ati-20240331false2024Q1000181584912/310.02.0010000018158492024-01-012024-03-310001815849us-gaap:CommonClassAMember2024-01-012024-03-310001815849us-gaap:WarrantMember2024-01-012024-03-3100018158492024-05-01xbrli:shares00018158492024-03-31iso4217:USD00018158492023-12-31iso4217:USDxbrli:shares0001815849us-gaap:RelatedPartyMember2023-12-310001815849us-gaap:RelatedPartyMember2024-03-310001815849us-gaap:HealthCarePatientServiceMember2024-01-012024-03-310001815849us-gaap:HealthCarePatientServiceMember2023-01-012023-03-310001815849us-gaap:ProductAndServiceOtherMember2024-01-012024-03-310001815849us-gaap:ProductAndServiceOtherMember2023-01-012023-03-3100018158492023-01-012023-03-310001815849us-gaap:CommonStockMember2023-12-310001815849us-gaap:TreasuryStockCommonMember2023-12-310001815849us-gaap:AdditionalPaidInCapitalMember2023-12-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001815849us-gaap:RetainedEarningsMember2023-12-310001815849us-gaap:NoncontrollingInterestMember2023-12-310001815849us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001815849us-gaap:CommonStockMember2024-01-012024-03-310001815849us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001815849us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001815849us-gaap:RetainedEarningsMember2024-01-012024-03-310001815849us-gaap:CommonStockMember2024-03-310001815849us-gaap:TreasuryStockCommonMember2024-03-310001815849us-gaap:AdditionalPaidInCapitalMember2024-03-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001815849us-gaap:RetainedEarningsMember2024-03-310001815849us-gaap:NoncontrollingInterestMember2024-03-310001815849us-gaap:CommonStockMember2022-12-310001815849us-gaap:TreasuryStockCommonMember2022-12-310001815849us-gaap:AdditionalPaidInCapitalMember2022-12-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001815849us-gaap:RetainedEarningsMember2022-12-310001815849us-gaap:NoncontrollingInterestMember2022-12-3100018158492022-12-310001815849us-gaap:CommonStockMember2023-01-012023-03-310001815849us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001815849us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001815849us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001815849us-gaap:RetainedEarningsMember2023-01-012023-03-310001815849us-gaap:CommonStockMember2023-03-310001815849us-gaap:TreasuryStockCommonMember2023-03-310001815849us-gaap:AdditionalPaidInCapitalMember2023-03-310001815849us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001815849us-gaap:RetainedEarningsMember2023-03-310001815849us-gaap:NoncontrollingInterestMember2023-03-3100018158492023-03-31ati:clinicati:state0001815849us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2024-03-310001815849ati:DelayedDrawRightMemberus-gaap:ConvertibleDebtMember2023-06-15ati:segment00018158492023-06-142023-06-14xbrli:pure0001815849ati:A2024ClinicsHeldForSaleMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-03-310001815849ati:A2023ClinicsHeldForSaleMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-12-310001815849ati:ATIWorksiteSolutionsMember2024-01-012024-03-310001815849ati:ATIWorksiteSolutionsMember2023-01-012023-03-310001815849ati:ManagementServiceAgreementsMember2024-01-012024-03-310001815849ati:ManagementServiceAgreementsMember2023-01-012023-03-310001815849ati:ProductsAndServicesSportsMedicineAndOtherMiscellaneousRevenueMember2024-01-012024-03-310001815849ati:ProductsAndServicesSportsMedicineAndOtherMiscellaneousRevenueMember2023-01-012023-03-310001815849ati:CommercialPayorClassMemberus-gaap:HealthCarePatientServiceMember2024-01-012024-03-310001815849ati:CommercialPayorClassMemberus-gaap:HealthCarePatientServiceMember2023-01-012023-03-310001815849us-gaap:HealthCarePatientServiceMemberati:GovernmentPayorClassMember2024-01-012024-03-310001815849us-gaap:HealthCarePatientServiceMemberati:GovernmentPayorClassMember2023-01-012023-03-310001815849us-gaap:HealthCarePatientServiceMemberati:WorkersCompensationPayorClassMember2024-01-012024-03-310001815849us-gaap:HealthCarePatientServiceMemberati:WorkersCompensationPayorClassMember2023-01-012023-03-310001815849ati:OtherPayorClassMemberus-gaap:HealthCarePatientServiceMember2024-01-012024-03-310001815849ati:OtherPayorClassMemberus-gaap:HealthCarePatientServiceMember2023-01-012023-03-310001815849us-gaap:TradeNamesMember2024-03-310001815849us-gaap:TradeNamesMember2023-12-310001815849us-gaap:NoncompeteAgreementsMember2024-03-310001815849us-gaap:NoncompeteAgreementsMember2023-12-310001815849us-gaap:OtherIntangibleAssetsMember2024-03-310001815849us-gaap:OtherIntangibleAssetsMember2023-12-310001815849us-gaap:EquipmentMember2024-03-310001815849us-gaap:EquipmentMember2023-12-310001815849us-gaap:FurnitureAndFixturesMember2024-03-310001815849us-gaap:FurnitureAndFixturesMember2023-12-310001815849us-gaap:LeaseholdImprovementsMember2024-03-310001815849us-gaap:LeaseholdImprovementsMember2023-12-310001815849us-gaap:AutomobilesMember2024-03-310001815849us-gaap:AutomobilesMember2023-12-310001815849ati:ComputerEquipmentAndSoftwareMember2024-03-310001815849ati:ComputerEquipmentAndSoftwareMember2023-12-310001815849us-gaap:ConstructionInProgressMember2024-03-310001815849us-gaap:ConstructionInProgressMember2023-12-310001815849ati:RentClinicSuppliesContractLaborAndOtherMember2024-01-012024-03-310001815849ati:RentClinicSuppliesContractLaborAndOtherMember2023-01-012023-03-310001815849us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-03-310001815849us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-03-310001815849ati:ATIShareholdersVsATIIndividualDefendantsMember2024-03-310001815849ati:ATIShareholdersVsATIIndividualDefendantsMember2023-12-310001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2024-03-310001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-12-310001815849us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2023-12-310001815849ati:SecuredDebtAndLineOfCreditMemberati:SeniorSecuredTermLoanAnd2022CreditAgreementMember2024-03-310001815849ati:SecuredDebtAndLineOfCreditMemberati:SeniorSecuredTermLoanAnd2022CreditAgreementMember2023-12-310001815849ati:SeniorSecuredTermLoanMember2023-12-310001815849ati:SeniorSecuredTermLoanMember2024-03-310001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-12-312023-12-310001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2024-03-312024-03-310001815849ati:A2LNotesMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001815849ati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-06-152023-06-150001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-06-152023-06-150001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-06-140001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-01-012023-12-310001815849ati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-06-150001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2023-06-150001815849us-gaap:SecuredDebtMemberati:HPSInvestmentPartnersLLCMemberati:SeniorSecuredTermLoanMember2023-06-150001815849us-gaap:SecuredDebtMemberati:OnexCreditPartnersLLCMemberati:SeniorSecuredTermLoanMember2023-06-150001815849us-gaap:SecuredDebtMemberati:KnightheadCapitalManagementLLCMemberati:SeniorSecuredTermLoanMember2023-06-150001815849us-gaap:SecuredDebtMemberati:MarathonAssetManagementLPMemberati:SeniorSecuredTermLoanMember2023-06-150001815849us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2023-06-152023-06-150001815849ati:A2LNotesMemberati:KnightheadCapitalManagementLLCMemberus-gaap:ConvertibleDebtMember2023-06-152023-06-150001815849ati:A2LNotesMemberati:MarathonAssetManagementLPMemberus-gaap:ConvertibleDebtMember2023-06-152023-06-150001815849ati:A2LNotesMemberati:OnexCreditPartnersLLCMemberus-gaap:ConvertibleDebtMember2023-06-152023-06-150001815849ati:SeriesBPreferredStockVotingRightsMember2023-06-150001815849ati:SeriesBPreferredStockVotingRightsMember2023-12-310001815849ati:SeriesBPreferredStockVotingRightsMember2024-01-012024-03-310001815849ati:SeriesBPreferredStockVotingRightsMember2024-03-310001815849ati:A2LNotesMemberus-gaap:ConvertibleDebtMember2024-01-012024-03-310001815849ati:A2LNotesMemberati:KnightheadCapitalManagementLLCMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2LNotesMemberati:MarathonAssetManagementLPMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2LNotesMemberati:OnexCreditPartnersLLCMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2LNotesMemberati:CaspianCapitalL.PMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2LNotesMemberati:KnightheadCapitalManagementLLCMemberus-gaap:ConvertibleDebtMember2023-12-310001815849ati:A2LNotesMemberati:MarathonAssetManagementLPMemberus-gaap:ConvertibleDebtMember2023-12-310001815849ati:A2LNotesMemberati:OnexCreditPartnersLLCMemberus-gaap:ConvertibleDebtMember2023-12-3100018158492023-06-150001815849ati:DelayedDrawRightMemberus-gaap:ConvertibleDebtMember2024-03-310001815849us-gaap:ConvertibleDebtMemberati:KnightheadCapitalManagementLLCMember2024-03-310001815849ati:MarathonAssetManagementLPMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:CaspianCapitalL.PMemberus-gaap:ConvertibleDebtMember2024-03-310001815849ati:A2022CreditAgreementMember2022-02-240001815849us-gaap:SecuredDebtMemberati:A2022CreditAgreementMember2022-02-240001815849us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2022-02-240001815849us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberati:A2022CreditAgreementMember2022-02-2400018158492022-02-242022-02-240001815849us-gaap:SecuredDebtMemberati:SeniorSecuredTermLoanMember2022-02-240001815849us-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberati:SeniorSecuredTermLoanMember2024-03-312024-03-310001815849us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2024-01-012024-03-310001815849us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberati:A2022CreditAgreementMember2024-03-312024-03-310001815849us-gaap:LineOfCreditMemberati:A2022CreditAgreementMember2022-02-242022-02-240001815849ati:DebtInstrumentCovenantPeriodFourMemberati:A2022CreditAgreementMember2024-03-310001815849ati:DebtInstrumentCovenantPeriodFiveMemberati:A2022CreditAgreementMember2024-01-012024-03-310001815849ati:DebtInstrumentCovenantPeriodSixMemberati:A2022CreditAgreementMember2024-01-012024-03-310001815849ati:A2022CreditAgreementMember2024-01-012024-03-310001815849us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberati:A2022CreditAgreementMember2024-03-310001815849us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberati:A2022CreditAgreementMember2023-12-310001815849ati:SecuredDebtAndLineOfCreditMemberati:A2022CreditAgreementMember2024-03-310001815849ati:ATIPhysicalTherapy2021EquityIncentivePlanMember2024-03-310001815849us-gaap:PreferredClassAMember2022-02-240001815849ati:SeriesIWarrantsMember2022-02-240001815849ati:SeriesIIWarrantsMember2022-02-240001815849us-gaap:PreferredClassAMember2022-02-242022-02-240001815849us-gaap:PreferredClassAMember2024-01-012024-03-310001815849us-gaap:PreferredClassAMember2023-01-012023-03-310001815849us-gaap:PreferredClassAMember2024-03-312024-03-310001815849us-gaap:PreferredClassAMember2024-03-310001815849us-gaap:PreferredClassAMember2023-12-31ati:director0001815849ati:SeriesASeniorPreferredStockMember2023-06-150001815849ati:SeriesIWarrantsMemberus-gaap:CommonClassAMember2022-02-242022-02-240001815849ati:SeriesIIWarrantsMemberus-gaap:CommonClassAMember2022-02-242022-02-240001815849us-gaap:CommonClassAMember2024-03-31ati:vote0001815849ati:A2LNotesMember2024-03-310001815849us-gaap:StockCompensationPlanMember2024-03-310001815849us-gaap:StockCompensationPlanMemberati:ATIPhysicalTherapy2021EquityIncentivePlanMember2024-03-310001815849ati:EarnoutSharesMember2024-03-310001815849ati:A2022WarrantsMember2024-03-310001815849us-gaap:WarrantMember2024-03-310001815849ati:VestingSharesMember2024-03-310001815849us-gaap:RestrictedStockMember2024-03-310001815849us-gaap:CarryingReportedAmountFairValueDisclosureMemberati:SeniorSecuredTermLoanMember2024-03-310001815849us-gaap:EstimateOfFairValueFairValueDisclosureMemberati:SeniorSecuredTermLoanMember2024-03-310001815849us-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2024-03-310001815849us-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001815849us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2024-03-310001815849us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001815849us-gaap:FairValueInputsLevel3Memberati:MeasurementInputSelectedYieldMemberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2024-03-310001815849us-gaap:FairValueInputsLevel3Memberati:MeasurementInputSelectedYieldMemberati:A2LNotesMemberus-gaap:ConvertibleDebtMember2023-12-310001815849us-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputExpectedTermMember2024-03-31utr:Y0001815849us-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001815849us-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputSharePriceMember2024-03-310001815849us-gaap:FairValueInputsLevel3Memberati:A2LNotesMemberus-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001815849us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-310001815849us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-03-310001815849us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-12-310001815849us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-03-310001815849us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMember2024-03-310001815849us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMember2023-12-310001815849us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NondesignatedMember2024-03-310001815849us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NondesignatedMember2023-12-310001815849srt:MinimumMember2024-03-310001815849srt:MaximumMember2024-03-310001815849ati:ATIShareholdersVsATIIndividualDefendantsMember2021-08-162021-08-16ati:plaintiff0001815849ati:DerivativeActionMember2021-12-012022-09-22ati:claim00018158492022-11-210001815849ati:A2LNotesMember2024-01-012024-03-310001815849ati:A2LNotesMember2023-01-012023-03-310001815849ati:SeriesIWarrantsMember2024-01-012024-03-310001815849ati:SeriesIWarrantsMember2023-01-012023-03-310001815849us-gaap:WarrantMember2024-01-012024-03-310001815849us-gaap:WarrantMember2023-01-012023-03-310001815849us-gaap:RestrictedStockMemberati:WilcoHoldcoIncMember2024-01-012024-03-310001815849us-gaap:RestrictedStockMemberati:WilcoHoldcoIncMember2023-01-012023-03-310001815849us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001815849us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001815849us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001815849us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001815849us-gaap:RestrictedStockMember2024-01-012024-03-310001815849us-gaap:RestrictedStockMember2023-01-012023-03-310001815849ati:EarnoutSharesMember2021-06-162021-06-160001815849ati:VestingSharesMember2021-06-162021-06-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For transition period from to

