U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

Enigma MPC, Inc.

(Exact name of registrant as specified in charter)

| Delaware | 61-1781492 | |

| (State or other jurisdiction of incorporation or registration) |

(I.R.S. Employer Identification No.) |

|

| 186 Museum Way, San Francisco | 94114 | |

| (Address of principal executive offices) | (Zip Code) | |

| 585-233-1118 | ||

| (Registrant’s telephone number, including area code) | ||

with copies to:

Oded Har-Even, Esq.

David Huberman, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

(212) 660-3000

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

ENG Tokens

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

| Page | ||

| Explanatory Note | ii | |

| Forward-Looking Statements | iii | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 11 |

| Item 2. | Financial Information | 19 |

| Item 3. | Properties | 24 |

| Item 4. | Security Ownership of Certain Beneficial Owners and Management | 24 |

| Item 5. | Directors and Executive Officers | 24 |

| Item 6. | Executive Compensation | 25 |

| Item 7. | Certain Relationships and Related Transactions, and Director Independence | 26 |

| Item 8. | Legal Proceedings | 27 |

| Item 9. | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 28 |

| Item 10 | Recent Sales of Unregistered Securities | 29 |

| Item 11. | Description of Registrant’s Securities to be Registered | 30 |

| Item 12. | Indemnification of Directors and Officers | 31 |

| Item 13. | Financial Statements and Supplementary Data | 33 |

| Item 14. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 33 |

| Item 15. | Financial Statements and Exhibits | 33 |

i

Enigma MPC, Inc. is filing this General Form for Registration of Securities on Form 10, or the Registration Statement, to register its Enigma Tokens, or ENG Tokens, pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Unless otherwise mentioned or unless the context requires otherwise, when used in this Registration Statement, the terms “Enigma,” “Company,” “we,” “us,” and “our” refer to Enigma MPC, Inc. and its subsidiaries.

We have filed this Registration Statement with the U.S. Securities and Exchange Commission, or the SEC, under the Exchange Act, in connection with the settlement that we entered into with the SEC, or the Settlement, relating to the issuance, through our wholly-owned subsidiary, Enigma ENG International Ltd., of ENG Tokens in our initial coin offering that took place in two phases: a pre-sale phase, or the Pre-Sale, in which ENG Tokens were sold pursuant to Simple Agreements for Future Tokens, each a SAFT, and a crowd-sale phase, taking place on September 11, 2017, and to provide current information to holders of ENG Tokens who are potential claimants against the Company pursuant to Section 12(a) of the Securities Act of 1933, as amended, or the Securities Act. We are not offering or selling ENG Tokens or any other digital asset, including SCRT coins (as such term is defined in this Registration Statement) pursuant to this Registration Statement.

Once this Registration Statement has become effective, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated thereunder, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and not being required to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. For implications of our status as smaller reporting company and as an emerging growth company, please see the section titled “Business – Emerging Growth Company” of this Registration Statement.

ii

This Registration Statement contains forward-looking statements that involve substantial known and unknown risks, uncertainties and other factors. Undue reliance should not be placed on such statements. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our company, our current and prospective portfolio investments, our industry, our beliefs and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements.

Forward-looking statements include, but are not limited to, statements about:

| ● | the development and timeline for development of the Secret Network; |

| ● | the development and timeline for development of other solutions on which we are working or for which we are providing support; |

| ● | the utility of Secret Coins, or SCRT coins; | |

| ● | our ability to pay all valid claims made pursuant to the rescission offer; |

| ● | the participation of independent third parties in the development of the Secret Network; |

| ● | our ability to generate revenues, if any, and become profitable, if ever; |

| ● | our role in the development and governance of the Secret Network; |

| ● | the impact of COVID-19 on us, the Secret Network and SCRT coins; |

| ● | adoption of blockchain technology by certain industries; |

| ● | the utility of the Secret Network; and |

| ● | our financing needs. |

These statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this Registration Statement in greater detail under the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

iii

| ITEM 1. | BUSINESS |

Overview

We are a technology company focused on changing and improving the way that data is shared, aggregated and monetized through the use of privacy preserving computation technology. Our mission is to improve the adoption and usability of decentralized technologies, for the benefit of all. During the years 2017-2018, we developed Catalyst and the Enigma Data Marketplace, or collectively, the Enigma Network. Concurrently, and throughout 2019, we also developed the Enigma Protocol. was All of these products were meant to support ENG Tokens. Since the beginning of 2020, we have been supporting the development of Secret Network. In February 2020, together with an initial group of 20 other independent parties, consisting of cryptocurrency and privacy enthusiasts and entities, including funds, companies that offer professional staking service providers (validators), exchanges and companies building products in the cryptocurrency ecosystem, or, the Secret Network Community, the Secret Network was launched and its Genesis Block was signed by the entire Secret Network Community. The Secret Network was developed and launched and shares a mission with the previously developed Enigma Protocol, a prior initiative undertaken by us to enable “secret” contracts on blockchain technology.

We, together with the Secret Network Community, are currently working on and funding upgrades, through our work with Gamma Research and Development Ltd., or Gamma, for the Secret Network (see “Item 7. Certain Relationships and Related Transactions, and Director Independence” for additional information on Gamma). During September 2020, the Secret Network was updated to enable decentralized applications to perform computations on encrypted data, bringing privacy to blockchain applications, which are called smart contracts, as described below. Over time, we expect the number of participants in the Secret Network Community to grow.

We believe that blockchain technology is slow at computing code and smart contracts, which challenges widespread adoption of blockchain technology. In addition to being slow, which limits scalability for decentralized applications, blockchains lack privacy by their inherent design, which also limits the kind of applications that can be built in fields that are seeking to utilize blockchain technology. We believe that the solutions Enigma funds the development of, together with the development efforts put forth by the Secret Network Community, for the Secret Network will bring privacy and scalability features that will increase adoption of blockchain technology by improving current user experience and enabling new applications and industries to build blockchain based products.

In addition to our work in the field of blockchain technology, we are seeing interest for our privacy preserving computation technology from enterprises to securely share and collaborate on sensitive data.

Glossary

A “block” is a discrete group of records written to a blockchain that can effectively be identified and referenced by the use of “headers” that contain a digital fingerprint of the records each block contains.

A “blockchain” is a database created and shared by the members of a peer-to-peer computer network which each member of that network can independently trust due to the rules governing the database’s creation. A blockchain can therefore be used to replace centralized databases.

A “delegator” is any individual or entity who holds the cryptocurrency token of the network, (in the case of the Secret Network, this token is referred to as “SCRT”) and indicates that they wish their SCRT to be included in the stake of a particular validator, for governance and consensus purposes.

A “digital asset” (also referred to as a “cryptographic asset”) is any set of unique digital information—including, for example, programs, decentralized programs, isolated chunks of programming code, collections of data, e-mail or web addresses or cryptocurrency tokens—that is capable of being stored and uniquely tracked on a computer network such as the Secret Network and over which a user can maintain control through that network.

