UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23199

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios

L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name

and address of agent for service)

Registrant’s telephone number, including area code: 630-765-8000

Date of fiscal year end: May 31

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

|

1

|

|

|

2

|

|

|

4

|

|

|

8

|

|

|

19

|

|

|

20

|

|

|

21

|

|

|

22

|

|

|

23

|

|

|

24

|

|

|

31

|

|

|

32

|

|

|

34

|

|

|

43

|

|

|

45

|

|

Fund Statistics

|

|

|

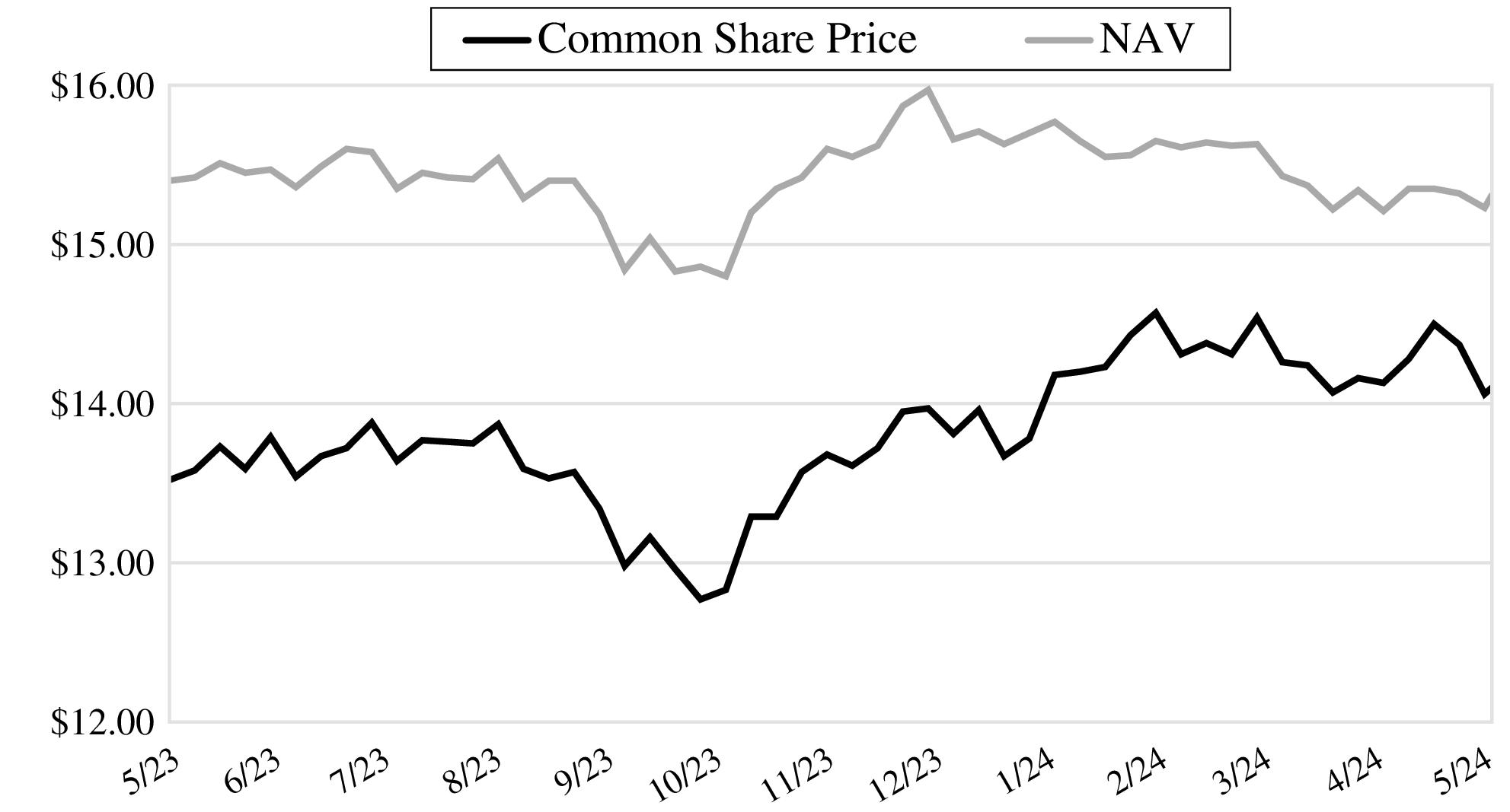

Symbol on New York Stock Exchange

|

FTHY

|

|

Common Share Price

|

$14.10

|

|

Common Share Net Asset Value (“NAV”)

|

$15.31

|

|

Premium (Discount) to NAV

|

(

)%

|

|

Net Assets Applicable to Common Shares

|

$563,093,133

|

|

Current Distribution per Common Share(1)

|

$0.1300

|

|

Current Annualized Distribution per Common Share

|

$1.5600

|

|

Current Distribution Rate on Common Share Price(2)

|

11.06

%

|

|

Current Distribution Rate on NAV(2)

|

10.19

%

|

|

Performance

|

|

|

|

|

|

|

|

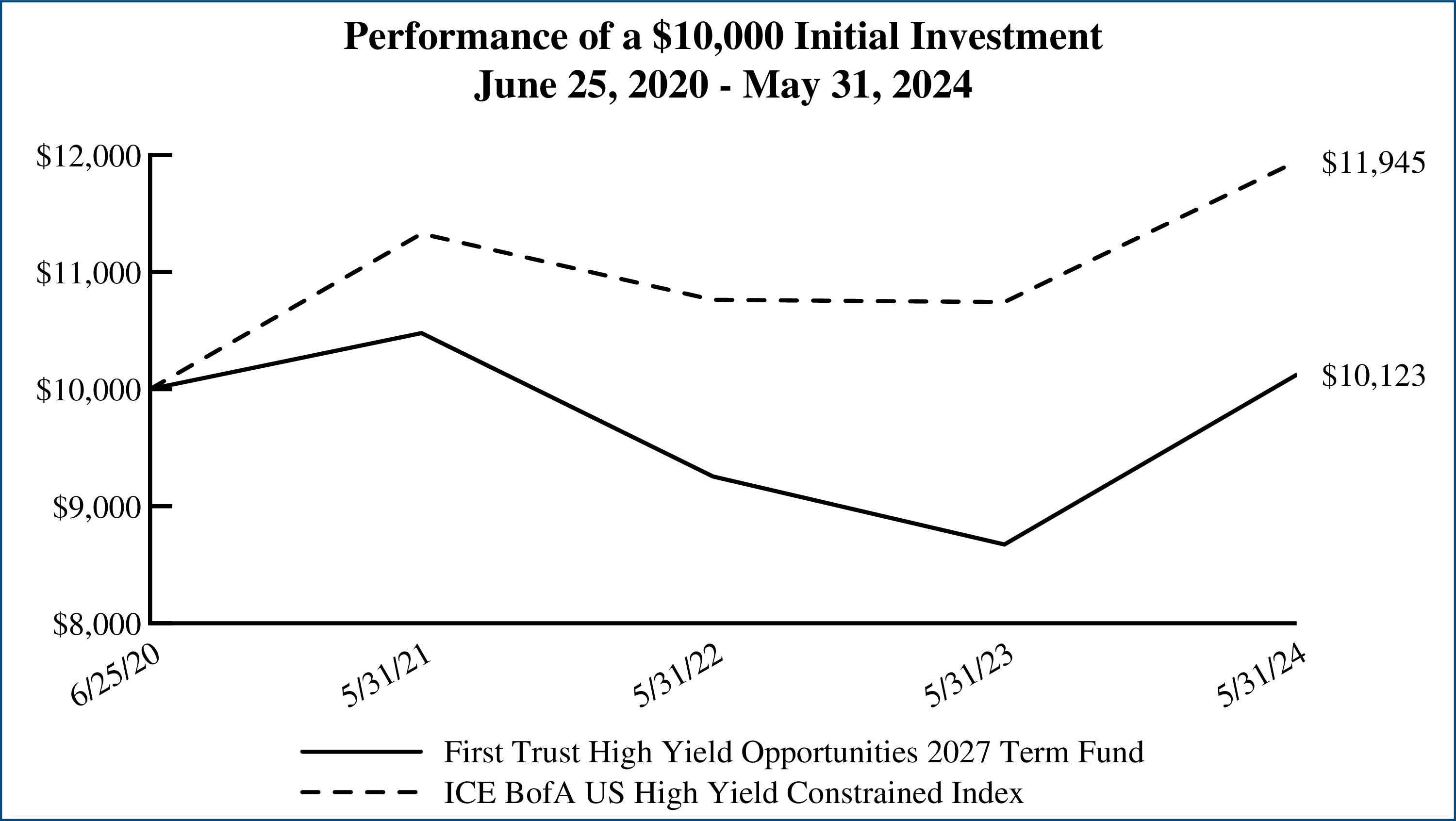

Average Annual

Total Returns

|

|

|

|

1 Year Ended

5/31/24

|

Inception (6/25/20)

