UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended | |||||

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from _______ to _______ | ||||||||

Commission File Number: | ||||||||

| (Exact name of registrant as specified in its charter) | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address, including zip code, of principal executive offices) | ||||||||

( | ||||||||

(Registrant's telephone number, including area code) | ||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. | ||||||||||||||

| ☒ | Accelerated filer | ☐ | ||||||||||||

Non‑accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |||||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes | ||||||||||||||

As of May 1, 2024, there were 390,861,717 shares of the registrant's common stock outstanding.

UNITY SOFTWARE INC.

FORM 10‑Q

For the Quarter Ended March 31, 2024

TABLE OF CONTENTS

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This Quarterly Report on Form 10‑Q contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact, including statements regarding our future results of operations or financial condition, business strategy and plans, and objectives of management for future operations are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as "aim," "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "toward," "will," "would," or the negative of these words or other similar terms or expressions.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10‑Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. Readers are cautioned that these forward‑looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified and discussed in greater detail below, under "Part II, Item 1A. Risk Factors" and summarized below.

•We have a history of losses and may not achieve or sustain profitability on a GAAP basis in the future.

•If we fail to successfully execute our plans to reset our portfolio to focus on our Strategic Portfolio and to right-size our investments, our business will be harmed.

•If we are not able to grow efficiently and manage our costs, we may not achieve profitability on a GAAP basis.

•We may fail to realize the possible synergies between our Create and Grow Solutions, including the benefits of the ironSource Merger, or those synergies may take longer to realize than expected.

•If we are unable to retain our existing customers and expand their use of our platform, or attract new customers, our growth and operating results could be adversely affected, and we may be required to reconsider our growth strategy.

•The markets in which we participate are competitive, and if we do not compete effectively, our business, financial condition, and results of operations could be harmed. For example, in the third quarter of 2023 we announced changes to our pricing model for our Create Solutions, which will become effective for users of the next major release of the software expected to be available in 2024. We experienced a high volume of negative customer feedback including a boycott and a slowdown of signing new contracts and renewals as a result of these changes which we believe negatively impacted our Grow Solutions revenue in the second half of 2023. If we fail to recover or reengage our customers or fail to attract new customers as a result of this announcement, our business could be harmed.

•Operating system platform providers or application stores may change terms of service, policies or technical requirements applicable to us or our customers, which could adversely impact our business.

•If we are unable to further expand into new industries, or if our solutions for any new industry fail to achieve market acceptance, our growth and operating results could be adversely affected, and we may be required to reconsider our growth strategy.

•We are increasingly building artificial intelligence ("AI") into certain of our offerings, and issues raised by the use of AI in our offerings may adversely affect our business, reputation, or financial results.

•Recent negative macroeconomic factors, such as inflation, interest rates, and limited credit availability have and could further cause economic uncertainty and volatility, which could harm our business.

•Increased competition in the advertising market and ongoing restrictions related to the gaming industry in China have impacted our growth rates and may continue to do so.

•Ongoing geopolitical instability, particularly in Israel, where a significant portion of our Grow Solutions operations is located, has impacted and may further adversely affect our business.

•The loss of one or more members of our senior management or key employees could harm our business, and we may not be able to find adequate replacements. For example, in the second quarter of 2024, we announced the hiring of our permanent Chief Executive Officer and President, Matthew Bromberg. Our ability to successfully transition the Chief Executive Officer role and to retain Mr. Bromberg and other senior executives could impact our operations and our business.

The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10‑Q. While we believe such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report on Form 10‑Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this Quarterly Report on Form 10‑Q or to reflect new information, actual results, revised expectations, or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

Additional Information

Unless the context otherwise requires, all references in this Quarterly Report on Form 10-Q to "we," "us," "our," "our company," "Unity," and "Unity Technologies" refer to Unity Software Inc. and its consolidated subsidiaries. The Unity design logos, "Unity" and our other registered or common law trademarks, service marks, or trade names appearing in this Quarterly Report on Form 10-Q are the property of Unity Software Inc. or its affiliates.

Investors and others should note that we may announce material business and financial information using our investor relations website (www.investors.unity.com), our filings with the Securities and Exchange Commission, press releases, public conference calls, and public webcasts as means of complying with our disclosure obligations under Regulation FD. We encourage investors and others interested in our company to review the information that we make available.

| Unity Software Inc. | ||||||||

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||||

(In thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| As of | |||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable, net | |||||||||||

| Prepaid expenses and other | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and stockholders' equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued expenses and other | |||||||||||

| Publisher payables | |||||||||||

| Deferred revenue | |||||||||||

| Total current liabilities | |||||||||||

| Convertible notes | |||||||||||

| Long-term deferred revenue | |||||||||||

| Other long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and Contingencies (Note 7) | |||||||||||

| Redeemable noncontrolling interests | |||||||||||

| Stockholders' equity: | |||||||||||

Common stock, $ | |||||||||||

Authorized shares - | |||||||||||

Issued and outstanding shares - | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total Unity Software Inc. stockholders' equity | |||||||||||

| Noncontrolling interest | |||||||||||

| Total stockholders' equity | |||||||||||

| Total liabilities and stockholders' equity | $ | $ | |||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||

| (In thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | $ | $ | |||||||||

| Cost of revenue | |||||||||||

| Gross profit | |||||||||||

| Operating expenses | |||||||||||

| Research and development | |||||||||||

| Sales and marketing | |||||||||||

| General and administrative | |||||||||||

| Total operating expenses | |||||||||||

| Loss from operations | ( | ( | |||||||||

| Interest expense | ( | ( | |||||||||

| Interest income and other income (expense), net | |||||||||||

| Loss before income taxes | ( | ( | |||||||||

| Provision for (benefit from) Income taxes | ( | ||||||||||

| Net loss | ( | ( | |||||||||

| Net loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ( | |||||||||

| Net loss attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

| Basic and diluted net loss per share attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

| Weighted-average shares used in computation of basic and diluted net loss per share | |||||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

2

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Other comprehensive income (loss), net of taxes: | |||||||||||

| Change in foreign currency translation adjustment | ( | ||||||||||

| Change in unrealized gains (losses) on derivative instruments | ( | ||||||||||

| Other comprehensive income (loss) | ( | ||||||||||

| Comprehensive loss | ( | ( | |||||||||

| Net loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ( | |||||||||

| Foreign currency translation attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ||||||||||

| Comprehensive loss attributable to noncontrolling interest and redeemable noncontrolling interests | ( | ( | |||||||||

| Comprehensive loss attributable to Unity Software Inc. | $ | ( | $ | ( | |||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

3

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||

| (In thousands, except share data) | |||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||

| Additional | Other | Unity Software Inc. | |||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders' | Noncontrolling | Total | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | Loss | Deficit | Equity | Interest (1) | Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock from employee equity plans | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock‑based compensation expense | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Adjustments to redeemable noncontrolling interest | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||

| Additional | Other | Unity Software Inc. | |||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders' | Noncontrolling | Total | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | Loss | Deficit | Equity | Interest (1) | Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock from employee equity plans | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock‑based compensation expense | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Adjustments to redeemable noncontrolling interest | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

(1) Excludes redeemable noncontrolling interests.

