UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-39671

MediaAlpha, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

85-1854133 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

700 South Flower Street, Suite 640

Los Angeles, California 90017

(Address of principal executive offices, including zip code)

(213) 316-6256

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Class A Common Stock, $0.01 par value per share |

|

MAX |

|

NYSE |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

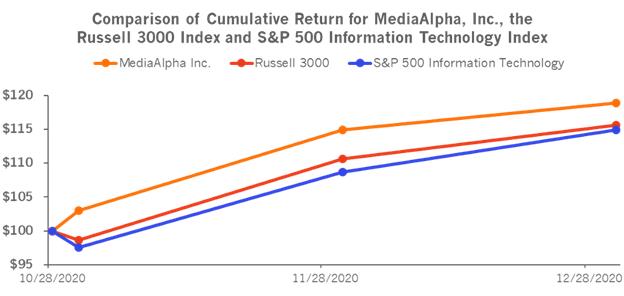

The aggregate market value of the Registrant’s Class A Common Stock held by non-affiliates of the Registrant was approximately $359.9 million based on the closing market price as of the close of business on October 28, 2020, the first day of trading on the New York Stock Exchange of the Registrant’s Class A Common Stock.

As of February 26, 2021, there were 33,815,086 shares of MediaAlpha, Inc.'s Class A common stock, $0.01 par value per share, and 25,536,043 shares of MediaAlpha, Inc.’s Class B common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

6 |

|

|

Item 1A. |

21 |

|

|

Item 1B. |

55 |

|

|

Item 2. |

55 |

|

|

Item 3. |

55 |

|

|

Item 4. |

55 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

56 |

|

|

Item 6. |

57 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

58 |

|

Item 7A. |

81 |

|

|

Item 8. |

82 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

114 |

|

Item 9A. |

114 |

|

|

Item 9B. |

115 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

116 |

|

|

Item 11. |

122 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

128 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

130 |

|

Item 14. |

132 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

134 |

|

|

Item 16 |

136 |

1

As used in this Annual Report on Form 10-K:

|

|

• |

“Class A-1 units” refers to the Class A-1 units of QL Holdings LLC (“QLH”). |

|

|

• |

“Class B-1 units” refers to the Class B-1 units of QLH. |

|

|

• |

“CAGR” means compound annual growth rate. |

|

|

• |

“Consumer Referral” means any consumer click, call or lead purchased by a buyer on our platform. |

|

|

• |

“Consumers” and “customers” refer interchangeably to end consumers. Examples include individuals shopping for insurance policies. |

|

|

• |

“Digital consumer traffic” refers to visitors to the mobile, tablet, desktop and other digital platforms of our supply partners, as well as to our proprietary websites. |

|

|

• |

“Direct-to-consumer” or “DTC” means the sale of insurance products or services directly to end consumers, without the use of retailers, brokers, agents or other intermediaries. |

|

|

• |

“Distributor” means any company or individual that is involved in the distribution of insurance, such as an insurance agent or broker. |

|

|

• |

“Founders” means, collectively, Steven Yi, Eugene Nonko, and Ambrose Wang. |

|

|

• |

“High-intent” consumer or customer means an in-market consumer that is actively browsing, researching or comparing the types of products or services that our partners sell. |

|

|

• |

“Insignia” means Insignia Capital Group, L.P. and its affiliates. |

|

|

• |

“InsurTech” means insurance technology. |

|

|

• |

“Intermediate Holdco” means Guilford Holdings, Inc., our wholly owned subsidiary and the owner of all Class A-1 units, after giving effect to the IPO. |

|

|

• |

“Inventory,” when referring to our supply partners, means the volume of Consumer Referral opportunities. |

|

|

• |

“IPO” means our initial public offering of our Class A common stock on October 30, 2020. |

|

|

• |

“Legacy Profits Interest Holders” means certain current or former employees of QLH or its subsidiaries (other than the Senior Executives), who indirectly held Class B units in QLH prior to our IPO, and includes any estate planning vehicles or other holding companies through which such persons hold their units in QLH. |

|

|

• |

“Lifetime value” or “LTV” is a type of metric that many of our business partners use to measure the estimated total worth to a business of a customer over the expected period of their relationship. |

|

|

• |

“NAIC” means the National Association of Insurance Commissioners. |

|

|

• |

“Open platform” refers to one of our two business models. In open platform transactions, we have separate agreements with demand partners and suppliers. We earn fees from our demand partners and separately pay a revenue share to suppliers and a fee to Internet search companies to drive consumers to our proprietary websites. |

|

|

• |

“Partner” refers to a buyer or seller on our platform, also referred to as “demand partners” and “supply partners,” respectively. |

|

|

o |

“Demand partner” refers to a buyer on our platform. As discussed under Item 2. Management’s Discussion & Analysis – Management Overview, our demand partners are generally insurance carriers and distributors looking to target high-intent consumers deep in their purchase journey. |

|

|

o |

“Supply partner” or “supplier” refers to a seller to our platform. As discussed under Item 2. Management’s Discussion & Analysis – Management Overview, our supply partners are primarily insurance carriers looking to maximize the value of non-converting or low LTV consumers, and insurance-focused research destinations looking to monetize high-intent consumers. |

2

|

|

• |

“Proprietary” means, when used in reference to our properties, the websites and other digital properties that we own and operate. Our proprietary properties are a source of Consumer Referrals on our platform. |

|

|

• |

“Reorganization Transaction” means the series of reorganization transactions completed on October 27, 2020 in connection with our IPO, as described under Part II, Item 8 “Financial Statements and Supplementary Data - Note 1 to the Consolidated Financial Statements – Organization and Background” of this Annual Report on Form 10-K. |

|

|

• |

“Senior Executives” means the Founders and the following officers at the Company that held Class B units in QLH prior to the IPO: Keith Cramer, Tigran Sinanyan, Lance Martinez, Brian Mikalis, Robert Perine, Jeff Sweetser, Serge Topjian, and Amy Yeh. This term also includes any estate planning vehicles or other holding companies through which such persons hold their units in QLH. |

|

|

• |

“Selling Class B-1 Unit Holders” means Insignia, the Senior Executives, and the Legacy Profits Interests Holders, who sold a portion of their Class B-1 units to Intermediate Holdco in connection with the IPO. |

|

|

• |

“Transaction Value” means the total gross dollars transacted by our partners on our platform. |

|

|

• |

“Vertical” means a market dedicated to a specific set of products or services sold to end consumers. Examples include property & casualty insurance, life insurance, health insurance, and travel. |

|

|

• |

“White Mountains” means White Mountains Insurance Group, Ltd. and its affiliates. |

|

|

• |

“Yield” means the return to our sellers on their inventory of Consumer Referrals sold on our platform. |

3

Cautionary note regarding forward-looking statements

We are including this Cautionary Statement to caution investors and qualify for the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the "Act") for forward-looking statements. This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

