As filed with the Securities and Exchange Commission on November 21, 2022

Registration No. 333-267313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||

(408 ) 263-9200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bill Krause

Chief Legal Officer

View, Inc.

195 S. Milpitas Blvd.

Milpitas, CA

95035 (408) 263-9200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Michael J. Mies, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

525 University Avenue

14th Floor

Palo Alto, California 94301

(650) 470-4500

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. A registration statement relating to the securities described herein has been filed with the Securities and Exchange Commission. Neither we nor the selling securityholders may sell or distribute the securities described herein until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 21, 2022

PRELIMINARY PROSPECTUS

View, Inc.

167,665,943 Shares of Class A common stock

366,666 Warrants to Purchase Class A common stock

20,305,462 Shares of Class A common stock underlying warrants

20,728,596 Shares of Class A common stock underlying options

This prospectus relates to the issuance by us of an aggregate of up to 41,034,058 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), which consist of (i) up to 366,666 shares of Class A common stock that are issuable upon the exercise of private placement warrants (the “Private Placement Warrants”) originally issued in a private placement (“Private Placement”) to CF Finance Holdings II, LLC (the “Sponsor”), in connection with our initial public offering (View, Inc. at the time of its initial public offering and prior to the consummation of its initial business combination (the “Business Combination”), “CF II”), (ii) up to 16,666,637 shares of Class A common stock that are issuable upon the exercise of public warrants (the “Public Warrants” and, together with the Private Placement Warrants, the “Warrants”), (iii) up to 3,272,159 shares of Class A common stock that are issuable upon the exercise of certain warrants (the “Rollover Warrants”) which were warrants of View Operating Corporation (“Legacy View”) that were converted to warrants of View, Inc. (“View”) upon the closing of the Business Combination, and (iv) up to 20,728,596 shares of Class A common stock issuable upon the exercise of certain options (the “Rollover Options”) which were options of Legacy View that were converted to options of View upon the closing of the Business Combination.

This prospectus also relates to the offer and sale, from time to time, by the selling holders identified in this prospectus (the “Selling Holders”), or their permitted transferees, of (1) up to 167,665,943 shares of Class A common stock, comprised of (i) up to 1,100,000 shares of Class A common stock (the “Private Placement Shares”) and up to 366,666 shares of Class A common stock issuable upon exercise of the Private Placement Warrants issued to the Sponsor in the Private Placement. The applicable Selling Holders paid $10.00 per private placement unit, which consisted of one Private Placement Share and one-third of one Private Placement Warrant, (ii) up to 34,026,436 shares of Class A common stock (the “Registered PIPE Shares”) issued on March 8, 2021, in a private placement pursuant to subscription agreements, dated as of November 30, 2020, and January 11, 2021, at a purchase price of $10.00 or $11.25 per share, (iii) up to 12,500,000 shares of Class A common stock issued to the Sponsor (the “Founder Shares”), 30,000 of which were transferred to CF II’s independent directors prior to the Business Combination. The Sponsor originally purchased 11,500,000 Founder Shares in September 2019 for an aggregate price of $25,000, or $0.00217 per share, which were converted to 15,093,750 shares upon the Company’s 1.3125-for-1 stock split in June 2020. In August 2020, the Sponsor returned to the Company, at no cost, 718,750 Founder Shares. 1,875,000 Founder Shares were forfeited by the Sponsor and cancelled by the Company for no consideration in order for the Sponsor and the other holders of Founder Shares to maintain ownership of 20.0% of the issued and outstanding shares of the Company’s common stock (excluding the shares underlying the private placement units issued to the Sponsor). The Founder Shares automatically converted into shares of Class A common stock at the time of the consummation of the Business Combination, (iv) up to 355,176 shares of Class A common stock issued in exchange for services pursuant to an engagement letter, under which Cantor Fitzgerald & Co. agreed to serve as financial advisor in connection with the Business Combination, dated as of October 3, 2020, as amended on November 26, 2020 (the “Engagement Letter”), (v) up to 1,423,020 shares of Class A common stock (the “Rollover Warrants Shares”) issuable upon exercise of the Rollover Warrants held by Guardians of New Zealand Superannuation and Madrone Partners, L.P, (vi) up to

109,096,250 shares (the “Affiliate Shares”) held by certain of our affiliates, for which the purchase price is unknown, and (vii) up to 8,798,395 shares issuable upon the vesting of restricted stock units granted under our 2021 Equity Incentive Plan, and (2) up to 366,666 Private Placement Warrants.

This prospectus provides you with a general description of such securities and the general manner in which we and the Selling Holders may offer or sell the securities. More specific terms of any securities that we and the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the sale of shares of Class A common stock or warrants by the Selling Holders pursuant to this prospectus or of the shares of Class A common stock by us pursuant to this prospectus, except with respect to amounts received by us upon exercise of warrants to the extent such warrants are exercised for cash. We could receive up to an aggregate of approximately $247.5 million from the exercise of all Warrants and Rollover Warrants, consisting of (i) approximately $195.9 million from the exercise of all Warrants assuming the exercise in full of all such warrants for cash at a price of $11.50 per share of Class A common stock and (ii) approximately $51.6 million from the exercise of all Rollover Warrants assuming the exercise in full of all such warrants for cash based on the weighted-average exercise price of $15.77 per share of Class A common stock of the Rollover Warrants. We could receive up to an aggregate of approximately $194.1 million from the exercise of all Rollover Options assuming the exercise in full of all such options for cash based on the weighted-average exercise price of $9.36 per share of the Rollover Options. The likelihood that the Selling Holders will exercise their Warrants, Rollover Warrants and Rollover Options, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Class A Common Stock. On November 15, 2022, the closing price of our Class A common stock was $1.40 per share. If the market price of our Class A common stock continues to be less than the exercise price, it is unlikely that holders will exercise the Warrants, Rollover Warrants and Rollover Options, and therefore unlikely that we will receive any proceeds from the exercise of these warrants and options in the near future, or at all.

The Selling Holders will determine the timing, pricing and rate at which they sell such shares into the public market. Significant sales of shares of Class A common stock pursuant to the registration statement of which this prospectus forms a part may have negative pressure on the public trading price of our Class A common stock. The shares being registered for resale currently represent approximately 76% of the total number of shares outstanding, based on the number of shares of Class A common stock outstanding as of November 15, 2022. Also, even though the current trading price is significantly below the Company’s initial public offering price, based on the closing price of the Class A common stock on November 15, 2022, certain private investors may have an incentive to sell their shares, because they will still profit on sales due to the lower prices at which they purchased their shares as compared to the public investors.