See accompanying Notes to Condensed Consolidated Financial Statements.

4

| Unity Software Inc. | ||||||||

| UNITY SOFTWARE INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||

| (In thousands) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Operating activities | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Stock-based compensation expense | |||||||||||

| Gain on repayment of convertible note | ( | ||||||||||

| Other | |||||||||||

| Changes in assets and liabilities, net of effects of acquisitions: | |||||||||||

| Accounts receivable, net | ( | ||||||||||

| Prepaid expenses and other | ( | ||||||||||

| Other assets | ( | ||||||||||

| Accounts payable | |||||||||||

| Accrued expenses and other | ( | ( | |||||||||

| Publisher payables | ( | ||||||||||

| Other long-term liabilities | ( | ( | |||||||||

| Deferred revenue | ( | ( | |||||||||

| Net cash used in operating activities | ( | ( | |||||||||

| Investing activities | |||||||||||

| Purchases of short-term investments | ( | ||||||||||

| Proceeds from principal repayments and maturities of short-term investments | |||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

| Financing activities | |||||||||||

| Repayments of convertible note | ( | ||||||||||

| Proceeds from issuance of common stock from employee equity plans | |||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | ( | ||||||||||

| Increase (decrease) in cash, cash equivalents, and restricted cash | ( | ||||||||||

| Cash, cash equivalents, and restricted cash, beginning of period | |||||||||||

| Cash, cash equivalents, and restricted cash, end of period | $ | $ | |||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Cash paid for income taxes, net of refunds | $ | $ | |||||||||

| Cash paid for operating leases | $ | $ | |||||||||

| Supplemental disclosures of non‑cash investing and financing activities: | |||||||||||

| Assets acquired under operating lease | $ | $ | |||||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

5

| Unity Software Inc. | ||||||||

UNITY SOFTWARE INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Accounting Policies

Basis of Presentation and Consolidation

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make certain estimates, judgments, and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates, and such differences could be material to our financial position and results of operations.

Employee Separation and Restructuring Costs

In January 2024, we committed to a plan to eliminate approximately 25 % of our workforce, and we mutually agreed to the departure of the founders of ironSource Ltd. Following these announcements, we incurred incremental employee separation costs of approximately $193 million in the first quarter of 2024, which included $126 million of incremental stock-based compensation. Additionally we incurred $19 million of restructuring costs, primarily related to office closures.

2. Revenue

The following table presents our revenue disaggregated by source, which also have similar economic characteristics (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Create Solutions | $ | $ | |||||||||

| Grow Solutions | |||||||||||

| Total revenue | $ | $ | |||||||||

6

| Unity Software Inc. | ||||||||

The following table presents our revenue disaggregated by geography, based on the invoice address of our customers (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| United States | $ | $ | |||||||||

Greater China (1) | |||||||||||

EMEA (2) | |||||||||||

APAC (3) | |||||||||||

Other Americas (4) | |||||||||||

| Total revenue | $ | $ | |||||||||

(1) Greater China includes China, Hong Kong, and Taiwan.

(2) Europe, the Middle East, and Africa ("EMEA")

(3) Asia-Pacific, excluding Greater China ("APAC")

(4) Canada and Latin America ("Other Americas")

Accounts Receivable, Net

Sales Commissions

Contract Balances and Remaining Performance Obligations

7

| Unity Software Inc. | ||||||||

3. Financial Instruments

Cash, Cash Equivalents, and Restricted Cash

Cash, cash equivalents, and restricted cash are recorded at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. To increase the comparability of fair value measures, the following hierarchy prioritizes the inputs to valuation methodologies used to measure fair value:

•Level 1—Valuations based on quoted prices in active markets for identical assets or liabilities.

•Level 2—Valuations based on quoted prices for similar assets and liabilities in active markets or inputs that are observable for the assets or liabilities, either directly or indirectly through market corroboration.

•Level 3—Valuations based on unobservable inputs reflecting our own assumptions used to measure assets and liabilities at fair value. These valuations require significant judgment.

The following table summarizes, by major security type, our cash, cash equivalents, and restricted cash that are measured at fair value on a recurring basis and are categorized using the fair value hierarchy (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

Fair Value (1) | |||||||||||

| Cash | $ | $ | |||||||||

| Level 1: | |||||||||||

| Restricted cash and cash equivalents: | |||||||||||

| Restricted cash | $ | $ | |||||||||

| Money market funds | |||||||||||

| Time deposits | |||||||||||

| Total restricted cash and cash equivalents | $ | $ | |||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

(1) Due to the highly liquid nature of our investments, amortized cost approximates fair value.

Nonrecurring Fair Value Measurements

We hold equity investments in certain unconsolidated entities without a readily determinable fair value. These strategic investments represent less than a 20 % ownership interest in each of the entities, and we do not have significant influence over or control of the entities. We use the measurement alternative to account for adjustments to these investments for observable transactions for the same or similar investments of the same issuer in any given quarter. If we determine an impairment has occurred, the investment is written down to the estimated fair value. As of March 31, 2024 and December 31, 2023, such equity investments totaled $33.6

4. Investment in Unity China

The results of Unity China, of which third-party investors hold a 20.5 % ownership interest, are included in our condensed consolidated financial statements. Under certain conditions we may be required to repurchase the third-party interest in Unity China. The redeemable noncontrolling interests in Unity China are recorded as temporary equity on our condensed consolidated balance sheet.

8

| Unity Software Inc. | ||||||||

The following table presents the changes in redeemable noncontrolling interests (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Balance at beginning of period | $ | $ | |||||||||

| Net loss attributable to redeemable noncontrolling interests | ( | ( | |||||||||

| Accretion for redeemable noncontrolling interests | |||||||||||

| Foreign currency translation and foreign exchange adjustments for redeemable noncontrolling interests | ( | ||||||||||

| Balance at end of period | $ | $ | |||||||||

5. Leases

We have operating leases for offices, which have remaining lease terms of up to nine years .

