FALSE000181577612/3100018157762024-03-212024-03-210001815776dei:FormerAddressMember2024-03-212024-03-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 21, 2024

LENZ THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40532 | | 84-4867570 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 445 Marine View Ave., Ste. #320 | | |

Del Mar, California | | 92014 |

(Address of principal executive offices) | | (Zip code) |

(858) 925-7000

(Registrant’s telephone number, including area code)

Graphite Bio, Inc.

611 Gateway Blvd., Suite 120

South San Francisco, CA 94080

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share | | LENZ | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

On March 21, 2024 (the “Closing Date”), Graphite Bio, Inc., a Delaware corporation and our predecessor company (“Graphite”), consummated the previously announced merger pursuant to the terms of the Agreement and Plan of Merger, dated as of November 14, 2023 (the “Merger Agreement”), by and among Graphite, Generate Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Graphite (“Generate Merger Sub”) and LENZ Therapeutics Operations, Inc. (previously named Lenz Therapeutics, Inc.), a Delaware corporation (“LENZ OpCo”).

Pursuant to the Merger Agreement, on the Closing Date, (i) Graphite effected a reverse stock split of Graphite’s issued common stock at a ratio of 1:7, (ii) Graphite changed its name to “LENZ Therapeutics, Inc.”, and (iii) Generate Merger Sub merged with and into LENZ OpCo (the “Merger”), with LENZ OpCo as the surviving company in the Merger and, after giving effect to such Merger, LENZ OpCo becoming a wholly-owned subsidiary of LENZ Therapeutics, Inc. (together with its consolidated subsidiary, “New LENZ” or “LENZ”).

Unless the context otherwise requires, “LENZ,” “we,” “us,” “our,” and the “Company” refer to New LENZ. All references herein to the “Board” refer to the board of directors of New LENZ. All references herein to the “Closing” refer to the closing of the transactions contemplated by the Merger Agreement (the “Transactions” or the “Merger”), including the Merger and the transactions contemplated by the subscription agreement entered into by Graphite and certain investors (the “PIPE Investors”) pursuant to which the PIPE Investors collectively subscribed for and purchased shares of Common Stock for an aggregate purchase price of approximately $53.5 million (the “PIPE Financing”).

Item 2.01. Completion of Acquisition or Disposition of Assets.

As previously reported, on March 14, 2024, Graphite held a special meeting (the “Special Meeting”) at which the Graphite stockholders considered and approved, among other matters, (i) the issuance of Common Stock, which represented more than 20% of the shares of Common Stock outstanding immediately prior to the Merger, to stockholders of LENZ OpCo, pursuant to the terms of the Merger Agreement, (ii) the change of control of Graphite resulting from the Merger pursuant to Nasdaq Listing Rule 5635(b), and (iii) the issuance of shares of Common Stock to the PIPE Investors pursuant to Nasdaq Listing Rule 5635(d), which shares of Common Stock represented more than 20% of the shares of Common Stock outstanding as of the date of the execution of the Subscription Agreement.

On March 21, 2024, the parties to the Merger Agreement completed the Merger and the other transactions contemplated thereby in accordance with the terms of the Merger Agreement. Effective at 4:01 p.m. eastern time on March 21, 2024, the Company effected a reverse stock split at a ratio of 1:7 and changed its name to “LENZ Therapeutics, Inc.”, and effective at 4:02 p.m. eastern time on March 21, 2024 the parties to the Merger Agreement consummated the Merger.

In accordance with the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), (i) each share of LENZ OpCo outstanding as of immediately prior to the Effective Time was exchanged for shares of common stock of New LENZ, par value $0.00001 per share (“Common Stock”), (ii) all vested and unvested options to purchase shares of LENZ OpCo were exchanged for comparable options to purchase shares of Common Stock, and (iii) each warrant to purchase shares of LENZ OpCo outstanding as of immediately prior to the Effective Time was converted into a warrant to purchase shares of Common Stock, in each case, based on an exchange ratio of 0.2022. Each share of Common Stock and each option to purchase shares of Common Stock that was issued and outstanding as of immediately prior to the Effective Time remain issued and outstanding in accordance with its terms and such shares and options, subject to the special cash dividend and reverse stock split (each described below), were unaffected by the Merger; provided that, each outstanding and unexercised option to purchase shares of Common Stock with a per share exercise price equal to or greater than $3.00 (prior to giving effect to the special cash dividend and reverse stock split) (the “Out-of-the-Money Graphite Options”) were accelerated in full immediately prior to the Effective Time and each such Out-of-the-Money Graphite Option not exercised as of immediately prior to the Effective Time was cancelled at the Effective Time for no consideration. All options to purchase shares of Common Stock immediately prior to the Effective Time with a per share exercise price of less than $3.00 (prior to giving effect to the special cash dividend and reverse stock split)

continue to be subject to the same terms and conditions after the Effective Time as were applicable to such options as of immediately prior to the Effective Time.

Upon the closing of the Transactions, (i) an aggregate of 13,654,408 shares of Common Stock were issued in exchange for the shares of LENZ OpCo outstanding as of immediately prior to the Effective Time, (ii) warrants to purchase 164,676 shares of Common Stock were issued pursuant to the conversion of warrants to purchase shares of LENZ OpCo outstanding as of immediately prior to the Effective Time, and (iii) an aggregate of 3,559,565 shares of Common Stock were issued to the PIPE Investors in the PIPE Financing. Moreover, at the Closing, all options to purchase shares of LENZ OpCo were exchanged for comparable options to purchase shares of Common Stock based on an exchange ratio of 0.2022. Immediately after giving effect to the Transactions, there were approximately 25,533,533 shares of Common Stock outstanding, 164,676 shares of Common Stock subject to outstanding warrants, and 1,590,018 shares of Common Stock subject to outstanding options under LENZ OpCo’s 2020 Equity Incentive Plan. The Common Stock, which was previously listed on The Nasdaq Stock Market LLC (“Nasdaq”) and traded under the ticker symbol “GRPH” through the close of business on March 21, 2024, will commence trading on Nasdaq under the ticker symbol “LENZ” on March 22, 2024.

The material terms and conditions of the Merger Agreement are described in the definitive proxy statement/prospectus (the “Proxy Statement/Prospectus”) included in Graphite’s Registration Statement on Form S-4 (File No. 333-275919), filed with the Securities and Exchange Commission (the “SEC”) on February 9, 2024, in the section entitled “Merger Agreement” beginning on page 203 of the Proxy Statement/Prospectus, which is incorporated herein by reference.

