ghw-202203040001819438False1P3Y4400018194382021-01-012021-12-3100018194382021-12-31iso4217:USD00018194382020-12-31iso4217:USDxbrli:sharesxbrli:shares00018194382020-01-012020-12-310001819438srt:ScenarioPreviouslyReportedMember2019-12-310001819438us-gaap:CommonStockMembersrt:ScenarioPreviouslyReportedMember2019-12-310001819438srt:ScenarioPreviouslyReportedMemberus-gaap:WarrantMember2019-12-310001819438us-gaap:AdditionalPaidInCapitalMembersrt:ScenarioPreviouslyReportedMember2019-12-310001819438us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2019-12-310001819438srt:RestatementAdjustmentMember2019-12-310001819438us-gaap:CommonStockMembersrt:RestatementAdjustmentMember2019-12-310001819438us-gaap:WarrantMembersrt:RestatementAdjustmentMember2019-12-310001819438us-gaap:AdditionalPaidInCapitalMembersrt:RestatementAdjustmentMember2019-12-310001819438us-gaap:RetainedEarningsMembersrt:RestatementAdjustmentMember2019-12-3100018194382019-12-310001819438us-gaap:CommonStockMember2019-12-310001819438us-gaap:WarrantMember2019-12-310001819438us-gaap:AdditionalPaidInCapitalMember2019-12-310001819438us-gaap:RetainedEarningsMember2019-12-310001819438us-gaap:CommonStockMember2020-01-012020-12-310001819438us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001819438us-gaap:RetainedEarningsMember2020-01-012020-12-310001819438us-gaap:CommonStockMember2020-12-310001819438us-gaap:WarrantMember2020-12-310001819438us-gaap:AdditionalPaidInCapitalMember2020-12-310001819438us-gaap:RetainedEarningsMember2020-12-310001819438us-gaap:CommonStockMember2021-01-012021-12-310001819438us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncCommonStockMemberus-gaap:CommonStockMember2021-01-012021-12-310001819438us-gaap:AdditionalPaidInCapitalMemberghw:LegacyEssTechIncCommonStockMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncCommonStockMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncCommonStockMemberus-gaap:WarrantMember2021-01-012021-12-310001819438us-gaap:CommonStockMemberghw:SeriesC2RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001819438us-gaap:AdditionalPaidInCapitalMemberghw:SeriesC2RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001819438us-gaap:RetainedEarningsMember2021-01-012021-12-310001819438us-gaap:CommonStockMember2021-12-310001819438us-gaap:WarrantMember2021-12-310001819438us-gaap:AdditionalPaidInCapitalMember2021-12-310001819438us-gaap:RetainedEarningsMember2021-12-3100018194382021-10-08xbrli:pureghw:segment0001819438srt:MinimumMember2021-01-012021-12-310001819438srt:MaximumMember2020-01-012020-12-310001819438us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001819438us-gaap:SubsequentEventMemberus-gaap:AccountingStandardsUpdate201602Member2022-01-010001819438ghw:LegacyEssTechIncMember2021-10-070001819438ghw:LegacyEssTechIncShareholdersMember2021-10-082021-10-080001819438ghw:TransactionExpenseAdjustmentMemberghw:LegacyEssTechIncShareholdersMember2021-10-082021-10-080001819438us-gaap:PrivatePlacementMemberghw:ACONS2AcquisitionCorpMember2021-10-082021-10-080001819438us-gaap:PrivatePlacementMemberghw:ACONS2AcquisitionCorpMember2021-10-080001819438us-gaap:RestrictedStockUnitsRSUMember2021-10-082021-10-080001819438us-gaap:RestrictedStockUnitsRSUMember2021-11-092021-11-090001819438us-gaap:CommonStockMember2021-10-08ghw:tranche0001819438us-gaap:CommonStockMemberghw:LegacyEssTechIncMember2021-11-092021-11-090001819438us-gaap:SubsequentEventMemberghw:EarnoutSharesMember2022-01-012022-03-030001819438ghw:ACONS2AcquisitionCorpMember2021-10-080001819438us-gaap:CommonClassAMemberghw:ACONS2AcquisitionCorpMember2021-10-070001819438us-gaap:CommonClassBMemberghw:ACONS2AcquisitionCorpMember2021-10-070001819438ghw:ACONS2AcquisitionCorpMember2021-10-072021-10-0700018194382021-10-082021-10-080001819438us-gaap:RedeemableConvertiblePreferredStockMember2021-10-082021-10-080001819438us-gaap:CommonStockMember2021-10-082021-10-080001819438ghw:ProductsShippedOneMember2021-12-310001819438ghw:ProductsShippedOneMember2020-12-310001819438ghw:ProductsShippedTwoMember2021-12-310001819438ghw:ProductsShippedTwoMember2020-12-310001819438ghw:OtherContractsWithCustomerMember2021-12-310001819438ghw:OtherContractsWithCustomerMember2020-12-310001819438us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001819438us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001819438us-gaap:RestrictedStockUnitsRSUMember2021-12-310001819438us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819438us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001819438us-gaap:WarrantMember2021-01-012021-12-310001819438us-gaap:WarrantMember2020-01-012020-12-310001819438ghw:EarnoutSharesMember2021-01-012021-12-310001819438ghw:EarnoutSharesMember2020-01-012020-12-310001819438us-gaap:MachineryAndEquipmentMember2021-12-310001819438us-gaap:MachineryAndEquipmentMember2020-12-310001819438us-gaap:FurnitureAndFixturesMember2021-12-310001819438us-gaap:FurnitureAndFixturesMember2020-12-310001819438us-gaap:LeaseholdImprovementsMember2021-12-310001819438us-gaap:LeaseholdImprovementsMember2020-12-310001819438us-gaap:ConstructionInProgressMember2021-12-310001819438us-gaap:ConstructionInProgressMember2020-12-310001819438us-gaap:NotesPayableToBanksMember2021-12-310001819438us-gaap:NotesPayableToBanksMember2020-12-310001819438ghw:PayrollProtectionProgramLoansMember2021-12-310001819438ghw:PayrollProtectionProgramLoansMember2020-12-310001819438ghw:PayrollProtectionProgramLoansMember2020-04-190001819438ghw:PayrollProtectionProgramLoansMember2021-07-012021-07-310001819438ghw:PayrollProtectionProgramLoansMember2021-01-012021-12-310001819438us-gaap:BridgeLoanMember2021-07-310001819438us-gaap:BridgeLoanMember2021-10-080001819438us-gaap:BridgeLoanMember2021-12-310001819438us-gaap:BridgeLoanMember2021-01-012021-12-310001819438us-gaap:NotesPayableToBanksMember2018-12-310001819438us-gaap:NotesPayableToBanksMember2020-03-310001819438us-gaap:NotesPayableToBanksMember2020-01-012020-12-310001819438us-gaap:NotesPayableToBanksMember2020-04-300001819438us-gaap:PrimeMemberus-gaap:NotesPayableToBanksMember2020-03-012020-03-310001819438ghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2018-07-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMember2020-03-310001819438us-gaap:WarrantMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2018-07-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberus-gaap:WarrantMember2020-03-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMember2021-01-012021-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMember2020-01-012020-12-310001819438ghw:FirstRepublicBankMemberus-gaap:LetterOfCreditMember2020-12-310001819438ghw:FirstRepublicBankMemberus-gaap:LetterOfCreditMember2021-12-310001819438ghw:FirstRepublicBankMemberus-gaap:LetterOfCreditMember2020-01-012020-12-310001819438ghw:FirstRepublicBankMemberus-gaap:LetterOfCreditMember2021-01-012021-12-310001819438ghw:NoncancellableAgreementsMember2021-12-310001819438ghw:NoncancellableAgreementsMember2020-12-310001819438ghw:CancellableAgreementsMember2021-12-310001819438ghw:CancellableAgreementsMember2020-12-310001819438us-gaap:CommonStockMember2021-10-072021-10-070001819438ghw:LegacyEssTechIncMemberghw:SeriesC2RedeemableConvertiblePreferredStockMember2020-12-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2020-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesC2RedeemableConvertiblePreferredStockMember2021-03-012021-03-310001819438ghw:LegacyEssTechIncMemberghw:SeriesC2RedeemableConvertiblePreferredStockMember2021-03-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-03-012021-03-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-03-310001819438ghw:LegacyEssTechIncMember2021-03-310001819438ghw:LegacyEssTechIncMemberus-gaap:WarrantMember2021-03-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2021-05-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-05-072021-05-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-05-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2021-05-072021-05-070001819438ghw:LegacyEssTechIncMember2021-05-072021-05-070001819438ghw:LegacyEssTechIncMember2021-05-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsAndWarrantsMember2021-10-082021-10-080001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-01-012021-12-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockPurchaseRightsMemberghw:LegacyEssTechIncMember2021-12-310001819438ghw:LegacyEssTechIncMemberghw:CommonStockWarrantsMember2021-12-310001819438ghw:LegacyEssTechIncMemberghw:CommonStockWarrantsMember2020-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438ghw:LegacyEssTechIncMember2021-12-310001819438ghw:LegacyEssTechIncMember2020-12-310001819438ghw:LegacyEssTechIncMembersrt:MinimumMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438srt:MaximumMemberghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438ghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMembersrt:MinimumMember2021-10-070001819438ghw:LegacyEssTechIncMembersrt:MinimumMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMembersrt:MaximumMemberghw:LegacyEssTechIncMember2021-10-070001819438srt:MaximumMemberghw:LegacyEssTechIncMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2021-10-070001819438ghw:LegacyEssTechIncMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2021-10-070001819438ghw:LegacyEssTechIncMemberghw:CommonStockWarrantsMember2021-10-070001819438ghw:LegacyEssTechIncMemberghw:CommonStockWarrantsMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncMemberghw:SeriesC1RedeemableConvertiblePreferredStockWarrantsMember2021-01-012021-12-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2020-12-310001819438ghw:SeriesC2RedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncMember2021-01-012021-12-310001819438ghw:LegacyEssTechIncMemberus-gaap:MeasurementInputPriceVolatilityMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438ghw:LegacyEssTechIncMembersrt:MinimumMemberus-gaap:MeasurementInputPriceVolatilityMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438srt:MaximumMemberghw:LegacyEssTechIncMemberus-gaap:MeasurementInputPriceVolatilityMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438us-gaap:MeasurementInputExpectedTermMemberghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-31utr:Y0001819438us-gaap:MeasurementInputExpectedTermMemberghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2021-12-310001819438us-gaap:MeasurementInputRiskFreeInterestRateMemberghw:LegacyEssTechIncMembersrt:MinimumMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMemberghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMemberghw:LegacyEssTechIncMembersrt:MinimumMember2021-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMemberghw:LegacyEssTechIncMember2021-12-310001819438ghw:LegacyEssTechIncMemberus-gaap:MeasurementInputExpectedDividendRateMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2021-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMemberus-gaap:MeasurementInputExpectedDividendRateMember2021-12-310001819438ghw:LegacyEssTechIncMemberus-gaap:MeasurementInputPriceVolatilityMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-310001819438us-gaap:MeasurementInputExpectedTermMemberghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438us-gaap:MeasurementInputExpectedTermMemberghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMember2020-12-310001819438us-gaap:MeasurementInputRiskFreeInterestRateMemberghw:LegacyEssTechIncMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMemberghw:LegacyEssTechIncMember2020-12-310001819438ghw:LegacyEssTechIncMemberus-gaap:MeasurementInputExpectedDividendRateMemberghw:SeriesBRedeemableConvertiblePreferredStockWarrantsMember2020-12-310001819438ghw:SeriesCRedeemableConvertiblePreferredStockWarrantsMemberghw:LegacyEssTechIncMemberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-310001819438ghw:PublicWarrantsMember2021-12-310001819438ghw:PrivateWarrantsMember2021-12-310001819438ghw:EarnoutWarrantsMember2021-12-310001819438ghw:PublicWarrantsMemberghw:ACONS2AcquisitionCorpMember2021-10-082021-10-080001819438us-gaap:CommonStockMemberghw:PublicWarrantHoldersMemberghw:ACONS2AcquisitionCorpMember2020-09-210001819438us-gaap:CommonStockMemberghw:ACONS2AcquisitionCorpMember2020-09-210001819438ghw:PublicWarrantsMemberghw:ACONS2AcquisitionCorpMember2020-09-210001819438ghw:PublicWarrantsMemberghw:RedemptionScenarioOneMember2021-12-310001819438ghw:PublicWarrantsMemberghw:RedemptionScenarioOneMember2021-01-012021-12-310001819438ghw:PublicWarrantsMemberghw:RedemptionScenarioTwoMember2021-12-310001819438ghw:RedemptionScenarioTwoMember2021-01-012021-12-310001819438ghw:ACONS2AcquisitionCorpSponsorMemberus-gaap:PrivatePlacementMemberghw:PrivateWarrantsMemberghw:ACONS2AcquisitionCorpMember2020-09-212020-09-210001819438ghw:PrivateWarrantsMemberghw:ACONS2AcquisitionCorpSponsorMember2021-10-082021-10-080001819438ghw:PrivateWarrantsMember2021-10-080001819438ghw:EarnoutWarrantsMember2021-11-090001819438us-gaap:CommonStockMemberghw:PrivateWarrantHoldersMember2021-10-080001819438us-gaap:CommonStockMemberghw:EarnoutWarrantHoldersMember2021-10-080001819438ghw:PublicWarrantsMemberghw:RedemptionScenarioThreeMember2021-01-012021-12-310001819438ghw:EarnoutWarrantsMember2020-12-310001819438ghw:EarnoutWarrantsMember2021-01-012021-12-310001819438ghw:PublicWarrantsMember2020-12-310001819438ghw:PublicWarrantsMember2021-01-012021-12-310001819438ghw:PrivateWarrantsMember2020-12-310001819438ghw:PrivateWarrantsMember2021-01-012021-12-310001819438us-gaap:EmployeeStockMember2021-01-012021-12-310001819438us-gaap:EmployeeStockMember2021-12-310001819438ghw:A2014EquityIncentivePlanMember2021-12-310001819438us-gaap:RestrictedStockUnitsRSUMemberghw:A2014EquityIncentivePlanMember2021-12-310001819438us-gaap:StockAppreciationRightsSARSMemberghw:A2014EquityIncentivePlanMember2020-12-310001819438us-gaap:StockAppreciationRightsSARSMemberghw:A2014EquityIncentivePlanMember2021-12-310001819438us-gaap:RestrictedStockUnitsRSUMemberghw:A2014EquityIncentivePlanMember2020-12-310001819438us-gaap:RestrictedStockMemberghw:A2014EquityIncentivePlanMember2021-12-310001819438us-gaap:RestrictedStockMemberghw:A2014EquityIncentivePlanMember2020-12-310001819438us-gaap:EmployeeStockOptionMemberghw:A2014EquityIncentivePlanMember2020-01-012020-12-310001819438us-gaap:EmployeeStockOptionMemberghw:A2014EquityIncentivePlanMember2021-01-012021-12-310001819438ghw:A2021EquityIncentivePlanMember2021-12-310001819438ghw:A2021EquityIncentivePlanMemberus-gaap:SubsequentEventMember2022-01-012022-01-010001819438ghw:A2021EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001819438ghw:A2021EquityIncentivePlanMemberghw:NonQualifiedStockOptionsNSOsMember2021-12-310001819438ghw:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockMember2021-12-310001819438ghw:A2021EquityIncentivePlanMemberghw:IncentiveStockOptionsISOsMember2021-12-310001819438ghw:A2021EquityIncentivePlanMemberus-gaap:StockAppreciationRightsSARSMember2021-12-310001819438srt:ScenarioPreviouslyReportedMember2019-01-012019-12-3100018194382019-01-012019-12-310001819438us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819438us-gaap:EmployeeStockOptionMember2021-12-310001819438us-gaap:EmployeeStockOptionMember2020-12-310001819438us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001819438us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001819438us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001819438us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001819438us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001819438us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001819438us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2021-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMember2021-12-310001819438ghw:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819438us-gaap:FairValueInputsLevel2Memberghw:PublicWarrantsMember2021-12-310001819438ghw:PublicWarrantsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819438ghw:PublicWarrantsMember2021-12-310001819438us-gaap:FairValueInputsLevel1Memberghw:PrivateWarrantsMember2021-12-310001819438us-gaap:FairValueInputsLevel2Memberghw:PrivateWarrantsMember2021-12-310001819438us-gaap:FairValueInputsLevel3Memberghw:PrivateWarrantsMember2021-12-310001819438ghw:PrivateWarrantsMember2021-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2020-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2020-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2020-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001819438us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001819438us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001819438us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001819438us-gaap:FairValueMeasurementsRecurringMember2020-12-310001819438us-gaap:BridgeLoanMember2020-12-310001819438us-gaap:BridgeLoanMember2019-12-310001819438us-gaap:BridgeLoanMember2021-01-012021-12-310001819438us-gaap:BridgeLoanMember2020-01-012020-12-310001819438us-gaap:BridgeLoanMember2021-12-310001819438ghw:WarrantLiabilitiesMember2020-12-310001819438ghw:WarrantLiabilitiesMember2019-12-310001819438ghw:WarrantLiabilitiesMember2021-01-012021-12-310001819438ghw:WarrantLiabilitiesMember2020-01-012020-12-310001819438ghw:WarrantLiabilitiesMember2021-12-310001819438us-gaap:RedeemableConvertiblePreferredStockMember2020-12-310001819438us-gaap:RedeemableConvertiblePreferredStockMember2019-12-310001819438us-gaap:RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001819438us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001819438us-gaap:RedeemableConvertiblePreferredStockMember2021-12-310001819438us-gaap:DomesticCountryMember2021-12-310001819438us-gaap:StateAndLocalJurisdictionMember2021-12-310001819438ghw:TechnologyConsultingMember2020-01-012020-12-310001819438us-gaap:CommonStockMemberghw:LegacyEssTechIncMemberghw:RelatedPartiesMember2021-11-092021-11-090001819438ghw:EnergyWarehouseSalesMember2021-12-310001819438us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SubsequentEventMember2022-02-012022-02-28

