As filed with the Securities and Exchange Commission on January 18, 2024

Registration No. 333-275761

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chief Executive Officer

EzFill Holdings, Inc.

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gregory Sichenzia, Esq. | Mitchell S. Nussbaum, Esq. | |

| Jeff Cahlon, Esq. | Norwood P. Beveridge, Esq. | |

| Sichenzia Ross Ference Carmel LLP | Lili Taheri, Esq. | |

| 1185 Avenue of the Americas | Loeb & Loeb LLP | |

| New York, New York 10036 | 345 Park Avenue | |

| Tel: (212) 930-9700 | New York, New York 10154 | |

| Tel: (212) 407-4000 |

(Approximate date of commencement of proposed sale to the public)

As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

Smaller

reporting company | ||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION | DATED JANUARY 18, 2024 |

10,135,135 Shares

Common Stock

EzFill Holdings, Inc.

This is a firm commitment public offering of our common stock. We have assumed a public offering price of $1.48 per share, based on the last reported sale price of our common stock on January 12, 2024.

Our common stock is listed on the Nasdaq Capital Market under the symbol “EZFL”. On January 12, 2024, the last reported sales price of our common stock on Nasdaq was $1.48 per share.

The final public offering price of the shares of common stock in this offering will be determined through negotiation between us and the representative of the underwriters in the offering and the recent market price used throughout this prospectus may not be indicative of the final offering price.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of this prospectus, and under similar headings in any amendments or supplements to this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to ThinkEquity LLC, the representative of the underwriters (the “Representative”). See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 45 day option to the Representative to purchase a maximum of 1,520,270 additional shares of common stock at the public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the securities to purchasers in the offering on or about , 2024.

ThinkEquity

The date of this prospectus is , 2024

TABLE OF CONTENTS

| i |

We use our registered trademark, EzFill, in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with any information other than that contained in this prospectus. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not, and the underwriter is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not, and the underwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby the distribution of this prospectus outside the United States.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Information contained in, and that can be accessed through, our web site www. https://ezfl.com/ shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the shares offered hereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements reflect our current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements.

| ii |

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the following summary together with the more detailed information regarding us and our common stock being sold in the offering, including the risks of investing in our common stock discussed under “Risk Factors,” beginning on page 5 and our historical and pro forma condensed combined financial statements and the related notes appearing elsewhere in this prospectus, before making an investment decision. For convenience, in this prospectus, unless the context suggests otherwise, the terms “we,” “our,” “our company,” “Company” and “us” and “EzFill” refer to EzFill Holdings Inc., a Delaware corporation.

Overview

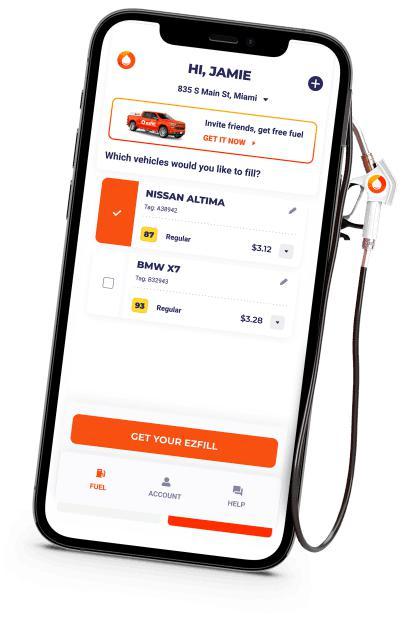

EzFill is a leading app-based mobile-fueling company based in South Florida and the only company which provides fuel-delivery ‘on-demand’ or ‘in subscription’ to customers in three verticals – CONSUMER, COMMERCIAL and SPECIALTY. We are capitalizing on the ever-increasing trend in ‘at home’ or ‘at work’ delivery of products to enable this convenience in the $500 B (according to market estimates) market segment of fueling services. We believe consumers and commerce’s pain points in the time, risk and costs of fueling at stations can be resolved by our on-demand and subscription-based fuel delivery services.

Our app-based interface provides customers the ability to select the time and location of their fueling needs, whether their service request is ‘on demand’ or structured within routine delivery schedules based on their fuel consumption patterns. We streamline our logistics and fuel purchasing with proprietary, backend software which manages customer accounts and mobilizes our fleet of almost 40 delivery trucks. The Company plans to acquire additional trucks to the extent supported by business growth and available resources. We are able to achieve volume discounted truckloads of fuel at depots, with subsequent delivery of this fuel to customers at home, work or business locations using our team of trained and certified drivers. We have a strong foothold in the South Florida market and are currently the dominant player in the area. We our open in West Palm Beach, Jacksonville, Orlando and Tampa, with a plan to continue growing strategically in major metros and metropolitan statistical areas (“MSAs”) in Florida and eventually other states.

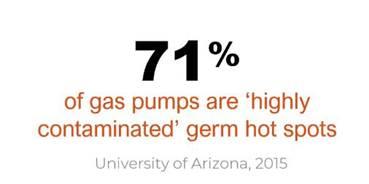

We have begun to disrupt the gas station fueling model by providing consumers and businesses the convenience of gas fueling services brought directly to their locations. EzFill provides a safe, convenient and touch-free way for consumers to fuel their cars. For our commercial and specialty customers, at-site delivery of fuel during the down-times of their vehicles provides operators the benefit of beginning their daily operations with fully-fueled vehicles at cost-savings versus traditional fueling options.

