The Carbon instrument is a universal automated sample preparation instrument. Carbon is designed to help automate the workflow by addressing a process that is traditionally complicated and manual. Carbon is designed to enable a wide range of

applications through a simple single-use fluidics cartridge. Specific features include the ability to:

|

● |

Transport and meter out small volumes of reagents/samples between reservoirs;

|

|

● |

Perform chemical or enzymatic incubations with or without temperature control;

|

|

● |

Purify target analyte; and

|

|

● |

Automate sample prep through to library creation.

|

For protein sequencing, Carbon is designed to automate the processes of loading the Chips and protein digestion, capping, conjugation and clean-up with walk-away operation.

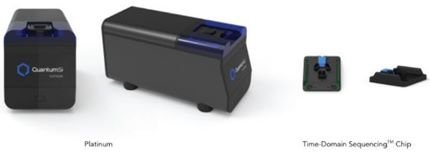

Platinum — Single Molecule Detection Instrument

Platinum Instrument and Time-Domain Sequencing™ Chip

Our flagship sequencing instrument, Platinum, is designed to make the power of single-molecule detection and NGPS broadly accessible. While

traditional instruments like mass spectrometers may cost anywhere from $250,000 to over $1,000,000 per new instrument, our Platinum device retails for approximately $70,000. Platinum is designed to provide a streamlined rapid workflow compared to legacy MS workflows. Platinum uses our proprietary semiconductor chip that leverages Time-Domain Sequencing™ with an initial focus on NGPS for an

unbiased view of the proteome. We believe the digital nature of the sequencing readout could enable users to answer three key questions:

|

● |

What protein is present? Amino acid resolution can provide insight into more than just whether a protein is present or absent. The sequence information could also

indicate what version of the protein is present and how it has been changed from the normal version.

|

|

● |

How much of the protein is present? A digital quantification provides precise protein abundance, not an analog theoretical abundance based on a colorimetric or mass

abundance readout.

|

|

● |

How has the protein been modified? Single-molecule sensitivity could show how the protein has been post-translationally modified thus providing greater insights to its

role in the context of biological processes within the cell.

|

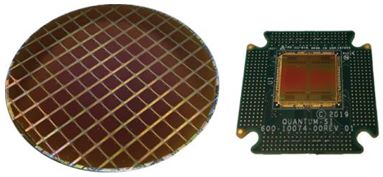

Our semiconductor chip is the core of our technology. By leveraging developments in the semiconductor industry, we are developing our scalable single-molecule next generation protein sequencer.

Similar to the camera in a mobile phone, our chip is produced in standard semiconductor foundries and has been designed to provide insight into biology. The power of our approach is that rather than analyzing proteins one at a time, our chip is

designed to enable parallel sequencing across millions of independent chambers, and the number of parallel sequencing reactions to scale rapidly. Each independent sequencing reaction takes place at the ultimate level of sensitivity and

specificity, single molecules, which is critical to protein detection because there is no way to amplify protein, preventing existing amplification-based technologies to enable protein sequencing.

A Wafer of Quantum-Si Time-Domain™ Sequencing Chip (left) and Individual Chip Mounted to a Printed Circuit Board (right)

Our team has considerable experience in the fabrication processes for semiconductor chips, which is a complex process, and has successfully used chips to advance NGS previously at other companies.

We have developed and optimized processes with the third-party foundry that supplies our chips, which allows us to make integrated chips using standard foundry processes with sufficient performance for our commercial needs and to scale to meet

our customer demand. We believe that our proprietary chip is a core component in our ability to scale. Ultimately, we will need to utilize larger and more powerful chips capable of processing more complex biological samples.

In November 2021, we acquired Majelac Technologies LLC (“Majelac”), a semiconductor packaging company based in Garnet Valley, Pennsylvania. The acquisition brought our semiconductor chip assembly

and packaging capabilities in-house in order to secure our supply chain and support our commercialization efforts.

Consumables for Use in Carbon and Platinum

In addition, we expect to begin to derive recurring revenue from the sale of consumables. These consumables will be required for users to run samples through the Carbon and Platinum instruments.

Consumables consist of our reagent kits and chips and are designed for use only with our instruments.

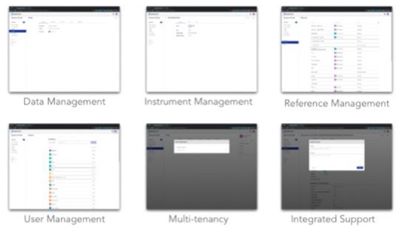

Quantum-Si Cloud™ — Faster, Simpler, Data Analysis

Quantum-Si Cloud™

Our platform is designed to integrate a cloud-based solution into the instrument to stream data in real-time to the cloud where analytical workflows can then interpret the data. For example, while

we expect that sequencing data will be stored on the Platinum instrument itself, our cloud-based solution is designed to map peptide sequences to proteins and facilitate the required counting for protein identification and quantitation in the

cloud.

We are also developing our cloud-based solution to include the following features:

|

● |

User management for secured data access;

|

|

● |

Light-weight library information management system for data management;

|

|

● |

Multi-tenancy to enable data sharing and collaborations; and

|

We believe we have designed our cloud solution to address the key needs of researchers today, including to address potential bottlenecks that we believe might otherwise limit customer satisfaction

and routine use of our instruments, while providing the data governance and security required for clinical use in the future.

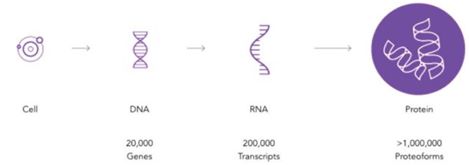

Time-Domain Sequencing™ and Next Generation Protein Sequencing (NGPS)

With proteins, there are 20 amino acids, therefore technologies that use color alone, would not be able to scale to that number of characters. Our proprietary chip is designed to use time, instead of color, to detect amino acids, and we combine time with intensity and single-molecule kinetics to capture three

dimensions of data. We expect that three dimensions of data will ultimately enable us to cover all 20 amino acids.

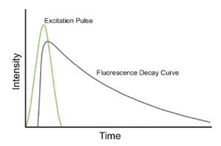

The core of our proprietary detection method, which we refer to as Time-Domain Sequencing™, is based on the fluorescence lifetime of dyes. Fluorescence lifetime is a measure of the time a

fluorophore dye spends in the excited state before returning to the ground state by emitting a photon of light. Different dyes emit photons of light at different rates that follow a known distribution.

Example Photon Emission Distribution of a Dye After Excitation

Our Platinum instrument includes a proprietary mode-locked laser, which provides the excitation light pulse, and our semiconductor chip allows us to

reject the laser light and then rapidly collect, bin and measure the arrival time of emitted photons of a fluorescently labeled molecule. By binning and

measuring the arrival times of photons we can then calculate the fluorescence lifetime, which can be used as a surrogate for the wavelength/color measurements. By using time instead of color to analyze proteins, we can leverage semiconductors’

ability to measure time.

For NGPS, we fluorescently label recognizer molecules, which are designed to bind to the terminal end of a peptide (piece of a protein) that has been immobilized to the bottom of the reaction

chamber. A single recognizer is capable of uniquely identifying more than one amino acid. By leveraging the fluorescent lifetime and intensity of the dye, our technology is designed to accurately determine the recognizer. By measuring the on

and off rate (kinetic information) of a recognizer as it interacts with the terminal amino acid tens to hundreds of times, we believe our technology can accurately identify the amino acid.

