | 1,977(d) | | | 6,483 |

Net income (loss) | | | (83,202) | | | 660 | | | (986) | | | (83,528) |

Less: Net income (loss) attributable to redeemable noncontrolling interest | | | 14,069 | | | — | | | — | | | 14,069 |

Less: Net income (loss) attributable to noncontrolling interest in subsidiaries | | | 11,617 | | | — | | | — | | | 11,617 |

Less: Net Income (loss) attributable to noncontrolling interest in GCMH | | | (112,937) | | | 660 | | | (8,102)(e) | | | (120,379) |

Net income (loss) attributable to GCM Grosvenor Inc. | | | $4,049 | | | $— | | | $7,118 | | | $11,167 |

| | | | | | | | | |||||

Weighted average number of common stock outstanding: | | | | | | | | | ||||

Class A - Basic | | | 39,984,515 | | | | | | | 39,984,515 | ||

Class A - Diluted | | | 184,219,761 | | | | | | | 184,219,761 | ||

| | | | | | | | | |||||

Net income (loss) per share: | | | | | | | | | ||||

Class A - Basic | | | 0.19(g) | | | | | | | $0.28(f) | ||

Class A - Diluted | | | $(0.50)(g) | | | | | | | $(0.66)(f) |

(a) | Represents the GCM Grosvenor Inc. historical audited consolidated statement of income for the year ended December 31, 2020. |

(b) | Reflects the pro forma adjustment to interest expense assuming the paydown of a portion of GCM Companies’ debt from the proceeds of the Mosaic Transaction as if it occurred on January 1, 2020 based on the interest rate in effect at the time of each monthly interest payment. |

(c) | Reflects the pro forma adjustment to interest expense assuming the $42 million paydown of GCM Companies’ revolving credit facility balance from the proceeds of the Transactions, net of the incremental unused commitment fee as if it occurred on January 1, 2020. |

(d) | Represents adjustment to record the tax provision of the company on a pro forma basis using a federal statutory tax rate of 21% and a state blended rate of 3.4%, which was calculated assuming the U.S. federal rates currently in effect and the statutory rates applicable to each state, local and foreign jurisdiction where we estimate our income will be apportioned, which was applied to the income attributable to the company. The income attributable to the noncontrolling interest is pass-through income. However, the effective tax rate of the company could differ as a result of actions taken by the company subsequent to the business combination and other factors, including any changes in tax laws and the impact of permanent tax differences. |

(e) | Represents the pro forma adjustment to adjust noncontrolling interests in GCMH for the portion of net income attributable to GCMH Equity Holders based on the ownership upon Closing. Profits and losses, other than partnership interest-based compensation are allocated to noncontrolling interests in proportion to their relative ownership interests regardless of their basis. |

(f) | Represents net income (loss) per common share computed by dividing net income (loss) attributable to GCM Grosvenor Inc. by the pro forma weighted average number of common shares outstanding for the period. GCM Grosvenor Inc. has not considered the effect of the warrants to purchase shares of GCM Class A common stock in the calculation of diluted income per share, since their inclusion would be anti-dilutive. In addition, GCM Grosvenor Common Units may be exchanged for GCM Class A common stock on a one-for-one basis. As such, diluted income per share has been calculated under the “if converted” method. |

Diluted net income (loss) per share for the year ended December 31, 2020: | | | |

Numerator | | | |

Net income (loss) attributable to GCM Grosvenor Inc. | | | $11,167 |

Effect of assumed exchange of GCM Grosvenor common units for Class A common stock, net of tax | | | (132,154) |

Net income (loss) attributable to GCM Grosvenor Inc.—Diluted | | | $(120,988) |

Denominator | | | |

Weighted average number of Class A common stock outstanding—Basic | | | 39,984,515 |

Assumed exchange of GCM Grosvenor common units for Class A common stock | | | 144,235,246 |

Weighted-average shares of Class A common stock outstanding—Diluted | | | 184,219,761 |

Net income (loss) attributable to GCM Grosvenor Inc.—Diluted | | | $(0.66) |

(g) | The historical Net income (loss) per share of GCM Grosvenor Inc. for the year ended December 31, 2020 represents only the period of November 17, 2020 to December 31, 2020. |

• | Private Equity |

• | Infrastructure |

• | Real Estate |

• | Alternative Credit |

• | Absolute Return Strategies |

• | Restrictions on travel and public gatherings as well as stay-at-home orders in the U.S. and abroad have resulted in most of our client and prospect meetings not currently taking place in person, and the vast majority of our employees are working from home. As a consequence, we are conducting client and prospective client dialogue remotely, which has impeded and may continue to impede our ability to market our funds and raise new business, which may result in lower or delayed revenue growth, and it has become more difficult to conduct due diligence on investments. |

• | The pandemic may result in a slowdown of our fundraising activity. A slowdown in fundraising activity has in the past resulted in delayed or decreased management fees and could result in delayed or decreased management fees in the future compared to prior periods. |

