UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2020

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39568

Radius Global Infrastructure, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

98-1524226 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

660 Madison Avenue, Suite 1435 |

|

|

New York, New York |

10065 |

|

(Address of principal executive offices) |

(Zip Code) |

(212) 301-2800

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Class A Common Stock, $0.0001 par value |

RADI |

Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 16, 2020, there were 58,425,000 shares of Class A Common Stock outstanding.

Cautionary Note Regarding Forward-Looking Statements

Some of the statements in this Quarterly Report constitute forward-looking statements that do not directly or exclusively relate to historical facts, and which may concern our possible or assumed future results of operations, including descriptions of our business strategy. In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “targets”, “believes”, “estimates”, “anticipates”, “expects”, “intends”, “may”, “will”, “should” or, in each case, their negative or other variations or comparable terminology. Any forward-looking statements contained in this Quarterly Report are based upon our historical performance and on our current plans, estimates and expectations in light of information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. These forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to:

|

|

• |

the extent to which wireless carriers or tower companies consolidate their operations, exit the wireless communications business or share site infrastructure; |

|

|

• |

the extent to which new technologies reduce demand for wireless infrastructure; |

|

|

• |

competition for assets; |

|

|

• |

the extent to which the Tenant Leases (as defined herein) for the wireless communication tower or antennae located on our real property interests are renewed; |

|

|

• |

the extent of unexpected lease cancellations, given that substantially all of the Tenant Leases associated with our assets may be terminated upon limited notice by the wireless carrier or tower company and unexpected lease cancellations could materially impact cash flow from operations; |

|

|

• |

economic, political, cultural and other risks to our operations outside the United States, including risks associated with fluctuations in foreign currency exchange rates and local inflation rates; |

|

|

• |

the effect of foreign currency exchange rates; |

|

|

• |

the effect of the Electronic Communications Code enacted in the United Kingdom, which may limit the amount of lease income we generate in the United Kingdom; |

|

|

• |

the extent to which we continue to grow at an accelerated rate, which may prevent us from achieving profitability or positive cash flow at a company level (as determined in accordance with U.S. GAAP) for the foreseeable future, particularly given the history of net losses and negative net cash flow; |

|

|

• |

the fact that we have incurred a significant amount of debt and may in the future incur additional indebtedness; |

|

|

• |

the extent to which the terms of our debt agreements limit our flexibility in operating our business; |

|

|

• |

the ongoing impact of the COVID-19 (coronavirus) pandemic on global economic activity and financial markets, including the possibility of a global recession and volatility in the global capital markets; |

|

|

• |

the extent to which unfavorable capital markets impair our growth strategy, which requires access to new capital; |

|

|

• |

the adverse effect that increased market interest rates could have on our interest costs, the value of our assets and on the growth of our business; |

|

|

• |

the adverse effect that perceived health risks from radio frequency energy may have on the demand for wireless communication services; |

|

|

• |

our ability to protect and enforce our real property interests in, or contractual rights to, the revenue streams generated by leases on our communications sites; |

|

|

• |

the loss, consolidation or financial instability of any of our limited number of customers; |

|

|

• |

our ability to pay dividends or satisfy our other financial obligations; |

i

|

|

Agreement”), or upon the exercise of the warrants to subscribe for Class A Common Shares (the “Warrants”) or options to acquire Class A Common Shares, any of which would dilute the interests of our securityholders in the Class A Common Shares; |

|

|

• |

the possibility that an active, liquid and orderly trading market for our securities may not develop or be maintained; |

|

|

• |

the possibility that securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our market, or if they change their recommendations regarding our securities adversely; |

|

|

• |

the possibility that the Warrants may not be in the money at a time when they are exercisable or may be mandatorily redeemed prior to their exercise, which may render them worthless to the holders of the Warrants; |

|

|

• |

the effect that the significant resources and management attention required as a U.S. public company may have on our results and on our ability to attract and retain executive management and qualified members of our Board of Directors; and |

|

|

• |

the other risks and uncertainties described under “Risk Factors” in Item 3 of our Post-Effective Amendment to Form S-4 (File No. 333-240173) filed on October 21, 2020 and Item 1A. of Part II herein. |

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere in this Quarterly Report. The forward-looking statements made in this Quarterly Report relate only to events as of the date on which the statements are made. We do not undertake any obligation to publicly update or review any forward-looking statement except as required by law, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this Quarterly Report that could cause actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

ii

RADIUS GLOBAL INFRASTRUCTURE, INC.

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

2 |

||

|

|

|

|

|

2 |

||

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

32 |

|

|

|

|

|

|

50 |

||

|

|

|

|

|

51 |

||

|

|

|

|

|

52 |

||

|

|

|

|

|

52 |

||

|

|

|

|

|

52 |

||

|

|

|

|

|

52 |

||

|

|

|

|

|

52 |

||

|

|

|

|

|

53 |

||

1

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

Successor |

|

|

|

Predecessor |

|

||

|

|

|

September 30, 2020 |

|

|

|

December 31, 2019 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

169,135 |

|

|

|

$ |

62,892 |

|

|

Restricted cash |

|

|

1,727 |

|

|

|

|

1,140 |

|

|

Trade receivables, net |

|

|

4,935 |

|

|

|

|

7,578 |

|

|

Prepaid expenses and other current assets |

|

|

11,994 |

|

|

|

|

9,199 |

|

|

Total current assets |

|

|

187,791 |

|

|

|

|

80,809 |

|

|

Real property interests, net: |

|

|

|

|

|

|

|

|

|

|

Right-of-use assets - finance leases, net |

|

|

201,197 |

|

|

|

|

80,498 |

|

|

Cell site leasehold interests, net |

|

|

760,381 |

|

|

|

|

346,662 |

|

|

Real property interests, net |

|

|

961,578 |

|

|

|

|

427,160 |

|

|

Intangible assets, net |

|

|

5,134 |

|

|

|

|

2,848 |

|

|

Property and equipment, net |

|

|

613 |

|

|

|

|

1,095 |

|

|

Goodwill |

|

|

89,164 |

|

|

|

|

— |

|

|

Deferred tax asset |

|

|

— |

|

|

|

|

991 |

|

|

Restricted cash, long-term |

|

|

153,065 |

|

|

|

|

14,014 |

|

|

Other long-term assets |

|

|

5,735 |

|

|

|

|

5,892 |

|

|

Total assets |

|

$ |

1,403,080 |

|

|

|

$ |

532,809 |

|

|

Liabilities and Stockholders’ Equity/Members’ Deficit |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

