xos-20221231FALSE00018194932022FYhttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2022#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#GainLossOnDerivativeInstrumentsNetPretaxhttp://fasb.org/us-gaap/2022#GainLossOnDerivativeInstrumentsNetPretax00018194932022-01-012022-12-310001819493us-gaap:CommonStockMember2022-01-012022-12-310001819493us-gaap:WarrantMember2022-01-012022-12-3100018194932023-03-23xbrli:shares00018194932022-06-30iso4217:USD0001819493us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberxos:Customer3Member2022-01-012022-12-31xbrli:pure00018194932022-12-3100018194932021-12-31iso4217:USDxbrli:shares00018194932021-01-012021-12-3100018194932020-12-310001819493us-gaap:CommonStockMember2020-12-310001819493us-gaap:AdditionalPaidInCapitalMember2020-12-310001819493us-gaap:RetainedEarningsMember2020-12-310001819493us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001819493us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001819493us-gaap:CommonStockMember2021-01-012021-12-310001819493us-gaap:RetainedEarningsMember2021-01-012021-12-310001819493us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001819493us-gaap:CommonStockMember2021-12-310001819493us-gaap:AdditionalPaidInCapitalMember2021-12-310001819493us-gaap:RetainedEarningsMember2021-12-310001819493us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001819493us-gaap:CommonStockMember2022-01-012022-12-310001819493us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001819493us-gaap:RetainedEarningsMember2022-01-012022-12-310001819493us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001819493us-gaap:CommonStockMember2022-12-310001819493us-gaap:AdditionalPaidInCapitalMember2022-12-310001819493us-gaap:RetainedEarningsMember2022-12-310001819493us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100018194932022-01-0100018194932021-08-012021-08-310001819493us-gaap:EquipmentMember2022-01-012022-12-310001819493us-gaap:VehiclesMember2022-01-012022-12-310001819493us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001819493xos:ComputersSoftwareAndRelatedEquipmentMembersrt:MinimumMember2022-01-012022-12-310001819493srt:MinimumMember2022-01-012022-12-310001819493srt:MaximumMember2022-01-012022-12-310001819493xos:CommonStockPublicWarrantsMember2022-12-3100018194932020-10-3000018194932020-10-302020-10-3000018194932021-02-012021-02-280001819493srt:MinimumMember2022-12-310001819493srt:MaximumMember2022-12-310001819493us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberxos:Customer1Member2021-01-012021-12-310001819493xos:Customer2Memberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001819493us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberxos:Customer3Member2021-01-012021-12-310001819493us-gaap:CustomerConcentrationRiskMemberxos:Customer1Memberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819493xos:Customer2Memberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819493us-gaap:CustomerConcentrationRiskMemberxos:Customer1Memberus-gaap:AccountsReceivableMember2021-01-012021-12-310001819493xos:Customer2Memberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2021-01-012021-12-310001819493srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001819493xos:StepvansAndVehicleIncentivesMember2022-01-012022-12-310001819493xos:StepvansAndVehicleIncentivesMember2021-01-012021-12-310001819493xos:PowertrainsMember2022-01-012022-12-310001819493xos:PowertrainsMember2021-01-012021-12-310001819493xos:FleetAsAServiceMember2022-01-012022-12-310001819493xos:FleetAsAServiceMember2021-01-012021-12-310001819493us-gaap:ProductMember2022-01-012022-12-310001819493us-gaap:ProductMember2021-01-012021-12-3100018194932021-08-2000018194932021-08-202021-08-200001819493xos:FoundersMember2021-08-202021-08-200001819493xos:FoundersMember2021-08-200001819493xos:NextGenMember2021-08-202021-08-200001819493xos:CommonStockPublicWarrantsMember2021-08-200001819493xos:CommonStockPrivateWarrantsMember2021-08-200001819493xos:NextGenSponsorAndRelatedPartiesMember2021-01-012021-12-310001819493xos:NextGenPublicShareholdersMember2021-01-012021-12-310001819493xos:XosShareholdersMember2021-01-012021-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2021-08-202021-08-200001819493xos:DerivativeInstrumentTrancheOneMember2021-08-200001819493xos:DerivativeInstrumentTrancheOneMember2021-08-202021-08-20xos:day0001819493srt:MinimumMemberxos:DerivativeInstrumentTrancheOneMember2021-08-200001819493srt:MaximumMemberxos:DerivativeInstrumentTrancheOneMember2021-08-200001819493xos:DerivativeInstrumentTrancheTwoMember2021-08-200001819493xos:DerivativeInstrumentTrancheTwoMember2021-08-202021-08-200001819493xos:DerivativeInstrumentTrancheTwoMembersrt:MinimumMember2021-08-200001819493xos:DerivativeInstrumentTrancheTwoMembersrt:MaximumMember2021-08-200001819493xos:DerivativeInstrumentTrancheThreeMember2021-08-200001819493xos:DerivativeInstrumentTrancheThreeMember2021-08-202021-08-2000018194932022-08-0900018194932022-08-1100018194932022-09-2100018194932022-09-092022-09-090001819493us-gaap:ConvertibleNotesPayableMember2022-12-310001819493us-gaap:ConvertibleDebtMember2022-12-310001819493xos:SecuritiesPurchaseAgreementMember2022-12-310001819493us-gaap:ConvertibleDebtMember2022-01-012022-12-31xos:vehicle0001819493us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001819493us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ConvertibleDebtMember2022-12-3100018194932022-08-112022-08-1100018194932022-11-302022-11-300001819493us-gaap:ConvertibleNotesPayableMemberxos:SecuritiesPurchaseAgreementMember2022-12-310001819493us-gaap:ConvertibleNotesPayableMember2022-01-012022-12-310001819493us-gaap:ConvertibleNotesPayableMember2020-12-310001819493us-gaap:ConvertibleNotesPayableMembersrt:MaximumMember2020-01-012020-12-310001819493srt:MinimumMemberus-gaap:ConvertibleNotesPayableMember2020-01-012020-12-310001819493us-gaap:ConvertibleNotesPayableMember2021-01-012021-03-310001819493us-gaap:ConvertibleNotesPayableMember2021-12-310001819493xos:Group1ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2021-12-310001819493xos:Group1ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2021-01-012021-12-310001819493xos:Group1ConvertedNotesMembersrt:MinimumMemberus-gaap:ConvertibleNotesPayableMember2021-01-012021-12-310001819493xos:Group1ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMembersrt:MaximumMember2021-01-012021-12-310001819493xos:Group1ConvertedNotesMembersrt:MaximumMember2021-01-012021-12-310001819493xos:Group1ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2022-03-310001819493us-gaap:ConvertibleNotesPayableMemberxos:Group2ConvertedNotesMember2022-03-310001819493srt:MinimumMemberus-gaap:ConvertibleNotesPayableMemberxos:Group2ConvertedNotesMember2021-01-012021-12-310001819493us-gaap:ConvertibleNotesPayableMembersrt:MaximumMemberxos:Group2ConvertedNotesMember2021-01-012021-12-310001819493us-gaap:ConvertibleNotesPayableMemberxos:Group2ConvertedNotesMember2021-01-012021-12-310001819493us-gaap:ConvertibleNotesPayableMemberxos:Group2ConvertedNotesMember2021-12-310001819493us-gaap:ConvertibleNotesPayableMemberxos:Group2ConvertedNotesMember2021-03-310001819493xos:Group3ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2019-12-310001819493xos:Group3ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2019-01-012019-12-310001819493xos:Group3ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2020-12-310001819493xos:Group3ConvertedNotesMemberus-gaap:ConvertibleNotesPayableMember2021-01-012021-12-310001819493us-gaap:CorporateDebtSecuritiesMember2022-12-310001819493us-gaap:CorporateDebtSecuritiesMember2022-01-012022-12-310001819493us-gaap:USTreasurySecuritiesMember2022-12-310001819493us-gaap:USTreasurySecuritiesMember2022-01-012022-12-310001819493us-gaap:AssetBackedSecuritiesMember2022-12-310001819493us-gaap:AssetBackedSecuritiesMember2022-01-012022-12-310001819493us-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001819493us-gaap:ForeignGovernmentDebtSecuritiesMember2022-01-012022-12-310001819493us-gaap:CorporateDebtSecuritiesMember2021-12-310001819493us-gaap:CorporateDebtSecuritiesMember2021-01-012021-12-310001819493us-gaap:USTreasurySecuritiesMember2021-12-310001819493us-gaap:USTreasurySecuritiesMember2021-01-012021-12-310001819493us-gaap:AssetBackedSecuritiesMember2021-12-310001819493us-gaap:AssetBackedSecuritiesMember2021-01-012021-12-310001819493us-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001819493us-gaap:ForeignGovernmentDebtSecuritiesMember2021-01-012021-12-310001819493us-gaap:CertificatesOfDepositMember2021-12-310001819493us-gaap:CertificatesOfDepositMember2021-01-012021-12-31xos:vote0001819493xos:LegacyXosMember2020-12-310001819493xos:LegacyXosMember2020-10-012020-12-310001819493xos:LegacyXosMember2021-01-012021-03-310001819493xos:LegacyXosMember2020-01-012020-12-310001819493us-gaap:SubsequentEventMemberxos:StandbyEquityPurchaseAgreementMember2023-03-232023-03-230001819493xos:CommonStockPrivateWarrantsMember2022-12-310001819493xos:WarrantRedemptionScenarioOneMember2022-12-310001819493xos:WarrantRedemptionScenarioOneMember2022-01-012022-12-310001819493xos:WarrantRedemptionScenarioTwoMember2022-12-310001819493xos:WarrantRedemptionScenarioTwoMember2022-01-012022-12-3100018194932021-07-012021-09-300001819493xos:A2018StockPlanMember2022-12-310001819493xos:A2018StockPlanMember2022-01-012022-12-310001819493xos:A2018StockPlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-12-310001819493us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxos:A2018StockPlanMember2022-01-012022-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2021-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2022-12-310001819493us-gaap:CostOfSalesMember2022-01-012022-12-310001819493us-gaap:CostOfSalesMember2021-01-012021-12-310001819493us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001819493us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001819493us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001819493us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001819493us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001819493us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819493us-gaap:EquipmentMember2022-12-310001819493us-gaap:EquipmentMember2021-12-310001819493us-gaap:FurnitureAndFixturesMember2022-12-310001819493us-gaap:FurnitureAndFixturesMember2021-12-310001819493us-gaap:VehiclesMember2022-12-310001819493us-gaap:VehiclesMember2021-12-310001819493us-gaap:LeaseholdImprovementsMember2022-12-310001819493us-gaap:LeaseholdImprovementsMember2021-12-310001819493xos:ComputersSoftwareAndRelatedEquipmentMember2022-12-310001819493xos:ComputersSoftwareAndRelatedEquipmentMember2021-12-310001819493us-gaap:ConstructionInProgressMember2022-12-310001819493us-gaap:ConstructionInProgressMember2021-12-3100018194932020-01-012020-12-31xos:note_payable0001819493us-gaap:DomesticCountryMember2022-12-310001819493us-gaap:StateAndLocalJurisdictionMember2022-12-310001819493us-gaap:DomesticCountryMemberus-gaap:ResearchMember2022-12-310001819493us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2022-12-310001819493us-gaap:ResearchMemberus-gaap:ForeignCountryMember2022-12-310001819493us-gaap:ForeignCountryMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberxos:CommonStockPrivateWarrantsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPublicWarrantsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberxos:CommonStockPublicWarrantsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberxos:CommonStockPublicWarrantsMember2022-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPrivateWarrantsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberxos:CommonStockPrivateWarrantsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPublicWarrantsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberxos:CommonStockPublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberxos:CommonStockPublicWarrantsMember2021-12-310001819493us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberxos:CommonStockPublicWarrantsMember2021-12-310001819493xos:DerivativeLiabilityOnConvertibleNotesMember2021-12-310001819493xos:ConvertiblePreferredStockWarrantLiabilityMemberus-gaap:WarrantMember2021-12-310001819493xos:DerivativeLiabilityOnConvertibleNotesMember2022-01-012022-12-310001819493xos:ConvertiblePreferredStockWarrantLiabilityMemberus-gaap:WarrantMember2022-01-012022-12-310001819493xos:DerivativeLiabilityOnConvertibleNotesMember2022-12-310001819493xos:ConvertiblePreferredStockWarrantLiabilityMemberus-gaap:WarrantMember2022-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2022-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2021-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2022-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2021-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2022-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2021-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001819493us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2021-12-310001819493us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001819493us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001819493xos:ContingentEarnOutSharesMember2022-01-012022-12-310001819493xos:ContingentEarnOutSharesMember2021-01-012021-12-310001819493us-gaap:WarrantMember2022-01-012022-12-310001819493us-gaap:WarrantMember2021-01-012021-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001819493us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819493xos:StockOptionsMember2022-01-012022-12-310001819493xos:StockOptionsMember2021-01-012021-12-310001819493us-gaap:ConvertibleCommonStockMember2022-01-012022-12-310001819493us-gaap:ConvertibleCommonStockMember2021-01-012021-12-310001819493us-gaap:SubsequentEventMemberxos:VWAPMember2023-01-232023-01-230001819493us-gaap:SubsequentEventMemberxos:VWAPMember2023-01-102023-01-100001819493us-gaap:SubsequentEventMemberxos:VWAPMember2023-03-312023-03-310001819493us-gaap:SubsequentEventMemberxos:VWAPMember2023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For transition period from to