• | In light of uncertainty in public equity markets and other components of their investment portfolios, investors may become restricted by their asset allocation policies to invest in new or successor funds that we provide, or may be prohibited by new laws or regulations from funding existing commitments. |

• | Our liquidity and cash flows may be adversely impacted by declines or delays in realized incentive fees and management fee revenues. |

• | Our funds invest in industries that have been materially impacted by the COVID-19 pandemic, including healthcare, travel, entertainment, hospitality and retail, which in turn has impacted and may continue to impact the value of our investments. |

| | | Three Months Ended March 31, | ||||||||||

| | | 2021 | | | 2020 | | | Change | | | % Change | |

| | | (in thousands, unaudited) | ||||||||||

Revenues | | | | | | | | | ||||

Management fees | | | $82,625 | | | $77,701 | | | $4,924 | | | 6% |

Incentive fees | | | 18,214 | | | 3,233 | | | 14,981 | | | 463% |

Other operating income | | | 2,380 | | | 1,683 | | | 697 | | | 41% |

Total operating revenues | | | 103,219 | | | 82,617 | | | 20,602 | | | 25% |

| | | | | | | | | |||||

Expenses | | | | | | | | | ||||

Employee compensation and benefits | | | 83,353 | | | 55,477 | | | 27,876 | | | 50% |

General, administrative and other | | | 24,532 | | | 24,596 | | | (64) | | | —% |

Total operating expenses | | | 107,885 | | | 80,073 | | | 27,812 | | | 35% |

Operating income (loss) | | | (4,666) | | | 2,544 | | | (7,210) | | | (283)% |

Investment income | | | 13,048 | | | 3,373 | | | 9,675 | | | 287% |

Interest expense | | | (4,491) | | | (5,867) | | | 1,376 | | | (23)% |

Other income (expense) | | | 1,317 | | | (9,733) | | | 11,050 | | | (114)% |

Change in fair value of warrant liabilities | | | 14,057 | | | — | | | 14,057 | | | NM |

Net other income (expense) | | | 23,931 | | | (12,227) | | | 36,158 | | | (296)% |

Income (loss) before income taxes | | | 19,265 | | | (9,683) | | | 28,948 | | | (299)% |

Provision (benefit) for income taxes | | | (663) | | | 643 | | | (1,306) | | | (203)% |

Net income (loss) | | | 19,928 | | | (10,326) | | | 30,254 | | | (293)% |

Less: Net income attributable to redeemable noncontrolling interest | | | 8,089 | | | 2,093 | | | 5,996 | | | 286% |

| | | Three Months Ended March 31, | ||||||||||

| | | 2021 | | | 2020 | | | Change | | | % Change | |

| | | (in thousands, unaudited) | ||||||||||

Less: Net income attributable to noncontrolling interests in subsidiaries | | | 8,589 | | | 2,536 | | | 6,053 | | | 239% |

Less: Net income (loss) attributable to noncontrolling interests in GCMH | | | 703 | | | (14,955) | | | 15,658 | | | (105)% |

Net income (loss) attributable to GCM Grosvenor Inc. | | | $2,547 | | | $— | | | $2,547 | | | NM |

| | | Three Months Ended March 31, | ||||||||||

| | | 2021 | | | 2020 | | | Change | | | % Change | |

| | | (in thousands, unaudited) | ||||||||||

Private markets strategies | | | $40,373 | | | $36,464 | | | $3,909 | | | 11% |

Absolute return strategies | | | 39,892 | | | 39,263 | | | 629 | | | 2% |

Fund expense reimbursement revenue | | | 2,360 | | | 1,974 | | | 386 | | | 20% |

Total management fees | | | 82,625 | | | 77,701 | | | 4,924 | | | 6% |

Incentive fees | | | 18,214 | | | 3,233 | | | 14,981 | | | 463% |

Administrative fees | | | 2,105 | | | 1,526 | | | 579 | | | 38% |

Other | | | 275 | | | 157 | | | 118 | | | 75% |

Total other operating income | | | 2,380 | | | 1,683 | | | 697 | | | 41% |

Total operating revenues | | | $103,219 | | | $82,617 | | | $20,602 | | | 25% |

| | | Three Months Ended March 31, | ||||||||||

| | | 2021 | | | 2020 | | | Change | | | % Change | |

| | | (in thousands, unaudited) | ||||||||||

Cash-based employee compensation and benefits | | | $41,780 | | | $44,302 | | | $(2,522) | | | (6)% |

Equity-based compensation | | | 27,036 | | | — | | | 27,036 | | | NM |

Partnership interest-based compensation | | | 4,903 | | | 7,920 | | | (3,017) | | | (38)% |

Carried interest compensation | | | 6,860 | | | 2,190 | | | 4,670 | | | 213% |

Cash-based incentive fee related compensation | | | 1,833 | | | — | | | 1,833 | | | NM |

Other non-cash compensation | | | 941 | | | 1,065 | | | (124) | | | (12)% |

Total employee compensation and benefits | | | $83,353 | | | $55,477 | | | $27,876 | | | 50% |

| | | Three Months Ended March 31, 2021 | |||||||

| | | (in millions, unaudited) | |||||||

| | | Private Markets Strategies | | | Absolute Return Strategies | | | Total | |

