As filed with the Securities and Exchange Commission on November 3, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Applied UV, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3648 | 84-4373308 | ||

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

150 N. Macquesten Parkway

Mount Vernon, NY 10550

(914) 665-6100

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Keyoumars Saeed

Chief Executive Officer

Applied UV, Inc.

150 N. Macquesten Parkway

Mount Vernon, NY 10550

(914) 665-6100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Ross D. Carmel, Esq. | |

| Jeffrey P. Wofford, Esq. | Michael F. Nertney, Esq. |

| Carmel, Milazzo & Feil LLP | Ellenoff Grossman & Schole LLP |

| 55 West 39th Street, 18th Floor | 1345 Avenue of the Americas |

| New York, New York 10018 | New York, New York 10105 |

| Telephone: (212) 658-0458 | Telephone: (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||||||

| Common Stock, $0.0001 par value per share | $ | 9,200,000 | $ | 1,003.72 | ||||

| Warrants to purchase Common Stock to be issued to the Underwriter (3)(4)(5) | ||||||||

| Common Stock issuable upon exercise of Warrants to purchase Common Stock to be issued to the Underwriters (3) | $ | 575,000 | $ | 62.74 | ||||

| Total | $ | 9,775,000 | $ | 1,066.46 | ||||

(1) Includes additional shares (15% of the shares being sold in this offering) that may be purchased by the underwriters pursuant to their over-allotment option for a period of 45 days from the date of the prospectus.

(2) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(3) Pursuant to Rule 416 under the Securities Act of 1933, as amended, there is also being registered hereby such indeterminate number of additional shares as may be issued or issuable because of stock splits, stock dividends and similar transactions.

(4) We have agreed to issue to the representative of the several underwriters, who we refer to as the representative, warrants to purchase the number of shares of common stock in the aggregate equal to five percent (5%) of the shares of common stock to be issued and sold in this offering (excluding shares of common stock sold to cover over-allotments, if any). The warrants are exercisable for a price per share equal to 125% of the public offering price.

(5) No fee required pursuant to Rule 457(g).

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated November 3, 2020

PRELIMINARY PROSPECTUS

Applied UV, Inc.

1,240,000 Shares of Common Stock

This is an offering of 1,240,000 shares of common stock of Applied UV, Inc. at an assumed offering price of $6.45. Upon completion of this offering, a single shareholder will own approximately 64.2% of our outstanding common stock (approximately 62.7% if the underwriters exercise their over-allotment option in full). For additional information regarding this shareholder, see “Principal Stockholders.” Upon completion of this offering, we will be a “controlled company” within the meaning of the listing rules of The Nasdaq Stock Market LLC.

Our common stock is listed on The Nasdaq Capital Market under the symbol “AUVI.” The closing price of our common stock on November 2, 2020, as reported by The Nasdaq Capital Market, was $6.08. We have assumed a public offering price of $6.45 per share. The final public offering price will be determined through negotiation between us and the underwriters in the offering and may be at a discount to the then current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus, the underwriters named below, for whom Ladenburg Thalmann & Co. Inc. is acting as representative, have severally agreed to purchase, and we have agreed to sell to them, severally, 1,240,000 shares of common stock and the representative shall have an option, exercisable for 45 days from the date of this prospectus, to purchase up to an additional 186,000 shares of common stock.

We intend to use the proceeds from this offering for corporate acquisitions and general corporate purposes, including working capital. See “Use of Proceeds.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company reporting requirements.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1)(2) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | Represents an underwriting discount and commissions equal to 8.5% per share (or $ per share), which is the underwriting discount we have agreed to pay on all investors in this offering introduced by the underwriters. |

| (2) | Does not include a management fee equal to 1.0% of the total gross proceeds from the offering and accountable expenses up to $85,000 payable to Ladenburg Thalmann & Co. Inc., as representative of the underwriters. See “Underwriting” beginning on page 73 of this prospectus for additional information regarding underwriting compensation. |

| In addition to the underwriting discounts listed above and the management fee and accountable expense allowance described in the footnote, we have agreed to issue upon the closing of this offering to Ladenburg Thalmann & Co. Inc., as representative of the underwriters, warrants that will expire on the fifth anniversary of the commencement of sales in this offering entitling the representative to purchase 5.0% of the total number of shares of common stock sold in this offering. The registration statement of which this prospectus is a part also covers the underwriters’ warrants and the shares of common stock issuable upon the exercise thereof. For additional information regarding our arrangement with the underwriters, please see “Underwriting” beginning on page 73. |

We have granted the representative an option, exercisable for 45 days from the date of this prospectus, to purchase up to an additional 186,000 shares of common stock on the same terms as the other shares being purchased by the underwriters from us.

The underwriters expect to deliver the shares against payment on , 2020.

Prospectus dated , 2020

Ladenburg Thalmann

Table of Contents

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the underwriters, have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer is unlawful.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all references to the “Company,” the “registrant,” “we,” “our,” or “us” in this prospectus mean Applied UV, Inc. and its subsidiaries; | |

| ● | “year” or “fiscal year” mean the year ending December 31st; | |

| ● | all common share and per common share information in this prospectus gives effect to a 1 for 5 reverse stock split of our common stock, which became effective as of June 17, 2020, and all preferred share and per preferred share information in this prospectus gives effect to a 1 for 5 reverse stock split of our preferred stock, which became effective as of June 23, 2020, and | |

| ● | all dollar or $ references, when used in this prospectus, refer to United States dollars. |

2

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic. Accordingly, those third-party projections may be overstated and should not be given undue weight. We have not independently verified any of the data from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

3

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

As used in this prospectus, all references to “capital stock,” “common stock,” “Shares,” “preferred stock,” “stockholders,” “shareholders” applies only to Applied UV, Inc. and “we,” “our,” “us,” the “Company,” the “registrant,” or “Applied UV” refer to Applied UV, Inc., a Delaware corporation and its subsidiaries, which currently consist of SteriLumen, Inc., a New York corporation (“SteriLumen”) and Munn Works, LLC, a New York limited liability company (“Munn Works”).