to 5/31/24

|

|

Fund Performance(3)

|

|

|

|

|

NAV

|

|

11.27

%

|

2.43

%

|

|

Market Value

|

|

16.72

%

|

0.31

%

|

|

Index Performance

|

|

|

|

|

ICE BofA US High Yield Constrained Index

|

|

11.18

%

|

4.70

%

|

|

Credit Quality (S&P Global Ratings)(4)

|

% of Total

Fixed-Income

Investments(5)

|

|

BBB

|

0.6%

|

|

BBB-

|

7.1

|

|

BB+

|

8.1

|

|

BB

|

12.1

|

|

BB-

|

11.3

|

|

B+

|

14.6

|

|

B

|

14.5

|

|

B-

|

16.1

|

|

CCC+

|

11.2

|

|

CCC

|

1.6

|

|

CCC-

|

1.3

|

|

Not Rated

|

1.5

|

|

Total

|

100.0%

|

|

Top 10 Issuers

|

% of Total

Long-Term

Investments(5)

|

|

SS&C Technologies Holdings, Inc.

|

3.5%

|

|

Open Text Corp.

|

3.1

|

|

Alliant Holdings I LLC

|

2.9

|

|

Nexstar Media, Inc.

|

2.1

|

|

Sinclair Television Group, Inc.

|

2.1

|

|

AssuredPartners, Inc.

|

2.0

|

|

Medline Borrower LP

|

2.0

|

|

HUB International Ltd.

|

2.0

|

|

Go Daddy Operating Co. LLC / GD Finance Co., Inc.

|

1.8

|

|

1011778 BC ULC / New Red Finance, Inc.

|

1.8

|

|

Total

|

23.3%

|

|

Industry Classification

|

% of Total

Long-Term

Investments(5)

|

|

Software

|

17.1%

|

|

Insurance

|

13.6

|

|

Media

|

9.9

|

|

Containers & Packaging

|

7.7

|

|

Hotels, Restaurants & Leisure

|

5.6

|

|

Commercial Services & Supplies

|

4.9

|

|

Health Care Providers & Services

|

4.6

|

|

Health Care Technology

|

3.7

|

|

IT Services

|

3.3

|

|

Trading Companies & Distributors

|

2.3

|

|

Diversified Telecommunication Services

|

2.3

|

|

Health Care Equipment & Supplies

|

2.0

|

|

Food Products

|

1.9

|

|

Machinery

|

1.7

|

|

Automobile Components

|

1.5

|

|

Professional Services

|

1.4

|

|

Building Products

|

1.4

|

|

Aerospace & Defense

|

1.2

|

|

Interactive Media & Services

|

1.2

|

|

Life Sciences Tools & Services

|

1.1

|

|

Entertainment

|

1.0

|

|

Pharmaceuticals

|

1.0

|

|

Construction & Engineering

|

0.9

|

|

Specialty Retail

|

0.8

|

|

Construction Materials

|

0.8

|

|

Consumer Finance

|

0.7

|

|

Household Products

|

0.7

|

|

Food Staples & Retailing

|

0.7

|

|

Diversified Consumer Services

|

0.7

|

|

Automobiles

|

0.6

|

|

Financial Services

|

0.5

|

|

Independent Power & Renewable Electricity Producers

|

0.5

|

|

Capital Markets

|

0.5

|

|

Electronic Equipment, Instruments & Components

|

0.4

|

|

Electric Utilities

|

0.3

|

|

Industrial Conglomerates

|

0.3

|

|

Leisure Products

|

0.3

|

|

Real Estate Management & Development

|

0.3

|

|

Chemicals

|

0.3

|

|

Personal Care Products

|

0.2

|

|

Ground Transportation

|

0.1

|

|

Electrical Equipment

|

0.0*

|

|

Total

|

100.0%

|

|

*

|

Amount is less than 0.1%.

|

|

Performance

|

|

|

|

|

|

|

|

Average Annual

Total Returns

|

|

|

|

1 Year Ended

5/31/24

|

Inception (6/25/20)

to 5/31/24

|

|

Fund Performance(3)

|

|

|

|

|

NAV

|

|

11.27

%

|

2.43

%

|

|

Market Value

|

|

16.72

%

|

0.31

%

|

|

Index Performance

|

|

|

|

|

ICE BofA US High Yield Constrained Index

|

|

11.18

%

|

4.70

%

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES – 87.7%

|

||||

|

|

Aerospace & Defense – 1.5%

|

|

|

|

|

$158,000

|

Booz Allen Hamilton, Inc. (a) (b)

|

3.88

%

|

09/01/28

|

$148,331

|

|

4,311,000

|

TransDigm, Inc. (a) (b)

|

6.75

%

|

08/15/28

|

4,365,277

|

|

1,552,000

|

TransDigm, Inc. (a) (b)

|

6.38

%

|

03/01/29

|

1,550,573

|

|

2,281,000

|

TransDigm, Inc. (a) (b)

|

6.63

%

|

03/01/32

|

2,290,612

|

|

|

|

8,354,793

|

||

|

|

Agricultural Products & Services – 0.8%

|

|

|

|

|

623,000

|

Lamb Weston Holdings, Inc. (a) (b)

|

4.88

%

|

05/15/28

|

602,492

|

|

4,297,000

|

Lamb Weston Holdings, Inc. (a) (b)

|

4.38

%

|

01/31/32

|

3,798,342

|

|

|

|

4,400,834

|

||

|

|

Alternative Carriers – 0.9%

|

|

|

|

|

4,662,000

|

Level 3 Financing, Inc. (a) (b)

|

11.00

%

|

11/15/29

|

4,785,188

|

|

|

Apparel Retail – 0.9%

|

|

|

|

|

4,040,000

|

Nordstrom, Inc. (b)

|

4.00

%

|

03/15/27

|

3,863,604

|

|

1,146,000

|

Nordstrom, Inc. (b)

|

4.38

%

|

04/01/30

|

1,042,971

|

|

|

|

4,906,575

|

||

|

|

Application Software – 3.6%

|

|

|

|

|

2,892,000

|

Alteryx, Inc. (a) (b)

|

8.75

%

|

03/15/28

|

2,969,552

|

|

2,445,875

|

GoTo Group, Inc. (a) (b)

|

5.50

%

|

05/01/28

|

2,036,191

|

|

2,445,875

|

GoTo Group, Inc. (a) (b)

|

5.50

%

|

05/01/28

|

1,265,850

|

|

3,000,000

|

McAfee Corp. (a) (b)

|

7.38

%

|

02/15/30

|

2,779,884

|

|

1,513,000

|

Open Text Holdings, Inc. (a) (b)

|

4.13

%

|

12/01/31

|

1,303,059

|

|

3,092,000

|

RingCentral, Inc. (a) (b)

|

8.50

%

|

08/15/30

|

3,238,771

|

|

6,521,000

|

UKG, Inc. (a) (b)

|

6.88

%

|

02/01/31

|

6,566,812

|

|

|

|

20,160,119

|

||

|

|

Automobile Manufacturers – 0.7%

|

|

|

|

|

3,369,000

|

Ford Motor Co (b)

|

9.63

%

|

04/22/30

|

3,904,837

|

|

|

Automotive Parts & Equipment – 0.2%

|

|

|

|

|

1,298,000

|

Wand NewCo 3, Inc. (a) (b)

|

7.63

%

|

01/30/32

|

1,331,156

|

|

|

Automotive Retail – 0.1%

|

|

|

|

|

635,000

|

Mavis Tire Express Services Topco Corp. (a) (b)

|

6.50

%

|

05/15/29

|

585,504

|

|

|

Broadcasting – 9.1%

|

|

|

|

|

13,053,000

|

iHeartCommunications, Inc.