Risk Factor Summary

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following:

|

|

• |

Our ability to attract and retain insurance carriers to our platform and to make available quality Consumer Referrals at attractive volumes and prices to drive transactions on our platform; |

|

|

• |

Our reliance on a limited number of insurance carriers, many of which have no long-term contractual commitments with us, and any potential termination of those relationships; |

|

|

• |

Existing and future laws and regulations affecting the property & casualty insurance, health insurance and life insurance verticals; |

|

|

• |

Changes and developments in the regulation of the underlying industries in which our partners operate; |

|

|

• |

Competition with other technology companies engaged in digital customer acquisition, as well as buyers that attract consumers through their own customer acquisition strategies, third-party online platforms or other traditional methods of distribution; |

|

|

• |

Our ability to attract, integrate and retain qualified employees; |

|

|

• |

Reductions in DTC digital spend by our buyers; |

|

|

• |

Our dependence on supply partners for the generation of a majority of our Consumer Referrals; |

|

|

• |

Our dependence on internet search companies to direct a significant portion of visitors to our suppliers’ websites and our proprietary websites; |

|

|

• |

The novel strain of the coronavirus and the disease it causes (COVID-19); |

|

|

• |

Our existing and future indebtedness; |

|

|

• |

Disruption to operations as a result of future acquisitions; |

|

|

• |

Failure to obtain, maintain, protect and enforce our intellectual property rights, proprietary systems, technology and brand; |

|

|

• |

Our ability to develop new offerings and penetrate new vertical markets; |

|

|

• |

Our ability to manage future growth effectively; |

|

|

• |

Our reliance on data provided to us by our demand and supply partners and consumers; |

|

|

• |

Natural disasters, public health crises, political crises, economic downturns, or other unexpected events; |

|

|

• |

Significant estimates and assumptions in the preparation of our financial statements; |

4

|

|

• |

Our ability to collect our receivables from our partners; |

|

|

• |

Developments with respect to LIBOR; |

|

|

• |

Fluctuations in our financial results caused by seasonality; |

|

|

• |

The development of the DTC insurance distribution sector and evolving nature of our relatively new business model; |

|

|

• |

Disruptions to or failures of our technological infrastructure and platform; |

|

|

• |

Failure to manage and maintain relationships with third-party service providers; |

|

|

• |

Cybersecurity breaches or other attacks involving our systems or those of our partners or third-party service providers; |

|

|

• |

Our ability to protect consumer information and other data and risks of reputational harm due to an actual or perceived failure by us to protect such information and other data; |

|

|

• |

Risks related to being a public company; |

|

|

• |

Risks related to our common stock; |

|

|

• |

Risks related to our intention to take advantage of certain exemptions as a “controlled company” under the rules of the NYSE, and the fact that the interests of our controlling stockholders (White Mountains, Insignia, and the Founders) may conflict with those of other investors; |

|

|

• |

Risks related to our corporate structure; and |

|

|

• |

The other risk factors described under “Risk factors.” |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this Annual Report on Form 10-K. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

5

Except as otherwise indicated or required by the context, all references in this Annual Report to the “Company,” “MediaAlpha,” “we,” “us” and “our” refer to (i) QL Holdings, LLC (“QLH”) and its consolidated subsidiaries prior to the completion of our initial public offering and (ii) MediaAlpha, Inc. (“MediaAlpha, Inc.”) and its consolidated subsidiaries following the completion of our initial public offering on October 30, 2020.

Our Company

Our mission is to help insurance carriers and distributors target and acquire customers more efficiently and at greater scale through technology and data science. Our technology platform brings leading insurance carriers and high-intent consumers together through a real-time, transparent, and results-driven ecosystem. We believe we are the largest online customer acquisition channel in our core verticals of property & casualty insurance, health insurance, and life insurance, supporting over $1.4 billion in Transaction Value across our platform over the last two years.

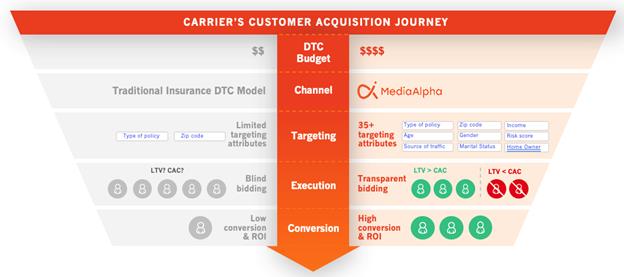

We believe in the disruptive power of transparency. Traditionally, insurance customer acquisition platforms operated in a black box. We recognized that a consumer may be valued differently by one insurer versus another; therefore, insurers should be able to determine pricing granularly based on the value that a particular customer segment is expected to bring to their business. As a result, we developed a technology platform that powers an ecosystem where buyers and sellers can transact with full transparency, control, and confidence.

We have multi-faceted relationships with top-tier insurance carriers and distributors. A buyer or a demand partner within our ecosystem is generally an insurance carrier or distributor seeking to reach high-intent insurance consumers. A seller or a supply partner is typically an insurance carrier looking to maximize the value of non-converting or low LTV consumers, or an insurance-focused research destination looking to monetize the high-intent insurance shoppers on their websites. Our model’s versatility allows for the same insurance carrier to be both a demand and supply partner, which deepens the partner’s relationship with us. In fact, it is this supply partnership that presents insurance carriers with a highly differentiated monetization opportunity, enabling them to capture revenue from website visitors who either do not qualify for a policy or otherwise may be more valuable as a potential referral to another carrier.

6

For the year ended December 31, 2020, we had 15 of the top 20 largest auto insurance carriers by customer acquisition spend as demand partners on our platform, accounting for 43% of our revenue. Of these demand partners, 67% were also supply partners in our ecosystem. On a monthly basis, an average of 31.2 million consumers shop for insurance products through the websites of our diversified group of supply partners and our proprietary websites, driving an average of over 6.6 million Consumer Referrals on our platform for the twelve month period ended December 31, 2020.

We believe our technology is a key differentiator and a powerful driver of our performance. We maintain deep, custom integrations with partners representing the majority of our Transaction Value to enable automated, data-driven processes that optimize our partners’ customer acquisition spend and revenue. Through our platform, our insurance carrier partners can target and price across over 35 separate consumer attributes to manage customized acquisition strategies. We enable our insurance partners to target consumers based on a precise calculation of the expected lifetime value to that partner and to make real-time, automated customer acquisition decisions through a combination of granular price management tools and robust predictive analytics capabilities.

We built our business model to align the interests of all parties participating on our platform. We generate revenue by earning a fee for each Consumer Referral sold on our platform. Our revenue is not contingent on the sale of an insurance product to the consumer.