After removing the terminal amino acid, the recognition process repeats until the full peptide chain is sequenced. While traditional single-molecule platforms rely on single measurement for the

detection of an event, the advantage of our approach is that our technology can actually obtain tens to hundreds of data points for each amino acid. Cumulatively, we expect the multiple measurements to deliver high amino acid call accuracy.

Overview of the Protein Sequencing Process

Our Competitive Strengths

We believe that our competitive strengths include the following:

|

● |

Differentiated single molecule detection providing the ultimate level of protein sensitivity and specificity. Our platform is based on our proprietary semiconductor chip

designed to enable measurements at the ultimate level of sensitivity and specificity, single molecules. By enabling single molecule detection, we are not reliant on ensemble measurements, which can often vary from sample to sample and

even run to run.

|

|

● |

Amino acid resolution and Post-Translational Modification (PTM) detection. Moving beyond simple confirmatory information provided by affinity-based platforms, our

platform delivers amino acid resolution shifting the output from analog to digital. The ability to also identify PTMs could provide novel insights into how pathways are turned on/off to improve our understanding of the estimated 1 million

+ proteoforms.

|

|

● |

Real-time data processing and Cloud platform provides fast, simple data analysis. During sequencing our Platinum instrument is designed to stream data to the cloud in

real-time, which could allow for faster time to results. In addition, we have developed our cloud-based platform to provide key tools needed to streamline use of the platform such as secure access, data management, and an open platform

where developers can create new analytical workflows to run in our cloud and share them easily with other users.

|

|

● |

Innovative proprietary end-to-end proteomic platform offering differentiated full suite of protein sequencing solutions. We believe that our platform will enable full

end-to-end proteomics workflow solution spanning sample preparation through protein sequencing and analysis, allowing our customers a seamless opportunity to perform proteomic studies at scale. We also believe that we are the first

company to successfully enable NGPS. We believe the digital nature of our readout provides an accurate and repeatable quantification of proteins in the sample and could scale to enable millions of data points working at the ultimate

level of sensitivity — single molecule resolution.

|

|

● |

Platform to enable democratized access to proteomics tools. Our platform is designed to provide an easy-to-use workflow with the potential to enable users the ability to

better characterize and understand the full complexity of the proteome in an unbiased fashion. Current workflows are typically disaggregated, expensive, require significant training to operate, and are often performed in a separate

specialty laboratory. We aim for our technology platform to be broadly available across pharmaceutical and academic research centers, basic research labs, and other healthcare centers and clinical laboratories (for RUO until appropriate

regulatory authorization is secured to allow clinical or diagnostic uses) at a price point that is a significant discount to most legacy technologies. The reduction in both cost and complexity could allow for rapid adoption, whether a

user is replacing a legacy technology or buying a new instrument. In addition to appealing to users of existing proteomics tools, we believe that our proteomics platform will appeal to users of DNA sequencing technologies who seek to

augment their research and discovery of biomarkers and further deepen their understanding of biology.

|

|

|

●

|

Business model that leverages growing installed base of instruments. In

December 2022, we launched Platinum™ for RUO. As part of our commercialization efforts, we aim to grow our installed base, optimize workflows, and

expand our applications, which we expect will then generate substantial, recurring revenues from our consumables.

|

|

● |

Robust patent protection. We have a strong intellectual property strategy in which we have 214 issued patents and 797 pending applications as of December 31, 2022. Many

from our management team worked directly with our Founder, Dr. Jonathan Rothberg, as he revolutionized the creation of next generation DNA sequencing while founding Ion Torrent, which was acquired by Life Technologies in 2010. Our team

has similarly devoted its efforts to revolutionizing unbiased proteomic analysis using a similar scientific and technical validation approach since our founding in 2013.

|

|

● |

Experienced Life Science Management team combined with a visionary founder and experienced financial partners with deep experience in healthcare. We have a world-class

management team, including our executive officers and other senior management, with decades of cumulative experience in the healthcare and life sciences end-markets. Many members of the team worked directly with our Founder and Chairman,

Dr. Jonathan Rothberg to successfully commercialize previous DNA sequencing technologies. Dr. Rothberg has dedicated his career to developing breakthrough technologies to revolutionize healthcare. He has founded more than 10 healthcare

technology companies and has received numerous awards, including the Presidential Medal of Technology & Innovation in 2016. Dr. Rothberg previously founded 454 Life Sciences, a high throughput DNA sequencing platform which was later

sold to Roche, as well as founded Ion Torrent, a next generation sequencing platform which was later sold to Life Technologies. We believe this leadership team positions us as a potentially disruptive force in creating a new market of

next generation protein sequencing.

|

Our Strategies

Our strategies include the following:

|

● |

Systematic and phased approach to broad commercialization and adoption. In December 2022, we launched Platinum™ for RUO. Members of our team have previously utilized a

systematic approach designed to drive early adoption to successfully launch other disruptive sequencing technologies, including the roll out of Ion Torrent’s next generation DNA sequencing technology. We believe this approach will allow

us to introduce our platform in a structured manner to demonstrate its use and practicality, while working directly with our key potential customers and industry thought leaders to help ensure a positive experience. Our core leadership

team has decades of cumulative experience working directly in the life sciences industry with many of the companies and research centers that have the potential to become key customers and that we will seek to build into our prospective

customer pipeline.

|

|

● |

Build our commercial infrastructure to help ensure successful initial commercial launch in the U.S. We expect to build out our commercial and operational infrastructure

to sell and support our platform as we commercialize our technology and gain traction. Our investments will be aligned with our initial traction in the Market. We also have manufacturing partnerships that we believe will allow us to

rapidly expand our capacity, with the ability to create new manufacturing lines to meet potential customer demand. In November 2021, we acquired Majelac, a semiconductor packaging company based in Garnet Valley, Pennsylvania. The

acquisition brings our semiconductor chip assembly and packaging capabilities in-house in order to secure our supply chain and support our commercialization efforts.

|

|

● |

Invest in market development activities to increase awareness of the importance of the proteome and the strengths of our platform. We believe our platform has the

capability to enable users to generate significant amounts of proteomic information at speed, scale, and simplicity through a solution that until our launch, was not available. We believe the utility of our platform will span basic and

discovery applications and translational research in which there is a strong market need for proteomic analysis for novel discoveries and better insights into the complexity of disease. We plan to invest in market development activities

and partnerships to increase awareness of the importance and utility of proteomics to expand and accelerate demand for our products.

|

|

● |

Continued technical innovation to drive product enhancements, new products, and additional applications. Our leadership team has deep expertise in scientific and

technological development and commercialization. After we commercialize our initial products, we aim to continually innovate and develop new products, product enhancements, applications, workflows, and other tools to enable our customers

to generate unbiased proteomic information at scale on a benchtop platform.

