Table of Contents

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Brian T. Casey, Esq. Locke Lord LLP Terminus 200, Suite 2000 3333 Piedmont Road, NE Atlanta, GA 30305 (404) 870-4600 |

Michael J. Kessler, Esq. David E. Brown, Esq. Alston & Bird LLP 90 Park Avenue New York, NY 10016 (202) 239-3300 |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

☒ |

Smaller reporting company |

|||||

Emerging growth company |

||||||

Table of Contents

This preliminary prospectus relates to a registration statement under the Securities Act of 1933 but is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated September 29, 2023.

PRELIMINARY PROSPECTUS

Up to $60,000,000

% Fixed Rate Senior Notes due 2028

Abacus Life, Inc., a Delaware corporation (“Abacus” or the “Company”), is offering up to $60,000,000 aggregate principal amount of Fixed Rate Senior Notes (the “notes”). The notes will bear interest at the rate of % per annum, payable quarterly in arrears on March 30, June 30, September 30 and December 30 of each year, beginning on December 30, 2023 and ending on the maturity date. The notes will mature on September 30, 2028 (the “maturity date”).

The Company may, at its option, redeem the notes in whole or in part at any time or from time to time on or after September 30, 2025 at a redemption price of 100% of the outstanding principal amount of the notes to be redeemed plus accrued and unpaid interest payments otherwise payable thereon for the then-current quarterly interest period accrued to, but excluding, the date fixed for redemption as further described under “Description of the Notes—Optional Redemption.” In addition, each holder of the notes may require the Company to repurchase all or a portion of such holder’s notes at a purchase price equal to 100% of their principal amount, plus accrued and unpaid interest thereon, if any, to, but excluding, the date of repurchase as further described under “Description of the Notes-Offer to Repurchase Upon a Change of Control Repurchase Event.” The notes will not be entitled to any sinking fund.

The notes will be senior unsecured obligations of the Company and will rank equal in right of payment to all of the Company’s other senior unsecured indebtedness from time to time outstanding (including the Company’s $10.5 million Amended and Restated Unsecured Senior Promissory Note, dated as of July 5, 2023). Because the notes will not be secured by any of the Company’s assets, they will be effectively subordinated to any future secured indebtedness of the Company to the extent of the value of the assets securing such indebtedness. The notes will be structurally subordinated to all existing and future indebtedness and other obligations of any of the Company’s subsidiaries because the notes will be obligations exclusively of the Company and will not be guaranteed by any of the Company’s subsidiaries.

The notes will be issued only in registered book-entry form, in minimum denominations of $25 and integral multiples of $25 in excess thereof. The Company intends to list the notes on the Nasdaq Capital Market® (“NASDAQ”) within 30 days of the original issue date under the trading symbol “ .” Currently, there is no public market for the notes and there can be no assurance that one will develop.

Investing in the notes involves risks. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of risks that you should consider in connection with an investment in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes nor have any of the foregoing authorities determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Note |

Total(2) | |||||||

| Price to Public(1) |

$ | 60,000,000 | ||||||

| Underwriting discount |

||||||||

| Proceeds, before expenses, to the Company |

||||||||

| Total |

$ | 60,000,000 | ||||||

| (1) | Plus accrued interest, if any, from , 2023. |

| (2) | We have granted the underwriters an option to purchase up to an additional $ aggregate principal amount of the notes, solely to cover overallotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total public offering price will be $ , the total underwriting discounts and commissions paid by us will be $ , and total proceeds, before expenses, to us will be $ . |

The underwriters expect to deliver the notes in book-entry only form through the facilities of The Depository Trust Company on or about October , 2023, which is the fifth business day following the pricing of the Notes.

| Piper Sandler |

The date of this prospectus is , 2023

Table of Contents

Neither we nor the underwriters have authorized any other person to provide you with any information other than that contained or incorporated by reference in this prospectus. Neither we nor the underwriters take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you.

We are not, and the underwriters are not, making an offer to sell the notes in any jurisdiction where the offer or sale is not permitted. This prospectus does not constitute an offer of, or an invitation on our behalf or on behalf of the underwriters to subscribe for and purchase, any securities, and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. You should assume that the information contained in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Table of Contents

TABLE OF CONTENTS

Prospectus

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 10 | ||||

| 30 | ||||

| CAPITALIZATION OF ABACUS LIFE AND ITS CONSOLIDATED SUBSIDIARIES |

31 | |||

| 32 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

40 | |||

| 80 | ||||

| 94 | ||||

| 100 | ||||

| 107 | ||||

| 109 | ||||

| 110 | ||||

| 118 | ||||

| 120 | ||||

| 126 | ||||

| 130 | ||||

| 131 | ||||

| 132 | ||||

i

Table of Contents

INFORMATION ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 (File No. 333- ). As permitted by SEC rules, this prospectus does not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits. Statements contained in this prospectus about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

You should read this prospectus together with any additional information you may need to make your investment decision. You should also read and carefully consider the information in the documents we have referred you to in “Where You Can Find Additional Information” below. Neither we nor the underwriters have authorized any other person to provide you with any information other than that contained in this prospectus. Neither we nor the underwriters take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you.

References in this prospectus to “Abacus,” “the Company,” “we,” “us,” and “our” refer to Abacus Life, Inc. (formerly known as East Resources Acquisition Company), and not to any of its consolidated subsidiaries, unless otherwise specified or as the context otherwise requires.

1

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of the Company. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are based on the beliefs and assumptions of the management of the Company. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “predicts,” “projects,” “forecasts,” “may,” “might,” “will,” “could,” “should,” “would,” “seeks,” “plans,” “scheduled,” “possible,” “continue,” “potential,” “anticipates” or “intends” or similar expressions; provided that the absence of these does not means that a statement is not forward-looking. Forward-looking statements contained in this prospectus include, but are not limited to, statements about the ability of the Company to:

| • | realize the benefits expected from the previously disclosed business combination (the “Business Combination”) and related transactions consummated by the Company on June 30, 2023; |

| • | maintain the listing of the Company on a securities exchange; |

| • | achieve projections and anticipate uncertainties relating to the business, operations and financial performance of the Company, including: |

| • | expectations with respect to financial and business performance, including financial projections and business metrics and any underlying assumptions thereunder; |

| • | expectations regarding product development and pipeline; |

| • | expectations regarding market size; |

| • | expectations regarding the competitive landscape; |

| • | expectations regarding future acquisitions, partnerships or other relationships with third parties; and |

| • | future capital requirements and sources and uses of cash, including the ability to obtain additional capital in the future. |

| • | develop, design and sell services that are differentiated from those of competitors; |

| • | retain and hire necessary employees; |

| • | attract, train and retain effective officers, key employees or directors; |

| • | enhance future operating and financial results; |

| • | comply with laws and regulations applicable to its business; |

| • | stay abreast of modified or new laws and regulations applying to its business, including privacy regulation; |

| • | anticipate the impact of, and response to, new accounting standards; |

| • | anticipate the significance and timing of contractual obligations; and |

| • | maintain key strategic relationships with partners and customers. |

2

Table of Contents

SUMMARY

This summary highlights selected information included in this prospectus and does not contain all of the information that may be important to you. You should read the entire prospectus and the other documents to which we refer before you decide to invest.