30,282 |

|

|

|

$ |

22,786 |

|

|

Rent received in advance |

|

|

17,008 |

|

|

|

|

13,856 |

|

|

Finance lease liabilities, current |

|

|

8,032 |

|

|

|

|

5,749 |

|

|

Cell site leasehold interest liabilities, current |

|

|

5,521 |

|

|

|

|

8,379 |

|

|

Current portion of long-term debt, net of deferred financing costs |

|

|

— |

|

|

|

|

48,884 |

|

|

Total current liabilities |

|

|

60,843 |

|

|

|

|

99,654 |

|

|

Finance lease liabilities |

|

|

22,142 |

|

|

|

|

10,451 |

|

|

Cell site leasehold interest liabilities |

|

|

10,269 |

|

|

|

|

8,462 |

|

|

Long-term debt, net of debt discount and deferred financing costs |

|

|

695,308 |

|

|

|

|

524,047 |

|

|

Deferred tax liability |

|

|

58,121 |

|

|

|

|

— |

|

|

Other long-term liabilities |

|

|

7,267 |

|

|

|

|

5,531 |

|

|

Total liabilities |

|

|

853,950 |

|

|

|

|

648,145 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity/Members’ deficit: |

|

|

|

|

|

|

|

|

|

|

Series A Founder Preferred Shares (Successor), no par value; 1,600,000 shares authorized; 1,600,000 shares issued and outstanding as of September 30, 2020 |

|

|

— |

|

|

|

|

— |

|

|

Series B Founder Preferred Shares (Successor), no par value; 1,386,033 shares authorized; 1,386,033 shares issued and outstanding as of September 30, 2020 |

|

|

— |

|

|

|

|

— |

|

|

Ordinary Shares (Successor), no par value; 1,590,000,000 shares authorized; 58,425,000 shares issued and outstanding as of September 30, 2020 |

|

|

— |

|

|

|

|

— |

|

|

Class B Shares (Successor), no par value; 200,000,000 shares authorized; 11,414,030 shares issued and outstanding as of September 30, 2020 |

|

|

— |

|

|

|

|

— |

|

|

Class A units (Predecessor) |

|

|

— |

|

|

|

|

33,672 |

|

|

Common units (Predecessor) |

|

|

— |

|

|

|

|

85,347 |

|

|

Additional paid-in capital (Successor) |

|

|

669,707 |

|

|

|

|

— |

|

|

Members’ accumulated deficit (Predecessor) |

|

|

— |

|

|

|

|

(208,883 |

) |

|

Members’ accumulated other comprehensive loss (Predecessor) |

|

|

— |

|

|

|

|

(25,472 |

) |

|

Accumulated other comprehensive loss (Successor) |

|

|

(4,900 |

) |

|

|

|

— |

|

|

Accumulated deficit (Successor) |

|

|

(173,523 |

) |

|

|

|

— |

|

|

Total stockholders’ equity attributable to Radius Global Infrastructure, Inc./ members’ deficit |

|

|

491,284 |

|

|

|

|

(115,336 |

) |

|

Noncontrolling interest |

|

|

57,846 |

|

|

|

|

— |

|

|

Total liabilities and stockholders’ equity/members' deficit |

|

$ |

1,403,080 |

|

|

|

$ |

532,809 |

|

See accompanying notes to condensed consolidated financial statements.

2

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

Successor |

|

|

|

Predecessor |

|

||||||||||||||

|

|

|

Three months ended September 30, 2020 |

|

|

Period from February 10, 2020 to September 30, 2020 |

|

|

|

Period from January 1, 2020 to February 9, 2020 |

|

|

Three months ended September 30, 2019 |

|

|

Nine months ended September 30, 2019 |

|

|||||

|

Revenue |

|

$ |

17,861 |

|

|

$ |

42,797 |

|

|

|

$ |

6,836 |

|

|

$ |

14,002 |

|

|

$ |

40,939 |

|

|

Cost of service |

|

|

200 |

|

|

|

375 |

|

|

|

|

34 |

|

|

|

14 |

|

|

|

88 |

|

|

Gross profit |

|

|

17,661 |

|

|

|

42,422 |

|

|

|

|

6,802 |

|

|

|

13,988 |

|

|

|

40,851 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

14,231 |

|

|

|

42,915 |

|

|

|

|

4,344 |

|

|

|

7,764 |

|

|

|

23,562 |

|

|

Share-based compensation |

|

|

4,072 |

|

|

|

79,173 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Management incentive plan |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

