DocumentAs filed with the Securities and Exchange Commission on March 17, 2023

Registration No. 333-261027

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1

to

Form S-3 on

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MediaAlpha, Inc.

(Exact Name of Registrant as Specified in Its Charter)

700 South Flower Street, Suite 640

Los Angeles, California 90017

| | | | | | | | |

| Delaware | (213) 316-6256 | 85-1854133 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) | (I.R.S. Employer Identification Number) |

Jeffrey B. Coyne, Esq.

MediaAlpha, Inc.

700 South Flower Street, Suite 640

Los Angeles, California 90017

(213) 316-6256

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Please send copies of all communications to:

C. Daniel Haaren, Esq.

Cravath, Swaine & Moore LLP

825 Eighth Avenue

New York, New York 10019

(212) 474-1000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

MediaAlpha, Inc.:

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

The registrant previously filed with the Securities and Exchange Commission a registration statement on Form S-3 (File No. 333-261027) (as amended, the “Registration Statement”) to register shares of the registrant’s Class A common stock for resale by the selling stockholders named therein. The Registration Statement was declared effective by the SEC on November 23, 2021. This Post-Effective Amendment No. 1 to Form S-3 on Form S-1 is being filed to convert the registration statement on Form S-3 into a registration statement on Form S-1 and to update the prospectus contained in the Registration Statement. All applicable registration fees were paid by the registrant in connection with the initial filing of the Registration Statement.

In addition, this Post-Effective Amendment No. 1 to Form S-3 on Form S-1 terminates the registration of the resale of 584,386 shares of Class A common stock previously registered under the Registration Statement.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated March 17, 2023

PROSPECTUS

MediaAlpha, Inc.

Class A Common Stock

This prospectus covers the offer and resale by the selling stockholders (as defined herein), from time to time in one or more offerings, of up to 34,351,485 shares of Class A common stock of MediaAlpha, Inc. (“Class A common stock”) held by such selling stockholders at prices and on terms that will be determined at the time of any such offerings. The 34,351,485 shares of Class A common stock offered hereby includes 17,385,493 shares of Class A common stock which are issuable upon exchange of Class B-1 Units of QL Holdings LLC (“Class B-1 units”), together with a corresponding share of Class B common stock of the Company (“Class B common stock”), held by the selling stockholders.

MediaAlpha, Inc. is not selling any shares of Class A common stock under this prospectus and will not receive any proceeds from the sale by the selling stockholders of such shares. For a detailed discussion about the selling stockholders, please see “Selling Stockholders.”

This prospectus provides you with a general description of the shares of Class A common stock and the manner in which they may be sold by the selling stockholders. If necessary, the specific manner in which these shares of Class A common stock may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may also add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, before you invest in the shares of Class A common stock registered hereunder.

The shares of Class A common stock may be offered and sold on a delayed or continuous basis by the selling stockholders through agents, underwriters or dealers as designated from time to time, directly to purchasers, or through a combination of these methods. In addition, certain selling stockholders may offer and sell these shares of Class A common stock from time to time, together or separately. If any underwriters, dealers or agents are involved in the sale of any of the shares of Class A common stock by the selling stockholders, then, to the extent required, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See “Plan of Distribution.”

See “Risk Factors” on page 8 for information on certain risks related to the purchase of our shares of Class A common stock described in this prospectus. MediaAlpha, Inc.’s Class A common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “MAX.” On March 16, 2023, the last reported sale price of MediaAlpha, Inc.’s Class A common stock on the New York Stock Exchange was $14.12 per share.

None of the Securities and Exchange Commission, any state securities commission or any other regulatory body has approved or disapproved of these shares of Class A common stock or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 17, 2023

Table of Contents

Glossary

As used in this prospectus:

•“Class A-1 units” refers to the Class A-1 units of QL Holdings LLC.

•“Class B-1 units” refers to the Class B-1 units of QL Holdings LLC.

•“Consumer Referral” means any consumer click, call or lead purchased by a buyer on our platform.

•“Consumers” and “customers” refer interchangeably to end consumers. Examples include individuals shopping for insurance policies.

•“Direct-to-consumer” or “DTC” means the sale of insurance products or services directly to end consumers, without the use of retailers, brokers, agents or other intermediaries.

•“Distributor” means any company or individual that is involved in the distribution of insurance, such as an insurance agent or broker.

•“Exchange agreement” means the exchange agreement, dated as of October 27, 2020 by and among MediaAlpha, Inc., QL Holdings LLC, Guilford Holdings, Inc. and certain Class B-1 unitholders party thereto, a copy of which is filed as an exhibit to the registration statement of which this prospectus is a part.

•“Founders” means, collectively, Steven Yi, Eugene Nonko, and Ambrose Wang.

•“Fourth amended and restated limited liability company agreement of QL Holdings LLC” means the limited liability company agreement dated as of October 27, 2020.

•“High-intent” consumer or customer means an in-market consumer that is actively browsing, researching or comparing the types of products or services that our partners sell.

•“Insignia” means Insignia Capital Group, L.P. and its affiliates.

•“Intermediate Holdco” means Guilford Holdings, Inc., our wholly owned subsidiary and the owner of all Class A-1 units.

•“IPO” means our initial public offering of our Class A common stock, which closed on October 30, 2020.

•“IPO reorganization” means the series of reorganization transactions completed on October 27, 2020 in connection with our IPO, as described under “Organizational structure—Fourth amended and restated limited liability company agreement of QL Holdings LLC” in our registration statement on Form S-1 (File No. 333-249326), which was declared effective by the Securities and Exchange Commission on October 27, 2020.

•“Legacy Profits Interest Holders” means certain current or former employees of QL Holdings LLC or its subsidiaries (other than the Senior Executives), who indirectly held Class B units in QL Holdings LLC prior to the IPO reorganization and includes any estate planning vehicles or other holding companies through which such persons hold their units in QL Holdings LLC (which holding companies may or may not include QL Management Holdings LLC).

•“Lifetime value” or “LTV” is a type of metric that many of our business partners use to measure the estimated total worth to a business of a customer over the expected period of their relationship.

•“Partner” refers to a buyer or seller on our platform, also referred to as “demand partners” and “supply partners,” respectively.

◦“Demand partner” refers to a buyer on our platform. Our demand partners are generally insurance carriers and distributors looking to target high-intent consumers deep in their purchase journey.

◦“Supply partner” or “supplier” refers to a seller to our platform. Our supply partners are primarily insurance carriers looking to maximize the value of non-converting or low LTV consumers, and insurance-focused research destinations or other financial websites looking to monetize high-intent consumers.

•“Proprietary” means, when used in reference to our properties, the websites and other digital properties that we own and operate. Our proprietary properties are a source of Consumer Referrals on our platform.

•“QL Holdings LLC” or “QLH” is a limited liability company which, together with its subsidiaries, has historically conducted, and will continue to conduct, our business.

•“Registration rights agreement” means the registration rights agreement dated as of October 27, 2020, by and among MediaAlpha, Inc., White Mountains Investments (Luxembourg) S.à r.l., Insignia QL Holdings, LLC, Insignia A QL Holdings, LLC, Steven Yi, Eugene Nonko, Ambrose Wang and certain other parties thereto, a copy of which is filed as an exhibit to the registration statement of which this prospectus is a part.

•“Reorganization agreement” means the reorganization agreement dated as of October 27, 2020, by and among MediaAlpha, Inc., QL Holdings LLC, QuoteLab, LLC, Guilford Holdings, Inc., White Mountains Investments (Luxembourg) S.à r.l., White Mountains Insurance Group, Ltd., Insignia QL Holdings, LLC, Insignia A QL Holdings, LLC, Steven Yi, Eugene Nonko, Ambrose Wang and certain other parties thereto, a copy of which is filed as an exhibit to the registration statement of which this prospectus is a part.