FORM 10 INFORMATION

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K and the information incorporated herein by reference may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to the Transactions and their expected benefits; New LENZ’s performance following the Transactions; our plans relating to the clinical development of our product candidates, including the size, number and areas to be evaluated; our plans relating to commercializing our product candidates, if approved, including the geographic areas of focus and strategy; and New LENZ’s ability to obtain funding for its operations. Forward-looking statements include statements relating to our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to the Transactions. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting us will be those that we have anticipated. Forward-looking statements include, but are not limited to, statements concerning the following:

•the likelihood of our clinical trials demonstrating safety and efficacy of our product candidates, and other positive results;

•the timing, progress and results of our clinical trials for our current product candidates, including statements regarding the timing of completion of trials, and the reporting of data from our current trials;

•our plans relating to the clinical development of our product candidates, including the size, number and areas to be evaluated;

•the size of the market opportunity for our product candidates, including our estimates of the size of the affected population and potential adoption rate;

•our plans relating to commercializing our product candidates, if approved, including the geographic areas of focus and sales strategy;

•our competitive position and the success of competing therapies that are or may become available;

•the beneficial characteristics, and the potential safety, efficacy and therapeutic effects of our product candidates;

•the need to hire additional personnel and our ability to attract and retain such personnel;

•the timing, scope and likelihood of regulatory filings and approvals for our current product candidates;

•our ability to obtain and maintain regulatory approval of our product candidates;

•our plans relating to the further development and manufacturing of our product candidates;

•the expected potential benefits of strategic collaborations with third parties and our ability to attract collaborators with development, regulatory and commercialization expertise;

•the rate and degree of market acceptance and clinical utility of our current product candidates and other product candidates we may develop;

•the impact of existing laws and regulations and regulatory developments in the United States and other jurisdictions;

•our intellectual property position, including the scope of protection we are able to establish and maintain for intellectual property rights covering our current product candidates, including the extensions of existing patent terms where available, the validity of intellectual property rights held by third parties, and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights;

•our continued reliance on third parties to conduct additional clinical trials of our product candidates, and for the manufacture of our product candidates for clinical trials;

•the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•our financial performance;

•costs related to the Merger;

•our ability to recognize the anticipated benefits of the Merger;

•the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements;

•our expectations regarding the period during which we will remain an emerging growth company under the JOBS Act; and

•our anticipated use of our existing resources and the proceeds from the Transactions.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, including but not limited to those described under the heading "Risk Factors" beginning on page 26 of the Proxy Statement/Prospectus, which is incorporated herein by reference, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. There may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Business

We are a late-stage biopharmaceutical company focused on developing and commercializing innovative therapies to improve vision. Our initial focus is the treatment of presbyopia, the inevitable loss of near vision that impacts the daily lives of nearly all people over 45. In the United States, the estimated addressable population who suffer from this condition, known as presbyopes, is 128 million, almost four times the number of individuals suffering from dry eye disease and three times the number of individuals suffering from childhood myopia, macular degeneration, diabetic retinopathy and glaucoma combined. We believe that a once-daily pharmacological eye drop that can effectively and safely improve near vision throughout the full workday, without the need for reading glasses, will be a highly attractive commercial product with an estimated U.S. market opportunity in excess of $3 billion. It is our goal to develop and commercialize such a product, and we have assembled an executive team with extensive clinical and commercial experience to execute this goal and become the category leader.

Our product candidates LNZ100 and LNZ101 are preservative-free, single-use, once-daily eye drops containing aceclidine and aceclidine plus brimonidine, respectively. We believe our product candidates are differentiated based on rapid onset, degree and duration of near vision improvement, as well as their ability to be used across the full age range of presbyopes, from their mid-40s to well into their mid-70s, as well as the broadest refractive range. Aceclidine’s pupil-selective mechanism of action was demonstrated in our clinical trials where near vision improved while avoiding blurry distance vision. Our product candidates were well-tolerated in clinical trials, and their active ingredients have favorable tolerability profiles that have been well-established empirically. Our product candidates have patent protection until 2039, at a minimum, due to a robust intellectual property portfolio underpinned by issued patents. If one of our product candidates is approved, we believe that it could be the first aceclidine-based product approved by the U.S. Food and Drug Administration (“FDA”) and would then be eligible for five years of new chemical entity (“NCE”) exclusivity in the United States.

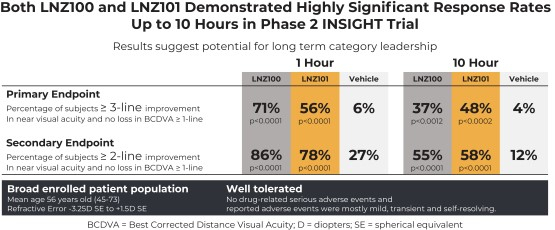

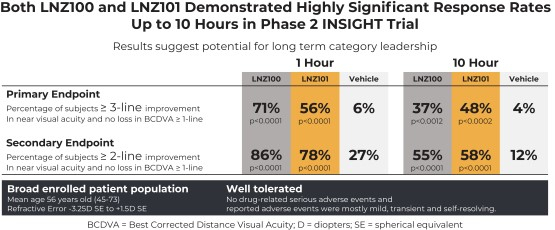

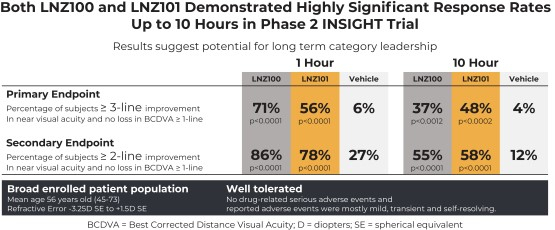

In our Phase 2 trial (NCT05294328, the “INSIGHT”, or “Phase 2” trial), both LNZ100 and LNZ101 achieved the primary endpoint of three-lines or greater improvement in near visual acuity without losing one or more lines in Best Corrected Distance Visual Acuity (“BCDVA”) at one-hour post-treatment, with a response rate of 71% (p<0.0001) and 56% (p<0.0001), respectively, compared to 6% for vehicle, with three-lines or greater improvement being observed as early as 30 minutes post-treatment, the earliest timepoint measured, and lasting up to 10 hours, the last timepoint measured. BCDVA in this context refers to the best possible distance vision that an individual’s eye can see using corrective lenses. For more details, see the section entitled “INSIGHT: Phase 2 Clinical Trial — Trial Design” in the Proxy Statement/Prospectus in the section titled “LENZ’s Business” beginning on page 311.

Based on the positive results in our Phase 2 trial, we conducted three Phase 3 clinical trials (the “CLARITY” or “Phase 3” trials) with top-line results expected to be announced in April 2024. Subject to successful completion of these trials, we plan to submit a New Drug Application (“NDA”) to the FDA for one or both of our product candidates in mid-2024. If approval is granted, we will rigorously evaluate the results of our Phase 3 data, especially patient reported outcomes, and FDA feedback to select and commercialize the product we believe will have the greatest commercial potential, with a launch target date in second half of 2025.

It is estimated that there are 1.8 billion presbyopes globally and 128 million presbyopes in the United States. As people age, the crystalline lens in their eyes gradually hardens, resulting in a loss of lens elasticity that reduces the ability of the lens to increase its curvature and refractive power to focus incoming light for near vision onto the retina, known as accommodation. Although the progression of presbyopia is gradual, presbyopes often experience an abrupt change in their daily life as the symptoms become more pronounced starting in their mid-40s, when reading glasses or other corrective aids are suddenly necessary to read text or conduct close-up work. Presbyopia is typically self-diagnosed and self-managed with over-the-counter reading glasses, or managed, after evaluation by an eye care professional (“ECP”), with prescription reading or bifocal glasses or multifocal contact lenses. Currently, the only approved and marketed pharmaceutical treatment for presbyopia is marketed by AbbVie under the brand Vuity.