The “gas” refers to the fee, or pricing value, required to successfully conduct a transaction or execute a contract on the Secret Network.

The “genesis block” is the first block of the Secret Network, which was created in February 2020 and created the initial supply of 50 million SCRT coins.

A “node” is a computer that connects to the Secret Network protocol layer and that uses a peer-to-peer protocol to communicate with other nodes on the network and share information on transactions and blocks. Information is distributed among such nodes and they are what blockchain network consists of.

“On-chain” means that the data is stored on the Secret Network’s blockchain itself.

A “proposer” is a validator that has been chosen to propose the next block of transactions in the blockchain based on a proof-of-stake algorithm.

A “proof-of-stake algorithm” is a type of sybil-resistant algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus.

1

A “smart contract” is a computer program or application written and deployed to a blockchain, such as the Secret Network, by developers. This computer program defines a set of functions users and other contracts can interact with from the outside. Among other things, these functions can involve the manipulation of digital assets issued on the blockchain.

A “validator” is a node that can also propose and confirm blocks, each block including a set of transactions and contract executions. Validators must have adequate infrastructure to prevent downtime. The Secret Network validators are responsible for proposing new blocks to the blockchain, and confirming blocks proposed by other validators.

Secret Network Community

In February 2020, the Secret Network Community jointly agreed to create the genesis block of the Secret Network’s blockchain. Together, these parties ran the first version of the Secret Network software, instantiating the Secret Network’s blockchain. This means that each party agreed on certain parameters regarding the initial distribution of SCRT at the launch of the Secret Network, and which modules, such as governance and staking, would be included at the outset of the network. These decisions, and future decisions, are coordinated on Secret Network Community-run and Enigma-run communication channels, such as an chatroom hosted by community members, and various public github repositories. After the initial launch of the Secret Network, anyone who holds SCRT is free to participate in network governance. Any member is free to participate or stop participating in the Secret Network Community at any time, which is an informal coordination among aligned individuals and entities. Anyone can participate in Secret Network Community discussions, whether they hold SCRT or not. The goal of the Secret Network Community is to coordinate governance, decision making, educate and welcome new Secret Network Community members, and work towards positive development of the Secret Network.

The Secret Network Community refers to any user actively participating in discussions around the network’s functionality and governance, and in particular – any holder of SCRT that chooses to actively delegate their coins to other validators, or run a validator that is providing computational resources to the Secret Network. By delegating SCRT coins to others, these parties can enable other individuals or entities to participate as validators in the Secret Network, thereby further decentralizing the Secret Network. Any validator can cease participating in such capacity on the Secret Network at will and is under no obligation to us or to the Secret Network Community, rather they are participants in an economically incentivized, decentralized network. Any proposals to modify the Secret Network, which may be submitted by any holder of SCRT (subject to having a sufficient number of SCRT), are submitted on-chain, where they can be viewed by anyone, and voted on by any SCRT holder. SCRT holders do not need to be validators to vote, rather any SCRT holder may vote on and create proposals.

Secret Network

The Secret Network, the successor of the Enigma Protocol, is a decentralized, stand-alone, “proof-of-stake” blockchain, which is currently live and released on mainnet (the main network, whereby actual transactions take place on a distributed ledger). Blocks are created and validated by an open, decentralized network of validators, who are part of the larger Secret Network Community, who are also responsible for voting on any proposed modifications to the network. The more SCRT a holder is willing to stake, the great the likelihood that the holder will be selected by the Secret Network as a validator (that is, the probability of a validator being selected to validate a new block that is being proposed to be added to the Secret Network is proportional to the amount of SCRT coins staked by the validator). Validators receive gas fees in the form of additional SCRT from transactions included in the block and network rewards also paid in SCRT for ensuring the accuracy and correctness of transactions in the Secret Network. Validators can have some portion of their staked SCRT forfeited if they lose connectivity or stop validating future blocks. This forfeiture risk provides an incentive for good network reliability in that it serves as a mechanism to increase the likelihood of continued participation by validators. Any holder of SCRT, if selected, can become a validator and secure the Secret Network by running software developed by us. Regardless, any holder of SCRT not directly participating as a validator can delegate their SCRT and pool them together with a validator (or multiple validators) of their choice. Generally speaking, a larger amount of staked tokens, whether through validators or indirectly by delegators, increases network security.

The validators in the Secret Network are equipped with specialized hardware called Trusted Execution Environments, or TEEs, (available on computers using an Intel Corporation chip) that enable them to perform computation over data that the node operator, or any code outside of the TEE, cannot access. As with the Ethereum and Bitcoin networks, nodes are an inherent and crucial part of the blockchain’s success – without nodes, the blockchain will not run.

2

In addition to creating an incentive structure for validators to secure the Secret Network, SCRT also enables holders to participate in governance decisions regarding future development, use of community funds of the Secret Network (see “Governance of the Secret Network” below for additional information regarding the governance process) and enables holders to interact with secret smart contracts on the Secret Network. The community funds are not controlled by any entity, but rather by the Secret Network as a whole. In order to make use of these funds, a proposal needs to be proposed to the network, and a majority of SCRT holders need to vote and approve it. Proceeds from the community fund are then available to fund the development of the proposed feature.

We are funding development of upgrades for the Secret Network, as well as applications that are intended to run on the Secret Network. Alongside us, the Secret Network Community, through informal collaboration coordinated via public communication channels and open source development principles, is also adding improvements, ecosystem tools and applications for the Secret Network. Recently, Enigma funded work that resulted in a proposed network upgrade that enabled the development of secret smart contracts. The network upgrade, implemented following a voting process by SCRT holders, enables decentralized applications, or DApps, to perform computations on data encrypted from the hosts, bringing privacy to blockchain applications, which are called smart contracts. Secret contracts have auditable code, which means any network participant can audit the implied functionality of a secret contract. Secret contracts also ensure data is kept private from all observers, including node operators. These capabilities provide enhanced privacy to DApps that run on the Secret Network, while ensuring accuracy and correctness of the DApp code (i.e., the Secret Contract) being executed.

For example, a “voting” secret contract would enable users to encrypt their votes and submit them to the secret smart contract. When all votes are received, the secret contract would tally the encrypted votes and return the result to the Secret Network. However, no individual vote would ever be revealed. Private votes are important because they protect voting and governance systems from serious threats, including bribery, retaliation, and other types of undesired voter influence. This is a particularly critical feature in blockchains, where data is traditionally visible on-chain, and voting is one of the primary means by which governance decisions about blockchain networks are made. Other use-cases where privacy is critical include multiplayer gaming, content access control, and transactional privacy, as further detailed below.

We also intend to propose to the Secret Network Community that the Secret Network be modified so that it can interoperate with other blockchains by creating bridges to other blockchains. Such bridges would allow data to be transferred and transactions to be processed between the Secret Network and other blockchains. It could also enable DApps built on other blockchains, such as Ethereum, to interoperate with DApps built on the Secret Network. Leveraging these bridges, the Secret Network Community and independent developers of the Secret Network are seeking to make the Secret Network one of the pillars of the decentralized internet.