|

|

● |

Accessibility and Enablement: Enable broad adoption of protein sequencing. Our mission is to democratize single molecule proteomic analysis by providing a full workflow

of solutions at an affordable cost. We believe that our platform will directly address many of the key bottlenecks that exist within legacy proteomic technologies, namely low sensitivity, lack of dynamic range, complex workflow, complex

analysis, and high cost. We believe our platform offers the potential for a more practical, affordable, and intuitive end-to-end workflow solution relative to many legacy proteomic technologies. We have specifically developed our

platform to be adopted and integrated into any existing lab. We believe that our platform will have wide utility across the study of proteins, including basic and discovery research and, subject to regulatory authorization, clinical

diagnostics, and potentially industrial applications like bioproduction. Our ability to develop our platform such that it will be offered at a significant discount to many legacy instruments and other proteomic technologies, may allow

proteomic analysis to reach new markets and new users, potentially enabling and accelerating innovative discoveries.

|

|

● |

Continue to strengthen our intellectual property portfolio for existing and new technologies. We have a broad and deep patent protection strategy, which includes 214

issued patents and over 797 pending applications as of December 31, 2022. Protection of our intellectual property is a strategic priority for the business. We have taken, and will continue to take, steps to protect our current and

future intellectual property and proprietary technology. We believe our broad patent portfolio and continued rigorous patent protection strategy will help to allow us to focus on our key priorities of commercializing our platform,

continuing to innovate with new technologies, and preventing fast-followers.

|

|

● |

Foster extraordinary talent inspired and unified by our mission. With decades of cumulative experience in the healthcare and life sciences markets among our executive

officers and other senior management, our world-class management team is unified by our mission to democratize single molecule proteomic analysis by making protein sequencing accessible globally. We seek to execute at scale the vision of

our Founder and Chairman, Dr. Jonathan Rothberg. He has dedicated his career to enabling breakthrough technologies to revolutionize healthcare by bringing together talented, innovative people. We plan to continue to add talented and

experienced members to our team and maintain our commitment to our mission of democratizing proteomic analysis by making protein sequencing accessible globally.

|

Commercial Strategy and Launch Plan

Our proprietary platform has been specifically designed to provide full, rapid insight into the proteome at various scales. Our end-to-end workflow

solution, at launch, will be comprised of instruments, consumables, and software and has been designed at a favorable price point relative to legacy technologies to promote easy adoption, while simplifying and automating the single molecule

proteomics workflow. Our commercial strategy is designed to place our instruments initially with a wide variety of customer types, and ultimately to improve our products by increasing throughput and developing additional applications to expand

our users and increase the consumable utilization by our installed base. In December 2022, we launched Platinum™ for RUO. We expect to start our Carbon beta testing program in 2023 as well. As our instruments are placed with research customers

and we build the installed base, we expect to derive recurring revenue from the sale of consumables.

As we continue to commercialize our platform, we plan to build out our commercial operations infrastructure necessary to sell and support our platform,

across a growing number of market segments and geographies. We are focusing our direct sales and marketing efforts primarily on principal investigators, directors, and other core personnel at academic research and biopharma labs that are

critical to their organization’s buying decisions. In addition, we have manufacturing partnerships that we believe will allow us to rapidly expand our capacity, with the ability to create new manufacturing lines to meet potential customer

demand. We will expand into other geographies through a combination of our own direct sales force as well as the use of third-party channel partners.

Members of our team have previously successfully utilized this approach to launch other disruptive technologies at other companies. We believe this approach will allow us to introduce our platform

in a structured manner to demonstrate its use and practicality, while working directly with key potential customers to help ensure a positive experience. Our core leadership team has decades of experience working directly in the life sciences

industry with many of the companies and research centers that have the potential to become key customers and we expect to build into our prospective customer pipeline.

Our commercial launch plan is comprised of the following phases following beta testing in product development:

|

1. |

Metered Launch: In December 2022, we launched Platinum™ for RUO. In our initial launch, we are targeting established academic research centers and pharmaceutical

companies in the United States and Europe. During our initial launch phase, we are focusing on driving our technology into research centers. Our platform is currently intended for RUO applications, and it will continue to be marketed as

RUO until regulatory authorizations allowing for clinical or diagnostic uses are obtained. We are targeting customers that will directly benefit from the value of our platform across a number of applications, including basic and

discovery research and translational research. We anticipate these customers may already have existing proteomic capabilities through legacy instruments such as a MS, and so will understand the importance of single molecule, unbiased

proteomic analysis. During this phase, we expect to continue to strengthen our commercial organization and broaden our commercial footprint to support an increasing number of customers.

|

|

2. |

Product Updates: As we continue commercialization in 2023 and beyond, we expect to focus on building our installed base and expanding global access to our platform. We

expect to make product enhancements to our initial platform and to make them available to our new and then existing customers. Potential improvements could include an increase in the capacity of our semiconductor chips or chemistry

enhancements to our instruments, which may improve accuracy, coverage, speed and data output.

|

|

3. |

Portfolio Expansion: Ultimately, we plan to advance and develop new products and key applications designed to “scale up” our Platinum instrument to provide higher

throughput and enable greater levels of data output and broader coverage of the proteome. We also plan to “scale down” by eventually launching our Atto instrument, which will be a low cost, low throughput instrument, potentially creating

a pathway to point of care testing. We may also seek regulatory authorization for clinical or diagnostic use of our products.

|

Product Roadmap

Our product roadmap is designed to position us as a potential leader in the proteomic analysis market. We believe we are the first company to successfully enable NGPS on a semiconductor chip.

Following our expected commercial launch, we plan to continue to improve our platform through product improvements and to eventually offer lower-throughput instruments at a lower price point.

Following our commercial launch, we are focused on building our installed

base and expanding global access to our platform. We expect to make product enhancements to our initial platform and to make them available to our new and then existing customers. Potential improvements could include an increase in the

capacity of our semiconductor chips or chemistry enhancements to our instruments, which may improve accuracy, coverage, and speed. In the future, we may seek to expand our product line, such as by increasing, or decreasing, the throughput of

our Platinum instrument to offer specialized products to address key markets and applications.

In addition to potential future advancements in hardware, we plan to expand our computational capabilities by developing firmware and data analytics tools. We believe that our software solutions

could be a key differentiating advantage relative to legacy systems. We believe the integration of our cloud system solution directly into the platform can ensure seamless real time data streaming real time to the cloud where analytical

workflows can help simplify data interpretation.

Through this product roadmap, we have the potential to become a leader in the proteomic analysis market, with the mission of transforming single molecule analysis and democratizing its use by

directly enabling researchers and clinicians access to the proteome. We believe we are the first company to successfully enable NGPS on a semiconductor chip, thus digitizing a substantial proteomics opportunity, which allows for a massively

parallel solution at the ultimate level of sensitivity — single molecule detection.

Suppliers and Manufacturing

Our products are built using both custom-made and off-the-shelf components supplied by outside manufacturers and vendors located in Asia, Europe, and the United States. One key custom-made

component is the disposable semiconductor chip. Others include the proprietary mode-locked laser and enzymes, and buffers used for protein sequencing. The majority of other components for the instruments are off-the-shelf.

We purchase some of our components and materials used in manufacturing, including the semiconductor chip, from single source suppliers. We believe

that alternatives would be available; however, it may take time to identify and validate replacement components, which could negatively affect our ability to supply our products on a timely basis. To mitigate this future risk, we and our

third-party contractors will typically carry a significant inventory of our critical components and develop a second source strategy.