765 |

|

|

Amortization and depreciation |

|

|

11,683 |

|

|

|

30,512 |

|

|

|

|

2,584 |

|

|

|

5,064 |

|

|

|

14,273 |

|

|

Impairment - decommission of cell sites |

|

|

1,462 |

|

|

|

2,059 |

|

|

|

|

530 |

|

|

|

122 |

|

|

|

1,327 |

|

|

Total operating expenses |

|

|

31,448 |

|

|

|

154,659 |

|

|

|

|

7,458 |

|

|

|

12,950 |

|

|

|

39,927 |

|

|

Operating income (loss) |

|

|

(13,787 |

) |

|

|

(112,237 |

) |

|

|

|

(656 |

) |

|

|

1,038 |

|

|

|

924 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized (loss) gain on foreign currency debt |

|

|

(18,138 |

) |

|

|

(17,408 |

) |

|

|

|

11,500 |

|

|

|

11,668 |

|

|

|

13,508 |

|

|

Interest expense, net |

|

|

(7,499 |

) |

|

|

(16,821 |

) |

|

|

|

(3,623 |

) |

|

|

(8,248 |

) |

|

|

(23,820 |

) |

|

Other income (expense), net |

|

|

987 |

|

|

|

1,362 |

|

|

|

|

(277 |

) |

|

|

(2,031 |

) |

|

|

(2,436 |

) |

|

Gain on extinguishment of debt |

|

|

— |

|

|

|

1,264 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total other income (expense), net |

|

|

(24,650 |

) |

|

|

(31,603 |

) |

|

|

|

7,600 |

|

|

|

1,389 |

|

|

|

(12,748 |

) |

|

Income (loss) before income tax expense |

|

|

(38,437 |

) |

|

|

(143,840 |

) |

|

|

|

6,944 |

|

|

|

2,427 |

|

|

|

(11,824 |

) |

|

Income tax expense |

|

|

3,455 |

|

|

|

4,884 |

|

|

|

|

767 |

|

|

|

1,284 |

|

|

|

2,233 |

|

|

Net income (loss) |

|

|

(41,892 |

) |

|

|

(148,724 |

) |

|

|

$ |

6,177 |

|

|

$ |

1,143 |

|

|

$ |

(14,057 |

) |

|

Net loss attributable to noncontrolling interest |

|

|

(3,373 |

) |

|

|

(6,347 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Radius Global Infrastructure, Inc. ordinary shareholders |

|

$ |

(38,519 |

) |

|

$ |

(142,377 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.66 |

) |

|

$ |

(2.44 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average ordinary shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

58,425,000 |

|

|

|

58,425,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

3

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (Unaudited)

(in thousands)

|

|

|

Successor |

|

|

|

Predecessor |

|

||||||||||||||

|

|

|

Three Months Ended September 30, 2020 |

|

|

Period from February 10, 2020 to September 30, 2020 |

|

|

|

Period from January 1, 2020 to February 9, 2020 |

|

|

Three months ended September 30, 2019 |

|

|

Nine months ended September 30, 2019 |

|

|||||

|

Net income (loss) |

|

$ |

(41,892 |

) |

|

$ |

(148,724 |

) |

|

|

$ |

6,177 |

|

|

$ |

1,143 |

|

|

$ |

(14,057 |

) |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

8,817 |

|

|

|

(4,900 |

) |

|

|

|

(7,165 |

) |

|

|

(10,044 |

) |

|

|

(9,620 |

) |

|

Comprehensive loss |

|

$ |

(33,075 |

) |

|

$ |

(153,624 |

) |

|

|

$ |

(988 |

) |

|

$ |

(8,901 |

) |

|

$ |

(23,677 |

) |

See accompanying notes to condensed consolidated financial statements.

4

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY/MEMBERS’ DEFICIT (Unaudited)

(in thousands, except share and per share amounts)

|

Predecessor |

|

|||||||||||||||||||||||||||

|

|

Class A units |

|

|

Common units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Units |

|

|

Amount |

|

|

Units |

|

|

Amount |

|

|

Accumulated deficit |

|

|

Accumulated other comprehensive loss |

|

|

Members' deficit |

|

|||||||

|

Balance at June 30, 2019 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(185,717 |

) |

|

$ |

(25,952 |

) |

|

$ |

(92,650 |

) |

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,044 |

) |

|

|

(10,044 |

) |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,143 |

|

|

|

— |

|

|

|

1,143 |

|

|

Balance at September 30, 2019 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(184,574 |

) |

|

$ |

(35,996 |

) |

|

$ |

(101,551 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2019 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(170,517 |

) |

|

$ |

(26,376 |

) |

|

$ |

(77,874 |

) |

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,620 |

) |

|

|

(9,620 |

) |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,057 |

) |

|

|

— |

|

|

|

(14,057 |

) |

|

Balance at September 30, 2019 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(184,574 |

) |

|

$ |

(35,996 |

) |

|

$ |

(101,551 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2020 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(208,883 |

) |

|

$ |

(25,472 |

) |

|

$ |

(115,336 |

) |

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,165 |

) |

|

|

(7,165 |

) |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,177 |

|

|

|

— |

|

|

|

6,177 |

|

|

Balance at February 9, 2020 |

|

|

4,003,603 |

|

|

$ |

33,672 |

|

|

|

20,000,000 |

|

|

$ |

85,347 |

|

|

$ |

(202,706 |

) |

|

$ |

(32,637 |

) |

|

$ |

(116,324 |

) |

See accompanying notes to condensed consolidated financial statements.