We have a track record of delivering rapid and profitable growth, enabled by our unique business model and technology platform. For the year ended December 31, 2020, we generated $584.8 million of revenue, representing a 43.3% increase over the $408.0 million of revenue that we generated for the year ended December 31, 2019. This translated to net income of $10.6 million for the year ended December 31, 2020, a decrease of 40.7% over the $17.8 million of net income we generated for the year ended December 31, 2019, driven predominantly by an increase in employee equity-based compensation, and professional fees in connection with our initial public offering. We also generated $58.1 million of Adjusted EBITDA(1) for the year ended December 31, 2020, representing a 35.3% increase over the $42.9 million of Adjusted EBITDA(1) generated for the year ended December 31, 2019.

7

For the quarter ended December 31, 2020, we generated $190.2 million of revenue, representing a 50.8% increase over the $126.1 million of revenue that we generated for the quarter ended December 31, 2019. This translated to a net loss of $13.2 million for the quarter ended December 31, 2020, a decrease of 227.6% over the $10.4 million of net income for the quarter ended December 31, 2019. We also generated $18.2 million of Adjusted EBITDA for the quarter ended December 31, 2020, representing a 30.5% increase over the $13.9 million of Adjusted EBITDA generated for the quarter ended December 31, 2019. See “Management’s discussion and analysis of financial condition and results of operations” for more information.

We designed our business model to be capital efficient, with high operating leverage and cash flow conversion. Since inception and prior to our IPO, we have funded our growth through internally generated cash flow with no outside primary capital. Our strong cash flow generation is driven by (i) the nature of our revenue model, which is fee based and generated at the time a Consumer Referral is sold, and (ii) our proprietary technology platform, which is highly scalable and requires minimal capital expenditure requirements ($0.3 million and $0.1 million for the year ended December 31, 2020 and 2019, respectively).

The foundation of our success is our company culture. Personal development is critical to our team’s engagement and retention, and we continually invest to support our core values of open-mindedness, intellectual curiosity, candor, and humility. This has resulted in a growth-minded team, with exceptionally low turnover, committed to building great products and the long-term success of our partners.

We are poised to capitalize on the expected growth in our core insurance verticals and the continued shift in these markets to direct, digital distribution. We aim to drive deeper adoption and integration of our platform within the insurance ecosystem to continue delivering strong results to our partners. While our focus remains on insurance, we plan to continue to grow opportunistically in sectors with similar market dynamics.

|

(1) |

“Adjusted EBITDA” is a non-GAAP financial measure that we present in this Annual Report on Form-10K to supplement the financial information we present on a GAAP basis. For a reconciliation of Adjusted EBITDA to the most directly comparable financial measure calculated and presented in accordance with GAAP, see “Management’s discussion and analysis of financial condition and results of operations—Key business and operating metrics.” |

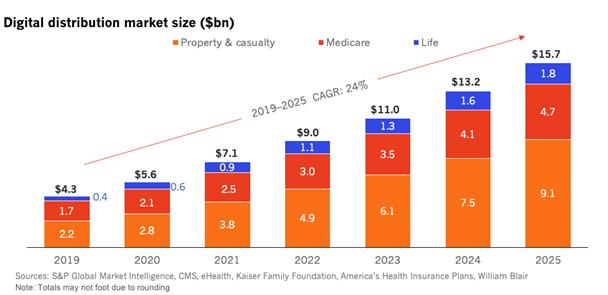

Our market opportunity

Insurance is one of the largest industries in the United States, with attractive growth characteristics and market fundamentals. Insurance companies wrote over $2 trillion in premiums in 2019, and the industry grew at a 6% CAGR from 2017 through 2019, according to the NAIC. Demand for insurance products is stable, due to, in many instances, coverage being mandatory by law (for example, auto insurance) or federally subsidized (for example, senior health insurance). The industry as a whole is highly competitive and invests heavily in customer acquisition. Total customer acquisition spend in the insurance industry was approximately $144 billion in 2019, representing year over year growth of approximately 6%, according to S&P Global Market Intelligence.

8

Our technology platform was created to serve and grow with our insurance end markets. As such, we believe secular trends in the insurance industry will continue to provide strong tailwinds for our business.

|

|

• |

Direct-to-consumer is the fastest growing insurance distribution channel. In the auto insurance industry, there are direct-to-consumer carriers (such as Progressive and GEICO) and more traditional, agent-based carriers (such as Liberty Mutual and Allstate). DTC carriers accounted for approximately 30% of industry premiums in 2018, up from approximately 23% in 2013, according to S&P Global Market Intelligence. This industry shift to more direct distribution is accelerating. According to J.D. Power, GEICO and Progressive captured nearly 84% of premium growth within the auto insurance industry in 2019. This growth is largely driven by their outsized investments, relative to peers, in direct customer acquisition channels. According to S&P Global Market Intelligence, GEICO’s customer acquisition spend increased from $0.9 billion in 2017 to $1.7 billion in 2019, representing 82% growth, and Progressive’s customer acquisition spend increased from $1.5 billion in 2017 to $1.9 billion in 2019, representing 28% growth. Traditional, agent-based carriers have responded by investing more heavily in direct customer acquisition efforts themselves, as well as launching digital brands (such as Nationwide and Spire), acquiring digital agencies (such as Prudential and AssuranceIQ), or acquiring digital insurers (such as Allstate and Squaretrade). At the same time, a number of personal lines InsurTech companies have entered the space to capitalize on this shift (such as Root, Lemonade, and Hippo). |

Similarly, tech-enabled distribution businesses focused on health and life insurance, such as eHealth, GoHealth, and SelectQuote, have also emerged in recent years, with revenue growth in excess of 40% in 2020. These companies advertise and acquire customers primarily through digital means and rank among the largest distribution platforms for health and life insurance products.

|

|

• |

More insurance consumers are shopping online. Consumers are increasingly using the internet not just for research and price discovery but to purchase insurance as well. The J.D. Power 2020 U.S. Insurance Shopping Study suggests that 90% of consumers are open to purchasing their auto insurance online. A decade ago, 35% of consumers who had not made an online auto insurance policy purchase in the past said they would consider doing so in the future, according to the Comscore 2010 Online Auto Insurance Shopping Report. This shift is not only prevalent among younger insurance shoppers. According to LexisNexis Insurance Demand Meter, consumers 56 and older are the fastest growing online auto insurance shoppers in the first quarter of 2020. This older demographic is also going online for health information. According to BMC Health Services Research, 63% of people age 65 and older had obtained health information from a website in 2013. |

|

|

• |

Insurance customer acquisition spending is growing. Total insurance customer acquisition spending in 2019 totaled $144 billion, up 6% over the previous year, according to S&P Global Market Intelligence. In fact, two of the top three most-advertised brands in the U.S. across traditional and online channels are insurance companies—Progressive and GEICO. Progressive’s customer acquisition spend grew approximately 29% year over year to nearly $1.7 billion in 2019, while GEICO’s customer acquisition spend grew almost 12% to nearly $2 billion in the same period. In the face of such aggressive spending and customer acquisition by DTC insurance carriers such as Progressive and GEICO, agent-based carriers are compelled to spend heavily to remain competitive. |