All our instruments are co-manufactured tested, and supported by our manufacturer partner with which we have long-standing relationships, including our key manufacturing partners for the manufacture

of instruments and chips which we have worked with for the past four-to-five years. We believe that our manufacturing strategy is efficient and conserves capital. However, we do not have long-term supply or manufacturing commitments from our

suppliers or manufacturers, as our products and components are currently supplied on a purchase order basis. In addition, we will need to increase the supply and manufacturing of our products as we continue to commercialize our platform. In the

event it becomes necessary to utilize a different contract manufacturer for our products, we may experience additional costs, delays and difficulties in doing so, and our business could be harmed. We are continually evaluating our supply chain

to help ensure our manufacturing and supply chain footprint will meet our business objectives.

In November 2021, we acquired Majelac, a semiconductor packaging company based in Garnet Valley, Pennsylvania. The acquisition brought our semiconductor chip assembly and packaging capabilities

in-house to secure our supply chain and support our commercialization efforts.

Human Capital

Our people are the reason for our success, and we have structured our organization to maximize productivity and performance. Our future success largely depends upon our continued ability to attract

and retain highly skilled employees. As of December 31, 2022, we employed 196 full-time employees in the United States and 6 full-time employees internationally with the majority of our employees engaged

directly in research and development, and are actively building our commercial organization as demand increases; 43% of whom hold PhDs. None of our employees are covered by collective bargaining agreements. We understand that our success depends

on our highly talented employees, and our human capital management practices focus on attracting and retaining a diverse and engaged workforce.

Mission and Core Values. Our mission is to make

proteomics available to researchers around the world by using our proprietary technology. We are committed to providing an unbiased view of all the molecules of

life through improved scale, resolution and sensitivity leading to better understanding of disease and improved general health. Employees are made aware of our values - Team, Accountability, Passion, Excellence, Transparency, Competitive and

Diversity. These values are the basis of our actions and decisions.

Diversity, Equity and Inclusion. Much of our

success is rooted in the diversity of our teams and our commitment to inclusion. We value diversity at all levels. We believe that our business benefits from the different perspectives a diverse workforce brings, and we strive to maintain a

strong, inclusive and positive culture based on our shared mission and values.

We believe in attracting, developing, and retaining diverse talent that is inclusive of every age, gender, gender identity, race, sexual orientation,

physical capability, ethnicity, belief and perspective. Each individual, regardless of their role makes a difference and impacts our progress. We continue to

focus on seeking diverse candidates for all open opportunities.

Employee Engagement. We have established an annual employee survey process to gather feedback from our employees. The feedback received allows us to grow

stronger as a company and allows us to create an environment where employee contributions matter and employees feel valued.

Training and Development. We listen to our employees to understand their training needs. Employees are encouraged to take advantage of our Learning

Management System which has a plethora of online learning courses. We conduct monthly seminars to update employees on what is happening throughout our Company.

Compensation and Benefits. Healthcare

technology companies, both large and small compete for a limited number of qualified applicants to fill specialized positions. To attract qualified applicants

and retain employees, we offer a total rewards package consisting of base salary, cash bonus, and equity compensation. Bonus opportunity and equity compensation increase as a percentage of total compensation based on level of responsibility. The actual bonus payout is based on performance. In addition, we also provide a comprehensive benefits package inclusive of medical, dental, and vision healthcare

coverage including a paid reimbursement account, life insurance and disability coverage, 401(k) investment plans, tax advantaged savings account, generous paid time off and leaves of absence, employee assistance programs, and wellness programs.

Employee Health and Safety. We have training programs for general, chemical and biological safety. We are continuously evaluating the guidance from federal

and local authorities and have created strict policies and guidelines that put our employees’ health and safety first.

Information About Our Executive Officers and Directors

The following persons were our executive officers and directors as of March 1, 2023:

|

Name

|

|

Position

|

|

Executive Officers

|

|

|

|

Jeffrey Hawkins

|

|

Chief Executive Officer and Director

|

|

Claudia Drayton

|

|

Chief Financial Officer

|

|

Patrick Schneider, Ph.D.

|

|

President and Chief Operating Officer

|

|

Grace Johnston, Ph.D.

|

|

Chief Commercial Officer

|

|

Michael P. McKenna, Ph.D.

|

|

Executive Vice President, Product Development and Operations

|

|

Christian LaPointe, Ph.D.

|

|

General Counsel and Corporate Secretary

|

|

Directors

|

|

|

|

Jonathan M. Rothberg, Ph.D.

|

|

Chairman of the Board of Directors

|

|

Vikram Bajaj, Ph.D.

|

|

Managing Director, Foresite Capital Management, LLC

|

|

Marijn Dekkers, Ph.D.

|

|

Founder and Chairman, Novalis LifeSciences LLC

|

|

Ruth Fattori

|

|

Managing Partner, Pecksland Partners

Senior Advisor, Boston Consulting Group

|

|

Brigid A. Makes

|

|

Independent Consultant

|

|

Michael Mina, M.D., Ph.D.

|

|

Chief Science Officer, eMed

|

|

Kevin Rakin

|

|

Co-Founder and Partner, HighCape Capital

|

Competition

We face significant competition in the life sciences technology market. We currently compete with life sciences technology and the diagnostic companies that are supplying components, products and

services that serve customers engaged in proteomics analysis. These companies include Agilent Technologies, Bio-Rad Laboratories, Danaher, Luminex, Merck KGaA (and its subsidiary MilliporeSigma) and Thermo Fisher Scientific.

We also may compete with a number of emerging growth companies that have developed, or are developing, proteomic products and solutions, such as Nautilus Biotechnology, Olink Proteomics, Quanterix,

Seer and SomaLogic.

We believe there are currently no commercially available NGPS platforms. The legacy proteomics market today is largely served by companies that offer a variety of analytical instruments, such as MS

and microarray instruments and associated reagents and consumables. There are also a number of companies that provide proteomic analysis services and have developed or are developing novel proteomic technologies. Additional competing products

may emerge from various sources, including life sciences tools, diagnostics, pharmaceutical and biotechnology companies, third-party service providers, academic research institutions, governmental agencies and/or public and private research

institutions, among others. Many of the companies with which we compete have substantially greater resources than we have.

The life science instrumentation industry is highly competitive and expected to grow more competitive with the increasing knowledge gained from ongoing research and development. Given the potential

market opportunity and scientific importance of proteomic analysis, we expect increased competition and competitor technologies to emerge in the future. We believe the principal competitive factors in our target markets include:

|

● |

resolution and sensitivity;

|

|

● |

cost of instruments and consumables;

|

|

● |

efficiency and speed of workflows;

|

|

● |

the scale required to address the complexity and dynamic range of the proteome;

|

|

● |

throughput to meet lab testing volume;

|

|

● |

reputation among customers and key thought leaders;

|

|

● |

innovation in product offerings;

|

|

● |

accuracy and reproducibility of results;

|

|

● |

strength of intellectual property portfolio;

|

|

● |

operational and manufacturing footprint;

|

|

● |

customer support infrastructure; and

|

|

● |

a leadership and commercial team with extensive execution and scientific background.

|

We believe that there are currently no other commercially available products that provide the same level of end-to-end NGPS analysis at the same scale and sensitivity that we expect our platform

will provide. Following our commercial launch for RUO, we aim to enhance our position through our ongoing product development, commercial strategy, potential new products and ongoing collaborations and partnerships with key thought leaders.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patents, trademark, copyright, trade secret and other intellectual property rights

protection and contractual restrictions to protect our proprietary technologies.