5

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY/MEMBERS’ DEFICIT (Unaudited)

(in thousands, except share and per share amounts)

|

Successor |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Series A Founder Preferred Shares |

|

|

Series B Founder Preferred Shares |

|

|

Ordinary Shares |

|

|

Class B Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Units |

|

|

Amount |

|

|

Units |

|

|

Amount |

|

|

Units |

|

|

Amount |

|

|

Units |

|

|

Amount |

|

|

Additional paid-in capital |

|

|

Accumulated other comprehensive loss |

|

|

Accumulated deficit |

|

|

Noncontrolling interest |

|

|

Total stockholders' equity |

|

|||||||||||||

|

Balance at June 30, 2020 |

|

|

1,600,000 |

|

|

$ |

— |

|

|

|

1,386,033 |

|

|

$ |

— |

|

|

|

58,425,000 |

|

|

$ |

— |

|

|

|

11,414,030 |

|

|

$ |

— |

|

|

$ |

665,635 |

|

|

$ |

(13,717 |

) |

|

$ |

(135,004 |

) |

|

$ |

61,219 |

|

|

$ |

578,133 |

|

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,072 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,072 |

|

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,817 |

|

|

|

— |

|

|

|

— |

|

|

|

8,817 |

|

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(38,519 |

) |

|

|

(3,373 |

) |

|

|

(41,892 |

) |

|

Balance at September 30, 2020 |

|

|

1,600,000 |

|

|

$ |

— |

|

|

|

1,386,033 |

|

|

$ |

— |

|

|

|

58,425,000 |

|

|

$ |

— |

|

|

|

11,414,030 |

|

|

$ |

— |

|

|

$ |

669,707 |

|

|

$ |

(4,900 |

) |

|

$ |

(173,523 |

) |

|

$ |

57,846 |

|

|

$ |

549,130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at February 10, 2020 |

|

|

1,600,000 |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

58,425,000 |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

$ |

590,534 |

|

|

$ |

— |

|

|

$ |

(31,146 |

) |

|

$ |

— |

|

|

$ |

559,388 |

|

|

Issuances of shares in APW Acquisition |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,014,030 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

64,193 |

|

|

|

64,193 |

|

|

Share-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,386,033 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,400,000 |

|

|

|

— |

|

|

|

79,173 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

79,173 |

|

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,900 |

) |

|

|

— |

|

|

|

— |

|

|

|

(4,900 |

) |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(142,377 |

) |

|

|

(6,347 |

) |

|

|

(148,724 |

) |

|

Balance at September 30, 2020 |

|

|

1,600,000 |

|

|

$ |

— |

|

|

|

1,386,033 |

|

|

$ |

— |

|

|

|

58,425,000 |

|

|

$ |

— |

|

|

|

11,414,030 |

|

|

$ |

— |

|

|

$ |

669,707 |

|

|

$ |

(4,900 |

) |

|

$ |

(173,523 |

) |

|

$ |

57,846 |

|

|

$ |

549,130 |

|

See accompanying notes to condensed consolidated financial statements.

6

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

Successor |

|

|

|

Predecessor |

|

||||||

|

|

|

Period from February 10, 2020 to September 30, 2020 |

|

|

|

Period from January 1, 2020 to February 9, 2020 |

|

|

Nine months ended September 30, 2019 |

|

|||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(148,724 |

) |

|

|

$ |

6,177 |

|

|

$ |

(14,057 |

) |

|

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization and depreciation |

|

|

30,512 |

|

|

|

|

2,584 |

|

|

|

14,273 |

|

|

Amortization of finance lease and cell site leasehold interest liabilities discount |

|

|

1,157 |

|

|

|

|

213 |

|

|

|

1,557 |

|

|

Impairment – decommission of cell sites |

|

|

2,059 |

|

|

|

|

530 |

|

|

|

1,327 |

|

|

Realized and unrealized loss (gain) on foreign currency debt |

|

|

17,408 |

|

|

|

|

(11,500 |

) |

|

|

(13,508 |

) |

|

Amortization of debt discount and deferred financing costs |

|

|

80 |

|

|

|

|

280 |

|

|

|

1,985 |

|

|

Provision for bad debt expense |

|

|

238 |

|

|

|

|

26 |

|

|

|

565 |

|

|

Share-based compensation |

|

|

79,173 |

|

|

|

|

— |

|

|

|

— |

|

|

Deferred income taxes |

|

|

2,123 |

|

|

|

|

339 |

|

|

|

— |

|

|

Gain on extinguishment of debt |

|

|

(1,264 |

) |

|

|

|

— |

|

|

|

— |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables, net |

|

|

2,463 |

|

|

|

|

(682 |

) |

|

|

(892 |

) |

|

Prepaid expenses and other assets |

|

|

(740 |

) |

|

|

|

935 |

|

|

|

(682 |

) |

|

Accounts payable, accrued expenses and other long-term liabilities |

|

|

(16,199 |

) |

|

|

|

(4,605 |

) |

|

|

1,442 |

|

|

Rent received in advance |

|

|

922 |

|

|

|

|

2,251 |

|

|

|

773 |

|

|

Net cash used in operating activities |

|

|

(30,792 |

) |

|

|

|

(3,452 |

) |

|

|

(7,217 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid in APW Acquisition, net of cash acquired |

|

|

(277,065 |

) |

|

|

|

— |

|

|

|

— |

|

|

Investments in real property interests and related intangible assets |

|

|

(72,823 |

) |

|

|

|

(5,064 |

) |

|

|

(49,256 |

) |

|

Advances on note receivable |

|

|

(2,500 |

) |

|

|

|

(17,500 |

) |

|

|

— |

|

|

Payments received on note receivable |

|

|

20,000 |

|

|

|

|

— |

|

|

|

— |

|

|

Purchases of property and equipment |

|

|

(296 |

) |

|

|

|

(40 |

) |

|

|

(163 |

) |

|

Net cash used in investing activities |

|

|

(332,684 |

) |

|

|

|

(22,604 |

) |

|

|

(49,419 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings under the Facility Agreement |

|

|

160,475 |

|

|

|

|

— |

|

|

|

18,600 |

|

|

Repayments of the Loan Agreement |

|

|

(48,025 |

) |

|

|

|

(250 |

) |

|

|

(500 |

) |

|

Debt issuance costs |

|

|

(3,692 |

) |

|

|

|

— |

|

|

|

(610 |

) |

|

Repayments of finance lease and cell site leasehold interest liabilities |

|

|

(9,003 |

) |

|

|

|

(3,149 |

) |

|

|

(10,485 |

) |

|

Net cash provided by (used in) financing activities |

|

|

99,755 |

|

|

|

|

(3,399 |

) |

|

|

7,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents and restricted cash |

|

|

(263,721 |

) |

|

|

|

(29,455 |

) |

|

|

(49,631 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of change in foreign currency exchange rates on cash and restricted cash |

|

|

(980 |

) |

|

|

|

(232 |

) |

|

|

1,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

|

588,628 |

|

|

|

|

78,046 |

|

|

|

101,414 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

323,927 |

|

|

|

$ |

48,359 |

|

|

$ |

52,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash and non-cash transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

