As

filed with the Securities and Exchange Commission on

Securities Act File No. 333-238475

Investment Company Act File No. 811-23570

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

| ☑ THE SECURITIES ACT OF 1933 |

| ☐ Pre-Effective Amendment No. __ |

| ☑ Post-Effective Amendment No. 70 |

| AND/OR |

| ☑ THE INVESTMENT COMPANY ACT OF 1940 |

| ☑ Amendment No. 71 |

(Exact Name of Registrant as Specified in its Charter)

222 Broadway, 22nd Floor

New York NY 10038

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: 646-741-2438

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and address of agent for service)

Copy to:

JoAnn M. Strasser

Thompson Hine LLP

41 South High Street, Suite 1700

Columbus, Ohio 43215

It is proposed that this filing will become effective:

| ☐ | Immediately upon filing pursuant to paragraph (b) | |

| ☑ |

| |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) | |

| ☐ | On (date) pursuant to paragraph (a)(1) | |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) | |

| ☐ | On (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment |

| Fund Name | Ticker Symbol (Exchange) | |

| Simplify Aggregate Bond ETF | (NYSE Arca, Inc.) | |

| Simplify Bitcoin Strategy PLUS Income ETF | (Nasdaq Stock Market LLC) | |

| Simplify Commodities Strategy No K-1 ETF | (NYSE Arca, Inc.) | |

| Simplify Conservative Allocation ETF | (NYSE Arca, Inc.) | |

| Simplify Enhanced Income ETF | (NYSE Arca, Inc.) | |

| Simplify Growth Allocation ETF | (NYSE Arca, Inc.) | |

| Simplify Health Care ETF | (NYSE Arca, Inc.) | |

| Simplify Hedged Equity ETF | (NYSE Arca, Inc.) | |

| Simplify High Yield PLUS Credit Hedge ETF | (NYSE Arca, Inc.) | |

| Simplify Income Allocation ETF | (NYSE Arca, Inc.) | |

| Simplify Interest Rate Hedge ETF | (NYSE Arca, Inc.) | |

| Simplify Intermediate Term Treasury Futures Strategy ETF | (CBOE BZX Exchange, Inc.) | |

| Simplify Macro Strategy ETF | (NYSE Arca, Inc.) | |

| Simplify Managed Futures Strategy ETF | (NYSE Arca, Inc.) | |

| Simplify Market Neutral Equity Long/Short ETF | (NYSE Arca, Inc.) | |

| Simplify Moderate Allocation ETF | (NYSE Arca, Inc.) | |

| Simplify Multi-QIS Alternative ETF | (NYSE Arca, Inc.) | |

| Simplify Opportunistic Income ETF | (NYSE Arca, Inc.) | |

| Simplify Short Term Treasury Futures Strategy ETF | (NYSE Arca, Inc.) | |

| Simplify Stable Income ETF | (NYSE Arca, Inc.) | |

| Simplify Tail Risk Strategy ETF | (NYSE Arca, Inc.) | |

| Simplify US Equity PLUS Convexity ETF | (NYSE Arca, Inc.) | |

| Simplify US Equity PLUS Downside Convexity ETF | (NYSE Arca, Inc.) | |

| Simplify US Equity PLUS GBTC ETF | (Nasdaq Stock Market LLC) | |

| Simplify US Equity PLUS Upside Convexity ETF | (NYSE Arca, Inc.) | |

| Simplify Volatility Premium ETF | (NYSE Arca, Inc.) |

each a series of Simplify Exchange Traded Funds

PROSPECTUS

| www.simplify.us/etfs |

Advised by: Simplify Asset Management Inc. 222 Broadway, 22nd Floor New York, NY 10038 phone: 1 (855) 772-8488 |

This Prospectus provides important information about the Funds that you should know before investing. Please read it carefully and keep it for future reference.

These securities have not been approved or disapproved by the Securities and Exchange Commission nor has the Securities and Exchange Commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Each Fund’s shares are listed and traded on the respective Exchange listed above.

TABLE OF CONTENTS

i

Investment Objective: Simplify Aggregate Bond ETF (the “Fund” or “AGGH”) seeks to maximize total return.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, sell, and hold shares of the Fund. Investors purchasing or selling shares of the Fund in the secondary market may be subject to costs (including customary brokerage commissions) charged by their broker. These costs are not included in the expense example below.

(expenses that you pay each year as a percentage of the value of your investment) |

|

| Management Fees | |

| Distribution and Service (12b-1) Fees | |

| Other Expenses(1) | |

| Acquired Fund Fees and Expenses(2) | |

| Total Annual Fund Operating Expenses | |

| Fee Waiver(3) | ( |

| Total Annual Fund Operating Expenses After Fee Waiver |

| (1) | |

| (2) | |

| (3) |

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in mutual funds and other exchange traded funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| 1 Year | 3 Years | 5 Years | 10 Years |

| $ |

$ |

$ |

$ |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was

1

Principal Investment Strategies: The adviser seeks to achieve the Fund’s investment objective by investing in investment grade bonds primarily by purchasing exchange traded funds and applying derivative overlays intended to hedge risk or generate income.

Bond Strategy

The Fund has adopted a non-fundamental investment policy that, under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. investment grade bonds primarily by purchasing exchange traded funds (“ETFs”).

The Fund pursues its strategy primarily by purchasing ETFs that invest principally in the U.S. investment grade bonds of the U.S. government, corporate issuers, and mortgage-backed securities (“MBS”). However, the Fund invests without restriction as to the credit quality, maturity, or duration of an individual security. The adviser does not frequently trade securities but seeks to maintain consistent exposure to such companies through its investments in ETFs. The adviser determines which ETFs to purchase based on factors such as price, liquidity, and track record. The adviser selects ETFs that are representative of an asset class (e.g., invests primarily in investment grade corporate bonds) and have a minimum five-year track record and adequate trading volume relative to the Fund’s size. The adviser considers trading volume adequate if it can buy and sell an ETF in a desired quantity without materially affecting its price.