Based on data collected in a third-party study commissioned by us in early 2023 that is further described in the section “Market Opportunity” in the Proxy Statement/Prospectus in the section titled “LENZ’s Business” beginning on page 311, we found that presbyopes have high willingness to use a daily prescription eye drop that improves their near vision throughout the full workday. We expect that there will be a wide range of presbyopes that will be interested in using the eye drops at least four times a week. The large initial demand seen for Vuity during its launch in late 2021 and early 2022 corroborates the market demand for a pharmaceutical option for the treatment of presbyopia. However, despite a promising initial launch, Vuity’s user uptake has been limited by reportedly lower-than-expected efficacy and duration of effect across users. Additionally, Vuity use is associated with some side effects, including retinal tears and detachments, induced by the stimulation of the ciliary muscle. These limitations on efficacy and safety subsequently resulted in lower than anticipated prescription refill rates and a label amendment reflecting the risk of retinal tears and detachment specifically associated with Vuity. We believe that our once-daily eye drop, if approved, could become the leading brand for presbyopes, by improving near vision throughout the full workday.

Our product candidates LNZ100 and LNZ101 are formulated with aceclidine, a miotic, and designed to achieve optimal pupil diameter without impacting distance vision, a key limitation of other miotics. Miotics are compounds that cause pupil constriction, or miosis, creating a pinhole effect that enables better focus of incoming light from near objects onto the retina. Research has shown that a pupil diameter below two millimeters (2 mm) is optimal for presbyopia treatment and results in clinically meaningful improvement in near vision. Unlike other miotics such as pilocarpine and carbachol, aceclidine’s mechanism of action is pupil-selective, meaning it can activate the iris sphincter muscle and cause miosis of the pupil to a diameter below 2 mm without overstimulating the ciliary muscles that can cause a myopic shift and impair distance vision. As a result, aceclidine does not require any remaining accommodation to improve near vision, broadening its benefits to older presbyopes whose lens has lost this capacity. Therefore, we expect that users may be able to benefit from treatment even as they age from mid-40s to well into their mid-70s and across a broader range of refractive errors, as demonstrated in clinical testing to date.

LNZ101 contains the active ingredient brimonidine in addition to aceclidine. Brimonidine is an alpha 2 (“α2”) adrenergic receptor agonist that has also been used for lowering intraocular pressure as a treatment for glaucoma since the 1990s. Brimonidine causes vasoconstriction, prolonging the presence of aceclidine on the ocular surface and increasing aceclidine’s penetration into the anterior chamber. As a result, brimonidine extends the duration of the miotic effect of aceclidine.

While aceclidine is new to the United States, it has a long-established history outside the United States having been approved in Europe since the 1970s for the treatment of glaucoma, and marketed by Merck under the brand Glaucostat, at higher concentrations than in LENZ’s product candidates and up to four times a day. Similarly, brimonidine also has a long-established history of use. It is the active ingredient in Alphagan and Alphagan P, products initially marketed by Allergan (now AbbVie) for the treatment of glaucoma, in each case at higher concentrations than in our product candidates, and is also used in Lumify (“OTC”), invented by the founders of LENZ OpCo and marketed by Bausch & Lomb. Given the known favorable tolerability profile of both active ingredients used for decades, and the unique mechanism of action of aceclidine, we believe LNZ100 and LNZ101 have the potential to treat the broadest population of presbyopes and become the category leader.

In the INSIGHT trial, both product candidates demonstrated rapid onset with 73% and 62% three-lines or greater improvement in near visual acuity within 30 min for LNZ100 and LNZ101, respectively, compared to 8% for vehicle, and sustained the statistically significant three-lines or greater improvement in near visual acuity over an extended duration of 10 hours post-treatment, the last measured timepoint. Both LNZ100 and LNZ101 were well-tolerated with no serious drug-related adverse events.

In December 2022, we initiated our three Phase 3 multi-center, double-masked, randomized, active and vehicle-controlled, U.S.-based efficacy and safety trials for LNZ100 and LNZ101, for which we expect to announce top-line results in April 2024. The Phase 3 study consists of two six-week safety and efficacy trials, CLARITY-1 and CLARITY-2, and a six-month safety trial, CLARITY-3. The primary efficacy endpoints and the study population for the CLARITY trials are similar to that of the INSIGHT trial, enrolling participants in the same age range from 45 to 75 years and with a refractive range of -4.0 diopters (“D”) spherical equivalent (“SE”) to

+1.0D SE. As with the INSIGHT trial, the CLARITY trials will also permit enrollment of users who had previously undergone prior vision correction, such as LASIK, or cataract extraction with lens implant. Subject to successful completion of the CLARITY trials, we plan to submit an NDA for at least one of our product candidates to the FDA in mid-2024. If approval is granted, we will rigorously evaluate the results of its Phase 3 data, especially patient reported outcomes, and FDA feedback to select and commercialize the product we believe will have the greatest commercial potential, with a launch target date in second half of 2025.

Given our goal to develop and commercialize the leading, once-daily eye drop for presbyopia that can effectively and safely improve near vision throughout the full workday, we continue to build a robust commercial strategy in the United States to be launch-ready upon expected timing of FDA approval. We retain the flexibility to not only seek commercialization of our product candidates, but to also remain opportunistic in developing, in-licensing or partnering other products or product candidates to further leverage our commercial infrastructure to drive growth and operating leverage. Our product candidates have patent protection until 2039, at a minimum, due to a robust intellectual property portfolio underpinned by issued patents. If one of our product candidates is approved, we believe that it could be the first FDA-approved aceclidine-based product and would then be eligible for five years of NCE exclusivity in the United States. As of March 21, 2024, we had at least 18 issued U.S. patents, at least 25 issued patents outside the United States and at least 74 pending applications globally.

To execute our vision, we have assembled a team with extensive experience building successful life science and consumer product companies. Our team has helped launch and commercialize over a dozen ophthalmic products and therapies, including Acuvue, Alphagan P, Combigan, Dailies AquaComfort Plus, Durysta, Latisse, Lumigan, Pred Forte, Refresh, Restasis, Truetear, and Vuity, as well as major consumer-focused brands such as Botox, Herbalife and Ray-Ban. Members of our management team have held senior positions at Alcon, Allergan, Alvotech, Avanir, Bausch + Lomb, Herbalife, Hospira, Johnson & Johnson, Pfenex, Pfizer, VISX and others. We have also engaged a strong team of medical advisors across the ophthalmology and optometry fields. Our team is further supported by a strong group of investors that share our commitment to helping the millions of people experiencing symptoms of presbyopia in the United States and globally.

Our business is further described in the Proxy Statement/Prospectus in the section titled “LENZ’s Business” beginning on page 311 of the Proxy Statement/Prospectus and that information is incorporated herein by reference.

Risk Factors

The risk factors related to LENZ’s business and operations and the Transactions are set forth in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 26 of the Proxy Statement/Prospectus and that information is incorporated herein by reference.

Audited Financial Statements

The audited financial statements as of and for the years ended December 31, 2023 and 2022 of LENZ OpCo set forth in Exhibit 99.1 hereto have been prepared in accordance with U.S. generally accepted accounting principles and pursuant to the regulations of the SEC.

These audited financial statements should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included herein.