About our Company

The Company was formed on February 26, 2019, for the purpose of acquiring all of the equity of SteriLumen and Munn Works. The Company acquired all of the capital stock of SteriLumen in March of 2019 pursuant to two exchange agreements in which the shareholders of SteriLumen exchanged all of their shares in SteriLumen for shares of common stock in the Company. The Company acquired all of the membership interests of Munn Works in July of 2019 pursuant to an exchange agreement in exchange for shares of common stock in the Company. The Company conducts all of its operations through SteriLumen and Munn Works.

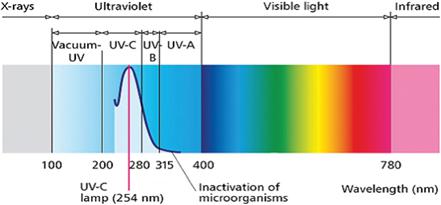

SteriLumen. SteriLumen was incorporated on December 8, 2016 in New York for the purpose of developing, designing and manufacturing disinfection systems, that eliminate pathogens that may cause healthcare-acquired infections (“HAIs”), for distribution and sale to facilities that have high customer or patient turnover such as hospitals, assisted living facilities, doctors’ offices and walk-in clinics as well as hotels, cruise lines, airplanes, schools, government buildings, commercial offices and other facilities that offer access to the public. SteriLumen has developed, designed and manufactured a unique, patented and automated disinfecting system that will be embedded into certain bathroom fixtures (in each case, a “SteriLumen Disinfecting System”), which we believe will be effective in reducing HAIs caused by viruses, bacteria, fungi, and other pathogens, including SARS-CoV-2, the virus that causes COVID-19 (referred to herein as the “Coronavirus”) and human coronaviruses in general. The SteriLumen Disinfecting System currently has five product lines: (i) disinfecting back-lit mirror that replaces the typical mirror (and wall lighting) found above the sink in a public facility bathroom; (ii) disinfecting drain device; (iii) disinfecting shelf that would be installed above the sink in cases where there is not enough room for a bathroom mirror or beneath an existing bathroom mirror; (iv) disinfecting mirrored medicine cabinet for residential use and (v) retrofit kit. The Company has received confirmation from the U.S. Food & Drug Administration that the SteriLumen Disinfecting System is not a “device” under Section 201(h) of the Federal Food, Drug, and Cosmetic Act (the “FDA Act”) and therefore the Company is not required to comply with the requirements of the FDA Act.

4

The SteriLumen Disinfecting System has previously been submitted to ResInnova Laboratories (“ResInnova”), a laboratory that tests products that reduce pathogens on solid and porous surfaces, for an analysis of its effectiveness in killing certain pathogens such as Clostridium difficile spores (“C diff”), Escherichia coli (“E coli”) and Staphylococcus aureus (“MRSA”). ResInnova provided SteriLumen with their findings in a report dated September 8, 2017, which were updated on May 8, 2020 (the “Initial ResInnova Report”) which found the SteriLumen Disinfecting System to be effective in dramatically reducing pathogens in the bathroom vanity/sink area. In a Report dated June 30, 2020, ResInnova found the SteriLumen Disinfecting System to be effective in killing OC43 human coronavirus (“OC43”), which according to ResInnova is a common surrogate for SARS-CoV-2, as described in further detail under “Business—Second ResInnova Report.” The ResInnova study did not test the SteriLumen Disinfecting System against SARS-CoV-2. Furthermore, SteriLumen has an agreement (the “Mount Sinai Agreement”) with Icahn School of Medicine at Mount Sinai (“Mount Sinai”) dated April 20, 2020, in which the Company will sponsor an evaluation by Mount Sinai of the effectiveness of the SteriLumen Disinfecting System in 17 patient bathrooms in Mount Sinai St. Luke’s Hospital in New York, NY. Mount Sinai has agreed to provide SteriLumen the results of their research in a report by the second quarter of 2021 as well as publishing their results in an academic, peer-reviewed journal. The Initial ResInnova Report and the Mount Sinai Agreement are more fully described in the sections entitled “Business—SteriLumen—The Initial ResInnova Report,” and “—The Mount Sinai Agreement.”

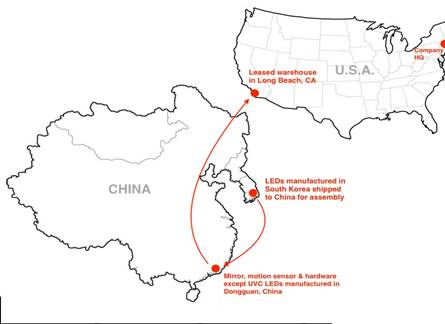

Since its inception, SteriLumen has devoted substantially all of its efforts to research and development, business planning, recruiting management and sales personnel, raising capital, developing relationships with existing and new suppliers and creating its own network of professional consultants. SteriLumen has manufacturing and assembly suppliers in Warwick, Rhode Island, southern China and South Korea, and warehousing and distribution suppliers in California. By outsourcing the manufacturing, assembly, warehousing and distribution of SteriLumen Disinfecting Systems and other related products, we can efficiently focus our resources on the design, marketing and sales of SteriLumen’s products while keeping overhead costs lower. SteriLumen recently sold in Saudi Arabia and is currently in discussions with two major international hotel chains who have expressed interest in reducing pathogen levels in their hotels and restaurants.

HAIs. The U.S. Center for Disease Control (“CDC”) defines HAIs as infections patients contract, while receiving treatment in a healthcare facility. HAI is a significant problem in the United States and is the cause of an estimated 99,000 deaths annually. The CDC states that preventing HAI is a national priority. Between 2000 and 2050, the percentage of people aged 85 and over will increase by 350%1. This estimated increase will result in more HAIs for this age group. While this problem is of great concern to the elderly, it also affects the population at large.2 Research shows that the most common germs causing HAIs are C diff (12%), MRSA(11%), E coli (9%), and Candida auris (7%).3 Environmental disinfection is an important method in reducing the risk of HAIs. Evidence shows that traditional cleaning methods still leave persistent contamination of environmental surfaces.4 Without question, secondary disinfection technologies are needed for reducing the risk of surface contamination.