As discussed above, all such future developments to the Secret Network protocol layer will require majority approval of SCRT coin holders participating in the voting. See “Governance of the Secret Network” below for additional information.

Secret Contracts in Action

The first version of the Secret Network, which went live in February 2020, supported staking, governance and the transfer of SCRT between accounts. The second version, proposed and approved by the network, became effective in September 2020, and enabled secret contract functionality and development, on top of any capabilities that were available in the prior version. As of September 15, 2020, there are 46 active validators and there have been 17 governance proposals that were voted by the network. The following sections describe how secret contracts currently work in the Secret Network.

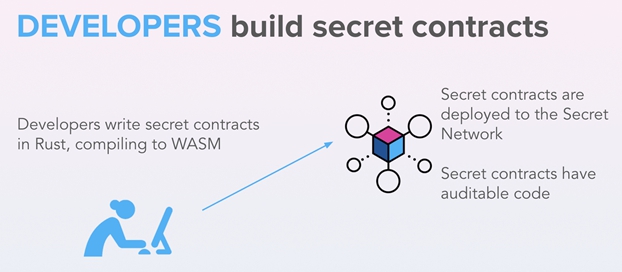

Write. As shown in Figure 1 below, a developer writes a secret contract and deploys it to the Secret Network. Developers will build blockchain applications using secret contracts that are written in Rust (a programming language) and compiled to WebAssembly virtual-machine code, or WASM.

3

Figure 1

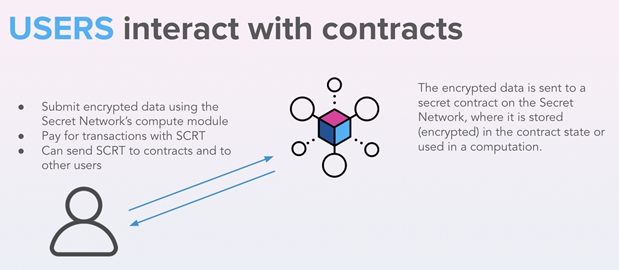

Submission. As shown in Figure 2 below, users are able to encrypt data locally (i.e., on one’s own computer or device), and then send that data to a secret contract on the Secret Network, along with payment of a SCRT gas fee to the validator nodes who perform the computation specified by the secret contract. Such computations are necessary for any application to function, be it a financial application such as a lending platform, a user-centric application such as a decentralized social network platform, or any other application developers can come up with that utilize the privacy benefits and distributed nature of the Secret Network. The data cannot be read by anyone other than the party that uploaded the data, including the node doing the computation. Here “smart” contracts become “secret” contracts. Users interact with secret contracts using one of the “Secret Network Clients”, such as SecretJS, a JavaScript library that facilitates encryption and decryption protocols between the user and nodes in the Secret Network. Any of the Secret Network Clients are responsible for encrypting user inputs locally and sending them to the Secret Network.

Figure 2

Secret contracts enable DApps to easily and safely utilize sensitive or private information for industries such as finance, credit, gaming, machine learning, healthcare, and others that depend on the use of sensitive data. For example, secret contracts can enable decentralized transparent credit scoring. Today the exact process through which our credit score is calculated is unknown. With secret contracts, where code (for example, the credit scoring algorithm) is auditable, consumers would be able to clearly see how different factors affect their credit score. Secret contracts can also allow users to encrypt and share sensitive financial information within the Secret Network to get their credit score, without disclosing sensitive personal information even to a credit bureau. As a result, we believe that secret contracts have the potential to improve credit scoring, an industry plagued by security breaches and lack of transparency.

4

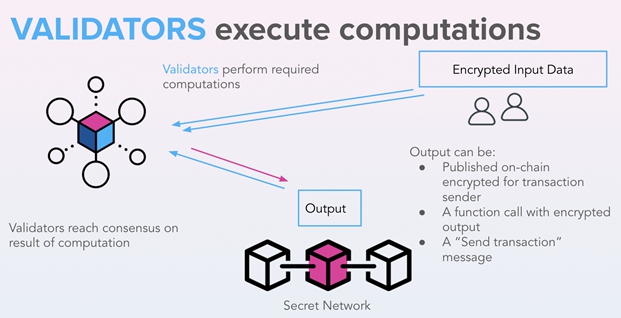

Computation and Verification. As shown in Figure 3 below, when a secret contract transaction is broadcasted, via a proposing validator and originating from a user to the Secret Network, each node interprets it as a request to perform some functionality. That functionality is provided as part of the transaction’s payload, which also includes any encrypted input data supplied by the user. Each node in the network then executes the requested functionality over the encrypted input data, inside of their TEE. Validators then achieve consensus on the result, and the validator who originally proposed the block containing this transaction is paid a “gas fee” in SCRT for doing so. Then, the transaction (or, as highlighted in Figure 3 below, the “output”) is recorded in encrypted form on the Secret Network.

Figure 3

Figure 4 below highlights how the different aspects of smart contracts come together on the Secret Network.

Figure 4

5

Governance of the Secret Network

As the Secret Network is a decentralized blockchain, no entity has sole authority over its structure or development. Rather, any upgrades to the Secret Network must be made through a process of decentralized governance where SCRT holders vote on proposals to modify the network. SCRT holders need to bond their SCRT holdings, which means to lock-up SCRT for 3 weeks, in order to participate in governance and network security. SCRT that is not bonded cannot be used in the governance or Proof-of-Stake based consensus process. Governance is the process by which users in the Secret Network reach consensus on software upgrades, parameters of the mainnet, such as the rate of inflation, if any, on the underlying digital asset, or in the case of the Secret Network, SCRT. The process of governance is done through voting on proposals, which are submitted by SCRT holders on the mainnet. Anyone who holds SCRT can submit a proposal to be voted on. Proposals are public, and anyone who is validating or delegating to a validator can cast their vote on a proposal. Governance can also discuss subjective matters, such as topics that have no formal bearing over the Secret Network, but are related to concerns that are of interest to the broader Secret Network Community, like which social channel should the community use to interact online.

In order to create a governance proposal, the proposer must submit an initial deposit of SCRT along with a title and description for the proposal on the matter to be voted upon by SCRT coin holders. The deposit can be submitted by one or more SCRT holders. The SCRT that is submitted in order to put a proposal up for a vote is deposited to the governance module data store. Currently, in order to enter the voting period, a proposal must accumulate, within a week of it being put up for a vote, deposits in the amount of at least 1000 SCRT, or the MinDeposit value. This value is decided upon by the Secret Network, and currently is 1000 SCRT. If the Secret Network decides to raise or lower this number, it would be decided via a proposal and vote. After a proposal’s deposit reaches the MinDeposit value, the voting period opens. Voting is done by bonded SCRT holders on a 1 bonded SCRT 1 vote basis. They can cast votes of “no,” “no with veto,” or “yes”. If a supermajority vote “no with veto”, the deposit is burned rather than returned. Delegators (any SCRT holder may delegate their SCRT to a validator, and thus earn a portion of the Validator’s rewards) inherit the vote of their Validator if they don’t vote. Votes are tallied at the end of the voting period where each address can vote multiple times to update its vote and its weight. Only the last vote counts as valid. For example, a voter could vote with 100 SCRT, and decide later to up that vote to 1,000 SCRT and change their vote from ‘Yes’ to ‘No’. In this case, the 1,000 SCRT vote will be counted towards the ‘No’ option. Each vote requires gas payment in SCRT.