Components of lease expense were as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Operating lease expense | $ | $ | |||||||||

| Variable lease expense | |||||||||||

| Sublease income | ( | ( | |||||||||

| Total lease expense | $ | $ | |||||||||

Supplemental balance sheet information related to leases was as follows (in thousands, except weighted-average figures):

| As of | |||||||||||||||||

| Classification | March 31, 2024 | December 31, 2023 | |||||||||||||||

| Operating lease assets | $ | $ | |||||||||||||||

| Current operating lease liabilities | $ | $ | |||||||||||||||

| Long-term operating lease liabilities | |||||||||||||||||

| Total operating lease liabilities | $ | $ | |||||||||||||||

As of March 31, 2024 and December 31, 2023, our operating leases had a weighted-average remaining lease term of 5.0 years and 5.1 years, respectively, and a weighted-average discount rate of 5.2 % and 5.2 %, respectively.

As of March 31, 2024, our lease liabilities were as follows (in thousands):

| Operating Leases | |||||

| Gross lease liabilities | $ | ||||

| Less: imputed interest | |||||

| Present value of lease liabilities | $ | ||||

6. Borrowings

Convertible Notes

As of March 31, 2024, we had $2.2 billion of unsecured convertible notes outstanding including $1.0 billion issued in November 2022 (the "2027 Notes") and $1.2 billion issued in November 2021 (the "2026 Notes"). The table below summarizes the principal and unamortized debt issuance costs and other material features of the Notes (in thousands):

9

| Unity Software Inc. | ||||||||

Carrying Amount as of | |||||||||||||||||||||||||||||||||||

| Conversion Rate per $1,000 Principal | Conversion Price | Maturities | Stated Interest Rates | March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||

| Convertible notes: | |||||||||||||||||||||||||||||||||||

Principal – 2026 Notes | 3.2392 | $ | 2026 | $ | $ | ||||||||||||||||||||||||||||||

Principal – 2027 Notes | 20.4526 | $ | 2027 | ||||||||||||||||||||||||||||||||

| Unamortized debt issuance costs, net | ( | ( | |||||||||||||||||||||||||||||||||

| Net carrying amount | $ | $ | |||||||||||||||||||||||||||||||||

Interest on the Notes is payable semi-annually in arrears. The combined interest expense on the Notes related to regular interest and the amortization of debt issuance cost was $6.0 million and $6.1 million for the three months ended March 31, 2024 and March 31, 2023, respectively.

As of March 31, 2024 and December 31, 2023, the estimated fair value of the 2027 Notes were approximately $1.1 billion and 1.3 billion, respectively, and the estimated fair value of the 2026 Notes were approximately $1.1 billion and 1.4 billion, respectively. The fair value of the 2027 Notes was based on a combination of a discounted cash flow and Black-Scholes option-pricing model. The fair value of the 2026 Notes was based on quoted prices as of that date.

The 2026 Notes are convertible at the option of the holder if a conversion condition of the 2026 Notes is triggered. During the three months ended March 31, 2024, none of the conversion conditions of the 2026 Notes were triggered and the 2026 Notes were not convertible as of March 31, 2024. The 2027 Notes are convertible at the option of the holder prior to maturity. Upon conversion of the Notes, we will deliver cash, shares of our common stock, or a combination of cash and shares of our common stock,at our election. The conversion rates for the Notes is subject to customary adjustments for certain events as described in the indentures governing the Notes.

The Notes are subject to additional terms. In connection with certain corporate events, as described in the Indentures, we will increase the conversion rate for a holder of the Notes who elects to convert those notes in connection with the event. Additionally, upon the occurrence of certain corporate events and subject to certain exceptions, as described in the Indentures, holders of the Notes may require us to repurchase all or a portion of their notes at a price equal to 100 % of the principal amount to be repurchased, plus any accrued and unpaid interest to date. The 2026 Notes are also redeemable at our option if certain conditions are met, as described in the Indenture governing the 2026 Notes.

As of March 31, 2024, no holders of the 2027 and 2026 Notes have exercised the conversion rights, and the if-converted value of the 2027 and 2026 Notes did not exceed the principal amount.

Convertible Note Repurchase

During the first quarter of 2024, the Company repurchased in privately negotiated transactions and extinguished a portion of the 2026 Notes, with a total principal balance of $480 million. The aggregate repurchase price for these notes was $415 million, resulting in pre-tax gains of $61.4 million, net of the write-off of unamortized issuance costs. The gain was included in Interest income and other income (expense), net, in the condensed consolidated statement of operations.

Capped Call Transactions

In connection with the pricing of the 2026 Notes, we entered into the Capped Call Transactions at a net cost of $48.1 million, with call options totaling approximately 5.6 million of our common shares, and with expiration dates ranging from September 18, 2026 to November 12, 2026. The strike price is $308.72 , and the cap price is initially $343.02 per share, subject to adjustments in certain circumstances. The Capped Call Transactions are freestanding and are considered separately exercisable from the 2026 Notes.

| Unity Software Inc. | ||||||||

The Capped Call Transactions are intended to reduce potential dilution to our common stock upon any conversion of the 2026 Notes and/or offset any cash payments we are required to make in excess of the principal amount of converted 2026 Notes, as the case may be, with such reduction and/or offset subject to a cap. As of March 31, 2024, the Capped Call Transactions met the conditions for equity classification and were not in the money.

7. Commitments and Contingencies

The following table summarizes our non-cancelable contractual commitments as of March 31, 2024 (in thousands):

| Total | Remainder of 2024 | 2025‑2026 | 2027‑2028 | Thereafter | |||||||||||||||||||||||||

Operating leases (1) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Purchase commitments (2) | |||||||||||||||||||||||||||||

Convertible note principal and interest (3) | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

(1) Operating leases consist of obligations for real estate that are active.

(2) The substantial majority of our purchase commitments are related to agreements with our data center hosting providers.

(3) Convertible notes due 2026 and 2027. See Note 6, "Borrowings," above for further discussion.

We expect to meet our remaining commitments.

Legal Matters

In the normal course of business, we are subject to various legal matters. We accrue a liability when management believes that it is both probable that a liability has been incurred and the amount of loss can be reasonably estimated. We also disclose material contingencies when we believe a loss is not probable but reasonably possible. Legal costs related to such potential losses are expensed as incurred. In addition, recoveries are shown as a reduction in legal costs in the period in which they are realized. With respect to our outstanding matters, based on our current knowledge, we believe that the resolution of such matters will not, either individually or in aggregate, have a material adverse effect on our business or our condensed consolidated financial statements. However, litigation is inherently uncertain, and the outcome of these matters cannot be predicted with certainty. Accordingly, cash flows or results of operations could be materially affected in any particular period by the resolution of one or more of these matters.

Indemnifications

In the ordinary course of business, we may provide indemnifications of varying scope and terms to customers, vendors, lessors, investors, directors, officers, employees and other parties with respect to certain matters. Indemnification may include losses from our breach of such agreements, services we provide, or third-party intellectual property infringement claims. These indemnifications may survive termination of the underlying agreement and the maximum potential amount of future indemnification payments may not be subject to a cap. As of March 31, 2024, there were no known events or circumstances that have resulted in a material indemnification liability to us and we did not incur material costs to defend lawsuits or settle claims related to these indemnifications.