According to the CDC:

| · | approximately 1.7 million people in the United States contract a HAI every year, or 1 out of every 25 hospital patients; |

| · | an estimated 99,000 people die from HAI’s annually; |

| · | HAI cost to the healthcare system is $45 billion annually; |

| · | patients with a HAI spend an average of 6.5 extra days in the hospital; and |

| · | patients with a HAI are five times more likely to be readmitted and twice as likely to die. |

HAI’s are preventable, and the federal government has instituted policies and penalties to ensure this issue is being addressed. In 2009, the Centers for Medicare and Medicaid Services (“CMS”) stopped paying hospital-related reimbursement for patients who acquired a HAI during their hospital stay. In 2011, CMS established fines for facilities with high rates of infection. The effects of reduced reimbursements have seriously impacted healthcare facilities. Some facilities have reported a reduction of up to 40% of their total revenue due to lost reimbursement.

______________________

1 American Journal of Infection Control (“AJIC”)

2 AJIC

3 AJIC

4 AJIC

5

Munn Works. Munn Works was formed on November 9, 2012, as a New York limited liability company. It manufactures and supplies custom designed decorative framed mirrors, framed art, and bathroom vanities primarily to the hospitality market. Max Munn, the President of Applied UV, is also the Chief Executive Officer of Munn Works and has been involved in related businesses for over 35 years. Munn Works manufactures its products domestically and overseas. Its domestic manufacturing operations are located in its headquarters in Mount Vernon, New York. Munn Works supplies the major hotel brands in North America with its products. These brands include Hilton Hotels & Resorts, the various Hyatt branded hotels, the various Marriott branded hotels, Four Seasons Hotels and Resorts and the subsidiary hotel brands for each of these major brands. Munn Works has a national sales force and an established distribution network for hotels and restaurants in every major market in the United States and has begun to develop a distribution network for the assisted living market. These distribution networks will also be a significant asset for SteriLumen, as those networks will be utilized for the marketing and sales of the SteriLumen Disinfecting System. Additionally, Munn Works advertises its products in hotel design magazines and participates in major national trade shows. During the last three years, Munn Works has significantly expanded its sales force, including hiring a vice president of sales, increased investments in advertising, including expanding its presence at industry trade shows and full-page advertising in trade magazines such as Boutique Design and Hospitality Design and establishing a presence on social media outlets such as Facebook, Instagram, and Twitter.

Recent Developments

Acquisition of SteriLumen and Munn Works. The Company acquired all of the issued and outstanding common shares of SteriLumen pursuant to an Exchange Agreement dated March 26, 2019 among the Company, SteriLumen and the shareholders of SteriLumen in which the SteriLumen shareholders exchanged their SteriLumen common shares for 201,252 shares of Company common stock, of which Laurie Munn, the spouse of Max Munn, our President and a director of the Company, received 200,000 shares. The Company acquired all of the issued and outstanding preferred shares of SteriLumen pursuant to an Exchange Agreement dated March 27, 2019 among the Company, SteriLumen and Laurie Munn in which Ms. Munn exchanged all of her SteriLumen Series A preferred stock for 1,800,000 shares of Company common stock and 2,000 shares of Company Series A preferred stock. Upon consummation of this exchange the Company owned 100% of the capital shares of SteriLumen. The Company acquired all of the membership interests in Munn Works pursuant to an Exchange Agreement dated July 1, 2019 among the Company, Munn Works and Laurie Munn in which Laurie Munn exchange her membership interests in Munn Works for 3,000,000 shares of Company common stock. All of the equity in the Company owned by Laurie Munn has been transferred to The Munn Family 2020 Irrevocable Trust, of which the spouse of Max Munn is the trustee.

Effects of Coronavirus Outbreak. In December 2019, a novel strain of Coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to over 150 countries and every state in the United States. On January 30, 2020, the World Health Organization declared the outbreak of Coronavirus a “Public Health Emergency of International Concern.” On March 11, 2020, the World Health Organization declared the outbreak a pandemic, and on March 13, 2020, the United States declared a national emergency.

The spread of the virus in many countries continues to adversely impact global economic activity and has contributed to significant volatility and negative pressure in financial markets and supply chains. The pandemic has had, and could have a significantly greater, material adverse effect on the U.S. economy where we conduct a majority of our business. The pandemic has resulted, and may continue to result for an extended period, in significant disruption of global financial markets, which may reduce our ability to access capital in the future, which could negatively affect our liquidity.

Most states and cities have reacted by instituting quarantines, restrictions on travel, “stay at home” and “social distancing” rules and restrictions on the types of businesses that may continue to operate, as well as guidance in response to the pandemic and the need to contain it. On March 20, 2020, the Governor of New York announced a stay at home order to go into effect on March 22, 2020, that has been extended to at least June 6, 2020, unless regions in the state can meet certain criteria related to the Coronavirus. Pursuant to this order, non-essential businesses were forced to close. However, as of the date of this prospectus, our Mount Vernon office is open with the majority of our employees working from home.

We have taken steps to take care of our employees, including providing the ability for employees to work remotely and implementing strategies to support appropriate social distancing techniques for those employees who are not able to work remotely. We have also taken precautions with regard to employee, facility, and office hygiene as well as implementing significant travel restrictions. We are also assessing our business continuity plans for all business units in the context of the pandemic. This is a rapidly evolving situation, and we will continue to monitor and mitigate developments affecting our workforce, our suppliers, our customers, and the public at large to the extent we are able to do so. We have and will continue to carefully review all rules, regulations, and orders and responding accordingly.

6

We are dependent upon suppliers to provide us with all of the raw materials for products that we manufacture and sell and we currently manufacture the majority of our products in China. The pandemic has impacted and may continue to impact suppliers of materials and the manufacturing locations for our products. As a result, we have faced and may continue to face delays or difficulty manufacturing certain products, which could negatively affect our business and financial results. Even if we are able to find alternate sources for materials and manufacturing, they may cost more, which could adversely impact our profitability and financial condition. Also, because of the disruption to travel and the decline in the demand for and the closure of hotels, Munn Works has experienced and may continue to experience a decline in demand for its products which could have a material adverse effect on its operations and financial condition.