|

8.38

%

|

05/01/27

|

4,729,018

|

|

15,519,000

|

Nexstar Media, Inc. (a) (b)

|

5.63

%

|

07/15/27

|

14,660,222

|

|

611,000

|

Scripps Escrow II, Inc. (a) (b)

|

3.88

%

|

01/15/29

|

393,003

|

|

16,304,000

|

Sinclair Television Group, Inc. (a) (b)

|

5.13

%

|

02/15/27

|

14,618,032

|

|

7,069,000

|

Sirius XM Radio, Inc. (a) (b)

|

3.13

%

|

09/01/26

|

6,619,901

|

|

343,000

|

Sirius XM Radio, Inc. (a) (b)

|

5.50

%

|

07/01/29

|

318,877

|

|

8,987,000

|

TEGNA, Inc. (b)

|

4.63

%

|

03/15/28

|

8,173,770

|

|

2,027,000

|

Univision Communications, Inc. (a) (b)

|

6.63

%

|

06/01/27

|

1,960,049

|

|

|

|

51,472,872

|

||

|

|

Building Products – 1.5%

|

|

|

|

|

3,647,000

|

American Builders & Contractors Supply Co., Inc. (a) (b)

|

4.00

%

|

01/15/28

|

3,399,590

|

|

588,000

|

Beacon Roofing Supply, Inc. (a) (b)

|

6.50

%

|

08/01/30

|

588,987

|

|

2,241,000

|

Builders FirstSource, Inc. (a) (b)

|

6.38

%

|

03/01/34

|

2,199,703

|

|

971,000

|

Miter Brands Acquisition Holdco, Inc. / MIWD Borrower

LLC (a) (b)

|

6.75

%

|

04/01/32

|

965,162

|

|

574,000

|

Standard Industries, Inc. (a) (b)

|

4.75

%

|

01/15/28

|

547,266

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

Building Products (Continued)

|

|

|

|

|

$858,000

|

Standard Industries, Inc. (a) (b)

|

4.38

%

|

07/15/30

|

$766,319

|

|

|

|

8,467,027

|

||

|

|

Cable & Satellite – 2.9%

|

|

|

|

|

1,567,000

|

CCO Holdings LLC / CCO Holdings Capital Corp. (a) (b)

|

6.38

%

|

09/01/29

|

1,467,988

|

|

1,184,000

|

CCO Holdings LLC / CCO Holdings Capital Corp. (a) (b)

|

4.75

%

|

03/01/30

|

1,009,525

|

|

1,953,000

|

CCO Holdings LLC / CCO Holdings Capital Corp. (a) (b)

|

4.50

%

|

08/15/30

|

1,624,312

|

|

3,219,000

|

CCO Holdings LLC / CCO Holdings Capital Corp. (a) (b)

|

7.38

%

|

03/03/31

|

3,116,498

|

|

1,736,000

|

CSC Holdings LLC (a) (b)

|

7.50

%

|

04/01/28

|

970,867

|

|

667,000

|

CSC Holdings LLC (a) (b)

|

11.25

%

|

05/15/28

|

538,869

|

|

5,113,000

|

CSC Holdings LLC (a)

|

5.75

%

|

01/15/30

|

2,214,448

|

|

250,000

|

CSC Holdings LLC (a) (b)

|

3.38

%

|

02/15/31

|

146,666

|

|

8,320,000

|

CSC Holdings LLC (a) (b)

|

4.50

%

|

11/15/31

|

5,097,546

|

|

|

|

16,186,719

|

||

|

|

Casinos & Gaming – 3.2%

|

|

|

|

|

1,438,000

|

Boyd Gaming Corp. (a) (b)

|

4.75

%

|

06/15/31

|

1,291,114

|

|

1,999,000

|

Caesars Entertainment, Inc. (a) (b)

|

4.63

%

|

10/15/29

|

1,807,258

|

|

77,000

|

Caesars Entertainment, Inc. (a) (b)

|

7.00

%

|

02/15/30

|

77,880

|

|

71,000

|

Churchill Downs, Inc. (a) (b)

|

5.75

%

|

04/01/30

|

68,150

|

|

3,891,000

|

Fertitta Entertainment LLC / Fertitta Entertainment Finance Co,

Inc. (a) (b)

|

6.75

%

|

01/15/30

|

3,441,986

|

|

930,000

|

Light & Wonder International, Inc. (a) (b)

|

7.50

%

|

09/01/31

|

956,744

|

|

582,000

|

MGM Resorts International (b)

|

5.75

%

|

06/15/25

|

580,832

|

|

643,000

|

MGM Resorts International (b)

|

6.50

%

|

04/15/32

|

629,136

|

|

284,000

|

Scientific Games Holdings LP / Scientific Games US FinCo,

Inc. (a) (b)

|

6.63

%

|

03/01/30

|

269,229

|

|

2,694,000

|

Station Casinos LLC (a) (b)

|

4.50

%

|

02/15/28

|

2,510,446

|

|

3,155,000

|

VICI Properties LP (b)

|

5.75

%

|

04/01/34

|

3,105,075

|

|

1,624,000

|

VICI Properties LP / VICI Note Co., Inc. (a) (b)

|

3.50

%

|

02/15/25

|

1,596,962

|

|

60,000

|

VICI Properties LP / VICI Note Co., Inc. (a) (b)

|

3.75

%

|

02/15/27

|

56,845

|

|

2,000,000

|

VICI Properties LP / VICI Note Co., Inc. (a) (b)

|

4.63

%

|

12/01/29

|

1,873,237

|

|

|

|

18,264,894

|

||

|

|

Commercial Printing – 0.9%

|

|

|

|

|

2,000,000

|

LABL, Inc. (a) (b)

|

6.75

%

|

07/15/26

|

1,978,306

|

|

471,000

|

LABL, Inc. (a) (b)

|

10.50

%

|

07/15/27

|

459,018

|

|

2,612,000

|

LABL, Inc. (a) (b)

|

9.50

%

|

11/01/28

|

2,660,111

|

|

|

|

5,097,435

|

||

|

|

Construction & Engineering – 1.1%

|

|

|

|

|

2,445,000

|

Advanced Drainage Systems, Inc. (a) (b)

|

6.38

%

|

06/15/30

|

2,442,529

|

|

3,855,000

|

Pike Corp. (a) (b)

|

5.50

%

|

09/01/28

|

3,672,245

|

|

|

|

6,114,774

|

||

|

|

Construction Materials – 0.9%

|

|

|

|

|

74,000

|

GYP Holdings III Corp. (a) (b)

|

4.63

%

|

05/01/29

|

68,438

|

|

5,167,000

|

Summit Materials LLC / Summit Materials Finance Corp. (a) (b)

|

5.25

%

|

01/15/29

|

4,980,279

|

|

160,000

|

Summit Materials LLC / Summit Materials Finance Corp. (a) (b)

|

7.25

%

|

01/15/31

|

165,091

|

|

|

|

5,213,808

|

||

|

|

Consumer Finance – 0.9%

|

|

|

|

|

3,056,000

|

FirstCash, Inc. (a) (b)

|

4.63

%

|

09/01/28

|

2,868,062

|

|

2,269,000

|

FirstCash, Inc. (a) (b)

|

6.88

%

|

03/01/32

|

2,252,861

|

|

|

|

5,120,923

|

||

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

Diversified Support Services – 0.3%

|

|

|

|

|

$901,000

|

Ritchie Bros Holdings, Inc. (a) (b)

|

6.75

%

|

03/15/28

|

$911,130

|

|

625,000

|

Ritchie Bros Holdings, Inc. (a) (b)

|

7.75

%

|

03/15/31

|

653,155

|

|

|

|

1,564,285

|

||

|

|

Electric Utilities – 0.4%

|

|

|

|

|

1,588,000

|

Vistra Operations Co. LLC (a) (b)

|

5.00

%

|

07/31/27

|

1,536,863

|

|

641,000

|

Vistra Operations Co. LLC (a) (b)

|

7.75

%

|

10/15/31

|

666,475

|

|

|

|

2,203,338

|

||

|

|

Electrical Components & Equipment – 0.1%

|

|

|

|

|

333,000

|

Sensata Technologies, Inc. (a) (b)

|

3.75

%

|

02/15/31

|

287,568

|

|

|

Environmental & Facilities Services – 0.9%

|

|

|

|

|

933,000

|

Allied Universal Holdco LLC (a) (b)

|

7.88

%

|

02/15/31

|

931,021

|

|

4,419,000

|

Waste Pro USA, Inc. (a) (b)

|

5.50

%

|

02/15/26

|

4,356,213

|

|

|

|

5,287,234

|

||

|

|

Fertilizers & Agricultural Chemicals – 0.3%

|

|

|

|

|

2,000,000

|

Scotts Miracle-Gro Co. (The) (b)

|

4.50

%

|

10/15/29

|

1,801,169

|

|

|

Financial Exchanges & Data – 0.4%

|

|

|

|

|

2,550,000

|

MSCI, Inc. (a) (b)

|

3.25

%

|

08/15/33

|

2,096,476

|

|

|

Food Distributors – 0.9%

|

|

|

|

|

603,000

|

US Foods, Inc. (a) (b)

