Our franchisees are expected to meet the same quality and customer service standards as our Company-operated locations. We select potential franchisees based on a set of strict qualification criteria which includes background checks, financial net worth assessment and personal interviews. We enter into a franchise agreement with each of our franchisees, stipulating a standard set of terms and conditions for operating the salons and each party's duties and responsibilities.

Customers

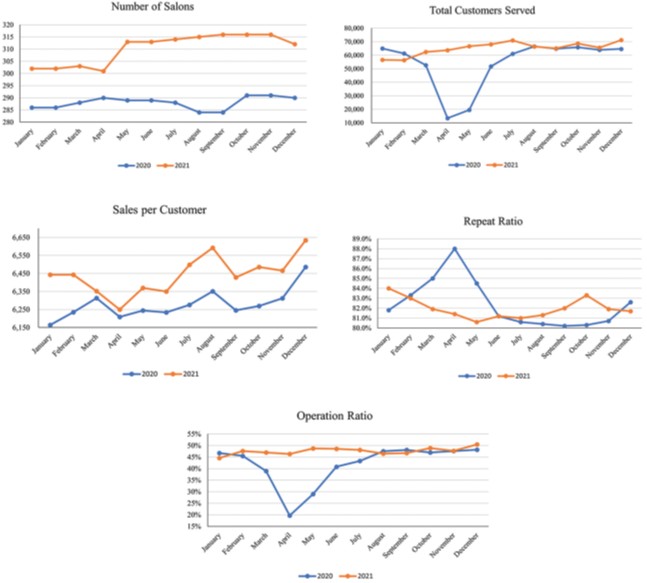

Our relaxation salons are designed to appeal to individuals seeking to improve their mental and/or physical well-being. Our customers include individuals who are health conscious and other individuals seeking stress and pain relief, therapeutic reflexology, or to improve their overall mental and physical health. The majority of our customers are employed females with disposable income, but our demographic mix varies by salon and geography. Our customer base has grown each year with the opening of new salons. We benefit from and rely on the value and recognition of our Re.Ra.Ku® and other brands which drive word of mouth and direct referrals. Additionally, we utilize an omnichannel advertising strategy across print, affiliate referrals and digital marketing to reach out to and cultivate potential customers.

Services

Our relaxation salons offer a variety of individual services, each with multiple price ranges, including: anti-fatigue therapy; athletic support therapy; slim-down therapy; and reflexology. Anti-fatigue therapy is designed to relieve fatigue and discomfort, and concentrates on the shoulder blade, neck, lower back and posture. We suggest that first-time customers begin with anti-fatigue therapy because most new customers visit our salons with stiff muscles and are unable to do more difficult stretches. Anti-fatigue therapy helps enhance the customer's stretching ability. Athletic support therapy is intended to provide quick gains in active and passive range of motion to help improve athletic performance and increase flexibility, by performing shoulder blade alignment adjustments and resistance exercise. Slim-down therapy focuses on pelvic and shoulder blade alignment and is intended to help dieting by moving the muscles near the pelvis, which normally get little exercise, thereby increasing metabolism and improving posture. Our reflexology therapy is designed to target specific pressure points and areas on the feet to promote relaxation, improve circulation and reduce pain. While most Re.Ra.Ku® locations offer these four therapies, some individual salons offer other select therapy methods, such as Thai traditional stretching. Pursuant to the terms of our standard franchise agreements, our approval is required for any changes to the services provided in franchised salons.

Our customers can arrive at our salons with or without appointments at times convenient to their schedule. Upon checking-in, salon staff provides customers with a questionnaire that asks for their contact information and certain health information to help the therapist identify the service that is most appropriate for the customer and whether the customer is experiencing muscle pain or other health problems. Upon completion of the therapy, the therapist will meet with the customers to obtain feedback on the services provided.

In December 2008, we began issuing prepaid cards, called the Re.Ra.Ku® Card, to relaxation salon customers. Users of the Re.Ra.Ku® Card can continuously use and replenish the card at most of our Company's relaxation salons. The customer receives rewards on a tiered basis, so the more the customer spends on the Re.Ra.Ku® Card, the greater the reward that can be used at Re.Ra.Ku® locations. In addition, following the acquisition of SAWAN, we started to issue another line of prepaid cards, called the Free Pass, which can be used at Ruam Ruam branded salons. As of December 31, 2021, the aggregate prepaid amounts by customers on the Re.Ra.Ku® Cards and the Free Pass were approximately

33