Patented Technologies

The patents owned and in-licensed by us provide comprehensive coverage of our sample preparation, peptide sequencing and nucleic acid sequencing devices and are directed to aspects including sample

preparation, instrument and laser light source architecture, pixel design, waveguide architecture, lifetime discrimination methods, machine learning, and surface chemistry. We have developed a portfolio of issued patents and pending patent

applications directed to commercial products and technologies for potential development. We believe that our intellectual property is a core strength of our business, and our strategy includes the continued development of our patent portfolio.

Patent Portfolio

As of December 31, 2022, we owned 214 issued patents and 797 pending patent applications. Of our 214 issued patents, 61 were issued U.S. utility patents. Of our 797 pending patent applications,

124 were pending U.S. utility patent applications, 4 of which were allowed. In addition, we owned 153 issued patents in foreign jurisdictions, including Australia, Europe, Japan, China, Brazil, Hong Kong, Mexico, Taiwan, Korea, and India, and

673 pending patent applications in foreign jurisdictions, including Australia, Canada, Europe, Japan, China, Brazil, Hong Kong, Mexico, Taiwan, Korea, India, Malaysia, Singapore, and Thailand, 16 of which were allowed. In total, we owned 115

patent families generally directed to our sample preparation, peptide sequencing and nucleic acid sequencing devices. These issued patents and pending patent applications (if they were to issue as patents) have expected expiration dates ranging

between 2025 and 2042.

Trademark Portfolio

We also protect important marks through trademark registrations. As of December 31, 2022, we owned 43 trademark registrations and 56 trademark applications, of which 14 are U.S. trademark

applications. 12 of the U.S. trademark applications have been allowed.

Other Intellectual Property

In addition to patents, we also rely on trade secrets, technical know-how and continuing innovation to develop and maintain our competitive position. We seek to protect our proprietary information

and other intellectual property by generally requiring our employees, consultants, contractors, suppliers, outside scientific collaborators and other advisors to execute non-disclosure and assignment of invention agreements on commencement of

their employment or engagement. Agreements with our employees also forbid them from using or incorporating the proprietary rights of third parties during their engagement with us.

We also generally require confidentiality or material transfer agreements from third parties that receive our confidential data or materials.

Licensed Intellectual Property

We have entered into exclusive and non-exclusive licenses in the ordinary course of business relating to our technologies or other intellectual property rights or assets.

Government Regulation

Life Sciences Research Use Only Technologies

Our protein sequencing products are currently intended for RUO applications, although the systems may provide data to customers and other third parties that are themselves engaged in the research

and development of potential diagnostic and therapeutic products and services for which they may later pursue clearance, authorization or approval from regulatory authorities, such as the U.S. Food and Drug Administration (“FDA”). All our

products will be labeled “For Research Use Only,” and, will be sold to academic and research life sciences institutions that conduct basic and translational research, and biopharmaceutical and biotechnology companies for non-diagnostic and

non-clinical purposes.

Under a long-standing FDA regulation, products that are intended for RUO and are labeled as RUO are not regulated by the FDA as IVD devices and are not subject to the regulatory requirements

discussed below for clinical diagnostic products. RUO products may therefore be used or distributed for research use without first obtaining FDA clearance, authorization, or approval. Such products must bear the statement: “For Research Use

Only. Not for Use in Diagnostic Procedures.” RUO products also cannot make any claims related to safety, effectiveness or diagnostic utility, and they cannot be intended for human clinical diagnostic use.

Accordingly, a product labeled RUO but intended or promoted for clinical diagnostic use may be viewed by the FDA as adulterated and misbranded under the Federal Food, Drug, and Cosmetic Act (“FDCA”)

and subject to FDA enforcement action. The FDA will consider the totality of the circumstances surrounding distribution and use of an RUO product, including how the product is marketed and to whom, when determining its intended use. If the FDA

disagrees with a company’s RUO status for its product, the company may be subject to FDA enforcement activities, including, without limitation, requiring the company to seek clearance, authorization or approval for the product.

Clinical Diagnostics in the United States

In the United States, medical devices are subject to extensive regulation by the FDA under the FDCA and its implementing regulations, and other federal and state statutes and regulations. The laws

and regulations govern, among other things, medical device design and development, pre-clinical and clinical testing, pre-market clearance, authorization or approval, establishment registration and product listing, product manufacturing, product

packaging and labeling, product storage, advertising and promotion, product distribution, recalls and field actions, servicing and post-market clinical surveillance. A number of U.S. states also impose licensing and compliance regimes on

companies that manufacture or distribute prescription devices into or within the state.

The Federal Trade Commission (“FTC”) also oversees the advertising and promotion of our current and future products pursuant to its broad authority to police deceptive advertising for goods or

services within the United States. Under the Federal Trade Commission Act, the FTC is empowered, among other things, to (a) prevent unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce; (b) seek

monetary redress and other relief for conduct injurious to consumers; and (c) gather and compile information and conduct investigations relating to the organization, business, practices, and management of entities engaged in commerce. In the

context of performance claims for products such as our goods and services, compliance with the FTC Act includes ensuring that there is scientific data to substantiate the claims being made, that the advertising is neither false nor misleading,

and that any user testimonials or endorsements we or our agents disseminate related to the goods or services comply with disclosure and other regulatory requirements. In addition, with respect to any of our future products that are marketed as in vitro diagnostic or clinical products, FDA’s regulations applicable to medical device products prohibit them from being promoted for uses not within the scope of a given product’s intended use(s), among

other promotional and labeling rules applicable to products subject to the FDCA.

When our products are marketed for clinical or diagnostic uses, they will be regulated by the FDA as IVD medical devices. The FDCA and FDA’s implementing regulations define a medical device as an

instrument, apparatus, implement, machine, contrivance, implant, in vitro reagent or other similar or related article, including any component part or accessory, which is (i) intended for use in the diagnosis of disease or other conditions, or in

the cure, mitigation, treatment, or prevention of disease, in man or other animals, or (ii) intended to affect the structure or any function of the body of man or other animals and which does not achieve any of its primary intended purposes

through chemical action within or on the body of man or other animals and which is not dependent upon being metabolized for the achievement of any of its primary intended purposes. IVDs are a type of medical device and include reagents and

instruments used in the diagnosis or detection of diseases, conditions or infections, including, without limitation, the presence of certain chemicals, genetic information or other biomarkers. Predictive, prognostic, and screening tests can also

be IVDs. Medical devices, including IVD products, must undergo pre-market review by and receive clearance, authorization, or approval from the FDA prior to commercialization, unless the device is of a type exempted from such review by statute,

regulation, or an FDA exercise of enforcement discretion. The FDA classifies medical devices into three classes based on risk. Regulatory control increases from Class I (lowest risk) to Class III (highest risk). The FDA generally must clear or

approve the commercial sale of most new medical devices that fall within product categories designated as Class II and III. Commercial sales of most Class II and III medical devices within the United States must be preceded either by pre-market

notification and FDA clearance pursuant to Section 510(k) of the FDCA (Class II) or by the granting of a pre-market approval (“PMA”) (Class III), after a pre-market application is submitted. Both 510(k) notifications and PMA applications must be

submitted to FDA with significant user fees, although reduced fees for small businesses are available. Class I devices are generally exempt from pre-market review and notification, as are some moderate-risk Class II devices. Manufacturers of all

classes of devices must comply with FDA’s Quality System Regulation (“QSR”), establishment registration, medical device listing, labeling requirements, and medical device reporting (“MDR”) regulations, which are collectively referred to as

medical device general controls. Class II devices may also be subject to special controls such as performance standards, post-market surveillance, FDA guidelines, or particularized labeling. Some Class I and Class II devices may be exempted by

regulation from the requirement of compliance with substantially all of the QSR.