Commission File Number 001-39439

ATI Physical Therapy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 85-1408039 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

790 Remington Boulevard

Bolingbrook, IL 60440

(630) 296-2223

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value | | ATIP | | New York Stock Exchange |

| Redeemable Warrants, exercisable for Class A common stock at an exercise price of $575.00 per share | | ATIPW | | OTC Market |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of May 1, 2024, there were approximately 4,395,617 shares of the registrant's common stock legally outstanding.

Table of Contents

| | | | | |

| Page |

PART I - FINANCIAL INFORMATION - UNAUDITED | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included in this Form 10-Q that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of the words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the impact of physical therapist attrition and ability to achieve and maintain clinical staffing levels and clinician productivity, anticipated visit and referral volumes and other factors on the Company's overall profitability, and estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Form 10-Q, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks and uncertainties, including:

•our liquidity position raises substantial doubt about our ability to continue as a going concern;

•risks associated with liquidity and capital markets, including the Company's ability to generate sufficient cash flows, together with cash on hand, to run its business, cover liquidity and capital requirements and resolve substantial doubt about the Company's ability to continue as a going concern;

•our ability to meet financial covenants as required by our 2022 Credit Agreement, as amended;

•risks related to outstanding indebtedness and preferred stock, rising interest rates and potential increases in borrowing costs, compliance with associated covenants and provisions and the potential need to seek additional or alternative debt or capital financing in the future;

•risks related to the Company's ability to access additional financing or alternative options when needed;

•our dependence upon reimbursement by governmental and third-party private payors and that decreases in reimbursement rates, renegotiation or termination of payor contracts, billing disputes with third-party payors or unfavorable changes in payor, state and service mix may adversely affect our financial results;

•federal and state governments’ continued efforts to contain growth in Medicaid expenditures, which could adversely affect the Company’s revenue and profitability;

•payments that we receive from Medicare and Medicaid being subject to potential retroactive reduction;

•changes in Medicare rules and guidelines and reimbursement or failure of our clinics to maintain their Medicare certification and/or enrollment status;

•compliance with federal and state laws and regulations relating to the privacy of individually identifiable patient information, and associated fines and penalties for failure to comply;

•risks associated with public health crises, epidemics and pandemics, as was the case with the novel strain of COVID-19, and their direct and indirect impacts or lingering effects on the business, which could lead to a decline in visit volumes and referrals;

•our inability to compete effectively in a competitive industry, subject to rapid technological change and cost inflation, including competition that could impact the effectiveness of our strategies to improve patient referrals and our ability to identify, recruit, hire and retain skilled physical therapists;

•our inability to maintain high levels of service and patient satisfaction;

•risks associated with the locations of our clinics, including the economies in which we operate, and the potential need to close clinics and incur closure costs;

•our dependence upon the cultivation and maintenance of relationships with customers, suppliers, physicians and other referral sources;

•the severity of climate change or the weather and natural disasters that can occur in the regions of the United States in which we operate, which could cause disruption to our business;

•risks associated with future acquisitions, divestitures and other business initiatives, which may use significant resources, may be unsuccessful and could expose us to unforeseen liabilities;

•failure of third-party vendors, including customer service, technical and information technology ("IT") support providers and other outsourced professional service providers to adequately address customers’ requests and meet Company requirements;

•risks associated with our ability to secure renewals of current suppliers and other material agreements that the Company currently depends upon for business operations;

•risks associated with our reliance on IT infrastructure in critical areas of our operations including, but not limited to, cyber and other security threats;

•a security breach of our IT systems or our third-party vendors’ IT systems may subject us to potential legal action and reputational harm and may result in a violation of the Health Insurance Portability and Accountability Act of 1996 or the Health Information Technology for Economic and Clinical Health Act;

•maintaining clients for which we perform management and other services, as a breach or termination of those contractual arrangements by such clients could cause operating results to be less than expected;

•our failure to maintain financial controls and processes over billing and collections or disputes with third-party private payors could have a significant negative impact on our financial condition and results of operations;

•our operations are subject to extensive regulation and macroeconomic uncertainty;

•our ability to meet revenue and earnings expectations;

•risks associated with applicable state laws regarding fee-splitting and professional corporation laws;

•inspections, reviews, audits and investigations under federal and state government programs and third-party private payor contracts that could have adverse findings that may negatively affect our business, including our results of operations, liquidity, financial condition and reputation;

•changes in or our failure to comply with existing federal and state laws or regulations or the inability to comply with new government regulations on a timely basis;

•our ability to maintain necessary insurance coverage at competitive rates;

•the outcome of any legal and regulatory matters, proceedings or investigations instituted against us or any of our directors or officers, and whether insurance coverage will be available and/or adequate to cover such matters or proceedings;

•general economic conditions, including but not limited to inflationary and recessionary periods;

•our facilities face competition for experienced physical therapists and other clinical providers that may increase labor costs, result in elevated levels of contract labor and reduce profitability;

•risks associated with our ability to attract and retain talented executives and employees amidst the impact of unfavorable labor market dynamics, wage inflation and recent reduction in value of our share-based compensation incentives, including potential failure of steps being taken to reduce attrition of physical therapists and increase hiring of physical therapists;

•risks resulting from the 2L Notes, IPO Warrants, Earnout Shares and Vesting Shares being accounted for as liabilities at fair value and the changes in fair value affecting our financial results;

•further impairments of goodwill and other intangible assets, which represent a significant portion of our total assets, especially in view of the Company’s recent market valuation;

•our inability to maintain effective internal control over financial reporting;

•risks related to dilution of common stock ownership interests and voting interests as a result of the issuance of 2L Notes and Series B Preferred Stock;

•costs related to operating as a public company; and

•risks associated with our efforts and ability to regain and sustain compliance with the listing requirements of our securities on the New York Stock Exchange ("NYSE").

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Form 10-Q are more fully described under the heading “Item 1A. Risk Factors” and elsewhere in our Annual Report on Form 10-K filed with the SEC on February 27, 2024 and in this Form 10-Q. The risks described under the heading “Item 1A. Risk Factors” are not exhaustive. Other sections of this Form 10-Q describe additional factors that could adversely affect the business, financial condition or results of operations of the Company. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can the Company assess the impact of all such risk factors on the business of the Company or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. Readers should not place undue reliance on forward-looking statements. The Company undertakes no obligations to publicly update or revise any forward-looking statements after the date they are made or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements of belief and similar statements reflect the beliefs and opinions of the Company on the relevant subject. These statements are based upon information available to the Company, as applicable, as of the date of this Form 10-Q, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

PART I - FINANCIAL INFORMATION - UNAUDITED

Item 1. Financial Statements

ATI Physical Therapy, Inc.

Condensed Consolidated Balance Sheets

($ in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 23,727 | | | $ | 36,802 | |

Accounts receivable (net of allowance for doubtful accounts of $50,443 and $48,055 at March 31, 2024 and December 31, 2023, respectively) | 100,518 | | | 88,512 | |

| Prepaid expenses | 10,515 | | | 12,920 | |

| Insurance recovery receivable | 28,680 | | | 23,981 | |

| Other current assets | 1,125 | | | 4,367 | |

| Assets held for sale | 1,606 | | | 2,056 | |

| Total current assets | 166,171 | | | 168,638 | |

| | | |

| Property and equipment, net | 93,815 | | | 100,422 | |

| Operating lease right-of-use assets | 191,499 | | | 194,423 | |

| Goodwill, net | 289,650 | | | 289,650 | |

| Trade name and other intangible assets, net | 245,714 | | | 245,858 | |

| Other non-current assets | 4,644 | | | 4,290 | |

| Total assets | $ | 991,493 | | | $ | 1,003,281 | |

| | | |

| Liabilities, Mezzanine Equity and Stockholders' Equity: | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 10,860 | | | $ | 14,704 | |

| Accrued expenses and other liabilities | 76,205 | | | 88,435 | |

| Current portion of operating lease liabilities | 51,339 | | | 51,530 | |

| | | |

| Liabilities held for sale | 1,319 | | | 1,778 | |

| Total current liabilities | 139,723 | | | 156,447 | |

| | | |

Long-term debt, net (1) | 439,274 | | | 433,578 | |

| 2L Notes due to related parties, at fair value | 95,615 | | | 79,472 | |

| | | |

| | | |

| Deferred income tax liabilities | 21,233 | | | 21,367 | |

| Operating lease liabilities | 181,975 | | | 185,602 | |

| Other non-current liabilities | 2,063 | | | 2,277 | |

| Total liabilities | 879,883 | | | 878,743 | |

Commitments and contingencies (Note 14) | | | |

| Mezzanine equity: | | | |

Series A Senior Preferred Stock, $0.0001 par value; 1.0 million shares authorized; 0.2 million shares issued and outstanding; $1,286.53 stated value per share at March 31, 2024; $1,249.06 stated value per share at December 31, 2023 | 225,014 | | | 220,393 | |

| Stockholders' equity: | | | |

Class A common stock, $0.0001 par value; 470.0 million shares authorized; 4.5 million shares issued, 4.2 million shares outstanding at March 31, 2024; 4.2 million shares issued, 4.0 million shares outstanding at December 31, 2023 | — | | | — | |