The underlying ETFs that the Fund will invest in may target bonds with different maturities, durations, and quality requirements in connection with their investment strategies. Duration is a measure of price sensitivity of a debt security or a portfolio of debt securities to relative changes in interest rates. For instance, a duration of “five years” means that a security’s or portfolio’s price would be expected to decrease by approximately 5% with a 1% increase in interest rates (assuming a parallel shift in yield curve). Maturity is the period during which its owner will receive interest payments on the investment. When the bond reaches maturity, the Fund is repaid its par, or face value. A bond’s quality is a reference to the grade given to a bond by a rating service that indicates its credit quality. The rating takes into consideration a bond issuer’s financial strength or its ability to pay a bond’s principal and interest in a timely fashion. For instance, a “AAA” high-grade rated bond offers more security and lower profit potential (lower yield) than a “B-” rated speculative bond.

Derivatives Overlay-Generally

In total, the Fund may invest up to 20% of the Fund’s portfolio in derivatives (measured by purchase price in the case of options or collateral pledged in the case of other derivatives). The adviser anticipates purchasing and selling its derivatives on a monthly, quarterly, and annual basis, depending upon the Fund’s rebalancing requirements and expiration dates. However, the adviser may rebalance the Fund’s derivative portfolio on a more frequent basis for a number of reasons such as when market volatility renders the protection provided by the derivative strategy ineffective or a derivative position has appreciated to the point that it is prudent to decrease the Fund’s exposure and realize gains for the Fund’s shareholders. Derivatives may be exchange-traded or over-the-counter (“OTC”); index-based or linked to a specific security. The adviser selects derivatives based upon its evaluation of relative value based on expected hedging effectiveness, cost; and in the case of options, strike price (price that the option can be bought or sold by the option holder) and maturity (the last date the option contract is valid). The adviser will exercise or close the options based typically on maturity.

When the Fund purchases a call option, the Fund has the right, but not the obligation, to buy a stock or other asset at a specified price (strike price) within a specific time period. When the Fund purchases a put option, the Fund has the right, but not the obligation, to sell a stock or other asset at a specified price (strike price) within a specific time period. Futures contracts allow the buyer or seller to purchase or sell an asset at a future date. The Fund will invest in total return swaps that use investment grade or high yield debt instruments or investment grade or high yield indexes as reference assets and equity indexes or ETFs.

The Fund executes a portion of its derivatives overlay strategy indirectly by investing in a wholly-owned subsidiary. The Fund gains exposure to certain investments related to this strategy by investing up to 25% of its assets in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the adviser. Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to certain derivatives in accordance with applicable tax rules and regulations.

2

Derivatives Overlay-Hedge Strategy

The Fund may invest up to 20% of the Fund’s portfolio in derivatives to hedge against interest rate risk and credit risk. The adviser uses long and short positions in futures, options, and swaps linked to equities, fixed income securities, volatility indices, commodities, and currencies to manage risk. When the adviser believes interest rates will be rising in general, or within a sector, it will hedge primarily by initiating short positions in interest rate-related futures, swaps, and or options. When the adviser believes credit risk will be increasing, it will hedge primarily by receiving protection through a credit default swap or a total return swap that uses investment grade or high yield debt instruments or investment grade or high yield index as the reference asset. However, when the adviser believes a short-term opportunity for a more-effective hedge is available, it may also use derivatives linked to equities, volatility indices, commodities (i.e., gold and oil), and currencies to manage interest rate and credit risk. The adviser closes derivative positions when it believes the related risk is no longer significant or to use a more efficient or cost-effective derivative.

Derivatives Overlay-Income Strategy

The Fund may invest up to 20% of the Fund’s portfolio in derivatives to generate additional income. While derivative-based gains are considered capital gains under GAAP (generally accepted accounting principles) they are commonly described as income by securities market participants. When the adviser believes a put or call option presents insignificant risk, the Fund will write put and or call options with the expectation that they will expire worthless. As an alternative, when the adviser believes an option is not likely to expire worthless it may use put and call spreads. In a call option spread, the Fund sells (writes) an out of the money (above current market price) call option while also purchasing a call option that is further out of the money to partially offset the risk of the written option. In a put option spread, the Fund sells (writes) an out of money (below current market price) put option while also purchasing a put option that is further out of the money to partially offset the risk of the written option. The adviser may also use a combination of derivatives and cash equivalents as a substitute for a bond ETF when it generates more income. The adviser may also engage in reverse repurchase agreements and use the proceeds for investment purposes. Reverse repurchase agreements are contracts in which a seller of securities, for example, U.S. government securities, agrees to buy the securities back at a specified time and price. Reverse repurchase agreements are primarily used by the Fund as an indirect means of borrowing. When the Fund earns more on its additional investments than the interest cost related to the reverse repurchase agreement, it generates additional income.

Principal Investment Risks:

The following describes the risks the Fund bears with respect to its investments. As with any fund, there is no guarantee that the Fund will achieve its goal.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default), extension risk (an issuer may exercise its right to repay principal on a fixed rate obligation held by the Fund later than expected), and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment by the Fund, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments.

Active Management Risk. The Fund is subject to the risk that the investment management strategy may not produce the intended results and may negatively impact Fund performance. The adviser’s overlay strategy will not fully protect the Fund from declines in the market.

3

Commodity and Currency Risk. Investments linked to commodities or currencies can be highly volatile compared to investments in traditional securities, and may experience large losses. The value of instruments linked to commodities or currencies may be affected by market movements, commodity or currency benchmarks (as the case may be), volatility, changes in interest rates, or factors affecting a particular industry, commodity or currency. For example, commodities may be affected by numerous factors, including drought, floods, fires, weather, livestock disease, pipeline ruptures or spills, embargoes, tariffs and international, economic, political or regulatory developments.