If the current pace of the pandemic cannot be slowed and the spread of the virus is not contained, our business operations could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. We may also experience limitations in employee resources. In addition, our operations could be disrupted if any of our employees were suspected of having the virus, which could require quarantine of some or all such employees or closure of our facilities for disinfection. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

Although it is difficult to predict the effect and ultimate impact of the Coronavirus outbreak on our business, it is likely that the impact of Coronavirus will adversely affect our results of operations, financial condition and cash flows in fiscal year 2020. See “Risk Factors—Risks Related to our Business and Operations—The Coronavirus pandemic may cause a material adverse effect on our business.”

Options. On February 18, 2020, the Board approved the grant to each member of the Board, on a quarterly basis, of options to purchase 500 shares of the Company’s common stock at a per share exercise equal to the greater of $2.50 and the market value per share of the Company’s common stock on the date of the grant. Market value will be determined by an independent valuation company engaged by the Company; provided, however, if on the date of the grant the Company common stock is listed on a national exchange or quoted on an established quotation system, then the market value shall equal the closing price of the Company common stock listed on such exchange or quoted on such quotation system on the trading day immediately prior to the date of the grant. On April 1, 2020, we issued options to purchase 2,000 shares of Company common stock to members the Board, of which 1,250 have been cancelled. The options are subject to equal quarterly vesting over a one-year period. On July 1, 2020, we issued an additional 1,000 options to certain Board members. To date 375 of these options have vested. On July 9, 2020, the Board cancelled any further issuance of these quarterly options.

Applied UV, Inc. 2020 Omnibus Incentive Plan. On May 4, 2020, we adopted the Applied UV, Inc. 2020 Omnibus Incentive Plan (the “Plan”). Under the Plan, the Company may grant nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units, and other awards. Awards of up to 600,000 shares of common stock to Company employees, officers, directors, consultants, and advisors are available under the Plan. The type of grant, vesting provisions, exercise price and expiration dates are to be established by the Board at the date of grant.

Mount Sinai Agreement. On April 20, 2020, SteriLumen entered into the Mount Sinai Agreement pursuant to which Mount Sinai has agreed to conduct a study of the effectiveness of the SteriLumen Disinfecting System in 17 patient bathrooms at Mount Sinai St. Luke’s Hospital in New York, NY. SteriLumen will be responsible for funding the direct and indirect costs of Mount Sinai’s research in the amount of $160,000 plus all of the cost of microbiological testing. To the extent any intellectual property resulting from the research is conceived by Mount Sinai it will be the intellectual property of Mount Sinai and to the extent it is conceived by SteriLumen it will be the intellectual property of SteriLumen. SteriLumen has a 60-day exclusive option to negotiate a license for Mount Sinai’s resulting patent rights if such patent was obtained at SteriLumen’s request and SteriLumen has paid for all the costs in obtaining the patent. If the results of the study contained in Mount Sinai’s final report are used by SteriLumen in a successful regulatory filing or a successful fundraising effort, the Sponsor will be obligated to pay Mount Sinai a fee of $30,000.

Second ResInnova Report. In April 2020, the Company submitted the SteriLumen Disinfecting System to ResInnova for testing on its effectiveness in killing the Coronavirus. ResInnova tested the SteriLumen mirror and drain product lines against OC43. In a Report dated June 30, 2020, ResInnova found the SteriLumen mirror and drain to be greater than 97% and 99.99%, respectively, effective in killing the OC43 human coronavirus in the bathroom sink area. According to ResInnova, it is expected that the Coronavirus, will be killed in a similar manner to OC43 since they both are in the Beta genre of coronaviruses. See “Business—Second ResInnova Report” and “Risk Factors—Certain ResInnova Testing Limitations.”

7

Paycheck Protection Program Loan. On May 4, 2020, Munn Works received $296,287 in net proceeds from a loan (the “PPP Loan”) from JP Morgan Chase Bank under the Paycheck Protection Program (“PPP”), which was established under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) administered by the U.S. Small Business Administration. The proceeds from the PPP Loan will be used in accordance with the terms of the CARES Act program, as described further below.

The term of the PPP Loan is two years with an interest rate of 1.00% per annum, which shall be deferred for the first six months of the term of the loan. Pursuant to the terms of the CARES Act, the proceeds of the PPP Loan may be used for payroll costs, mortgage interest, rent, or utility costs. Under the terms of the CARES Act, Munn Works can apply for and be granted forgiveness for all or a portion of the PPP Loan. Such forgiveness will be determined, subject to limitations, based on the use of loan proceeds in accordance with the terms of the CARES Act, as described above, during the 8-week period after loan origination and the maintenance or achievement of certain employee levels. No assurance is provided that Munn Works will obtain forgiveness under the PPP Loan in whole or in part.

Reverse Stock Splits. On June 17, 2020 and June 23, 2020, the Company effected a 1 for 5 reverse stock split of its issued and outstanding Common Stock and effected a 1 for 5 reverse stock split of its issued and outstanding preferred stock, respectively (each a “Reverse Stock Split”) by filing on each date an amendment of the Company’s Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. No fractional shares were issued as a result of a Reverse Stock Split. Any fractional shares that would have resulted from a Reverse Stock Split were rounded up to the nearest whole share. The authorized common stock and preferred stock of the Company was not impacted by the Reverse Stock Splits. The Company has retrospectively adjusted the 2018, 2019 financial statements for profit per share and share amounts as a result of the reverse stock splits.

Appointment of Executive Officers. On June 30, 2020 the Company entered into employment agreements and appointed the Company’s Chief Executive Officer and Chief Operations Officer.