15,039 |

|

|

|

$ |

4,684 |

|

|

$ |

19,117 |

|

|

Cash paid for income taxes |

|

$ |

2,222 |

|

|

|

$ |

1,112 |

|

|

$ |

895 |

|

See accompanying notes to condensed consolidated financial statements.

7

RADIUS GLOBAL INFRASTRUCTURE, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(in thousands, except share and per share amounts and unless otherwise disclosed)

|

1. |

Organization |

Radius Global Infrastructure, Inc. (together with its subsidiaries, “Radius Global Infrastructure”, “RADI” and/or the “Company”), formerly known as Landscape Acquisition Holdings Limited (“Landscape”) and Digital Landscape Group, Inc., is one of the largest international aggregators of rental streams underlying wireless sites through the acquisition of wireless telecom real property interests and contractual rights. The Company purchases, primarily for a lump sum, the right to receive future rental payments generated pursuant to an existing ground lease or rooftop lease (and any subsequent lease or extension or amendment thereof) between a property owner and an owner of a wireless tower or antennae (each such lease, a “Tenant Lease”). Typically, the Company acquires the rental stream by way of a purchase of a real property interest in the land underlying the wireless tower or antennae, most commonly easements, usufructs, leasehold and sub-leasehold interests, or fee simple interests, each of which provides the Company the right to receive the rents from the Tenant Lease. In addition, the Company purchases contractual interests, such as an assignment of rents, either in conjunction with the property interest or as a stand-alone right.

The Company was incorporated with limited liability under the laws of the British Virgin Islands under the BVI Business Companies Act, 2004, as amended, on November 1, 2017. The Company was originally formed to undertake an acquisition of a target company or business.

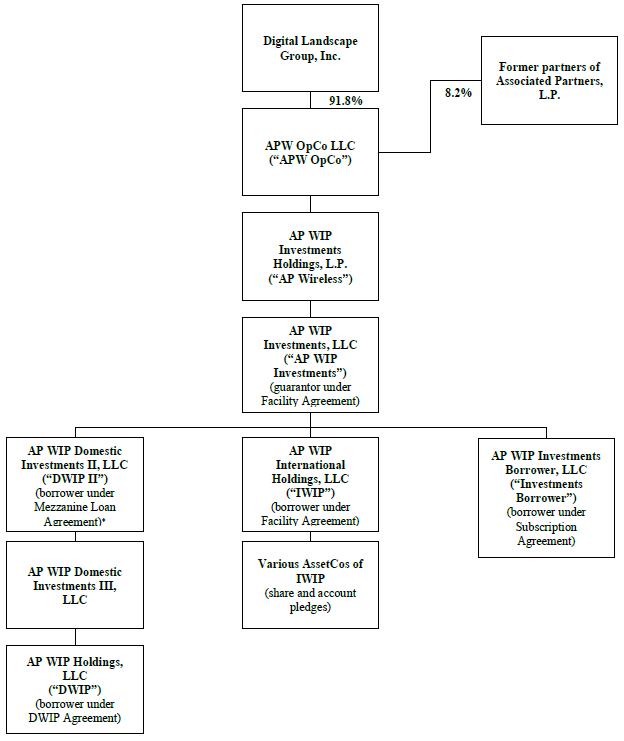

On February 10, 2020 (the “Closing Date”), the Company completed its acquisition by purchasing AP WIP Investments Holdings, LP (“AP Wireless”), a Delaware limited partnership and the direct parent of AP WIP Investments, LLC (“AP WIP Investments”), pursuant to a merger agreement entered into on November 19, 2019. The acquisition, together with the other transactions contemplated by the merger agreement are referred to herein as the “Transaction” and/or “APW Acquisition”. In connection with the closing of the Transaction, Landscape changed its name to Digital Landscape Group, Inc.

Upon completion of the Transaction, on the Closing Date, the Company acquired a 91.8%. interest in APW OpCo LLC (“APW OpCo”), the parent of AP Wireless and the indirect parent of AP WIP Investments, for consideration of approximately $860,000 less (i) debt as of September 30, 2019 of approximately $539,000, (ii) approximately $65,000 to redeem a minority investor in the AP Wireless business, and (iii) allocable transaction expenses of approximately $10,700 plus (iv) cash as of September 30, 2019 of approximately $66,500 (subject to certain limited adjustments). The Transaction was completed through a merger of a newly created subsidiary of RADI with and into APW OpCo, with APW OpCo surviving such merger as a majority owned subsidiary of RADI. Following the Transaction and as noted above, the Company owned 91.8% of APW OpCo. The remaining 8.2% interest in APW OpCo is owned by certain former partners of Associated Partners, L.P. (“Associated Partners”), the selling party in the Transaction. Such partners of Associated Partners were members of APW OpCo immediately prior to the Closing Date and elected to roll over their investment in AP Wireless in connection with the APW Acquisition (the “Continuing OpCo Members”). As a result, the AP Wireless business is 100% owned by RADI and the Continuing OpCo Members.