Commission File Number 001-39598

XOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 98-1550505 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

3550 Tyburn Street

Los Angeles, CA 90065

(818) 316-1890

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | XOS | Nasdaq Global Market |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | XOSWW | Nasdaq Global Market |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b).☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of March 23, 2023, there were approximately 169,012,203 shares of the registrant's common stock outstanding.

The aggregate market value of the common stock held by non-affiliates of the registrant on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $110,700,000 based on the closing price reported for such date on the NASDAQ Global Market. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for the 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein. The 2023 Proxy Statement will be filed with Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2022.

TABLE OF CONTENTS

PART I

As used herein, “Xos”, the “Company,” “our,” “we,” or “us” and similar terms include Xos, Inc. and its subsidiaries, unless the context indicates otherwise.

Glossary of Terms

Unless otherwise stated in this Report or the context otherwise requires, reference to:

•“Business Combination” means the Domestication, the Merger and the other transactions contemplated by the Merger Agreement, collectively, including the PIPE Financing;

•“Class 5 to 8 Vehicles” means medium and heavy duty trucks that typically travel on last-mile, back-to-base routes of up to 200 miles per day;

•“Closing” means the closing of the Business Combination;

•“Closing Date” means August 20, 2021;

•“Common Stock” means the shares of common stock, par value $0.0001 per share, of Xos;

•“Domestication” means the transfer by way of continuation and deregistration of NextGen from the Cayman Islands and the continuation and domestication of NextGen as a corporation incorporated in the State of Delaware;

•“Fleet-as-a-Service” means our comprehensive suite of products and services facilitating commercial battery-electric fleet operations through a combination of in-house proprietary technology and turnkey solutions from industry-leading partners. The platform offering includes our X-Pack battery system, X-Platform modular chassis, Xos Energy SolutionsTM, service, digital fleet management products, over-the-air software update technology, and a wide range of additional service products;

•“Flex Manufacturing Strategy” means leveraging smaller, more-nimble existing facilities and labor talent to assemble vehicles through our strategic manufacturing partnerships, while the Company coordinates other aspects of the manufacturing process, including supply chain logistics, quality control, and manufacturing engineering;

•“Founders” means Dakota Semler and Giordano Sordoni;

•“Founder Shares” means Class B ordinary shares, par value $0.0001 per share, of NextGen, which were converted into shares of Common Stock in connection with the Business Combination;

•“Initial public offering” means NextGen’s initial public offering that was consummated on October 9, 2020;

•“Legacy Xos Common Stock” means shares of common stock, par value $0.0001 per share, issued by Legacy Xos prior to the Business Combination;

•“Legacy Xos Preferred Stock” means Class A through A-10 shares of preferred stock, par value $0.001 per share, issued by Legacy Xos prior to the Business Combination;

•“Legacy Xos” means Xos, Inc., a Delaware corporation, prior to the consummation of the Business Combination;

•“Merger” means the merger of NextGen Merger Sub with and into Legacy Xos pursuant to the Merger Agreement, with Legacy Xos as the surviving company in the Merger and, after giving effect to such Merger, Legacy Xos becoming a wholly owned subsidiary of Xos;

•“Merger Agreement” means that certain Merger Agreement, dated as of February 21, 2021, as amended on May 14, 2021, by and among NextGen, Sky Merger Sub I, Inc., a Delaware corporation and direct wholly owned subsidiary of NextGen, and Legacy Xos;

•“NextGen” means NextGen Acquisition Corp., a Cayman Islands exempted company, prior to the consummation of the Domestication;

•”NextGen Sponsor” means NextGen Sponsor LLC.

•“PIPE Financing” means the transactions contemplated by the Subscription Agreements, pursuant to which the PIPE Investors collectively subscribed for 21,600,000 shares of Common Stock for an aggregate purchase price of $216,000,000 in connection with the Closing;

•“PIPE Investors” means the investors who participated in the PIPE Financing and entered into the Subscription Agreements;

•“Powertrain” means an assembly of every component that pushes a vehicle forward. A vehicle’s powertrain creates power from the engine and delivers it to the wheels on the ground. The key components of a powertrain include an engine, transmission, driveshaft, axles, and differential;

•“Preferred Stock” means preferred stock, par value $0.0001 per share, authorized under the Certificate of Incorporation of Xos, Inc.;

•“Private Placement Warrants” means the warrants to purchase Common Stock originally issued in a private placement in connection with the initial public offering of NextGen;

•“Public Warrants” means the redeemable warrants to purchase shares of Common Stock at an exercise price of $11.50 per share originally issued in connection with the initial public offering of NextGen;

•“Sponsor” means NextGen’s sponsor, NextGen Sponsor LLC;

•“Subscription Agreements” means the subscription agreements entered into by NextGen and each of the PIPE Investors in connection with the PIPE Financing;

•“Warrants” means Private Placement Warrants and Public Warrants;

•“Xos Energy Solutions™” means our infrastructure-as-a-service offering which includes charging infrastructure deployment, energy procurement and management, and the Xos HubTM, our proprietary mobile charging unit deployable for on-demand charging requirements;

•“X-Pack” means our proprietary battery system; and

•“X-Platform” means our proprietary, purpose-built vehicle chassis platform.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (the “Report”), including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, (“the Exchange Act”). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this Report are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of such terms or other similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

•our ability to successfully commercialize Fleet-as-a-Service to customers over time;

•delays in the design, manufacturing and wide-spread deployment of our products;