Non-Employee Director Compensation. On July 9, 2020 the Board approved a compensation package for non-employee directors of the Board. The compensation for non-employee directors include; (i) for each newly appointed director, a one-time issuance of 10,000 shares of restricted common stock which vests evenly on an annual basis over a four year period beginning on January 1 of the next calendar year from the date of issuance; (ii) the annual issuance of 7,500 shares of restricted common stock to each such director which vests in full on January 1 of the next calendar year from the date of issuance; (iii) quarterly cash payments of $6,250 to each such director, commencing November 1, 2020; (iv) the annual issuance of 10,000 shares of restricted common stock to the Chairman of the Board, which vests in full on January 1 of the next calendar year from the date of issuance and (v) the annual issuance of 5,000 shares of restricted common stock to each chairman of the Audit, Compensation and Nominating and Corporate Governance committees, which vests in full on January 1 of the next calendar year from the date of issuance.

Initial Public Offering. On September 2, 2020 the Company completed its initial public offering of 1,000,000 shares of its common at $5.00 per share and on September 3, 2020, the representative of the underwriters exercised its full overallotment option to purchase an additional 150,000 shares of the Company’s common stock at $5.00 per share. The Company received offering proceeds of $5,152,500 which were net of underwriting discounts and expenses. The Company’s common stock is listed on the Nasdaq Capital Market under the symbol “AUVI.”

Preliminary September 30, 2020 Financial Results

A brief summary of certain of our consolidated preliminary unaudited financial results from operations for the quarter ended September 30, 2020 is set forth below. This summary is not meant to be a comprehensive statement of our consolidated financial results from operations for this period. The following financial data from operations for the quarter ended September 30, 2020 is preliminary and based upon our estimates, and actual results may materially differ from these estimates following the completion of our financial closing procedures and related adjustments.

In the three and nine months ended September 30, 2020, our revenue is expected to be in the range of approximately $1.7 million to $2.0 million and approximately $4.6 million to $5.0 million, respectively, as compared to $2.7 million and $6.4 million, respectively, for the three and nine months ended September 30, 2019. In the three and nine months ended September 30, 2020, our net cash used in operating activities is expected to be approximately (negative) $0.7 million and (negative) $0.5 million, respectively, as compared to $0.1 million and $0.6 million, respectively, for the three and nine months ended September 30, 2019. As of September 30, 2020, our cash and cash equivalents balance is expected to be approximately $6.0 million and there is approximately $100,000 of long term debt.

You should read this data together with our financial statements and related notes incorporated by reference in this prospectus, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020. The preliminary financial data included in this registration statement has been prepared by, and is the responsibility of, our management.

Joint Development and Licensing Agreement. On October 19, 2020, we entered into a Joint Development and License Agreement (the “JDLA”) with Axis Lighting Inc., one of the largest independent architectural lighting companies in North America. Axis is headquartered in Lasalle, Quebec (Canada) and has a 100,000 sq. ft manufacturing facility with onsite design, engineering and marketing. Pursuant to the JDLA, we will collaborate with BalancedCare™, Axis’s new, dedicated healthcare facilities lighting group, on the development and commercialization of new LED-based technologies and solutions in UVC products designed for use in the hospital sector and addresses infection control. BalancedCare™ is supported by 98 agents across North America.

Non-Binding Letter of Intent. On November 2, 2020 we executed a non-binding letter of intent (“LOI”) with Akida Holdings LLC (“Akida”), the manufacturer of the Airocide™ system of air purification technologies, originally developed by NASA with assistance from the University of Wisconsin at Madison, that uses a combination of UV-C and a proprietary, titanium dioxide based photocatalyst that may aid in the reopening of the global economy with applications in the hospitality, hotel, healthcare, nursing homes, grocer, wine, commercial buildings and retail sectors. The Airocide™ system has been used by brands such as NASA, Whole Foods, Dole, Chiquita, Opus One, Sub-Zero Refrigerators and Robert Mondavi Wines. Pursuant to the LOI, we may explore the possibility of negotiating a definitive agreement for the acquisition of Akida or substantially all of its assets for up to an initial estimated purchase price of $12,000,000. Akida has agreed to cooperate with us in the conduct of our due diligence and not pursue alternative sale or financing options until after March 2, 2021, each of which are exceptions to the LOI being non-binding. We have not commenced our due diligence on Akida, made an assessment of its actual value and our board of directors has not approved the acquisition or sale of Akida. We are in the initial stages of exploring the acquisition of Akida, there is no guarantee that such acquisition will occur and the probability of such acquisition may be less than likely. See “Risk Factors—Risks Related to our Busines and Operations.”

Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors,” which begins on page 11 of this prospectus.

Information Regarding our Capitalization

As of November 3, 2020, we have 6,543,129 shares of common stock issued and outstanding, of which Max Munn, our President and a director of the Company has beneficial ownership of 5,000,000 shares through a trust for which his spouse is the trustee. We also have 2,000 shares of Series A preferred stock issued and outstanding, which provide the holder thereof with 1,000 votes per share (2 million votes in aggregate) that vote as a single class with common stock on all matters submitted to the shareholders for a vote. Mr. Munn is the beneficial owner of all of the Series A preferred stock through a trust in which his spouse is the trustee. Additional information regarding our issued and outstanding securities may be found under “Market for Common Equity and Related Stockholder Matters” and “Description of Securities.”

Unless otherwise specifically stated, information throughout this prospectus does not assume the exercise of outstanding options or warrants to purchase shares of our common stock.

Corporate Information

Our principal executive offices are located at 150 N. Macquesten Parkway, Mount Vernon, NY 10550. Our website address is www.applieduvinc.com. The information included on our website is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

8

These exemptions include:

| ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; | |

| ● | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | reduced disclosure obligations regarding executive compensation; and | |

| ● | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

| Common stock offered by us | 1,240,000 shares. |

| Common stock outstanding prior to the offering (1) |

6,543,129 shares common stock. |

| Common stock to be outstanding after the offering (2) |

7,783,129 (7,969,129 shares if the underwriters exercise their option to purchase additional shares in full). |

| Over-allotment option | The underwriters have a 45-day option to purchase up to 186,000 additional shares of common stock. (15% of the shares sold in this offering). |

| Use of Proceeds | We currently intend to use the net proceeds to us from this offering to hire additional employees, including executive officers and sales professionals and for general corporate purposes, including working capital and sales and marketing activities. See the section of this prospectus titled “Use of Proceeds” beginning on page 31. |

| Listing | Our common stock is listed on the Nasdaq Capital Market under the symbol “AUVI.” |

| Underwriters’ warrants | Upon the closing of this offering, we have agreed to issue to Ladenburg Thalmann & Co. Inc., as representative of the underwriters, warrants, that will expire on the fifth anniversary of the commencement of sales in this offering, entitling the representative to purchase 5.0% of the number of shares of common stock sold in this offering. The registration statement of which this prospectus is a part also covers the underwriters’ warrants and the common shares issuable upon the exercise thereof. For additional information regarding our arrangement with the underwriters, please see “Underwriting.” |