In connection with the APW Acquisition, the Company entered into a subscription agreement, dated as of November 20, 2019 and amended and supplemented as of February 7, 2020 (the “Centerbridge Subscription Agreement”), with Centerbridge Partners Real Estate Fund, L.P., Centerbridge Partners Real Estate Fund SBS, L.P. and Centerbridge Special Credit Partners III, L.P. (collectively, the “Centerbridge Entities”). Pursuant to the Centerbridge Subscription Agreement, the Centerbridge Entities subscribed for $100,000 of Ordinary Shares at a price of $10.00 per share (the “Centerbridge Subscription”) in connection with, and contingent upon the consummation of, the APW Acquisition. The cash proceeds from the Centerbridge Subscription are available for general corporate purposes, including the acquisition of real property interests and revenue streams critical for wireless communications.

On October 2, 2020, the Company effected a discontinuance under Section 184 of the BVI Business Companies Act, 2004, as amended, and a domestication under Section 388 of the General Corporation Law of the State of Delaware, pursuant to which the Company’s jurisdiction of incorporation was changed from the British Virgin Islands to the State of Delaware (the “Domestication”). Effective upon the Domestication, the Company was renamed “Radius Global Infrastructure, Inc.”

On October 2, 2020, in connection with the Domestication, the Company delisted its ordinary shares (the “Ordinary Shares”) and warrants (the “Warrants”) from trading on the London Stock Exchange (the “LSE”) and on October 5, 2020 began trading its shares of Class A common stock (the “Class A Common Shares” or “Class A Shares”) on the

8

Nasdaq Global Market under the symbol “RADI”. Accordingly, for disclosures of historical transactions and end of period balances involving the Company’s Class A Shares pertaining to periods prior to October 2, 2020 (the date of Domestication), references are made in the condensed consolidated financial statements and notes thereto to “Ordinary Shares”, the legal form of the Company’s shares prior to October 2, 2020. For prospective references in these disclosures, including with respect to the outcome of any exercise, conversion, vesting or acquisition of different classes or types of securities, references are made to “Class A Common Shares” or “Class A Shares”.

|

2. |

Basis of Presentation and Summary of Significant Accounting Policies |

Basis of Presentation and Principles of Consolidation

Unless the context otherwise requires, the “Company”, refers, for periods prior to the completion of the Transaction, to AP WIP Investments, and its subsidiaries and, for periods after the completion of the Transaction, to Radius Global Infrastructure and its subsidiaries, including AP WIP Investments and its subsidiaries.

As a result of the Transaction, for accounting purposes, the Company is the acquirer and AP WIP Investments is the acquiree and accounting Predecessor to RADI, as Landscape had no operations prior to the Transaction. Accordingly, the financial statement presentation includes the financial statements of AP WIP Investments as “Predecessor” for periods prior to the Closing Date and RADI as “Successor” for periods after the Closing Date, including the consolidation of AP WIP Investments and its subsidiaries. The Transaction was accounted for as a business combination under the scope of the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, (“ASC 805”).

The condensed consolidated financial statements included herein have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) and the rules and regulations of Securities and Exchange Commission (“SEC”). The accompanying condensed consolidated financial statements include the accounts of the Company and its majority-owned or controlled subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

For the Successor period from February 10, 2020 through September 30, 2020, Radius Global Infrastructure consolidated the financial position and results of operations of AP WIP Investments and its subsidiaries. For the Predecessor periods, the consolidated financial statements include the accounts of AP WIP Investments and its subsidiaries, as well as a variable interest entity (“VIE”).

Use of Estimates

The preparation of the condensed consolidated financial statements, in conformity with U.S. GAAP, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash includes cash on hand and demand deposits. The Company maintains its deposits at high quality financial institutions and monitors the credit ratings of those institutions. The Company considers all highly liquid investments with an original maturity date of three months or less to be cash equivalents. While cash held by financial institutions may at times exceed federally insured limits, the Company believes that no material credit or market risk exposure exists due to the high quality of the institutions. The Company has not experienced any losses on such accounts. Gains and losses on highly liquid investments classified as cash equivalents are reported in other income in the condensed consolidated statements of operations.

9

The Company is required to maintain cash collateral at certain financial institutions. Additionally, amounts that are required to be held in an escrow account, which, subject to certain conditions, are available to the Company under the loan agreements. Accordingly, these balances contain restrictions as to their availability and usage and are classified as restricted cash in the condensed consolidated balance sheets. The reconciliation of cash and cash equivalents and restricted cash reported within the applicable balance sheet that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows is as follows:

|

|

Successor |

|

|

|

Predecessor |

|

|||||||

|

|

|

September 30, 2020 |

|

|

|

February 9, 2020 |

|

|

December 31, 2019 |

|

|||

|

Cash and cash equivalents |

|

$ |

169,135 |

|

|

|

$ |

33,333 |

|

|

$ |

62,892 |

|

|

Restricted cash |

|

|

1,727 |

|

|

|

|

2,642 |

|

|

|

1,140 |

|

|

Restricted cash, long term |

|

|

153,065 |

|

|

|

|

12,384 |

|

|

|

14,014 |

|

|

Total cash and cash equivalents and restricted cash |

|

$ |

323,927 |

|

|

|

$ |

48,359 |

|

|

$ |

78,046 |

|

Fair Value Measurements

The Company applies ASC Topic 820, Fair Value Measurement (“ASC 820”), which establishes a framework for measuring fair value and clarifies the definition of fair value within that framework. ASC 820 defines fair value as an exit price, which is the price that would be received for an asset or paid to transfer a liability in the Company’s principal or most advantageous market in an orderly transaction between market participants on the measurement date. The fair value hierarchy established in ASC 820 generally requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Observable inputs reflect the assumptions that market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the entity’s own assumptions based on market data and the entity’s judgments about the assumptions that market participants would use in pricing the asset or liability and are to be developed based on the best information available in the circumstances.