9

|

|

• |

Carriers and distributors are increasingly focused on optimizing customer acquisition budgets. Mass-market customer acquisition spend is becoming more costly, leading carriers and distributors to increasingly focus on optimizing customer acquisition spend. They are able to do so by adopting the more sophisticated customer acquisition strategies enabled by data science. A significant percentage of marketers believe the inability to measure customer acquisition impact across channels and campaigns is one of their biggest challenges in demonstrating customer acquisition performance. We believe there is growing demand for improved transparency of Consumer Referral quality, for carriers to secure higher quality Consumer Referrals online, and for the ability to manage consumer acquisition spend across multiple vendors. A survey by CMO in February 2020 reported that marketing analytics spending is expected to increase by 56% in the next three years. |

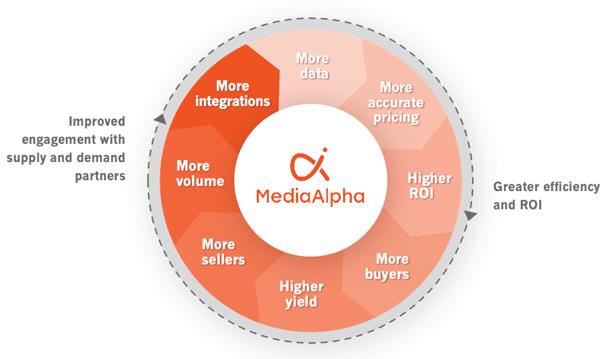

MediaAlpha is poised to capitalize on these trends. We believe we provide one of the leading technology platforms that enables insurance carriers and distributors to efficiently acquire customers online at scale. Our platform allows buyers to target consumers granularly and to determine their pricing based on how they value various consumer segments. Buyers leveraging our predictive analytics and data science capabilities make value-maximizing decisions on how to acquire customers. This results in greater customer acquisition efficiency and better return on investment, allowing us to attract more buyers into the ecosystem. Simultaneously, we provide our supply partners the insights and tools they need to drive competition for their high-intent consumers and maximize yield, which draws more supply partners into the ecosystem, providing our buyers with even more high-quality demand sources. As both demand and supply partners begin to see the benefits of the platform, we deepen our relationships with them through additional integrations that drive more data into the platform. All of this creates the powerful “flywheel” effect that has propelled our business forward as a result of the value created within our ecosystem.

10

Our platform

We have created one of the largest global insurance customer acquisition technology platforms. For the year ended December 31, 2020, we had $815.7 million in Transaction Value and served over 1,000 total insurance partners. For the year ended December 31, 2019, we had $560.1 million in Transaction Value and served over 760 total insurance partners.

Our buyers use our platform to access over 370 million high-intent consumers annually, sourced from over 380 insurance sellers as of December 31, 2020. We serve over 750 buyers across our core insurance verticals, including insurance carriers, InsurTech companies, agencies, and brokers. Our platform was designed for multiple Consumer Referral products and flexible deployment models to best serve the varying needs of our partners.

11

Insurance carriers access our platform through a self-service web interface that enables them to manage customer acquisition strategies across all sources of Consumer Referrals, efficiently and with full transparency. Our platform provides insurance companies sophisticated targeting capabilities for efficient customer acquisition. Further, it offers our partners the ability to offset customer acquisition costs by using predictive analytics to refer non-converting consumers to other carriers, delivering better returns on investment relative to traditional channels.

12

We connect insurance companies with websites where consumers shop for insurance. Insurance carriers and distributors are able to target high-intent consumers when they are actively shopping for insurance. Our end consumers typically access our partners’ websites or our proprietary websites looking for an insurance quote, where they volunteer relevant data in connection with their quote request. Our platform then controls the matching of these consumers with insurance companies, presenting them with multiple brands to choose from. We believe the rich data available with every consumer quote request gives our platform the unparalleled ability to direct each Consumer Referral to the right set of carriers. We maximize value to both demand and supply partners by allowing insurance companies to reach consumers when they are actively shopping and precisely target granular consumer segments using rich data.

We enable insurance companies to reach and acquire new customers in multiple ways. In our platform, end consumers can engage with insurance companies based on their preferences. Our platform enables consumers to (i) proceed to an insurance carrier’s website on a self-directed basis to purchase a policy (click), (ii) engage with an insurance carrier or agent via phone (call), or (iii) submit their data to insurance companies to receive inbound inquiries (lead). Our platform’s flexibility in turn enables insurance carriers to acquire and convert consumers through one or more touchpoints, depending on their strengths and preferences. As of December 31, 2020, clicks, calls, and leads represented 79.9%, 8.1%, and 12.0% of our Transaction Value, respectively. As of December 31, 2019, clicks, calls, and leads represented 75.2%, 8.3%, and 16.5% of our Transaction Value, respectively.

Our platform leverages precise data and data science for maximum efficiency. Insurance carriers use precise data to target and price consumer segments across demographic and geographic attributes on a source transparent basis. This allows insurance carriers to pay the right price for every customer acquisition opportunity based on their business objectives. Insurance carriers integrate with our platform to provide real-time conversion feedback, allowing them to measure returns granularly and execute algorithmic optimization of customer acquisition cost to match expected LTV. We have conversion data integrations with 15 of the top 20 insurance buyers as of December 31, 2020 and 2019 representing 54% and 46% of Transaction Value attributed to our insurance verticals, respectively. Increasing the number and depth of our conversion integrations with our partners remains a key priority.

Insurance carriers are able to extract the maximum value from each consumer opportunity. We have extensive data integrations with our partners to support efficient customer acquisition. These data integrations allow us to more seamlessly transact a Consumer Referral by taking information an end consumer has already provided and pre-populating it into an insurance carrier’s purchase process, potentially increasing policy conversion rates. This enhances the value of the Consumer Referral to our insurance carriers, adding significant value to all parties in our platform. Currently, we have 77 buyers with this type of integration, representing 70% of Transaction Value attributed to our insurance verticals as of December 31, 2020. Increasing the number and depth of our data integrations with our partners remains a key priority, and we believe this number will increase as our platform grows.

Our transaction models. We transact with our demand partners and supply partners through two operating models, open platform and private platform. In our open platform transactions, we have separate agreements with demand partners and suppliers and have control over the Consumer Referrals that are sold to our demand partners. In our private platform transactions, demand partners and suppliers contract with one another directly, and we earn fees from our demand and supply partners based on the Consumer Referrals transacted. For a description of these arrangements, see “Management’s discussion and analysis—Key components of our results of operations—Revenue.”

Our technology

Our product is a technology platform that allows insurance carriers and distributors to acquire customers and optimize customer acquisition costs to align with expected customer LTV, in a single data-rich but user-friendly environment. Our technology is what enables our growth, scale, and operating leverage and differentiates us from our competitors. It is also what enables our partners to scale their customer acquisition and monetization, or both, efficiently and with minimal operating overhead. With over 79 million paid transactions on our platform in 2020, we believe we offer the largest source of Consumer Referrals in the insurance sector.