Treasury stock, at cost, 0.085 million shares and 0.007 million shares at March 31, 2024 and December 31, 2023, respectively | (697) | | | (219) | |

| Additional paid-in capital | 1,305,766 | | | 1,308,119 | |

| Accumulated other comprehensive income | 266 | | | 406 | |

| Accumulated deficit | (1,423,957) | | | (1,409,306) | |

| Total ATI Physical Therapy, Inc. equity | (118,622) | | | (101,000) | |

| Non-controlling interests | 5,218 | | | 5,145 | |

| Total stockholders' equity | (113,404) | | | (95,855) | |

| Total liabilities, mezzanine equity and stockholders' equity | $ | 991,493 | | | $ | 1,003,281 | |

(1) Includes $17.0 million of principal amount of debt due to related parties as of March 31, 2024 and December 31, 2023, respectively.

The accompanying notes to the condensed consolidated financial statements are an integral part of these statements.

ATI Physical Therapy, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | March 31, 2024 | | March 31, 2023 | | |

| | | | | | | | | |

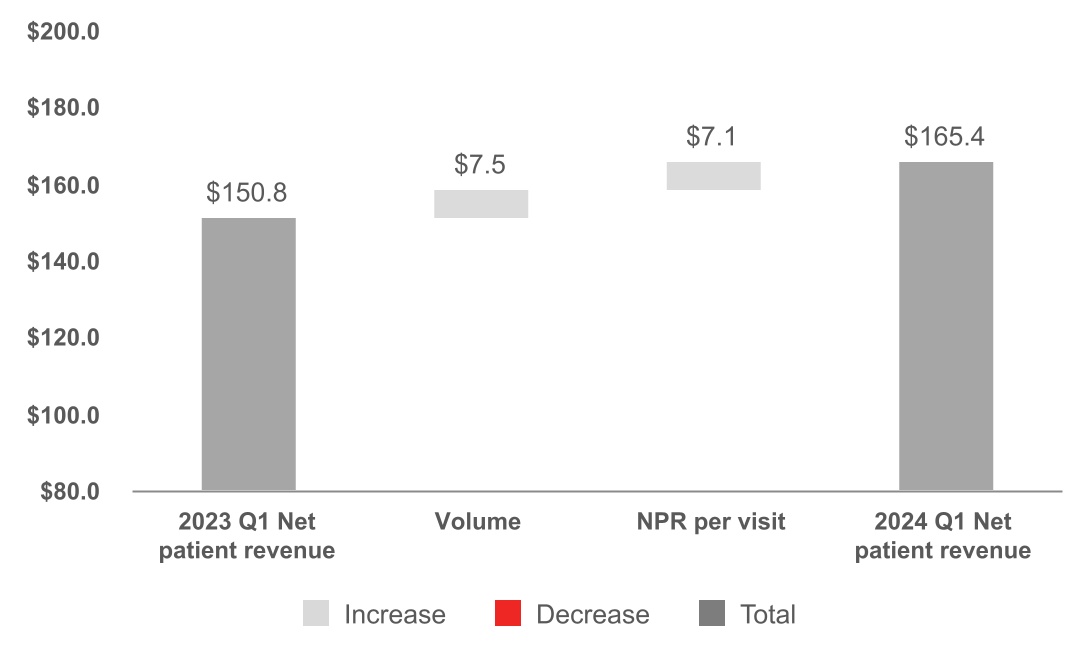

| Net patient revenue | | | | | $ | 165,407 | | | $ | 150,754 | | | |

| Other revenue | | | | | 16,065 | | | 16,178 | | | |

| Net revenue | | | | | 181,472 | | | 166,932 | | | |

| | | | | | | | | |

| Cost of services: | | | | | | | | | |

| Salaries and related costs | | | | | 99,328 | | | 90,703 | | | |

| Rent, clinic supplies, contract labor and other | | | | | 55,261 | | | 52,878 | | | |

| Provision for doubtful accounts | | | | | 4,981 | | | 4,125 | | | |

| Total cost of services | | | | | 159,570 | | | 147,706 | | | |

| Selling, general and administrative expenses | | | | | 26,202 | | | 30,595 | | | |

| Goodwill, intangible and other asset impairment charges | | | | | 478 | | | — | | | |

| Operating loss | | | | | (4,778) | | | (11,369) | | | |

| Change in fair value of 2L Notes | | | | | (5,407) | | | — | | | |

Change in fair value of warrant liability and contingent common shares liability | | | | | (103) | | | (511) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense, net | | | | | 14,483 | | | 13,936 | | | |

Other (income) expense, net | | | | | (94) | | | 354 | | | |

| Loss before taxes | | | | | (13,657) | | | (25,148) | | | |

Income tax (benefit) expense | | | | | (134) | | | 62 | | | |

| Net loss | | | | | (13,523) | | | (25,210) | | | |

Net income attributable to non-controlling interests | | | | | 1,128 | | | 1,060 | | | |

| Net loss attributable to ATI Physical Therapy, Inc. | | | | | (14,651) | | | (26,270) | | | |

| Less: Series A Senior Preferred Stock redemption value adjustments | | | | | (1,562) | | | — | | | |

| Less: Series A Senior Preferred Stock cumulative dividend | | | | | 6,183 | | | 5,303 | | | |

| Net loss available to common stockholders | | | | | $ | (19,272) | | | $ | (31,573) | | | |

| | | | | | | | | |

| Loss per share of Class A common stock: | | | | | | | | | |

| Basic | | | | | $ | (4.61) | | | $ | (7.70) | | | |

| Diluted | | | | | $ | (4.61) | | | $ | (7.70) | | | |

| Weighted average shares outstanding: | | | | | | | | | |

| Basic and diluted | | | | | 4,180 | | | 4,098 | | | |

The accompanying notes to the condensed consolidated financial statements are an integral part of these statements.

ATI Physical Therapy, Inc.

Condensed Consolidated Statements of Comprehensive Loss

($ in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | March 31, 2024 | | March 31, 2023 | | |

| | | | | | | | | |

| Net loss | | | | | $ | (13,523) | | | $ | (25,210) | | | |

| Other comprehensive (loss) income: | | | | | | | | | |

| Cash flow hedges | | | | | (140) | | | (3,456) | | | |

| Comprehensive loss | | | | | (13,663) | | | (28,666) | | | |

Net income attributable to non-controlling interests | | | | | 1,128 | | | 1,060 | | | |

| Comprehensive loss attributable to ATI Physical Therapy, Inc. | | | | | $ | (14,791) | | | $ | (29,726) | | | |

The accompanying notes to the condensed consolidated financial statements are an integral part of these statements.

ATI Physical Therapy, Inc.