Fee-paying AUM | | | | | | | |||

Balance, beginning of period | | | $27,839 | | | $24,130 | | | $51,969 |

Contributions | | | 1,735 | | | 659 | | | 2,394 |

Withdrawals | | | — | | | (450) | | | (450) |

Distributions | | | (907) | | | (4) | | | (911) |

Change in Market Value | | | 223 | | | 123 | | | 346 |

Foreign Exchange and Other | | | (1) | | | 15 | | | 14 |

Balance, end of period | | | $28,889 | | | $24,473 | | | $53,362 |

| | | Year Ended December 31, 2020 | |||||||

| | | (in millions) | |||||||

| | | Private Markets Strategies | | | Absolute Return Strategies | | | Total | |

Fee-paying AUM | | | | | | | |||

Balance, beginning of period | | | $26,477 | | | $23,556 | | | $50,033 |

Contributions | | | 3,563 | | | 1,625 | | | 5,188 |

Withdrawals | | | — | | | (3,386) | | | (3,386) |

Distributions | | | (2,022) | | | (256) | | | (2,278) |

Change in Market Value | | | (2) | | | 2,721 | | | 2,719 |

Foreign Exchange and Other | | | (177) | | | (130) | | | (307) |

Balance, end of period | | | $27,839 | | | $24,130 | | | $51,969 |

| | | Three Months Ended March 31, 2021 (unaudited) | | | Year Ended December 31, 2020 | |

| | | (in millions) | ||||

Contracted, not yet Fee-Paying AUM at period end | | | $7,454 | | | $7,057 |

AUM at period end | | | $64,862 | | | $61,943 |

• | Private markets strategies FPAUM increased $1.1 billion, or 4%, to $28.9 billion as of March 31, 2021, primarily due to $1.7 billion of contributions, partially offset by $0.9 billion of distributions. |

• | Absolute return strategies FPAUM increased $0.3 billion, or 1%, to $24.5 billion as of March 31, 2021, primarily due to $0.7 billion of contributions, partially offset by $0.5 billion of withdrawals. |

| | | Year Ended December 31, | ||||||||||

| | | 2020 | | | 2019 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Revenues | | | | | | | | | ||||

Management fees | | | $310,745 | | | $324,716 | | | $(13,971) | | | (4)% |

Incentive fees | | | 111,650 | | | 84,165 | | | 27,485 | | | 33% |

Other operating income | | | 7,586 | | | 7,513 | | | 73 | | | 1% |

Total operating revenues | | | 429,981 | | | 416,394 | | | 13,587 | | | 3% |

| | | | | | | | | |||||

Expenses | | | | | | | | | ||||

Employee compensation and benefits | | | 388,465 | | | 242,967 | | | 145,498 | | | 60% |

General, administrative and other | | | 84,631 | | | 88,458 | | | (3,827) | | | (4)% |

Total operating expenses | | | 473,096 | | | 331,425 | | | 141,671 | | | 43% |

Operating income (loss) | | | (43,115) | | | 84,969 | | | (128,084) | | | (151)% |

Investment income | | | 10,742 | | | 7,521 | | | 3,221 | | | 43% |

Interest expense | | | (23,446) | | | (25,680) | | | 2,234 | | | (9)% |

Other income (expense) | | | (9,562) | | | (4,494) | | | (5,068) | | | 113% |

Change in fair value of warrant liabilities | | | (13,315) | | | — | | | (13,315) | | | NM |

Net other income (expense) | | | (35,581) | | | (22,653) | | | (12,928) | | | 57% |

Income (loss) before income taxes | | | (78,696) | | | 62,316 | | | (141,012) | | | (226)% |

Income taxes | | | 4,506 | | | 2,318 | | | 2,188 | | | 94% |

Net income (loss) | | | (83,202) | | | 59,998 | | | (143,200) | | | (239)% |

Less: Net income attributable to redeemable noncontrolling interest | | | 14,069 | | | — | | | 14,069 | | | NM |

Less: Net income attributable to noncontrolling interests in subsidiaries | | | 11,617 | | | 13,221 | | | (1,604) | | | (12)% |

Less: Net income (loss) attributable to noncontrolling interests in GCMH | | | (112,937) | | | 46,777 | | | (159,714) | | | (341)% |

Net income attributable to GCM Grosvenor Inc. | | | $4,049 | | | $— | | | $4,049 | | | NM |

| | | Year Ended December 31, | ||||||||||

| | | 2020 | | | 2019 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Private markets strategies | | | $149,990 | | | $150,985 | | | $(995) | | | (1)% |

Absolute return strategies | | | 152,349 | | | 167,023 | | | (14,674) | | | (9)% |

Fund expense reimbursement revenue | | | 8,406 | | | 6,708 | | | 1,698 | | | 25% |