13

Our product is a robust and real-time customer acquisition and predictive analytics platform. It is fueled by rich, anonymized consumer data through extensive data integrations. At the heart of our platform is a set of proprietary predictive analytics algorithms that incorporate hundreds of variables to generate conversion probabilities for each unique consumer, enabling our partners to align customer acquisition costs with expected customer LTV across the platform.

Our platform architecture is elegant, scalable, and vertical agnostic, which has enabled us to innovate rapidly in our core insurance verticals and grow opportunistically across sectors with similarly attractive attributes. We continuously invest in our technology and believe that our focus on innovation enhances our competitive position.

We believe the following attributes collectively differentiate the MediaAlpha technology platform:

Multiple high-quality Consumer Referrals accessible through a single platform with transparent pricing and control. Most insurance carriers and distributors today have multiple sources for customer acquisition. These sources offer a wide range of Consumer Referral quality and, in most cases, must be managed manually and separately by insurance carriers. Our platform allows users to access multiple sources of Consumer Referrals made available by us transparently through a unified platform with a single sign-on, creating scale and operational efficiencies.

Proprietary user data integrated in a secure environment. Our platform allows buyers to fully integrate first-party consumer data to enhance targeting parameters, bidding granularity, and conversion tracking, resulting in more accurate customer acquisition and lifetime value predictions. We maintain robust data security protections and preserve the confidentiality of each insurance carrier’s customer acquisition strategy. We are able to seamlessly aggregate this data across all of our users to enhance our predictive analytics model while maintaining end-consumer confidentiality. We believe this has allowed us to continue strengthening our rich consumer database and analytics platform and maintain strong relationships with our partners.

Robust data science tools to optimize customer acquisition. Our unique search and conversion datasets enable automated, algorithmic customer acquisition optimizations. As our platform grows and processes more customer acquisition transactions, we gather more conversion data to further refine our predictive analytics algorithms. This further enhances our platform’s capability to predict our partners’ expected return per consumer and support more efficient customer acquisition strategies. We believe this creates a flywheel effect by which the attractiveness and value of our platform will grow as we continue to scale.

Self-service model. We offer a self-service model that empowers our partners to directly manage the buying and selling process independently. Supply partners can easily manage their digital consumer traffic on our platform, while demand partners can direct their consumer acquisition spend in real time with minimal involvement from our team. We believe this enables us to scale efficiently without requiring significant investments in sales and support functions.

Highly extensible and scalable platform. Our platform and industry-agnostic technology enables us to quickly expand our operations into existing and adjacent verticals with minimal investments. We have organically scaled the property & casualty insurance vertical and the health and life insurance verticals to $550 million and $218 million in Transaction Value for the twelve month period ended December 31, 2020, respectively. While our focus remains on insurance, we will continue to grow opportunistically in sectors with similar, attractive market fundamentals. We believe our proprietary technology will allow us to react nimbly to growing demands and opportunities in emerging verticals.

14

Our buyers: Our demand partners are insurance carriers and distributors looking to target high-intent consumers deep in their purchase journey. Repeat buyers continue to be a strong driver of our growth, with 96.7% of our Transaction Value for 2020 driven by repeat buyers from 2019 (with Transaction Value from such repeat buyers increasing 39.6% in 2020) and 96.8% of our Transaction Value for 2019 driven by repeat buyers from 2018. Annual spend per demand partner on our platform who contribute over $1 million in Transaction Value annually has continued to increase from $5.0 million in 2018 to $6.0 million in 2019 to $9.0 million for 2020.

Our value proposition for buyers

|

|

• |

Efficiency at scale. We believe we operate the insurance industry’s largest customer acquisition platform, delivering the volume insurance companies need to drive meaningful business results, while also providing precise targeting capabilities to ensure they connect with the right prospects. We believe this gives our demand partners the ability to realize greater efficiencies relative to other customer acquisition channels. |

|

|

• |

Granular and transparent control. Our platform allows for real-time, granular control and full-source transparency with every buying and pricing decision. We believe this gives our buyers the flexibility they need to realize favorable lifetime value relative to customer acquisition costs to maximize their revenue opportunities. |

|

|

• |

Unparalleled partnership. With a fully managed service option, custom integrations, and industry-leading technology, we are dedicated to providing long-term value to our buyers’ businesses. We have designed our platform to put the best interests of our partners first, fostering a healthy ecosystem within which buyers can transact with confidence. |

Our Sellers: Our supply partners use our platform to monetize their digital consumer traffic. Our supply partners are primarily insurance carriers looking to maximize the value of non-converting or low LTV consumers, and insurance-focused research destinations looking to monetize high-intent customers. Repeat sellers continue to be a strong driver of our growth, with 97.9% of our Transaction Value for 2020 driven by repeat sellers from 2019 (with Transaction Value from such repeat sellers increasing 73.2% in 2020) and 95.7% of our Transaction Value for 2019 driven by repeat sellers from 2018. Annual spend per supply partner on our platform who contribute over $1 million in Transaction Value annually has continued to increase from $6.5 million in 2018 to $7.8 million in 2019 and further to $11.9 million for 2020.

Our value proposition for sellers

|

|

• |

Yield maximization. Our proprietary technology platform provides sellers with a suite of optimization tools, as well as inventory and buyer management features that maximize competition for, and yield from, their high-intent consumers. |

|

|

• |

Predictive analytics. Through our platform’s advanced predictive analytics features, sellers can assess conversion probabilities and expected customer LTV for every consumer in real time. We believe the integration of these data science models with our sellers’ user experience decision engines is a unique differentiator of our business. |

|

|

• |

Real-time insights. We provide our sellers with unique data as to the type of consumer segments each buyer values. By providing in-depth reporting and real-time, granular insights, our sellers have the ability to continuously optimize their own customer acquisition and monetization decisions. |

15

Our End Consumers: Our end consumers are primarily high-intent, online insurance shoppers. Due to the broad participation of top-tier insurance carriers within our ecosystem, consumers are able to more efficiently navigate a range of options and offers relevant to their policy searches. Through December 31, 2020, an average of 31 million consumers shopped for insurance products monthly through the websites of sellers on our platform and our proprietary websites.