On August 10, 2023, the Company, the members (the “Members”) of Next Charging LLC (“Next Charging”) and Michael Farkas, as the representative of the Members, entered into an exchange agreement, and on November 2, 2023, the Members, Next Charging, and Mr. Farkas entered into an amended and restated exchange agreement (as amended and restated, the “Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members 100% of the membership interests of Next Charging (the “Membership Interests”) in exchange for the issuance (the “Share Exchange”) by the Company to the Members of an aggregate of 100 million shares of common stock of the Company. In the event Next Charging completes the acquisition of the acquisition target as set forth in the Exchange Agreement’s disclosure schedules (directly or indirectly through Next Charging or through a subsidiary of Next Charging) prior to the Closing, then 70,000,000 shares will vest on the closing date, and the remaining 30,000,000 shares will be subject to vesting or forfeiture. In the event Next Charging does not complete such acquisition prior to the closing, then 35,000,000 shares will vest on the closing date, and the remaining 65,000,000 shares will be subject to vesting or forfeiture (such shares subject to vesting or forfeiture, the “Restricted Shares”).

The Restricted Shares will vest, if at all, according to the following schedule:

(1) In the event Next Charging does not complete the acquisition of the acquisition target as set forth in the Exchange Agreement’s disclosure schedules (directly or indirectly through Next Charging or through a subsidiary of Next Charging) prior to the closing, then 35,000,000 of the Restricted Shares will vest upon the Company (directly or indirectly through Next Charging or a subsidiary of Next Charging), completing the acquisition of such acquisition target. In the event that Mr. Farkas determines that such an acquisition target is not capable of being acquired, either prior to or after the closing, then the Mr. Farkas and the Company will negotiate in good faith to determine a replacement acquisition target, which replacement would thereafter be considered as the acquisition target under the Exchange Agreement; and

| 1 |

(2) 30,000,000 Restricted Shares will vest upon the Company commercially deploying the third solar, wireless electric vehicle charging, microgrid, and/or battery storage system (such systems as more specifically defined under the Exchange Agreement).

As an additional condition to be satisfied prior to the closing, Next Charging is also required to take actions to record the assignment to itself of a patent mentioned in the Exchange Agreement.

Mr. Farkas is the managing member of Next Charging and (as of November 2, 2023) has also lent sums amounting to $2,934,650 through issuance of 15 promissory notes to Next Charging. Mr. Farkas is also the beneficial owner of approximately 20% of the Company’s issued and outstanding common stock. At closing, the Company has agreed to appoint Mr. Farkas to the board of directors as Executive Chairman and to appoint him Chief Executive Officer of the Company. The closing of the transactions contemplated under the Exchange Agreement are subject to certain customary closing conditions, including (i) that the Company file a Certificate of Amendment with the Secretary of State of the State of Delaware to increase its authorized common stock from 50 million shares to 500 million shares (ii) the receipt of the requisite third-party consents, and (iii) compliance with the rules and regulations of The Nasdaq Stock Market (“Nasdaq”), which includes the filing of an Initial Listing Application with Nasdaq and approval of such application by Nasdaq. In addition, while the stockholders of the Company have provided written consent approving the Exchange Agreement in November 2023, the effectiveness of such written consent is dependent upon the dissemination of a definitive Information Statement on Schedule 14C, which we anticipate completing in January 2024. Upon consummation of the transactions contemplated by the Exchange Agreement, Next Charging will become a wholly-owned subsidiary of the Company.

Next Charging is a renewable energy company formed by Michael D. Farkas. Next Charging is a development stage enterprise which has plans to develop and deploy wireless electric vehicle charging technology coupled with battery storage and solar energy solutions. In furtherance of this objective, in November 2023 Next Charging (through its controlled entity NextNRG, LLC) entered into a stock purchase agreement to acquire STAT-EI, Inc. (“SEI”), a development stage enterprise party to certain licenses from the Florida International University Board of Trustees and Florida International University to develop certain smart microgrid and wireless charging technologies for a purchase price of $5.5 million in cash. The licenses held by SEI are exclusive and worldwide, and require milestone payments of $75,000 upon the achievement of $2.0 million in net revenues and an annual royalty payment of $50,000 in 2024, $60,000 in 2025 and $75,000 for each year thereafter (in the case of microgrid technologies) and $40,000 in 2024, $50,000 in 2025 and $60,000 for each year thereafter (in the case of the wireless charging technologies), subject to the receipt of change of control fee ($350,000 in the case of microgrid technologies and $300,000 in the case of the wireless charging technologies) in each case payable upon the acquisition of SEI by Next Charging. We anticipate that Next Charging’s acquisition of SEI will close prior to this offering and that the acquisition of SEI will be accounted for as an asset acquisition because substantially all of the fair value of the gross assets being acquired will consist of license agreements and the acquisition will include only inputs with no substantiative process that significantly contributes to the ability to create outputs. Further, while there is no guarantee that the transaction will close, or that the combined entities (including SEI) will be successful, if the transaction closes, we believe EzFill is poised to become the touchless fueling provider for all types of vehicles, both internal combustion and electric.

As used in this prospectus, references to Next Charging following our acquisition thereof include SEI unless otherwise indicated.

The Share Exchange, if it is completed, will result in substantial dilution to our shareholders See “Risk Factors—Risks Related to the Pending Acquisition of Next Charging.”