Condensed Consolidated Statements of Changes in Stockholders' Equity

($ in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other

Comprehensive Income (Loss) | | Accumulated Deficit | | Non-Controlling Interests | | Total Stockholders' Equity |

| Shares | | Amount | | Shares | | Amount | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at January 1, 2024 | 4,032,621 | | $ | — | | | 6,794 | | $ | (219) | | | $ | 1,308,119 | | | $ | 406 | | | $ | (1,409,306) | | | $ | 5,145 | | | $ | (95,855) | |

| Series A Senior Preferred Stock dividends and redemption value adjustments | — | | — | | | — | | | — | | | (4,621) | | | — | | | — | | | — | | | (4,621) | |

Vesting of restricted shares distributed to holders of Incentive Common Units | 684 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Issuance of common stock upon vesting of restricted stock units and awards | 263,719 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlement of restricted stock units and awards | (78,412) | | — | | | 78,412 | | | (478) | | | — | | | — | | | — | | | — | | | (478) | |

| Non-cash share-based compensation | — | | — | | | — | | | — | | | 2,268 | | | — | | | — | | | — | | | 2,268 | |

| Other comprehensive loss | — | | — | | | — | | | — | | | — | | | (140) | | | — | | | — | | | (140) | |

| Distribution to non-controlling interest holders | — | | — | | | — | | | — | | | — | | | — | | | — | | | (1,055) | | | (1,055) | |

| Net income attributable to non-controlling interests | — | | — | | | — | | | — | | | — | | | — | | | — | | | 1,128 | | | 1,128 | |

| Net loss attributable to ATI Physical Therapy, Inc. | — | | — | | | — | | | — | | | — | | | — | | | (14,651) | | | — | | | (14,651) | |

| Balance at March 31, 2024 | 4,218,612 | | $ | — | | | 85,206 | | $ | (697) | | | $ | 1,305,766 | | | $ | 266 | | | $ | (1,423,957) | | | $ | 5,218 | | | $ | (113,404) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other

Comprehensive Income (Loss) | | Accumulated Deficit | | Non-Controlling Interests | | Total Stockholders' Equity |

| Shares | | Amount | | Shares | | Amount | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at January 1, 2023 | 3,967,146 | | $ | — | | | 1,540 | | $ | (146) | | | $ | 1,378,716 | | | $ | 4,899 | | | $ | (1,339,511) | | | $ | 4,489 | | | $ | 48,447 | |

| | | | | | | | | | | | | | | | | |

Vesting of restricted shares distributed to holders of Incentive Common Units | 751 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Issuance of common stock upon vesting of restricted stock units and awards | 25,387 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlement of restricted stock units and awards | (3,163) | | — | | | 3,163 | | | (51) | | | — | | | — | | | — | | | — | | | (51) | |

| Non-cash share-based compensation | — | | — | | | — | | | — | | | 1,454 | | | — | | | — | | | — | | | 1,454 | |

| Other comprehensive loss | — | | — | | | — | | | — | | | — | | | (3,456) | | | — | | | — | | | (3,456) | |

| Distribution to non-controlling interest holders | — | | — | | | — | | | — | | | — | | | — | | | — | | | (710) | | | (710) | |

| Net income attributable to non-controlling interests | — | | — | | | — | | | — | | | — | | | — | | | — | | | 1,060 | | | 1,060 | |

| Net loss attributable to ATI Physical Therapy, Inc. | — | | — | | | — | | | — | | | — | | | — | | | (26,270) | | | — | | | (26,270) | |

| Balance at March 31, 2023 | 3,990,121 | | $ | — | | | 4,703 | | $ | (197) | | | $ | 1,380,170 | | | $ | 1,443 | | | $ | (1,365,781) | | | $ | 4,839 | | | $ | 20,474 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The accompanying notes to the condensed consolidated financial statements are an integral part of these statements.

ATI Physical Therapy, Inc.

Condensed Consolidated Statements of Cash Flows

($ in thousands)

(unaudited)

| | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2024 | | March 31, 2023 | | |

| Operating activities: | | | | | |

| Net loss | $ | (13,523) | | | $ | (25,210) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Goodwill, intangible and other asset impairment charges | 478 | | | — | | | |

| Depreciation and amortization | 8,883 | | | 9,691 | | | |

| Provision for doubtful accounts | 4,981 | | | 4,125 | | | |

| Deferred income tax provision | (134) | | | 62 | | | |

| Non-cash lease expense related to right-of-use assets | 12,000 | | | 11,850 | | | |

| Non-cash share-based compensation | 2,268 | | | 1,454 | | | |

| Amortization of debt issuance costs and original issue discount | 710 | | | 838 | | | |

| Non-cash interest expense | — | | | 1,736 | | | |

| | | | | |

Loss on disposal and sale of assets | 16 | | | 489 | | | |

| Change in fair value of 2L Notes | (5,407) | | | — | | | |

Change in fair value of warrant liability and contingent common shares liability | (103) | | | (511) | | | |

| | | | | |

| | | | | |

Change in fair value of non-designated derivative instrument | (351) | | | — | | | |

| Changes in: | | | | | |

| Accounts receivable, net | (16,987) | | | (5,770) | | | |

Insurance recovery receivable | (4,699) | | | — | | | |

| Prepaid expenses and other current assets | 2,315 | | | 4,073 | | | |

| Other non-current assets | (354) | | | 33 | | | |

| Accounts payable | (3,498) | | | (2,439) | | | |

| Accrued expenses and other liabilities | (12,229) | | | (6,168) | | | |

| Operating lease liabilities | (13,383) | | | (8,476) | | | |

| Other non-current liabilities | (49) | | | (1) | | | |

| | | | | |

| | | | | |

| Net cash used in operating activities | (39,066) | | | (14,224) | | | |

| | | | | |

| Investing activities: | | | | | |

| Purchases of property and equipment | (2,672) | | | (5,434) | | | |

| | | | | |

| Proceeds from sale of property and equipment | 96 | | | — | | | |

| Proceeds from sale of clinics | 84 | | | 355 | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (2,492) | | | (5,079) | | | |

| | | | | |

| | | | | | | | | | | | | |

| Financing activities: | | | | | |

| | | | | |

| Proceeds from 2L Notes from related parties | 25,000 | | | — | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Proceeds from revolving line of credit | 23,473 | | | — | | | |

| Payments on revolving line of credit | (18,450) | | | — | | | |

| | | | | |

| | | | | |

| | | | | |

| Payment of contingent consideration liabilities | (7) | | | — | | | |

| Taxes paid on behalf of employees for shares withheld | (478) | | | (51) | | | |

| Distribution to non-controlling interest holders | (1,055) | | | (710) | | | |

Net cash provided by (used in) financing activities | 28,483 | | | (761) | | | |

| | | | | |

| Changes in cash and cash equivalents: | | | | | |

Net decrease in cash and cash equivalents | (13,075) | | | (20,064) | | | |

| Cash and cash equivalents at beginning of period | 36,802 | | | 83,139 | | | |

| Cash and cash equivalents at end of period | $ | 23,727 | | | $ | 63,075 | | | |

| | | | | |

| Supplemental noncash disclosures: | | | | | |

Derivative changes in fair value (1) | $ | 140 | | | $ | 3,456 | | | |

| Purchases of property and equipment in accounts payable | $ | 2,299 | | | $ | 1,771 | | | |

| | | | | |

| | | | | |

| | | | | |

| Series A Senior Preferred Stock dividends and redemption value adjustments | $ | 4,621 | | | $ | — | | | |

| | | | | |

Exchange of delayed draw right for related party 2L Notes | $ | 3,450 | | | $ | — | | | |

| | | | | |

| Other supplemental disclosures: | | | | | |

| Cash paid for interest | $ | 14,174 | | | $ | 9,563 | | | |

| Cash received from hedging activities | $ | 134 | | | $ | 3,418 | | | |

Cash paid for taxes, net of refunds | $ | 17 | | | $ | — | | | |

(1) Derivative changes in fair value related to unrealized loss (gain) on cash flow hedges, including the impact of reclassifications.