Derivatives Risk. The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfil its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. Such prices are influenced by numerous factors that affect the markets, including, but not limited to: changing supply and demand relationships; government programs and policies; national and international political and economic events, changes in interest rates, inflation and deflation and changes in supply and demand relationships. Trading derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities.

Early Close/Trading Halt Risk. An exchange or market may close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may prevent the Fund from buying or selling certain securities or financial instruments. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and may incur substantial trading losses.

Equity Securities Risk. The net asset value of the Fund will fluctuate based on changes in the value of the equity securities that serve as reference assets to a total return swap held by the Fund. Equity prices can fall rapidly in response to developments affecting a specific company or industry, or to changing economic, political or market conditions.

ETF Structure Risks. The Fund is structured as an ETF and will invest in underlying ETFs. As a result, the Fund is subject to special risks, including:

| ● | Not Individually Redeemable. The Fund’s shares (“Shares”) are not redeemable by retail investors and may be redeemed only by Authorized Participants at net asset value (“NAV”) and only in Creation Units. A retail investor generally incurs brokerage costs when selling shares. |

| ● | Trading Issues. Trading in Shares on NYSE Arca, Inc. (the “Exchange”) may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable, such as extraordinary market volatility. There can be no assurance that Shares will continue to meet the listing requirements of the Exchange which may result in the Shares being delisted. An active trading market for the Shares may not be developed or maintained. If the Shares are traded outside a collateralized settlement system, the number of financial institutions that can act as Authorized Participants that can post collateral on an agency basis is limited, which may limit the market for the Shares. |

| ● | Market Price Variance Risk. The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and will include a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the Shares. There may be times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to NAV. |

| ○ | In times of market stress, market makers may step away from their role market making in the Shares and in executing trades, which can lead to differences between the market value of the Shares and the Fund’s NAV. |

| ○ | The market price of the Shares may deviate from the Fund’s NAV, particularly during times of market stress, with the result that investors may pay significantly more or significantly less for the Shares than the Fund’s NAV, which is reflected in the bid and ask price for the Shares or in the closing price. |

| ○ | In stressed market conditions, the market for the Shares may become less liquid in response to the deteriorating liquidity of the Fund’s portfolio. This adverse effect on the liquidity of the Shares may, in turn, lead to differences between the market value of the Shares and the Fund’s NAV. |

4

| ● | Authorized Participant Risk. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as an Authorized Participant on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. Authorized Participant concentration risk may be heightened for securities or instruments that have lower trading volumes. |

Futures Risk. The Fund’s use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) leverage risk (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the futures contract may not correlate perfectly with the underlying index.

High Yield Risk. The Fund may invest in high yield bonds also known as “junk bonds”. High yield securities and unrated securities of similar credit quality are subject to greater levels of credit, call and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments, and may be more volatile than higher-rated securities of similar maturity.

Large Capitalization Risk. Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large capitalization companies has trailed the overall performance of the broader securities markets.

Leverage Risk. The use of leverage by the Fund, such as the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. The Fund may borrow for investment purposes indirectly using reverse repurchase agreements. The cost of borrowing may reduce the Fund’s return, increases the risk of loss and may increase the volatility of the Fund.

Limited History Risk. The Fund is a new ETF and has a limited history of operations for investors to evaluate.

Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolios may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, international conflicts, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Mortgage-Related Risks. MBS represent interests in “pools” of mortgages and often involve risks that are different from or possibly more acute than risks associated with other types of debt instruments. Generally, rising interest rates tend to extend the duration of fixed rate mortgage-related securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, the Fund may exhibit additional volatility since individual mortgage holders are less likely to exercise prepayment options, thereby putting additional downward pressure on the value of these securities and potentially causing the Fund to lose money. When interest rates decline, borrowers may pay off their mortgages sooner than expected. This can reduce the returns of a Fund because the Fund may have to reinvest that money at the lower prevailing interest rates.

Option Risk. As the buyer of put and call options, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option.

Over-the-Counter Market Risk. Securities and options traded in over-the-counter markets may trade less frequently and in limited volumes and thus exhibit more volatility and liquidity risk, and the prices paid by the Fund in over-the-counter transactions may include an undisclosed dealer markup. The Fund is also exposed to default by the over-the-counter option writer who may be unwilling or unable to perform its contractual obligations to the Fund.

Subsidiary Investment Risk. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary are organized, respectively, could result in the inability of the Fund to operate as intended and could negatively affect the Fund and its shareholders. The Subsidiary is not registered under the 1940 Act and is not subject to all the investor protections of the 1940 Act. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies.

5

Swap Risk. Swaps are subject to tracking risk because they may not be perfect substitutes for the instruments they are intended to hedge or replace. Over the counter swaps are subject to counterparty default. Leverage inherent in derivatives will tend to magnify the Fund’s losses.

U.S. Treasury Market Risk. The U.S. Treasury market can be volatile, and the value of instruments correlated with these markets may fluctuate dramatically from day to day. U.S. Treasury obligations may provide relatively lower returns than those of other securities. Similar to other debt instruments, U.S. Treasury obligations are subject to debt instrument risk and interest rate risk. In addition, changes to the financial condition or credit rating of the U.S. Government may cause the value of U.S. Treasury obligations to decline.

Underlying Fund Risk. ETFs in which the Fund invests are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in the ETFs and may be higher than other funds that invest directly in stocks and bonds. Each of the ETFs is subject to its own specific risks, but the adviser expects the principal investments risks of such ETFs will be similar to the risks of investing in the Fund.

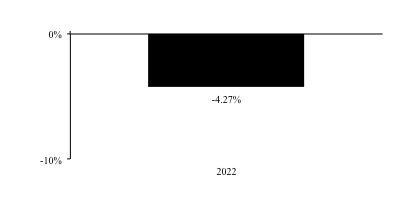

Performance:

Investment Adviser: Simplify Asset Management Inc. (the “Adviser”).