We will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Holders will issue, offer or sell, as applicable, any of the securities. The Selling Holders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our Class A common stock and warrants are traded on the National Association of Securities Dealers Automated Quotations (“Nasdaq”) under the symbols “VIEW” and “VIEWW,” respectively. On November 15, 2022, the closing price of our Class A common stock was $1.40 per share and the closing price of our warrants was $0.06 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 14 and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 21, 2022.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a Registration Statement on Form S-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we and the Selling Holders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. We may use the shelf registration statement to issue an aggregate of up to 41,034,058 shares of our Class A common stock, which consists of (i) up to 366,666 shares of Class A common stock that are issuable upon the exercise of the Private Placement Warrants, (ii) up to 16,666,637 shares of Class A common stock that are issuable upon the exercise of the Public Warrants, (iii) up to 3,272,159 shares of Class A common stock that are issuable upon the exercise of the Rollover Warrants, and (iv) up to 20,728,596 shares of Class A common stock issuable upon the exercise of certain options (the “Rollover Options”) which were options of Legacy View that were converted to options of View upon the closing of the Business Combination. The Selling Holders may use the shelf registration statement to sell (i) up to 167,665,943 shares of Class A common stock, comprised of (a) up to 1,100,000 Private Placement Shares, (b) up to 34,026,436 Registered PIPE Shares, (c) up to 12,500,000 Founder Shares, (d) up to 355,176 shares of Class A common stock under the Engagement Letter, (e) up to 366,666 shares of Class A common stock issuable upon exercise of the Private Placement Warrants, (f) up to 1,423,020 Rollover Warrants Shares, (g) up to 109,096,250 Affiliate Shares, and (h) up to 8,798,395 shares issuable upon the vesting of restricted stock units granted under our 2021 Equity Incentive Plan, and (ii) up to 366,666 Private Placement Warrants.

More specific terms of any securities that the Selling Holders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Class A common stock and/or warrants being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Holders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Holders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On March 8, 2021 (the “Closing Date”), View, Inc. (formerly known as CF Finance Acquisition Corp. II) (the “Company”), consummated its previously announced business combination pursuant to that certain Agreement and Plan of Merger, dated as of November 30, 2020 (the “Merger Agreement,” and the transactions contemplated thereby, the “Business Combination”), by and among the Company, PVMS Merger Sub, Inc. (“Merger Sub”), a

ii

Delaware corporation and wholly-owned subsidiary of the Company, and View Operating Corporation (formerly known as View, Inc.) (“Legacy View”), a Delaware corporation. As contemplated by the Merger Agreement, Merger Sub merged with and into Legacy View, with Legacy View continuing as the surviving corporation and as a wholly-owned subsidiary of the Company.

iii

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain market, ranking and industry data included in this prospectus, including the size of certain markets and our size or position and the positions of our competitors within these markets, including their products and services relative to their competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate, which, in each case, we believe are reliable.

We are responsible for all of the disclosure in this prospectus and while we believe the data from these sources to be accurate and complete, we have not independently verified data from these sources or obtained third-party verification of market share data and this information may not be reliable. In addition, these sources may use different definitions of the relevant markets. Data regarding our industry is intended to provide general guidance, but is inherently imprecise. Market share data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. In addition, customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be reliable. References herein to us being a leader in a market or product category refers to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. In addition, the discussion herein regarding our various markets is based on how we define the markets for our products, which products may be either part of larger overall markets or markets that include other types of products and services.

Assumptions and estimates of our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

iv

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus contains some of our trademarks, service marks and trade names, including, among others, “VIEW”, “VIEW NET”, “INTELLIGENCE”, “VIEW SENSE”, “VIEW DISPLAY” AND “SMARTPROTECT”. Each one of these trademarks, service marks or trade names is either (1) our registered trademark, (2) a trademark for which we have a pending application or (3) a trade name or service mark for which we claim common law

rights. All other trademarks, trade names or service marks of any other company appearing in this prospectus belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our respective rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

v

SELECTED DEFINITIONS

Unless stated otherwise in this prospectus or the context otherwise requires, references to:

•“2018 Plan” are to Legacy View’s Amended and Restated 2018 Equity Incentive Plan terminated in connection with the Business Combination following the Closing;

•“2021 Equity Incentive Plan” are to the 2021 Equity Incentive Plan approved in connection with the

•Business Combination and effective as of the Closing;

•“Additional Subscription Agreement” are to the Subscription Agreement, dated as of January 11, 2021, by and between the Company and the investor named therein;

•“Affiliate Shares” are to the 109,096,250 shares of Class A common stock held by certain affiliates of the Company;

•“Board” or “Board of Directors” are to the board of directors of the Company;

•“Business Combination” are to the transactions contemplated by the Merger Agreement, including: (1) the merger of Merger Sub, a wholly-owned subsidiary of the Company, with and into Legacy View, with Legacy View continuing as the surviving corporation and as a wholly-owned subsidiary of the Company; and (2) the PIPE Investment, which transactions were consummated on March 8, 2021;

•“Bylaws” are to the Amended and Restated Bylaws of the Company, as amended on November 8, 2021;

•“CEO Equity Incentive Plan” are to the 2021 Chief Executive Officer Incentive Plan approved in connection with the Business Combination and effective as of the Closing;

•“Certificate of Incorporation” are to the Amended and Restated Certificate of Incorporation of the Company;

•“CF II” are to CF Finance Acquisition Corp. II, prior to the consummation of the Business Combination;

•“Class A common stock” or “common stock” are to Class A common stock, par value $0.0001 per share, of the Company;

•“Closing” are to the closing of the Business Combination;

•“Closing Date” are to March 8, 2021, the date on which the Business Combination was consummated;

•“Code” are to the Internal Revenue Code of 1986, as amended;

•“Company,” “Combined Entity,” “View,” “we,” “us,” and “our” are to View, Inc., a Delaware corporation, and its consolidated subsidiaries;

•“DGCL” are to the General Corporation Law of the State of Delaware;

•“Effective Time” are to the effective time of the Business Combination;