•“Selling Class B-1 Unit Holders” means Insignia, the Senior Executives, and the Legacy Profits Interests Holders who sold a portion of their Class B-1 units to Intermediate Holdco in connection with the IPO.

•“Senior Executives” means the Founders and the other current and former officers of the Company listed in Exhibit A to the exchange agreement. This term also includes any estate planning vehicles or other holding companies through which such persons hold their units in QL Holdings LLC.

•“Stockholders’ agreement” means the stockholders agreement, dated as of October 27, 2020, as amended, modified or supplemented from time to time, by and among MediaAlpha, Inc., White Mountains Investments (Luxembourg) S.à r.l., Insignia QL Holdings, LLC, Insignia A QL Holdings, LLC, Bridge Holdings (Bermuda) Ltd. and Steven Yi, Eugene Nonko and Ambrose Wang, together with their respective holding entities through which they indirectly hold common stock of MediaAlpha, Inc., a copy of which is filed as an exhibit to the registration statement of which this prospectus is a part.

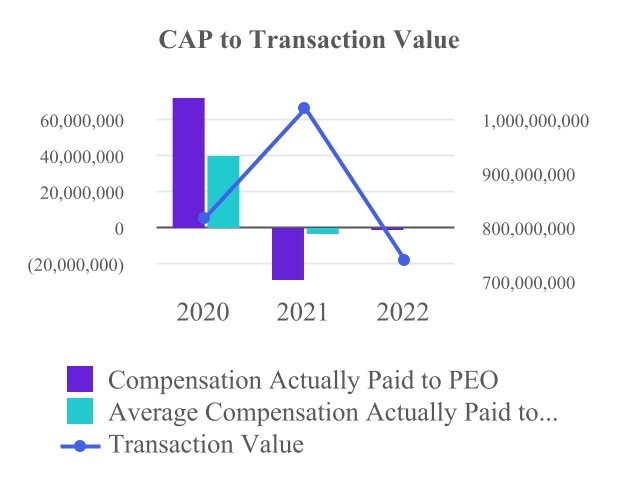

•“Transaction Value” means the total gross dollars transacted by our partners on our platform.

•“Vertical” means a market dedicated to a specific set of products or services sold to end consumers. Examples include property & casualty insurance, life insurance, health insurance, and travel.

•“White Mountains” means White Mountains Insurance Group, Ltd. and its affiliates.

About this prospectus

This prospectus is part of a registration statement that MediaAlpha, Inc. filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. As used in this prospectus, unless the context otherwise indicates, any reference to “MediaAlpha,” “our Company,” the “Company,” “we,” “us,” and “our” refers to MediaAlpha, Inc., the issuer of the shares offered hereby, together with its consolidated subsidiaries. QL Holdings LLC is the predecessor to MediaAlpha. When we refer to the “selling stockholders” in this prospectus, we refer to the selling stockholders named in this prospectus or in any supplement to this prospectus or certain transferees, assignees, pledgees, donees or other successors-in-interest that received shares of Class A common stock from the selling stockholders. Capitalized terms used in this prospectus and not otherwise defined herein have the meanings given such terms in MediaAlpha’s Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference into this prospectus.

Under this shelf registration process, the selling stockholders may from time to time offer and sell up to 34,351,485 shares of Class A common stock in one or more offerings or resales as described in this prospectus. This prospectus provides you with only a general description of the shares of Class A common stock that are registered hereunder. This prospectus does not contain all of the information set forth in the registration statement of which this prospectus is a part, as permitted by the rules and regulations of the SEC. For additional information regarding us, the selling stockholders and the offered shares of Class A common stock, please refer to the registration statement of which this prospectus is a part.

When the selling stockholders sell shares of Class A common stock under this prospectus, we and/or the selling stockholders will, if necessary and required by law, provide a prospectus supplement that contains specific information about the offering and the terms of the offered shares of Class A common stock. Any such prospectus supplement may also add, delete, update or change information contained in this prospectus. You should rely only on the information in the applicable prospectus supplement if this prospectus and the applicable prospectus supplement are inconsistent. Before purchasing any shares of Class A common stock, you should carefully read both this prospectus and the applicable prospectus supplement, if any, together with the additional information described under the section of this prospectus titled “Where You Can Find More Information.” In particular, you should carefully consider the risks and uncertainties described under the section titled “Risk Factors” or otherwise included in any applicable prospectus supplement or incorporated by reference in this prospectus before you decide whether to purchase the shares of Class A common stock. These risks and uncertainties, together with those not known to us or those that we may deem immaterial, could impair our business and ultimately affect our ability to make payments on the shares of Class A common stock.

Neither we nor the selling stockholders take any responsibility for, nor can provide any assurance as to, the reliability of, any information that others may give you. Neither we nor the selling stockholders have authorized any other person to provide you with information different from the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. Neither we, the selling stockholders nor any underwriter, dealer or agent will make an offer to sell the shares of Class A common stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus and any applicable prospectus supplement is accurate only as of the dates on their covers and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Cautionary statement regarding forward-looking statements

Certain statements made in this prospectus and the documents incorporated herein by reference and in other written or oral statements made by us or on our behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following:

•Our ability to attract and retain supply partners and demand partners to our platform and to make available quality Consumer Referrals at attractive volumes and prices to drive transactions on our platform;

•Our reliance on a limited number of supply partners and demand partners, many of which have no long-term contractual commitments with us, and any potential termination of those relationships;

•Fluctuations in customer acquisition spending by property and casualty insurance carriers due to unexpected changes in underwriting profitability as the carriers go through cycles in their business;

•Existing and future laws and regulations affecting the property & casualty insurance, health insurance and life insurance verticals;

•Changes and developments in the regulation of the underlying industries in which our partners operate;

•Competition with other technology companies engaged in digital customer acquisition, as well as buyers that attract consumers through their own customer acquisition strategies, third-party online platforms or other traditional methods of distribution;

•Our ability to attract, integrate and retain qualified employees;

•Reductions in DTC digital spend by our buyers;

•Mergers and acquisitions could result in additional dilution and otherwise disrupt our operations and harm our operating results and financial condition;

•Our dependence on internet search companies to direct a significant portion of visitors to our suppliers’ websites and our proprietary websites;

•The impact of broad-based pandemics or public health crises, such as COVID-19;

•The terms and restrictions of our existing and future indebtedness;

•Disruption to operations as a result of future acquisitions;

•Our failure to obtain, maintain, protect and enforce our intellectual property rights, proprietary systems, technology and brand;

•Our ability to develop new offerings and penetrate new vertical markets;

•Our ability to manage future growth effectively;

•Our reliance on data provided to us by our demand and supply partners and consumers;

•Natural disasters, public health crises, political crises, economic downturns, or other unexpected events;

•Significant estimates and assumptions in the preparation of our financial statements;

•Potential litigation and claims, including claims by regulatory agencies and intellectual property disputes;

•Our ability to collect our receivables from our partners;

•Fluctuations in our financial results caused by seasonality;

•The development of the DTC insurance distribution sector and evolving nature of our relatively new business model;

•Disruptions to or failures of our technological infrastructure and platform;

•Failure to manage and maintain relationships with third-party service providers;

•Cybersecurity breaches or other attacks involving our systems or those of our partners or third-party service providers;

•Our ability to protect consumer information and other data and risks of reputational harm due to an actual or perceived failure by us to protect such information and other data;

•Risks related to changes in tax laws or exposure to additional income or other tax liabilities could affect our future profitability;

•Risks related to being a public company;

•Risks related to internal control on financial reporting;

•Risks related to shares of our Class A common stock;

•Risks related to our intention to take advantage of certain exemptions as a “controlled company” under the rules of the NYSE, and the fact that the interests of our controlling stockholders (White Mountains, Insignia, and the Founders) may conflict with those of other investors;

•Risks related to our corporate structure; and

•The other risk factors described in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2022.