Unaudited Pro Forma Condensed Combined Financial Information

The unaudited pro forma condensed combined financial information of the Company for the year ended December 31, 2023 is set forth in Exhibit 99.2 hereto and is incorporated herein by reference.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Reference is made to the disclosure contained in Graphite's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 27, 2024, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 62 of the Annual Report on Form 10-K, which is incorporated herein by reference.

Management’s discussion and analysis of the financial condition and results of operation of LENZ OpCo as of and for the year ended December 31, 2023 is set forth below.

The following discussion and analysis provides information that the Company’s management believes is relevant to an assessment and understanding of the Company’s results of operations and financial condition. The discussion should be read together with the audited financial statements and related notes and unaudited pro forma condensed financial information that are included elsewhere in this Current Report on Form 8-K. This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in the Proxy Statement/Prospectus in the section entitled “Risk Factors” beginning on page 26 of the Proxy Statement/Prospectus or in other parts of this Current Report on Form 8-K. Unless the context otherwise requires, references in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” to “LENZ OpCo,” “the Company,” “we,” “us” and “our” refer to the business and operations of LENZ OpCo prior to the Merger and to New LENZ and its consolidated subsidiary following the Closing.

Overview

We are a late-stage biopharmaceutical company focused on developing and commercializing innovative therapies to improve vision. Our initial focus is the treatment of presbyopia, the inevitable loss of near vision that impacts the daily lives of nearly all people over 45. In the United States, the estimated addressable population which suffers from this condition, known as presbyopes, is 128 million, almost four times the number of individuals suffering from dry eye disease and three times the number of individuals suffering from childhood myopia, macular degeneration, diabetic retinopathy and glaucoma combined. We believe that a once-daily pharmacological eye drop that can effectively and safely improve near vision throughout the full workday, without the need for reading glasses, will be a highly attractive commercial product with an estimated U.S. market opportunity in excess of $3 billion. It is our goal to develop and commercialize such a product, and we have assembled an executive team with extensive clinical and commercial experience to execute this goal and become the category leader.

Our product candidates LNZ100 and LNZ101 are preservative-free, single-use, once-daily eye drops containing aceclidine and aceclidine plus brimonidine, respectively. We believe our product candidates are differentiated based on rapid onset, degree and duration of near vision improvement, as well as their ability to be used across the full age range of presbyopes, from their mid-40s to well into their mid-70s, as well as the broadest refractive range. Aceclidine’s pupil-selective mechanism of action was demonstrated in our clinical trials where near vision improved while avoiding blurry distance vision. Our product candidates were well-tolerated in clinical trials, and their active ingredients have favorable tolerability profiles that have been well-established empirically.

In our INSIGHT Phase 2 trial, both LNZ100 and LNZ101 achieved the primary endpoint of three-lines or greater improvement in near visual acuity without losing one or more lines in Best Corrected Distance Visual Acuity at one hour post-treatment, with a response rate of 71% and 56%, respectively, compared to 6% for vehicle. Based on the positive results in our Phase 2 trial, we conducted three Phase 3 clinical trials (the CLARITY or Phase 3 trials) with results expected to be announced in April 2024. Subject to successful completion of these trials, we plan to submit an NDA to the FDA for one or both of our product candidates in mid-2024. If approval is granted, we will rigorously evaluate the results of our Phase 3 data, especially patient reported outcomes, and FDA feedback to select and commercialize the product that we believe will have the greatest commercial potential, with a launch target date in second half of 2025.

For more information regarding our business, see the section titled “Business” of this Current Report on Form 8-K.

As of December 31, 2023, we had $65.8 million of cash, cash equivalents and short-term investments. Based on our current plans, we believe our existing cash, cash equivalents and short-term investments, together with the proceeds from the merger and the Graphite private placement will allow the company to continue to build infrastructure and commercialize our lead product candidate, subject to successful completion of the ongoing Phase 3 trials, the NDA submission and FDA approval. We do not expect to generate any revenues from product sales unless and until we successfully complete development and obtain regulatory approval for one or more of our product candidates. We have incurred net losses in each year since inception, and as of December 31, 2023, we had an accumulated deficit

of $95.2 million. These losses have resulted principally from costs incurred in connection with research and development activities and selling, general and administrative costs associated with our operations. We expect to continue to incur significant expenses and operating losses for the foreseeable future due to the cost of research and development, including conducting clinical trials, the regulatory approval process and preparation for and the commercial launch of LNZ100 or LNZ101, subject to FDA approval, including expenses related to product sales, marketing and distribution, and additional costs associated with being a public company, including audit, legal, regulatory and tax-related services associated with maintaining compliance with an exchange listing and SEC requirements. As a result of these and other factors, it is possible that we may require additional financing to fund our operations and planned growth.

Through the completion of the Merger, Lenz OpCo financed its operations primarily through private placements of its common stock and convertible preferred stock, including the following financings during the periods presented:

•In March 2023, LENZ OpCo issued and sold an aggregate of 28,019,181 shares of Series B preferred stock at a purchase price of $2.9801 per share for an aggregate purchase price of approximately $83.5 million.

•In October 2022, LENZ OpCo issued and sold an aggregate of 9,899,340 shares of Series A Preferred Stock at a purchase price of $2.15 per share for an aggregate purchase price of approximately $21.3 million as part of a milestone closing of the 2021 Series A Preferred Stock financing.

•In April 2022, LENZ OpCo issued and sold an aggregate of 2,950,548 shares of Series A-1 Preferred Stock at a purchase price of $3.3892 per share for an aggregate purchase price of approximately $10.0 million.

Until such time as we can generate significant revenue from sales of our product candidates, if ever, we expect to finance our cash needs through equity offerings, debt financings or other capital sources, including potential collaborations, licenses and other similar arrangements. However, we may be unable to raise additional funds or enter into such other arrangements when needed on favorable terms or at all. Our failure to raise capital or enter into such other arrangements when needed would have a negative impact on our financial condition and could force us to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourself.

Ji Xing License and Collaboration Agreement

In April 2022, we entered into a License and Collaboration Agreement with Ji Xing Pharmaceuticals Hong Kong Limited (“Ji Xing”) granting Ji Xing an exclusive license (the “Ji Xing License”) to certain of our intellectual property rights to develop, use, import, and sell products containing LNZ100 or LNZ101 (“Products”) for the treatment of presbyopia in humans in mainland China, Hong Kong Special Administrative Region, Macau Special Administrative Region, and Taiwan (collectively, “Greater China). We also granted Ji Xing (i) the right to negotiate in good faith and enter into agreements to purchase Products from us for clinical and commercial uses at cost plus a negotiated percentage and (ii) the right of first negotiation to obtain a regional license from us on other products we might develop outside of the field of presbyopia for commercialization in Greater China.

We received nonrefundable, non-creditable upfront payments totaling $15.0 million as initial consideration under the Ji Xing License. In addition, we are also eligible to receive (i) up to $95.0 million in regulatory and sales milestone payments, (ii) tiered, escalating royalties in the range of 5% to 15% on net sales of Products in Greater China by Ji Xing, its affiliates and sublicensees, and (iii) tiered, deescalating royalties in the range of 15% to 5% of sublicensing income received by Ji Xing prior to the regulatory approval of the first Product in Greater China.

