Delaware (State or other jurisdiction of incorporation or organization) | | | 6770 (Primary Standard Industrial Classification Code Number) | | | 85-1615012 (I.R.S. Employer Identification Number) |

Emily Oldshue Christopher Comeau Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199 Telephone: (617) 951-7000 | | | Benjamin Potter Ryan Maierson Drew Capurro Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 Telephone: (650) 328-4600 |

☐ | | | Large accelerated filer | | | ☐ | | | Accelerated filer |

☒ | | | Non-accelerated filer | | | ☒ | | | Smaller reporting company |

| | | | | ☒ | | | Emerging growth company |

Title of Each Class of Securities to be Registered | | | Amount to be Registered | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price(3) | | | Amount of Registration Fee(4) |

Class A common stock, par value $0.0001 per share(1)(2) | | | 44,116,721 | | | $9.91 | | | $437,196,705.11 | | | $47,698.16 |

(1) | Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from share sub-divisions, share dividends or similar transactions. |

(2) | Based on the maximum number of shares of Class A common stock, par value $0.0001 per share (“Sandbridge Class A common stock” or “New Owlet common stock”), of the registrant (“Sandbridge”) estimated to be issued in connection with the business combination described herein (the “Business Combination”) other than to stockholders of Owlet Baby Care Inc. (“Owlet”) who have voted for the approval of the Business Combination prior to the date hereof. This number is based on the product of (a) the sum of (i) 5,608,844, the aggregate number of shares of common stock, par value $0.0001 per share, of Owlet outstanding as of March 22, 2021, (ii) 11,167,137, the aggregate number of shares of preferred stock, par value $0.0001 per share, of Owlet, outstanding as of March 22, 2021, (iii) 892,456, the aggregate number of shares of Owlet common stock issuable upon the cashless exercise of the Owlet warrants outstanding as of March 22, 2021 and, (iv) 695,107, the aggregate number of shares of Owlet preferred stock issuable upon the conversion of the Owlet convertible promissory notes outstanding as of March 22, 2021, and (v) 3,153,776, the aggregate number of shares of Owlet common stock issuable upon the cash exercise of Owlet options outstanding as of March 22, 2021, and (b) an estimated Exchange Ratio (as defined herein) of 2.050. |

(3) | Pursuant to Rules 457(c) and 457(f)(1) promulgated under the Securities Act and solely for the purpose of calculating the registration fee, the proposed maximum aggregate offering price is calculated as the product of 44,116,721 shares of Sandbridge Class A common stock and (ii) $9.91, the average of the high and low trading prices of Sandbridge Class A common stock on March 24, 2021 (within five business days prior to the date of this Registration Statement). |

(4) | Calculated pursuant to Rule 457 under the Securities Act by multiplying the proposed maximum aggregate offering price of securities to be registered by 0.0001091. |

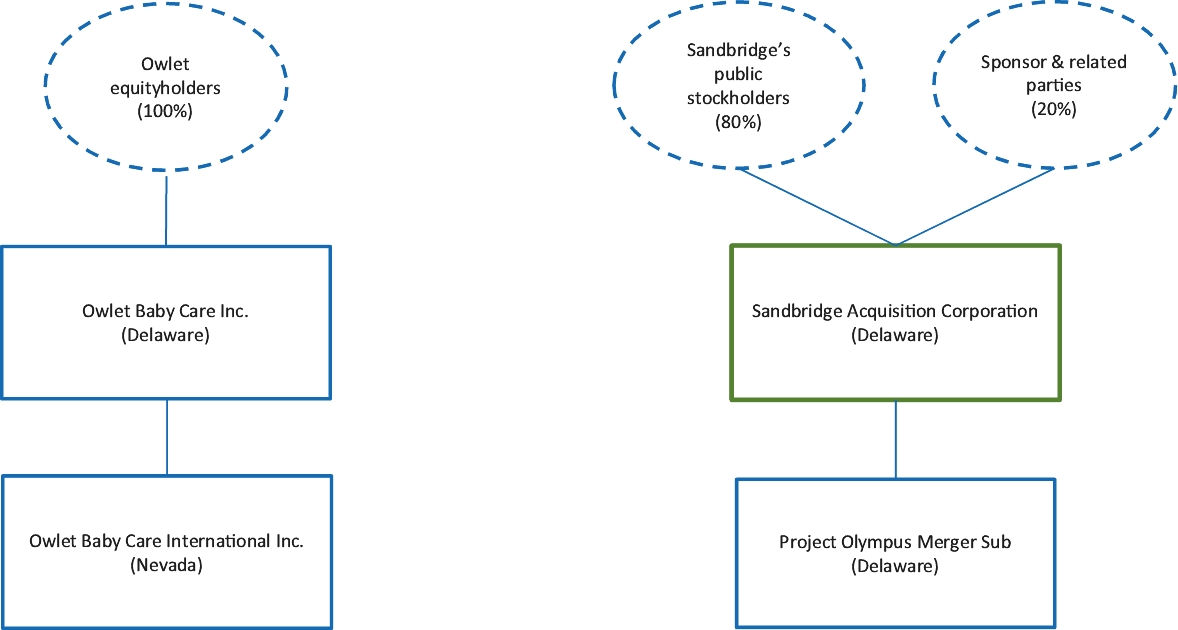

(a) | Proposal No. 1 - The Business Combination Proposal - to consider and vote upon a proposal to approve the business combination agreement, dated as of February 15, 2021 (as may be amended and/or restated from time to time, the “Business Combination Agreement”), by and among Sandbridge, Project Olympus Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Sandbridge (“Merger Sub”), and Owlet Baby Care Inc., a Delaware corporation (“Owlet”), and the transactions contemplated thereby, pursuant to which Merger Sub will merge with and into Owlet (the “Merger”) with Owlet surviving the Merger as a wholly owned subsidiary of Sandbridge (the transactions contemplated by the Business Combination Agreement, the “Business Combination” and such proposal, the “Business Combination Proposal”); |

(b) | Proposal No. 2 - The Charter Amendment Proposal, including the Advisory Charter Amendment Proposals - to consider and vote upon a proposal to approve, assuming the Business Combination Proposal is approved and adopted, the proposed amended and restated certificate of incorporation of Sandbridge (the “Proposed Charter”), which will replace Sandbridge’s amended and restated certificate of incorporation, dated September 14, 2020 (the “Current Charter”), and which will be in effect as of the Effective Time (we refer to such proposal as the “Charter Amendment Proposal”); and to consider and vote upon separate proposals to approve, on a non-binding advisory basis, the following material differences between the Proposed Charter and the Current Charter, which are being presented in accordance with the requirements of the Securities and Exchange Commission (the “SEC”) as six separate sub-proposals (we refer to such proposals as the “Advisory Charter Amendment Proposals”); |

(i) | Advisory Charter Amendment Proposal A – Under the Proposed Charter, New Owlet will be authorized to issue 1,100,000,000 shares of capital stock, consisting of (i) 1,000,000,000 shares of New Owlet common stock, par value $0.0001 per share and (ii) 100,000,000 shares of undesignated preferred stock, par value $0.0001 per share, as opposed to the Current Charter, which authorizes Sandbridge to issue 111,000,000 shares of capital stock, consisting of (a) 110,000,000 shares of common stock, including 100,000,000 shares of Sandbridge Class A common stock, par value $0.0001 per share, and 10,000,000 shares of Sandbridge Class B common stock, par value $0.0001 per share, and (b) 1,000,000 shares of Sandbridge preferred stock, par value $0.0001 per share; |

(ii) | Advisory Charter Amendment Proposal B – Under the Proposed Charter, New Owlet will remove the provisions regarding New Owlet not being governed by Section 203 of the DGCL relating to takeovers by interested stockholders; |

(iii) | Advisory Charter Amendment Proposal C –Under the Proposed Charter, in addition to any vote required by Delaware law, Part B of Article IV, Article V, Article VI, Article VII, Article VIII and Article IX of the Proposed Charter may be amended only by the affirmative vote of the holders of at least two-thirds of the total voting power of the then outstanding shares of stock of New Owlet entitled to vote thereon, voting together as a single class; |

(iv) | Advisory Charter Amendment Proposal D – Under the Proposed Charter, directors can be removed only for cause and only by the affirmative vote of the holders of at least a two-thirds of the outstanding shares entitled to vote at an election of directors; |

(v) | Advisory Charter Amendment Proposal E – Under the Proposed Charter, the New Owlet Board is expressly authorized to adopt, alter, amend or repeal the Bylaws in accordance with Delaware law; provided that, in addition to any vote required by Delaware law, the adoption, amendment or repeal of |