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this prospectus. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should read this prospectus, any applicable prospectus supplement, the documents that we incorporate by reference herein and therein, the documents that we have included as exhibits to the registration statement of which this prospectus forms a part and the documents that we refer to under the section of this prospectus titled “Where You Can Find More Information” completely and with the understanding that our actual future results could be materially different from what we expect when making the forward-looking statement.

Prospectus summary

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, any applicable prospectus supplement and the information incorporated by reference herein and therein carefully, including the sections entitled “Risk factors” included and incorporated by reference in this prospectus and “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and related notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference herein, before making any investment decision. In this prospectus, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect our management’s view of our prospects and are subject to the risks described under “Risk factors” and “Cautionary statement regarding forward-looking statements.” Our expectations for our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate.

Our company

MediaAlpha, Inc. was incorporated as a Delaware corporation on July 9, 2020 in contemplation of our IPO. Following a series of reorganization transactions, we serve as the ultimate holding company, by and through our wholly owned subsidiary Guilford Holdings, Inc., of QLH and its subsidiaries. QLH was formed on March 7, 2014 as a Delaware limited liability company.

Our mission is to help insurance carriers and distributors target and acquire customers more efficiently and at greater scale through technology and data science. Our technology platform brings leading insurance carriers and high-intent consumers together through a real-time, programmatic, transparent, and results-driven ecosystem. We believe we are the largest online customer acquisition platform in our core verticals of property & casualty (“P&C”) insurance, health insurance, and life insurance, supporting $696 million in Transaction Value across our platform from these verticals during the year ended December 31, 2022.

We believe in the disruptive power of transparency. Traditionally, insurance customer acquisition platforms operated in a black box. We recognized that consumers may be valued differently by one insurer versus another; therefore, insurers should be able to determine pricing granularly based on the value that a particular customer segment is expected to bring to their business. As a result, we developed a technology platform that powers an ecosystem where buyers and sellers can transact with full transparency, control, and confidence.

We have multi-faceted relationships with top-tier insurance carriers and distributors. A buyer or a demand partner within our ecosystem is generally an insurance carrier or distributor seeking to reach high-intent insurance consumers. A seller or a supply partner is typically an insurance carrier looking to maximize the value of non-converting or low LTV consumers, or an insurance-focused research or other financial destination looking to monetize the high-intent shoppers on their websites. Our model’s versatility allows for the same insurance carrier or distributor to be both a demand and supply partner, which deepens the partner’s relationship with us. In fact, it is this supply partnership that presents insurance carriers with a highly differentiated monetization opportunity, enabling them to capture revenue from website visitors who either do not qualify for a policy or otherwise may be more valuable as a potential referral to another carrier.

We believe our technology is a key differentiator and a powerful driver of our performance. We maintain deep, custom integrations with partners representing the majority of our Transaction Value, which enable automated, data-driven processes that optimize these partners’ customer acquisition spend and revenue. Through our platform, our insurance carrier partners can target and price across over 35 separate consumer attributes to manage customized acquisition strategies. Our platform’s granular price management tools and robust data science capabilities enable our insurance partners to target consumers based on a precise calculation of the expected lifetime value of the consumer to that partner and to make real-time, automated customer acquisition decisions.

We built our business model to align the interests of all parties participating on our platform. We generate revenue by earning a fee for each Consumer Referral sold on our platform. Our revenue is generally not contingent on the sale of an insurance product to the consumer.

Our executive offices are located at 700 South Flower Street, Suite 640, Los Angeles, California 90017. Our telephone number is (213) 316-6256.

Controlled company

We are a “controlled company” under the NYSE rules. Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements, including the requirement to have a board that is composed of a majority of independent directors. We intend to take advantage of certain of these exemptions for so long as we continue to qualify as a “controlled company.” These exemptions do not modify the independence requirements for our audit committee, and we intend to comply with the applicable requirements of the Sarbanes-Oxley Act and rules with respect to our audit committee within the applicable time frame.

Organizational structure

Overview

In connection with the completion of the IPO, we completed our IPO reorganization, pursuant to which we amended and restated our certificate of incorporation to, among other things, authorize two classes of common stock, Class A common stock and Class B common stock and consummated the other reorganization transactions described below. In addition, pursuant to the IPO reorganization, we issued shares of our Class B common stock to Insignia and the Senior Executives. Insignia and the Senior Executives directly or indirectly own substantially all of the Class B-1 units of QL Holdings LLC. Shares of our Class B common stock vote together with shares of our Class A common stock as a single class, except as otherwise required by law or pursuant to our amended and restated certificate of incorporation or amended and restated bylaws. See “Description of capital stock—Class A Common Stock.” As of February 28, 2023, White Mountains, Insignia, and the Senior Executives (who were the direct and indirect investors of QL Holdings LLC prior to the IPO) beneficially owned 62.0% in the aggregate of our outstanding Class A common stock and Class B common stock on a combined basis. As described in more detail below, each Class B-1 unit of QL Holdings LLC held by Insignia and the Senior Executives can be exchanged (together with one share of our Class B common stock) for one share of our Class A common stock (or, at our election, cash of an equivalent value) and is otherwise nontransferable.

As of February 28, 2023, there were 44,258,656 shares of our Class A common stock outstanding. These shares represent 100% of the economic rights of the holders of all classes of our capital stock and a 70.1% indirect economic interest in QL Holdings LLC.

IPO Reorganization Transactions

MediaAlpha, Inc. was formed for purposes of the IPO and had, prior to the consummation of the IPO, engaged only in activities in contemplation of the IPO. Historically, our business has been operated through QL Holdings LLC, together with its subsidiaries, all of the equity ownership interests of which were directly or indirectly held by White Mountains (through its wholly owned subsidiary Intermediate Holdco), Insignia, the Senior Executives and the Legacy Profits Interest Holders prior to the completion of the IPO.

In connection with the IPO, we undertook a series of reorganization transactions and entered into agreements with various pre-IPO shareholders. See “Selling stockholders—Material Relationships with Selling Stockholders.”

MediaAlpha, Inc. is a holding company and its sole material asset is all of the shares of its wholly owned subsidiary, Intermediate Holdco, which in turn owns all of the Class A-1 units of QL Holdings LLC, deferred tax assets and liabilities primarily related to Intermediate Holdco’s historical net operating loss carryforwards attributable to periods prior to the IPO, and an indemnity from White Mountains with respect to any pre-IPO liabilities of Intermediate Holdco.