Moreover, as electronic and digital medical devices have become increasingly connected to the Internet, hospital networks, and other medical devices to provide features that improve health care and

patient accessibility, FDA and other regulatory authorities have recognized that those same features also increase the risk of potential cybersecurity threats. These types of medical devices may be vulnerable to security breaches, potentially

impacting the safety and effectiveness of the device, and accordingly device manufacturers are responsible for identifying cybersecurity risks and hazards associated with their products. In recent years, the FDA has increased its scrutiny of this

issue as part of the review and marketing authorization process for new medical devices; the agency also monitors reports of cybersecurity risks as part of its post-marketing device surveillance activities. In addition, as part of the

Consolidated Appropriations Act for 2023, signed into law on December 29, 2022 (P.L. 117-328), Congress created new pre-market requirements for developers of “cyber devices,” defined as medical devices that include software, connect to the

Internet, and contain any technological features that could be vulnerable to cybersecurity threats.

510(k) Clearance Pathway

A 510(k) pre-market notification must contain information sufficient to demonstrate that the new device is substantially equivalent to a device commercially distributed prior to May 28, 1976 or to a

device that has been determined by the FDA to be substantially equivalent to such a so-called “pre-amendments” device. To obtain 510(k) clearance for a non-exempt Class II device, the product developer must submit a pre-market notification to

the FDA demonstrating that its product is substantially equivalent to such a predicate device. The FDA’s 510(k) clearance process generally takes from three to twelve months from the date the application is submitted, but it may take

significantly longer if FDA has significant questions or needs more information about the new device or its manufacturing or quality controls.

As part of the 510(k) notification process for Class II devices that have an existing classification regulation available for purposes of the regulatory filing, the FDA may require the following:

|

● |

Development of comprehensive product description and indications for use.

|

|

● |

Completion of extensive nonclinical tests and/or animal studies, performed in accordance with the FDA’s Good Laboratory Practice (“GLP”) regulations, as well as any performance standards or other testing

requirements established by the FDA through regulations or device-specific guidance.

|

|

● |

Comprehensive review of one or more predicate devices and development of data supporting the new product’s substantial equivalence to such predicate devices.

|

Assuming successful completion of all required testing, a detailed 510(k) notification is submitted to the FDA requesting clearance to market the product. This pre-market notification includes all

relevant data from pertinent nonclinical studies and clinical trials (if applicable), together with detailed information relating to the product’s manufacturing controls and proposed labeling, and other relevant documentation. The FDA evaluates

all 510(k) submissions prior to filing for substantive review based on specific acceptance criteria and may issue a refuse-to-accept notification if the submission is deficient with respect to any of the established criteria. If the FDA

determines that the applicant’s device is substantially equivalent to the identified predicate device(s), the agency will issue a 510(k) clearance letter that authorizes commercial marketing of the device for one or more specific indications for

use. If the FDA determines that the applicant’s device is not substantially equivalent to the predicate device(s), the agency will issue a not-substantially-equivalent letter stating that the new device may not be commercially distributed.

After a new medical device receives 510(k) clearance from the FDA, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its

intended use, requires a new 510(k) clearance or could require the submission of a PMA. The FDA requires each manufacturer to make the determination of whether a device modification requires a new 510(k) notification or PMA in the first

instance, but the FDA may review any such decision. If the FDA disagrees with a manufacturer’s decision not to seek a new 510(k) clearance or PMA for a particular change, the FDA may retroactively require the manufacturer to submit a 510(k)

pre-market notification or a PMA. The FDA may also require the manufacturer to cease U.S. marketing and/or recall the modified device until 510(k) clearance or PMA approval for the modification is obtained.

De Novo Classification

If a previously unclassified new medical device does not qualify for the 510(k) pre-market notification process because no predicate device to which it is substantially equivalent can be identified,

the device is automatically classified into Class III. However, if such a device would be considered low or moderate risk (in other words, it does not rise to the level of requiring the approval of a PMA), it may be eligible for the De Novo

classification process. The De Novo classification process allows a device developer to request that the novel medical device be reclassified as either a Class I or Class II device, rather than having it regulated as a high-risk Class III device

subject to the PMA requirements. If the manufacturer seeks reclassification into Class II, the classification request must include a draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and

effectiveness of the medical device.

Under the FDCA, the FDA is required to classify a device within 120 days following receipt of the De Novo classification request from an applicant; however, the most recent FDA performance review

goals state that in fiscal year 2023, the FDA will attempt to issue a decision within 150 days of receipt on 70% of all De Novo classification requests received during the year. De Novo classification requests are subject to user fees, unless a

specific exemption applies (over $132,000 in fiscal year 2023).

As with the 510(k) pre-market notification process described above, any modification to a device authorized through the De Novo process that could significantly affect the safety or effectiveness of

such device, or that would constitute a major change in its intended use, requires a new 510(k) clearance or could require the submission of a PMA.

As an alternative to the De Novo classification process, a company could also file a reclassification petition seeking to change the automatic Class III designation of a novel post-amendment device

under Section 513(f)(3) of the FDCA. The FDA can also initiate reclassification of an existing device type on its own initiative. To reclassify a device under Section 513(e) of the FDCA, the FDA must first publish a proposed reclassification

order that includes a summary of the valid scientific evidence that supports the reclassification; convene a device classification panel meeting; and consider comments to the public docket before it then publishes a final reclassification order

in the Federal Register.

Pre-market Approval Pathway

Products classified by the FDA as Class III generally require marketing approval via a PMA. A PMA application must be supported by valid scientific

evidence, which typically requires extensive data, including technical, nonclinical, clinical, manufacturing and labeling data, to demonstrate to the FDA’s satisfaction the safety and efficacy of the device for its intended use(s). A PMA

application also must include a complete description of the device and its components, a detailed description of the methods, facilities and controls used to manufacture the device, and proposed labeling. After a PMA application is submitted

and found to be sufficiently complete, it is considered “filed” and the FDA begins an in-depth review of the submitted information. During this substantive review period, the FDA may request additional information or clarification of

information already provided. Also, during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the

application and provide recommendations to the FDA. In addition, the FDA generally will conduct a pre-approval inspection of the manufacturing facility to evaluate compliance with the QSR, which requires manufacturers to implement and follow

design, testing, control, documentation and other quality assurance procedures.