•our ability to grow market share in our existing markets or any new markets we may enter;

•our ability to successfully complete strategic relationships and alliances with third parties or acquisitions in the future;

•changes in domestic and foreign business, market, financial, political and legal conditions;

•changes in applicable laws or regulations;

•the outcome of any legal proceedings against us;

•our financial and business performance, including financial projections and business metrics and any underlying assumptions thereunder;

•changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans;

•the restatement of our financial statements as of and for the quarters ended March 31, 2022, June 30, 2022 and September 30, 2022 and our ability to maintain an effective system of internal controls over financial reporting, including our ability to remediate the existing material weakness in our internal controls;

•our ability to manage our growth effectively;

•our ability to achieve and maintain profitability in the future;

•our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth;

•our ability to maintain and enhance our products and brand, and to attract customers;

•our ability to execute our business model, including market acceptance of our planned products and services and achieving sufficient production volumes at acceptable quality levels and prices;

•our ability to source certain of our critical inventory items, including battery cells, semiconductor chips and vehicle bodies and aluminum;

•our ability to successfully manage supply shortages and disruptions, product delivery delays, and anticipate costs and production timing in light of those challenges;

•our ability to scale in a cost-effective manner, including hiring qualified personnel, particularly during recent hiring difficulties, to meet our manufacturing and delivery goals;

•developments and projections relating to our competitors and industry;

•general macroeconomic and political conditions, such as the effects of the COVID-19 pandemic, recessions, rising inflation and interest rates, uncertain credit and global financial markets, including the recent and potential bank failures, supply chain disruption, fuel prices, international currency fluctuations, and geopolitical events, such as local and national elections, corruption, political instability and acts of war or military conflict, including repercussions of the recent military conflict between Russia and Ukraine, or terrorism on our business and the actions we may take in response thereto;

•our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

•expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012, as amended;

•our future capital requirements and sources and uses of cash;

•the outcome of any known and unknown litigation and regulatory proceedings; and

•other risks and uncertainties set forth in this Report in the section entitled “Risk Factors”. A discussion of these and other factors affecting our business and prospects is set forth in Item 1A. Risk Factors. We encourage investors to review these risk factors.

Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this Report may not prove to be accurate. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved.

Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Report, and we expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

Item 1. Business

Overview

Xos is a leading fleet electrification solutions provider committed to the decarbonization of commercial transportation. We design and manufacture Class 5-8 battery-electric commercial vehicles that travel on last-mile, back-to-base routes of up to 200 miles per day. We also offer charging infrastructure products and services to support electric vehicle fleets. Our proprietary fleet management software integrates vehicle operation and vehicle charging to provide commercial fleet operators a more seamless and cost-efficient vehicle ownership experience than traditional internal combustion engine counterparts.

Our Products & Services

Xos Vehicles

Class 5-6 Medium Duty Rolling Chassis: We currently manufacture a Class 5-6 Medium Duty Rolling Chassis (the “MD X-Platform”) with multiple body options to address different customer use cases. The modularity of our MD X-Platform allows for numerous use cases and body configurations to meet customer needs. Today our most common customer configurations uses the MD X-Platform include the following:

•Stepvan: Stepvan configurations are most popular among our parcel delivery, linen, and food & beverage customers.

•Armored Trucks: Armored truck configurations using our MD X-Platform are popular with our customers specializing in armored cash transport and logistics.

Class 7-8 Heavy Duty Chassis: In May 2022 we launched our Class 7-8 Heavy Duty Chassis (the “HD X-Platform,” and together with the “MD X-Platform, the “X-Platform”). We plan to continue to develop the HD X-Platform for use by future customers in regional haul fleets with body configurations to include box trucks, refrigerated units, and flatbeds.

Xos Product Development: We are continuously developing cutting-edge technology for our battery-electric vehicles. We recently introduced our 2023 Stepvan—our next-generation chassis designed to reduce per-unit production costs, increase technological capabilities and improve total cost of ownership (“TCO”) for fleet operators. The 2023 Stepvan will be available for a wide range of use cases, including parcel delivery, uniform rental, and cash-in-transit industries.

Powered by Xos™

Our Powered by Xos™ business provides mix-use powertrain solutions for off-highway, industrial and other commercial equipment. Our powertrain offerings encompass a broad range of solutions, including high-voltage batteries, power distribution and management componentry, battery management systems, system controls, inverters, electric traction motors and auxiliary drive systems. One common application of our Powered by Xos™ powertrain solutions is industrial electric forklifts.

Xos Energy Solutions™

Xos Energy Solutions™ is our comprehensive charging infrastructure through which we offer charging equipment, mobile energy storage, and turnkey infrastructure services to help traditional fleets accelerate electric fleet transition by maximizing incentive capture and reducing implementation lead times and costs. Xos Energy Solutions™ provides customers with full service project management, electric vehicle chargers and charging equipment, and solutions for charging infrastructure installation. This service is available to customers whether they use Xos trucks, competitor trucks, or a mixed fleet.

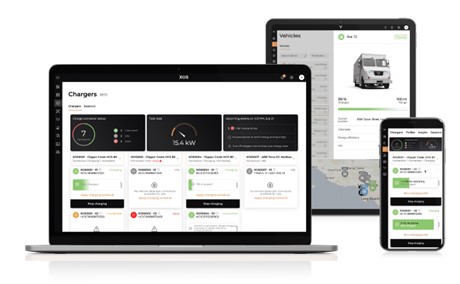

Xosphere™

We have developed a fleet management platform called Xosphere™ that interconnects vehicle, maintenance, charging, and service data. Xosphere™ is aimed at minimizing electric fleet TCO through fleet management integration. This comprehensive suite of tools allows fleet operators to monitor vehicle and charging performance in real-time with in-depth telematics; reduce charging cost; optimize energy usage; and manage maintenance and support with a single software tool. This software also contains connection modules that feature over-the-air update capabilities through our cloud intelligence platform and allow for remote diagnostics and maintenance services. Xosphere™ is compatible with our vehicles, powertrains and charging solutions regardless of the customer's specific mix of products and services. This allows customers to connect across Xos products to optimize their fleet.