Organizational structure

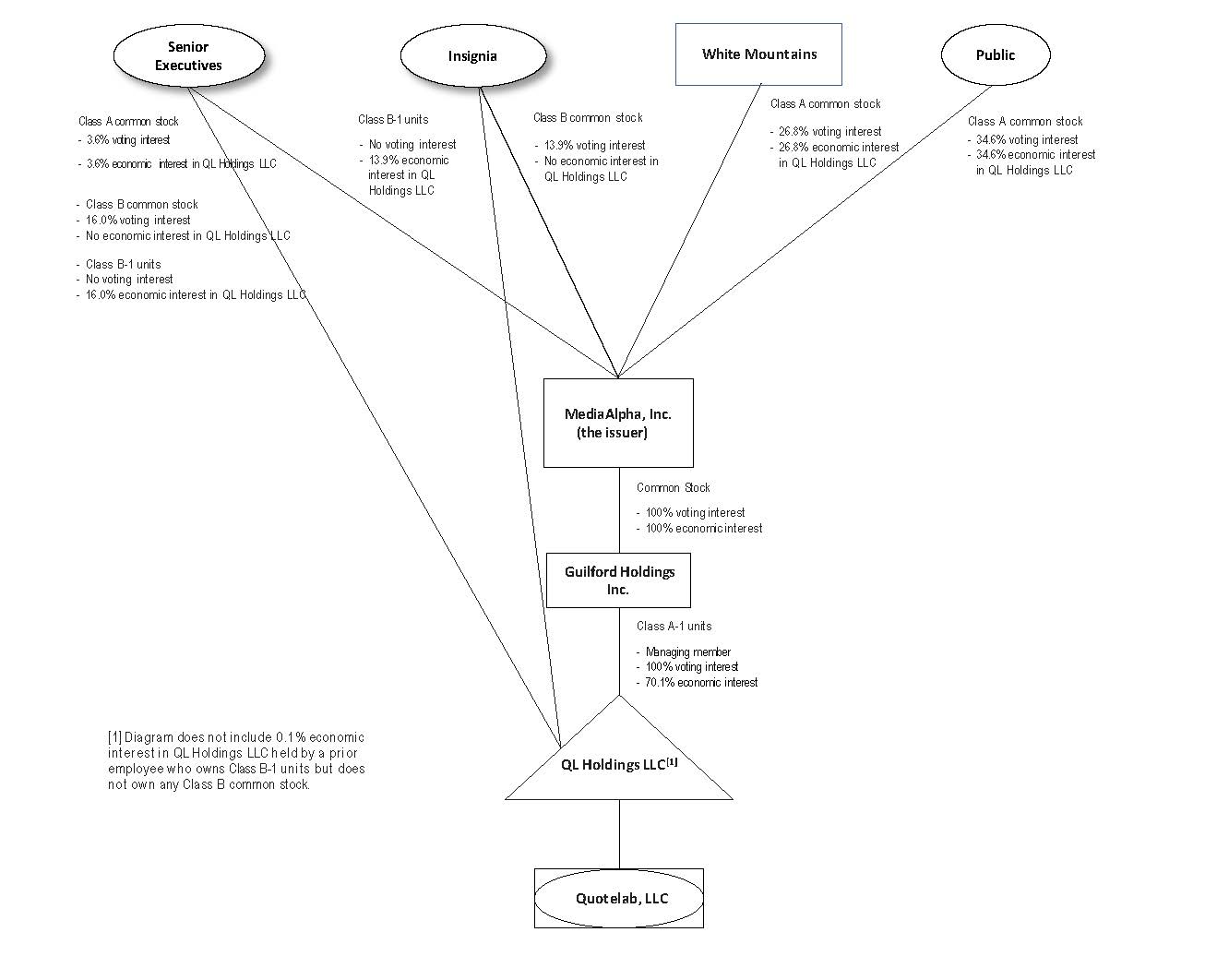

The diagram below shows our organizational structure as of February 28, 2023.

As of February 28, 2023, White Mountains and our other Class A common stockholders indirectly own 26.8% and 34.6%, respectively, of the economic interests in QL Holdings LLC through MediaAlpha, Inc. and Intermediate Holdco. Insignia directly owns 13.9% of the economic interests in QL Holdings LLC, and the Senior Executives directly or indirectly own 19.6% of the economic interests in QL Holdings LLC.

Holding company structure

Our only business is acting as the sole stockholder of Intermediate Holdco and, through Intermediate Holdco, acting as sole managing member of QL Holdings LLC. We operate and control all of our businesses and affairs through Intermediate Holdco and QL Holdings LLC (and its subsidiaries). In connection with the IPO reorganization, QL Holdings LLC’s limited liability company agreement was amended and restated to, among other things, establish two classes of equity: Class A-1 units indirectly held by us and Class B-1 units held only by persons or entities we permit which, immediately following the IPO, included Insignia and the Senior Executives. The financial results of Intermediate Holdco and QL Holdings LLC are consolidated in our financial statements.

Our organizational structure allows the Senior Executives and Insignia to retain their equity ownership (either directly or indirectly) in QL Holdings LLC, an entity that is classified as a partnership for U.S. federal income tax purposes, in the form of Class B-1 units. The investors who participate in any future offering of our Class A common stock (including this offering) will, by contrast, hold equity in MediaAlpha, Inc., a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes. Additionally, because the Senior Executives and Insignia may

exchange their Class B-1 units of QL Holdings LLC (together with the corresponding shares of our Class B common stock) for shares of our Class A common stock (or, at our election, cash of an equivalent value), our structure provides the Senior Executives and Insignia with potential liquidity that holders of non-publicly traded limited liability companies are not typically afforded.

Risk factors

Investing in our Class A common stock involves risk. You are urged to carefully read and consider the risk factors described in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information contained or incorporated by reference in this prospectus and the applicable supplement to this prospectus, if any. The risks and uncertainties described are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations and financial results and the value of our Class A common stock.

Use of proceeds

We will not receive any of the proceeds from the sale of Class A common stock by the selling stockholders.

Dividend policy

We do not anticipate declaring or paying any cash dividends on our Class A common stock in the foreseeable future. Any future determination to declare and pay cash dividends, if any, will be made at the discretion of our Board of Directors and will depend on a variety of factors, including applicable laws, our financial condition, results of operations, contractual restrictions, capital requirements, business prospects, general business or financial market conditions, and other factors our Board of Directors may deem relevant. In addition, our credit agreement with the lenders that are party thereto and JPMorgan Chase Bank, N.A., as administrative agent contains covenants that restrict QuoteLab, LLC’s and, in turn, our ability to pay cash dividends, subject to certain exceptions. Investors should not purchase our Class A common stock with the expectation of receiving cash dividends.

Our Class B common stock is not entitled to any dividend payments.

Management

Executive Officers

The following table sets forth information as of the date hereof regarding individuals who serve as our executive officers:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

Steven Yi | | 52 | | Chief Executive Officer, President, and Co-Founder |

Eugene Nonko | | 42 | | Chief Technology Officer and Co-Founder |

Patrick Thompson | | 44 | | Chief Financial Officer and Treasurer |

Jeffrey Coyne | | 56 | | General Counsel and Secretary |

Steven Yi has served as the Chief Executive Officer of the Company (including its predecessor) since June 2011. Prior to joining the Company, Mr. Yi co-founded and served as the Chief Executive Officer of Fareloop LLC, a travel comparison website, from 2009 to 2011, and served as Senior Vice President and General Manager, Marketing Services, at Oversee.net, a technology-driven media company that owned and operated a portfolio of consumer and business-to-business properties, from 2007 to 2009. Mr. Yi received his undergraduate degree in East Asian Studies from Harvard University and his J.D. from Harvard Law School.

Eugene Nonko has served as the Chief Technology Officer of the Company (including its predecessor) since June 2011. Prior to joining the Company, Mr. Nonko served as Vice President, Research and Development at Oversee.net, a technology-driven media company that owned and operated a portfolio of consumer and business-to-business properties, from 2004 to 2010, and served as a Software Engineer at Microsoft, a leading multinational technology company, from 2001 to 2004. Mr. Nonko received his B.S. and M.S. in Information Technology and Economics from Altai State Technical University.

Patrick Thompson has served as the Chief Financial Officer of the Company since December 2021. Prior to joining the Company, Mr. Thompson served at Expedia Group, Inc., a global online travel company, in various senior financial roles, including as Chief Financial Officer, Retail from March 2021 to November 2021, as Interim Head, Investor Relations from January 2021 to November 2021, as Senior Vice President, Corporate Finance from 2019 to 2021, as Vice President, Corporate Financial Planning & Analysis from 2018 to 2019, as Vice President, Strategy and Analytics, Expedia Partner Solutions from 2016 to 2018, and as Vice President, Corporate Development from 2015 to 2016. Prior to joining Expedia, Mr. Thompson served as a management consultant at Bain & Company, Inc., a leading management consulting firm, and as an associate at Bain Capital LP, a global alternative investment firm. Mr. Thompson received his B.A. in Physics and Mathematics from Bowdoin College and his M.B.A. from the Tuck School of Business.