Secret Network Applications

We are also funding development of DApps for the Secret Network. In addition to the DApps that we are funding, anyone can write and deploy DApps to the Secret Network.

One of the applications we are currently funding the development of is one that enables secret ballots, especially in the context of supporting decentralized governance in blockchain networks. Decentralized governance is a key feature of blockchain ecosystems which are composed of various stakeholders that need to agree on the future of a decentralized ecosystem. Currently decentralized governance suffers from a phenomenon called bribery attacks. Since smart contracts are programmable functions, an attacker can create a programmable bribery attack by which each participant who votes in favor of the attacker gets paid. Since all data (votes) are publicly visible on blockchains, there is presently no effective way of getting around this attack. Using secret contracts, we believe that the Secret Network could ensure a participant’s votes are kept private, thereby minimizing the potential for such attacks.

In addition, we are currently supporting the development of a standard for privacy-preserving and auditable tokens (known hereafter as Secret Tokens). Secret Tokens provide developers a simple template for creating privacy-preserving tokens that can be launched on the Secret Network. Because all blockchain transactions are public (even where the parties to the transactions remain private), it is difficult to meet basic consumer expectations for privacy in payments. For example, a contractor who is paid in cryptocurrency has no way to conceal subsequent transactions from whoever paid the contractor. With Secret Tokens, users can lock in collateral in a form of a non-private token, and then receive in return a new Secret-enabled token which provides them with the appropriate level of privacy. Secret Tokens can also assist in remaining compliant, since they allow token holders to produce viewing-only keys, allowing authorized parties (such as an auditor or a government agency) to probe a user’s transaction history, while ensuring privacy is maintained from any unauthorized party.

Finally, we and the entire Secret Network community, are exploring use cases for the Secret Network in gaming that require “secret state”, such as card games like poker, or turn-based games like Battleship. Enabling these simple use-cases can set the foundation for more complex game applications in the future. Games often require temporarily private information, such as a hand of cards that is known to only one player, or a shuffled deck which is not visible to any actors (players or node operators). Secret contracts make game state privacy possible and provably fair. In this respect, players can be assured that the gameplay is not influenced by players who try to cheat by directly observing the blockchain to view cards or play data belonging to other players, or by nodes with privileged access to data, a type of manipulation known as “front running” in other blockchains such as Ethereum.

6

Additional Enterprise Products

In addition to our work for the Secret Network, we are actively building and funding the development of additional products outside of the Secret Network itself, or that leverage a variant of the Secret Network infrastructure that is private and not part of the decentralized network. One such example is SafeTrace, an application programming interface, or API, for contact tracing and disease spread analysis. Target customers for SafeTrace are application developers who wish to bring privacy to their users, healthcare institutions who perform crisis response, as well as epidemiologists and research institutions who work on environmental contamination. We have already built a functional minimum viable product, or MVP, for the SafeTrace API. This MVP allows users to share their location and infection status in a privacy-preserving manner and receive individual reports showing whether they have been in close spatiotemporal proximity with a diagnosed patient. This product is in early stages of development, and we have begun the process of identifying potential partners and integrations. In connection with the development of this API, we joined the TCN Coalition, a global coalition for privacy-first digital contact tracing protocols.

Potential Application of the Secret Network

The Secret Network is an extremely versatile and flexible platform, which we believe can be used to solve some of the most pressing challenges in the digital era. In addition to some applications of the technology described above, we believe that the Secret Network can serve as a solution for other applications and industries. Among other potential future applications and uses for the Secret Network, are the following:

| ● | Access control / Digital content management in the blockchain ecosystem. DApps offer content creators an opportunity to directly monetize their work, enabling users to purchase media such as articles, songs, videos, or other material directly from the content creator and bypass intermediaries. However, because data on blockchains is public by default, the information needed to access purchased content cannot be shared directly with the buyer of the content on the blockchain. To overcome this problem, DApps need to introduce an off-chain channel, which adds additional complexities as the buyer cannot prove that access to purchased data was shared by the seller after a payment was made. Secret contracts have the ability to share encrypted information with selected users (encrypted outputs) in order to overcome this problem. These secret contracts can enable creators to share content with a select list of users, as well as update that list depending on payment or nonpayment. All this information can be stored on-chain and would remove complexities around sharing access to purchased data. This type of access control and digital content management could provide significant value to the decentralized application ecosystem for content creators and owners. |

| ● | Decentralized encrypted group messaging. While encrypted peer-to-peer (p2p) messaging is a solved problem, encrypted decentralized group messaging is more challenging, especially if you still want to retain the ability to collect aggregate statistics in a privacy-preserving manner. Secret Network may be able to enable encrypted group messaging to be implemented on a blockchain, given its unique features.

| |

| ● | Decentralized sealed bid auctions. Sealed bid auctions are not possible given the public nature of data on blockchains. Using secret contracts which have encrypted state, the Secret Network could enable decentralized sealed bid auctions. |

| ● | Decentralized exchanges with execution logic. Decentralized exchanges (DEXs) are one of the most popular applications in the blockchain ecosystem. Currently DEXs typically operate with an off-chain order book. Both buyers and sellers submit orders to the off-chain order book and if there are matching orders, an interested party can take commitments from the off-chain order book and trigger an on-chain swap. This means that there is no order matching logic that allows order types that exist in traditional markets such as limit orders, stop limit orders etc. The Secret Network’s secret contracts could potentially be used to maintain the order book and also integrate execution logic to the DEX ecosystem. Furthermore, the privacy-preserving nature of the Secret Network could assist in solving the front-running problem of existing DEXs – one of the largest problems plaguing these solutions today. |

7

ENG Tokens

We sold digital tokens, or the ENG Tokens, in an ICO through our wholly owned subsidiary in the Cayman Islands, Enigma ENG International. From June to September 11, 2017, the Company sold approximately 75 million ENG Tokens in exchange for Bitcoin or Ether, valued at approximately $42 million . The sale was conducted in two phases – a presale phase, in which ENG Tokens were sold pursuant to SAFTs and a crowd-sale phase, taking place on September 11, 2017. The ENG Tokens were delivered to the purchasers in October 2017.