(vi) | Advisory Charter Amendment Proposal F – to provide for certain additional changes, including, among other things, (i) changing the corporate name from “Sandbridge Acquisition Corporation” to “Owlet, Inc.”, and (ii) removing certain provisions related to Sandbridge’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination, all of which the Sandbridge Board believes is necessary to adequately address the needs of New Owlet after the Business Combination; |

(c) | Proposal No. 3 - The NYSE Proposal – to consider and vote upon a proposal to approve, assuming the Business Combination Proposal and the Charter Amendment Proposal are approved and adopted, for the purposes of complying with the applicable listing rules of the New York Stock Exchange (the “NYSE”), the issuance of (i) 13,000,000 shares of Sandbridge Class A common stock to certain investors (the “PIPE Investors”) pursuant to subscription agreements (the “Subscription Agreements”) immediately prior to the Closing, plus any additional shares issued pursuant to Subscription Agreements we may enter into prior to Closing, and (ii) an aggregate of up to 102,500,000 shares of New Owlet common stock to existing Owlet equityholders pursuant to the terms of the Business Combination Agreement (we refer to this proposal as the “NYSE Proposal”); |

(d) | Proposal No. 4 - The Incentive Award Plan Proposal - to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Charter Amendment Proposal and the NYSE Proposal are approved and adopted, the Owlet, Inc. 2021 Incentive Award Plan (the “New Owlet Incentive Award Plan”), a copy of which is attached to this proxy statement/prospectus as Annex D, including the authorization of the initial share reserve under the New Owlet Incentive Award Plan (the “Incentive Award Plan Proposal”), including with respect to the number of shares that may be issued pursuant to the exercise of incentive stock options granted; |

(e) | Proposal No. 5 - The ESPP Proposal - to consider and vote upon a proposal to approve, assuming the Business Combination Proposal, the Charter Amendment Proposal, the NYSE Proposal and the Incentive Award Plan Proposal are approved and adopted, the Owlet, Inc. 2021 Employee Stock Purchase Plan (the “New Owlet ESPP”), a copy of which is attached to this proxy statement/prospectus as Annex E, including the authorization of the initial share reserve under the New Owlet ESPP (the “ESPP Proposal”); |

(f) | Proposal No. 6 - The Adjournment Proposal - to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, any of the Business Combination Proposal, the Charter Amendment Proposal, the NYSE Proposal, the Incentive Award Plan Proposal and the ESPP Proposal (collectively, the “Required Transaction Proposals”) would not be duly approved and adopted by our stockholders or we determine that one or more of the closing conditions under the Business Combination Agreement is not satisfied or waived (we refer to this proposal as the “Adjournment Proposal” and the Adjournment Proposal, collectively with the Required Transaction Proposals, the “Transaction Proposals”). |

(i) | (a) hold public shares or (b) hold public shares through units and you elect to separate your units into the underlying public shares and public warrants prior to exercising your redemption rights with respect to the public shares; and |

(ii) | prior to , New York City time, on , 2021, (a) submit a written request, including the legal name, telephone number and address of the beneficial owner of the shares for which redemption is requested, to Continental Stock Transfer & Trust Company, Sandbridge’s transfer agent (the “Transfer Agent”), that Sandbridge redeem your public shares for cash and (b) deliver your public shares to the Transfer Agent, physically or electronically through The Depository Trust Company (“DTC”). |

• | the ability of Sandbridge and Owlet to meet the closing conditions in the Business Combination Agreement, including the receipt of approval by the stockholders of Sandbridge of the Required Transaction Proposals and the availability of an aggregate cash amount of at least $140 million available at Closing from the Trust Account; |

• | the occurrence of any event, change or other circumstances, including the outcome of any legal proceedings that may be instituted against Sandbridge and Owlet following the announcement of the Business Combination Agreement and the transactions contemplated therein, that could give rise to the termination of the Business Combination Agreement or could otherwise cause the transactions contemplated therein to fail to close; |

• | the ability to obtain or maintain the listing of New Owlet common stock on the NYSE, as applicable, following the Business Combination; |

• | the risk that the proposed Business Combination disrupts current plans and operations of Owlet as a result of the announcement and consummation of the Business Combination; |

• | the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of New Owlet to grow and manage growth profitably and retain its key employees; |

• | costs related to the proposed Business Combination; |

• | changes in applicable laws or regulations; |

• | the ability of New Owlet to raise financing in the future; |

• | the success, cost and timing of Owlet’s and New Owlet’s product development activities; |

• | the potential attributes and benefits of Owlet’s and New Owlet’s products and services; |

• | Owlet’s and New Owlet’s ability to obtain and maintain regulatory approval for Owlet’s or New Owlet’s products, and any related restrictions and limitations of any approved product; |

• | Owlet’s and New Owlet’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

• | Owlet’s and New Owlet’s financial performance; |

• | the impact of the COVID-19 pandemic on Owlet’s and New Owlet’s business, including on the ability of Sandbridge and Owlet to consummate the Business Combination; and |

• | other factors detailed under the section titled “Risk Factors” and elsewhere in this proxy statement/prospectus. |

Q: | Why am I receiving this proxy statement/prospectus? |

A: | Sandbridge is proposing to consummate the Business Combination with Owlet. Sandbridge, Merger Sub and Owlet have entered into the Business Combination Agreement, the terms of which are described in this proxy statement/prospectus. A copy of the Business Combination Agreement is attached hereto as Annex A. Sandbridge urges its stockholders to read the Business Combination Agreement in its entirety. |

Q: | Why is Sandbridge proposing the Business Combination? |

A: | Sandbridge was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination. |

Q: | When and where will the Special Meeting take place? |

A: | The Special Meeting will be held on , 2021, at local time, via live webcast at the following address: www.virtualshareholdermeeting.com/SBG2021SM, or such other date, time and place to which such meeting may be adjourned or postponed, to consider and vote upon the proposals. To participate in the Special Meeting, a Sandbridge stockholder of record will need the 16-digit control number included on their proxy card or instructions that accompanied their proxy materials, if applicable, or to obtain a proxy form from their broker, bank or other nominee. The Special Meeting webcast will begin promptly at , New York City time. Sandbridge stockholders are encouraged to access the Special Meeting prior to the start time. If you encounter any difficulties accessing the virtual meeting or during the meeting time, please call the technical support number that will be posted on the virtual meeting login page. |

Q: | What matters will be considered at the Special Meeting? |

A: | The Sandbridge stockholders will be asked to consider and vote on the following proposals: |

• | The Business Combination Proposal, which is a proposal to approve the Business Combination Agreement and approve the Business Combination; |

• | The Charter Amendment Proposal, which is a proposal to approve, assuming the Business Combination Proposal is approved and adopted, the Proposed Charter, which will replace the Current Charter, including the proposals to approve, on a non-binding advisory basis and as required by applicable SEC guidance, certain material differences between the Current Charter and the Proposed Charter (the “Advisory Charter Amendment Proposals”); |

• | The NYSE Proposal, which is a proposal to approve, assuming the Business Combination Proposal and the Charter Amendment Proposal are approved and adopted, for the purposes of complying with the applicable listing rules of the NYSE, the issuance of (i) 13,000,000 shares of Sandbridge Class A common stock to the PIPE Investors in the PIPE Financing, plus any additional shares pursuant to Subscription Agreements we may enter into prior to Closing, and (ii) an aggregate of up to 102,500,000 shares of New Owlet common stock to existing Owlet equityholders pursuant to the terms of the Business Combination Agreement; |

• | The Incentive Award Plan Proposal, which is a proposal to approve, assuming the Business Combination Proposal, the Charter Amendment Proposal and the NYSE Proposal are approved and adopted, the New Owlet Incentive Award Plan; |

• | The ESPP Proposal, which is a proposal to approve, assuming the Business Combination Proposal, the Charter Amendment Proposal, the NYSE Proposal and the New Owlet Incentive Award Plan are approved and adopted, the New Owlet ESPP; and |

• | The Adjournment Proposal, which is a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, any of the Required Transaction Proposals would not be duly approved and adopted by our stockholders or we determine that one or more of the closing conditions under the Business Combination Agreement is not satisfied or waived. |