Risks Associated With Our Business and This Offering

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include, but are not limited to:

| ● | The occurrence of an uncontrolled event, such as the Covid-19 pandemic, is likely to negatively affect our operations. | |

| ● | We will require substantial additional capital to support our operations and growth plans, and such capital may not be available on terms acceptable to us, if at all. This could hamper our growth and adversely affect our business. | |

| ● | Operating and litigation risks may not be covered by insurance. | |

| ● | Future climate change laws and regulations and the market response to these changes may negatively impact our operations. | |

| ● | The Share Exchange, if completed, will result in significant dilution to the Company’s stockholders. | |

| ● | High fuel prices can lead to customer conservation and attrition, resulting in reduced demand for our product. | |

| ● | Low fuel prices may also impact our profitability. | |

| ● | The concentration of sales in certain large customers could result in significantly lower future revenue. | |

| ● | Changes in commodity market prices may have a negative effect on our liquidity. | |

| ● | The decline of the retail fuel market may impact our potential to get new customers. |

| 2 |

| ● | Competition in the mobile fuel delivery industry may negatively impact our operations. | |

| ● | Our auditors have issued a going concern opinion on our financial statements. | |

| ● | Our current dependence on a small number of fuel suppliers increases our risk of an interruption in fuel supply, impacting our operations. | |

| ● | Local governments may make and enforce laws and regulations that ban mobile fuel delivery. | |

| ● | The Company’s common stock is concentrated in a small number of shareholders. | |

| ● | Additional stock offerings in the future may dilute your percentage ownership of our company. |

JOBS Act

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act, which such fifth anniversary will occur in 2026. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and, as long as we continue to qualify as an emerging growth company, we may elect to take advantage of this and other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We are also a “smaller reporting company,” as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and also are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our shares held by non-affiliates equals or exceeds $250 million as of the prior June 30th and our annual revenues equaled or exceeded $100 million during such completed fiscal year, or (2) the market value of our shares held by non-affiliates equals or exceeds $700 million as of the prior June 30th, regardless of our annual revenues during such completed fiscal year. Such reduced disclosure and corporate governance obligations may make it more challenging for investors to analyze our results of operations and financial prospects.

| 3 |

THE OFFERING

| Issuer | EzFill Holdings, Inc. | |

Common stock offered by us |

10,135,135 shares | |

| Over-allotment option | We have granted a 45-day option to the representative of the underwriters to purchase a maximum of 1,520,270 additional shares of common stock (15% of the shares of common stock sold in this offering). | |

| Common stock to be outstanding immediately after this offering | 14,651,666 shares (or 16,171,936 shares if the underwriter exercises in full its option to purchase additional shares of common stock). | |

Use of proceeds

|

We intend to use the net proceeds from this offering for acquisitions, debt repayment, and general corporate purposes, including working capital. See “Use of Proceeds” on page 14. | |

| Lock-up | We, our more than 5% stockholders and all of our directors and executive officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of six months, with respect to our officers and directors, and three months, with respect to us and such stockholders, commencing on the date of this prospectus. See “Underwriting” beginning on page 56. | |

| Risk factors | This investment involves a high degree of risk. You should read the description of risks set forth under “Risk Factors” beginning on page 5 of this prospectus for a discussion of factors to consider before deciding to purchase our securities. | |

| Market | Our shares are listed on the Nasdaq Capital Market under the symbol “EZFL”. |

The number of shares of common stock shown above to be outstanding after this offering is based on 4,516,531 shares outstanding as of January 12, 2024 and excludes:

| ● | up to 100 million shares issuable pursuant to the Exchange Agreement, of which 35-65 million will be vested upon the achievement of future milestones; |

| ● | warrants to purchase 203,629 shares of common stock at a weighted average exercise price of $4.15; |

| ● | 439,845 shares reserved for future issuance under our 2023 Equity Incentive Plan; and |

| ● | Warrants to purchase 506,757 shares of common stock at an exercise price of $1.85, 125% of the offering price, to be issued to the Representative or its designees in this offering. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares of common stock or the exercise of any Representative Warrants.

| 4 |

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section of this document entitled “Information Regarding Forward Looking Statements.”

Our business, financial condition or operating results could be materially adversely affected by any of these risks. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in our securities.

Risks Related to Our Business

We will require substantial additional capital to support our operations and growth plans, and such capital may not be available on terms acceptable to us, if at all. This could hamper our growth and adversely affect our business.

Revenues generated from our operations are not presently sufficient to sustain our operations and our current liabilities substantially exceeded our current assets as of September 30, 2023. Therefore, we will need to raise additional capital in the future to continue our operations. We anticipate that our principal sources of liquidity will only be sufficient to fund our activities through January 1, 2024. In order to have sufficient cash to fund our operations beyond January 1, 2024, we will need to raise additional equity or debt capital. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. We will be required to pursue sources of additional capital through various means, including debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition. Our ability to obtain needed financing may be impaired by such factors as the capital markets and our history of losses, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to curtail or cease operations.

Uncertain geopolitical conditions could adversely affect our results of operations.

Uncertain geopolitical conditions, including the war in Israel and invasion of Ukraine, sanctions, and other potential impacts on this region’s economic environment and currencies, may cause demand for our products and services to be volatile, cause abrupt changes in our customers’ buying patterns, and interrupt our ability to supply products or limit customers’ access to financial resources and ability to satisfy obligations to us. Specifically, terrorist attacks, the outbreak of war, or the existence of international hostilities could damage the world economy, adversely affect the availability of and demand for crude oil and petroleum products and adversely affect both the price of our fuel and our ability to obtain fuel.

Operating and litigation risks may not be covered by insurance.

Our operations are subject to all of the operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing combustible liquids such as gasoline for use by consumers. These risks could result in substantial losses due to personal injury and/or loss of life, and severe damage to and destruction of property and equipment arising from explosions and other catastrophic events, including acts of terrorism. Additionally, environmental contamination could result in future legal proceedings. There can be no assurance that our insurance coverage will be adequate to protect us from all material expenses related to pending and future claims or that such levels of insurance would be available in the future at economical prices. Moreover, defense and settlement costs may be substantial, even with respect to claims and investigations that have no merit. If we cannot resolve these matters favorably, our business, financial condition, results of operations and future prospects may be materially adversely affected.