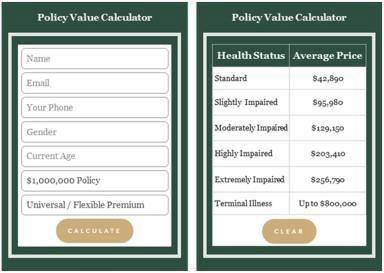

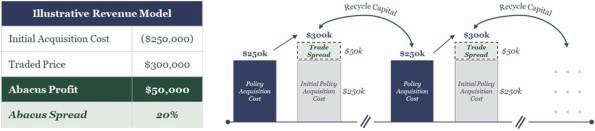

Overview of the Company

Abacus Life, Inc. is composed of two principal operating subsidiaries, Abacus Settlements, LLC (“Abacus Settlements”) and Longevity Market Assets, LLC (“LMA”). These principal operating subsidiaries comprise a leading vertically integrated alternative asset manager specializing in investing in inforce life insurance products throughout the lifecycle of a life insurance policy. As an alternative asset manager, the Company focuses on originating, holding and servicing life insurance policies. The Company purchases life insurance policies from consumers seeking liquidity and actively manages those policies over time (via trading, holding and/or servicing). To date, the Company has purchased over $2.9 billion in policy value and has helped thousands of clients maximize the value of their life insurance policies.

The mailing address of the Company’s principal executive office is 2101 Park Center Drive, Suite 170, Orlando, Florida 32835 and the telephone number of the Company’s principal executive office is 800-561-4148.

Summary of Historical Financial Data for LMA

The summary of historical statements of income data of LMA for the years ended December 31, 2022 and 2021 and the historical balance sheet data as of December 31, 2022 and December 31, 2021 are derived from LMA’s audited financial statements included elsewhere in this prospectus. The summary historical statements of income data of LMA for the six months ended June 30, 2023 and 2022 and the balance sheet data as of June 30, 2023 and 2022 are derived from LMA’s unaudited interim condensed financial statements included elsewhere in this prospectus.

LMA’s historical results are not necessarily indicative of the results that may be expected in the future. The information below is only a summary and should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, and the notes and schedules related thereto, which are included elsewhere in this prospectus.

| As of and for the six months ended June 30, 2023 |

As of and for the six months ended June 30, 2022 |

As of and for the year ended December 31, 2022 |

As of and for the year-ended December 31, 2021 |

|||||||||||||

| Statement of Income Data: |

||||||||||||||||

| Total revenue |

$ | 21,584,974 | $ | 18,276,299 | $ | 44,713,553 | $ | 1,199,986 | ||||||||

| Total cost of revenue |

1,462,950 | 2,086,075 | 6,245,131 | 735,893 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

20,122,024 | 16,190,224 | 38,468,422 | 464,093 | ||||||||||||

| Sales, general, administrative, and depreciation |

2,689,417 | 2,298,344 | 3,666,826 | 597,702 | ||||||||||||

| Change in fair value of debt |

2,398,662 | 375,513 | 90,719 | — | ||||||||||||

| Unrealized loss on investments |

(798,156 | ) | 1,054,975 | 1,045,623 | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

15,832,101 | 12,461,392 | 33,665,255 | (133,609 | ) | |||||||||||

| Other (expense) income Other (expense) |

(21,651 | ) | (242,247 | ) | (347,013 | ) | — | |||||||||

| Interest (expense) |

(941,458 | ) | — | (42,798 | ) | — | ||||||||||

| Interest income |

7,457 | — | 1,474 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) |

(955,652 | ) | (242,247 | ) | (388,337 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

14,876,449 | 12,219,145 | 33,276,917 | (133,609 | ) | |||||||||||

| Provision for Income taxes (benefit) |

(528,104 | ) | (296,806 | ) | 889,943 | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

3

Table of Contents

| As of and for the six months ended June 30, 2023 |

As of and for the six months ended June 30, 2022 |

As of and for the year ended December 31, 2022 |

As of and for the year-ended December 31, 2021 |

|||||||||||||

| Less: Net Income (Loss) attributable to Noncontrolling Interest |

(487,303 | ) | 406,641 | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net and Comprehensive Income (loss) |

$ | 14,835,648 | $ | 11,515,698 | $ | 32,386,975 | $ | (133,609 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance Sheet Data: |

||||||||||||||||

| Total assets |

$ | 277,334,437 | $ | 22,933,083 | $ | 59,094,847 | $ | 1,840,218 | ||||||||

| Total liabilities |

116,835,522 | 10,626,292 | 30,945,150 | 1,073,325 | ||||||||||||

| Total members’ equity |

160,498,915 | 12,306,791 | 28,149,697 | 766,893 | ||||||||||||

Summary of Historical Financial Data for Abacus Settlements

The summary historical statements of income data of Abacus Settlements for the years ended December 31, 2022 and 2021 and the historical balance sheet data as of December 31, 2022 and December 31, 2021 are derived from Abacus Settlement’s audited financial statements included elsewhere in this prospectus. The summary historical statements of income data of Abacus Settlements for the three months ended June 30, 2023 and 2022 and the balance sheet data as of June 30, 2023 and 2022 are derived from our unaudited interim financial statements included elsewhere in this prospectus.

Abacus Settlement’s historical results are not necessarily indicative of the results that may be expected in the future. The information below is only a summary and should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, and the notes and schedules related thereto, which are included elsewhere in this prospectus.

| As of and for the six months ended June 30, 2023 |

As of and for the six months ended June 30, 2022 |

As of and for the year ended December 31, 2022 |

As of and for the year-ended December 31, 2021 |

|||||||||||||

| Statement of Income Data: |

||||||||||||||||

| Total revenue |

$ | 13,184,676 | $ | 13,014,664 | $ | 25,203,463 | $ | 22,592,144 | ||||||||

| Total cost of revenue |

9,293,303 | 8,787,625 | 16,561,005 | 14,205,341 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

3,891,373 | 4,227,039 | 8,642,458 | 8,386,803 | ||||||||||||

| Operating Expenses |

4,854,177 | 3,954,346 | 8,686,590 | 7,449,688 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

(962,804 | ) | 272,693 | (44,132 | ) | 937,115 | ||||||||||

| Other (expense) income |

||||||||||||||||

| Interest income |

1,917 | 1,147 | 2,199 | 10,870 | ||||||||||||

| Interest (expense) |

(11,725 | ) | — | (8,817 | ) | — | ||||||||||

| Consulting income . . . . . . . . . . . . . . . |

— | — | 273 | 50,000 | ||||||||||||

| Other income . . . . . . . . . . . . . . . . . . . |

— | 273 | — | 630 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income . . . . . |

(9,808 | ) | 1,420 | (6,345 | ) | 61,500 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