•“Engagement Letter” are to the Engagement Letter, dated as of October 3, 2020, by and between CF II and Cantor Fitzgerald & Co., as amended on November 26, 2020;

•“Engagement Letter Shares” are to the 750,000 shares of Class A common stock issued to Cantor Fitzgerald & Co. pursuant to the Engagement Letter;

•“Equity Incentive Plans” are to, collectively, the 2021 Equity Incentive Plan and the CEO Equity Incentive Plan, each approved by CF II’s stockholders on March 5, 2021;

vi

•“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

•“Founder Shares” are to the shares of CF II Class B common stock, par value $0.0001 per share, initially purchased by the Sponsor in September 2019, which shares were converted to shares of Class A common stock upon the Closing;

•“GAAP” are to the Generally Accepted Accounting Principles in the United States of America;

•“Initial Stockholders” are to the Sponsor and each of Robert Hochberg and Charlotte Blechman, CF II’s independent directors prior to the Business Combination;

•“Initial Subscription Agreements” are to those Subscription Agreements entered into contemporaneously with the execution of the Merger Agreement, by and between the Company and each of the PIPE Investors, not including the Additional Subscription Agreement;

•“IPO” or “initial public offering” are to CF II’s initial public offering, which was consummated on August 31, 2020;

•“JOBS Act” are to the Jumpstart Our Business Startups Act of 2012;

•“Legacy View” are to View Operating Corporation (formerly known as View, Inc.);

•“management” or “management team” of an entity are to the officers and directors of such entity;

•“Merger” are to the merger of Merger Sub with and into Legacy View, with Legacy View continuing as the surviving corporation and as a wholly-owned subsidiary of the Company;

•“Merger Agreement” are to that certain Agreement and Plan of Merger, dated as of November 30, 2020 (as it may be further amended from time to time), by and among Legacy View, Merger Sub, and the Company;

•“Merger Sub” are to PVMS Merger Sub, Inc., a wholly-owned subsidiary of CF II;

•“Nasdaq” are to the National Association of Securities Dealers Automated Quotations;

•“Organizational Documents” are to the Bylaws and the Certificate of Incorporation;

•“PIPE Investment” are to the private placement pursuant to which the PIPE Investors purchased 42,103,156 shares of Class A common stock for an aggregate purchase price equal to approximately $441.1 million;

•“PIPE Investors” are to the “accredited investors” (as defined in Rule 501 under the Securities Act), and their permitted transferees, that subscribed for and purchased shares of Class A common stock in the PIPE Investment;

•“PIPE Shares” are to the 42,103,156 shares of Class A common stock that were issued to the PIPE Investors in connection with the PIPE Investment;

•“Private Placement” are to the private placement consummated simultaneously with the IPO on August 31, 2020, in which CF II issued the Private Placement Units to the Sponsor;

•“Private Placement Shares” are to the 1,100,000 shares of Class A common stock that were underlying the Private Placement Units initially issued to the Sponsor in the Private Placement;

•“Private Placement Units” are to the CF II units, each consisting of one share of CF II Class A common stock and one-third of one warrant to purchase one share of CF II Class A common stock, initially issued to the Sponsor in the Private Placement;

•“Private Placement Warrants” are to the 366,666 warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock that were underlying the Private Placement Units initially issued to the Sponsor in the Private Placement;

vii

•“public shares” are to the shares of Class A common stock (including those that underlie the units) that were initially offered and sold by CF II in its IPO;

•“Public Warrants” are to the 16,666,637 public warrants;

•“public stockholders” are to the holders of the public shares (including certain of the Initial Stockholders, provided that each of their status as a “public stockholder” shall only exist with respect to such public shares);

•“Restricted Stock Units” are to restricted stock units based on shares of View’s Class A common stock;

•“Registered PIPE Shares” are to the 34,026,436 PIPE Shares being registered for resale on the registration statement of which this prospectus forms a part;

•“Registration Rights Agreement” are to the Registration Rights Agreement, dated as of November 30, 2020, by and among CF II and the undersigned stockholders of Legacy View listed thereto;

•“Rollover Options” are to the 20,728,596 options which were options of Legacy View that were converted to options of View upon the closing of the Business Combination;

•“Rollover Warrants” are to the 3,272,159 warrants which were warrants of Legacy View that were converted to warrants of View upon the closing of the Business Combination;

•“Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002;

•“SEC” are to the U.S. Securities and Exchange Commission;

•“Securities Act” are to the Securities Act of 1933, as amended;

•“Selling Holders” are to the selling holders identified in this prospectus and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Selling Holders’ interest in the shares of Class A common stock and/or warrants, as applicable, after the date of this prospectus such that registration rights shall apply to those securities;

•“Sponsor” are to CF Finance Holdings II, LLC, a Delaware limited liability company;

•“Sponsor Registration Rights Agreement” are to the Registration Rights Agreement, dated as of August 26, 2020, by and among CF II, Sponsor and the undersigned investors listed thereto, as amended on March 8, 2021;

•“Subscription Agreements” are to the Initial Subscription Agreements together with the Additional Subscription Agreement;

•“transfer agent,” or “Continental” are to Continental Stock Transfer & Trust Company;

•“trust account” are to the trust account of CF II that held proceeds from its IPO and the sale of the Private Placement Units, together with interest earned thereon, less amounts released to pay tax obligations and up to $100,000 for dissolution expenses; and

•“Warrants” are to the Private Placement Warrants together with Public Warrants.

•Unless otherwise stated in this prospectus or as the context otherwise requires, all references in this prospectus to Class A common stock or warrants include such securities underlying the units.

viii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that are forward-looking within the meaning of the federal securities laws, including safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995, and as such are not historical facts. This includes, without limitation, statements regarding our financial position, capital structure, indebtedness and business strategy, and plans and objectives of our management for future operations, as well as statements regarding growth, anticipated demand for our products and services and our business prospects. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of future performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. When we discuss our strategies or plans, we are making projections, forecasts or forward-looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, our management.