Jeffrey Coyne has served as General Counsel and Secretary of the Company since May 2021. Prior to joining the Company, Mr. Coyne served as Executive Vice President, General Counsel and Secretary of Veritone, Inc. a leading provider of artificial intelligence (AI) technology and solutions, from 2016 to 2021. Mr. Coyne served as Senior Vice President, General Counsel and Corporate Secretary of Newport Corporation, a global supplier of advanced technology products that was acquired by MKS Instruments, Inc., from 2004 to 2016, and served as Vice President, General Counsel and Corporate Secretary of Newport Corporation from 2001 to 2004. Prior to that, Mr. Coyne was a partner in the Corporate and Securities Law Department of Stradling Yocca Carlson & Rauth, a technology-focused law firm. Mr. Coyne received his undergraduate degree in Economics from Duke University and his J.D. from the University of Southern California Law Center.

Composition of the Board of Directors

Our Board of Directors consists of nine members. The following table sets forth information as of the date hereof regarding individuals who serve as members of our Board of Directors:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Term Expires | | Committee memberships |

Venmal (Raji) Arasu | | 53 | | Director | | 2023 | | Audit Committee, Compensation Committee |

Anthony Broglio | | 48 | | Director | | 2024 | | Compensation Committee |

Christopher Delehanty | | 40 | | Director | | 2024 | | Compensation Committee |

David Lowe | | 62 | | Director | | 2025 | | Nominating & Corporate Governance Committee |

Jennifer Moyer | | 52 | | Director | | 2025 | | Nominating & Corporate Governance Committee |

Eugene Nonko | | 42 | | Director, Chief Technology Officer, and Co-Founder | | 2024 | | — |

Lara Sweet | | 48 | | Director | | 2023 | | Audit Committee, Compensation Committee |

Kathy Vrabeck | | 59 | | Director and Board Chair | | 2023 | | Compensation Committee; Nominating & Corporate Governance Committee |

Steven Yi | | 52 | | Director, Chief Executive Officer, President, and Co-Founder | | 2025 | | Nominating & Corporate Governance Committee |

The biographies of Steven Yi and Eugene Nonko are presented above under the heading “—Executive Officers.” The biographies of our other directors are set forth below.

Venmal (Raji) Arasu was appointed director of the Company upon the completion of the IPO. Since April 2021, Ms. Arasu has served as Executive Vice President and Chief Technology Officer of Autodesk, Inc., a leader in 3D design, engineering, and entertainment software and services. From January 2016 to April 2021, Ms. Arasu was Senior Vice President, Intuit Platform of Intuit Inc., a business and financial software company that develops and sells financial, accounting, tax preparation software, and related services for small businesses, accountants, and individuals. Ms. Arasu previously served as the Chief Technology Officer for StubHub, Inc., the online and mobile ticketing marketplace subsidiary of eBay Inc., from November 2011 to January 2016. At eBay, she served as the Vice President of Engineering from 2008 to 2011, and in other positions of increasing authority from 2001 to 2008. She has served as one of NIC Inc.’s directors since 2015. Ms. Arasu holds a B.S. in Computer Engineering from Pune University, Pune, India. Ms. Arasu is qualified to serve on the Board of Directors because of her engineering expertise and her technology, business strategy and management experience.

Anthony Broglio was appointed director of the Company in July 2020 and prior to the IPO served as director of QL Holdings LLC. Mr. Broglio is a founding Partner at Insignia Capital Group, a San Francisco Bay Area private equity firm focused on lower middle-market companies. Insignia has owned a minority stake in QL Holdings LLC since 2019 and is a stockholder of the Company. Prior to co-founding Insignia in 2012, Mr. Broglio worked as a Principal and member of the executive committee of Lake Capital, a Chicago-based private equity fund with over $1.3 billion under management. During his more than nine years with Lake Capital, Mr. Broglio served on the boards of twelve portfolio companies. Mr. Broglio received a B.S. in Finance from the University of Colorado and an M.B.A. with Honors from the University of Chicago Booth School of Business. Mr. Broglio is qualified to serve on our Board of Directors because of his financial expertise and management and board experience.

Christopher Delehanty was appointed director of the Company in July 2020 and prior to the IPO served as a director of QL Holdings LLC. Mr. Delehanty is Head of Corporate Development and M&A at White Mountains Capital, where he focuses on the company’s direct investing and merger and acquisition activity in the insurance and financial services sectors. White Mountains has owned a stake in QL Holdings LLC since 2014 and is a stockholder of the Company. Prior to joining White Mountains in 2009, Mr. Delehanty worked in private equity and investment banking at Alta Communications and UBS Investment Bank. Over the course of his career, Mr. Delehanty has served on the boards of directors of a number of privately-held companies. Mr. Delehanty received his B.S. in Finance from Boston College. Mr. Delehanty is qualified to serve on our Board of Directors because of his financial expertise and management and board experience.

David Lowe was appointed director of the Company upon the completion of the IPO. Mr. Lowe is a founding Partner and Chief Executive Officer of Insignia Capital Group, a San Francisco Bay Area private equity firm focused on lower middle-market companies. Insignia has owned a minority stake in QL Holdings LLC since 2019 and is a stockholder of the Company. Prior to co-founding Insignia in 2012, Mr. Lowe was a co-founder and Vice Chairman of Friedman Fleischer & Lowe, a San Francisco-based private equity firm with over $2.5 billion under management. During his 13 years at Friedman Fleischer & Lowe, Mr. Lowe was on the Investment Committee and served as Chairman of the boards of directors of Guardian Home Care Holdings, Discovery Foods, Church’s Chicken, Benevis, GeoVera Insurance Group Holdings, and Advanced Career Technologies, as well as a director at DPMS, SteelPoint Technologies, and Korn/Ferry International. Mr. Lowe currently serves as Chairman of the boards of Tillamook Country Smoker and Century Snacks. Mr. Lowe received a B.A. with Honors from the University of California at Davis and an M.B.A. from the Stanford Graduate School of Business. Mr. Lowe is qualified to serve on our Board of Directors because of his financial expertise and management experience.

Jennifer Moyer was appointed director of the Company upon the completion of the IPO and serves as the chair of the Nominating and Corporate Governance Committee. Ms. Moyer has been the Chief Administrative Officer of White Mountains, a financial services holding company, since 2017. White Mountains has owned a stake in QL Holdings LLC since 2014 and is a stockholder of the Company. Prior to joining White Mountains, Ms. Moyer worked at Goldman Sachs for 23 years in a variety of leadership roles including Chief of Staff for Asia Pacific Ex-Japan and Managing Director in Human Capital Management for Asia Pacific. Ms. Moyer received a B.A. in Social Anthropology from Harvard College and an M.B.A. from the Tuck School of Business at Dartmouth. Ms. Moyer is qualified to serve on our Board of Directors because of her experience as a senior executive with management expertise, as well as her human capital management and corporate governance experience.

Lara Sweet was appointed director of the Company upon the completion of the IPO and serves as the chair of the Audit Committee. From May 2019 to June 2021, Ms. Sweet served as the Chief People Officer at Snap Inc., a camera company and owner of the application Snapchat. Prior to that, Ms. Sweet served as Snap’s interim Chief Financial Officer from January 2019 to May 2019, as Chief Accounting Officer from October 2017 to September 2019, and as Controller from June 2016 to October 2017. Prior to Snap, Ms. Sweet worked at AOL, Inc. for over six years, most recently serving as Controller and Chief Accounting Officer from November 2014 to June 2016. Prior to that, Ms. Sweet served as AOL’s Vice President, Internal Audit from April 2014 to November 2014 and Vice President and Assistant Controller from August 2011 to April 2014. Ms. Sweet holds a B.S. in Accounting from George Mason University. Ms. Sweet is qualified to serve on our Board of Directors because of her financial expertise and management experience.