|

4.75

%

|

02/15/29

|

566,543

|

|

2,250,000

|

US Foods, Inc. (a) (b)

|

4.63

%

|

06/01/30

|

2,067,649

|

|

2,078,000

|

US Foods, Inc. (a) (b)

|

7.25

%

|

01/15/32

|

2,147,216

|

|

|

|

4,781,408

|

||

|

|

Health Care Facilities – 2.1%

|

|

|

|

|

1,510,000

|

Acadia Healthcare Co., Inc. (a) (b)

|

5.00

%

|

04/15/29

|

1,424,888

|

|

2,218,000

|

HCA, Inc. (b)

|

5.88

%

|

02/15/26

|

2,222,021

|

|

569,000

|

HCA, Inc. (b)

|

5.38

%

|

09/01/26

|

567,157

|

|

7,842,000

|

Select Medical Corp. (a) (b)

|

6.25

%

|

08/15/26

|

7,849,826

|

|

|

|

12,063,892

|

||

|

|

Health Care Supplies – 2.5%

|

|

|

|

|

9,847,000

|

Medline Borrower LP (a) (b)

|

3.88

%

|

04/01/29

|

8,970,930

|

|

4,833,000

|

Medline Borrower LP (a) (b)

|

5.25

%

|

10/01/29

|

4,559,700

|

|

428,000

|

Medline Borrower LP / Medline Co-Issuer, Inc. (a) (b)

|

6.25

%

|

04/01/29

|

428,622

|

|

|

|

13,959,252

|

||

|

|

Health Care Technology – 1.3%

|

|

|

|

|

6,527,000

|

AthenaHealth Group, Inc. (a) (b)

|

6.50

%

|

02/15/30

|

5,928,330

|

|

1,365,000

|

HealthEquity, Inc. (a) (b)

|

4.50

%

|

10/01/29

|

1,252,105

|

|

|

|

7,180,435

|

||

|

|

Hotels, Resorts & Cruise Lines – 0.2%

|

|

|

|

|

937,000

|

Vail Resorts, Inc. (a) (b)

|

6.50

%

|

05/15/32

|

943,717

|

|

289,000

|

Wyndham Hotels & Resorts, Inc. (a) (b)

|

4.38

%

|

08/15/28

|

268,293

|

|

|

|

1,212,010

|

||

|

|

Household Products – 0.9%

|

|

|

|

|

2,733,000

|

Energizer Holdings, Inc. (a) (b)

|

6.50

%

|

12/31/27

|

2,712,548

|

|

1,746,000

|

Energizer Holdings, Inc. (a) (b)

|

4.75

%

|

06/15/28

|

1,612,391

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

Household Products (Continued)

|

|

|

|

|

$650,000

|

Energizer Holdings, Inc. (a) (b)

|

4.38

%

|

03/31/29

|

$578,437

|

|

|

|

4,903,376

|

||

|

|

Human Resource & Employment Services – 0.5%

|

|

|

|

|

1,913,000

|

TriNet Group, Inc. (a) (b)

|

7.13

%

|

08/15/31

|

1,932,619

|

|

1,153,000

|

ZipRecruiter, Inc. (a) (b)

|

5.00

%

|

01/15/30

|

1,001,040

|

|

|

|

2,933,659

|

||

|

|

Independent Power Producers & Energy Traders – 0.6%

|

|

|

|

|

3,627,000

|

Calpine Corp. (a) (b)

|

5.13

%

|

03/15/28

|

3,458,820

|

|

|

Industrial Conglomerates – 0.4%

|

|

|

|

|

2,116,000

|

Hillenbrand, Inc. (b)

|

6.25

%

|

02/15/29

|

2,107,150

|

|

|

Industrial Machinery & Supplies & Components – 1.3%

|

|

|

|

|

561,000

|

EMRLD Borrower LP / Emerald Co-Issuer, Inc. (a) (b)

|

6.63

%

|

12/15/30

|

562,679

|

|

158,000

|

Gates Corp. (The) (a) (b)

|

6.88

%

|

07/01/29

|

159,715

|

|

6,597,000

|

Gates Global LLC / Gates Corp. (a) (b)

|

6.25

%

|

01/15/26

|

6,618,844

|

|

|

|

7,341,238

|

||

|

|

Insurance Brokers – 11.7%

|

|

|

|

|

11,724,000

|

Alliant Holdings Intermediate LLC / Alliant Holdings

Co-Issuer (a) (b)

|

6.75

%

|

10/15/27

|

11,501,721

|

|

7,588,000

|

Alliant Holdings Intermediate LLC / Alliant Holdings

Co-Issuer (a) (b)

|

6.75

%

|

04/15/28

|

7,607,661

|

|

210,000

|

Alliant Holdings Intermediate LLC / Alliant Holdings

Co-Issuer (a) (b)

|

5.88

%

|

11/01/29

|

195,581

|

|

3,710,000

|

AmWINS Group, Inc. (a) (b)

|

6.38

%

|

02/15/29

|

3,703,230

|

|

7,828,000

|

AmWINS Group, Inc. (a) (b)

|

4.88

%

|

06/30/29

|

7,202,722

|

|

10,162,000

|

AssuredPartners, Inc. (a) (b)

|

5.63

%

|

01/15/29

|

9,465,785

|

|

1,996,000

|

AssuredPartners, Inc. (a) (b)

|

7.50

%

|

02/15/32

|

1,985,874

|

|

1,247,000

|

Baldwin Insurance Group Holdings LLC / Baldwin Insurance

Group Holdings Finance (a) (b)

|

7.13

%

|

05/15/31

|

1,260,216

|

|

2,092,000

|

BroadStreet Partners, Inc. (a) (b)

|

5.88

%

|

04/15/29

|

1,917,314

|

|

675,000

|

Brown & Brown, Inc. (b)

|

2.38

%

|

03/15/31

|

552,758

|

|

2,101,000

|

GTCR AP Finance, Inc. (a) (b)

|

8.00

%

|

05/15/27

|

2,104,841

|

|

4,934,000

|

HUB International Ltd (a) (b)

|

5.63

%

|

12/01/29

|

4,582,964

|

|

925,000

|

HUB International Ltd (a) (b)

|

7.25

%

|

06/15/30

|

940,474

|

|

4,625,000

|

HUB International Ltd (a) (b)

|

7.38

%

|

01/31/32

|

4,644,307

|

|

4,606,000

|

Panther Escrow Issuer LLC (a) (b)

|

7.13

%

|

06/01/31

|

4,648,152

|

|

3,801,000

|

Ryan Specialty LLC (a) (b)

|

4.38

%

|

02/01/30

|

3,511,515

|

|

|

|

65,825,115

|

||

|

|

Integrated Telecommunication Services – 0.7%

|

|

|

|

|

5,814,000

|

Zayo Group Holdings, Inc. (a) (b)

|

6.13

%

|

03/01/28

|

3,961,894

|

|

|

Interactive Media & Services – 1.4%

|

|

|

|

|

8,270,000

|

Cars.com, Inc. (a) (b)

|

6.38

%

|

11/01/28

|

8,131,044

|

|

|

Internet Services & Infrastructure – 2.2%

|

|

|

|

|

6,210,000

|

Go Daddy Operating Co. LLC / GD Finance Co., Inc. (a) (b)

|

5.25

%

|

12/01/27

|

6,047,265

|

|

7,217,000

|

Go Daddy Operating Co. LLC / GD Finance Co., Inc. (a) (b)

|

3.50

%

|

03/01/29

|

6,453,453

|

|

|

|

12,500,718

|

||

|

|

Investment Banking & Brokerage – 0.2%

|

|

|

|

|

1,045,000

|

LPL Holdings, Inc. (a) (b)

|

4.63

%

|

11/15/27

|

1,007,536

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

IT Consulting & Other Services – 0.4%

|

|

|

|

|

$613,000

|

Central Parent, Inc. / CDK Global, Inc. (a) (b)

|

7.25

%

|

06/15/29

|

$616,836

|

|

2,000,000

|

Gartner, Inc. (a) (b)

|

4.50

%

|

07/01/28

|

1,905,983

|

|

|

|

2,522,819

|

||

|

|

Leisure Facilities – 0.1%

|

|

|

|

|

283,000

|

SeaWorld Parks & Entertainment, Inc. (a) (b)

|

5.25

%

|

08/15/29

|

264,835

|

|

313,000

|

Six Flags Entertainment Corp. / Six Flags Theme Parks,

Inc. (a) (b)

|

6.63

%

|

05/01/32

|

313,424

|

|

|

|

578,259

|

||

|

|

Leisure Products – 0.4%

|

|

|

|

|

1,413,000

|

Acushnet Co. (a) (b)