As filed with the Securities and Exchange Commission on March 4, 2022

Registration No. 333-

Registration No. 333-260693

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

AND

POST-EFFECTIVE AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

NO. 333-260693

Under

The Securities Act of 1933

ESS TECH, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 3690 | 98-1550150 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

26440 SW Parkway Ave., Bldg. 83

Wilsonville, OR 97070

(855) 423-9920

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Eric Dresselhuys

ESS Tech, Inc.

Chief Executive Officer

26440 SW Parkway Ave., Bldg. 83

Wilsonville, Oregon 97070

(855) 423-9920

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | |

Mark B. Baudler Alexandra Perry Christoph Luschin Wilson Sonsini Goodrich & Rosati Professional Corporation 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 | Amir Moftakhar Chief Financial Officer 26440 SW Parkway Ave., Bldg. 83 Wilsonville, Oregon 97070 98101 (888) 423-9920 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (“Securities Act”), check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934, as amended (“Exchange Act”).

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On October 8, 2021 (the “Closing Date”), ESS Tech, Inc., a Delaware corporation (“ESS”, the “Company,” “we,” “us” or “our”) f/k/a ACON S2 Acquisition Corp., a Cayman Islands exempted company (“STWO”), consummated the previously announced merger pursuant to that certain Agreement and Plan of Merger, dated May 6, 2021 (the “Merger Agreement”), by and among STWO, SCharge Merger Sub, Inc., a Delaware corporation and wholly owned direct subsidiary of STWO (“Merger Sub”), and ESS Subsidiary Tech, Inc., a Delaware corporation (f/k/a ESS Tech, Inc.) (“Legacy ESS”) following the approval at a special meeting of the stockholders of STWO held on October 5, 2021 (the “Special Meeting”).