Future climate change laws and regulations and the market response to these changes may negatively impact our operations.

Increased regulation of greenhouse (GHG) emissions, from products such as petroleum and diesel, could impose significant additional costs on us, our suppliers, and our customers. Some states have adopted laws and regulations regulating the emission of GHGs for some industry sectors. Mandatory reporting by our customers and suppliers could have an effect on our operations or financial condition.

The adoption of additional federal or state climate change legislation or regulatory programs to reduce emissions of GHGs could also require us or our suppliers to incur increased capital and operating costs, with resulting impact on product price and demand. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv)the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance. At this time, we cannot predict the effect that climate change regulation may have on our business, financial condition or operations in the future.

| 5 |

Our auditors have included an explanatory paragraph in their opinion regarding our ability to continue as a going concern. If we are unable to continue as a going concern, our securities will have little or no value.

M&K CPA’s, PLLC, our independent registered public accounting firm for the fiscal year ended December 31, 2022, has included an explanatory paragraph in their opinion that accompanies our audited consolidated financial statements as of and for the year ended December 31, 2022, indicating that our current liquidity position raises substantial doubt about our ability to continue as a going concern. If we are unable to improve our liquidity position, we may not be able to continue as a going concern.

We anticipate that we will continue to generate operating losses and use cash in operations through the foreseeable future. As further set forth above, we anticipate that we will need significant additional capital by January 1, 2024, or we may be required to curtail or cease operations.

If we are unable to protect our information technology systems against service interruption, misappropriation of data, or breaches of security resulting from cyber security attacks or other events, or we encounter other unforeseen difficulties in the operation of our information technology systems, our operations could be disrupted, our business and reputation may suffer, and our internal controls could be adversely affected.

In the ordinary course of business, we rely on information technology systems, including the Internet and third-party hosted services, to support a variety of business processes and activities and to store sensitive data, including (i) intellectual property, (ii) our proprietary business information and that of our suppliers and business partners, (iii) personally identifiable information of our customers and employees, and (iv) data with respect to invoicing and the collection of payments, accounting, procurement, and supply chain activities. In addition, we rely on our information technology systems to process financial information and results of operations for internal reporting purposes and to comply with financial reporting, legal, and tax requirements. Despite our security measures, our information technology systems may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, sabotage, or other disruptions. A loss of our information technology systems, or temporary interruptions in the operation of our information technology systems, misappropriation of data, or breaches of security could have a material adverse effect on our business, financial condition, results of operations, and reputation.

Moreover, the efficient execution of our business is dependent upon the proper functioning of our internal systems. Any significant failure or malfunction of this information technology system may result in disruptions of our operations. Our results of operations could be adversely affected if we encounter unforeseen problems with respect to the operation of this system.

High fuel prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Prices for fuel are subject to volatile fluctuations in response to changes in supply and other market conditions. During periods of high fuel costs our prices generally increase. High prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Low fuel prices may also result in less demand for our product.

Low fuel prices may lead to us being unable to attract customers due to the fact that we charge a delivery price that may make our pricing less competitive.

| 6 |

Changes in commodity market prices may have a negative effect on our gross margin.

Our current fuel supplier agreements set terms and establishes formulas based on Oil Price Information Service (OPIS) pricing as of the time of wholesale acquisition, and we do not store inventory. OPIS is a leading source for worldwide petroleum pricing. There is a mark-up for retail fuel prices above wholesale cost, per standard practice in the retail fuel distribution model. Cost of goods sold includes direct labor, including drivers. Our gross margin as a percentage of revenue decreases as a result of increase in fuel costs.

The decline of the retail fuel market may impact our potential to get new customers.

The retail gasoline industry has been declining over the past several years, with no or modest growth or decline in total demand foreseen in the next several years. Accordingly, we expect that year-to-year industry volumes will be principally affected by weather patterns. Therefore, our ability to grow within the industry is dependent on our ability to acquire other retail distributors and to achieve internal growth, which includes the success of our sales and marketing programs designed to attract and retain customers. Any failure to retain and grow our customer base would have an adverse effect on our results.

Competition in the fuel delivery industry may negatively impact our operations.

We compete with other mobile fuel delivery companies nationwide. There is little to no barrier to entry and therefore, our competition in the industry may grow. Our ability to compete in our current markets and expand to new markets may be negatively impacted by our competitors’ successes. Additionally, fuel competes with other sources of energy, some of which are less costly on an equivalent energy basis. In addition, we cannot predict the effect that the development of alternative energy sources might have on our operations. We compete for customers against suppliers of electricity. Electricity is becoming a competitor of fuel. The convenience and efficiency of electricity make it an attractive energy source for vehicle drivers. The expansion of the electric vehicle industry may have a negative impact on our customer base.

Our trucks transport hazardous flammable fuel, which may cause environmental damage and liability to us.

Due to the hazardous nature and flammability of our product, we face the risk of a simple accident causing serious damage to life and property. Additionally, a spill of our product may result in environmental damage, the liability for which our Company may not be able to overcome. If we are involved in a spill, leak, fire, explosion or other accident involving hazardous substances or if there are releases of fuel or fuel products we own or are transporting, our operations could be disrupted and we could be subject to material liabilities, such as the cost of investigating and remediating contaminated properties or claims by customers, employees or others who may have been injured, or whose property may have been damaged. These liabilities, to the extent not covered by insurance, could have a material adverse effect on our business, financial condition and results of operations. Some environmental laws impose strict liability, which means we could have liability without regard to whether we were negligent or at fault.