The $15.0 million upfront payments allocated to that single performance obligation was recognized on execution of the Ji Xing License in the year ended December 31, 2022. No additional amounts under the Ji Xing License were received during the year ended December 31, 2022.

In connection with the Ji Xing License, RTW Investments, LP (“RTW”), a significant investor in Ji Xing, through three funds managed or advised by RTW, invested approximately $10.0 million in exchange for 2,950,548 shares of LENZ OpCo's Series A-1 Preferred Stock at a purchase price of $3.3892 per share.

Key Trends and Factors Affecting Comparability Between Periods

•The Ji Xing License was signed in April 2022, and we recorded $15.0 million of revenue for the year ended December 31, 2022. We did not generate any revenue related to the Ji Xing License or from other sources for the year ending December 31, 2023.

•We continue to build out our research and development team and our research and development costs increased in 2023, relative to 2022, as a result of significant expenses related to the CLARITY trials. See the section of this Current Report on Form 8-K titled “Business” for more information about the CLARITY trials.

•We have built a cross-functional commercial team consisting of marketing, market access and commercial operations and will continue to strategically build our sales and our commercial infrastructure with capabilities designed to scale when necessary to support a commercial launch if approval is received. These expenses increased in 2023 as compared to 2022.

•Following the Merger, the combined company’s expenses will increase from those that we incurred in prior years as a privately held company, including (i) costs to comply with the rules and regulations of the SEC and those of Nasdaq, (ii) legal, accounting and other professional services, (iii) insurance, (iv) investor relations activities, and (v) other administrative and professional services.

Recent Developments

The Merger and PIPE Financing

On November 14, 2023, we entered into the Merger Agreement with Graphite and Generate Merger Sub, pursuant to which LENZ OpCo merged with and into Generate Merger Sub at the Effective Time on March 21, 2024, with LENZ OpCo continuing after the Merger as the surviving company and a wholly-owned subsidiary of Graphite. At the Effective Time, each outstanding share of LENZ OpCo capital stock was converted into the right to receive shares of Graphite common stock, par value $0.00001, as set forth in the Merger Agreement. Upon closing of the Merger, the combined company was named “LENZ Therapeutics, Inc.” and will continue to be listed on the Nasdaq.

Under the exchange ratio formula in the Merger Agreement, immediately following the Effective Time, the LENZ OpCo securityholders owned approximately 65% of the outstanding shares of the combined company’s common stock on a fully-diluted basis and securityholders of Graphite as of immediately prior to the Effective Time owned approximately 35% of the outstanding shares of the combined company’s common stock on a fully-diluted basis (prior to giving effect to the PIPE Financing and excluding shares reserved for future grants under the 2024 Plan and the 2024 ESPP, each described elsewhere in this Current Report on Form 8-K).

Concurrently with the execution of the Merger Agreement, Graphite entered into the subscription agreement with the PIPE Investors, pursuant to which, immediately following the Effective Time, the PIPE Investors subscribed for and purchased an aggregate of 3,559,565 shares of Common Stock at a price of $15.0299 per share for aggregate gross proceeds of approximately $53.5 million.

Basis of Presentation

The following discussion highlights our results of operations and the principal factors that have affected our financial condition as well as our liquidity and capital resources for the periods described and provides information that management believes is relevant for an assessment and understanding of the balance sheets and statements of operations and comprehensive loss presented herein. The following discussion and analysis are based on our audited financial statements and related notes thereto, which we have prepared in accordance with GAAP. You should read the discussion and analysis together with such audited financial statements and the related notes thereto.

Components of Statements of Operations and Comprehensive Loss

Revenue

We currently have no products approved for sale, and we have not generated any revenue from product sales to date. We have generated revenue related to the Ji Xing License, and in the future may generate revenue from payments received under licenses or collaboration agreements we may enter into with respect to our product candidates.

We recorded $15.0 million of license revenue related to the Ji Xing License for the year ended December 31, 2022.

We did not generate any revenue related to the Ji Xing License or from other sources for the year ended December 31, 2023.

Operating Expenses

Research and Development

Research and development expenses, which consist primarily of costs associated with our product research and development efforts, are expensed as incurred. Research and development expenses consist primarily of: (i) employee related costs, including salaries, benefits and share-based compensation expense for employees engaged in research and development activities; (ii) third-party contract costs relating to research, formulation, manufacturing, nonclinical studies and clinical trial activities; (iii) external costs of outside consultants who assist with technology development, regulatory affairs, clinical development and quality assurance; and (iv) allocated facility-related costs. We track research and development costs collectively for LNZ100 or LNZ101 because expenses incurred are interrelated and disaggregation would not be meaningful.

Costs for certain activities, such as manufacturing, nonclinical studies and clinical trials are generally recognized based on the evaluation of the progress of completion of specific tasks using information and data provided by our vendors and collaborators. Research and development activities are central to our business.

We continue to build out our research and development team and we expect our research and development costs will decrease in 2024, relative to 2023, given the completion of the CLARITY trials expected to occur in April 2024.

Selling, General and Administrative

Selling, general and administrative expenses consist primarily of salaries and related benefits, including share-based compensation, related to our executive, finance, business development, sales and marketing, and other corporate functions. Other general and administrative expenses include professional fees for legal, auditing, tax and business consulting services, insurance costs, intellectual property and patent costs, facility costs and travel costs. We expect that selling, general and administrative expenses will increase in the future as we expand our operating activities. Additionally, we expect that the combined company will incur significant additional expenses associated with being a public company that LENZ OpCo did not incur as a privately-held company, including (i) costs to comply with the rules and regulations of the SEC and those of Nasdaq, (ii) legal, accounting and other professional services, (iii) insurance, (iv) investor relations activities, and (v) other administrative and professional services.

Other Income (Expense), Net

Other income (expense), net consists of the change in fair value of preferred stock warrants liability and interest income earned on cash, cash equivalents and short-term investments.

Provision for Income Taxes

Income tax expense (benefit) consists of U.S. federal and state income taxes.

Results of Operations

Comparison of the Year Ended December 31, 2022 and 2023

The following table presents the results of operations for the periods indicated (amounts in thousands, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, | | | | |

| 2022 | | 2023 | | $ Change | | % Change |

Revenue: | | | | | | | |

License revenue | $ | 15,000 | | | $ | — | | | $ | (15,000) | | | (100) | % |

Total revenue | 15,000 | | | — | | | (15,000) | | | (100) | % |

Operating expenses: | | | | | | | |

Research and development | 21,125 | | | 59,504 | | | 38,379 | | | 182 | % |

Selling, general and administrative | 4,358 | | | 12,925 | | | 8,567 | | | 197 | % |

Total operating expenses | 25,483 | | | 72,429 | | | 46,946 | | | 184 | % |

Loss from operations | (10,483) | | | (72,429) | | | (61,946) | | | 591 | % |

Other income: | | | | | | | |

Other | 15 | | | 93 | | | 78 | | | 520 | % |

Interest income | 4 | | | 2,189 | | | 2,185 | | | 54,625 | % |

Total other income (expense), net | 19 | | | 2,282 | | | 2,263 | | | 11,911 | % |

Net loss before income taxes | (10,464) | | | (70,147) | | | (59,683) | | | 570 | % |

Income tax expense (benefit) | 347 | | | (179) | | | (526) | | | (152) | % |

Net loss | $ | (10,811) | | | $ | (69,968) | | | $ | (59,157) | | | 547 | % |

License Revenue

During the year ended December 31, 2022, we recognized $15.0 million of license revenue related to the Ji Xing License. This revenue was recognized upon completion of the related performance obligation. We did not recognize any revenue for the year ended December 31, 2023.