Pursuant to the terms of the Merger Agreement, STWO deregistered by way of continuation under the Cayman Islands Companies Act (2021 Revision) and registered as a corporation in the State of Delaware under Part XII of the Delaware General Corporation Law (the “Domestication”), and a business combination between STWO and Legacy ESS was effected through the merger of Merger Sub with and into Legacy ESS, with ESS surviving as a wholly owned subsidiary of STWO (together with the other transactions described in the Merger Agreement, the “Merger”). On the Closing Date, the registrant changed its name from “ACON S2 Acquisition Corp.” to “ESS Tech, Inc.” On the Closing Date, a number of third-party purchasers (the “Other PIPE Investors”) and certain existing securityholders of Legacy ESS (the “Insider PIPE Investors”, and together with the Other PIPE Investors, the “PIPE Investors”) purchased from ESS an aggregate of 25,000,000 newly issued shares of Common Stock (the “PIPE Financing”), for a purchase price of $10.00 per share and an aggregate purchase price of $250.0 million (the “PIPE Shares”), each pursuant to a separate subscription agreement (each, a “Subscription Agreement”), entered into effective as of May 6, 2021. Pursuant to the Subscription Agreements, ESS gave certain registration rights to the PIPE Investors with respect to their PIPE Shares. The sale of the PIPE Shares was consummated concurrently with the closing of the Merger (the “Closing”). Pursuant to the Merger Agreement, ESS entered into a Registration Rights Agreements, dated as of October 8, 2021, providing for certain registration rights to the Sponsor and certain securityholders of ESS.

Post-Effective Amendment No. 2 to Registration Statement on Form S-1 (File No. 333-260693)

On November 2, 2021, ESS filed a registration statement with the Securities and Exchange Commission (the “SEC”), on Form S-1 (File No. 333-260693) (the “Prior Registration Statement”), to initially register for resale by the selling stockholders named therein or their permitted transferees (i) 25,000,000 shares of our common stock, par value $0.0001 per share (the “Common Stock”) purchased or owned by the PIPE Investors; and (ii) 100,952,180 shares of Common Stock consisting of (a) 86,477,462 shares of Common Stock beneficially owned by certain former stockholders of ESS Tech Subsidiary, Inc. (f/k/a ESS Tech, Inc.), (b) up to 13,638,114 to be issued to eligible ESS securityholders representing shares of earnout stock under the Merger Agreement, (c) up to 824,998 shares underlying restricted stock units issued to certain Legacy ESS stockholders and (d) 11,606 shares of restricted Common Stock held by Legacy ESS securityholders that were issued pursuant to the exercise of options issued pursuant to the ESS 2014 Equity Incentive Plan that were assumed by us pursuant to the Merger Agreement. The Prior Registration Statement was declared effective by the SEC on November 10, 2021. Subsequently, we issued a Current Report on Form 8-K on November 22, 2021 notifying investors that they should not rely on certain previously issued financial statements. On December 9, 2021, we filed the Post-Effective Amendment No. 1 to the Prior Registration Statement with the SEC to include restated financial statements and to update certain other information, which was declared effective by the SEC on December 13, 2021. Pursuant to Rule 429 this registration statement shall constitute Post-Effective Amendment No. 2 to the Prior Registration Statement with respect to the offering of any unsold shares thereunder and is being filed (i) to include information from our Annual Report on Form 10-K for the year ended December 31, 2021 that was filed on March 3, 2022 (the “Annual Report”); and (ii) to update certain other information in the Prior Registration Statement. No additional securities are being registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

Registration Statement on Form S-1

This registration statement registers for resale from time to time by the selling stockholders described herein or their permitted transferees (the “Selling Stockholders”) of up to 4,092,576 shares of Common Stock, which were

previously registered pursuant to the registration statement on Form S-4 initially filed with the SEC on June 21, 2021 (File No. 333-257232). Since these shares are deemed “restricted” or “control” securities within the meaning of Rule 144, as promulgated under the Securities Act and are currently not freely tradable and may only be sold pursuant to an effective registration statement or an exemption from registration, if available, these shares are being registered for resale on this registration statement.

As used herein, unless otherwise stated or the context clearly indicates otherwise, the terms “Company,” “Registrant,” “we,” “us,” and “our” refer to the parent entity formerly named ACON S2 Acquisition Corp., after giving effect to the Merger, and as renamed “ESS Tech, Inc.”

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | | | | | |

| PRELIMINARY PROSPECTUS | Subject to Completion | March 4, 2022 |

130,044,756 Shares of Common Stock

This prospectus relates to the registration of common stock, par value $0.0001 per share (“Common Stock”), of ESS Tech, Inc. as described herein.

This prospectus relates to the resale from time to time by the selling stockholders described in this prospectus or their permitted transferees (the “Selling Stockholders”) of up to 130,044,756 shares of Common Stock beneficially owned by certain former stockholders of Legacy ESS (as defined herein).

The Selling Stockholders may sell any, all or none of the securities and we do not know when or in what amount the Selling Stockholders may sell their securities hereunder following the date of this prospectus. The Selling Stockholders may sell the securities described in this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Stockholders may sell their securities in the section titled “Plan of Distribution” beginning on page 119 of this prospectus. We are registering the offer and sale of these securities to satisfy certain registration rights we have granted under certain agreements between us and the Selling Stockholders. We will not receive any of the proceeds from the sale of the securities by the Selling Stockholders. We will pay the expenses associated with registering the sales by the Selling Stockholders other than any underwriting discounts and commissions, as described in more detail in the section titled “Use of Proceeds” appearing in this prospectus beginning on page 54. Of the 130,044,756 shares of Common Stock that may be offered or sold by the Selling Stockholders identified in this prospectus, certain of our Selling Stockholders are subject to lock-up restrictions with respect to 105,044,756 of those shares pursuant to our amended and restated bylaws until March 7, 2022.

Our Common Stock is listed on The New York Stock Exchange (“NYSE”) under the symbol “GWH”. On March 3, 2022, the last quoted sale price for our Common Stock as reported on NYSE was $4.89 per share.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 12 of this prospectus. You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), this prospectus is a combined prospectus relating to (a) up to 125,952,180 shares of our Common Stock previously registered for resale pursuant to the registration statement on Form S-1 initially filed with the Securities and Exchange Commission (the “SEC”) on November 3, 2021 (File No. 333-260693) and (b) of up to 4,092,576 shares of our Common Stock previously registered pursuant to the registration statement on Form S-4 initially filed with the SEC on June 21, 2021 (File No. 333-257232).