Q: | Is my vote important? |

A: | Yes. The Business Combination cannot be completed unless the Business Combination Proposal receives the affirmative vote of a majority of the votes cast by Sandbridge stockholders present in person (which would include presence at a virtual meeting) or represented by proxy at the Special Meeting and entitled to vote thereon and the other Required Transaction Proposals achieve the necessary vote outlined below. Only Sandbridge stockholders as of the close of business on , 2021, the record date for the Special Meeting, are entitled to vote at the Special Meeting. The Sandbridge Board unanimously recommends that such Sandbridge stockholders vote “FOR” the approval of the Business Combination Proposal, “FOR” the approval of the Charter Amendment Proposal, including, on an advisory basis, the Advisory Charter Amendment Proposals, “FOR” the approval of the NYSE Proposal, “FOR” the approval of the Incentive Award Plan Proposal, “FOR” the approval of the ESPP Proposal, and “FOR” the approval of the Adjournment Proposal. |

Q: | If my shares are held in “street name” by my bank, brokerage firm or other nominee, will my bank, brokerage firm or other nominee automatically vote those shares for me? |

A: | No. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” If this is the case, this proxy statement/prospectus may have been forwarded to you by your brokerage firm, bank or other nominee, or its agent. As the beneficial holder, you also have the right to direct your broker, bank or other nominee as to how to vote your shares. If you do not provide voting instructions to your broker on a particular proposal on which your broker does not have discretionary authority to vote, your shares will not be voted on that proposal. This is called a “broker non-vote.” Abstentions and broker non-votes will count as present for the purposes of establishing a quorum. If you decide to vote, you should provide instructions |

Q: | What Sandbridge stockholder vote is required for the approval of each proposal brought before the Special Meeting? What will happen if I fail to vote or abstain from voting on each proposal? |

A: | The Business Combination Proposal. Approval of the Business Combination Proposal requires the affirmative vote of a majority of the votes cast by Sandbridge stockholders present in person (which would include presence at a virtual meeting) or represented by proxy at the Special Meeting and entitled to vote thereon. In connection with our initial public offering, our initial stockholders and our other directors and officers at the time of our initial public offering entered into a letter agreement to vote their founder shares and any public shares acquired by them during or after the initial public offering in favor of the Business Combination Proposal and the other Transaction Proposals being presented at the Special Meeting, all of which are unanimously recommended by the Sandbridge Board. The shares held by our Sponsor, our other initial stockholders and our other directors and officers that are obligated to vote in favor of the Business Combination represent approximately 27% of the voting power of Sandbridge. Abstentions will be treated as votes against this proposal. |

Q: | What will Owlet’s equityholders receive in connection with the Business Combination? |

A: | As a consequence of the Merger, at the Effective Time, (i) each share of Owlet capital stock (as defined herein) that is issued and outstanding immediately prior to the Effective Time will become the right to receive the number of shares of New Owlet common stock equal to the Exchange Ratio; (ii) each option to purchase shares of Owlet common stock, whether vested or unvested, that is outstanding and unexercised as |

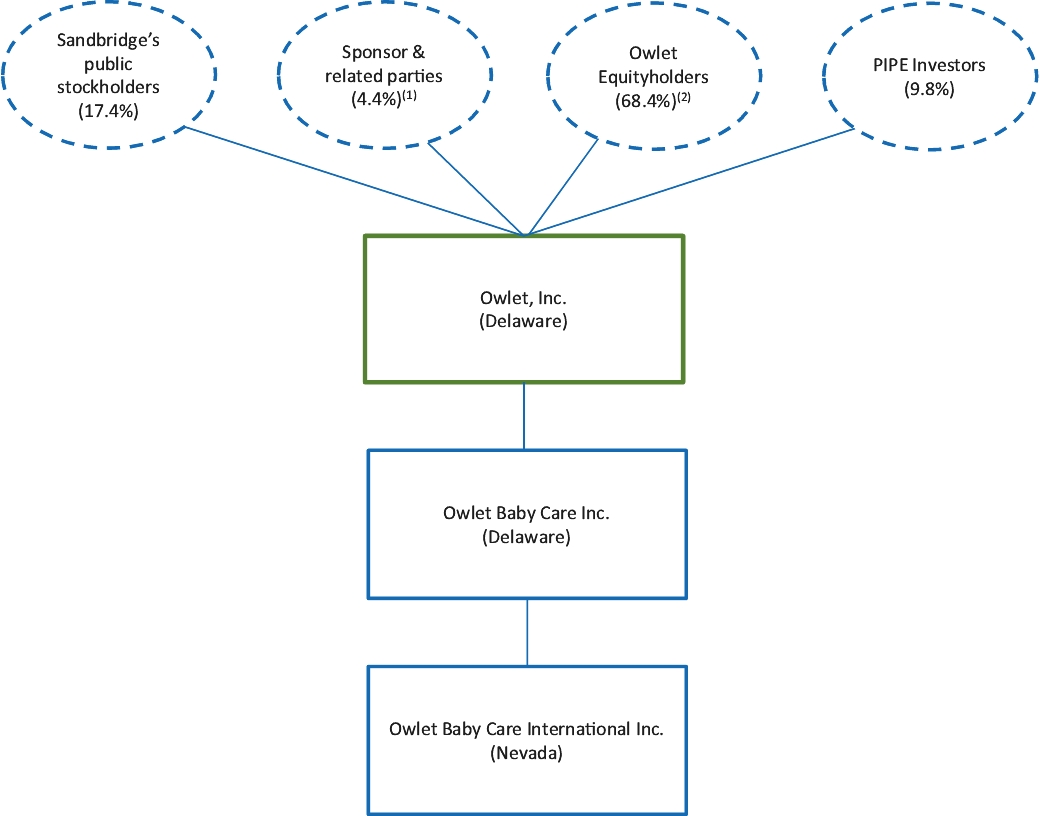

Q: | What voting power will current Sandbridge stockholders and Owlet stockholders hold in New Owlet immediately after the consummation of the Business Combination? |

A: | It is anticipated that, upon completion of the Business Combination, the voting power in New Owlet will be as set forth in the table below: |

| | | No Redemption (Shares) | | | % | | | Maximum Redemption (Shares) | | | % | |

Owlet equityholders(1) | | | 90,466,363 | | | 68.4% | | | 90,466,363 | | | 72.2% |

Sandbridge’s public stockholders | | | 23,000,000 | | | 17.4% | | | 16,000,000 | | | 12.8% |

Sponsor & related parties(2) | | | 5,750,000 | | | 4.4% | | | 5,750,000 | | | 4.6% |

PIPE Investors | | | 13,000,000 | | | 9.8% | | | 13,000,000 | | | 10.4% |

Pro Forma New Owlet Common Stock at Closing | | | 132,216,363 | | | 100% | | | 125,216,363 | | | 100% |

(1) | Excludes 9,533,637 shares of New Owlet common stock underlying outstanding New Owlet option awards on a net exercise basis. |

(2) | Represents the shares of New Owlet common stock the Sponsor and the independent directors and an advisor of Sandbridge will receive upon conversion of the Sandbridge Class B common stock at Closing. Of such shares, 2,807,500 shares of New Owlet common stock will be outstanding following the Closing but will remain subject to price-based performance vesting terms as described in the Sponsor Letter Agreement. |

Q: | What happens to the funds deposited in the Trust Account after consummation of the Business Combination? |

A: | A total of $230 million, including approximately $8.05 million of underwriters’ deferred discount and approximately $4.6 million of the proceeds of the sale of the private placement warrants, was placed in the Trust Account and is maintained by Continental Stock Transfer & Trust Company, acting as trustee. As of December 31, 2020, there were investments and cash held in the Trust Account of $230,053,249. These funds will not be released until the earlier of Closing or the redemption of our public shares if we are unable to complete an initial business combination by September 17, 2022, during any stockholder-approved extension period, although we may withdraw the interest earned on the funds held in the Trust Account to pay franchise and income taxes. Upon the Closing of the Business Combination, the funds remaining in the Trust Account will be released and, together with the proceeds of the PIPE Financing, if any, will remain on the balance sheet of New Owlet. |

Q: | What happens if a substantial number of the public stockholders vote in favor of the Business Combination Proposal and exercise their redemption right? |

A: | Sandbridge stockholders who vote in favor of the Business Combination may also nevertheless exercise their redemption rights. Accordingly, the Business Combination may be consummated even though the funds available from the Trust Account and the number of public stockholders are reduced as a result of redemptions by public stockholders. The consummation of the Business Combination is conditioned upon, among other things, Sandbridge having an aggregate cash amount of at least $140 million available at Closing from the Trust Account, after certain fees and expenses (the “Available Sandbridge Cash,” and such condition to the consummation of the Business Combination, the “Minimum Available Sandbridge Cash Amount” (though this condition may be waived by Owlet)). In addition, with fewer public shares and public stockholders, the trading market for New Owlet common stock may be less liquid than it otherwise would |