Portfolio Managers: Paul Kim, Chief Executive Officer of the Adviser, and David Berns, Chief Investment Officer of the Adviser, have each served the Fund as a portfolio manager since it commenced operations in February 2022. Shailesh Gupta, Portfolio Manager and Head of Trading for the adviser has served the Fund as a portfolio manager since August 2023. Mr. Kim, Mr. Berns and Mr. Gupta are jointly and primarily responsible for the management of the Fund.

Purchase and Sale of Fund Shares: The Fund will issue and redeem Shares at NAV only in large blocks of 25,000 Shares (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed primarily in-kind for securities but may include cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units in transactions with Authorized Participants, the Shares are not redeemable securities of the Fund.

Shares of the Fund are listed for trading on the Exchange and trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV. An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market.

Tax Information: The Fund’s distributions generally will be taxable as ordinary income or long-term capital gains. A sale of Shares may result in capital gain or loss.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

Investment Objective: The Simplify Bitcoin Strategy PLUS Income ETF (the “Fund” or “MAXI”) seeks income and capital appreciation.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, sell, and hold shares of the Fund. Investors purchasing or selling shares of the Fund in the secondary market may be subject to costs (including customary brokerage commissions) charged by their broker. These costs are not included in the table and expense example below.

(expenses that you pay each year as a percentage of the value of your investment) |

|

| Management Fees | |

| Distribution and Service (12b-1) Fees | |

| Other Expenses(1) | |

| Total Annual Fund Operating Expenses |

| (1) |

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| 1 Year | 3 Years | 5 Years | 10 Years |

| $ |

$ |

$ |

$ |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the period September 30, 2022 (commencement of operations) through June 30, 2023, the Fund’s portfolio turnover rate was

Principal Investment Strategies: The Fund is an actively managed exchange-traded fund (an “ETF”). The Fund’s adviser seeks to achieve the Fund’s investment objective by using three strategies: (1) a Bitcoin futures strategy, (2) an income strategy, and (3) an option overlay strategy. Even though the adviser employs three strategies, the Fund’s portfolio is composed primarily of income producing securities.

The Fund does not invest in Bitcoin directly.

7

Bitcoin Futures Strategy

The adviser seeks capital gains through a Bitcoin futures strategy. Under normal market conditions, the adviser selects Bitcoin futures so that the total value of economic Bitcoin exposure is approximately 100% of the net assets of the Fund. Bitcoin futures are intended to track, although not lockstep, the price of Bitcoin. The Fund only invests in standardized, cash-settled Bitcoin futures contracts traded on commodity exchanges registered with the Commodity Futures Trading Commission, such as the Chicago Mercantile Exchange (the “CME”). As of the date of this prospectus, only the CME has such contracts. The value of Bitcoin futures is determined by reference to the CME CF Bitcoin Reference Rate, which is designed to provide an indication of the price of Bitcoin across certain cash Bitcoin exchanges. The adviser invests primarily in front-month Bitcoin futures. Front-month Bitcoin futures contracts are those contracts with the shortest time to maturity.

The Fund executes its Bitcoin futures strategy indirectly by investing up to 25% of its total assets (measured at the time of investment) in a wholly owned and controlled subsidiary, which is designed to enhance the ability of the Fund to obtain exposure to Bitcoin futures consistent with the limits of the U.S. federal tax law requirements applicable to regulated investment companies. The Fund does not control any other entity. The Fund is deemed to be concentrated because it invests more than 25% of its net assets in Bitcoin futures contracts.

Bitcoin

Bitcoin is a digital asset, commonly referred to as a “cryptocurrency.” The ownership and operation of Bitcoin is determined by participants in an online, peer-to-peer network commonly referred to as the “Bitcoin Network”. The Bitcoin Network connects computers that run publicly accessible open-source software that follows the rules governing the Bitcoin Network. This is commonly referred to as the Bitcoin Protocol. The value of Bitcoin is not backed by any government, corporation, or other entity. Rather, its value is determined by the supply and demand in markets created to facilitate trading of Bitcoin. Ownership records and transaction records for Bitcoin are protected through public-key cryptography. The supply of Bitcoin is determined by the “Bitcoin Protocol.” No single entity owns or operates the Bitcoin Network. The Bitcoin Network is collectively maintained by (1) a decentralized group of participants running software that results in the recording and validation of transactions (this group is commonly referred to as “miners”), (2) software developers who propose improvements to the Bitcoin Protocol and related software and (3) users who choose which version of the Bitcoin software to run. Occasionally, developers suggest changes to the Bitcoin software. If a sufficient number of users and miners elect not to adopt the changes, a new digital asset, operating on the earlier version of the Bitcoin software, may be created. This is referred to as a “fork.”

Income Strategy

The adviser seeks to generate income through an income strategy focused on high-quality short-term debt instruments: U.S. Treasury securities and unaffiliated ETFs that investment primarily in U.S. Treasury securities. A portion of these securities serve as collateral for the Fund’s futures positions. Additionally, the Fund increases its income producing portfolio through leverage by entering into reverse repurchase agreements. Reverse repurchase agreements are contracts in which the Fund is a seller of securities under an agreement to buy the securities back at a specified time and price. Reverse repurchase agreements are used by the Fund as an indirect means of borrowing.

Option Overlay Strategy

The adviser seeks additional capital gains through an option overlay strategy with up to 20% of Fund assets. However, gains from written option premiums are often referred to as income. The core of the option overlay strategy consists of writing exchange-traded put and call option spreads on securities, index futures or ETFs that the adviser believes are sufficiently correlated to Bitcoin futures to contribute to the Fund’s investment objective. A call option gives the owner the right, but not the obligation, to buy a security, index future, or ETF at a specified price (strike price) within a specific time period. A put option gives the owner the right, but not the obligation, to sell index futures or sell a security, index future, or ETF at a specified price (strike price) within a specific time period.