Fleet-as-a-Service

Our Fleet-as-a-Service offering facilitates the transition from traditional internal combustion engine (“ICE”) vehicles to battery-electric vehicles and provides fleet operators with a comprehensive set of solutions and products by which to transition and operate an electric fleet. Our Fleet-as-a-Service offering includes, but is not limited to (i) charging solutions via Xos Energy Services™; (ii) vehicle telematics and over-the-air (OTA) updates via Xosphere™; (iii) service; (iv) risk mitigation products; and (v) and financing through our partners. Fleet-as-a-Service integrates services into a bundled service package to reduce cost and improve efficiency in fleet electrification. Fleet-as-a-Service is intended to increase the lifetime revenue of each vehicle sold by Xos. We plan to continue to expand on this offering through both in-house developments and offerings through industry-leading partners.

Technology Supporting Our Products & Services

Xos Vehicles & Powered by Xos™

Our proprietary battery pack systems (the “X-Pack”) and the X-Platform were engineered to be modular. Such modular design for the X-Pack and X-Platform enables fleet operators to upfit our chassis with their preferred vehicle body and tailor battery range to satisfy their specific commercial application (e.g., upfitting with a specific vehicle body and/or tailoring battery range).

X-Pack

Xos maintains the ability to design and engineer battery systems in house and integrate battery systems from third-party partners. We have developed proprietary battery pack technology purpose-built for last-mile commercial use cases. Our Xos battery packs (“X-Packs”) feature “cut-to-length” modular architecture to provide flexibility and satisfy customers’ preferred range and payload capacity needs. We strive to continuously improve our in-house designs while also utilizing partner battery packs to provide innovative solutions for our customers and improve vehicle TCO.

X-Platform

The X-Platform is the foundation of Xos vehicle products. Our modular proprietary chassis accommodates a wide range of commercial use applications and vehicle body upfits. Such modularity provides us with a competitive advantage in the commercial transportation sector in which commercial fleet operators deploy vehicles across an array of applications and environments.

Each X-Platform is able to accommodate a sufficient number of X-Packs to provide up to 270 miles of range across our current vehicle product variants. Our vehicle range capability allows Xos vehicles to meet the demands of rigorous last-mile routes. Each X-Platform is constructed with high-strength steel, which is designed to provide enhanced durability relative to other options on the market.

Vehicle Control Software

We designed and developed on-board vehicle control software, which leverages basic third-party software and integrates our proprietary powertrain controls, body controls, instrument cluster and infotainment and Xosphere™ software.

•Powertrain controls. Our powertrain controls include, but are not limited to, torque arbitration and power state management, thermal management for our powertrain and high-voltage battery systems, advanced driver assistance and safety (ADAS) and charging system communication and controls.

•Body controls. Our body controls include cabin heater and air conditioning, shifter communication, power steering control, electronic parking brake system and certain other software critical for vehicle controls.

•Instrument cluster and infotainment. We designed a fully digital instrument cluster specifically for last-mile commercial electric vehicles. Our custom user interface integrates into all Xos vehicles and is designed to enhance safe vehicle operation and provide critical safety information and driver efficiency guidance.

Xos Energy Solutions™

DC Fast Chargers

Xos Energy Solutions™ offers a suite of Xos DC Fast Chargers that are compatible with both passenger and commercial electric vehicles. Charger types on offer include: (i) 30kW and 60kW EV portable chargers, (ii) 30kW and 60kW EV wall-mount chargers; (iii) 30kW and 60kW EV pedestal EV chargers (iv) 150kW cabinet EV chargers; and (v) 300kW cabinet EV chargers. The DC Fast Chargers can be configured with different features to meet different use cases and budgets. Fleet owners and operators can monitor chargers through the Xosphere™ fleet management platform to remotely observe performance, maintain charging profiles and optimize TCO.

Xos Hub™

We also offer the Xos Hub™, a mobile energy storage and charging system. Utilizing our X-Pack battery technology, the Xos Hub™ enables charging of up to five vehicles at a time with standard CCS1 connectors. Our mobile Xos Hub™ can be transported to various locations and are intended to extend the range of electric routes. The Xos Hub™ also allows fleet operators a means to quickly deploy electric trucks without first implementing other charging infrastructure. We expect the Xos Hub™ to begin scaling production by the third quarter of 2023 and continue to believe that mobile, flexible methods of charging like the Xos Hub™ will play a key role in accelerating fleet electrification.

Sales & Marketing

Direct Sales

Our sales efforts consist of both inside sales representatives and field-based personnel who work to educate fleets on the wide-ranging benefits of our zero-tailpipe emission trucks and efficient methods to transition to electric fleets.

Dealer Sales

To supplement our direct sales organization we partner with various distributors and dealers with long-established fleet relationships in key markets. Such partnerships add sales expertise and deep industry knowledge, as well as access to hundreds of technicians to support customers with best-in-class parts and service support.

Energy & Infrastructure

In order to accelerate the adoption of electric trucks across all sectors, Xos has a dedicated sales force with specialized expertise in charging and infrastructure installations to facilitate fleet transition to electric vehicles. Our energy sales representatives are able to assist customers throughout the entire construction process, including managing projects, permitting, and securing available funding when applicable.

Powered by Xos

With our deep level of battery and powertrain technology, Xos actively pursues opportunities to supply OEM’s with powertrain kits as first-fit solutions to electrify industrial and off-highway equipment such as cranes, forklifts, and related equipment.

Customers

In addition to large-scale national accounts with major commercial fleet operators, we deliver vehicles directly to small -and medium-sized fleets via our in-house sales representatives and established distribution and channel partners. Such accounts include independent service providers (ISPs), which fulfill last-mile routes for enterprise partners. We have also entered into robust partnerships with established distributors such as Thompson Truck Centers to facilitate sales to commercial fleets. During the year ended December 31, 2022, one customer accounted for 42% of the Company’s revenues.

Competition

We have experienced, and expect to continue to experience, competition from a number of companies, particularly as the commercial transportation sector increasingly shifts towards low-emission, zero-tailpipe emission and carbon neutral solutions. Existing commercial diesel vehicle OEMs, such as Freightliner, Ford, General Motors, Navistar, Paccar, and Volvo/Mack, are shifting their focus to developing zero-tailpipe emissions solutions for the customers.

In addition to competition from traditional diesel OEMs, we face competition from disruptive vehicle manufacturers that are developing alternative fuel and electric commercial vehicles, such as Nikola, Rivian, Workhorse, BYD Motors, Harbinger, Lightning e-Motors, The Lion Electric Company, SEA Electric, Motiv Power Systems, Blue Arc, and Proterra.