Q: | What amendments will be made to the Current Charter? |

A: | We are asking Sandbridge stockholders to approve the Proposed Charter that will be effective upon the consummation of the Business Combination. The Proposed Charter provides for various changes that the Sandbridge Board believes are necessary to address the needs of the post-combination company, including, among other things: (i) the change of Sandbridge’s name to “Owlet, Inc.”; (ii) the increase of the total number of authorized shares of all classes of capital stock, par value of $0.0001 per share, from 111,000,000 shares to 1,100,000,000 shares, consisting of 1,000,000,000 shares of Class A common stock and 100,000,000 shares of undesignated preferred stock, par value $0.0001 per share; (iii) changes to the required vote to amend the charter and bylaws; and (iv) the elimination of certain provisions specific to Sandbridge’s status as a blank check company. |

Q: | Did the Sandbridge Board obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination? |

A: | No. The Sandbridge Board did not obtain a third-party valuation or fairness opinion in connection with its determination to approve the Business Combination. However, Sandbridge’s management, the members of the Sandbridge Board and the other representatives of Sandbridge have substantial experience in evaluating the operating and financial merits of companies similar to Owlet and reviewed certain financial information of Owlet and compared it to certain publicly traded companies, selected based on the experience and the professional judgment of Sandbridge’s management team, which enabled them to make the necessary analyses and determinations regarding the Business Combination. Accordingly, investors will be relying solely on the judgment of the Sandbridge Board in valuing Owlet’s business and assuming the risk that the Sandbridge Board may not have properly valued such business. |

Q: | Do I have redemption rights? |

A: | If you are a public stockholder, you have the right to request that Sandbridge redeem all or a portion of your public shares for cash, provided that you follow the procedures and deadlines described elsewhere in this proxy statement/prospectus under the heading “The Special Meeting - Redemption Rights.” Public stockholders may elect to redeem all or a portion of their public shares even if they vote for the Business Combination Proposal. We sometimes refer to these rights to elect to redeem all or a portion of the public shares into a pro rata portion of the cash held in the Trust Account as “redemption rights.” If you wish to exercise your redemption rights, please see the answer to the question: “How do I exercise my redemption rights?” |

Q: | How do I exercise my redemption rights? |

A: | If you are a public shareholder and wish to exercise your right to redeem your public shares, you must: |

(i) | (a) hold public shares, or (b) if you hold public shares through units, you elect to separate your units into the underlying public shares and public warrants prior to exercising your redemption rights with respect to the public shares; |

(ii) | prior to p.m., New York City time, on , 2021, (a) submit a written request, including the legal name, telephone number and address of the beneficial owner of the shares for which redemption is requested, to Continental Stock Transfer & Trust Company, Sandbridge’s transfer agent (the “Transfer Agent”) that Sandbridge redeem your public shares for cash and (b) deliver your public shares to the Transfer Agent, physically or electronically through The Depository Trust Company (“DTC”). |

Q: | If I am a holder of units, can I exercise redemption rights with respect to my units? |

A: | No. Holders of outstanding units must first elect to separate the units into the underlying public shares and public warrants prior to exercising redemption rights with respect to the public shares. If you hold your units in an account at a brokerage firm or bank, you must notify your broker or bank that you elect to separate the units into the underlying public shares and public warrants, or if you hold units registered in your own name, you must contact the Transfer Agent directly and instruct them to do so. If you fail to cause your units to be separated and delivered to the Transfer Agent by , 2021, you will not be able to exercise your redemption rights with respect to your public shares. |

Q: | What are the U.S. federal income tax consequences of exercising my redemption rights? |

A: | The U.S. federal income tax consequences of exercising your redemption rights depend on your particular facts and circumstances. It is possible that you may be treated as selling your public shares for cash and, as a result, recognize capital gain or capital loss. It is also possible that the redemption may be treated as a distribution for U.S. federal income tax purposes depending on the amount of public shares that you own or are deemed to own (including through the ownership of New Owlet warrants). For a more complete discussion of the U.S. federal income tax considerations of an exercise of redemption rights, see “Certain Material U.S. Federal Income Tax Considerations.” |

Q: | How does the Sandbridge Board recommend that I vote? |

A: | The Sandbridge Board recommends that the Sandbridge stockholders vote “FOR” the approval of the Business Combination Proposal, “FOR” the approval of the Charter Amendment Proposal, including the Advisory Charter Amendment Proposals, “FOR” the approval of the NYSE Proposal, “FOR” the approval of the Incentive Award Plan Proposal, “FOR” for the approval of the ESPP Proposal and “FOR” the approval of the Adjournment Proposal. For more information regarding how the Sandbridge Board recommends that Sandbridge stockholders vote, see the section titled “The Business Combination Proposal - Sandbridge’s Board of Directors’ Reasons for the Approval of the Business Combination.” |

Q: | How do our Sponsor and the other initial stockholders intend to vote their shares? |

A: | In connection with our initial public offering, our initial stockholders and our other directors and officers at the time of our initial public offering entered into a letter agreement to vote their founder shares, as well as any public shares purchased by them during or after our initial public offering, in favor of the Business Combination Proposal and the other Transaction Proposals, all of which are unanimously recommended by the Sandbridge Board, being presented at the Special Meeting. These stockholders collectively own approximately 27% of our issued and outstanding shares of common stock. |

Q: | May our Sponsor and the other initial stockholders purchase public shares or warrants prior to the Special Meeting? |

A: | At any time prior to the Special Meeting, during a period when they are not in possession of any material nonpublic information regarding Sandbridge or its securities, the initial stockholders, Owlet and/or their respective affiliates may purchase shares and/or warrants from investors, or they may enter into transactions with such investors and others to provide them with incentives to acquire public shares, vote their public shares in favor of the Business Combination Proposal or not redeem their public shares. The purpose of any such transaction could be to (i) vote such shares in favor of the Business Combination and thereby increase the likelihood of the consummation of the Business Combination or (ii) increase the likelihood that the Minimum Available Sandbridge Cash Amount is satisfied. Any such stock purchases and other transactions may thereby increase the likelihood that the Business Combination is consummated. While the exact nature of any such incentives has not been determined as of the date of this proxy statement/prospectus, they might include, without limitation, arrangements to protect such investors or holders against potential loss in value of their shares, including the granting of put options and the transfer to such investors or holders of shares or rights owned by Sandbridge’s initial stockholders for nominal value. |

Q: | Who is entitled to vote at the Special Meeting? |

A: | The Sandbridge Board has fixed , 2021 as the record date for the Special Meeting. All holders of record of Sandbridge common stock as of the close of business on the record date are entitled to receive notice of, and to vote at, the Special Meeting, provided that those shares remain outstanding on the date of the Special Meeting. Physical attendance at the Special Meeting is not required to vote. See the question “How can I vote my shares without attending the Special Meeting?” below for instructions on how to vote your Sandbridge common stock without attending the Special Meeting. |

Q: | How many votes do I have? |

A: | Each Sandbridge stockholder of record is entitled to one vote for each share of Sandbridge common stock held by such holder as of the close of business on the record date. As of the close of business on , 2021, the record date for the Special Meeting, there were outstanding shares of Sandbridge common stock. |

Q: | What constitutes a quorum for the Special Meeting? |

A: | A quorum is the minimum number of stockholders necessary to hold a valid meeting. |

Q: | What is Owlet? |

A: | Owlet Baby Care Inc. was founded on a commitment to designing and selling products and services that empower parents with technology and data to proactively monitor the health and wellness of their children from conception to kindergarten. Owlet’s ecosystem of connected smart products, which currently includes its flagship Owlet Smart Sock, the Owlet Cam and Owlet Dream Lab, is helping to transform modern parenting by bringing simplified child monitoring solutions in-home so parents can rest easier. The Owlet Smart Sock is intended for use by healthy infants of up to 18 months of age. The Owlet Cam can be used by parents to help monitor children of any age. Owlet Dream Lab is an interactive online platform that assists families in building healthy sleep habits with their babies of up to 12 months in age. |

Q: | What will happen to my shares of Sandbridge common stock as a result of the Business Combination? |