Total management fees | | | 310,745 | | | 324,716 | | | (13,971) | | | (4)% |

Incentive fees | | | 111,650 | | | 84,165 | | | 27,485 | | | 33% |

Administrative fees | | | 6,775 | | | 6,684 | | | 91 | | | 1% |

Other | | | 811 | | | 829 | | | (18) | | | (2)% |

Total other operating income | | | 7,586 | | | 7,513 | | | 73 | | | 1% |

Total operating revenues | | | $429,981 | | | $416,394 | | | $13,587 | | | 3% |

| | | Year Ended December 31, | ||||||||||

| | | 2020 | | | 2019 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Cash-based employee compensation and benefits | | | $165,829 | | | $169,862 | | | $(4,033) | | | (2)% |

Partnership interest-based compensation | | | 172,358 | | | 30,233 | | | 142,125 | | | 470% |

Carried interest compensation | | | 34,260 | | | 38,842 | | | (4,582) | | | (12)% |

Cash-based incentive fee related compensation | | | 11,454 | | | — | | | 11,454 | | | NM |

Other | | | 4,564 | | | 4,030 | | | 534 | | | 13% |

Total employee compensation and benefits | | | $388,465 | | | $242,967 | | | $145,498 | | | 60% |

| | | Year Ended December 31, | ||||||||||

| | | 2019 | | | 2018 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Revenues | | | | | | | | | ||||

Management fees | | | $324,716 | | | $315,598 | | | $9,118 | | | 3% |

Incentive fees | | | 84,165 | | | 57,059 | | | 27,106 | | | 48% |

Other operating income | | | 7,513 | | | 5,839 | | | 1,674 | | | 29% |

Total operating revenues | | | 416,394 | | | 378,496 | | | $37,898 | | | 10% |

| | | | | | | | | |||||

Expenses | | | | | | | | | ||||

Employee compensation and benefits | | | 242,967 | | | 210,414 | | | 32,553 | | | 15% |

General, administrative and other | | | 88,458 | | | 92,955 | | | (4,497) | | | (5)% |

Total operating expenses | | | 331,425 | | | 303,369 | | | 28,056 | | | 9% |

Operating income | | | 84,969 | | | 75,127 | | | 9,842 | | | 13% |

Investment income | | | 7,521 | | | 16,963 | | | (9,442) | | | (56)% |

Interest expense | | | (25,680) | | | (26,468) | | | 788 | | | (3)% |

Other income (expense) | | | (4,494) | | | (542) | | | (3,952) | | | 729% |

Net other income (expense) | | | (22,653) | | | (10,047) | | | (12,606) | | | 125% |

Income before income taxes | | | 62,316 | | | 65,080 | | | (2,764) | | | (4)% |

Income taxes | | | 2,318 | | | 1,395 | | | 923 | | | 66% |

Net income | | | 59,998 | | | 63,685 | | | (3,687) | | | (6)% |

Less: Net income attributable to noncontrolling interests in subsidiaries | | | 13,221 | | | 24,486 | | | (11,265) | | | (46)% |

Less: Net income attributable to noncontrolling interests in GCMH | | | 46,777 | | | 39,199 | | | 7,578 | | | 19% |

Net income attributable to GCM Grosvenor Inc. | | | $— | | | $— | | | $— | | | NM |

| | | Year Ended December 31, | ||||||||||

| | | 2019 | | | 2018 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Private markets strategies | | | $150,985 | | | $131,508 | | | $19,477 | | | 15% |

Absolute return strategies | | | 167,023 | | | 179,948 | | | (12,925) | | | (7)% |

Fund expense reimbursement revenue | | | 6,708 | | | 4,142 | | | 2,566 | | | 62% |

Total management fees | | | 324,716 | | | 315,598 | | | 9,118 | | | 3% |

Incentive fees | | | 84,165 | | | 57,059 | | | 27,106 | | | 48% |

Administrative fees | | | 6,684 | | | 5,839 | | | 845 | | | 14% |

Other | | | 829 | | | — | | | 829 | | | NM |

Total other operating income | | | 7,513 | | | 5,839 | | | 1,674 | | | 29% |

Total operating revenues | | | $416,394 | | | $378,496 | | | $37,898 | | | 10% |

| | | Year Ended December 31, | ||||||||||

| | | 2019 | | | 2018 | | | Change | | | % Change | |

| | | (in thousands) | ||||||||||

Cash-based employee compensation and benefits | | | $169,862 | | | $157,351 | | | $12,511 | | | 8% |

Partnership interest-based compensation | | | 30,233 | | | 19,495 | | | 10,738 | | | 55% |

Carried interest compensation | | | 38,842 | | | 31,780 | | | 7,062 | | | 22% |

Other non-cash compensation | | | 4,030 | | | 1,788 | | | 2,242 | | | 125% |

Total employee compensation and benefits | | | $242,967 | | | $210,414 | | | $32,553 | | | 15% |

| | | Year Ended December 31, 2020 | |||||||

| | | (in millions) | |||||||

| | | Private Markets Strategies | | | Absolute Return Strategies | | | Total | |