In addition, compliance with existing and future environmental laws regulating fuel storage terminals, fuel delivery vessels and/or storage tanks that we own or operate may require significant capital expenditures and increased operating and maintenance costs. The remediation and other costs required to clean up or treat contaminated sites could be substantial and may not be covered by insurance.

Our cash flow and net income may decrease if we are forced to comply with new governmental regulation surrounding the transportation of fuel.

We are subject to various federal, state, and local safety, health, transportation, and environmental laws and regulations governing the storage, distribution, and transportation of fuel. It is possible we will incur increased costs as a result of complying with new safety, health, transportation and environmental regulations and such costs will reduce our net income. It is also possible that material environmental liabilities will be incurred, including those relating to claims for damages to property and persons.

| 7 |

Our current dependence on a single fuel supplier increases our risk of an interruption in fuel supply, impacting our operations.

Although we are in the process of establishing other sources, we currently purchase almost all of our fuel needs from two principal suppliers in Florida. We do not have a written agreement with the largest supplier, and as such, if fuel from this source was interrupted, the cost of procuring replacement fuel and transporting that fuel from alternative locations might be materially higher and, at least on a short-term basis, our earnings could be negatively affected. This supplier is also a shareholder in the Company.

Our profitability is subject to fuel pricing and inventory risk.

The retail fuel business is a “margin-based” business in which gross profits are dependent upon the excess of the sales price over the fuel supply costs. Fuel is a commodity, and, as such, its unit price is subject to volatile fluctuations in response to changes in supply or other market conditions. We have no control over supplies, commodity prices or market conditions. Consequently, the unit price of the fuel that we and other marketers purchase can change rapidly over a short period of time, including daily.

Loss of a major customer could result in a decrease in our future sales and earnings.

In any given quarter or year, sales of our products may be concentrated in a few major customers. We anticipate that a limited number of customers in any given period may account for a substantial portion of our total net revenue for the foreseeable future. The business risks associated with this concentration, including increased credit risks for these and other customers and the possibility of related bad debt write-offs, could negatively affect our margins and profits. Additionally, the Company does not have any long-term agreements with its customers. All customer agreements are cancelable at any time by either party and as such there cannot be any assurance that any customer will continue to use the Company’s services. The loss of a major customer, whether through competition or consolidation, or a termination in sales to any major customer, could result in a decrease of our future sales and earnings.

We operate in a new industry segment and may be subject to new and existing laws, regulations and oversight

The Company operates in a new industry segment, on-demand mobile fuel delivery, in which new state and local law adoptions are occurring. Effective December 31, 2020, Florida adopted Florida Fire Prevention Code (“Code”) Section 42.12 recognizing and setting various requirements for the consumer on-demand mobile fuel delivery business. Permitting authority is contemplated under an “Authority Having Jurisdiction” (“AHJ”). Other pre-existing Code provisions similarly contemplate AHJ permitting for commercial mobile fueling. Miami-Dade County, where most of our business is conducted adopted the Code by reference. Unlike some other states and counties, neither Florida nor Miami-Dade County have designated an AHJ for mobile fueling. Miami-Dade’s extensive permitting and fee schedule does not contemplate or assert permitting authority over mobile fueling, consumer or commercial. We may be subject to oversight, including audits, in existing or future areas of operation. If we cannot comply with the Code, or County, State or Federal rules and regulations or the laws, rules and regulations or oversight in areas in which we currently operate or may seek to operate, we could lose the ability to service those areas and our earnings could be affected.

Our License Agreement with Fuel Butler may be terminated and as such our expansion plans into the state of New York may be delayed

On April 7, 2021, the Company entered into a Technology License Agreement with Fuel Butler LLC (“Technology Agreement”). Under the Technology Agreement, the Company licensed proprietary technology that the Company believes will allow the Company to provide its fuel service in high density areas like New York City. Fuel Butler has delivered a purported notice of termination of the Technology Agreement based on certain alleged breaches arising from our failure to issue equity securities to Fuel Butler. We have been in communications with Fuel Butler regarding the termination of the Technology Agreement and continue to believe that the Company is in compliance with the Technology Agreement and that the Technology Agreement continues to be in force. While we contest Fuel Butler’s claims of breach and contend that in fact Fuel Butler is in breach, we have communicated to Fuel Butler that we wish to terminate the Technology Agreement. We have sent a proposal to Fuel Butler whereby we will cease utilizing the Technology and Fuel Butler will return any shares it received under the Technology Agreement. However, to date, the Company has not had further communications with Fuel Butler regarding this matter. Currently, the Company does not expect to expand into the state of New York for the foreseeable future.

| 8 |

Risks Related to the Pending Acquisition of Next Charging

Neither the Company’s board of directors nor any committee thereof obtained a fairness opinion (or any similar report or appraisal) in determining whether or not to pursue the acquisition of Next Charging, which is owned by the Company’s largest shareholder. Consequently, you have no assurance from an independent source that the price the Company is paying for Next Charging is fair to the Company — and, by extension, its securityholders — from a financial point of view.