A: | If the Business Combination is completed, each share of Sandbridge Class B common stock that is issued and outstanding as of immediately prior to the Effective Time will be converted, on a one-for-one basis, into a share of New Owlet common stock. The Business Combination will have no effect on Sandbridge Class A common stock that is issued and outstanding as of immediately prior to the Effective Time, which will continue to remain outstanding. See the section titled “The Business Combination Proposal - Consideration to the Owlet Stockholders.” |

Q: | Where will the New Owlet common stock that Sandbridge stockholders receive in the Business Combination be publicly traded? |

A: | Assuming the Business Combination is completed, the shares of New Owlet common stock (including the |

Q: | What happens if the Business Combination is not completed? |

A: | If the Business Combination Agreement is not approved by the Sandbridge stockholders or if the Business Combination is not completed for any other reason by July 31, 2021, then we will seek to consummate an alternative initial business combination prior to September 17, 2022, or during any stockholder-approved extension period. If we do not consummate an initial business combination by September 17, 2022, or during any stockholder-approved extension period, we will cease all operations except for the purpose of winding up and redeem our public shares and liquidate the Trust Account, in which case our public stockholders may only receive approximately $10.00 per share and our warrants will expire worthless. |

Q: | How can I attend and vote my shares at the Special Meeting |

A: | Shares of Sandbridge common stock held directly in your name as the stockholder of record of such shares as of the close of business on , 2021, the record date, may be voted electronically at the Special Meeting. If you choose to attend the Special Meeting, you will need to visit www.virtualshareholdermeeting.com/SBG2021SM and enter the control number found on your proxy card, voting instruction form or notice you previously received. You may vote during the Special Meeting by following instructions available on the meeting website during the meeting. The Special Meeting starts at , New York City time. We encourage you to allow ample time for online check-in, which will open at , New York City time. Please have your 16-digit control number to join the Special Meeting webcast. Instructions on who can attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com |

Q: | How can I vote my shares without attending the Special Meeting? |

A: | If you are a stockholder of record of Sandbridge as of the close of business on , 2021, the record date, you may submit your proxy before the Special Meeting in any of the following ways, if available: |

• | Vote by Mail: by signing, dating and returning the enclosed proxy card; |

• | Vote by Internet: visit http://www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. New York City time on , 2021 (have your proxy card in hand when you visit the website); |

• | Vote by Phone: by calling toll-free (within the U.S. or Canada) 1-800-690-6903, until 11:59 p.m. New York City time on , 2021 (have your proxy card in hand when you call); or |

• | Vote at the Special Meeting: by casting your vote at the Special Meeting via the Special Meeting website. Any stockholder of record as of the close of business on , the record date, can attend the Special Meeting webcast by visiting: www.virtualshareholdermeeting.com/SBG2021SM, where such stockholders may vote during the Special Meeting. The Special Meeting starts at , New York City time. We encourage you to allow ample time for online check-in, which will open at , New York City time. Please have your 16-digit control number to join the Special Meeting webcast. |

Q: | What is a proxy? |

A: | A proxy is a legal designation of another person to vote the stock you own. If you are a stockholder of record of Sandbridge common stock as of the close of business on the record date, and you vote by telephone, by Internet or by signing, dating and returning your proxy card in the enclosed postage-paid envelope, you designate two of Sandbridge’s officers as your proxies at the Special Meeting, each with full power to act without the other and with full power of substitution. These two officers are Ken Suslow and Richard Henry. |

Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

A: | If your shares of Sandbridge common stock are registered directly in your name with the Transfer Agent, you are considered the stockholder of record with respect to those shares, and access to proxy materials is being provided directly to you. If your shares are held in a stock brokerage account or by a bank or other nominee, then you are considered the beneficial owner of those shares, which are considered to be held in street name. Access to proxy materials is being provided to you by your broker, bank or other nominee who is considered the stockholder of record with respect to those shares. |

Q: | If a Sandbridge stockholder gives a proxy, how will the Sandbridge common stock covered by the proxy be voted? |

A: | If you provide a proxy by returning the applicable enclosed proxy card, the individuals named on the enclosed proxy card will vote your Sandbridge common stock in the way that you indicate when providing your proxy in respect of the Sandbridge common stock you hold. When completing the proxy card, you may specify whether your Sandbridge common stock should be voted “FOR” or “AGAINST”, or should be abstained from voting on, all, some or none of the specific items of business to come before the Special Meeting. |

Q: | How will my Sandbridge common stock be voted if I return a blank proxy? |

A: | If you sign, date and return your proxy and do not indicate how you want your Sandbridge common stock to be voted, then your Sandbridge common stock will be voted “FOR” the approval of the Business Combination Proposal, “FOR” the approval of the Charter Amendment Proposal, including the Advisory Charter Amendment Proposals, “FOR” the approval of the NYSE Proposal, “FOR” the approval of the Incentive Award Plan Proposal, “FOR” for the approval of the ESPP Proposal and “FOR” the approval of the Adjournment Proposal. |

Q: | Can I change my vote after I have submitted my proxy? |

A: | Yes. If you are a stockholder of record of Sandbridge common stock as of the close of business on the record date, you can change or revoke your proxy before it is voted at the meeting in one of the following ways: |

• | submit a new proxy card bearing a later date; |

• | give written notice of your revocation to Sandbridge’s Corporate Secretary, which notice must be received by Sandbridge’s Corporate Secretary prior to the vote at the Special Meeting; or |

• | vote electronically at the Special Meeting by visiting www.virtualshareholdermeeting.com/SBG2021SM and entering the control number found on your proxy card, voting instruction form or notice you previously received. Please note that your attendance at the Special Meeting will not alone serve to revoke your proxy. |

Q: | Where can I find the voting results of the Special Meeting? |

A: | The preliminary voting results are expected to be announced at the Special Meeting. In addition, within four business days following certification of the final voting results, Sandbridge will file the final voting results of its Special Meeting with the SEC in a Current Report on Form 8-K. |

Q: | Are Sandbridge stockholders able to exercise dissenters’ rights or appraisal rights with respect to the matters being voted upon at the Special Meeting? |

A: | No. Sandbridge stockholders are not entitled to exercise dissenters’ rights or appraisal rights under Delaware law in connection with the Business Combination. Dissenters’ rights or appraisal rights are unavailable under Delaware law in connection with the Business Combination to holders of Sandbridge Class A common stock because it is currently listed on a national securities exchange and such holders are not receiving any consideration. Holders of Sandbridge Class A common stock may vote against the Business Combination Proposal or redeem their shares of Sandbridge Class A common stock if they are not in favor of the approval of the Business Combination Agreement or the Business Combination. Dissenters’ rights or appraisal rights are unavailable under Delaware law in connection with the Business Combination to holders of Sandbridge Class B common stock because they have agreed to vote in favor of the Business Combination. |

Q: | Are there any risks that I should consider as a Sandbridge stockholder in deciding how to vote or whether to exercise my redemption rights? |

A: | Yes. You should read and carefully consider the risk factors set forth in the section titled “Risk Factors” in this proxy statement/prospectus. You also should read and carefully consider the risk factors of Sandbridge and Owlet contained in the documents that are incorporated by reference herein. |

Q: | What happens if I sell my Sandbridge common stock before the Special Meeting? |

A: | The record date for Sandbridge stockholders entitled to vote at the Special Meeting is earlier than the date of the Special Meeting. If you transfer your shares of Sandbridge common stock before the record date, you will not be entitled to vote at the Special Meeting. If you transfer your shares of Sandbridge common stock after the record date but before the Special Meeting, you will, unless special arrangements are made, retain your right to vote at the Special Meeting but will transfer the right to hold New Owlet common stock to the person to whom you transfer your Sandbridge common stock. |

Q: | What are the material U.S. federal income tax consequences of the Business Combination to me? |

A: | Certain material U.S. federal income tax considerations that may be relevant to you in respect of the Business Combination are discussed in more detail in the section titled “Certain Material U.S. Federal Income Tax Considerations.” The discussion of the U.S. federal income tax consequences contained in this proxy statement/prospectus is intended to provide only a general discussion and is not a complete analysis or description of all of the U.S. federal income tax considerations that are applicable to you in respect of the Business Combination, nor does it address any tax considerations arising under U.S. state or local or non-U.S. tax laws. |

Q: | When is the Business Combination expected to be completed? |

A: | Subject to the satisfaction or waiver of the Closing conditions described in the section titled “The Business Combination Agreement - Conditions to Closing of the Business Combination,” including the approval of the |