We believe the primary competitive factors in the commercial vehicle market for medium- and heavy-duty last-mile and return-to-base segments include, but are not limited to:

•total cost of ownership;

•emissions profile;

•effectiveness within target applications and use cases;

•ease of integration into existing operations;

•product performance and uptime;

•vehicle quality, reliability and safety;

• service and support;

•technological innovation specifically around battery, software and data analytics; and

•fleet management.

We believe that we compete favorably with our competitors on the basis of these factors; however, our competitors may be able to deploy greater resources to the design, development, manufacturing, distribution, promotion, sales, marketing and support of their alternative fuel and electric vehicle programs. These competitors also compete with us in recruiting and retaining qualified research and development, sales, marketing and management personnel, as well as in acquiring technologies complementary to, or necessary for, our products. Additional mergers and acquisitions may result in even more resources being concentrated in our competitors.

Service & Maintenance

We continue to grow our service network with added Xos field service technicians, third party service partners, including W.W. Williams and Hwy 7 & 50, and full line dealer partnerships with the addition of Foley Equipment and Ventura Truck Sales (Gabrielli). This growth continues to support our ability to provide customers with comprehensive after-sales services to ensure maximum uptime and minimal operational disruption.

Manufacturing & Supply Chain

Manufacturing

We utilize a flexible manufacturing approach that leverages manufacturing partnerships to develop smaller and adaptable facilities relative to the large-scale greenfield manufacturing plants popular amongst traditional automotive manufacturers. Our flex manufacturing approach is structured such that the manufacturing partner provides real property facilities and vehicle assembly services while we coordinate other aspects of the manufacturing process, including supply chain logistics, battery assembly and manufacturing engineering. The smaller footprint of a flex facility and our utilization of existing facilities and labor allows us to establish each flex facility in under one year. We are able to upstart our facilities in lockstep

with our order book and address market demand in real-time ahead of competitors with longer lead-time manufacturing strategies. Our nimble flex facilities can also be strategically positioned in geographies near customers and suppliers — both domestic and international — and reduce logistics complexity and shipping costs.

Our current flex facility is located in Byrdstown, Tennessee and utilizes the facilities of Fitzgerald Manufacturing Partners, LLC. The flex facility is designed to manufacture up to 5,000 vehicles per year once fully tooled.

In addition to our flex manufacturing facility in Tennessee, we maintain a battery production line in Los Angeles to produce batteries for specific use cases and research and development.

Supply Chain

Our suppliers include CATL (providing battery packs from China), BEL Power (providing power electronics from Europe) and Dana (providing motors & inverters from India and China), among others. As is the case for some automotive companies, certain of our procured components and systems are sourced from single suppliers. We work to qualify multiple suppliers for key components where feasible in order to minimize potential production risks. We also mitigate risk by maintaining safety inventory for certain key components. Our products use various raw materials including aluminum, steel, cobalt, lithium, nickel and copper. Pricing for these materials is governed by market conditions and may fluctuate due to various factors outside of our control, such as supply and demand and market speculation. We are currently securing all raw materials and components that are either available or becoming available in the global supply chain to support our operations.

Governmental Programs, Incentives & Regulations

Our business is impacted by various government programs, credits, incentives and policies. Our business and products are also subject to numerous governmental regulations that vary among jurisdictions. Electric vehicle demand has been spurred by government incentives and regulations at federal, state and local levels. Government agencies around the world are expected to continue providing incentives for the purchase of electric vehicles, and regulations may be introduced to reduce emissions and encourage the use of clean energy vehicles.

Governmental regulations regarding the manufacture, sale and implementation of products and systems similar to ours are subject to future change. We cannot predict what impact, if any, such changes may have on our business.

Programs & Incentives

EV Tax Credits (Inflation Reduction Act)

On August 16, 2022, the Inflation Reduction Act of 2022 (“IRA”) was enacted into law and is effective for taxable years beginning after December 31, 2022, and remains subject to future guidance releases. The IRA includes multiple incentives to promote clean energy, electric vehicles, battery and energy storage manufacture or purchase, including through providing tax credits to consumers. For example, qualifying Xos customers may receive up to $40,000 per vehicle in federal tax credits for the purchase of qualified electric vehicles in the U.S. through 2032.

State Vehicle Incentives

Numerous states, as well as certain private enterprises, offer incentive programs to encourage the adoption of alternative fuel vehicles, including tax exemptions, tax credits, exemptions, and special privileges. Most of these programs have eligibility requirements such as a certain fleet size, required diesel truck trade-in, and environmental regulation compliance. For some state rebate and incentive programs, only a finite amount of funding is available.

Notable for Xos customers is the California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (“HVIP”), which provides point-of-sale vouchers for certain qualifying ZEVs. Under HVIP, dealers and fleet operators may request vouchers from HVIP on a first-come first-served basis, up to the funding amount available for that year, to reduce the cost of purchasing hybrid and zero-emission medium- and heavy-duty trucks and buses. Voucher amounts vary depending on a range of factors, such as the type of vehicle, the location where the vehicle is operated, and the number of vehicles sold. To qualify for HVIP, dealers are required to complete extensive training, initiate and complete applications for each sales order, and complete the voucher redemption process upon delivery to the end-user. HVIP represents the most utilized of the subsidy programs due to its ease of access and amount of funding per vehicle.

Infrastructure Incentives

A number of states and municipalities also offer incentive programs to encourage the installation of charging infrastructure for electric vehicles. The magnitude of incentives varies based on individual charging capabilities.

Emissions Credit Programs

California has greenhouse gas emissions standards that closely follow the standards of the U.S. Environmental Protection Agency (“EPA”). The registration and sale of zero-emission vehicles (“ZEV”) in California could earn us ZEV credits that we could in turn sell to traditional original equipment manufacturers (“OEMs”) looking to offset emissions from their traditional internal combustion engine vehicles in order to meet California’s emissions regulations. Other U.S. states have adopted similar standards including Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island and Vermont. We may take advantage of these regimes by registering and selling ZEVs in these other U.S. states.

ZEV credits in California are calculated under the ZEV regulation and are paid in relation to ZEVs sold and registered in California including battery electric vehicles (“BEVs”) and fuel cell electric vehicles (“FCEVs”). The ZEV program assigns ZEV credits to each vehicle manufacturer. Vehicle manufacturers are required to maintain ZEV credits equal to a set percentage of non-electric vehicles sold and registered in California. Each vehicle sold and registered in California earns a number of credits based on the drivetrain type and the all-electric range (“AER”) of the vehicle under the Urban Dynamometer Driving Schedule Test Cycle.