Fee-paying AUM | | | | | | | |||

Balance, beginning of period | | | $26,477 | | | $23,556 | | | $50,033 |

Contributions | | | 3,563 | | | 1,625 | | | 5,188 |

Withdrawals | | | — | | | (3,386) | | | (3,386) |

Distributions | | | (2,022) | | | (256) | | | (2,278) |

Change in Market Value | | | (2) | | | 2,721 | | | 2,719 |

Foreign Exchange and Other | | | (177) | | | (130) | | | (307) |

Balance, end of period | | | $27,839 | | | $24,130 | | | $51,969 |

| | | Year Ended December 31, 2019 | |||||||

| | | (in millions) | |||||||

| | | Private Markets Strategies | | | Absolute Return Strategies | | | Total | |

Fee-paying AUM | | | | | | | |||

Balance, beginning of period | | | $24,900 | | | $23,957 | | | $48,857 |

Contributions | | | 3,542 | | | 1,182 | | | 4,724 |

Withdrawals | | | (8) | | | (2,889) | | | (2,897) |

Distributions | | | (2,095) | | | (165) | | | (2,260) |

Change in Market Value | | | 114 | | | 1,461 | | | 1,575 |

Foreign Exchange and Other | | | 24 | | | 10 | | | 34 |

Balance, end of period | | | $26,477 | | | $23,556 | | | $50,033 |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in millions) | |||||||

Contracted, not yet Fee-Paying AUM at period end | | | $7,057 | | | $5,153 | | | $2,318 |

AUM at period end | | | $61,943 | | | $57,746 | | | $53,795 |

• | Private markets strategies FPAUM increased $1.4 billion, or 5%, to $27.8 billion as of December 31, 2020, primarily due to $3.6 billion of contributions, partially offset by $2.0 billion of distributions. |

• | Absolute return strategies FPAUM increased $0.6 billion, or 2%, to $24.1 billion as of December 31, 2020, primarily due to $1.6 billion and $2.7 billion of contributions and change in market value, respectively, partially offset by $3.4 billion of withdrawals. |

• | Private markets strategies FPAUM increased $1.6 billion, or 6%, to $26.5 billion during the year ended December 31, 2019, primarily due to $3.5 billion of contributions, offset by $2.1 billion of distributions. |

• | Absolute return strategies FPAUM decreased $0.4 billion, or 2%, to $23.6 billion during the year ended December 31, 2019, primarily due to $2.9 billion of withdrawals, offset by $1.2 billion of contributions and $1.5 billion increase related to foreign exchange, market value and other adjustments. |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Revenues | | | | | ||

Private markets strategies | | | $40,373 | | | $36,464 |

Absolute return strategies | | | 39,892 | | | 39,263 |

Management fees, net(1) | | | 80,265 | | | 75,727 |

Administrative fees and other operating income | | | 2,380 | | | 1,683 |

Fee-Related Revenue | | | 82,645 | | | 77,410 |

Less: | | | | | ||

Cash-based employee compensation and benefits, net(2) | | | (41,192) | | | (42,022) |

General, administrative and other, net(1) | | | (22,171) | | | (22,619) |

Plus: | | | | | ||

Amortization of intangibles | | | 583 | | | 1,876 |

Non-core items(3) | | | 5,328 | | | 2,916 |

Fee-Related Earnings | | | 25,193 | | | 17,561 |

Incentive fees: | | | | | ||

Performance fees | | | 6,113 | | | 605 |

Carried interest | | | 12,101 | | | 2,628 |

Incentive fee related compensation and NCI: | | | | | ||

Cash-based incentive fee related compensation | | | (1,833) | | | — |

Carried interest compensation, net(4) | | | (7,503) | | | (1,201) |

Carried interest attributable to noncontrolling interest | | | (4,430) | | | (1,333) |

Interest income | | | 7 | | | 296 |

Other (income) expense | | | 51 | | | 118 |

Depreciation | | | 473 | | | 696 |

Adjusted EBITDA | | | 30,172 | | | 19,370 |

Depreciation | | | (473) | | | (696) |

Interest expense | | | (4,491) | | | (5,867) |

Adjusted Pre-tax Income | | | 25,208 | | | 12,807 |

Adjusted income taxes(5) | | | (6,302) | | | (3,202) |

Adjusted Net Income | | | $18,906 | | | $9,605 |

(1) | Excludes fund reimbursement revenue of $2.4 million and $2.0 million and for the three months ended March 31, 2021 and 2020, respectively. |

(2) | Excludes severance expense of $0.6 million and $2.3 million for the three months ended March 31, 2021 and 2020, respectively. |

(3) | Includes corporate transaction related costs of $5.3 million and $3.4 million for the three months ended March 31, 2021 and 2020, respectively. |

(4) | Excludes the impact of non-cash carried interest expense of $0.6 million and $1.0 million for the three months ended March 31, 2021 and 2020, respectively. |

(5) | Represents corporate income taxes at a blended statutory rate of 25.0% applied to adjusted pre-tax income for all periods presented. The 25.0% is based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 4.0%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory rate of 25.0% has been applied to all periods presented for comparability purposes. |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Net incentive fees attributable to GCM Grosvenor | | | | | ||