(972,612 | ) | 274,113 | (50,477) | 998,615 | |||||||||||

| Provision for Income taxes. |

2,289 | 1,325 | 2,018 | 1,200 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | (974,901 | ) | $ | 272,788 | $ | (52,495 | ) | $ | 997,415 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance Sheet Data: |

||||||||||||||||

| Total assets |

— | $ | 3,666,138 | $ | 3,215,812 | $5,291,997 | ||||||||||

| Total liabilities |

— | 1.330.224 | 1,204,675 | 2,569,002 | ||||||||||||

| Total members’ equity |

— | 2.335.914 | 2,011,137 | 2,722,995 | ||||||||||||

4

Table of Contents

Risk Factors Summary

| • | The notes will be unsecured and therefore are effectively subordinated to any secured indebtedness we have incurred or may incur in the future. |

| • | The notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries. |

| • | The indenture under which the notes are issued contains limited protection for holders of the notes. |

| • | There is no existing trading market for the notes, and, even if NASDAQ approves the listing of the notes, an active trading market for the notes may not develop, which could limit your ability to sell the notes or the market price of the notes. |

| • | We may choose to redeem the notes when prevailing interest rates are relatively low. |

| • | An increase in interest rates could result in a decrease in the fair value of the notes. |

| • | A downgrade, suspension or withdrawal of any credit rating assigned by a rating agency to us or the notes or change in the debt markets could cause the liquidity or market value of the notes to decline significantly. |

| • | If we default on our obligations to pay our other indebtedness, we may not be able to make payments on the notes. |

| • | We may not be able to repurchase the notes upon a Change of Control Repurchase Event. |

| • | The Company has entered into certain credit agreements. Each of these agreements limit the Company’s ability to enter into further credit facilities or take on additional debt which could result in additional financial strain on the Company. |

| • | The Company’s valuation of certain life insurance policies is tied to their actual maturity date and any erroneous valuations could have a material adverse impact on the Company’s business. |

| • | The Company could fail to accurately forecast life expectancies. There may also be changes to life expectancies generally, which could result in a lower return on the Company’s life settlement policies. |

| • | The Company’s policy acquisitions are limited by the market availability of life insurance policies that meet the Company’s eligibility criteria and purchase parameters; failure to secure a sufficient number of quality life insurance policies could have a material adverse effect on the Company’s business. |

| • | The Company may experience increased competition from originating life insurance companies, life insurance brokers, and investment funds which could adversely affect the Company’s business. |

| • | Historically, there has been a negative public perception of the life settlement industry that could affect the value and/or liquidity of the Company’s investments and the life settlement industry faces political opposition from life insurance companies which could adversely affect the Company’s business. |

| • | The Company or third parties the Company relies upon could fail to accurately evaluate, acquire, maintain, track, or collect on life settlement policies, which could adversely affect the Company. |

| • | There is a risk of fraud in the origination of the original life insurance policy or in subsequent sales of the life insurance policy that could adversely affect the Company’s returns. |

| • | The Company may become subject to claims by life insurance companies, individuals and their families, or regulatory authorities. |

| • | If the life settlements in which the Company invests were to become regulated as securities, further compliance with federal and state securities laws would be required, which could result in significant additional regulatory burdens on the Company and limit the Company’s investments. |

5

Table of Contents

| • | The Company faces privacy and cyber security risks related to its maintenance of proprietary information, including information regarding life settlement policies and the related insureds, and any adverse impact related to such risks could have a material adverse impact on the Company’s business. |

| • | The Company is subject to U.S. privacy laws and regulations. Failure to comply with such obligations could lead to regulatory investigations or actions; litigation; fines and penalties; disruptions of operations; reputational harm; loss of revenue or profits; and other adverse business consequences. |

| • | The Company’s business may be subject to additional or different government regulation in the future, which could have a material adverse impact on the Company’s business. |

| • | There is currently no direct legal authority regarding the proper federal tax treatment of life settlements and potential future rulings from the Internal Revenue Service (“IRS”) may have significant tax consequences on the Company. |

| • | There have been lawsuits in various states questioning whether a purchaser of a life insurance policy has the requisite “insurable interest” in the policy which would permit the purchaser to collect the insurance benefits and an adverse finding in any of these lawsuits could have a material adverse effect on the Company’s business. |

| • | The failure of the Company to accurately and timely track and pay premium payments on the life insurance policies it holds could result in the lapse of such policies which would have a material adverse impact on the Company’s business. |

| • | The originating life insurance company may increase the cost of insurance premiums, which would adversely affect the Company’s returns. |

| • | The Company may not be able to liquidate its life insurance policies which could have a material adverse effect on the Company’s business. |

| • | The Company assumes the credit risk associated with life insurance companies and may not be able to realize the full value of insurance company payouts. |

| • | The Company’s success is dependent upon the services of its management and employees. If the Company is unable to such individuals, its ability to compete could be harmed. |

| • | The Company’s intellectual property rights may not adequately protect the Company’s business. |

| • | The Company may become subject to costly intellectual property disputes. |

| • | The ongoing COVID-19 pandemic, along with rising interest rates and inflation, may disrupt the ability of the Company and its providers to originate life settlement policies which could have a material adverse impact on the Company’s financial position. |

| • | We have identified material weaknesses in our internal control over financial reporting. If our remediation of these issues is not effective, or if we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to accurately or timely report our financial condition or results of operations. |

| • | If we do not develop and implement all required accounting practices and policies, we may be unable to provide the financial information required of a public company in a timely and reliable manner. |

| • | Our ability to raise capital in the future may be limited, or may be unavailable on acceptable terms, if at all. Debt issued to raise additional capital could affect our ability to execute our investment strategy or impact the value of our investments. |

| • | Our management has limited experience in operating a public company. |

6

Table of Contents

THE OFFERING

The following is a brief summary of certain terms of this offering. For a more complete description of the terms of the notes, see “Description of the Notes” in this prospectus.

| Issuer | Abacus Life, Inc., a Delaware corporation. | |

| Title of the securities | % Fixed Rate Senior Notes due 2028 (the “notes”). | |

| Initial aggregate principal amount being offered | $60,000,000 | |

| Overallotment option | The underwriters may also purchase from us up to an additional $ aggregate principal amount of notes solely to cover overallotments, if any, within 30 days of the date of this prospectus. | |

| Principal payable at maturity | 100% of the aggregate principal amount. The outstanding principal amount of the notes will be payable on the stated maturity date at the office of the trustee, paying agent and security registrar for the notes or at such other office as we may designate. | |

| Maturity date | The notes will mature on September 30, 2028. | |

| Interest rate | % per annum. | |

| Interest periods | The initial interest period will be the period from and including the issue date, to, but excluding, the initial interest payment date, and the subsequent interest periods will be the periods from and including an interest payment date to, but excluding, the next interest payment date or the stated maturity date, as the case may be. | |

| Interest payment dates | Each March 30, June 30, September 30 and December 30, beginning on December 30, 2023 and ending on the maturity date. If an interest payment date falls on a non-business day, the applicable interest payment will be made on the next business day and no additional interest will accrue as a result of such delayed payment. | |

| Interest day count convention | Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. | |

| Record dates | Interest will be paid to the person in whose name a note is registered at the close of business on the 15th calendar day (whether or not a Business Day) preceding the related date an interest payment is due with respect to such note; provided that if the notes are global notes held by DTC, the record date for such notes will be the close of business on the Business Day preceding the applicable interest payment date. | |

| No guarantees | The notes are not guaranteed by any of the Company’s subsidiaries. As a result, the notes will be structurally subordinated to the liabilities of the Company’s subsidiaries as discussed below under “Ranking.” | |