Letters of Credit

We had $14.5 million and $13.9 million of secured letters of credit outstanding as of March 31, 2024 and December 31, 2023, respectively. These primarily relate to our office space leases and are fully collateralized by certificates of deposit which we record in restricted cash as other assets on our condensed consolidated balance sheets.

| Unity Software Inc. | ||||||||

8. Stock‑Based Compensation

Stock-based compensation expense is as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cost of revenue | $ | $ | |||||||||

| Research and development | |||||||||||

| Sales and marketing | |||||||||||

| General and administrative | |||||||||||

| Total stock-based compensation expense | $ | $ | |||||||||

Included in the above expenses for the three months ended March 31, 2024, is $93 million of incremental stock-based compensation expense from modifications, primarily within general and administrative. These amounts predominately relate to the modification of awards held by the founders of ironSource Ltd. that departed in the first quarter of 2024.

Stock Options

A summary of our stock option activity is as follows:

| Options Outstanding | |||||||||||||||||

| Stock Options Outstanding | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Term (In Years) | |||||||||||||||

| Balance as of December 31, 2023 | $ | ||||||||||||||||

| Granted | $ | ||||||||||||||||

| Exercised | ( | $ | |||||||||||||||

| Forfeited, cancelled, or expired | ( | $ | |||||||||||||||

| Balance as of March 31, 2024 | $ | ||||||||||||||||

The calculated grant-date fair value of stock options granted was estimated using the Black-Scholes option-pricing model with the following assumptions:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Expected dividend yield | |||||||||||

| Risk-free interest rate | |||||||||||

| Expected volatility | |||||||||||

| Expected term (in years) | |||||||||||

| Fair value of underlying common stock | $ | $ | |||||||||

| Unity Software Inc. | ||||||||

Restricted Stock Units

A summary of our restricted stock unit ("RSU"), including price-vested unit ("PVU"), activity is as follows:

| Unvested RSUs | |||||||||||

| Number of Shares | Weighted-Average Grant-Date Fair Value | ||||||||||

| Unvested as of December 31, 2023 | $ | ||||||||||

| Granted | $ | ||||||||||

| Vested | ( | $ | |||||||||

| Forfeited | ( | $ | |||||||||

| Unvested as of March 31, 2024 | $ | ||||||||||

Price-Vested Units

In October 2022, we granted to certain of our executive officers a total of 989,880 PVUs, which are RSUs for which vesting is subject to the fulfillment of both a service period that extends up to four years and the achievement of a stock price hurdle during the relevant performance period that extends up to seven years . The fair value of each PVU award is estimated using a Monte Carlo simulation that uses assumptions determined on the date of grant. During the three months ended March 31, 2024, the service period condition and stock price hurdle were not met.

Employee Stock Purchase Plan

The fair value of shares offered under our Employee Stock Purchase Plan ("ESPP") was determined on the grant date using the Black-Scholes option pricing model. The following table summarizes the assumptions used and the resulting grant-date fair values of our ESPP:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Expected dividend yield | |||||||||||

| Risk-free interest rate | |||||||||||

| Expected volatility | |||||||||||

| Expected term (in years) | |||||||||||

| Grant-date fair value per share | $ | $ | |||||||||

Additional information related to the ESPP is provided below (in thousands, except per share amounts):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Shares issued under the ESPP | |||||||||||

| Weighted-average price per share issued | $ | $ | |||||||||

9. Income Taxes

Our tax provision for interim periods is determined using an estimated annual effective tax rate, adjusted for discrete items arising in that quarter. In each quarter, we update the estimated annual effective tax rate and make a year-to-date adjustment to the provision. The estimated annual effective tax rate is subject to volatility due to several factors, including variability in accurately predicting our pre-tax income or loss and the mix of jurisdictions to which they relate, intercompany transactions, changes in how we do business, and tax law developments.

| Unity Software Inc. | ||||||||

Our effective tax rate for the three months ended March 31, 2024 differs from the U.S. federal statutory tax rate of 21% primarily due to the need to record a valuation allowance on U.S. losses, a tax benefit on foreign losses in connection with employee separation costs, and to a lesser extent tax expense on foreign earnings taxed at different rates. In addition, during the first quarter of 2024, we continued to restructure our tax operations which resulted in a reduction to our U.S. valuation allowance. Our effective tax rate for the three months ended March 31, 2023 differed from the U.S. federal statutory tax rate of 21% primarily due to the need to record a valuation allowance in the U.S. on losses and to a lesser extent, tax expense on foreign earnings taxed at different rates. In addition, the Company undertook certain tax restructuring efforts during the period that enhanced our ability to offset deferred tax liabilities in the U.S. in future periods, thereby partially reducing the need for a valuation allowance.

The realization of deferred tax assets is dependent upon the generation of sufficient taxable income of the appropriate character in future periods. We regularly assess the ability to realize our deferred tax assets and establish a valuation allowance if it is more-likely-than-not that some portion of the deferred tax assets will not be realized. In performing this assessment with respect to each jurisdiction, we review all available positive and negative evidence. Primarily due to our history of losses, we believe that it is more likely than not that the deferred tax assets of our U.S. federal, certain U.S. states, Denmark, U.K., and other non-U.S. jurisdictions will not be realized and we have maintained a full valuation allowance against such deferred tax assets.

As of March 31, 2024, we had $184.3 million of gross unrecognized tax benefits, of which $29.7 million would impact the effective tax rate, if recognized. It is reasonably possible that the amount of unrecognized tax benefits as of March 31, 2024 could increase or decrease significantly as the timing of the resolution, settlement, and closure of audits is highly uncertain. We believe that we have adequately provided for any reasonably foreseeable outcome related to our tax audits and that any settlement will not have a material impact on our financial condition and operating results at this time.

10. Net Loss per Share of Common Stock

Basic and diluted net loss per share is the same for all periods presented because the effects of potentially dilutive items were antidilutive given our net loss in each period.

The following table presents potentially dilutive common stock excluded from the computation of diluted net loss per share (in thousands) because the impact of including them would have been antidilutive:

| As of March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Convertible notes | |||||||||||

| Stock options | |||||||||||

| Unvested RSUs and PVUs | |||||||||||

| Unity Software Inc. | ||||||||

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Please read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and related notes included under Part I, Item 1 of this Quarterly Report on Form 10-Q. The following discussion and analysis contains forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that attempt to forecast or anticipate future developments in our business, financial condition, or results of operations. When reviewing the discussion below, you should keep in mind the substantial risks and uncertainties that could impact our business. In particular, we encourage you to review the risks and uncertainties described in "Part II, Item 1A. Risk Factors" included elsewhere in this report. These risks and uncertainties could cause actual results to differ materially from those projected in forward-looking statements contained in this report or implied by past results and trends. Forward-looking statements, like all statements in this report, speak only as of their date (unless another date is indicated), and we undertake no obligation to update or revise these statements in light of future developments. See the section titled "Note Regarding Forward-Looking Statements and Risk Factor Summary" in this report.