8

In a put spread, the Fund writes an out of the money (below current market price) put option while also buying a further out of the money put option. The written put option is intended to generate income, and the purchased put option is intended to partially limit the Fund’s potential losses from the written put option. The adviser selects written put options that it believes will expire worthless or are likely to decline in value. An additional portion of the option overlay strategy consists of call option spreads. In a call option spread, the Fund sells (writes) an out of the money (above current market price) call option while also purchasing a further out of the money call option. The purchased call option is intended to limit the Fund’s potential losses from the written call option. The adviser selects written call options that it believes will expire worthless or are likely to decline in value.

If the price of Bitcoin goes up, the Fund’s returns may underperform Bitcoin because the adviser will buy back the written call options at a likely-higher price. If the price of Bitcoin goes down, the Fund’s returns may underperform Bitcoin because the adviser will buy back the written put options at a likely-higher price. To a lesser extent, the Fund may also purchase exchange-traded protective put options on securities, index futures or ETFs that the adviser believes are sufficiently correlated to Bitcoin futures to contribute to the Fund’s investment objective.

Generally, the adviser selects options based upon its evaluation of relative value based on cost, strike price (price that the optioned asset can be bought or sold by the option holder) and maturity (the last date the option contract is valid) and will exercise or close the options based on maturity or opportunistic portfolio rebalancing. The Fund anticipates purchasing and selling options on a weekly, monthly, quarterly, and annual basis, depending upon the Fund’s rebalancing requirements and the individual option expiration dates. However, the Fund may rebalance its option portfolio on a more frequent basis for a number of reasons such as if market volatility renders the protection provided by the option strategy less effective or ineffective or an option position has appreciated to the point that it is prudent to decrease the Fund’s exposure and realize gains for the Fund’s shareholders. While the option overlay is intended to improve the Fund’s performance, there is no guarantee that it will do so.

Subsidiary

The Fund expects to gain indirect exposure to the Bitcoin market indirectly by investing up to 25% of its total assets (measured at the time of investment) in a wholly owned and controlled subsidiary, the Simplify Bitcoin Strategy PLUS Income Cayman Fund (the “Subsidiary”), which is designed to enhance the ability of the Fund to obtain indirect exposure to the Bitcoin market consistent with the limits of the U.S. federal tax law requirements applicable to registered investment companies. The Subsidiary is advised by the adviser. Unlike the Fund, the Subsidiary may invest without limitation indirectly in Bitcoin-related investments, however, the Subsidiary will comply with the same Investment Company Act of 1940 asset coverage requirements, when viewed on a consolidated basis with the Fund, with respect to its investments in derivatives; and also complies with the provisions of the Investment Company Act of 1940 in Section 15 (regarding investment advisory contract approvals).

The Fund is classified as a “non-diversified” investment company under the Investment Company Act of 1940, as amended, which means that the Fund may invest a higher percentage of its assets in a fewer number of issuers than is permissible for a “diversified” fund.

Principal Investment Risks:

The following describes the risks the Fund bears with respect to its investments. As with any fund, there is no guarantee that the Fund will achieve its goal.

Bitcoin Risk. The value of the Fund’s investment in Bitcoin futures is subject to fluctuations in the value of bitcoins. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. The value of bitcoins is determined by the supply of and demand for bitcoins in the global market for the trading of bitcoins, which consists of transactions on electronic bitcoin exchanges (“Bitcoin Exchanges”). Pricing on Bitcoin Exchanges and other venues can be volatile and can adversely affect the value of Bitcoin futures. Currently, there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to the relatively large use of bitcoins by speculators, thus contributing to price volatility that could adversely affect the Fund’s investment in Bitcoin futures.

9

The further development of the Bitcoin Network and the acceptance and use of bitcoin are subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development of the Bitcoin Network or the acceptance of Bitcoin may adversely affect the price of Bitcoin. Bitcoin is subject to the risk of fraud, theft, manipulation or security failures, operational or other problems that impact Bitcoin trading venues. Additionally, if one or a coordinated group of miners were to gain control of 51% of the Bitcoin Network, they would have the ability to manipulate transactions, halt payments and fraudulently obtain Bitcoin. A significant portion of Bitcoin is held by a small number of holders sometimes referred to as “whales”. These holders have the ability to manipulate the price of Bitcoin.

Unlike the exchanges for more traditional assets, such as equity securities and futures contracts, Bitcoin and Bitcoin trading venues are largely unregulated. As a result of the lack of regulation, individuals or groups may engage in fraud or market manipulation (including using social media to promote Bitcoin in a way that artificially increases the price of Bitcoin). Investors may be more exposed to the risk of theft, fraud and market manipulation than when investing in more traditional asset classes. Over the past several years, a number of Bitcoin trading venues have been closed due to fraud, failure or security breaches. Investors in Bitcoin may have little or no recourse should such theft, fraud or manipulation occur and could suffer significant losses. Legal or regulatory changes may negatively impact the operation of the Bitcoin Network or restrict the use of Bitcoin. Federal, state or foreign governments may restrict the use and exchange of Bitcoin, and regulation in the U.S. is still developing. Increased regulation might tend to depress the price of Bitcoin. The creation of a “fork” (as described above) or a substantial giveaway of Bitcoin (sometimes referred to as an “air drop”) may result in significant and unexpected declines in the value of Bitcoin, Bitcoin futures, and the Fund.