The accompanying notes to the condensed consolidated financial statements are an integral part of these statements.

Note 1. Overview of the Company

ATI Physical Therapy, Inc., together with its subsidiaries (herein referred to as “we,” "our," “the Company,” “ATI Physical Therapy” or “ATI”), is a nationally recognized healthcare company, specializing in outpatient rehabilitation and adjacent healthcare services. The Company provides outpatient physical therapy services under the name ATI Physical Therapy and, as of March 31, 2024, had 884 clinics located in 24 states (as well as 18 clinics under management service agreements). The Company was founded in 1996 under the name Assessment Technologies Inc. ATI Physical Therapy, Inc., a Delaware corporation, was organized in 2020 originally under the name Fortress Value Acquisition Corp. II (herein referred to as "FAII" or "FVAC"). The Company offers a variety of services within its clinics, including physical therapy to treat spine, shoulder, knee and neck injuries or pain; work injury rehabilitation services, including work conditioning and work hardening; hand therapy; and other specialized treatment services.

Note 2. Basis of Presentation and Recent Accounting Standards

Basis of presentation

The accompanying unaudited condensed consolidated financial statements of the Company were prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and in accordance with the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading.

Management believes the unaudited condensed consolidated financial statements for interim periods presented contain all necessary adjustments to state fairly, in all material respects, the Company's financial position, results of operations and cash flows for the interim periods presented. Such adjustments are of a normal recurring nature.

Operating results for the three months ended March 31, 2024 are not necessarily indicative of the results the Company expects for the entire year. In addition, the influence of seasonality, changes in payor contracts, changes in rate per visit, changes in referral and visit volumes, strategic transactions and initiatives, labor market dynamics and wage inflation, changes in laws and general economic conditions in the markets in which the Company operates and other factors impacting the Company's operations may result in any period not being comparable to the same period in previous years.

Use of estimates

The preparation of the unaudited condensed consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. The effect of any change in estimates will be recognized in the current period of the change. Certain prior year amounts have been reclassified to conform to the current year presentation. The Company's unaudited condensed consolidated financial statements include its wholly-owned subsidiaries. All intercompany balances and accounts are eliminated in consolidation.

For further information regarding the Company's accounting policies and other information, these unaudited condensed consolidated financial statements should be read in conjunction with our audited consolidated financial statements and notes thereto for the year ended December 31, 2023 included in our Annual Report on Form 10-K filed with the SEC on February 27, 2024.

Reverse Stock Split

On June 14, 2023, the Company effected a one-for-fifty (1-for-50) reverse stock split of its Class A common stock (the “Reverse Stock Split”). The Reverse Stock Split was approved by the Company’s stockholders at the Company’s 2023 Annual Meeting of Stockholders held on June 13, 2023, and the final reverse split ratio was subsequently approved by the Company’s board of directors (the "Board") on June 14, 2023. The Company's common stock commenced trading on a reverse split-adjusted basis on June 15, 2023.

As a result of the Reverse Stock Split, every fifty (50) shares of common stock either issued and outstanding or held as treasury stock were combined into one new share of common stock. Any fractional shares of common stock resulting from the Reverse Stock Split were rounded up to the nearest whole share. All outstanding securities entitling their holders to purchase or acquire shares of common stock, including stock options, warrants, Earnout Shares, Vesting Shares and shares of common stock subject to vesting were adjusted as a result of the Reverse Stock Split, as required by the terms of those securities. The Reverse Stock Split did not change the par value of the common stock or the number of shares authorized for issuance.

All information included in these unaudited condensed consolidated financial statements and related notes has been adjusted, on a retrospective basis, to reflect the Reverse Stock Split.

Liquidity and going concern

The accompanying unaudited condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business within twelve months after the date that these unaudited condensed consolidated financial statements are issued.

As of March 31, 2024, the Company had $23.7 million in cash and cash equivalents and no available capacity under its revolving credit facility. The Company was in compliance with its minimum liquidity covenant under the 2022 Credit Agreement (as defined in Note 8) as of March 31, 2024.

The Company has continued to generate negative operating cash flows, operating losses and net losses. For the three months ended March 31, 2024, the Company had cash flows used in operating activities of $39.1 million, operating loss of $4.8 million and net loss of $13.5 million. These results are, in part, due to our current capital structure, including cash interest costs, and continuation of trends experienced by the Company in recent years including a tight labor market for available physical therapy and other healthcare providers in the workforce. The Company has continued to fund cash used in operations primarily from financing activities and expects to need additional liquidity to continue funding working capital requirements, necessary capital expenditures as well as to be available for general corporate purposes, including interest repayments. The Company is at risk of insufficient funding to meet its obligations as they become due as well as non-compliance with its minimum liquidity financial covenant under its 2022 Credit Agreement. These conditions and events raise substantial doubt about the Company's ability to continue as a going concern.

On June 15, 2023, the Company completed a debt restructuring transaction under its 2022 Credit Agreement including: (i) a delayed draw new money financing in an aggregate principal amount of $25.0 million, comprised of (A) second lien paid-in-kind convertible notes (the “2L Notes”) and (B) shares of Series B Preferred Stock (as defined in Note 8). The Company utilized the delayed draw of $25.0 million during the quarter.

The Company plans to continue its efforts to improve its operating results and cash flow through increases to clinical staffing levels, improvements in clinician productivity, controlling costs and capital expenditures and increases in patient visit volumes, referrals and rate per visit. There can be no assurance that the Company's plan will be successful in any of these respects.

Future liquidity needs are expected to require additional sources of liquidity beyond operating results. Additional liquidity sources considered include but are not limited to:

•raising additional debt and/or equity capital,

•disposal of assets, and/or

•other strategic alternatives to improve its business, results of operations and financial condition.

There can be no assurance that the Company will be successful in accessing such alternative options or financing if or when needed. Failure to do so could have a material adverse impact on our business, financial condition, results of operations and cash flows, and may lead to events including bankruptcy, reorganization or insolvency.

Management plans have not been fully implemented and, as a result, the Company has concluded that management's plans do not alleviate substantial doubt about the Company's ability to continue as a going concern.

The unaudited condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

Segment reporting

The Company reports segment information based on the management approach. The management approach designates the internal reporting used by management for making decisions and assessing performance as the source of the Company’s reportable segments. All of the Company’s operations are conducted within the United States. Our chief operating decision maker is our Chief Executive Officer, who reviews financial information presented on a consolidated basis for purposes of making decisions, assessing financial performance and allocating resources. We operate our business as one operating segment and therefore we have one reportable segment.

Cash, cash equivalents and restricted cash

Cash and cash equivalents include all cash balances and highly liquid investments with original maturities of three months or less when issued. Restricted cash consists of cash held as collateral in relation to the Company's corporate card agreement. Restricted cash included within cash and cash equivalents as presented within our unaudited condensed consolidated balance sheets as of March 31, 2024 and December 31, 2023, and our unaudited condensed consolidated statements of cash flows for the three months ended March 31, 2024 and March 31, 2023 was $0.8 million.