Overview

Unity is the world's leading platform for creating and growing interactive, real-time 3D ("RT3D") content and experiences. Our comprehensive set of software, including AI solutions, supports creators through the entire development lifecycle as they build, run, and grow immersive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.

Our platform consists of two complementary sets of solutions: Create Solutions and Grow Solutions, which together comprise our strategic portfolio surrounding the Unity Engine, Cloud and Monetization.

Impact of Macroeconomic Trends and Geopolitical Events

Recent negative macroeconomic factors, such as inflation, high interest rates, and limited credit availability have and could further cause economic uncertainty and volatility, which could harm our business. Further, increased competition in the advertising market and ongoing restrictions related to the gaming industry in China have impacted our growth rates and may continue to do so. Ongoing geopolitical instability, particularly in Israel, where a significant portion of our Grow Solutions operations is located, may adversely affect our business.

Recent Developments in Our Business

Starting in the fourth quarter of 2023, we began to reset our product and service offerings to focus on our core businesses, which we refer to as our "Strategic Portfolio": the Unity Engine, Cloud, and Monetization, while narrowing our investments in new businesses to those most attractive, mainly industries beyond gaming. We also exited businesses where we do not believe that we can provide unique value to customers or generate a sound return to investors. Specifically, we have limited our Professional Services business to a few selected strategic engagements, we will shift our multiplayer business to orchestration and managed solutions, and we will stop the independent development of professional artistry tools, which we will instead integrate into the Unity Editor and AI tools. In the first quarter of 2024, we recognized approximately $34 million of revenue associated with these non-strategic portfolios and we expect that these amounts will decline throughout the remainder of 2024.

In the first quarter of 2024, we substantially completed reductions to our workforce and our office footprint. This resulted in approximately $193 million in employee separation costs, primarily related to the acceleration and modifications of equity awards, and $19 million of non-employee charges associated with these reductions.

In the second quarter of 2024, we announced the hiring of our permanent Chief Executive Officer and President, Matthew Bromberg. Our ability to successfully transition the Chief Executive Officer role and to retain Mr. Bromberg and other senior executives could impact our operations and our business.

15

| Unity Software Inc. | ||||||||

Our ability to execute on these plans or execute them in a timely manner is critical to our success, and their timing and full impact on our future results of operations, cash flows, or financial condition are uncertain.

For additional details, refer to the section titled "Risk Factors."

Key Metrics

As further discussed in Item 2 of Part I, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K, we monitor the following key metrics to help us evaluate the health of our business, identify trends affecting our growth, formulate goals and objectives, and make strategic decisions. We have revised and restated these metrics to include inputs from our Strategic Portfolio only.

Customers Contributing More Than $100,000 of Revenue

We had 1,243 and 1,214 customers contributing more than $100,000 of revenue in the trailing 12 months as of March 31, 2024 and 2023, respectively. The year over year increase was largely a result of our core subscriptions growth. While these customers represented the substantial majority of revenue for the three months ended March 31, 2024 and 2023, respectively, no one customer accounted for more than 10% of our revenue for either period.

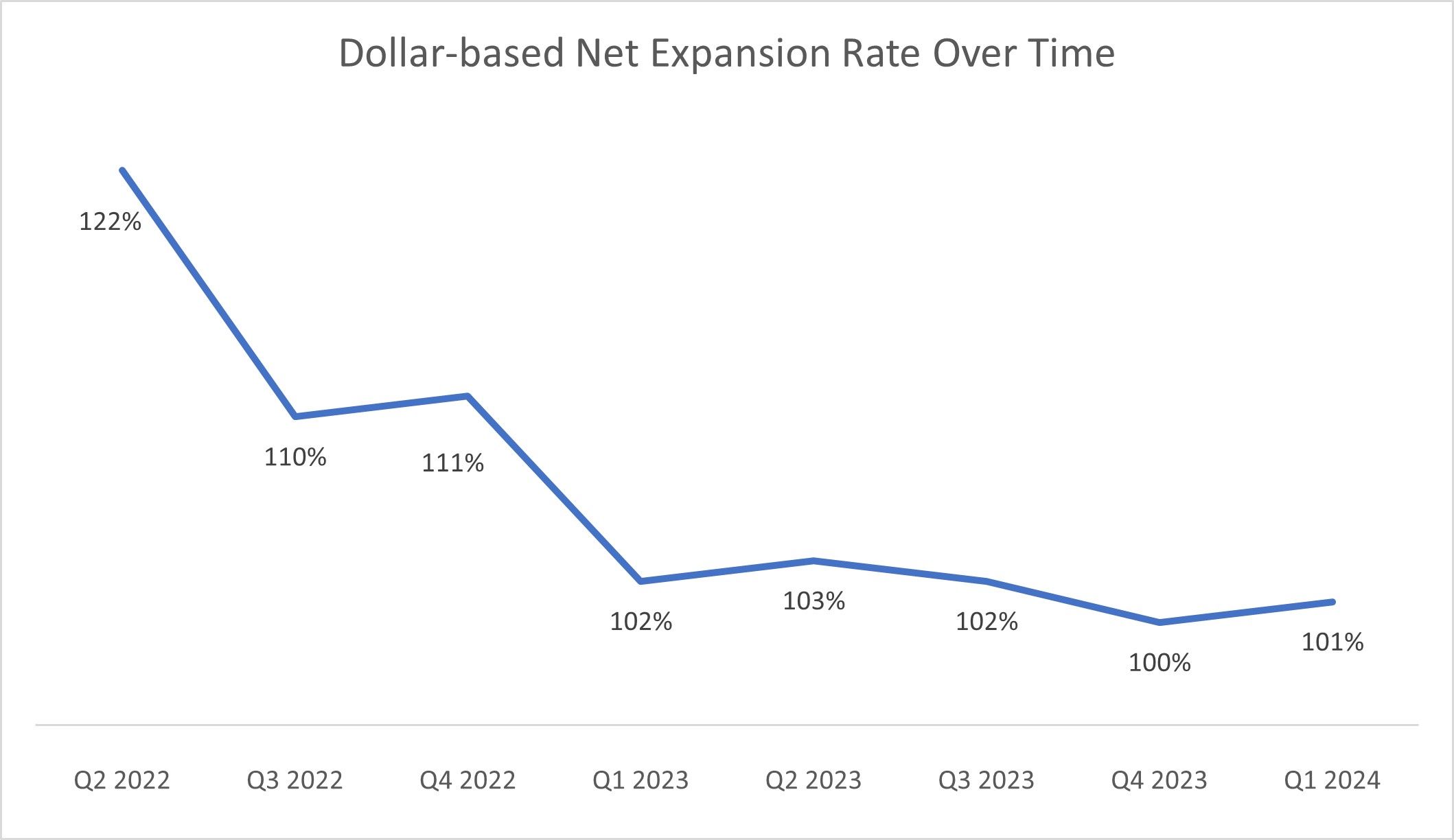

Dollar-Based Net Expansion Rate

Our ability to drive growth and generate incremental revenue depends, in part, on our ability to maintain and grow our relationships with our Create and Grow Solutions customers and to increase their use of our platform. We track our performance by measuring our dollar-based net expansion rate, which compares our Create and Grow Solutions revenue, excluding Strategic Partnerships and Supersonic, from the same set of customers across comparable periods, calculated on a trailing 12-month basis.