Using proceeds from the ICO, our plan was to build the infrastructure of a decentralized, secure, open data marketplace in the cryptocurrency space so that anyone can gain access to useful data from the cryptocurrency markets. The first product that we planned to build to interface on top of this infrastructure was the Catalyst application. The Catalyst application connects traders and investors with relevant data in order to give such traders an edge in the cryptocurrency markets. According to this plan, we developed Catalyst, an open-source project, which as of the date hereof has over 1,800 Stars (a metric indicating the software’s popularity among developers) and which was forked 550 times based on GitHub. The Company also developed the Enigma Data Marketplace. Within that context, our goals were for ENG Tokens to serve as a way to incentivize and monetize data curation on the Enigma Network, both of which were live as of February 28, 2019.

Since early 2018, Enigma has also been focusing on the development of the Enigma Protocol, which became the company’s main development, and was intended to be a second-layer decentralized network for privacy-preserving computations, built alongside Ethereum. In this protocol, ENG tokens were meant to be used by their holders to participate in the protocol by paying transaction fees (without which, no transaction can be executed on the blockchain), to stake and run nodes to secure the network, to receive network incentives and fees and to reward nodes for successful contributions to the network. In the beginning of 2020, the company decided to divert its business focus and join the Secret Network Community in supporting the development of the Secret Network.

See “Item 10. Recent Sales of Unregistered Securities” and “Item 11. Description of Registrant’s Securities to be Registered” for additional information on the sale of ENG Tokens and for a description of ENG Tokens, respectively.

Our Strategy

Our goal is to continue working with the Secret Network community to advance the continued development of upgrades, features, and developer resources for the Secret Network, product research and development for DApps that can be deployed on the Secret Network, as well as business development and research for enterprise products.

In the near-term, and following the integration of secret contracts, we and the Secret Network Community plan to support the development of additional decentralized applications built on top of the network, as well as research related to future network upgrades and improvements.

Competitive Position

Blockchain technology is characterized by rapidly advancing technologies and intense competition. Although we operate in a competitive space and also compete with companies outside of the blockchain space that seek to enhance privacy of user data, we believe that we, along with the Validator Community, hold certain competitive advantages that will help make the Secret Network a leading blockchain platform and privacy solution.

Certain competitive advantages of the Secret Network versus other solutions include our belief that there is no other public blockchain that is currently purpose-built for data privacy, and we believe that the Secret Network community and SCRT holders will continue to help the Secret Network be a leading privacy-centered blockchain solution. The Secret Network utilizes Intel-SGX trusted execution environment (TEE) technology for privacy, which provides greater speed and other advantages over software-only privacy solutions such as zero-knowledge proofs or commit-reveal mechanisms, two other approaches to achieve privacy in decentralized apps. Zero-knowledge proofs are difficult to design, slow, and costly in gas. Commit-reveal mechanisms provide only temporary privacy, and require two user interactions, resulting in poor user experience.

Moreover, we believe that SafeTrace, the privacy-preserving contact tracing API we built, has advantages over other solutions. Specifically, SafeTrace can enable location-aware contact tracing, as opposed to Bluetooth only solutions. This makes it more useful for crisis responders who need to ID geographic hotspots.

8

Government Regulation

U.S. Considerations

Regulation of blockchain technologies, cryptocurrencies (or virtual currencies) and digital assets by U.S. federal and state governments, foreign governments and self-regulatory organizations remains in relatively early stages. As cryptocurrencies and digital assets have grown in popularity and in market size, the Federal Reserve Board, U.S. Congress and certain U.S. regulatory bodies such as the SEC, the Commodity Futures Trading Commission, or CFTC, Financial Crimes Enforcement Network, or FinCEN, and the Federal Bureau of Investigation, have begun to examine the nature of cryptocurrency and digital assets and the markets on which they are traded. The SEC believes that many cryptocurrencies and digital assets are “investment contracts”, a type of security under U.S. federal securities laws. The U.S. Supreme Court, in SEC v. W.J. Howey Co., determined that an “investment contract” exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others. Whether a particular digital asset at the time of its offer or sale satisfies the Howey test depends on the specific facts and circumstances. In considering the facts and circumstances surrounding the offer and sale of ENG, the SEC determined that ENG was an investment contract and, thus, a security for purposes of U.S federal securities laws. However, the regulatory landscape may differ from country to country and we do not know if any other foreign jurisdiction will follow in such a determination regarding the status of ENG.

In addition, the CFTC has asserted the belief that bitcoin and other virtual currencies meet the definition of a commodity and that the CFTC has regulatory authority over futures and other derivatives based on virtual currencies, subject to facts and circumstances. Although the CFTC generally does not oversee “spot” or cash market exchanges and transactions involving virtual currencies that do not utilize margin, leverage, or financing, the CFTC does have anti-fraud and market manipulation regulatory oversight responsibilities for all spot commodities markets including virtual currencies.

Currently, New York is the only state that requires a license to operate a virtual currency business, but it is possible that other states may require licenses in the future. If additional states begin to regulate virtual currency businesses as New York has, or impose other regulatory restrictions, and take the position that we or other network participants are operating regulated virtual currency businesses, it could have a material adverse effect on our ability to operate in those states, or for holders of the tokens to engage in any activities related to the tokens in those states, which could affect the value of the ENG Tokens.

We may also be subject to a variety of other U.S. laws and regulations that involve matters central to our business. We have adopted policies and procedures designed to comply with the laws that apply to us as we understand them. The risk of our Company being found in violation of applicable U.S. laws and regulations is complicated by the fact that many potentially applicable laws and regulations are open to a variety of interpretations given the absence of formal interpretation by regulatory authorities or the courts.

Any action brought against us by a U.S. regulator or in a private action based on U.S. law could cause us to incur significant legal expenses and divert our management’s attention from the operation of the business. If our operations are found to be in violation of any laws and regulations, we may be subject to penalties associated with the violation, including civil and criminal penalties, damages and fines; we could be required to refund payments received by us; and we could be required to curtail or cease operations. Any of these consequences could seriously harm our business and financial results. In addition, existing and proposed laws and regulations can be costly to comply with and can delay or impede the development of new products, result in negative publicity, increase operating costs, require significant management time and attention, and subject us to claims or other remedies, including fines or demands that we modify or cease existing business practices.

Foreign Considerations

We may also be subject to a variety of foreign laws and regulations that involve matters central to our business. These could include, for example, regulations related to user privacy such as the European Union’s General Data Protection Regulation, blockchain technology, potential broker-dealer or exchange activities, data protection, and intellectual property, among others. In certain cases, foreign laws may be more restrictive than those in the United States. Although we believe we are operating in compliance with the laws of jurisdictions in which we exist, foreign laws and regulations are constantly evolving and can be subject to significant change. In addition, the application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate. As a result, cryptocurrency networks, blockchain technologies face an uncertain regulatory landscape in many foreign jurisdictions, including but not limited to the European Union, China and Russia. Other foreign jurisdictions may also, in the near future, adopt laws, regulations or directives that affect ENG tokens.

9

We have adopted policies and procedures designed to comply with the laws that apply to us as we understand them. However, the growth of our business and its expansion outside of the United States may increase the potential of violating foreign laws or our own internal policies and procedures. The risk of our Company being found in violation of applicable laws and regulations is further increased by the fact that many of them are open to a variety of interpretations given the absence of formal interpretation by regulatory authorities or the courts.