Research and Development

Substantially all of our research and development expenses incurred for the years ended December 31, 2022 and 2023 were related to the development of LNZ100 and LNZ101, which were both included together in our INSIGHT and CLARITY trials.

The following table presents a detailed breakdown of our research and development expenses for the periods indicated (in thousands):

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2022 | | 2023 |

| Contract clinical research expense | $ | 11,598 | | | $ | 37,949 | |

| Contract manufacturing expense | 6,006 | | | 8,339 | |

| Contract nonclinical research expense | 1,216 | | | 6,835 | |

| Contract regulatory consulting expense | 237 | | | 1,107 | |

| Employee salaries and related expense | 1,810 | | | 4,131 | |

| Other expense | 258 | | | 1,143 | |

| Total research and development | $ | 21,125 | | | $ | 59,504 | |

Research and development expenses increased $38.4 million, or 182%, from $21.1 million for the year ended December 31, 2022 to $59.5 million for the year ended December 31, 2023. The increase was primarily driven by a $26.4 million increase in contract research expense for our clinical trials, a $2.3 million increase in contract manufacturing expenses for clinical drug product manufacturing, a $5.6 million increase in contract nonclinical research expense, and a $2.3 million increase in employee salaries and related expenses. These increases were primarily related to our CLARITY trials and preparation for our potential NDA filing.

Selling, General and Administrative

Selling, general and administrative expenses increased $8.6 million, or 197%, from $4.4 million for the year ended December 31, 2022 to $12.9 million for the year ended December 31, 2023. The increase was primarily driven by a $4.6 million increase in legal and other professional services (principally related to legal fees incurred in connection with our abandoned initial public offering), a $2.2 million increase in employee salaries and related expenses due to increased headcount, and a $1.4 million increase in sales infrastructure and marketing expenses.

Other Income (Expense), Net

Other income, net for the year ended December 31, 2022, was $19,000, compared to $2.3 million for the year ended December 31, 2023. The change was primarily driven by a $2.2 million increase in interest income and a reduction in fair value of preferred stock warrants liability of $0.1 million.

Provision for Income Taxes

During the year ended December 31, 2022, we recognized income tax expense $0.3 million due to the requirement to capitalize research and development expenses under the Tax Cuts and Jobs Act (the “TCJA”), compared to an income tax benefit of $0.2 million for the year ended December 31, 2023 primarily due to our income derived in foreign markets, which is subject to a lower tax rate as a result of the foreign-derived intangible income deduction that was introduced as part of the TCJA. The TCJA requires taxpayers to capitalize and amortize research and development expenditures under section 174 for tax years beginning after December 31, 2021. This rule became effective for us during the year ended December 31, 2022 resulting in a gross deferred tax asset for capitalized research and development expenditures of approximately $66.0 million as of December 31, 2023. We will continue to amortize these costs for tax purposes over 5 years for R&D performed in the U.S. and over 15 years for R&D performed outside the U.S.

Liquidity and Capital Resources

Sources of Liquidity

As of December 31, 2023, we had $65.8 million of cash, cash equivalents and marketable securities. Based on our current operating plans, we believe our existing cash, cash equivalents and short-term investments will be sufficient to fund our planned operations into 2025. Further, based on our current operating plans, we believe our cash, cash equivalents, and short-term investments as of December 31, 2023, together with the proceeds from the merger and the Graphite private placement, will be sufficient to fund our planned operations through several anticipated value-creating milestones and through at least 2026, and will allow us to continue to build infrastructure and commercialize our lead product candidate, subject to successful completion of the ongoing Phase 3 trials, NDA submission and FDA approval.

We have incurred net losses in each year since inception and as of December 31, 2023, we had an accumulated deficit of $95.2 million. Our net losses were $10.8 million and $70.0 million for the years ended December 31, 2022 and 2023, respectively. These losses have resulted principally from costs incurred in connection with research and development activities and selling, general and administrative costs associated with our operations. We expect to continue to incur significant expenses and operating losses for the foreseeable future due to the cost of research and development, the regulatory approval process for either LNZ100 or LNZ101, and the commercial launch of either product, if approved.

From inception through December 31, 2023, we received funding of $13.0 million from our initial seed financing, $47.0 million from the sale of Series A Convertible Preferred Stock, $10.0 million from the sale of Series A-1 Convertible Preferred Stock, and gross proceeds of $83.5 million from the sale of Series B Convertible Preferred Stock.

Funding Requirements

We believe that our existing cash, cash equivalents and marketable securities will be sufficient to fund our planned operations into 2025. Further, based on our current operating plans, we believe our existing cash, cash equivalents, and short-term investments, together with the proceeds from the Merger and the PIPE Financing, will be sufficient to fund our planned operations through several anticipated value-creating milestones and through at least 2026, and will allow us to continue to build infrastructure and commercialize our lead product candidate, subject to successful completion of the ongoing Phase 3 trials, NDA submission and FDA approval. This belief is based on assumptions that may prove to be wrong, and we could use our available capital resources sooner than expected. Changing circumstances, some of which may be beyond our control, could cause us to consume capital significantly faster than currently anticipated, and we may need to seek additional funds sooner than planned.

Our future capital requirements will depend on many factors, including but not limited to:

•the results, costs, and timing of our ongoing clinical trials for LNZ100 and LNZ101;

•the costs and timing of manufacturing for our product candidates and commercial manufacturing if any product candidate is approved;

•costs associated with establishing a sales, marketing, and distribution infrastructure to commercialize any products for which we may obtain marketing approval;

•the costs, timing, and outcome of regulatory review of our product candidates;

•the legal costs of obtaining, maintaining, and enforcing our patents and other intellectual property rights;

•our efforts to enhance operational systems and hire additional personnel to satisfy our obligations as a public company;

•the terms and timing of establishing and maintaining licenses and other similar arrangements;

•our ability to achieve sufficient market acceptance and adequate market share and revenue for any approved products; and

•costs associated with any products or technologies that we may in-license or otherwise acquire or develop.

Prior to the Merger, LENZ OpCo funded its operations primarily through the sale and issuance of convertible preferred stock and it is possible that, following the Merger, we may require additional financing. We intend to evaluate financing opportunities from time to time, and our ability to obtain financing will depend, among other things, on our development efforts, business plans, operating performance and the condition of the capital markets at the time we seek financing. We cannot assure you that additional financing will be available to us on favorable terms when required, or at all. If we raise additional funds through the issuance of equity or equity-linked securities, those securities may have rights, preferences or privileges senior to the rights of our Common Stock, and our stockholders may experience dilution. If we raise additional funds through the incurrence of indebtedness, then we may be subject to increased fixed payment obligations and could be subject to restrictive covenants, such as limitations on our ability to incur additional debt, and other operating restrictions that could adversely impact our ability to conduct our business.