The carrying amounts reflected in the condensed consolidated balance sheets for cash and cash equivalents, restricted cash, trade receivables, prepaid expenses and other current assets, accounts payable and accrued expenses, and rent received in advance approximate fair value due to their short‑term nature. As of September 30, 2020 (Successor) and December 31, 2019 (Predecessor), the carrying amounts of the Company’s debt and lease and other leasehold interest liabilities approximated its fair value, as the obligation bears interest at rates currently available for debt with similar maturities and collateral requirements.

Level 1 — Assets and liabilities with unadjusted, quoted prices listed on active market exchanges. Inputs to the fair value measurement are observable inputs, such as quoted prices in active markets for identical assets or liabilities.

Level 2 — Inputs to the fair value measurement are determined using prices for recently traded assets and liabilities with similar underlying terms, as well as direct or indirect observable inputs, such as interest rates and yield curves that are observable at commonly quoted intervals.

Level 3 — Inputs to the fair value measurement are unobservable inputs, such as estimates, assumptions, and valuation techniques when little or no market data exists for the assets or liabilities.

Trade Receivables, Net

Trade receivables are recorded at the invoiced amount and are generally unsecured as they are uncollateralized. The Company provides an allowance for doubtful accounts to reduce receivables to their estimated net realizable value. Judgement is exercised in establishing allowances and estimates are based on the tenants’ payment history and liquidity. Any amounts that were previously recognized as revenue and subsequently determined to be uncollectible are charged to bad debt expense included in selling, general and administrative expense in the accompanying condensed consolidated statements of operations. The allowance for doubtful accounts was $731 and $491 at September 30, 2020 (Successor) and December 31, 2019 (Predecessor), respectively.

10

The Company’s core business is to contract for the purchase of cell site leasehold interests either through an up-front payment or on an installment basis from property owners who have leased their property to companies that own telecommunications infrastructure assets. Real property interests include costs recorded under cell site leasehold interest arrangements either as intangible assets or right-of-use assets, depending on whether or not the arrangement is determined to be a lease at the inception of the agreement. For acquisitions of real property interests that meet the definition of an asset acquisition, the cell site leasehold interests are recorded as intangible assets and are stated at cost less accumulated amortization. Amortization is computed using the straight-line method over the estimated useful lives of these real property interests, which is estimated as the lesser of the useful life of the underlying cell site asset or the term of the arrangement.

ASC Topic 842, Leases (“ASC 842”), requires the Company to recognize a right-of-use asset and a lease liability arising from a lease arrangement, which also must be classified as either a financing or an operating lease. This classification determines whether the lease expense associated with future lease payments is recognized based on an effective interest method or on a straight-line basis over the term of the lease.

On January 1, 2019, the Predecessor adopted the guidance in ASC 842 using the modified retrospective method applied to lease arrangements that were in place on the transition date. Commencing with the adoption of ASC 842, the Company determines if an arrangement, including cell site leasehold interest arrangements, is a lease at the inception of the agreement. The Company considers an arrangement to be a lease if it conveys the right to control the use of the asset for a specific period of time in exchange for consideration.

The Predecessor elected certain available practical expedients which permit the adopter to not reassess certain items upon adoption, including: (i) whether any existing contracts are or contain leases, (ii) the classification of existing leases, (iii) initial direct costs for existing leases and (iv) short-term leases, which permits an adopter to not apply the lease standard to leases with a remaining maturity of one year or less and applied the new lease accounting standard to all leases, including short-term leases. The Predecessor also elected the practical expedient related to easements, which permits carryforward accounting treatment for land easements (included in cell site leasehold interests in the consolidated balance sheets) on existing agreements.

Commencing with the adoption of ASC 842, the Company determines if an arrangement, including cell site leasehold interest arrangements, is a lease at the inception of the agreement. The Company considers an arrangement to be a lease if it conveys the right to control the use of the asset for a specific period of time in exchange for consideration.

The Company’s lease liability is the present value of the remaining minimum lease payments to be made over the remaining lease term, including renewal options reasonably certain to be exercised. The Company also considers termination options and factors those into the determination of lease payments when appropriate. To determine the lease term, the Company considers all renewal periods that are reasonably certain to be exercised, taking into consideration all economic factors, including the cell site’s estimated economic life. Leases with an initial term of twelve months or less are not recorded in the condensed consolidated balance sheet. The finance lease right-of-use asset is amortized over the lesser of the lease term or the estimated useful life of the underlying asset associated with the leasing arrangement, which is estimated to be twenty-five years.

Operating Leases

Rights and obligations are primarily related to operating leases for office space. The Company records lease expense for operating leases on a straight-line basis over the lease term.

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Maintenance and repairs are charged to expense when incurred. Additions and improvements that extend the economic useful life of the asset are capitalized and depreciated over the remaining useful lives of the assets. The cost and accumulated depreciation of assets sold or retired are removed from the respective accounts, and any resulting gain or loss is reflected in the consolidated statement of operations. Depreciation is recognized using the straight‑line method in amounts considered to be sufficient to allocate the cost of the assets to operations over their estimated useful lives. Depreciation expense was $97 and $248 for the three months ended September 30, 2020 and the period from February 10 to September 30, 2020 (Successor),

11

respectively, $44 for the period from January 1 to February 9, 2020 (Predecessor), and $93 and $276 for the three and nine months ended September 30, 2019 (Predecessor), respectively.