Forward-looking statements are based on current expectations, estimates, assumptions, projections, forecasts and management’s beliefs, which are subject to change. There can be no assurance that future developments affecting our company will be those that we have anticipated. Forward-looking statements involve a number of risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. Should one or more of these risks or uncertainties materialize, or should any of the expectations, estimates, assumptions, projections, forecasts or beliefs prove incorrect, actual results may differ materially from what is expressed or forecasted in such forward-looking statements. Such risks include, but are not limited to: actual or anticipated variations in our quarterly operating results; results of operations that vary from the expectations of our company or of securities analysts and investors; the impact of the global COVID-19 pandemic; changes in financial estimates by our management or by any securities analysts who might cover our securities; conditions or trends in the industries in which we operate; changes in the market valuations of similar companies; changes in the markets in which we operate; stock market price and volume fluctuations of comparable companies and, in particular, those that operate in the smart glass industry; disruptions to our business relationships, performance, current plans, employee retention and business generally; publication of research reports about our company or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts; announcements by our company or our competitors of significant contracts, acquisitions, joint marketing relationships, joint ventures, capital commitments, strategic partnerships or divestitures; investors’ general perceptions of our company and our business; announcements by third parties or the outcome of any claims or legal proceedings that may be instituted against our company; the ability to maintain compliance with the continued listing requirements of, and to maintain the listing of our securities on, The Nasdaq Stock Market LLC; volatility in the price of our securities due to a variety of factors, including downturns or other changes in the highly competitive and regulated industries in which we operate, variations in performance across competitors, and changes in laws and regulations affecting our business; our ability to implement business plans, forecasts and other expectations, and identify and realize additional opportunities; actions by stockholders, including the sale of shares of our common stock; speculation in the press or investment community; recruitment or departure of key personnel; overall performance of the equity markets; disputes or other developments relating to intellectual property rights, including patents, litigation matters and our ability to obtain, maintain, defend, protect and enforce patent and other intellectual property rights for our technologies, and the potential infringement on the intellectual property rights of others; cyber security risks or potential breaches of data security; uncertainty regarding economic events; changes in interest rates; general market, political and economic conditions, including an economic slowdown, recession or depression; our operating performance and the performance of other similar companies; our ability to accurately project future results and our ability to achieve those and other industry and analyst forecasts; new legislation or other regulatory developments that adversely affect our company or the markets or industries in which we operate; our ability to continue as a going concern; our ability to raise additional capital on acceptable terms or at all; and other risks and uncertainties described in the “Risk Factors” section of this prospectus. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of this prospectus. These filings

ix

identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused significant economic uncertainty. The foregoing list of factors is not exhaustive.

Forward-looking statements included in this prospectus speak only as of the date of this prospectus or any earlier date specified for such statements. Readers are cautioned not to put undue reliance on forward-looking statements, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. We do not give any assurance that we will achieve our expectations.

x

PROSPECTUS SUMMARY

This summary highlights certain significant aspects of our business and is a summary of information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary Statement Regarding Forward Looking Statements,” “View, Inc.’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus before making an investment decision. The definitions of some of the terms used in this prospectus are set forth under the section “Selected Definitions.”

Business Summary

Our Business

We are a leading smart buildings platform and technology company that transforms buildings to improve human health and experience, reduce energy consumption and carbon emissions, and generate additional revenue for building owners.

Our innovative products are designed to enable people to lead healthier and more productive lives by increasing access to daylight and views, while minimizing associated glare and heat from the sun and keeping occupants comfortable. These products also simultaneously reduce energy consumption from lighting and HVAC, thus reducing carbon emissions. To achieve these benefits, we design, manufacture, and provide electrochromic or smart glass panels to which we add a 1 micrometer (~1/100th the thickness of human hair) proprietary electrochromic coating. These smart glass panels, in combination with our proprietary network infrastructure, software and algorithms, intelligently adjust in response to the sun by tinting from clear to dark states, and vice versa, to minimize heat and glare without ever blocking the view. In addition, we offer a suite of fully integrated, cloud-connected smart-building products that are designed to enable us to further optimize the human experience within buildings, improve cybersecurity, further reduce energy usage and carbon footprint, reduce real estate operating costs, provide real estate owners greater visibility into and control over the utilization of their assets, and provide a platform on which to integrate and deploy new technologies into buildings.

Our earlier generation products are described best as “smart glass,” which are primarily composed of three components that all work together to produce a solution:

•the insulating glass unit; which is either double or triple pane with a micrometer semiconductor (or electrochromic) coating.

•the network infrastructure; which is composed of the controllers, connectors, sensors, and cabling.

•the software: which includes the predictive algorithms, artificial intelligence, remote management tools, and user-facing iOS and Android apps, to control the tint of the glass.

After we completed installations in a few hundred buildings, we identified an opportunity to use our network infrastructure and cabling as the backbone on which different smart and connected devices in a typical building could operate. We believe customers using View Smart Glass can leverage our network as their building’s operations technology infrastructure to reduce duplicative labor costs, reduce materials usage, provide better cyber security, improve visibility and management of connected devices, and future-proof the building through easy upgradability.

Recognizing the opportunity to significantly improve the human experience, energy performance and carbon footprint in buildings, and real estate operating costs through adoption of technology, we began selling a Smart Building Platform, which is a fully integrated smart window platform, to building owners starting in 2021. Concurrent with the commencement of the sales efforts, we also began hiring an extensive team of construction managers, project managers, and building specialists to enable us to work towards delivering the fully installed and

1

integrated Smart Building Platform, which had historically been the responsibility of the general contractor’s glazing and low voltage electrician (“LVE”) subcontractors.

The Smart Building Platform includes an upgraded network infrastructure and end-to-end design and deployment services, and also enables next generation Smart Building Technologies. We began offering our Smart Building Platform for the following strategic reasons:

•To optimize the design, aesthetics, energy performance and cost of the entire smart façade (or digital skin) of the building, rather than just one component (smart glass), thus benefiting both customers and our company.

•To elevate the window selection and purchase decision to a customer and decision maker that has a more global view of the project and is in a much better position to make an informed decision regarding all the benefits provided by our Smart Building Platform.

•To accelerate the integration of new technologies into the fabric of the building. Today, this includes integrating environmental quality sensors and immersive, transparent, high-definition displays into smart windows. Importantly, our smart façade design enables future hardware and software upgrades into the building infrastructure.

•We believe delivering a digital, connected façade and smart building platform will enable future business opportunities and pricing models as buildings, both existing and new, incorporate additional technology and connected products.