Our value proposition for end consumers

|

|

• |

Search relevancy. By enabling insurance carriers and distributors to apply sophisticated targeting, we facilitate the delivery of hyper-relevant product options to our end consumers based on consumer-provided demographics and other relevant characteristics. We believe this improves the overall research and purchase experience and allows our end consumers to make better real-time decisions. |

|

|

• |

Shopping efficiency. We facilitate access to the most relevant products for each respective end consumer, allowing for minimal research and maximum efficiency, through an omni-channel, seamless consumer platform experience. We enable consumers to comparison shop and interact with insurance carriers and distributors through multiple mediums, including directly online or offline. |

Our strengths

We believe that our competitive advantages are based on the following key strengths:

|

|

• |

Highly scalable, innovative technology platform with rich data. Our proprietary platform is built to be highly extensible and flexible, enabling us to quickly and efficiently develop custom solutions and tools to address the varying and evolving needs of our partners. Supported by our predictive analytics algorithms, our platform is able to provide continuous, real-time feedback and insights that buyers use to maximize the value of every consumer opportunity. Our deep data integrations allow our buyers to utilize millions of anonymized data points to target and acquire their desired customers with a unique level of precision and control. As of December 31, 2020, there were over 380 insurance supply partners on our platform. We also provide our supply partners with sophisticated, data-driven yield management and monetization capabilities. We believe these capabilities are critical to our partners’ monetization strategies, as they enable optimization of business performance and revenue. Our platform is vertical agnostic, allowing us to expand into new markets with attractive attributes. |

The increased participation in our technology-driven platform will continue to generate valuable data, enhance feedback loops, and drive stronger results for all participants in the ecosystem. We believe this creates a flywheel effect as our platform grows.

|

|

• |

Superior operating leverage. We designed our business to be highly scalable, driving sustainable long-term growth that delivers superior value to both demand and supply partners. Our technology enables us to grow in a highly capital efficient manner, with minimal need for working capital or capital expenditure investment. In 2020, we employed 100 individuals on average, who drove $815.7 million of Transaction Value ($8.2 million per employee), $10.6 million of net income ($0.1 million per employee), and $58.1 million of Adjusted EBITDA ($0.6 million per employee) and for 2019, we employed 81 individuals on average who drove $560.1 million of Transaction Value ($6.9 million per employee), $17.8 million of net income ($0.2 million per employee), and $42.9 million of Adjusted EBITDA ($0.5 million per employee) for the year, reflecting the high operating leverage of our platform. |

16

We believe the versatility and breadth of our offerings, coupled with our focus on high-quality products, provide significant value to insurance carriers and distributors, resulting in strong retention rates. As a result, many insurance carriers and distributors use our platform as their central hub for broadly managing digital customer acquisition and monetization.

Our relationships with our partners are deep, long standing, and involve the top-tier insurance carriers in the industry. In terms of buyers, 15 of the top 20 largest auto insurance carriers by customer acquisition spend are on our platform. In 2020, 96.7% of total Transaction Value executed on our platform came from demand partner relationships from 2019. In 2019, 96.8% of total Transaction Value executed on our platform came from demand partner relationships from 2018. Approximately half of our supply partners have been on our platform since 2016.

|

|

• |

Culture of transparency, innovation, and execution. Since inception, our co-founders have led with the vision of bringing unparalleled transparency and efficiency to the online customer acquisition ecosystem, executed through a powerful technology-enabled platform. Transparency is built into our platform and is at the heart of our culture, enabling us to focus on sustainable long-term success over near-term wins. We are relentless about continuous innovation and aim to use our platform to solve big industry-wide problems. We are data-driven and focused on delivering measurable results for our partners. We believe that our long-term vision, dedication to solving systemic problems in the industry, and our relentless drive to improve will continue to empower us to be the platform of choice for our partners. |

Our growth opportunities

We intend to grow our business through the following key areas:

|

|

• |

Increase Transaction Value from our partners. We aim to increase overall Transaction Value from our partners across our insurance verticals by continuously improving the volume and accuracy of customer conversion data, eliminating friction between consumer handoffs, and developing additional tools and features to increase engagement. We believe that providing our platform participants with better value and a larger selection of high-quality Consumer Referrals over time will lead to increased spending on our platform. |

|

|

• |

Improve ecosystem efficiency. We believe that traditional customer acquisition models are highly inefficient, charging platform users inflated prices while lacking the transparency and granularity to allow participants to reach end consumers effectively. We were founded to disrupt and address these systemic inefficiencies and will continue to do so by enhancing automated buying strategies and granular price discovery processes. We will continue to expand our platform and drive value for all participants within the ecosystem by increasing the data integration with our partners into our platform. |

|

|

• |

Bring new partners to our platform. There are potential buyers and sellers who are not yet using our platform. We intend to gain adoption of our platform with new insurance partners through business development, word-of-mouth referrals, and inbound inquiries. |

|

|

• |

Grow our product offerings. We are constantly exploring new ways to deliver value to our partners through development of new tools and services and improvement of our conversion analytics model. We believe that providing further customized solutions and higher touch services for our partners will enhance the stickiness of our offerings and drive more customer acquisition spend and users to our platform. |

17

|

|

• |

Expand into and scale new verticals. While we have primarily focused our efforts on growing our core insurance verticals, we continue to seek expansion opportunities in markets that share similar characteristics. For example, we entered the health insurance and life insurance markets in 2014 and were able to scale to $217.7 million and $157.2 million in Transaction Value for the twelve months ended December 31, 2020 and 2019, respectively, representing 38.5% and 38.2% year over year growth, respectively. We believe our vertical-agnostic platform and established playbook for entering new markets will allow us to capture attractive market opportunities effectively. |

Our competition

We operate in the broadly defined tech-enabled insurance distribution sector. We are part of a sector that is disrupting the conventional agent-based insurance distribution channels. This sector is comprised of companies engaged in varied aspects of customer acquisition. On one end of the spectrum, there are companies that are engaged in simple Consumer Referrals acquisition. These Consumer Referrals are delivered to the insurance carriers or distributors. On the other end of the spectrum, there are companies that acquire the customer through digital channels and take them through the entire needs-based assessment and policy application and submission process.

Within this sector, our closest competitors are technology companies engaged in digital customer acquisition. Traditional digital consumer acquisition models focus on serving buyers of Consumer Referrals by acquiring consumers on behalf of insurance carriers from paid search, proprietary websites or other digital avenues. Our model is different. We operate a transparent, results-driven platform where sophisticated demand and supply partners transact on high-quality Consumer Referrals. We compete on the basis of a number of factors, including return on investment, technology, and client service.

Our platform also offers DTC digital spend optimization capabilities that compete primarily with home grown systems that buyers use to aggregate multiple sources of digital customer acquisition. As the number of digital consumer acquisition sources grows, the complexity and cost of managing those sources continues to increase. As a result, we are seeing significant increases in the frequency and customer acquisition spend of participants on our platform, further enhancing our scale and return on investment to all our partners. We have deep integrations with our partners that cost time and money. We believe our growing scale makes it hard for new entrants to gain direct access to buyers and sellers and replicate what we have built over the years.

18

The protection of our technology, intellectual property and proprietary rights is an important aspect of our business. We rely on a combination of trade secret, trademark and copyright laws, confidentiality agreements, and technical measures to establish, maintain and protect our intellectual property rights and technology. Additionally, we enter into confidentiality and invention assignment agreements with our employees and enter into confidentiality agreements with third parties, including our buyers and sellers. However, our contractual provisions may not always be effective at preventing unauthorized parties from obtaining our intellectual property and proprietary technologies. Intellectual property laws, procedures, and restrictions provide only limited protection and any of our intellectual property or proprietary rights may be challenged, invalidated, circumvented, infringed, misappropriated or otherwise violated. Further, the laws of certain countries do not protect intellectual property or proprietary rights to the same extent as the laws of the U.S., and, therefore, in certain jurisdictions, we may be unable to protect our proprietary technology.