9

| Lock-up agreements | Our executive officers and directors have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for 180 days following the effective date of the registration statement for the Company’s initial public offering (February 24, 2021). For additional information regarding our arrangement with the underwriters, please see “Underwriting.” |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 11 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| (1) | As of November 3, 2020. Does not include 165,000 shares of our common stock issuable upon exercise of common stock purchase warrants. For voting purposes only, does not include 2,000 shares of preferred stock that have been designated as Series A Preferred Stock, all of which are issued and outstanding and are entitled to 1,000 votes per share (2,000,000 votes in aggregate) and vote with the common stock as a single class. |

| (2) | Does not include 226,000 shares of our common stock issuable upon exercise of common stock purchase warrants. For voting purposes only, does not include 2,000 shares of preferred stock that have been designated as Series A Preferred Stock, all of which are issued and outstanding and are entitled to 1,000 votes per share (2,000,000 votes in aggregate) and vote with the common stock as a single class. |

On June 17, 2020 we effected a 1 for 5 reverse stock split of the issued and outstanding shares of our common stock. On June 23, 2020 we effected a 1 for 5 reverse stock split of the issued and outstanding shares of our preferred stock. Except as otherwise indicated, all of the common stock and preferred stock information in this prospectus gives effect to the reverse stock splits.

10

Our business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price of our stock could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business and Operations

The Company operates through SteriLumen and Munn Works and its only material assets are its equity interests in those subsidiaries. As a result, our only current source of revenue is distributions from our subsidiaries and SteriLumen has incurred losses since its inception and we anticipate it will continue to incur significant losses for the foreseeable future and revenue from Munn Works may not be sufficient to offset those loses.

The Company is a holding company for SteriLumen and Munn Works and has no material assets other than its equity interests in those subsidiaries. Therefore, the only current revenue source is future distributions from its subsidiaries. SteriLumen is an early-stage designer and marketer of disinfection systems with limited operating history spanning from December 2016. We expect negative cash flows from SteriLumen’s operations for the foreseeable future which may not be off-set by cash flows from Munn Works. Our utilization of cash has been and will continue to be highly dependent on SteriLumen’s product development programs and cash flow from Munn Works’ operations. Our cash expenses will be highly dependent on the product development programs SteriLumen chooses to pursue, the progress of these product development programs, the results of SteriLumen’s validation/marketing studies, the terms and conditions of SteriLumen’s contracts with service providers and manufacturing contractors, and the terms of recruitment of facilities in our validation/marketing studies. In addition, the continuation of SteriLumen’s validation/marketing studies, and quite possibly its entire business, will depend on results of upcoming clinical data analyses and our financial resources at the time. Failure to raise capital as and when needed, on favorable terms or at all, would have a negative impact on our financial condition and SteriLumen’s ability to develop its product candidates.

SteriLumen has devoted substantially all of its financial resources to develop its product candidates. SteriLumen has financed its operations primarily through the contributions of its founders. The amount of SteriLumen’s future net losses will depend, in part, on the development of adequate distribution channels for the SteriLumen Disinfecting System, the demand for the SteriLumen Disinfecting System, the rate of its future expenditures and our ability to obtain funding through the issuance of our securities, strategic collaborations or grants. Disinfection product development is a highly speculative undertaking and involves a substantial degree of risk. SteriLumen successfully completed the prototype phase of testing and development for the SteriLumen Disinfecting System, but has not yet commenced pivotal testing in health care facility settings. Even if SteriLumen obtains positive results from such testing, its future revenue will depend upon its ability to achieve sufficient market acceptance, pricing, the performance of its independent sales representatives and its manufacturing and distribution suppliers.

We expect SteriLumen to continue to incur significant losses until it is able to commercialize the SteriLumen Disinfecting System, which it may not be successful in achieving. We anticipate that SteriLumen’s expenses will increase substantially if and as SteriLumen:

| · | continues the research and development of the SteriLumen Disinfecting System and other disinfecting products; | |

| · | expands the scope of its testing for the SteriLumen Disinfecting System and other disinfecting products; | |

| · | establishes a sales, marketing, and distribution infrastructure to commercialize its product candidates; | |

| · | seeks to maintain, protect, and expand its intellectual property portfolio; | |

| · | seeks to attract and retain skilled personnel; and |

11

| · | creates additional infrastructure to support its product candidate development and planned future commercialization efforts. |

Furthermore, any additional fundraising efforts may divert our management from our subsidiaries’ day-to-day activities, which may adversely affect our ability to develop and commercialize their product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our securities and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely affect our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results, and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any product candidates or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

The pandemic caused by the spread of the Coronavirus could have an adverse impact on our financial condition and results of operations and other aspects of our business.

In December 2019, a novel strain of Coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to over 150 countries and every state in the United States. On January 30, 2020, the World Health Organization declared the outbreak of Coronavirus a “Public Health Emergency of International Concern.” On March 11, 2020, the World Health Organization declared the outbreak a pandemic, and on March 13, 2020, the United States declared a national emergency.

The spread of the virus in many countries continues to adversely impact global economic activity and has contributed to significant volatility and negative pressure in financial markets and supply chains. The pandemic has had, and could have a significantly greater, material adverse effect on the U.S. economy where we conduct a majority of our business. The pandemic has resulted, and may continue to result for an extended period, in significant disruption of global financial markets, which may reduce our ability to access capital in the future, which could negatively affect our liquidity

Most states and cities have reacted by instituting quarantines, restrictions on travel, “stay at home” and “social distancing” rules and restrictions on the types of businesses that may continue to operate, as well as guidance in response to the pandemic and the need to contain it.