Any action brought against us by a foreign regulator or in a private action based on foreign law could cause us to incur significant legal expenses and divert our management’s attention from the operation of the business. If our operations are found to be in violation of any laws and regulations, we may be subject to penalties associated with the violation, including civil and criminal penalties, damages and fines; we could be required to refund payments received by us; and we could be required to curtail or cease operations. Any of these consequences could seriously harm our business and financial results. In addition, existing and proposed laws and regulations can be costly to comply with and can delay or impede the development of new products, result in negative publicity, increase operating costs, require significant management time and attention, and subject us to claims or other remedies, including fines or demands that we modify or cease existing business practices.

Any applicable foreign laws, regulations or directives may also conflict with those of the United States. The effect of any future regulatory change is impossible to predict, but any change could be substantial and materially adverse to the adoption and value of the tokens and our operations (see also “Risk Factors—Risks Related to Government Regulation”).

Employees

As of September 15, 2020, we had two employees, both of which are employed on a full-time basis. None of our employees are represented by a labor union or covered under a collective bargaining agreement. We consider our employee relations to be good.

Corporate Information

We were incorporated under the laws of the state of Delaware in August 2015 under the name Newton Security Labs, Inc. On June 15, 2016, we changed our name to Enigma MPC, Inc. Our registered address is 186 Museum Way, San Francisco, CA 94114, USA. Our website address is https://enigma.co/. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this Registration Statement. We have included our website address in this Registration Statement solely as an inactive textual reference.

The Securities and Exchange Commission, or the SEC, also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings with the SEC are also available to the public through the SEC’s website at http://www.sec.gov.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act and not being required to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.07 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

10

| ITEM 1A. | RISK FACTORS |

Investing in our ENG Tokens involves a number of significant risks. Before you purchase our ENG Tokens, you should carefully consider these risk factors, together with all of the other information included in this Registration Statement. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us may also impair our operations and performance. If any of the following events occur, our financial condition, results of operations and cash flows could be materially and adversely affected.

Risks Related to our Business and Operations

The prices of blockchain assets are extremely volatile. Fluctuations in the price of Bitcoin, Ether and/or other blockchain assets could materially and adversely affect us or on the trading price of ENG tokens.

The prices of blockchain assets such as Bitcoin, Ether and other cryptographic tokens and coins have historically been subject to dramatic fluctuations and are highly volatile. As relatively new products and technologies, blockchain assets have only recently become accepted as a means of payment for goods and services, and such acceptance and use remains limited and far from mainstream. Conversely, a significant portion of demand for blockchain assets is generated by speculators and investors seeking to profit from the short- or long-term holding of blockchain assets.

In addition, some blockchain industry participants have reported that a significant percentage of blockchain asset trading activity is artificial or non-economic in nature and may represent attempts to manipulate the price of certain blockchain assets. As a result, trading platforms or blockchain assets may seek to inflate demand for a specific blockchain asset, or blockchain assets generally, which could increase the volatility of that asset or blockchain asset trading prices generally.

The market price of these blockchain assets, as well as other blockchain assets that may be developed in the future, may continue to be highly volatile, which could have an adverse effect on the trading price of ENG, if a trading market should exist at such time. A lack of expansion, or a contraction of adoption and use of blockchain assets, may result in increased volatility or a reduction in the price of blockchain assets.

Several additional factors may influence the market price of blockchain assets, including, but not limited to:

| ● | global blockchain asset supply; | |

| ● | global blockchain asset demand; | |

| ● | changes in the software, software requirements or hardware requirements underlying the blockchain networks; | |

| ● | changes in the rights, obligations, incentives, or rewards for the various participants in blockchain networks; | |

| ● | the cost of trading and transacting in blockchain assets, and whether such costs may become fixed or standardized; | |

| ● | expectations with respect to the rate of inflation; | |

| ● | currency exchange rates, including the rates at which blockchain assets may be exchanged for fiat currencies; | |

| ● | fiat currency withdrawal and deposit policies of blockchain asset trading platforms and liquidity on such platforms; | |

| ● | interruptions in service or other failures of major blockchain asset trading platforms; | |

| ● | Investment and trading activities of cryptographic assets of large enterprises as well as their utilization of such assets; |

| ● | monetary policies of governments, trade restrictions, currency devaluations and revaluations; |

11

| ● | regulatory measures, if any, that affect the use of blockchain assets; |

| ● | the maintenance and development of the open-source software utilized in blockchain networks; | |

| ● | global or regional political, economic or financial events and situations; or | |

| ● | expectations among blockchain network participants that the value of such blockchain assets will soon change. |

The value of blockchain assets and fluctuations in the price of blockchain assets could materially and adversely affect the trading price of ENG, if a market should exist at that time.

Security attacks against us could result in a loss of our blockchain assets, including ENG Tokens, theft of personal information of our users and partners or damage to our reputation and our brand, each of which could adversely affect the trading price of ENG, if a market should then exist, and our financial position. We could be required to incur significant expense to protect our systems and/or investigate any alleged attack.

Security breaches, computer malware and computer hacking attacks have been a prevalent concern since the launch of blockchain networks. Since 2011, we believe that at least $1.7 billion has been publicly reported stolen from cryptocurrency exchanges and investors. Our security system and operational infrastructure may be breached due to the actions of outside parties, error or malfeasance of an employee of ours, or otherwise. Techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be designed to remain dormant until a predetermined event. Outside parties may also attempt to fraudulently induce employees of ours to disclose sensitive information in order to gain access to our infrastructure. Furthermore, we believe that, as our assets grow, we may become a more appealing target for security threats such as hackers and malware.

Our security measures may prove insufficient depending upon the attack or threat posed. We may be unable to anticipate these techniques or implement adequate preventative measures. As a result, an unauthorized party may obtain access to our private keys, and our or user data or blockchain assets. The theft of blockchain assets could have a material adverse effect on our financial position.

Any such breach or unauthorized access result in business interruptions from the disruption of our information technology systems, or negative publicity resulting in reputational damage with our shareholders and other stakeholders and/or increased costs to prevent, respond to or mitigate cybersecurity events. Furthermore, as a direct result such adverse effects, any such breach or unauthorized access could also result in significant legal and financial exposure, damage to our reputation, and a loss of confidence in our supported networks that could potentially have an adverse effect on our business, while resulting in regulatory penalties or the imposition of burdensome obligations by regulators. In addition, any of these aforementioned activities could cause the trading price of ENG to decrease, if a trading market for ENG should then exist. In the event of a security breach, we may also be forced to cease operations, or suffer a reduction in assets, the occurrence of each of which could adversely affect our business and financial positions.

Data collection in Europe and some U.S. states are governed by restrictive regulations governing the use, processing, and cross-border transfer of personal information.