7

Table of Contents

| Ranking | The notes will be the Company’s senior unsecured obligations and will rank: (i) equal in right of payment to the Company’s other outstanding and future senior unsecured indebtedness (including the Company’s $10.5 million Amended and Restated Unsecured Senior Promissory Note, dated as of July 5, 2023); (ii) senior to any of the Company’s existing and future indebtedness that expressly provides it is subordinated to the notes (including the Company’s indebtedness under its SPV Investment Facility, dated as of July 5, 2023); (iii) effectively subordinated to all of the Company’s existing and future secured indebtedness (including indebtedness that is initially unsecured to which the Company subsequently grants security), to the extent of the value of the assets securing such indebtedness; and (iv) structurally subordinated to all existing and future indebtedness and other obligations of any of the Company’s subsidiaries.

As of , 2023, the Company had approximately $ million in principal amount of other senior unsecured long-term debt outstanding, $ of which will be repaid with the proceeds of this offering, and approximately $ million in principal amount of subordinated long-term debt outstanding. | |

| Optional redemption | The notes may be redeemed in whole or in part at any time or from time to time at the Company’s option on or after September 30, 2025, upon not less than 15 days nor more than 60 days written notice to holders prior to the date fixed for redemption thereof, at a redemption price of 100% of the outstanding principal amount of the notes to be redeemed plus accrued and unpaid interest payments otherwise payable for the then-current quarterly interest period accrued to, but not including, the date fixed for redemption.

You may be prevented from exchanging or transferring the notes when they are subject to redemption. Any exercise of our option to redeem the notes will be done in compliance with the Indenture.

If the Company redeems only some of the notes by partial redemption, the global notes shall be selected in accordance with applicable rules and procedures of the Depository Trust Company (“DTC”), or in the case of certificated notes, any other method in accordance with the policies and procedures of the trustee. Unless we default in payment of the redemption price, on and after the date of redemption, interest will cease to accrue on the notes called for redemption. | |

| Change of control offer to repurchase | If the Company is subject to a Change of Control Repurchase Event, each holder of the Notes may require the Company to purchase all or a portion of such holder’s notes at a price equal to 100% of their principal amount, plus accrued and unpaid interest thereon, if any, to, but excluding, the date of purchase. | |

| Repayment at holder’s option | The notes will not be subject to repayment at the option of the holder at any time prior to the maturity date, except as set forth under “Description of the Notes-Offer to Repurchase Upon a Change of Control Repurchase Event” and will not be entitled to any sinking fund. | |

8

Table of Contents

| Use of proceeds | The net proceeds from the offering will be approximately $ million, after deducting the discounts and commissions payable to the underwriters and estimated offering expenses payable by us. The Company intends to use these proceeds for to refinance outstanding debt, which will include the Owl Rock Credit Facility, with the remained used for general corporate purposes. For further information, see “Use of Proceeds” in this prospectus. | |

| Form and denomination | The notes will be issued as fully registered global notes which will be deposited with, or on behalf of, the DTC and registered, at the request of DTC, in the name of Cede & Co. Beneficial interests in the global notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as participants in DTC. Beneficial interests in the global notes must be held in minimum denominations of $25 or any amount in excess thereof which is an integral multiple of $25. | |

| Further issuances | The amount of debt securities the Company can issue under the Indenture is unlimited. The Company will issue notes in the initial aggregate principal amount of $ ($ if the underwriters’ overallotment option is exercised in full). However, the Company may, without your consent and without notifying you, create and issue further notes, which notes may be consolidated and form a single series with the series of notes offered by this prospectus and may have the same terms as to interest rate, maturity, covenants or otherwise; provided that if any such additional notes are not fungible with the notes for U.S. federal income tax purposes, such additional notes will have a separate CUSIP or other identifying number. | |

| Events of default | For a discussion of events that will permit acceleration of the payment of the principal of the notes, see “Description of the Notes—Events of Default; Waivers” in this prospectus. | |

| Indenture and trustee | The notes will be issued under an indenture, to be entered into with U.S. Bank Trust Company, National Association, as trustee, as supplemented by a supplemental indenture relating to the issuance of the notes. | |

| Governing law | The notes will be governed by and construed in accordance with the laws of the State of New York. | |

| Listing | We intend to list the notes on NASDAQ within 30 days of the issue date under the trading symbol “ .” | |

| Risk factors | An investment in the notes involves risks. You should carefully consider the information set forth in the section entitled “—Risk Factors” below, as well as other information included in this prospectus before deciding whether to invest in the notes. | |

9

Table of Contents

RISK FACTORS

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making an investment in our notes. Our business, financial condition, results of operations, or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our notes could decline and you could lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See the section titled “Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including those set forth below.

Risks Related to our Notes

The notes will be unsecured and therefore are effectively subordinated to any secured indebtedness we have incurred or may incur in the future.

The notes will not be secured by any of our assets or any of the assets of our subsidiaries, including our wholly owned subsidiaries. As a result, the notes will be effectively subordinated to all of our existing and future secured indebtedness (including indebtedness that is initially unsecured to which we subsequently grant security), to the extent of the value of the assets securing such indebtedness. As of June 30, 2023, the Company and its subsidiaries had long-term debt with a fair market value of $66,165,396. Because the notes will not be secured by any of our assets, they will be effectively subordinated to any secured indebtedness we may incur in the future (or any indebtedness that is initially unsecured to which we subsequently grant security), to the extent of the value of the assets securing such indebtedness. In any liquidation, dissolution, bankruptcy or other similar proceeding, the holders of any of our future secured indebtedness may assert rights against the assets pledged to secure that indebtedness in order to receive full payment of their indebtedness before the assets may be used to pay other creditors, including the holders of the notes.

The notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries.

The notes will be obligations exclusively of the Company, and will not be of any of our subsidiaries. None of our subsidiaries will be a guarantor of the notes and the notes are not required to be guaranteed by any subsidiary we may acquire or create in the future. Any assets of our subsidiaries will not be directly available to satisfy the claims of our creditors, including holders of the notes. Except to the extent we are a creditor with recognized claims against our subsidiaries, all claims of creditors of our subsidiaries will have priority over our equity interests in such entities (and therefore the claims of our creditors, including holders of the notes) with respect to the assets of such entities. Even if we are recognized as a creditor of one or more of these entities, our claims would still be effectively subordinated to any security interests in the assets of any such entity and to any indebtedness or other liabilities of any such entity senior to our claims. Consequently, the notes will be structurally subordinated to all indebtedness and other liabilities of any of our subsidiaries and portfolio companies with respect to which we hold equity investments. As of June 30, 2023, the Company and its subsidiaries had long-term debt with a fair market value of $66,165,396. In addition, the Company and its subsidiaries may incur substantial indebtedness in the future, all of which would be structurally senior to the notes.