Cash Flows

The following table summarizes our cash flows for the years presented (amounts in thousands):

| | | | | | | | | | | |

| Years Ended December 31, |

| 2022 | | 2023 |

| Net cash (used in) provided by: | | | |

| Operating activities | $ | (4,091) | | | $ | (60,380) | |

| Investing activities | (37) | | | (29,621) | |

| Financing activities | 30,262 | | | 80,700 | |

| Net increase in cash and cash equivalents | $ | 26,134 | | | $ | (9,301) | |

Net Cash Used in Operating Activities

Our net cash used in operating activities primarily results from our net loss adjusted for non-cash expenses, changes in working capital components, amounts due to contract research organizations to conduct our clinical programs, manufacturing of drug product and employee-related expenditures for research and development and selling, general and administrative activities. Our cash flows from operating activities will continue to be affected by spending to develop and pursue regulatory approval for either LNZ100 or LNZ101 and commercialization activities, if approval is obtained. Our cash flows will also be affected by other operating and general administrative activities, including operating as a public company.

For the year ended December 31, 2022, cash used in operating activities was $4.1 million and resulted from (i) our net loss of $10.8 million plus a $2.1 million increase in operating assets, offset by (ii) a $8.2 million increase in accounts payable and accrued liabilities and $0.7 million in non-cash adjustments primarily related to share-based compensation expense.

For the year ended December 31, 2023, cash used in operating activities was $60.4 million and resulted from (i) our net loss of $70.0 million, plus $1.1 million in amortization of premiums and discounts on marketable securities, offset by (ii) an $8.6 million increase in accounts payable and accrued liabilities, $1.3 million of share-based compensation expense, and a $0.8 million decrease in operating assets.

Net Cash Used in Investing Activities

Cash used in investing activities for the year ended December 31, 2022 was $37,000 and related to the purchase of property and equipment.

For the year ended December 31, 2023, cash used in investing activities was $29.6 million and related primarily to the purchase of marketable securities of $52.1 million offset by proceeds from maturities of marketable securities of $22.5 million.

Net Cash Provided by Financing Activities

Cash provided by financing activities for the year ended December 31, 2022 includes $20.2 million in net cash proceeds from the sale by LENZ OpCo of Series A Convertible Preferred Stock, $9.9 million in net cash proceeds from the sale by LENZ OpCo of Series A-1 Convertible Preferred Stock, and $0.1 million in net cash proceeds from the exercise of LENZ OpCo stock options.

For the year ended December 31, 2023, cash provided by financing activities was $80.7 million and consisted of $83.0 million in net cash proceeds from the sale by LENZ OpCo of Series B Convertible Preferred Stock, and $0.2 million in net cash proceeds from the exercise of LENZ OpCo stock options, offset by an increase in deferred offering costs of $2.5 million.

Material Cash Requirements from Contractual Obligations

In February 2022, we entered into a lease for 2,930 square feet of office space in Del Mar, California. In March 2023, we entered into a lease amendment for a 647 square feet expansion of our office space at the same facility. The term of the lease, as amended, is forty-eight months from the original commencement date, terminating March 31, 2026, unless terminated sooner.

Rent expense is recorded on a straight-line basis. Rent expense related to the Del Mar lease was $0.1 million for the years ended December 31, 2022 and 2023, respectively. See Note 6 to our audited financial statements for details related to future lease payments.

We also have contracts with various organizations to conduct research and development activities, including clinical trial organizations to manage clinical trial activities and manufacturing companies to manufacture the drug product used in the clinical trials. The scope of the services under these research and development contracts can be modified and the contracts cancelled by us upon written notice. In the event of a cancellation, the company would be liable for the cost and expenses incurred to date as well as any close out costs of the service arrangement.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements as defined in the rules and regulations of the SEC.

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of the financial condition and results of operations is based on our financial statements, which have been prepared in accordance with GAAP. The preparation of our financial statements requires us to make certain estimates, judgements and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, as well as the reported amounts of revenues and expenses during the periods presented. We believe that the estimates, judgments and assumptions are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. To the extent there are material differences between these estimates, judgments or assumptions and actual results, our financial statements will be affected. Historically, revisions to our estimates have not resulted in a material change to our financial statements.

While our significant accounting policies are described in more detail in the notes to our financial statements, we believe the following accounting policies to be most critical to the judgments and estimates used in the preparation of our financial statements.

Prepaid and Accrued Research and Development Expenses

As part of the process of preparing our financial statements, we are required to estimate our prepaid and accrued research and development expenses. This process involves reviewing open contracts and purchase orders, communicating with our personnel to identify services that have been performed on our behalf and estimating the level of service performed and the associated cost incurred for the service when we have not yet been invoiced or otherwise notified of the actual cost. We make estimates of our prepaid and accrued research and development expenses as of each balance sheet date in our financial statements based on facts and circumstances known to us at the time.

Although we do not expect our estimates to be materially different from amounts actually incurred, if our estimates of the status and timing of services performed differ from the actual status and timing of services performed, we may report amounts that are too high or too low in any particular period. To date, there have been no material differences between our estimates and amounts actually incurred.

Preferred Stock Warrants Liability

LENZ OpCo had freestanding warrants to purchase shares of Series A convertible preferred stock, referred to herein as the Series A Warrants. Upon certain change in control events that were outside of LENZ OpCo's control, including liquidation, sale or transfer of control, holders of the preferred stock could cause redemption of such

warrants. The Series A Warrants are revalued at each subsequent balance sheet date, with fair value changes recognized as increases or reductions to other income (expense), net in the accompanying statements of operations. See Note 3 to our audited financial statements for information concerning certain of the specific assumptions we used in determining the value of the Series A Warrants at each reporting period. Upon completion of the Merger, the Series A Warrants became exercisable into shares of the Common Stock and will no longer continue to be remeasured at each reporting date.

Stock-Based Compensation Expense

Stock-based compensation expense represents the cost of the grant date fair value of equity awards recognized over the requisite service period of the awards (usually the vesting period) on a straight-line basis. We estimate the fair value of equity awards using the Black-Scholes option pricing model and recognize forfeitures as they occur. Estimating the fair value of equity awards as of the grant date using valuation models, such as the Black-Scholes option pricing model, is affected by assumptions regarding a number of variables, including the risk-free interest rate, the expected stock price volatility, the expected term of stock options, the expected dividend yield and the fair value of the underlying common stock on the date of grant. Changes in the assumptions can materially affect the fair value and ultimately how much stock-based compensation expense is recognized. These inputs are subjective and generally require significant analysis and judgment to develop. See Note 10 to our audited financial statements for information concerning certain of the specific assumptions we used in applying the Black-Scholes option pricing model to determine the estimated fair value of our stock options granted, if any, during the years ended December 31, 2022 and 2023.

Common Stock Valuations

LENZ OpCo was required to estimate the fair value of the common stock underlying its equity awards when performing fair value calculations. The fair value of the common stock underlying such equity awards was determined on the grant date by the LENZ OpCo board of directors considering the most recently available third-party valuations of LENZ OpCo common stock and the LENZ OpCo board of directors’ assessment of additional objective and subjective factors that it believed were relevant, and factors that may have changed from the date of the most recent valuation through the date of the grant. All options were intended to be granted with an exercise price per share no less than the fair value per share of common stock underlying those options on the date of grant, based on the information known to the LENZ OpCo board of directors on the date of grant. In the absence of a public trading market for the LENZ OpCo common stock prior to the Merger, on each grant date LENZ OpCo developed an estimate of the fair value of our common stock in order to determine an exercise price for the option grants.

