The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offer, solicitation, or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2022

PRELIMINARY PROSPECTUS

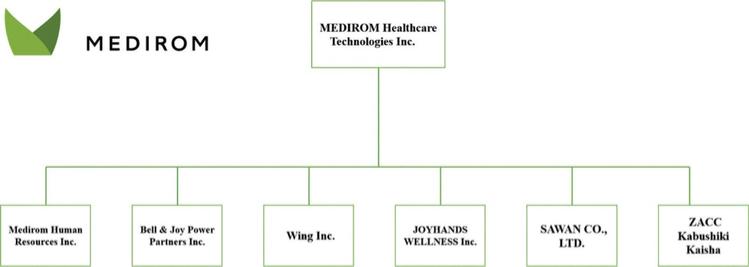

MEDIROM Healthcare Technologies, Inc.

800,000 American Depositary Shares

Representing 800,000 Common Shares

We are offering American 800,000 Depositary Shares (which we refer to as “ADSs”) representing our common shares, no par value (which we refer to as our “common shares”).

ADSs representing our common shares are listed on The Nasdaq Capital Market under the symbol “MRM.” The last reported sale price of the ADSs on The Nasdaq Capital Market on February 10, 2022 was $7.02 per ADS.

We are organized under the laws of Japan and are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012, under applicable U.S. federal securities laws, and are eligible for reduced public company reporting requirements. See “Prospectus Summary — Emerging Growth Company Status.”

Kouji Eguchi, our Chief Executive Officer and director, owns one Class A common share, or “golden share,” with key veto rights, which may limit a shareholder’s ability to influence our business and affairs, including, among others, amendments to our articles of incorporation and the issuance of additional common shares. See “Risk Factors” and “Description of Shares Capital and Articles of Incorporation — Special Voting and Consent Rights — Class A Voting Rights.”

Investing in the ADSs involves a high degree of risk. Before buying any of the ADSs, you should carefully read the discussion of material risks of investing in the ADSs in “Risk Factors” beginning on page 18 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per ADS |

| Total | |||

Offering price | $ | · | $ | · | ||

Underwriting discounts and commissions(1) | $ | · | $ | · | ||

Proceeds to us (before expenses) | $ | · | $ | · | ||

| (1) | See “Underwriting — Commissions and Discounts” for additional information regarding compensation payable to the underwriters. |

We have granted the underwriters an option to purchase up to 120,000 additional ADSs from us at the public offering price, less underwriting discounts and commissions, for 45 days after the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the ADSs to purchasers on or about ·, 2022.

Maxim Group LLC

The date of this prospectus is ·, 2022.