The indenture under which the notes are issued contains limited protection for holders of the notes.

The indenture under which the notes are issued offers limited protection to holders of the notes. The terms of the indenture and the notes do not restrict our or any of our subsidiaries’ ability to engage in, or otherwise be a party to, a variety of corporate transactions, circumstances or events that could have a material adverse impact on your investment in the notes. In particular, the terms of the indenture and the notes do not place any restrictions on our or our subsidiaries’ ability to:

| • | issue securities or otherwise incur additional indebtedness or other obligations, including (1) any indebtedness or other obligations that would be equal in right of payment to the notes, (2) any |

10

Table of Contents

| indebtedness or other obligations that would be secured and therefore rank effectively senior in right of payment to the notes to the extent of the values of the assets securing such debt and (3) indebtedness of ours that is guaranteed by one or more of our subsidiaries and which therefore is structurally senior to the notes; |

| • | sell assets (other than certain limited restrictions on our ability to consolidate, merge or sell all or substantially all of our assets); |

| • | enter into transactions with affiliates; |

| • | create liens (including liens on the shares of our subsidiaries) or enter into sale and leaseback transactions; |

| • | make investments; or |

| • | create restrictions on the payment of dividends or other amounts to us from our subsidiaries. |

Furthermore, the terms of the indenture and the notes do not protect holders of the notes in the event that we experience changes (including significant adverse changes) in our financial condition, results of operations or credit ratings, if any, as they do not require that we adhere to any financial tests or ratios or specified levels of net worth, revenues, income, cash flow, or liquidity.

Our ability to recapitalize, incur additional debt and take a number of other actions that are not limited by the terms of the notes may have important consequences for you as a holder of the notes, including making it more difficult for us to satisfy our obligations with respect to the notes or negatively affecting the trading value of the notes.

Other debt we issue or incur in the future could contain more protections for its holders than the indenture and the notes, including additional covenants and events of default. The issuance or incurrence of any such debt with incremental protections could affect the market for and trading levels and prices of the notes.

There is no existing trading market for the notes, and, even if NASDAQ approves the listing of the notes, an active trading market for the notes may not develop, which could limit your ability to sell the notes or the market price of the notes.

The notes will be a new issue of debt securities for which there initially will not be a trading market. We intend to list the notes on NASDAQ within 30 days of the original issue date under the symbol “ .” However, there is no assurance that the notes will be approved for listing on NASDAQ.

Moreover, even if the listing of the notes is approved, we cannot provide any assurances that an active trading market will develop or be maintained for the notes or that you will be able to sell your notes. If the notes are traded after their initial issuance, they may trade at a discount from their initial offering price depending on prevailing interest rates, the market for similar securities, our credit ratings, if any, general economic conditions, our financial condition, performance and prospects and other factors. The underwriters have advised us that they intend to make a market in the notes, but they are not obligated to do so. The underwriters may discontinue any market-making in the notes at any time at their sole discretion.

Accordingly, we cannot assure you that the notes will be approved for listing on NASDAQ, that a liquid trading market will develop for the notes, that you will be able to sell your notes at a particular time or that the price you receive when you sell will be favorable. To the extent an active trading market does not develop, the liquidity and trading price for the notes may be harmed. Accordingly, you may be required to bear the financial risk of an investment in the notes for an indefinite period of time.

11

Table of Contents

We may choose to redeem the notes when prevailing interest rates are relatively low.

On or after , 2025, we may choose to redeem the notes from time to time, especially when prevailing interest rates are lower than the rate borne by the notes. If prevailing rates are lower at the time of redemption, you would not be able to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as the interest rate on the notes being redeemed. Our redemption right also may adversely impact your ability to sell the notes as the optional redemption date or period approaches.

An increase in interest rates could result in a decrease in the fair value of the notes.

In general, as market interest rates rise, notes bearing interest at a fixed rate generally decrease in value. Consequently, if you purchase these notes and market interest rates increase, the fair value of your notes will likely decrease. We cannot predict the future level of market interest rates.

A downgrade, suspension or withdrawal of any credit rating assigned by a rating agency to us or the notes or change in the debt markets could cause the liquidity or market value of the notes to decline significantly.

Any credit rating is an assessment by rating agencies of our ability to pay our debts when due. Consequently, real or anticipated changes in any credit ratings will generally affect the market value of the notes. These credit ratings may not reflect the potential impact of risks relating to the structure or marketing of the notes. Credit ratings are not a recommendation to buy, sell or hold any security, and may be revised or withdrawn at any time by the issuing organization in its sole discretion. Neither we nor any underwriter undertakes any obligation to obtain or maintain any credit ratings or to advise holders of notes of any changes in any credit ratings. There can be no assurance that any credit ratings will remain for any given period of time or that such credit ratings will not be lowered or withdrawn entirely by the rating agencies if in their judgment future circumstances relating to the basis of the credit ratings, such as adverse changes in our company, so warrant. The conditions of the financial markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future, which could have an adverse effect on the market price of the notes.

If we default on our obligations to pay our other indebtedness, we may not be able to make payments on the notes.

Any default under the agreements governing our indebtedness that is not waived by the required lenders and the remedies sought by the holders of such indebtedness could make us unable to pay principal, premium, if any, and interest on the notes and substantially decrease the market value of the notes. If we are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we otherwise fail to comply with the various covenants, including financial and operating covenants, in the instruments governing our indebtedness, we could be in default under the terms of the agreements governing such indebtedness, including the notes. In the event of such default, the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the other debt we may incur in the future could elect to terminate its commitment, cease making further loans and institute foreclosure proceedings against our assets and we could be forced into bankruptcy or liquidation. In addition, any such default may constitute a default under the notes, which could further limit our ability to repay our debt, including the notes. If our operating performance declines, we may in the future need to seek to obtain waivers from the lender under the other debt that we may incur in the future to avoid being in default. If we breach our covenants under the other debt and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under the other debt, the lender could exercise its rights as described above, and we could be forced into bankruptcy or liquidation. If we are unable to repay debt, lenders having secured obligations could proceed against the collateral securing the debt.

12

Table of Contents

We may not be able to repurchase the notes upon a Change of Control Repurchase Event.

Upon the occurrence of a Change of Control Repurchase Event, unless we have exercised our right to redeem the notes, each holder of the notes will have the right to require us to repurchase all or any part of such holder’s notes at a price equal to 100% of their principal amount of the notes to be repurchased, plus accrued and unpaid interest to, but excluding, the date of repurchase. If we experience a Change of Control Repurchase Event, there can be no assurance that we would have sufficient financial resources available to satisfy our obligations to repurchase the notes and any other indebtedness that may be required to be repaid or repurchased as a result of such event. A failure to repurchase the notes as required under the indenture would result in a default under the indenture, which could have material adverse consequences for us and the holders of the notes. See “Description of the Notes—Offer to Repurchase Upon a Change of Control Repurchase Event” herein.