The realization of any of these risks could result in a decline in the acceptance of Bitcoin and consequently a reduction in the value of Bitcoin, Bitcoin futures, and the Fund.

| ● | Bitcoin Tax Risk. By investing in Bitcoin futures indirectly through the Subsidiary, the Fund will obtain exposure to the cryptocurrency Bitcoin within the federal tax requirements that apply to the Fund. However, because the Subsidiary is a controlled foreign corporation, any income received by the Fund from its investments in the Subsidiary will be passed through to the Fund as ordinary income, which may be taxed at less favorable rates than capital gains. |

| ● | Bitcoin Futures Contract Risk. The market for Bitcoin futures may be less developed, and potentially less liquid and more volatile, than more established futures markets as Bitcoin futures are relatively new. The successful use of futures contracts draws upon the adviser’s skill and experience with respect to such instruments and are subject to special risk considerations. The primary risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the reference asset and the price of the futures contract; (b) possible lack of a liquid secondary market and the resulting inability to close a futures contract when desired; (c) investments in futures contracts involves leverage, which means a small percentage of assets in futures can have a disproportionately large impact on the Fund and the Fund can lose more than the principal amount invested; (d) losses caused by unanticipated market movements, which are potentially unlimited; (e) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so. Bitcoin futures may trade at a price premium above Bitcoin. As a futures contract approaches expiration, the price premium will tend to erode, which will result in losses to the Fund assuming other things equal. |

Active Management Risk. The Fund is subject to the risk that the investment management strategy may not produce the intended results and may negatively impact Fund performance.

Concentration Risk. The Fund’s net asset value may fluctuate more than that of a fund that does not concentrate in Bitcoin futures.

Early Close/Trading Halt Risk. An exchange or market may close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may prevent the Fund from buying or selling certain securities or financial instruments. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and may incur substantial trading losses.

10

ETF Structure Risks. The Fund is structured as an ETF and will invest in underlying ETFs. As a result, the Fund is subject to the special risks, including:

| ● | Not Individually Redeemable. The Fund’s shares (“Shares”) are not redeemable by retail investors and may be redeemed only by Authorized Participants at net asset value (“NAV”) and only in Creation Units. A retail investor generally incurs brokerage costs when selling shares. |

| ● | Trading Issues. Trading in Shares on The Nasdaq Stock Market LLC (the “Exchange”) may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable, such as extraordinary market volatility. There can be no assurance that Shares will continue to meet the listing requirements of the Exchange which may result in the Shares being delisted. An active trading market for the Shares may not be developed or maintained. If the Shares are traded outside a collateralized settlement system, the number of financial institutions that can act as Authorized Participants that can post collateral on an agency basis is limited, which may limit the market for the Shares. |

| ● | Market Price Variance Risk. The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and will include a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the Shares. There may be times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to NAV. |

| ○ | In times of market stress, market makers may step away from their role market making in the Shares and in executing trades, which can lead to differences between the market value of the Shares and the Fund’s NAV. |

| ○ | The market price of the Shares may deviate from the Fund’s NAV, particularly during times of market stress, with the result that investors may pay significantly more or significantly less for the Shares than the Fund’s NAV, which is reflected in the bid and ask price for the Shares or in the closing price. |

| ○ | In stressed market conditions, the market for the Shares may become less liquid in response to the deteriorating liquidity of the Fund’s portfolio. This adverse effect on the liquidity of the Shares may, in turn, lead to differences between the market value of the Shares and the Fund’s NAV. |

| ● | Authorized Participant Risk. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as an Authorized Participant on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. Authorized Participant concentration risk may be heightened for securities or instruments that have lower trading volumes. |

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment by the Fund, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments. A rise in interest rates may result in a decline in the value of the fixed income investments held by the Fund.

Leverage Risk. The use of leverage by the Fund, such as borrowing money through reverse repurchase agreements or the use of options, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses.

11

Limited History Risk. The Fund is a new ETF and has a limited history of operations for investors to evaluate.

Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Assets in the Fund’s portfolios may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Non-Diversification Risk.

Option Risk. Option spreads expose the Fund to potential losses of the amount between the strike price of the written option and the purchased option. As the buyer of a put or call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. Written options will limit the Fund’s gains with respect to the reference asset.

Reverse Repurchase Agreements Risk. The reverse repurchase agreement counterparty may fail to return securities to the Fund. Such securities may be costly to replace.

U.S. Treasury Market Risk. The U.S. Treasury market can be volatile, and the value of instruments correlated with these markets may fluctuate dramatically from day to day. U.S. Treasury obligations may provide relatively lower returns than those of other securities. Similar to other debt instruments, U.S. Treasury obligations are subject to debt instrument risk and interest rate risk. In addition, changes to the financial condition or credit rating of the U.S. Government may cause the value of U.S. Treasury obligations to decline.

Underlying Fund Risk. ETFs in which the Fund invests are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in the ETFs and may be higher than other funds that invest directly in stocks and bonds. Each of the ETFs is subject to its own specific risks, but the adviser expects the principal investments risks of such ETFs will be similar to the risks of investing in U.S. Treasury securities.

Wholly-Owned Subsidiary Risk. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary, respectively, are organized, could result in the inability of the Fund and/or Subsidiary to operate as described in this Prospectus and could negatively affect the Fund and its shareholders. The Subsidiary is not registered under the Investment Company Act of 1940 (“1940 Act”), as amended, and, unless otherwise noted in this Prospectus, is not subject to all of the investor protections of the 1940 Act, such as limits on leverage when viewed in isolation from the Fund.

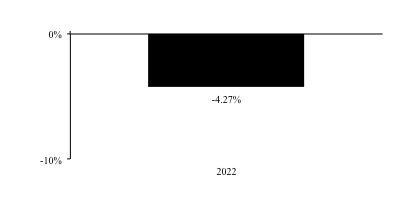

Performance:

12

Investment Adviser: Simplify Asset Management Inc. (the “Adviser”).

Portfolio Managers: Paul Kim, Chief Executive Officer of the Adviser; David Berns, Chief Investment Officer of the Adviser and John Downing, Managing Director of the Adviser, have each served the Fund as a portfolio manager since it commenced operations. Mr. Kim, Dr. Berns, and Mr. Downing are jointly and primarily responsible for the management of the Fund.