Our next generation, smart building network is designed as a scalable and open infrastructure in which the smart window is now another node of the network; in addition, the network is now equipped to host other connected devices and applications, from both our company and third parties, as additional nodes on the network. The network has its own 48v direct current power and power-over-ethernet ports to incorporate other connected devices on a standard protocol. Also integrated into the network throughout the building is gigabit speed linear ethernet coaxial cable, as well as optical fiber. Computer processing is also built into the backbone of the network with x86 and ARM processing cores. The network also includes an operating system with capabilities to run third party applications and services, security protocol to protect buildings from cyberattacks, and several elements of a digital twin of the building. Our smart building network also hosts artificial intelligence and machine learning engines, which we developed, and also provides access to artificial intelligence and machine learning engines that are in the cloud. The exterior of the building is the largest in surface area. With the smart building network, the entire exterior of the building can be digitized. Activating the exterior through digitization creates multiple opportunities for building owners and occupants.

Our Smart Building Platform enables other devices and smart building applications to be built and connected to our smart building network. A few applications we have already built and deployed on our next generation network include:

Transparent Displays: View Immersive Display. Integrated into the smart window and connected to the same network as the glass, Immersive Display allows users to turn their windows into the equivalent of an iPad or tablet — an interactive digital display that allows users a new way to digest multi-media content. Immersive Displays are large-format (55 inches and larger), digital, high-definition, interactive canvases that can be used to broadcast content, host video calls and display information and digital art to large groups of people, while maintaining a view of the outdoors through the window on which it is integrated.

Personalized Health: View Sense. An integrated, enterprise-grade, secure, sensor module that monitors multiple environmental variables (e.g., CO2, Temperature, Volatile Organic Compounds, Humidity, Dust, Light, and Noise) to provide illustrative data and information to building management teams in order to improve building performance and enhance human health and comfort.

Our R&D continues to focus on not only improving the smart glass product but also on continually bringing more smart building applications and capabilities to market, as well as collaborating with other industry partners to

2

integrate their devices and applications with our smart building network, with the aim of making building occupants more comfortable, healthier, and more productive, making buildings more sustainable, and providing better information to building owners to streamline operations and reduce operating costs.

In terms of the value propositions to our customers, our earlier generation smart glass product focused primarily on improving occupant experience and reducing energy costs through adjustments of the glass tint. The current generation of the product focuses not only on improving energy savings and user experience through smart glass; it also focuses on increasing occupant productivity, creating healthier buildings, and using data from other devices to develop broader insights that further improve building operations and reduce energy usage. Current scientific research supports that cognitive function and in turn, productivity goes up when building occupants are exposed to more natural light and comfortable workspaces; they sleep better, and they experience less eye strain, fewer headaches, and lower stress. In a study published in the International Journal of Environmental Health and Public Health in 2020, researchers at the University of Illinois and SUNY Upstate Medical University found that employees working next to View Smart Glass during the day slept 37 minutes longer each night, experienced half as many headaches, and performed 42% better on cognitive tests. The research was sponsored in part by our company.

We also recognized that the new Smart Building Platform offering would potentially enable the company to move ‘up’ the supply chain of the construction industry. Whereas our traditional offering placed us in the role of a supplier to subcontractors of the General Contractor (“GC”), the level of integration and oversight needed to ensure a quality installation and integration of the complete smart building platform is designed to incentivize building owners and GCs to engage directly with us, engaging us to assume the role of the prime contractor for the platform rather than supplier of subcomponent materials. This would also better position us to upsell additional goods and services to the building owners in the future, which could be more efficiently integrated into the smart building platform than with the traditional offering.

Today, our Smart Glass products are installed into over 40 million square feet of buildings, including offices, hospitals, airports, educational facilities, hotels, and multi-family residences. In addition to our Smart Building Platform, we continue to sell smart windows through our Smart Glass offering and several individual smart building products through our Smart Building Technologies offerings.

Our Strengths

We believe we have several strengths that will allow us to drive the rapid adoption of our products and to maintain our market leading position:

•Complete product solution: We offer complete product solutions, in which we design and deploy all critical aspects of the product, including the electrochromic nano-coatings, smart glass panels, electronics, cabling, converged secure network infrastructure, algorithms, software, customized framing, and end-to-end design and deployment services. Having complete design and deployment control over our products enables us to provide a superior, more elegant and more integrated solution and experience to customers and end users as compared to our competitors.

•Proven product durability: We have demonstrated projected lifetimes of our electrochromic nano-coating of over 30 years, with no degradation in performance, in tests conducted by independent laboratories.

•Strong record of execution: View Smart Glass and View Smart Building Platform have now been installed into over 40 million square feet of buildings of significant scale and prominence.

•Manufacturing scale: We have a manufacturing footprint of over 800 thousand square feet in North America and have full control of our manufacturing processes, allowing us to rapidly scale while reducing production costs and maintaining quality.

•Intellectual property portfolio: We have more than 1,400 patents and patent filings, over 14 years of research and development experience, and continue to drive innovation across materials science, electronics, networking, hardware, software, and human factors research.

3

•Smart Building Platform: Our Smart Building Platform’s network architecture offers a competitive advantage, as it has greater functionality and utilizes less cabling, and we believe it is significantly simpler and cheaper to install than solutions from competing smart glass suppliers. As “smart buildings” grow in popularity, our Smart Building Platform’s enterprise-grade network provides yet another reason for building owners to choose smart glass.

•Growing product portfolio: We have continued to develop several new products that will optimize the human experience in buildings, help reduce energy usage and carbon footprint, and make buildings more intelligent and adaptable. Our Smart Building Platform enables smart building applications to be built and connected to our smart building network.

•Strong ecosystem relationships: In the process of View Smart Glass and View Smart Building Platform being installed into over 40 million square feet of buildings of significant scale and prominence, we have developed strong relationships with members of the construction ecosystem including architects, general contractors, glaziers and low voltage electricians. In addition, we have built strong relationships with owners, tenants, and building developers who are in the best position to recognize and appreciate the multiple benefits we bring to their employees and tenants, as well as their energy efficiency initiatives. Approximately 50% of our design wins over the last two years have been from building owners, developers and tenants that have previously had View Smart Glass installed in their buildings. See “Our Customers” below for more details on our sales process.

•Experienced leadership team: We have built an experienced leadership team with a strong track record of driving product innovation, revenue growth and profitability in several technology businesses.