Recent accounting pronouncements

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which provides guidance to improve the disclosures for reportable segments through enhanced disclosures about significant segment expenses. This ASU is effective for the Company's annual financial statements to be issued for the year ended December 31, 2024, and the Company's interim financial statements during the year ended December 31, 2025, with early adoption permitted. This ASU shall be applied on a retrospective basis for all prior periods presented in the financial statements. The Company expects to adopt this new accounting standard in its Annual Report on Form 10-K for the year ended December 31, 2024, and does not expect the adoption of this standard to have a material impact on the Company's consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which provides guidance to improve the disclosures for income taxes primarily through enhanced rate reconciliation and income taxes paid disclosures. This ASU is effective for the Company's annual financial statements to be issued for the year ended December 31, 2025, with early adoption permitted, and shall be applied on a prospective basis. The Company expects to adopt this new accounting standard in its Annual Report on Form 10-K for the year ended December 31, 2025, and does not expect the adoption of this standard to have a material impact on the Company's consolidated financial statements.

Note 3. Divestitures

Clinics held for sale

During the fourth quarter of 2023, the Company classified the assets and liabilities of certain clinics as held for sale as a result of the Company's decision to sell the clinics. The divestiture transactions are anticipated to be completed within twelve months. The clinics did not meet the criteria to be classified as discontinued operations. During the first quarter of 2024, the Company completed a portion of its anticipated divestiture transactions, which were immaterial.

Major classes of assets and liabilities classified as held for sale as of March 31, 2024 and December 31, 2023 were as follows (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| | | |

| | | |

| Property and equipment, net | 646 | | | 674 | |

| Operating lease right-of-use assets | 960 | | | 1,382 | |

| | | |

| | | |

| Total assets held for sale | $ | 1,606 | | | $ | 2,056 | |

| | | |

| | | |

| | | |

| Current portion of operating lease liabilities | 261 | | | 357 | |

| Operating lease liabilities | 1,058 | | | 1,421 | |

| Total liabilities held for sale | $ | 1,319 | | | $ | 1,778 | |

Note 4. Revenue from Contracts with Customers

The following table disaggregates net revenue by major service line for the periods indicated below (in thousands):

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | March 31, 2024 | | March 31, 2023 | | |

| Net patient revenue | | | | | $ | 165,407 | | | $ | 150,754 | | | |

ATI Worksite Solutions (1) | | | | | 9,331 | | | 9,201 | | | |

Management Service Agreements (1) | | | | | 3,733 | | | 3,725 | | | |

Sports Medicine and other revenue (1) | | | | | 3,001 | | | 3,252 | | | |

| | | | | $ | 181,472 | | | $ | 166,932 | | | |

(1)ATI Worksite Solutions, Management Service Agreements and Sports Medicine and other revenue are included within other revenue on the face of the unaudited condensed consolidated statements of operations.

The following table disaggregates net patient revenue for each associated payor class as a percentage of total net patient revenue for the periods indicated below:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | March 31, 2024 | | March 31, 2023 | | |

| Commercial | | | | | 58.5 | % | | 58.1 | % | | |

| Government | | | | | 21.8 | % | | 23.6 | % | | |

| Workers’ compensation | | | | | 12.2 | % | | 12.0 | % | | |

Other (1) | | | | | 7.5 | % | | 6.3 | % | | |

| | | | | 100.0 | % | | 100.0 | % | | |

(1) Other is primarily comprised of net patient revenue related to auto personal injury reimbursement.

Note 5. Goodwill, Trade Name and Other Intangible Assets

Changes in the carrying amount of goodwill during the current year consisted of the following (in thousands):

| | | | | |

Goodwill at December 31, 2023 (1) | $ | 289,650 | |

Impairment charges (2) | — | |

| |

| |

| |

Goodwill at March 31, 2024 (1) | $ | 289,650 | |

(1) Net of accumulated impairment losses of $1,045.7 million.

(2) The Company did not note any triggering events during the three months ended March 31, 2024 that resulted in the recording of an impairment loss.

The table below summarizes the Company’s carrying amount of trade name and other intangible assets at March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Gross intangible assets: | | | |

ATI trade name (1) | $ | 245,000 | | | $ | 245,000 | |

| Non-compete agreements | 2,395 | | | 2,395 | |

| Other intangible assets | 640 | | | 640 | |

| Accumulated amortization: | | | |

| Accumulated amortization – non-compete agreements | (1,940) | | | (1,807) | |

| Accumulated amortization – other intangible assets | (381) | | | (370) | |

| Total trade name and other intangible assets, net | $ | 245,714 | | | $ | 245,858 | |

(1) Not subject to amortization.

Amortization expense for the three months ended March 31, 2024 and 2023 was immaterial. The Company estimates that amortization expense related to intangible assets will be immaterial over the next five fiscal years and thereafter.

Note 6. Property and Equipment

Property and equipment consisted of the following at March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

Equipment | $ | 37,993 | | | $ | 37,980 | |

Furniture and fixtures | 14,414 | | | 14,311 | |

Leasehold improvements | 178,350 | | | 178,888 | |

Automobiles | — | | | 4 | |

Computer equipment and software | 111,006 | | | 108,749 | |

Construction-in-progress | 918 | | | 2,134 | |

| 342,681 | | | 342,066 | |

Accumulated depreciation and amortization | (248,866) | | | (241,644) | |

Property and equipment, net (1) | $ | 93,815 | | | $ | 100,422 | |

(1) Excludes $0.6 million and $0.7 million reclassified as held for sale as of March 31, 2024 and December 31, 2023, respectively. Refer to Note 3 - Divestitures for additional information.

The following table presents the amount of depreciation and amortization expense related to property and equipment recorded in rent, clinic supplies, contract labor and other and selling, general and administrative expenses in the Company’s unaudited condensed consolidated statements of operations for the periods indicated below (in thousands):

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | March 31, 2024 | | March 31, 2023 | | |

Rent, clinic supplies, contract labor and other | | | | | $ | 6,006 | | | $ | 6,458 | | | |

Selling, general and administrative expenses | | | | | 2,733 | | | 3,049 | | | |

Total depreciation expense | | | | | $ | 8,739 | | | $ | 9,507 | | | |

Note 7. Accrued Expenses and Other Liabilities

Accrued expenses and other liabilities consisted of the following at March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

Salaries and related costs | $ | 17,822 | | $ | 37,630 |

Accrued legal settlement (1) | 27,608 | | 21,324 |

| Credit balances due to patients and payors | 8,188 | | 7,712 |

Accrued interest | 4,834 | | 4,913 |

| Accrued professional fees | 3,938 | | 4,146 |

| | | |

| Accrued occupancy costs | 2,738 | | 2,593 |

| Accrued contract labor | 2,452 | | 2,255 |

| | | |

| | | |

| | | |

| | | |

| Other payables and accrued expenses | 8,625 | | 7,862 |

Total | $ | 76,205 | | $ | 88,435 |

(1) Includes estimated liability of $26.5 million and $20.0 million related to settlement agreement in principle as of March 31, 2024 and December 31, 2023, respectively. Refer to Note 14 - Commitments and Contingencies for additional information.

Note 8. Borrowings

Long-term debt, net consisted of the following at March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

Senior Secured Term Loan (1, 2) (due February 24, 2028) | $ | 410,048 | | | $ | 410,048 | |

Revolving Loans (3) (due February 24, 2027) | 43,473 | | | 38,450 | |

Less: unamortized debt issuance costs | (7,062) | | | (7,395) | |

Less: unamortized original issue discount | (7,185) | | | (7,525) | |

Total debt, net | 439,274 | | | 433,578 | |

Less: current portion of long-term debt | — | | | — | |

Long-term debt, net | $ | 439,274 | | | $ | 433,578 | |

(1) Interest rate of 12.7% at both March 31, 2024 and December 31, 2023, with interest payable in designated installments at a variable interest rate. The effective interest rate for the Senior Secured Term Loan was 13.9% at both March 31, 2024 and December 31, 2023.