Incentive fees: | | | | | ||

Performance fees | | | $6,113 | | | $605 |

Carried interest | | | 12,101 | | | 2,628 |

Less: | | | | | ||

Cash-based incentive fee related compensation | | | (1,833) | | | — |

Cash carried interest compensation | | | (6,860) | | | (2,190) |

Non-cash carried interest compensation | | | (643) | | | 989 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | (1,905) | | | (865) |

Carried interest expense attributable to other noncontrolling interest holders, net | | | (2,525) | | | (468) |

Net incentive fees attributable to GCM Grosvenor | | | $4,448 | | | $699 |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Net fees attributable to GCM Grosvenor | | | | | ||

Total operating revenues | | | $103,219 | | | $82,617 |

Less: | | | | | ||

Fund expense reimbursement revenue | | | (2,360) | | | (1,974) |

Cash-based incentive fee related compensation | | | (1,833) | | | — |

Cash carried interest compensation | | | (6,860) | | | (2,190) |

Non-cash carried interest compensation | | | (643) | | | 989 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | (1,905) | | | (865) |

Carried interest expense attributable to other noncontrolling interest holders, net | | | (2,525) | | | (468) |

Net fees attributable to GCM Grosvenor | | | $87,093 | | | $78,109 |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Adjusted pre-tax income & Adjusted net income | | | | | ||

Net income (loss) attributable to GCM Grosvenor Inc. | | | $2,547 | | | $— |

Plus: | | | | | ||

Net income (loss) attributable to GCMH | | | 703 | | | (14,955) |

Income taxes | | | (663) | | | 643 |

Change in fair value of derivatives | | | (1,934) | | | 8,634 |

Change in fair value of warrants | | | (14,057) | | | — |

Amortization expense | | | 583 | | | 1,876 |

Severance | | | 588 | | | 2,280 |

Transaction expenses(1) | | | 5,300 | | | 3,355 |

Loss on extinguishment of debt | | | 675 | | | 1,032 |

Other | | | 8 | | | — |

Partnership interest-based compensation | | | 4,903 | | | 7,920 |

Equity-based compensation | | | 27,036 | | | — |

Other non-cash compensation | | | 941 | | | 1,065 |

Less: | | | | | ||

Investment income, net of noncontrolling interests | | | (779) | | | (32) |

Non-cash carried interest compensation | | | (643) | | | 989 |

Adjusted pre-tax income | | | 25,208 | | | 12,807 |

Less: | | | | | ||

Adjusted income taxes(2) | | | (6,302) | | | (3,202) |

Adjusted net income | | | $18,906 | | | $9,605 |

| | | | | |||

Adjusted EBITDA | | | | | ||

Adjusted net income | | | $18,906 | | | $9,605 |

Plus: | | | | | ||

Adjusted income taxes(2) | | | 6,302 | | | 3,202 |

Depreciation expense | | | 473 | | | 696 |

Interest expense | | | 4,491 | | | 5,867 |

Adjusted EBITDA | | | $30,172 | | | $19,370 |

(1) | Represents 2020 expenses related to the Mosaic transaction and 2021 expenses related to a debt offering, other contemplated corporate transactions, and other public company readiness expenses. |

(2) | Represents corporate income taxes at a blended statutory rate of 25.0% applied to adjusted pre-tax income for all periods presented. The 25.0% is based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 4.0%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory rate of 25.0% has been applied to all periods presented for comparability purposes. |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020(1) | |

| | | (in thousands, except share and per share amounts; unaudited) | ||||

| | | | | |||

Adjusted net income | | | $18,906 | | | $9,605 |

| | | | | |||

Weighted-average shares of Class A common stock outstanding - basic | | | 42,084,366 | | | 39,984,515 |

Exercise of private warrants - incremental shares under the treasury stock method | | | 307,858 | | | — |

Exercise of public warrants - incremental shares under the treasury stock method | | | 2,244,583 | | | — |

Exchange of partnership units | | | 144,235,246 | | | 144,235,246 |

Weighted-average shares of Class A common stock outstanding - diluted | | | 188,872,053 | | | 184,219,761 |

Effective dilutive warrants, if antidilutive for GAAP | | | — | | | 897,151 |

Adjusted shares - diluted | | | 188,872,053 | | | 185,116,912 |

| | | | | |||

Adjusted net income per share - diluted | | | $0.10 | | | $0.05 |

(1) | As Class A common stock did not exist prior to the Transaction, the computation of Adjusted net income per share assumes the same weighted average shares of Class A common stock outstanding, dilutive warrants, and number of adjusted shares outstanding as of December 31, 2020 for all periods prior to the Transaction. |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Adjusted EBITDA | | | $30,172 | | | $19,370 |

Less: | | | | | ||

Incentive fees | | | (18,214) | | | (3,233) |

Depreciation expense | | | (473) | | | (696) |

Other non-operating income | | | (58) | | | (414) |

Plus: | | | | | ||

Incentive fee related compensation | | | 9,336 | | | 1,201 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | 1,905 | | | 865 |