Neither the Company’s board of directors nor any committee thereof is required to obtain an opinion (or any similar report) from an independent investment banking or accounting firm that the price that the Company is paying for Next Charging is fair to the Company from a financial point of view, although pursuant to Nasdaq Rule 5630 the Company is required to conduct an appropriate review and oversight of all related party transactions for potential conflict of interest situations on an ongoing basis by the Company’s audit committee or another independent body of the board of directors. In analyzing the acquisition of Next Charging, the Company’s board of directors reviewed summaries of due diligence results and financial analyses prepared by management. The Company’s board of directors also consulted with legal counsel and with the Company management and considered a number of factors, uncertainty and risks and concluded that the acquisition of Next Charging was in the best interest of the Company’s stockholders. The Company’s board of directors believes that because of the professional experience and background of its directors, it was qualified to conclude that the acquisition of Next Charging was fair from a financial perspective to its stockholders. Accordingly, investors will be relying solely on the judgment of the Company’s board of directors in valuing Next Charging, and the Company’s board of directors may not have properly valued such acquisition. As a result, the terms may not be fair from a financial point of view to the public stockholders of the Company.

If the conditions to completion of the Share Exchange are not met, the Share Exchange may not occur.

Although the Share Exchange was approved by the stockholders of the Company and the members of Next Charging, specified conditions must be satisfied or waived to complete the Share Exchange. These conditions are described in detail in the Exchange Agreement and in addition to stockholder and member consent, include among other requirements, (i) receipt of requisite regulatory approvals and no law or order preventing the transactions, (ii) the representations and warranties of the representative of the members of Next Charging and of such members being true and correct as of the date of the Exchange Agreement and as of the Closing in all material respects, (iii) the Company having amended its Certificate of Incorporation to increase its authorized share capital and having completed and filed a listing of additional securities with Nasdaq and the waiting period thereunder shall have expired, and the Company shall have completed such additional requirements of Nasdaq such that the Share Exchange may be consummated in compliance with the rules and regulations of Nasdaq, (iv) no Material Adverse Effect with respect to Next Charging, (v) the members of the post-Closing board being elected or appointed, (vi) Next Charging shall have provided to the Company audited financial statements for Next Charging and related auditor reports thereon from a Public Company Accounting Oversight Board-registered auditor, which consents to the inclusion of its statements in SEC public filings, for each of the two most recently ended fiscal years and any other period audited or unaudited but reviewed financials are required to be included in the Company’s SEC filings following the closing pursuant to applicable law, and unaudited statements for any other required interim periods, and (vi) the stockholder approval by the Company’s stockholders shall have become effective under applicable law, including the requirement that an Information Statement on Schedule 14C shall have been disseminated to the Company’s stockholders at least 20 days prior to the closing of the Share Exchange. We anticipate the stockholder approval will become effective in January 2024. The Company and Next Charging cannot assure you that all of the conditions will be satisfied. If the conditions are not satisfied or waived, the Share Exchange may not occur, or may be delayed and such delay may cause the Company and Next Charging to each lose some or all of the intended benefits of the Share Exchange.

The Share Exchange, if it is completed, will result in significant dilution to the Company’s stockholders.

Pursuant to the Share Exchange, the Company will issue up to an aggregate of 100,000,000 shares of common stock to the Members of Next Charging, including 35-65 million shares that will be subject to vesting or forfeiture (see “Prospectus Summary”) pursuant to future milestones. Based on 4,516,531 shares of common stock outstanding as of January 12, 2024 and assuming (i) the issuance of 10,135,135 shares in this offering and (ii) the issuance of all 100,000,000 shares pursuant to the Share Exchange, following this offering and the closing of the Share Exchange, the Company will have 114,651,666 shares of common stock issued and outstanding. Of such shares, 10,135,135 shares (8.8%) will be beneficially owned by investors in this offering, 659,102 shares (0.6%) will be beneficially owned by current officers and directors of the Company, 100,875,845 shares (88.0%) will be beneficially owned by the Members of Next Charging (including shares held by entities controlled by Michael Farkas, the managing member of Next Charging), and 2,956,584 shares (2.6%) will be beneficially owned by other current shareholders of the Company.

In addition, in connection with the approval of the Share Exchange our stockholders have approved an increase in the number of shares that may be issued under our equity incentive plan from 900,000 shares to 2.9 million shares. Issuance of awards regarding such additional shares will result in further dilution to stockholders, including investors in this offering.

| 9 |

Next Charging has a very limited operating history, which makes it difficult to evaluate its business and prospects.

Next Charging has a very limited operating history, which makes it difficult to evaluate its business and prospects or forecast its future results. Next Charging is subject to the same risks and uncertainties frequently encountered by new companies in rapidly evolving markets. Next Charging’s financial results in any given quarter can be influenced by numerous factors, many of which it is unable to predict or are outside of its control, including:

| ● | perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs; | |

| ● | the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use; | |

| ● | concerns regarding the stability of the electrical grid; | |

| ● | improvements in the fuel economy of the internal combustion engine; | |

| ● | consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive; | |

| ● | the environmental consciousness of consumers; | |

| ● | volatility in the cost of oil and gasoline; | |

| ● | consumers’ perceptions of the dependency of the United States on oil from unstable or hostile countries and the impact of international conflicts; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV; and | |

| ● | the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles. |

To date, Next Charging has not generated significant revenues or achieved profitability, and may never generate significant revenues or become profitable.

Next Charging has incurred net losses since inception, and may not be able to achieve or maintain profitability in the future. Next Charging’s expenses will likely increase in the future as it develops and launches its products, expands new markets, increases its sales and marketing efforts and continues to invest in technology. These efforts to grow its business may be more costly than Next Charging expects and may not result in increased revenue or growth in its business. Next Charging will likely be required to make significant capital investments and incur recurring or new costs, and its investments (if any) may not generate sufficient returns and its results of operations, financial condition and liquidity may be adversely affected. Any failure to increase revenues sufficiently to keep pace with such investments and other expenses could prevent Next Charging from achieving or maintaining profitability or positive cash flow on a consistent basis or at all. If Next Charging is unable to successfully address these risks and challenges as it encounters them, its business, financial condition, results of operations and prospects could be adversely affected. If it is unable to generate adequate revenue growth and manage expenses, Next Charging may continue to incur net losses in the future, which may be substantial, and it may never be able to achieve or maintain profitability. Next Charging also expects its costs and expenses to increase in future periods, which could negatively affect future results of operations if revenues do not increase. In particular, Next Charging intends to continue to expend significant funds to further develop its technology. Furthermore, if Next Charging’s future growth and operating performance fail to meet investor or analyst expectations, or if it has future negative cash flow or losses resulting from investment in technology or expanding operations, this could have a material adverse effect on its business, financial condition and results of operations.