•Company culture: Most importantly, we have built a strong culture of safety, inclusion, curiosity, customer delight, iterative learning, commitment to excellence, ownership, and teamwork. This has enabled us to tackle hard technical and business problems and opportunities, challenge conventional wisdom, deliver value to our customers, and build a strong competitive advantage over incumbents and other entrants.

Growth Strategies

Each of the below growth initiatives will be propelled by our ability to develop mainstream acceptance of our products. We continuously work to market our products and believe we will have mainstream acceptance of our products through the execution of the following:

•Compelling, proven product with growing installed base: Our technology is patented, functional and proven, with an increasing number of installations across major markets in North America driving both greater product awareness and higher interest from the real estate ecosystem. We expect this trend to accelerate as our base of installations continues to grow.

•New product introduction: We have significantly expanded our product portfolio and offer several smart building products to the market. In addition to a strong existing installed base who we believe will be likely adopters of these products, we also anticipate that strong interest in our smart building products will accelerate adoption of View Smart Glass and Smart Building Platform.

•Sales channel expansion: We plan to create greater awareness and education among building owners and tenants, of the significant benefits of our company, by forming business relationships with real estate brokers. Given the large number of commercial real estate brokers across North America, such business arrangements have the potential to significantly increase the awareness and recognition of our company, our products and our benefits multiple fold.

•Deepen delivery ecosystem relationships: In the process of View Smart Glass and View Smart Building Platform being installed into over 40 million square feet of buildings of significant scale and prominence, we have developed strong relationships with members of the construction delivery ecosystem including architects, general contractors, glaziers and low voltage electricians. We will continue to focus on

4

developing stronger relationships with these partners to facilitate smooth execution and positive momentum.

•Expansion into new geographies: We currently derive the majority of our business from select markets in North America. We believe our solutions will have universal appeal and anticipate significant growth opportunities to expand our business in additional regions in North America and in international markets around the world.

•Serving new applications and industries: We believe there are significant benefits to using smart glass solutions in automotive applications such as windows and glass roofs that automatically adjust to sunlight, mobile phones and computing, wearables, mixed and augmented reality applications, and in other industries. We anticipate serving these applications in the future.

By focusing on innovation, continually enhancing our product offerings and leveraging our platform to offer new products, we believe we can increase building project originations, product usage and customer satisfaction, which we believe will increase revenue per customer and expand our customer base while reducing customer attrition. With over 14 years of research and development experience and more than 1,400 patents and patent applications, our research and development and engineering teams include people with expertise in all aspects of the development process, including materials science, electronics and networking, product design, software development, machine learning and AI, and quality assurance. Our research and development activities are conducted at our headquarters in Milpitas, California and also at our manufacturing facility located in Olive Branch, Mississippi.

Business Combination

On the Closing Date, View, Inc. (formerly known as CF Finance Acquisition Corp. II), consummated the Business Combination pursuant to the Merger Agreement, by and among the Company, Merger Sub, and View Operating Corporation (formerly known as View, Inc.). As contemplated by the Merger Agreement, Merger Sub merged with and into View Operating Corporation, with View Operating Corporation continuing as the surviving entity and as a wholly owned subsidiary of View.

On March 5, 2021, CF Finance Acquisition Corp. II’s stockholders, at a special meeting of CF Finance Acquisition Corp. II, approved and adopted the Merger Agreement, and approved the Business Combination proposal and the other related proposals presented in the definitive proxy statement filed by CF II on

February 16, 2021 (the “Proxy Statement”), and the supplement thereto filed by CF II on February 23, 2021 (the “Supplement”).

At the Effective Time:

(1)each share of Legacy View capital stock that was issued and outstanding immediately prior to the Effective Time (other than any shares of Legacy View capital stock held by a Legacy View stockholder who validly exercised its appraisal rights pursuant to Section 262 of the DGCL with respect to its Legacy View capital stock, “Dissenting Shares,” or Legacy View capital stock held in treasury or by CF II, the Sponsor or any of their Affiliates, as defined in the Merger Agreement), was automatically cancelled and ceased to exist in exchange for the right to receive such fraction of a share of newly issued Class A common stock equal to 0.02325 (the “Exchange Ratio”), without interest, subject to rounding up such fractional shares of each holder to the nearest whole share of Class A common stock (after aggregating all fractional shares of Class A common stock that otherwise would be received by such holder);

(2)each share of Merger Sub common stock outstanding immediately prior to the Effective Time was automatically converted into and exchanged for one validly issued, fully paid and nonassessable share of Class A common stock;

(3)each Legacy View option that was outstanding immediately prior to the Effective Time, whether vested or unvested, was assumed by CF II and converted into an option exercisable for that number of shares of

5

Class A common stock equal to the product (rounded down to the nearest whole number) of (a) the number of shares of Legacy View common stock subject to the Legacy View option immediately prior to the Effective Time multiplied by (b) the Exchange Ratio, such option having a per share exercise price for each share of Class A common stock issuable upon exercise of the option equal to the quotient (rounded up to the nearest whole cent) obtained by dividing (i) the exercise price per share of Legacy View common stock subject to such Legacy View option immediately prior to the Effective Time by (ii) the Exchange Ratio, and, except as specifically provided in the Merger Agreement, each option to continue to be governed by the same terms and conditions (including vesting and exercisability terms) as were applicable to the corresponding former Legacy View options immediately prior to the Effective Time; and

(4)each Legacy View warrant that was outstanding immediately prior to the Effective Time was assumed by CF II and converted into a warrant exercisable for that number of shares of Class A common stock equal to the product (rounded down to the nearest whole number) of (a) the number of shares of Legacy View capital stock subject to the Legacy View warrant immediately prior to the Effective Time multiplied by (b) the Exchange Ratio, such warrant having a per share exercise price for each share of Class A common stock issuable upon exercise of the warrant equal to the quotient (rounded up to the nearest whole cent) obtained by dividing (i) the exercise price per share of Legacy View capital stock subject to the Legacy View warrant immediately prior to the Effective Time by (ii) the Exchange Ratio, and, except as specifically provided in the Merger Agreement, each warrant to continue to be governed by the same terms and conditions (including vesting and exercisability terms) as were applicable to the corresponding former Legacy View warrant immediately prior to the Effective Time.