|

7.38

%

|

10/15/28

|

1,454,457

|

|

611,000

|

Amer Sports Co. (a) (b)

|

6.75

%

|

02/16/31

|

609,177

|

|

|

|

2,063,634

|

||

|

|

Managed Health Care – 2.6%

|

|

|

|

|

6,806,000

|

Centene Corp. (b)

|

4.25

%

|

12/15/27

|

6,482,280

|

|

968,000

|

Molina Healthcare, Inc. (a) (b)

|

4.38

%

|

06/15/28

|

901,467

|

|

4,000,000

|

Molina Healthcare, Inc. (a) (b)

|

3.88

%

|

11/15/30

|

3,491,073

|

|

4,576,000

|

Molina Healthcare, Inc. (a) (b)

|

3.88

%

|

05/15/32

|

3,876,022

|

|

|

|

14,750,842

|

||

|

|

Metal, Glass & Plastic Containers – 2.9%

|

|

|

|

|

903,000

|

Ball Corp. (b)

|

6.88

%

|

03/15/28

|

922,558

|

|

4,227,000

|

Ball Corp. (b)

|

2.88

%

|

08/15/30

|

3,574,987

|

|

5,419,000

|

Berry Global, Inc. (a) (b)

|

5.63

%

|

07/15/27

|

5,352,201

|

|

1,460,000

|

Berry Global, Inc. (a) (b)

|

5.65

%

|

01/15/34

|

1,426,327

|

|

75,000

|

Crown Americas LLC (b)

|

5.25

%

|

04/01/30

|

72,163

|

|

4,321,000

|

Owens-Brockway Glass Container, Inc. (a) (b)

|

7.25

%

|

05/15/31

|

4,311,763

|

|

650,000

|

Owens-Brockway Glass Container, Inc. (a) (b)

|

7.38

%

|

06/01/32

|

650,600

|

|

|

|

16,310,599

|

||

|

|

Movies & Entertainment – 1.3%

|

|

|

|

|

4,380,000

|

Live Nation Entertainment, Inc. (a) (b)

|

5.63

%

|

03/15/26

|

4,320,610

|

|

2,620,000

|

Live Nation Entertainment, Inc. (a) (b)

|

4.75

%

|

10/15/27

|

2,484,355

|

|

394,000

|

WMG Acquisition Corp. (a) (b)

|

3.00

%

|

02/15/31

|

333,741

|

|

|

|

7,138,706

|

||

|

|

Packaged Foods & Meats – 1.5%

|

|

|

|

|

1,198,000

|

Fiesta Purchaser, Inc. (a) (b)

|

7.88

%

|

03/01/31

|

1,232,018

|

|

7,308,000

|

Post Holdings, Inc. (a) (b)

|

6.25

%

|

02/15/32

|

7,273,795

|

|

|

|

8,505,813

|

||

|

|

Paper & Plastic Packaging Products & Materials – 4.6%

|

|

|

|

|

12,810,000

|

Graham Packaging Co., Inc. (a) (b)

|

7.13

%

|

08/15/28

|

12,087,357

|

|

1,060,000

|

Graphic Packaging International LLC (a) (b)

|

3.75

%

|

02/01/30

|

940,407

|

|

936,000

|

Graphic Packaging International LLC (a) (b)

|

6.38

%

|

07/15/32

|

939,026

|

|

6,990,000

|

Pactiv Evergreen Group Issuer, Inc. / Pactiv Evergreen Group

Issuer LLC (a) (b)

|

4.00

%

|

10/15/27

|

6,530,149

|

|

180,000

|

Pactiv LLC (b)

|

7.95

%

|

12/15/25

|

184,991

|

|

566,000

|

Sealed Air Corp. (a) (b)

|

5.00

%

|

04/15/29

|

537,016

|

|

4,070,000

|

Sealed Air Corp. / Sealed Air Corp. US (a) (b)

|

6.13

%

|

02/01/28

|

4,044,345

|

|

774,000

|

Verde Purchaser LLC (a) (b)

|

10.50

%

|

11/30/30

|

816,718

|

|

|

|

26,080,009

|

||

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

Personal Care Products – 0.2%

|

|

|

|

|

$1,389,000

|

Prestige Brands, Inc. (a) (b)

|

5.13

%

|

01/15/28

|

$1,339,505

|

|

|

Pharmaceuticals – 1.2%

|

|

|

|

|

3,000,000

|

Charles River Laboratories International, Inc. (a) (b)

|

3.75

%

|

03/15/29

|

2,716,610

|

|

1,483,000

|

Charles River Laboratories International, Inc. (a) (b)

|

4.00

%

|

03/15/31

|

1,304,755

|

|

2,802,000

|

IQVIA, Inc. (a) (b)

|

6.50

%

|

05/15/30

|

2,832,357

|

|

|

|

6,853,722

|

||

|

|

Rail Transportation – 0.2%

|

|

|

|

|

922,000

|

Genesee & Wyoming, Inc. (a) (b)

|

6.25

%

|

04/15/32

|

912,469

|

|

|

Real Estate Services – 0.3%

|

|

|

|

|

2,219,000

|

CoStar Group, Inc. (a) (b)

|

2.80

%

|

07/15/30

|

1,881,761

|

|

|

Research & Consulting Services – 1.4%

|

|

|

|

|

3,973,000

|

Clarivate Science Holdings Corp. (a) (b)

|

3.88

%

|

07/01/28

|

3,641,461

|

|

3,114,000

|

Clarivate Science Holdings Corp. (a) (b)

|

4.88

%

|

07/01/29

|

2,842,506

|

|

342,000

|

CoreLogic, Inc. (a) (b)

|

4.50

%

|

05/01/28

|

309,275

|

|

900,000

|

Dun & Bradstreet Corp. (The) (a) (b)

|

5.00

%

|

12/15/29

|

837,770

|

|

|

|

7,631,012

|

||

|

|

Restaurants – 1.1%

|

|

|

|

|

5,088,000

|

IRB Holding Corp. (a) (b)

|

7.00

%

|

06/15/25

|

5,092,671

|

|

812,000

|

Raising Cane’s Restaurants LLC (a) (b)

|

9.38

%

|

05/01/29

|

875,249

|

|

|

|

5,967,920

|

||

|

|

Security & Alarm Services – 0.3%

|

|

|

|

|

2,000,000

|

Brink’s Co. (The) (a) (b)

|

4.63

%

|

10/15/27

|

1,911,072

|

|

|

Specialized Consumer Services – 0.8%

|

|

|

|

|

4,932,000

|

Aramark Services, Inc. (a) (b)

|

5.00

%

|

02/01/28

|

4,719,510

|

|

|

Specialized Finance – 0.3%

|

|

|

|

|

2,392,000

|

Radiate Holdco LLC / Radiate Finance, Inc. (a) (b)

|

4.50

%

|

09/15/26

|

1,778,500

|

|

|

Specialty Chemicals – 1.4%

|

|

|

|

|

8,153,000

|

Avantor Funding, Inc. (a) (b)

|

4.63

%

|

07/15/28

|

7,679,149

|

|

|

Systems Software – 6.2%

|

|

|

|

|

2,724,000

|

Boxer Parent Co., Inc. (a) (b)

|

9.13

%

|

03/01/26

|

2,736,682

|

|

765,000

|

Crowdstrike Holdings, Inc. (b)

|

3.00

%

|

02/15/29

|

679,911

|

|

3,484,000

|

Gen Digital, Inc. (a) (b)

|

7.13

%

|

09/30/30

|

3,544,806

|

|

1,000,000

|

Oracle Corp. (b)

|

6.15

%

|

11/09/29

|

1,044,342

|

|

1,000,000

|

Oracle Corp. (b)

|

6.25

%

|

11/09/32

|

1,055,380

|

|

1,796,000

|

Oracle Corp. (b)

|

6.50

%

|

04/15/38

|

1,918,336

|

|

22,859,000

|

SS&C Technologies, Inc. (a) (b)

|

5.50

%

|

09/30/27

|

22,403,969

|

|

1,643,000

|

SS&C Technologies, Inc. (a) (b)

|

6.50

%

|

06/01/32

|

1,648,741

|

|

|

|

35,032,167

|

||

|

|

Trading Companies & Distributors – 1.9%

|

|

|

|

|

1,794,000

|

Herc Holdings, Inc. (a) (b)

|

5.50

%

|

07/15/27

|

1,752,864

|

|

8,786,000

|

United Rentals North America, Inc. (a) (b)

|

6.00

%

|

12/15/29

|

8,751,205

|

|

|

|

10,504,069

|

||

|

|

Transaction & Payment Processing Services – 0.1%

|

|

|

|

|

638,000

|

Boost Newco Borrower LLC (a) (b)

|

7.50

%

|

01/15/31

|

661,716

|

|

|

Total Corporate Bonds and Notes

|

493,798,328

|

||

|

|

(Cost $513,337,939)

|

|

|

|

|

Principal

Value

|

Description

|

Rate (c)

|

Stated

Maturity (d)

|

Value

|

|

SENIOR FLOATING-RATE LOAN INTERESTS – 18.7%

|

||||

|

|

Application Software – 7.1%

|

|

|

|

|

$704,012

|

Applied Systems, Inc., 2024 Term Loan, 3 Mo. CME Term SOFR

+ 3.50%, 0.00% Floor (b)

|

8.81

%

|

02/23/31

|

$711,023

|

|

8,565,357

|

Gainwell Acquisition Corp. (f/k/a Milano), Term Loan B, 3 Mo.