The market for Next Charging’s platform and services may not be as large as Next Charging believes it to be.

We believe the market for our values-aligned platform is substantial, but it is still relatively new, and it is uncertain to what extent or how widespread market acceptance of our platform will be or how long such acceptance, if achieved, may be sustained. Our success will depend on the willingness of people to widely adopt the Next Charging experience, values and the products and services that we offer through our platform. If the public does not perceive our products and services sold through our platform to be beneficial, or chooses not to adopt them as a result of concerns regarding privacy, accessibility, or for other reasons, including an unwillingness to confirm that they respect our five core values or as a result of negative incidents or experiences they encounter through our platform, or instead opt to use alternatives to our platform, then the market for our platform may not continue to grow, may grow slower than we expect, or may not achieve the growth potential we expect, any of which could materially adversely affect our business, financial condition, and results of operations.

Next Charging has limited experience with respect to determining the optimal prices and pricing structures for its products and services, which may impact its financial results.

Next Charging expects that it may need to change its pricing model from time to time, including as a result of competition, global economic conditions, changes in product mix or pricing studies. Similarly, as Next Charging introduces new products and services, it may have difficulty determining the appropriate price structure for future products and services, including because we may pursue business lines or enter markets in which Next Charging’s current management team has limited prior experience. In addition, as new and existing competitors introduce new products or services that compete with Next Charging’s, or revise their pricing structures, it may be unable to attract new customers at the same price or based on the same pricing model as it has used historically. As a result, Next Charging may be required from time to time to revise its pricing structure or reduce prices, which could adversely affect its business, operating results, and financial condition.

Next Charging is in a highly competitive EV charging services industry and there can be no assurance that it will be able to compete with many of its competitors which are larger and have greater financial resources.

Next Charging faces strong competition from competitors in the EV charging services industry, including competitors who could duplicate its model. Many of these competitors may have substantially greater financial, marketing and development resources and other capabilities than Next Charging. In addition, there are very few barriers to entry into the market for its services. There can be no assurance, therefore, that any of Next Charging’s current and future competitors, many of whom may have far greater resources, will not independently develop services that are substantially equivalent or superior to its services.

| 10 |

Next Charging’s competitors may be able to provide customers with different or greater capabilities or benefits than it can provide in areas such as technical qualifications, past contract performance, geographic presence and driver price. Further, many of its competitors may be able to utilize substantially greater resources and economies of scale to develop competing products and technologies, divert sales away from Next Charging by winning broader contracts or hire away our employees by offering more lucrative compensation packages. In the event that the market for EV charging stations expands, Next Charging expects that competition will intensify as additional competitors enter the market and current competitors expand their product lines. In order to secure contracts successfully when competing with larger, well-financed companies, Next Charging may be forced to agree to contractual terms that provide for lower aggregate payments to it over the life of the contract, which could adversely affect its margins. Next Charging’s failure to compete effectively with respect to any of these or other factors could have a material adverse effect on its business, prospects, financial condition or operating results.

Next Charging’s revenue growth ultimately depends on consumers’ willingness to adopt electric vehicles in a market which is still in its early stages.

Next Charging’s growth is highly dependent upon the adoption by consumers of EVs, and it is subject to a risk of any reduced demand for EVs. If the market for EVs does not gain broader market acceptance or develops slower than expected, Next Charging’s business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements, long development cycles for EV original equipment manufacturers, and changing consumer demands and behaviors. Factors that may influence the purchase and use of alternative fuel vehicles, specifically EVs, include:

| ● | perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs; | |

| ● | the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use; | |

| ● | concerns regarding the stability of the electrical grid; | |

| ● | improvements in the fuel economy of the internal combustion engine; | |

| ● | consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive; | |

| ● | the environmental consciousness of consumers; | |

| ● | volatility in the cost of oil and gasoline; | |

| ● | consumers’ perceptions of the dependency of the United States on oil from unstable or hostile countries and the impact of international conflicts; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV; and | |

| ● | the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles. |

The influence of any of the factors described above may negatively impact the widespread consumer adoption of EVs, which would materially and adversely affect Next Charging’s business, operating results, financial condition and prospects.

| 11 |

Risks Related to Ownership of Our Common Stock and this Offering

Our stock price is expected to fluctuate significantly.

Our common stock was approved for listing on The Nasdaq Capital Market under the symbol “EZFL” and began trading on September 15, 2021. There can be no assurance that an active trading market for our shares will be sustained. The market price of shares of our common stock could be subject to wide fluctuations in response to many risk factors listed in this section, and others beyond our control, including:

| ● | actual or anticipated fluctuations in our financial condition and operating results; |

| ● | geopolitical developments affecting supply and demand for oil and gas and an increase or decrease in the price of fuel; |

| ● | actual or anticipated changes in our growth rate relative to our competitors; |

| ● | competition from existing companies in the space or new competitors that may emerge; |

| ● | issuance of new or updated research or reports by securities analysts; |

| ● | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| ● | share price and volume fluctuations attributable to inconsistent trading volume levels of our shares; |

| ● | additions or departures of key management or technology personnel; |

| ● | disputes or other developments related to proprietary rights, including intellectual property, litigation matters, and our ability to obtain patent protection for our technologies; |

| ● | announcement or expectation of additional debt or equity financing efforts; |

| ● | sales of our common stock by us, our insiders or our other stockholders; and |

| ● | general economic and market conditions. |

These and other market and industry factors may cause the market price and demand for our common stock to fluctuate substantially, regardless of our actual operating performance, which may limit or prevent investors from readily selling their shares of common stock and may otherwise negatively affect the liquidity of our common stock. In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the Company.