The collection, use, storage, disclosure, transfer, or other processing of personal data regarding individuals in the EU, including personal health data, is subject to the EU General Data Protection Regulation, or GDPR, which became effective on May 25, 2018. The GDPR is wide-ranging in scope and imposes numerous requirements on companies that process personal data, including requirements relating to processing health and other sensitive data, obtaining consent of the individuals to whom the personal data relates, providing information to individuals regarding data processing activities, implementing safeguards to protect the security and confidentiality of personal data, providing notification of data breaches, and taking certain measures when engaging third-party processors. The GDPR also imposes strict rules on the transfer of personal data to countries outside the EU, including the United States, and permits data protection authorities to impose large penalties for violations of the GDPR, including potential fines of up to €20 million or 4% of annual global revenues, whichever is greater. The GDPR also confers a private right of action on data subjects and consumer associations to lodge complaints with supervisory authorities, seek judicial remedies, and obtain compensation for damages resulting from violations of the GDPR. In addition, the GDPR includes restrictions on cross-border data transfers. The GDPR increased our responsibility and liability in relation to personal data that we process where such processing is subject to the GDPR, and we may be required to put in place additional mechanisms to ensure compliance with the GDPR, including as implemented by individual countries. Compliance with the GDPR will be a rigorous and time-intensive process that may increase our cost of doing business or require us to change our business practices, and despite those efforts, there is a risk that we may be subject to fines and penalties, litigation, and reputational harm in connection with our European activities. Further, the United Kingdom’s decision to leave the EU, often referred to as Brexit, has created uncertainty with regard to data protection regulation in the United Kingdom. In particular, it is unclear how data transfers to and from the United Kingdom will be regulated now that the United Kingdom has left the EU.

12

In addition, California enacted the California Consumer Privacy Act, or CCPA, which took effect on January 1, 2020. The CCPA creates individual privacy rights for California consumers and increases the privacy and security obligations of entities handling certain personal data. In the event that we are subject to or affected by privacy and data protection laws, including the CCPA, the EU’s General Data Protection Regulation, or GDPR, and other domestic or international privacy and data protection laws, we may expend significant resources to comply with such laws, and any liability from failure to comply with the requirements of these laws could adversely affect our financial condition.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or SOX, we will be required to furnish a report by our management on our internal control over financial reporting. However, while we remain an emerging growth company, we will not be required to include an attestation report on internal control over financial reporting issued by its independent registered public accounting firm. To achieve compliance with Section 404 of SOX within the prescribed period, we will be engaged in a process to document and evaluate our internal control over financial reporting, which is both costly and challenging. In this regard, we will need to continue to dedicate internal resources, potentially engage outside consultants and counsel and adopt a detailed work plan to assess and document the adequacy of internal control over financial reporting, continue steps to improve control processes as appropriate, validate through testing that controls are functioning as documented and implement a continuous reporting and improvement process for internal control over financial reporting. Despite our efforts, there is a risk that we will not be able to conclude within the prescribed timeframe that our internal control over financial reporting is effective as required by Section 404 of SOX. In addition, we may be required to incur costs in improving its internal control system and the hiring of additional personnel. Any such action could negatively affect our results of operations and cash flows.

General global market and economic conditions may have an adverse impact on our operating performance, results of operations and/or cash flow and cause the trading price of ENG tokens to decrease, should a trading market then exist.

We may be affected by general global economic and market conditions. Challenging economic conditions worldwide have from time to time, contributed, and may continue to contribute, to slowdowns in the information technology industry at large. Weakness in the economy could have a negative effect on our business, operations and financial condition. Additionally, in a down-cycle economic environment, we may experience the negative effects of a slowdown in usage of our supported networks and, as a result thereof, we or any other independent third-party working on our supported networks, including members of the Consortium, may delay or cancel the development and/or launch of anticipated future developments. For example, in December 2019, a novel strain of coronavirus, COVID-19, was identified in Wuhan, China. This virus continues to spread globally and, as of May 2020, has spread to over 200 countries, including the United States and Israel. The spread of COVID-19 from China to other countries has resulted in the World Health Organization declaring the outbreak of COVID-19 as a “pandemic,” or a worldwide spread of a new disease, on March 11, 2020. Many countries around the world have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus. The economic effect of the pandemic and the restrictions imposed and actions enacted as a result thereof is still being assessed; however, during this time, and potentially for a period of time once the pandemic is over, companies have elected to cancel certain expenses not deemed to be mandatory. This could cause adoption of the Secret Network, and blockchain technology in general, to slow down as companies cut more “exploratory” expenses.

There can be no assurance, therefore, that current economic conditions or worsening economic conditions or a prolonged or recurring recession will not have a significant, adverse impact on our business, financial condition and results of operations, and hence, our business outlook. Any such circumstances would then correspondingly negatively impact the functionality, liquidity, and trading price of ENG Tokens.

13

The application of distributed ledger technology is novel and untested and may contain inherent flaws or limitations.

Blockchain is an emerging technology that offers new capabilities which are not fully proven in use. There are limited examples of the application of blockchain technology. In most cases, software used by blockchain asset issuing entities will be in an early development stage and still unproven. Insufficient testing of infrastructure-level or application-level smart contract code, as well as the use of external code libraries, may cause the software to break or function incorrectly. Any error or unexpected functionality may result in a material adverse effect on our business.

The creation and operation of blockchain technology in new industries will be subject to potential technical, legal and regulatory constraints. There is no warranty that the process for receiving, use and ownership of blockchain assets will be uninterrupted or error-free and there is an inherent risk that the software, network, blockchain assets and related technologies and theories could contain undiscovered technical flaws or weaknesses, the cryptographic security measures that authenticate transactions and the distributed ledger could be compromised, and breakdowns could cause the partial or complete inability to use or loss of blockchain assets.

Moreover, advances in cryptography and/or technical advances, could present risks to our supported networks by undermining or vitiating the cryptographic consensus mechanism that underpins the blockchain protocols. Similarly, legislatures and regulatory agencies could prohibit the use of current and/or future cryptographic protocols, resulting in a significant loss of value or the termination of the ENG Tokens.

We could be subject to additional civil penalties or face criminal penalties and sanctions if we violate the terms of settlement with the SEC.

In connection with our ICO, we entered into the Settlement with the SEC. While we have already paid the penalties imposed by the order into which we entered pursuant to the Settlement, the order contains ongoing and continuing requirements that we refrain from violating the Securities Act. Any future violation of applicable securities laws by us could result in harsher sanctions and fines, which would have a material adverse effect on our ability to implement our business plans. The SEC Order requires, among other things, that we conduct the rescission offer in accordance with those requirements generally described elsewhere in this Registration Statement. In addition to requiring us to provide regular written updates regarding the rescission offer and a final certification, SEC staff can make reasonable requests from us for further evidence of compliance, and we are required to retain all records and communications relating to the ICO and the rescission offer for at least one year subsequent to the delivery of the certification to the SEC. Such requests for further information, record-keeping requirements and managing the rescission offer generally could divert management’s attention from implementing its business plans and could require additional material expenditures by us to legal counsel or other advisors and service providers. A copy of the SEC Order can be found at https://www.sec.gov/litigation/admin/2020/33-10755.pdf.