Kathy Vrabeck was appointed director of the Company upon the completion of the IPO and serves as the chair of our Board of Directors as well as the chair of the Compensation Committee. Since May 2022, Ms. Vrabeck has served as Chief Operating Officer of The Beachbody Company, a leading health and wellness solutions company, and from April 2021 to May 2022, she was Chief Strategy Officer at The Beachbody Company. Prior to that, from October 2015 to April 2021, Ms. Vrabeck was a Senior Client Partner in the Los Angeles office of Korn Ferry, a global talent and organizational advisory firm, where she led Korn Ferry’s Consumer Digital sector. Prior to that, she was a Partner at Heidrick & Struggles International, Inc., an executive search firm, where she served as both Global Sector Leader of their Media, Entertainment and Digital practice and partner-in-charge of the Los Angeles office. Prior to that, Ms. Vrabeck was with Legendary Entertainment, a media company, from March 2009 to March 2011 where she served as President, Legendary Digital and was responsible for the creation, management and delivery of digital entertainment, with a focus on video games, across current and next-generation platforms. From May 2007 to November 2008, Ms. Vrabeck was with Electronic Arts, Inc., a developer, marketer, publisher and distributor of video games (“EA”), where she served as President, EA Casual Entertainment. Ms. Vrabeck received a bachelor’s degree in French and Economics from DePauw University and an M.B.A. from Indiana University. Ms. Vrabeck is qualified to serve on our Board of Directors because of her expertise in digital media and her management and board experience.

Other Directorships

Ms. Arasu previously served on the board of directors of one other publicly reporting company, NIC Inc., from May 2015 to April 2021. Ms. Vrabeck has served on the board of directors of one other publicly reporting company, UTA Acquisition Corp., since July 2021, and previously served on the board of directors of one other publicly reporting company, GameStop, Inc., from July 2012 to June 2021. No other director of the Company currently serves, or during the past five years has served, on the board of directors of any other publicly reporting company or investment company.

Board Composition and Practices

Ensuring the Board is composed of directors who possess a wide variety of relevant skills, professional experience and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of shareholders is a top priority of the Board and the Nominating and Corporate Governance Committee.

•78% of our Board members are independent directors;

•44% of our Board members are women;

•22% of our Board members are racially and/or ethnically diverse;

•the Board and each of its Committees are chaired by women;

•the Board and the Nominating and Corporate Governance Committee regularly evaluate the size and composition of the Board to ensure appropriate alignment with the Company’s evolving business and strategic needs; and

•the Board conducts an annual self-assessment of the Board and its Committees to evaluate effectiveness.

Corporate Governance

Director Independence

Our corporate governance guidelines provide that our Board shall consist of such number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the NYSE and SEC rules. The Board has determined affirmatively, based upon its review of all relevant facts and circumstances and after considering all applicable relationships of which the Board had knowledge, between or among the directors and the Company or our management (some of such relationships are described in the section of this prospectus entitled “Selling stockholders—Material Relationships with Selling Stockholders”), that each of the following directors and director nominees is independent under the listing standards of the NYSE: Venmal (Raji) Arasu, Anthony Broglio, Christopher Delehanty, David Lowe, Jennifer Moyer, Lara Sweet and Kathy Vrabeck. Our Board also determined that Venmal (Raji) Arasu, Lara Sweet and Kathy Vrabeck, who serve on our Audit Committee, satisfy the independence standards for that committee established by the SEC and the rules of the NYSE, and that Venmal (Raji) Arasu, Anthony Broglio, Christopher Delehanty, Lara Sweet and Kathy Vrabeck, who serve on our Compensation Committee, satisfy the independence standards for that committee established by the SEC and the rules of the NYSE. In making such determinations, our Board considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director and any institutional stockholder with which he or she is affiliated.

Compensation Committee Interlocks and Insider Participation

Venmal (Raji) Arasu, Anthony Broglio, Christopher Delehanty, Lara Sweet and Kathy Vrabeck served on our Compensation Committee during 2022. None of the members of our Compensation Committee has at any time been an officer or employee of the Company. Anthony Broglio and Christopher Delehanty were appointed to our Board by Insignia and White Mountains, respectively, pursuant to the provisions of our stockholders’ agreement as described above. Certain transactions involving these parties are described under the heading “Selling stockholders—Material Relationships with Selling Stockholders.” During 2022, none of our executive officers served as a member of the board of directors or a compensation committee of any entity for which a member of our Board or Compensation Committee served as an executive officer.

Executive Compensation

Compensation Discussion and Analysis

Overview

This Compensation Discussion and Analysis describes our executive compensation philosophy, process, objectives and the elements of our compensation program for our “named executive officers” (“NEOs”) for fiscal 2022, and provides the context for understanding and evaluating the compensation information contained in the tables and related disclosures that follow. For fiscal 2022, our NEOs consisted of (a) our principal executive officer, (b) our principal financial officer, and (c) the three other most highly compensated individuals who were serving as executive officers at the end of fiscal 2022, as listed in the table below.

| | | | | | | | |

Name | | Position |

| Steven Yi | | Chief Executive Officer, President and Co-Founder |

| Eugene Nonko | | Chief Technology Officer and Co-Founder |

| Patrick Thompson | | Chief Financial Officer and Treasurer |

| | |

| | |

| Jeffrey Coyne | | General Counsel and Secretary |

| Cathy Cunningham | | Chief People Officer |

| | |

| | |

Compensation Philosophy and Objectives

Our executive compensation program is designed to (i) attract, retain and motivate top-level talent who possess the skills and leadership necessary to grow our business, (ii) provide compensation packages that are competitive with market practice and drive and reward the achievement of our business objectives; (iii) closely align the interests of our NEOs with those of our stockholders by linking pay to performance to produce sustainable, long-term value growth for our stockholders and (iv) utilize a balance of short-term and long-term incentives that serve as meaningful inputs to value creation and reward outperformance.

At the core of our compensation philosophy, we aim to provide a compensation package to each of our NEOs that emphasizes pay-for-performance, and that is both externally competitive to the market and internally equitable within our organization. We believe that a performance-based culture is critical to our growth and success, and our compensation program is designed to foster these core beliefs.

Our executive compensation program design includes a mix of three key compensation elements—(i) base salary, (ii) short-term cash incentive awards and (iii) long-term equity incentive awards. In determining the amount of each compensation element awarded to our NEOs, our Compensation Committee looks at each NEO’s overall compensation package, as well as the amount of each compensation element for the NEO, to determine whether such amounts and the overall mix of elements for the NEO’s role further the principles and objectives of our executive compensation program.

Consistent with our pay-for-performance philosophy, and to ensure our NEOs’ interests are closely aligned with those of our stockholders, a substantial portion of our NEOs’ compensation is awarded in the form of variable, “at-risk” short-term and long-term incentive awards. Specifically:

•89% of 2022 target total compensation for our Chief Executive Officer (“CEO”) and Chief Technology Officer (“CTO”) (our “Co-Founders”) was comprised of at-risk compensation elements (i.e., short-term and long-term incentive awards); and

•On average, 81% of 2022 target total compensation for our other NEOs was comprised of at-risk compensation elements.

The short-term incentive awards are earned based on the achievement of rigorous financial top-line and profitability performance goals set by the Compensation Committee in the first quarter of each year. The long-term incentives are granted in the form of equity incentive awards, the realized value of which bears a direct relationship to our stock price.

The Compensation Committee periodically reviews and analyzes market trends and adjusts the design and operation of our executive compensation program from time to time as it deems necessary and appropriate. While the

Compensation Committee considers a multitude of factors in its deliberations, it places no formal weighting on any one factor. As we continue to transition from a newly public company to a more mature public company, the Compensation Committee will evaluate our executive compensation program to ensure that it continues to align with our compensation philosophy and objectives and helps to drive the future growth of the Company.