A significant percentage of the Company’s common stock is held by a small number of shareholders.

One beneficial owner controls approximately 20% of our outstanding common stock as of January 12, 2024, and our officers and directors beneficially own approximately an additional 15% of our outstanding common stock. As a result, these shareholders are able to influence the outcome of shareholder votes on various matters, including the election of directors and extraordinary corporate transactions, including business combinations. In addition, the conversion of existing convertible notes, occurrence of sales of a large number of shares of our common stock, or the perception that these conversions or sales could occur, may affect our stock price and could impair our ability to obtain capital through an offering of equity securities. Furthermore, the current ratios of ownership of our common stock reduce the public float and liquidity of our common stock, which can in turn affect the market price of our common stock.

Our Amended and Restated Certificate of Incorporation includes an exclusive forum provision that identifies the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation, including any derivative actions, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us, our directors, officers or employees.

Our Amended and Restated Certificate of Incorporation provides that unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company; (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders; (iii) any action asserting a claim against the Company arising pursuant to any provision of the General Corporation Law of Delaware, the Amended and Restated Certificate of Incorporation or the Bylaws of the Company; or (iv) any action asserting a claim against the Company governed by the internal affairs doctrine. To the extent that any such claims may be based upon federal law claims, Section 27 of the Securities Exchange Act of 1934, as amended, creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act of 1933, as amended, provides for concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder, and as such, the exclusive jurisdiction clauses of our Amended and Restated Certificate of Incorporation would not apply to such suits. The choice of forum provisions in our Amended and Restated Certificate of Incorporation may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits against us and our directors, officers and other employees. By agreeing to these provisions, however, stockholders will not be deemed to have waived our compliance with the federal securities laws and the rules and regulations thereunder. Furthermore, the enforceability of similar choice of forum provisions in other companies’ certificates of incorporation and bylaws has been challenged in legal proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable. If a court were to find the choice of forum provisions in our Amended and Restated Certificate of Incorporation” to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business and financial condition.

| 12 |

We have never paid dividends on our capital stock, and we do not anticipate paying any dividends in the foreseeable future. Consequently, any gains from an investment in our common stock will likely depend on whether the price of our common stock increases.

We have not paid dividends on any of our classes of capital stock to date and we currently intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the terms of any future indebtedness we may incur could preclude us from paying dividends. As a result, capital appreciation, if any, of our common stock will be your sole source of gain from an investment in our common stock for the foreseeable future. Consequently, in the foreseeable future, you will likely only experience a gain from your investment in our common stock if the price of our common stock increases.

If we fail to comply with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited public market for our shares and make obtaining future debt or equity financing more difficult for us.

On August 22, 2023, the Company received a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that the Company’s stockholders’ equity as reported in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023 (the “Form 10-Q”), did not satisfy the continued listing requirement under Nasdaq Listing Rule 5550(b)(1), which requires that a listed company’s stockholders’ equity be at least $2,500,000 (the “Stockholders’ Equity Requirement”). As reported in its Form 10-Q, the Company’s stockholders’ equity as of June 30, 2023 was approximately $1,799,365. As of September 30, 2023, the Company’s stockholders’ equity was $137,506. The Staff’s notice has no immediate impact on the listing of the Company’s common stock on Nasdaq.

On October 1, 2023, the Company submitted its compliance plan to Nasdaq and is awaiting Nasdaq’s compliance determination. If the plan is accepted, the Staff may grant the Company an extension period of up to 180 calendar days from the date of the deficiency notice to regain compliance.

There can be no assurance that the Staff will accept the Company’s plan to regain compliance with the Stockholders’ Equity Requirement, or, if accepted, that the Company will evidence compliance with the Stockholders’ Equity Requirement during any extension period that the Staff may grant. If the Staff does not accept the Company’s plan or if the Company is unable to regain compliance within any extension period granted by the Staff, the Staff would be required to issue a delisting determination. The Company would at that time be entitled to request a hearing before a Nasdaq Hearings Panel to present its plan to regain compliance and to request a further extension period to regain compliance. The request for a hearing would stay any delisting action by the Staff.

If we are unable to achieve and maintain compliance with such listing standards or other Nasdaq listing requirements in the future, we could be subject to suspension and delisting proceedings. A delisting of our common stock and our inability to list on another national securities market could negatively impact us by: (i) reducing the liquidity and market price of our common stock; (ii) reducing the number of investors willing to hold or acquire our common stock, which could negatively impact our ability to raise equity financing; (iii) limiting our ability to use certain registration statements to offer and sell freely tradable securities, thereby limiting our ability to access the public capital markets; and (iv) impairing our ability to provide equity incentives to our employees.

We have elected to take advantage of specified reduced disclosure requirements applicable to an “emerging growth company” under the JOBS Act, the information that we provide to stockholders may be different than they might receive from other public companies.

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; | |

| ● | reduced disclosure about our executive compensation arrangements; | |

| ● | no non-binding advisory votes on executive compensation or golden parachute arrangements; | |

| ● | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting and delaying the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. |