On or about June 30, 2023, the Company entered into each of the Owl Rock Credit Facility, the SPV Purchase and Sale, including the Policy APA, and the SPV Investment Facility. Each of these agreements limits the Company’s ability to enter into further credit facilities or take on additional debt which could result in additional financial strain on the Company.

Owl Rock Credit Facility

On July 5, 2023, the Company entered into a Credit Agreement (the “Owl Rock Credit Facility”), among the Company, as borrower, the several banks and other persons from time to time party thereto (the “Owl Rock Lenders”), and Owl Rock Capital Corporation, as administrative and collateral agent for the Owl Rock Lenders thereunder.

The Owl Rock Credit Facility, among other things:

| • | requires Abacus Settlements and LMA and certain subsidiaries of Abacus Settlements and LMA to guarantee the loans to be provided under the Owl Rock Credit Facility pursuant to separate loan documentation; |

| • | provides credit extensions for (i) an initial term loan in an aggregate principal amount of $25.0 million upon the closing of the Owl Rock Credit Facility, and (ii) a delayed draw term loan in an aggregate principal amount of $25.0 million, with the delayed draw term loan drawn in a period between 90 and 120 days after the closing of the Owl Rock Credit Facility upon satisfaction of certain conditions precedent; |

| • | provides proceeds from the Owl Rock Credit Facility for working capital and the business requirements of the enterprise, and to fund acquisitions, investments and other transactions not prohibited by the loan documentation (with expected prohibitions related to, among other potential items, the use of such proceeds to pay transaction costs incurred in connection with the Business Combination); |

| • | contains a maturity date that shall be the date that is five years after the closing of the Owl Rock Credit Facility; |

| • | is secured by a first-priority security interest in substantially all of the assets of the Company and the subsidiary guarantors. No pledge of any equity interests in the Company shall be required by any holder of such equity interests; |

| • | provides for interest to accrue on such loans, at the election of the Company, by reference to either (i) an alternative base rate (such loans, “ABR Loans”) or (ii) an adjusted term SOFR rate (such loans, “SOFR Loans”) plus an applicable margin. The adjusted term SOFR rate is expected to be determined by the applicable term SOFR for a relevant interest period plus a credit spread adjustment of 0.10%, 0.15% and 0.25% per annum for interest periods of 1, 3 and 6 months, respectively. The applicable margin for each type of loan is expected to be (i) 6.25% per annum for any ABR Loans and (ii) 7.25% per annum for any SOFR Loans, with an expected interest period for SOFR Loans of one, three or six months (or other periods if agreed by all lenders); |

13

Table of Contents

| • | provides a default rate that will accrue at 2.00% per annum over the rate otherwise applicable; |

| • | provides for amortization payments based on the initial principal amount of the loans outstanding of 1.0% per year (0.25% due per quarter), with adjustments expected to be made to the overall amortization amount upon the incurrence of the delayed draw loans; |

| • | contains provisions requiring mandatory prepayment of the initial term loans and delayed draw term loans with 100% of the proceeds of (i) indebtedness not permitted by the Owl Rock Credit Facility and (ii) non-ordinary course asset dispositions and settlements or payments in respect of any property, casualty insurance claims or condemnation proceedings, with the proceeds received under clause (ii) subject to certain specified reinvestment rights and procedures to be set forth in the Owl Rock Credit Facility. The Owl Rock Credit Facility permits voluntary prepayments of outstanding loans at any time; |

| • | provides for a prepayment premium equal to (i) 4.00% of the principal amount of such loans prepaid on or prior to the first anniversary of the closing of the Owl Rock Credit Facility, (ii) 3.00% of the principal amount of such loans prepaid after the first anniversary of the closing of the Owl Rock Credit Facility but on or prior to the second anniversary of the closing of the Owl Rock Credit Facility and (iii) 2.00% of the principal amount of such loans prepaid after the second anniversary of the closing of the Owl Rock Credit Facility but on or prior to the third anniversary of the closing of the Owl Rock Credit Facility. No prepayment premium will be applicable for any such prepayment made after the third anniversary of the closing of the Owl Rock Credit Facility. The prepayment premium is expected to be applicable to voluntary prepayments and certain specified mandatory prepayment during such applicable periods; |

| • | contains certain closing conditions that the Owl Rock Credit Facility is subject to, including (i) the consummation of the Business Combination pursuant to the terms of the Merger Agreement and (ii) satisfaction of the conditions precedent to funding of the initial term loans, which is expected to include, among others, (A) customary deliverables for financings of this type, (B) a notice of borrowing request and (C) payment of certain other specified fees. It is also expected that the funding of delayed draw term loans will be subject to certain specified conditions, including, among others, the making of representations, the absence of events of defaults and a notice of borrowing request; |

| • | provides for financial covenants such that (i) a consolidated net leverage ratio cannot exceed 2.50 to 1.00 and (ii) a liquid asset coverage ratio cannot be less than 1.80 to 1.00; |

| • | contains affirmative covenants related to, among other things, delivery of certain financial reports and compliance certificates, maintenance of existence, compliance with laws, payment of taxes, property and insurance matters, inspection of property, books and records, notices, collateral matters and future subsidiaries, in each case, subject to specified limitations and exceptions; |

| • | contains negative covenants related to, among other things, incurrence of debt, creation of liens, mergers, acquisitions and certain other fundamental changes, conditions concerning the creation of new subsidiaries, conditions concerning opening of new accounts, disposition of assets, dividends and other restricted payments, transactions with affiliates, burdensome agreements, investments and limitations on lines of business, in each case, subject to specified limitations and exceptions; and |

| • | provides for certain specified events of default upon the occurrence and continuation of certain events or conditions (subject to specified exceptions, grace periods or cure rights, as applicable) each as set forth in the Owl Rock Credit Facility, which includes, among other things, with respect to non-payment, representations and warranties, compliance with covenants, cross-default to other material indebtedness, bankruptcy and insolvency matters, ERISA matters, material judgments, collateral and perfection matters, and the occurrence of a change of control. The occurrence and continuance of an event of default that is not cured or waived will enable the agent and/or the lenders, as applicable, to accelerate the loans or take other remedial steps as provided in the Owl Rock Credit Facility and the other loan documents. |

14

Table of Contents

SPV Purchase and Sale

On or about June 30, 2023 the Company entered into the Abacus Investment SPV, LLC (“SPV”) Purchase and Sale, including the Asset Purchase Agreement (“Policy APA”). The Company and the SPV are parties to the Policy APA. The payable obligation owing by the Company to the SPV in connection with the SPV Purchase and Sale is evidenced by a note issued by the Company under the SPV Investment Facility in an original principal amount equal to the aggregate fair market value of the acquired insurance policies. The aforementioned note has the same material terms and conditions as the other credit extensions under the SPV Investment Facility (as defined below).