Current and future litigation could adversely affect us.

We may be in the future, party to legal, arbitration and administrative investigations, inspections and proceedings arising in the ordinary course of our business or from extraordinary corporate, tax or regulatory events, involving or relating to our partners or users of our supported networks, as well as competition, government agencies, tax and environmental authorities, particularly with respect to civil, tax and labor claims. Our indemnities may not cover all claims that may be asserted against us, and any claims asserted against us, regardless of merit or eventual outcome, may harm our reputation. Furthermore, there is no guarantee that we will be successful in defending ourselves in pending or future litigation or similar matters under various laws. Should the ultimate judgments or settlements in any pending litigation or future litigation or investigation significantly exceed our indemnity rights, they could have a material adverse effect on our business, financial condition and results of operations. Further, even if we adequately address issues raised by an inspection conducted by an agency or successfully defend our case in an administrative proceeding or court action, we may have to set aside significant financial and management resources to settle issues raised by such proceedings or to those lawsuits or claims, which could adversely affect our business.

14

Risks Related to Government Regulation

The regulatory regime governing cryptocurrencies is still developing, and regulatory changes or actions may alter the nature of an investment in ENG Tokens or restrict the use of ENG Tokens in a manner that adversely affects holders and our business plans.

The regulation of cryptocurrencies and cryptocurrency exchanges are currently under-developed and likely to rapidly evolve and vary significantly among U.S. and non-U.S. jurisdictions, and are subject to significant uncertainty. As cryptocurrencies have grown in both popularity and market size, governments around the world have reacted differently to cryptocurrencies, with certain governments deeming them illegal while others have allowed their use and trade. Various legislative and executive bodies in the United States, and other countries, are, or are considering, enacting laws, regulations, guidance, or other actions, which could adversely impact us and the value of ENG Tokens. Our failure to comply with any laws, rules and regulations, some of which may not exist yet or are subject to interpretation and may be subject to change, could result in a variety of adverse consequences, including criminal and civil penalties and fines against us. The variation among applicable laws and regulations across multiple jurisdictions may result in materially different consequences to holders of ENG Tokens based upon their respective country of residence. New or changing laws and regulations or interpretations of existing laws and regulations (whether in the U.S. or elsewhere) could have material adverse consequences to you and us, including, but not limited to: the value of ENG Tokens, the liquidity and market price, if any market should ever exist, of ENG Tokens, and your ability to access marketplaces that trade ENG Tokens, if any should ever exist.

It may be illegal now, or in the future, to acquire, own, hold, sell or use ENG Tokens in one or more countries, and ownership of, holding or trading in any such blockchain assets may also be considered illegal and subject to sanction.

The regulation of blockchain assets remains uncertain or undefined in many jurisdictions. Although we are registering the ENG Tokens in this Registration Statement as securities, we do not know how other jurisdictions will treat ENG Tokens or whether ENG Tokens will be treated as securities under the laws and regulations of other jurisdictions. In addition, one or more foreign governmental authorities, such as those in China or Russia, may take regulatory action in the future that severely restricts the right to acquire, own, hold, sell or use blockchain assets or to exchange blockchain assets for fiat currency. Such an action may result in the restriction of ownership, holding or trading in the ENG Tokens.

Risks Related to Owning ENG Tokens

The ENG Tokens have a limited history and no actual utility and thus face significant uncertainties around their valuation.

The ENG Tokens have a limited performance history and when issued, were a relatively new investment format. Holders of ENG Tokens will have limited ability to compare them against other like instruments as our operation have steered away from any operational work that relates to the utilization of ENG Tokens. As of the beginning of 2020, we stopped providing support to the Enigma Protocol and the Enigma Network. Moreover, the Secret Network and the decentralized applications that may be developed for use on such blockchain are not intended to support the ENG Tokens, but rather, a different, unique cryptographic coin, known as SCRT.

Holders of SCRT coins have voted to enable the Secret Network to generate additional SCRT coins to be granted to holders of ENG Tokens in exchange for burning such tokens, or the Community Swap. Burning tokens is a technical manner by which the token is destroyed and ceases to exist and does not return to our “treasury”.

We have not initiated, and are not facilitating or endorsing the Community Swap in any manner to date, however, in light of the decentralized nature of the Secret Network, our support and/or involvement is not necessary in order to conduct the Community Swap. In addition, we are not receiving the burnt ENG Tokens nor are we responsible for the creation or allocation of the SCRT coins that would be generated in the Community Swap and as such, we are a bystander to this Community Swap and act as a network participant, similar to other SCRT coin holders.

We do not believe that the Community Swap contemplates a tender offer or any other offering of securities subject to SEC or other regulation, but it is possible that the SEC or another regulator would disagree with that position.

15

The prices of cryptocurrencies, such as ENG Tokens, are extremely volatile.

Fluctuations in the price of cryptocurrencies could subject ENG Tokens to significant price volatility, The price of cryptocurrencies, including ENG Tokens, is affected by many factors beyond our control including global supply and demand, the expected future price, inflation expectations, interest rates, currency exchange rates, fiat currency withdrawal and deposit policies at virtual token exchanges, interruptions in service or failures of such exchanges, investment and trading activities of large holders of cryptocurrencies, government monetary policies, regulatory measures that restrict the use of cryptocurrencies and global political, economic or financial events. In addition, a decrease in the price of one cryptocurrency may cause volatility in the entire cryptocurrency industry, including the ENG Tokens. For example, a security breach that affects investor or user confidence in Bitcoin may affect the industry as a whole and may also cause the price of ENG Tokens and cryptocurrencies to fluctuate dramatically.

The development and acceptance of transactions in cryptocurrencies are subject to a variety of factors that are difficult to evaluate.

The use of cryptocurrencies to buy and sell goods and services and complete transactions is part of a new and rapidly evolving industry, and the continued growth of this industry and the use of cryptocurrencies is subject to a high degree of uncertainty. The slowing or stopping of the development or acceptance of cryptocurrencies could have a material adverse effect on our plan of business, and we cannot assure you this will not occur. Factors that could affect the expansion or contraction of the use of cryptocurrencies and our related business plans, but are not limited to:

| ● | continued worldwide growth in the adoption and use of cryptocurrencies; |

| ● | governmental and quasi-governmental regulation of cryptocurrencies and their use, or restrictions on or regulation of access to and operation of cryptocurrency systems; |

| ● | the maintenance and development of the open-source software protocol on which many cryptocurrencies are dependent; |

| ● | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| ● | general economic conditions and the regulatory environment relating to cryptocurrencies; and |

| ● | negative consumer sentiment and perception of cryptocurrencies in general. |

We cannot predict with certainty any outcome regarding use of cryptocurrencies, and any of the above factors may have a material adverse effect on our business and the price of ENG Tokens.