Our in-house know-how is an important element of our intellectual property. The development and management of our platform requires sophisticated coordination among many specialized employees. We believe that duplication of this coordination by competitors or individuals seeking to copy our platform would be difficult. The risk of a competitor effectively replicating the functionality of our platform is further mitigated by the fact that our service offerings are cloud-based such that most of the core technology operating on our systems is never exposed to a user or to our competitors. To protect our technology, we implement multiple layers of security. Access to our platform, other than to obtain basic information, requires system usernames and passwords. We also add additional layers of security such as dual-factor authentication, encryption in transit and intrusion detection. See “Risk factors—Risks related to our intellectual property rights and our technology.”

Seasonality

Our results are subject to significant seasonal fluctuations as a result of vertical level seasonality. Our property & casualty insurance vertical is characterized by seasonal weakness during our fourth quarter due to lower customer acquisition budgets from buyers and lower supply of Consumer Referrals during the holiday period. During our first quarter, our property & casualty insurance vertical exhibits seasonal strength as customer acquisition budgets from our buyers and Consumer Referral volume from our sellers, both increase to start the year. In 2020, we did not experience the typical seasonality curve in our property & causality insurance vertical, generating a record $122.9 million of revenue, a 96.9% increase over $62.4 million of revenue generated for the quarter ended December 31, 2019. The increased revenue was driven by increased year-end budget allocations from our buyers as they continued to shift budget to the direct-to-consumer channel and increased Consumer Referral volume from both new and existing supply partners to meet the demand.

Our health insurance vertical experiences seasonal strength during the fourth quarter due to a material increase in Consumer Referrals and a related increase in customer acquisition budgets in connection with the Medicare annual enrollment period, which typically runs from October 15 to December 7 each year, and the under-65 health insurance open enrollment period, which typically runs from November 1 through December 15 each year. This trend generally reverses for our health insurance vertical for the rest of the year with the end of the annual and open enrollment periods. The seasonal strength results in a corresponding build-up of accounts receivable related to our health insurance vertical as of year-end with cash realized during the subsequent first quarter.

Regulation

Various aspects of our business are, may become, or may be viewed by regulators from time to time as subject, directly or indirectly, to U.S. federal, state and foreign laws and regulations. We are subject to laws and regulations that apply to businesses in general, such as those relating to worker classification, employment, payments, worker confidentiality obligations, consumer protection and taxation. As an online business, we are also subject to laws and regulations governing the internet, such as those relating to intellectual property ownership and infringement, trade secrets, the distribution of electronic communications, search engines and internet tracking technologies, and could be affected by potential changes to laws and regulations that affect the growth, popularity or use of the internet, including with respect to net neutrality and taxation on the use of the internet or e-commerce transactions.

19

Because we collect, process, store, share, disclose, transfer and use consumer information and other data and engage in marketing and advertising activities via the phone, email and text messages, we are also subject to laws and regulations that address privacy, data protection and collection, storing, sharing, use, disclosure, retention, security, protection transfer and other processing of personal information and other data, including the California Online Privacy Protection Act, the CCPA, the Personal Information Protection and Electronic Documents Act, the CAN-SPAM Act, CASL, the TCPA, HIPPA, Section 5(c) of the Federal Trade Commission Act, the GDPR, supplemented by national laws (such as, in the United Kingdom, the Data Protection Act 2018) and further implemented through binding guidance from the European Data Protection Board, the EU’s e-Privacy Directive, which is expected to be replaced by the EU’s e-Privacy Regulation, which is still under development and will replace current national laws that implement the ePrivacy Directive. The burdens imposed by these and other laws and regulations that may be enacted, or new interpretation of existing laws and regulations, may require us to modify our data processing practices and policies and to incur substantial costs in order to comply. We take a variety of technical and organizational security measures and other measures to protect our data, including data pertaining to our end consumers, employees and business partners. Despite measures we put in place, we may be unable to anticipate or prevent unauthorized access to such data.

A substantial majority of the insurance carriers using our platform are property & casualty insurance carriers, health insurance carriers or life insurance carriers. As a result, we are indirectly affected by laws and regulations relating to the insurance and healthcare industries, both of which are heavily regulated. For example, the PPACA and related regulatory reforms have materially changed the regulation of health insurance. While it is difficult to determine the impact of potential reforms on our future business, it is possible that such changes in industry regulation could affect demand for our platform.

Because the laws and regulations governing the internet, privacy, data security, marketing, insurance and healthcare are constantly evolving and striving to keep pace with innovations in technology and media, it is possible that we may need to materially alter the way we conduct some parts of our business activities or be prohibited from conducting such activities altogether at some point in the future. See “Risk factors—Risks related to laws and regulation.”

Human Capital Resources

We are committed to attracting and retaining the brightest and best talent, so investing in human capital is critical to our success. The employee traits we value include hands-on work no matter what the experience level, intellectual curiosity, open-mindedness, growth mindset, and deeply caring about the quality of work. As of December 31, 2020, we had 117 employees. The human capital measures and objectives that we focus on in managing our business include employee safety, talent acquisition and retention, employee engagement, development and training, diversity and inclusion, and compensation and pay equity. None of our employees are represented by a collective bargaining unit or are a party to a collective bargaining agreement.

Employee Engagement and Development

Our employee engagement efforts include our frequent and transparent “all-hands” meetings and executive communications, through which we aim to keep our employees well-informed and to increase transparency. We believe in continual improvement and use employee feedback to drive and improve processes that support our customers and ensure a deep understanding of our employees' needs. We conduct annual confidential employee surveys and believe that ongoing performance feedback encourages greater engagement in our business and improves individual performance. Each quarter, our employees participate in a 360-degree evaluation process to identify critical capabilities for development and establish new stretch goals.

We seek to achieve our business objectives through a deep commitment to talent development. Our talent development efforts include quarterly goals weekly “lunch and learn,” individualized professional development plans, management training, internal workshops, quarterly guest speakers, and quarterly book clubs related to enhancing business skills.

Objectives and Key Results are used to drive MediaAlpha’s business strategy. All our teams participate in an annual strategic planning process to identify objectives for business growth and innovation. Our teams and employees set goals quarterly to achieve the company’s annual objectives.

20

Our employee compensation strategy supports three primary objectives: attract and retain the best team members, reflect and reinforce our most important values, and align team member interests with shareholder interests in building enduring value. We believe people should be paid for what they do and how they do it, regardless of their gender, race, or other personal characteristics. To deliver on that commitment, we benchmark and set pay ranges based on market data and consider factors such as an employee’s role and experience, the location of their job, and their performance. We also regularly review our compensation practices, both in terms of our overall workforce and individual employees, to ensure our pay is fair and equitable.