Long-Lived Assets, Including Definite-Lived Intangible Assets

The Company’s primary long-lived assets include real property interests and intangible assets. Intangible assets recorded for in-place tenant leases are stated at cost less accumulated amortization and are amortized on a straight-line basis over the remaining cell site lease term with the in-place tenant, including ordinary renewals at the option of the tenant. The carrying amount of any long-lived asset group is evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable through the estimated undiscounted future cash flows derived from such assets. If the carrying amount of the long-lived asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying amount exceeds its fair value. The Company reviewed the portfolio of cell site leasehold interests and intangible assets for impairment, in which the Company identified cell sites for which impairment charges were recorded in Impairment – decommission of cell sites in the condensed consolidated statements of operations.

Goodwill

Goodwill, which represents the excess of purchase price over the fair value of net assets acquired, is carried at cost in a transaction accounted for as a business combination in accordance with ASC 805. Goodwill is not amortized; rather, it is subject to a periodic assessment for impairment by applying a fair value based test. The Company is organized in one reporting unit and evaluates the goodwill for the Company as a whole. Goodwill is assessed for impairment on an annual basis as of November 30th of each year or more frequently if events or changes in circumstances indicate that the asset might be impaired. Under the authoritative guidance issued by the FASB, the Company has the option to first assess the qualitative factors to determine whether it is more likely than not that the fair value of the reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform a quantitative goodwill impairment test. If the Company determines that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, then the goodwill impairment test is performed. The goodwill impairment test requires the Company to estimate the fair value of the reporting unit and to compare the fair value of the reporting unit with its carrying amount. If the fair value exceeds the carrying amount, then no impairment is recognized. If the carrying amount recorded exceeds the fair value calculated, then an impairment charge is recognized for the difference. There was no impairment of goodwill for the period ended September 30, 2020 (Successor).

Revenue Recognition

The Company receives rental payments from in‑place tenants of wireless communication sites under operating lease agreements. Revenue is recorded as earned over the period in which the lessee is given control over the use of the wireless communication sites and recorded over the term of the lease, not including renewal terms, since the operating lease arrangements are cancellable by the tenant.

Rent received in advance is recorded when the Company receives advance rental payments from the in‑place tenants. Contractually owed lease prepayments are typically paid one month to one year in advance. At September 30, 2020 (Successor) and December 31, 2019 (Predecessor), the Company’s rent received in advance was $17,008 and $13,856, respectively.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. Where applicable, the Company records a valuation allowance to reduce any deferred tax assets that it determines will not be realizable in the future.

For periods after the consummation of the Transaction, the Company is subject to U.S. federal and state income taxes. Additionally, AP WIP Investments files income tax returns in the various state and foreign jurisdictions in which it operates. AP WIP Investments’ tax returns are subject to tax examinations by foreign tax authorities until the expiration of the respective statutes of limitation. AP WIP Investments currently has no tax years under examination.

12

The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. The Company records interest related to unrecognized tax benefits and penalties as a component of income tax expense in the accompanying consolidated statements of operations.

The Company expenses share-based compensation over the requisite service period of the awards (usually the vesting period) based on the grant date fair value of awards. For share-based compensation awards with performance-based milestones, the expense is recorded over the service period after the achievement of the milestone is probable or the performance condition is achieved. An offsetting increase to stockholders’ equity is recognized equal to the amount of the compensation expense charge. The Company recognizes forfeitures as they occur as a reduction of share-based compensation expense in the condensed consolidated statement of operations.

The Company has warrants that were issued with its Ordinary Shares and Series A Founder Preferred Shares that were determined to be equity classified in accordance with ASC Topic 815, Derivatives and Hedging. The Company also issued warrants with shares issued to non-founder directors for compensation that were determined to be equity classified in accordance with ASC Topic 718, Compensation – Stock Compensation (“ASC 718”). The fair value of the warrants was recorded as additional paid-in capital on the issuance date, and no further adjustments were made.

Basic and Diluted Earnings per Ordinary Share

Basic earnings (loss) per Ordinary Share excludes dilution and is computed by dividing net income (loss) attributable to ordinary shares by the weighted average number of Ordinary Shares outstanding during the period. The Company has determined that its Series A Founder Preferred Shares are participating securities as the Series A Founder Preferred Shares participate in undistributed earnings on an as-if-converted basis. Accordingly, the Company used the two-class method of computing earnings per share, for Ordinary Shares and Series A Founder Preferred Shares according to participation rights in undistributed earnings. Under this method, net income applicable to holders of ordinary shares is allocated on a pro rata basis to the holders of Ordinary Shares and Series A Founder Preferred Shares to the extent that each class may share income for the period; whereas undistributed net loss is allocated to Ordinary Shares because Series A Founder Preferred Shares are not contractually obligated to share the loss.

Diluted earnings per ordinary share reflects the potential dilution that would occur if securities were exercised or converted into Ordinary Shares. The Company’s dilutive securities include Series A Founder Preferred Shares, warrants, options, and restricted shares. To calculate the number of shares for diluted earnings per ordinary shares, the effect of the participating preferred shares is computed using the as-if-converted method, and effects of the warrants, options, LTIP Units (as defined in Note 13) and restricted shares are computed using the treasury stock method. For all periods presented with a net loss, the effects of any incremental potential ordinary shares have been excluded from the calculation of loss per Ordinary Share because their effect would be anti-dilutive. Therefore, the weighted-average shares outstanding used to calculate both basic and diluted loss per share are the same for periods with a net loss attributable to ordinary shareholders of RADI.

Because the Company’s shares of Class B common stock (the “Class B Shares”) and shares of preferred stock, designated as Series B Founder Preferred Stock (the “Series B Founder Preferred Shares”) do not confer upon the holder a right to receive distributions, neither share class is included in the Company’s computation of basic or diluted earnings (loss) per Ordinary Share.