You should rely only on the information contained in this prospectus or in any applicable prospectus supplement prepared by us or on our behalf. Neither we nor the Selling Stockholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Selling Stockholders are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders hereunder may, from time to time, sell the securities offered by them described in this prospectus. Additionally, under the shelf process, in certain circumstances, we may provide a prospectus supplement that will contain certain specific information about the terms of a particular offering by one or more of the Selling Stockholders. We will not receive any proceeds from the sale by such Selling Stockholders of the securities offered by them described in this prospectus.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus titled “Where You Can Find Additional Information.”

Unless the context indicates otherwise, references to “we”, “us” and “our” refer to ESS Tech, Inc., a Delaware corporation, and its consolidated subsidiaries following the Business Combination (as defined herein).

The ESS Tech design logo and the ESS mark appearing in this prospectus are the property of ESS Tech, Inc. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. We have omitted the ® and TM designations, as applicable, for the trademarks used in this prospectus.

Within this prospectus, we reference information and statistics regarding the industries in which we operate. We have obtained this information and these statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Some data and other information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the Selling Stockholders can guarantee the accuracy or completeness of any such information contained in this prospectus.

FREQUENTLY USED TERMS

In this document:

“2014 Plan” means the ESS 2014 Equity Incentive Plan, as amended, supplemented or modified from time to time.

“2021 Employee Stock Purchase Plan” means the ESS Tech, Inc. 2021 Employee Stock Purchase Plan, as amended, supplemented or modified from time to time.

“2021 Plan” means the ESS 2021 Equity Incentive Plan, as amended, supplemented or modified from time to time.

“BEV” means Breakthrough Energy Ventures, LLC.

“Business Combination” means the transactions contemplated by the Merger Agreement.

“Closing” means the consummation of the Business Combination.

“Closing Date” means October 8, 2021, the date on which the Closing occurred.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock” means ESS’ common stock, par value $0.0001 per share.

“Companies Act” means the Companies Act (2021 Revision) of the Cayman Islands as the same may be amended from time to time.

“DGCL” means the General Corporation Law of the State of Delaware.

“ESPP” means the ESS Tech, Inc. 2021 Employee Stock Purchase Plan, as amended, supplemented or modified from time to time.

“ESS” or the “Company” means ESS Tech, Inc., a Delaware corporation (formerly known as ACON S2 Acquisition Corp.).

“ESS Board” means the board of directors of ESS.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“GAAP” means United States generally accepted accounting principles.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Legacy ESS” means ESS Tech, Inc., a Delaware corporation, prior to the Closing.

“Merger” means the merging of Merger Sub with and into Legacy ESS with Legacy ESS surviving the Merger as a wholly-owned subsidiary of STWO.

“Merger Agreement” means the Agreement and Plan of Merger, dated as of May 6, 2021, among Legacy ESS, ESS and Merger Sub.

“Merger Sub” means SCharge Merger Sub, Inc., a Delaware corporation and wholly-owned direct subsidiary of ESS.

“Merger Sub Common Stock” means Merger Sub’s common stock, par value $0.0001 per share.

“NYSE” means the New York Stock Exchange.

“PIPE Financing” means the sale of PIPE Shares to the PIPE Investors, for a purchase price of $10.00 per share and an aggregate purchase price of $250 million, in a private placement.

“PIPE Investors” means the purchasers of the PIPE Shares.

“PIPE Shares” means an aggregate of 25,000,000 shares of Common Stock issued to PIPE Investors in the PIPE Financing.

“Private Placement Warrants” means the warrants to purchase shares of Common Stock purchased by the Sponsor in a private placement in connection with the STWO IPO, exercisable for one share of Common Stock at a price of $11.50 per share, subject to adjustments.

“Public Warrants” means the warrants to purchase shares of Common Stock that are publicly traded on the NYSE under the ticker symbol “GWH.W,” exercisable for one share of Common Stock at a price of $11.50 per share, subject to adjustments.

“SBE” means SB Energy Global Holdings One Ltd.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means ACON S2 Sponsor, L.L.C., a Delaware limited liability company.

“STWO” means ACON S2 Acquisition Corp., a Cayman Islands exempted company.

“STWO IPO” means STWO’s initial public offering of Class A ordinary shares, consummated on September 21, 2020.

“Warrants” means the Public Warrants and Private Placement Warrants.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to our future financial performance, strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus include statements about:

•our financial and business performance, including financial projections and business metrics;

•changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans;

•the implementation, market acceptance and success of our technology implementation and business model;

•our ability to scale in a cost-effective manner;

•developments and projections relating to our competitors and industry;

•the impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto;

•our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

•expectations regarding the time during which we will be an emerging growth company under the JOBS Act;

•our future capital requirements and sources and uses of cash;

•our ability to obtain funding for our operations;

•our business, expansion plans and opportunities;

•our relationships with third-parties, including our suppliers;

•the outcome of any known and unknown litigation and regulatory proceedings;

•our ability to successfully deploy the proceeds from the Merger; and

•our ability to manage other risks and uncertainties set forth in the section titled “Risk Factors” beginning on page 12 of this prospectus. We caution you that the foregoing list does not contain all of the forward-looking statements made in this prospectus. You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, operating results, financial condition and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

Neither we nor the Selling Stockholders nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this prospectus to reflect events or circumstances after the date of this prospectus or to reflect new information or the occurrence of unanticipated events, except as required by law. You should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information you should consider before investing in our Common Stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Where You Can Find Additional Information,” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. In this prospectus, unless the context requires otherwise, all references to “we,” “our,” “us,” “ESS,” the “Registrant,” and the “Company” refer to ESS Tech, Inc. and its consolidated subsidiaries.

ESS TECH, INC.

ESS is a long-duration energy storage company specializing in iron flow battery technology. We design and produce long-duration batteries predominantly using earth-abundant materials that we believe can be cycled over 20,000 times without capacity fade. Because we designed our batteries to operate using an electrolyte of primarily salt, iron and water, they are non-toxic and substantially recyclable. Our batteries provide flexibility to grid operators and energy assurance for commercial and industrial customers. Our technology addresses energy delivery, duration and cycle-life in a single battery platform that compares favorably to lithium-ion batteries, the most widely deployed alternative technology. Using our iron flow battery technology, we are developing two products, each of which is able to provide reliable, safe, long-duration energy storage. As of December 31, 2021, we did not have any second-generation products fully deployed and we had not yet met revenue recognition criteria, but we began shipping our second-generation of Energy Warehouses in the third quarter of 2021 and were in the process of installing and commissioning such units. With each battery deployed, we will further our mission to accelerate the transition to a zero-carbon energy future with increased grid reliability.