Q: | Who will solicit and pay the cost of soliciting proxies? |

A: | Sandbridge has engaged a professional proxy solicitation firm, Okapi Partners LLC (“Okapi”), to assist in soliciting proxies for the Special Meeting. Sandbridge has agreed to pay Okapi a fee for such services, which it expects will be approximately $20,000. In addition, Sandbridge will reimburse Okapi for reasonable out-of-pocket expenses and will indemnify Okapi and its affiliates against certain claims, liabilities, losses, damages and expenses. Sandbridge will also reimburse banks, brokers and other custodians, nominees and fiduciaries representing beneficial owners of our common stock for their expenses in forwarding soliciting materials to beneficial owners of our common stock and in obtaining voting instructions from those owners. Sandbridge’s management team may also solicit proxies by telephone, by facsimile, by mail, on the Internet or in person. They will not be paid any additional amounts for soliciting proxies. |

Q: | What are the conditions to completion of the Business Combination? |

A: | The consummation of the Business Combination is conditioned upon the following non-waivable conditions: (i) the approval by our stockholders of the Required Transaction Proposals and the approval by Owlet’s stockholders of the Business Combination Agreement and related transactions being obtained; (ii) the applicable waiting period under the HSR Act relating to the Business Combination having expired or been terminated; (iii) after giving effect to the Transactions, Sandbridge having at least $5,000,001 of net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) of the Exchange Act) immediately after the Effective Time; (iv) the absence of any legal restraint or prohibition preventing consummation of the Business Combination; and (v) this proxy statement/registration statement having been declared effective by the SEC. |

Q: | What should I do if I receive more than one set of voting materials? |

A: | Stockholders may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your shares of Sandbridge common stock. |

Q: | Whom do I call if I have questions about the Special Meeting or the Business Combination? |

A: | If you have questions about the Special Meeting or the Business Combination, or desire additional copies of this proxy statement/prospectus or additional proxies, you may contact: |

(1) | Represents the shares of New Owlet common stock the Sponsor and the independent directors and an advisor of Sandbridge will receive upon conversion of the Sandbridge Class B common stock at Closing. Of such shares, 2,807,500 shares of New Owlet common stock will be outstanding following the Closing but will remain subject to price-based performance vesting terms as described in the Sponsor Letter Agreement. |

(2) | Excludes 9,533,637 shares of New Owlet common stock underlying outstanding New Owlet option awards on a net exercise basis. |

• | by the mutual written consent of Sandbridge and Owlet; |

• | by Sandbridge, subject to certain exceptions, if any of the representations or warranties made by Owlet are not true and correct or if Owlet fails to perform any of its respective covenants or agreements under the Business Combination Agreement (including an obligation to consummate the Closing) such that certain conditions to the obligations of Sandbridge, as described in the section titled “The Business Combination Agreement - Conditions to Closing of the Business Combination” below could not be satisfied and the breach (or breaches) of such representations or warranties or failure (or failures) to perform such covenants or agreements is (or are) not cured or cannot be cured within the earlier of (i) thirty (30) days after written notice thereof, and (ii) the Termination Date; |

• | by Owlet, subject to certain exceptions, if any of the representations or warranties made by the Sandbridge Parties are not true and correct or if any Sandbridge Party fails to perform any of its covenants or agreements under the Business Combination Agreement (including an obligation to consummate the Closing) such that the condition to the obligations of Owlet, as described in the section titled “The Business Combination Agreement - Conditions to Closing of the Business Combination” below could not be satisfied and the breach (or breaches) of such representations or warranties or failure (or failures) to perform such covenants or agreements is (or are) not cured or cannot be cured within the earlier of (i) thirty (30) days after written notice thereof, and (ii) the Termination Date; |

• | by either Sandbridge or Owlet, |

• | if the transactions contemplated by the Business Combination Agreement have not been consummated on or prior to the Termination Date, unless the breach of any covenants or obligations under the Business Combination Agreement by the party seeking to terminate proximately caused the failure to consummate the transactions contemplated by the Business Combination Agreement; |

• | if any governmental entity has issued an order or taken any other action permanently enjoining, restraining or otherwise prohibiting the transactions contemplated by the Business Combination Agreement and such order or other action has become final and nonappealable; |

• | if the approval of the Required Transaction Proposals are not obtained at the Special Meeting (including any adjournment thereof); and |

• | by Sandbridge, if Owlet does not deliver, or cause to be delivered to Sandbridge, the Owlet stockholder written consent when required under the Business Combination Agreement. |

• | (a) hold public shares or (b) hold public shares through units and you elect to separate your units into the underlying public shares and public warrants prior to exercising your redemption rights with respect to the public shares; and |

• | prior to p.m., New York City time, on , 2021, (a) submit a written request, including the legal name, telephone number and address of the beneficial owner of the shares for which redemption is requested, to the Transfer Agent that Sandbridge redeem your public shares for cash and (b) deliver your public shares to the Transfer Agent, physically or electronically through DTC. |

• | If we are unable to complete our initial business combination by September 17, 2022, or during any stockholder-approved extension period, we will: (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than 10 business days thereafter, redeem 100% of the public shares, at a per share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the funds held in the Trust Account and not previously released to us to pay our franchise and income taxes (less up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under the DGCL to provide for claims of creditors and the requirements of other applicable law. |

• | There will be no liquidating distributions from the Trust Account with respect to our founder shares if we fail to complete our initial business combination by September 17, 2022, or during any stockholder-approved extension period. Our Sponsor purchased the founder shares prior to our initial |

• | In connection with the closing of our initial public offering, we consummated the sale of 6,600,000 private placement warrants at a price of $1.00 per warrant in a private placement to our Sponsor. The warrants are each exercisable commencing the later of 30 days following the Closing and 12 months from the closing of our initial public offering, which occurred on September 17, 2020, for one share of Sandbridge Class A common stock at $11.50 per share. If we do not consummate a business combination transaction by September 17, 2022, or during any stockholder-approved extension period, then the proceeds from the sale of the private placement warrants will be part of the liquidating distribution to the public stockholders and the warrants held by our Sponsor will be worthless. The warrants held by our Sponsor had an aggregate market value of approximately $11.8 million based upon the closing price of $1.79 per public warrant on the NYSE on February 12, 2021. Upon the Closing, the private placement warrants will become 6,600,000 warrants to purchase shares of New Owlet common stock at an exercise price of $11.50 per share, subject to certain contractual restrictions on transfer. |

• | Our initial stockholders, including certain of our officers and directors, will lose their entire investment in us if we do not complete an initial business combination by September 17, 2022, or during any stockholder-approved extension period, including their initial investment in the founder shares and their at-risk capital, for which the Sponsor received 6,600,000 private placement warrants at a price of $1.00 per warrant. Our initial stockholders, officers and directors own an aggregate of 5,750,000 founder shares, which were purchased prior to our initial public offering for an aggregate purchase price of $25,000, or approximately $0.004 per share. |

• | Concurrently with the execution of the Business Combination Agreement, Sandbridge entered into the Subscription Agreements with the PIPE Investors, pursuant to which the PIPE Investors have agreed to purchase, immediately prior to the Closing, an aggregate of 13,000,000 shares of Sandbridge Class A common stock at a purchase price of $10.00 per share. The PIPE Investors include the PIMCO private funds and certain other investors designated by our Sponsor. |

• | Certain of our officers and directors are expected to continue to serve as directors of New Owlet after the Closing. As such, in the future they may receive cash fees, stock options or stock awards that the New Owlet Board determines to pay to its directors. |

• | In order to protect the amounts held in the Trust Account, the Sponsor has agreed that it will be liable to us if and to the extent any claims by a third party for services rendered or products sold to us, or a prospective target business with which we have entered into a written letter of intent, confidentiality or similar agreement or business combination agreement, reduce the amount of funds in the Trust Account to below (1) $10.00 per public share or (2) the actual amount per public share held in the Trust Account as of the date of the liquidation of the Trust Account, if less than $10.00 per share due to reductions in the value of the trust assets, less taxes payable, provided that such liability will not apply to any claims by a third party or prospective target business who executed a waiver of any and all rights to the monies held in the trust account (whether or not such waiver is enforceable) nor will it apply to any claims under our indemnity of the underwriters of Sandbridge’s initial public offering against certain liabilities, including liabilities under the Securities Act. |

• | Following the consummation of the Business Combination, we will continue to indemnify our existing directors and officers and will maintain a directors’ and officers’ liability insurance policy. |

• | Upon the Closing, subject to the terms and conditions of the Business Combination Agreement, our Sponsor, our officers and directors and any of their respective affiliates may be entitled to reimbursement for any reasonable out-of-pocket expenses related to identifying, investigating, |