Concurrently with the execution of the Merger Agreement, CF II entered into the Initial Subscription Agreements with certain of the PIPE Investors, and on January 11, 2021, CF II entered into the Additional Subscription Agreement with GIC Private Ltd. Pursuant to the Subscription Agreements, the PIPE Investors purchased an aggregate of 42,103,156 shares of Class A common stock in a private placement, in the case of the Initial Subscription Agreements at a price of $10.00 per share and in the case of the Additional Subscription Agreement at a price of $11.25 per share, for an aggregate purchase price of approximately $441.1 million. The PIPE Investment was consummated in connection with the consummation of the Business Combination. See “—Related Agreements” below for a summary of the Subscription Agreements.

On the Closing Date, in connection with the Business Combination, we entered into certain other related agreements which are described below in “—Related Agreements.”

6

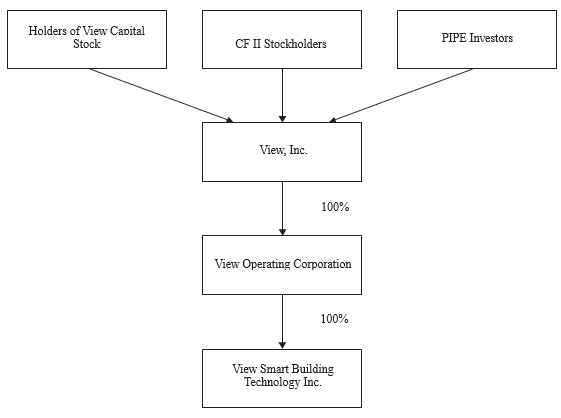

The following diagram illustrates our structure following the consummation of the Business Combination:

Summary of Risk Factors

The business and financial condition of our company is subject to numerous risks and uncertainties. Below is a summary of material factors that make an investment in our securities speculative or risky. The occurrence of one or more of the events or circumstances described below, alone or in combination with other events or circumstances, may have an adverse effect on the business, cash flows, financial condition and results of operations of our company. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under the section titled “Risk Factors” in this prospectus beginning on page 14. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider carefully the risks and uncertainties described under the section titled “Risk Factors” as part of your evaluation of an investment in our securities:

•We have determined that there is substantial doubt about our ability to continue as a going concern, as our continued existence is dependent upon our ability to raise additional capital through outside sources.

•There can be no assurance that we will be able to maintain compliance with the continued listing standards of Nasdaq.

•Our failure to prepare and timely file our periodic reports with the SEC limits our access to the public markets to raise debt or equity capital.

•We have restated our consolidated financial statements for prior annual and interim periods, which has affected and may continue to affect investor confidence, our stock price, our ability to raise capital in the future, our reputation with our customers, and our ability to timely file our periodic reports with the SEC,

7

which may result in additional stockholder litigation and may reduce customer confidence in our ability to complete new contract opportunities.

•We have identified deficiencies in our internal control over financial reporting resulting in material weaknesses and the conclusion that our internal control over financial reporting and our disclosure controls and procedures were not effective as of December 31, 2021 and September 30, 2022. If we fail to properly remediate these or any future material weaknesses or deficiencies or to maintain effective internal control over financial reporting, further material misstatements in our financial statements could occur and impair our ability to produce accurate and timely financial statements, which could cause current and potential stockholders to lose confidence in our financial reporting, which in turn could adversely affect the trading price of our common stock.

•We are involved in, and may in the future be subject to, litigation and regulatory examinations, investigations, proceedings or orders as a result of or relating to our Restatement and our failure to timely file our Annual and Quarterly Reports with the SEC; if any of these are resolved adversely against us, it could harm our business, financial condition and results of operations.

•We have incurred and expect to continue to incur significant expenses related to the Investigation, Restatement and remediation of deficiencies in our internal control over financial reporting and disclosure controls and procedures, and any resulting litigation.

•The Investigation, the findings thereof and the Restatement process, have diverted, and may continue to divert, management and other human resources from the operation of our business.

•Our limited operating history and history of financial losses make evaluating our business and future prospects difficult, and may increase the risk of your investment.

•Our revenue and backlog may not be adequate or grow sufficiently, and that backlog may not convert into future sales.

•Our financial results may vary significantly from period-to-period due to fluctuations in our operating costs, revenue and other factors.

•Our operating and financial results forecast relies in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our forecasted results.

•We may not be able to accurately estimate the future supply and demand for our products, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements, we could incur additional costs or experience delays.

•Disruption of supply or shortage of materials, in particular for glass and semiconductor chips, could harm our business.

•Increases in cost of materials, including glass and semiconductor chips, could harm our business.

•Any significant disruption to our sole manufacturing production line or the failure of our facility to operate according to our expectation could have a material adverse effect on our results of operations.

•COVID-19 and other public health crises could materially impact our business, financial condition, and results of operations.

•Our business, financial condition and results of operations could be adversely affected by disruptions in the global economy caused by the ongoing conflict between Russia and Ukraine.

•While we obtain components from multiple sources whenever possible, there are important components used in our products that are purchased from single source suppliers. Delivery of necessary components of

8

our products by these and other suppliers according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have an adverse effect on our financial condition and operating results.

•We face risks associated with our national and future global operations and expansion, including unfavorable regulatory, political, economic, tax and labor conditions, and with establishing ourselves in new markets, all of which could harm our business.

•The markets in which we operate are highly competitive, and we may not be successful in competing in these industries. We currently face competition from new and established national and international competitors and expect to face competition from others in the future, including competition from companies with new technology and greater financial resources.

•We may be unable to meet our growing production demand, product sales, delivery plans and servicing needs, or accurately project and manage this growth nationwide or internationally, which could harm our business and prospects.

•Our patent applications may not result in issued patents or our patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on our ability to prevent others from interfering with our commercialization of our products.

•Our products and services are subject to substantial regulations, which are evolving, and unfavorable changes or failure by us to comply with these regulations could substantially harm our business and operating results.

•Many of our products must comply with local building codes and ordinances, and failure of our products to comply with such codes and ordinances may have an adverse effect on our business.

•Our business model of manufacturing smart glass is capital-intensive, and we may not be able to raise additional capital on attractive terms, if at all, which could be dilutive to stockholders. If we cannot raise additional capital when needed, our operations and prospects could be materially and adversely affected.

▪Warrants are or will in the future become exercisable for our Class A common stock, which, if exercised, would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

▪There is no guarantee that our Warrants, Rollover Warrants and Rollover Options will be in the money at the time they become exercisable, and they may expire worthless.