CME Term SOFR + CSA + 4.00%, 0.75% Floor (b)

|

9.41

%

|

10/01/27

|

8,347,668

|

|

4,374,990

|

Genesys Cloud Services Holding II LLC (f/k/a Greeneden), Term

Loan B, 1 Mo. CME Term SOFR + 3.50%, 0.75% Floor (b)

|

8.83

%

|

12/01/27

|

4,411,324

|

|

6,365,607

|

Informatica Corp., Initial Term Loan B, 1 Mo. CME Term SOFR +

CSA + 2.75%, 0.00% Floor (b)

|

8.19

%

|

10/29/28

|

6,401,413

|

|

8,877,441

|

Internet Brands, Inc. (Web MD/MH Sub I. LLC), 2nd Lien Term

Loan, 1 Mo. CME Term SOFR + 6.25%, 0.00% Floor (b)

|

11.58

%

|

02/23/29

|

8,881,614

|

|

80,271

|

ION Trading Technologies Ltd., Initial Dollar Term Loan, 1 Mo.

CME Term SOFR + 4.00%, 0.00% Floor (b)

|

9.34

%

|

04/01/28

|

80,443

|

|

2,993,109

|

LogMeIn, Inc. (GoTo Group, Inc.), First Lien First Out TL, 1 Mo.

CME Term SOFR + CSA + 4.75%, 0.00% Floor (b)

|

10.17

%

|

04/30/28

|

2,822,247

|

|

2,457,982

|

LogMeIn, Inc. (GoTo Group, Inc.), First Lien Second Out TL, 1

Mo. CME Term SOFR + CSA + 4.75%, 0.00% Floor (b)

|

10.17

%

|

04/30/28

|

1,523,949

|

|

2,992,327

|

Solera Holdings, Inc. (Polaris Newco), Term Loan B, 3 Mo. CME

Term SOFR + CSA + 4.00%, 0.50% Floor (b)

|

9.59

%

|

06/04/28

|

2,997,669

|

|

3,745,039

|

Ultimate Kronos Group (UKG, Inc.), 2024 Term Loan B, 1 Mo.

CME Term SOFR + 3.50%, 0.00% Floor (b)

|

8.82

%

|

02/10/31

|

3,777,640

|

|

|

|

39,954,990

|

||

|

|

Diversified Support Services – 0.5%

|

|

|

|

|

2,992,327

|

Consilio (Skopima Consilio Parent LLC), Initial Term Loan, 1 Mo.

CME Term SOFR + CSA + 4.00%, 0.50% Floor (b)

|

9.44

%

|

05/17/28

|

2,992,642

|

|

|

Electronic Equipment & Instruments – 0.5%

|

|

|

|

|

2,905,963

|

Verifone Systems, Inc., Term Loan B, 3 Mo. CME Term SOFR +

CSA + 4.00%, 0.00% Floor (b)

|

9.60

%

|

08/20/25

|

2,516,084

|

|

|

Health Care Facilities – 0.8%

|

|

|

|

|

443,128

|

Gentiva Health Services, Inc. (Kindred at Home/Charlotte Buyer),

Initial Term B Loan, 1 Mo. CME Term SOFR + 5.25%, 0.50%

Floor (b)

|

10.57

%

|

02/11/28

|

446,527

|

|

1,718,438

|

IVC Evidensia (IVC Acquisition Midco Ltd.), Facility B9, 3 Mo.

CME Term SOFR + 5.50%, 0.50% Floor (b)

|

10.81

%

|

12/06/28

|

1,725,604

|

|

2,333,040

|

Select Medical Corp., Tranche B-1, 1 Mo. CME Term SOFR +

3.00%, 0.00% Floor (b)

|

8.33

%

|

03/08/27

|

2,345,428

|

|

|

|

4,517,559

|

||

|

|

Health Care Technology – 3.2%

|

|

|

|

|

1,940,698

|

Datavant Group (f/k/a Ciox) (CT Technologies Intermediate

Holdings, Inc.), New Term Loan B, 1 Mo. CME Term SOFR +

CSA + 4.25%, 0.75% Floor (b)

|

9.69

%

|

12/16/25

|

1,944,744

|

|

9,295,770

|

Navicure, Inc. (Waystar Technologies, Inc.), 2024 Refi Term Loan,

1 Mo. CME Term SOFR + 4.00%, 0.00% Floor (b)

|

9.33

%

|

10/22/29

|

9,336,439

|

|

6,800,000

|

Verscend Technologies, Inc. (Cotiviti), Fixed Rate Term Loan, 1

Mo. Fixed + 0.00%, 0.00% Floor (b)

|

7.63

%

|

05/01/31

|

6,773,072

|

|

92,242

|

WS Audiology (Auris Lux III SARL), USD Term Loan B, 6 Mo.

CME Term SOFR + CSA + 4.25%, 0.00% Floor (b)

|

9.99

%

|

02/08/29

|

92,589

|

|

|

|

18,146,844

|

||

|

|

Industrial Machinery & Supplies & Components – 0.8%

|

|

|

|

|

4,302,024

|

Filtration Group Corp., 2021 Incremental Term Loan B, 1 Mo.

CME Term SOFR + 3.50%, 0.50% Floor (b)

|

8.94

%

|

10/21/28

|

4,329,256

|

|

Principal

Value

|

Description

|

Rate (c)

|

Stated

Maturity (d)

|

Value

|

|

SENIOR FLOATING-RATE LOAN INTERESTS (Continued)

|

||||

|

|

Insurance Brokers – 4.8%

|

|

|

|

|

$440,791

|

Alliant Holdings I LLC, Term Loan B-6, 1 Mo. CME Term SOFR

+ 3.50%, 0.50% Floor (b)

|

8.82

%

|

11/06/30

|

$443,066

|

|

6,291,631

|

BroadStreet Partners, Inc., Term Loan B-4, 1 Mo. CME Term

SOFR + 3.25%, 0.00% Floor (b)

|

8.59

%

|

06/14/31

|

6,325,920

|

|

7,988

|

HUB International Ltd., 2024 Refi Term Loan B, 1 Mo. CME

Term SOFR + 3.25%, 0.75% Floor (b)

|

8.58

%

|

06/20/30

|

8,050

|

|

3,186,985

|

HUB International Ltd., 2024 Refi Term Loan B, 3 Mo. CME

Term SOFR + 3.25%, 0.75% Floor

|

8.57

%

|

06/20/30

|

3,211,811

|

|

6,404,650

|

OneDigital Borrower LLC, Term Loan B, 1 Mo. CME Term SOFR

+ CSA + 4.25%, 0.50% Floor (b)

|

9.68

%

|

11/16/27

|

6,448,842

|

|

5,308,425

|

Ryan Specialty Group LLC, 2024 Term Loan, 1 Mo. CME Term

SOFR + 2.75%, 0.75% Floor (b)

|

8.08

%

|

09/01/27

|

5,350,229

|

|

2,101,934

|

Truist Insurance Holdings LLC (McGriff/Panther Escrow), Second

Lien Term Loan, 2 Mo. CME Term SOFR + 4.75%, 0.00%

Floor (b)

|

10.09

%

|

05/06/32

|

2,153,169

|

|

3,258,649

|

USI, Inc., 2030 Term Loan B, 1 Mo. CME Term SOFR + 2.75%,

0.00% Floor (b)

|

8.08

%

|

09/29/30

|

3,270,576

|

|

|

|

27,211,663

|

||

|

|

Integrated Telecommunication Services – 0.1%

|

|

|

|

|

448,562

|

Numericable (Altice France SA or SFR), Term Loan B-13, 3 Mo.