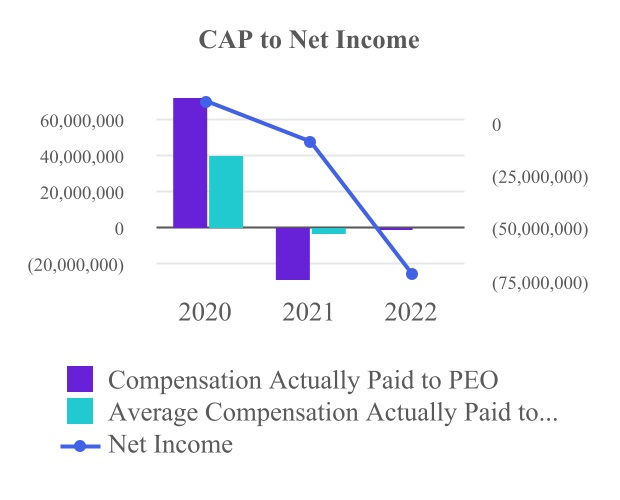

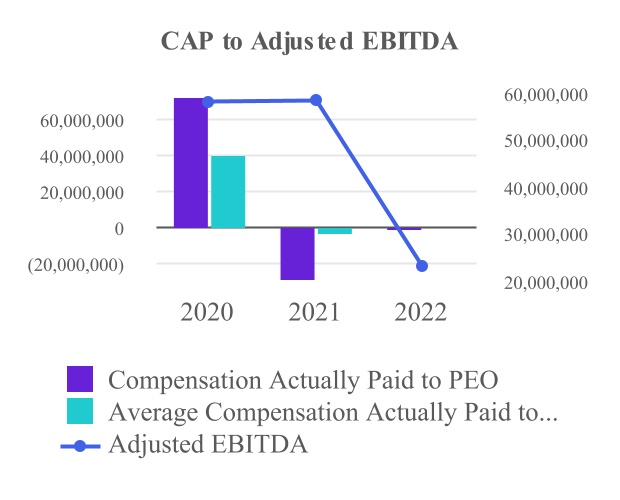

Fiscal 2022 Business Performance

Fiscal 2022 was a challenging year for our business, as property and casualty (P&C) insurance carriers experienced worsening underwriting profitability concerns due to historically high levels of inflation in automobile claims costs, leading them to reduce their customer acquisition spending on our platform as they sought regulatory approval to increase their premium rates. As a result, our revenue from the P&C insurance vertical declined 46% year over year to $224.4 million, and our total revenue declined by 29% year over year to $459.1 million. This revenue decline drove a net loss for fiscal 2022 of $(72.4) million (compared with a net loss of $(8.5) million for fiscal 2021), and our Adjusted EBITDA declined by 61% year over year to $22.9 million. Despite the challenging business conditions in our primary markets, we had some positive highlights during the year, including:

•Delivered positive Adjusted EBITDA and free cash flow despite the 28.9% year-over-year decline in our revenue, underscoring our operating expense discipline and the efficiency of our operating model;

•Made strong progress on our initiative to increase our Transaction Value from Medicare carriers;

•Managed our capital effectively, using excess cash to fund an acquisition, pay down debt and execute a share repurchase program;

•Continued to enhance our internal controls over financial reporting in compliance with Section 404 of the Sarbanes-Oxley Act; and

•Implemented additional processes as we transition from being a newly public company to a more mature public company.

Executive Compensation Practices

Our executive compensation program incorporates the following corporate governance best practices, which are designed to protect the interests of our stockholders and are consistent with high standards of risk management. As we continue to transition from a newly public company to a more mature public company, we will continue to evaluate our compensation program relative to our market peers.

| | | | | |

| What We Do | What We Don’t Do |

Pay-for-Performance Philosophy. We align pay and performance by awarding a substantial portion of the compensation paid to our executives in the form of variable, “at-risk” performance-based compensation linked to achievement of rigorous performance goals. | No Guaranteed Bonuses. Our annual bonus plans are performance-based and generally do not include any guaranteed minimum payment levels. |

Maintain an Independent Compensation Committee. Our Compensation Committee is comprised solely of independent directors with extensive industry experience. | No “Single-Trigger” Change of Control Arrangements. Following our IPO, we do not provide for “single-trigger” acceleration of compensation or benefits solely upon a change of control for our NEOs. |

Maintain an Independent Compensation Committee Advisor. The Compensation Committee engages its own independent compensation consultant. | No Excise Tax “Gross-Ups”. We do not provide any “gross-ups” for excise taxes that our employees might owe as a result of the application of Sections 280G or 4999 of the IRC. |

Conduct Annual Compensation Review. The Compensation Committee conducts a review at least annually of our executive compensation philosophy and strategy, including a review of the compensation peer group used for comparative purposes. | No Perquisites. We do not provide material perquisites or other personal benefits to our NEOs or directors, |

Perform Annual Compensation-Related Risk Assessment. We have strong risk and control policies, we take risk management into account in making executive compensation decisions, and we conduct an annual risk assessment of our executive and broad-based compensation programs to promote prudent risk management. | No Executive Pensions. We do not offer any executive pension plans. |

Executive Compensation Process

Role of the Compensation Committee

The Compensation Committee establishes our overall compensation philosophy and objectives, and is responsible for establishing, overseeing and evaluating our executive compensation program. The Compensation Committee is comprised entirely of independent directors and operates under a written charter adopted and reviewed annually by our Board. The Compensation Committee reviews and assesses whether our executive compensation program aligns with our compensation philosophy and objectives, and approves the specific compensation of our NEOs, typically during the first quarter of our fiscal year. The Compensation Committee has not delegated any of its authority with respect to the compensation of our executive officers.

Role of Management

The Compensation Committee consults with members of our management team, including our CEO and our people operations, finance and legal professionals, when making compensation decisions. Our CEO works closely with the Compensation Committee and provides the Compensation Committee with performance assessments and compensation recommendations for each NEO other than himself, based on each NEO’s level of performance and corporate performance, retention risk and taking into consideration market practices. While the Compensation Committee considers our CEO’s recommendations, the Compensation Committee ultimately uses its own business judgment and experience in approving individual compensation elements and the amount of each element for our NEOs.

Role of Compensation Consultant

Pursuant to its charter, the Compensation Committee has the authority to engage its own legal counsel and other advisors, including compensation consultants, to assist in carrying out its responsibilities. The Compensation Committee is directly responsible for the appointment, compensation and oversight of the work of any such advisor and has sole authority to approve all such advisors’ fees and other retention terms.

Pursuant to this authority, for fiscal 2022, the Compensation Committee engaged Compensia, Inc. (“Compensia”) to provide independent advice on matters relating to our executive compensation program, including information regarding competitive market practices, assessments and trends and advice relating to the design and structure of our executive compensation program. Compensia also updates the Compensation Committee on corporate governance and regulatory issues and developments. A representative of Compensia attends meetings of the Compensation Committee as requested. The Compensation Committee may replace its compensation consultant or hire additional advisors at any time. Compensia has not provided any other services to us and has received no compensation other than with respect to the services described below.

The Compensation Committee has evaluated Compensia’s independence by considering the requirements adopted by the NYSE and the SEC, and has determined that its relationship with Compensia does not raise any conflict of interest.

In October 2022, the Compensation Committee engaged ClearBridge Compensation Group, LLC (“ClearBridge”) to replace Compensia as its compensation consultant to advise the Compensation Committee with respect to our executive compensation program for 2023. In connection with such decision, the Compensation Committee evaluated ClearBridge’s independence by considering the requirements adopted by the NYSE and the SEC, and has determined that its relationship with ClearBridge does not raise any conflict of interest.

