services at our salons, including anti-fatigue therapy, athletic support therapy, slim-down therapy and reflexology. Each therapy is unique and designed to target specific areas of the body.

Our salons operate under several brand names. Our core brand is Re.Ra.Ku®. Our salons are generally located in metro stations/subways, shopping malls, plazas and high-traffic streets. On average, our salons measure approximately 722 square feet (which excludes data from salons in spa facilities and salons where the franchisees have direct contracts with the landlords) and contain a reception area and treatment space. A typical salon under the Re.Ra.Ku® brand is staffed by six relaxation therapists.

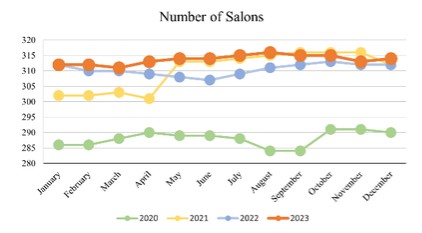

From our founding in 2000 until the COVID-19 pandemic, we steadily increased the number of Re.Ra.Ku®-branded salons. We intend to continue to grow our salon business over time through both organic growth, including acquisition and turnaround of underperforming franchised salons, and opportunistic acquisition and consolidation of competitor salons. As of December 31, 2023, we had 314 salons in operation throughout Japan under all of our brands. However, the rate of growth of our Re.Ra.Ku®-branded salons in recent years has slowed or paused due to our shift to focus on the acquisition of third-parties’ salons.

Our largest source of revenue derives from our directly-operated salons. Revenue from operating our directly-operated salons accounted for 59.5% of our consolidated revenue for the year ended December 31, 2023. Revenue from our franchise business consists of recurring franchise royalty, franchise membership fees, staffing services fees, sublease revenue and other franchise revenues and accounted for 11.8% of our consolidated revenue for the year ended December 31, 2023. As part of our new growth strategy, we have sold, and plan to continue to sell, certain of our owned salons to investors and we charge management fees to the owners of such sold salons. Our revenue from salon sales accounted for 14.8% of our consolidated revenue for the year ended December 31, 2023.

Our franchisees are expected to meet the same quality and customer service standards as our Company-operated locations. We select potential franchisees based on a set of strict qualification criteria which includes background checks, financial net worth assessment and personal interviews. We enter into a franchise agreement with each of our franchisees, stipulating a standard set of terms and conditions for operating the salons and each party's duties and responsibilities.

Customers

Our relaxation salons are designed to appeal to individuals seeking to improve their mental and/or physical well-being. Our customers include individuals who are health conscious and other individuals seeking stress and pain relief, therapeutic reflexology, or to improve their overall mental and physical health. The majority of our customers are employed females with disposable income, but our demographic mix varies by salon and geography. Our customer base has grown each year with the opening of new salons. We benefit from and rely on the value and recognition of our Re.Ra.Ku® and other brands which drive word of mouth and direct referrals. Additionally, we utilize an omnichannel advertising strategy across print, affiliate referrals and digital marketing to reach out to and cultivate potential customers.

Services

Our relaxation salons offer a variety of individual services, each with multiple price ranges, including: anti-fatigue therapy; athletic support therapy; slim-down therapy; and reflexology. Anti-fatigue therapy is designed to relieve fatigue and discomfort, and concentrates on the shoulder blades, neck, lower back and posture. We suggest that first-time customers begin with anti-fatigue therapy because most new customers visit our salons with stiff muscles and are unable to do more difficult stretches. Anti-fatigue therapy helps enhance the customer's stretching ability. Athletic support therapy is intended to provide quick gains in active and passive range of motion to help

37