Synthetic USD LIBOR + 4.00%, 0.00% Floor (b)

|

9.58

%

|

08/14/26

|

363,818

|

|

|

Metal, Glass & Plastic Containers – 0.5%

|

|

|

|

|

3,019,147

|

ProAmpac PG Borrower LLC, 2024 Refi Term Loan B, 4 Mo.

CME Term SOFR + 4.00%, 0.75% Floor (b)

|

9.32%-9.33%

|

09/15/28

|

3,042,922

|

|

|

Security & Alarm Services – 0.1%

|

|

|

|

|

725,035

|

Garda World Security Corp., 2024 Refi Term Loan, 3 Mo. CME

Term SOFR + 4.25%, 0.00% Floor (b)

|

9.58

%

|

02/01/29

|

732,920

|

|

|

Specialized Finance – 0.2%

|

|

|

|

|

1,532,974

|

Radiate Holdco LLC (Astound), Amendment No. 6 Term Loan, 1

Mo. CME Term SOFR + CSA + 3.25%, 0.75% Floor (b)

|

8.69

%

|

09/25/26

|

1,214,644

|

|

|

Systems Software – 0.1%

|

|

|

|

|

244,731

|

Idera, Inc., 2nd Lien Term Loan, 3 Mo. CME Term SOFR + CSA

+ 6.75%, 0.75% Floor (b)

|

12.23

%

|

03/02/29

|

238,613

|

|

|

Total Senior Floating-Rate Loan Interests

|

105,261,955

|

||

|

|

(Cost $105,534,746)

|

|

|

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

FOREIGN CORPORATE BONDS AND NOTES – 15.3%

|

||||

|

|

Application Software – 3.9%

|

|

|

|

|

1,721,000

|

ION Trading Technologies Sarl (a) (b)

|

5.75

%

|

05/15/28

|

1,565,190

|

|

11,666,000

|

Open Text Corp. (a) (b)

|

6.90

%

|

12/01/27

|

11,978,264

|

|

6,881,000

|

Open Text Corp. (a) (b)

|

3.88

%

|

02/15/28

|

6,329,531

|

|

2,108,000

|

Open Text Corp. (a) (b)

|

3.88

%

|

12/01/29

|

1,857,956

|

|

|

|

21,730,941

|

||

|

|

Automotive Parts & Equipment – 1.5%

|

|

|

|

|

8,691,000

|

Clarios Global LP / Clarios US Finance Co. (a) (b)

|

8.50

%

|

05/15/27

|

8,762,988

|

|

|

Building Products – 0.2%

|

|

|

|

|

973,000

|

Cemex SAB de CV (a)

|

5.45

%

|

11/19/29

|

950,242

|

|

Principal

Value

|

Description

|

Stated

Coupon

|

Stated

Maturity

|

Value

|

|

FOREIGN CORPORATE BONDS AND NOTES (Continued)

|

||||

|

|

Casinos & Gaming – 0.0%

|

|

|

|

|

$140,000

|

Flutter Treasury Designated Activity Co (a) (b)

|

6.38

%

|

04/29/29

|

$140,805

|

|

|

Environmental & Facilities Services – 1.6%

|

|

|

|

|

473,000

|

GFL Environmental, Inc. (a) (b)

|

3.75

%

|

08/01/25

|

462,117

|

|

3,000,000

|

GFL Environmental, Inc. (a) (b)

|

5.13

%

|

12/15/26

|

2,945,715

|

|

1,300,000

|

GFL Environmental, Inc. (a) (b)

|

4.00

%

|

08/01/28

|

1,189,916

|

|

1,686,000

|

GFL Environmental, Inc. (a) (b)

|

4.75

%

|

06/15/29

|

1,571,001

|

|

2,750,000

|

GFL Environmental, Inc. (a) (b)

|

6.75

%

|

01/15/31

|

2,808,484

|

|

|

|

8,977,233

|

||

|

|

Integrated Telecommunication Services – 1.2%

|

|

|

|

|

2,542,000

|

Altice France Holding SA (a)

|

10.50

%

|

05/15/27

|

942,986

|

|

2,511,000

|

Altice France SA (a) (b)

|

5.50

%

|

01/15/28

|

1,760,761

|

|

1,000,000

|

Altice France SA (a) (b)

|

5.13

%

|

01/15/29

|

676,690

|

|

5,117,000

|

Altice France SA (a) (b)

|

5.13

%

|

07/15/29

|

3,441,449

|

|

|

|

6,821,886

|

||

|

|

IT Consulting & Other Services – 0.5%

|

|

|

|

|

3,464,000

|

Elastic NV (a) (b)

|

4.13

%

|

07/15/29

|

3,100,294

|

|

|

Metal, Glass & Plastic Containers – 1.3%

|

|

|

|

|

7,245,000

|

Trivium Packaging Finance BV (a) (b)

|

5.50

%

|

08/15/26

|

7,148,474

|

|

|

Restaurants – 2.2%

|

|

|

|

|

14,344,000

|

1011778 BC ULC / New Red Finance, Inc. (a) (b)

|

4.00

%

|

10/15/30

|

12,491,516

|

|

|

Security & Alarm Services – 1.1%

|

|

|

|

|

2,000,000

|

Garda World Security Corp. (a) (b)

|

9.50

%

|

11/01/27

|

2,003,222

|

|

4,034,000

|

Garda World Security Corp. (a) (b)

|

7.75

%

|

02/15/28

|

4,099,552

|

|

|

|

6,102,774

|

||

|

|

Trading Companies & Distributors – 1.0%

|

|

|

|

|

2,721,000

|

VistaJet Malta Finance PLC / Vista Management Holding,

Inc. (a) (b)

|

7.88

%

|

05/01/27

|

2,466,009

|

|

3,858,000

|

VistaJet Malta Finance PLC / Vista Management Holding,

Inc. (a) (b)

|

6.38

%

|

02/01/30

|

3,100,841

|

|

|

|

5,566,850

|

||

|

|

Transaction & Payment Processing Services – 0.8%

|

|

|

|

|

4,738,000

|

Paysafe Finance PLC / Paysafe Holdings US Corp. (a) (b)

|

4.00

%

|

06/15/29

|

4,313,916

|

|

|

Total Foreign Corporate Bonds and Notes

|

86,107,919

|

||

|

|

(Cost $89,471,027)

|

|

|

|

|

Shares

|

Description

|

Value

|

|

COMMON STOCKS – 0.0%

|

||

|

|

Pharmaceuticals – 0.0%

|

|

|

220,989

|

Akorn, Inc. (e) (f) (g)

|

16,906

|

|

|

(Cost $2,534,056)

|

|

|

Shares

|

Description

|

Value

|

|

MONEY MARKET FUNDS – 0.2%

|

||

|

1,009,138

|

Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional

Class -

5.15% (b) (h)

|

$1,009,138

|

|

|

(Cost $1,009,138)

|

|

|

|

Total Investments – 121.9%

|

686,194,246

|

|

|

(Cost $711,886,906)

|

|

|

|

Outstanding Loan – (23.3)%

|

(131,000,000

)

|

|

|

Net Other Assets and Liabilities – 1.4%

|

7,898,887

|

|

|

Net Assets – 100.0%

|

$563,093,133

|

|

(a)

|

This security, sold within the terms of a private placement memorandum, is exempt

from registration upon resale under

Rule 144A of the Securities Act of 1933, as amended (the “1933 Act”), and may be resold in transactions exempt from

registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this

security has been determined to be liquid by First Trust Advisors L.P. (the “Advisor”). Although market instability can result in

periods of increased overall market illiquidity, liquidity for each security is determined

based on security specific factors and

assumptions, which require subjective judgment. At May 31, 2024, securities noted

as such amounted to $530,691,801 or 94.2%

of net assets.

|

|

(b)

|

All or a portion of this security serves as collateral for the outstanding loan. At

May 31, 2024, the segregated value of these

securities amounts to $677,340,646.

|

|

(c)

|

Senior Floating-Rate Loan Interests (“Senior Loans”) in which the Fund invests pay interest at rates which are periodically

predetermined by reference to a base lending rate plus a premium. These base lending

rates are generally (i) the SOFR obtained

from the U.S. Department of the Treasury’s Office of Financial Research or another major financial institution, (ii) the lending

rate offered by one or more major European banks, such as the synthetic LIBOR, (iii)

the prime rate offered by one or more

United States banks or (iv) the certificate of deposit rate. Certain Senior Loans

are subject to a SOFR or synthetic LIBOR floor

that establishes a minimum SOFR or synthetic LIBOR rate. When a range of rates is

disclosed, the Fund holds more than one

contract within the same tranche with identical SOFR or synthetic LIBOR period, spread

and floor, but different SOFR or

synthetic LIBOR reset dates.