Relationships

The Sponsor, members of the Company’s founding team, directors or officers of Abacus Settlements and LMA or its or their affiliates are members of the SPV and thereby indirectly receive economic or other benefits from the Policy APA.

SPV Investment Facility

On or about July 5, 2023, the Company entered into a SPV Investment Facility (the “SPV Investment Facility”), between the Company, as borrower, and the SPV, as lender.

The SPV Investment Facility, among other things:

| • | was unsecured without collateral security expected to be provided in favor of the SPV; |

| • | evidenced or provided for certain credit extensions to include: (i) an initial credit extension in an original principal amount of $15.0 million that is expected to be funded upon the closing of the SPV Investment Facility, (ii) a note in favor of the SPV in an original principal amount of $10.0 million to finance the purchase of the insurance policies under the Policy APA and (iii) a delayed draw credit extension in an original principal amount of $25.0 million, with the delayed draw credit extension drawn in a period between 90 and 120 days after the closing of the SPV Investment Facility upon satisfaction of certain conditions precedent (such $25.0 million delayed drawing expected to be made substantially concurrently with the delayed drawing in the same amount expected under the Owl Rock Credit Facility); |

| • | provided proceeds from the SPV Investment Facility for payment of certain transaction expenses, general corporate purposes and any other purposes not prohibited by law (it being expected that a significant portion of the proceeds from the SPV Investment Facility will be used by the Company for purchasing insurance policies, among other purposes); |

| • | was subordinated in right of payment to the Company’s obligations under the Owl Rock Credit Facility, subject to limited specified exceptions and circumstances for permitting early payment; |

| • | required Abacus Settlements and LMA and certain subsidiaries of Abacus Settlements and LMA to guarantee the credit extensions to be provided under the SPV Investment Facility pursuant to separate documentation; |

| • | contained a maturity date that is at least three years after the closing of the SPV Investment Facility, subject to two automatic extensions of one year each without any amendment of the relevant documentation; |

| • | provided for interest to accrue on the SPV Investment Facility at a rate of 12.00% per annum, payable quarterly, all of which is expected be paid in-kind by the Company by increasing the principal amount of the SPV Investment Facility owing to the SPV on each interest payment date; |

| • | provided a default rate that will accrue at 2.00% per annum (subject to applicable subordination restrictions) over the rate otherwise applicable. If cash payment is not permitted due to applicable subordination restrictions or otherwise, such default interest shall be paid in-kind; |

15

Table of Contents

| • | provided that no amortization payments shall be required prior to maturity; |

| • | provided for financial and other covenants no worse than those contained in the Owl Rock Credit Facility from the perspective of the Company; and |

| • | provided for certain specified events of default (including certain events of default which are expected to be subject to grace or cure periods), with the occurrence and continuance of such events of default enabling the lender under the SPV Investment Facility to accelerate the obligations under the SPV Investment Facility, among other potential rights or remedies; and contain certain specified closing conditions. The SPV’s investment resulting from credit extensions under the SPV Investment Facility is expected to be treated by the Company as debt for U.S. Generally Accepted Accounting Principles (“GAAP”) accounting purposes. To the extent that multiple notes are issued under the SPV Investment Facility, it is expected that the documentation will provide flexibility for the SPV to request such notes be reissued as a single note under such facility. |

Relationships

Directors and officers of the Company and significant shareholders of the Company are members of the SPV and thereby indirectly receive economic or other benefits from the SPV Investment Facility.

Risks Related to the Business of the Company

The Company’s valuation of life insurance policies is uncertain as many life insurance policies’ values are tied to their actual maturity date and any erroneous valuations could have a material adverse impact on the Company’s business.

The valuation of life insurance policies involves inherent uncertainty (including, without limitation, the life expectancies of insureds and future increases in premium costs to keep the policies in force). There is no guarantee that the value determined with respect to a particular life settlement policy by the Company will represent the value that will be realized by the Company on the eventual disposition of the related investment or that would, in fact, be realized upon an immediate disposition of the investment. In addition, there can be no guarantee that such valuation accurately reflects the current present value of such life insurance policy at its actual maturity. Uncertainties as to the valuation of life insurance policies held by the Company could require adjustments to reported net asset values and could have a material adverse impact on the Company’s business. Uncertainties as to the valuation may also result in the Company being less competitive in the market for originating new life settlement policies and could adversely affect the profits the Company realizes on life settlements purchased and sold.

The Company could fail to accurately forecast life expectancies. There may also be changes to life expectancies generally, resulting in people living longer in the future, which could result in a lower return on the Company’s life settlement policies.

Prices for life insurance policies and annuities that may be obtained by the Company depend, in large measure, upon the life expectancy of the underlying insureds. The returns of the Company’s hold portfolio is almost entirely dependent upon how accurate the actual longevity of an insured is as compared to the Company’s expectation for that insured. Life expectancies are estimates of the expected longevity or mortality of an insured. In determining the life expectancy of an insured, the Company relies on medical underwriting conducted by various medical underwriting firms. The medical underwriting process underlying life expectancy estimates is highly subjective, and mortality and longevity estimates are inherently uncertain. In addition, there can be no assurance that the applicable medical underwriting firm received accurate or complete information regarding the health of an insured under a life insurance policy, or that such insured’s health has not changed since the information was received. Different medical underwriting firms use different methods and may arrive at materially different mortality estimates for the same individual based on the same information, thus causing a life

16

Table of Contents

insurance policy’s value to vary. Moreover, as methods of calculating mortality estimates change over time, a mortality estimate prepared by any medical underwriting firm in connection with the acquisition of a life insurance policy may be different from a mortality estimate prepared by the same person at a later time. The valuation of the life insurance policies will vary depending on the dates of the related mortality estimates and the medical underwriting firms that provide the supporting information.

Other factors, including, but not limited to, better access to health care, better adherence to treatment plans, improved nutritional habits, improved lifestyle, an improved economic environment and a higher standard of living could also lead to increases in the longevity of the insureds under the life insurance policies. In addition to other factors affecting the accuracy of life expectancy estimates, improvements in medicine, disease treatment, pharmaceuticals and other medical and health services may enable insureds to live longer.

The actual longevity of an insured may be materially different than the predicted mortality estimate. If the actual maturity date of life insurance policies are longer than projected, it would delay when the Company could expect to receive a return on its investment and the Company may be unable to meet its investment objectives and goals. For example, a term life insurance policy in which the Company may invest have a stated expiration date on the date at which the underlying insured reaches a certain attained age and, beyond such date, the issuing insurance company may not be obligated to pay the face value, but rather only the cash surrender value which is usually maintained at a low value by investors, if any, in accordance with the terms of such life insurance policy. Therefore, if the underlying insured survives to the stated maturity date set forth in the terms of the life insurance policy, the issuing insurance company may only be obligated to pay an amount substantially less than the face value, which could have an adverse effect on the performance of the Company.