(in millions) | | | Assuming No Redemptions of Public Shares | | | Assuming Maximum Redemptions of Public Shares(1) |

Sources | | | | | ||

Owlet Rollover Equity | | | $1,000.0 | | | $1,000.0 |

Proceeds from Trust Account | | | 230.0 | | | 160.0 |

Founder Shares(2) | | | 29.4 | | | 29.4 |

PIPE Investors | | | 130.0 | | | 130.0 |

Total Sources | | | $1,389.4 | | | $1,319.4 |

Uses | | | | | ||

Equity Consideration to Existing Investors | | | $1,000.0 | | | $1,000.0 |

Cash to Balance Sheet | | | 325.0 | | | 255.0 |

Founder Shares | | | 29.4 | | | 29.4 |

Estimated Transaction Fees & Expenses(3) | | | 35.0 | | | 35.0 |

Total Uses | | | $1,389.4 | | | $1,319.4 |

(1) | These numbers assume that the Minimum Available Sandbridge Cash Amount is not waived. |

(2) | Excludes 2,807,500 shares of New Owlet common stock that will be outstanding following the Closing but will remain subject to price-based performance vesting terms as described in the Sponsor Letter Agreement. |

(3) | Consists of $8.05 million in deferred underwriting commissions from Sandbridge’s initial public offering, $4.23 million in placement agent fees in connection with the PIPE Investment, $8 million in Owlet financial advisory fees, $6.5 million in legal fees, $2.22 million in accounting fees, and an estimated $6 million in miscellaneous fees and expenses, including consulting fees, proxy solicitation fees, SEC registration fees, printing fees and audit fees. |

• | Owlet stockholders will have the largest voting interest in the post-combination company; |

• | the board of directors of the post-combination company will have up to nine members, and Owlet will have the ability to nominate the majority of the members of the board of directors; |

• | Owlet management will continue to hold executive management roles for the post-combination company and be responsible for the day-to-day operations; |

• | the post-combination company will assume the Owlet name; |

• | the post-combination company will maintain the current Owlet headquarters; and |

• | the intended strategy of the post-combination entity will continue Owlet’s current strategy of product development and market penetration. |

• | Owlet has a limited operating history and has grown significantly in a short period of time. Owlet needs to continue to increase the size of its organization and, if unable to manage its growth effectively, Owlet’s business could be materially and adversely affected. |

• | Owlet has a history of net losses and may not achieve or maintain profitability in the future. |

• | If the U.S. Food and Drug Administration (“FDA”) or any other governmental authority were to require marketing authorization for the Owlet Smart Sock, or for any other product that Owlet sells and which Owlet does not believe requires such marketing authorization, Owlet could be required to cease selling or recall the product pending receipt of marketing authorization from the FDA or such other governmental authority, which can be a lengthy and time-consuming process, harm financial results and Owlet may also be subject to regulatory enforcement action. |

• | Owlet is required to obtain and maintain marketing authorizations from the FDA for any products intended to be and/or classified as medical device products in the United States, which can be a lengthy and time-consuming process, and a failure to do so on a timely basis, or at all, could severely harm Owlet’s business. |

• | Owlet currently relies on sales of its Owlet Smart Sock technologies and related products for the majority of its revenue and expects to continue to do so for the foreseeable future. |

• | A substantial portion of Owlet sales comes through a limited number of channel partners and resellers. |

• | Owlet currently relies on a single manufacturer for the assembly of the Owlet Smart Sock and a single manufacturer for the assembly of the Owlet Cam and expects to rely on limited manufacturers for future products. If Owlet encounters manufacturing problems or delays, Owlet may be unable to promptly transition to alternative manufacturers and its ability to generate revenue will be limited. |

• | If Owlet is unable to obtain key materials and components from sole or limited source suppliers, Owlet will not be able to deliver its products to customers. |

• | If Owlet is unable to adequately protect its intellectual property rights, or if Owlet is accused of infringing on the intellectual property rights of others, its competitive position could be harmed or Owlet could be required to incur significant expenses to enforce or defend its rights or to pay damages. |

• | Owlet relies significantly on information technology (“IT”) and any failure, inadequacy, interruption or security lapse of that technology, including any cybersecurity incidents, could lead to misappropriation of confidential or otherwise protected information and harm Owlet’s business and its ability to operate our business effectively. |

• | Owlet faces the risk of product liability claims and the amount of insurance coverage held now or in the future may not be adequate to cover all liabilities Owlet might incur. |

• | Increased expansion into international markets will expose Owlet to additional business, political, regulatory, operational, financial and economic risks. |

• | Owlet may be required to obtain and maintain regulatory authorizations in order to commercialize its products in international markets, and failure to obtain regulatory authorizations in relevant foreign jurisdictions may prevent Owlet from marketing medical device products abroad. |

• | Customer or third-party complaints or negative reviews or publicity about Owlet or its products and services could harm Owlet’s reputation and brand. |

• | Some of Owlet’s products and services are in development or have been recently introduced into the market and may not achieve market acceptance, which could limit Owlet’s growth and adversely affect its business, financial condition and results of operations. |

• | Owlet may acquire other businesses or form other joint ventures or make investments in other companies or technologies but has no experience in doing so. These types of transactions could negatively affect Owlet’s operating results, dilute its stockholders’ ownership, increase debt or lead to significant expense or lose focus on core operations. |

• | We have identified material weaknesses in our internal control over financial reporting and we may identify additional material weaknesses in the future or otherwise fail to maintain effective internal control over financial reporting, which may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations or cause our access to the capital markets to be impaired. |

• | We may need to raise additional capital in the future in order to execute our strategic plan following the Business Combination and related transactions, which may not be available on terms acceptable to us, or at all. |

• | Owlet’s business, financial condition, results of operations and growth may be impacted by the effects of the COVID-19 pandemic. |

• | Following the Business Combination, Owlet will incur increased costs and become subject to additional regulations and requirements as a result of becoming a public company. |

Statement of Operations Data: | | | Period from June 23, 2020 (inception) Through December 31 2020 |

General and administrative expenses | | | $480,436 |

Net loss | | | $(427,187) |

Weighted average shares outstanding of Class A redeemable common stock | | | 23,000,000 |

Basic and diluted income per share, Class A redeemable common stock | | | $— |

Weighted average shares outstanding of Class A and Class B non-redeemable common stock | | | 5,435,083 |

Basic and diluted net loss per share, Class B non-redeemable common stock | | | $(0.08) |

Condensed Balance Sheet Data (at period end) | | | December 31, 2020 |

Total Assets | | | $231,614,335 |

Total Liabilities | | | $315,328 |

Class A common stock, $0.0001 par value; 100,000,000 shares authorized; 1,175,100 shares issued and outstanding (excluding 21,824,900 shares subject to possible redemption) | | | 118 |

Class B common stock, $0.0001 par value; 10,000,000 shares authorized; 5,750,000 shares issued and outstanding | | | 575 |

Total Stockholders’ Equity | | | $5,000,007 |

Cash Flow Data | | | Period from June 23, 2020 (inception) Through December 31, 2020 |

Net cash used in operating activities | | | $(455,960) |

Net cash used in investing activities | | | $(230,000,000) |

Net cash provided by financing activities | | | $231,743,194 |

(in thousands, except share and per share numbers) | | | Year Ended December 31, 2020 | | | Year Ended December 31, 2019 |

Consolidated Statement of Operations data: | | | | | ||

Revenues | | | $75,403 | | | $49,801 |

Cost of revenues | | | 39,526 | | | 26,897 |

Gross profit | | | 35,877 | | | 22,904 |

Total operating expenses | | | 42,868 | | | 39,954 |

Operating loss | | | (6,991) | | | (17,050) |

Net loss | | | $(10,521) | | | $(17,851) |

Net loss per share attributable to common stockholders, basic and diluted | | | $(0.98) | | | $(1.76) |

Weighted-average number of shares outstanding used to compute net loss per share attributable to common stockholders, basic and diluted | | | 10,693,984 | | | 10,132,242 |