Our batteries are non-flammable, non-toxic, do not have explosion risk and can operate in temperatures ranging from -5°C to 50°C without requiring heating or cooling systems, so they can be located in sites where lithium-ion batteries cannot be placed due to fire, chemical or explosion risks. In addition, our batteries are environmentally sustainable, predominantly utilizing easily sourced materials and recyclable components.

Our batteries and technology can be purchased with a ten-year performance guarantee which is backed by an investment-grade, ten-year warranty and project insurance policies from Munich Reinsurance Company (“Munich Re”), a leading provider of reinsurance, primary insurance and insurance-related risk solutions, which stands behind the performance of our energy storage products. To our knowledge, we are the first long-duration energy storage company to receive this type of insurance, which provides a warranty backstop for our proprietary flow battery technology, supporting our performance guarantee regardless of project size or location and de-risking the technology for our customers. We have also collaborated with Munich Re to develop separate project finance coverage. This allows us to secure project financing when installing our energy storage products, reducing the cost of capital for deployment, and which can be extended in order to provide long-term assurance of project performance to our customers, investors and lenders. Bonding and surety capital are provided through Aon and OneBeacon Insurance Group (“OneBeacon”) as well as qualification from the U.S. Export-Import Bank, which provides additional product assurance. We believe each of these elements allows us to increase our total addressable market, as customers have reduced technology risk, financing risk and importing risk.

We believe that as we scale up our production, our battery technology will be priced competitively. When comparing products on a lifetime levelized cost of storage (“LCOS”) basis, which is the total cost of the investment in an electricity storage technology divided by its cumulative delivered electricity, we expect our batteries to be less expensive on a LCOS basis than lithium-ion alternatives for storage durations greater than four hours, which we believe is the operational maximum for lithium-ion technologies. Our cost advantage increases as the storage duration extends beyond four hours because of the scalable nature of our technology.

Energy storage solutions of various sizes and durations must be installed throughout global electrical grids to enable decarbonization in line with global climate objectives. Our energy storage products are intended to supply long-duration power across this expanding spectrum of use cases. As described below in the section entitled “Business—Our Technology and Products,” we believe our energy storage products will be capable of addressing

customer needs across multiple use cases and markets. We are an early mover in long-duration energy storage and we believe we will enable more rapid implementation of renewable energy while also improving grid stability. The safety, flexibility and durability of our energy storage products enable customers to use them in nearly any location globally. Examples of use cases range from localized energy storage at commercial and industrial sites to grid-scale use cases, such as peaker plant replacement and grid stabilization.

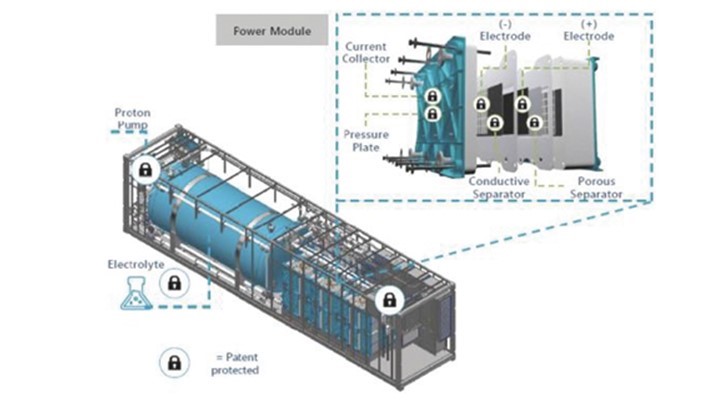

We are developing two products that provide reliable, safe, long-duration energy storage. Our first energy storage product, the Energy Warehouse, is a “behind-the-meter” solution (meaning that it is based at the energy consumer’s location, or behind the service demarcation with the utility). The Energy Warehouse offers energy storage ranging from 50 kilowatts (“kW”) to 90 kW and four to 12-hour duration. A 50 kW system, when used for eight hours of storage, can power the equivalent of 20 homes with a total output of 400 kilowatt-hours (“kWh”). Energy Warehouses are deployed in shipping container units, allowing for a fully turnkey system that can be installed easily at nearly any customer’s site. Potential use cases for Energy Warehouses include microgrids, peaker plant replacement on a small-scale and commercial and industrial (“C&I”) demand. For customers who require additional energy storage capacity, multiple units can be added to the same system. The first generation of our Energy Warehouse was deployed in 2015. Since then, all of our first-generation units have been returned to us except for two where the prototype trials continue. As of December 31, 2021, we did not have any second-generation products fully deployed and we had not yet met revenue recognition criteria, but we began shipping our second-generation of Energy Warehouses in the third quarter of 2021 and were in the process of installing and commissioning such units.

Our second, larger scale energy storage product, the Energy Center, is a “front-of-the-meter” solution, meaning that it is designed for use in front of the service demarcation with the utility. Energy Center solutions are designed specifically for utilities, independent power producers (“IPPs”) and large C&I consumers. The Energy Center offers a fully customizable configuration range and is installed to meet our customers’ power, energy and duration needs. We anticipate energy storage capacities starting at 3 megawatts (“MW”) and six- to 12-hour duration. The Energy Center’s modular design allows the product to scale to meet IPP and utility-scale applications, including large renewable-plus-storage projects and standalone energy storage projects. The modular design of the Energy Center also allows for it to be flexibly configured to meet varying power and energy capacity needs and deployment in a variety of settings.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. The following is a summary of the principal risks we face:

•Our expectations for future operating and financial results and market growth rely in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our anticipated results;

•We face significant barriers in our attempts to produce our energy storage products, our energy storage products are still under development, and we may not be able to successfully develop our energy storage products at commercial scale. If we cannot successfully overcome those barriers, our business will be negatively impacted and could fail;

•We are in the early stage of commercialization. In addition, certain aspects of our technology have not been fully field tested. If we are unable to develop our business and effectively commercialize our energy storage products as anticipated, we may not be able to generate revenues or achieve profitability;

•We depend on third-party suppliers for the development and supply of key raw materials and components for our energy storage products. In 2021 and 2020, we saw significant disruptions to key supply chains, shipping times, manufacturing times, and associated costs;

•Continued delays in our supply chain or the inability to procure needed raw materials and components could further harm our ability to manufacture and commercialize our energy storage products;

•We may experience delays, disruptions, or quality control problems in our manufacturing operations;

•Our ability to expand depends on our ability to hire, train and retain an adequate number of manufacturing employees, in particular employees with the appropriate level of knowledge, background and skills;

•We have experienced disruption related to COVID-19, which continues to cause significant uncertainty;

•We may be unable to adequately control the costs associated with our operations and the components necessary to build our energy storage products, and if we are unable to reduce our cost structure and effectively scale our operations in the future, our ability to become profitable may be impaired;

•We rely on complex machinery for our operations, and the production of our iron flow batteries involves a significant degree of risk and uncertainty in terms of operational performance and costs;

•We have a history of losses and have to deliver significant business growth to achieve sustained, long-term profitability and long-term commercial success;

•Our warranty insurance provided by Munich Re is important to many potential customers. Should we be unable to maintain our relationship with Munich Re and be unable to find a similar replacement, demand for our products may suffer;

•Failure to deliver the benefits offered by our technology, or the emergence of improvements to competing technologies, could reduce demand for our energy storage products and harm our business;

•Our plans are dependent on the development of a market acceptance of our products and the development of a market for long-duration batteries;

•We may face regulatory challenges to or limitations on our ability to sell our Energy Centers and Energy Warehouses directly in certain markets. Expanding operations internationally could expose us to additional risks;

•If we fail to protect, or incur significant costs in defending, our intellectual property and other proprietary rights, then our business and results of operations could be materially harmed; and

•As we endeavor to expand our business, we will incur significant costs and expenses, which could outpace our cash reserves. Unfavorable conditions or disruptions in the capital and credit markets may adversely impact business conditions and the availability of credit.

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act and have elected to take advantage of the benefits of the extended transition period for new or revised financial accounting standards. We expect to remain an emerging growth company at least through the end of the 2022 fiscal year and expect to continue to take advantage of the benefits of the extended transition period, although we may decide to early adopt such new or revised accounting standards to the extent permitted by such standards. This may make it difficult or impossible to compare our financial results with the financial results of another public company that is either not an emerging growth company or is an emerging growth company that has chosen not to take advantage of the extended transition period exemptions because of the potential differences in accounting standards used.

Additional Information

On October 8, 2021 (the “Closing Date”), ESS Tech, Inc., a Delaware corporation (“ESS”), f/k/a ACON S2 Acquisition Corp., a Cayman Islands exempted company (“STWO”), consummated the previously announced merger pursuant to that certain Agreement and Plan of Merger, dated May 6, 2021 (the “Merger Agreement”), by and among STWO, SCharge Merger Sub, Inc., a Delaware corporation and wholly owned direct subsidiary of STWO (“Merger Sub”), and ESS Tech, Inc., a Delaware corporation (“Legacy ESS”) following the approval at a special meeting of the stockholders of STWO held on October 5, 2021 (the “Special Meeting”).

Pursuant to the terms of the Merger Agreement, STWO deregistered by way of continuation under the Cayman Islands Companies Act (2021 Revision) and registered as a corporation in the State of Delaware under Part XII of the Delaware General Corporation Law (the “Domestication”), and a business combination between STWO and ESS was effected through the merger of Merger Sub with and into Legacy ESS, with ESS surviving as a wholly owned subsidiary of STWO (together with the other transactions described in the Merger Agreement, the “Merger”). On the Closing Date, the registrant changed its name from “ACON S2 Acquisition Corp” to “ESS Tech, Inc.”

On October 11, 2021, our Common Stock and Public Warrants, formerly those of STWO, began trading on the New York Stock Exchange (“NYSE”) under the ticker symbols “GWH” and “GWH.W,” respectively.

Our principal executive offices are located at 26440 SW Parkway Ave., Bldg. 83, Wilsonville, Oregon 97070, and our telephone number is (855) 423-9920.

Our website address is https://essinc.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information contained on our website in deciding whether to purchase shares of our Common Stock.

The Offering

| | | | | |

Shares of Common Stock offered by the Selling Stockholders hereunder | 130,044,756 shares. |

| |

Use of proceeds | We will not receive any proceeds from the sale of our Common Stock offered by the Selling Stockholders. See the section of this prospectus titled “Use of Proceeds” appearing on page 54 of this prospectus for more information. |

| |

Risk factors | See the section titled “Risk Factors” beginning on page 12 of this prospectus and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our Common Stock. |

| |

NYSE symbol | “GWH” for our Common Stock. |

| |

Lock-up restrictions | Of the 130,044,756 shares of Common Stock that may be offered or sold by the Selling Stockholders identified in this prospectus, certain of our Selling Stockholders are subject to lock-up restrictions with respect to 105,044,756 of those shares (the “Lock-Up Shares”), pursuant to our amended and restated bylaws. Pursuant to our amended and restated bylaws, the Lock-Up Shares will be locked up until March 7, 2022. |

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 56 of this prospectus and our consolidated financial statements and related notes thereto included elsewhere in this prospectus. Our business, operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the risks actually occur, our business, operating results, financial condition and prospects could be adversely affected. In that event, the market price of our Common Stock could decline, and you could lose part or all of your investment. References to “we,” “our,” or “us” generally refer to ESS, unless otherwise specified. Risks Related to Our Technology, Products and Manufacturing

Our expectations for future operating and financial results and market growth rely in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our anticipated results.

We operate in rapidly changing and competitive markets and our expectations for future performance are subject to the risks and assumptions made by management with respect to our industry. Operating results are difficult to predict because they generally depend on our assessment of the timing of adoption of our technology and energy storage products, which is uncertain. Expectations for future performance are also subject to significant economic, competitive, industry and other uncertainties and contingencies, all of which are difficult or impossible to predict and many of which are beyond our control, and subsequent developments may affect such expectations. As discussed further elsewhere in this prospectus, any future sales and related future cash flows may not be realized in full or at all. Furthermore, our planned expansion into new revenue streams such as franchising opportunities for our energy storage products may never be realized or achieve commercial success, whether because of lack of market adoption of our energy storage products, competition or otherwise. Important factors that may affect the actual results and cause our operating and financial results and market growth expectations to not be achieved include risks and uncertainties relating to our business, industry performance, the regulatory environment, general business and economic conditions and other factors described under the section entitled “Cautionary Note Regarding Forward-Looking Statements” in this prospectus.

In addition, expectations for future performance also reflect assumptions that are subject to change and do not reflect revised prospects for our business, changes in general business or economic conditions or any other transaction or event that has occurred or that may occur and that was not previously anticipated. In addition, long-term expectations by their nature become less predictive with each successive year. There can be no assurance that our future financial condition or results of operations will be consistent with our expectations or with the expectations of investors or securities research analysts, which may cause the market price of our Common Stock to decline. If actual results differ materially from our expectations, we may be required to make adjustments in our business operations that may have a material adverse effect on our financial condition and results of operations.

We face significant barriers in our attempts to produce our energy storage products, our energy storage products are still under development, and we may not be able to successfully develop our energy storage products at commercial scale. If we cannot successfully overcome those barriers, our business will be negatively impacted and could fail.

Producing long-duration iron flow batteries that meet the requirements for wide adoption by commercial and utility-scale energy storage applications is a difficult undertaking. We are still in the early stage of commercialization and face significant challenges in completing the development of our containerized energy storage products and in producing our energy storage products in commercial volumes. We are currently in pre-production for our second-generation S200 iron flow battery design, which will be incorporated into our Energy Warehouses and Energy Centers. Some of the development challenges that could prevent the introduction of our iron flow batteries include difficulties with (i) increasing the volume, yield, reliability and uniformity of the porous

polyethylene separators and cells housed within the power module of our batteries, (ii) increasing the size and layer count of the multi-layer cells within the power module of our batteries, (iii) increasing manufacturing capacity to produce the volume of cells needed for our energy storage products, (iv) installing and optimizing higher volume manufacturing equipment, (v) packaging our batteries to ensure adequate cycle life, (vi) cost reduction, (vii) the completion of rigorous and challenging battery safety testing required by our customers or partners, including but not limited to, performance, life and abuse testing and (viii) the development of the final manufacturing processes.

Our Energy Warehouses are in the development stage. As of December 31, 2021, we did not have any second-generation S200 iron flow batteries deployed and there may be significant yield, cost, performance and manufacturing process challenges to be solved prior to commercial production and use. We are likely to encounter engineering challenges as we increase the dimensions, reduce the thickness and increase the volume of our batteries. If we are not able to overcome these barriers in developing and producing our iron flow batteries, our business could fail.

Our second-generation energy storage products and S200 batteries are manufactured on our first-generation (“Gen I”) automation line. The Gen I automation line requires qualified labor to inspect the parts to ensure proper assembly. Lack of qualified labor to inspect our assemblies may slow our production and impact our production costs and schedule. We have commissioned third parties to develop more sophisticated automation lines to minimize the required skilled labor, however, delays in production and delivery of the new second-generation manufacturing line are not in our control. If we experience delivery or installation delays under our customer contracts, we could experience order cancellations and lose business.

Even if we complete development and achieve volume production of our iron flow batteries, if the cost, performance characteristics or other specifications of the batteries fall short of our targets, our sales, product pricing and margins would likely be adversely affected.

We are in the early stage of commercialization. In addition, certain aspects of our technology have not been fully field tested. If we are unable to develop our business and effectively commercialize our energy storage products as anticipated, we may not be able to generate revenues or achieve profitability.

The growth and development of our operations will depend on the successful commercialization and market acceptance of our energy storage products and our ability to manufacture products at scale while timely meeting customers’ demands. There is no certainty that, once shipped, our products will operate as expected, and we may not be able to generate sufficient customer confidence in our latest designs and ongoing product improvements. There are inherent uncertainties in our ability to predict future demand for our energy storage products and, as a consequence, we may have inadequate production capacity to meet demand, or alternatively, have excess available capacity. Our inability to predict the extent of customer adoption of our proprietary technologies in the already-established traditional energy storage market makes it difficult to evaluate our future prospects.

As of December 31, 2021, we did not have any second-generation products fully deployed and we had not yet met revenue recognition criteria, but we began shipping our second-generation Energy Warehouses in the third quarter of 2021 and were in the process of installing and commissioning such units. Any significant problems in the production process could result in unplanned increases to production costs and production delays. In addition, although we believe our iron flow battery technology is field tested and ready for sale, there are no assurances that our proprietary technologies, such as our Proton Pump, will operate as expected and with consistency. Our Energy Center product is still being developed and has not been completely designed or produced. In addition, certain operational characteristics of our Energy Warehouse or Energy Center products with S200 batteries, such as cyclability with no degradation, have never been witnessed in the field. If our batteries are damaged during shipment, we may be required to replace such units. Once our Energy Warehouse or Energy Center products with S200 batteries are installed and used, we may discover further aspects of our technology that require improvement. Any significant improvement needed to our technology could delay existing contracts and new sales, result in order cancellations and negatively impact the market’s acceptance of our technology. If we experience significant delays or order cancellations, or if we fail to develop and install our energy storage products in accordance with contract specifications, then our operating results and financial condition could be adversely affected. In addition, there is no assurance that if we alter or change our energy storage products in the future, that the demand for these new

products will develop, which could adversely affect our business and any possible revenues. If our energy storage products are not deemed desirable and suitable for purchase and we are unable to establish a customer base, we may not be able to generate revenues or attain profitability.

We depend on third-party suppliers for the development and supply of key raw materials and components for our energy storage products. We also depend on vendors for the shipping of our energy storage products. Continued delays in our supply chain and shipments could further harm our ability to manufacture and commercialize our energy storage products.

We depend on third-party suppliers for the development and supply of key raw materials and components for our energy storage products, including power module components (e.g., bipolar plates, frames, end plates and separators), shipping containers and chemicals. We will need to maintain and significantly grow our access to key raw materials and control our related costs. We use various raw materials and components to construct our energy storage products, including polypropylene, iron and potassium chloride, that are critical to our manufacturing process. We also rely on third-party suppliers for injected molded parts, and power electronics suppliers must undergo a qualification process, which takes four to 12 months.

The cost of electronic components for our iron flow batteries, whether manufactured by our suppliers or by us, depends in part upon the prices and availability of raw materials. In recent periods, we have seen an increase in costs for a wide range of materials and components. Additionally, supply chain disruptions and access to materials have impacted our vendors and suppliers’ ability to deliver materials and components to us in a timely manner. In 2020 and 2021, we saw significant disruptions to key supply chains, shipping times, shipping availability, manufacturing times, and associated costs, both with respect to the sourcing of supplies and the delivery of our products. We experienced and continue to experience delays to deliveries, vendor quality issues, as well as increases in our supply costs of many of our key components, including polypropylene, resin, power electronics, circuit board components and shipping containers. We expect such delays to continue in 2022. It is also possible that the semiautomated and automated production lines that we have contracted for the second quarter of 2022 and the fourth quarter of 2022, respectively, may also face delays in delivery and/or installation due to similar supply chain issues. If these issues persist, they may further delay our ability to produce our products and to recognize revenue, particularly for our larger scale Energy Center products (see also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Components of Results of Operations—Revenue”). Any delay or impediment to our ability to recognize revenue for any given period could materially adversely affect our results of operations and the market price of our Common Stock.