Regulations in the United States

We operate in an industry that is subject to extensive environmental regulation, which has become more stringent over time. The laws and regulations to which we are subject govern, among others, vehicle emissions and the storage, handling, treatment, transportation and disposal of hazardous materials and the remediation of environmental contamination. Compliance with such laws and regulations at an international, regional, national, state and local level is an important aspect of our ability to continue our operations.

Environmental standards applicable to us are established by the laws and regulations of the countries in which we operate, standards adopted by regulatory agencies and the permits and licenses issued to us. Each of these sources is subject to periodic modifications and what we anticipate will be increasingly stringent requirements. Violations of these laws, regulations or permits and licenses may result in substantial administrative, civil, or even criminal fines, penalties, and possibly orders to cease any violating operations or to conduct or pay for corrective works. In some instances, violations may also result in the suspension or revocation of permits or licenses.

EPA Emissions and Certificate of Conformity

The U.S. Clean Air Act requires that we obtain a Certificate of Conformity issued by the EPA for vehicles sold in all states, and a California Executive Order issued by the California Air Resources Board (“CARB”) is required for vehicles sold in California. Additionally, certain states, known as “CARB opt-in states” have adopted the California standards that are either already effective or take effect in the next few years. CARB sets more stringent standards for emissions control for certain regulated pollutants for new vehicles and engines sold in California and must obtain a waiver of preemption from the EPA before implementing and enforcing such standards. States that have adopted the California standards as approved by the EPA also recognize the CARB Executive Order for sales of vehicles.

Although our vehicles have zero tailpipe emissions, we are required to seek an EPA Certificate of Conformity for vehicles sold in states covered by the Clean Air Act’s standards or a CARB Executive Order for vehicles sold in California or any of the other states that have adopted the stricter California standards. We have received our Certificate of Conformity from the EPA and have submitted our documentation for the CARB executive order. We expect to receive approval from CARB in the second half of 2023.

Vehicle Safety & Testing

Our vehicles are subject to regulation by the National Highway Traffic Safety Administration (“NHTSA”), including all applicable Federal Motor Vehicle Safety Standards (“FMVSS”). Numerous FMVSS apply to our vehicles specifying design, construction, and performance requirements. Xos vehicles meet all applicable FMVSS standards in effect at the date of manufacture. While our current vehicles fully comply and we expect that our vehicles in the future will fully comply with all applicable FMVSS with limited or no exemptions, FMVSS are subject to change from time to time. As a manufacturer, we must self-certify that our vehicles meet all applicable FMVSS, or otherwise are exempt, before the vehicles may be imported or sold in the U.S.

We are also required to comply with other federal laws and regulations administered by NHTSA, as well as Federal Motor Carrier Safety Regulations (“FMCSR”), Federal Highway Administration (“FHA”) requirements, and standards set forth by the EPA.

Our vehicles sold outside of the U.S. are subject to similar foreign compliance, safety, environmental and other regulations. Many of those regulations are different from those applicable in the United States and may require redesign and/or retesting.

Automobile Manufacturer and Dealer Regulation

State laws regulate the manufacture, distribution, sale, and service (including delivery) of automobiles, and generally require motor vehicle manufacturers and dealers to be licensed in order to sell vehicles directly to customers in the state. Certain states have asserted that the laws in such states do not permit automobile manufacturers to be licensed as dealers or to act in the capacity of a dealer, or that they otherwise restrict a manufacturer’s ability to deliver or service vehicles. To sell vehicles to customers in states where we are not licensed as a dealer, we generally conduct the sale out of the state or via our authorized dealer partner in that state. However, certain states permit us, as a manufacturer of motor vehicles, to apply for and receive a dealer license to conduct vehicle sales, provided we meet certain requirements. Once licensed in one of these states, we may sell our vehicles to any consumer in the United States as a matter of interstate commerce. As of the date of this filing, we sell all vehicles using our California dealer license.

Battery Safety & Testing

Our battery packs are required to conform to mandatory regulations that govern transport of “dangerous goods,” defined to include lithium-ion batteries, which may present a risk in transportation. The governing regulations, which are issued by the Pipeline and Hazardous Materials Safety Administration, are based on the UN Recommendations on the Safe Transport of Dangerous Goods Model Regulations and related UN Manual Tests and Criteria. The regulations vary by mode of shipping transportation, such as by ocean vessel, rail, truck or air. We use lithium-ion cells in the high voltage battery packs in our vehicles. The use, storage, and disposal of our battery packs is regulated under U.S. federal law. Our battery packs conform to such “dangerous goods” shipping standards at a cell level.

Regulations in Canada

Our vehicles available for sale in the Canadian market are subject to environmental and safety certifications administered by the appropriate Canadian regulatory authorities, including, but not limited to the Canada Motor Vehicle Safety Standards (“CMVSS”), which is administered by Transport Canada. Air quality standards are administered by Environment Canada, which accepts US EPA certification. Unlike the United States, there are no impediments to a manufacturer applying for and receiving a dealer license to perform sales and services, however, we must obtain the necessary provincial licenses to enable sales and services in each location. We have completed the Registration of Imported Vehicles (RIV) process for vehicles originally manufactured for distribution in the U.S. market that are being permanently imported into Canada. We are currently in the process of seeking approval under the Appendix G Pre-Clearance Program.

Seasonality

Historically, the automotive industry has experienced higher revenue in the spring and summer months. Additionally, we expect volumes of commercial vehicle sales to be less in the winter months as many customers shift focus to executing high-volume holiday deliveries. An estimated 40% of our customers operate in the parcel and delivery segment which has a “peak season” between the Thanksgiving and Christmas season, resulting in preparatory fleet expansions leading into such period followed by declined new vehicle purchases thereafter. Additionally, due to the recent introduction of our 2023 Stepvan, we expect deliveries to be weighted towards the second half of fiscal 2022.

Intellectual Property

Our ability to protect our material intellectual property is important to our business. We rely upon a combination of protections afforded to owners of patents, copyrights, trade secrets, and trademarks, along with employee and third-party non-disclosure agreements and other contractual restrictions to establish and protect our intellectual property rights. In particular, unpatented trade secrets in the fields of research, development and engineering are an important aspect of our business by ensuring that our technology remains confidential. We also pursue patent protection when we believe we have developed a patentable invention and the benefits of obtaining a patent outweigh the risks of making the invention public through patent filings.