FDA review of a PMA application is required to be completed within 180 days of the application’s filing date although the process generally takes between one and three years, but may take

significantly longer. The current user fee agreement between the FDA and the medical device industry sets as a target for PMA reviews to be completed in under one year. The FDA can delay, limit or deny approval of a PMA application for many

reasons, including:

|

● |

the product may not be safe or effective for its intended use(s) to the FDA’s satisfaction;

|

|

● |

the data from the applicant’s nonclinical studies and clinical trials may be insufficient to support approval;

|

|

● |

the manufacturing process or facilities that the applicant uses may not meet applicable requirements; and

|

|

● |

changes in FDA approval policies or adoption of new regulations may require additional data to demonstrate the safety or effectiveness of the device.

|

If an FDA evaluation of a PMA application or manufacturing facilities is favorable, the FDA will either issue an approval letter, or approvable letter, which usually contains a number of conditions

which must be met in order to secure final approval of the PMA. When and if those conditions have been fulfilled to the satisfaction of the FDA, the agency will issue a PMA approval letter authorizing commercial marketing of a device, subject to

the conditions of approval and the limitations established in the approval letter. If the FDA’s evaluation of a PMA application or manufacturing facilities is not favorable, the FDA will deny approval of the PMA or issue a not approvable letter.

The FDA may also determine that additional trials are necessary, in which case the PMA approval may be delayed for several months or years while the trials are conducted and data is submitted in an

amendment to the PMA. The PMA process can be expensive, uncertain and lengthy. PMA approval may also be granted with post-approval requirements such as the need for additional patient follow-up for an indefinite period of time.

New PMA applications or PMA supplements may be required for modifications to the manufacturing process, labeling, device specifications, materials or design of a device that is approved through the

PMA process. PMA supplements often require submission of the same type of information as an initial PMA application, except that the supplement is limited to information needed to support any changes from the device covered by the approved PMA

application and may or may not require as extensive clinical data or the convening of an advisory panel.

Clinical Investigations Using Devices in Development

Clinical trials are almost always required to support a PMA application and are sometimes required for a De Novo classification request or 510(k) pre-market notification. In order to conduct a

clinical investigation involving human subjects for the purpose of demonstrating the safety and effectiveness of a medical device, an investigator acting on behalf of the company must, among other things, apply for and obtain Institutional Review

Board (“IRB”) approval of the proposed investigation. In addition, if the clinical study involves a “significant risk” (as defined by the FDA) to human health, the company sponsoring the investigation (referred to as the “sponsor”) must also

submit and obtain FDA approval of an Investigational Device Exemption (“IDE”) application. An IDE application must be supported by appropriate data, such as animal and laboratory testing results, showing that it is safe to test the device in

humans and that the testing protocol is scientifically sound. The IDE application must be approved in advance by the FDA for a specified number of study participants, unless the product is deemed a non-significant risk device and eligible for

abbreviated IDE requirements. Generally, clinical trials for a significant risk device may begin once the IDE application is approved by the FDA and the study protocol and informed consent are approved by a duly-appointed IRB for each clinical

trial site. Most clinical studies of IVDs are exempt from the IDE requirements, if certain requirements are met.

FDA’s IDE regulations govern investigational device labeling, prohibit promotion, and specify an array of Good Clinical Practice, or GCP, requirements, which include, among other things,

recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. Clinical trials must further comply with the FDA’s regulations for IRB approval and for informed consent and other human subject protections.

Required records and reports are subject to inspection by the FDA. The results of clinical testing may be unfavorable or, even if the intended safety and efficacy success criteria are achieved, may not be considered sufficient for the FDA to

grant approval or clearance of a product.

The Consolidated Appropriations Act for 2023 also recently amended the FDCA to require sponsors of most clinical studies of investigational medical devices intended to support marketing

authorization to develop and submit a diversity action plan for such clinical trial. The action plan must include the sponsor’s diversity goals for enrollment, as well as a rationale for the goals and a description of how the sponsor will meet

them. Depending on the type of medical device investigation, such diversity action plans would be submitted with the sponsor’s IDE application or with the device’s pre-market submission (in the case of human studies that may be IDE exempt). It is

unknown at this time how the diversity action plan may affect the planning and timing of medical device investigations or what specific information FDA will expect in such plans, but if FDA objects to a sponsor’s diversity action plan, it may

delay trial initiation or review of the pre-market submission.

The commencement or completion of any clinical trials may be delayed or halted, or be inadequate to support approval of a PMA application (or FDA’s grant of a De Novo classification request or

clearance of a 510(k) notification, as applicable), for numerous reasons, including, but not limited to, the following:

|

● |

the FDA, the IRB(s), or other regulatory authorities do not approve a clinical trial protocol or a clinical trial, or place a clinical trial on hold;

|

|

● |

participants do not enroll in clinical trials at the expected rate;

|

|

● |

participants do not comply with trial protocols;

|

|

● |

participant follow-up is not at the expected rate;

|

|

● |

participants experience adverse side effects;

|

|

● |

participants die during a clinical trial, even though their death may not be related to the investigational products;

|

|

● |

third-party clinical investigators decline to participate in a trial or do not perform a trial on the sponsor’s anticipated schedule or consistent with the clinical trial protocol, GCPs or other FDA

requirements;

|

|

● |

the sponsor or third-party organizations do not perform data collection, monitoring and analysis in a timely or accurate manner or consistent with the clinical trial protocol or investigational or statistical

plans;

|

|

● |

third-party clinical investigators have significant financial interests related to the sponsor or the study that the FDA deems to make the study results unreliable, or the sponsor or investigators fail to

disclose such interests;

|

|

● |

unfavorable regulatory inspections of the sponsor’s clinical trial sites or manufacturing facilities, which may, among other things, require the sponsor to undertake corrective action or suspend or terminate the

sponsor’s clinical trials;

|

|

● |

changes in governmental regulations or administrative actions applicable to the sponsor’s trial protocols;

|

|

● |

the interim or final results of the clinical trial are inconclusive or unfavorable as to safety or effectiveness; and

|

|

● |

the FDA concludes that the results from the sponsor’s trial and/or trial design are inadequate to demonstrate safety and effectiveness of the product.

|

Ongoing Post-Market Regulatory Requirements and FDA Enforcement

After a medical device is authorized for marketing and placed in commercial distribution (or, for 510(k)-exempt products, placed into commerce without first obtaining FDA clearance or approval),

numerous regulatory requirements apply. These general controls that must be met for all device classes include:

|

● |

establishment registration and device listing;

|

|

● |

the QSR, which requires manufacturers, including third-party manufacturers, to follow design, testing, control, storage, supplier/contractor selection, complaint handling, documentation and other quality

assurance procedures;

|

|

● |

labeling regulations, which govern the mandatory elements of the device labels and packaging (including Unique Device Identifier markings for certain categories of products);

|

|

● |

FDA’s prohibitions against the promotion of products for uncleared, unapproved or “off-label” uses and other requirements related to promotional activities;

|

|

● |

the MDR regulations, which require that manufacturers report to the FDA if a device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to

a death or serious injury if it were to recur;

|

|

● |

voluntary and mandatory device recalls addressing problems when a device is defective and/or could be a risk to health;

|

|

● |

correction and removal reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or

to remedy a violation of the FDCA that may present a risk to health; and

|

|

● |

post-market surveillance regulations, which apply to certain Class II or III devices when necessary to protect the public health or to provide additional safety and effectiveness data for the device.

|

To ensure compliance with regulatory requirements, medical device manufacturers are subject to market surveillance and periodic, pre-scheduled and unannounced inspections by the FDA and certain

state authorities. Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, which may lead to any of the following sanctions:

|

● |

Warning Letters or Untitled Letters that require corrective action;

|

|

● |

fines and civil penalties;

|

|

● |

unanticipated expenditures;

|

|

● |

delays in approving/clearing or refusal to approve/clear any of our future products;

|

|

● |

FDA refusal to issue certificates to foreign governments needed to export our products for sale in other countries;

|

|

● |

suspension or withdrawal of FDA approval or clearance (as may be applicable);

|

|

● |

product recall or seizure;

|

|

● |

partial suspension or total shutdown of production;

|

|

● |

operating restrictions;

|

|

● |

injunctions or consent decrees; and

|

|

● |

civil or criminal prosecution.

|

We, any contract manufacturers, and some suppliers of components or device accessories would also be required to manufacture medical device products

in compliance with current Good Manufacturing Practice requirements set forth in the QSR, unless explicitly exempted by regulation, should we develop and seek regulatory authorization for one or more diagnostic intended uses for our products.