Purchase and Sale of Fund Shares: The Fund will issue and redeem Shares at NAV only in large blocks of 10,000 Shares (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed primarily in-kind for securities but may include cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units in transactions with Authorized Participants, the Shares are not redeemable securities of the Fund.

Shares of the Fund are listed for trading on the Exchange and trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV.

Tax Information: The Fund’s distributions generally will be taxable as ordinary income or long-term capital gains. A sale of Shares may result in capital gain or loss.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

13

Investment Objective: The Simplify Commodities Strategy No K-1 ETF (the “Fund” or “HARD”) seeks to provide long-term capital appreciation.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. Investors purchasing or selling shares of the Fund in the secondary market may be subject to costs (including customary brokerage commissions) charged by their broker. These costs are not included in the table and expense example below.

(expenses that you pay each year as a percentage of the value of your investment) |

|

| Management Fees | |

| Distribution and Service (12b-1) Fees | |

| Other Expenses(1) | |

| Total Annual Fund Operating Expenses |

| (1) |

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in mutual funds and other exchange traded funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| 1 Year | 3 Years | 5 Years | 10 Years |

| $ |

$ |

$ |

$ |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the period March 28, 2023 (commencement of operations) through June 30, 2023, the Fund’s portfolio turnover rate was

Principal Investment Strategies: The adviser seeks to achieve the Fund’s investment objective by investing in commodity futures contracts. The futures adviser, Altis Partners (Jersey) Limited (the “Futures Adviser”), advises the adviser with respect to futures contracts; however, the adviser ultimately decides on the selection and execution of the contracts.

Under normal market conditions, the Fund invests in a portfolio of futures contracts on commodities and commodity indices that the Futures Adviser believes will provide exposure across commodities markets (collectively, “Futures Contracts”). The Fund attempts to capture the economic benefit derived from rising trends based on the price changes of the Futures Contracts. Each month, each Futures Contract is generally positioned long if the Futures Contract is experiencing a positive price trend. The Fund may take short positions if the Futures Contract is experiencing a negative price trend. However, the Fund expects its Futures Contract portfolio to have a net long bias in most market environments.

14

Price trends and the determination whether to take a long or short position are based on the expected returns of each Futures Contract, derived from the Futures Adviser’s models that use valuation (price changes relative to economic indicators such as inflation) and momentum signals (prices trending higher or lower over various look back periods). In addition to return, the Futures Adviser considers the risk of each Futures Contract and the correlation between Futures Contracts. The Fund will also hold short-term U.S. Treasury securities or other high credit quality, short-term fixed-income or similar securities (such as shares of money market funds and collateralized repurchase agreements) for direct investment or as collateral for Futures Contracts.

Unlike a typical commodity pool that is taxed as a partnership and provides each partner with a Schedule K-1 annually, the Fund provides shareholders with a Form 1099 but no Schedule K-1. To deliver 1099s consistent with applicable tax law, the Fund intends to invest in an underlying subsidiary, as discussed below.

Typically, the Fund will not invest directly in commodity Futures Contracts. The Fund expects to gain exposure to these investments by investing up to 25% of its assets in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by Simplify Asset Management Inc., which obtains research support from the Futures Adviser. Unlike the Fund, the Subsidiary is not an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment in the Subsidiary is intended to provide the Fund with exposure to commodity markets in accordance with applicable rules and regulations.

Principal Investment Risks:

The following describes the risks the Fund bears with respect to its investments. As with any fund, there is no guarantee that the Fund will achieve its goal.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. In general, the market price of fixed income securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment by the Fund, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments. A rise in interest rates may result in a decline in the value of the fixed income investments held by the Fund.

Futures Risk. The Fund’s use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) leverage risk (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the futures contract may not correlate perfectly with the underlying asset. Investments in futures involve leverage, which means a small percentage of assets invested in futures can have a disproportionately large impact on the Fund. This risk could cause the Fund to lose more than the principal amount invested. Futures contracts may become mispriced or improperly valued when compared to the adviser’s expectation and may not produce the desired investment results. Additionally, changes in the value of futures contracts may not track or correlate perfectly with the underlying index because of temporary, or even long-term, supply and demand imbalances and because futures do not pay dividends unlike the stocks upon which they are based.

Active Management Risk. The Fund is subject to the risk that the investment management strategy may not produce the intended results and may negatively impact Fund performance.

Commodity Risk. Investments linked to commodity futures contracts can be highly volatile compared to investments in traditional securities, and funds holding instruments linked to commodity futures contracts may experience large losses. The value of instruments linked to commodity futures contracts may be affected by market movements, commodity benchmarks, volatility, changes in interest rates, or factors

15

affecting a particular industry, or commodity. For example, commodity futures contracts may be affected by numerous factors, including drought, floods, fires, weather, livestock disease, pipeline ruptures or spills, embargoes, tariffs and international, economic, political or regulatory developments. In particular, trading in natural gas futures contracts (or other financial instruments linked to natural gas) has historically been very volatile and can be expected to be very volatile in the future. High volatility may have an adverse impact on the Fund.

Derivatives Risk. The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. Such prices are influenced by numerous factors that affect the markets, including, but not limited to: changing supply and demand relationships; government programs and policies; national and international political and economic events, changes in interest rates, inflation and deflation and changes in supply and demand relationships. Trading derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities.

Early Close/Trading Halt Risk. An exchange or market may close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may prevent the Fund from buying or selling certain securities or financial instruments. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and may incur substantial trading losses.