Carried interest expense attributable to other noncontrolling interest holders, net | | | 2,525 | | | 468 |

Fee-Related Earnings | | | $25,193 | | | $17,561 |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands) | |||||||

Revenues | | | | | | | |||

Private markets strategies | | | $149,990 | | | $150,985 | | | $131,508 |

Absolute return strategies | | | 152,349 | | | 167,023 | | | 179,948 |

Management fees, net(1) | | | 302,339 | | | 318,008 | | | 311,456 |

Administrative fees and other operating income | | | 7,586 | | | 7,513 | | | 5,839 |

Less: | | | | | | | |||

Cash-based employee compensation and benefits, net(2) | | | (158,194) | | | (165,212) | | | (152,568) |

General, administrative and other, net(1) | | | (76,225) | | | (81,749) | | | (88,813) |

Plus: | | | | | | | |||

Amortization of intangibles | | | 7,504 | | | 7,794 | | | 7,813 |

Non-core items(3) | | | 12,059 | | | 1,740 | | | 5,246 |

Adjusted Fee Related Earnings | | | 95,069 | | | 88,094 | | | 88,973 |

Incentive fees: | | | | | | | |||

Performance fees | | | 52,726 | | | 14,413 | | | 3,111 |

Carried interest | | | 58,924 | | | 69,752 | | | 53,948 |

Incentive fee related compensation and NCI: | | | | | | | |||

Cash-based incentive fee related compensation | | | (11,454) | | | — | | | — |

Carried interest compensation, net(4) | | | (34,970) | | | (39,560) | | | (27,912) |

Carried interest attributable to noncontrolling interest | | | (16,089) | | | (11,344) | | | (8,963) |

Interest income | | | 377 | | | 1,064 | | | 889 |

Other (income) expense | | | 147 | | | (142) | | | (88) |

Depreciation | | | 2,314 | | | 2,544 | | | 3,850 |

Adjusted EBITDA | | | 147,044 | | | 124,821 | | | 113,808 |

Depreciation | | | (2,314) | | | (2,544) | | | (3,850) |

Interest expense | | | (23,446) | | | (25,680) | | | (26,468) |

Adjusted Pre-tax Net Income | | | 121,284 | | | 96,597 | | | 83,490 |

Adjusted income taxes(5) | | | (30,321) | | | (24,149) | | | (20,873) |

Adjusted Net Income | | | $90,963 | | | $72,448 | | | $62,617 |

(1) | Excludes fund reimbursement revenue of $8.4 million, $6.7 million and $4.1 million for the years ended December 31, 2020, 2019 and 2018, respectively. |

(2) | Excludes incentive fee related compensation of $50.3 million, $42.9 million, and $40.4 million for the years ended December 31, 2020, 2019 and 2018, respectively, and severance expense of $7.6 million, $4.6 million and $4.8 million for the years ended December 31, 2020, 2019 and 2018, respectively. |

(3) | Includes transaction related costs of $11.6 million, $0.8 million and $4.6 million for the years ended December 31, 2020, 2019 and 2018, respectively, and other non-core operating expenses. |

(4) | Excludes the impact of non-cash carried interest compensation of $0.7 million, $0.7 million, and $3.9 million for the years ended December 31, 2020, 2019 and 2018, respectively. |

(5) | Represents corporate income taxes at a blended statutory rate of 25.0% applied to pre-tax adjusted net income for all periods presented. The 25.0% is based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 4.0%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory rate of 25.0% has been applied to all periods presented for comparability purposes. |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands) | |||||||

Net incentive fees attributable to GCM Grosvenor | | | | | | | |||

Incentive fees: | | | | | | | |||

Performance fees | | | $52,726 | | | $14,413 | | | $3,111 |

Carried Interest | | | 58,924 | | | 69,752 | | | 53,948 |

Less: | | | | | | | |||

Cash-based incentive compensation | | | (11,454) | | | — | | | — |

Carried interest compensation | | | (34,260) | | | (38,842) | | | (31,780) |

Non-cash carried interest compensation | | | (710) | | | (718) | | | 3,868 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | (7,751) | | | — | | | — |

Carried interest attributable to other noncontrolling interest holders, net | | | (8,338) | | | (11,344) | | | (8,963) |

Net incentive fees attributable to GCM Grosvenor | | | $49,137 | | | $33,261 | | | $20,184 |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands) | |||||||

Net fees attributable to GCM Grosvenor | | | | | | | |||

Total operating revenues | | | $429,981 | | | $416,394 | | | $378,496 |

Less: | | | | | | | |||

Fund expense reimbursement revenue | | | (8,406) | | | (6,708) | | | (4,142) |

Cash-based incentive compensation | | | (11,454) | | | — | | | — |

Carried interest compensation | | | (34,260) | | | (38,842) | | | (31,780) |

Non-cash carried interest compensation | | | (710) | | | (718) | | | 3,868 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | (7,751) | | | — | | | — |

Carried interest attributable to other noncontrolling interest holders, net | | | (8,338) | | | (11,344) | | | (8,963) |