|

|

(d)

|

Senior Loans generally are subject to mandatory and/or optional prepayment. As a result,

the actual remaining maturity of Senior

Loans may be substantially less than the stated maturities shown.

|

|

(e)

|

This issuer has filed for protection in bankruptcy court.

|

|

(f)

|

Security received in a transaction exempt from registration under the 1933 Act. The

security may be resold pursuant to an

exemption from registration under the 1933 Act, typically to qualified institutional

buyers (see Note 2E - Restricted Securities in

the Notes to Financial Statements).

|

|

(g)

|

Non-income producing security.

|

|

(h)

|

Rate shown reflects yield as of May 31, 2024.

|

|

Abbreviations throughout the Portfolio of Investments:

|

|

|

CME

|

– Chicago Mercantile Exchange

|

|

CSA

|

– Credit Spread Adjustment

|

|

LIBOR

|

– London Interbank Offered Rate

|

|

SOFR

|

– Secured Overnight Financing Rate

|

|

USD

|

– United States Dollar

|

|

|

Total

Value at

5/31/2024

|

Level 1

Quoted

Prices

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

Corporate Bonds and Notes*

|

$493,798,328

|

$—

|

$493,798,328

|

$—

|

|

Senior Floating-Rate Loan Interests*

|

105,261,955

|

—

|

105,261,955

|

—

|

|

Foreign Corporate Bonds and Notes*

|

86,107,919

|

—

|

86,107,919

|

—

|

|

Common Stocks*

|

16,906

|

—

|

16,906

|

—

|

|

Money Market Funds

|

1,009,138

|

1,009,138

|

—

|

—

|

|

Total Investments

|

$686,194,246

|

$1,009,138

|

$685,185,108

|

$—

|

|

*

|

See Portfolio of Investments for industry breakout.

|

|

ASSETS:

|

|

|

Investments, at value

|

$ 686,194,246

|

|

Cash

|

84,228

|

|

Receivables:

|

|

|

Interest

|

9,759,420

|

|

Investment securities sold

|

7,143,923

|

|

Reclaims

|

159

|

|

Prepaid expenses

|

31,254

|

|

Total Assets

|

703,213,230

|

|

LIABILITIES:

|

|

|

Outstanding loan

|

131,000,000

|

|

Payables:

|

|

|

Investment securities purchased

|

7,352,934

|

|

Investment advisory fees

|

793,975

|

|

Interest and fees on loan

|

782,565

|

|

Audit and tax fees

|

73,143

|

|

Administrative fees

|

37,424

|

|

Shareholder reporting fees

|

36,066

|

|

Custodian fees

|

18,821

|

|

Legal fees

|

12,442

|

|

Trustees’ fees and expenses

|

8,616

|

|

Transfer agent fees

|

1,933

|

|

Financial reporting fees

|

771

|

|

Other liabilities

|

1,407

|

|

Total Liabilities

|

140,120,097

|

|

NET ASSETS

|

$563,093,133

|

|

NET ASSETS consist of:

|

|

|

Paid-in capital

|

$ 690,142,097

|

|

Par value

|

367,730

|

|

Accumulated distributable earnings (loss)

|

(127,416,694

)

|

|

NET ASSETS

|

$563,093,133

|

|

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)

|

$15.31

|

|

Number of

|

|

|

Investments, at cost

|

$711,886,906

|

|

INVESTMENT INCOME:

|

|

|

|

Interest

|

$ 51,206,846

|

|

|

Other

|

78,411

|

|

|

Total investment income

|

51,285,257

|

|

|

EXPENSES:

|

|

|

|

Investment advisory fees

|

9,370,251

|

|

|

Interest and fees on loan

|

8,656,138

|

|

|

Administrative fees

|

354,966

|

|

|

Legal fees

|

197,796

|

|

|

Shareholder reporting fees

|

126,425

|

|

|

Audit and tax fees

|

78,302

|

|

|

Custodian fees

|

47,332

|

|

|

Listing expense

|

36,217

|

|

|

Trustees’ fees and expenses

|

34,645

|

|

|

Transfer agent fees

|

19,985

|

|

|

Financial reporting fees

|

9,250

|

|

|

Licensing fees

|

1,806

|

|

|

Other

|

28,561

|

|

|

Total expenses

|

18,961,674

|

|

|

NET INVESTMENT INCOME (LOSS)

|

32,323,583

|

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS):

|

|

|

|

Net realized gain (loss) on:

|

|

|

|

Investments

|

(27,380,921

)

|

|

|

Swap contracts

|

(147,114

)

|

|

|

Net realized gain (loss)

|

(27,528,035

)

|

|

|

Net change in unrealized appreciation (depreciation) on investments

|

49,264,479

|

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

21,736,444

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

|

$ 54,060,027

|

|

|

|

Year

Ended

5/31/2024

|

Year

Ended

5/31/2023

|

|

OPERATIONS:

|

|

|

|

Net investment income (loss)

|

$ 32,323,583

|

$ 33,809,782

|

|

Net realized gain (loss)

|

(27,528,035

)

|

(66,424,648

)

|

|

Net change in unrealized appreciation (depreciation)

|

49,264,479

|

13,008,655

|

|

Net increase (decrease) in net assets resulting from operations

|

54,060,027

|

(19,606,211

)

|

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

|

|

|

Investment operations

|

(33,594,516

)

|

(35,642,807

)

|

|

Return of capital

|

(23,771,347

)

|

(21,134,688

)

|

|

Total distributions to shareholders

|

(57,365,863

)

|

(56,777,495

)

|

|

Total increase (decrease) in net assets

|

(3,305,836

)

|

(76,383,706

)

|

|

NET ASSETS:

|

|

|

|

Beginning of period

|

566,398,969

|

642,782,675

|

|

End of period

|

$ 563,093,133

|

$ 566,398,969

|

|

COMMON SHARES:

|

|

|

|

Common Shares at end of period

|

36,772,989

|

36,772,989

|

|

Cash flows from operating activities:

|

|

|

|

Net increase (decrease) in net assets resulting from operations

|

$54,060,027

|

|

|

Adjustments to reconcile net increase (decrease) in net assets resulting from operations

to net cash

provided by operating activities:

|

|

|

|

Purchases of investments

|

(539,522,650

)

|

|

|

Sales, maturities and paydown of investments

|

559,329,079

|

|

|

Net amortization/accretion of premiums/discounts on investments

|

(3,248,909

)

|

|

|

Net realized gain/loss on investments

|

27,380,921

|

|

|

Net change in unrealized appreciation/depreciation on investments

|

(49,264,479

)

|

|

|

Changes in assets and liabilities:

|

|

|

|

Decrease in interest receivable

|

584,770

|

|

|

Increase in reclaims receivable

|

(159

)

|

|

|

Decrease in prepaid expenses

|

276

|

|

|

Increase in interest and fees payable on loan

|

41,714

|

|

|

Increase in investment advisory fees payable

|

699

|

|

|

Increase in audit and tax fees payable

|

19,182

|

|

|

Decrease in legal fees payable

|

(10,975

)

|

|

|

Increase in shareholder reporting fees payable

|

7,095

|

|

|

Decrease in administrative fees payable

|

(2,276

)

|

|

|

Increase in custodian fees payable

|

11,608

|

|

|

Increase in transfer agent fees payable

|

416

|

|

|

Increase in trustees’ fees and expenses payable

|

869

|

|

|

Decrease in other liabilities payable

|

(3,516

)

|

|

|

Cash provided by operating activities

|

|

$49,383,692

|

|

Cash flows from financing activities:

|

|

|

|

Distributions to Common Shareholders from investment operations

|

(33,594,516

)

|

|

|

Distributions to Common Shareholders from return of capital

|

(23,771,347

)

|

|

|

Repayment of borrowing

|

(198,000,000

)

|

|

|

Proceeds from borrowing

|

206,000,000

|

|

|

Cash used in financing activities

|

|

(49,365,863

)

|

|

Increase in cash

|

|

17,829

|

|

Cash at beginning of period

|

|

66,399

|

|

Cash at end of period

|

|

$84,228

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

Cash paid during the period for interest and fees

|

|

$8,614,424

|

|

|

Year Ended

|

Period

Ended

5/31/2021 (a)

|

||

|

5/31/2024

|

5/31/2023

|

5/31/2022

|

||

|

Net asset value, beginning of period

|

$ 15.40

|

$ 17.48

|

$ 21.13

|

$ 20.00

|

|

Income from investment operations:

|

|

|

|

|

|

Net investment income (loss)

|

0.88

(b)

|

0.92

|

1.16

|

1.08

|

|

Net realized and unrealized gain (loss)

|

0.59

|

(1.46

)