▪We may redeem unexpired Warrants prior to their exercise at a time that is disadvantageous to a Warrant holder, thereby making the Warrants worthless.

•Resales of our securities may cause the market price of our securities to drop significantly, even if our business is doing well.

•The trading price of our Class A common stock and warrants has been volatile and may be in the future.

•Sales of shares of our Class A common stock pursuant to the registration statement of which this prospectus forms a part may have negative pressure on the public trading price of our Class A common stock.

Corporate Information

We were incorporated on September 27, 2019, as a Delaware corporation under the name “CF Finance Acquisition Corp. II” and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. On March 8, 2021, in connection with the consummation of the Business Combination, we changed our name to "View, Inc." Our principal executive offices are located at 195 S. Milpitas Blvd., Milpitas, CA 95035, and our telephone number is

9

(408) 263-9200. Our website is www.view.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this prospectus. Our common stock and warrants trade on Nasdaq under the tickers "VIEW'' and "VIEWW", respectively.

10

THE OFFERING

We are registering the issuance by us of an aggregate of up to 41,034,058 shares of our Class A common stock, which consists of (i) up to 366,666 shares of Class A common stock that are issuable upon the exercise of the Private Placement Warrants, (ii) up to 16,666,637 shares of Class A common stock that are issuable upon the exercise of the Public Warrants, (iii) up to 3,272,159 shares of Class A common stock that are issuable upon the exercise of the Rollover Warrants, and (iv) up to 20,728,596 shares of Class A common stock issuable upon the exercise of the Rollover Options. We are also registering the resale by the Selling Holders or their permitted transferees of (i) up to 167,665,943 shares of Class A common stock, comprised of (a) up to 1,100,000 Private Placement Shares, (b) up to 34,026,436 Registered PIPE Shares, (c) up to 12,500,000 Founder Shares, (d) up to 355,176 shares of Class A common stock under the Engagement Letter, (e) up to 366,666 shares of Class A common stock issuable upon exercise of the Private Placement Warrants, (f) up to 1,423,020 Rollover Warrants Shares, (g) up to 109,096,250 Affiliate Shares, and (h) up to 8,798,395 shares issuable upon the vesting of restricted stock units granted under our 2021 Equity Incentive Plan,, and (ii) up to 366,666 Private Placement Warrants. Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” beginning on page 14 of this prospectus.

Issuance of Class A common stock, options, and warrants

The following information is as of November 15, 2022, and does not give effect to issuances of our Class A common stock or warrants after such date, or the exercise of warrants after such date.

| Shares of Class A common stock that may be issued upon exercise of Private Placement Warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock | 366,666 shares | ||||

| Shares of Class A common stock that may be issued upon exercise of Public Warrants | 16,666,637 shares | ||||

| Shares of Class A common stock that may be issued upon exercise of Rollover Warrants | 3,272,159 shares | ||||

| Shares of Class A common stock that may be issued upon exercise of Rollover Options | 20,728,596 shares | ||||

| Shares of common stock outstanding prior to exercise of all Warrants, Rollover Warrants and Rollover Options | 221,620,884 shares (as of November 15, 2022) | ||||

| Shares of common stock outstanding assuming exercise of all Warrants, Rollover Warrants and Rollover Options | 262,654,942 shares (based on total shares outstanding on November 15, 2022) | ||||

| Exercise price of Warrants | $11.50 per share, subject to adjustment as described herein. | ||||

| Weighted-Average Exercise price of Rollover Warrants | $15.77 per share | ||||

| Weighted-Average Exercise price of Rollover Options | $9.36 per share | ||||

11

| Use of proceeds | We could receive an aggregate of approximately $247.5 million from the exercise of all Warrants and Rollover Warrants, consisting of (i) approximately $195.9 million from the exercise of all Warrants assuming the exercise in full of all such warrants for cash and (ii) approximately $51.6 million from the exercise of all Rollover Warrants assuming the exercise in full of all such warrants for cash based on the weighted-average exercise price of such warrants. We could receive an aggregate of approximately $194.1 million from the exercise of all Rollover Options assuming the exercise in full of all such options for cash based on the weighted-average exercise price of such options. The likelihood that the Selling Holders will exercise their Warrants, Rollover Warrants and Rollover Options, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Class A Common Stock. On November 15, 2022, the closing price of our Class A common stock was $1.40 per share. If the market price of our Class A common stock continues to be less than the exercise price, it is unlikely that holders will exercise the Warrants, Rollover Warrants and Rollover Options, and therefore unlikely that we will receive any proceeds from the exercise of these warrants and options in the near future, or at all. Unless we inform you otherwise in a prospectus supplement or free writing prospectus, we intend to use the net proceeds from the exercise of such warrants or options for general corporate purposes which may include acquisitions or other strategic investments or repayment of outstanding indebtedness. | ||||

12

Resale of Class A common stock and warrants

| Founder Shares | 12,500,000 shares | ||||

| Registered PIPE Shares | 34,026,436 shares | ||||

| Private Placement Shares | 1,100,000 shares | ||||

| Shares of Class A common stock under the Engagement Letter | 355,176 shares | ||||

| Shares of Class A common stock issuable upon exercise of the Private Placement Warrants | 366,666 shares | ||||

| Rollover Warrants Shares | 3,272,159 shares | ||||

| Affiliate Shares | 109,096,250 shares | ||||

| Shares of Class A common stock issuable upon vesting of restricted stock units | 8,798,395 shares | ||||

| Private Placement Warrants | 366,666 warrants | ||||

| Exercise Price of Private Placement Warrants | $11.50 per share, subject to adjustment as described herein. | ||||

| Weighted-Average Exercise Price of Rollover Warrants | $15.77 per share | ||||

| Redemption | The warrants are redeemable in certain circumstances. See “Description of Securities—Private Placement Warrants” for further discussion. | ||||

| Use of Proceeds | We will not receive any proceeds from the sale of the Class A common stock and warrants to be offered by the Selling Holders. With respect to shares of Class A common stock underlying the warrants, we will not receive any proceeds from such shares except with respect to amounts received by us upon exercise of such warrants to the extent such warrants are exercised for cash. | ||||

| Nasdaq Ticker Symbols | Class A common stock: VIEW Warrants: VIEWW | ||||

13

RISK FACTORS