Peer Group

For purposes of comparing our executive compensation program against the competitive market, the Compensation Committee reviews and considers the compensation levels and practices of a specified group of peer companies. For 2022, the Compensation Committee, with the assistance of Compensia, reviewed and updated our compensation peer group to account for acquisitions of certain peer companies and changes in the market capitalization and/or revenue levels of certain peer companies.

The companies in this compensation peer group were selected on the basis of their similarity to us in terms of industry and financial characteristics, as determined using the following criteria:

•similar size, as measured by revenue and market capitalization;

•similar industry, business model and/or services;

•headquartered in the United States and traded on a major stock exchange; and

•preference for high annual revenue growth companies.

As a result, the Compensation Committee approved a revised compensation peer group for purposes of understanding the competitive market for executive talent to help inform the Compensation Committee's fiscal 2022 compensation decisions:

Fiscal 2022 Peer Group Companies

| | | | | | | | |

| Blackbaud | GoHealth | QuinStreet |

| Cardlytics | LendingTree | SelectQuote |

| CarGurus | Magnite | Shutterstock |

| Cars.com | Momentive Global | Sprinklr |

| Ebix | PagerDuty | Trupanion |

| eHealth | PROS Holdings | Yelp |

| Envestnet | Pubmatic | Yext |

| EverQuote | Quotient Technology | |

Compensation-Setting Process and Competitive Positioning

When determining recommendations for our NEOs’ fiscal 2022 compensation levels, the Compensation Committee reviewed base salary, target annual incentive compensation opportunity, target total cash compensation (i.e., base salary plus target incentive opportunity), annual long-term incentive, and total direct compensation values for our NEOs and those of similarly situated executives of our compensation peer group. Compensia provided data at the 25th, 50th, and 75th percentiles of the peer group for such compensation, which our Compensation Committee used as a reference. In addition, in connection with its assessment of annual long-term incentives to be granted to our NEOs, the Compensation Committee reviewed the overall retentive value of our NEOs’ existing unvested equity incentive awards. The Compensation Committee considers such data relevant to, but not determinative of, its consideration of overall executive compensation matters. The Compensation Committee does not benchmark any compensation element to a specific percentile, and the Compensation Committee instead establishes our NEOs’ compensation at levels it deems appropriate after considering other factors, including the Compensation Committee's assessment of each of our NEOs’ performance and contributions, our short-term and long-term objectives, retention considerations, prevailing market conditions, and the recommendations provided by our CEO with respect to the compensation of our other executive officers. The Compensation Committee believes that it is appropriate for the compensation levels for our Co-Founders to be at the same level given the criticality of both roles to the future success of the Company.

Analysis of Fiscal 2022 Compensation

Compensation Elements

Our executive compensation program is comprised of the following primary components:

•Base salary;

•Annual incentive awards; and

•Long-term equity compensation.

Base Salary

We believe that a competitive base salary is a necessary element of our executive compensation program in order to attract and retain top performing senior executives, including our NEOs. Base salaries provide a fixed source of compensation to our NEOs, allowing them a modest degree of certainty relative to the significant portion of their compensation that is based on performance or dependent on our stock price. Base salaries for our NEOs are also intended to be competitive with those received by other individuals in similar positions at the companies with which we compete for talent, as well as equitable internally across our executive team.

The Compensation Committee reviews the base salaries of our NEOs annually and makes adjustments to base salaries as it determines to be necessary or appropriate. To the extent base salaries are adjusted, the amount of any such adjustment would reflect a review of competitive market data, consideration of relative levels of pay internally, individual performance of the executive, and any other circumstances that the Compensation Committee determines are relevant.

In March 2022, the Compensation Committee reviewed the base salaries of our CEO and our other NEOs, taking into consideration a competitive market analysis performed by Compensia, which included a review of the market data of the compensation peer group for our executive officer positions, as well as broader technology company survey data and an evaluation of how the compensation we pay our executive officers compares both to our performance and to our peers. The Compensation Committee also considered the recommendations of our CEO (except with respect to his own base salary), as well as the other factors described under “Executive Compensation Process—Compensation-Setting Process and Competitive Positioning” above. Based on this review, the Compensation Committee approved an increase in Mr. Coyne's annual base salary for fiscal 2022, and did not make any other changes to the salaries of our other NEOs, as set forth in the table below.

| | | | | | | | | | | | | | | | | | | | |

Name | | 2021 Base Salary | | 2022 Base Salary | | Percentage Increase |

Steve Yi | | $ | 550,000 | | | $ | 550,000 | | | — | % |

Eugene Nonko | | $ | 550,000 | | | $ | 550,000 | | | — | % |

Patrick Thompson | | $ | 450,000 | | | $ | 450,000 | | | — | % |

Jeff Coyne | | $ | 375,000 | | | $ | 385,000 | | | 2.7 | % |

Cathy Cunningham | | $ | 350,000 | | | $ | 350,000 | | | — | % |

Annual Incentive Bonus Plan

We use incentive bonus programs to motivate our NEOs to achieve our short-term financial and operational objectives while making progress towards our longer-term growth and other key goals and initiatives. These incentive bonuses are generally tied to the achievement of rigorous top-line and/or profitability goals, as those are the key metrics that the Compensation Committee believes will ultimately drive the creation of long-term shareholder value. Consistent with our executive compensation philosophy, these incentive bonus awards are intended to offer market competitive incentive opportunities to our NEOs. In the first quarter of 2022, the Compensation Committee undertook a process, in consultation with Compensia, to develop a new incentive compensation plan for our NEOs for 2022. As part of this effort, the Compensation Committee reviewed incentive compensation plan structures and practices among the peer companies, as well as among publicly-traded technology companies generally, and discussed how different plan structures would align with the Company's compensation philosophy and strategic goals.

As a result of this process, the Compensation Committee developed and approved an incentive plan structure for the NEOs, which is tied to achievement of rigorous financial goals approved by the Compensation Committee at the beginning of the year. For fiscal 2022, each NEO had a specified target bonus opportunity under such plan equal to a specified percentage of his or her annual base salary. Payouts under such plan (calculated as a percentage of the target payout) are determined by the Compensation Committee in the first quarter of the following year, following completion of the audit of the Company’s financial statements for the completed fiscal year.

Target Incentives

In March 2022, the Compensation Committee conducted an assessment of the target bonus opportunities of our CEO and our other NEOs, in consultation with Compensia, and reviewed market data, relative levels of responsibility

across the Company, tenure, and other relevant factors. Based on such assessment, the Compensation Committee established the following target cash incentives for such NEOs for fiscal 2022:

| | | | | | | | | | | | | | |

Name | | Target Incentive (as % of Base Salary) | | Target Incentive ($) |

Steve Yi | | 100 | % | | $ | 550,000 | |

Eugene Nonko | | 100 | % | | $ | 550,000 | |

Patrick Thompson | | 66.7 | % | | $ | 300,000 | |

Jeff Coyne | | 49.4 | % | | $ | 190,000 | |

Cathy Cunningham | | 42.9 | % | | $ | 150,000 | |

Measures and Targets Under 2022 Incentive Bonus Plan

The financial performance measures for each NEO, and their relative weighting, are selected by the Compensation Committee each year based on our corporate goals for that year and the Board’s priorities. The Compensation Committee generally seeks to balance top-line and profitability measures, so as to reward overall performance and not overemphasize any single area of focus. Management provides recommendations to the Compensation Committee with respect to the financial performance measures and their relative weighting, but the Compensation Committee makes all final determinations with respect to the performance measures and relative weightings. In the first quarter of 2022, the Compensation Committee determined that the incentive bonus plan for the NEOs for 2022 would be based on achievement of two financial measures: Transaction Value and Adjusted EBITDA, with 50% of each NEO's target bonus tied to each such financial measure. The Compensation Committee believes that these financial measures are among the most important measures of management’s performance in achieving the Board's goals of profitable growth, which it views as among the most important drivers of stockholder value.