We have taken steps to take care of our employees, including providing the ability for employees to work remotely and implementing strategies to support appropriate social distancing techniques for those employees who are not able to work remotely. We have also taken precautions with regard to employee, facility, and office hygiene as well as implementing significant travel restrictions. We are also assessing our business continuity plans for all business units in the context of the pandemic. This is a rapidly evolving situation, and we will continue to monitor and mitigate developments affecting our workforce, our suppliers, our customers, and the public at large to the extent we are able to do so. We have and will continue to carefully review all rules, regulations, and orders and responding accordingly.

We are dependent upon suppliers to provide us with all of the raw materials for products that we manufacture and sell and we currently manufacture the majority of our products in China. The pandemic has impacted and may continue to impact suppliers of materials and the manufacturing locations for our products. As a result, we have faced and may continue to face delays or difficulty manufacturing certain products, which could negatively affect our business and financial results. Even if we are able to find alternate sources for materials and manufacturing, they may cost more, which could adversely impact our profitability and financial condition.

12

If the current pace of the pandemic cannot be slowed and the spread of the virus is not contained, our business operations could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. We may also experience limitations in employee resources. In addition, our operations could be disrupted if any of our employees were suspected of having the virus, which could require quarantine of some or all such employees or closure of our facilities for disinfection. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

Although it is difficult to predict the effect and ultimate impact of the Coronavirus outbreak on our business, it is likely that the impact of Coronavirus will adversely affect our results of operations, financial condition and cash flows in fiscal year 2020.

We are vulnerable to continued global economic uncertainty and volatility in financial markets.

Our business is highly sensitive to changes in general economic conditions as a seller of goods and services. Financial markets inside the United States and internationally have experienced extreme disruption in recent times, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, and declining valuations of investments. We believe these disruptions are likely to have an ongoing adverse effect on the world economy. A continuing economic downturn and financial market disruptions could have a material adverse effect on our business, financial condition, and results of operations, including by:

| · | reducing demand for our products and services, increasing order cancellations and resulting in longer sales cycles and slower adoption of new technologies; |

| · | increasing the difficulty of collecting accounts receivable and the risk of excess and obsolete inventories; |

| · | increasing price competition in our served markets; and |

| · | resulting in supply interruptions, which could disrupt our ability to produce our products. |

We could need to raise additional capital in the future, and if we are unable to secure adequate funds on terms acceptable to us, we could be unable to execute our business plan.

To remain competitive, we must continue to make significant investments in the development of our products, the expansion of our sales and marketing activities, and the expansion of our operating and management infrastructure as we increase sales domestically and internationally. If cash generated from our operations is insufficient to fund such growth, we could be required to raise additional funds through the issuance of equity or debt securities in the public or private markets, or through a collaborative arrangement or sale of assets. Additional financing opportunities may not be available to us, or if available, may not be on favorable terms. The availability of financing opportunities will depend, in part, on market conditions, and the outlook for our business. Any future issuance of equity securities or securities convertible into equity securities could result in substantial dilution to our stockholders, and the securities issued in such a financing could have rights, preferences or privileges senior to those of our common stock. In addition, if we raise additional funds through debt financing, we could be subject to debt covenants that place limitations on our operations. We could not be able to raise additional capital on reasonable terms, or at all, or we could use capital more rapidly than anticipated. If we cannot raise the required capital when needed, we may not be able to satisfy the demands of existing and prospective customers, we could lose revenue and market share and we may have to curtail our capital expenditures.

The following factors, among others, could affect our ability to obtain additional financing on favorable terms, or at all:

| · | our results of operations; |

| · | general economic conditions and conditions in the sanitation and disinfection industries and performance of sanitation devices as opposed to sanitation and disinfection substances; |

| · | the perception of our business in the capital markets; |

13

| · | making capital improvements to improve our infrastructure; |

| · | hiring qualified management and key employees; |

| · | responding to competitive pressures; |

| · | complying with regulatory requirements, if any; |

| · | our ratio of debt to equity; |

| · | our financial condition; |

| · | our business prospects; and |

| · | interest rates. |

If we are unable to obtain sufficient capital in the future, we could have to curtail our capital expenditures. Any curtailment of our capital expenditures could result in a reduction in net revenue, reduced quality of our products, increased manufacturing costs for our products, harm to our reputation, or reduced manufacturing efficiencies and could have a material adverse effect on our business, financial condition, and results of operations.

Raising additional capital may cause dilution to our existing stockholders and restrict our operations or require us to relinquish certain intellectual property rights.

We may seek additional capital through a combination of public and private equity offerings, debt financings, strategic partnerships and alliances, licensing arrangements, and grants. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest of our existing stockholders may be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our stockholders. Debt and receivables financings may be coupled with an equity component, such as warrants to purchase shares, which could also result in dilution of our existing stockholders’ ownership. The incurrence of indebtedness would result in increased fixed payment obligations and could also result in certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our or our subsidiaries’ products or grant licenses on terms that are not favorable to us. A failure to obtain adequate funds may cause us to curtail certain operational activities, including research and development, validation/marketing studies, sales and marketing, and manufacturing operations, in order to reduce costs and sustain the business, and would have a material adverse effect on our business and financial condition.

Our success depends, in part, on our relationships with, and the efforts of, third-party manufacturers, distributors, and other third parties that perform various tasks for us. If these third parties do not successfully carry out their contractual duties or meet expected, we may not be able to commercialize our product candidates and our business could be substantially harmed.

While we internally manufacture all of Munn Works’ products that are manufactured domestically, currently approximately 75% of Munn Works’ products and all of SteriLumen’s products are manufactured overseas in China by third party manufacturers. We do not currently have the infrastructure or capability internally to manufacture all of the components of our products and systems, and we lack the resources and the capability to manufacture and distribute the SteriLumen Disinfecting System on a commercial scale. We plan to rely on third parties for such operations. There are a limited number of manufacturers who have the ability to produce our products, and there may be a need to identify alternate manufacturers to prevent a possible disruption of our manufacturing and distribution process. Switching manufacturers or distributors, if necessary, may involve substantial costs and is likely to result in a delay in our desired commercial timelines, which could harm our business and results of operations.