ETF Structure Risks. The Fund is structured as an ETF and will invest in underlying ETFs. As a result, the Fund is subject to special risks, including:

| ● | Not Individually Redeemable. The Fund’s shares (“Shares”) are not redeemable by retail investors and may be redeemed only by Authorized Participants at net asset value (“NAV”) and only in Creation Units. A retail investor generally incurs brokerage costs when selling shares. |

| ● | Trading Issues. Trading in Shares on NYSE Arca, Inc. (the “Exchange”) may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable, such as extraordinary market volatility. There can be no assurance that Shares will continue to meet the listing requirements of the Exchange which may result in the Shares being delisted. An active trading market for the Shares may not be developed or maintained. If the Shares are traded outside a collateralized settlement system, the number of financial institutions that can act as Authorized Participants that can post collateral on an agency basis is limited, which may limit the market for the Shares. |

| ● | Market Price Variance Risk. The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and will include a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the Shares. There may be times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to NAV. |

| ○ | In times of market stress, market makers may step away from their role market making in the Shares and in executing trades, which can lead to differences between the market value of the Shares and the Fund’s NAV. |

| ○ | The market price of the Shares may deviate from the Fund’s NAV, particularly during times of market stress, with the result that investors may pay significantly more or significantly less for the Shares than the Fund’s NAV, which is reflected in the bid and ask price for the Shares or in the closing price. |

| ○ | In stressed market conditions, the market for the Shares may become less liquid in response to the deteriorating liquidity of the Fund’s portfolio. This adverse effect on the liquidity of the Shares may, in turn, lead to differences between the market value of the Shares and the Fund’s NAV. |

16

| ● | Authorized Participant Risk. Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as an Authorized Participant on an agency basis (i.e., on behalf of other market participants). To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. Authorized Participant concentration risk may be heightened for securities or instruments that have lower trading volumes. |

Futures Adviser Risk. The Futures Adviser’s judgments about the attractiveness, value and potential appreciation of particular asset classes and securities in which the Fund invests may prove to be incorrect and may not produce the desired results.

Leverage Risk. The use of leverage by the Fund, through its use of futures, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses.

Limited History Risk. The Fund is a new ETF and does not yet have a history of operations for investors to evaluate.

Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolios may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, international conflicts, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Money Market Funds Risk. Money market funds are subject to management fees and other expenses, and the Fund’s investments in money market funds will cause it to bear proportionately the costs incurred by the money market funds’ operations while simultaneously paying its own management fees and expenses.

Repurchase Agreement Risk. The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements. Investments in repurchase agreements also may be subject to the risk that the market value of the underlying obligations may decline prior to the expiration of the repurchase agreement term.

Rolling Futures Contract Risk. The Fund will invest in and have exposure to Futures Contracts and is subject to risks related to rolling. Rolling occurs when the Fund closes out of a Futures Contract as it nears its expiration and replaces it with a contract that has a later expiration. The Fund does not intend to hold Futures Contracts through expiration, but instead intends to “roll” its futures positions. When the market for these Futures Contracts is such that the prices are higher in the more distant delivery months than in the nearer delivery months, the sale during the course of the “rolling process” of the more nearby contract would take place at a price that is lower than the price of the more distant contract. This pattern of higher Futures Contract prices for longer expiration contracts is often referred to as “contango.” Alternatively, when the market for futures contracts is such that the prices are higher in the nearer months than in the more distant months, the sale during the course of the “rolling process” of the more nearby contract would take place at a price that is higher than the price of the more distant contract. This pattern of higher futures prices for shorter expiration futures contracts is referred to as “backwardation.” Extended periods of contango or backwardation have occurred in the past and can in the future cause significant losses for the Fund.

17

Subsidiary Investment Risk. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary are organized, respectively, could result in the inability of the Fund to operate as intended and could negatively affect the Fund and its shareholders. The Subsidiary is not registered under the 1940 Act and is not subject to all the investor protections of the 1940 Act. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies.

U.S. Treasury Market Risk. The U.S. Treasury market can be volatile, and the value of instruments correlated with these markets may fluctuate dramatically from day to day. U.S. Treasury obligations may provide relatively lower returns than those of other securities. Similar to other debt instruments, U.S. Treasury obligations are subject to debt instrument risk and interest rate risk. In addition, changes to the financial condition or credit rating of the U.S. Government may cause the value of U.S. Treasury obligations to decline.

Performance:

Investment Adviser: Simplify Asset Management Inc. (the “Adviser”).

Futures Adviser: Altis Partners (Jersey) Limited.

Portfolio Managers: Paul Kim, Chief Executive Officer of the Adviser; David Berns, Chief Investment Officer of the Adviser; Michael Green, Managing Director and Chief Strategist of the Adviser, and Ken Miller, Portfolio Manager of the Adviser serve as portfolio managers of the Fund. Mr. Kim, Mr. Berns, Mr. Green and Mr. Miller have each served the Fund as a portfolio manager since it commenced operations and are jointly and primarily responsible for the management of the Fund.

Purchase and Sale of Fund Shares: The Fund will issue and redeem Shares at NAV only in large blocks of 25,000 Shares (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed primarily in-kind for securities but may include cash. Individual Shares may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units in transactions with Authorized Participants, the Shares are not redeemable securities of the Fund.

Shares of the Fund are listed for trading on the Exchange and trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV. An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market. Recent information on Fund’s NAV, market price, premiums and discounts, and bid-ask spreads is available at www.simplify.us/etfs.

Tax Information: The Fund’s distributions generally will be taxable as ordinary income or long-term capital gains. A sale of Shares may result in capital gain or loss.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

18

Investment Objective: The Simplify Conservative Allocation ETF (the “Fund” or “SAAC”) seeks income and capital appreciation.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, sell, and hold shares of the Fund. Investors purchasing or selling shares of the Fund in the secondary market may be subject to costs (including customary brokerage commissions) charged by their broker. These costs are not included in the table and expense example below.

(expenses that you pay each year as a percentage of the value of your investment) |

|

| Management Fees | |

| Distribution and Service (12b-1) Fees | |

| Other Expenses(1) | |

| Acquired Fund Fees and Expenses(2) | |

| Total Annual Fund Operating Expenses |

| (1) | |

| (2) |

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| 1 Year | 3 Years |

| $ |

$ |