The various objective and subjective factors the LENZ OpCo board of directors considered, along with input from management, to determine the fair value of the LENZ OpCo common stock, included:

•valuations of the LENZ OpCo common stock performed by independent third-party valuation specialists;

•LENZ OpCo's stage of development and business strategy, including the status of research and development efforts of its platforms, programs and product candidates, and the material risks related to its business and industry;

•LENZ OpCo's results of operations and financial position, including levels of available capital resources;

•the valuation of publicly traded companies in the life sciences and biotechnology sectors, as well as recently completed mergers and acquisitions of peer companies;

•the lack of marketability of the LENZ OpCo common stock as a private company;

•the prices of LENZ OpCo convertible preferred stock sold to investors in arm’s length transactions and the rights, preferences, and privileges of LENZ OpCo convertible preferred stock relative to those of LENZ OpCo common stock;

•the likelihood of achieving a liquidity event for the holders of LENZ OpCo common stock, such as an initial public offering or a sale of the company, given prevailing market conditions;

•trends and developments in LENZ OpCo's industry; and

•external market conditions affecting the life sciences and biotechnology industry sectors.

Prior to the Merger, determinations of the fair value of LENZ OpCo common stock have included the consideration by the LENZ OpCo board of directors of valuations prepared by an independent third-party valuation specialist using methodologies, approaches and assumptions consistent with the American Institute of Certified Public Accountants Accounting and Valuation Guide: Valuation of Privately Held Company Equity Securities Issued as Compensation (the “Practice Aid”).

The Practice Aid prescribes several valuation approaches for setting the value of an enterprise, such as the cost, income and market approaches, and various methodologies for allocating the value of an enterprise to the LENZ OpCo common stock. The cost approach establishes the value of an enterprise based on the cost of reproducing or replacing the property less depreciation and functional or economic obsolescence, if present. The income approach establishes the value of an enterprise based on the present value of future cash flows that are reasonably reflective of LENZ OpCo's future operations, discounting to the present value with an appropriate risk adjusted discount rate or capitalization rate. The market approach is based on the assumption that the value of an asset is equal to the value of a substitute asset with the same characteristics. Each valuation methodology was considered in LENZ OpCo's valuations.

The Practice Aid also identifies various available methods for allocating enterprise value across classes and series of capital stock to determine the estimated fair value of common stock at each valuation date. In accordance with the Practice Aid, the LENZ OpCo board of directors considered the following methods:

•Probability-weighted expected return method (“PWERM”). The PWERM is a scenario-based analysis that estimates the fair value of common stock based upon an analysis of future values for the business, assuming various outcomes. The common stock value is based on the probability-weighted present value of expected future investment returns considering each of the possible forecasted outcomes as well as the rights of each class of stock. The future value of the common stock under each outcome is discounted back to the valuation date at an appropriate risk-adjusted discount rate and probability weighted to arrive at a non-marketable indication of value for the common stock.

•Option Pricing Method (“OPM”). Under the OPM, shares are valued by creating a series of call options, representing the present value of the expected future returns to the stockholders, with exercise prices based on the liquidation preferences and conversion terms of each equity class. The estimated fair values of the preferred and common stock are inferred by analyzing these options.

•Hybrid Return Method. The hybrid return method is a blended approach using aspects of both the PWERM and OPM, in which the equity value in one of the scenarios is calculated using an OPM.

LENZ OpCo generally estimated the enterprise value of its business using a market approach. For each of the valuations conducted as of October 30, 2020, May 1, 2022 and October 31, 2022, LENZ OpCo used the precedent transaction method (one of the three general methodologies of the market approach) to determine enterprise value. The precedent transaction method considers the sale price of shares in a recent financing and then back- solves using an option pricing model that gives consideration to the company's capitalization structure and rights of the preferred and common stockholders as well as an assumption for a discount for lack of marketability (“DLOM”). For the March 6, 2023, June 30, 2023, and September 6, 2023 valuations, LENZ OpCo examined two scenarios to estimate enterprise value: (1) the “IPO Scenario,” which represents the future value of LENZ OpCo common stock upon an initial public offering, based on certain assumptions, and then risk-adjusts to estimate the present value of LENZ OpCo's common stock excluding any DLOM, and (2) the “Stay Private Scenario,” in which LENZ OpCo would remain an independent and private company and for which it used the precedent transaction method including a DLOM. We then probability weighted the valuations for the IPO Scenario and the Stay Private Scenario to estimate enterprise value.

Given the uncertainty associated with both the timing and type of any future exit scenario, and based on LENZ OpCo's stage of development and other relevant factors, for the valuations conducted as of October 30, 2020, May 1, 2022, and October 31, 2022, LENZ OpCo concluded that the OPM was most appropriate for allocating enterprise value. LENZ OpCo believed the OPM was the most appropriate given the expectation of various potential liquidity outcomes and the difficulty of selecting and supporting appropriate enterprise values given LENZ OpCo's early stage of development. Under the OPM, shares are valued by creating a series of call options with exercise prices based on the liquidation preferences and conversion terms of each equity class. The values of LENZ OpCo's preferred stock and common stock are inferred by analyzing these options. For the valuations conducted as of March 6, 2023, June 30, 2023, and September 6, 2023, LENZ OpCo determined to allocate enterprise value using the hybrid return method, which is a hybrid between PWERM and OPM and estimates the probability weighted value across multiple scenarios but uses the OPM to estimate the allocation of value within one or more of those scenarios. The hybrid method is useful when certain discrete future outcomes can be predicted, but also accounts for uncertainty regarding the timing or likelihood of specific alternative exit events.

The assumptions underlying these valuations represented LENZ OpCo management’s best estimates, which involved inherent uncertainties and the application of management’s judgment. As a result, if LENZ OpCo had used significantly different assumptions or estimates, the fair value of LENZ OpCo's common stock and LENZ OpCo's stock-based compensation expense could have been materially different. Following the closing of the Merger, our board of directors will determine the fair value of our common stock based on our closing price as reported on the date of grant on the primary stock exchange on which our common stock is traded.

Other Company Information

Jumpstart Our Business Startups Act (“JOBS Act”)

We will be an emerging growth company, as defined in the JOBS Act, and we may remain an emerging growth company until the last day of the fiscal year following the fifth anniversary of the initial public offering of Graphite’s common stock. For so long as we remain an emerging growth company, we are permitted and intend to rely on certain exemptions from various public company disclosure and reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. In particular, we have provided only two years of audited financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may not be comparable with the information stockholders receive from other public companies in which they may hold stock.

Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards apply to private companies. Prior to the Merger, Graphite has elected to use, and we intend to continue to use, this extended transition period for complying with certain or new or revised accounting standards until the earlier of (i) the last day of the fiscal year (a) following the fifth anniversary of the closing of Graphite's initial public offering, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the prior June 30th, (ii) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period, or (iii) if we affirmatively and irrevocably opt out of the extended transition period provided by the JOBS Act.