The QSR requires a quality system for the design, manufacture, packaging, labeling, storage, installation and servicing of marketed devices, and includes extensive requirements with respect to quality management and organization, device design,

buildings, equipment, purchase and handling of components or services, production and process controls, packaging and labeling controls, device evaluation, distribution, installation, complaint handling, servicing, and record keeping. The FDA

evaluates compliance with the QSR through periodic pre-scheduled or unannounced inspections that may include registered manufacturing facilities. Following such inspections, FDA may issue reports known as Forms FDA 483 or Notices of

Inspectional Observations, which list instances where the FDA inspector believes the manufacturer has failed to comply with applicable regulations and/or procedures. If the observations are sufficiently serious or the manufacturer fails to

respond appropriately, the FDA may issue Warning Letters, which are notices of intended enforcement actions against the manufacturer. For less serious violations that may not rise to the level of regulatory significance, FDA may issue Untitled

Letters. The FDA may take more significant administrative or legal action if a manufacturer continues to be in substantial noncompliance with applicable

regulations.

For example, if the FDA believes a medical device developer or any of its contract manufacturers or regulated suppliers are not in compliance with these requirements and patients are being subjected

to serious risks, the agency can shut down manufacturing operations, require recalls of medical device products, refuse to approve new marketing applications for future products, initiate legal proceedings to detain or seize products, enjoin

future violations, or assess civil and criminal penalties against a manufacturer or its officers or other employees.

U.S. Fraud and Abuse Laws and Other Compliance Requirements

Successfully commercializing a medical device or technology depends not on only FDA authorization, but also on broad health insurance or third party payor coverage. Government and private payors

institute coverage criteria to ensure the appropriate utilization of products and services and to control costs. Limited third party payor coverage for a technology or procedure may limit adoption and commercial viability, while broader coverage

supports optimal market uptake. Favorable coverage decisions by government payors like Medicare or Medicaid is critical because private payors typically follow the government’s lead regarding reimbursement. However, manufacturers whose

technology is reimbursed by government payors are subject to various U.S. federal and state laws pertaining to healthcare fraud and abuse. These laws can be implicated by inappropriate sales and marketing arrangements with healthcare providers.

Many commonly accepted commercial practices are illegal in the healthcare industry and violations of these laws are punishable by criminal and civil sanctions, including, in some instances, exclusion from participation in U.S. federal and state

healthcare programs, including Medicare and Medicaid.

Anti-kickback Laws. The federal Anti-Kickback Statute (AKS) prohibits persons from knowingly and willfully soliciting, receiving, offering or paying

remuneration directly or indirectly to induce either the referral of an individual, or the furnishing, recommending, or arranging of a good or service, for which payment may be made under a federal healthcare program such as Medicare and

Medicaid. A person or entity does not need to have actual knowledge of the AKS or specific intent to violate it to have committed a violation. Certain arrangements are protected from enforcement through AKS safe harbors and exceptions, but an

arrangement must meet every element of the applicable safe harbor or exception in order to obtain this protection. The fact that an arrangement does not meet the requirements of a safe harbor or exception does not mean that it violates the AKS;

such arrangements would be subject to a facts and circumstances analysis to determine compliance with the AKS or lack thereof. The definition of “remuneration” has been broadly interpreted to include anything of value, including such items as

gifts, discounts, the furnishing of supplies or equipment, credit arrangements, waiver of payments, and providing anything at less than its fair market value. The AKS is broadly interpreted and aggressively enforced with the result that

beneficial commercial arrangements can be criminalized in the health care industry because of the AKS. The penalties for violating the federal AKS can be severe, include fines and imprisonment for up to ten years, as well as possible exclusion

from federal healthcare programs such as Medicare and Medicaid. Additionally, a claim including items or services resulting from a violation of the AKS constitutes a false or fraudulent claim for purposes of the False Claims Act.

Federal False Claims Act. The federal False

Claims Act (FCA) prohibits knowingly presenting or causing to be presented a false claim or the knowing use of false statements or records to obtain payment from the federal government. The FCA also prohibits the knowing retention of

overpayments (sometimes referred to as “reverse false claims”). When an entity is determined to have violated the FCA, it must pay three times the actual damages sustained by the government, plus mandatory and substantial civil penalties for

each separate false claim. The entity also faces the possibility of exclusion from federal health care programs. Suits filed under the False Claims Act, known as “qui tam” actions, can be brought by any individual on behalf of the government

and such individuals (known as “relators” or, more commonly, as “whistleblowers”) may share in any amounts paid by the entity to the government in fines or settlement.

Civil Monetary Penalties Law. The Civil Monetary Penalties Law (CMPL) authorizes the imposition of substantial civil money penalties and the possibility of

exclusion against an entity that engages in certain prohibited activities including but not limited to violations of the Stark Law or Anti-Kickback Statute, knowing submission of a false or fraudulent claim, employment of an excluded individual,

and the provision or offer of anything of value to a Medicare or Medicaid beneficiary that the transferring party knows or should know is likely to influence beneficiary selection of a particular provider for which payment may be made in whole or

part by a federal health care program, commonly known as the Beneficiary Inducement CMP.

State Analogs of Federal Fraud and Abuse Laws.

Many U.S. states have their own laws intended to protect against fraud and abuse in the health care industry and more broadly. In some cases, these laws prohibit

or regulate additional conduct beyond what federal law affects. Penalties for violating these laws can range from fines to criminal sanctions.

HIPAA. The Health Insurance Portability and Accountability Act of 1996, as amended by the American Recovery and Reinvestment Act of 2009, and implementing

regulations (“HIPAA”), created two new federal crimes: healthcare fraud and false statements relating to healthcare matters. The healthcare fraud statute prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit

program, including private payors. A violation of this statute is a felony and may result in fines, imprisonment or exclusion from government sponsored programs. The false statements statute prohibits knowingly and willfully falsifying,

concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services.

FCPA and Other Anti-Bribery and Anti-Corruption Laws. The U.S. Foreign Corrupt Practices Act (“FCPA”) prohibits U.S. corporations and their representatives

from offering, promising, authorizing or making payments to any foreign government official, government staff member, political party or political candidate in an attempt to obtain or retain business abroad. The scope of the FCPA would include