(2) As of both March 31, 2024 and December 31, 2023, the Company has paid $10.0 million of its interest in-kind on its Senior Secured Term Loan by capitalizing and adding such interest to the principal amount of the debt.

(3) Weighted average interest rate of 9.5% at both March 31, 2024 and December 31, 2023, with interest payable in designated installments at a variable interest rate.

2L Notes due to related parties, at fair value consisted of the following at March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

2L Notes due to related parties, at fair value | $ | 95,615 | | | $ | 79,472 | |

2023 Debt Restructuring Transaction

On June 15, 2023 (the "Closing Date"), the Company completed a debt restructuring transaction to improve the Company's liquidity (the "2023 Debt Restructuring"). On the Closing Date, certain previously executed agreements became effective, including (i) Amendment No. 2 to the Credit Agreement, (ii) a Second Lien Note Purchase Agreement and (iii) certain other definitive agreements relating to the 2023 Debt Restructuring.

As part of the 2023 Debt Restructuring, the Company exchanged a principal amount of $100.0 million of the $507.8 million then outstanding Senior Secured Term Loan for an equal amount of 2L Notes, which are convertible into shares of the Company's common stock, stapled with a number of shares of Series B Preferred Stock (the "Series B Preferred Stock"), which represent voting interests only. The exchange was consummated through the Intercreditor and Subordination Agreement and Second Lien Note Purchase Agreement dated April 17, 2023 (the "Signing Date").

The Company accounted for the exchange as a debt extinguishment and recognized $0.4 million in loss on debt extinguishment during the year ended December 31, 2023. The loss on debt extinguishment consisted of various offsetting components, including the derecognition of $4.3 million of unamortized deferred financing costs and original issue discount on the Senior Secured Term Loan and the recognition of $0.7 million of fair value premium at issuance on the 2L Notes, offset by the recognition of $2.8 million in delayed draw right assets related to the commitment provided by certain lenders and the recognition of $1.8 million of incremental original issue discount on the Senior Secured Term Loan. The loss on debt extinguishment associated with the 2023 Debt Restructuring has been reflected in other expense, net in the consolidated statements of operations.

Amendment No. 2 to the Credit Agreement

Pursuant to Amendment No. 2 to the Credit Agreement, the terms of the remaining unexchanged $407.8 million principal amount of the Senior Secured Term Loan as of the Signing Date were revised to: (i) increase the interest rate in the form of paid-in-kind interest by 1.0% per annum until the achievement of certain financial metrics, (ii) reset the prepayment premiums with respect to any repayment of the Senior Secured Term Loan, and (iii) amend certain covenants. At the completion of the 2023 Debt Restructuring, $391.0 million principal of amended Senior Secured Term Loan was outstanding with HPS Investment Partners, LLC (“HPS”), $16.3 million principal was outstanding with Onex Credit Partners, LLC (“Onex”), $0.3 million principal was outstanding with Knighthead Capital Management, LLC (“Knighthead”), and the remaining $0.2 million principal was outstanding with Marathon Asset Management LP (“Marathon”). Additionally, the terms of the Company's Revolving Loans (as defined below) were revised to increase the cash interest rate by 1.0% until the achievement of certain financial metrics.

Amendment No. 2 to the Credit Agreement also provides, among other terms, (i) a reduction of the thresholds applicable to the minimum liquidity financial covenant under the 2022 Credit Agreement for certain periods, (ii) a waiver of the requirement to comply with the Secured Net Leverage Ratio financial covenant under the 2022 Credit Agreement for the fiscal quarters ending June 30, 2024, September 30, 2024 and December 31, 2024 and a modification of the levels and certain component definitions applicable thereto in the fiscal quarters ending after December 31, 2024, (iii) an extension of the minimum liquidity financial covenant for the fiscal quarters in which the Secured Net Leverage Ratio financial covenant was waived, (iv) a waiver of the requirement for the Company to deliver audited financial statements without a going concern explanatory paragraph for the years ended December 31, 2022, December 31, 2023, and December 31, 2024, and (v) board representation and observer rights and other changes to the governance of the Company.

Based on the results of the cash flow tests and requirements pursuant to Accounting Standards Codification ("ASC") Topic 470, Debt, the Company accounted for the impacts of Amendment No. 2 to the Credit Agreement related to the amount held by HPS as a modification, and the impacts related to the amounts held by Onex, Knighthead, and Marathon as an extinguishment. As part of the 2023 Debt Restructuring, the Company recognized $1.8 million of incremental original issue discount on the Senior Secured Term Loan related to lenders treated under extinguishment accounting.

Second Lien Note Purchase Agreement and Designation of Series B Preferred Stock

Knighthead, Marathon, and Onex collectively exchanged a principal amount of $100.0 million of Senior Secured Term Loan for $100.0 million of 2L Notes stapled with a number of shares of Series B Preferred Stock. Of the $100.0 million of 2L Notes issued, approximately $50.8 million were issued to Knighthead, $40.4 million were issued to Marathon, and $8.8 million were issued to Onex. The 2L Notes are subordinated in right of payment and lien priority to the 2022 Credit Facility (as defined below) and mature on August 24, 2028, unless earlier converted, accrue interest at an annual rate of 8.0% payable in-kind on a quarterly basis in the form of additional 2L Notes, and are convertible into shares of common stock, at the holder’s option, at a fixed conversion price of $12.50, subject to certain adjustments in the agreement (the "Conversion Price"). Upon conversion of the 2L Notes, the Company shall deliver to the holder a number of shares of common stock equal to (i) the principal amount of such 2L Notes plus any accrued and unpaid interest divided by (ii) the Conversion Price.

The 2L Notes are effectively stapled with one share of the Company’s Series B Preferred Stock for every $1,000 principal amount of the 2L Notes. The Series B Preferred Stock represents voting rights only, with the number of votes being equal to the number of shares of common stock that each share of Series B Preferred Stock would convert into at a conversion price of $12.87 per share (the "Voting Rights Conversion Price"). Additional voting rights accrue to the lenders through the deemed issuance of the annual 8.0% paid-in-kind 2L Notes with stapled shares of Series B Preferred Stock. The Series B Preferred Stock does not have any dividend or redemption rights. Upon conversion of 2L Notes to common stock, the stapled shares of Series B Preferred Stock would be canceled in an amount commensurate with the portion of 2L Notes converted. Based on the voting rights associated with the Series B Preferred Stock attached to the 2L Notes as well as other terms to the 2023 Debt Restructuring, the Company determined that Knighthead, Marathon, and Onex became related parties on the Closing Date.

On the Closing Date, an additional $3.2 million of 2L Notes with stapled Series B Preferred Stock were issued as part of the First Amendment to the Second Lien Note Purchase Agreement. The terms of the issued 2L Notes and Series B Preferred Stock are the same as those that were subject to the exchange.

The following table presents approximate changes in outstanding shares of Series B Preferred Stock during the current year (in thousands):

| | | | | | | |

| March 31, 2024 | | |

Series B Preferred Stock, shares at beginning of period | 108 | | | |

| Increase (decrease) in shares during period | 27 | | | |

| Series B Preferred Stock, shares at end of period | 135 | | | |

| | | |

Common stock voting rights, as converted basis(1) | 10,514 | | | |

(1) Represents approximate shares of Series B Preferred Stock outstanding at end of period, times $1,000, divided by the contractual Voting Rights Conversion Price of $12.87 per share.

On or after the second anniversary of the Closing Date and subject to certain conditions, the Company may, at its option, elect to convert (a “Forced Conversion”) a portion of the outstanding 2L Notes into the number of shares of common stock based on the Conversion Price then in effect.