Net fees attributable to GCM Grosvenor | | | $359,062 | | | $358,782 | | | $337,479 |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands) | |||||||

Adjusted pre-tax income & Adjusted net income | | | | | | | |||

Net income attributable to GCM Grosvenor Inc. | | | $4,049 | | | $— | | | $— |

Plus: | | | | | | | |||

Net income (loss) attributable to GCMH | | | (112,937) | | | 46,777 | | | 39,199 |

Income taxes | | | 4,506 | | | 2,318 | | | 1,395 |

Change in fair value of derivatives | | | 8,572 | | | 5,417 | | | 1,344 |

Change in fair value of warrants | | | 13,315 | | | — | | | — |

Amortization expense | | | 7,504 | | | 7,794 | | | 7,813 |

Severance | | | 7,636 | | | 4,650 | | | 4,783 |

Transaction expenses(1) | | | 11,603 | | | 770 | | | 4,639 |

Other non-cash compensation | | | 4,944 | | | 4,935 | | | 3,787 |

Loss on extinguishment of debt | | | 1,514 | | | — | | | — |

Partnership interest-based compensation | | | 172,358 | | | 30,233 | | | 19,495 |

Less: | | | | | | | |||

Investment income, net of noncontrolling interests | | | (1,070) | | | (5,579) | | | (2,833) |

Non-cash carried interest compensation | | | (710) | | | (718) | | | 3,868 |

Adjusted pre-tax income | | | 121,284 | | | 96,597 | | | 83,490 |

Less: | | | | | | | |||

Adjusted income taxes(2) | | | (30,321) | | | (24,149) | | | (20,873) |

Adjusted net income | | | $90,963 | | | $72,448 | | | $62,617 |

| | | | | | | ||||

Adjusted EBITDA | | | | | | | |||

Adjusted net income | | | $90,963 | | | $72,448 | | | $62,617 |

Plus: | | | | | | | |||

Adjusted income taxes(2) | | | 30,321 | | | 24,149 | | | 20,873 |

Depreciation expense | | | 2,314 | | | 2,544 | | | 3,850 |

Interest expense | | | 23,446 | | | 25,680 | | | 26,468 |

Adjusted EBITDA | | | $147,044 | | | $124,821 | | | $113,808 |

(1) | Represents expenses incurred in 2019 related to the Mosaic Transaction. 2020 expenses relate to the Mosaic Transaction, the public offering Transaction and other non-core public company related expenses. |

(2) | Represents corporate income taxes at a blended statutory rate of 25.0% applied to pre-tax adjusted net income for all periods presented. The 25.0% is based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 4.0%. As we were not subject to U.S. federal and state income taxes prior to The Transaction, the blended statutory rate of 25.0% has been applied to all periods presented for comparability purposes. |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands, except share and per share amounts) | |||||||

Adjusted net income | | | $90,963 | | | $72,448 | | | $62,617 |

| | | | | | |||||

Weighted-average shares of Class A common stock outstanding - basic | | | 39,984,515 | | | 39,984,515 | | | 39,984,515 |

Exchange of partnership units(1) | | | 144,235,246 | | | 144,235,246 | | | 144,235,246 |

Weighted-average shares of Class A common stock outstanding - diluted | | | 184,219,761 | | | 184,219,761 | | | 184,219,761 |

Effect of dilutive warrants(2) | | | 897,152 | | | 897,152 | | | 897,152 |

Adjusted shares - diluted | | | 185,116,913 | | | 185,116,913 | | | 185,116,913 |

| | | | | | |||||

Adjusted net income per share - diluted | | | $0.49 | | | $0.39 | | | $0.34 |

(1) | Assumes the full exchange of partnership units in GCMH for Class A common stock of GCM Grosvenor Inc. pursuant to the exchange agreement. |

(2) | Warrants were determined to be antidilutive for GAAP diluted EPS purposes. |

| | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands) | |||||||

Adjusted EBITDA | | | $147,044 | | | $124,821 | | | $113,808 |

Less: | | | | | | | |||

Incentive fees | | | (111,650) | | | (84,165) | | | (57,059) |

Depreciation expense | | | (2,314) | | | (2,544) | | | (3,850) |

Other non-operating income | | | (524) | | | (922) | | | (801) |

Plus: | | | | | | | |||

Incentive fee related compensation | | | 46,424 | | | 39,560 | | | 27,912 |

Carried interest expense attributable to redeemable noncontrolling interest holder | | | 7,751 | | | — | | | — |

Carried interest attributable to other noncontrolling interest holders, net | | | 8,338 | | | 11,344 | | | 8,963 |

Adjusted FRE | | | $95,069 | | | $88,094 | | | $88,973 |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | (in thousands, unaudited) | ||||

Net cash provided by (used in) operating activities | | | $15,791 | | | $(33,037) |

Net cash provided by (used in) investing activities | | | (3,999) | | | (1,684) |

Net cash provided by (used in) financing activities | | | (53,004) | | | 94,540 |

Effect of exchange rate changes on cash | | | (661) | | | (325) |