As of December 31, 2022, we had five awarded U.S. patents. We pursue the registration of our domain names and material trademarks and service marks in the United States. In an effort to protect our brand, as of December 31, 2022, we had 26 pending or approved U.S. trademark applications.

We regularly review our development efforts to assess the existence and patentability of new inventions, and we are prepared to file additional patent applications when we determine it would benefit our business to do so.

Facilities

Our headquarters are located in an 85,142 square foot facility in Los Angeles, California, where we design, engineer and develop our vehicles and battery packs. We entered a new lease agreement for the facility with the landlord in August 2021. The new lease commenced on January 1, 2022 and will terminate pursuant to its terms on January 31, 2027, unless amended and/or extended.

We also have a flex facility located in Byrdstown, Tennessee that utilizes the facilities of Fitzgerald Manufacturing Partners, LLC, the largest manufacturer of glider kits in the United States.

Human Capital

People Strategy and Governance

We firmly believe an integral part of our growth story is through elevating the most important asset we have: our people. By focusing on the fundamentals of our people strategy, leadership, culture and talent, we remain strong, adaptive, innovative, and well-equipped to respond to the ever-changing commercial vehicle landscape. Our Employee Experience Team and Sustainability and Innovation Committee are and will be responsible for our human capital policies and strategies and their collective recommendations to our CEO and key leadership members allow us to proactively manage our human capital and care for our employees in a manner that is consistent with our values.

Commitment to Diversity, Equity, and Inclusion

At Xos, we believe that creating an inclusive environment for all our employees is foundational to our success and, more importantly, morally the right thing to do. One of our organizational values is “One team: Be actively inclusive. Embrace diversity. Support and celebrate others.” We are committed to creating and maintaining a workplace in which all employees have an opportunity to participate and contribute to the success of our business and are valued for their skills, experience, and unique perspectives.

We administer Employee Resource Groups that represent various dimensions of our employee population, including racial, ethnic, gender, religious, and generational communities, as well as provide training materials to team leaders on inclusive leadership. These groups provide a place for employees of diverse backgrounds to find belonging at Xos in addition to helping all employees learn about experiences that differ from their own.

Talent Attraction, Growth, and Capability Assessment

We leverage best practices in assessments and talent management to strengthen and expand our current capabilities and future pipeline while reinforcing a culture of belonging, empowerment, and innovation. We also create targeted learning experiences, democratizing learning and career development opportunities across the organization, and empowering employees to design their own career paths with skill development targeted for the roles of today and the future.

The extent to which our leaders are equipped to care for, inspire, and empower our people plays a vital role in our strategy. Our set of leadership standards outlines clear expectations for our leaders: that they regularly connect with team members, spend time teaching and coaching, and champion their team’s career development. We are committed to helping our leaders strengthen these capabilities with dedicated learning paths and non-traditional learning opportunities.

Employee Well-Being Initiatives

Our holistic approach to well-being encompasses the financial, social, mental/emotional, physical, and professional needs of our employees. Foundational to our well-being philosophy is providing a broad array of resources and solutions to educate employees and build capability and support for meeting individual well-being needs and goals. These initiatives include financial seminars, weekly mindfulness sessions, an on-site gym, and healthy food in our kitchens.

We employ programs to understand employee sentiment on their mental and emotional well-being, health & safety, employee experience, culture, diversity, equity and inclusion, leadership and strategic alignment. Weekly check-ins gather pulse scores and employee feedback on those topics. Suggestion boxes and focus groups collect additional information on employee sentiment and needs, and we communicate the resulting actions taken with our employee population.

Our well-being programs are an integral part of our total rewards strategy as we work to address business and employee challenges through a multi-channel approach that provides our diverse populations with choices to meet their specific needs.

Employment Data

As of December 31, 2022, we had 272 full-time employees, 25 contractors and 3 interns. We have not experienced any work stoppages and consider our relationships with our employees to be good. None of our employees are subject to a collective bargaining agreement or represented by a labor union.

Corporate Information

Xos, Inc. was initially incorporated on July 29, 2020 as a Cayman Islands exempted company under the name “NextGen Acquisition Corporation” (“NextGen”). On August 20, 2021, the transactions contemplated by the Agreement and Plan of Merger, as amended on May 14, 2021, by and among NextGen, Sky Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of NextGen (“Merger Sub”), and Xos, Inc., a Delaware corporation (now known as Xos Fleet, Inc., “Legacy Xos”), were consummated (the “Closing”), whereby Merger Sub merged with and into Legacy Xos, the separate corporate existence of Merger Sub ceased and Legacy Xos became the surviving corporation and a wholly owned subsidiary of NextGen (such transaction the “Merger” and, collectively with the Domestication, the “Business Combination”). As a result, Xos became the publicly traded entity listed on the Nasdaq Global Market.

Available Information (Website)

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed with or furnished to the Securities and Exchange Commission (“SEC”) pursuant to Sections 13(a) and 15(d) of the “Exchange Act”, are available, free of charge, on our Investor Relations website at https://investors.xostrucks.com/ as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website at http://www.sec.gov that contains reports, proxy, information statements and other information regarding registrants that file electronically with the SEC. We use our Investor Relations website as a means of disclosing material information. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, and public conference calls and webcasts. The information provided on, or accessible through, our Investor Relations website is not a part of this Annual Report on Form 10-K, nor is such information incorporated by reference herein, and such information should not be relied upon in determining whether to make an investment in our common stock.

Item 1A. Risk Factors

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the risks and uncertainties set forth herein as well as the other information in this Report, including our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The occurrence of any of the events or developments described below, or of additional risks and uncertainties not presently known to us or that we currently deem immaterial, could materially and adversely affect our business, financial condition, growth prospects, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this Report are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Summary of Risks:

Our business is subject to a number of known and unknown risks, uncertainties and assumptions that could cause actual results to differ materially from those projected or otherwise implied by the forward-looking statements provided herein. Below we summarize what we believe are the principal risk factors relating to our business but these risks are not the only ones that we face. You should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors”,

together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occurs (or if any of those listed elsewhere in this Annual Report on Form 10-K occurs), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

•Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment.