UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

of the units |

||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 8.01. | Other Events. |

As previously disclosed, on May 6, 2021, ACON S2 Acquisition Corp., a Cayman Islands exempted company, (the “Company” or “STWO”), entered into an Agreement and Plan of Merger (as it may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”) with SCharge Merger Sub, Inc., a Delaware corporation and a wholly-owned direct subsidiary of STWO (“Merger Sub”), and ESS Tech, Inc., a Delaware corporation (“ESS”), pursuant to which, subject to the terms and conditions of the Merger Agreement, STWO will consummate its initial business combination with ESS (the “Business Combination”). On September 9, 2021, STWO filed a registration statement (the “Registration Statement”) on Form S-4 (No. 333- 257232) containing a proxy statement/prospectus of STWO in connection with the Business Combination (such proxy statement/prospectus in definitive form, the “Proxy Statement/Prospectus”), which was declared effective by the Securities and Exchange Commission (the “SEC”) on September 14, 2021, and STWO commenced mailing the Proxy Statement/Prospectus on September 14, 2021.

On July 14, 2021, August 13, 2021, September 15, 2021 and September 16, 2021, STWO received a total of four demand letters from purported shareholders of STWO (the “Demand Letters”) alleging that the Proxy Statement/Prospectus contained disclosure deficiencies and/or incomplete information regarding the Business Combination.

STWO believes that the disclosures set forth in the Proxy Statement/Prospectus comply fully with applicable law and that the allegations contained in the Demand Letters are entirely without merit. However, in order to moot the purported STWO shareholders’ unmeritorious disclosure claims, preclude any efforts to delay the closing of the Business Combination, avoid nuisance and alleviate the costs, distractions, risks and uncertainties inherent in litigation, STWO has determined to voluntarily supplement the Proxy Statement/Prospectus with certain supplemental disclosures (the “Supplemental Disclosures”) as described in the following section entitled “Supplemental Disclosures to Proxy Statement Prospectus” in this Current Report on Form 8-K. Nothing in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, STWO specifically denies all allegations by the purported STWO shareholders in the Demand Letters that any additional disclosure was or is required.

The Supplemental Disclosures contained herein will not affect the timing of STWO’s extraordinary general meeting of its shareholders, which is scheduled to be held virtually on October 5, 2021 at 10:30 AM Eastern Time. You will be able to virtually attend, vote your shares and submit questions during the extraordinary general meeting via a live audio webcast by pre-registering at https://www.cstproxy.com/acon/sm2021.

STWO’s board of directors continues to recommend that STWO shareholders vote “FOR” each proposal being submitted to a vote of the STWO shareholders at the extraordinary general meeting.

Entry Into Irrevocable Proxy and Power of Attorney Agreement

As previously disclosed, ESS and SB Energy Global Holdings One Ltd. (“SBE”) filed a joint Committee on Foreign Investment in the United States (“CFIUS”) notice in August 2021 seeking CFIUS’s approval of SBE’s acquisition of certain voting shares, as well as certain deferred information and governance rights, in New ESS (the “SBE CFIUS Approval”). ESS and SBE will use their reasonable best efforts to satisfy CFIUS and provide any documentation or information requested or required by CFIUS prior to Closing, but the receipt of CFIUS approval is not a condition to Closing. The receipt and timing of the SBE CFIUS Approval is uncertain. In anticipation of Closing, ESS, STWO, and SBE entered into an Irrevocable Proxy and Power of Attorney Agreement, dated as of September 30, 2021 (the “Irrevocable Proxy Agreement”), pursuant to which certain SBE rights will be subject to receipt of the SBE CFIUS Approval. In particular, SBE will grant the Secretary of New ESS an irrevocable proxy to vote its shares in New ESS that represent more than 9.9% of all issued and outstanding shares of New ESS pro rata in the same manner and proportion as how the other holders of New ESS common stock vote their shares. Such proxy shall remain in place for all SBE shares above 9.9% of all issued and outstanding shares until the SBE CFIUS Approval is obtained, at which time it shall continue in place but with a revised threshold, applying to all SBE shares above 19.9% of all issued and outstanding shares. We cannot assure you that we will receive the SBE CFIUS Approval, and cannot predict what (if any) mitigation measures CFIUS may request, require or impose before granting the SBE CFIUS Approval or the impact of such mitigation measures on New ESS’ business, including our

relationship with SBE. Failure to receive the SBE CFIUS Approval could have a materially adverse effect on our business, prospects, and financial condition. In addition, if we do become subject to CFIUS mitigation measures, actual or alleged violations could damage New ESS’ reputation and ability to do business.

The following is a summary of certain material terms and provisions of the Irrevocable Proxy Agreement. This summary does not purport to describe all of the terms and provisions of the Irrevocable Proxy Agreement and is qualified in its entirety by the complete text of the Irrevocable Proxy Agreement, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Supplemental Disclosures to Proxy Statement/Prospectus

The following supplemental information should be read in conjunction with the Proxy Statement/Prospectus, which should be read in its entirety. All page references are to pages in the Proxy Statement/Prospectus, and terms used below, unless otherwise defined, have the meanings set forth in the Proxy Statement/Prospectus.

The following disclosure replaces the third sentence of the last paragraph on page 102 of the Proxy Statement/Prospectus:

STWO entered into non-disclosure agreements with over 50 of these potential business combination targets, each of which STWO believes contained customary confidentiality terms for a special purpose acquisition company and a private company target, including ESS, for purposes of performing due diligence and further evaluating and analyzing these companies as potential business combination targets.

The following disclosure is added after the second paragraph on page 105 of the Proxy Statement/Prospectus:

On January 9, 2021, ESS provided STWO with ESS’ unaudited financial results for the fiscal year ended December 31, 2020.

The following disclosure is added before the first paragraph on page 112 of the Proxy Statement/Prospectus before the heading “Certain ESS Projected Financial Information”.

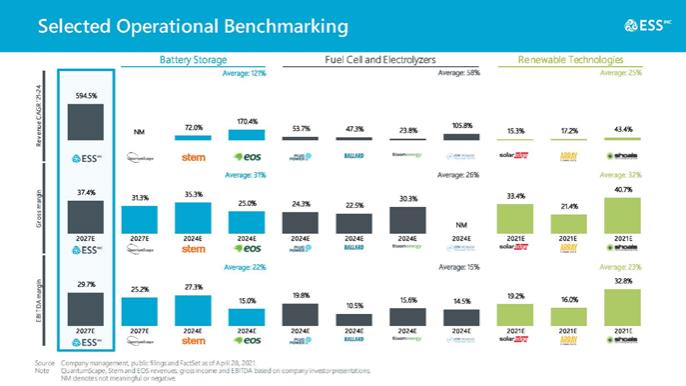

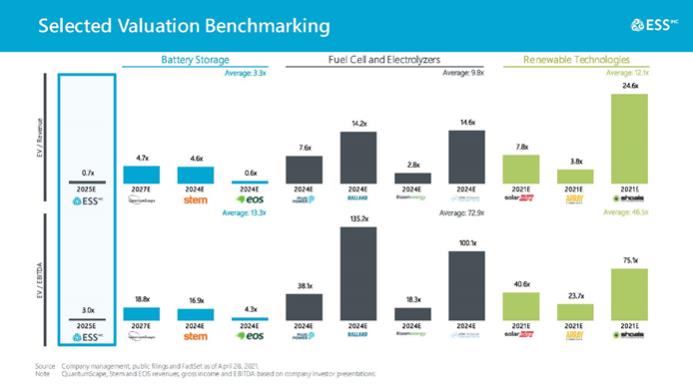

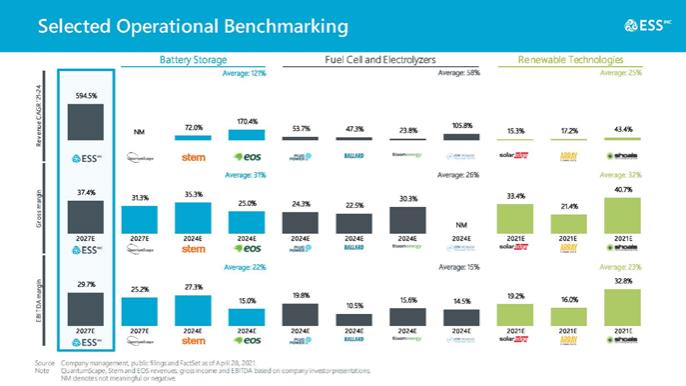

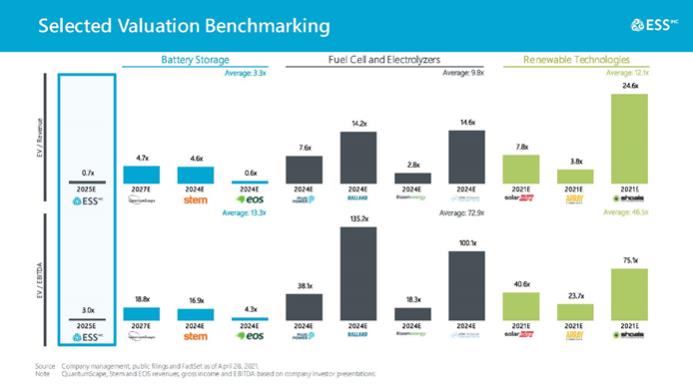

Comparable Public Companies

STWO’s management worked with its financial advisors to develop a comparable companies data set and ran a comparable companies analysis to assess the value that the public markets would likely ascribe to STWO following a business combination with ESS. The relative valuation analysis was based on selected publicly traded companies in the battery storage, fuel cell and electrolyzers, and renewable technologies sectors (each further described below and together, the “Publicly Traded Benchmark Companies”). The selected companies were chosen because they were determined by STWO’s management to be relevant comparisons to ESS (but, for the avoidance of doubt, each of the selected companies is not necessarily a direct competitor of ESS). Some of the factors considered by STWO’s management in selecting these companies as examples of comparable publicly traded companies include the similarity of their end markets, business models, go-to-market strategies, ESG characteristics, and forecasted margins and growth rates relative to ESS. While these companies may share certain characteristics that are similar to those of ESS, STWO recognized that no company was identical in nature to ESS.

Using publicly available information, STWO’s management reviewed, among other things, the estimated revenues, revenue growth rate, estimated gross profit margin, estimated EBITDA, and estimated EBITDA margin with respect to each such selected comparable company over a range of years. The data reviewed by STWO for the Publicly Traded Benchmark Companies is summarized as follows:

Based on the review of these selected comparable publicly traded companies, the STWO Board concluded that ESS’ estimated revenues, revenue growth rate, gross profit margin, EBITDA and EBITDA margin were attractive relative to the selected comparable companies, as well as the median of the Publicly Traded Benchmark Companies. The results of this analysis supported the STWO Board’s determination, based on a number of factors, that the terms of the merger were fair to and in the best interests of STWO and its shareholders. The STWO Board did not rely extensively on the results of this analysis because it saw ESS as a category catalyst in long duration energy storage solutions.

The following disclosure amends the third sentence of the third paragraph on page 112 of the Proxy Statement/Prospectus:

Management of ESS provided STWO with internally prepared projections for estimated total revenue, gross profit, EBITDA, debt and capital expenditures of ESS for 2021 through 2027 on March 3, 2021.

The following disclosure is added after the last paragraph on page 117 of the Proxy Statement/Prospectus:

Interests of ESS’ and STWO’s Financial Advisors in the Business Combination

In connection with the consummation of the Business Combination, (i) Deutsche Bank is entitled to (a) expense reimbursement and customary indemnification in connection with its services as a M&A advisor to STWO and as placement agent for the PIPE Financing and (b) customary placement agent fees from STWO in connection with its services as placement agent for the PIPE Financing, and (ii) Nomura is entitled to (a) expense reimbursement and customary indemnification in connection with its services as a financial and capital markets advisor to ESS and (b) customary financial advisory fees and a discretionary bonus. Additionally, in connection with the consummation of the Business Combination, Deutsche Bank will be entitled to deferred underwriting compensation, as set forth in the registration statement for STWO’s initial public offering, which closed on September 18, 2020. These fees will be paid at the closing of the Business Combination and are conditioned upon the successful completion of the Business Combination. If the Business Combination does not close, Deutsche Bank and Nomura will be entitled to expense reimbursement and customary indemnification, but will not be entitled to such fees.

In addition, Deutsche Bank (together with its affiliates) and Nomura (together with its affiliates) are each full service financial institutions engaged in various activities, which may include sales and trading, commercial and investment banking, advisory, investment management, investment research, principal investing, hedging, market making, brokerage and other financial and non-financial activities and services. Deutsche Bank has not provided any investment banking or other commercial dealings unrelated to the Business Combination (or STWO’s Initial Public Offering) to STWO, ESS or their respective affiliates.

In addition, in the ordinary course of its business activities, Deutsche Bank, Nomura and their respective affiliates, officers, directors and employees may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of STWO or its affiliates or ESS or its affiliates. Deutsche Bank and Nomura and their respective affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The table of the Proxy Statement/Prospectus entitled “Security Ownership of Certain Beneficial Owners and Management” is amended and supplemented for the following stockholders to account for shares purchased in the PIPE Financing:

| After the Business Combination | ||||||||||||||||||||||||||||||||||||

| Before the Business Combination | Assuming No Redemption | Assuming Maximum Redemption | ||||||||||||||||||||||||||||||||||

| Five percent holders |

Number of STWO Class A Ordinary Shares |

Number of STWO Class B Ordinary Shares |

% of Total Voting Power |

Number of Shares of New ESS Common Stock |

% of Class |

% of Total Voting Power |

Number of Shares of New ESS Common Stock |

% of Class |

% of Total Voting Power |

|||||||||||||||||||||||||||

| BASF Venture Capital GmbH (1) |

— | — | — | % | 7,721,878 | 5.1 | % | 5.1 | % | 7,721,878 | 6.1 | % | 6.1 | % | ||||||||||||||||||||||

| Breakthrough Energy Ventures, LLC (2) |

— | — | — | % | 15,527,317 | 10.2 | % | 10.2 | % | 15,527,317 | 12.2 | % | 12.2 | % | ||||||||||||||||||||||

| SB Energy Global Holdings One Ltd. (3) |

— | — | — | % | 31,127,200 | 20.4 | % | 20.4 | % | 31,127,200 | 24.4 | % | 24.4 | % | ||||||||||||||||||||||

| (1) | Consists of shares to be held directly by BASF Ventures Capital GmbH upon Closing including 150,000 shares purchased in the PIPE Financing. The address for BASF Ventures Capital GmbH is BE 01, Benckiserplatz 1, Ludwigshagen/Rhine, Germany 67059. |

| (2) | Consists of shares to be held directly by Breakthrough Energy Ventures, LLC upon Closing including 150,000 shares purchased in the PIPE Financing. Breakthrough Energy Ventures, LLC is managed by Breakthrough Energy Investments, LLC, its manager, which may be deemed to have beneficial ownership over the shares and exercises voting and investment control through its investment committee. The address for each of Breakthrough Energy Ventures, LLC and Breakthrough Energy Investments, LLC is 250 Summer Street, 4th Floor, Boston, MA 02210. |

| (3) | Consists of shares to be held directly by SB Energy Global Holdings One Ltd., an affiliate of Softbank Group Corp., upon Closing including 5,000,000 shares purchased in the PIPE Financing. The address for SB Energy Global Holdings One Ltd. is 69 Grosvenor Street, London, United Kingdom, W1K 3JP. The address of SoftBank Group Corporation is 1-9-1, Higashi-Shimbashi Minato-ku, Tokyo 105-7303 Japan. |

Important Information About the Proposed Business Combination and Where to Find It

STWO has filed, and the SEC has declared effective, a registration statement on Form S-4 containing a definitive proxy statement/prospectus of STWO relating to the proposed Business Combination. STWO has mailed the definitive proxy statement/prospectus and other relevant documents to its shareholders. Investors, STWO’s shareholders and other interested persons are advised to read the definitive proxy statement/prospectus in connection with STWO’s solicitation of proxies for the extraordinary general meeting to be held to approve the Business Combination as these materials will contain important information about ESS and STWO and the proposed Business Combination. The definitive proxy statement/prospectus has been mailed to the shareholders of STWO as of the record date of August 16, 2021; shareholders that hold their shares in registered form are entitled to vote their shares held on the date of the meeting. Shareholders are also able to obtain copies of the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, at the SEC’s website at http://www.sec.gov, or by directing a request to: 1133 Connecticut Avenue NW, Ste. 700 Washington, DC 20036.

Participants in the Solicitation

STWO and ESS and their respective directors and officers may be deemed to be participants in the solicitation of proxies from STWO’s stockholders in connection with the proposed transaction. Information about STWO’s directors and executive officers and their ownership of STWO’s securities is set forth in STWO’s filings with the SEC. To the extent that holdings of STWO’s securities have changed since the amounts printed in STWO’s Registration Statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/consent solicitation statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of STWO, ESS or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Forward-Looking Statements

This communication contains certain forward-looking statements, including statements regarding STWO’s, ESS’ or their management teams’ expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on STWO’s and ESS’ current expectations and beliefs concerning future developments and their potential effects on STWO, ESS or any successor entity of the proposed transactions. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) the risk that the proposed transactions may not be completed in a timely manner or at all, which may adversely affect the price of STWO’s securities, (ii) the failure to satisfy the conditions to the consummation of the proposed transactions, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination, (iv) the effect of the announcement or pendency of the proposed transactions on ESS’ business relationships, operating results and business generally, (v) risks that the proposed transactions disrupt current plans and operations of ESS, (vi) changes in the competitive and highly regulated industries in which ESS plans to operate, variations in operating performance across competitors, changes in laws and regulations affecting ESS’ business and changes in the combined capital structure and (vii) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transactions, and identify and realize additional opportunities. There can be no assurance that the future developments affecting STWO, ESS or any successor entity of the proposed transactions will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond STWO’s or ESS’ control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of STWO’s registration statement on Form S-1 (File No. 333-248515), the registration statement on Form S-4 (File No. 333-257232) filed in connection with the business combination, and other documents filed by STWO from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Except as required by law, STWO and ESS are not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Neither STWO nor ESS gives any assurance that either STWO or ESS, or the combined company, will achieve its expectations.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Irrevocable Proxy and Power of Attorney Agreement, dated as of September 30, 2021 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 1, 2021

| ACON S2 ACQUISITION CORP. | ||

| By: | /s/ Adam Kriger | |

| Name: | Adam Kriger | |

| Title: | Chief Executive Officer | |