| As of | |||||||||||

| March 31, 2024 | March 31, 2023 | ||||||||||

| Dollar-based net expansion rate | 101 | % | 102 | % | |||||||

Our dollar-based net expansion rate as of March 31, 2024 and 2023, was driven primarily by the sales of additional subscriptions and services to our existing Create Solutions customers and cross-selling our solutions to all of our customers. The decrease in dollar-based net expansion rate, compared to the comparable prior year period, is primarily attributable to Grow Solutions, due to increased competition in the advertising market.

16

| Unity Software Inc. | ||||||||

The chart below illustrates that our dollar-based net expansion rate has been declining over the last year with a slight rebound in the fourth quarter of 2022 due to the ironSource Merger.

Results of Operations

The following table summarizes our historical consolidated statements of operations data for the periods indicated (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | $ | 460,380 | $ | 500,361 | |||||||

| Cost of revenue | 144,387 | 161,964 | |||||||||

| Gross profit | 315,993 | 338,397 | |||||||||

| Operating expenses | |||||||||||

| Research and development | 282,728 | 280,480 | |||||||||

| Sales and marketing | 230,625 | 216,127 | |||||||||

| General and administrative | 177,569 | 96,774 | |||||||||

| Total operating expenses | 690,922 | 593,381 | |||||||||

| Loss from operations | (374,929) | (254,984) | |||||||||

| Interest expense | (6,035) | (6,129) | |||||||||

| Interest income and other income (expense), net | 76,643 | 13,615 | |||||||||

| Loss before income taxes | (304,321) | (247,498) | |||||||||

| Provision for (benefit from) Income taxes | (12,843) | 6,205 | |||||||||

| Net loss | (291,478) | (253,703) | |||||||||

17

| Unity Software Inc. | ||||||||

The following table sets forth the components of our condensed consolidated statements of operations data as a percentage of revenue for the periods indicated:

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenue | 100 | % | 100 | % | |||||||

| Cost of revenue | 31 | 32 | |||||||||

| Gross profit | 69 | 68 | |||||||||

| Operating expenses | |||||||||||

| Research and development | 61 | 56 | |||||||||

| Sales and marketing | 50 | 43 | |||||||||

| General and administrative | 39 | 19 | |||||||||

| Total operating expenses | 150 | 118 | |||||||||

| Loss from operations | (81) | (51) | |||||||||

| Interest expense | (1) | (1) | |||||||||

| Interest income and other income (expense), net | 16 | 3 | |||||||||

| Loss before income taxes | (66) | (49) | |||||||||

| Provision for (benefit from) Income taxes | (3) | 1 | |||||||||

| Net loss | (63) | % | (50) | % | |||||||

Revenue

Create Solutions

We generate Create Solutions revenue primarily through our suite of Create Solutions subscriptions inclusive of enterprise support, cloud and hosting services, and professional services. Our subscriptions provide customers access to technologies that allow them to edit, run, and iterate interactive, RT3D and 2D experiences that can be created once and deployed to a variety of platforms. Enhanced support services are provided to our enterprise customers and are sold separately from the Create Solutions subscriptions. Cloud and hosting services are provided to our customers to simplify and enhance the way our users access and harness our solutions. Professional services are provided to our customers and include consulting, platform integration, training, and custom application and workflow development.

Grow Solutions

We generate Grow Solutions revenue primarily through our monetization solutions and game publishing services. Our monetization solutions allow publishers, original equipment manufacturers, and mobile carriers to sell available advertising inventory on their mobile applications or hardware devices to advertisers for in-application or on-device placements. Our revenue represents the amount we retain from the transaction we are facilitating through our Unified Auction and mediation platform. Our game publishing services provide game developers with the infrastructure and expertise to launch their mobile games and manage their growth; this is achieved through marketability testing tools, live games management tools and game design support, and optimizing the implementation of the customer’s commercial model. Through these game publishing services, we generate revenue from in-app advertising in published games and in some cases, in app purchase revenue.

18

| Unity Software Inc. | ||||||||

Our total revenue is summarized as follows (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Create Solutions | $ | 163,670 | $ | 187,369 | |||||||

| Grow Solutions | 296,710 | 312,992 | |||||||||

| Total revenue | $ | 460,380 | $ | 500,361 | |||||||

Total revenue decreased in the three months ended March 31, 2024, compared to the comparable prior year period, primarily due to a decrease in Create Solutions revenue, driven by the termination of the subscription agreement with Wētā FX Limited, and by a decrease in cloud and hosting services revenue from reduced usage of those offerings, partially offset by increases in core subscription revenue, which excludes Wētā. The decrease in total revenue was further driven by a decrease in Grow Solutions revenue, which was negatively impacted by increased competition.

Cost of Revenue, Gross Profit, and Gross Margin

Cost of revenue consists primarily of personnel costs (including salaries, benefits, and stock-based compensation) for employees and subcontractors associated with our product support and professional services organizations, hosting expenses, the amortization of intangible assets, and depreciation of related property and equipment.

Gross profit, or revenue less cost of revenue, has been and will continue to be affected by various factors, including our product mix, the costs associated with third-party hosting services and the extent to which we expand and drive efficiencies in our hosting costs, professional services, and customer support organizations. We expect our gross profit to increase in absolute dollars in the long term but decrease in the short term as a result of the reset of our product portfolio to focus on the Unity Engine and Monetization solutions. We expect our gross profit as a percentage of revenue, or gross margin, to fluctuate from period to period.

Cost of revenue for the three months ended March 31, 2024 decreased, compared to the comparable prior year period, primarily due to a decrease of approximately $7 million in amortization expenses related to the Wētā FX Limited contract that was terminated in 2023, and a decrease in our hosting and professional service expenses in connection with our portfolio reset. Personnel costs were comparable period over period inclusive of employee separation costs in the first quarter of 2024.