Our suppliers may not supply us with a sufficient amount or adequate quality of materials, which could have a material adverse effect on our business, financial condition, and results of operations.

Our business depends on our ability to obtain timely deliveries of materials, components, and subassemblies of acceptable quality and in acceptable quantities from third-party suppliers. We generally purchase components and subassemblies from a limited group of suppliers through purchase orders, rather than written supply contracts. Consequently, many of our suppliers have no obligation to continue to supply us on a long-term basis. In addition, our suppliers manufacture products for a range of customers, and fluctuations in demand for the products those suppliers manufacture for others could affect their ability to deliver components for us in a timely manner. Moreover, our suppliers could encounter financial hardships, be acquired, or experience other business events unrelated to our demand for components, which could inhibit or prevent their ability to fulfill our orders and satisfy our requirements.

14

If any of our suppliers cease to provide us with sufficient quantities of our components in a timely manner or on terms acceptable to us, or ceases to manufacture components of acceptable quality, we could incur manufacturing delays and sales disruptions while we locate and engage alternative qualified suppliers, and we might be unable to engage acceptable alternative suppliers on favorable terms. In addition, we could need to reengineer our components, which could significantly delay production. Any interruption or delay in the supply of components or materials, or our inability to obtain components or materials from alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to cancel orders or switch to competitive procedures. We are continually in the process of identifying and qualifying alternate source suppliers for our key components. There can be No assurance, however, that we will successfully identify and qualify an alternate source supplier for any of our key components or that we could enter into an agreement with any such alternate source supplier on terms acceptable to us, or at all.

Our reliance on third parties requires us to share our trade secrets, which increases the possibility that a competitor will discover them or that our trade secrets will be misappropriated or disclosed.

Because we rely on third parties to develop and manufacture our products, we must, at times, share trade secrets with them. We seek to protect our proprietary technology in part by entering into confidentiality agreements and, if applicable, material transfer agreements, collaborative research agreements, consulting agreements or other similar agreements with our collaborators, advisors, employees and consultants prior to beginning research or disclosing proprietary information. These agreements typically limit the rights of the third parties to use or disclose our confidential information, such as trade secrets. Despite the contractual provisions employed when working with third parties, the need to share trade secrets and other confidential information increases the risk that such trade secrets become known by our competitors, are inadvertently incorporated into the technology of others, or are disclosed or used in violation of these agreements. Given that our proprietary position is based, in part, on our know-how and trade secrets, a competitor’s discovery of our trade secrets or other unauthorized use or disclosure would impair our competitive position and may have a material adverse effect on our business.

Our near-term success is dependent in large part upon SteriLumen’s ability to commence sales of the SteriLumen Disinfecting System and continued sales and positive cash flow from Munn Works’ products.

Our success will depend, in part, upon SteriLumen’s ability to create a commercial market for the SteriLumen Disinfecting System. Attracting new customers and distribution networks requires substantial time and expense. Any failure to commercialize SteriLumen’s products would adversely affect its operating results and adversely affect our business, results of operations and financial condition. Many factors could affect the market acceptance and commercial success of SteriLumen’s products, including:

| · | SteriLumen’s ability to convince its potential customers of the advantages and economic value of products over competing products and methodologies; |

| · | the breadth of its product menu; |

| · | changes to policies, procedures or currently accepted best practices in the health care industry; |

| · | the extent and success of its marketing and sales efforts; and |

| · | its ability to manufacture in quantity its products and meet demand in a timely fashion. |

While we have entered into a non-binding letter of intent with Akida for its acquisition, we cannot assure you that the acquisition will be consummated or, that if such acquisition is consummated, it will be accretive to stockholder value.

On November 2, 2020, we entered into a non-binding letter of intent with Akida pursuant to which we agreed to explore an acquisition of Akida or substantially all of its assets. However, we are in the initial stages of discussions with Akida and the non-binding letter of intent does not include material terms to any potential acquisition of Akida and there is no guarantee that we will agree to terms or definitive documentation with Akida in order to effect an acquisition and the probability of such acquisition may be less than likely. Further, even if we are able to agree to terms with Akida for an acquisition, there is no guarantee that the terms will be approved by our board of directors, that the transaction will be completed, or that if the transaction is completed it will result in additional value to our stockholders.

We may engage in future acquisitions or strategic transactions, including the transaction with Akida, which may require us to seek additional financing or financial commitments, increase our expenses and/or present significant distractions to our management.

As described herein, we have recently entered into a non-binding letter of intent to explore the possibility of negotiating an acquisition of Akida or substantially all of its assets, which enables us to conduct due diligence and negotiate the terms of a definitive acquisition agreement. In the event we engage in an acquisition or strategic transaction, we may need to acquire additional financing (particularly, if the acquired entity is not cash flow positive or does not have significant cash on hand). Obtaining financing through the issuance or sale of additional equity and/or debt securities, if possible, may not be at favorable terms and may result in additional dilution to our current stockholders. Additionally, any such transaction may require us to incur non-recurring or other charges, may increase our near and long-term expenditures and may pose significant integration challenges or disrupt our management or business, which could adversely affect our operations and financial results. For example, an acquisition or strategic transaction may entail numerous operational and financial risks, including the risks outlined above and additionally:

| · | exposure to unknown liabilities; |

| · | disruption of our business and diversion of our management’s time and attention in order to develop acquired products or technologies higher than expected acquisition and integration costs; |

| · | write-downs of assets or goodwill or impairment charges; |

| · | increased amortization expenses; |

| · | difficulty and cost in combining the operations and personnel of any acquired businesses with our operations and personnel; |

| · | impairment of relationships with key suppliers or customers of any acquired businesses due to changes in management and ownership; |

| · | inability to retain key employees of any acquired businesses. |

Accordingly, although there can be no assurance that we will undertake or successfully complete any transactions of the nature described above, and any transactions that we do complete could have a material adverse effect on our business, results of operations, financial condition and prospects.

15

Recent U.S. tax legislation may materially affect our financial condition, results of operations and cash flows.