COVID-19 and Employee Safety

During the COVID-19 pandemic, our primary focus has been on the safety and well-being of our employees and their families. Our pandemic efforts include leveraging the advice and recommendations of infectious disease experts to establish proper safety standards and secure appropriate levels of personal protective equipment. Our offices continue to be closed due to the pandemic. As our employees continue to work remotely, we offer benefits such as internet reimbursement, office supply purchasing, flexible work schedules, and access to other tools and supplies to enhance productivity and ease the stress of working from home.

Available Information

We file with the SEC Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") with the SEC. The SEC maintains an Internet website that contains reports, proxy, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our internet website address is https://mediaalpha.com/. We make available on our internet website, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Risks related to our business and industry

Our business is dependent on our relationships with our partners using our platform, many of which have no long-term contractual commitments with us. If demand partners stop purchasing Consumer Referrals on our platform, if supply partners stop making Consumer Referrals available on our platform, or if we are unable to establish and maintain new relationships with demand or supply partners on our platform, our business, financial condition, operating results, cash flows, and prospects could be materially and adversely affected.

A substantial majority of our revenue is derived from sales of Consumer Referrals to demand partners on our platform. Our relationships with such demand partners are dependent on our ability to make available on our platform quality Consumer Referrals at attractive volumes and prices, which in turn depends on our relationship with our supply partners. If demand partners are not able to acquire their preferred Consumer Referrals on our platform, they may stop purchasing on our platform. If demand partners are not able to reach desired consumer segments precisely or do not maximize return on customer acquisition spend, they may stop using our platform.

Supply partners use our platform to optimize consumer conversions while minimizing customer acquisition costs. If supply partners are not able to obtain the best yield on their traffic using our platform, they may stop using our platform to make their Consumer Referrals available.

The majority of our partners can stop using our platform at any time with no notice. Many of our agreements with our partners have no fixed term and are cancellable upon 30 or 60 days’ notice. Furthermore, the agreements with our partners do not require that such partners transact a minimum amount on our platform. As a result, we cannot guarantee that our partners will continue to work with us, or, if they do, the amount of Consumer Referrals demand partners will purchase or the amount of Consumer Referrals supply partners will make available on our platform.

21

If a partner is not satisfied with our platform, it could cause us to lose our relationship with them. In addition to a loss of revenue, this may produce publicity that could hurt our reputation and adversely affect our ability to retain business or secure new business with other partners. The success of our platform depends on both our supply partners making available a robust supply of Consumer Referrals and our demand partners’ willingness to pay to purchase such Consumer Referrals. Accordingly, the loss of a supply partner’s traffic could affect our ability to provide a sufficient supply of Consumer Referrals for demand partners to acquire. In turn, the loss of a demand partner’s purchasing power on our platform could decrease the payouts to supply partners, which could decrease our supply of Consumer Referrals.

We may decide to terminate our relationship with a partner for a number of reasons and at any time. For example, in October 2020, we terminated our relationship with a supply partner that represented approximately 2% of revenue for the year ended December 31, 2020. The termination of our relationship with a partner could reduce the number of demand partners seeking to purchase Consumer Referrals and supply partners seeking to sell their Consumer Referrals to our platform. In connection with such a termination, we would lose a source of Transaction Value and fees for future sales. Our business, financial condition, operating results, cash flows, and prospects could also be harmed if in the future we fail to develop new partner relationships.

We depend on a small group of insurance carriers for a substantial portion of our business. Changes in our relationships with these insurance carriers may adversely affect our business, financial condition, operating results, cash flows, and prospects.

We derive a large portion of our revenue from a limited number of insurance carriers. For example, Progressive, which is both a buyer and seller on our platform, accounted for 23% of revenue for the year ended December 31, 2020. Customer concentration for the year ended December 31, 2020 and 2019 consisted of one customer that accounted for approximately $132.3 million and $78.8 million, or 23% and 19%, of revenue, respectively. Our two largest customers accounted for approximately $23.7 million and $9.8 million, or 24% and 10%, respectively, of the Company’s accounts receivable as of December 31, 2020 compared to one customer for approximately $4.7 million, or 8%, as of December 31, 2019. Many of our agreements with insurance carriers do not require minimum transaction volume commitments on our platform and, accordingly, our demand partners can reduce or eliminate their purchasing on our platform at any time. In addition, many of our agreements with insurance carriers are terminable by the insurance carriers without cause upon 30 or 60 days’ notice. Should we become dependent on fewer insurance partner relationships (whether as a result of the termination of existing relationships, insurance carrier consolidation or otherwise), we may become more vulnerable to adverse changes in our relationships with insurance carriers, which in turn could harm our business, financial condition, operating results, cash flows, and prospects.

Our business is substantially dependent on revenue from property & casualty insurance, health insurance, and life insurance carriers and subject to risks related to such industries in which our partners operate.

A substantial majority of the insurance carriers using our platform are property & casualty insurance carriers, health insurance carriers, and life insurance carriers. Revenue from property & casualty insurance carriers, health insurance carriers, and life insurance carriers accounted for 97.1% and 87.4% of our total revenue for the year ended December 31, 2020 and 2019, respectively. If insurance carriers experience large or unexpected losses through the offering of insurance, these carriers may choose to decrease the amount of money they spend on customer acquisition, including with us.

In addition, we are dependent upon the economic success of the automobile, home, and healthcare industries. Decreases in consumer demand generally in such underlying industries could adversely affect the demand for property & casualty insurance, health insurance, and life insurance and, in turn, the number of Consumer Referrals available on our platform. In addition, consumer spending on automobile, home, and healthcare products generally declines during recessionary periods and other periods in which disposable income is adversely affected and may be affected by negative trends in the broader economy, including the cost of energy and gasoline, the availability and cost of credit, reductions in business and consumer confidence, stock market volatility and increased unemployment. Downturns in any of these underlying industries, which could be caused by a downturn in the economy at large, could materially and adversely affect our business, financial condition, operating results, cash flows, and prospects.

22

Our partners may negotiate with us to reduce our platform fees, which could harm our business, financial condition, operating results, cash flows, and prospects.

Many of the terms of our agreements with our partners, including our platform fees, are specifically negotiated with each partner. Our partners may negotiate with us to reduce our platform fees. The outcome of such negotiations could result in terms that are less favorable to us than those contained in our existing agreements or those obtained by our competitors, which could impact our relationship with our partners and could harm our business, financial condition, operating results, cash flows, and prospects.

Demand partners who access our platform can attract consumers directly through their own customer acquisition strategies, including third-party online platforms and other traditional methods of distribution, or obtain similar services from our competitors. Similarly, supply partners can seek to monetize high-intent consumers or maximize the value of non-converting consumers on their websites by building their own solutions or turning to other service providers or our competitors.