Operating Expenses

Our operating expenses consist of research and development, sales and marketing, and general and administrative expenses. The most significant component of our operating expenses is personnel-related costs, including salaries and wages, sales commissions, bonuses, benefits, stock-based compensation, and payroll taxes. In January 2024, we committed to a plan to eliminate approximately 25% of our workforce, and we mutually agreed to the departure of the founders of ironSource Ltd. Following these announcements, we incurred incremental employee separation costs of approximately $193 million in the first quarter of 2024, largely driven by the modification of equity awards, including $15 million within cost of revenue, $43 million within research and development expense, $47 million within sales and marketing expense, and $88 million within general and administrative expense. These personnel-related costs were the main driver of the increase in expenses period over period. In addition, we incurred $19 million of non-employee charges associated with this restructuring.

Research and Development

Research and development expenses primarily consist of personnel-related costs for the design and development of our platform, IT hosting and SaaS expenses, and amortization expenses related to intangible assets. We expect our research and development expenses to increase in absolute dollars in the long term, as we expand our teams to develop new solutions, expand features and functionality with existing solutions, and enter new markets, but decrease in the short term as a result of the reset of our

19

| Unity Software Inc. | ||||||||

Strategic Portfolio. We expect research and development expenses to fluctuate as a percentage of revenue from period to period.

Research and development expense for the three months ended March 31, 2024 increased, compared to the comparable prior year period, primarily due to personnel costs which were comparable period over period inclusive of employee separation costs in the first quarter of 2024.

Sales and Marketing

Our sales and marketing expenses consist primarily of personnel-related costs, advertising and marketing programs, including user acquisition costs and digital account-based marketing, user events such as developer-centric conferences and our annual Unite user conferences, and amortization expenses related to intangible assets. We expect that our sales and marketing expense will increase in absolute dollars in the long term, as we hire additional personnel, increase our account-based marketing, direct marketing and community outreach activities, invest in additional tools and technologies, and continue to build brand awareness, but decrease in the short term as a result of the reset of our Strategic Portfolio. We expect sales and marketing expenses to fluctuate as a percentage of revenue from period to period.

Sales and marketing expense for the three months ended March 31, 2024 increased, compared to the comparable prior year period, primarily due to higher personnel-related costs, driven by employee separation costs in the first quarter of 2024.

General and Administrative

Our general and administrative expenses primarily consist of personnel-related costs for finance, legal, human resources, IT and administrative employees; allocated overhead, and professional fees for external legal, accounting and other professional services. We expect that our general and administrative expenses will increase in absolute dollars in the long term, as we scale to support the growth of our business but decrease in the short term as a result of the reset of our Strategic Portfolio. We expect general and administrative expenses to fluctuate as a percentage of revenue from period to period.

General and administrative expense for the three months ended March 31, 2024 increased, compared to the comparable prior year period, primarily due to higher personnel-related costs, driven by employee separation costs in the first quarter of 2024.

Interest Expense

Interest expense consists primarily of interest expense associated with our convertible debt and amortization of debt issuance costs.

Interest expense for the three months ended March 31, 2024 decreased, compared to the comparable prior year period, due to a reduction in the amortization of debt issuance costs, driven by the repurchase of the 2026 notes.

Interest Income and Other Income (Expense), Net

Interest income and other income (expense), net, consists primarily of gains on the repurchase of convertible debt, interest income earned on our cash, cash equivalents, and short-term investments, foreign currency gains and losses. As we have expanded our global operations, our exposure to fluctuations in foreign currencies has increased, and we expect this to continue.

Interest income and other income (expense), net, for the three months ended March 31, 2024 increased, compared to the comparable prior year period, primarily due to a gain on the repurchase of convertible debt of $61.4 million in the first quarter of 2024.

Provision for (benefit from) Income taxes

Provision for (benefit from) income taxes consists primarily of income taxes in certain foreign jurisdictions where we conduct business. We have a valuation allowance against certain of our deferred tax assets, including net operating loss ("NOL") carryforwards and tax credits related primarily to research

20

| Unity Software Inc. | ||||||||

and development. Our overall effective income tax rate in future periods may be affected by the geographic mix of earnings in the countries in which we operate. Our future effective tax rate may also be affected by changes in the valuation of our deferred tax assets or liabilities, or changes in tax laws, regulations, or accounting principles in the jurisdictions in which we conduct business. See Note 9, "Income Taxes," of the Notes to Condensed Consolidated Financial Statements.

Provision for (benefit from) income taxes for the three months ended March 31, 2024 increased, compared to the comparable prior year period, primarily due to a larger tax benefit from our continued restructuring efforts in the first quarter of 2024 that enhanced our ability to offset deferred tax liabilities in the U.S. in future periods, thereby partially reducing the need for a valuation allowance.

Non-GAAP Financial Measures

To supplement our consolidated financial statements prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe the following non-GAAP measures are useful in evaluating our operating performance. We are presenting these non-GAAP financial measures because we believe, when taken collectively, they may be helpful to investors because they provide consistency and comparability with past financial performance.

However, non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. As a result, our non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered in isolation or as a substitute for our consolidated financial statements presented in accordance with GAAP.

Adjusted Gross Profit and Adjusted EBITDA

We define adjusted gross profit as GAAP gross profit excluding expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, and restructurings and reorganizations. We define adjusted EBITDA as net income or loss excluding benefits or expenses associated with stock-based compensation, amortization of acquired intangible assets, depreciation, acquisitions, restructurings and reorganizations, interest, income tax, and other non-operating activities, which primarily consist of foreign exchange rate gains or losses.

We use adjusted gross profit and adjusted EBITDA in conjunction with traditional GAAP measures to evaluate our financial performance. We believe that adjusted gross profit and adjusted EBITDA provide our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as these metrics exclude expenses that we do not consider to be indicative of our overall operating performance.

21

| Unity Software Inc. | ||||||||

The following table presents a reconciliation of our adjusted gross profit to our GAAP gross profit, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| GAAP gross profit | $ | 315,993 | $ | 338,397 | |||||||

| Add: | |||||||||||

| Stock-based compensation expense | 15,636 | 18,849 | |||||||||

| Amortization of intangible assets expense | 26,997 | 34,265 | |||||||||

| Depreciation expense | 2,744 | 2,364 | |||||||||

| Restructuring and reorganization costs | 15,213 | 119 | |||||||||

| Adjusted gross profit | $ | 376,583 | $ | 393,994 | |||||||

| GAAP gross margin | 69 | % | 68 | % | |||||||

| Adjusted gross margin | 82 | % | 79 | % | |||||||

The following table presents a reconciliation of our adjusted EBITDA to net loss, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| GAAP net loss | $ | (291,478) | $ | (253,703) | |||||||

| Stock-based compensation expense | 139,888 | 163,028 | |||||||||

| Amortization of intangible assets expense | 87,957 | 97,920 | |||||||||

| Depreciation expense | 13,853 | 11,640 | |||||||||

| Acquisition-related costs | — | 729 | |||||||||

| Restructuring and reorganization costs | 211,746 | 14,130 | |||||||||

| Interest expense | 6,035 | 6,129 | |||||||||

| Interest income and other income (expense), net | (76,643) | (13,615) | |||||||||

| Provision for (benefit from) income taxes | (12,843) | 6,205 | |||||||||

| Adjusted EBITDA | $ | 78,515 | $ | 32,463 | |||||||

Free Cash Flow

We define free cash flow as net cash provided by (used in) operating activities less cash used for purchases of property and equipment. We believe that free cash flow is a useful indicator of liquidity as it measures our ability to generate cash, or our need to access additional sources of cash, to fund operations and investments.