The medical underwriting and other firms that provide information for the Company’s forecasts of life expectancies are generally not regulated by the U.S. federal or state governments, with the exception of the states of Florida and Texas, which require life expectancy providers to register with their respective offices of insurance regulation. There can be no assurance that this business will not become more broadly regulated and, if so, that any such regulation would not have a material adverse effect on the ability of the Company to establish appropriate life expectancies in connection with the purchase or sale of policies.

The Company’s policy acquisitions are limited by the market availability of life insurance policies that meet the Company’s eligibility criteria and purchase parameters, and failure to secure a sufficient number of quality life insurance policies could have a material adverse effect on the Company’s business.

The life insurance policy secondary market has grown substantially in the past several years, however, as to whether and how it will continue to develop is uncertain. There are only a limited number of life insurance policies available in the market from time to time. There can be no assurance that the Company will be able to source life insurance policies on terms acceptable to the Company. As more investment funds flow into the market for life insurance policies, margins may be squeezed and the value of the collateral may become comparatively more expensive to purchase or subject to greater competition on the purchase side. There can be no assurance that secondary market life insurance policies will be available to the Company on satisfactory or competitive terms.

The supply of life insurance policies available in the market may be reduced by, among other things: (i) improvement in the economy, resulting in higher investment returns to insureds and other owners of life insurance policies from their investment portfolios; (ii) improvements in health insurance coverage, limiting the need of insureds to obtain funds to pay the cost of their medical treatment by selling their life insurance policies; (iii) the entry into the market of less reputable third-party brokers who submit inaccurate or false life insurance policy information to the Company; (iv) the establishment of new licensing requirements for market participants and a delay in complying or an inability to comply with such new requirements; or (v) refusal of the carrier that issued a life insurance policy to consent to its transfer. A change in the availability of life insurance policies could adversely affect the Company’s ability to execute its strategy and meet its objectives.

17

Table of Contents

The Company may experience increased competition from originating life insurance companies, life insurance brokers, and investment funds which could have a material adverse effect on the Company’s business.

Life insurance companies have begun offering to repurchase their own in-force life insurance policies from their current policyholders by offering “enhanced cash surrender value payments” above the amount of the net cash surrender value provided under the life insurance contracts’ terms and thus compete directly with the Company and other life settlement providers. The life settlements industry has challenged the legal validity of the life insurance companies’ actions, and some state insurance regulators have declared that these repurchase offers are unlawful while other state insurance regulators have approved them. To the extent that life insurance companies can seek to repurchase their own in-force life insurance policies, they present competition to the Company in acquiring policies.

In addition, the Company is subject to significant competition from other life settlement brokers and investment funds for the purchase of life settlement policies. Increased competition for life settlement policies may result in the Company being unable to access the number of life settlement policies that it desires for its business at prices that it deems acceptable.

Historically, there has been a negative public perception of the life settlement industry that could affect the value and/or liquidity of the Company’s investments and the life settlement industry faces political opposition from life insurance companies which could have a material adverse effect on the Company’s business.

Many regulators, lawmakers and other governmental authorities, as well as many insurance companies and insurance industry organizations, are hostile to or otherwise concerned about certain aspects of the longevity-contingent asset markets. The life settlement industry and some of its participants have also been, and may continue to be, portrayed negatively in a number of widely read publications and other forms of media. These opponents regularly contend that life settlement transactions are contrary to public policy by promoting financial speculation on human life and often involve elements of fraud and other wrongdoing. Continued public opposition to the life settlement industry, as well as actual or alleged wrongdoing by participants in the industry, could have a material adverse effect on the Company and its investors, including on the value and/or liquidity of the Company’s investments.

In March 2010, the American Council of Life Insurers, an insurance carrier trade association, issued a press release calling for a complete ban on life settlement securitization. While that effort was not successful, any such federal or state legislation, if passed, could have the effect of severely limiting or potentially prohibiting the continued operation of the Company’s life settlement purchasing operations. All of the foregoing could adversely affect the Company’s ability to execute its investment strategy and meet its investment objective.

The Company or third parties the Company relies upon could fail to accurately evaluate, acquire, maintain, track, or collect on life settlement policies, which could have a material adverse impact on the Company’s revenues.

The Company relies on third party data for tracking and servicing its life settlement policies. This includes the origination and servicing of life settlement policies by the servicing and tracking agent, market counterparties and other service providers, and the Company may not be in a position to verify the risks or reliability of such third-party data and systems. Failures in the systems employed by the Company and other service providers, counterparties, and other parties could result in mistakes made in the evaluation, acquisition, maintenance, tracking and collection of life settlement policies and other longevity-linked investments. This could result in the Company overpaying for life settlement policies it acquires or underpricing life settlement policies it sells. In addition, disruptions in the Company’s operations as a result of a failure in a third party system may cause the Company to suffer, among other things, financial loss, the disruption of its business, liability to third-parties, regulatory intervention or reputational damage. Any of the foregoing failures or disruptions could have a material adverse effect on the Company.

18

Table of Contents

There is a risk of fraud in the origination of the original life insurance policy or in subsequent sales of the life insurance policy that could adversely affect the Company’s returns which could have a material adverse impact on the Company’s business.

The Company faces the risk that an original owner of a life insurance policy, the related insured, the insurance agent involved in the issuance of such life insurance policy, or other party may have committed fraud, or misstated or failed to provide material information in connection with the origination or subsequent sale of that life insurance policy. While most life insurance policies may not be challenged for fraud after the end of the two-year contestability period, there may be situations where such fraud in connection with the issuance of a life insurance policy may survive the contestability period. If an issuing insurance company successfully challenges a life insurance policy acquired by the Company on the grounds of fraud, the Company may lose its entire investment in that life insurance policy. Furthermore, if the age of an insured was misstated, the Company may receive lower death benefits than expected. In addition, there may be information directly relevant to the value of a life insurance policy, including, but not limited to, information relating to the insured’s medical or financial condition, to which the Company will not have access. It is not possible to verify the accuracy or completeness of each piece of information or the completeness of the overall information supplied by such parties. Any such misstatement or omission could cause the Company to rely on assumptions which turn out to be inaccurate. Additionally, there can be no assurance that the seller of a life insurance policy in the tertiary market properly acquired that policy from the former owner, or that a former beneficiary or other interested party will not attempt to challenge the validity of the transfer. The occurrence of any one or more of these factors could adversely affect the Company’s performance and returns.

The Company may become subject to claims by life insurance companies, individuals and their families, or regulatory authorities which could have a material adverse impact on the Company’s business.

The secondary market for life insurance policies has been subjected to allegations of fraud and misconduct as reflected in certain litigated cases. Some of these cases, some of which have been brought by regulatory authorities, involve allegations of fraud, breaches of fiduciary duty, bid rigging, non-disclosure of material facts and associated misconduct in life settlement transactions. Cases have also been brought by the life insurance companies that challenge the legality of the original issuance of the life insurance policies based on lack of insurable interest, fraud and misrepresentation grounds.