(in thousands) | | | As of December 31, 2020 | | | As of December 31, 2019 |

Consolidated Balance Sheet data: | | | | | ||

Total assets | | | $40,118 | | | $28,200 |

Total liabilities | | | 60,939 | | | 39,914 |

Redeemable convertible preferred stock | | | 47,188 | | | 47,188 |

Additional paid-in capital | | | 3,708 | | | 2,294 |

Accumulated deficit | | | (71,718) | | | (61,197) |

Total stockholders' deficit | | | (68,009) | | | $(58,902) |

| | | Year Ended December 31, 2020 | | | Year Ended December 31, 2019 | |

Consolidated Cash Flow data: | | | | | ||

Net cash used in operating activities | | | $(129) | | | $(16,061) |

Net cash used in investing activities | | | (1,056) | | | (1,959) |

Net cash provided by financing activities | | | 6,458 | | | 12,455 |

Net change in cash and cash equivalents | | | $5,273 | | | $(5,565) |

• | Assuming No Redemptions: This presentation assumes that no public stockholders of Sandbridge exercise redemption rights with respect to their public shares for a pro rata share of the funds in the Trust Account. |

• | Assuming Maximum Redemptions: This presentation assumes 7,000,000 of the public shares are redeemed for their pro rata share of the funds in Trust Account for aggregate redemption payments of $70.0 million. The Business Combination Agreement includes as a condition to closing the Business Combination that, at the Closing, Sandbridge will have a minimum of $140.0 million in cash comprising the cash held in the Trust Account after deducting (x) amounts payable for Sandbridge share redemptions and (y) deferred underwriting commissions held in the Trust Account and Sandbridge’s expenses incurred in connection with the transactions contemplated by the Business Combination Agreement and Sandbridge’s operations (such commissions and expenses estimated to be $20.0 million), but excluding the PIPE Investment Amount actually received by Sandbridge prior to or substantially concurrent with the Closing. This scenario is based on satisfaction of the Minimum Available Sandbridge Cash Amount condition. |

| | | No Redemption (Shares) | | | % | | | Maximum Redemption (Shares) | | | % | |

Owlet equityholders(1) | | | 90,466,363 | | | 68.4% | | | 90,466,363 | | | 72.2% |

Sandbridge’s public stockholders | | | 23,000,000 | | | 17.4% | | | 16,000,000 | | | 12.8% |

Sponsor & related parties(2) | | | 5,750,000 | | | 4.4% | | | 5,750,000 | | | 4.6% |

PIPE Investors | | | 13,000,000 | | | 9.8% | | | 13,000,000 | | | 10.4% |

Pro Forma New Owlet Common Stock at Closing | | | 132,216,363 | | | 100% | | | 125,216,363 | | | 100% |

(1) | Excludes 9,533,637 shares of New Owlet common stock underlying outstanding New Owlet option awards on a net exercise basis. |

(2) | Represents the shares of New Owlet common stock the Sponsor and the independent directors and an advisor of Sandbridge will receive upon conversion of the Sandbridge Class B common stock at Closing. Of such shares, 2,807,500 shares of New Owlet common stock will be outstanding following the Closing but will remain subject to price-based performance vesting terms as described in the Sponsor Letter Agreement. |

• | historical per share information of Sandbridge for the period from June 23, 2020 (inception) through December 31, 2020; |

• | historical per share information of Owlet for the year ended December 31, 2020; and |

• | unaudited pro forma per share information of the combined company for the year ended December 31, 2020 after giving effect to the Business Combination, assuming two redemption scenarios as follows: |

• | Assuming No Redemptions: This presentation assumes that no public stockholders of Sandbridge exercise redemption rights with respect to their public shares for a pro rata share of the funds in the Trust Account. |

• | Assuming Maximum Redemptions: This presentation assumes that 7,000,000 of the public shares are redeemed for their pro rata share of the funds in the Trust Account for aggregate redemption payments of $70.0 million. The Business Combination Agreement includes as a condition to closing the Business Combination that, at the Closing, Sandbridge will have a minimum of $140.0 million in cash generated from the cash held in the Trust Account after deducting (x) amounts payable for Sandbridge share redemptions and (y) deferred underwriting commissions held in the Trust Account and Sandbridge’s expenses incurred in connection with the transactions contemplated by the Business Combination Agreement and Sandbridge’s operations (such commissions and expenses estimated to be $20.0 million), and disregarding the PIPE Investment Amount actually received by Sandbridge prior to or substantially concurrent with the Closing. This scenario is based on satisfaction of the Minimum Available Sandbridge Cash Amount Condition. |

| | | Historical | | | Pro Forma Combined | | | Equivalent Pro Forma Combined | ||||||||||

| | | Sandbridge | | | Owlet | | | No redemption scenario | | | Maximum redemption scenario | | | No redemption scenario | | | Maximum redemption scenario | |

For the Year Ended December 31, 2020 | | | | | | | | | | | | | ||||||

Book value per share - basic and diluted Class A redeemable common stock(1a) | | | $0.22 | | | $6.36 | | | $2.27 | | | $1.86 | | | $3.49 | | | $2.71 |

Book value per share of Class A and B non-redeemable common stock(1b) | | | 0.92 | | | — | | | | | | | | | ||||

Net loss per share - basic and diluted(2a) | | | (0.00) | | | (0.98) | | | (0.06) | | | (0.07) | | | (0.10) | | | (0.10) |

Net loss per share – basic and diluted Class A and B non-redeemable common stock(2b) | | | (0.08) | | | — | | | | | | | | | ||||

Weighted average shares outstanding – basic and diluted Class A redeemable common stock | | | 23,000,000 | | | 10,693,984 | | | 138,942,500 | | | 131,942,500 | | | 90,466,363 | | | 90,466,363 |

Weighted average shares outstanding – basic and diluted Class A and Class B redeemable common stock | | | 5,435,083 | | | | | | | | | | | |||||

Cash dividends declared per share | | | — | | | — | | | — | | | — | | | — | | | — |

(1a) | Book value per share is calculated as total equity divided by: Sandbridge Class A redeemable common stock outstanding at December 31, 2020; and Owlet common stock outstanding at December 31, 2020 and pro forma information. |

(1b) | Book value per share is calculated as total equity divided by: Sandbridge Class A and Class B non-redeemable common stock outstanding at December 31, 2020. |

(2a) | Net loss per share is based on: weighted average number of shares of Sandbridge Class A redeemable common stock outstanding for the period from June 23, 2020 (inception) through December 31, 2020; and weighted average number of shares of Owlet common stock outstanding for the year ended December 31, 2020 and the pro forma information. |

(2b) | Net loss per share is based on: weighted average number of shares of Sandbridge Class A and Class B non-redeemable common stock outstanding for the period from June 23, 2020 (inception) through December 31, 2020. |

• | manage our commercial operations effectively; |

• | identify, recruit, retain, incentivize and integrate additional employees; |

• | provide adequate training and supervision to maintain our high quality standards and preserve our culture and values; |

• | manage our internal development and operational efforts effectively while carrying out our contractual obligations to third parties; and |

• | continue to improve our operational, financial and management controls, reports systems and procedures. |

• | perceived benefits from our products and services; |

• | perceived cost effectiveness of our products and services; |

• | perceived safety and effectiveness of our products and services; |

• | our ability to obtain any required marketing authorizations for our products and services and the label requirements of any approvals we may obtain; |

• | reimbursement available through government and private healthcare programs for using some of our products and services; and |

• | introduction and acceptance of competing products and services or technologies. |

• | the imposition of additional U.S. and foreign governmental controls or regulations; |

• | the imposition of costly and lengthy new export licensing requirements; |

• | the imposition of requirements to maintain data and the processing of that data on servers located within the United States or in foreign countries; |

• | a shortage of high-quality employees, sales people and distributors; |

• | the loss of any key personnel that possess proprietary knowledge, or who are otherwise important to our success in certain international markets; |

• | changes in duties and tariffs, license obligations and other non-tariff barriers to trade; |

• | the imposition of new trade restrictions; |

• | the imposition of restrictions on the activities of foreign agents, representatives and distributors; |

• | compliance with or changes in foreign tax laws, regulations and requirements and economic and trade sanctions programs; |

• | evolution in regulatory landscapes, such as on account of the United Kingdom (“UK”) leaving the European Union (“EU”), and uncertainties that arise from such evolution; |

• | pricing pressure; |

• | changes in foreign currency exchange rates; |

• | laws and business practices favoring local companies; |

• | political instability and actual or anticipated military or political conflicts; |

• | financial and civil unrest worldwide; |

• | outbreaks of illnesses, pandemics or other local or global health issues; |

• | natural or man-made disasters; |

• | the inability to collect amounts paid by foreign government customers to our appointed foreign agents; |

• | longer payment cycles, increased credit risk and different collection remedies with respect to receivables; and |

• | difficulties in enforcing or defending intellectual property rights. |