22

| Unity Software Inc. | ||||||||

The following table presents a reconciliation of free cash flow to net cash provided by (used in) operating activities, the most directly comparable measure as determined in accordance with GAAP, for the periods presented (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net cash used in operating activities | $ | (7,373) | $ | (5,099) | |||||||

| Less: | |||||||||||

| Purchases of property and equipment | (7,190) | (14,350) | |||||||||

| Free cash flow | $ | (14,563) | $ | (19,449) | |||||||

| Net cash provided by (used in) investing activities | $ | (7,190) | $ | 88,111 | |||||||

| Net cash provided by (used in) financing activities | $ | (389,001) | $ | 21,971 | |||||||

Liquidity and Capital Resources

As of March 31, 2024, our principal sources of liquidity were cash, and cash equivalents totaling $1.2 billion, which were primarily held for working capital purposes. Our cash equivalents are invested primarily in government money market funds.

Our material cash requirements from known contractual and other obligations consists of our convertible notes, obligations under operating leases for office space, and contractual obligations for hosting services to support our business operations. See Part I, Item I, Note 7 — "Commitments and Contingencies" for additional discussion of our principal contractual commitments.

In connection with the ironSource Merger in November 2022, we issued $1.0 billion in aggregate principal amount of 2.0% convertible senior notes due 2027, the proceeds of which were used to fund repurchases under our share repurchase program. We previously issued $1.7 billion in aggregate principal amount of 0% convertible senior notes due 2026 in November 2021, of which $480 million in aggregate principal was repurchased in March 2024 for $415 million (together with the 2027 Notes, the "Notes"). See Part I, Item I, Note 6, "Borrowings" for additional discussion of the Notes.

In July 2022, our board of directors approved our share repurchase program, which authorized the repurchase of up to $2.5 billion of shares of our common stock in open market transactions through November 2024 (the "Share Repurchase Program"). As of March 31, 2024, $750 million remains available for future share repurchases under this program.

Since our inception, we have generated losses from our operations as reflected in our accumulated deficit of $3.4 billion as of March 31, 2024. We expect to continue to incur operating losses on a GAAP basis for the foreseeable future due to the investments we will continue to make in research and development, sales and marketing, and general and administrative. As a result, we may require additional capital to execute our strategic initiatives to grow our business.

We believe our existing sources of liquidity will be sufficient to meet our working capital and capital expenditures for at least the next 12 months. We believe we will meet longer-term expected future cash requirements and obligations through a combination of cash flows from operating activities, available cash balances, and potential future equity or debt transactions. Our future capital requirements, however, will depend on many factors, including our growth rate; the timing and extent of spending to support our research and development efforts; capital expenditures to build out new facilities and purchase hardware and software; the expansion of sales and marketing activities; and our continued need to invest in our IT infrastructure to support our growth. In addition, we may enter into additional strategic partnerships as well as agreements to acquire or invest in complementary offerings, teams and technologies, including intellectual property rights, which could increase our cash requirements. As a result of these and other factors, we may choose or be required to seek additional equity or debt financing sooner than we currently anticipate. In addition, depending on prevailing market conditions, our liquidity requirements,

23

| Unity Software Inc. | ||||||||

contractual restrictions, and other factors, we may also from time to time seek to retire or purchase our outstanding debt, including the Notes, through cash purchases and/or exchanges for equity securities, in open market purchases, privately negotiated transactions or otherwise. If additional financing is required from outside sources, we may not be able to raise it on terms acceptable to us, or at all, including as a result of macroeconomic conditions such as high interest rates, volatility in the capital markets and liquidity concerns at, or failures of, banks and other financial institutions. If we are unable to raise additional capital when required, or if we cannot expand our operations or otherwise capitalize on our business opportunities because we lack sufficient capital, our business, results of operations, and financial condition would be adversely affected.

Our changes in cash flows were as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net cash used in operating activities | $ | (7,373) | $ | (5,099) | |||||||

| Net cash provided by (used in) investing activities | (7,190) | 88,111 | |||||||||

| Net cash provided by (used in) financing activities | (389,001) | 21,971 | |||||||||

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | (6,202) | 3,151 | |||||||||

| Net change in cash, cash equivalents, and restricted cash | $ | (409,766) | $ | 108,134 | |||||||

Cash Used in Operating Activities

During the three months ended March 31, 2024, net cash used in operating activities was primarily due to an increase in working capital. Our cash flows fluctuate from period to period due to revenue seasonality, timing of billings, collections, and publisher payments. Historical cash flows are not necessarily indicative of our results in any future period.

Cash Used in Investing Activities

During the three months ended March 31, 2024, net cash used in investing activities consisted primarily of purchases of property and equipment.

Cash Used in Financing Activities

During the three months ended March 31, 2024, net cash used in financing activities consisted of repayments of convertible notes, offset by the proceeds from the issuance of common stock under our employee equity plans.

Critical Accounting Policies and Estimates

Management's discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which have been prepared in accordance with U.S. GAAP. These principles require us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosures. Our estimates are based on our historical experience and on various other assumptions that we believe are reasonable under the circumstances. To the extent that there are material differences between these estimates and our actual results, our future financial statements will be affected.

There have been no material changes to our critical accounting policies and estimates from those disclosed in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024.

24

| Unity Software Inc. | ||||||||

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Our assessment of our exposures to market risk has not changed materially since the presentation set forth in Part II, Item 7A of our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024.

Item 4. Controls and Procedures

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as of the end of the period covered by this report.

(a) Evaluation of Disclosure Controls and Procedures

Based on management's evaluation, our principal executive officer and principal financial officer concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were designed to, and were effective to, provide assurance at a reasonable level that the information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosures.

(b) Changes in Internal Control Over Financial Reporting

Based on management's evaluation, our principal executive officer and principal financial officer concluded that there has not been any material change in our internal control over financial reporting during the quarter ended March 31, 2024 that has materially affected, or is reasonably likely to materially effect, our internal control over financial reporting.

25

| Unity Software Inc. | ||||||||

PART II—OTHER INFORMATION

Item 1. Legal Proceedings